Professional Documents

Culture Documents

Portability Law (RA 7699) : Creditable Service Valdez Vs Gsis G.R. 14617 June 30, 2008

Uploaded by

Debra Ruth0 ratings0% found this document useful (0 votes)

49 views8 pagesdthd

Original Title

AGRA- MINE

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentdthd

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

49 views8 pagesPortability Law (RA 7699) : Creditable Service Valdez Vs Gsis G.R. 14617 June 30, 2008

Uploaded by

Debra Ruthdthd

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

creditable service

valdez vs gsis g.r. 14617 june 30, 2008

UNDER PD 1146

Section 10. Computation of Service. the computation of service for calculating the pension shall be from the date of

original service with an employee; including:

(1) periods of honorable service in the Philippines under the authority of the United States Government if

rendered prior to July four, nineteen hundred and forty-six; and

(2) period from January one, nineteen hundred and forty-two, to February twenty-eight, nineteen hundred

and forty-six for those who were in the service on December eight, nineteen hundred and forty-one;

but excluding:

(i) period of military service for which an employee receives separation, retirement or disability pay; and

(ii) periods of service rendered after June sixteen, nineteen hundred and fifty-one during which contributions

were not required, unless the contributions with interest be later on paid to the System.

For the purpose of this section, the term service shall include full time service with compensation: Provided,

That part-time and other services with compensation may be included under such rules and regulations prescribed by

the System.

UNDER RA 8291

"SECTION 10. Computation of Service. (a) The computation of service for the purpose of determining the amount

of benefits payable under this Act shall be from the date of original appointment/election, including periods of

service at different times under one or more employers, those performed overseas under the authority of the

Republic of the Philippines, and those that may be prescribed by the GSIS in coordination with the Civil

Service Commission.

"(b) All service credited for retirement, resignation or separation for which corresponding benefits have been awarded

under this Act or other laws shall be excluded in the computation of service in case of reinstatement in the service of

an employer and subsequent retirement or separation which is compensable under this Act.

"For the purpose of this section the term service shall include full time service with compensation: Provided,

That part time and other services with compensation may be included under such rules and regulations as may be

prescribed by the GSIS.

Portability Law (RA 7699)

Admittedly most of us move from one job to another in a move to find a higher pay and better career. Many

government retirees have had a history in the private sector. In certain cases, they dont have enough years of

service in the government to qualify to any GSIS retirement program.

With the help of RA 7699, otherwise known as the Portability Law, government retirees who do

not meet the required number of years provided under PD 1146 and RA 8291 can still avail of

retirement and other benefits.

Under the scheme, you may combine your years of service in the private sector represented by

your contributions to the Social Security System (SSS) with your government service and

contributions to the GSIS to satisfy the required years of service under PD 1146 and RA 8291.

However, if you have satisfied the required years of service under the GSIS retirement option

you have chosen, you would not be allowed to incorporate your contributions to the SSS

anymore for availment of additional benefits.

In case of death, disability and old age, the periods of creditable services or contributions to the

SSS and GSIS shall be summed up to entitle you to receive the benefits under either PD 1146 or

RA 8291.

If qualified under RA 8291, all the benefits shall apply EXCEPT the cash payment. The reason

for this is that the Portability Law or RA 7699 provides that only benefits common to both

Systems (GSIS and SSS) shall be paid. Cash payment is NOT included in the benefits provided

by the SSS.

FIRST DIVISION

[G.R. NO. 146175 : June 30, 2008]

SIMEON M. VALDEZ, Petitioner, v. GOVERNMENT SERVICE INSURANCE SYSTEM, Respondent.

D E C I S I O N

LEONARDO-DE CASTRO, J.:

Before the Court is a special civil action for certiorari under Rule 65 of the Rules of Court, filed by petitioner

Simeon M. Valdez assailing the July 31, 2000 Decision

1

of the Court of Appeals (CA) in CA-G.R. SP No.

54870, as reiterated in its Resolution

2

of October 17, 2000, upholding the Civil Service Commission's (CSC's)

January 14, 1999 Opinion and Resolution No. 991940.

Principally, the CSC held that petitioner's services rendered in the Manila Economic Cultural Office (MECO),

Mariano Memorial State University (MMSU), Philippine Veterans Investment Development Company

(PHIVIDEC) and as OIC Vice-Governor of Ilocos Norte cannot be credited in the computation of his

retirement benefits.

