Professional Documents

Culture Documents

FTSE Annual Country Classification PDF

Uploaded by

Cronista.com0 ratings0% found this document useful (0 votes)

10K views3 pagesFTSE Group today announces the results of the Annual Country Classification Review for 2014. The process by which global equity markets are classified as Developed, Advanced Emerging, Secondary Emerging or Frontier within FTSE's global indices. Argentina will be demoted from Frontier to unclassified market status due to continuing stringent capital controls imposed on international investors.

Original Description:

Original Title

FTSE Annual Country Classification.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFTSE Group today announces the results of the Annual Country Classification Review for 2014. The process by which global equity markets are classified as Developed, Advanced Emerging, Secondary Emerging or Frontier within FTSE's global indices. Argentina will be demoted from Frontier to unclassified market status due to continuing stringent capital controls imposed on international investors.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10K views3 pagesFTSE Annual Country Classification PDF

Uploaded by

Cronista.comFTSE Group today announces the results of the Annual Country Classification Review for 2014. The process by which global equity markets are classified as Developed, Advanced Emerging, Secondary Emerging or Frontier within FTSE's global indices. Argentina will be demoted from Frontier to unclassified market status due to continuing stringent capital controls imposed on international investors.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Media Information

FTSE Annual Country Classification Review 2014

London, 22 September 2014: FTSE Group today announces the results of the Annual

Country Classification Review for 2014.

The FTSE Country Classification Annual Review, carried out every September, is the process

by which global equity markets are classified as Developed, Advanced Emerging, Secondary

Emerging or Frontier within FTSEs global indices.

FTSE Country Classification Changes 2014

FTSE confirms the following Country Classification changes for September 2014:

Argentina will be demoted from Frontier

Morocco will be demoted from Secondary Emerging to Frontier.

Argentina will be demoted from Frontier to unclassified market status due to continuing

stringent capital controls imposed on international investors. Morocco will be demoted from

Secondary Emerging to Frontier market status due to the continued decline in broad market

liquidity below the level sufficient to support sizeable global investment. The demotion of

Argentina from Frontier to unclassified market status and the demotion of Morocco from

Secondary Emerging to Frontier market status will be implemented in conjunction with the

J une 2015 FTSE Global Equity Index Series quarterly review and the 2015 FTSE Frontier

Index Series annual review.

Latvia and Palestine will join the Watch List for possible addition to Frontier market status

based on the markets meeting the five FTSE Quality of Markets criteria required for

FTSE Watch List 2014

In order to ensure that the potential, as well as confirmed, movement of markets between

categories is completely transparent for investors, FTSE maintains a Watch List of markets

being considered for promotion or demotion between the various market classifications.

The following changes to the Watch List have been confirmed at this review:

Latvia will be added to the Watch List for possible addition to Frontier

Palestine will be added to the Watch List for possible addition to Frontier

attaining Frontier status and will be considered for possible addition to Frontier market

status at the next annual review in September 2015.

The markets on the Watch List as of September 2015 are therefore as follows:

China A Share: Possible inclusion as Secondary Emerging

Greece: Possible demotion from Developed to Advanced Emerging

Kazakhstan: Possible inclusion as Frontier

Kuwait: Possible inclusion as Secondary Emerging

Latvia: Possible inclusion as Frontier

Mongolia: Possible inclusion as Frontier

Palestine: Possible inclusion as Frontier

Poland: Possible promotion from Advanced Emerging to Developed

Qatar: Possible promotion from Frontier to Secondary Emerging

Taiwan: Possible promotion from Advanced Emerging to Developed

China A Shares, Greece, Kazakhstan, Kuwait, Mongolia, Poland, Qatar and Taiwan will

remain on the Watch List. FTSE, supported by the Country Classification Committee, will

continue to closely monitor the progress of all FTSE Watch List markets.

FTSE will provide a formal interim update in March 2015, the next Annual Review of the

FTSE Watch List markets will take place in September 2015. FTSE will provide a minimum of

six months notice prior to changes being implemented in its indices, as a result of a country

classification review.

