Professional Documents

Culture Documents

Credit Appraisal For Working Capital and Term Loan

Uploaded by

Akanksha KapoorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Appraisal For Working Capital and Term Loan

Uploaded by

Akanksha KapoorCopyright:

Available Formats

1

A REPORT

ON

ANALYSIS OF CREDIT APPRAISAL PROCESS AT

PUNJAB NATIONAL BANK

BY

PRIYANKA BANSAL

1302004535

PUNJAB NATIONAL BANK

2

A REPORT

ON

ANALYSIS OF CREDIT APPRAISAL PROCESS AT

PUNJAB NATIONAL BANK

BY

PRIYANKA BANSAL

1302004535

SIKKIM MANIPAL UNIVERSITY

A Report Submitted in the partial fulfilment of the requirement of

MBA Program of

SIKKIM MANIPAL UNIVERSITY (KAMLA NAGAR)

Submitted to:

Company guide

Mr. Arun Kumar Rastogi

(Senior Manager)

Date of Submission: 4

TH

JUNE 2014

3

Authorization

This is to certify that the project report submitted is submitted as a partial fulfilment of the

requirement of MBA program of Sikkim manipal university (SMU).

This report is titled Analysis of Credit Appraisal Process at Punjab National Bank.

4

ACKNOWLEDGEMENT

I would like to express my profound gratitude to all those who have been instrumental in the

preparation of my project report. To start with, I would like to thank Punjab National Bank

for providing me the chance to undertake this internship study and allowing me to explore the

area of corporate credit provided by banks which was entirely new to me and which will

surely prove to be very beneficial to me in my future assignments, my studies and my career

ahead.

I wish to place on records, my deep sense of gratitude and sincere appreciation to Mr. Pankaj

Srivastava Assistant General Manager, Circle Office, and also my company guide Mr. Arun

Kumar Rastogi, Senior manager Credit dppt. Who suggested and helped me prepare the

frame work of the project. I would also like to thank him for his continuous support, advice

and encouragement, without which this report could never have been completed. His patience

and faith in my abilities always boosted my confidence.

PRIYANKA BANSAL

5

TABLE OF CONTENTS

EXECUTIVE SUMMARY

1. Introduction ---------------------------------------------------------------------------------------7

1.1 definition of banking ----------------------------------------------------------------------------7

1.2 punjab national bank- brief history ------------------------------------------------------------9

1.3 objectives of the project--------------------------------------------------------------------------10

1.4 methodology ---------------------------------------------------------------------------------------11

1.5 scope & limitations: ------------------------------------------------------------------------------11

2. Banking industry analysis ----------------------------------------------------------------------12

2.1 evolution of banking industry -----------------------------------------------------------------12

2.2 industry structure ----------------------------------------------------- ----------------------------13

2.3 industry model -------------------------------------------------------------------------------------18

3. Pestel analysis of industry ------------------------------------------------------------------------20

3.1 political scenario ---------------------------------------------------------------------------------21

3.2 economic scenario --------------------------------------------------------------------------------22

3.3performance of banking sector (2013)-----------------------------------------------------------23

3.4 technological , social and ethical aspects ------------------------------------------------------27

4 .Michael Poerter Analysis Of Indian Banking Industry -----------------------------------28

4.1 future growth factors ------------------------------------------------------------------------------33

4.2 challenges --------------------------------------------------------------------------------------------34

5.Company Analysis --------------------------------------------------------------------------------37

5.1 introduction -----------------------------------------------------------------------------------------37

5.2 business performance ------------------------------------------------------------------------------40

5.4 ratio analysis.---------------------------------------------------------------------------------------43.

5.4 share performance ----------------------------------------------------------------------------------45

5.5 swot analysis ---------------------------------------------------------------------------------------46.

6.Onsite Project --------------------------------------------------------------------------------------49

6.1 credit appraisal -------------------------------------------------------------------------------------52

6.2 types of fund based and non fund based loans -------------------------------------------------59

6.3 credit risk management----------------------------------------------------------------------------70

6.4 preventive monitoring system --------------------------------------------------------------------74

7.Npa Norms Under Pnb------------------------------------------------------------------------------76

8.On Site Project ---------------------------------------------------------------------------------------79

8.1 Recommendations ------------------------------------------------------------------------------109

9.Learning From Sip--------------------------------------------------------------------------------111

10.My Contribution --------------------------------------------------------------------------------112

11.Conclusion----------------------------------------------------------------------------------------113

12 References -----------------------------------------------------------------------------------------114

6

EXECUTIVE SUMMARY

In India, the banking sector has been remarkably successful in some respects. Its immense

size and enormous penetration in rural areas are exemplary among developing countries, as is

its solid reputation for stability among depositors.

This internship is being done in order to understand various credit facilities and processes

followed by one of the most reputed bank in the country, Punjab National Bank.

Each bank has its own set of policies that must be followed while sanctioning a loan and care

must be taken that the money provided by the bank is being used up for the intended purpose

only. The task ranging from acceptance of loan proposal to sanctioning of loan is carried out

at Credit Division of the bank. Moreover, each loan proposals fall under powers of different

levels depending on the size of the proposal.

The internship is intended to understand the process of project appraisal for term loans and

assessment for working capital requirements being followed at PNB. With a developing

economy and many multinational companies coming up, new projects are being undertaken.

These projects require huge amount of capital and thus banks come forward to finance these

projects depending on the feasibility of the project. PNB carries out an extensive study of the

project and checks for it feasibility and if the project seems to be feasible, a decision is taken.

This process of carrying out the feasibility test of the project based on the financial position

of the company is called Project Appraisal.

Since the project appraisal also includes a very essential step of Credit Risk Rating carried

out at Risk Management Division (RMD) of the bank, I also took training under risk

department for two weeks in order to closely understand the working.

Rating is done in order to find out the capability or the willingness of the company to pay its

debt. PNB uses its own model to rate a company and this model is one of its kind in the

country. The software used in this is known as PNB TRAC. Depending on the type of

project, a suitable model is chosen and based on financials of the company and the track

record of the management, rating is done. This rating also helps in determining the rate of

interest at which the loan should be given. Generally, a company with good ratings is gives

loan at a lower ROI as the risk involved is lower.

7

1. INTRODUCTION

Banks today are important not just from the point of view of economic growth, but also

financial stability. In emerging economies, banks are special for three important reasons.

First, they take a leading role in developing other financial intermediaries and

markets.

Second, due to the absence of well developed equity and bond markets, the corporate

sector depends heavily on banks to meet its financing needs.

Finally, in emerging markets such as India, banks cater to the needs of a vast number

of savers from the household sector, which prefer assured income and liquidity and

safety of funds, because of their inadequate capacity to manage financial risks.

Indias banking sector has the potential to become the fifth largest banking sector globally by

2020 and the third largest by 2025. The industry has witnessed discernable development, with

deposits growing at a CAGR of 21.2 per cent (in terms of INR) in the period FY 0613; in

FY 13 total deposits stood at US$ 1,274.3 billion.

1.1 DEFINITION OF BANKING

The most basic function of a Bank is to lend money to the borrowers. Banks accept the

deposit from the public for safe-keeping and compensate them by paying interest. They lend

this money to others borrowers and earn higher interest on this money. Thus, banks act as

intermediaries between the people who have the money to lend and those who have the need

for money to carry out any business transactions.

In India, the definition of the business of banking has been given in the Banking Regulation

Act, (BR Act), 1949. According to Section 5(c) of the BR Act, 'a banking company is a

company which transacts the business of banking in India.' Further, Section 5(b) of the BR

Act defines banking as, 'accepting, for the purpose of lending or investment, of deposits of

money from the public, repayable on demand or otherwise, and withdraw able, by cheque,

draft, and order or otherwise.'