The facts are as follows:

On October 09, 1998, petitioner filed his application for retirement benefits with the Government Service

Insurance System (GSIS).

On November 03, 1998, petitioner filed the same application with the CSC and at the same time, he sought

the CSC's opinion on whether his two (2) years and three (3) months stint as MECO Director can be

accredited as government service among others.

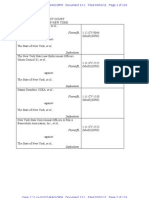

In support of his claim for retirement benefits, petitioner submitted a summary of his government service

record, to wit:

SUMMARY

1. As Congressman (5

th

, 6

th

, 7

th

&

10

th

Congress) - 15 years

2. As Director of PHIVIDEC November

1974 to March 1987 -

12 years 5

months

Sub total

27 years 5

months

3. As Member, Board of Regents

a) INIT (1975-1977) - 3 years

b) MMSU (1978-1987) - 10 years

c) MMSU (1989-1992) - 4 years

Sub total - 17 years

4. As OIC Vice-Governor Ilocos Norte

Nov. 1986-Dec. 1986 - 2 months

Jan. 1, 1987 to Mar. 1987 - 3 months

Sub total - 5 months

5. As Director of MECO

1 Jan. 1993 to 31 Dec. 1994 - 2 year

1 Jan. 1995 to March 1995 - 3 months

Sub total - 2 years 3months

REMARKS

1. Please note therefore that there is overlapping of my services at PHIVIDEC & MMSU. My services of 12

years 5 months with PHIVIDEC should be counted and only 4 years and 7 months with MMSU where there is

no overlapping.

2. My services as OIC Governor should not be counted as I was still with PHIVIDEC during the 6 months I

served as OIC Vice-Governor.

3. Therefore the length of service to be credited for my retirement will cover only the following:

a) As Congressman - 15 years

b) As Director of PHIVIDEC - 12 years 5 months

c) As Board of Regent MMSU - 4 years 7 months

d) As Director of MECO - 2 years 3 months

Total - 33 years 15 months

On February 23, 1999, petitioner received two mails, one from the CSC and the other from GSIS. The letter

from CSC contained the challenged January 14, 1999 Opinion

3

denying the accreditation of petitioner's

services as former Director of MECO and of PHIVIDEC and as Member of the Board of Regents of MMSU,

pertinently reading as follows:

Section 2 (1), Article IX of the 1987 Constitution provides that the "civil service embraces all branches,

subdivisions, instrumentalities and agencies of the Government,including government-owned or

controlled corporations with original charters." (Underscoring Ours). Equivocably, subsidiary

corporations created under the Corporation Code are not considered part of the Civil Service. Since MECO is

a subsidiary corporation of the government governed by its Articles of Incorporation and By-Laws, whatever

services rendered therein shall not be considered part and parcel of government service.

x x x

We note that at the time you were still a member of the Board of Regents of the Mariano Marcos State

University (MMSU) from 1978 to 1992, you were likewise holding the positions of Philvidic Director

(November 1974-March 1987) and as OIC-Vice Governor (August 1986-March 1987). As such, it must be

reiterated that a part-time employee is not entitled to leave benefits unless he works part-time in two

different government offices and renders the required office hours. This rule has been emphasized in CSC

Resolution No. 90-1087, pertinent portion of which reads as follows:

"Under the Leave Law and Rules, Leave Privileges are accorded only to regular, temporary, provisional or

casual officials and employees who are rendering full time service in an agency or government. However,

the status of appointment of employees in the government further identify certain specifications in the

entitlement of leave privileges; hence, a part-time employee is not entitled to leave unless he works

part-time in two different offices and renders the required office hours (Manual of Leave

Administration, p.3.2). Thus it is completely inconceivable that members of the various Regulatory Board of

the PRC who hold concurrently other positions in the civil service are, at the same time on full-time basis in

other positions. x x x To grant them leave benefits in consideration of their services would be tantamount to

double compensation, the receipt of which is constitutionally prescribed. x x x This has to be so, otherwise

they would be enjoying leave privileges over and above what is provided in the leave Law and Rules (Valdez

v. Commission on Audit: GR 87277, 25 May 1989). Besides, CSC Memorandum Circular No. 43, series of

1989 (Retirement of Employees Holding More than One Positions), is explicit that 'an appointment to a

second position must be regarded only as imposing additional duties to the regular functions of an employee

and consequently an employee can retire only from his regular or main position and not from his additional

position."

