Professional Documents

Culture Documents

Actuaries 201213

Uploaded by

Ahmed Raza0 ratings0% found this document useful (0 votes)

172 views122 pagesactuarial sciences

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentactuarial sciences

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

172 views122 pagesActuaries 201213

Uploaded by

Ahmed Razaactuarial sciences

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 122

Do you want to work for one of the worlds largest actuarial employers?

Considering a

career in consulting? Then make your mark at Towers Watson.

We bring together professionals from around the world with expertise in their specialist

feld to deliver advice that gives our clients a clear path forward and helps them succeed.

We offer talented graduates actuarial career opportunities with fully funded and supported

study packages.

To learn more, visit us online at towerswatson.com/careers

Copyright 2012 Towers Watson. All rights reserved.

TW-EU-2012-27350. August 2012.

Towers Watson is an equal opportunities employer.

towerswatson.com

TW-EU-2012-27350 Inside careers advert_V01.indd 1 09/08/2012 13:49

In-depth career advice

Graduate & senior profiles

Salaries & career paths

Professional qualifications explained

Directory of graduate employers

WHATS INSIDE

Live jobs at www.insidecareers.co.uk/act

2

0

1

2

/

1

3

The definitive guide to a career as an actuary.

Jenny Elliott, Chair of the Career Committee,

The Actuarial Profession

A

C

T

U

A

R

I

E

S

ACTUARIES

THE ONLY GRADUATE CAREER GUIDE TO

2012/13

IN PARTNERSHIP WITH

your

actuarial career

starts here

FURTHER STUDY

REFERENCE TABLE

RECRUITMENT CONSULTANTS

EMPLOYER DIRECTORY

54

56

THE INSTITUTE & QUALIFICATIONS

Actuarial syllabus and exams

The UK Actuarial Profession

PwC - Associate 28

Aon - Trainee Pensions Actuary 26

Hymans Robertson - Actuarial Trainee 24

Guy Carpenter - Actuarial Analyst 22

GRADUATE PROFILES

HSBC - Head of Insurance Pricing 38

Prudential - Senior Qualifed Actuary 36

Friends Life - MCEV Reviewing Actuary

34

Mercer - Senior Consultant 32

SENIOR PROFILES

Jobs on offer: graduate training schemes 46

Internships: what to expect 44

Education required 42

FINDING THE RIGHT JOB

Fields of work 12

Salaries and benefts 11

Why become an actuary? 10

What is an actuary? 08

THE PROFESSION

CONTENTS

05 Introduction

The future of the pensions sector 16

FAQs 18

Key skills required by employers 50

VISIT OUR WEBSITE

For more advice, live jobs, internships,

actuarial forums, industry news and updates

Publisher

Cambridge Market Intelligence Ltd

The Quadrangle

49 Atalanta Street

London SW6 6TU

T: 020 7565 7900

F: 020 7565 7938

www.insidecareers.co.uk

Editorial

Editor

Laura McFarlane

Associate Publisher

The Actuarial Profession

Staple Inn Hall

High Holborn

London WC1V 7QJ

T: 020 7632 2100

www.actuaries.org.uk

Acknowledgments

We are indebted to the Actuarial

Profession for their support, in particular

to Jenni Hughes, Alison Jiggins and Barbara

Beebee for their help throughout the

preparation of the guide and for reviewing

the text for balance and accuracy.

ISBN 978-1-86213-169-9

Printed and bound in the UK by

Cambrian Printers, Aberystwyth

Design

Anna Kirkham

Bandbox Design

Ascend Creative Ltd

Copyright in individual articles 2012 the

authors, who have asserted their right to

be identifed as the author under s.7 of the

Copyright, Designs and Patents Act 1988.

The compilation 2012 Cambridge

Market Intelligence Ltd.

All rights reserved. No part of this

publication may be reproduced, stored

in a retrieval system or transmitted, in

any form or by any means electronic,

mechanical, photocopying, recording or

otherwise without the prior permission of

the copyright owner.

While every effort has been made to

ensure its accuracy, no responsibility for

loss occasioned to any person acting or

refraining from action as a result of any

material in this publication can be accepted

by the publisher or authors.

Inside Careers is an associate member of

The Association of Graduate Recruiters.

05

Philip Scott, President of the Institute and Faculty of Actuaries, introduces

the Inside Careers Guide to Actuaries, and outlines the many benefts and career

highlights that await graduates who choose to work in this industry.

INTRODUCTION

On behalf of the Institute and Faculty of

Actuaries, I am pleased to introduce the latest

edition of the Inside Careers Guide to Actuaries and

thank you for your interest in this exciting and

rewarding career.

In this guide you will fnd a wealth of information

about the Profession, our education system and

the range of employment opportunities. If the

work sounds appealing, please take the frst step

towards an actuarial career by applying to the

employers listed at the back of the guide, or

learning more by visiting www.actuaries.org.uk.

The Actuarial Profession represents the members

of the Institute and Faculty of Actuaries. While

the majority of our members come from the UK,

a signifcant number (41%) live and work overseas

and, if you join us, you will be joining a truly

global community.

If you are like me, deciding the direction in which

to take your career is both exciting and daunting.

With so many choices, it can sometimes be

diffcult to pin down exactly what will be the right

career path for you. No doubt you will want to

make sure that it all pays off.

A career as an actuary offers a wide range of

opportunities and challenges to those who want

to apply their skills in mathematics or statistics to

problems in the real world of business and fnance.

These skills give actuaries an unrivalled appreciation

of fnancial risk management, one of the most

fundamental but least understood areas of business.

Actuaries are able to analyse past events, assess

the present risks involved and model what could

happen in the future. They may then forecast

the long-term fnancial implications of business

decisions. The ability to stress test different

scenarios is invaluable to business planning.

Traditionally, actuaries have been heavily involved

in life insurance and pension scheme work. While

actuaries remain at the heart of those disciplines, the

range of what actuaries do is expanding dramatically.

Today, you will fnd actuaries in fnancial product

design, in investment management, in fnancial

modelling and in helping their clients harness the

power of new fnancial instruments to manage their

risks better. Outside these traditional areas, actuaries

are increasing their infuence in general insurance,

corporate fnance, banking and risk management.

Risk management is a signifcant growth area for

actuaries. The Actuarial Profession has its own

risk management qualifcation, the Chartered

Enterprise Risk Actuary (CERA), and for those

interested in pursuing a career in risk management,

an actuarys skill set provides the ideal base.

Actuarial work is especially suited to those who

enjoy solving problems by analysis, mathematics

and logical reasoning. Yet the challenge does not

end there communication and management

skills are vitally important if an actuary is to be

effective in what he or she does.

Many actuaries trained in the UK will spend some,

or all, of their career working abroad and the UK

qualifcation is highly valued all over the world.

Actuarial work provides a rewarding career in terms

of intellectual challenge, fnancial rewards and status.

There is no doubt in my mind that a career as an

actuary is exceptionally fulflling and the profession

continues to attract fresh new talent.

