Professional Documents

Culture Documents

Hinduja Global Solutions Limited

Uploaded by

Praveen UppalaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hinduja Global Solutions Limited

Uploaded by

Praveen UppalaCopyright:

Available Formats

HGS LTD.

As at 31.03.2014

EQUITY AND LIABILITIES

Shareholders Funds

Share Capital 3,433

Reserves and Surplus 242,355

245,787

Minority Interest 2

2

Non Current Liabilities

Long term Borrowings 74,679

Deferred tax liabilities(Net) 4,950

Long term Provisions 1,066

80,695

Current Liabilities

Short term Borrowings 17,610

Trade Payables 22,279

Other Current Liabilities 32,165

Short term Provisions 6,016

78,070

TOTAL 404,554

ASSETS

Non - Current Assets

Fixed Assets

Tangible assets 62,667

Intangible Assets 118,559

Capital work-in-progress 217

Intangible assets under development 94

Non current investments 1,140

Long-term loans and advances 22,720

Other non-current assets 1,294

206,692

Current Assets

Current investments 22

CONSOLIDATED BALANCE SHEET

Trade Receivables 78,123

Cash and Bank Balances 75,759

Short-term loans and advances 29,761

Other Current Assets 14,197

197,863

TOTAL 404,554

(000s USD)

As at 31.03.2013

3,793

223,797

227,590

2

2

66,010

4,456

1,113

71,580

16,903

14,805

36,375

13,391

81,474

380,646

54,791

118,672

423

294

1,393

20,506

1,236

197,315

23

CONSOLIDATED BALANCE SHEET

66,309

74,808

24,100

18,091

183,331

380,646

HGS LTD.

Year Ended 31.03.2014

Revenue from operations 412,278

Other Income 5,597

Total Revenue 417,875

EXPENSES

Employee Benefit Expense 278,510

Finance costs 6,378

Depreciation/ Amortisation 14,189

Other Expenses 80,787

Total Expenses 379,864

Profit before exceptional item and tax 38,012

Exceptional Item 0

Profit before tax 38,012

Tax expense

Current tax 11,701

MAT Credit -2,078

Net Current tax 9,624

Deferred tax 481

Profit After Tax 27,907

Minority Interest 0

Profit After Tax and Minority Interest 27,907

CONSOLIDATED STATEMENT OF PROFIT & LOSS

Year Ended 31.03.2013

(000'S USD)

364,299

6,112

370,411

246,340

8,020

14,188

76,868

345,417

24,994

971

24,023

6,483

0

6,483

905

16,635

0

16,635

CONSOLIDATED STATEMENT OF PROFIT & LOSS

HGS LTD.

NAME OF THE RATIO 2014 2013

SHORT TERM SOLVENCY RATIO

Current Ratio 2.534431 2.250178

Cash Ratio 0.970398 0.9181825

LONG TERM SOLVENCY RATIO

Total debt Ratio 0.233033 0.2248297

Debt-Equity Ratio 0.303836 0.2900391

Times Interest Earned Ratio 6.959862 3.9953865

Cash-Coverage Ratio 9.184541 5.7644638

Equity Multiplier 1.645954 1.6725076

ASSETS UTILIZATION RATIOS

Receivable Turnover Ratio 5.277293 5.4939601

Days' Sales in Receivables 69.16424 66.436595

Total Asset Turnover 1.019093 0.9570546

Capital Intensity 0.981265 1.0448725

PROFITABILITY RATIOS

Profit Margin 6.77% 4.57%

Return on Assets 6.90% 4.37%

Return on Equity 11.35% 7.31%

DUPONT ANALYSIS (3STEP)

ROE 11.35% 7.31%

Profit Margin 0.06769 0.0456718

Total Asset Turnover 1.019093 0.0970546

Equity Multiplier 1.645954 1.6725076

DUPONT ANALYSIS (5STEP)

ROE 11.35% 7.31%

Tax Retention Rate 0.734163 0.6924614

Interest Expense Rate 0.856319 0.7497113

RATIOS

Operating Profit Rate 0.10767 0.087958

Total Asset Turnover 1.019093 0.0970546

Equity Multiplier 1.645954 1.6725076

HGS LTD.