Let is (sic) be stressed that for purposes of computation of government service, only "full-time services with

compensation" are included (Section 10 (b), RA 8291). Moreover, under Section 2(l) of RA 8291,

"compensation" refers to the basic pay or salary received by an employee, pursuant to his

election/appointment, excluding per diems, bonuses, overtime pay, honoraria, allowances and other

emoluments received in addition to the basic pay which are not integrated into the basic pay under existing

laws. (Underscoring Ours)

Premised on our answer in your first query, your services at the MECO for 2 years and 3 months did not

earn any leave credit for you.

The correspondence from the GSIS contained a Letter

4

and a Retirement Voucher informing petitioner of the

approval of his retirement benefits computed on the basis of the CSC's opinion.

Displeased, petitioner sought reconsideration of the subject CSC opinion in a Letter

5

addressed to the CSC

and the GSIS. Petitioner insisted on the inclusion of his services rendered in the MECO, PHIVIDEC and MMSU

in the computation of his retirement benefits pursuant to Sections 10 (b) and 2 (l) of Republic Act (RA) No.

8291.

6

The GSIS indorsed

7

the Letter to the CSC with a view that the same is within the jurisdiction of the latter.

The CSC, for its part, rendered Resolution No. 991940

8

dated August 31, 1999 denying petitioner's request

for reconsideration of the subject CSC opinion, thus:

WHEREFORE, the Commission hereby resolves to deny the instant request of Simeon Valdez. Accordingly,

the assailed Opinion is affirmed.

Petitioner then elevated the matter to the CA by way of Petition for Review on Certiorari against the CSC

and the GSIS. There, petitioner argued that his services rendered as Director of MECO should have been

credited for retirement purposes and that his salary thereat should have been the highest remuneration

considered in the computation of his retirement benefits. Petitioner likewise insisted that his respective

tenures as Member of the Board of Regents of Ilocos Norte Institute of Technology (INIT) and the MMSU, as

Director of the PHIVIDEC and as OIC Vice-Governor of Ilocos Norte be included as government service in the

computation of his retirement benefits.

On July 31, 2000, the CA rendered the herein challenged decision dismissing the petition and affirming both

the January 14, 1999 Opinion and Resolution No. 991940 of the CSC. Dispositively, the Decision reads:

With the foregoing, the assailed CSC Opinion dated 14 January 1999 and Resolution No. 991940 dated 31

August 1999 are hereby AFFIRMED.

SO ORDERED.

Thereafter, petitioner filed a motion for reconsideration of the foregoing decision and for the first time raised

as an issue the lack of jurisdiction of the CSC and the CA over the case.

In the resolution of October 17, 2000, the CA denied petitioner's motion for reconsideration.

Petitioner now comes to this Court via this Petition for Certiorari. Although the CSC was the author of the

challenged issuances which were affirmed by the CA and in fact it was a respondent in the case below, it

was not impleaded in the instant petition. Petitioner now lays all the blame on the GSIS as he raises the

following assigned errors:

I.

THE INDORSEMENT OF THE GSIS OF PETITIONER'S CLAIM FOR RETIREMENT BENEFITS TO THE CSC

SUFFERS JURAL INFIRMITY AND ALL THE RESULTING CSC PROCEEDINGS AND RESOLUTIONS THEREON

ARE NULL AND VOID AB INITIO, INCLUDING THE NOW QUESTIONED COURT OF APPEALS DECISION AND

RESOLUTION (ANNEXES A AND B), FOR LACK OF JURISDICTION.

II.

ASSUMING THAT CSC AND THE COURT OF APPEALS HAVE JURISDICTION, THE HOLDING THAT

PETITIONER'S CLAIM FOR RETIREMENT BENEFITS HAD ALREADY PRESCRIBED IS DEFINITELY A LEGAL

ERROR.

III.

ASSUMING THAT CSC AND THE COURT OF APPEALS HAVE JURISDICTION, THE DENIAL OF THE

ACCREDITATION OF PETITONER'S SERVICES RENDERED WITH MECO IS PLAINLY A LEGAL ERROR.

IV.

THE LACK OF JURISDICTION EXTENDS TO THE COURT OF APPEALS' AFFIRMING THE EXCLUSION OF

PETITIONER'S SERVICES RENDERED WITH INIT, MMMCST, MMSU, PHIVEDEC AND OIC VICE-GOVERNOR OF

ILOCOS NORTE.

