Professional Documents

Culture Documents

Final Report of FDI

Uploaded by

Gokul Rungta0 ratings0% found this document useful (0 votes)

32 views11 pageseconomics fdi

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenteconomics fdi

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views11 pagesFinal Report of FDI

Uploaded by

Gokul Rungtaeconomics fdi

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 11

ECONOMICS PROJECT:-

FOREIGN DIRECT INVESTMENT

Part 1 by swikriti-----

What is the full form of FDI :

The full form of FDI is Foreign Direct Investment.

What is the meaning of FDI ?

The Foreign Direct Investment means cross border investment made by a

resident in one economy in an enterprise in another economy, with the

objective of establishing a lasting interest in the investee economy.

FDI is also described as investment into the business of a country by a

company in another country. Mostly the investment is into production by

either buying a company in the target country or by expanding operations of an

existing business in that country. Such investments can take place for many

reasons, including to take advantage of cheaper wages, special investment

privileges (e.g. tax exemptions) offered by the country.

Foreign direct investment is of growing importance to global economic

growth. This is especially important for developing and emerging

marketcountries.

FDI from investors in developed areas like the European Union and the U.S.

provide funding and expertise to help smaller companies in these emerging

markets to expand and increase international sales.

In 2012, these emerging markets became the greatest beneficiary of FDI.

Foreign direct investment (FDI) is a direct investment into production

or business in a country by an individual or company of another country,

either by buying a company in the target country or by expanding

operations of an existing business in that country.

Foreign direct investment is in contrast to portfolio investment which is a

passive investment in the securities of another country such

as stocks and bonds.

Broadly, foreign direct investment includes "mergers and acquisitions, building

new facilities, reinvesting profits earned from overseas operations and intra

company loans".

[1]

In a narrow sense, foreign direct investment refers just to

building new facilities.

The numerical FDI figures based on varied definitions are not easily

comparable.

As a part of the national accounts of a country, and in regard to the GDP

equation Y=C+I+G+(X-M)

[Consumption + gross Investment + Government spending +(exports - imports],

where I is domestic investment plus foreign investment,

FDI is defined as the net inflows of investment (inflow minus outflow) to

acquire a lasting management interest (10 percent or more of voting stock) in an

enterprise operating in an economy other than that of the investor.

[2]

FDI is the sum of equity capital, other long-term capital, and short-term capital

as shown the balance of payments.

FDI usually involves participation in management, joint-venture, transfer of

technology and expertise.

.

[3]

FDI is one example of international factor movements

Part -2 by Aprajita

Why Countries Seek FDI ?

(a) Domestic capital is inadequate for purpose of economic growth;

(b) Foreign capital is usually essential, at least as a temporary measure, during the

period when the capital market is in the process of development;

(c) Foreign capital usually brings it with other scarce productive factors like

technical know how, business expertise and knowledge

What are the major benefits of FDI :

(a) Improves forex position of the country;

(b) Employment generation and increase in production ;

(c) Help in capital formation by bringing fresh capital;

(d) Helps in transfer of new technologies, management skills, intellectual property

(e) Increases competition within the local market and this brings higher

efficiencies

(f) Helps in increasing exports;

(g) Increases tax revenues

Why FDI is Opposed by Local People or Disadvantages of FDI :

(a) Domestic companies fear that they may lose their ownership to overseas

company

(b) Small enterprises fear that they may not be able to compete with world class

large companies and may ultimately be edged out of business;

(c) Large giants of the world try to monopolise and take over the highly

profitable sectors;

(d) Such foreign companies invest more in machinery and intellectual property

than in wages of the local people;

(e) Government has less control over the functioning of such companies as they

usually work as wholly owned subsidiary of an overseas company;

Brief Latest Developments on FDI (all sectors including retail):-

2012 October: In the second round of economic reforms, the government

cleared amendments to raise the FDI cap

(a) in the insurance sector from 26% to 49%;

(b) in the pension sector it approved a 26 percent FDI;

Now, Indian Parliament will have to give its approval for the final shape,"

2012 - September : The government approved the

(a) Allowed 51% foreign investment in multi-brand retail,

(b) Relaxed FDI norms for civil aviation and broadcasting sectors. FDI cap in

Broadcasting was raised to 74% from 49%;

(c) Allowed foreign investment in power exchanges

Part -3 by Gokul

Types

1. Horizontal FDI -arises when a firm duplicates its home country-based

activities at the same value chain stage in a host country through FDI.

[4]

2. Platform FDI -Foreign direct investment from a source country into a

destination country for the purpose of exporting to a third country.