This definition points to the three primary activities of a commercial bank which distinguish

it from the other financial institutions. These are:

(i) maintaining deposit accounts including current accounts,

(ii) issue and pay cheques, and

(iii) collect cheques for the bank's customers.

The difference between the rates at which the interest is paid on deposits and is charged on

loans, is called the "spread", and is actually how the banks make profit. Banks lend money in

various forms and for practically every activity.

8

The others activities of Bank are:

a) Accept Deposits / Make Loans

b) Provide Safety

c) Act as Payment Agents

d) Buy/Hold Securities

e) Treasury Services

f) Loan Sales

The operations of Banks are can be classified into:

1. Retail Banking: Retail banking is the business of making consumer loans, mortgages ,

taking deposits and offering products such as savings account. The Retail banks compete

on convenience, the accessibility of branches and ATMs for example, cost such as the

rate of interest, and service charges, or combination of the two.

2. Commercial Banking: Commercial banking is not that different than retail banking, the

banking operations still revolve around collecting deposits, making loans and convincing

customers to use other fee-generating services. One of the primary differences is that

business customers tend to have somewhat more sophisticated demands from their banks,

often leaning on banks for assistance in managing their payables, receivables and other

treasury functions. Commercial also tends to be less demanding in terms of branch

networks and infrastructure, but more competitive in terms of rates and fees.

3. Private Banking: In addition to the standard bank service offerings, like savings

accounts and safe deposit boxes, private banks often offer a host of trust, tax and Planning

services.

4. Investment Banking: Investment banking is a very different business than commercial

banking, Investment banks specialize in underwriting the securities (equity and/or debt),

making markets for securities, trading for their own accounts and providing advisory

services to the corporate clients.

In India, the banking sector has been remarkably successful in some respects. Its immense

size and enormous penetration in rural areas are exemplary among developing countries, as is

its solid reputation for stability among depositors.

The last decade has seen many positive developments in the Indian banking sector. The

policy makers, which comprise the Reserve Bank of India (RBI), Ministry of Finance and

related government and financial sector regulatory entities, have made several notable efforts

to improve regulation in the sector. The sector now compares favourably with banking

sectors in the region on metrics like growth, profitability and non-performing assets (NPAs).

A few banks have established an outstanding track record of innovation, growth and value

creation. This is reflected in their market valuation.

9

This internship is being done in order to understand various credit facilities and processes

followed by one of the most reputed bank in the country, Punjab National Bank.

1.2 PUNJAB NATIONAL BANK: A BRIEF HISTORY

PNB was founded in the year 1895 at Lahore (presently in Pakistan) as an off-shoot of the

Swadeshi Movement. Among the inspired founders were Sardar Dayal Singh Majithia, Lala

HarKishen Lal, Lala Lalchand, Shri Kali Prosanna Roy, Shri E.C. Jessawala, Shri Prabhu

Dayal, Bakshi Jaishi Ram, Lala Dholan Dass.

With a common missionary zeal they set about establishing a national bank; the first one with

Indian capital owned, managed and operated by the Indians for the benefit of the Indians.

The Lion of Punjab, Lala Lajpat Rai, was actively associated with the management of the

Bank in its formative years.

PROFILE

With more than 119

years of strong existence and 6081 total branches including 5 foreign

branches, 6698 ATMs as on Dec13, Punjab National Bank is serving more than 87 million

esteemed customers. PNB, being one of the largest nationalized banks, has continued to

provide prudent and trustworthy banking services to its customers. The Bank enjoys strong

fundamentals, large franchise value and good brand image. To meet the growing aspirations

of the people and compete in these tough conditions, the Bank offers wide range of products

and services.

At present, commercial loans are available for practically all kinds of activities and also for

both long and short tenures. Based on customer profile, these loans are of two types:

Retail Loans

Corporate Loans

Retail Loans

This retail loan is meant for small entrepreneurs as well as individuals who are engaged in

some commercial activity and have the due capacity to repay the loan in time. Loans are

given on the strength of the means of the borrower with regards to their repaying capacity i.e

the credit worthiness of the borrower. The latter is judged through the cash streams (income)

or the fund flow from operations available with the borrower for repayment of the loan.

Corporate Loans

These loans are meant for corporate bodies (and larger other entities or constitutions like

proprietorships, partnerships and Pvt. Ltd.) engaged in any activity with the objective of

making profit. Banks often sanction loans to such entities only after a detailed research of

their management and financials such as experience of management, strength of their balance

sheet, income statement, the length of cash cycle, operating cycle and depending upon the

products available with respective banks.

10

There are various kinds of loan products available for corporate clients in India in form of

funded and non- funded credit facility( Funded are term loan, Working capital and Non

Funded are LC/BG which will be explained in detail in later stage of the report) . The loans

are prepared depending upon the need of the client and the product available with the lending

Bank.

Every loan proposal made to the bank is necessarily appraised by its officers and only then a

decision is taken whether to sanction the loan money or not. Corporate credit appraisal or

project appraisal is a fundamental business practice which assesses the potentialities of a

corporation in terms of financial capabilities to honour debts and other securities.

A critical role of credit rating is, in its very basic essence, to ensure that the borrowers

activity has good potential to repay debts and as such determine the level of confidence a

lender has with the borrower. The credit rating also determines the interest rate at which the

loan will be sanctioned to the borrower

According to Rose and Hudgins, Credit Analysis and Lending (2005), all credit officers

usually never lose sight of the 5 Cs of lending.

They are:

1. Character: The specific purpose for loan and serious intent to repay it.

2. Capacity: Whether the customer has legal authority to sign binding contract.

3. Cash: Whether the borrower has the ability to generate enough cash to repay the loan.

4. Collateral: Whether the borrower has adequate assets to support the loan.

5. Conditions: Must look at the industry and changing economic conditions to assess ability

to repay.

1.3 OBJECTIVE OF THE PROJECT:

The main objective of the study is to study the sanctioning procedure and analysis of the

term loan, working capital loan in depth and their appraisal by PUNJAB NATIONAL

BANK for corporate projects.

The project has following objectives:

To carry out the Financial Analysis/Appraisal of the borrower/Project. .

Understanding the Credit monitoring arrangement (CMA) data

Checking the viability of the project through ratio analysis.

Assessment of working capital limits and term loans.

Finding permissible banking finance ( PBF)

To assess the credit rating of borrower company.

To analyze the Non Performing Assets in Bank and various reasons that leads an account

to become an NPA.

11

1.4 METHODOLOGY

Sources of Data:

Data is collected is majorly done from secondary sources.

Secondary Sources:

Reading live project reports ; proposal , stock audit report , credit risk report

Analysing financials of the proposals

Checking the proper due diligence with PNB and RBI guidelines.

Various knowledge centers of Corporate Banking.

Techniques:

Techniques adopted for the project will be:

Exploratory and Analytical.

Learning from Live project

Cost and Value Analysis of projects using CMA Data, PBF analysis on MS Excel.

1.5 SCOPE & LIMITATIONS:

SCOPE:

The title of the project states that it is a decision making process regarding the granting of

credit facilities/ sanction of credit to the business client. It relates to determination of the Risk

of Default /credit risk which is nothing but the risk the borrower may be unwilling to owner

his obligations under the terms of contract for credit.

A major part of the asset of a bank consists of loan portfolio. Bank suffers maximum loss

when their assets turn into NPA.