As at 31.03.2014

EQUITY AND LIABILITIES

Shareholders Funds

Share Capital 0.85%

Reserves and Surplus 59.91%

60.75%

Minority Interest 0.00%

0.00%

Non Current Liabilities

Long term Borrowings 18.46%

Deferred tax liabilities(Net) 1.22%

Long term Provisions 0.26%

19.94%

Current Liabilities

Short term Borrowings 4.35%

Trade Payables 5.51%

Other Current Liabilities 7.95%

Short term Provisions 1.49%

19.30%

TOTAL 100%

ASSETS

Non - Current Assets

Fixed Assets

Tangible assets 15.49%

Intangible Assets 29.31%

Capital work-in-progress 0.05%

Intangible assets under development 0.02%

Non current investments 0.28%

Long-term loans and advances 5.62%

Other non-current assets 0.32%

51.09%

Current Assets

Current investments 0.01%

Trade Receivables 19.31%

Cash and Bank Balances 18.73%

Short-term loans and advances 7.36%

Other Current Assets 3.51%

48.91%

TOTAL 100%

As at 31.03.2013 As at 31.03.2012

1.00% 0.96%

58.79% 51.79%

59.79% 52.75%

0.00% 0.00%

0.00% 0.00%

17.34% 17.45%

1.17% 0.88%

0.29% 0.09%

18.80% 18.42%

4.44% 14.06%

3.89% 3.62%

9.56% 7.55%

3.52% 3.62%

21.40% 28.84%

100% 100%

14.39% 14.48%

31.18% 26.98%

0.11% 0.01%

0.08% 0.00%

0.37% 0.29%

5.39% 5.11%

0.32% 0.00%

51.84% 46.88%

COMMON-SIZE BALANCE SHEETS

0.00% 0.00%

17.42% 12.73%

19.65% 33.61%

6.33% 2.44%

4.75% 4.32%

48.16% 53.11%

100% 100%

As at 31.03.2011

1.51%

71.91%

73.42%

0.00%

0.00%

6.92%

1.30%

1.42%

9.64%

3.82%

2.96%

5.60%

4.55%

16.93%

100%

15.24%

12.44%

0.00%

0.00%

0.36%

6.37%

0.03%

34.44%

COMMON-SIZE BALANCE SHEETS

0.00%

13.12%

45.46%

2.96%

4.00%

65.55%

100%

HGS LTD.

HGS, part of the multi-billion dollar conglomerate - Hinduja Group,

provides outsourcing solutions that include Back Office Processing, Contact

Center services and customized IT solutions to its global clientele

comprising several Fortune 500 Companies. We have been ranked among

the Top 3 & Best Performing Call Centers Worldwide & by the Global

Services Magazine in 2008. We were among the Global Best 10 for Sales

Service in the 2010 Global Outsourcing 100 list by the International

Association of Outsourcing Professionals.

HGS has aglobal footprintwith 58 delivery centers in India, the United

States of America, the United Kingdom, Canada, UAE, France, Germany,

Italy, Jamaica, the Netherlands, and Philippines. With our targeted

solutions, designed for the diversified sourcing and servicing needs of our

clients, we live by our mission of making our clients more competitive. The

Contact Center & Back Office Services Division houses multiple

international voice centers & back office processing units for leading

Insurance, Telecommunications, Pharmaceuticals, Life Sciences, Banking &

Financial Services, Consumer Electronics / Products, Technology,

Automotive, Government, Media & Entertainment, Retail, Hospitality,

Government & Public sector, Hospitality, Energy & Utilities and

Transportation & Logistics companies.

