Professional Documents

Culture Documents

Study The Awareness of Mutual Fund in Mumbai

Uploaded by

Prianca Kadam67%(3)67% found this document useful (3 votes)

4K views48 pagesPriyanka kadam is a Student of parle tilak viyalaya association's institute of management, MUMBAI. She has completed the project titled To Study the Awareness of Mutual Fund in MUMBAI during the Academic Year 2014. The report work is original and the information / data and the references included in the report are true to the best of my knowledge.

Original Description:

Original Title

study the awareness of Mutual Fund in Mumbai

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPriyanka kadam is a Student of parle tilak viyalaya association's institute of management, MUMBAI. She has completed the project titled To Study the Awareness of Mutual Fund in MUMBAI during the Academic Year 2014. The report work is original and the information / data and the references included in the report are true to the best of my knowledge.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

67%(3)67% found this document useful (3 votes)

4K views48 pagesStudy The Awareness of Mutual Fund in Mumbai

Uploaded by

Prianca KadamPriyanka kadam is a Student of parle tilak viyalaya association's institute of management, MUMBAI. She has completed the project titled To Study the Awareness of Mutual Fund in MUMBAI during the Academic Year 2014. The report work is original and the information / data and the references included in the report are true to the best of my knowledge.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 48

To Study the Awareness of Mutual Fund in Mumbai Page 1

SUMMER INTERNSHIP PROJECT WORK ON

TO STUDY THE AWARENESS OF MUTUAL FUND IN MUMBAI

THE PROJECT SUBMITTED TO THE

UNIVERSITY OF MUMBAI

IN PARTIAL FULFILLMENT OF THE REQUIREMENT

FOR THE AWARD OF DEGREE OF

MASTER OF MANAGEMENT STUDIES (MMS)

BY

KADAM PRIYANKA BHARAT SHOBHA

PARLE TILAK VIDYALAYA ASSOCIATIONS

INSTITUTE OF MANAGEMENT

VILE PARLE (E), MUMBAI 400 057.

2013-2015

To Study the Awareness of Mutual Fund in Mumbai Page 2

To Study the Awareness of Mutual Fund in Mumbai Page 3

To Study the Awareness of Mutual Fund in Mumbai Page 4

DECLARATION

I, Ms.Priyanka B. Kadam MMS Student of Parle Tilak Vidyalaya Associations Institute

of Management (PTVAS IM),, hereby declare that I have completed the project titled To

Study the Awareness of Mutual Fund in Mumbai during the Academic Year 2014.

The report work is original and the information/data and the references included in the report

are true to the best of my knowledge. Due credit is extended on the work of

Literature/Secondary Survey by endorsing it in the Bibliography as per the prescribed format.

(Signature of the Student with Date)

Priyanka B. Kadam

To Study the Awareness of Mutual Fund in Mumbai Page 5

ACKNOWLEDGEMENT

It gives me great pleasure to deep sense of gratitude towards Mrs. Krutika Zarapkar for her

guidance, motivation and help

I would like to express my thanks to Dr. Harish Kumar S. Purohit and other staff of PTVAs

Institute of Management for providing an environment to complete project successfully.

My heartfelt gratitude and thanks to all those who have helped me for completing my project.

I am also thankful to my colleagues and friends for their suggestion and support.

To Study the Awareness of Mutual Fund in Mumbai Page 6

TABLE OF CONTENTS

Sr. No PARTICULARS Page

No.

1 Executive Summary 7

2 Introduction 8

3 Industry Overview 9-13

4 Company Overview 14-17

5 Literature Review 18-21

6 Objectives & Need Of Study 22

7 Research Methodology 23

8 Mutual Fund 24-38

9 Findings 39-42

10 Recommendations & Suggestions 43

11 Conclusion 44

12 Bibliography 45-46

13 Annexure 47-48

To Study the Awareness of Mutual Fund in Mumbai Page 7

EXECUTIVE SUMMARY

The project is on the Mutual fund awareness. A mutual fund is a scheme in which several people

invest their money for a common financial goal. The collected money invests in the capital

market, debt and the money market, which they earned, is dividend based on the number of units

which they hold. The mutual fund industry in India has seen dramatic improvements in quantity

as well as quality of product and service offerings in recent years. Along with this project also

touches on the aspect of Systematic Investment Plan and steps of how to invest in Mutual Fund.

An effort has been made to work on the concepts that have been learned in ICICI SECURITIES

along with other useful parameters so that better study can be done.

This report explains the meaning of mutual fund and the investors awareness for investing in

mutual funds with small amount of risk. ICICI DIRECT gives the platform to their investors to

be a part of mutual fund market.

It also explains the Mutual Fund as financial product that how it is important to invest in MF for

the better investment and important to get better returns though Mutual Fund.

Basically, the project is to understand the investors, behaviour& to give recommendations to

common investors on how to select mutual fund as a long term investment option.

To Study the Awareness of Mutual Fund in Mumbai Page 8

INTRODUCTION

A mutual fund is an entity that pools the money of many investors -- its unit-holders -- to invest

in different securities. Investments may be in shares, debt securities, money market securities or

a combination of these. Those securities are professionally managed on behalf of the unit-

holders, and each investor holds a pro-rata share of the portfolio i.e. entitled to any profits when

the securities are sold, but subject to any losses in value as well.

Theproject To Study the Awareness of Mutual Fund in Mumbai tries to understand the

investors behaviour term investment option. The project will seek to cover all the fundamental

aspects related to mutual funds and investment in them.

The project will also cover the various problems of the global scenario that has affected the

Indian market. Then it will analyse the behaviour of investors in changing scenario. There will

also be a comparative analysis of traditional options of investment available in India & some of

the mutual funds as per the expectations of the investors, so as to understand whether the mutual

funds are catering to the requirements & expectations of the investors or not.

To Study the Awareness of Mutual Fund in Mumbai Page 9

INDUSTRY OVERVIEW

The Indian mutual fund industry, though still small in comparison to the size of

the Indian economy, offers Indian, and in some cases global investors, both big and small, an

avenue to invest safely and securely, at a reduced cost, in a diverse range of securities, spread

across a wide range of industries and sectors.

The financial services landscape is transforming, with a plethora of changes taking place on the

regulatory front. Against this backdrop, asset management companies (AMCs) realize that they

need to re-structure their businesses in order to meet the evolving needs of their clients and

provide them with complete investment solutions. Although emerging markets such as India

provide a wide range of opportunities, it is important to tap into these avenues to fuel the growth

of the mutual fund industry.

Amidst volatility and uncertainty in the markets, average assets under management (AUM)

posted a growth of 23% for the year ended March 2013. This was considerably higher than the

12% growth reported in March 2012. The industry has grown at a compound annual growth rate

(CAGR) of 18% from 2009 -2013.

Growth in average assets under management (in INR )

Source: AMFI (Association of Mutual Fund in India)

4,173,000

6,139,790

5,922,500

6,647,916

8,164,017

0

1000000

2000000

3000000

4000000

5000000

6000000

7000000

8000000

9000000

2009 2010 2011 2012 2013

CAGR = 18%

To Study the Awareness of Mutual Fund in Mumbai Page 10

However, the trend from 2010 depicts that net sales for the mutual fund industry has dipped,

picking up slightly in 2013, to grow by 7%

Net sales vs. net redemptions (2009 -13)

Source: AMFI

A total of 139 new schemes were launched for the year ended March 2013, generating sales of

236,470 million INR. Furthermore, AUM under the equity segment has actually declined 5%,

whereas the debt segment has grown significantly at 36% (see figure 3), which implies that

investors are still wary of investing in the market looking for relatively safer investments by

directing their investments into the debt bucket. Assets under management in the liquid and

money market and gold exchange traded funds (ETFs) grew by 16% and 18% respectively.

