Professional Documents

Culture Documents

Home Depot in The New Millennium

Uploaded by

ElaineKong0 ratings0% found this document useful (0 votes)

92 views3 pagesHome Depot new Millenium

Original Title

Home Depot in the New Millennium

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHome Depot new Millenium

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

92 views3 pagesHome Depot in The New Millennium

Uploaded by

ElaineKongHome Depot new Millenium

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 3

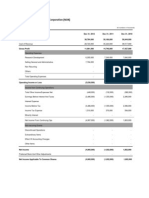

Income Statement ($MM)

Year ended January 31 1999 2000 2001

Net Sales 30,219 38,434 45,738

Cost of Merchandise Sold 21,614 27,023 32,057

Gross Profit 8,605 11,411 13,681

Operating Expenses

Selling and Store Operating 5,341 6,832 8,513

Pre-Opening 88 113 142

General and Administrative 515 671 835

Non-Recurring Charge

Total Operating Expenses 5,944 7,616 9,490

Operating Income 2,661 3,795 4,191

Interest and Investment Income 30 37 47

Interest Expense (37) (28) (21)

Interest, net (7) 9 26

Earnings Before Income Taxes 2,654 3,804 4,217

Income Taxes 1,040 1,484 1,636

Net Earnings 1,614 2,320 2,581

Basic Earnings Per Share 0.73 1.03 1.11

Diluted Earnings Per Share 0.71 1.00 1.10

Weighted Average Number of

Common Shares Outstanding 2,206 2,244 2,315

Balance Sheet ($MM)

Year ended January 31 1999 2000 2001

Assets

Cash and Cash Equivalents 62 168 167

Short-Term Investments - 2 10

Receivables, net 469 587 835

Merchandise Inventories 4,293 5,489 6,556

Other Current Assets 109 144 209

Total Current Assets 4,933 6,390 7,777

Property and Equipment

Land 2,739 3,248 4,230

Buildings 3,757 4,834 6,167

Furniture, Fixtures and Equipment 1,761 2,279 2,877

Leasehold Improvements 419 493 665

Construction in Progress 540 791 1,032

Capital Leases 206 245 261

9,422 11,890 15,232

Less Accumulated Depreciation and Amortization 1,262 1,663 2,164

Net Property and Equipment 8,160 10,227 13,068

Cost in Excess of the Fair Value of Net Assets Acquired 268 311 314

Other 104 153 226

Total Assets 13,465 17,081 21,385

Liabilities and Stockholders' Equity

Accounts Payable 1,586 1,993 1,976

Accrued Salaries and Related Expenses 395 541 627

Sales Taxes Payable 176 269 298

Other Accrued Expenses 586 763 1,402

Income Taxes Payable 100 61 78

Current Installments of Long-Term Debt 14 29 4

Total Current Liabilities 2,857 3,656 4,385

Long-Term Debt, excluding current installments 1,566 750 1,545

Other Long-Term Liabilities 208 237 245

Deferred Income Taxes 85 87 195

Minority Interest 9 10 11

Total Liabilities 4,725 4,740 6,381

Stockholders' Equity

Common Stock 111 115 116

Paid-In Capital 2,817 4,319 4,810

Retained Earnings 5,876 7,941 10,151

Other (64) (34) (73)

Total Stockholders' Equity 8,740 12,341 15,004

Total Liabilities and Stockholders' Equity 13,465 17,081 21,385

Cash Flow Statement ($MM)

Year ended January 31 1999 2000 2001

CASH FLOW PROVIDED BY OPERATING ACTIVITY

Net Income (Loss) 1,614 2,320 2,581

Depreciation/Amortization 373 463 601

Net Incr (Decr) Assets/Liabs -131 -314 -416

Cash Prov (Used) by Disc Oper NA NA NA

Other Adjustments, Net 61 -23 30

Net Cash Prov (Used) by Oper 1,917 2,446 2,796

CASH FLOW PROVIDED BY INVESTING ACTIVITY

Fiscal Year Ending

(Incr) Decr in Prop, Plant -2,269 -2,494 -3,463

(Acq) Disp of Subs, Business -6 -101 -26

(Incr) Decr in Securities Inv 2 -2 -9

Other Cash Inflow (Outflow) 2 -25 -32

Net Cash Prov (Used) by Inv -2,271 -2,622 -3,530

CASH FLOW PROVIDED BY FINANCING ACTIVITY

Fiscal Year Ending

Issue (Purchase) of Equity 178 274 351

Issue (Repayment) of Debt 246 -246 754

Incr (Decr) In Borrowing -8 508 3

Dividends, Other Distribution -168 -255 -371

Other Cash Inflow (Outflow) NA NA NA

Net Cash Prov (Used) by Finan 248 281 737

Effect of Exchg Rate On Cash -4 1 -4

Net Change in Cash or Equiv -110 106 -1

Cash or Equiv at Year Start 172 62 168

Cash or Equiv at Year End 62 168 167

You might also like

- Statement of Operations For The Fiscal Year Ended January 2, 2011 RevenuesDocument5 pagesStatement of Operations For The Fiscal Year Ended January 2, 2011 RevenuesVasantha ShetkarNo ratings yet