With an inspired global team of 26,000 people, we partner with our clients

to deliver outsourced contact center and back office solutions that improve

business processes and strengthen customer relationships. Across our

geographically diverse organization, we design and deploy customized

solutions on behalf of our clients, across a wide range of industry verticals.

Our client partners enjoy a high quality of service, optimized cost

containment, and a competitive edge.

HGS is a public limited company, listed as HGS on both the leading stock

exchanges in India, the National Stock Exchange (NSE), and the Bombay

Stock Exchange (BSE).

OVERVIEW

OVERVIEW

HGS LTD.

i. Up to September 30, 2011, the forward exchange contracts

other than those covered under Accounting Standard11 - The

Effects of Changes in Foreign Exchange Rates, were valued on

mark to market basis at the period end and any loss on valuation

was recognised in the Statement of Profit and Loss, on a

portfolio basis and any gain arising on this valuation were not

recognised in line with the principle of prudence as enunciated in

Accounting Standard 1 Disclosure of Accounting Policies.

Effective October 1, 2011, the Company has adopted the

principles of accounting for derivatives and hedge accounting as

prescribed in Accounting Standard 30 - Financial Instruments

Recognition and Measurement to the extent they do not confl ict

with the requirements of the existing accounting standards

notified under section 211(3C) of the Companies Act, 1956

and/or other regulatory requirements. Under such principles, for

qualifying hedge relationships, mark to market gain/ loss at the

period-end on derivatives are accounted for in the Hedging

Reserves. In respect of derivatives which do not qualify for

hedge relationships, the mark to market gain/loss at the period-

end are recognised in the Statement of Profit and Loss. Had the

Company followed its previous accounting policy, the profit

before tax for the year ended March 31, 2012 would have been

lower by R 262.51 Lacs.

ii. The Company has opted to avail the option provided under

paragraph 46A of AS-11 - The Effects of changes in Foreign

Exchange Rates inserted vide Notification dated December 29,

2011. Refer Note 2.7 for policy regarding accounting treatment

of foreign exchange differences on long-term foreign currency

items. In the absence of long-term foreign currency monetary

items as at March 31, 2012 and for the year ended thereon, there

is no impact on profit before tax for the year ended March 31,

2012.

ACCOUNTING POLICY

You might also like

- Infosys 1nfosys 13-143-14Document29 pagesInfosys 1nfosys 13-143-14AdityaMahajanNo ratings yet

- Infosys Balance SheetDocument28 pagesInfosys Balance SheetMM_AKSINo ratings yet

- BK ProjectDocument38 pagesBK ProjectJagdish HegdeNo ratings yet

- INTERIM FINANCIALSDocument44 pagesINTERIM FINANCIALS2friendNo ratings yet

- Texhong Textile GroupDocument23 pagesTexhong Textile GroupHatcafe HatcafeNo ratings yet

- Provisional 2014 15Document29 pagesProvisional 2014 15maheshfbNo ratings yet

- Tut 4 - Reliance Financial StatementsDocument3 pagesTut 4 - Reliance Financial StatementsJulia DanielNo ratings yet

- Tute3 Reliance Financial StatementsDocument3 pagesTute3 Reliance Financial Statementsvivek patelNo ratings yet

- Infosys Limited Balance Sheet and Profit & Loss AnalysisDocument29 pagesInfosys Limited Balance Sheet and Profit & Loss Analysisvikiabi28No ratings yet

- Auditors Report Financial StatementsDocument57 pagesAuditors Report Financial StatementsSaif Muhammad FahadNo ratings yet

- HBS Investment Limited 2015Document32 pagesHBS Investment Limited 2015Areej FatimaNo ratings yet

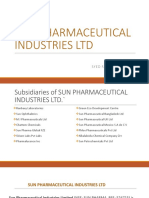

- Financial Analysis - SUN PHARMADocument16 pagesFinancial Analysis - SUN PHARMASyed fayas thanveer SNo ratings yet

