Professional Documents

Culture Documents

Baaa

Uploaded by

Rahul ReinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Baaa

Uploaded by

Rahul ReinCopyright:

Available Formats

Question 1

0 out of 10 points

Harvest Catering is a local catering service. Conceptually, when should Harvest

recognize revenue from its catering service?

Answer

Selected Answer: At the date the customer's payment is received

Correct Answer: At the date the meals are served

Question 2

10 out of 10 points

A pool cleaning service signs a contract with a new customer on May 1. The pool

is vacuumed and shocked for the customer on June 1, and the bill for the services

is paid on July 1. Under the accrual basis, the business should recognize revenu

e on:

Answer

Selected Answer: June 1

Correct Answer: June 1

Question 3

10 out of 10 points

Starlight Associates, Inc. recorded salary expense of $100,000 in 2014. However,

additional salaries of $5,000 had been earned, but not paid or recorded at Dece

mber 31, 2014. After the adjustments are recorded and posted at December 31, 201

4, the balances in the Salaries Expense and Salaries Payable accounts will be

Salaries Expense ; Salaries Payable

Answer

Selected Answer: $105,000; $5,000

Correct Answer: $105,000; $5,000

Question 4

10 out of 10 points

Measurement of the economic effects on an entity involves each of the following

except

Answer

Selected Answer: Recording the economic effects in the financial state

ments

Correct Answer: Recording the economic effects in the financial statements

Question 5

0 out of 10 points

Zebra Company overstated its December 31, 2014 inventory by $5,200. Which statem

ent is true concerning Zebras financial statement amounts for 2014?

Answer

Selected Answer: Net income is understated.

Correct Answer: The current ratio is overstated.

Question 6

10 out of 10 points

If a company understates its ending inventory balance for 2012 by $15,500, what

are the effects on its net income for 2012 and 2011?

Effect on 2012 Net Income Effect on 2011 Net Income

Answer

Selected Answer: Understated by $15,500 No effect

Correct Answer: Understated by $15,500 No effect

Question 7

0 out of 10 points

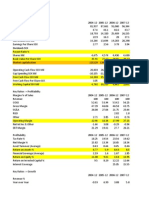

The following information is reported in the operating activities section of Gat

eway's statement of cash flows for 2014:

Net income

$1,200,000

Increase in inventories

600,000

Decrease in accounts payable

400,000

Which one of the following conclusions can be assumed from the information provi

ded?

Answer

Selected Answer: Cash payments for merchandise purchases were less tha

n the amount of merchandise purchased on credit during 2014.

Correct Answer: Gateway purchased more merchandise than it sold in 2014.

Question 8

0 out of 10 points

A company using the periodic inventory system has the following account balances

: Merchandise Inventory at the beginning of the year, $3,600; Freight-In, $650;

Purchases, $10,700; Purchases Returns and Allowances, $1,950; Purchases Discount

s, $330. The cost of merchandise purchased is equal to

Answer

Selected Answer: $12,670

Correct Answer: $9,070

Question 9

10 out of 10 points

The comparative balance sheets for Spring Co. for 2014 and 2013 indicate that ac

counts receivable decreased during 2014. Spring uses the indirect method of prep

aring the operating activities section of its statement of cash flows. How will

the decrease in accounts receivable be reported on the statement of cash flows?

Answer

Selected Answer: It will be added to net income in the operating activ

ities section.

Correct Answer: It will be added to net income in the operating activities se

ction.

Question 10

10 out of 10 points

Which one of the following is an accurate description of Allowance for Doubtful

Accounts?

Answer

Selected Answer: Contra account

Correct Answer: Contra account

Question 11

10 out of 10 points

What is the impact on the cash flow statement from a decrease in accounts receiv

able, assuming the indirect method is used?

Answer

Selected Answer: An increase in the cash flow from operating activitie

s

Correct Answer: An increase in the cash flow from operating activities

Question 12

10 out of 10 points

Refer to information for Satin Corporation

If Satin uses 2% of net credit sales to estimate its bad debts, what will be the

balance in the Allowance for Doubtful Accounts account after the adjustment for

bad debts?