3. Vertical FDI- takes place when a firm through FDI moves upstream or

downstream in different value chains i.e., when firms perform value-

adding activities stage by stage in a vertical fashion in a host country.

[4]

Methods[edit] ( give breifly )

The foreign direct investor may acquire voting power of an enterprise in an

economy through any of the following methods:

by incorporating a wholly owned subsidiary or company anywhere

by acquiring shares in an associated enterprise

through a merger or an acquisition of an unrelated enterprise

participating in an equity joint venture with another investor or enterprise

[5]

procedure for receiving Foreign Direct Investment in an Indian company

An Indian company may receive Foreign Direct Investment under the two

routes as given under:

i. Automatic Route

FDI is allowed under the automatic route without prior approval either of

the Government or the Reserve Bank of India in all activities/sectors as

specified in the consolidated FDI Policy, issued by the Government of

India from time to time.

ii. Government Route

FDI in activities not covered under the automatic route requires prior

approval of the Government which are considered by the Foreign

Investment Promotion Board (FIPB), Department of Economic Affairs,

Ministry of Finance.

Part-4 by karan

Forms of FDI incentives

Foreign direct investment incentives may take the following form low corporate

tax and individual income tax rates

tax holidays

other types of tax concessions

preferential tariffs

special economic zones

EPZ Export Processing Zones

Bonded warehouses

Maquiladoras

investment financial subsidies

soft loan or loan guarantees

free land or land subsidies

relocation & expatriation

infrastructure subsidies

R&D support

derogation from regulations (usually for very large projects)

Governmental Investment Promotion Agencies (IPAs) use various marketing

strategies inspired by the private sector to try and attract inward FDI,

including Diaspora marketing.

by excluding the internal investment to get a profited downstream.

part-5 by vishwendra

What is Scope of FDI in India? Why World is looking towards India for

Foreign Direct Investments :

India is the 3rd largest economy of the world in terms of purchasing power

parity and thus looks attractive to the world for FDI.

Even Government of India, has been trying hard to do away with the FDI caps

for majority of the sectors, but there are still critical areas like retailing and

insurance where there is lot of opposition from local Indians / Indian

companies.

Some of the major economic sectors where India can attract investment are as

follows:-

Telecommunications

Apparels

Information Technology

Pharma

Auto parts

Jewelry

Chemicals

In last few years, certainly foreign investments have shown upward trends but

the strict FDI policies have put hurdles in the growth in this sector. India is

however set to become one of the major recipients of FDI in the Asia-Pacific

region because of the economic reforms for increasing foreign investment and

the deregulation of this important sector. India has technical expertise and

skilled managers and a growing middle class market of more than 300 million

and this represents an attractive market.

Name the sectors where FDI is NOT allowed in India, both

under the Automatic Route as well as under the Government

Route?

FDI is prohibited under the Government Route as well as the Automatic

Route in the following sectors:

i) Atomic Energy

ii) Lottery Business

iii) Gambling and Betting

iv) Business of Chit Fund

v) Nidhi Company

vi) Agricultural (excluding Floriculture, Horticulture, Development of

seeds, Animal Husbandry, Pisciculture and cultivation of vegetables,

mushrooms, etc. under controlled conditions and services related to agro

and allied sectors) and Plantations activities (other than Tea Plantations)

vii) Housing and Real Estate business (except development of townships,

construction of residential/commercial premises, roads or bridges to the

extent specified in notification

viii) Trading in Transferable Development Rights (TDRs).

ix) Manufacture of cigars , cheroots, cigarillos and cigarettes , of tobacco

or of tobacco substitutes.

****Background and Recent Developments for FDI in Retail Sector which

has raised lot of controversies in political circles :****

As part of the economic liberalization process set in place by the Industrial

Policy of 1991, the Indian government has opened the retail sector to FDI

slowly through a series of steps:

1995 : World Trade Organisations (WTO) General Agreement on Trade in

Services, which includes both wholesale and retailing services, came into effect

1997 : FDI in cash and carry (wholesale) with 100% rights allowed under the

government approval route;

2006 : FDI in cash and carry (wholesale) was brought under automatic

approval route; Upto 51% investment in single brand retail outlet permitted,

subject to Press Note 3 (2006 series)

2011 : 100% FDI in Single Brand Retail allowed

2012 : On Sept. 13, Government approved the allowance of 51 percent foreign

investment in multi-brand retail, [ It also relaxed FDI norms for civil aviation

and broadcasting sectors]

After Walmart, Amazon lobbies in US for Indian FDI

WASHINGTON: After supermarket giant Walmart, it is online retail major Amazon which has begun

lobbying with the US lawmakers to seek their support for facilitating its "foreign direct investment in

India".