- Balance Coca-Cola 2011Document4 pagesBalance Coca-Cola 2011AinMoraNo ratings yet

- Ford Motor Company Financial Analysis 2010-2012Document14 pagesFord Motor Company Financial Analysis 2010-2012aegan27No ratings yet

- Worldcom Financials 2000 2002 ADocument5 pagesWorldcom Financials 2000 2002 AmominNo ratings yet

- Merk v2Document19 pagesMerk v2Ardian WidiNo ratings yet

- TOKAI RIKA CO., LTD. and Consolidated SubsidiariesDocument1 pageTOKAI RIKA CO., LTD. and Consolidated SubsidiariesMartin BMartinNo ratings yet

- Komprehensif KonsolidasianDocument2 pagesKomprehensif KonsolidasianABDUL AjisNo ratings yet

- Macy's 10-K AnalysisDocument39 pagesMacy's 10-K Analysisapb5223No ratings yet

- Nokia Financial StatementsDocument5 pagesNokia Financial StatementsSaleh RehmanNo ratings yet

- Finals Output-AgadDocument16 pagesFinals Output-AgadClarito, Trisha Kareen F.No ratings yet

- 60 HK Food Investment 1Q2011Document17 pages60 HK Food Investment 1Q2011Lye Shyong LingNo ratings yet

- Annual Income Statement, Balance Sheet and Cash Flow for 2010-2009-2008Document5 pagesAnnual Income Statement, Balance Sheet and Cash Flow for 2010-2009-2008Zead MahmoodNo ratings yet

- 3Q14 Financial StatementsDocument58 pages3Q14 Financial StatementsFibriaRINo ratings yet

- SMC Financial StatementDocument4 pagesSMC Financial StatementHoneylette Labang YballeNo ratings yet

- Sony Corp IncomeDocument1 pageSony Corp IncomePriyank ShahNo ratings yet

- Puma Energy Results Report q4 2016Document8 pagesPuma Energy Results Report q4 2016KA-11 Єфіменко ІванNo ratings yet

- Dr. Reddy's 2009Document3 pagesDr. Reddy's 2009Narasimhan SrinivasanNo ratings yet

- Financial Analysis ToolDocument50 pagesFinancial Analysis ToolContessa PetriniNo ratings yet

- 04 Pfizer AnalysisDocument5 pages04 Pfizer AnalysisKapil AgarwalNo ratings yet

- DemonstraDocument75 pagesDemonstraFibriaRINo ratings yet

- TSAU - Financiero - ENGDocument167 pagesTSAU - Financiero - ENGMonica EscribaNo ratings yet

- Particulars: Gross ProfitDocument2 pagesParticulars: Gross ProfitpreetilakhotiaNo ratings yet

- Four Year Financial Performance ReviewDocument15 pagesFour Year Financial Performance ReviewRahmati RahmatullahNo ratings yet

- Consolidated First Page To 11.2 Property and EquipmentDocument18 pagesConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564No ratings yet

- Working Capital of Hindalco Industries LTD For THE YEARS 2009-2013Document30 pagesWorking Capital of Hindalco Industries LTD For THE YEARS 2009-2013VaibhavSonawaneNo ratings yet

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Document5 pagesConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryNo ratings yet

- IT Return IT1 WithAnnexure 8432374Document9 pagesIT Return IT1 WithAnnexure 8432374just_urs207No ratings yet

- DCF Valuation and WACC CalculationDocument1 pageDCF Valuation and WACC CalculationJennifer Langton100% (1)

- 155.ASX IAW Aug 16 2012 16.33 Preliminary Final ReportDocument14 pages155.ASX IAW Aug 16 2012 16.33 Preliminary Final ReportASX:ILH (ILH Group)No ratings yet

- Sony Corporation Financial StatementDocument4 pagesSony Corporation Financial StatementSaleh RehmanNo ratings yet

- 2011 Financial Statements NESTLE GROUPDocument118 pages2011 Financial Statements NESTLE GROUPEnrique Timana MNo ratings yet

- ROE NI/EBT X EBT/EBIT X Sales/Total Assets X Total Assets/Common EquityDocument6 pagesROE NI/EBT X EBT/EBIT X Sales/Total Assets X Total Assets/Common Equityasadguy2000No ratings yet