Answer

Selected Answer: $31,800

Correct Answer: $31,800

Question 13

0 out of 10 points

Arena, Inc. uses straight-line depreciation for its equipment. Arena purchased e

quipment for $300,000 and estimated its useful life at 8 years. The bookkeeper f

ailed to consider the residual value of $50,000. What is the impact on earnings

per share and operating income of failing to consider the residual value?

Answer

Selected Answer: Earnings per share will be overstated and operating i

ncome will be understated.

Correct Answer: Both earnings per share and operating income will be understa

ted.

Question 14

10 out of 10 points

All of the following are included in the acquisition cost of property, plant, an

d equipment except:

Answer

Selected Answer: maintenance costs

Correct Answer: maintenance costs

Question 15

0 out of 10 points

Grover, Inc. purchased a crane at a cost of $80,000. The crane has an estimated

residual value of $5,000 and an estimated life of 8 years, or 12,500 hours of op

eration. The crane was purchased on January 1, 2013 and was used 2,700 hours in

2013 and 2,600 hours in 2014.

If Grover uses the units-of-production method, what is the depreciation rate per

hour for the equipment?

Answer

Selected Answer: $7.50

Correct Answer: $6.00

Question 16

0 out of 10 points

Eagles Nest sold equipment for $4,000 cash. This resulted in a $1,500 loss. What

is the impact of this sale on the working capital?

Answer

Selected Answer: Has no effect on working capital

Correct Answer: Increases working capital

You might also like

- Review Test Submission: Mid-Term Test 1 - Trial: Amanabbi Abbi 5/23/13 2:19 PM Completed 100 Out of 160 PointsDocument3 pagesReview Test Submission: Mid-Term Test 1 - Trial: Amanabbi Abbi 5/23/13 2:19 PM Completed 100 Out of 160 Pointsfriend_foru2121No ratings yet

- Kiểm tra LMS - lần 2Document17 pagesKiểm tra LMS - lần 2Kotoru HanoelNo ratings yet

- Section 3 (Submitted) QBPDocument12 pagesSection 3 (Submitted) QBPMiriam Manansala100% (1)

- Adv Acct Quiz 3 Chapter 4Document5 pagesAdv Acct Quiz 3 Chapter 4Nikki Harris100% (1)

- Profitability ratios documentDocument12 pagesProfitability ratios documentEDPSENPAI100% (1)

- Financial-Managementuprgdall-In 3 PDFDocument67 pagesFinancial-Managementuprgdall-In 3 PDFCasey Collera Mediana100% (1)

- Quiz 10Document8 pagesQuiz 10shivnilNo ratings yet

- Quiz C13 & 18 - Attempt ReviewDocument4 pagesQuiz C13 & 18 - Attempt ReviewXuan TraNo ratings yet

- Bài kiểm tra trắc nghiệm tổng hợp các chủ đề - Xem lại bài làmDocument22 pagesBài kiểm tra trắc nghiệm tổng hợp các chủ đề - Xem lại bài làmAh TuanNo ratings yet

- Audit Questions on Accounts Receivable, Bad Debts, Notes ReceivableDocument41 pagesAudit Questions on Accounts Receivable, Bad Debts, Notes ReceivableBonak KidNo ratings yet

- Financial Management: Operating Profit AssetsDocument11 pagesFinancial Management: Operating Profit AssetsKirthika KumarNo ratings yet

- WWW - Oqp.in: For More Solved Assignments, Assignment and Project Help - Visit - orDocument8 pagesWWW - Oqp.in: For More Solved Assignments, Assignment and Project Help - Visit - ornk20No ratings yet

- MA2Document32 pagesMA2eklavyaa_gauravNo ratings yet

- Managerial Economics - Answer KeyDocument11 pagesManagerial Economics - Answer KeyJunna BuNo ratings yet

- Product Costs and Operating Activities CalculationsDocument9 pagesProduct Costs and Operating Activities Calculationsghenni199No ratings yet

- Solution Accounting FundamentalsDocument4 pagesSolution Accounting FundamentalsadamNo ratings yet

- AAT Skillcheck ResultsDocument9 pagesAAT Skillcheck ResultsCiprian IchimNo ratings yet

- ELMS-MOCK-BOARD-REVIEWERDocument121 pagesELMS-MOCK-BOARD-REVIEWERbths6rxq6fNo ratings yet

- AcctDocument17 pagesAcctRoger Tan100% (1)

