Professional Documents

Culture Documents

CIR Vs Marubeni

Uploaded by

Trish VerzosaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIR Vs Marubeni

Uploaded by

Trish VerzosaCopyright:

Available Formats

CIR vs Marubeni

The dividends received by Marubeni Corporation from Atlantic Gulf and Pacific

Co. are not income arising from the business activity in which Marubeni

Corporation is engaged. Accordingly, said dividends if remitted abroad are not

considered branch profits subject to ranch Profit !emittance Ta".

Facts:

Marubeni Corporation is a Japanese corporation licensed to engage in business in

the Philippines. When the profits on Marubenis investments in tlantic !ulf and

Pacific Co. of Manila "ere declared# a $%& final dividend ta' "as "ithheld from

it# and another $(& profit remittance ta' based on the remittable amount after the

final $%& "ithholding ta' "ere paid to the )ureau of Internal Revenue. Marubeni

Corp. no" claims for a refund or ta' credit for the amount "hich it has allegedl*

overpaid the )IR.

Issues and Ruling:

$. Whether or not the dividends Marubeni Corporation received from tlantic !ulf

and Pacific Co. are effectivel* connected "ith its conduct or business in the

Philippines as to be considered branch profits sub+ect to $(& profit remittance ta'

imposed under ,ection -./b0/-0 of the 1ational Internal Revenue Code.

12. Pursuant to ,ection -./b0/-0 of the 3a' Code# as amended# onl* profits

remitted abroad b* a branch office to its head office "hich are effectivel*

connected "ith its trade or business in the Philippines are sub+ect to the $(& profit

remittance ta'. 3he dividends received b* Marubeni Corporation from tlantic

!ulf and Pacific Co. are not income arising from the business activit* in "hich

Marubeni Corporation is engaged. ccordingl*# said dividends if remitted abroad

are not considered branch profits for purposes of the $(& profit remittance ta'

imposed b* ,ection -./b0/-0 of the 3a' Code# as amended.

-. Whether Marubeni Corporation is a resident or non4resident foreign

corporation.

Marubeni Corporation is a non4resident foreign corporation# "ith respect to the

transaction. Marubeni Corporations head office in Japan is a separate and distinct

income ta'pa*er from the branch in the Philippines. 3he investment on tlantic

!ulf and Pacific Co. "as made for purposes peculiarl* germane to the conduct of

the corporate affairs of Marubeni Corporation in Japan# but certainl* not of the

branch in the Philippines.

5. t "hat rate should Marubeni be ta'ed6

$(&. 3he applicable provision of the 3a' Code is ,ection -./b0/$0/iii0 in

con+unction "ith the Philippine4Japan 3a' 3reat* of $78%. s a general rule# it is

ta'ed 5(& of its gross income from all sources "ithin the Philippines. 9o"ever# a

discounted rate of $(& is given to Marubeni Corporation on dividends received

from tlantic !ulf and Pacific Co. on the condition that Japan# its domicile state#

e'tends in favor of Marubeni Corporation a ta' credit of not less than -%& of the

dividends received. 3his $(& ta' rate imposed on the dividends received under

,ection -./b0/$0/iii0 is easil* "ithin the ma'imum ceiling of -(& of the gross

amount of the dividends as decreed in rticle $%/-0/b0 of the 3a' 3reat*.

Note: Each tax has a different tax basis.:nder the Philippine4Japan 3a'

Convention# the -(& rate fi'ed is the ma'imum rate# as reflected in the phrase

;shall not e'ceed.< 3his means that an* ta' imposable b* the contracting state

concerned hould not e'ceed the -(& limitation and said rate "ould appl* onl* if

the ta' imposed b* our la"s e'ceeds the same.

)PI FMI=> ,?I1!, )1@# I1C.# ? C !.R. 1o. $--.8%# pril $-# -%%%

Monda*# Januar* -A# -%%7 Posted b* Coffeeholic Writes

=abels: Case Bigests# 3a'ation

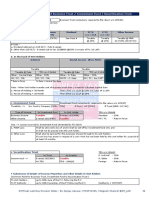

Facts: Petitioner banCs annual corporate income ta' return for $787 sho"ed that

it suffered a loss of P8#-8A#7A%# and that it had a total refundable amount of

P-7D#.7- inclusive of P$$-#.7$ being claimed as ta' refund in the present case.

