Professional Documents

Culture Documents

ACC501 Accounts

Uploaded by

Sandip KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC501 Accounts

Uploaded by

Sandip KumarCopyright:

Available Formats

Lovely Professional University, Punjab

Course Code Course Title Course Planner Lectures Tutorials Practicals Credits

ACC501 ACCOUNTING FOR MANAGERS 16413::Jasneet Kaur 3.0 2.0 0.0 4.0

Course Category Courses with numerical and conceptual focus

TextBooks

Sr No Title Author Edition Year Publisher Name

T-1 ACCOUNTING FOR MANAGERS DR.S N MAHESHWARI 3rd 2012 VIKAS PUBLICATION

Reference Books

Sr No Title Author Edition Year Publisher Name

R-1 ACCOUNTING FOR

MANAGEMENT

LAL, JAWAHAR 10th 2012 HIMALAYA PUBLISHING HOUSE

R-2 ACCOUNTING FOR DECISION

MAKING

BELVERED. E.

NEEDLES

5th CENGAGE LEARNING

R-3 FINANCIAL ACCOUNTING FOR

MANAGEMENT

GUPTA, AMBRISH 4th 2012 PEARSON

R-4 FUNDAMENTALS OF COST

ACCOUNTING

WIILIAM N. LANEN,

SHANNON W.

ANDERSON, MICHAEL

W. MAHER

2nd TATA MCGRAW HILL

R-5 MANAGEMENT ACCOUNTING SHAH PARESH 2nd 2012 OXFORD UNIVERSITY PRESS

R-6 COST AND MANAGEMENT

ACCOUNTING

ARORA M.N 4th 2013 HIMALAYA PUB.HOUSE, DELHI

Other Reading

Sr No Journals articles as Compulsary reading (specific articles, complete reference)

OR-1 "Missouri Solvents: Managing Cash Flow", David A Kunz, Rebecca Summary. Journal of the International Academy for Case Studies. Cullowhee: 2010. Vol. 16,

Iss.4, pg.43, 10 pgs, URL: http://sbaer.uca.edu/research/allied/2008-tunica/09.pdf ,

OR-2 http://www.apexcpe.com/publications/171016.pdf ,

OR-3 http://educ.jmu.edu/~drakepp/principles/module2/fin_rat.pdf ,

OR-4 http://www.daveramsey.com/media/broadcast/mytmmo/pdf/guide-to-budgeting.pdf ,

Relevant Websites

Sr No (Web address) (only if relevant to the course) Salient Features

RW-1 http://www.accounting4management.com/preparing_cash_flow_statement.htm Contains lessons on cash flow statement.

RW-2 http://www.accounting4management.com/cvp_formulas.htm Contains details related to CVP Analysis.

RW-3 http://www.maaw.info/ResponsibilityAccountingConcept.htm This website contains the real time functioning of the responsibility

centers in the organisations.

RW-4 www.informationforaccountants.com/Cost_Accounting.html Details of all cost concepts.

RW-5 http://www.caclubindia.com/articles/ratio-analysis-15063.asp Details related to ratio analysis.

Audio Visual Aids

Sr No (AV aids) (only if relevant to the course) Salient Features

AV-1 http://www.youtube.com/watch?v=IEyDfgdHJf0 Details of recording transactions using accounting terms.

Week

Number

Lecture

Number

Broad Topic(Sub Topic) Chapters/Sections of

Text/reference

books

Other Readings,

Relevant Websites,

Audio Visual Aids,

software and Virtual

Labs

Lecture Description Learning Outcomes Pedagogical Tool

Demonstration/

Case Study /

Images /

animation / ppt

etc. Planned

Live Examples

Week 1 Lecture 1 Introduction to Accounting

(Objectives, Advantages and

Limitations of Accounting)

T-1:Section I- Ch 1 AV-1 L 1- Introduction to the

course (Discussion

about course objectives,

LTP etc) and meaning,

objectives, advantages

and limitations of

accounting

Analyze the nature,

functions and limits

of accounting in a

global environment

Discussion through

powerpoint

presentation

Lecture 2 Introduction to Accounting

(Accounting Concepts and

Conventions)

T-1:Section I- Ch 2 AV-1 Principles of accounting Understand the

nature and purpose of

generally accepted

accounting principles

Example based

discussion

Lecture 3 Introduction to Accounting

(Accounting Terminology)

T-1:Section I- Ch 2 Different terms used in

accounting

Familiarity with the

different terms used

in accounting

Example based

discussion

Week 2 Lecture 4 Introduction to Accounting

(Accounting Equation)

T-1:Section I- Ch 2 Elements and

preparation of

accounting equation

Properly record

transactions under the

relevant head by

calculating the

amount of the

accounting impact of

a transaction under

accrual accounting

system

Problem Solving

Detailed Plan For Lectures

LTP week distribution: (LTP Weeks)

Weeks before MTE 8

Weeks After MTE 7

Spill Over 3

Week 2 Lecture 5 Introduction to Accounting

(Rules of Accounting)

T-1:Section I- Ch 4 Debit and credit rules of

different kinds of

accounts

Evaluate the

strengths and

weaknesses of

organisational

business process

transaction cycles

Explanation

through examples

Lecture 6 Corporate Financial

Statements(Features and

Importance)

R-2:Ch 11

R-3:Ch 11

Features and format of

corporate profit and loss

account and balance

sheet

Identify and construct

financial statements

based on their

elements

Discussion on

Corporate

Financial Practices

Annual Report

of Nestle

Corporate Financial

Statements(Vertical Format

of Corporate Financial

Statements)

R-2:Ch 11

R-3:Ch 11

Features and format of

corporate profit and loss

account and balance

sheet

Identify and construct

financial statements

based on their

elements

Discussion on

Corporate

Financial Practices

Annual Report

of Nestle

Week 3 Lecture 7 Corporate Financial

Statements(Concept and

Significance of Notes to the

Accounts)