- Ennia Financial Highlights 2013 Met Accountantsverklaring KPMG PDFDocument1 pageEnnia Financial Highlights 2013 Met Accountantsverklaring KPMG PDFKnipselkrant CuracaoNo ratings yet

- Chinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012Document50 pagesChinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012alan888No ratings yet

- Financial Statements AnalysisDocument20 pagesFinancial Statements AnalysisWasseem Atalla100% (1)

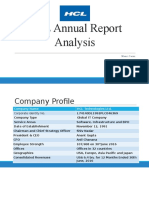

- HCL Annual Report Analysis: Revenue Growth, Profit IncreaseDocument16 pagesHCL Annual Report Analysis: Revenue Growth, Profit IncreasemehakNo ratings yet

- Financial Statements2014 Lotte ChemicalDocument95 pagesFinancial Statements2014 Lotte ChemicalDaniel Hanry SitompulNo ratings yet

- PhilipsFullAnnualReport2015 EnglishDocument238 pagesPhilipsFullAnnualReport2015 EnglishSita AuliaNo ratings yet

- ONGC Financial Analysis: India's Top Oil Producer Saw Revenue Rise in 2013Document34 pagesONGC Financial Analysis: India's Top Oil Producer Saw Revenue Rise in 2013Apeksha SaggarNo ratings yet

- HDFC Life Annual Report FY 2015 16Document347 pagesHDFC Life Annual Report FY 2015 16sunnyNo ratings yet

- Financial StatementDocument115 pagesFinancial Statementammar123No ratings yet

- Third Quarter March 31 2014Document18 pagesThird Quarter March 31 2014major144No ratings yet

- 5ead0financial RatiosDocument3 pages5ead0financial RatiosGourav DuttaNo ratings yet

- Annual Report EnglishDocument17 pagesAnnual Report EnglishAhmed FoudaNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Kansai Nerolac Balance SheetDocument19 pagesKansai Nerolac Balance SheetAlex KuriakoseNo ratings yet

- Manac-1: Group Assignment BM 2013-15 Section ADocument12 pagesManac-1: Group Assignment BM 2013-15 Section AKaran ChhabraNo ratings yet

- 2011 Annual Report NXP SemiconductorsDocument161 pages2011 Annual Report NXP SemiconductorsHazr Rayn HashimNo ratings yet

- Guide IfrsDocument192 pagesGuide IfrsTALAI100% (2)

- WCL Annual Report 2011 - 12Document92 pagesWCL Annual Report 2011 - 12shah1703No ratings yet

- Ennia Financial Highlights 2014 Met Accountantsverklaring KPMGDocument1 pageEnnia Financial Highlights 2014 Met Accountantsverklaring KPMGKnipselkrant CuracaoNo ratings yet

- FY2014 - HHI - English FS (Separate) - FIN - 1Document88 pagesFY2014 - HHI - English FS (Separate) - FIN - 1airlanggaputraNo ratings yet

- Investor Presentation - November 2016 (Company Update)Document37 pagesInvestor Presentation - November 2016 (Company Update)Shyam SunderNo ratings yet

- 18 Financial StatementsDocument35 pages18 Financial Statementswsahmed28No ratings yet

- Industry Profile: Overview of The IndustryDocument17 pagesIndustry Profile: Overview of The Industrysainandan pvnNo ratings yet

- Ar 11 pt03Document112 pagesAr 11 pt03Muneeb ShahidNo ratings yet

- 22mbr002-Sapm Mini ProjectDocument23 pages22mbr002-Sapm Mini ProjectABUBAKAR SIDIQ M 22MBR002No ratings yet

- McKinsey 2012Document10 pagesMcKinsey 2012LuxembourgAtaGlanceNo ratings yet

- Financial Reporting & Analysis Session Provides InsightsDocument41 pagesFinancial Reporting & Analysis Session Provides InsightspremoshinNo ratings yet