It is at this stage that the credit risk is quantified in terms of default probabilities and also

recovery rates are determined. The credit risk is thus a major concern on management of asset

portfolio of any bank.

With the opening up of the economy, rapid changes are taking place in the technology and

financial sector, exposing banks to greater risks. Thus, in the present scenario efficient project

appraisal has assumed a great importance as it can check and prevent induction of weak

accounts to our loan portfolio. All possible steps need to be taken to strengthen pre sanction

appraisal.

LIMITATION OF THE STUDY:

1. Since credit appraisal is one of the very crucial area of banking, some of the technicalities

may not be revealed.

2. The use of internal records and files of the bank are restricted for trainees.

3. Borrowers detail is not disclosed as per NDA of the Bank

12

2. THE BANKING INDUSTRY

2.1 EVOLUTION OF INDIAN BANKING INDUSTRY

The banking industry of India started taking its shape after the independence in 1947. Though

the history of Indian banking industry can be traced as far back as 1806 with the

establishment of the Bank of Bengal, (which has now evolved as the State Bank of India) the

industry was in a state of turmoil.

From the year 1906 to1911, several banks were set up based on the principles of the Swadesi

movement started by M.K. Gandhi. The movement inspired Indian businessmen and

politicians to set up banks for the Indian community and several new banks were launched to

promote trade and finance in the country. Some of the prominent ones among these are Bank

of India, Corporation Bank, Bank of Baroda, Indian bank, Canara Bank, and Central bank of

India. Bank of Bengal, along with its sister banks, Bank of Bombay and Bank of Madras

(Now SBI), set up by British East India Company, merged in 1921 to give birth to Imperial

bank of India, now known as State bank of India.

After the partition of India post independence, the government took drastic steps to regulate

the banking industry. For example, in 1948, additional powers and authority were vested in

the Reserve bank of India (RBI) to monitor and regulate the functioning of the entire banking

system. The passing the Banking regulation acts in 1949, empowered RBI to further regulate,

inspect, and control Indian banks.

The nationalization and liberalization of banks 1969 and 1991 respectively also gave thrust

the development of the Indian banking sector. Nationalization resulted in 91% of government

holding in the banking industry and liberalization paved the path for private players to

participate in the industry. As a result, many private player banks like Oriental bank of

Commerce, HDFC bank, ICICI bank, and AXIS bank came into the sector. Foreign banks too

were permitted to set up their offices in India. The rationalization of FDI norms in 2002 also

allowed foreign players to acquire stakes in Indian banks.

These banks implemented innovative forms of banking like ATMs, mobile banking, phone

banking, internet banking, and debit/credit cards. The private players constantly improved

services in order to retain customers and win the severe competition which had become a

feature of the Indian banking industry.

Thus, the Indian banking industry has its foundations in the 18th century, and has had a

varied evolutionary experience since then. The initial banks in India were primarily traders

banks engaged only in financing activities. Banking industry in the pre-independence era

developed with the Presidency Banks, which were transformed into the Imperial Bank of

India and subsequently into the State Bank of India. The initial days of the industry saw a

13

majority private ownership and a highly volatile work environment. Major strides towards

public ownership and accountability were made with nationalisation in 1969 and 1980 which

transformed the face of banking in India. The industry in recent times has recognised the

importance of private and foreign players in a competitive scenario and has moved towards

greater liberalisation.

In the evolution of this strategic industry spanning over two centuries, immense

developments have been made in terms of the regulations governing it, the ownership

structure, products and services offered and the technology deployed. The entire evolution

can be classified into four distinct phases.

Phase I- Pre-Nationalisation Phase (prior to 1955)

Phase II- Era of Nationalisation and Consolidation (1955-1990)

Phase III- Introduction of Indian Financial & Banking Sector Reforms and Partial

Liberalisation (1990-2004)

Phase IV- Period of Increased Liberalisation (2004 onwards)

2.2 THE INDUSTRY STRUCTURE:

Currently the Indian banking industry has a diverse structure. The present structure of the

Indian banking industry has been analyzed on the basis of its organised status, business as

well as product segmentation.

14

Organisational Structure

The entire organised banking system comprises of scheduled and non-scheduled banks.

Largely, this segment comprises of the scheduled banks, with the unscheduled ones forming

a very small component. Banking needs of the financially excluded population is catered to

by other unorganised entities distinct from banks, such as, moneylenders, pawnbrokers and

indigenous bankers.

Scheduled Banks

A scheduled bank is a bank that is listed under the second schedule of the RBI Act, 1934. In

order to be included under this schedule of the RBI Act, banks have to fulfill certain

conditions such as having a paid up capital and reserves of at least 0.5 million and satisfying

the Reserve Bank that its affairs are not being conducted in a manner prejudicial to the

interests of its depositors. Scheduled banks are further classified into commercial and

cooperative banks. The basic difference between scheduled commercial banks and

scheduled cooperative banks is in their holding pattern. Scheduled cooperative banks are

cooperative credit institutions that are registered under the Cooperative Societies Act. These

banks work according to the cooperative principles of mutual assistance.

Scheduled Commercial Banks (SCBs):

Scheduled commercial banks (SCBs) account for a major proportion of the business of the

scheduled banks. As at end-March, 2009, 80 SCBs were operational in India. SCBs in India

are categorized into the five groups based on their ownership and/or their nature of

operations. State Bank of India and its six associates (excluding State Bank of Saurashtra,

which has been merged with the SBI with effect from August 13, 2008) are recognised as a

separate category of SCBs, because of the distinct statutes (SBI Act, 1955 and SBI

Subsidiary Banks Act, 1959) that govern them. Nationalised banks (10) and SBI and

associates (7), together form the public sector banks group and control around 70% of the

total credit and deposits businesses in India. IDBI ltd. has been included in the nationalised

banks group since December 2004. Private sector banks include the old private sector banks

and the new generation private sector banks- which were incorporated according to the

revised guidelines issued by the RBI regarding the entry of private sector banks in 1993. As

at end-March 2009, there were 15 old and 7 new generation private sector banks operating in

India.

Foreign banks are present in the country either through complete branch/subsidiary route

presence or through their representative offices. At end-June 2009, 32 foreign banks were

operating in India with 293 branches. Besides, 43 foreign banks were also operating in India

through representative offices.

15

Regional Rural Banks (RRBs) were set up in September 1975 in order to develop the rural

economy by providing banking services in such areas by combining the cooperative

specialty of local orientation and the sound resource base which is the characteristic of

commercial banks. RRBs have a unique structure, in the sense that their equity holding is

16

jointly held by the central government, the concerned state government and the sponsor bank

(in the ratio 50:15:35), which is responsible for assisting the RRB by providing financial,

managerial and training aid and also subscribing to its share capital.

Between 1975 and 1987, 196 RRBs were established. RRBs have grown in geographical

coverage, reaching out to increasing number of rural clientele. At the end of June 2008, they

covered 585 out of the 622 districts of the country. Despite growing in geographical

coverage, the number of RRBs operational in the country has been declining over the past

five years due to rapid consolidation among them. As a result of state wise amalgamation of

RRBs sponsored by the same sponsor bank, the number of RRBs fell to 86 by end March

2009.

Scheduled Cooperative Banks:

Scheduled cooperative banks in India can be broadly classified into urban credit cooperative

institutions and rural cooperative credit institutions. Rural cooperative banks undertake long

term as well as short term lending. Credit cooperatives in most states have a three tier

structure (primary, district and state level).