R-3:Ch 13 Meaning and

significance of notes to

accounts

Analyze the nature

and significance of

financial reporting in

a global environment

Discussion on

Corporate

Financial Practices

Annual Report

of Nestle

Lecture 8 Financial Statement

Analysis(Objectives of

Analysis)

R-1:Ch 14

R-3:Ch 18

R-6:Ch 14

OR-2 Objectives and vested

interests of stakeholders

of financial information

Recognize the

information conveyed

by financial

statements and the

way it is used by

investors, creditors,

regulators, and

managers

Examples based

discussion

Financial Statement

Analysis(Various

Stakeholders and their

Interests)

R-1:Ch 14

R-3:Ch 18

OR-2 Objectives and vested

interests of stakeholders

of financial information

Recognize the

information conveyed

by financial

statements and the

way it is used by

investors, creditors,

regulators, and

managers

Examples based

discussion

Lecture 9 Financial Statement

Analysis(Techniques of

Financial Statement

Analysis-Horizontal

Analysis)

T-1:Section III- Ch 1

R-1:Ch 14

R-3:Ch 18

R-6:Ch 14

L9-10 Concept and

numericals of horizontal

analysis

L9-10 Measure the

quality of financial

statements by

investigating

management strategic

accounting choice

Problem Solving

and discussion

based on annual

report

Annual Report

of HUL

Week 4 Lecture 10 Financial Statement

Analysis(Techniques of

Financial Statement

Analysis-Horizontal

Analysis)

T-1:Section III- Ch 1

R-1:Ch 14

R-3:Ch 18

R-6:Ch 14

L9-10 Concept and

numericals of horizontal

analysis

L9-10 Measure the

quality of financial

statements by

investigating

management strategic

accounting choice

Problem Solving

and discussion

based on annual

report

Annual Report

of HUL

Week 4 Lecture 11 Financial Statement

Analysis(Common Size

Analysis)

T-1:Section III- Ch 1

R-1:Ch 14

R-3:Ch 18

R-6:Ch 14

Concept and numericals

of common size analysis

Construct and

comment on the

financial position of

companies using

common size analysis

Problem Solving

and discussion on

annual report

Annual Report

of Infosys

Lecture 12 Financial Statement

Analysis(Preparation of

Financial Statements Using

Excel)

T-1:Section III- Ch 1

R-1:Ch 14

R-3:Ch 18

R-6:Ch 14

Numerical of trend

analysis and preparation

of different statements

using excel

Comment on the

trend pattern of

different elements of

financial statements

and use of excel for

preparing financial

statements

Problem Solving

and discussion on

annual report

Annual Report

of Infosys

Financial Statement

Analysis(Trend Analysis)

T-1:Section III- Ch 1

R-1:Ch 14

R-3:Ch 18

R-6:Ch 14

Numerical of trend

analysis and preparation

of different statements

using excel

Comment on the

trend pattern of

different elements of

financial statements

and use of excel for

preparing financial

statements

Problem Solving

and discussion on

annual report

Annual Report

of Infosys

Week 5 Lecture 13 Cash Flow Statement

(Meaning and Significance)

T-1:Section III- Ch 3

R-2:Ch 21

R-3:Ch 14

RW-1 Meaning and

significance of cash

flow statement

Identify the utility of

cash flow statement

preparation for

organisations

Discussion through

power point

presentation

Lecture 14 Cash Flow Statement

(Construction of Cash Flow

Statement by Indirect

Method using Excel)

T-1:Section III- Ch 3

R-2:Ch 21

R-3:Ch 14

L 14 and L 15-

Construction of cash

flow statement

L14-15 Recognize

the importance of

operating, investing,

and financing

activities reported in

the statement of cash

flows while

evaluating the firm

performance and

solvency

Problem Solving

Lecture 15 Cash Flow Statement

(Construction of Cash Flow

Statement by Indirect

Method using Excel)

T-1:Section III- Ch 3

R-2:Ch 21

R-3:Ch 14

L 14 and L 15-

Construction of cash

flow statement

L14-15 Recognize

the importance of

operating, investing,

and financing

activities reported in

the statement of cash

flows while

evaluating the firm

performance and

solvency

Problem Solving

Week 6 Lecture 16 Cash Flow Statement

(Analysis of Cash Flow

Statement)

T-1:Section III- Ch 3

R-2:Ch 21

R-3:Ch 14

OR-1 Analyzing cash flow

statement

Illustrate and

comment on the

performance of

companies by

evaluating its cash

position

Case Analysis

Lecture 17 Homework,Test2

Week 6 Lecture 18 Ratio Analysis(Importance

and Objectives)

T-1:Section III- Ch 1

R-1:Ch 14

R-3:Ch 20

OR-3

RW-5

Importance of ratio

analysis and

computation of liquidity

ratios

To be able to

compute and interpret

liquidity ratios

Calculation of

ratios from the

annual statements

Annual

Statements of

Nestle India Ltd

Ratio Analysis(Liquidity

Ratios)

T-1:Section III- Ch 1

R-1:Ch 14

R-3:Ch 20

OR-3

RW-5

Importance of ratio

analysis and

computation of liquidity

ratios

To be able to

compute and interpret

liquidity ratios

Calculation of

ratios from the

annual statements

Annual

Statements of

Nestle India Ltd

Week 7 Lecture 19 Ratio Analysis(Turnover

Ratios)

T-1:Section III- Ch 1

R-1:Ch 14

R-3:Ch 20

OR-3

RW-5

Concept and

computation of turnover

ratios

To be able to

compute and interpret

efficiency ratios

Calculation of

ratios from the

annual statements

Annual

Statements of

Nestle India Ltd

Lecture 20 Ratio Analysis(Profitability

Ratios)