Introduction

For actuaries jobs & more info, visit www.insidecareers.co.uk/act

Philip Scott is President of the

Institute and Faculty of Actuaries.

THE PROFESSION

BACK TO CONTENTS

11

10

08

Mark Crail

12

FIELDS OF WORK

SALARIES AND BENEFITS

WHY BECOME AN ACTUARY?

WHAT IS AN ACTUARY?

Alex Jefferson

16

THE FUTURE OF THE PENSIONS SECTOR

18 FAQS

08

THE PROFESSION

BACK TO CONTENTS

An actuary is more than just a number cruncher. They not only have to be

good at maths but an innovative thinker and problem solver in order to help

companies manage their risk.

Actuaries analyse past and present data to solve

real business problems. A lot of actuaries work

is about risk management: assessing how likely

an event may be and the costs associated with it.

To make things more challenging, actuaries really

need to understand how businesses operate;

they need to keep up to date with legislative

changes, long-term demographic trends and have

general commercial and economic awareness.

Career paths

An actuarys early training has a split focus on

passing the professional exams and building

practical experience. Once qualifed many

actuaries go on to be practising specialists in

one of the traditional felds, with many actuaries

becoming senior managers in frms of consultants

or insurance companies.

There are many different career paths: some

actuaries specialise in technical research, whilst

others may focus more on commercial activities.

The different roles require different mixes

of skills, but whatever a particular actuarys

strengths, there will be a niche for them.

How do you become a qualifed actuary?

Passing the professional exams is the frst

hurdle to becoming an actuary, and this must

be coupled with at least three years practical

experience to fully qualify. It takes a lot of

hard work, so ensure you work towards your

actuarial qualifcations with a frm that really

supports you, meets the costs associated with

your exams and study, provides you with

study leave and also gives you the practical

experience you need to make your mark.

Beyond this you will need to develop the capacity

to give expert advice. Often this will involve dealing

with non-actuaries and the general public, so the

ability to communicate and articulate diffcult topics

to non-specialists is of paramount importance.

And the rewards?

Being an expert in such a complex area brings

great rewards. Actuaries pay and conditions

compare well with other leading professions.

The rewards of being an actuary are far

more than fnancial. It is a stimulating job that

challenges you to think at all times and offers you

the opportunity to make a positive impact on the

organisations and their employees.

Expert domains

The traditional areas in which actuaries operate

are: consultancy, investment, life and general

insurance and pensions. Actuaries are also

increasingly moving into other areas of the

fnancial sector such as risk management, banking

and capital project management, where their

analytical skills can be employed.

Consultancy

Actuarial consultancies offer a whole range

of services to their clients on issues such as

What is an actuary?

The different roles

require different mixes

of skills, but whatever

a particular actuarys

strengths, there will be a

niche for them.

09

For actuaries jobs & more info, visit www.insidecareers.co.uk/act

WHAT IS AN ACTUARY

acquisitions, mergers, corporate recovery

and fnancing capital projects. Many also

offer advice to employers and trustees who

run occupational pension schemes. In fact,

such consultancies are probably the biggest

employers of actuaries in the UK.

A successful consultant will work to develop

a real partnership with their client, allowing

them to gain an in-depth understanding of

commercial operations and business objectives.

Actuarial consultants also need to be able

to communicate effectively, often explaining

complex technical issues and ideas to all kinds

of people, whether they are fnance directors,

CEOs, shareholders or trustees.

Investment

In the area of investment, actuaries are involved

in a range of work such as: pricing fnancial

derivatives, working in fund management, or

working in quantitative investment research.

Often investment actuaries work in felds

where their understanding of insurance or

pension liabilities helps them to manage the

investment of the corresponding assets.

Insurance

The work carried out by actuaries in insurance

includes designing new insurance policies,

setting premium rates, calculating a companys

fnancial status (based on the policies already

sold) and answering technical queries from

policyholders. Insurance actuaries also

undertake detailed investigations of different

experiences such as how assets and expenses

have performed and the extent of different

types of claims for different types of insurance

policies (e.g. death claims for life insurance or

car theft for motor insurance).

Pensions

The work of actuaries is vital to the health

of pension schemes. Actuaries are heavily

involved in designing and advising occupational

pension schemes. This could be a formal

valuation for one persons benefits or for a

whole scheme with one million members.

As actuaries gain experience, they spend less

of their time working on the strictly technical

aspects, instead applying their expertise to

wider business challenges. These may include

advice on financial strategy advising a client

on remuneration policy, consultancy around

a corporate takeover and other large scale

projects. This demands proactive and creative

thinking, as well as technical prowess and

great interpersonal skills.

What next?

If you have found this overview interesting then

read the rest of this guide, where you will fnd

more information on all the areas that have been

touched on here.

As actuaries gain

experience, they spend

less of their time working

on the strictly technical

aspects, instead applying

their expertise to wider

business challenges.

BACK TO CONTENTS

10

THE PROFESSION

Intellectual challenge

An actuarial career is a very stable and secure

one, as our society will continue to demand

pensions and insurance whatever the state

of the economy. The actuarial environment

also offers constant intellectual challenge and

variety, requiring the application of a multi-

faceted skill set. To be successful you will need

to demonstrate excellent analytical thinking

and an ability to solve complicated fnancial

problems. Solid commercial and economic

understanding alongside the skills to interpret

and communicate complex information in a

clear way is also essential.

A prestigious industry

The Actuarial Profession in the UK is relatively

small compared to other professional bodies.

With over 23,000 members, you will become

part of a high-profle, prestigious and well

respected profession. You will work towards

a world-recognised qualifcation. The exam

syllabus refects the latest developments within

fnance and industry. It is not easy to qualify

and you must be willing to work hard to get

through the rigorous examinations alongside

performing well in your day job. On average

between 15-20 hours study at home in the

evenings and weekends are required per week.

This requires great focus, determination and an

ability to cope well under pressure. The training

can be undertaken at your own pace; the usual

time to qualifcation is between three to six

years, but could be longer.

Excellent study support and training

The help and support given by employers is

generous, although this will vary from employer

to employer. The training company provides a

great deal of assistance. The Actuarial Profession

can review any failed exams and give you pointers

as to what went wrong. Exam failure is a part of

life: very few get through all papers frst time.

It is important to assess what training support

and help is offered by the employer: how

much paid (or unpaid) study leave is given,

whether they pay for all the external tuition

and exam costs, what their attitude is to any

hiccups with exams, how varied the training

placements offered are and what the longer-

term opportunities are.

A wide range of opportunities

The range of opportunities within the

profession continues to grow. Actuarial

careers used to be found mainly in the life

insurance and non-life insurance industries.

Over half of our qualifed actuaries in the UK

now work in non-traditional areas. There are

some qualifed actuaries in the UK and over

half now work in these non-traditional areas.

Qualifed and trainee actuaries are now to be

found in investment management, corporate

fnance, liquidations, mergers and acquisitions,

derivatives, fund and asset management, project

fnance and risk assessment.

Well paid

Graduate entry salaries are offered from

25,000 to 35,000, newly qualifed actuaries

can command in excess of 55,000, and senior

positions can attract 100,000 plus. A very

satisfying and clearly defned career progression

is there for the taking for highly motivated and

driven individuals.