- Conceptual Midterm QuizDocument21 pagesConceptual Midterm Quizmalou reyesNo ratings yet

- FIN571 FREE Final Exam Study GuideDocument17 pagesFIN571 FREE Final Exam Study GuideRogue Phoenix100% (2)

- CourseHeroExam1 1Document8 pagesCourseHeroExam1 1David LewisNo ratings yet

- SCDL Finance Management Q1docxDocument7 pagesSCDL Finance Management Q1docxSandeepNayak100% (1)

- All ReviewerDocument149 pagesAll ReviewermsjoyevangelistaNo ratings yet

- Chuẩn mực BCTCQT1-Chapter 1Document11 pagesChuẩn mực BCTCQT1-Chapter 1Thu TramNo ratings yet

- Company Receives Excess Share Applications May Refund or Retain FundsDocument12 pagesCompany Receives Excess Share Applications May Refund or Retain FundsMoira Emma N. EdmondNo ratings yet

- Analyzing Interactive Quiz QuestionsDocument6 pagesAnalyzing Interactive Quiz Questionsummara_javedNo ratings yet

- CH 14 QuizDocument6 pagesCH 14 Quizpjama2012No ratings yet

- Wall Street Prep Certification Exam ReviewDocument21 pagesWall Street Prep Certification Exam Reviewduc anh100% (1)

- Quizzes - IAS 1 - Topic7 - Attempt ReviewDocument6 pagesQuizzes - IAS 1 - Topic7 - Attempt ReviewNguyễn Hữu ThọNo ratings yet

- Ngọc 31201022522 - Nguyễn Phan BảoDocument10 pagesNgọc 31201022522 - Nguyễn Phan BảoNGỌC NGUYỄN PHAN BẢONo ratings yet

- Maso Company journal entries effect owners' equityDocument12 pagesMaso Company journal entries effect owners' equitydaejina64No ratings yet

- MidtermDocument7 pagesMidtermToni WashingtonNo ratings yet

- Multiple Choice Multiple Answer: List of Attempted Questions and AnswersDocument14 pagesMultiple Choice Multiple Answer: List of Attempted Questions and Answerssandy1982yadavNo ratings yet

- Acct 410 - Government and Not-for-ProfitDocument7 pagesAcct 410 - Government and Not-for-Profitllutz7No ratings yet

- SCDL Sem 1Document86 pagesSCDL Sem 1Manish NegiNo ratings yet

- Understanding Short-Term Financing OptionsDocument56 pagesUnderstanding Short-Term Financing OptionsQuendrick SurbanNo ratings yet

- Grading Summary Exam Results Less Than 40 CharactersDocument4 pagesGrading Summary Exam Results Less Than 40 CharactersBella DavidovaNo ratings yet

- Special Tansaction Quiz 1 and 2Document4 pagesSpecial Tansaction Quiz 1 and 2Helen Fiedalan Falcutila MondiaNo ratings yet

- FIN 534 Midterm Part 1Document9 pagesFIN 534 Midterm Part 1ghassanhatemNo ratings yet

- LIST OF ATTEMPTED QUESTIONS AND ANSWERS (Legal Aspect of Finance - 9)Document4 pagesLIST OF ATTEMPTED QUESTIONS AND ANSWERS (Legal Aspect of Finance - 9)api-3745584No ratings yet

- 5930 QuizDocument31 pages5930 QuizLê Thanh ThủyNo ratings yet

- Accounting MCQSDocument94 pagesAccounting MCQSYaseenNo ratings yet

- Final Exam Review AssessmentDocument14 pagesFinal Exam Review Assessmentbusinessdoctor23No ratings yet

- Multiple Choice Multiple AnswerDocument9 pagesMultiple Choice Multiple Answeranon-708003No ratings yet

- MGT101 - Financial Accounting - MCQsDocument15 pagesMGT101 - Financial Accounting - MCQsusman ghaniNo ratings yet

- Quiz AnsDocument14 pagesQuiz AnsRosalind WangNo ratings yet

- FinMa PDFDocument86 pagesFinMa PDFJolex Acid0% (1)

- Test 1 QuizzDocument7 pagesTest 1 QuizzEleni AnastasovaNo ratings yet

- Genap2021 - AKK201 - Akuntansi Keuangan Menengah I - S1 - AKUNTANSI - 2017 - ODocument11 pagesGenap2021 - AKK201 - Akuntansi Keuangan Menengah I - S1 - AKUNTANSI - 2017 - ORaaniiNo ratings yet