T-1:Section III- Ch 1

R-1:Ch 14

R-3:Ch 20

OR-3

RW-5

Concept and

computation of

profitability ratios based

on sales and investment

To be able to

compute and interpret

profitability ratios

Calculation of

ratios from the

annual statements

Annual

Statements of

Nestle India Ltd

Lecture 21 Ratio Analysis(Solvency

Ratios)

T-1:Section III- Ch 1

R-1:Ch 14

R-3:Ch 20

OR-3

RW-5

L 21 and L 22- Concept

and computation of

solvency ratios

L21-22 To be able to

compute and

comment on the

company's solvency

position

Calculation of

ratios from the

annual statements

Annual

Statements of

Nestle India Ltd

Week 8 Lecture 22 Ratio Analysis(Solvency

Ratios)

T-1:Section III- Ch 1

R-1:Ch 14

R-3:Ch 20

OR-3

RW-5

L 21 and L 22- Concept

and computation of

solvency ratios

L21-22 To be able to

compute and

comment on the

company's solvency

position

Calculation of

ratios from the

annual statements

Annual

Statements of

Nestle India Ltd

Lecture 23 Ratio Analysis(Leverage

Ratios)

T-1:Section III- Ch 1

R-1:Ch 14

R-3:Ch 20

OR-3

RW-5

Concept and

computation of leverage

ratios

To be able to

compute and interpret

leverage ratios

Calculation of

ratios from the

annual statements

Annual

Statements of

Nestle India Ltd

Lecture 24 Ratio Analysis(Du-Pont

Analysis)

T-1:Section III- Ch 1

R-1:Ch 14

R-3:Ch 20

Du Pont Analysis Identify and illustrate

the inter dependence

of elements of

income statement and

balance sheet to be

able to comment on

organisational

effectiveness

Du Pont analysis

using financial

statements

Annual

Statements of

Grasim

Laboratories Ltd

MID-TERM

Week 9 Lecture 25 Basic Aspects of Cost

Accounting(Meaning & Cost

Concepts)

T-1:Section II- Ch 2

R-4:Ch 1

RW-4 Meaning, differentiation

between cost, financial

and management

accounting and concepts

of costing

Define and illustrate

various cost terms

and concepts

Discussion through

powerpoint

presentation

Basic Aspects of Cost

Accounting(Introduction to

Material, Labor and

Overhead Costs)

T-1:Section II- Ch 2

R-4:Ch 1

RW-4 Meaning, differentiation

between cost, financial

and management

accounting and concepts

of costing

Define and illustrate

various cost terms

and concepts

Discussion through

powerpoint

presentation

Week 9 Lecture 26 Basic Aspects of Cost

Accounting(Preparation of

Cost Sheet and Estimated

Cost Sheet)

T-1:Section II- Ch 3

R-4:Ch 16

L 26 and 27-

Preparation of Cost

Sheet

L 28 and 29-

Preparation of Estimated

Cost Sheet

L 26 and L 28-

Identify the cost

incurred and

bifurcate it on the

basis of different

elements of cost

L 28 and L 29- To be

able to project

expected expenditure

in terms of cost by

learning to prepare

the estimated cost

sheet

Problem Solving

Lecture 27 Basic Aspects of Cost

Accounting(Preparation of

Cost Sheet and Estimated

Cost Sheet)

T-1:Section II- Ch 3

R-4:Ch 16

L 26 and 27-

Preparation of Cost

Sheet

L 28 and 29-

Preparation of Estimated

Cost Sheet

L 26 and L 28-

Identify the cost

incurred and

bifurcate it on the

basis of different

elements of cost

L 28 and L 29- To be

able to project

expected expenditure

in terms of cost by

learning to prepare

the estimated cost

sheet

Problem Solving

Week 10 Lecture 28 Basic Aspects of Cost

Accounting(Preparation of

Cost Sheet and Estimated

Cost Sheet)

T-1:Section II- Ch 3

R-4:Ch 16

L 26 and 27-

Preparation of Cost

Sheet

L 28 and 29-

Preparation of Estimated

Cost Sheet

L 26 and L 28-

Identify the cost

incurred and

bifurcate it on the

basis of different

elements of cost

L 28 and L 29- To be

able to project

expected expenditure

in terms of cost by

learning to prepare

the estimated cost

sheet

Problem Solving

Lecture 29 Basic Aspects of Cost

Accounting(Preparation of

Cost Sheet and Estimated

Cost Sheet)

T-1:Section II- Ch 3

R-4:Ch 16

L 26 and 27-

Preparation of Cost

Sheet

L 28 and 29-

Preparation of Estimated

Cost Sheet

L 26 and L 28-

Identify the cost

incurred and

bifurcate it on the

basis of different

elements of cost

L 28 and L 29- To be

able to project

expected expenditure

in terms of cost by

learning to prepare

the estimated cost

sheet

Problem Solving

Week 10 Lecture 30 Budgetary Control(Meaning

and Types of Budgets)

T-1:Section IV- Ch 1

R-4:Ch 13

R-6:Ch 12

OR-4 Meaning, need, process

of budgetary control and

types of budgets

Able to explain the

purposes of

budgeting and the

master budget and

relate the budget to

planning and control

Case Analysis

Budgetary Control(Need and

Steps involved in Budgetary

Control)

T-1:Section IV- Ch 1

R-4:Ch 13

R-6:Ch 12

OR-4 Meaning, need, process

of budgetary control and

types of budgets

Able to explain the

purposes of

budgeting and the

master budget and

relate the budget to

planning and control

Case Analysis

Week 11 Lecture 31 Budgetary Control

(Preparation of Cash

Budget)

T-1:Section IV- Ch 1

R-4:Ch 13

R-6:Ch 12

L 31 and L 32-

Preparation of cash

budget

Explain and illustrate

how budgetary

accounting

contributes to

achieving control

over revenues and

expenditures

Problem Solving

Lecture 32 Budgetary Control

(Preparation of Cash

Budget)