57000000

109000000

97000000

75000000

79500000

52000000

105000000

98000000

75000000

78000000

0

20000000

40000000

60000000

80000000

100000000

120000000

2009 2010 2011 2012 2013

DEBT

EQUTY

To Study the Awareness of Mutual Fund in Mumbai Page 11

o Category wise assets under management

Source:AMFI

In a scenario of declining interest rates, for March 2013 the distribution of assets under

management have understandably been heavily skewed towards debt at72% of total assets

under management. A fall in interest rates is indicative of higher returns for long-term debt

and gilt funds. Furthermore, it has been observed that in the case of investments held for over a

period of 24 months, assets under management held by retail investors in the non-equity

segment was 36%, whereas for the short term, it was only 11%, suggesting the fact that in the

current environment, investors are preferring debt funds for an even longer time span

exceeding 24 months.

Retail investors One to three

months

Six to twelve

months

Over 24 months

Equity (% to

category )

4.02 7.52 63.04

Non-equity (% to

category)

11.18 15.96 36.25

Source: AMFI

230000

350000

112500

24000

215000

450000

150000

25000

0

100000

200000

300000

400000

500000

equity debt liquid/money

market

gold ETF

2012

2013

To Study the Awareness of Mutual Fund in Mumbai Page 12

INDUSTRY AT GLANCE

A decline in total number of folios 8%

AUM in equity segment registered a decline

Net year for the investment year march 2013 declined 33 %

Source:AMFI

Assets under management

grew to 8,164 billion INR 23%

Net sales increased for the

year ended March 2013 7 %

Huge inflows in the debt

segment, with a significant

36%

growth in AUM

To Study the Awareness of Mutual Fund in Mumbai Page 13

Challenges of under penetrated market

The under-penetrated market in India, although showcasing huge opportunities for market

players to sell their products, places multiple roadblocks to tap into these opportunities up to

their optimum potential.

1. Low level of awareness and financial literacy

2. Cultural and attitudinal changes

3. Adapting the distribution channels

4. Reach and scalability

Some basic challenges arise due to very low levels of awareness and financial literacy. The

situation in these cases is such that even if the ability to invest exists, these savings are prevented

from being directed into mutual fund products. This is because of the slow capital market

growth, lack of awareness of mutual funds being a low-cost investment vehicle and the returns

they can generate. In this case, there is also the interplay of cultural and behavioural change

which prevents savings from being streamlined into investment products, diverted from gold or

property.

Indians still feel that gold and property is a less risky alternative as compared to investment in

the capital markets. Also, investors are not aware of low risk products that they can invest in. A

culture change is required in this case, if people are to be convinced to invest in the capital

markets.

To Study the Awareness of Mutual Fund in Mumbai Page 14

COMPANY OVERVIEW

ICICI Bank was originally promoted in 1994 by ICICI Limited, an Indian financial institution,

and was its wholly-owned subsidiary. ICICI (Industrial Credit and Investment Corporation

of India) was formed in 1955 at the initiative of the World Bank, the Government of India and

representatives of Indian industry. The principal objective was to create a development financial

institution for providing medium-term and long-term project financing to Indian businesses.

In the 1990s, ICICI transformed its business from a development financial institution offering

only project finance to a diversified financial services group offering a wide variety of products

and services, both directly and through a number of subsidiaries and affiliates like ICICI Bank.

In 1999, ICICI become the first Indian company and the first bank or financial institution from

non-Japan Asia to be listed on the NYSE. In October 2001, the Boards of Directors of ICICI and

ICICI Bank approved the merger of ICICI and two of its wholly-owned retail finance

subsidiaries, ICICI Personal Financial Services Limited and ICICI Capital Services Limited,

with ICICI Bank.

ICICIs role in Indian financial infrastructure

The bank has contributed to the setup of a number of Indian institutions to establish financial

infrastructure in the country over the years;

National Stock Exchange - NSE was promoted by India's leading financial objective are

establishing a nationwide trading facility for equities, debt instruments and hybrids, by

ensuring equal access to investors all over the country through an appropriate

communication network.

Credit Rating Information Services of India Limited (CRISIL) - In 1987, ICICI Ltd along

with UTI set up CRISIL as India's first professional credit rating agency.

To Study the Awareness of Mutual Fund in Mumbai Page 15

Asset Reconstruction Company India Limited - Following the enactment of the

Securitization Act in 2002, ICICI Bank together with other institutions, set up Asset

Reconstruction Company India Limited (ARCIL) in 2003

Credit Information Bureau of India Limited - ICICI Bank has also helped in setting

up CIBIL, India's first national credit bureau in 2000

Products :

ICICI Group has always been at the forefront of developing innovative financial products, which

caters to various needs of people from all walks of life. Over the years, it has launched several

financial products that offer financial support, security and more to not just individuals, but too

big and small organizations too.

-Banking

1. Personal Banking

2. Global Private Clients

3. Corporate Banking

4. Business Banking

5. NRI Banking

-Insurance & Investment

1. Life Insurance

2. General Insurance

3. Securities

4. Mutual Fund

5. Private Equity Practice

To Study the Awareness of Mutual Fund in Mumbai Page 16

ICICIs Group:

ICICI Group's performance and aspirations are underpinned by a strong organizational

culture of dynamism, meritocracy, excellence in execution and high standards of professional

integrity that have helped it become an industry leader

ICICI Bank

ICICI Prudential Life Insurance Company

ICICI Securities Limited

ICICI Securities Primary Dealership Limited

ICICI Lombard General Insurance Company

ICICI Venture.

ICICI SECURITIES

ICICI Securities empowers over 2 million Indians to seamlessly access the capital market

with ICICIdirect.com, an award winning and pioneering online broking platform.

ICICI direct.com

ICICIdirect.com offers a convenient and easy to use platform to invest in equity and various

other financial products using its unique 3-in-1 account which integrates customer's saving,

trading and demat accounts.ICICIdirect.com is the first broker in India to introduce `Digitally

Signed Contract Note' to its customers

ICICI Direct offers an efficient way to investing the benefits of choosing ICICI Direct for

financial planning are:

Convenience - Provides a well-diversified set of investment products under a single sign-

on and completely paper-less investing experience

Expertise - access some of the researched funds selected based on rigorous criterion

Flexibility- select the fund that best suits individuals need

To Study the Awareness of Mutual Fund in Mumbai Page 17

BOARD OF DIRECTORS

ICICI Securities Limited.

Ms.Chanda D. Kochhar,Chairperson

Mr.UdayChitale

Mr.NarendraMurkumbi

Ms.ZarinDaruwala

Ms.Shilpa Kumar

Mr.AnupBagchi, Managing Director & CEO

Mr. Ajay Saraf, Executive Director

ICICI Securities Holding Inc.

Mr.SankerParameswaran, Director

Mr.SriramIyer, Director

Mr. Warren Law

ICICI Securities, Inc.

Mr.AnupBagchi, Chairman

Mr. Ajay Saraf

Mr.SubirSaha

Mr.JaideepGoswami

Mr.BishenPertab

Mr. Robert Ng

To Study the Awareness of Mutual Fund in Mumbai Page 18

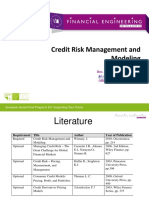

LITERATURE REVIEW

Singh (2009) conducted a study on awareness & acceptability of mutual funds and found that

consumers basically prefer mutual fund due to return potential, liquidity and safety and they

were not totally aware about the systematic investment plan. The investors will also consider

various factors before investing in mutual fund.

The study shows that most of respondents are still confused about the mutual funds and have not

formed any attitude towards the mutual fund for investment purpose. It has been observed that

most of the respondents having lack of awareness about the various function of mutual funds.