If youre looking for an opportunity to apply your mathematical skills to real life

problems, then an actuarial career could be for you.

Why become an actuary?

11

For actuaries jobs & more info, visit www.insidecareers.co.uk/act

SALARIES AND BENEFITS

What are the fnancial rewards for being an actuary? We ask Mark Crail from

XpertHR to provide us with an overview of expected earnings for this challenging

and prestigious profession.

Salaries and benefits

What can I earn?

XpertHR publish salary surveys for a number

of professions annually; the following results

come from their fndings from Salary Survey of

Actuaries and Actuarial Students October 2011.

Average earnings

Despite the economic gloom elsewhere, this

has been a good year to be an actuary. Basic

salaries increased by 5.5% in 2011, while average

earnings (which includes both basic pay and

earnings) went up by 10.3%.

Actuaries at all levels of the profession commonly

receive an annual bonus, with 86.6% receiving

a bonus in 2011, averaging 11,327. These are

obviously skewed towards more senior staff and

partners, but if you push yourself and perform

well you can progress quickly, getting your hands

on that bonus in the longer term.

Recruitment

We are pleased to reveal that of the consultancies

and companies who took part in the XpertHR

survey, 95% were recruiting qualifed actuaries

during Sept 10 Sept 11. So, get your CV up to

scratch and investigate your options by looking

over the Employer Directory.

Mark Crail is Head of Salary Surveys and HR

Benchmarking at Xpert HR. (www.xperthr.co.uk).

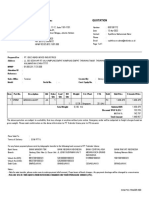

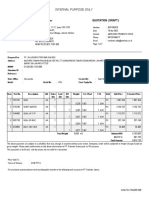

ACTUARIAL SALARIES BY SENIORITY

Responsibility level Average basic salary

Student Actuary 32,842

Actuary 46,515

Senior Actuary/Junior Consultant 59,836

Section Leader/Consultant 67,298

Section Manager/Senior Consultant 81,239

Department Manager/Managing Consultant 87,557

Function Head/Practice Head 110,747

Senior Function Head/Practice Director 134,343

Chief Actuary/Senior Partner 221,250

Source: Salary Survey of Actuaries and Actuarial Students - 2011-12, published by XpertHR Salary Surveys,

www.xperthr.co.uk.

BACK TO CONTENTS

BACK TO CONTENTS

12

THE PROFESSION

The business world today is becoming more complex, fraught with uncertainty

and often with conficting pressures. The need for a business both to perform

competitively, and to respect the interests of its customers and the economy in

which it operates, poses some particular problems. See how you can help tackle

these issues in the different areas of this profession.

Actuaries have the skills for tackling the risks and

uncertainties that fnancial businesses face in the

interest of both customers and owners.

As the skills of an actuary are increasingly

recognised, the range of employment

opportunities will increase. Traditionally

actuaries have worked in pensions, insurance

and investment. However, actuaries,

alongside the Profession, have sought new

opportunities to move into other areas of

business whilst at the same time maintaining

their presence in traditional employment

areas. Ageing populations, damages, finance,

genetics, healthcare, personal finance planning

and risk management are all new areas in

which the effective contribution of actuaries

has been recognised.

Where do actuaries work?

Of the 10,498 Fellows of the Profession, 72%

are based in the UK, 8% in the rest of Europe

and 20% in the rest of the world. 35% of

those Fellows work in Insurance, 37% work in

consultancy, 7% work in fnance and investment

and 4% work in the public sector and education,

as well as other newer areas such as industry.

Consultancy

Actuarial consultancies are the biggest employers

of actuaries in the UK. Many offer advice to

employers and trustees who run occupational

pension schemes. The 1995 Pensions Act made

it a statutory requirement for the trustees of

a pension scheme to appoint an actuary. The

advice given to clients covers a wide range

of topics, from setting up a new scheme, to

assessing the level of contribution to be paid by

the members and valuing the fund if the company

is to be taken over. Additionally, consultancies

will offer a range of services to their clients,

such as enterprise risk management, merger

and acquisition advice, corporate recovery and

fnancing capital projects.

The Government Actuarys Department (GAD)

provides advice to the Government via Royal

Commissions, as well as giving advice to other

government departments and a wide range of

public sector bodies, including local authorities

and the NHS. An important part of this work

concerns the occupational pensions for about

four million people via the operation of the

National Insurance Fund.

Fields of work

13

For actuaries jobs & more info, visit www.insidecareers.co.uk/act

FIELDS OF WORK

Insurance industry

Life insurance

Life insurance companies provide life insurance,

pensions and other fnancial services. Actuaries

are involved at all stages in the product

development and in the pricing, risk assessment

and marketing of the products. In addition,

actuaries fll key roles in fnancial management

and the investment of policyholders money by

developing strategies that ensure customers get

a good return.

It is currently a legislative requirement that each

UK life offce appoints one or more actuaries

to perform the actuarial function, advising

the frms directors on the frms ability to pay

claims and how to ensure that the life insurance

and pensions benefts from the many millions

of pounds invested by policyholders are secure.

Firms that have with-profts business must also

appoint one or more with-profts actuaries

to advise the frms directors on the use of

discretion in the management of with-profts

funds: in particular, the addition of bonuses to

policies, having regard to the fair treatment of

with-profts policyholders.

With recent legislation leading to more

private healthcare provision, insurance

companies are extending their range of

products to include medical insurance, critical

illness and disability insurance.

In an increasingly global business world, mergers

between life companies are becoming more

frequent. When life offces are bought and

sold or life funds merged, actuaries tend to be

retained by both sides.

General insurance

General insurance is a fast-growing area for

actuaries, both within insurance companies,

consultancies and at Lloyds of London, where

they have certain statutory duties. Many are

employed by consultancies which provide

services to insurers and Lloyds syndicates.

General insurance actuaries are also to be found

in reinsurance and broking operations. General

insurance includes personal insurance, such as

home and motor insurance, as well as insurance

for large commercial risks. As there are many

different factors that can affect the size and

number of claims, general insurance companies

employ actuaries to assist with their fnancial

management, in particular in connection with

premium rating and reserving.

Actuarial and statistical techniques are used

extensively in the analysis of often substantial

amounts of available data. Statistical models

are thus a key part of an actuarys work. This

analysis is then used to rate the risks and to

ensure that claims reserves are adequate to

meet the eventual settlement of insurance claims.

Terrorist attacks, Caribbean windstorms and

industrial diseases like asbestosis are all examples

of insurance liabilities where actuaries have been

integrally involved in estimating ultimate costs

into an uncertain future.