V.

THE LACK OF JURISDICTION OF THE CSC AND THE COURT OF APPEALS, LAWLESSLY DEPRIVED PETITIONER

THE RIGHT TO A RETIREMENT BENEFITS COMPUTED AT HIS HIGHEST SALARY RATE WITH MECO.

The petition is utterly bereft of merit.

First off, petitioner's argument that the GSIS violated RA No. 8291 when it indorsed petitioner's claim to the

CSC for resolution is untenable. Section 10 of RA No. 8291, otherwise known as the "Government Service

Insurance System Act of 1997," explicitly authorizes the GSIS and the CSC to work hand in hand in the

computation of service in the government for the purpose of availment of the retirement benefits under the

said Act. Pertinently, the said Act provides:

Sec. 10. Computation of Service.(a) The computation of service for the purpose of determining the amount of benefits

payable under this Act shall be from the date of original appointment/election, including periods of service at different times under one

or more employers, those performed overseas under the authority of the Republic of the Philippines, and those that may be prescribed by

the GSIS in coordination with the Civil Service Commission.

Besides, the petitioner himself sought the CSC's opinion on matters related to his application for retirement.

He too filed a motion for the CSC to reconsider its opinion. Surely, the GSIS could not be faulted for merely

referring his letter seeking reconsideration of the CSC opinion which was addressed to the GSIS, stated, "I

respectfully seek to reconsider the denial of the Chairman of the Civil Service Commission of the other

benefits xxx." Moreover, the GSIS' action on petitioner's claim relied on the CSC's Opinion.

9

Unless the CSC

would reconsider or revise its earlier opinion, which it did not, it was unlikely for the GSIS to reconsider its

previous opinion, given the statutory mandate for the said two institutions of government to coordinate on

the matter of computation of government services of retirees.

While it is a rule that jurisdictional question may be raised at any time, this, however, admits of an

exception where, as in this case, estoppel has supervened. The Court has, time and again, frowned upon the

undesirable practice of a party submitting his case for decision and then accepting the judgment only if

favorable, and attacking it for lack of jurisdiction when adverse.

10

Secondly, petitioner argues that the CSC and the CA erroneously held that his claim had already prescribed.

A perusal of the record shows that no such finding was ever made, neither by the CSC in its January 14,

1999 Opinion and Resolution No. 991940 nor by the CA in the herein challenged July 31, 2000 Decision

in CA-G.R. SP No. 54870, as reiterated the resolution of October 17, 2000.

The remaining three assigned errors being interrelated, we shall address them together. Petitioner would

have the Court reverse the CA's rejecting his assertion that his services rendered in the MECO, MMSU,

PHIVIDEC and as OIC Vice-Governor of Ilocos Norte should be credited in the computation of his retirement

benefits. We are not convinced for two reasons. First, the assailed CA decision affirming the impugned CSC

issuances is anchored on law and jurisprudence. Thus, we quote with approval the following excerpt from

the decision of the CA:

None other than the 1987 Constitution of the Philippines, the Highest Law of the Land, confines the scope of

the civil service as embracing "all the branches, subdivisions, instrumentalities and agencies of the

government, including government-owned and controlled corporations with original charters."

x x x

In Philippine National Company-Energy Development Corporation v. Leogardo, 175 SCRA 26, 30 (1989), the

Supreme Court categorically ruled that "under the present law, the test in determining whether a

government-owned or controlled corporation is subject to the Civil Service Law is the manner of its creation

such that government corporations created by special charter are subject to its provision while those

incorporated under the General Corporation Law are not within its coverage."

With this in mind, the CSC was not in error in holding that:

"It is noted that MECO was created before the effectivity of the 1987 Constitution. In this regard, granting

without admitting that at the time of its incorporation (during the effectivity of the 1973 Constitution) MECO

was yet under the coverage of the Philippine Civil Service, the appellant's (i.e., petitioner's services

rendered thereat for that period, however, still cannot be accredited as government service because at the

time of his retirement/filing of the case/complaint, the abovequoted provision (i.e., Section 2(1), Article IX)

of the 1987 Constitution has already come into effect. As held by the Honorable Supreme Court in Lumanta,

et al. v. National Labor Relations Commission and Food Terminal, Inc. (170 SCRA 79), 'jurisdiction is

determined as of the time of the filing of the complaint.' "

The established rule is that the statute (in this case, the Constitution) in force at the time of the

commencement of the action determines the jurisdiction of the court (in this case, the administrative body).