- A Comparative Study On ITC PVT LTD and HUL PVT LTDDocument18 pagesA Comparative Study On ITC PVT LTD and HUL PVT LTDVishal RoyNo ratings yet

- Investors Capital, Inc. and Subsidiaries Consolidated Statements of Financial Condition (Unaudited) (In Thousands, Except Share Data)Document9 pagesInvestors Capital, Inc. and Subsidiaries Consolidated Statements of Financial Condition (Unaudited) (In Thousands, Except Share Data)abdimmNo ratings yet

- Financial Status-Somany Ceramics LTD 2011-12Document15 pagesFinancial Status-Somany Ceramics LTD 2011-12Roshankumar S PimpalkarNo ratings yet

- SAMP - 1H2013 Earnings Note - BUY - 27 August 2013Document4 pagesSAMP - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkNo ratings yet

- Contoh Asgn FMDocument21 pagesContoh Asgn FMnira_110No ratings yet

- AZGARD NINE LTD (Nine Months Accounts)Document32 pagesAZGARD NINE LTD (Nine Months Accounts)hammadicmapNo ratings yet

- Nishat Mills Ltd financial reviewDocument6 pagesNishat Mills Ltd financial reviewALI SHER HaidriNo ratings yet

- DemonstraDocument74 pagesDemonstraFibriaRINo ratings yet

- HUL Post Mid TermDocument13 pagesHUL Post Mid TermSweta SinghNo ratings yet

- 1Q13 Financial StatementsDocument52 pages1Q13 Financial StatementsFibriaRINo ratings yet

- Finance & Accounts SOP (Final)Document46 pagesFinance & Accounts SOP (Final)MasterArif Hipnoterapi78% (27)

- Fibria Celulose S.ADocument124 pagesFibria Celulose S.AFibriaRINo ratings yet

- Accounting StandardsDocument45 pagesAccounting StandardsriteshnirmaNo ratings yet

- Annual Report 2010 70 89Document1 pageAnnual Report 2010 70 89Manik SahaNo ratings yet

- UK Deloitte PlatformsDocument212 pagesUK Deloitte PlatformsNaisscentNo ratings yet

- Doosan Corp. Consolidated Financial Statements 2015 and 2014Document149 pagesDoosan Corp. Consolidated Financial Statements 2015 and 2014Leck DzNo ratings yet

- Creating a Balanced Scorecard for a Financial Services OrganizationFrom EverandCreating a Balanced Scorecard for a Financial Services OrganizationNo ratings yet

- Frequently Asked Questions in International Standards on AuditingFrom EverandFrequently Asked Questions in International Standards on AuditingRating: 1 out of 5 stars1/5 (1)

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- IPSAS Explained: A Summary of International Public Sector Accounting StandardsFrom EverandIPSAS Explained: A Summary of International Public Sector Accounting StandardsNo ratings yet

- Portfolio of MinistersDocument6 pagesPortfolio of MinistersPraveen UppalaNo ratings yet

- Hgs Sales and ExpendituresDocument41 pagesHgs Sales and ExpendituresPraveen UppalaNo ratings yet

- Balco SterliteDocument17 pagesBalco SterlitePraveen UppalaNo ratings yet

- Accounts BasicsDocument26 pagesAccounts BasicsPraveen UppalaNo ratings yet

- DLF CaseDocument1 pageDLF CasePraveen UppalaNo ratings yet

- Expansion Strategy - Joint Venture: Uppala PraveenDocument8 pagesExpansion Strategy - Joint Venture: Uppala PraveenPraveen UppalaNo ratings yet

- ZrikaDocument9 pagesZrikaPraveen UppalaNo ratings yet

- ToastmastersDocument1 pageToastmastersPraveen UppalaNo ratings yet

- Automated Cool AvenuesDocument49 pagesAutomated Cool AvenuesPraveen UppalaNo ratings yet

- Audit Module 3 - Financial Statements TemplateDocument11 pagesAudit Module 3 - Financial Statements TemplateSiddhant AggarwalNo ratings yet