- Homework #3 - Coursera CorrectedDocument10 pagesHomework #3 - Coursera CorrectedSaravind67% (3)

- Quiz 101314-0940Document8 pagesQuiz 101314-0940Wuhao KoNo ratings yet

- Mema FabmDocument29 pagesMema FabmJohuana Lhesty Sabordo Jabas100% (1)

- đề cô OanhDocument17 pagesđề cô OanhXuân Ngân Phùng HoàngNo ratings yet

- SCDL Assignment: Financial Management 3Document5 pagesSCDL Assignment: Financial Management 3bajpairameshNo ratings yet

- FMVA Sample TestDocument33 pagesFMVA Sample TestGrace XYZ100% (3)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Change Management: Learning To Thrive On ChangeDocument4 pagesChange Management: Learning To Thrive On ChangeRahul ReinNo ratings yet

- Courier Industry SpecificsDocument1 pageCourier Industry SpecificsRahul ReinNo ratings yet

- Group10 Eight Levers StrategyDocument6 pagesGroup10 Eight Levers StrategyRahul ReinNo ratings yet

- Book 1Document2 pagesBook 1Rahul ReinNo ratings yet

- Time TableDocument20 pagesTime TableRahul ReinNo ratings yet

- Va2.1 Grammar SupplementDocument3 pagesVa2.1 Grammar SupplementscochinNo ratings yet

- Just For LaughDocument1 pageJust For LaughRahul ReinNo ratings yet

- At The Beginning of The SimulationDocument6 pagesAt The Beginning of The SimulationRahul ReinNo ratings yet

- Debt FundsDocument2 pagesDebt FundsRahul ReinNo ratings yet

- ES Submission DeadlineDocument1 pageES Submission DeadlineRahul ReinNo ratings yet

- BADocument2 pagesBARahul ReinNo ratings yet

- ES Submission DeadlineDocument1 pageES Submission DeadlineRahul ReinNo ratings yet

- TISSDocument22 pagesTISSMohan KumarNo ratings yet

- Book 12Document2 pagesBook 12Rahul ReinNo ratings yet

- SR Company Last Price Change % CHGDocument44 pagesSR Company Last Price Change % CHGRahul ReinNo ratings yet

- Book1 MMDocument7 pagesBook1 MMRahul ReinNo ratings yet

- Oriental Bank of Commerce State Bank of India Punjab National BankDocument7 pagesOriental Bank of Commerce State Bank of India Punjab National BankRahul ReinNo ratings yet

- Bank of India: Total IncomeDocument2 pagesBank of India: Total IncomeRahul ReinNo ratings yet

- SR Company Last Price Change % CHGDocument44 pagesSR Company Last Price Change % CHGRahul ReinNo ratings yet

- Spreadshe Et 1 Day Price Market Long-Term Debt To Price To Net Descriptio N P/E Roe % Div. Yield %Document2 pagesSpreadshe Et 1 Day Price Market Long-Term Debt To Price To Net Descriptio N P/E Roe % Div. Yield %Rahul ReinNo ratings yet

- State Bank of India: Total IncomeDocument2 pagesState Bank of India: Total IncomeRahul ReinNo ratings yet

- Who Why What Whom Where When How: During NegotiationDocument9 pagesWho Why What Whom Where When How: During NegotiationRahul ReinNo ratings yet

- AnalysisDocument10 pagesAnalysisRahul ReinNo ratings yet

- State Bank of India: Total IncomeDocument2 pagesState Bank of India: Total IncomeRahul ReinNo ratings yet

- Data SBIDocument4 pagesData SBIRahul ReinNo ratings yet

- Who Why What Whom Where When How: During NegotiationDocument9 pagesWho Why What Whom Where When How: During NegotiationRahul ReinNo ratings yet

- Rural Craft Workshop Empowers Village WomenDocument1 pageRural Craft Workshop Empowers Village WomenRahul ReinNo ratings yet

- For TcsDocument1 pageFor TcsRahul ReinNo ratings yet

- TELIASONERADocument10 pagesTELIASONERARahul ReinNo ratings yet

- Bugs in ProwessDocument1 pageBugs in ProwessRahul ReinNo ratings yet

- Planning, organizing, staffing and directing roles in education administrationDocument1 pagePlanning, organizing, staffing and directing roles in education administrationtheresaNo ratings yet