It was likewise no error for the CSC to deny accreditation of petitioner's services rendered for MMSU,

PHIVIDEC and INIT, concurrently, because of the lack of sufficient basis to compute services rendered

therefor converted to their full-time equivalent, reckoned in hours or days actually rendered, using a Forty -

(40) hour week and 52 weeks a year as basis, in accordance with Section 5.3, Rule V of the Rules and

Regulations Implementing the Government Service Insurance System Act of 1997.

Relevantly, the last paragraph of Section 10 of RA No. 8291 dictates that for purposes of computation of

government service, only full-time services with compensation are included:

For the purpose of this section, the term service shall include full time service with compensation: Provided,

That part time and other services with compensation may be included under such rules and regulations as

may be prescribed by the GSIS.

While petitioner invokes the proviso in the above-quoted provision of law, the GSIS, which has been given

the authority to include part-time services in the computation, has pointed out that the services in the

MMSU, PHIVIDEC and as OIC Vice-Governor of Ilocos Norte cannot be credited because, aside from having

been rendered part-time in said agencies, the said positions were without compensation as defined in

Section 2(i) of RA No. 8291.

11

Petitioner's insistence that the emoluments he received as MECO director be the basis in the computation of

his retirement benefits, the same being the highest basic salary rate, is unavailing. Indeed, the salaries that

he received at the time he served as MECO director were unusually high for any position covered by the civil

service. Petitioner received a monthly pay of P40,000.00 in addition to a P65,000.00 representation and

travel allowance and US$2,500.00 per diem for overseas board meetings. The Constitution itself mandated

the standardization of compensation of government officials and employees covered by the civil service

under Article IX B, Section 5, viz:

Sec. 5. The Congress shall provide for the standardization of compensation of government officials and

employees, including those in government-owned or controlled corporations with original charters, taking

into account the nature of the responsibilities pertaining to, and the qualifications required for their

positions.

The salary received by petitioner during his stint at MECO appears to be way beyond that authorized by RA

No. 6758,

12

otherwise known as the Salary Standardization Law. For this reason, it is doubtful that

petitioner's employment with the MECO is embraced by the civil service. Otherwise, the salary rate received

by petitioner from MECO would not have been legally feasible, unless there was a law exempting the MECO

from the Salary Standardization Law.

Finally, the instant petition purports to be a Petition for Certiorari under Rule 65 of the Rules of Court.

However, a cursory reading of the issues raised discloses that petitioner's arguments are not anchored on

lack of jurisdiction but on questions of law which fall within the realm of Petitions for Review

onCertiorari under Rule 45 of the Rules of Court.

It is an elementary principle that a Petition for Certiorari under Rule 65 cannot be used if the proper remedy

is appeal. Being an extraordinary remedy, a party can only avail himself of certiorari, if there is no appeal,

or any plain, speedy, and adequate remedy in the ordinary course of law.

13

Here, appeal is the correct mode

but was not seasonably utilized by the petitioner. Resort to this Petition forCertiorari is, therefore, improper

because certiorari cannot be used as a substitute for a lost remedy of appeal.

14

Petitions for certiorari are

limited to resolving only errors of jurisdiction. It is not to stray at will and resolve questions or issues beyond

its competence such as errors of judgment. For, it is basic that certiorari under Rule 65 is a remedy narrow

in scope and inflexible in character. It is not a general utility tool in the legal workshop.

15

It offers only a

limited form of review. Its principal function is to keep an inferior tribunal within its jurisdiction. It can be

invoked only for an error of jurisdiction, that is, one where the act complained of was issued by the court,

officer or a quasi-judicial body without or in excess of jurisdiction, or with grave abuse of discretion which is

tantamount to lack or in excess of jurisdiction. It is not to be used for any other purpose, such as to cure

errors in proceedings or to correct erroneous conclusions of law or fact, as what petitioner would like the

Court to venture into. A Petition for Certiorari not being the proper remedy to correct errors of judgment as

alleged in the instant case, the herein petition should be dismissed pursuant to SC Circular No. 2-90.

16

WHEREFORE, in view of the foregoing, the petition is DISMISSED and the assailed decision and resolution

of the CA are AFFIRMED.

SO ORDERED.