T-1:Section IV- Ch 1

R-4:Ch 13

R-6:Ch 12

L 31 and L 32-

Preparation of cash

budget

Explain and illustrate

how budgetary

accounting

contributes to

achieving control

over revenues and

expenditures

Problem Solving

Lecture 33 Budgetary Control

(Preparation of Flexible

Budget)

T-1:Section IV- Ch 1

R-4:Ch 13

R-6:Ch 12

Preparation of flexible

budget

Compare and contrast

the changes in the

cost patterns over

different activity

levels

Problem Solving

Week 12 Lecture 34 Homework,Test3

Lecture 35 Marginal Costing and Profit

Planning(CVP Analysis)

T-1:Section IV- Ch 5

R-4:Ch 3

R-6:Ch 10

RW-2 Meaning, objectives and

tools of CVP Analysis

Understanding of the

importance of

marginal costing in

decision making and

conducting cost

volume profit

analysis

Problem Solving

Marginal Costing and Profit

Planning(Meaning and

Objectives)

T-1:Section IV- Ch 5

R-4:Ch 3

R-6:Ch 10

RW-2 Meaning, objectives and

tools of CVP Analysis

Understanding of the

importance of

marginal costing in

decision making and

conducting cost

volume profit

analysis

Problem Solving

Week 12 Lecture 36 Marginal Costing and Profit

Planning(Break even

analysis)

T-1:Section IV- Ch 5

R-4:Ch 3

R-6:Ch 10

Concept and numerical

related to break even

analysis and application

of marginal costing

techniques

Identify and illustrate

how break even

analysis as a marginal

costing technique

helps to manage and

control the firm

profits

Problem Solving

Marginal Costing and Profit

Planning(Application of

Marginal Costing

Technique)

T-1:Section IV- Ch 5

R-4:Ch 3

R-6:Ch 10

Concept and numerical

related to break even

analysis and application

of marginal costing

techniques

Identify and illustrate

how break even

analysis as a marginal

costing technique

helps to manage and

control the firm

profits

Problem Solving

Week 13 Lecture 37 Marginal Costing and Profit

Planning(Marginal Costing

versus Standard Costing)

T-1:Section IV- Ch 4

R-4:Ch 17

R-6:Ch 13

Meaning of standard

costing, difference

between standard

costing and marginal

costing and introduction

to different kinds of

variances

To be able to

understand standard

costing and variance

analysis as cost

controlling tools

Discussion through

powerpoint

presentations

Lecture 38 Decision involving

Alternative Choices(Concept

and Steps involved in

Decision Making)

T-1:Section IV- Ch 6

R-4:Ch 4

R-6:Ch 11

Steps in decision

making process and

decisions based on key

factor under different

conditions

To be able to identify

and decide under

conditions involving

choice in allocation

of resources

Problem Solving

Decision involving

Alternative Choices

(Limiting Factor)

T-1:Section IV- Ch 6

R-4:Ch 4

R-6:Ch 11

Steps in decision

making process and

decisions based on key

factor under different

conditions

To be able to identify

and decide under

conditions involving

choice in allocation

of resources

Problem Solving

Lecture 39 Decision involving

Alternative Choices(Shut

down or Continuance)

T-1:Section IV- Ch 6

R-4:Ch 4

R-6:Ch 11

Decision regarding

making or buying a

product and situations as

to deciding whether to

shut down or continue

with a product

Ability to recognize

the situations for

production or

purchase of materials

as well as to continue

with a product line or

not

Problem Solving

Decision involving

Alternative Choices

(Determination of Sales

Mix)

T-1:Section IV- Ch 6

R-4:Ch 4

R-6:Ch 11

Decision regarding

making or buying a

product and situations as

to deciding whether to

shut down or continue

with a product

Ability to recognize

the situations for

production or

purchase of materials

as well as to continue

with a product line or

not

Problem Solving

Week 14 Lecture 40 Decision involving

Alternative Choices

(Exploration of New

Markets)

T-1:Section IV- Ch 6

R-4:Ch 4

R-6:Ch 11

Decision regarding

making or buying a

product as well as

exploring new markets

under different

conditions

To take decisions

related to expansion

by comparing

production

capabilities with the

probable returns

Problem Solving

Week 14 Lecture 40 Decision involving

Alternative Choices

(Decision related to Make or

Buy a Component)

T-1:Section IV- Ch 6

R-4:Ch 4

R-6:Ch 11

Decision regarding

making or buying a

product as well as

exploring new markets

under different

conditions

To take decisions

related to expansion

by comparing

production

capabilities with the

probable returns

Problem Solving

Lecture 41 Responsibility Accounting

(Elements)

T-1:Section IV- Ch 2

R-4:Ch 12

R-6:Ch 18

RW-3 Concept, elements and

different centers of

responsibility

accounting

Recognize the need

for reporting and its

relationship with

cost, revenue, profit

and investment

centers

Discussion through

Examples

Responsibility Accounting

(Responsibility Centers)

T-1:Section IV- Ch 2

R-4:Ch 12

R-6:Ch 18

RW-3 Concept, elements and

different centers of

responsibility

accounting

Recognize the need

for reporting and its

relationship with

cost, revenue, profit

and investment

centers

Discussion through

Examples

Responsibility Accounting

(Concept and Significance)

T-1:Section IV- Ch 2

R-4:Ch 12

R-6:Ch 18

RW-3 Concept, elements and

different centers of

responsibility

accounting

Recognize the need

for reporting and its

relationship with

cost, revenue, profit

and investment

centers

Discussion through

Examples

Lecture 42 Transfer Pricing(Meaning

and Importance)