- Abacus v. AmpilDocument11 pagesAbacus v. AmpilNylaNo ratings yet

- Sakthi Fianance Project ReportDocument61 pagesSakthi Fianance Project ReportraveenkumarNo ratings yet

- Day 3 PDFDocument14 pagesDay 3 PDFDinesh GadkariNo ratings yet

- Nedbank Pricing 2020Document55 pagesNedbank Pricing 2020BusinessTech100% (1)

- Default Profile Customer Level Account - FusionDocument1 pageDefault Profile Customer Level Account - FusionhuyhnNo ratings yet

- Ch25 Insurance OperationsDocument42 pagesCh25 Insurance OperationsTHIVIYATHINI PERUMALNo ratings yet

- ACC 570 CQ3b Practice Tax QuestionsDocument2 pagesACC 570 CQ3b Practice Tax QuestionsMohitNo ratings yet

- Coa C2015-002Document71 pagesCoa C2015-002Pearl AudeNo ratings yet

- Accounting For Cash and Cash TransactionDocument63 pagesAccounting For Cash and Cash TransactionAura Angela SeradaNo ratings yet

- Caltex v Security Bank: 280 CTDs worth P1.12MDocument52 pagesCaltex v Security Bank: 280 CTDs worth P1.12MAir Dela CruzNo ratings yet

- Chapter 5 Bank Credit InstrumentsDocument5 pagesChapter 5 Bank Credit InstrumentsMariel Crista Celda Maravillosa100% (2)

- XLSXDocument2 pagesXLSXchristiewijaya100% (1)

- Highlights:: DCB Bank Announces Third Quarter FY 2022 ResultsDocument7 pagesHighlights:: DCB Bank Announces Third Quarter FY 2022 ResultsanandNo ratings yet

- Bcoc 136Document2 pagesBcoc 136Suraj JaiswalNo ratings yet

- 2 - Example Business PlanDocument14 pages2 - Example Business Planmuftahmail721No ratings yet

- Capital Budgeting NotesDocument3 pagesCapital Budgeting NotesSahil RupaniNo ratings yet

- 25dairy Cow ModuleDocument47 pages25dairy Cow ModulericoliwanagNo ratings yet

- Income Tax CalculatorDocument5 pagesIncome Tax CalculatorTanmay DeshpandeNo ratings yet

- Risk Management Strategies G2 - 20.3 (Final)Document4 pagesRisk Management Strategies G2 - 20.3 (Final)Phuong Anh NguyenNo ratings yet

- Mobile Services Tax InvoiceDocument3 pagesMobile Services Tax Invoicekumarvaibhav301745No ratings yet

- Salce Prelim Act102 E2Document8 pagesSalce Prelim Act102 E2Joshua P. SalceNo ratings yet

- Engineering Economics HandoutDocument6 pagesEngineering Economics HandoutRomeoNo ratings yet

- Subramanian Cibil ReportDocument13 pagesSubramanian Cibil ReportManish KumarNo ratings yet

- EAE0516 - 2022 - Slides 15Document25 pagesEAE0516 - 2022 - Slides 15Nicholas WhittakerNo ratings yet

- Risk Based Investment in Davanrik Drug CompoundDocument19 pagesRisk Based Investment in Davanrik Drug Compoundjk kumarNo ratings yet

- Ins - 21-1Document13 pagesIns - 21-1Siddharth Kulkarni100% (1)

- Securities and Exchange Board of India: Master CircularDocument236 pagesSecurities and Exchange Board of India: Master CircularViral_v2inNo ratings yet

- Universalcoal Annual Report 2017Document128 pagesUniversalcoal Annual Report 2017satyr01No ratings yet

- 22BSPHH01C1222 - Subham Deb - IrDocument22 pages22BSPHH01C1222 - Subham Deb - Irnilesh.das22hNo ratings yet