You might also like

- GSIS V Reynaldo Palmiery, G.R. No. 217949, February 20, 2019 FactsDocument20 pagesGSIS V Reynaldo Palmiery, G.R. No. 217949, February 20, 2019 FactsWilfredo Guerrero IIINo ratings yet

- Affidavit of Confirmation/ Notice of Non Response/ No Contest & AcceptanceDocument3 pagesAffidavit of Confirmation/ Notice of Non Response/ No Contest & AcceptanceSuzanne Cristantiello100% (14)

- Maharashtra Gunthewari DevelopmentsDocument11 pagesMaharashtra Gunthewari Developmentsbkamble1No ratings yet

- GR No 146175Document9 pagesGR No 146175John LacobNo ratings yet

- Chua Vs CSCDocument9 pagesChua Vs CSCleslansanganNo ratings yet

- G.R. No. 146175 June 30, 2008 SIMEON M. VALDEZ, Petitioner, Government Service Insurance System, Respondent. Decision Leonardo-De Castro, J.Document7 pagesG.R. No. 146175 June 30, 2008 SIMEON M. VALDEZ, Petitioner, Government Service Insurance System, Respondent. Decision Leonardo-De Castro, J.Christopher AdvinculaNo ratings yet

- Gsis V PauigDocument7 pagesGsis V PauigJhå Tölôsá SêrāpïónNo ratings yet

- Cases For GsisDocument32 pagesCases For GsisElaine Dianne Laig SamonteNo ratings yet

- CSC Case On Leave2Document5 pagesCSC Case On Leave2JOHAYNIE100% (1)

- Santos Vs CADocument10 pagesSantos Vs CARomy Ian LimNo ratings yet

- 8 - Goverment Service Insurance System v. Pauig G.R. No. 210328Document7 pages8 - Goverment Service Insurance System v. Pauig G.R. No. 210328Shash BernardezNo ratings yet

- GSIS v. CSC - DigestDocument6 pagesGSIS v. CSC - DigestJaysieMicabaloNo ratings yet

- Supreme Court: Her Letter For Reconsideration Dated 25 April 1989 Pleaded ThusDocument11 pagesSupreme Court: Her Letter For Reconsideration Dated 25 April 1989 Pleaded ThusErlSaberNo ratings yet

- Lydia Ochoa V CSCDocument7 pagesLydia Ochoa V CSCDat Doria PalerNo ratings yet

- 206 SCRA 65 G.R. No. 88979Document6 pages206 SCRA 65 G.R. No. 88979Jun RinonNo ratings yet

- Cases of Elvin 6Document29 pagesCases of Elvin 6Elvin Nobleza PalaoNo ratings yet

- AIS (Leave) RulesDocument13 pagesAIS (Leave) RulesRoop KumarNo ratings yet

- Chua VS Civil Service CommissionDocument10 pagesChua VS Civil Service CommissionandangNo ratings yet

- 1lydia Chua v. CSCDocument7 pages1lydia Chua v. CSCArbie Mae SalomaNo ratings yet

- Santos V CADocument11 pagesSantos V CANina AndresNo ratings yet

- Balochistan Province Civil Servants Leave Rules 1981Document10 pagesBalochistan Province Civil Servants Leave Rules 1981SirajMeerNo ratings yet

- Santos v. CADocument6 pagesSantos v. CAJoan SobredoNo ratings yet

- Gamo Gamo V PnocDocument5 pagesGamo Gamo V PnocClrzNo ratings yet

- Cayo G. Gamogamo, Petitioner, vs. Pnoc Shipping and TRANSPORT CORP., Respondent. DecisionDocument5 pagesCayo G. Gamogamo, Petitioner, vs. Pnoc Shipping and TRANSPORT CORP., Respondent. DecisionJen DioknoNo ratings yet

- The All India Services (Leave) RulesDocument29 pagesThe All India Services (Leave) RulesRenuka Prasad A100% (1)

- Hagonoy Water District v. Commission On AuditDocument5 pagesHagonoy Water District v. Commission On AuditChescaNo ratings yet

- The All India Services (Death-Cum-Retirement Benefits) Rules, 1958 (Updated Up To 15th March, 2007) PDFDocument30 pagesThe All India Services (Death-Cum-Retirement Benefits) Rules, 1958 (Updated Up To 15th March, 2007) PDFবন্ধুপ্রিয় সরকারNo ratings yet