According to lobby disclosure reports filed with the US Senate, Amazon.com and its group entities

includingAmazon Corporate LLC have been lobbying on various issues since at least year 2000.

Government may go slow on FDI in e-

commerce retail

NEW DELHI: With the political fortunes of Congress taking a beating in state assembly elections, the

government is unlikely to move forward on the proposal to allow FDI in e-commerce at retail level.

At present, 100 per cent foreign direct investment (FDI) is allowed in business-to-business (B2B) e-

commerce but not in retail trading.

(ADD SOME MORE IF YOU GET )

You might also like

- DWC CataDocument62 pagesDWC CataGokul RungtaNo ratings yet

- Professional Ethics Course OverviewDocument1 pageProfessional Ethics Course OverviewGokul RungtaNo ratings yet

- Licenses Building CriteriaDocument10 pagesLicenses Building CriteriaLee RobuzaNo ratings yet

- Course Contents/Syllabus: Module I - International Criminal Law: Basics and HistoryDocument2 pagesCourse Contents/Syllabus: Module I - International Criminal Law: Basics and HistoryGokul RungtaNo ratings yet

- Enrollment FormDocument1 pageEnrollment FormSSS1021995No ratings yet

- Drafting, Pleading & Conveyancing SyllabusDocument5 pagesDrafting, Pleading & Conveyancing SyllabusPrateek Gupta0% (1)

- The National Interest and The Law of The Sea - CSR46Document82 pagesThe National Interest and The Law of The Sea - CSR46formosa911100% (3)

- Ships, Nationality and RegistrationDocument17 pagesShips, Nationality and RegistrationGokul RungtaNo ratings yet

- Weekly Internship Progress Report 1: WEEK 1: (June 6 TO June 12)Document2 pagesWeekly Internship Progress Report 1: WEEK 1: (June 6 TO June 12)Gokul RungtaNo ratings yet

- International Criminal Law and ICCDocument5 pagesInternational Criminal Law and ICCGokul RungtaNo ratings yet

- Assemblée Des États PartiesDocument4 pagesAssemblée Des États PartiesGokul RungtaNo ratings yet

- Maritime Law Course ExplainedDocument5 pagesMaritime Law Course ExplainedGokul RungtaNo ratings yet

- Convention On Law of The SeaDocument202 pagesConvention On Law of The SeaJhonsu30100% (2)

- Course Curriculum After Incorporating Suggestions of Aab: Drafting, Pleading & Conveyancing"Document5 pagesCourse Curriculum After Incorporating Suggestions of Aab: Drafting, Pleading & Conveyancing"Gokul RungtaNo ratings yet

- International Criminal Law and ICCDocument5 pagesInternational Criminal Law and ICCGokul RungtaNo ratings yet

- Invitatiion Prof FinalDocument2 pagesInvitatiion Prof FinalGokul RungtaNo ratings yet

- Advantages of Institutional ArbitrationDocument3 pagesAdvantages of Institutional ArbitrationGokul RungtaNo ratings yet

- Int Regulations Related To Telecommunicatio NDocument22 pagesInt Regulations Related To Telecommunicatio NGokul RungtaNo ratings yet

- Dr. Ram Manohar Lohiya National Law University, LucknowDocument14 pagesDr. Ram Manohar Lohiya National Law University, LucknowAshutosh SinghNo ratings yet

- IPRDocument5 pagesIPRAnonymous SsLZVDNo ratings yet

- Amity PresentationDocument14 pagesAmity PresentationGokul RungtaNo ratings yet

- Advanced Problem Solving Systems PlanningDocument28 pagesAdvanced Problem Solving Systems PlanningAnik HasanNo ratings yet

- 03-Software Lifecycle ModelsDocument30 pages03-Software Lifecycle ModelsGokul RungtaNo ratings yet

- 14120167838837Document3 pages14120167838837Gokul RungtaNo ratings yet

- "Exploring International Commercial Arbitration in India": Gokul Rungta (A11911112114)Document1 page"Exploring International Commercial Arbitration in India": Gokul Rungta (A11911112114)Gokul RungtaNo ratings yet

- Trade BlocDocument12 pagesTrade BlocGokul RungtaNo ratings yet

- Synopsis IcaDocument4 pagesSynopsis IcaGokul RungtaNo ratings yet

- Minimum Wages Act 1948Document20 pagesMinimum Wages Act 1948Gokul RungtaNo ratings yet