Non-Scheduled Banks:

Non-scheduled banks also function in the Indian banking space, in the form of Local Area

Banks (LAB). As at end-March 2009 there were only 4 LABs operating in India. Local area

banks are banks that are set up under the scheme announced by the government of India in

1996, for the establishment of new private banks of a local nature; with jurisdiction over a

maximum of three contiguous districts. LABs aid in the mobilisation of funds of rural and

semi urban districts. Six LABs were originally licensed, but the license of one of them was

cancelled due to irregularities in operations, and the other was amalgamated with Bank of

Baroda in 2004 due to its weak financial position.

Business Segmentation

The entire range of banking operations are segmented into four broad heads- retail banking

businesses, wholesale banking businesses, treasury operations and other banking activities.

Banks have dedicated business units and branches for retail banking, wholesale banking

(divided again into large corporate, mid corporate) etc.

17

Retail banking

It includes exposures to individuals or small businesses. Retail banking activities are

identified based on four criteria of orientation, granularity, product criterion and low value

of individual exposures. In essence, these qualifiers imply that retail exposures should be to

individuals or small businesses (whose annual turnover is limited to Rs. 0.50 billion) and

could take any form of credit like cash credit, overdrafts etc. Retail banking exposures to

one entity is limited to the extent of 0.2% of the total retail portfolio of the bank or the

absolute limit of Rs. 50 million. Retail banking products on the liability side includes all

types of deposit accounts and mortgages and loans (personal, housing, educational etc) on

the assets side of banks. It also includes other ancillary products and services like credit

cards, demat accounts etc.

The retail portfolio of banks accounted for around 21.3% of the total loans and advances of

SCBs as at end-March 2009. The major component of the retail portfolio of banks is housing

loans, followed by auto loans. Retail banking segment is a well diversified business

segment. Most banks have a significant portion of their business contributed by retail

banking activities. The largest players in retail banking in India are ICICI Bank, SBI, PNB,

BOI, HDFC and Canara Bank.

Among the large banks, ICICI bank is a major player in the retail banking space which has

had definitive strategies in place to boost its retail portfolio. It has a strong focus on

movement towards cheaper channels of distribution, which is vital for the transaction

intensive retail business. SBIs retail business is also fast growing and a strategic business

unit for the bank. Among the smaller banks, many have a visible presence especially in the

auto loans business. Among these banks the reliance on their respective retail portfolio is

high, as many of these banks have advance portfolios that are concentrated in certain usages,

such as auto or consumer durables. Foreign banks have had a somewhat restricted retail

portfolio till recently. However, they are fast expanding in this business segment. The retail

banking industry is likely to see a high competition scenario in the near future.

18

Wholesale banking

Wholesale banking includes high ticket exposures primarily to corporates. Internal processes

of most banks classify wholesale banking into mid corporates and large corporates according

to the size of exposure to the clients. A large portion of wholesale banking clients also

account for off balance sheet businesses. Hedging solutions form a significant portion of

exposures coming from corporates. Hence, wholesale banking clients are strategic for the

banks with the view to gain other business from them. Various forms of financing, like

project finance, leasing finance, finance for working capital, term finance etc form part of

wholesale banking transactions. Syndication services and merchant banking services are also

provided to wholesale clients in addition to the variety of products and services offered.

Wholesale banking is also a well diversified banking vertical. Most banks have a presence in

wholesale banking. But this vertical is largely dominated by large Indian banks. While a

large portion of the business of foreign banks comes from wholesale banking, their market

share is still smaller than that of the larger Indian banks. A number of large private players

among Indian banks are also very active in this segment. Among the players with the largest

footprint in the wholesale banking space are SBI, ICICI Bank, IDBI Bank, Canara Bank,

Bank of India, Punjab National Bank and Central Bank of India. Bank of Baroda has also

been exhibiting quite robust results from its wholesale banking operations.

Treasury Operations

Treasury operations include investments in debt market (sovereign and corporate), equity

market, mutual funds, derivatives, and trading and forex operations. These functions can be

proprietary activities, or can be undertaken on customers account. Treasury operations are

important for managing the funding of the bank. Apart from core banking activities, which

comprises primarily of lending, deposit taking functions and services; treasury income is a

significant component of the earnings of banks. Treasury deals with the entire investment

portfolio of banks (categories of HTM, AFS and HFT) and provides a range of products and

services that deal primarily with foreign exchange, derivatives and securities. Treasury

involves the front office (dealing room), mid office (risk management including independent

reporting to the asset liability committee) and back office (settlement of deals executed,

statutory funds management etc).

Other Banking Businesses

This is considered as a residual category which includes all those businesses of banks that do

not fall under any of the aforesaid categories. This category includes para banking activities

like hire purchase activities, leasing business, merchant banking, factoring activities etc.

2.3 THE INDUSTRY MODEL

A bank can generate its income or revenue in many different ways including interest,

transaction fees and financial advices and many other services. The main method is via

charging interest on the capital it lends out to the customers. The bank make profits from the

difference between the level of interest it pays for deposits like the Savings (and other very

low interest deposits like Current Account) and other sources of funds, and the level of

interest it charges in its lending activities like giving Housing Loans, Car loans and Project

Financing etc..

19

This difference is referred to as the spread between the cost of funds and the loan interest

rate. Historically, profitability from lending activities has been cyclical and dependent on the

needs and strengths of loan customers and the stage of the economic cycle. Fees and

financial advice constitute a more stable revenue stream and banks have therefore placed

more emphasis on these revenue lines to smooth their financial performance

The major operating income of a bank is the interest income (comprises 75-85% of the total

income of almost all Indian Banks). Apart from the interest income, a bank also generates

fee-based income in the form of commissions and exchange, income from treasury

operations and other income from other banking activities. As banks were assigned a special

role in the economic development of the country, RBI has stipulated that a portion of bank

lending should be for the development of under-banked and under- privileged sections,

which is called the priority sector. Current rules by the central bank ( RBI) stipulate that

domestic banks should lend 40% and the foreign banks should lend 32% of their net credit to

the priority sector which includes agriculture as one of the priority sector. On the other hand

if we look at the cost sides, the major items for a bank are the interest paid on different

types of deposits like savings and CAs, bonds issued and borrowings, and provisioning cost

for the Non-performing Assets (NPAs)

Products of the Banking Industry

The products of the banking industry broadly include deposit products, credit products and

customized banking services. Most banks offer the same kind of products with minor

variations. The basic differentiation is attained through quality of service and the delivery

channels that are adopted. Apart from the generic products like deposits (demand deposits

20

current, savings and term deposits), loans and advances (short term and long term loans) and

services, there have been innovations in terms and products such as the flexible term deposit,

convertible savings deposit (wherein idle cash in savings account can be transferred to a

fixed deposit), etc. Innovations have been increasingly directed towards the delivery

channels used, with the focus shifting towards ATM transactions, phone and internet

banking. Product differentiating services have been attached to most products, such as

debit/ATM cards, credit cards, nomination and demat services.

Other banking products include fee-based services that provide non-interest income to the

banks. Corporate fee-based services offered by banks include treasury products; cash

management services; letter of credit and bank guarantee; bill discounting; factoring and

forfeiting services; foreign exchange services; merchant banking; leasing; credit rating;

underwriting and custodial services. Retail fee-based services include remittances and

payment facilities, wealth management, trading facilities and other value added services.

3. THE CURRENT SENARIO : PESTEL ANALYSIS

Indias banking sector is currently valued at Rs 81 trillion (US$ 1.31 trillion). It has the

potential to become the fifth largest banking industry in the world by 2020 and the third

largest by 2025, according to an industry report. The face of Indian banking has changed over

the years. Banks are now reaching out to the masses with technology to facilitate greater ease

of communication, and transactions are carried out through the Internet and mobile devices.