- Apple Inc: FORM 10-QDocument76 pagesApple Inc: FORM 10-Qwill2222No ratings yet

- FSA ProjectDocument59 pagesFSA ProjectIslam AbdelshafyNo ratings yet

- 40 CrosDocument11 pages40 CrosAijaz AslamNo ratings yet

- Westfield WDC 2011 FY RESULTS Presentation&Appendix 4EDocument78 pagesWestfield WDC 2011 FY RESULTS Presentation&Appendix 4EAbhimanyu PuriNo ratings yet

- Yahoo Inc!: Financial Statement For The Year Ended As atDocument16 pagesYahoo Inc!: Financial Statement For The Year Ended As atRohail AmjadNo ratings yet

- Hannans Half Year Financial Report 2012Document19 pagesHannans Half Year Financial Report 2012Hannans Reward LtdNo ratings yet

- MU PLC Annual Report 2002 Financial StatementsDocument21 pagesMU PLC Annual Report 2002 Financial StatementsNurlisaAlnyNo ratings yet

- Tiso Blackstar Annoucement (CL)Document2 pagesTiso Blackstar Annoucement (CL)Anonymous J5yEGEOcVrNo ratings yet

- 2014 IFRS Financial Statements Def CarrefourDocument80 pages2014 IFRS Financial Statements Def CarrefourawangNo ratings yet

- Hinopak Motors Limited Balance Sheet As at March 31, 2013Document40 pagesHinopak Motors Limited Balance Sheet As at March 31, 2013nomi_425No ratings yet

- Balance Sheet: As at June 30,2011Document108 pagesBalance Sheet: As at June 30,2011Asfandyar NazirNo ratings yet

- 2006 To 2008 Blance SheetDocument4 pages2006 To 2008 Blance SheetSidra IrshadNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- Final Report - Draft2Document32 pagesFinal Report - Draft2shyamagniNo ratings yet

- San Miguel Corporation separate financial statements for 2021 and 2020Document1 pageSan Miguel Corporation separate financial statements for 2021 and 2020HUPGUIDAN, GAUDENCIANo ratings yet

- Kuoni Gb12 Financialreport en 2012Document149 pagesKuoni Gb12 Financialreport en 2012Ioana ElenaNo ratings yet

- Integrated Micro-Electronics: Q2 Results (Press Release)Document17 pagesIntegrated Micro-Electronics: Q2 Results (Press Release)BusinessWorldNo ratings yet

- National Foods by Saqib LiaqatDocument14 pagesNational Foods by Saqib LiaqatAhmad SafiNo ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- Example of Financial TemplateDocument2 pagesExample of Financial Templatezeus33No ratings yet

- Analysis of Financial Statements: Bs-Ba 6Document13 pagesAnalysis of Financial Statements: Bs-Ba 6Saqib LiaqatNo ratings yet

- Assignment Ratio - A4 SizeDocument4 pagesAssignment Ratio - A4 SizekakurehmanNo ratings yet

- Consolidated Financial Statements Dec 312012Document60 pagesConsolidated Financial Statements Dec 312012Inamullah KhanNo ratings yet

- Analisis Laporan Keuangan PT XL AXIATA TBKDocument9 pagesAnalisis Laporan Keuangan PT XL AXIATA TBKmueltumorang0% (1)

- HUL Stand Alone StatementsDocument50 pagesHUL Stand Alone StatementsdilipthosarNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Week 1 News V1Document5 pagesWeek 1 News V1ElaineKongNo ratings yet

- Calculating AHC's Cost of Capital Using CAPMDocument9 pagesCalculating AHC's Cost of Capital Using CAPMElaineKongNo ratings yet

- Practice Mid-Session Exam MCQs IMF World Bank Currency OptionsDocument5 pagesPractice Mid-Session Exam MCQs IMF World Bank Currency OptionsElaineKongNo ratings yet

- The Financial Services Industry: Depository InstitutionsDocument39 pagesThe Financial Services Industry: Depository InstitutionsElaineKongNo ratings yet

- Case Study Dot Com CrashDocument2 pagesCase Study Dot Com CrashElaineKongNo ratings yet

- New Text DocumentDocument1 pageNew Text DocumentElaineKongNo ratings yet

- Week 2 Class Topic: Governance: Emerging Markets Review, 15 (2013) 1-33Document1 pageWeek 2 Class Topic: Governance: Emerging Markets Review, 15 (2013) 1-33ElaineKongNo ratings yet

- Case Study Dot Com CrashDocument2 pagesCase Study Dot Com CrashElaineKongNo ratings yet

- FINS3630 Finals Formula Sheet 2Document2 pagesFINS3630 Finals Formula Sheet 2ElaineKongNo ratings yet