For full information about the FTSE country classification process, including details of all

criteria for Developed, Emerging and Frontier status and an assessment of each of the

markets classified in FTSE equity indices, please visit www.ftse.com/country

-Ends-

For more information, please contact:

Press Office Harry Stein Tel: +44 20 7866 1821

Mark Benhard Tel: +1 212 314 1199

Contacts:

Hong Kong Fennie Wong Tel: +852 2164 3333

Sydney Laura McCrackle Tel: +61 2 9293 2867

Email media@ftse.com

Notes to the Editor:

About FTSE Group

FTSE is a global leader in indexing and analytic solutions. FTSE calculates thousands of unique

indices that measure and benchmark markets and asset classes in more than 80 countries around the

world. FTSE indices are used extensively by market participants worldwide for investment analysis,

performance measurement, asset allocation and hedging. Leading pension funds, asset

managers, ETF providers and investment banks work with FTSE to benchmark their investment

performance and use FTSEs indices to create world-class ETFs, index tracking funds, structured

products and index derivatives. FTSE also provides many exchanges around the world with their

domestic indices.

A core set of universal principles guides FTSEs index design and management: FTSEs transparent

rules-based methodology is overseen by independent committees of leading market participants,

focused on applying the highest industry standards in index design and governance. The foundation

of FTSEs global, regional, country and sector indices is the FTSE Global Equity I ndex Series, which

includes the flagship FTSE All-World Index.

FTSE is well known for index innovation and customer partnerships as it seeks to continually enhance

the breadth, depth and reach of its offering.

FTSE is wholly owned by London Stock Exchange Group

For more information, visit www.ftse.com

You might also like

- Russell 1000 Growth IndexDocument4 pagesRussell 1000 Growth IndexLuella Luken100% (1)

- Press Release: 4 June 2018Document2 pagesPress Release: 4 June 2018osdiabNo ratings yet

- FTSE Country Classification Update 2018Document8 pagesFTSE Country Classification Update 2018phamson1984No ratings yet

- Ftse Financial Times Stock ExchangeDocument16 pagesFtse Financial Times Stock ExchangeVarun RastogiNo ratings yet

- Epra Nareit Global Reits FactsheetDocument2 pagesEpra Nareit Global Reits FactsheetK.w. ChauNo ratings yet

- The VIX Index and Volatility-Ba - Matthew T. MoranDocument43 pagesThe VIX Index and Volatility-Ba - Matthew T. Morancodingfreek007No ratings yet

- Fid MoneybuilderDocument2 pagesFid Moneybuildersnake1977No ratings yet

- FTSE Global Equity Index Series: Ground RulesDocument46 pagesFTSE Global Equity Index Series: Ground RulesJOHN SKILLNo ratings yet

- Forex Magnates Q1 2014 Quarterly Industry ReportDocument18 pagesForex Magnates Q1 2014 Quarterly Industry ReportRon FinbergNo ratings yet

- Ftse Interim Country Classification Review 2024Document10 pagesFtse Interim Country Classification Review 2024muhammadghufran1No ratings yet

- L&T Mutual Fund: Built On Strong FoundationDocument23 pagesL&T Mutual Fund: Built On Strong Foundationanon_837511878No ratings yet

- India Demographics Key Driver of MF GrowthDocument23 pagesIndia Demographics Key Driver of MF GrowthReya GalaNo ratings yet

- Ifm Unit 2Document92 pagesIfm Unit 2Sachin D SalankeyNo ratings yet

- Marketing Brochure TradePlus S&P New China Tracker - July 2019 (English)Document14 pagesMarketing Brochure TradePlus S&P New China Tracker - July 2019 (English)Alyssa AnnNo ratings yet

- Who We Are and What We Do: Our ObjectiveDocument6 pagesWho We Are and What We Do: Our ObjectiveNick StathisNo ratings yet

- EFC Categories ReportDocument40 pagesEFC Categories ReportTurcan Ciprian SebastianNo ratings yet

- 11th MENAPEA AnnualVCReport 2016 PDFDocument70 pages11th MENAPEA AnnualVCReport 2016 PDFTarek DomiatyNo ratings yet

- OCTIS Asset Management: Octis Asia Pacific FundDocument3 pagesOCTIS Asset Management: Octis Asia Pacific FundoctisadminNo ratings yet

- FTSE4Good Index Series Ground RulesDocument28 pagesFTSE4Good Index Series Ground RulesAdel AdielaNo ratings yet

- Ftse Global Equity Index Series Ground RulesDocument49 pagesFtse Global Equity Index Series Ground Rulesone.pound100pNo ratings yet

- PatnaikPauly2001 IndianforexDocument28 pagesPatnaikPauly2001 IndianforexJustin ThomasNo ratings yet

- Lyxor ETF Iboxx Liquid High Yield 30Document2 pagesLyxor ETF Iboxx Liquid High Yield 30Roberto PerezNo ratings yet

- PIMCO GIS Euro Liquidity InstDocument2 pagesPIMCO GIS Euro Liquidity InstNeil WalshNo ratings yet

