Professional Documents

Culture Documents

Letter of Internship

Uploaded by

Zain AfzalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Letter of Internship

Uploaded by

Zain AfzalCopyright:

Available Formats

Uploaded by Mudassar

1

Letter of Internship

PREFACE

In order to be able to cope with the changing environment it is necessary to

have some practical experience. As the student of Commerce we have to pass through

a series of various managerial techniques. During this practical course we are

provided with an opportunity to learn that how the theoretical knowledge can be

implemented on practical grounds.

I worked there in Habib Bank Limited for six weeks & it gave me a great

practical knowledge about the operations of an organization. In the following pages I

have narrated my experience, observation & all the working activities which I

observed during my internship.

Uploaded by Mudassar

2

Dedicated to

My loving Parents

&

Respectable Teachers

(Mudassar)

Uploaded by Mudassar

3

Acknowledgements

First and foremost all the praise is for Allah, the merciful and Beneficent, who

blessed me with the knowledge, gave me the courage and allowed me to accomplish

this task. Through I did not conceal myself capable to do so.

In addition to internship advisor Sir --------, I am especially indebted to all my

teachers for instilling in me enough knowledge to be able to carry myself efficiently

during my internship and complete this report.

Secondly I am bound to thanks the whole staff of Habib Bank Limited, Jalal

Pur Bhattian for such a cooperation and good time. In particular I am grateful to;

Mr. M. Shafqat Mehmood (Branch Manager)

Mr M. Farrukh (Assistant)

Mr. Shoaib Shahzad (Assistant)

for their inspiring guidance, remarkable suggestion and friendly discussion, which

helped me to learn and enabled me to complete this report.

Uploaded by Mudassar

4

Executive Summary

Being a student of M Com in University of Sargodha, it is compulsory to

complete six to eight weeks internship in any leading organization. So I had selected

Habib Bank Limited (Jalal Pur Bhattian Branch) for this purpose. My internship

program was for the period of eight weeks (---------). HBL has not only provided me a

platform to applied knowledge and skills, but also provided me necessary training to

support this knowledge.

The report is about Habib Bank Limited. The report contains detail about what

I had learned in my eight weeks of internship in Habib Bank Limited Jalalpur

Bhattian It is divided into different parts like introduction of banking, introduction of

the HBL, vision & mission statement, its core values and corporate information which

includes organization structure, board of director and hierarchy of Jalalpur Bhattian

branch respectively.

Secondly, I explained the products and services of the HBL. Bank offers

different products like deposits, loan products (commercial and agriculture) and

business promotion scheme.

The purpose and scope of writing this report is to provide an overview of the

processes that is being practiced in the branch. As I have done my internship in a

branch, so I have tried to learn the basic banking procedures of different departments

in the branch. In the next part report contains the detail about various departments,

accounts opening, remittances, clearing, advances, Cash department, Credit

department and marketing department which are currently working in the branch.

In the next part, the report also contains the detail about the financial position

of Bank. I did financial analysis of HBL, which shows that HBL works in better way.

Each year it shows positive increments in its as well as its customers' financial health.

During my stay in the branch I have performed a SWOT analysis to find out strength,

weaknesses, threats and opportunities in the branch. On the basis of SWOT analysis I

have given some recommendations in the end.

Uploaded by Mudassar

5

TABLE OF CONTENTS

1. Industry Introduction 07

2. An overview of organization 08

- -- - History of Organization 08

- -- - Nature Of Organization 08

a. Vision Statement 09

b. Mission Statement 09

- -- - Main Features 10

- -- - Competitors 15

3. Organizational Structure 16

- -- - Hierarchy Chart 17

- -- - Number of Employees 20

- -- - Main offices 20

- -- - Comments on organizational Structure 22

4. Work done by Internee 23

5. Financial Analysis of Organization 31

- -- - Financial data of last year 39

a. Horizontal analysis 41

b. Vertical analysis 45

- -- - Significance of ratio 49

- -- - Components of ratios (formulae used ) 50

- -- - Interpretation of ratios 50

6. SWOT Analysis 61

7. Conclusion 62

8. Recommendations 63

9. Limitations 64

10. Bibliography 64

11. Glossary 65

12. Annexes 66

Uploaded by Mudassar

6

BANKS AND SCOPE OF BANKING

WHAT IS BANK?

A bank is an institution for the custody, loan or exchange of money for

sanctioning credit, for transferring funds by domestic foreign bills of exchange. It is a

pipeline through which currency moves into and out of circulation.

As it is clear from the definition of banking, the main activity or function of

banking is borrowing and lending of money with a margin of gain. However, as far as

the present day banking is concerned, there are a number of different banks, set up

under specific different objectives, performing various functions.

FUNCTIONS & ACTIVITIES OF THE BANK

Banks are providing all types of banking services whichever permissible in the

country. These service are following.

Accepting deposits in saving, current and fixed accounts.

Borrowing funds and arranging finance from other banks.

Advancing and lending money to its clients.

Promoting the export of Pakistan & Making investment in other companies.

Sponsoring different scheme & transacting guarantee and indemnity business.

Financing of seasonal crops like cotton, heat, sugar cane etc.

Generating, undertaking, promoting etc of issuance of shares.

Uploaded by Mudassar

7

HABIB BANK LIMITED

It is the prime bank in the country established in 1941 having a registered head

office in Karachi. It was nationalized in 1947, but recently on 26

th

February 2004 it

has been privatized by the Government of Pakistan and is taken over by Aga Khan

Fund for Economic Development (AKFED). They acquired 51 percent of shares of

HBL.

Brief History of HBL

HBL at present state has a long and rich history of deeds and sacrifices. All

this has been possible on the account of sustained efforts.

Perhaps the HABIB BANK LIMITED establish in 1941 at Bombay. But its

history starts in 1841 when a young boy name Ismail Habib reach Bombay for job.

After some time he got the job with a dealer in utensils and non ferrous metals. Ismail

Habib was very keen and intelligent and became partner of his boss. Later on he was

elected as a president of the market. Many years later he expended his business. He

engaged in private banking. So HBL has come a long way from its modest

beginnings in Bombay in 25 august, 1941 when it commenced business with a fixed

capital of 25000 rupees.

The first branch of HBL started functioning on 30

th

August, 1941 at Muhammad

Ali Road Bombay, where Quaid-e-Azam Muhammad Ali Jinnah first of all opened

his personal account.

In 1942, on the desire of Quaid-e-Azam, Habib family migrated to Pakistan and

later on shifted the Banks Head Office from Bombay to Karachi on 7

th

August, 1947

just one week prior to independence, to play its pivotal role in the development of this

newly born country. At the time of independence, the areas which now constitute

Pakistan were producing only agricultural products raw material for indo Pak

subcontinent. Partially no industries were there to process the raw material; therefore

the raw material was exported from Pakistan. There were 19 non-Indian foreign

Banks which were engaged in the exports of crops from Pakistan with only two

Pakistani Banks i.e. HBL and Australia bank. The confidence of the people had been

shaken by the un-friendly environment and till the time peace had not been restored,

people would naturally have been interested in other things. The nation was quite

young with extreme scarcity of resources and definitely added to the difficulties of the

government to run its own banking system immediately.

Following the announcement of the independence plan in June 1947 , the Hindus

residing in the territories now comprising Pakistan started transferring their assets to

India and vice versa. The Banks included those having their registered offices in

Pakistan, transferred them to India in order to bring a total collapse of the new state. It

had been decided that the Reserve Bank of India would continue to function in

Pakistan so that the problem of demand and time liabilities, coinage, currencies,

exchange rate etc be settled between India and Pakistan and the Indian Notes would

continue to be legal tender in Pakistan till 30

th

September ,1948. Again due to certain

differences between India Pakistan, the Indian Government withheld Pakistans share

of Rs 75 core in forward and subscribed heavily to the Government of Pakistan to the

tide over the crises, payment was made to the Government by the Bank at a very

nominal rate of interest, even before the actual issue of securities.