Moreover, as far as the demographic factors are concerned, gender, income and level of

education have significantly influence the investors attitude towards mutual funds. On the other

hand the other two demographic factors like age and occupation have not been found influencing

the attitude of investors towards mutual funds

Mr.Kohrana, Serves and Tufano (2003), These three author had concluded that studies of

mutual fund industry in 55 countries around the world and tests various hypotheses for why the

fund industry would be preferred by investors over two alternative asset management choices:

do-it-yourself options where the investors purchases primary assets and opaque financial

institution options, such as banking or insurance investments. Consistent with the law and

economics literature, we find that the mutual fund industry is larger in countries with stronger

rules, laws, and regulations, specifically where mutual fund investors rights are better protected.

Their findings that some types of regulation typically regulations that protect fund shareholder

rights lead to a larger fund industry, needs substantial additional study, probably in the form of

detailed country-level analysis. Regulators are writing standards in the European Union and

elsewhere to establish the appropriate forms of protection for fund investors.

To Study the Awareness of Mutual Fund in Mumbai Page 19

Sarish (2012) undertaken a study on mutual funds, opportunities and challenges. The mutual

fund sectors are one of the fastest growing sectors in Indian Economy and have awesome

potential for sustained future growth. Mutual funds make saving and investing simple,

accessible, and affordable. The advantages of mutual funds include professional management,

diversification, variety, liquidity, affordability, convenience, and ease of recordkeepingas well

as strict government regulation and full disclosure.

LubosPastor and Stambhaugh(2001) concluded on the study after investing in equity mutual

funds that it develops and applies the framework in which pricing models and managerial skills

are combined with information data to select portfolio of mutual funds.

In addition, non-benchmark assets help account for common variation in fund returns, making

the investment problem feasible with a large universe of funds.

Kaminsky, Lyons, and Schmukler (1999) provide an overview of mutual fund activity in

emerging markets .the author is explaining that how do mutual funds behave when they invest in

emerging economies? For one thing, mutual funds flows are not stable. Withdrawals from

emerging markets during recent crises were large, which squares with existing evidence of

financial contagion. International mutual funds are one of the main channels for capital flows to

emerging economies. Although mutual funds have become important contributors to financial

market integration, little is known about their investment allocation and strategies. First, they

describe international mutual funds relative size, asset allocation, and country allocation.

Second, they focus on fund behaviour during crises, by analysing data at the level of both

investors and fund managers. Among their findings: Equity investment in emerging markets has

grown rapidly in the 1990s, much of it flowing through mutual funds.

Russ Wermers (2000) have measured the performance of the mutual fund industry from 1975 to

1994, and we decomposed fund returns and costs into various components. This decomposition

is made possible by employing a new data-base not previously available to researchers. This

To Study the Awareness of Mutual Fund in Mumbai Page 20

database is created by merging a database of mutual fund holdings with a database of mutual

fund net returns, expenses, turnover levels, and other characteristics. With the database, we are

able to address issues that have been problematic to the study of mutual fund performance for

decades for example, they have provide an estimate of quarterly transactions costs for each

mutual fund in our sample to determine the role of trading costs in the performance puzzle.

Finally, all of their results ignore the higher tax burden of actively managed especially high-

turnover Funds. Of great current interest is whether managers of actively managed funds add

value, net of taxes.

Sahil (2012) Jain has investigated the performance of equity based mutual fund schemes in

India, using CAPM. In the long run, private sector companies have performed far better than the

public sector ones. While HDFC and ICICI have been the best performers, LIC has been the

worst. Among all the 9 mutual fund schemes of LIC theres not a single scheme which has over-

performed. Whereas on the other hand 11 out of 16 schemes of ICICI and 6 out of 9 schemes of

HDFC have over-performed. UTI has been an average performer, since majority of its schemes

have given the returns as expected. While 5 out of 11 schemes of UTI have performed average, 4

have over-performed. The results clearly indicate that over the period of last 15 years, private

sector mutual fund companies (HDFC and ICICI) have outperformed the public sector ones (LIC

and UTI). Beta (risk) analysis shows that while HDFC and ICICI mutual funds have been least

risky, LIC is the most risky. 8 out of 9 schemes (89%) of LIC had beta value greater than 80.

This has been one of the reasons behind the poor performance of LIC. The overall analysis finds

that the private sector mutual fund schemes have been less risky and more rewarding as

compared to the public sector ones.

Dr. Shantanu and Charmi (2012) have explained about financial sector and the developments

in the Indian financial markets, Mutual Funds have emerged to be an important investment

avenue for retail small investors. The investment habit of the small investors particularly has

undergone a sea change. Increasing number of players from public as well as private sectors has

entered in to the market with innovative schemes to cater to the requirements of the investors in

To Study the Awareness of Mutual Fund in Mumbai Page 21

India and abroad. For all investors, particularly the small investors, mutual funds have provided a

better alternative to obtain benefits of expertise- based equity investments to all types of

investors. So in this scenario where many schemes are flooded in to market, it is important to

analyses needs of consumers and to find out which factors affects consumers' needs the most.

Mrs. P Alekhya (2012) creates awareness that the mutual funds are worth investment practice.

The various schemes of mutual funds provide the investors with a wide range of Investments

options according to his risk bearing capacities and interest. Besides they also give a handy

return to the investors. The paper analyses various schemes of Different Companies. In India

Mutual funds are playing important role. The mutual fund Companies pool the Savings of small

investors and invest those collected huge amount of funds in different sectors of the economy.

They are performing like intermediary between small investor and the Indian

Capital market.

DrR.Narayanasamy, V. Rathnamani (2013) studied about performance analysis of the selected

five equity large cap funds, its clear that all the funds have performed well during the study

period. The fall in the CNX nifty during the year 2011 has impacted the performance of all the

selected funds. In the ultimate analysis it may be concluded that all the funds have performed

well in the high volatile market movement expect Reliance vision. Therefore it is essential for

investors to consider Statistical parameters like alpha, beta, standard deviation while investing in

mutual funds apart from considering NAV and total return in order to ensure consistent

performance of mutual funds.

To Study the Awareness of Mutual Fund in Mumbai Page 22

OBJECTIVES AND NEED FOR THE STUDY

ICICI SECURITIES had given a task, to seek an appointment of the ICICI Directs customer and

give them a demo on mutual fund simplified-investors awareness initiative. The study is to

understand the consumers mind set about mutual fund.

The objectives of the study are as following:

Awareness of mutual funds in market, especially in Mumbai area.

To identify the consumer behaviour while selecting a fund.

To identify the consumer perception about mutual funds.

Need for the study as following :

In some part of Mumbai, the consumers who are in banking and investment area they are still

unaware about the mutual fund scheme. The more of the people in Mumbai are middle class

background they think investing in mutual funds mean taking a more risk with low returns. The

study is for understanding the psyche towards the investments. Also making aware about Mutual

Fund is better investment in terms of good returns.

To Study the Awareness of Mutual Fund in Mumbai Page 23

RESEARCH METHODOLOGY

Research method:

Research methods are understood as all those methods and techniques that are used for conduction of

research. Research methods or techniques refer to methods the researchers use in performing research

operation. In other words, all those methods which are used by the researchers during the course of

studying his research problems are termed as research methods. Since the object of research, particularly

the applied research, is to arrive at a solution for a given problem, the available data and the unknown

aspects of the problem have to be related to each other to make a solution possible. Keeping this in view

the following methods are:

a) Interview

b) Demonstration on MF Simplified

Collection of data:

Primary data:- Survey methods:

This method was adopted because it helps to procure data and detail information from the

respondents. Here collected data size was 50 customers by giving demo and filling

questionnaires, directly talking to the customers

To Study the Awareness of Mutual Fund in Mumbai Page 24

MUTUAL FUND

Mutual fund

Mutual funds are operated by money managers, who invest the fund's capital and attempt to

produce capital gains and income for the fund's investors. A mutual fund's portfolio is structured

and maintained to match the investment objectives stated in its prospectus.