T-1:Section IV- Ch 7

R-4:Ch 15

L 42- Concept and

importance

of Transfer Pricing; Cost

based method of transfer

pricing

L 43- Cost and market

based method of transfer

pricing

L 42- Analyze the

economic

consequences of

transfer pricing on

business decision

making

L 43- To be able to

compare and contrast

different methods of

transfer pricing for

the best interests of

the organisation

Problem Solving

Transfer Pricing(Methods of

Calculating Transfer Price)

T-1:Section IV- Ch 7

R-4:Ch 15

L 42- Concept and

importance

of Transfer Pricing; Cost

based method of transfer

pricing

L 43- Cost and market

based method of transfer

pricing

L 42- Analyze the

economic

consequences of

transfer pricing on

business decision

making

L 43- To be able to

compare and contrast

different methods of

transfer pricing for

the best interests of

the organisation

Problem Solving

Week 15 Lecture 43 Transfer Pricing(Methods of

Calculating Transfer Price)

T-1:Section IV- Ch 7

R-4:Ch 15

L 42- Concept and

importance

of Transfer Pricing; Cost

based method of transfer

pricing

L 43- Cost and market

based method of transfer

pricing

L 42- Analyze the

economic

consequences of

transfer pricing on

business decision

making

L 43- To be able to

compare and contrast

different methods of

transfer pricing for

the best interests of

the organisation

Problem Solving

Transfer Pricing(Meaning

and Importance)

T-1:Section IV- Ch 7

R-4:Ch 15

L 42- Concept and

importance

of Transfer Pricing; Cost

based method of transfer

pricing

L 43- Cost and market

based method of transfer

pricing

L 42- Analyze the

economic

consequences of

transfer pricing on

business decision

making

L 43- To be able to

compare and contrast

different methods of

transfer pricing for

the best interests of

the organisation

Problem Solving

Lecture 44 Recent Trends in Cost

Accounting(Quality

Costing)

R-5:Ch 19 and 21

R-6:Ch 18

L 44- Introduction and

need of the different

contemporary issues in

costing

L 45- Revision

L44 -45 Compare and

contrast different cost

controlling

techniques for

bringing benefits to

the company

Examples based

discussion

Recent Trends in Cost

Accounting(Activity Based

Costing)

R-5:Ch 19 and 21

R-6:Ch 18

L 44- Introduction and

need of the different

contemporary issues in

costing

L 45- Revision

L44-45 Compare and

contrast different cost

controlling

techniques for

bringing benefits to

the company

Examples based

discussion

Recent Trends in Cost

Accounting(Kaizen Costing)

R-5:Ch 19 and 21

R-6:Ch 18

L 44- Introduction and

need of the different

contemporary issues in

costing

L 45- Revision

L44-45 Compare and

contrast different cost

controlling

techniques for

bringing benefits to

the company

Examples based

discussion

Lecture 45 Recent Trends in Cost

Accounting(Kaizen Costing)

R-5:Ch 19 and 21

R-6:Ch 18

L 44- Introduction and

need of the different

contemporary issues in

costing

L 45- Revision

L44-45 Compare and

contrast different cost

controlling

techniques for

bringing benefits to

the company

Examples based

discussion

Week 15 Lecture 45 Recent Trends in Cost

Accounting(Activity Based

Costing)

R-5:Ch 19 and 21

R-6:Ch 18

L 44- Introduction and

need of the different

contemporary issues in

costing

L 45- Revision

L44-45 Compare and

contrast different cost

controlling

techniques for

bringing benefits to

the company

Examples based

discussion

Recent Trends in Cost

Accounting(Quality

Costing)

R-5:Ch 19 and 21

R-6:Ch 18

L 44- Introduction and

need of the different

contemporary issues in

costing

L 45- Revision

L44 -45 Compare and

contrast different cost

controlling

techniques for

bringing benefits to

the company

Examples based

discussion

SPILL OVER

Week 16 Lecture 46 Spill Over

Lecture 47 Spill Over

Lecture 48 Spill Over

Scheme for CA:

Component Frequency Out Of Each Marks Total Marks

Homework,Test 2 3 15 30

Total :- 15 30

Details of Academic Task(s)

AT No. Objective Topic of the Academic Task Nature of Academic Task

(group/individuals/field

work

Evaluation Mode Allottment /

submission Week

HW1 To expose the

students to practical

aspects of financial

statement analysis

and make them able

to interpret the

financial

performance and

financial position of

the organization.

Each student will be allocated a company for analyzing the

financial position for the past three years by using common size

analysis and compare different firms in an industry by using ratio

analysis.

Group Evaluation will be

done as per Rubric.

3 / 9

Test1 To check the

understanding of the

students.

Test based assignment on practical problems on the topics

covered so far.

Individual Accuracy in test

(having minimum 4

questions,

maximum marks

45).

5 / 6

Test2 To check the

understanding of the

students.

Test based assignment on practical problems on the topics

covered so far.

Individual Accuracy in test

(having minimum 4

questions,

maximum marks

45).

10 / 12

Plan for Tutorial: (Please do not use these time slots for syllabus coverage)

Tutorial No. Lecture Topic Type of pedagogical tool(s) planned

(case analysis,problem solving test,role play,business game etc)