9o"ever# petitioner declared in its $787 income ta' return as a ta' credit in the

succeeding ta'able *ear.

2n 2ctober $$# $77$# petitioner banC filed a "ritten claim for refund of P$$-#.7$

"ith the )IR alleging that it did not appl* the $787 refundable amount of

P-7D#.7- as ta' credit to its $77% annual corporate income ta' return or either ta'

liabilities due to business losses it incurred for the same *ear. Without "aiting for

respondent CIRs action in its claim for refund# petitioner filed a petition for

revie" "ith the C3.

C3 dismissed the petition on the ground that petitioner banC failed to present as

evidence its $77% annual income ta' return to prove that it had not *et credited the

amount of P-7D#.--# inclusive of P$$-#.7$ "hich is the sub+ect of the present

controvers* to its $77% ta' liabilit*. ,ince petitioner declared in its $787 income

ta' return that it "ould appl* the e'cess "ithholding ta' as ta' credit for the

follo"ing *ear# the ta' court presumed that it did so. Petitioner failed to overcome

this presumption because it did not present its $77% ta' return "hich "ould have

sho"n that the amount "as not applied as a ta' credit. 9ence# it "as concluded

that petition "as not entitled to a ta' refund. 3he C affirmed said decision of the

C3.

Issue: Whether or not petitioner is entitled to a ta' refund of P$$-#.7$

representing creditable "ithholding ta' paid for $787.

Held: 3he petition is meritorious. s a rule# the factual findings on the appellate

court are binding on the ,C. 3his rule# ho"ever# does not appl* "here# inter alia#

the +udgment is premised on a misapprehension of facts or "hen the appellate

court failed to notice certain relevant facts "hich if considered "ould +ustif* a

different conclusion. 3his case is one such e'ception.

,trict procedural rules generall* fro"n up the submission of the return the trial.

R.. $$-(# the la" creating the C3# ho"ever# specificall* provides the

proceedings before it ;shall not be governed strictl* b* the technical rules of

evidence<. 3he paramount considerations remains the ascertainment of truth.

?eril*# the Euest for orderl* presentation of issues is not an absolute. It should not

bar courts from considering undisputed facts to arrive at a +ust determination of a

controvers*.

While ta' refunds are in the nature of the e'ceptions and are to the construct

strictissimi +uris against the claimant# under the facts of this case# petitioner has

established its claim.

,ubstantial +ustice eEuit*# and fair pla* are on the side of petitioner. 3echnicalities

and legalisms# ho"ever# e'alted# should not be misused b* the government to Ceep

mone* not belonging to it and thereb* enrich "ould be better b* allo"ing to

appeal.

CIR v. BPIG.R. No. 1!"#$ %ul& ' ($$#Chico)Na*ario' J.

+octrine:#. The phrase $for that ta"able period% merely identifies the e"cess

income ta", subject of the option, by referring to the ta"able period when it was

ac&uired by the ta"payer.

'. (hen circumstances show that a choice has been made by the ta"payer to carry

over the e"cess income ta" as credit, it should be respected) but when indubitable

circumstances clearly show that another choice, a ta" refund, is in order, it should

be granted. As to which option the ta"payer chose is generally a matter of

evidence.

$Technicalities and legalisms, however e"alted, should not be misused by the

government to *eep money not belonging to it and thereby enrich itself at the

e"pense of its law+abiding citi,ens.%

Facts:In filing its Corporate Income 3a' Return for the Calendar >ear -%%%# )PI

carried over the e'cess ta' credits from the previous *ears of $77D# $778 and

$777. 9o"ever# )PI failed to indicate in its I3R its choice of "hether to carr* over

its e'cess ta' credits or to claim the refund of or issuance of a ta' credit certificate.

)PI filed "ith the Commissioner of Internal Revenue /CIR0 an administrative

claim for refund. 3he CIR failed to act on the claim for ta' refund of )PI. 9ence#

)PI filed a Petition for Revie" before the C3# "hom denied the claim.