- NotesDocument3 pagesNotesElaineKongNo ratings yet

- Case Study Dot Com CrashDocument2 pagesCase Study Dot Com CrashElaineKongNo ratings yet

- FINS3630 Finals Formula SheetDocument3 pagesFINS3630 Finals Formula SheetElaineKongNo ratings yet

- Brain Chip ReportDocument30 pagesBrain Chip Reportsrikanthkalemla100% (3)

- Offer Letter for Tele Sales ExecutiveDocument3 pagesOffer Letter for Tele Sales Executivemamatha vemulaNo ratings yet

- Contract Costing and Operating CostingDocument13 pagesContract Costing and Operating CostingGaurav AggarwalNo ratings yet

- Technical Contract for 0.5-4X1300 Slitting LineDocument12 pagesTechnical Contract for 0.5-4X1300 Slitting LineTjNo ratings yet

- Notes Socialism in Europe and RussianDocument11 pagesNotes Socialism in Europe and RussianAyaan ImamNo ratings yet

- PIA Project Final PDFDocument45 pagesPIA Project Final PDFFahim UddinNo ratings yet

- Detailed Lesson Plan in Bread and Pastry Production NC IiDocument3 pagesDetailed Lesson Plan in Bread and Pastry Production NC IiMark John Bechayda CasilagNo ratings yet

- Lesson 2 Globalization of World EconomicsDocument17 pagesLesson 2 Globalization of World EconomicsKent Aron Lazona Doromal57% (7)

- Tadesse JaletaDocument160 pagesTadesse JaletaAhmed GemedaNo ratings yet

- CSR of Cadbury LTDDocument10 pagesCSR of Cadbury LTDKinjal BhanushaliNo ratings yet

- Markle 1999 Shield VeriaDocument37 pagesMarkle 1999 Shield VeriaMads Sondre PrøitzNo ratings yet

- Heidegger - Nietzsches Word God Is DeadDocument31 pagesHeidegger - Nietzsches Word God Is DeadSoumyadeepNo ratings yet

- MiQ Programmatic Media Intern RoleDocument4 pagesMiQ Programmatic Media Intern Role124 SHAIL SINGHNo ratings yet

- Note-Taking StrategiesDocument16 pagesNote-Taking Strategiesapi-548854218No ratings yet

- (Class 8) MicroorganismsDocument3 pages(Class 8) MicroorganismsSnigdha GoelNo ratings yet

- Codilla Vs MartinezDocument3 pagesCodilla Vs MartinezMaria Recheille Banac KinazoNo ratings yet

- Solidworks Inspection Data SheetDocument3 pagesSolidworks Inspection Data SheetTeguh Iman RamadhanNo ratings yet

- AI Capstone Project Report for Image Captioning and Digital AssistantDocument28 pagesAI Capstone Project Report for Image Captioning and Digital Assistantakg29950% (2)

- Opportunity, Not Threat: Crypto AssetsDocument9 pagesOpportunity, Not Threat: Crypto AssetsTrophy NcNo ratings yet

- 2020 Book WorkshopOnFrontiersInHighEnerg PDFDocument456 pages2020 Book WorkshopOnFrontiersInHighEnerg PDFSouravDeyNo ratings yet

- Casey at The BatDocument2 pagesCasey at The BatGab SorianoNo ratings yet

- TAX & DUE PROCESSDocument2 pagesTAX & DUE PROCESSMayra MerczNo ratings yet

- HRM in A Dynamic Environment: Decenzo and Robbins HRM 7Th Edition 1Document33 pagesHRM in A Dynamic Environment: Decenzo and Robbins HRM 7Th Edition 1Amira HosnyNo ratings yet

- Maternity and Newborn MedicationsDocument38 pagesMaternity and Newborn MedicationsJaypee Fabros EdraNo ratings yet

- My PDSDocument16 pagesMy PDSRosielyn Fano CatubigNo ratings yet

- National Family Welfare ProgramDocument24 pagesNational Family Welfare Programminnu100% (1)

- Page 17 - Word Connection, LiaisonsDocument2 pagesPage 17 - Word Connection, Liaisonsstarskyhutch0% (1)

- Transformation of Chinese ArchaeologyDocument36 pagesTransformation of Chinese ArchaeologyGilbert QuNo ratings yet

- MBA Third Semester Model Question Paper - 2009: Management and Organization Development-MU0002 (2 Credits)Document11 pagesMBA Third Semester Model Question Paper - 2009: Management and Organization Development-MU0002 (2 Credits)ManindersuriNo ratings yet

- MVD1000 Series Catalogue PDFDocument20 pagesMVD1000 Series Catalogue PDFEvandro PavesiNo ratings yet