Uploaded by Mudassar

8

At a time when this newly born country was at whirlwind of crises, it was HBL

which fulfilled generously the financial needs of all its sectors, paid salaries to the

employees of Government departments, helped in the establishment of state Bank of

Pakistan which the Quaid-e-Azam inaugurated on July 1

st

, 1948. HBL after partition

opened its branches throughout Pakistan to provide finance and other facilities to the

business community. In association with HBL, the Government sponsored Pakistan

Finance Corporation Limited for financing of cotton. The Bank helped handsomely in

the construction of WARSAK DAM PROJECT, WAPDA and K.D.A.by provided

finance and other facilities. It was also the first in making available such new facilities

as Gift Cheque, Rupee Travelers Cheques, Credit Card System, short term and long

term schemes for small businessmen.

Besides this, HABIB BANK has been a pioneer in providing innovative banking

services such as first installation of mainframe computer in Pakistan followed by

ATM and more Internet banking facilities in all branches. The main strength of HBL

brand is its great services to all customers especially to the corporate customers and

its prominent head office building that has dominated Karachi's skyline for 35 years.

VISION STATEMENT

Enabling people to advance with confidence and success

MISSION STATEMENT

To be recognized as the leading financial institution of Pakistan and a

dynamic international bank in the emerging markets, providing our customers with a

premium set of innovative products and services, and granting superior value to our

stakeholder s shareholders, customers and employees.

Uploaded by Mudassar

9

Features:

OBJECTIVES OF HBL

Following are some of the main objectives of HBL.

To earn profit for the Bank itself and for its shareholders.

To promote and boost up business sector inside the country.

To provide employment opportunities to people.

To help in development and industrialization of the country.

To provide loan and advances to help out in self employment schemes.

PRODUCTS OF HBL

1. LOAN PRODUCTS

House Finance:

HBL provides the facility of house finance:

Financing available for:

Purchase of house

Home improvement and renovation

Self Construction

Some characteristics of House Finance of HBL Are;

Lowest mark-Ups leading to affordable monthly installments

5 years fixed Rate/ one year Floating Rate available.

Lowest processing charges

Financing limits of up to Rs: 7.5 million (Rs: 3.0 million for Home

Improvement/Renovation)

Quick Processing

Auto Finance:

Habib Bank Auto Finance, a lease product, designed to offer you an economical

Way for owing the car of your choice.

Some characteristics are:

Lowest Down Payment

Lowest monthly rentals

Fixed repayment tenures of 36, 48 and 60 months.

Lowest Processing Charges

Insurance premium rates as low as 3%

Worldwide personal accidental insurance coverage of up to Rs: 200,000.

Uploaded by Mudassar

10

All locally assembled new cars can be financed through this scheme.

HBL Flexi Loan:

HBL had introduced a unique loan system for the middle income serving people

in various HBL sectors. It is basically meant for those in service people who earn

more than Rs 5000 per month. This loan meets the petty requirements of the

salaried calls. Since the introduction of this scheme Rs 6 billion is advanced

throughout the county. The maximum limit of this loan is Rs: 3000000.

Life Style:

Habib Bank Lifestyle is an economical financing scheme for Household

Appliances and consumer Electronics.

Salient features of HBL LIFESTYLES:

Loans for salaried/self Employed individuals or business persons

Low Mark-ups leading to affordable monthly installments.

Financing from Rs: 10000 to Rs: 500000

Fixed tenures of 6, 12, 18, 24 and 36 months

Low Processing charges

Full credit life insurance

Free Doorstep Delivery of items

Available throughout Pakistan from over 330 designated Habib Bank

Branches

Personal Loans:

Maximum loan up to Rs: 1000000

Choice of 12, 24, 36, 48 and 60 months for payback

Lowest Mark-up

Quick processing

Full Credit Life insurance

Available from over 400 designated branches throughout Pakistan

Agricultural Loans:

It entails all kind of agricultural finance facility for the rural market such as.

Kissan Dost Agricultural Finance Scheme

Kissan Dost Tractor Finance Scheme

Kissan Dost Mechanization Support Scheme

Kissan Dost Farm Transport Scheme

Kissan Dost Live Stock Scheme etc.

2. SERVICES

Retail Banking

The Retail Banking network, with 1450 branches, is the core strength of Habib

Bank. The network provides HBL with the largest diversified low cost deposit base of

any bank in Pakistan, and forms the basis for many of our other business lines:

corporate and investment banking and treasury activities. The network provides HBL

Uploaded by Mudassar

11

with the largest diversified low cost deposit base of any bank in Pakistan, and forms

the basis for many of our other business lines: corporate and investment banking and

treasury activities.

Commercial Banking:

Enterprises operating in the middle market contribute significantly to the

economy of a country. During FY-2000 HBLs management decided to address this

issue. On November 1, 2000 Commercial Banking came into being.

The objective of settling-up Commercial Banking was twofold:

First to stop the erosion of market share in the middle market;

Second, to regain the lost market share

Commercial Banking is making headway with improvement not only in terms of

the business figures but also in its ambiance. Renovation of is being carried out in

order to give a professional look to all the Commercial Banking Centers.

Corporate Banking:

The Corporate Banking Group serves large institutional customers who

require sophisticated products in an environment of intense competition. HBL

Corporate & Investment Banking Group is now recognized as a market leader and

regularly arranges and participates in most large structured finance deals.

International Operations:

HBLs ability to operate successfully in diversified markets and cultures is a

function of a long history in international banking when first international branch

was opened in 1951. The Bank's branches in financial centers continue to provide

efficient trade settlement and reimbursement services to the entire network and

business with other banks.

AGENCY SERVICES TO THE CUSTOMERS

HBL also provides agency services to its customers. Some of which are as follow:

Collection of Cheques

HBL pays and collects cheques on behalf of their customers, and for this it

receives commission form their account holders.

Collection of dividends

The Bank provides a very useful service by acting as an agent for its

customers. It arranges the collection of dividends on shares and securities held by its

customers. The customer is simply to inform the issuer of the securities that the

interest on the securities is to be credited to his account in the Bank. Bank charges

commission for the collection of the dividends on behalf of account holders.

Purchase and sale of securities

HBL if authorized by the customers also makes purchase and sale of securities

on the behalf of its customers. Bank charges commission for the purchase or sale

made by its on behalf of the customers.

Uploaded by Mudassar

12

Execution of standing instruction

HBL also executes the standing in case if it is ordered by the customers of the

Bank to do so. These instructions are usually given in writing to Bank. The Bank

debits and credits the accounts of its customer for the transactions carried out by the

individual or firm.

Transfer of Funds

HBL also transfers funds of the customers from one Bank to another Bank. If

the transfer is within one station, they dont charge any commission and even if they

charge, they charge on reduced rates.

Acts as an agent

HBL also acts as an agent, correspondent or representative of its customers at

home and abroad.

General utility services

HBL transacts foreign exchange business by discounting foreign bills of

exchange and thus provides facilities for financing in foreign trade.

Issuance of travelers cheques

HBL also issues travelers cheques. These cheques can be issued to anyone

whether an account holder or not and charges no commission on issuance of such

cheques. HBL has recently introduced Muhafiz rupee traveler cheques with enhanced

features.

Collection of Utility Bill

Electricity, telephone and other such bills can be deposited with HBL.

Locker Facility

HBL also provides locker facility to its customers where valuables of

customers can be kept.

Other Services

Auto Cash (Debit/ATM Card)

Habib Bank provides cards for dual purposes-a debit card and an ATM card

and provides you the direct access to cash in your account.