3he C3 relied on the irrevocabilit* rule laid do"n in ,ection DA of the 1ational

Internal Revenue Code /1IRC0 of $77D# "hich states that once the ta'pa*er opts

to carr* over and appl* its e'cess income ta' to succeeding ta'able *ears# its

option shall be irrevocable for that ta'able period and no application for ta' refund

or issuance of a ta' credit shall be allo"ed for the same.

3he Court of ppeals reversed the C3 decision stating that there "as no actual

carr*ing over of the e'cess ta' credit# given that )PI suffered a net loss in $777#

and "as not liable for an* income ta' for said ta'able period# against "hich the

$778 e'cess ta' credit could have been applied.

3he Court of ppeals further stated that even if ,ection DA "as to be construed

strictl* and literall*# the irrevocabilit* rule "ould still not bar )PI from seeCing a

ta' refund of its $778 e'cess ta' credit despite previousl* opting to carr* over the

same. 3he phrase ;for that ta'able period< Eualified the irrevocabilit* of the option

of )IR to carr* over its $778 e'cess ta' credit to onl* the $777 ta'able periodF

such that# "hen the $777 ta'able period e'pired# the irrevocabilit* of the option of

)PI to carr* over its e'cess ta' credit from $778 also e'pired.

Issue:$. What is the period captured b* the irrevocabilit* rule6-. Whether or not

the ta'pa*ers failure to marC the option chosen is fatal to "hatever claim

Held:$. 3he last sentence of ,ection DA of the 1IRC of $77D reads: ;2nce the

option to carr*4over and appl* the e'cess Euarterl* income ta' against income ta'

due for the ta'able Euarters of the succeeding ta'able *ears has been made# such

o,tion shall be considered irrevocable for that taxable ,eriod and no

a,,lication for tax refund or issuance of a tax credit certificate shall be

allo-ed therefor.< 3he phrase ;for that ta'able period< merel* identifies the

e'cess income ta'# sub+ect of the option# b* referring to the ta'able period "hen it

"as acEuired b* the ta'pa*er.

In the present case# the e'cess income ta' credit# "hich )PI opted to carr* over#

"as acEuired b* the said banC during the ta'able *ear $778. 3he option of )PI to

carr* over its $778 e'cess income ta' credit is irrevocableF it cannot later on opt to

appl* for a refund of the ver* same $778 e'cess income ta' credit.

-. 1o. Failure to signif* ones intention in the FR does not mean outright barring

of a valid reEuest for a refund# should one still choose this option later on. 3he

reason for reEuiring that a choice be made in the FR upon its filing is to ease ta'

administration /Philam Asset Management, -nc. v. C-! G.!. .o. #/0012 and .o.

#0'334, #4 5ecember '33/0. When circumstances sho" that a choice has been

made b* the ta'pa*er to carr* over the e'cess income ta' as credit# it should be

respectedF but "hen indubitable circumstances clearl* sho" that another choice G

a ta' refund G is in order# it should be granted. 3herefore# as to "hich option the

ta'pa*er chose is generall* a matter of evidence.

;3echnicalities and legalisms# ho"ever e'alted# should not be misused b* the

government to Ceep mone* not belonging to it and thereb* enrich itself at the

e'pense of its la"4abiding citiHens.<

You might also like

- Tax CompilationDocument57 pagesTax CompilationCresteynTeyngNo ratings yet

- Tax Cases (Marubeni, Wander Phils, Cyanamid and Dlsu) (Digest and Full Text)Document22 pagesTax Cases (Marubeni, Wander Phils, Cyanamid and Dlsu) (Digest and Full Text)Harlene Kaye Dayag TaguinodNo ratings yet

- CIR vs. British Overseas Airways (BOAC)Document4 pagesCIR vs. British Overseas Airways (BOAC)Arthur John GarratonNo ratings yet

- TAX Set 6 DigestsDocument56 pagesTAX Set 6 DigestsBen Dover McDuffinsNo ratings yet

- Tax-Public Purpose (Digest)Document9 pagesTax-Public Purpose (Digest)GM AlfonsoNo ratings yet