With the Parliament passing the Banking Laws (Amendment) Bill in 2012, the landscape of

the sector is likely to change. The bill allows the Reserve Bank of India (RBI) to make final

21

guidelines on issuing new bank licenses. This could lead to a greater number of banks in the

country; the style of operation could also evolve with the integration of modern technology

into the industry.

Key Statistics

The revenue of Indian banks increased four-fold from US$ 11.8 billion to US$ 46.9 billion

in the period 20012010. In that phase, the profit after tax rose about nine-fold from US$ 1.4

billion to US$ 12 billion.

Banking Index with the Sensex (Bankex) that tracks the performance of primary banking

sector stocks grew at a compounded annual growth rate (CAGR) of nearly 20 per cent over

the period 20032012.

Total number of onsite and offsite ATMs of Indian Banks reached 100042 in July 2012

Recent Developments

The central banks of Japan and India have agreed to a proposal that expands the maximum

amount of the Bilateral Swap Arrangement (BSA) between the two countries to US $50

billion. The agreement is for a three-year period (201215); the previous size of the BSA

was US $15 million. The new agreement will enable the two countries to swap their local

currencies against the US dollar for an amount up to US$50 billion.

Public sector banks will soon offer customers insurance products from different companies

as against products from one company. The finance ministry has asked public sector banks to

become insurance brokers instead of corporate agents. This move was one of the steps stated

by finance minister Mr P Chidambaram in early 2013, as a way to increase insurance

penetration.

3.1 THE POLITICAL SCENARIO:

This period broadly coincides with the 2014 Indian elections to spur a public debate about

the program that the next government should pursue in order to return the country to a path

of high growth. There is however a dire demand to recommend policies in every major

sector of the Indian economy. The topic in debate is not only the political scenario but how

much is it conducive towards a stable economic picture as a whole.

Government Initiatives:

The Cabinet Committee on Economic Affairs (CCEA) has given the go-ahead to a proposal

to increase foreign holding in Axis Bank to 62 per cent from the current 49 per cent. The

move could lead to overseas investment of nearly Rs 7,250 crore (US$ 1.17 billion) into the

22

country. The approval is subject to foreign institutional investors (FII) holding being capped

at 49 per cent.

To counter the liquidity pressure faced by micro and small enterprises, the RBI will provide

refinance aggregating up to Rs 5,000 crore (US$ 813.16 million) to the Small Industries

Development Bank of India (SIDBI). SIDBI can use the funds for direct and onward lending

to banks. Also, in an effort to encourage more lending to medium enterprises, the RBI will

include incremental credit given to these units by scheduled commercial banks (which do not

include regional rural banks) under the domain of priority sector lending.

The RBI has issued extra guidelines for banks giving gold metal loans (GMLs). To safeguard

against fraud, the central bank has asked lenders to check the credit worthiness of borrowers;

collateral securities against the loan; and trade cycle of the manufacturing activity, before

sanctioning the loans. "Lack of proper monitoring mechanism and not ensuring end use of

GML has resulted in certain instances of frauds/misuse related to GML by certain

unscrupulous jewellers," stated the RBI in a notification.

The Cabinet Committee on Economic Affairs (CCEA) has given the green signal to a

proposal to increase foreign holding in Axis Bank from 49 per cent to 62 per cent. The move

could bring in overseas investment of nearly Rs 7,250 crore (US$ 1.20 billion) into the

country. The CCEA nod is dependent on FIIs holding capped at 49 per cent.

3.2 THE ECONOMIC SCENARIO:

The global slowdown has taken its toll on Indian economy. Besides, the domestic economy

too is having its own set of problems. High inflation, subdued growth, slowing investments,

undesirable current account deficit levels, high fiscal deficit and battered currency have

together made the growth visibility rather muted. The banking sector, being the barometer of

the economy, has succumbed to these challenges. Amidst this challenging scenario, the

Indian banking system is continues to deal with improvement in operational efficiency and

execution of prudent risk management practices

23

RBI's hawkish monetary policy stance in order to combat inflation has led to sharp increase

in interest rates during FY13. The elevated costs of deposits and limited pricing power

ensured margin pressures for most of the banks for major part of FY13.

The economy slowed to around 5.0% for the 201213 fiscal year compared with 6.2% in the

previous fiscal but still remained the 2nd fastest growing Major Economy of G20 just behind

China

.

According to Moody's, the Economic Growth Rate of India would be 5.5% in 2014-

15 India's GDP grew by 9.3% in 201011; thus, the growth rate has nearly halved in just

three years. GDP growth rose marginally to 4.8% during the quarter through March 2013,

from about 4.7% in the previous quarter. The government has forecast a growth rate of

6.1%6.7% for the year 201314, whilst the RBI expects the same to be at 5.7%.

.

3.3 The Performance of Indian Banking Sector

The Central Statistical organization (CSO) reported the lowest real GDP growth at 5%

during FY13. This growth stands lowest in the decade and even weaker than the recorded

during the first year of global financial crisis. Banking sector, being inextricably linked to

the economy, stood in a state of limbo for major part of FY13

During FY13, the gross bank credit grew at a slower pace recording 15.1% YoY growth

as against 17.3% a year ago. The numbers also stood below RBI's projections for FY13.

Sluggish demand conditions, weak monetary policy transmission, poor asset quality and

debilitating macro economic conditions led to lower credit growth during FY13

Except retail, the slowdown in credit was witnessed across sectors such as agriculture,

industry and service segments. The RBI data reveals that retail trade and credit card

outstanding were the only buoyant segments during FY13. Mid-sized businesses and

loans for professional services were the worst hit.

Against a backdrop of GDP growth deceleration, weak IIP data and persistent inflation

during FY13, banks became more risk averse to lending credit. This deceleration also

The data analysis

Details

2010

2011

2012

2013

2014

Real GDP Growth 9.6 6.9 4.4 5.7 5.5

Inflation 8.5 8 8.2 7 6.2

Consumer Price Index 10.4 8.4 10 7.7 6.6

Wholesale Price Index (WPI) 9.6 8.9 7.6 6.7 6.1

Short-term Interest Rate 6 8.1 7.9 6.6 6

Long-term Interest Rate 7.9 8.4 8.3 8 7.9

Fiscal Deficit (per cent of GDP) -6.9 -8.2 -8.5 -8.1 -7.5

Current Account Deficit (per cent of

GDP) -2.7 -4.2 -3.2 -3.8 -3.6

24

reflected banks' risk aversion in face of rising NPAs and increased leverage of corporate

balance sheets. The deceleration was observed across all bank groups, being high for

PSUs and private sector banks, which jointly account for above 90% of the total bank

credit.

25

The RBI had administered a 1% repo rate cut and injected liquidity through CRR and

SLR cuts as also through open market operations during FY13. However, banks have

only cut their base rate by meagre 0.25%-0.30% owing to the liquidity constraints and

weak deposit growth.