Finance and investment

Investment management

Actuaries have been involved in the feld of

investment management for decades. Indeed,

it is probably true to say that more people

see the word actuaries through the daily

stock exchange indices than through any other

Terrorist attacks,

Caribbean windstorms

and industrial diseases

are all examples of

insurance liabilities where

actuaries have been

integrally involved

BACK TO CONTENTS

14

THE PROFESSION

source. Actuaries are involved in buying and

selling assets, investment analysis and portfolio

management. In addition, actuarial techniques

are ideal for use in measuring investment

performance. Solving problems while making

correct investment decisions is a constant

stimulus. Many employers recognise the skills

that the training provides and have allowed

actuaries to develop these skills as well as

others, such as the skills of fnancial economists.

Actuaries are seeking to improve their tools

both in the development of valuation models and

in the refnement of traditional methods.

Corporate fnance

Although generally regarded as the province

of the investment banker, actuaries can add

value in this area. An actuarys basic skills in

forecasting and assessing risks are ideal for

estimating whether a capital project (e.g. for

a new hospital or a transport infrastructure

project) is fnancially viable. Employers might

include government departments, management

consultancies, or property companies

specialising in this area.

Banking

Actuaries are becoming increasingly involved

in banking. For example, some of the leading

insurance companies now have their own

established banking operations, with actuaries

flling some of the senior executive positions

for fnance and risk. The leading retail banks

are also increasingly employing actuaries, as

they recognise that the longer term approaches

advocated by actuaries can add value to

their businesses. As insurance companies

increasingly hedge their risks, we have seen

a corresponding increase in the demand for

actuaries from the investment banks that

provide the hedge products.

As the insurance and banking markets continue to

converge, we can expect to see the demand for

actuaries within banking felds continue to grow.

International opportunities

The UK qualifcation is highly valued throughout

the world. Of the qualifed members of the UK

profession, 41% are working internationally.

The Actuarial Profession works with other

international actuarial bodies to arrange

reciprocal recognition of the professional

qualifcations between the different bodies.

Most overseas opportunities arise in Australia,

continental Europe, India, New Zealand, Pakistan

and South Africa.

Hopefully this brief overview demonstrates the

variety of opportunities available. An actuarial

qualifcation is an excellent base for a business

career that is recognised worldwide.

Visit our NEW website, for an

even closer look at the actuarial

profession

NEW & latest vacancies

EVEN more employers

NEW employer Q&A sessions

BRAND-NEW actuarial forum

LATEST industry news & updates

EVENTS & presentations

Go to www.insidecareers.co.uk/act

Follow us

f

Get online...

BACK TO CONTENTS

16

THE PROFESSION

The pensions industry is no longer the slow moving, tried and tested one of years

ago. The actuaries of today (and tomorrow) will need to be sharper and more

innovative than ever if they are to fnd the solutions to ever more challenging

yet fascinating problems.

This article highlights the opportunities and

challenges that exist in the pensions sector

and what this could mean for the graduates and

actuarial careers of the future.

Changes in the sector

Actuarial techniques are continually evolving and

being applied in more and more sophisticated

ways. The ability to match up projects,

appropriate actuarial techniques and the needs of

your client requires an in-depth understanding of

both your specialism and your client.

The range of work has widened and the need to

communicate issues and solutions is a genuine

challenge. The world is taking more and more

notice of the need and diffculty of saving

for retirement. A key role for the pensions

actuaries of the future will lie in leading the way

to identifying, communicating and presenting

solutions to both clients, governments and to

the wider public.

Education and learning

The pensions industry is a complex area which

is constantly evolving. New graduates need

to gain a thorough grounding in the pensions

world and why it exists as it is. The early years

of your career are vital in building up this

knowledge and understanding.

The exams for actuarial qualifications help

to bed down the key concepts and the best

graduates use the exams as a springboard

to apply and extend their knowledge. Some

students now study part of the actuarial

exams through a part-time university-based

course and many find this helps to put

actuarial work into a business context as well

as enabling them to build up a strong network

within the industry.

The current environment: challenges

and opportunities

The pensions sector is not without challenges

(or opportunities, depending on how you view

these things):

The economic environment is tough, but

many of our clients see the value that

pensions actuaries add particularly in

helping them to manage the fnancial risks

associated with their pension funds.

The bread and butter work of years gone by

will inevitably start to reduce as many fnal

salary schemes have closed or are closing

to new members. The opportunity exists to

broaden the range of work we can provide to

clients and also shape the future of pension

provision (and indeed beneft provision)

more widely. Graduates who are fexible and

embrace the changing face of the sector still

have the chance to make a big impact.

The future of the pensions sector

Graduates who are

fexible and embrace

the changing face of

the sector still have the

chance to make a big

impact.

17

For actuaries jobs & more info, visit www.insidecareers.co.uk/act

The impact on the graduate job market

The graduate job market is tough and as

things stand, the number of graduates being

recruited and trained as pensions actuaries in

the UK will fall in the coming years. At first

glance, this may sound a daunting prospect,

as it will inevitably be a more competitive

recruitment environment. However, graduates

who demonstrate the aptitude, the attitude

and the drive to become a pensions actuary

will increasingly be expected to progress their

career quickly and develop consulting skills

earlier in their careers than those who have

gone before.

For example, an increasingly common business

model is for the employers of pensions

actuaries to move the tried and tested mainly

calculation-based pensions work to offshore

locations. This leaves the onshore team to

focus on delivering bespoke work and projects.

Career prospects

A grounding in pensions actuarial work provides

a good base from which to expand your career.

The people in the industry who are making the

most from their careers are those who embrace

change, are open to new opportunities and push

themselves out of their comfort zone.

Actuaries can go down a variety of career

paths such as:

Specialising their actuarial/consulting skills

to advise either companies, trustees or

public sector clients.

Joining specialist teams, for example driving

thinking and techniques used in the area

of consulting on the issues of increased

longevity, or focusing on the lively space of

corporate transactions.

Developing strong careers in less technical

(but key business) areas of sales, people

management, project management and

communication.

Quite often people combine all of the above

mixing a specialism with business management

responsibility. There are many combinations of

things in which you can get involved if you are

proactive and willing to put yourself forward.

Traditional skills, new approaches

Some things do not change. The pensions

actuaries of today need to be every bit as

numerate and capable of learning the technical

skills that underpin being a good actuary as

has always been the case. In addition though,

the pensions actuary of the future needs to

be willing and able to evolve and to apply

their skills in a changing market-place. Its a

challenge that the best graduates will relish.

THE FUTURE OF THE PENSIONS SECTOR

Alex Jefferson qualifed as an

actuary in 2009 with Aon Hewitt and

now works on a variety management

projects in addition to his actuarial

consulting work.

Get actuarial news online

www.insidecareers.co.uk

BACK TO CONTENTS

18

THE PROFESSION

In this section, some of your more common queries are answered by the

Actuarial Profession, including where can I get work experience? and how many

years does it take to qualify?

Where can I get work experience?

Work experience can prove to be a real

asset when job hunting and indeed is now

often used as part of the recruitment process.

However, work experience can be hard to fnd

as places are limited and you need to apply

early. Companies which offer work experience

placements are listed on the Inside Careers

website: www.insidecareers.co.uk and the

Actuarial Professions at: www.actuaries.org.uk.

Where can I get sponsorship for studying?