- Cir Vs Dlsu Case DigestDocument1 pageCir Vs Dlsu Case DigestjovifactorNo ratings yet

- Philippine Acetylene Tax RulingDocument12 pagesPhilippine Acetylene Tax RulingKeith BalbinNo ratings yet

- CIR vs. Fortune Tobacco Tax RulingDocument18 pagesCIR vs. Fortune Tobacco Tax RulingJayson RHNo ratings yet

- HOSPITAL DE SAN JUAN VS CIR DEDUCTIONS INTEREST DIVIDENDSDocument1 pageHOSPITAL DE SAN JUAN VS CIR DEDUCTIONS INTEREST DIVIDENDSGrace Angelie C. Asio-SalihNo ratings yet

- CIR Vs MarubeniDocument2 pagesCIR Vs MarubeniKervy Sanell SalazarNo ratings yet

- Taxation of Interest Income Earned by Private LendersDocument1 pageTaxation of Interest Income Earned by Private LendersAlexis Von Te100% (2)

- Delpher and Pacheco v. IACDocument2 pagesDelpher and Pacheco v. IACIvan LuzuriagaNo ratings yet

- Tio v. Videogram Regulatory BoardDocument1 pageTio v. Videogram Regulatory Boardromelamiguel_2015100% (1)

- Tax DigestsDocument345 pagesTax DigestsKC Remorozo100% (1)

- Digested Cases in Tax 1Document35 pagesDigested Cases in Tax 1Rj FonacierNo ratings yet

- Manila Bank examines grace period for minimum corporate income taxDocument2 pagesManila Bank examines grace period for minimum corporate income taxCheska VergaraNo ratings yet

- Tax 1 Cases A.O - B.C (Digest)Document65 pagesTax 1 Cases A.O - B.C (Digest)CARLOSPAULADRIANNE MARIANO100% (2)

- Taxation Principles on Refunds and CreditsDocument70 pagesTaxation Principles on Refunds and CreditsXyrus Bucao100% (1)

- Income Tax Case Digest 2Document156 pagesIncome Tax Case Digest 2Xirkul Tupas100% (1)

- CIR v. SeagateDocument2 pagesCIR v. SeagateChristian Paul Lugo100% (1)

- Oil Price Stabilization Fund RulingDocument6 pagesOil Price Stabilization Fund Rulingabakada_kaye100% (1)

- Nodalo - Medicard vs. CirDocument3 pagesNodalo - Medicard vs. CirGenebva Mica NodaloNo ratings yet

- Collector Vs HendersonDocument1 pageCollector Vs HendersonLisa GarciaNo ratings yet

- Tax Case Digest VillavicencioDocument7 pagesTax Case Digest VillavicencioKathNo ratings yet

- Southern Cross Vs Phil Cement CorpDocument2 pagesSouthern Cross Vs Phil Cement CorpMaryanJunkoNo ratings yet

- Tax Case DigestsDocument107 pagesTax Case DigestsMenchu G. Maban100% (1)

- Taxation Cases DigestDocument11 pagesTaxation Cases Digestenzoaleno100% (2)

- CIR vs ICC Ruling on Expense DeductionsDocument1 pageCIR vs ICC Ruling on Expense DeductionsNatsu DragneelNo ratings yet

- Cir Vs Central Luzon Drug CorporationDocument7 pagesCir Vs Central Luzon Drug CorporationErika Libberman HeinzNo ratings yet

- NAPOCOR Franchise Tax Case Explains LGU Authority and Tax Exemption RepealDocument11 pagesNAPOCOR Franchise Tax Case Explains LGU Authority and Tax Exemption RepealRejean EscalonaNo ratings yet

- C.M. Hoskins and Co. Vs CirDocument1 pageC.M. Hoskins and Co. Vs CirSam FajardoNo ratings yet

- PHIL - GUARANTY V CIR Case DigestDocument1 pagePHIL - GUARANTY V CIR Case DigestZirk TanNo ratings yet

- Chavez vs. Ongpin G.R. No. 76778 - June 6, 1990 en Banc FactsDocument1 pageChavez vs. Ongpin G.R. No. 76778 - June 6, 1990 en Banc FactsmenforeverNo ratings yet