The aggregate deposits grew marginally to 14.2% at the end of March 2013 as against

13.8% in FY12. The growth differential between deposit and credit continued to

hover between 2-3% with deposit growth outpacing the credit growth. The credit-

deposit ratio was recorded at 78.1% during the same period. This ensured tight

liquidity conditions during the whole of the FY13

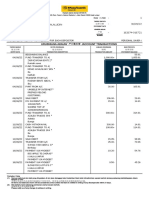

Following is the march quarter result of banking sector declared till date

Mar 2013 Mar 2014 YoY %-Change

Name

Net Sales

(Rs m)

PAT

(Rs m)

Net Sales

(Rs m)

PAT

(Rs m)

Net Sales

(%)

PAT

(%)

P/E*

(x)

ALLAHABAD BANK 42,524 1,262 48,115 1,578 13.1% 25.0% 4.6

ANDHRA BANK 33,590 3,446 37,213 881 10.8% -74.4% 9.7

AXIS BANK 70,476 15,552 79,652 18,423 13.0% 18.5% 12.5

BANK OF BARODA 90,716 10,661 102,886 11,728 13.4% 10.0% 8.6

CANARA BANK 84,651 7,254 105,397 6,108 24.5% -15.8% 6.3

CORPORATION

BANK

40,681 3,555 46,444 416 14.2% -88.3% 8.8

DCB BANK 2,532 341 3,079 391 21.6% 14.7% 10.3

DENA BANK 23,043 1,257 25,944 1,873 12.6% 49.0% 6.5

FEDERAL BANK 15,835 2,219 18,387 2,773 16.1% 25.0% 10.4

HDFC BANK 93,239 18,899 107,886 23,265 15.7% 23.1% 22.3

ICICI BANK 103,653 23,041 114,893 26,520 10.8% 15.1% 16.3

IDBI BANK 63,969 5,544 67,156 5,182 5.0% -6.5% 10.5

INDIAN BANK 35,620 2,922 39,107 2,713 9.8% -7.2% 5.6

INDIAN OVERSEAS

BANK

52,268 589 58,748 -559 12.4% -194.9% 28.7

INDUSIND BANK 18,228 3,074 21,793 3,871 19.6% 25.9% 20.0

ING VYSYA BANK 12,537 1,703 13,061 2,203 4.2% 29.4% 15.5

KOTAK MAH. BANK 29,468 6,656 30,323 6,633 2.9% -0.3% 26.9

ORIENTAL BANK 45,343 3,080 49,008 3,103 8.1% 0.8% 7.4

PNB 103,788 11,308 111,013 8,064 7.0% -28.7% 9.2

PUNJAB & SIND

BANK

19,050 1,245 21,361 359 12.1% -71.2% 4.5

SOUTH IND.BANK 11,654 1,538 13,026 1,246 11.8% -19.0% 6.4

SYNDICATE BANK 43,814 5,923 48,958 4,093 11.7% -30.9% 4.1

26

UNION BANK 66,251 7,894 76,707 5,790 15.8% -26.7% 6.3

UNITED BANK OF

INDIA

23,361 312 27,620 4,694 18.2% 1404.4% N.A.

VIJAYA BANK 24,036 2,241 28,389 1,358 18.1% -39.4% 6.3

YES BANK 22,877 3,622 25,681 4,302 12.3% 18.8% 11.6

Sector Aggregate 1,173,204 145,138 1,321,843 147,006 12.7% 1.3%

The findings :

CASA, the cheap source of funds for banks, also remained sluggish for the major part

of FY13. The elevated interest rates during FY13 led to migration of money from

CASA deposits to fixed deposits

Slower loan growth and weak CASA accretion resulted in margin (NIM) pressures for

the banking industry. Furthermore, lower NIMs combined with higher credit costs

that were earmarked for the bad and restructured loans dampened the earnings

performance of Indian banks during FY13

The sharp industrial slowdown during FY12 and FY13 took a toll on the asset quality

of the banks. Gross NPAs of 40 listed banks went up by 43.1% from levels a year ago.

The restructured book also spiked up dramatically with recast assets under CDR

standing around 50% more than the previous year. The repercussions were largely felt

by public sector banks as they were the ones to support the productive sectors of the

economy

Private sector banks, on the other hand, were better placed than its PSU peers during

FY13. Better asset quality, higher margins and strong loan growth boosted the

performance of private banks during the same period.

The prospects :

Going forward in FY14, the Economic Advisory Council of Prime minister expects the

economic growth to rise to 6.4% from the current 5% on the back of the recent structural

measures and normal monsoons

Growth is still a concern for the banking sector on account of a sustained slowdown in the

economy as well as reduced demand for credit on account of the current high interest rate

environment.

Sectors such as iron & steel, textiles, power generation, automobiles and ancillaries,

telecommunication, aviation, construction, real estate, infrastructure, steel and cement are

expected to throw-up challenges in terms of asset quality pressures for the forthcoming

periods.

27

The domestic economic slowdown will continue to play spoilsport resulting in increase in

non-performing loans and restructured loans especially for PSU banks. Given the greater

stress expected to confront PSU lenders going forward, the margins and earnings

performance are expected to take a hit..

As per regulatory requirements Indian banks need to shore up their capital base to adhere

to the incumbent BASEL III norms. With PSU banks falling short of the target, a

consistent annual equity infusion of Rs 160-180 bn is expected to flow from government

over the next 5 years. As per the FY13 budget, the government of India had allocated Rs

127 bn for capitalization of PSU banks and plans to invest Rs 140 bn in FY14

Going by the dynamic nature of the real economy, it is imperative that the banking system

will require being flexible and competitive. Notwithstanding the expanding branch

network of Indian banks, the banking penetration still stands low in comparison to the

global benchmark. Hence, the pressing need for financial inclusion and the issuances of

new banking licenses to the private sector will continue to take precedence even in FY14.

The RBI is in the process of issuing new bank licenses to those private players that would

stand consistent with the highest standards of transparency and diligence. Moreover,

necessary reforms, regulations for free entry and making the licensing process more

frequent also forms the agenda of the RBI for the coming periods

3.4 THE TECHNOLOGICAL ASPECTS:

Technology spread general banking concepts to people in the under-banked areas. All these

initiatives of promoting rural banking are taken with the help of mobile banking, self help

groups, microfinance institutions, etc.

New Media Mobile and Net banking is expected to become the second largest channel for

banking after ATMs: New channels used to offer banking services will drive the growth of

banking industry exponentially in the future by increasing efficiency and productivity by

acquiring new customer base. During the past 10 years, banking through ATMs and Net

Banking has shown a tremendous upsurge, which is still in the growth phase. After ATMs,

the mobile banking is another media which is expected to give another push to this industry

growth in a big way, with the help of new 3G and smart phone technology (mobile usage has

grown many folds over the years). This can be looked at as branchless banking and so will

also reduce costs as there is no need for physical infrastructure and human resources. This

will help in acquiring new customers, mainly who live in rural areas (though this will take

time due to technology and infrastructure issues). The IBA-FICCI-BCG in its report has

predicted that mobile banking would become the second largest channel of banking after

ATMs.

3.5 SOCIAL AND ETHICAL ASPECT:

There are some banks, which proactively undertake the responsibility to bear the social and

ethical aspects of banking. This is a challenge for commercial banks to consider the these

28

aspects in their working. Apart from profit maximization, commercial banks are supposed to

support those organizations, which have some social concerns.

Benedikter (2011) defines Social Banks as banks with a conscience. They focus on

investing in community, providing opportunities to the disadvantaged, and supporting social,

environmental, and ethical agendas. Social banks try to invest their money only in

endeavours that promote the greater good of society, instead of those, which generate private

profit just for a few. He has also explained the main difference between mainstream banks

and social banks that mainstream banks are in most cases focused solely on the principle of

profit maximization whereas, social banking implements the triple principle of profit-people-

planet .