Tutorial1 General discussion on the preparation of accounts Discussion

Tutorial2 General discussion on the preparation of accounts Discussion

Tutorial3 Accounting Equation Problem Solving

Tutorial4 Accounting Equation Problem Solving

Tutorial5 Horizontal Analysis Problem Solving

Tutorial6 Horizontal Analysis Problem Solving

Tutorial7 Vertical and Trend Analysis Problem Solving

Tutorial8 Vertical and Trend Analysis Problem Solving

Tutorial9 Preparation of Cash Flow Statement Problem Solving

Tutorial10 Preparation of Cash Flow Statement Problem Solving

Tutorial11 Cash Flow Statement Analysis Problem Solving

Tutorial12 Ratio Analysis Problem Solving

Tutorial13 Ratio Analysis Problem Solving

Tutorial14 Ratio Analysis Problem Solving

Tutorial15 Interpretations based on ratios Problem Solving,Discussion

Tutorial16 Interpretations based on ratios Problem Solving,Discussion

After Mid-Term

Tutorial17 Preparation of Cost Sheet Problem Solving

Tutorial18 Preparation of Cost Sheet Problem Solving

Tutorial19 Preparation of Estimated Cost Sheet Problem Solving

Tutorial20 Preparation of Cash Budget Problem Solving

Tutorial21 Preparation of Cash Budget Problem Solving

Tutorial22 Preparation of Flexible Budget Problem Solving

Tutorial23 CVP Analysis Problem Solving

Type of pedagogical tool(s) planned

(case analysis,problem solving test,role play,business game etc)

Discussion

Discussion

Problem Solving

Problem Solving

Problem Solving

Problem Solving

Problem Solving

Problem Solving

Problem Solving

Problem Solving

Problem Solving

Problem Solving

Problem Solving

Problem Solving

Problem Solving,Discussion

Problem Solving,Discussion

After Mid-Term

Problem Solving

Problem Solving

Problem Solving

Problem Solving

Problem Solving

Problem Solving

Problem Solving

Tutorial24 CVP Analysis

Tutorial27 Use of CVP Analysis for Managerial Decision Making

Tutorial28 Use of CVP Analysis for Managerial Decision Making

Tutorial29 Transfer Pricing

Tutorial30 Transfer Pricing

Tutorial25 BEP Analysis

Tutorial26 BEP Analysis

Problem Solving

Problem Solving

Problem Solving

Problem Solving

Problem Solving

Problem Solving

Problem Solving

You might also like

- Financial Planning & Analysis and Performance ManagementFrom EverandFinancial Planning & Analysis and Performance ManagementRating: 3 out of 5 stars3/5 (1)

- Pestle AnalysisDocument20 pagesPestle AnalysisSandip Kumar100% (3)

- Law of Agency CasesDocument10 pagesLaw of Agency CasesAndrew Lawrie75% (4)

- RP Tip Print NewDocument15 pagesRP Tip Print NewshinjasidhuNo ratings yet

- 01 Lesson Plan Financial AccountingDocument14 pages01 Lesson Plan Financial AccountingRajsha AliNo ratings yet

- 14 FRAV Prof Ramesh GuptaDocument7 pages14 FRAV Prof Ramesh GuptaSrinivaas GanesanNo ratings yet

- PGDM I Semester I Management Accounting - 1 (Ma-1) : 1. Course ObjectiveDocument4 pagesPGDM I Semester I Management Accounting - 1 (Ma-1) : 1. Course Objectivecooldude690No ratings yet

- Acc202 - Auditing Theory and PracticeDocument9 pagesAcc202 - Auditing Theory and PracticeEsha Jain100% (1)

- R PT Instruction PlanDocument7 pagesR PT Instruction PlanSk SharmaNo ratings yet

- Indian Institute of Management Kozhikode Executive Post Graduate Programme in ManagementDocument3 pagesIndian Institute of Management Kozhikode Executive Post Graduate Programme in Managementreva_radhakrish1834No ratings yet

- 2.accounting and Economics For EngineersDocument3 pages2.accounting and Economics For EngineersRNo ratings yet

- FIN633 Merchant Banking 12512::anoop Mohanty 3.0 1.0 0.0 4.0 Courses With Conceptual FocusDocument8 pagesFIN633 Merchant Banking 12512::anoop Mohanty 3.0 1.0 0.0 4.0 Courses With Conceptual Focusslachrummy4No ratings yet

- Fiannce Accounting Efpm 2020 Outline PDFDocument6 pagesFiannce Accounting Efpm 2020 Outline PDFHarsh MaheshwariNo ratings yet

- Course Outline FINANCIAL AND MANAGERIAL ACC DBU 2014 - 020642Document3 pagesCourse Outline FINANCIAL AND MANAGERIAL ACC DBU 2014 - 020642Ahmed YimamNo ratings yet

- Principles of Accounting: Course DescriptionDocument10 pagesPrinciples of Accounting: Course DescriptionFasil BulaNo ratings yet

- Course Outline Financial and Managerial Accounting 2023 24 Commented1Document3 pagesCourse Outline Financial and Managerial Accounting 2023 24 Commented1LALISA ABDISSANo ratings yet

- Weekly Work Plan of Financial Statement AnalysisDocument2 pagesWeekly Work Plan of Financial Statement AnalysisAmmar AsimNo ratings yet

- SY BCom NewDocument42 pagesSY BCom NewAamir KhanNo ratings yet

- FIN501 Financial Management 14120::sumit Goyal 4.0 1.0 0.0 5.0 Courses With Numerical and Conceptual FocusDocument10 pagesFIN501 Financial Management 14120::sumit Goyal 4.0 1.0 0.0 5.0 Courses With Numerical and Conceptual FocusSiddharth GautamNo ratings yet

- EMBA-FA Course Outline - 2023 - Sec C DDocument3 pagesEMBA-FA Course Outline - 2023 - Sec C DgeorgeavadakkelNo ratings yet

- 2011-12 B.C.A. Sem - I and IIDocument27 pages2011-12 B.C.A. Sem - I and IIanil_049No ratings yet

- Financial Accounting TheoryDocument8 pagesFinancial Accounting TheoryJustAHumanNo ratings yet

- Course Outline Financial and Managerial Accounting 2023 24 CommentedDocument2 pagesCourse Outline Financial and Managerial Accounting 2023 24 CommentedLALISA ABDISSANo ratings yet

- M.B.A Sem I NewDocument25 pagesM.B.A Sem I NewManish PariharNo ratings yet

- Financial Accounting and Accounting StandardDocument18 pagesFinancial Accounting and Accounting StandardZahidnsuNo ratings yet