- Juan vs. Ca: DOCTRINE/S: The Disallowance of ISSUE/S: Whether An Interest Can BeDocument2 pagesJuan vs. Ca: DOCTRINE/S: The Disallowance of ISSUE/S: Whether An Interest Can BeLucifer MorningNo ratings yet

- Digest Taxation Cases PDFDocument414 pagesDigest Taxation Cases PDFKent Bryan Rubin100% (2)

- Case Digests - Taxation IDocument5 pagesCase Digests - Taxation IFatima Sarpina HinayNo ratings yet

- Part 2. Vat - ZarateDocument46 pagesPart 2. Vat - Zaratesamjuan1234No ratings yet

- China Banking Corporation Vs CADocument5 pagesChina Banking Corporation Vs CAFrancis CastilloNo ratings yet

- MERALCO vs. PROVINCE OF LAGUNA: Local Governments Have Broad Tax Powers Under LGCDocument3 pagesMERALCO vs. PROVINCE OF LAGUNA: Local Governments Have Broad Tax Powers Under LGCAnton SingeNo ratings yet

- Tax DigestDocument47 pagesTax Digestiris virtudez100% (1)

- Maceda Vs MacaraigDocument2 pagesMaceda Vs MacaraigJf Maneja100% (1)

- 1st Set Tax 1Document51 pages1st Set Tax 1dnel13No ratings yet

- 1 Syllabus - NIRC Remedies (1st Sem 18-19)Document13 pages1 Syllabus - NIRC Remedies (1st Sem 18-19)Zyki Zamora Lacdao100% (3)

- PCGG Should Vote Sequestered UCPB Shares Bought With Coconut Levy FundsDocument13 pagesPCGG Should Vote Sequestered UCPB Shares Bought With Coconut Levy FundsDon YcayNo ratings yet

- Cir Vs Tours SpecialistDocument1 pageCir Vs Tours SpecialistJ.C. S. MaalaNo ratings yet

- British American Tobacco Vs CamachoDocument6 pagesBritish American Tobacco Vs CamachoBam Bathan100% (1)

- DIAZ Vs SECRETARY OF FINANCEDocument2 pagesDIAZ Vs SECRETARY OF FINANCEMCNo ratings yet

- Taxation CasesDocument13 pagesTaxation CasesmaeNo ratings yet

- CIR vs. Baier-NickelDocument1 pageCIR vs. Baier-NickelJakeDanduanNo ratings yet

- Commissioner of Internal Revenue v. Algue, Inc.Document6 pagesCommissioner of Internal Revenue v. Algue, Inc.Ro CheNo ratings yet

- CIR V Benguet CorpDocument1 pageCIR V Benguet CorpEm AlayzaNo ratings yet

- Yamane v. BA Lepanto Condo Corp.Document1 pageYamane v. BA Lepanto Condo Corp.Secret SecretNo ratings yet

- Hilado Vs Collector of Internal RevenueDocument1 pageHilado Vs Collector of Internal Revenuefranzadon100% (1)

- TAX 1 Digest Atty MonteroDocument46 pagesTAX 1 Digest Atty MonteroCHEENS100% (2)

- 07 NAPOCOR v. PROVINCE OF ALBAYDocument2 pages07 NAPOCOR v. PROVINCE OF ALBAYJose Edmundo DayotNo ratings yet

- CIR Denies Hilado's Claim for War Damage DeductionDocument2 pagesCIR Denies Hilado's Claim for War Damage DeductionMarie Mariñas-delos Reyes100% (1)

- Misamis Oriental Vs Cagayan ElectricDocument1 pageMisamis Oriental Vs Cagayan ElectricfranzadonNo ratings yet

- Legal Potential Power LettersDocument28 pagesLegal Potential Power LettersKNOWLEDGE SOURCENo ratings yet

- BPI Leasing V Court of Appeals G.R. 127624Document5 pagesBPI Leasing V Court of Appeals G.R. 127624Dino Bernard LapitanNo ratings yet