One of the main advantages of mutual funds is that they give small investors access to

professionally managed, diversified portfolios of equities, bonds and other securities, which

would be quite difficult (if not impossible) to create with a small amount of capital. Each

shareholder participates proportionally in the gain or loss of the fund. Mutual fund units, or

shares, are issued and can typically be purchased or redeemed as needed at the fund's current net

asset value (NAV) per share, which is sometimes expressed as NAVPs

Structure of mutual fund

Source: Nivesh Mantra Insurance and Financial Services

To Study the Awareness of Mutual Fund in Mumbai Page 25

Mutual funds are regulated by the Securities and Exchange Board of India (SEBI). SEBI

issued a comprehensive set of regulations in 1993 and revised them again in 1996. These

included regulations covering the Indian mutual fund industry. All mutual funds in India today

are regulated by SEBI. The Association of Mutual Funds of India (AMFI) is a self-governing

association of Indian Mutual Funds that regulates its members' sales, distribution and

communication practices. Investors can invest in Indian mutual funds directly or through

distributors under codes of practice developed by AMFI.

The fund manager, known as the fund sponsor or fund management company, trades the

fund's investments in accordance with the fund's investment objective. A fund manager must be

a registered investment advisor.

Mutual funds pass taxable income on to their investors by paying out dividends and capital gains

at least annually. The characterization of that income is unchanged as it passes through to the

shareholders. For example, mutual fund distributions of dividend income are reported as

dividend income by the investor. There is an exception: net losses incurred by a mutual fund are

not distributed or passed through to fund investors but are retained by the fund to be able to

offset future gains.

Mutual funds may invest in many kinds of securities. The types of securities that a particular

fund may invest in are set forth in the fund's prospectus, which describes the fund's investment

objective, investment approach and permitted investments. The investment objective describes

the type of income that the fund seeks. For example, a "capital appreciation" fund generally

looks to earn most of its returns from increases in the prices of the securities it holds, rather than

from dividend or interest income.

A mutual fund's investment portfolio is continually monitored by the fund's portfolio manager or

managers.Hedge funds are not considered a type of (unregistered) mutual fund.

To Study the Awareness of Mutual Fund in Mumbai Page 26

Types of mutual fund

A common man is so much confused about the various kinds of Mutual Funds that he is afraid of

investing in these funds as he cannot differentiate between various types of Mutual Funds with

fancy names. Mutual Funds can be classified into various categories under the following heads:-

o According To Type Of Investments :- While launching a new scheme, every Mutual Fund is

supposed to declare in the prospectus the kind of instruments in which it will make investments

of the funds collected under that scheme. Thus, the various kinds of Mutual Fund schemes as

categorized according to the type of investments are as follows :-

a. Equity Funds / Schemes

b. Debt Funds / Schemes (Also Called Income Funds)

c. Diversified Funds / Schemes (Also Called Balanced Funds)

d. Gilt Funds / Schemes

e. Money Market Funds / Schemes

f. Sector Specific Funds

g. Index Funds

o According To The Time Of Closure Of The Scheme : While launching new schemes,

Mutual Funds also declare whether this will be an open ended scheme (i.e. there is no specific

date when the scheme will be closed) or there is a closing date when finally the scheme will be

wind up. Thus, according to the time of closure schemes are classified as follows :-

a. Open Ended Schemes

b. Close Ended Schemes

Open ended funds are allowed to issue and redeem units any time during the life of the scheme,

but close ended funds cannot issue new units except in case of bonus or rights issue. Therefore,

unit capital of open ended funds can fluctuate on daily basis (as new investors may purchase

fresh units), but that is not the case for close ended schemes. In other words we can say that

new investors can join the scheme by directly applying to the mutual fund at applicable net asset

To Study the Awareness of Mutual Fund in Mumbai Page 27

value related prices in case of open ended schemes but not in case of close ended schemes. In

case of close ended schemes, new investors can buy the units only from secondary markets.

o According To Tax Incentive Schemes: Mutual Funds are also allowed to float some tax saving

schemes. Therefore, sometimes the schemes are classified according to this also:-

a. Tax Saving Funds

b. Not Tax Saving Funds / Other Funds

o According To the Time of Payout: Sometimes Mutual Fund schemes are classified according

to the periodicity of the pay outs (i.e. dividend etc.). The categories are as follows:-

(a) Dividend Paying Schemes

(b) Reinvestment Schemes

The mutual fund schemes come with various combinations of the above categories. Therefore,

we can have an Equity Fund which is open ended and is dividend paying plan. Before you

invest, you must find out what kind of the scheme you are being asked to invest. You should

choose a scheme as per your risk capacity and the regularity at which you wish to have the

dividends from such schemes

To Study the Awareness of Mutual Fund in Mumbai Page 28

Mutual Fund Scheme vs. Portfolio Management Scheme

In case of Mutual Fund schemes, the funds of large number of investors is pooled to form a

common investible corpus and the gains / losses are same for all the investors during that given

period of time. On the other hand, in case of Portfolio Management Scheme, the funds of a

particular investor remain identifiable and gains and losses for that portfolio are attributable to

him only. Each investor's funds are invested in a separate portfolio and there is no pooling of

funds.

Mfs are suitable for Small investors and big investors.

An individualshould invest in a Mutual Fund even if they can invest directly in the Same

Instruments

All other investments in equities and debts, the investments in Mutual funds also carry

risk. However, an investment through Mutual Funds is considered better due to the following

reasons:-

(a) Investments of individuals will be managed by professional finance managers who are in a

better position to assess the risk profile of the investments;

(b) In case there are small investors, then their investment cannot be spread into equity shares of

various good companies due to high price of such shares. Mutual Funds are in a much better

position to effectively spread investments across various sectors and among several products

available in the market. This is called risk diversification and can effectively shield the steep

slide in the value of investments.

Thus, the Mutual funds are better options for investments as they offer regular investors a chance

to diversify their portfolios, which is something they may not be able to do if they decide to

make direct investments in stock market or bond market. These are particularly good for small

investors who have limited funds and are not aware of the intricacies of stock markets. For

To Study the Awareness of Mutual Fund in Mumbai Page 29

example, if anyone want to build a diversified portfolio of 20 scrips, they would probably need

Rs 2, 00,000 to get started (assuming that they make minimum investment of Rs 10000 per

scrip). However, an individual can invest in some of the diversified Mutual Fund schemes for an

low as Rs.10, 000/-

What are risks by investing funds in Mutual Funds:

Everyone is aware that investments in stock market are risky as the value of our investments

goes up or down with the change in prices of the stocks where they have invested. Therefore, the

biggest risk for an investor in Mutual Funds is the market risk. However, different Schemes of

Mutual Funds have different risk profile, for example, the Debt Schemes are far less risk than

the equity funds. Similarly, Balance Funds are likely to be more risky than Debt Schemes, but

less risky than the equity schemes.

What is the difference between Mutual Funds and Hedge Funds:

Hedge Funds are the investment portfolios which are aggressively managed and use advanced

investment strategies, such as leveraged, long, short and derivative positions in both domestic

and international markets with a goal of generating high returns. In case of Hedged Funds, the

number of investors is usually small and minimum investment required is large. Moreover, they

are more risky and generally the investor is not allowed to withdraw funds before a fixed tenure.

To Study the Awareness of Mutual Fund in Mumbai Page 30

Some other important Terms Used in Mutual Funds

Sale Price: It is the price an individual can pay when they invest in a scheme and is also called

"Offer Price". It may include a sales load.

Repurchase Price: - It is the price at which a Mutual Fund repurchases its units and it may

include a back-end load. This is also called Bid Price.

Redemption Price: It is the price at which open-ended schemes repurchase their units and close-

ended schemes redeem their units on maturity. Such prices are NAV related.