- O-1 Visa Lawyer in San JoseDocument2 pagesO-1 Visa Lawyer in San JoseAlison YewNo ratings yet

- MS CAL Licensing Cheat SheetDocument1 pageMS CAL Licensing Cheat SheetbitoogillNo ratings yet

- Kevin Kato Fischer Swot AnalysisDocument17 pagesKevin Kato Fischer Swot AnalysisKevin Kato Fischer100% (2)

- All about Shezan's marketing strategyDocument2 pagesAll about Shezan's marketing strategySam HeartsNo ratings yet

- Part 5Document2 pagesPart 5PRETTYKO0% (1)

- Human Resource Management in PakistanDocument214 pagesHuman Resource Management in PakistanOsama0% (1)

- Ensuring E/CTRM Implementation SuccessDocument10 pagesEnsuring E/CTRM Implementation SuccessCTRM CenterNo ratings yet

- Financial Accounting I Assignment #2Document3 pagesFinancial Accounting I Assignment #2Sherisse' Danielle WoodleyNo ratings yet

- AFAR - 07 - New Version No AnswerDocument7 pagesAFAR - 07 - New Version No AnswerjonasNo ratings yet

- Tiong, Gilbert Charles - Financial Planning and ManagementDocument10 pagesTiong, Gilbert Charles - Financial Planning and ManagementGilbert TiongNo ratings yet

- Salim Ivomas Pratama TBK Bilingual 30 June 2019 Final Director StatementDocument124 pagesSalim Ivomas Pratama TBK Bilingual 30 June 2019 Final Director Statementilham pakpahanNo ratings yet

- Project Report On Installation of Unit For Fabrication of Shuttering/scaffolding MaterialDocument8 pagesProject Report On Installation of Unit For Fabrication of Shuttering/scaffolding MaterialEIRI Board of Consultants and Publishers0% (2)

- Chapter 5 Questions V1Document6 pagesChapter 5 Questions V1prashantgargindia_930% (1)

- T I C A P: HE Nstitute of Hartered Ccountants of AkistanDocument2 pagesT I C A P: HE Nstitute of Hartered Ccountants of AkistanaskermanNo ratings yet

- Resa Law24Document3 pagesResa Law24NaSheengNo ratings yet

- Customer equity value and lifetime revenue importanceDocument10 pagesCustomer equity value and lifetime revenue importanceSniper ShaikhNo ratings yet

- Finance Class 04 - New With TestDocument23 pagesFinance Class 04 - New With TestMM Fakhrul IslamNo ratings yet

- Marketing Mix and PricingDocument11 pagesMarketing Mix and PricingDiveshDuttNo ratings yet

- Book of RecordsDocument395 pagesBook of RecordsareyoubeefinNo ratings yet

- Business ProposalDocument4 pagesBusiness ProposalCatherine Avila IINo ratings yet

- Accounting principles, concepts and processesDocument339 pagesAccounting principles, concepts and processesdeepshrm100% (1)

- NFJPIA Mock Board 2016 - AuditingDocument8 pagesNFJPIA Mock Board 2016 - AuditingClareng Anne100% (1)

- Business Studies Glossary PDFDocument8 pagesBusiness Studies Glossary PDFAbdulaziz SaifuddinNo ratings yet

- Design Principles For Industrie 4.0 Scenarios: A Literature ReviewDocument16 pagesDesign Principles For Industrie 4.0 Scenarios: A Literature ReviewRogério MaxNo ratings yet

- 2022 Schindler q1 PresentationDocument22 pages2022 Schindler q1 Presentationmohammad ghassanNo ratings yet

- Ch04 Consolidation TechniquesDocument54 pagesCh04 Consolidation TechniquesRizqita Putri Ramadhani0% (1)

- Business Risk (D)Document5 pagesBusiness Risk (D)Tchao AdrienNo ratings yet

- Marketing Strategies of BSNLDocument5 pagesMarketing Strategies of BSNLRanjeet Pandit50% (2)

- Costco - Supplier Code of ConductDocument6 pagesCostco - Supplier Code of ConductalmariveraNo ratings yet