- Pacquiao Tax CaseDocument5 pagesPacquiao Tax CaseAyenGaileNo ratings yet

- Motion for Extension of Time in Domestic Violence CaseDocument2 pagesMotion for Extension of Time in Domestic Violence CaseTrish VerzosaNo ratings yet

- Provisional Remedies TableDocument6 pagesProvisional Remedies TableNowhere Man100% (12)

- Securities Regulation Code - NotesDocument6 pagesSecurities Regulation Code - NotesTrish VerzosaNo ratings yet

- AO No. 11 S. 2009Document32 pagesAO No. 11 S. 2009Eds GalinatoNo ratings yet

- FAST-TRACK LOCAL ADOPTIONS PHILIPPINESDocument23 pagesFAST-TRACK LOCAL ADOPTIONS PHILIPPINESRacinef TeeNo ratings yet

- Provisional RemediesDocument1 pageProvisional RemediesAndrea MilaorNo ratings yet

- Ao 2011-012 PDFDocument46 pagesAo 2011-012 PDFTrish VerzosaNo ratings yet

- Sabio v. GordonDocument3 pagesSabio v. GordonEsther ReyesNo ratings yet

- Supreme Court rules on student protest suspension at private universityDocument7 pagesSupreme Court rules on student protest suspension at private universityAys KwimNo ratings yet

- Prado Vs JudgeDocument7 pagesPrado Vs JudgeFrancis ArvyNo ratings yet

- Cayetano vs. MonsodDocument14 pagesCayetano vs. MonsodCristine TendenillaNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 3 Co vs. House of Representatives Electoral TribunalDocument65 pages3 Co vs. House of Representatives Electoral TribunalTrish VerzosaNo ratings yet

- Gudani v. SengaDocument2 pagesGudani v. SengaGol LumNo ratings yet

- Harvey v. Defensor-SantiagoDocument6 pagesHarvey v. Defensor-SantiagoRatani UnfriendlyNo ratings yet

- John McLeod v. NLRCDocument12 pagesJohn McLeod v. NLRCbearzhugNo ratings yet

- Stonehill vs. DioknoDocument13 pagesStonehill vs. DioknoRamon AquinoNo ratings yet

- 8.3 Navarro v. Court of AppealsDocument11 pages8.3 Navarro v. Court of AppealsGlenn Robin FedillagaNo ratings yet

- Philippines Supreme Court Rules on Constitutionality of Executive Order Banning Carabao TransportDocument7 pagesPhilippines Supreme Court Rules on Constitutionality of Executive Order Banning Carabao TransportSheila ManitoNo ratings yet

- G.R. No. 93833-September 28, 1995 - Ramirez Vs Court of AppealsDocument8 pagesG.R. No. 93833-September 28, 1995 - Ramirez Vs Court of AppealsKaren BandillaNo ratings yet

- Zulueta vs. CADocument3 pagesZulueta vs. CAJadz Tiu TamayoNo ratings yet

- 1 Villavicencio vs. Lukban PDFDocument19 pages1 Villavicencio vs. Lukban PDFTrish VerzosaNo ratings yet

- 6 Yu vs. Defensor SantiagoDocument10 pages6 Yu vs. Defensor SantiagoTrish VerzosaNo ratings yet

- McLeod Vs NLRCDocument2 pagesMcLeod Vs NLRCTrish Verzosa100% (1)

- Kasambahay BillDocument13 pagesKasambahay BillShine Reyes MackieNo ratings yet

- Ona Vs CIR FulltextDocument8 pagesOna Vs CIR FulltextTrish VerzosaNo ratings yet

- 3 Rodriguez vs. GellaDocument19 pages3 Rodriguez vs. GellaTrish VerzosaNo ratings yet

- Tax Remedies DigestDocument3 pagesTax Remedies DigestTrish VerzosaNo ratings yet

- 1 Garcia vs. Executive SecretaryDocument7 pages1 Garcia vs. Executive SecretaryTrish VerzosaNo ratings yet

- Vip System Sms Atm Processing Specs IntlDocument210 pagesVip System Sms Atm Processing Specs IntlMario NấmNo ratings yet