On social and ethical aspects of Banking Industry that Banks can project themselves as a

socially and ethically oriented organization by disbursement of loans merely to those

organizations, which has social, ethical and environmental concerns

4. MICHAEL PORTER ANALYSIS FOR BANKING

INDUSTRY

Indias healthy financial and banking sector is its other strength. This sector has shown

immense resilience in the face of the global financial crisis, and the RBI has played an

important role in preserving financial stability through a unique combination of monetary

policies and macro-prudential regulations. While the banking sector has experienced increase

in bad loans in recent years, it is not cause for concern yet. However, with rising global

policy uncertainties and Indias strong linkage to the global financial system, India should

keep a close check on liquidity and the stability of the banking system. Appropriate measures

such as increased competition and supervision can improve banks efficiency and access to

markets, as well as contain the contagion risk of any global financial crises.

Following is the Michael porter analysis that will help to analyse the industry with a birds

eye through varied angles for a clearer picture of this industry.

In case of banking industry :

29

Supply The Reserve Bank of India (RBI) is the central banking and monetary authority

of India, and acts as the regulator and supervisor of commercial banks.

Liquidity is controlled by the Liquidity is controlled by the Reserve Bank of

India (RBI).

Demand India is a growing economy and demand for credit is high though it could be

cyclical.

Barriers to

entry

Licensing requirement, investment in technology and branch network, capital

and regulatory requirements.

Bargaining

power of

suppliers

High during periods of tight liquidity. Trade unions in public sector banks can be

anti reforms and orchestrate strikes. Depositors may invest elsewhere if interest

rates fall.

Bargaining

power of

customers

For good creditworthy borrowers bargaining power is high due to the availability

of large number of banks.

Competition High- There are public sector banks, private sector and foreign banks along with

non banking finance companies competing in similar business segments.

Plus the RBI is all set to issue more new banking licenses .recently it gave to

IDFC and Bandhan .

Due to homogenous kind of services offered by banks, large number of players

in the banking industry and other players such as NBFCs, competition is already

high. Recently, the RBI released the new Banking License Guidelines for

NBFCs. So, the number of players in the Indian banking industry is going to

increase in the coming years. This will intensify the competition in the industry,

which will decrease the market share of existing banks.

30

4.1 BARGAINING POWER OF SUPPLIER:

The RBI led tight liquidity situation eased gradually in Q3 in line with unwinding of

exceptional measures

The policy induced tight liquidity conditions during Q2 of 2013-14 eased considerably in

October 2013 with the gradual normalisation of exceptional monetary measures. Although

the festival-induced increase in currency in circulation kept the liquidity situation generally

tight in November 2013, the buoyant capital inflows under the Reserve Banks swap facilities

for banks overseas borrowings and non-resident deposit funds (which were operational till

November 30, 2013), eased domestic liquidity significantly. The narrowing of wedge

between the credit and deposit growth also contributed to improving the liquidity condition.

The easing of liquidity conditions got reflected in the under-utilisation of limits by the banks

under the overnight LAF repo and export credit refinance, a steady decline in access to the

MSF and the parking of excess liquidity with the Reserve Bank through reverse repos.

In order to manage the evolving liquidity situation, the Reserve Bank conducted two OMO

purchase auctions during Q3 of 2013-14, injecting liquidity to the tune of `161 billion.

Liquidity support was also provided through the variable rate 7-day and 14-day term repo

facility up to a limit of 0.5 per cent of the banking systems NDTL. Anticipating liquidity

stress in mid-December, induced by the advance tax outflows, an additional liquidity support

31

of `100 billion was provided through a 14-day term repo on December 13, 2013. As the strain

on market liquidity is expected to continue in view of the fiscal targets set for the year, the

Reserve Bank also conducted an OMO purchase auction injecting liquidity of `95 billion and

two 28-day term repos to ease the liquidity pressure in January 2014.

4.2 THE BARGAINING POWER OF CONSUMERS :

The bargaining power of the customer increases as and when his credit worthiness increases.

Since interest rates show high opportunity costs, banks have to cautiously fix their rate of

interest with respect to RBI and its guidelines .

Moreover as and when the number of banks increases, the consumer prefers to borrow from a

bank with low interest and lend to the one which has the highest.

The corporate projects hence very quickly respond to fluctuations in rate of interest subject to

its bargaining power.

Thus the strategies such as long term finance, a higher savings interest rate , easy options of

retail lending can impact the bargaing power of the consumer

4.3 THE SUBSTITUTE AVAILABLE :

Banking services are most reliable source of finance. however the lack of financial inclusion

can leave the consumer with options such as money lender or any NBFC .

Also , since banks offer homogeneous services , substitutes in terms of products are easy to

imitate . Insurance , mutual fund schemes are required to stay best or close to best on the

market

Thus , in order to retain customers it is a big challenge for any company to maintain close

customer relationships .

4.5 THE ENTRY BARRIER :

The conditions in the banking industry have changed and are changing all over the

world. In our country, economic reform and in particular financial sector reform has altered

the atmosphere in which the participants operate.

The size of the market is so large and with GDP likely to grow at 6 per cent in the

medium-to long-term, the Indian banking industry has become very attractive-as never before

Also, entry/exit norms-While regulatory barriers have been eased, desirable barriers exist in

the form of capital and other requirements. After all banking license cannot be like a driving

license. But, entry norms are fairly clear, though exit norms are not clear yet.

The future aspects of financial inclusion motive and provision of banking licenses have

somehow eased the speculations about the entry .While YES bank and Kotak Mahindra were

given banking licenses in 2004 , IDFC and Bandhan are given in 2014 , where the list of

applicants carried 25 potential entrants.

32

4.6 THE COMPETITION

All industries are characterised by historical trends and new developments that either

gradually or speedily produce changes important enough to require a strategic response from

participating agents. The Indian banking industry is no exception. The rapid changes that

have occurred during the last few years in the financial sector have increased competition in

the banking industry.

PUBLIC SECTOR BANKS V/S PRIVATE SECTOR BANKS

Despite the existence of new private banks over the last two decades, PSU banks dominate in

deposits and lending.

Theres the trust factor too. As economic conditions turn dodgy, despite public sector banks

facing more asset quality issues than their rivals, people seem to prefer PSU names such as

SBI, believing in the tacit Government guarantee.

This impression has been strengthened by the Government infusing capital year after year

into PSU banks, to help them meet their capital adequacy norms.

In the last two years, SBI and its associates alone garnered about 3.8 lakh crore of

incremental deposits; this equals the amount amassed by all 20 private sector banks put

together. .

According to India Ratings & Research, employee productivity has improved steadily for

PSU banks. In 2012-13, the ratio of deposits per employee of a PSU bank was lower than that

for private players. The trend started to change from 2009-10. By 2012-13 the deposits per

employee stood at 7.2 crore for PSU banks against 5.2 crore for private banks.

The changes that are leading to competition are:

Also industry profitability-higher by the standards of the past or international standards is

attracting more new entrants. Hence, increasing competition in the industry. Product

innovations-Features such as home banking, ATMs are all making the industry to be

continuously alert, and fiercely competitive.

The markets are increasingly getting integrated in our country also. Domestic and foreign

currency, banking and non-banking are getting closer. Correspondingly, there are institutional

innovations and inter-linkages, both in ownership and operations - be it in depositories or

mutual funds.

The consumers of banking services are getting increasingly agile, enlightened, cost and

quality conscious. They are already forcing the pace of competition on price, product and

quality products.

33

The strategic alliance that can face competition

Competition does not mean that banks cannot enter into strategic alliances. The

clearing house is one form of strategic co-operation already in place. In fact, such

strategic cooperation will give banks a competitive advantage over others.

The banks should forge strategic alliance without undermining competition. At the same

time, there should not be any element of cartelisation. We can readily think of some areas

where banks can enter into strategic alliances.

First, technology related, where interconnectivity would be of great advantage.

Second, marketing related, such as exchange of information on credit record of

customers, customer guarantees, inter-bank participation, and of course, syndication.