Sales Load / Front End Load: It is a charge collected by a scheme when it sells the units. Also

called, Front-end load. Schemes which do not charge a load at the time of entry are called No

Load schemes.

Repurchase / Back-end Load: It is a charge collected by Mutual Funds when it buys back /

Repurchases the units from the unit holders.

To Study the Awareness of Mutual Fund in Mumbai Page 31

High NAV vs. Low NAV The Tale of Two Numbers

The Net Asset Value or the NAV is the price at which a single unit of a particular mutual fund is

traded. It is calculated by dividing the total net value of the assets held by the fund, to the

number of outstanding units.

NAV = Net Assets / Outstanding Units

How NAV differs from Stock Price?

While the NAV might seem to be similar to stock price, the two differ a lot. Since the NAV is

based on a bunch of underlying assets, its value is declared only once (at the end of a day), once

the trading in those underlying assets is completed. In comparison, a stock price (although

fluctuating) is available throughout trading hours. Moreover, unlike a stock price, the NAV does

not give you an idea about the performance of mutual fund scheme.

NAVs - The Highs and Lows of it

If you are planning to invest your money in a mutual fund, do not let the high and low NAV

values influence your decision about short-listing a fund. As discussed, unlike shares, the

absolute value of a mutual fund NAV does not say much about the performance of the fund.

- Low NAV - When a fund house launches a new fund (New Fund Offer - NFO), the units of the

fund are available for a standard NAV of Rs. 10 - this shouldn't be a deterrent. Further, as the

formula above states, a fund could have a lower NAV because its net assets are low or the no. of

outstanding units is high (due to a temporary transition like NAV split, etc.). Also, a fund's NAV

decreases proportionately, whenever it pays out dividends.

- High NAV- Similarly, a high NAV could be because of a good performance over the years.

But then, with mutual funds, the past performance is never a guarantee for future performance.

To Study the Awareness of Mutual Fund in Mumbai Page 32

Myth 1 - Low NAV means More Units = More Dividends

Investors should refrain from being attracted to low NAV funds just because you realize that

your money can fetch you more units and that this might be beneficial when the fund declares a

dividend. Here, the investor will not really benefit because a dividend is nothing but their own

money being paid out. In fact, after the dividend is paid out, the NAV is adjusted accordingly!

Myth 2 - Fund with High NAV have reached their potential

Another common myth is that mutual funds with a high NAV have maxed out their potential and

that they are no longer as lucrative. Now, one must remember that mutual funds have an

underlying portfolio of stocks, which are chosen by an experienced fund manager who has a

well-thought strategy for entering and exiting stocks. As soon as a particular stock has met its

objective, the fund manager sells the stock and buys newer ones that are likely to provide returns

in line with the scheme objectives.

One must understand that at the end, it is the fund performance that should matter and not the

absolute value of the NAV. The money growth will depend on how the fund is performing and

not on the NAV value. Hence, a 20% growth with NAV of 20 is the same as 20% growth with

NAV of 200.

To Study the Awareness of Mutual Fund in Mumbai Page 33

6 Key Questions that Mutual Fund Investors should ask

Once an individual have identified 'mutual funds' as their investment class, the next important

task is to select a scheme or set of schemes that can help to meet their goals.

1. Match individuals Objectives - When it comes to investments, knowledge is the key. Fund

performance is important, but simply picking up last year's top performing funds is not the right

approach because these are ever-changing set. Before arriving at a decision it is necessary to

consider key micro and macro-economic trends, and to align their investment objectives with

those of the scheme. In case of equity investments, it is ideal to remain invested for a long term.

2. Charges and Fees - Every investment comes with its own set of expenses - like transaction

cost, advisory fees, sales and purchase fees and the fund manager's expenses. Based on this

information, one can calculate the expected return on investment. Ensure that your fund house is

efficient and does not impose unreasonable charges/ barriers.

3.Risk v/s Reward - mutual fund scheme should have an allocation as per your risk appetite

(conservative, assertive, aggressive, etc.). Remember, if you are prepared to take more risks, the

scheme should have the potential to provide better returns over the longer term.

To Study the Awareness of Mutual Fund in Mumbai Page 34

4. Tax Treatment - Just like stocks and bonds, mutual funds' tax liabilities are based on short-

term and long-term capital gains. In fact, as an investor, you should consider the 'post-tax returns'

while calculating the absolute returns from a scheme.

Ask questions like:

- Is the invested amount tax exempted?

-Is there a lock-in period to avail the said tax benefit?

-Are the returns tax exempted? What about the dividends and payouts?

5. Evaluate long-term performance - The best metric to evaluate a scheme is its long-term

performance. Along with the average rate of return, see if the scheme has been able to meet its

investment objectives. Evaluate its long-term performance vis-a-vis similar funds in the market.

Also consider key portfolio parameters to ascertain if the fund is taking undue risks, etc.

6. Fund Manager's Capabilities and Investment Processes - Just like any other investment,

the performance of a mutual fund scheme largely depends upon the experience and expertise of

the fund manager and the processes it adheres to while managing your funds. Before handing

over your hard-earned money to them, learn about their credentials and their abilities to achieve

the scheme objectives even in challenging market conditions.

Risks Associated with MF investments

'Mutual funds investments are subject to market risks, please read the offer document carefully

before investing' is a much repeated, but crucial advice. Market risks can be in the form of

economic, financial and political factors that might affect your investments.

To Study the Awareness of Mutual Fund in Mumbai Page 35

Market risks are broadly classified into two types -systemic and non-systemic risks.

-Systemic risks are the ones that affect the entire market. It includes volatility in the stock

market (equity risk), interest rates (interest risk), foreign exchange rates (currency risk),

changes in commodity prices (commodity risk), political factors prevailing in a country and

even extreme changes in weather.

The most effective way to counter systemic risks is to look for investment ideas that can

counter volatility of the markets.

- Non-systemic risks affect investments of a particular sector or industry. While systemic risks

are usually unexpected and unavoidable, a diversified portfolio can reduce the impact of non-

systemic risks.

An investment in mutual funds, like any other, requires a thorough understanding of how

various markets operate. Investors should understand that risk and reward go hand in hand and

are a part of every investment.

To Study the Awareness of Mutual Fund in Mumbai Page 36

Comparison of ICICI with top 3 AMCs

Products Ranking according to the market share of Mutual Fund of ICICI and the top most

AMCs:

Product ICICI RELIANCE BIRLA

SUN LIFE

HDFC

Equity fund 3 1 4 2

Debt fund 5 4 3 3

Liquid fund 1 3 4 1

Debt-equity fund 1 3 3 2

Source:Crisil

The above ranking is according to Crisil. The methodology developed for mutual fund

rankings in India are based on global best practices. Over the past 10 years, these have gained

high acceptance among investors, intermediaries, and asset management companies. The

performance criteria covers not only risk adjusted returns, but also portfolio characteristics like

industry concentration, company concentration, liquidity etc. to make the analysis forward

looking.

Comparison Of Assets Under Management From June 2013-June 2014

Source:Crisil

91,695

97,771

79,761

104,977

118,056

112,914

98,556

130,036

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

ICICI RELIANCE BIRLA SUNLIFE HDFC

2013

To Study the Awareness of Mutual Fund in Mumbai Page 37

According to the survey, more of the people are invested in equity mutual fund therefore

following is the comparison of Equity Fund of four AMCs according to their fund size and the 5

years total average return on category:

Equity Fund Size

Source:Crisil

In the above chart, it is the size of total equity funds of the compared AMCs. HDFC has the

highest equity fund in current scenario. Compared to others reliance has the lowest equity fund in

crores.