Amaan-Retirement Plan:

A pension plan that offers attractive investment returns.

Tabeer-Childern Education:

An insurance plan that enables parents to cover education and marriage costs.

HBL iCard as your ATM Card:

Offer a number of facilities such as cash withdrawal, Funds transfer between

accounts, Balance Inquiry, Mini Statement, Pin Change etc.

Accepted at all 1 LINK and MNET ATMs across the Country.

Uploaded by Mudassar

13

HBL Easy Access:

Online access to banking services at over two hundred branches in Pakistan

HBL Fast Transfer

A unique solution for overseas Pakistanis to send money back home in a swift

and convenient manner.

HBL E-Bank

It provides services via a dedicated communication link on the internet. The E-

Banking services provide anytime, anywhere banking to all 5 million customers. This

service, designed to be user friendly, assures secured access and confidentiality.

SWIFT

The bank is a major SWIFT user in 70 domestic branches & 21 overseas

countries/ locations in the network. SWIFT services are being used for funds transfer,

remittances and trade related transactions, resulting in major improvement in payment

processing capability for enhanced customer services.

Business Volume

Business volume of HBL in last five years is a follows:

Sr.

#

Description 2007 2008 2009 2010 2011

1

Shareholders

Equity &

Revaluation

Surplus

63237429 66308587 84369798 96250771 109586988

2 Total Assets 691991521 749806715 863778621 924699403 1139554205

3

Total

Deposits

531298127 597090545 682750079 747374799 933631525

4

Advances

(net of

provision)

382172734 456355507 454662499 459750012 457367656

5

Investments

(Net of

provision)

177942251 129833446 216467532 254909116 418604147

Customer Satisfaction

With a customer base of 5 million and a network of 1494 branches in Pakistan,

HBL is the largest Private Bank in the country. Its network means that it is

geographically closer to our customer than any other bank. This gives us the insight

needed to provide a variety of Products that directly reflects the customers needs.

HBL provides that following products and services to meet its individual

customer requirements: -

Debit Card

Uploaded by Mudassar

14

Deposit Account

Phone Banking

Bank Assurance

Mutual Funds

Moral Values of Employees

HBL focuses on the moral values of employees.

1. Integrity: -

For HBL, integrity means a synergic approach toward abiding there moral

values. United with the force of shared values and integrity, they form a network

of a well integrated team.

2. Excellence: -

This is at the core of everything they do. The markets in which they operate

are becoming increasingly completive, giving their customers are abundance of

choice. Only through being the very best in term of service they offices, their

products and premises are widely acceptable.

3. Respect: -

HBL provides great respect of their employees. They motivate the employees

by providing friendly environment, better pay packages and awards etc.

4. Humility: -

HBL encourages a culture of mutual respect and treats both their team

members and customers with humility and care.

5. Team Work: -

Their team strives to become a cohesive and unified force, to offer the

customers a service beyond his expectations. The customer a service participative

and collective endeavors, a common set of goals and a spirit to share the glory and

the strength to face failures together.

6. Innovation

HBL focuses on the innovation of new products. It was the first in making

available such new facilities as Gift Cheques, Rupee Travelers Cheques, Credit

Card System, Short Term and Long Term Schemes for small businessmen, PC

based banking for corporate customers etc.

Competitors:

1. United Bank Limited (UBL)

Uploaded by Mudassar

15

2. National Bank of Pakistan (NBP)

3. Bank of Punjab (BOP)

4. Bank Alfalah

5. Meezan Bank

6. MCB

7. Allied Bank Limited (ABL)

ORGANIZATION STRUCTURE

A well-developed and properly coordinate structure is an important

requirement for the success of any organization. It provides the basic framework

within which functions and procedures are performed. Any organization needs a

structure, which provides a framework for successful operations. The operation of an

organization involves a number of activities, which are related to decision making,

and communication of these decisions. These activities must be well coordinated so

that the goals of the organization are achieved successfully.

STRUCTURE OF HBL

At present the Bank operates through one central and many branches, all over

Pakistan. The president and Executives Committee look after the affairs of the Bank.

Each Regional Head Quarter is headed by a Chief Executive and assisted by General

Manager Operations and General Manager Support Services. The Regional Head

Quarter controls the branches in their area.

Overseas operations consist of 65 main branches, two affiliates, two representative

offices and two subsidiaries.

President, from Head Office at Karachi controls the officers of the Bank with the

help of the senior management. Functional responsibilities of the Banks are broken

into seven groups known as

1) International Operations Group

2) Corporate Banking and Treasury Investment Group

3) Retail Banking and Operation Group

4) Finance, Audit and Administration Group

5) Assets Remedial Management Group

6) Credit Policy Group

7) Corporate Bank, Financial Institutions and Project Finance Group

In addition to the overall controlling authority, president also manages the

International Operations Group individually. While the Senior Execute Vice

Presidents supervise rest of the functional group. Each Senior Executive Vice

President is individually responsible for the group which is assigned to him.

At the level of provinces there are Regional head Quarters headed by Regional

Chief Executives (RCE). Each RCE is assisted by GM operations and GM Support

Service. Branches are also controlled by the RCEs. Circle Offices of the past times

have been removed to reduce Managerial Layers, which were working under the

Uploaded by Mudassar

16

control of Zonal Offices. This Happened as a result of policy of beginning new

changes in the organizational structure.

Organizational Chart of HBL

A chart defines the line of authority in an organization and its departmentation. It is a

sort of visual presentation of the organizational structure. It specifies the duties and

responsibilities of the personnel of the organization. The Organizational chart of HBL

is given below.

ACCORDING TO DUTIES:

A.

Uploaded by Mudassar

17

According to Designation/Grade

According to Designation/Grade:

PRESIDENT AND CEO

7 MEMBERS OF BOARD OF DIRECTORS

G.E, IOBG G.E, CPOD G.E, CPCS G.E, RBG G.E, CIBG G.E, ARM G.E,

AGA HEAD OF IT

HEAD OF HR HEAD OF FINANCE

SENIOR VICE PRESIDENTS

VICE PRESIDENTS

ASSISTANT VICE PRESIDENTS

GRADE I OFFICERS

GRADE II OFFICERS

Uploaded by Mudassar

18

GRADE III OFFICERS

CLERICAL STAFF

NON-CLERICAL STAFF

MEMBERS OF BOARD OF DIRECTORS:

G.E Group Executive

IOBG International and Overseas Banking Group

CPOD Corporate Planning and Organizational Development

CPCS Credit Policy and Company Secretary

RBG Retail Banking Group

CIBG Corporate and Institutional Banking Group

ARM Assets Remedial Management

AGA Audit and General Information

Hierarchy of Jalalpur Bhattian Branch

Uploaded by Mudassar

19

Number of Employees

HBL Jalalpur Bhattian branch has 7 employees the contact numbers of some

employees is as follows,

Main Offices of HBL

HBL has its network in 25 countries of the world. It has 1494 branches out of

which 1425 are domestic branches and 69 are international.

The location, addresses and contract of some of them is as follows.

BRANCH

MANAGER

RELATIONSHIP

MANAGER

(COMMERCIAL)

OPERATION

MANAGER

CASH

OFFICERR

JUNIOR OFFICER

(ACCOUNT

OPENING)

AAA

(ASSISTANT)

JUNIOR OFFICER

(CLEARING &

COLLECTION)

JUNIOR OFFICER

(OTHER WORK)

SYSTEM

ADMINISTRATOR

RELATIONSHIP

MANAGER

(Agriculture)

M. Shaqat Mehmood Branch Manager 0300-4350421

Irfan Naseer Operational Manager 0301-4719073

Iqbal Hussain Shah CD Incharge 0307-6747342

Ghullam Hussain AFO 0345-6650575

M. Arshad Assitant Manager 0321-7461400

M. Naeem Cash Officer 0336-6544635

M. Farrukh Assitant 0314-7882664

Shoaib Shahzad Assitant 0345-6982360

Uploaded by Mudassar

20

Head Office

Habib Bank Plaza

I.I.Chundrigar Road

Karachi-75650, Pakistan.