Third, organisation related, especially in dialogues with the law makers and regulators

on the need for changes.

In fact, the scope for self regulation should be actively explored. Perhaps, there should

be a Conference to explore avenues for cooperation that will enhance the strengths of

banks in relation to others.

Fourth, incidentally, there can be what is termed as segmented alliances also. For

example, public sector banks can cooperate, as in fact they are doing now in some

cases, to create common supporting services that will help them to capture economies

of scale.

As per the above discussion, we can say that the biggest challenge for banking industry is to

serve the mass market of India. Companies have shifted their focus from product to customer.

The better we understand our customers, the more successful we will be in meeting their

needs.

4.7 THE FUTURE GROWTH FACTORS

India is one of the top 10 economies in the world, where the banking sector has tremendous

potential to grow. The last decade saw customers embracing ATM, internet and mobile

banking. The number of ATMs has doubled over the past few years, with more than 100,000

in the country at present (70 per cent in urban areas). They are estimated to further double by

2016, with over 50 per cent expected to be set up in small towns. Also, the scope for mobile

and internet banking is big. At the start of 2013, only 2 per cent of banking payments went

through the electronic system in the country. Today, mobility and customer convenience are

viewed as the primary factors of growth and banks are continuously exploring new

technology, with terms such as mobile solutions and cloud computing being used with greater

regularity

34

High growth of Indian Economy:

The growth of the Indian banking industry is closely linked with the growth of the overall

Indian economy. India is one of the fastest growing economies in the world and is likely to

remain on that path for many years to come. This will be supported by the continuous growth

in infrastructure, industry, services and agriculture sector in the country. The expectation is to

boost the corporate credit growth in the economy and provide ample opportunities to banks to

lend to fulfil these requirements in the future.

Rising Standard Of Living and Per Capita Income:

The rising standard of living and the per capita income of Indian people will be a driving

force for the growth of the retail credit loans. Indians of late have a very conservative outlook

towards the credit except for housing loans, car loans and other necessities. However, with an

increase in disposable income ( which has increased with the rise in per capita income) and

increased exposure to a range of various products, consumers have shown a higher

willingness to take credit, particularly, the young age group people. A study of the customer

profiles of different types of banks shows that foreign and private banks share of younger

customers is over 60% whereas public banks have only 32% customers under the age of 40.

The Private Banks have a much higher share of the more profitable mass affluent segment.

Financial Inclusion Program:

Currently, in India, 41% of the adult population doesnt have bank accounts, which indicates

a large untapped market for banking players. Under the Financial Inclusion Program, RBI is

trying to tap this untapped market and the growth potential in rural markets by volume

growth for banks. Financial inclusion is the delivery of banking services at an affordable cost

to the vast sections of disadvantaged and low income groups. The RBI has also taken many

initiatives such as Financial Literacy Program, promoting effective use of development

communication and using Information and Communication Technology (ICT) to spread

general banking concepts to people in the under-banked areas.

All these initiatives of promoting rural banking are taken with the help of mobile banking,

self help groups, microfinance institutions, etc. Financial Inclusion, on the one side, helps

corporate in fulfilling their social responsibilities and on the other side it is fuelling growth in

other industries and so as a whole economy.

4.8 CHALLENGES

More stringent capital requirements to achieve as per Basel III:

Recently, the RBI released draft guidelines for implementing Basel III. As per the proposal,

banks will have to augment the minimum core capital after a stringent deduction. The two

new requirements capital conservative buffer (an extra buffer of 2.5% to reduce risk) and a

counter cyclical buffer (an extra capital buffer if possible during good times) have also been

introduced for banks. As the name indicates that the capital conservative buffer can be dipped

during stressed period to meet the minimum regulatory requirement on core capital. In this

scenario, the bank would not be supposed to use its earnings to make discretionary payouts

such as dividends, shares buyback, etc. The counter cyclical buffer, achieved through a pro-

35

cyclical build up of the buffer in good times, is expected to protect the banking industry from

system- wide risks arising out of excessive aggregate credit growth.

For Basel II , the fact reveals that even under current Basel Norm II, Indian banks follow

more stringent capital adequacy requirements than their international counterparts. For Indian

Banks, the minimum common equity requirement is 3.6%, minimum tier I capital

requirement is 6% and minimum total capital adequacy requirement is 9% as against 2%, 4%

and 8% respectively recommended in the Basel II Norm. Due to this the capital adequacy

position of Indian banks is at comfortable level. So, going ahead, they should not face much

problem in meeting the new norms requirements. But as we saw earlier, private sector banks

and foreign banks have considerable high capital adequacy ratio, hence are not expected to

face any problem. But, public sector banks are lagging behind. So, the Government will have

to infuse capital in public banks to meet Basel III requirements. With the higher minimum

core Tier I capital requirement of 7-9.5% and overall Tier I capital of 8.5-11%, Banks ROE is

expected to come down.

Increasing non-performing and restructured assets:

Due to a slowdown in economic activity in past couple of years and aggressive lending by

banks many loans have turned non-performing assets. Restructuring of assets means loans

whose duration has been increased or the interest rate has been decreased. This happens due

to inability of the loan taking company/individual to pay off the debt. Both of these have

impacted the profitability of banks as they are required to have a higher provisioning amount

which directly eats into the profitability. The key challenge going forward for banks is to

increase loans and effectively manage NPAs while maintaining profitability.

Intensifying competition:

Due to homogenous kind of services offered by banks, large number of players in the banking

industry and other players such as NBFCs, competition is already high. Recently, the RBI

released the new Banking License Guidelines for NBFCs. So, the number of players in the

Indian banking industry is going to increase in the coming years. This will intensify the

competition in the industry, which will decrease the market share of existing banks.

Managing Human Resources and Development:

Banks have to incur a substantial employee training cost as the attrition rate is very high.

Hence, banks find it difficult manage the human resources and development initiatives.

Currently, there are many challenges before Indian Banks such as improving capital

adequacy requirement, managing non-performing assets, enhancing branch sales & services,

improving organization design; using innovative technology through new channels and

working on lean operations.

Apart from this, frequent changes in policy rates to maintain economic stability, various

regulatory requirements, etc. are additional key concerns. Despite these concerns, we expect

36

that the Indian banking industry will grow through leaps and bounds looking at the huge

growth potential of Indian economy. High population base of India, mobile banking

offering banking operations through mobile phones, financial inclusion, rising disposable

income, etc. will drive the growth Indian banking industry in the long-term. The Indian

economy will require additional banks and expansion of existing banks to meet its credit.

4.9 CONCLUDING POINTS

1. In order to mitigate above mentioned challenges Indian banks must cut their cost of their

services.

2. Another aspect to encounter the challenges is product differentiation. Apart from

traditional banking services, Indian banks must adopt some product innovation so that

they can compete in gamut of competition.

3. Technology up gradation is an inevitable aspect to face challenges. The level of consumer

awareness is significantly higher as compared to previous years. Now-a-days they need

internet banking, mobile banking and ATM services.

4. Expansion of branch size in order to increase market share is another tool to combat

competitors.

5. Therefore, Indian nationalized and private sector banks must spread their wings towards

global markets as some of them have already done it. Indian banks are trustworthy brands

in Indian market; therefore, these banks must utilize their brand equity as it is a valuable

asset for them.

37

5. COMPANY ANALYSIS

Introduction

With more than 119

years of strong existence and 6081 total branches including 5 foreign

branches, 6698 ATMs as on Dec13, Punjab National Bank is serving more than 87 million

esteemed customers. PNB, being one of the largest nationalized banks, has continued to