- Financial Acccounting MBA KUKDocument125 pagesFinancial Acccounting MBA KUKlalit_wadhwa_1100% (2)

- Syllabus BCOMACCT 2020-2021Document30 pagesSyllabus BCOMACCT 2020-2021Prîyôjèét KârmåkàrNo ratings yet

- MBA 1 Course Outline October 2010Document67 pagesMBA 1 Course Outline October 2010Vu Hoang ThanhNo ratings yet

- Post Graduate Diploma in Management PGDM/ PGDM (General) Batch 2022-24Document32 pagesPost Graduate Diploma in Management PGDM/ PGDM (General) Batch 2022-24Rozy WasiNo ratings yet

- ABM - Business Finance CGDocument7 pagesABM - Business Finance CGJames FulgencioNo ratings yet

- Lovely Professional University, Punjab: Course No Cours Title Course Planner Lectures Tutorial Practical CreditsDocument7 pagesLovely Professional University, Punjab: Course No Cours Title Course Planner Lectures Tutorial Practical CreditsAmrish KumarNo ratings yet

- Syllabus Financial Reporting and Analysis - Level One ModuleDocument8 pagesSyllabus Financial Reporting and Analysis - Level One ModuleJazzer NapixNo ratings yet

- B. Tech Sem - I SUBJECT-Financial and Management Accounting (AF310) Teaching Scheme (Hr/week) Exam Scheme (Marks)Document6 pagesB. Tech Sem - I SUBJECT-Financial and Management Accounting (AF310) Teaching Scheme (Hr/week) Exam Scheme (Marks)ShaifaliMalukaniNo ratings yet

- MGT105Document8 pagesMGT105shahnwazNo ratings yet

- AccountsDocument4 pagesAccountscoolpeer91No ratings yet

- Intermediate AccountingDocument18 pagesIntermediate AccountingjtopuNo ratings yet

- Syllabus BUSS416 Fall2015Document3 pagesSyllabus BUSS416 Fall2015Stephen KimNo ratings yet

- Abe ManualDocument320 pagesAbe ManualNicole Taylor100% (2)

- Far 1Document5 pagesFar 1syid4hNo ratings yet

- Syllabus PGDM FMDocument73 pagesSyllabus PGDM FMyash_meetuNo ratings yet

- Accounting - I: Course Code: UIB 205 Credit Units: 04Document8 pagesAccounting - I: Course Code: UIB 205 Credit Units: 04SnigdhaNo ratings yet

- AcctsDocument3 pagesAcctsSimran GuptaNo ratings yet

- Fsa AsynchronousDocument10 pagesFsa AsynchronousPRATHAM MOTWANINo ratings yet

- IILM Graduate School of ManagementDocument15 pagesIILM Graduate School of ManagementMd. Shad AnwarNo ratings yet

- ECON F212 FOFA - Course Handout - 2015-16-2Document2 pagesECON F212 FOFA - Course Handout - 2015-16-2Chanakya CherukumalliNo ratings yet

- Accounting For Managers PDFDocument5 pagesAccounting For Managers PDFyashNo ratings yet

- Lesson Plan Far 600Document7 pagesLesson Plan Far 600ewinzeNo ratings yet

- Questions Tute DRLDocument3 pagesQuestions Tute DRLSmriti AggarwalNo ratings yet

- Financia Financial Statement AnalysisDocument4 pagesFinancia Financial Statement AnalysisAman SankrityayanNo ratings yet

- MBA 2 Accounting For Decision Making Jan 2014Document208 pagesMBA 2 Accounting For Decision Making Jan 2014rajabbanda100% (1)

- GM5101Document2 pagesGM5101rakeshsharmarv3577No ratings yet

- Indian Institute of Foreign Trade, Delhi: MBA IB 2017-19Document5 pagesIndian Institute of Foreign Trade, Delhi: MBA IB 2017-19Kunal SinghNo ratings yet

- Financial AccountingDocument4 pagesFinancial AccountingprachiNo ratings yet

- LP - Perform Vertical and Horizontal Analyses of Financial Statements of A Single ProprietorshipDocument6 pagesLP - Perform Vertical and Horizontal Analyses of Financial Statements of A Single ProprietorshipMARJON M. VILLONESNo ratings yet

- Finaman Graduate Syllabus Rev 1 PDFDocument3 pagesFinaman Graduate Syllabus Rev 1 PDFCaryl DominguezNo ratings yet

- Accounting For ManagersDocument2 pagesAccounting For ManagersAnbazhagan AjaganandaneNo ratings yet

- Chapter 1Document48 pagesChapter 1andm.enactusftuNo ratings yet

- Accounting For Managers - MS-102Document612 pagesAccounting For Managers - MS-102Shakti dodiyaNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Value Creation in Management Accounting and Strategic Management: An Integrated ApproachFrom EverandValue Creation in Management Accounting and Strategic Management: An Integrated ApproachNo ratings yet

- Pest Analysis of Banking IndustryDocument8 pagesPest Analysis of Banking IndustrySandip KumarNo ratings yet

- Cover PageDocument2 pagesCover PageSandip KumarNo ratings yet

- Public Health Status and Challenges of Nepal: Prepared by Sagar Prasad Ghimire MPH, Institute of Medicine, NepalDocument19 pagesPublic Health Status and Challenges of Nepal: Prepared by Sagar Prasad Ghimire MPH, Institute of Medicine, NepalSandip KumarNo ratings yet

- QuestionnaireDocument1 pageQuestionnaireSandip KumarNo ratings yet

- Rubric Acc501-Accountng For ManagersDocument1 pageRubric Acc501-Accountng For ManagersSandip KumarNo ratings yet

- Book 1Document2 pagesBook 1Sandip KumarNo ratings yet

- mgn514 - International Environment and ManagementDocument14 pagesmgn514 - International Environment and ManagementSandip KumarNo ratings yet