Employers will usually sponsor you through

the whole of your qualifcation route, however,

The Worshipful Company of Actuaries do offer

funding through a charitable trust. Their website

details are: www.companyofactuaries.co.uk. Also,

the Staple Inn Actuarial Society (SIAS) offers

funding at university level. Find more details at

www.sias.org.uk/aboutsias/UniversityStudents.

What recommendations do you give to

mature entrants?

There is no age limit for joining the profession,

but securing employment and sponsorship for

the professional examinations may prove diffcult

for mature entrants as you will be competing

against recent graduates. We recommend

that you study for one or two examinations

independently in order to improve your chances

of employment and to show you are committed.

What is the difference between working for

a consultancy and an insurance company?

Although there are many opportunities available

for actuaries, generally actuarial trainees start

working for either an insurance company offce

or a consultancy frm. These opportunities offer

different lifestyles and challenges.

Working in an insurance company

environment means that there is usually only

one client; your employer. A variety of work

is available, but tends to come more slowly

often youll be asked to work in one area for

a period of about one year before moving on

to the next challenge, taking the experience

you have gained with you.

The day to day work within consultancy frms

tends to be more varied, as in any year you

are likely to work for a number of different

clients (and partners) solving different types

of problems. This can become particularly

challenging if you have a number of projects

running in parallel and you need to ensure that

you meet and manage each of your clients

expectations and deadlines. Some consultancy

Frequently Asked Questions

19

For actuaries jobs & more info, visit www.insidecareers.co.uk/act

FAQS

projects can involve working at the clients

premises, which may not be in the same

town as your own offce. This can give you

an excellent opportunity to work with other

people and see the running of an organisation

other than your own consultancy. However,

you would need to consider the impact of

being away from home. You may also fnd

yourself working on just part of a project

rather than seeing it all the way through from

start to fnish.

How many years does it take to qualify?

In order to become a Fellow of the Institute

and Faculty of Actuaries, students must

pass examinations, demonstrate satisfactory

completion of modules and acquire a

satisfactory level of work-based skills.

Average qualification time is currently three

to six years.

What exemptions from the professional

examinations could I obtain?

This will depend on the scope and standard

of the subjects covered by the university

examinations you have taken and on the

performance you have achieved.

It is possible to gain exemptions from all

eight of the core technical subjects on some

undergraduate and postgraduate degrees. Some

postgraduate degrees offer the opportunity

for exemptions from core applications and

specialist technical subjects.

Details of the universities and courses we have

agreements with are available on the Actuarial

Profession website, along with information

on how to apply. If you have taken a different

university course, you may still be eligible for

exemption from some of our exams, but will

need to apply to us for confrmation. You must

be a member of the Profession before you can

gain any of the exemptions.

How do I obtain a work permit to work

in the UK?

Work permits are issued by the Borders and

Immigration Agency, which are part of the Home

Offce. Work permit applications can only be

made by employers based in the UK who wish

to employ people from outside the European

economic area. Individuals are not allowed to

make applications on their own behalf. To fnd

out more information about the Borders and

Immigration Agency visit their website:

www.bia.homeoffce.gov.uk/workingintheuk.

Do I have to work as an actuary to qualify?

Yes as well as passing the examinations,

fellowship requires the satisfactory completion

of a work-based learning log.

Will I need to continue training once I

have qualifed?

Members are required to maintain their

competence once qualifed through continuing

professional development. This is mandatory

for regulated roles.

GRADUATE PROFILES

BACK TO CONTENTS

Associate - Advait

PWC

Actuarial Trainee - Claire Singer

HYMANS ROBERTSON

Actuarial Analyst - Chris Apps

GUY CARPENTER

Trainee Pensions Actuary - Emma Cruddas

AON

22

24

26

28

22

BACK TO CONTENTS

I graduated from Oxford University with a

Masters degree in Physics in July 2011. Guy

Carpenter kick-started my actuarial career with

an analyst position in September. I am currently

studying for the actuarial exams and sat my frst

modules in April.

What does Guy Carpenter do?

Guy Carpenter is a reinsurance and risk

intermediary. Reinsurance is basically insurance

for insurers. Our primary task is helping our

clients place their reinsurance with Lloyds of

London or other reinsurance companies. If

effectively placed, it helps clients cope with

large claims they wouldnt otherwise be able

to survive similarly to how primary insurance

protects the public. It also spreads the risk of

losses over larger populations than insurance

companies can effectively manage; preventing

insurers from losing out if a big loss affects an

entire region, or an entire population subgroup,

where they make business.

How did you get your job at Guy Carpenter?

I was contacted by a recruitment consultant

in the summer following graduation, who

suggested the actuarial profession would suit

someone of my background. I interviewed

for several actuarial positions in the following

month and following many challenging, and

many more unsuccessful interviews received

several offers. I started working at Guy

Carpenter in September.

What is a typical day like for you?

The reinsurance workplace tends to

be closer to consulting than traditional

insurance. I frequently work with many clients

simultaneously, which can get very intense.

The tasks I perform vary in both diffculty and

length; from cleaning up spreadsheets just

received from clients, so we can input data into

our models; to building complex reinsurance

structures, and their respective models,

completely from scratch. As an intermediary,

Guy Carpenter is completely focused on serving

its clients in the best way possible. My actuarial

training has equipped me with strong technical

expertise to allow me to achieve this.

What do you enjoy most about your job?

There are many things to enjoy about working

at Guy Carpenter, as there is with many

actuarial frms. The pay is good, the work is

interesting, and Im actively improving my skills

in a way which many careers do not offer so

early on. Most of all, I enjoy working with a

team of like-minded individuals on a common

objective we all believe in.

Name Chris Apps

University University of Oxford

Degree Physics MSc

Location London

Role Actuarial Analyst

Guy Carpenter

GRADUATE PROFILES

The reinsurance

workplace is closer to

consulting than traditional

insurance. I work with

many clients simultaneously,

which can get very

intense.

23

For actuaries jobs & more info, visit www.insidecareers.co.uk/act

What are the most stressful parts of the job?

I rarely get stressed at work. Better

overworked than underworked! Fitting

in study and adequate exam preparation,

however, is not easy. If an exam is a week

away theres a lot less time remaining than at

university as Id most likely be in office for

five days out of the available seven. Rigorous

time management is critical. Fortunately

Ive learned to manage data well, with

spreadsheets, as part of my training. A few

thousand hours is nothing compared to a few

million insurance claims!

What was the interview process like?

The interviews were hard, but its

understandable why it was necessary. Thinking

and communicating on the spot, in unfamiliar

territory to unfamiliar audiences, is an important

part of my role. My interviews at Guy Carpenter

were fairly standard for graduate positions

questions about me and my experiences mixed

in with technical critical thinking style problems.

The key in both types of question is how you

communicate your answers as opposed to what

you say. Practice was very important.

Any advice for the interview process?