Phone: 021-32418000 (50 lines)

Fax: 021-39217511

Registered Office

4

th

Floor, Habib Bank Tower

Jinnah Avenue

Islamabad, Pakistan.

Phone: 051-2872203 & 051-2821183

Fax: 051-2872205

Uploaded by Mudassar

21

Branch Offices in Different Cities of Pakistan: -

1) Address: Al-Azam Square C-3

Al-Badar Square, Hadi Market,

Liaquatabad Town Karachi

Phone: +92-21-36688232

2) Address: Barkat-E-Hyderi SE-6, Block 6,

North Nazimabad Karachi

Phone: +92-21-36629335

3) Address: Union Council, Town & Tehsit,

Ali Pur, District Muzzafar Garh Multan

Phone: +92-61-2755090

4) Address: Aziz Bhatti Town, Union Counicl,

Lahore Cant, Board, Tehsil CANT, Lahore.

Phone: 042-36611667

042-36611670

5) Address: Ravi Town, Union Council 27,

Tehsil City Lahore, District Lahore, Lahore

Phone: 042-37652273

042-37634854

6) Address: Aabpara Market Islamabad,

Tehsil & District Islamabad

Phone: 051-2829110

051-2820772

7) Address: Khushab Union Council Khushab.

Tehsil & District Khushab

Phone: 0454-712216

8) Address: Main Bazar Jauharabad

District Khushab

Phone: 0454-720109

Uploaded by Mudassar

22

Comments on the Organizational Structure

(i) Centralized Decision Making

By looking at the organizational structure of HBL would be found that the

structure at HBL is a critical one. All the decisions are made at the top management

level and the subordinates have to obey this decision. This trend in decision making

shows a pattern of rigidity in structure of HBL.

(ii) Downward Communication

Communication is the process by which information is exchanged &

understood, by two or more people, usually with the interest to motivate or influence

the behavior of these in the organization Downward communication is the message

and information sent from top management to subordinates in a down word direction

Manages can communicate downward to the employees through speeches, messages

in a company publications, information leaflets, tucked into pay envelops materials

one bulletin boards, policy and procedure mandates.

The same pattern is followed at HBL no doubt its very traditional approach but can

create problems it ignores the receives of the communication became the issues of the

policies and procedures does not ensure communication. In reality message

communicated download may not understood perfectly.

(iii) Chain of Command

The chain of command is an unbroken line of authority that links all persons in

an organization and shows who reports to whom. By analyzing the organizational

structure it can be found that there is a scalar principle followed with in the bank

because each and every person knows to whom can one report. The authority of

responsibility for different tasks and duties are different, as well as everyone knows

the successive levels of management all the way to the top.

Uploaded by Mudassar

23

LEARINING AS A STUDENT INTERNEE

MY FIRST WEEK OF INTRENSHIP

I spend my first week in account opening department because it is the main

department of the bank.

The detail of this department is as under:

ACCOUNTS OPENING DEPARTMENT

Basically this department is the pillar of the whole banking system because

this is the department which initiates the relationship between the customer and the

bank. Here it is the responsibility of the officer that there is no element of fraud in

customer. Borrowing funds from different sources has become an essential feature of

todays business enterprises. But in the case of a bank borrowing funds from outside

parties is all more vital because the entire banking system is based on it. The

borrowed capital of a bank is much greater there own capital. Banks borrowing is

mostly in the form of deposits. These deposits are lent out to different parties. Such

deposits creation is done through opening of account in the bank.

Type of Account

The primary operation of bank is opening of account. Three types of account

normally used at Khushab branch:

1. SAVING ACCOUNTS

2. CURRENT OR DEMAND ACCOUNTS

3. FIXED ACCOUNTS

At the time of opening an account the customer must have following

characteristics:

1. Must be an adult/Guardian in case of minor.

2. Must not be insolvent & bankrupt.

3. Must not be bewared under any law from entering into any contract.

Documents required for Opening an Account

1. Photocopy of CNIC with original.

2. In case of a salaried person, attested copy of his service card, or any other

acceptable evidence of service.

3. In case the CNIC does not contain a photograph, the bank obtains the

photograph in addition to CNIC.

4. In case of illiterate person, a passport size photograph of the new account

holder besides taking his right and left thumb impression on the specimen

signature card.

5. Proof of age in case of minor

6. Copy of CNIC of next to kin

7. Submission of proper legal documents. (if any depend on nature of account)

Account Opening Procedure

Followings are the main steps for new account opening:

1. Filling of the application form.

Form contains the following documents which is filled by the customer

Uploaded by Mudassar

24

a. Account opening form.

b. Signing the specimen card.

c. Cheque book requisition form.

d. Acknowledge (if necessary).

e. Declaration form (if signature differ from NIC)

f. Vernacular form.

2. After filling the form account opening officer attached the following

documents which are necessary for the judgment of Fraud.

a. Print of Verisys (Document of verification from NADRA)

b. Filling of KYC form electronically

3. The account officer feed the data into the system of bank.

4. Allotment of account number.

5. Initial deposit is taken from customer (Which is applicable for new account)

6. After the account is opened a letter of thanks is issued to the customer. If the

customer had given the wrong address the letter will come back and the

account is marked as doubtful.

7. Also the letter of thanks is issued to the introducer, which verifies the client.

Method of Judging the Fraud

1. The original CNIC card is checked.

2. Check the name of new customer from the list of NAB which is given by the

Head office tot eh branch.

3. The signature of the customer is checked. In case if customer is illiterate then

his photo account is opened.

Nature of Accounts:

The current and saving accounts can be opened under the following

nominations. The documents required of opening a new account is also depend on the

nature of account which is given below.

a) Individual Account

One person can open it. He has to fulfill all the requirements of the bank. It is also

called the personal account. Following are requirement for individual account.

Photocopy of NIC individual.

In case the CNIC does not contain a photograph, the bank obtains the

Photograph in addition to CNIC.

In case of a salaried person, attested copy of his service card, or any other

acceptable v\evidence of service.

In case of illiterate person, a passport size photograph of the new account

holder besides taking his right and left thumb impression on the specimen

signature card.

b) Joint Account

When two or more persons open an account in their names it is called joint

account in case of joint account it is mentioned that how many will operate this

account.

Attested photocopies of identity cards of all persons.

Authority letter for supervision of account one or all.

Uploaded by Mudassar

25

c) Partnership Account

For partnership account along with the application from and signature card other

documents are also required including the following.

For partnership account along with the application from and signature card other

documents are also required including the following.

Attested photocopies of identity cards of all partners.

Attested copy of Partnership Deed duly signed by all partners of the firm.

Attested copy of Registration with Registrar of Firms. In case the partnership

is unregistered, this fact should be clearly mentioned on the Account Opening

form.

Authority letter, in original, in favor of the person authorized to operate on the

account of the firm.

d) Societies, Clubs and Associations

Along with the application form and signatures following are the documents

which are required:

Certified Copies of:

Certificate of Registration.

By-laws/Rules & regulations.

Resolution of the Governing Body/Executive Committee for opening of

account authorizing the persons to operate the account and attested copy of the

identity card of the authorized persons.

An undertaking signed by all the authorized persons on behalf of the

institution mentioning that which any change takes place in the persons

authorized to operate on the account, the banker will be informed

immediately.

e) Company Account

For company account following documents is required:

Certified copies of:

Resolution of Board of Directors for opening of account specifying gate

person(s) authorized to operate the company account.