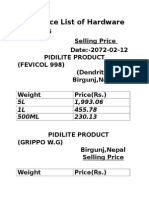

- Price List of Flush Door ProductsDocument1 pagePrice List of Flush Door ProductsSandip KumarNo ratings yet

- Questions: Strongly Disagree Disagree Neutral Agree Strongly AgreeDocument1 pageQuestions: Strongly Disagree Disagree Neutral Agree Strongly AgreeSandip KumarNo ratings yet

- Mkt501 TestDocument4 pagesMkt501 TestSandip KumarNo ratings yet

- SandeepDocument3 pagesSandeepSandip KumarNo ratings yet

- Price List of Hardware ProductsDocument2 pagesPrice List of Hardware ProductsSandip KumarNo ratings yet

- Ventus and Business Process Outsourcing: Submitted ByDocument5 pagesVentus and Business Process Outsourcing: Submitted BySandip KumarNo ratings yet

- Financial Management-An Overview Oxford Higher Education: Prepared by Sumit Goyal-LPUDocument33 pagesFinancial Management-An Overview Oxford Higher Education: Prepared by Sumit Goyal-LPUSandip KumarNo ratings yet

- Table of ContentDocument1 pageTable of ContentSandip KumarNo ratings yet

- Baba Glass House 1Document1 pageBaba Glass House 1Sandip KumarNo ratings yet

- Ethical DilemmaDocument36 pagesEthical DilemmaSandip Kumar100% (1)

- Profit Per Unit Hour Units A 80 40 10 B 50 20 15 Total Profit 1550Document1 pageProfit Per Unit Hour Units A 80 40 10 B 50 20 15 Total Profit 1550Sandip KumarNo ratings yet

- Cost of CapitalDocument38 pagesCost of CapitalSandip KumarNo ratings yet

- Alcoa MonopolyDocument14 pagesAlcoa MonopolySandip KumarNo ratings yet

- Partnership Dissolution and LiquidationDocument4 pagesPartnership Dissolution and Liquidationkat kaleNo ratings yet

- SME Products: Baroda Vidyasthali LoanDocument17 pagesSME Products: Baroda Vidyasthali LoanRavi RanjanNo ratings yet

- FICO Vox Pop Report - Fine Tuning Our Financial FuturesDocument16 pagesFICO Vox Pop Report - Fine Tuning Our Financial FuturesChidera UnigweNo ratings yet

- Balance Sheet of Indian Oil Corporation PDFDocument5 pagesBalance Sheet of Indian Oil Corporation PDFManpreet Kaur SekhonNo ratings yet

- Solution Manual For Contemporary Project Management 4th EditionDocument36 pagesSolution Manual For Contemporary Project Management 4th Editionmeawcocklofttp47100% (49)

- HSBC V PB TrustDocument3 pagesHSBC V PB Trustrgtan3No ratings yet

- Employee EngagementDocument25 pagesEmployee EngagementPratik Khimani100% (4)

- SBI PO Application FormDocument4 pagesSBI PO Application FormPranav SahilNo ratings yet

- Jose Luis Colon Roman v. United States of America, 817 F.2d 1, 1st Cir. (1987)Document4 pagesJose Luis Colon Roman v. United States of America, 817 F.2d 1, 1st Cir. (1987)Scribd Government DocsNo ratings yet

- Disposable SyringeDocument13 pagesDisposable SyringemanojassamNo ratings yet

- Risk Management Concepts: January 1998Document26 pagesRisk Management Concepts: January 1998IonutStanoiuNo ratings yet

- Sme WC AssessmentDocument8 pagesSme WC Assessmentvalinciamarget72No ratings yet

- HPPWD FORM No 7Document2 pagesHPPWD FORM No 7Ankur SheelNo ratings yet

- Acc CH 4Document16 pagesAcc CH 4Tajudin Abba RagooNo ratings yet

- Tflow®-Course-Level-1-Final-19Oct2015-Binni OngDocument48 pagesTflow®-Course-Level-1-Final-19Oct2015-Binni Ongchen mlNo ratings yet

- 80G CertificateTax ExemptionDocument56 pages80G CertificateTax ExemptionskunwerNo ratings yet

- Abhishek ReportDocument67 pagesAbhishek ReportAbhishek KarNo ratings yet

- Ravi Rao MinicaseDocument7 pagesRavi Rao MinicaseNawazish KhanNo ratings yet

- 15 DTPDocument256 pages15 DTP055Omkar salunkheNo ratings yet

- Latsol Abc Ujian 2 InterDocument9 pagesLatsol Abc Ujian 2 InterABIMANTRANANo ratings yet

- SDP Prospectus (Part4)Document565 pagesSDP Prospectus (Part4)Mazlinda Md RaisNo ratings yet

- Account Activity: Transaction Date Value Date Reference Description Debit Credit BalanceDocument9 pagesAccount Activity: Transaction Date Value Date Reference Description Debit Credit BalanceAmin KhanNo ratings yet

- f6vnm 2015dec Q PDFDocument16 pagesf6vnm 2015dec Q PDFSinhNo ratings yet

- Introduction To Income TaxDocument215 pagesIntroduction To Income Taxvikashkumar657No ratings yet

- Assignment Banking ShivaniDocument25 pagesAssignment Banking ShivaniAnil RajNo ratings yet

- Operation Profile: Basic DataDocument13 pagesOperation Profile: Basic DataAlan GarcíaNo ratings yet

- Monetary Policy and Fiscal PolicyDocument5 pagesMonetary Policy and Fiscal PolicySurvey CorpsNo ratings yet

- Business Risk Measurement MethodsDocument2 pagesBusiness Risk Measurement MethodsSahaa NandhuNo ratings yet

- Chapter 4Document7 pagesChapter 4Eumar FabruadaNo ratings yet