- Emerging Markets ETFs: Country, Cluster or Asser Class (ETFI Asia Q4 2013)Document2 pagesEmerging Markets ETFs: Country, Cluster or Asser Class (ETFI Asia Q4 2013)Imran AhmedNo ratings yet

- Institutionalvoice2015 1Document4 pagesInstitutionalvoice2015 1tabbforumNo ratings yet

- Current FTSE GM Issue Section1Document132 pagesCurrent FTSE GM Issue Section1pleumNo ratings yet

- Unit - 4 Foreign Investment Exchange Rate Mechanism Global Capital Market Eure CurrencyDocument21 pagesUnit - 4 Foreign Investment Exchange Rate Mechanism Global Capital Market Eure Currencyabhishek_shukla_60No ratings yet

- ABC of ETFDocument24 pagesABC of ETFAJITAV SILUNo ratings yet

- ETFs For Private InvestorsDocument12 pagesETFs For Private InvestorsRomil SinghNo ratings yet

- Vietnam Stock FactorDocument10 pagesVietnam Stock FactorPingky OngkowidjojoNo ratings yet

- Repsol N+1 29082011Document2 pagesRepsol N+1 29082011Soho1985No ratings yet

- Credit Suisse Hudge IndexDocument2 pagesCredit Suisse Hudge IndexSophia LeeNo ratings yet

- PatnaikPauly2001 IndianforexDocument28 pagesPatnaikPauly2001 IndianforexSubham ChoudhuryNo ratings yet

- Ftse Index Solutions:: The Foundation of Successful EtfsDocument12 pagesFtse Index Solutions:: The Foundation of Successful EtfshelyeeNo ratings yet

- Currency Markets-2Document24 pagesCurrency Markets-2Nandini JaganNo ratings yet

- Ishare PLC en Emea ProspectusDocument153 pagesIshare PLC en Emea ProspectusMNo ratings yet

- Octis Monthly Newsletter 2015-02 PDFDocument3 pagesOctis Monthly Newsletter 2015-02 PDFoctisadminNo ratings yet

- FRBS Assignment 3Document8 pagesFRBS Assignment 3tanya1jhaNo ratings yet

- Executive Summery: The Oxford College of Business ManagementDocument74 pagesExecutive Summery: The Oxford College of Business ManagementVivek kumarNo ratings yet

- Sovereign Wealth FundDocument22 pagesSovereign Wealth Fund2005raviNo ratings yet

- A Report On The Indian Exchange Traded Funds (ETF) IndustryDocument26 pagesA Report On The Indian Exchange Traded Funds (ETF) IndustryHitendra PanchalNo ratings yet

- MKT IBoxx BrochureDocument12 pagesMKT IBoxx Brochurealanpicard2303No ratings yet

- Chapter - 8 Ifm BY Keerti SarafDocument20 pagesChapter - 8 Ifm BY Keerti SarafkeertisarafNo ratings yet

- 39.lse Depositary Receipts FinalDocument146 pages39.lse Depositary Receipts FinalEli DhoroNo ratings yet

- Does The Stock Market in India Move With Asia?: A Multivariate Cointegration-Vector Autoregression ApproachDocument19 pagesDoes The Stock Market in India Move With Asia?: A Multivariate Cointegration-Vector Autoregression Approachdreamz_blogsNo ratings yet

- Impact of Fii On Stock MarketDocument22 pagesImpact of Fii On Stock MarketAnkit IwanatiNo ratings yet

- RothschildDocument124 pagesRothschildZerohedgeNo ratings yet

- Nationality RequirementDocument5 pagesNationality RequirementAndrew GallardoNo ratings yet

- UTI Corporate Presentation: UTI Mutual Fund - Private and Confidential - 31 March, 2013Document26 pagesUTI Corporate Presentation: UTI Mutual Fund - Private and Confidential - 31 March, 2013Atul SharmaNo ratings yet

- Reports HKFITHAItw 5454 We 5 W 5 W 4 W 4 W 34 Se 43 WDocument1,242 pagesReports HKFITHAItw 5454 We 5 W 5 W 4 W 4 W 34 Se 43 Wgse4trw3t63t54No ratings yet

- CCR Arbitrage Volatilité 150: Volatility StrategyDocument3 pagesCCR Arbitrage Volatilité 150: Volatility StrategysandeepvempatiNo ratings yet

- Octis Monthly Newsletter 2015-01 PDFDocument3 pagesOctis Monthly Newsletter 2015-01 PDFoctisadminNo ratings yet