Be prepared to do a lot of them. Its not

uncommon for an interview to go perfectly

well and yet not be offered a position. This can

happen for a variety of reasons; the competition

for the role could be very ferce, and an

employer needs to be completely certain youll

ft in with existing employees. In either case

its never personal. If a recruitment consultant

is getting you plenty of interviews, its mostly a

numbers game before you get a position. Just

ditch the recruiter if they arent (theres plenty

out there!), and make sure you really want the

jobs youre applying for. Interviewers can sniff

out lack of motivation instantly.

Is there a work/life balance?

Yes, although I dont agree with the term

balance as it implies the two are separate. If my

home life is good I rock up at work with a smile

on my face, bursting with energy, and perform

well; if not my work suffers. Its also important

for work to provide a continuous, but not

overwhelming, challenge otherwise it affects my

home life in a negative way.

What soft skills have you found useful?

Managing time well has been paramount.

Its important to manage both long-term

important, but not urgent, tasks along with

those that are urgent, but less important. An

ability to work well in any team is important,

but this is something interviewers try to

assess before employing you. Staying proactive

and on the ball in fast-paced environments is

also important not just so you can do your

job well, but so you enjoy doing it!

ACTUARIAL ANALYST

24

GRADUATE PROFILES

BACK TO CONTENTS

Were the professionals...

So youre considering a career as an actuarial

consultant...

When you frst came across it you may have

screamed with delight simply at the fact that

there exists a career that actually rewards you

for your mathematic genius! But Ive learned that

theres so much more it can offer you.

Learning to become an actuarial consultant is

something that shouldnt be taken lightly. The

exam process is tough; tenacity is undoubtedly

the most important quality you should possess,

and you have to ensure that you can balance the

technicalities with common sense.

Choosing an actuarial career

Pursuing an actuarial career for me was

a natural step from my university degree,

but so too was the choice to enter into

the consulting world. Although I really

enjoyed the mathematical and technical

aspects of my course, I also loved working

with people, especially communicating the

technical aspects and breaking them down in

a straightforward way.

Joining the working world

I joined Hymans Robertson in August

2010 as an actuarial student in the new

Edinburgh office. We are an employee

benefits consultancy providing a wide range

of services including actuarial, investment,

benefit consulting, third party administration,

longevity risk consulting and enterprise risk

management. We are a forward looking,

innovative company, and specialise in tailored

solutions to meet our clients needs.

The sorts of things I do

Even in the short time that Ive been here,

the opportunities and experiences Ive had

really has reflected Hymans Robertsons wide

range of services. For example, my work has

varied from the more traditional work of

calculating transfer values (the value in todays

money of pension payments that will be made

in the future), to more modern risk analysis

work, using our internal models to carry out

scenario testing on a pension scheme for

quantifying future uncertainties.

A lot of my work also involves drafting reports

and emails to clients who dont necessarily

have an actuarial background, which requires

a different skill set. Having a more numerical

mindset, I fnd this really pushes me to become a

more well-rounded person.

Name Claire Singer

University Heriot Watt University

Degree BSc (Hons) Actuarial Science

Location Edinburgh

Role Actuarial Trainee

Hymans Robertson

Although I really enjoyed

the mathematical and

technical aspects of my

course, I also loved

working with people.

25

For actuaries jobs & more info, visit www.insidecareers.co.uk/act

The studying...

Theres no getting away from the exams! The

work/life balance may sometimes tip too far

in the direction of study, but most employers

will give you study days to lighten the burden

and the work you put in will definitely pay

off in the end. Working alongside studying

can be rewarding in itself, as you can see the

concepts youre learning from the textbooks

being applied in real life.

I love my role!

What I really enjoy about working in a

consultancy is seeing the process of how

a real life practical problem can be solved,

communicated and implemented to the benefit

of everyone involved. Its through this process

that Ive realised what being a professional

really is all about and why an actuarial

consultant is so well respected. To be able to

balance both an understanding of complex real

life problems, often involving long-term

outlooks with many uncertainties, and apply

professional judgement to the situation at

hand takes a certain type of individual. Its for

this reason that the examination process to

become a qualified actuary is so demanding,

but the rewards are endless.

ACTUARIAL TRAINEE

What I enjoy

about working in a

consultancy is seeing how

a real life problem can be

solved, communicated and

implemented to the beneft

of everyone involved.

26

GRADUATE PROFILES

BACK TO CONTENTS

As a typical student, I wanted to put off having

to enter the terrifying world of work for as

long as possible, but inevitably, the time came

to choose a career.

I completed a Masters in Mathematics,

Operational Research, Statistics and

Economics (MORSE) at the University of

Warwick. This is one of only a few courses

in the country that helps prepare you for an

actuarial career, offering exemptions for up to

seven of the 15 exams.

Actuarial work offered a good combination

of being able to use my degree, a reasonable

work/life balance and pretty good starting pay

compared to my other graduate friends.

How did you get your job at Aon?

I applied for an internship in the summer

before my final year at university. This gave

me great insight into what the day to day

work would be like. You are treated as a

normal member of the team and have the

opportunity to get involved in small projects.

Without any formal training I did feel slightly

out of my depth at times but everyone was

really approachable and helpful if I didnt

understand something.

I was lucky enough to be offered a graduate

position at the end of the ten weeks, which

meant that I could spend my final year focused

on studying and not having to worry about job

applications and interviews.

What is a typical day like?

I work in the Leeds offce in the Pensions and

Actuarial Services team, providing support for

consultants who advise companies and trustees

of pension schemes (mostly fnal salary). I work

on around 11 client teams, with the schemes

varying in size from less than ten members up to

tens of thousands of members.

As a more senior member of the team, part of

my job is to liaise with the consultants to fnd

out what work our clients need doing and to

distribute the work amongst the client team.

Trustee work mainly involves statutory work,

such as a valuation of the scheme. This must

be carried out every three years and is a 12-15

month long project.

Work for companies is focused towards

managing their costs. Over the last few years

many companies have been looking to cut

their costs and running a pension scheme can

be a significant part of this. We recommend

ways of cutting costs and help to implement

these ideas.

Most of the day tends to involve performing

complex calculations, sometimes by hand but

usually using Excel models. For example, to value

future pension promises in todays money you

need to take individual member data, perform

checks on the data, set and apply assumptions

about the future (such as how long will people

live for) and test the sensitivity of the result by

looking at the effect of changing each assumption.

Name Emma Cruddas

University University of Warwick

Degree MSc MORSE

Location Leeds

Role Trainee Pensions Actuary

Aon

27

For actuaries jobs & more info, visit www.insidecareers.co.uk/act

An important part of the job is being able to

draw conclusions from the calculations and

communicate these effectively to the client

through a report, email or presentation. The

calculations can be quite complex so you need

to be able to avoid jargon and put things in a way

that can be easily understood so that the client

has enough information to make decisions. Good

communication skills, both written and verbal,

are therefore very important.

On average, one day a week is set aside for

study, which involves reading course notes,

completing assignments, revision and practicing

past exam papers. You need to have good self

motivation to make the most of study days

(resist the temptation to have a lie in and watch

daytime TV!). You also need to set aside time

in the evenings and at weekends as study days

alone are not enough to be thoroughly prepared.

What are the most stressful parts of

your job?