Memorandum and Article of Association

Certificate of Incorporations.

Certificate of Commencement of Business.

Attested photocopies of identity cards of all the directors.

f) Govt. Account:

For the Govt. account the following documents required for opening an account.

Attested photocopy of identity cards (CNIC) of the authorized persons.

Authority Letter to open & operate the A/C from concerned Govt. department.

g) Dormant/Inoperative Accounts

All depository accounts like Current/Saving/BBA etc., which are not operated

upon by the account holders for a period of one year, will be classified as dormant.

After passing one year in the dormant status, that is, no operation in the account for a

continuous period of two years, the account shall be classified as inoperative. This

entails certain restrictions on the operation of such accounts, for reactivations, the

Uploaded by Mudassar

26

account holder must in person request for a change of status and will produce original

CNIC or passport of Pakistan Origin Card or National Identity Card for Overseas

Pakistani with photo copy of Branch /Bank attestation. All accounts which are

inoperative and have nil balances shall be closed by the bank.

HBL ATM / Debit Card

Firstly an application form is filled by the person who is interested in ATM

card and then submitted to specific personnel with the all the documents required for

the ATM cards. Then all these information are passed over to regional office by

passing the entry into the system of bank. Than head office issues the ATM card &

pin code. ATM card is sent to related branch and pin code is sent to particular

customer.

The customer after receiving pin code approaches bank and puts his signature

on ATM issue book and then ATM facility is activated by calling to head office. The

client not issue through the ATM card above the daily limit of card.

CHEQUE BOOK ISSUANCE

First of all customer demand the Cheque book and we issue cheque form to him

containing information name, account no. address etc. he fills and returns that form to

us. Second step was that particular personnel fills a form known as Cheque book

requisition slip and send to regional office through NIFT. Regional office receives

that slip and issue Cheque book with particular title of different size 25 leafs, 50 leafs,

100 leafs) to the branch.

After receive Cheque books from regional office we issue Cheque book to customer

by getting his signature on a register known as Cheque book issuing register. Last

activity in this regard is activation of Cheque book. The Cheque book is activated in

the particular account with the system and the charges of the Cheque book is

deducted from the account of customer who gets Cheque book. After the 60 days the

check book is destroyed by the officer.

ISSUE OF BANK STATEMENT

Bank also provides statement of customers account on his request. The person who

wants to get his bank account statement should come himself and ask the bank officer

to issue him a bank statement maximum of one year period. The officer will verify

that the account is on his personal name and after verification bank statement is issued

to the customer. According to the bank rules the bank statement should be charged at

Rs: 50 per page but usually it is not charged for maintaining good relationship worth

customer.

ONLINE TRANSFER

Online inter branch funds transfer is a facility given to the customer through which

customer can transfer funds in the shape of cash or Cheque to any account of any

branch from any online branch of Habib Bank Ltd. For this purpose there is a form

used in the bank which is duly filled by the bank and signed be the customer. One

CNIC copy of the sender is also attached with the slip. The slip contains the following

information.

a) Applicants name.

b) Applicants address.

Uploaded by Mudassar

27

c) Applicants CNIC number,.

d) Remote branch.

e) Remote account number.

f) Remote account title.

g) Cheque number. (If funds are transferred through cheque).

h) Amount in figure.

i) Amount in words.

j) Commission

Second week of internship

My second week of internship was in clearing and collection department.

What is Clearing

The process of getting payment of Cheque, demand draft, payment order,

telegraphic transfer, mail transfer or dividends warrants deposited by the customer of

the branch and other branch of the same bank.

Clearing House

NIFT (National Institute of Facility Technologic) is the institute which works

under the supervision of SBP for the clearance of the cheque. NIFT branch works

under the specific area which assigned to it. So I was familiarized about the different

types of stamps used for clearing the cheque I had practically done that work at that

day. The stamp which are used are as under: -

On Front:

For the Cheque of National bank and Cheque of other banks

1. Clearing stamp of the next date on which the Cheque is going to present.

2. Special crossing stamp with the name of Habib bank Ltd.

On Back:

1. Credit guarantee of Disbursement stamp. For the Cheque of NBP and Khazana

2. Discharge stamp with the sign of two authorize persons.

I have personally done all the work.

There are two types of clearance

1. Outward clearance

2. Inward clearance

Outward Cleaerence

When the clients of the bank receives the cheque from other parties, which

are drawn on any other bank, the bank take these cheques and mark it for clearing,

this type of clearance is called outward clearance.

When bank received such types of cheques first of all officer crossed these cheques

and make them the property of the bank and issues acknowledgement of pay in slip to

the client by only single signature and enter in clearing and transfer delivery register.

After this all the cheques are sent to the main office and the party account is credited

with the head of clearing. Branch sent there check to NIFT for clearing and transfer

delivery cheques to their branches for transfer delivery.

Uploaded by Mudassar

28

Second day if the cheques will honor then main office will send the advice of these

cheques. If any cheque dishonor then the cheque is returned with the slip.

Inward Clearance

When the clients of HBL endorse the cheques of HBL to a person who is not

the client of HBL then the person will submit these cheques in the bank where he has

the account and then that bank will send the cheques to the State Bank of Pakistan for

clearing where cheques are delivered to the representative of HBL. The representative

then sends these cheques to the branch on which cheques are drawn. If there is

sufficient balance in the account of a person who has issued these cheques then:

BILLS FOR COLLECITON

There are two types of bills:

Outward bills for collection

Local bill for collection

Outward Bills for Collection (OBC)

What is OBC?

When an instrument is drawn on bank, which is located outside the city, its proceeds

can be collected through a mechanism called Outward Bills for Collection (OBC).

Banks receive different cheques for collection some of them pertain to

different branches of the bank but some of them pertain to the other branches in other

cities. In these cases the cheques are sent to the relevant branches for collection and

the procedure adopted is called outward bill for collection.

Procedure for OBC

First of all we sort the cheques city wise and bank wise and then they are

stamped.

Following stamps are required for OBC lodgment:

Crossing stamp

Bank endorsement stamp

OBC lodgment stamp

Local bill for collection (LBC)

The cheques received from other branches of HBL drawn at our branch or

different banks/branches in Khushab city or from any bank directly drawn at our

branch is called local bill for collection.

OBC of other branch of HBL or bank not having branch in Khushab will be our LBC.

When branch receive any cheque in LBC the same is entered in LBC register with

running sequence number.

Uploaded by Mudassar

29

Third week of internship

My third week of internship was in Remittance Department.

What is Remittance?

Remittance is transfer of funds from one place to another or from one person to

another.

A Remittance is an important service provided by banks to customers as well

as non-customers. Since it is not a free service it is a source of income for the bank.

Parties involve in remittances:

Four parties involved in remittance: -

1. Remitter

2. Remittee

3. Issuing Bank

4. Paying Bank

Remitter

One who initiates, or requests for a remittance. The remitter comes to the

issuing or originating branch, asks for a remittance to be made, and deposits the

money to be remitted. The bank charges him a commission for this service. He may or

may not be the branchs customer.

Remitter

A Remitter is also called the beneficiary, or the payee. The person in whose

name the remittance is also the one who receive the payment.

Issuing Bank

The bank that sends or affects the remittance, through demand drafts,

telegraphic transfers, or Mail Transfers.

Paying Bank

Paying Bank also knows as the drawee branch. The branch on which the

instrument is drawn. It has to make the payment (usually located in a different city

country).