- Wa0043.Document12 pagesWa0043.Santosh Kumar GuptaNo ratings yet

- Commissioner of Internal Revenue vs. Mcgeorge Food Industries, IncDocument1 pageCommissioner of Internal Revenue vs. Mcgeorge Food Industries, IncRaquel DoqueniaNo ratings yet

- Diferenc Between Tax and FeeDocument1 pageDiferenc Between Tax and FeeAyub ChowdhuryNo ratings yet

- PassportDocument1 pagePassportzjf4t2rkyrNo ratings yet

- Continuing Payroll Project ADocument5 pagesContinuing Payroll Project AEvon Herrera67% (3)

- Road Marking KanhanDocument2 pagesRoad Marking Kanhanmahesh.katlaNo ratings yet

- Pelzer Company Reconciled Its Bank and Book Statement Balances ofDocument2 pagesPelzer Company Reconciled Its Bank and Book Statement Balances ofAmit PandeyNo ratings yet

- DT Summary Book For Maynov 2020 PDFDocument416 pagesDT Summary Book For Maynov 2020 PDFajay guptaNo ratings yet

- Payslip For The Month of May 2021: ICE Data Services India Private LimitedDocument1 pagePayslip For The Month of May 2021: ICE Data Services India Private Limitedtirupathaiah pNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Shobhit BobinNo ratings yet

- Acknowledgement ReceiptDocument1 pageAcknowledgement ReceiptbLackSnow01No ratings yet

- Ratio Analysis of WALMART INCDocument5 pagesRatio Analysis of WALMART INCBrian Ng'enoNo ratings yet

- Corporation Bank Bank ChargesDocument15 pagesCorporation Bank Bank ChargesHimesh ShahNo ratings yet

- SAP INPY - Documentation Part 1Document80 pagesSAP INPY - Documentation Part 1AmithRaghavNo ratings yet

- Costing Misty CharmDocument1 pageCosting Misty CharmRachana PanditNo ratings yet

- Washing Machine InvoiceDocument1 pageWashing Machine Invoices.thrinadhraoNo ratings yet

- Bank Seal: Demand Draft / Manager'S ChequeDocument2 pagesBank Seal: Demand Draft / Manager'S ChequeParveen KumarNo ratings yet

- SAP B1 Accounting Cycle ExercisesDocument6 pagesSAP B1 Accounting Cycle ExercisesPatricia Andrea CariñoNo ratings yet

- Evershed Kroll White Consulting Ledgers Upto 19.02.24Document22 pagesEvershed Kroll White Consulting Ledgers Upto 19.02.24MILINDSWNo ratings yet

- Jenga API Proposal - Finserve AfricaDocument9 pagesJenga API Proposal - Finserve AfricaHerbertNo ratings yet

- Practical Accounting, Financial Accounting, Business Law, Taxation, Auditing NotesDocument2 pagesPractical Accounting, Financial Accounting, Business Law, Taxation, Auditing Notesbittersweet2441% (17)

- Types of Customs Duties ExplainedDocument16 pagesTypes of Customs Duties Explainedअभिशील राजेश जायसवालNo ratings yet

- DT - One Page Summary - Business Trust, Inv Fund, Sec. TrustDocument1 pageDT - One Page Summary - Business Trust, Inv Fund, Sec. TrustAruna RajappaNo ratings yet

- Contoh Soalan Seksyen C Bomba KB41 & KB29Document9 pagesContoh Soalan Seksyen C Bomba KB41 & KB29Aqilah HamzahNo ratings yet

- OilandGas Tax Guide 2011 FINALDocument498 pagesOilandGas Tax Guide 2011 FINALhundudeNo ratings yet

- About BOBCMABobrand CardDocument2 pagesAbout BOBCMABobrand CardDeepak UpadhyayNo ratings yet

- Customer Bill SummaryDocument173 pagesCustomer Bill SummaryTimothy GujjuNo ratings yet

- TLM 4 AllDocument3 pagesTLM 4 AllAdi BayannaNo ratings yet

- Fixed Deposits Application Form Only For Resident IndividualDocument9 pagesFixed Deposits Application Form Only For Resident IndividualkaushikNo ratings yet