As a student it can be diffcult to juggle the

demands on your time of work, study and having

a social life. Client work can involve demanding

deadlines and the odd late night is necessary,

however normal hours are roughly 9-5.

The bi-annual exam period can be tough.

Although study days are weighted more

towards the exam period it is not like

university where you could just coast through

the term and spend a week cramming, you

really need to work throughout the year as

you still need to be in the office most days.

The feeling of satisfaction at passing, not to

mention the celebratory night out and pay rise

make it worthwhile!

What would you like to achieve in the future?

After three and a half years of studying I now

have just one exam left to sit. Once I qualify I

hope to become a consultant and continue to

expand my knowledge of the feld of pensions.

Actuarial skills are quite transferrable so it is

possible that I could move into another feld

such as risk management or insurance.

Do you have any advice for anyone

wanting to get into the industry?

1. Get some work experience. This is highly

valued by employers and will help you

decide if this is really the right career

for you.

2. Practice your interview technique. Your

careers department should have courses

you can attend and may be able to offer

you a mock interview that will highlight

areas you need to work on.

3. Do your research. Spend some time

looking at the website of the company

you want to work for and keep an eye

out for relevant actuarial stories in the

news. This will give you an opportunity to

show the interviewer that you are already

taking an interest.

4. Get as many exemptions as you can from

your university course. This will give you

a head start on other graduates and mean

less time spent balancing work and study in

the long run.

TRAINEE PENSIONS ACTUARY

28

GRADUATE PROFILES

BACK TO CONTENTS

PwC

Name Advait

University Imperial College London

Degree MSci (Hons) Physics

Location Birmingham

Role Associate

Introduction

I cant honestly say that I wanted to be an

actuary ever since I was a child. In fact for a

long time, I didnt really know what an actuary

actually did. However, studying for a degree in

physics, I quickly realised that I wanted a job

that would allow me to use the numerical and

analytical skills I was developing and apply them

to real life business situations. It was only after

completing an internship in the pensions team

at PwC that I realised this was a career I wanted

to pursue. After graduating, I joined PwC on a

full-time basis.

What do PwC do?

The Actuarial practice at PwC is split between

two key areas Human Resource Consulting

(HRC) and Actuarial & Insurance Management

Solutions (AIMS). Within HRC, the primary focus

is on providing corporate advice to companies

with occupational pension schemes on a range of

issues, such as:

Funding of schemes.

Strategies for managing pension scheme

liabilities in various ways, including member

incentive exercises.

Managing pension scheme and investment

risks, including transactions which aim to

reduce or transfer risks.

Pensions aspects of mergers and acquisitions.

Accounting disclosures for pensions schemes

and stock option disclosures.

What do you enjoy most about your job?

Working in a consultancy means that you get

to work on a large variety of projects, making

the work both interesting and challenging. No

two clients are the same which requires us to

come up with new and innovative solutions to

the multitude of problems theyre looking to

solve. Its also really satisfying to work with a

range of clients both big and small, including

some highly prestigious companies which are

household names.

The most enjoyable aspect of my work though

would have to be the team I work with. Not

only is the atmosphere fun and supportive,

I get to work with some highly talented

individuals who are keen to pass on their

knowledge and experience.

What challenges have you come across

and how did you overcome these?

By far the most challenging aspect is

working full-time whilst studying for a tough

qualification. It does take a lot of time

management and discipline, but it doesnt get

in the way of a normal work/life balance.

I wanted a job that would

allow me to use the

numerical and analytical

skills I was developing and

apply them to real life

business situations.

29

For actuaries jobs & more info, visit www.insidecareers.co.uk/act

The support, both fnancial and in terms

of time off to study, is second to none at

PwC. Not only that, theres a strong focus

on ensuring we develop our careers as well

as passing our exams. The team take a keen

interest in making sure were able to manage

our workloads particularly during the busy

exam seasons.

What would you like to achieve?

My immediate goal is to pass my exams and

become a fully qualified actuary. I would like

to continue gaining a range of experiences

and one day bring in new clients of my own.

I also hope to be able to travel and work in

different PwC locations to get a flavour of

working internationally.

What soft skills have you found useful?

Despite actuaries having a reputation for being

back-room number crunchers lacking social

skills, the truth is quite the opposite. Apart

from being actuaries, were also consultants

and as result communication and team work

are at the heart of what we do. From trying to

win new clients, to working with other lines

of service, to presenting our results in a way

thats easy to understand for clients were

always required to be able to communicate

effectively. In fact theres even a whole course

and exam on communication. We also need

to be able to manage our time, be fexible and

work well under pressure.

ASSOCIATE

Apart from being

actuaries, were also

consultants and as a result

communication is at the

heart of what we do.

SENIOR PROFILES

BACK TO CONTENTS

Head of Insurance Pricing - Nick Reilly

HSBC

Senior Qualifed Actuary - Laura Goodwin

PRUDENTIAL

MCEV Reviewing Actuary - Chris Darby

FRIENDS LIFE

Senior Consultant - Bhavna Kumar

MERCER

32

34

36

38

SENIOR PROFILES

32

BACK TO CONTENTS

1998

1999

2005

Completed a summer placement

at Aon Hewitt (Then Aon) as

a student.

Moved to Mercer as a

Consultant, later being promoted

to Senior Consultant.

Bhavna wanted to become an actuary ever since she heard of its promise of

intellectual fullflment and rewards whilst still at school. After gaining a degree in

maths, she fulflled her early ambition and joined Aons graduate scheme in 1999.

13 years on, she tells us what its like to work as a Senior Consultant in pensions.

I always liked maths, but didnt want to be an accountant; I

had heard rumours it was quite boring! When I learned at

a school careers evening that becoming an actuary would

give me the opportunity to become a technical expert in

my feld as well as the chance to learn how to communicate

that knowledge to other people, I decided that becoming an

actuary was the plan for me.

I kept my options open by studying for a maths, rather than an

actuarial degree, but once I had completed a summer placement

prior to my fnal year I decided to make the commitment to

a career in actuarial work. I started my training in pensions

actuarial work in 1999.

What do you enjoy most about your job?

I love the fact that every day and every piece of work is

different. Even if the piece of work seems to be the same on the

face of it, because every client, every member and every pension

scheme is different, the advice required will differ for each case.

This means Im learning all the time and each day fies by.

The overarching satisfaction comes from helping clients make

the decisions they need to by simplifying the complexities and

making the process as painless as possible.

What is a typical day like for you?

My days involve working with trustees of defned beneft

pension schemes and employers who sponsor those schemes.

My clients need assistance and advice in relation to securing the

promised benefts, operating their scheme on a day to day basis

and their statutory duties. This includes:

Meeting days

After a frenzied couple of weeks preparing agendas and

papers, making sure all the items that require decisions are

covered, meeting days are a satisfying culmination of all my

hard work. They usually involve an early start to reach the

client with time to spare and a bit of last minute panicking

on the journey but once youre there, its great to be able

to share your knowledge and steer your clients through the

diffcult arena within which they need to operate.