Equity Returns

Source:Crisil

4704.57

10249.49

124.51

2434.44

0

2000

4000

6000

8000

10000

12000

ICICI HDFC Birla Sunlife Reliance

Fund Size(Cr)

Fund Size(Cr)

27.5

37.44

40.7

36.96

12.11

13.4 13.41

18.82

0

5

10

15

20

25

30

35

40

45

ICICI HDFC Birla Sunlife Reliance

YTD Return (%)

Categoty Average Return

(5 Yrs)

To Study the Awareness of Mutual Fund in Mumbai Page 38

In above chart, there comparison of category average return and Year to Date (YTD) return for 5

years on equity.HDFC and Birla sun life has high YTD returns and low returns in average

category. Same with the ICICI Prudential and Reliance.

NAV High - Low (52 Weeks)

Source:Crisil

According to the Crisil ranking, in the overall comparison HDFC has the highest potential for

being MF distributor in Equity fund. ICICI Prudential being the lowest. Also ICICI can be better

performed in debt and liquid fund market. It has well known identity in financial institution.

Reason for comparison only on the basis of Equity fund i.e. it has high demand in market. People

think it is less risky comparing to the other investments

0

50

100

150

200

250

300

350

400

450

ICICI HDFC Birla Sunlife Reliance

17.03

236.64

82.04

9.58

26.2

434.58

142.65

16.65

Low

High

To Study the Awareness of Mutual Fund in Mumbai Page 39

FINDINGS

During the survey, more of the people are not interested investing in mutual fund because they

think there is a high risk in returns. Some of the people dont have time to invest. HNIs are

investing in mutual fund but they dont have time to manage their portfolio or they probably not

interested.

Middle income people need more assistants before they invest in mutual fund. Lack of

knowledge about Mutual Fund is headed to less Interest in investing in MF.

Following is the data interpretation collected from the survey:

Q. What is your preferred mode of investment?

More of the people are started preferring online mode of investment. The survey conducted

through ICICI Securities 75% individual does online trading. There are also some people who

still believe in offline trading they feel it is safest.

75

25

mode of investment

online offline

To Study the Awareness of Mutual Fund in Mumbai Page 40

Q. Have you invested in any of the following in the last 12 months?

Equity is most preferable investment people think. Only 25% people who know about Mutual

Fund invest in it. And the other individual go for insurance and F&O.

Q. How often do you transact online in any of the above mentioned transactions?

More of the people do transactions like trading on monthly basis. As per their requirement or

preference. 15% people do manage their transactions on yearly basis.

35

15

15

25

product

Equity

future & options

insurance

mutual fund

45

20

20

15

0 10 20 30 40 50

monthly

weekly

quarterly

yearly

transaction

transaction

To Study the Awareness of Mutual Fund in Mumbai Page 41

Q. How does you /would you prefer to make your investments in Mutual Funds

ICICI direct.com is best way to invest through, 60% people use it. 20% go through the agent

because they dont know about stock market but still wants to invest. And rest of the people goes

directly with AMC or through company.

Q. Before the demo, were you aware that you can invest in Mutual funds through

ICICI DIRECT?

85% of the people were aware about the mutual fund through ICICI DIRECT.COM.

60

20

10 10

Portals

icici direct.com

Agent

Directly with AMC

Directly with company

0 20 40 60 80 100

YES

NO

85

15

AWARENESS

AWARENESS

To Study the Awareness of Mutual Fund in Mumbai Page 42

Q. If yes, what are the reasons for not investing in Mutual Funds through

ICICIdirect.com?

All ICICIdirect customers were aware about the mutual fund, but 25% investors were need for

the assistance before investing in it and 40% were not interested. Others were investing through

the brokers.

Q. Which medium of news information and analysis do you use to keep yourself

informed on investment products?

According to the survey, 55% investors keep updated themselves by using financial websites to

comparison with other investment products also they have their financial advisor, broker and,

MF distributor to keep them updating. Rest of the people read media reports and news

updates.20% investors do their ownresearch to keep them informed on their investments.

Q. How do you check the performance of all/any of your investments?

In survey 60% investors track their performances of their investments through there bank or

broker they inform them on weekly or monthly basis to manage their portfolio, 30% investors

ask or take advice from their financial advisor or MF distributor. But more of the people manage

portfolio by themselves to keep the track of the market.

0

20

40

need for assistance investing through

other broker

not intrested

25

35

40

Reasons

To Study the Awareness of Mutual Fund in Mumbai Page 43

RECOMMENDATIONS AND SUGGESTION

After a thorough study and analysis of the data and information, the financial market in Mumbai, is in its

booming stage, in the short run and in the long run as well. Recommendations and suggestions are

normally given when there are some problems or difficulties lying in the market. Here in this research

report recommendations and suggestions are totally based on the facts, reactions, attitudes, perceptions,

and many other things of the respondentswhich have received from them during research work.

Consumer survey has revealed the fact that the market for mutual fund is still in its expansion stage.

Hence the companies have to do a lot of things and activities to develop the market for mutual fund in this

capital city.

Awareness of mutual fund products must be increased in this city. Conference or seminars on Mutual

Fundscan be conducted. This will no doubt increase the awareness of mutual fund in the minds of the

investors.

While the Mutual fund has seen dramatic improvements in quantity as well as quality of product and

service offerings over the past decade. One of the primary reasons for this slow growth is the fact that

mutual funds are a new concept in India, which needs to be still understood by large sections of Indian

investors.

Booklets on mutual funds can be distributed at free of cost to the common people with the newspapers,

magazines, journals. This will help in attitude formation of the investors.

Mutual fund companies must tie up with other financial institute like banks, post office to reach to the

mass people in our country.

To Study the Awareness of Mutual Fund in Mumbai Page 44

CONCLUSION

On the basis of survey and analysis, Mutual Funds are less risky but the people in Mumbai, as in

role of investors they are unaware about its characteristics and features like good returns,

diversification.

More of the investors invest in Equity fund thinking of less risk and better returns. Also mutual

funds are high cost because of tax consequences and inability of management to guarantee a

superior return.

Their advantage is it can be easily bought or sell as it is a professional management.

ICICI DIRECT.COM taking an initiative to make more awareness about Mutual Fund in

common people.

To Study the Awareness of Mutual Fund in Mumbai Page 45

BIBLIOGRAPHY

Online articles

faculty.chicagobooth.edu/lubos.pastor/research/invest_jfe.pdf

http://timesofindia.indiatimes.com/business/mf-news/High-NAV-vs-Low-NAV-The-

Tale-of-Two-Numbers/articleshowhsbc/26047926.cms

Research Papers

Dr. Binod Kumar Singh, March 2012, Study on investors attitude towards mutual fund

as an investment option , International journal of research in management

Mr. Ajay Kohrana, Henry serves, Peter Tufano April 25,2003, The world of mutual fund

Sarish , 2012 , A Study of Opportunities and Challenges for Mutual Fund in India: Vision

2020,Vsrd International Journal, Research Communication Vol 2 (4)

12 September 2001, Investing in equity mutual funds

Sergio Schmukler and Richard Lyons, November 1999, Mutual Fund Investment in

Emerging Markets

Russ Wermers, August 2000, Mutual Fund Performance: An Empirical Decomposition

into Stock-Picking Talent, Style, Transactions Costs, and Expenses

To Study the Awareness of Mutual Fund in Mumbai Page 46

Sahil Jain, July-Aug. 2012, Analysis of Equity Based Mutual Funds in India

Dr.Shantanu Mehta, Charmi Shah, September 2012, Preference of Investors for Indian

Mutual Funds and its Performance Evaluation

Mrs. P Alekhya, October 2012,A Study on Performance Evaluation of Public & Private

Sector Mutual Funds In India

Dr.R.Narayanasamy, V. Rathnamani, April 2013, Performance Evaluation of Equity

Mutual Funds (On Selected Equity Large Cap Funds)