Modes of Remittance:

Habib Bank Ltd, like other commercial Banks undertakes to remit or transfer

money from one place to any part of the country and outside the country. The money

is remitted by means of:

1. Demand Draft (DD)

2. Mail Transfers (MT)

3. Telegraphic Transfers (TT)

4. Pay Order

Uploaded by Mudassar

30

1. Demand Draft (DD):

Demand Draft is a negotiable instrument, which is drawn by one branch to another

branch of the same bank. In case of agency arrangement Demand Draft can also be

issued by one branch of the bank payable to other branch of the other bank e.g. DD

issued by the HBL payable by HBL.

Explanation:

If any person wants to make payment from one city to another city then he can

make payment through demand draft. Bank charges a commission for performing this

kind of service according to bank rate schedule, which is revised after 6 months.

Demand draft may be issued or paid. There are two ways to issue.

Demand Draft: -

1. Issue of DD against cash payment

2. Issue of DD against Debit of the account.

Process of the Issuance of DD: -

When a customer requests HBL Khushab to provide him a DD made on his

account or against cash payment for a particular city like Islamabad. Then, after

having the total amount including commission demand draft is issued in favor of the

specified person in that city and is drawn on HBL, Islamabad Branch. So, when payee

in any bank presents this demand draft, it constitutes the inward clearing of HBL,

Islamabad Branch.

2. Mail Transfer:

In mail transfer money is transferred through mail. One branch of the bank sends

advice to the branch of the same bank to credit the amount of payee. In this type the

payee must have the bank account.

Precaution for Payment: -

It is drawn on the same bank.

Payee has signed the revenue stamps of adequate amount.

Payee is properly identified.

3. Telegraphic Transfer: -

Generally a mail transfer advice reaches the Drawee branch the next day, when

courier arrangements exist. However, when it is sent through post offices, it usually

takes 2 to 3 days to reach its destination. But sometimes an individual whether

customer or not, demands that his funds should be transferred from one place to

another though the quickest means. In such cases, transfer of funds message is passed

on through a telegram, ordinary or express, to the Drawee branch of the bank. A

tested message is sent to the Drawee branch followed by the confirmation copy. In

case the payment is immediately required by the payee, the tested message is given on

the telephone.

Besides normal charges as those recovered on issuance of demand draft, the bank

charges one additional expense i.e. Telephone Charges of amount Rs. 100 from the

customer.

Features:

Uploaded by Mudassar

31

TT is not negotiable

The funds are not remitted through the branch situated within city.

TT instruction regarding payment is sent through codes called test code.

4. Pay Order:

Pay order is a negotiable instrument made by the bank, on account of a customer,

to pay on order the specified amount to the directed person (payee).

Use of Pay Order: -

Pay orders are used to make payment or to transfer money, with in the same

city. Pay order is always drawn on the bank that has issued it. The main advantage of

pay order is that it cannot be dishonored by the bank. Pay order can be endorsed if it

is not crossed. The payee may present pay Order for payment either over the counter

for cash payment or the payee may transfer credit to his account.

Process of Issuance of Pay Order

Cash Deposited or gives Cheque in favor of HBL

Fill Application Form for Pay Order and signed by Applicant

Entry in Bank Smart

Bank Issue a Pay Order after recovering Charges (2 Copies) which is signed

by two officers

Do necessary Vouchering and Take Signature of Applicant at the Place of

received Instrument

Copy of Pay Order is given to customer

Copy is for Filing Purpose

Uploaded by Mudassar

32

Forth week of internship

My fourth week of internship was in INSURANCE department.

HBL and New Jubilee Life Insurance Company Limited (NJLI) introduce

Amaan (Retirement plan) and Tabeer (Child education & marriage). These products

have been designed keeping HBLs customers base as the focus and will provide life

insurance along with an investment option.

Amaan: (Retirement Plan)

Amaan is a pension plan that provides an opportunity for growth through

investment in a balanced portfolio with post-retirement income benefit. The plan

covers life insurance and gives attractive return on investment to its customers.

Eligible Age 18-60 years

Minimum Payment RS 2000 per month

Minimum Age to exercise pension option 55 Years

Benefits on accidental death

RS 800,000 will be paid along with other

benefits.

Benefits on death

RS 200,000 will be paid along with other

benefits

Partial Withdrawals Allowed

Maturity Benefits

Two Options available

1. Policy can be cashed in total

2. Pension can be received for life

Tabeer: (Child Education & marriage Plan)

Tabeer is a plan that provides parents with means to accumulate a fund over a

period of time which can be used to pay for a childs education or marriage. Plans are

available for both under & over 45 years of age.

Eligible age 18-60 years

Minimum payments RS 3000 per month

Benefit of accidental death In addition to other benefit, RS 500,000

will be paid for the marriage of the

nominated female child, given that

female child is at least 18 years of age.

Uploaded by Mudassar

33

Partial withdrawals Allowed

Maturity benefits Two options available:

1. Policy can be cashed in total

2. Funds are paid back as per policy

holders designated time period.

Fifth week of internship

My fifth week of internship was in Cash department.

Cash department:

The cash department is the most important department of the bank. It receives

cash from customers and then deposits it into the accounts of the customers and

maintained their balances.

The officers in this department are called casher and there were three chasher at the

counter. This department involves in two activates: -

1. Deposit cash in customers account (Collection of deposits, Utility bills and

collection of other funds)

2. Make payments from customers account (Payment of Cheques, Remittances

etc)

Cash Payment Procedure:

Following steps are involved in paying the cheques to customers:

First of all they check the balance of the account that weather there is credit

balance in the account available or not?

Then they verify the signatures from the specimen card, which had been given

by the account-opening department at the time of account opening.

Then cheque series is checked on the computer.

Finally they pay the check to the customer.

SPECIAL CONSIDERATIONS:

When cheque is received for payment special care is taken about the following

things.

Amount in figure and words is same

Signature at the back of the cheque

Signature of the account holder

No cross or cutting in figures

Date of presented cheque

Uploaded by Mudassar

34

If anything wrong then cheque is dishonored and a lip would be attached with the

cheque named as Reason for Dishonor.

Procedure of Receiving Cash:

For depositing the cash into customers account there is need to fill the pay in

slip. The pay is lip contains the related details of the transaction. This pay is slip

contains the date: account No A/C title, particulars, amount being deposited and

details of cash. There are two portions in the pay in slip. The depositor signs the part

of the slip that is retained by the bank to show the acceptance of the entries made in

the slip. The cashier is responsible to receive both pay in slip and cash from the

depositor. After matching the amount with figures the cashier fills the cash voucher

received record sheet and assigns a voucher no. and post his signatures on both part of

the voucher and post stamps on the slip. One part of the slip is then returned to the

customer and other to the computer operator.

Posting In Computer:

Then the officer posts the transaction entries in computerized ledger. After posting

these entries computer displays balance before and after posting. Computer operator

assigns the stamp POSTED on the voucher. He manually inspects the entries of

ledger and voucher. If both tallied he signs the ledger and put a mark of cancellation

on the voucher.

At the end of the day cashier is responsible to maintain the cash balance book. The

cashbook contains the date, opening balance, detail of cash payment and received in

figures Rs. And closing balance. The figures of receipt and payment cash are entered

into the cashbook and the closing balance of cash is drawn.

CASH RELATED BOOKS

The following books are maintained din the Cash Department:

1. Receiving Cash Book

2. Paying Cash Book

3. Token Book

4. Scroll Book

5. Cash Balance Book

When cash is received in counter, it is entered in the Scroll Book and Receiving

Cashier Book. At the close of the day, there are balanced with each other.

When the cheque or any negotiable instrument is presented at counter for

payment, it is entered in the token book and token is issued to the customer. The token

clerk and the Cashier make entries in the paying book and payment is made to payee.

At the close of day, the Token Book and Paying Cashier Book are balanced.

The consolidated figure of receipt and payment of cash is entered into eh cash

balance book and drawn closing balance of cash.