- Amity PresentationDocument14 pagesAmity PresentationGokul RungtaNo ratings yet

- Labour Law SyllabuDocument4 pagesLabour Law Syllaburmbj94_scribdNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sabah Offshore FieldsDocument16 pagesSabah Offshore FieldsMarlon Moncada50% (2)

- Role of PAODocument29 pagesRole of PAOAjay DhokeNo ratings yet

- Application Summary FormDocument2 pagesApplication Summary Formjqm printingNo ratings yet

- 3-Import ExportDocument13 pages3-Import ExportStephiel SumpNo ratings yet

- Saka 1h Presentation 2019 - 2 5d67a0eea24d1 PDFDocument18 pagesSaka 1h Presentation 2019 - 2 5d67a0eea24d1 PDFAnurag RayNo ratings yet

- The Entrepreneur Who Built Modern JapanDocument2 pagesThe Entrepreneur Who Built Modern JapanSteve RosenNo ratings yet

- Critique of PDP 2017-2022 on Monetary and Fiscal PoliciesDocument19 pagesCritique of PDP 2017-2022 on Monetary and Fiscal PoliciesKarlRecioBaroroNo ratings yet

- 21 Asian Terminals vs. First LepantoDocument9 pages21 Asian Terminals vs. First LepantoMichelle Montenegro - AraujoNo ratings yet

- Tgs Kelompok Ganda Kasus 3Document18 pagesTgs Kelompok Ganda Kasus 3GARTMiawNo ratings yet

- 1.a. PPT1 CR COLL Nature and Functions of CreditDocument41 pages1.a. PPT1 CR COLL Nature and Functions of CreditRoi Martin A. De VeyraNo ratings yet

- 1.1 Conceptual Framework (Student Guide)Document19 pages1.1 Conceptual Framework (Student Guide)Nikka Hazel MendozaNo ratings yet

- Consumer Buying Behaviour For Ball PensDocument110 pagesConsumer Buying Behaviour For Ball PensSalahuddin Saiyed100% (1)

- Where To Invest in Africa 2020Document365 pagesWhere To Invest in Africa 2020lindiNo ratings yet

- Definition of A ChequeDocument2 pagesDefinition of A Chequeashutoshkumar31311No ratings yet

- Benefits Administration - 1Document34 pagesBenefits Administration - 1vivek_sharma13No ratings yet

- Monthly Registration Stats 2015 - DecemberDocument3 pagesMonthly Registration Stats 2015 - DecemberBernewsAdminNo ratings yet

- CH 18 IFM10 CH 19 Test BankDocument12 pagesCH 18 IFM10 CH 19 Test Bankajones1219100% (1)

- Chapter 13 Capital Budgeting Estimating Cash FlowsDocument5 pagesChapter 13 Capital Budgeting Estimating Cash FlowsStephen Ayala100% (1)

- Chapter 5 - Sources of CapitalDocument42 pagesChapter 5 - Sources of CapitalLIEW YU LIANGNo ratings yet

- Mahmood Textile MillsDocument33 pagesMahmood Textile MillsParas RawatNo ratings yet

- OECD Economic Outlook - June 2023Document253 pagesOECD Economic Outlook - June 2023Sanjaya AriyawansaNo ratings yet

- Bbbscamtrackerannualreport Final 2017Document48 pagesBbbscamtrackerannualreport Final 2017KOLD News 13No ratings yet

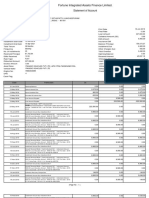

- Statement of Account for Mohansri ADocument2 pagesStatement of Account for Mohansri ASanthosh SehwagNo ratings yet

- Accounting EquationDocument11 pagesAccounting EquationNacelle SayaNo ratings yet

- Accountancy and Auditing 2-2011Document7 pagesAccountancy and Auditing 2-2011Muhammad BilalNo ratings yet

- Exercises (Time Value of Money) : TH TH THDocument2 pagesExercises (Time Value of Money) : TH TH THbdiitNo ratings yet

- ObjectionDocument10 pagesObjectionMy-Acts Of-SeditionNo ratings yet

- Dennis w2Document5 pagesDennis w2Dennis GieselmanNo ratings yet

- Efficio Survey Reveals Procurement ChallengesDocument13 pagesEfficio Survey Reveals Procurement ChallengesAditya JohariNo ratings yet

- Kot Addu Power Company LimitedDocument17 pagesKot Addu Power Company LimitedShanzae KhalidNo ratings yet