Websites and references

investopedia.com

icicisecurities.com

google.co.in

wikipedia.org

ndtv.com

timesofindia.indiatimes.com

elibrary.worldbank.org

moneycontrol.com

www.niveshmantra.in

To Study the Awareness of Mutual Fund in Mumbai Page 47

ANNEXURE1 : QUESTIONNAIRE

MUTUAL FUND SIMPLIFIED

INVESTORS INITIATIVE AWARENESS

1. What is your preferred mode of investment

o Online

o Offline

2. Have you invested in any of the following in the last 12 months

o Equity

o future & options

o insurance

o mutual fund

o corporate fixed deposits

3. How often do you transact online in any of the above mentioned transactions

o Weekly

o Monthly

o Quarterly

o Yearly

4. How do you /would you prefer to make your investments in Mutual Funds

o ICICI DIRECT.com

o Agent

o Directly With Company

o Directly With AMC

5. Before the demo, were you aware that you can invest in Mutual funds through

ICICI Direct

o Yes

o No

To Study the Awareness of Mutual Fund in Mumbai Page 48

6. If yes, what are the reasons for not investing in Mutual Funds through

ICICIdirect.com

o Need more knowledge before i invest in MF

o I invest through other broker or distributor

o Not interested investing in Mutual Fund

7. Which medium of news information and analysis do you use to keep yourself

informed on investment products

o I discuss with my friends, family and or colleagues

o I use financial websites for comparisons and news

o I have a financial advisor or broker or MF distributor who updates me

o I read media reports

o I prefer to do my own research

8. How do you check the performance of all/any of your investments

o I update investment details on a third party portfolio website and check regularly

o My broker or bank provides me the information

o I ask my financial advisor or broker or MF distributor to send me information

o Other

You might also like

- Forex Fundamental AnalysisDocument2 pagesForex Fundamental Analysistejasvigopal100% (1)

- Project On Ratio and Cash Flow Analysis For Titan Industries Pvt. Ltd.Document15 pagesProject On Ratio and Cash Flow Analysis For Titan Industries Pvt. Ltd.hemu1163% (16)

- A Comparative Analysis On Public and Private Mutual FundsDocument72 pagesA Comparative Analysis On Public and Private Mutual FundsMadhuri Tripathi80% (5)

- Customer Perception Towards The Mutual FundsDocument56 pagesCustomer Perception Towards The Mutual Fundsshikha gupta100% (1)

- The Study On Indian Money Market ProjectDocument62 pagesThe Study On Indian Money Market Project07 Bhavesh Jagtap100% (1)

- Project On Investor Preference in Mutual FundsDocument52 pagesProject On Investor Preference in Mutual FundsKevin IycNo ratings yet

- To Study What Is Portfolio Management ServicesDocument31 pagesTo Study What Is Portfolio Management ServicesRohanNo ratings yet

- Consumer Behaviour Towards Mutual FundDocument169 pagesConsumer Behaviour Towards Mutual FundShanky Kumar100% (1)

- Analysis of Demat Account and Online TradingDocument70 pagesAnalysis of Demat Account and Online Tradingpraveen18866882% (11)

- Trading Course SyllabusDocument13 pagesTrading Course SyllabusCrypto CosmonautNo ratings yet

- 2012 IOMA Derivatives Market Survey PDFDocument61 pages2012 IOMA Derivatives Market Survey PDFMiguel S OrdoñezNo ratings yet

- F9FM-Session11 d08Document16 pagesF9FM-Session11 d08MuhammadAliNo ratings yet

- Mutual Fund InvstDocument109 pagesMutual Fund Invstdhwaniganger24No ratings yet

- Project On Mutual FundDocument112 pagesProject On Mutual FundSharn GillNo ratings yet

- "Systematic Investment Plan: Sbi Mutual FundDocument60 pages"Systematic Investment Plan: Sbi Mutual Fundy2810No ratings yet

- A Synopsis On: "Project Report On Comparative Analysis On Mutual Funds of Reliance Mutual Funds & HDFC Mutual FundsDocument6 pagesA Synopsis On: "Project Report On Comparative Analysis On Mutual Funds of Reliance Mutual Funds & HDFC Mutual FundsNeeraj Agarwal0% (1)

- A Comparitive Study On Public and Private Sector Mutual FundsDocument45 pagesA Comparitive Study On Public and Private Sector Mutual FundsGauri Vishwakarma100% (1)

- summer Training Project: Under The Supervision Submitted By: & Guidance ofDocument41 pagessummer Training Project: Under The Supervision Submitted By: & Guidance ofAditya Gupra50% (2)

- A Study On Mutual FundsDocument98 pagesA Study On Mutual FundsJay Pawar100% (1)

- A Study On Portfolio Management of Individual Investors in MumbaiDocument77 pagesA Study On Portfolio Management of Individual Investors in MumbaiTechno GuysNo ratings yet

- Comparative Study of Two Mutual Fund CompanyDocument73 pagesComparative Study of Two Mutual Fund CompanySwathi Manthena100% (2)

- Project Report On Study of Mutual Funds IndustryDocument65 pagesProject Report On Study of Mutual Funds Industryananthakumar100% (1)

- Comparative Analysis On Mutual Fund Scheme MBA ProjectDocument83 pagesComparative Analysis On Mutual Fund Scheme MBA Projectvivek kumar100% (1)

- BLack BookDocument65 pagesBLack Bookabhishek mohiteNo ratings yet

- Customer Perception Towards Mutual FundsDocument63 pagesCustomer Perception Towards Mutual FundsMT RA100% (1)

- A Project Report On Comparative Analysis Ulip Vs Mutual Funds - NetworthDocument72 pagesA Project Report On Comparative Analysis Ulip Vs Mutual Funds - NetworthNagireddy Kalluri80% (5)

- Project Report On Portfolio ManagementDocument118 pagesProject Report On Portfolio ManagementMohan Chakradhar100% (1)

- Analysis of Demat Account and Online TradingDocument66 pagesAnalysis of Demat Account and Online Tradingkamdica57% (7)

- Portfolio Management and Mutual Fund Analysis PDFDocument53 pagesPortfolio Management and Mutual Fund Analysis PDFRenuprakash Kp75% (4)

- Mutual Fund As An Investment AvenueDocument62 pagesMutual Fund As An Investment Avenueamangarg13100% (8)

- Study of Tax Saving Schemes in Mutual Funds Mba ProjectDocument74 pagesStudy of Tax Saving Schemes in Mutual Funds Mba ProjectSachin Gala33% (6)

- Comparative Study of Mutual Fund NewDocument112 pagesComparative Study of Mutual Fund NewDebabrato Sasmal100% (4)

- Investors Awareness and Perception Towards Mutual Fund Investment:an Exploratory StudyDocument11 pagesInvestors Awareness and Perception Towards Mutual Fund Investment:an Exploratory StudyIJAR JOURNALNo ratings yet

- A Study On Investment Pattern of Investor in Mutual Funds: Mr. Ismayil Paisal KhanDocument19 pagesA Study On Investment Pattern of Investor in Mutual Funds: Mr. Ismayil Paisal KhanVandita KhudiaNo ratings yet

- Merger and Acquisition of Banking Sector in IndiaDocument70 pagesMerger and Acquisition of Banking Sector in IndiaAnil BatraNo ratings yet

- Report On Wealth ManagementDocument34 pagesReport On Wealth Managementarun883765No ratings yet

- A Project On Comparative Analysis of HDFC Mutual Fund With Other Mutual Funds in The City of Jamshedpur by Gopal Kumar Agarwal, CuttackDocument80 pagesA Project On Comparative Analysis of HDFC Mutual Fund With Other Mutual Funds in The City of Jamshedpur by Gopal Kumar Agarwal, Cuttackgopalagarwal238791% (23)

- Customer Perception Towards Mutual FundsDocument82 pagesCustomer Perception Towards Mutual FundsMohd Fahad100% (10)