Opening Balance + Receipts Payments = closing Balance.

This is very important department because cash is the most liquid asset and

mostly frauds are made in this department, therefore, extra care is taken in this

department and nobody is allowed to enter or leave the area freely. Mostly, cash area

is grilled and its door is under supervision of the head of that department. All the

books maintained in this department are checked by an officer.

Uploaded by Mudassar

35

Sixth week of internship

In spend three days in Credit department and remaining two days in Marketing

department.

CREDIT DEPARTMENT

Advances are the most important source of earning for the banks. HBL is also

giving full attention towards this aspect and it is also obvious from the growing

portfolio of advances and from very low delinquency rate. The receipt portfolio of this

institution is in a very much better shape than other financial institutions of Pakistan

and the redit goes to the management and the staff who are related to this department.

Types of Commercial Credit

There are two type of finance according to this branch.

a. Running finance

b. Demand finance

a) Running Finance:

Running finance is most popular sort of credit facility given to clients. This is

mostly obtained for the purpose of working capital requirements. Client can draw

money even daily from the account but not more than the limit. In running finance, it

is not necessary that security would be in the procession of bank, but all important

documents of stocks, property etc, are in its possession.

Procedure of Issuing Running Finance

Whenever the client request the bank for the approval of running finance the

document are collected. After the collection of related document and verification from

the RCAD (regional credit administration department) issue the approval of finance

and after that amount transfer the loan account. There are many documents which are

necessary for the loan which are followings:

Application for loan facility

Under taking for appropriate utilization of facility

Standing instruction

Letter of arrangement

Uploaded by Mudassar

36

Letter of hypothecation of stock

Stock report monthly

Letter of continuity with promissory note

Agreement of finance

CIB statement

Personal Guarantee

Approval letter from HBL

Mortgage of building etc

Running Finance mostly given against the security of Hypothecation of stock or

mortgage of building.

b) Demand Finance/Advance Salary

This type of advance given to government employee after the approval from the

government body. The installment of loan is deducted from the salary of person every

1

st

date of month. There are following document which are required for the granting

the case of advance salary.

Application for demand finance

Proposal for advance salary

Disbursement authorization certificate

CIB statement

Confidential statement

Letter of arrangement

Letter of authority

Personal Guarantee

Approval letter from RCAD etc..

Only two type of advance is granted in the branch of Khushab.

AGRICULTURAL FINANCE:

Purpose of finance:

Four renowned companies of the country such as Noon Group, Pak Kuwait,

PSO and Angro Service have established a joint venture company in the name of the

Agrimall (Pvt) Lted to provide agro services under one roof through its Franchisees.

The Agrimall (Pvt) Ltd has approached our Bank to provide financial help to their

franchisees to establish and run these Agrimalls under their specialized management

throughout the country. HBL has launched a kissan Dost Agrimall Finance Scheme.

All facilities required by the Franchisees of the Agrimall (Pvt) Ltd will be provided

through this scheme. The farmers, who will be the clients of Franchisees, will also be

provided production loans through Banks Kissan Dost Agriculture Finance Scheme

(For purchase of inputs).

The Schemes are:

Kissan Dost Agricultural Finance Scheme

Kissan Dost Tractor Finance Scheme

Kissan Dost Mechanization Support Scheme

Kissan Dost Farm Transport Scheme

Kissan Dost Live Stock Scheme etc

Uploaded by Mudassar

37

Procedure for issuance of agriculture loan

Kissan apply for loan facility the branch officer after the collection of related

document and verification from the RCAD (Regional Credit Administration

Department) issue the approval of finance and after that amount transfer to the loan

account.

There are many documents which are necessary for the Agriculture Credit which

are followings:

Application for Agriculture credit facility

Charge on agriculture land through Agri. Pass Book

Liquid Security in the shape of Bank Fixed Deposited

One personal guarantee of reputable person

Two written satisfactory market checking reports.

Insurance documents

Agreement of Finance

CIB statement

Approval letter from HBL etc

The documents for kissan dost agriculture schemes are differ from scheme to scheme.

Such types of schemes are providing farmers a real plate form to accelerate. Some

provisions related kissan Dost Agricultural Finance Scheme are:

Purpose

Provision of financial facility to farmers for purchase of inputs i.e seed, fertilizer,

pesticides, fungicides etc.

Facility Amount

Maximum of Rs: 500000 according to per acre limit of the crop. (different case to

case)

Security

Charge on Agriculture Land through Agriculture Pass Book.

One personal guarantee of reputable person.

Lease tractor (to be registered in the name of bank)

Tow written satisfactory market checking reports

Insurance

The borrower will have to arrange life assurance inder the Banks charge. Assets

insurance (i.e. tractor)

Mark-up

Average six months KIBOR +4.0% with floor of 16% per annum.

Repayment

10 qual half yearly installments (differ case to case)

MARKETING DEPARTMENT

The marketing department of the Habib Bank Ltd, Jalalpur Bhattian branch is

doing wonderful job. Because of competition in market there are many other Banks

existing in the market. So at that time Habib Bank Ltd. Also run a marketing

campaign especially in business filed and salary persons. Habib Bank Ltd. Uses a

marketing strategy with different way and different scheme.

Uploaded by Mudassar

38

7

th

and 8

th

Week Of Internship:

In 7

th

and 8

th

week of I worked almost on all seats randomly. I also collect

necessary data which can help me in preparation of this report.

Duties as an internee:-

I started my internship at HBL Jalalpur Bhattian branch here I performed different

duties as on follows: -

Issuance of cheque book

Posted cheque book in the register

Sorting out the vouchers

Fill the slips

Fill of account opening form

Filling of ATM card form

Debit voucher

Credit voucher

Filling of online form

Filling of cheque book

Issue cards

Form for demand draft

Letter of thanks

Unclaimed letter

Stock report

List of new accounts

Verification of NIC

Uploaded by Mudassar

39

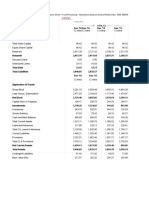

Financial Analysis:

Financial Statements:

Habib Bank Limited

Profit & Loss Account

Uploaded by Mudassar

40

Habib Bank Limited

Balance Sheet

2007 2008 2009 2010 2011

Mark up/Return/Interest earned 50481021 63376047 76076347 81325028 98580423

Mark up/Return/Interest expensed -19153957 -26525556 -33405813 -34330255 -42182220

Net mark-up/Interest income 31327064 36850491 42670534 46994773 56398203

Provision against non-performing loans and advances net 8238227 6904919 8794560 7602440 6687555

Provision against off balance sheet obligations -54626 372598 -513961 30895 -9141

Provision against diminution in the value of investments -84310 1909887 346495 -47671 237083

Bad debts written off directly - - - - -

8099291 9187404 9089659 7585664 6925497

Net mark up/interest income after provisions 23227773 27663087 33580875 39409109 49472706

Non Mark-up/Interest Income:

Fee, commission and brokerage income 3420051 4518408 5316479 5432706 6085970

Income/Gain on investments 2472663 1300975 597018 343252 434606

Share of profit of associates and joint venture - - - 713678 1081358

Gain on sale of securities - - - 316823 542118

Unrealised (loss) / gain on held for sale securities - - - 6409 -36820

Income from dealing in foreign currencies 1487374 2374318 1913115 3189333 3756094

Other income 2643076 3088994 3333000 2760230 2919535

Total non mark-up/interest income 10023164 11282659 11159612 12762431 14782861

33250937 38945782 44740487 52171540 64255567

Non Mark-up/Interest expenses:

Administrative expense 1829279 21425361 22745955 24252960 29433961

Other provisions/write offs net -276111 200163 210190 178148 -242427

Other Charges 85152 64751 3540 178700 77588

Worker welfare fund 323575 399166 521702 665047

Total non mark-up/interest expenses 18106320 22013850 23,358,851 25131510 29934169

Profit Before Taxation 15144617 16931932 21381636 27040030 34321398

Taxation:

Current 7220717 8308611 8095642 9698783 10459376

Prior Year 1668562 233100 -1095355 696908 28264

Deferred -3828699 -2473891 980600 -390041 1500736

5060580 6067820 7980887 10005650 11988376

Profit After Taxation 10084037 10864112 13400749 17034380 22333022

Profit After Taxation Attributable to:

Equity holder of the bank 10000231 10774584 13389452 16816179 22189763

Minority interest 83806 79009 90230 116475 57063

Minority investor of HBL Funds 10519 -78933 101726 86196

10084037 10864112 13400749 17034380 22333022

Basic and diluted earnings per share 13.18 11.83 14.7 15.26 20.13

Rupees (000)

Uploaded by Mudassar

41

Horizontal Analysis: -

Comparison of two or more years financial data is known as horizontal analysis or

trend analysis.