- Sebi Grade A 2020: Economics: Foreign Exchange MarketDocument17 pagesSebi Grade A 2020: Economics: Foreign Exchange MarketThabarak ShaikhNo ratings yet

- Nomura E-VOLution Fund Class I USD - FactsheetDocument2 pagesNomura E-VOLution Fund Class I USD - FactsheetMarkus SchullerNo ratings yet

- AboutDocument12 pagesAboutMrigendra MishraNo ratings yet

- 2015 q1 Ivf Webcast With WatermarkDocument10 pages2015 q1 Ivf Webcast With WatermarkCanadianValue0% (1)

- Introduction to Exchange RatesDocument23 pagesIntroduction to Exchange RatesHamza RanaNo ratings yet

- Capital MarketDocument21 pagesCapital MarketAmanuelNo ratings yet

- The ETF Book: All You Need to Know About Exchange-Traded FundsFrom EverandThe ETF Book: All You Need to Know About Exchange-Traded FundsNo ratings yet

- An Executive Guide to IFRS: Content, Costs and Benefits to BusinessFrom EverandAn Executive Guide to IFRS: Content, Costs and Benefits to BusinessNo ratings yet

- El FMI Sobre La Inteligencia ArtificialDocument42 pagesEl FMI Sobre La Inteligencia ArtificialCronista.comNo ratings yet

- YPF 3Q23 Earnings Webcast PresentationDocument9 pagesYPF 3Q23 Earnings Webcast PresentationCronista.comNo ratings yet

- Berkshire Hathaway IncDocument2 pagesBerkshire Hathaway IncZerohedgeNo ratings yet

- FMI ArgentinaDocument135 pagesFMI ArgentinaCronista.com100% (2)

- 2206 1Q Staff ReportDocument105 pages2206 1Q Staff ReportCronista.comNo ratings yet

- Igj KMBDocument21 pagesIgj KMBCronista.comNo ratings yet

- World Happiness ReportDocument158 pagesWorld Happiness ReportCronista.com100% (1)

- Documento Completo Del FMIDocument111 pagesDocumento Completo Del FMILPONo ratings yet

- Fallo Expropiación YPFDocument64 pagesFallo Expropiación YPFLPO100% (1)

- Carta MartinezDocument4 pagesCarta MartinezbracamontiNo ratings yet

- Vision Argentina FMIDocument17 pagesVision Argentina FMICronista.comNo ratings yet

- PR Russia ClassificationDocument3 pagesPR Russia ClassificationBAE NegociosNo ratings yet

- Paises Mas CarosjpgDocument1 pagePaises Mas CarosjpgCronista.comNo ratings yet

- CamScanner 12-16-2021 11.38Document2 pagesCamScanner 12-16-2021 11.38Cronista.comNo ratings yet

- JuntosDocument6 pagesJuntosCronista.comNo ratings yet

- Frente de TodosDocument10 pagesFrente de TodosCronista.comNo ratings yet

- Frente Vamos Con VosDocument4 pagesFrente Vamos Con VosCronista.comNo ratings yet

- YPF 3Q21 Earnings Webcast Presentation FINAL.Document11 pagesYPF 3Q21 Earnings Webcast Presentation FINAL.Cronista.com100% (1)

- Fdius Ubo Detailed Country Position 2008 2019Document7 pagesFdius Ubo Detailed Country Position 2008 2019Cronista.comNo ratings yet

- Fdius Ubo Detailed Country Position 2020, BEADocument5 pagesFdius Ubo Detailed Country Position 2020, BEACronista.comNo ratings yet

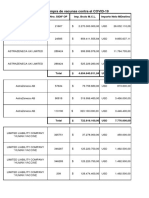

- Pagos Efectuados A LaboratoriosDocument14 pagesPagos Efectuados A LaboratoriosCronista.comNo ratings yet

- Inversión Extranjera Directa en Los EE - UU. Por País de Origen de Los FondosDocument19 pagesInversión Extranjera Directa en Los EE - UU. Por País de Origen de Los FondosCronista.comNo ratings yet

- Ley Alivio Fiscal MonotributoDocument18 pagesLey Alivio Fiscal MonotributoCronista.com100% (1)

- Direct Investment by Country and Industry, 2020Document12 pagesDirect Investment by Country and Industry, 2020Cronista.com100% (1)

- Gas DeudaDocument5 pagesGas DeudaCronista.comNo ratings yet

- Soñando Un Mejor ReinicioDocument4 pagesSoñando Un Mejor ReinicioCronista.comNo ratings yet