- A Study On Investor Perception Towards Mutual FundsDocument68 pagesA Study On Investor Perception Towards Mutual FundsTom Salunkhe0% (1)

- Comparative Analysis Between Mutual Funds and Equity MarketDocument18 pagesComparative Analysis Between Mutual Funds and Equity MarketAnonymous oRSVOtR4BNo ratings yet

- Derivative Market in India by ICICI, SBI & Yes Bank & Its BehaviorDocument90 pagesDerivative Market in India by ICICI, SBI & Yes Bank & Its BehaviorChandan SrivastavaNo ratings yet

- Risk Management in Mutual Fund IndustryDocument43 pagesRisk Management in Mutual Fund Industrydeepak100% (1)

- Risk Return Analysis of Icici & HDFC BankDocument76 pagesRisk Return Analysis of Icici & HDFC Banksachinji198983% (12)

- Equity Analysis ProjectDocument65 pagesEquity Analysis ProjectTanvir KhanNo ratings yet

- Consumer Perception Toward Mutual Fund in IndiaDocument59 pagesConsumer Perception Toward Mutual Fund in IndiaAmardeep SinghNo ratings yet

- Tybms Black Book Topics Finance Revisedxlsx PDF FreeDocument2 pagesTybms Black Book Topics Finance Revisedxlsx PDF FreeShreyaNo ratings yet

- Comparative Study of Mutual Funds and Fixed Deposit by SangramDocument32 pagesComparative Study of Mutual Funds and Fixed Deposit by SangramIrin Chhinchani100% (1)

- Literature ReviewDocument8 pagesLiterature ReviewKEDARANATHA PADHY100% (1)

- Comparative Analysis of Mutual Fund of HDFC & ICICIDocument80 pagesComparative Analysis of Mutual Fund of HDFC & ICICIStar83% (6)

- A Study On Risk-Return-Analysis at INDIA BULLSDocument57 pagesA Study On Risk-Return-Analysis at INDIA BULLSKalpana GunreddyNo ratings yet

- Comparison of Mutual Funds With Other Investment OptionsDocument56 pagesComparison of Mutual Funds With Other Investment OptionsDiiivya86% (14)

- A Study On Investors Preference Towards Mutual FundsDocument82 pagesA Study On Investors Preference Towards Mutual Fundsfazil shariffNo ratings yet

- Introduction To Brokerage IndustryDocument13 pagesIntroduction To Brokerage Industryapriti29No ratings yet

- A SYNOPSIS ON Mutual FundsDocument9 pagesA SYNOPSIS ON Mutual FundsPavan Pavi100% (1)

- A Study On Portfolio Management at Motilal Oswal Financial Services LTD SubmittedDocument11 pagesA Study On Portfolio Management at Motilal Oswal Financial Services LTD Submittedv raviNo ratings yet

- Project On Consumer Perception On Investment in Mutual FundsDocument85 pagesProject On Consumer Perception On Investment in Mutual Fundssulthana,rajia85% (20)

- Study The Awareness of Mutual Fund in Mumbai PDFDocument48 pagesStudy The Awareness of Mutual Fund in Mumbai PDFnikki karma100% (1)

- Riti Project ReportDocument37 pagesRiti Project ReportMadhukar Singh roll no 26No ratings yet

- Prashant SynopsisDocument6 pagesPrashant SynopsisPrashant BanerjeeNo ratings yet

- Overview of Mutual Fund Ind. HDFC AMCDocument67 pagesOverview of Mutual Fund Ind. HDFC AMCSonal DoshiNo ratings yet

- HDFC ProjectDocument97 pagesHDFC ProjectAamir KhanNo ratings yet

- A Comparative Analysis of Mutual Funds in Private Sector Bank & Public Sector BankDocument84 pagesA Comparative Analysis of Mutual Funds in Private Sector Bank & Public Sector BankSami Zama0% (1)

- Firoz ProjectDocument104 pagesFiroz ProjectRishi GoyalNo ratings yet

- Investers Preference Towards Mutual FundsDocument24 pagesInvesters Preference Towards Mutual FundsritishsikkaNo ratings yet

- Bharti Project ReportDocument107 pagesBharti Project ReportBharti SinghNo ratings yet

- Ashiana Housing Investor PresentationDocument37 pagesAshiana Housing Investor PresentationabmahendruNo ratings yet

- Case Study 2.1: Corporate Governance: Questions # 1Document2 pagesCase Study 2.1: Corporate Governance: Questions # 1Adeel Amir Siddiqui86% (7)

- Mock Reviewer in Management AccountingDocument6 pagesMock Reviewer in Management AccountingJA VicenteNo ratings yet

- CCME Top Pick of 2011 Northland SecuritiesDocument8 pagesCCME Top Pick of 2011 Northland SecuritieswctbillsNo ratings yet

- Aiq June2000Document8 pagesAiq June2000addinfoNo ratings yet

- FinQuiz Level1Mock2018Version2JuneAMSolutionsDocument79 pagesFinQuiz Level1Mock2018Version2JuneAMSolutionsYash Joglekar100% (2)

- 162 003Document5 pages162 003Alvin John San Juan33% (3)

- SecuritizationDocument76 pagesSecuritizationsrinu RizarrdsNo ratings yet

- Cemco Holdings, Inc. v. National Lfe Insurance Co., G.R. No. 171815 (August 7, 2007)Document9 pagesCemco Holdings, Inc. v. National Lfe Insurance Co., G.R. No. 171815 (August 7, 2007)MingNo ratings yet

- Risk Management in Banking (B-505) : Shah Mohammad Mohiuddin ID#12-038Document42 pagesRisk Management in Banking (B-505) : Shah Mohammad Mohiuddin ID#12-038Md Sifat KhanNo ratings yet

- Credit Risk SasDocument152 pagesCredit Risk SasShreyas DalviNo ratings yet

- Identify The Start of A Trend With DMIDocument8 pagesIdentify The Start of A Trend With DMIfendyNo ratings yet

- Graham & Doddsville - Issue 15 - Spring 2012Document64 pagesGraham & Doddsville - Issue 15 - Spring 2012Filipe DurandNo ratings yet

- CAPITAL ASSET PRICING MODEL - A Study On Indian Stock MarketsDocument78 pagesCAPITAL ASSET PRICING MODEL - A Study On Indian Stock Marketsnikhincc100% (1)

- Balance On Power BopDocument5 pagesBalance On Power BopAnam TawhidNo ratings yet

- Clearsight Monitor - Professional Services Industry UpdateDocument9 pagesClearsight Monitor - Professional Services Industry UpdateClearsight AdvisorsNo ratings yet

- JG Summit Holdings Vs CA GR 124293 2Document1 pageJG Summit Holdings Vs CA GR 124293 2Nurz A TantongNo ratings yet

- (##-See Rebate) : 1st Year 2nd Year 3rd Year 4th Year 5th Year 6th YearDocument1 page(##-See Rebate) : 1st Year 2nd Year 3rd Year 4th Year 5th Year 6th YearMita SethiNo ratings yet

- Wave Notes - ElliottwavepredictionsDocument14 pagesWave Notes - Elliottwavepredictionspier100% (1)

- Dividend TheoriesDocument25 pagesDividend TheoriessachinremaNo ratings yet

- Dynamic Zone RSI StrategyDocument14 pagesDynamic Zone RSI Strategybookdotcom7221No ratings yet

- MGT827Document2 pagesMGT827Yen GNo ratings yet

- Lecture 5 - Ratio AnalysisDocument37 pagesLecture 5 - Ratio AnalysisnopeNo ratings yet

- Cost of CapitalDocument4 pagesCost of Capitalkomal mishraNo ratings yet

- Far450 Fac450Document9 pagesFar450 Fac450aielNo ratings yet