The goal of horizontal analysis is to compare the figures of the current period with

that of the past period. It helps the company and its share holders to analyze their

performance and final out areas of improvement.

Habib Bank Limited

2007 2008 2009 2010 2011

ASSETS

Cash and balances with treasury banks 55487664 56533134 79839836 81640246 103399623

Balances with other banks 27020704 39364297 40366687 37413185 47349505

Lendings to financial institutions 1628130 6193787 5352873 30339344 41581029

Investments 177942251 129833446 216467532 254909116 418604147

Advances 382172734 456355507 454662499 459750012 457367656

Other assets 27346111 34588444 41116582 34920007 44808703

Operating fixed assets 13780555 14751252 16766668 16155290 19167654

Deferred tax assets 6613372 12186848 9205944 9,572,203 7275888

691991521 749806715 863778621 924699403 1139554205

LIABILITIES

Bills payable 15418230 9828082 10041542 9775093 13894502

Borrowing from financial institutions 58994609 46961165 52542978 40459860 39473670

Deposits and other accounts 531298127 597090545 682750079 747374799 933631525

Sub-ordinated loans 3100000 3954925 4212080 4281835 5036100

Liabilities against assets subject to finance lease

Other liabilities 19943126 25663411 29862144 26557045 37931420

Deferred tax liability

628754092 683498128 779408823 828448632 1029967217

NET ASSETS 63237429 66308587 84369798 96250771 109586988

REPRESENTED BY:

Shareholders Equity

Share Capital 6900000 7590000 9108000 10018800 11020680

Reserve 19821455 23658044 27527380 29355555 32145755

Unappropriated Profit 28341670 31933178 38498335 47467704 56980697

Total equity attributable to the equity holders of the bank 55063125 63179222 75133715 86842059 100,147,132

Minority interest 965642 890099 1143241 1212656 1236290

Surplus or revaluation of assets-net of deferred tax 7208662 2239266 8092842 8196056 8203566

63237429 66308587 84369798 96250771 109586988

691991521 749806715 863778621 924699403 1139554205

Rupees (000)

Uploaded by Mudassar

42

Balance Sheet

Horizontal Analysis/Trend Analysis

Uploaded by Mudassar

43

Analysis: -

There is a rapid increase in the cash and balances with treasury banks.

There is a decrease in the balances with other banks in the year of 2010. But

after and before it shows increasing trend.

On the other hand, lending to financial institutions is weaving every year upto

2008 and after it shows increasing trend.

Other assets have also increased as compared to base year.

There is an overall increase in assets.

The Bank has paid all the tax liabilities. Now there is no outstanding tax of the

bank.

Though the assets have increased but the decrease in liabilities is more then

increase in assets after 2008.

The main reason of decrease in liabilities is deposit and other accounts.

There is a prominent increase in net assets.

Uploaded by Mudassar

44

Habib Bank Limited

Horizontal /Trend Analysis

Profit & Loss Account

Uploaded by Mudassar

45

Analysis: -

There is a positive increase in net markup income.

Total non mark-up income & total no mark-up expenses, both have increasing

trends.

In fee, commission and brokerage income, there is increasing trend.

There is also an increasing trend in administrative expenses.

Uploaded by Mudassar

46

Vertical Analysis: -

Technique for indentifying relationship between items in the same financial statement

by expressing all amounts as a percentage of the total amount taken as look is known

as vertical or common size analysis.

In a balance sheet, for example, cash and other assets are shown as a percentage of the

total assets and in the income statement cash expense is shown as a percentage of

sales revenue.

Habib Bank Limited

Vertical/Common Size Analysis

Profit & Loss Account

Uploaded by Mudassar

47

Uploaded by Mudassar

48

Analysis: -

Mark up income is taken as a base for the vertical analysis of profit and loss

account.

In 2011,mark up income is higher as compared to previous years.

As compared to non-markup income, non mark up expenses are high in the

year 2011.

Fee, commission & brokerage remained very low/nominal throughout the

period.

Profit after taxation is 20% in 2007, but it is 23% in 2011 which shows an

increasing trend in profit.

Uploaded by Mudassar

49

Habib Bank Limited

Vertical/Common Size Analysis

Balance Sheet

Uploaded by Mudassar

50

Analysis: -

In the year 2007, out of total assets of 100%, liabilities and equity are 91% and

9% respectively as detailed below:

Assets = Liabilities + Equity

100 = 91 + 9

In assets, the largest part is from advances that is 40% out of 100%.

The second largest portion is investment.

Lending to financial institution is very minor / meager as compare to

advances.

Liabilities of the bank are more than its equity.

Uploaded by Mudassar

51

Ratio Analysis

Meaning and Definition of Ratio Analysis: -

Ratio analysis is a widely used tool of financial analysis. It is defined as The

systematic use of ratio to interpret the financial statements so that he strength and

weaknesses of a firm as well as its historical performance and current financial

condition can be determined. The term ratio refers to the numerical or

quantitative relationship between two variables.

Significance or Importance of Ratio Analysis: -

1. It Helps in Evaluating the Firms Performance: -

With the help of ratio analysis conclusion can be drawn regarding several aspects

such as financial health, profitability ratio points out the operating efficiency has utilized

the firms assets correctly, to increase the investors wealth. It ensure a fair return to its

owners and secures optimum utilization of firms assets.

2. It Helps in Inter-Firm comparison: -

Ratio analysis helps in inter-firm comparison by providing necessary data. An inter-

firm comparison indicates relative position. It provides the relevant data different

departments. It comparison shows a variance, may be identified and if results are

negative, the action may be initiated immediately to bring them in line.

3) It simplifies Financial Statement: -

The information given in the basic financial statements servers no useful purpose

unless it is interrupted and analyzed in some comparable terms the ration analysis is one

of the tools in the hands of those who want to know something from the financial

statements in the simplified manners.

4) It Help in Determining the Financial Position of the Concern: -

Ratio analysis facilitates the management to know whether the firms financial

position is improving the years by setting a trend with the help of ratios. The analysis

with the help of ratio analysis can know the direction of the trend of strategic task of

planning, forecasting and controlling.

5) It Helps in budgeting and Forecasting: -

Accounting ratios provide a reliable data, which can be compared, studiedly and

analyzed these ration provide, sound footing for future prospective. The ratios can also

serve as a basis for preparing budgeting future line of action.

6) Liquidity Position;-

With the help of ratio analysis conclusions can be drawn regarding the liquidity

position of the firm. The liquidity position of a firm would be satisfactory if it is able to

meet its current obligation when they become due. The ability to meet short term

liabilities is reflection in the liquidity ratio of firm.

7) Long Term Solvency: -

Ration analysis is important for assessing the long term financial ability of the firm.