Mercer

BHAVNA KUMAR

Began training as an actuarial

student at Aon Hewitt, going on

to become a consultant.

33

For actuaries jobs & more info, visit www.insidecareers.co.uk/act

Non-routine work

Sometimes I have to fgure out a query that

has been raised not always as straightforward

as it seems. We need to make sure that we

answer the question the client needs to know

the answer to, which isnt necessarily the same

as the question theyve asked. This work is

delegated to a doer, followed by a checker and

will come back to me for sign-off.

I will also need to arrange a peer review to

ensure the advice provided is appropriate,

hasnt missed any possible angles and is easy

to follow. A fair proportion of my time is also

spent peer reviewing.

Sign-off or peer review routine work

This usually involves using prior knowledge to

review work completed by the team or colleagues.

Responding to emails

This might involve doing some quick sums to

provide costings, checking legislation for fner

points of detail or clarifying the detail of a case.

What would you like to achieve in

the future?

I hope to continue to learn new skills and

expertise on a daily basis and thereby step up

to the next level in the profession to have a

portfolio of clients for which I am responsible

from both an actuarial and a business perspective.

Do you have any advice for anyone

wanting to get into the industry?

Consider carefully the area of actuarial work

in which you would like to work. Even the

traditional specialisms of pensions, investments,

life insurance and general insurance are very

different and it is not necessarily as easy as you

might think to transfer between them once you

have some experience under your belt.

Also, complete some work experience to ensure

it is what you think it will be!

Finally, be prepared for hard work. Its not easy

working and doing exams (and having a life

outside of work) all at the same time.

SENIOR CONSULTANT

Its great to be able to

share your knowledge

and steer your clients

through the diffcult arena

within which they need to

operate.

SENIOR PROFILES

34

BACK TO CONTENTS

2011

2006

Moved to Aon Hewitt to become

an actuarial consultant.

Works as an MCEV Reviewing

Actuary for Friends Life.

Having worked in a wide variety of actuarial roles I have

obtained experience of the rich and rewarding career paths

within the actuarial profession. My own career path has involved

time spent in the following practice areas:

Private sector pensions consulting

Actuarial software development

Public sector pensions consulting

Life insurance.

When I graduated from Southampton University with a degree

in Mathematics in 1999 I had no frm idea as to what I wanted

to do next. I started to do some research into various careers

and found myself drawn to the actuarial profession as it was

mathematically based and offered a variety of career paths. I was

fortunate enough to become an actuarial trainee shortly after.

Working history:

Private sector pensions consulting

I spent my early years working in a small department within a

private sector pension consultancy, whilst also making progress

with the actuarial exams which you are required to pass to

qualify as an actuary.

In this role I developed basic technical skills and enjoyed the

team atmosphere and variety of work. Being a smaller actuarial

department, it also enabled me to pursue my interest in

software development, and I spent time developing software

to perform various pension related calculations for use within

the companys actuarial and administration departments. The

experience I gained enabled me to move to a specialist actuarial

software development company.

Actuarial software developer

As an actuarial software developer I worked for a small

niche employer where I specified, wrote and optimised

internet based software products. This was a less traditional

actuarial role, but one which I found used my technical

actuarial skills, as we were developing actuarial based

solutions. As the software was innovative and there was no

set template to follow, it offered the opportunity for some

Chris started off in a more unusual end of the profession, developing actuarial

software. Since, he has become an MCEV reviewing actuary, reporting on the value

of a companys assets and projecting future proftability for shareholders.

He refects on the wealth of different opportunities within the actuarial profession.

Friends Life

CHRIS DARBY

2004

Worked as an actuarial software

developer for Pensions and

Actuarial Software (PAS).

2001

Joined Heath Lambert as an

actuarial trainee.

2000

Worked as a pensions review loss

assessor for HSBC.

35

For actuaries jobs & more info, visit www.insidecareers.co.uk/act

creativity: both over how the calculation code

should work, as well as the look and feel of

the software.

Public sector pensions consultant

My next move was to become a consultant

within the niche area of public sector pensions

consulting within a large multinational

consultancy frm. This involved providing

advice connected to several different public

sector pension schemes and various sub funds

within those schemes. This included large local

government pension scheme funds with pension

fund assets of over one billion pounds.

Public sector pensions consulting has its own

unique characteristics and I found myself adapting

my thought process accordingly. It was during

this time that I qualifed as an actuary, which was

a highly rewarding experience. Before long this

led to me taking more control and responsibility

for client work, including fnal scrutiny and sign

off of written advice to clients and presenting the

results of our analysis in client meetings. I also

enjoyed training more junior members of the

team, managing others and taking ownership of

some key projects.

MCEV reporting actuary

In my current role I work within the fnancial

reporting team in a large life insurance company.

There are many different areas within the

company in which actuaries may choose to

specialise and rotate. I currently work on Market

Consistent Embedded Value (MCEV) reporting.

This involves placing a value on the companys

current assets and future proftability from the

perspective of its shareholders.

This helps shareholders to monitor the

performance of the company. The primary role

involves analysing how the overall embedded

value changes from one reporting period to the

next. This requires an understanding of what

drives proftability within the business. Life

insurance company products are rich and varied

and different products respond differently to

changes in underlying conditions. This makes

the work both challenging and interesting.

In addition, the role requires liaising with

various other departments within the business,

managing the work to tight timescales and

explaining the results to others who are not so

close to the calculations.

Variety

One of the things I like about the profession is that

there are different roles and companies to suit to

different people. There is no such thing as a typical

actuary, and this is encouraged by the profession

whilst ensuring a high level of technical expertise

and professionalism which is common to all.

Whilst there is a mathematical grounding

required to complete the actuarial exams, a

career within the actuarial profession can develop

a wide range of skills from the more technical:

Actuarial analytical skills

Interpreting regulations and professional

guidance

Software programming and development

Spreadsheet development

Project management.

To softer skills such as:

Training and development of others

Managing people

Producing marketing literature

Presenting complex issues to a non-

actuarial audience

Drafting documentation for internal and

external use.

On top of this there is a wide range of specialist

areas within the profession of which I have

sampled only a few. This means that there is

likely to be a role to suit most people interested

in working in the actuarial industry.

Looking forward

The ever changing world, including technical

and regulatory development and fluctuating

economic conditions, continuously impacts

on actuarial work. This means the profession

is always evolving and there is always

something new or unexpected around the

corner. However, actuaries are always ready

to embrace and face new challenges. Every

change presents a new opportunity, and with

a strong actuarial grounding challenges can be

overcome. I look forward to my years ahead

in my chosen profession.

MCEV REVIEWING ACTUARY

SENIOR PROFILES

36

BACK TO CONTENTS

Prudential

2007

2008

Why did you choose a career in the industry?

From a young age I had always wanted to be a teacher, and as

I really enjoyed maths at school it was my intention to become

a maths teacher. I therefore chose to go to Stirling University

where it was possible to complete teacher training at the same

time as my degree.

Whilst I enjoyed the teaching, I also felt a bit too young to go

straight into a teaching career. The bulk of my fellow trainee