- Apéndice Del Acuerdo Mercosur-UE Con El Cronograma de Desgravación TarifariaDocument122 pagesApéndice Del Acuerdo Mercosur-UE Con El Cronograma de Desgravación TarifariaCronista.com100% (1)

- Ley Alivio Fiscal MonotributoDocument18 pagesLey Alivio Fiscal MonotributoCronista.com100% (1)

- Deuda Provincia Buenos Aires Propuesta BonistasDocument6 pagesDeuda Provincia Buenos Aires Propuesta BonistasCronista.comNo ratings yet

- El Informe de The LancetDocument2 pagesEl Informe de The LancetCronista.comNo ratings yet

- FTSE Global Micro Cap Index Methodology OverviewDocument4 pagesFTSE Global Micro Cap Index Methodology OverviewAna DwiyantiNo ratings yet

- Russell Global Sectors Methodology OverviewDocument5 pagesRussell Global Sectors Methodology OverviewSelva Bavani Selwadurai0% (1)

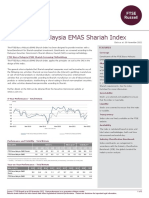

- FTSE Bursa Malaysia EMAS Shariah IndexDocument3 pagesFTSE Bursa Malaysia EMAS Shariah Indexdjfoo000No ratings yet

- FVTTT QUARTERLY-DAILYData-EUR StocksWeight 20201231Document2 pagesFVTTT QUARTERLY-DAILYData-EUR StocksWeight 20201231Vu MinhNo ratings yet

- BAC Prospectus PDFDocument25 pagesBAC Prospectus PDFDaniel KwanNo ratings yet

- Leykoma Irawards2009 PDFDocument140 pagesLeykoma Irawards2009 PDFBoris PopovNo ratings yet

- Leykoma Irawards2009Document140 pagesLeykoma Irawards2009Michael WeaverNo ratings yet

- Ftse 100Document0 pagesFtse 100james22121No ratings yet

- FTSE Annual Country Classification PDFDocument3 pagesFTSE Annual Country Classification PDFCronista.comNo ratings yet

- Reconstitution: Russell 3000 Index - AdditionsDocument10 pagesReconstitution: Russell 3000 Index - AdditionsepbeaverNo ratings yet

- 2007 FTSE All-ShareDocument103 pages2007 FTSE All-ShareThomasNo ratings yet

- 2006 FTSE All-Share PDFDocument103 pages2006 FTSE All-Share PDFtNo ratings yet

- FBMS 20221130Document3 pagesFBMS 20221130muhammad ihsanNo ratings yet

- ZAG FactsheetDocument2 pagesZAG FactsheetGonzalo AlvarezNo ratings yet

- FTSE All-World High Dividend Yield IndexDocument16 pagesFTSE All-World High Dividend Yield IndexLeonardo ToledoNo ratings yet

- FTSE4 GoodDocument5 pagesFTSE4 GoodJemayiNo ratings yet

- Vanguard FTSE Canada Index ETF VCE: December 31, 2019Document2 pagesVanguard FTSE Canada Index ETF VCE: December 31, 2019ChrisNo ratings yet

- Swdusa 20201231Document4 pagesSwdusa 20201231AadilNo ratings yet

- Axioma Q3 ReportDocument30 pagesAxioma Q3 ReportNapoleonNo ratings yet

- Short Notes by Latifur's Focus WritingDocument13 pagesShort Notes by Latifur's Focus WritingNicolas GonsalvezNo ratings yet

- My Wild Crypto Ride: Germany Fears Climate Change Caused FloodsDocument54 pagesMy Wild Crypto Ride: Germany Fears Climate Change Caused FloodsHoangNo ratings yet

- Ftse 1008v MergeDocument387 pagesFtse 1008v Mergedonatas_kontrimasNo ratings yet

- Etf and Etn ListDocument18 pagesEtf and Etn Listrebeltraders100% (2)

- Financial Times Europe February 252021Document18 pagesFinancial Times Europe February 252021HoangNo ratings yet

- FT Europe - April 29 2021Document30 pagesFT Europe - April 29 2021HoangNo ratings yet

- FTSE Vietnam Index Series FactsheetDocument2 pagesFTSE Vietnam Index Series FactsheetAnh Phuong NguyenNo ratings yet

- Icb Codes DescriptionDocument22 pagesIcb Codes DescriptionThai Binh TranNo ratings yet

- Capping Methodology GuideDocument21 pagesCapping Methodology GuideJOHN SKILLNo ratings yet

- Alexander ForbesDocument128 pagesAlexander ForbesSandra NarismuluNo ratings yet