- Santos Vs CADocument6 pagesSantos Vs CAVincent OngNo ratings yet

- Security Insurance Systems by Totalizing The Workers' Creditable Services or Contributions in Each of The SystemsDocument1 pageSecurity Insurance Systems by Totalizing The Workers' Creditable Services or Contributions in Each of The SystemsDael GerongNo ratings yet

- Chua V CSCDocument10 pagesChua V CSCPatricia RodriguezNo ratings yet

- II Chua vs. CSC and NIA - ImplicationsDocument7 pagesII Chua vs. CSC and NIA - ImplicationsAP CruzNo ratings yet

- OGCGDocument1 pageOGCGlifemandrinkNo ratings yet

- CSC - Santos Vs CADocument4 pagesCSC - Santos Vs CAPAMELA PARCENo ratings yet

- AL-SL - GSIS Act Of1997 CASESDocument47 pagesAL-SL - GSIS Act Of1997 CASESJonathan BravaNo ratings yet

- 56 - 61Document43 pages56 - 61Ervin John ReyesNo ratings yet

- In Re ZialcitaDocument6 pagesIn Re ZialcitaJunnieson BonielNo ratings yet

- 13Document43 pages13Rakesh Ranjan0% (1)

- Socleg Gsis CasesDocument51 pagesSocleg Gsis CasesRichard BakerNo ratings yet

- PRB Reading MaterialDocument77 pagesPRB Reading MaterialGK TiwariNo ratings yet

- Case 84 in Re ZialcitaDocument4 pagesCase 84 in Re ZialcitaAlexis Ailex Villamor Jr.No ratings yet

- (Digest) Gsis V CSCDocument3 pages(Digest) Gsis V CSCJulie Ann EnadNo ratings yet

- Borromeo v. Civil Service Commission (1991) DoctrineDocument3 pagesBorromeo v. Civil Service Commission (1991) Doctrinepoppy2890No ratings yet

- Agra Gsis CasesDocument3 pagesAgra Gsis CasesEmily LeahNo ratings yet

- C L - InstructionsDocument14 pagesC L - Instructionssameerdmrc03No ratings yet

- Limited Portability Law (Republic Act No. 7699) What Is Portability?Document3 pagesLimited Portability Law (Republic Act No. 7699) What Is Portability?Vikki Amorio100% (1)

- Statcon CaseDocument18 pagesStatcon CaseGladys QuiatchonNo ratings yet

- VITALICIA, Editha G.: PRO VersionDocument6 pagesVITALICIA, Editha G.: PRO VersionPaul Pleños TolomiaNo ratings yet

- Ra 10154 Retirement LawDocument2 pagesRa 10154 Retirement Lawhappy melsNo ratings yet

- Social Legislation PrinciplesDocument4 pagesSocial Legislation PrinciplesAppleSamsonNo ratings yet

- Gsis Vs PalmieryDocument4 pagesGsis Vs Palmieryjoyce magtibayNo ratings yet

- GDocument23 pagesGJovan Ace Kevin DagantaNo ratings yet

- Doctrine of Necessary InplicationDocument35 pagesDoctrine of Necessary InplicationRodel GarciaNo ratings yet

- D. Valdez v. GSISDocument1 pageD. Valdez v. GSISGen CabrillasNo ratings yet

- GoodDocument22 pagesGoodhari sharma100% (1)

- Note On Kerala Service Rules Part I: Upto April 2008Document19 pagesNote On Kerala Service Rules Part I: Upto April 2008durga7No ratings yet

- Revised AIS Rule Vol I Rule 03Document31 pagesRevised AIS Rule Vol I Rule 03Archana SivagamiNo ratings yet

- Legal OpinionDocument29 pagesLegal OpinionAnonymous 1lYUUy5TNo ratings yet

- Gsis VS ApolinarioDocument2 pagesGsis VS ApolinarioEarvin Joseph Barace100% (1)

- G.O. No. 9008-F (P)Document3 pagesG.O. No. 9008-F (P)Sumit GuptaNo ratings yet

- NBC-No.568 National Budget Circular 2017Document11 pagesNBC-No.568 National Budget Circular 2017Deped Tambayan100% (14)

- March 15, 2014 Leave A Comment: Transfield Philippines Vs Luzon Hydro Electric Corp. GR No 146717, Nov 22, 2004Document16 pagesMarch 15, 2014 Leave A Comment: Transfield Philippines Vs Luzon Hydro Electric Corp. GR No 146717, Nov 22, 2004Debra RuthNo ratings yet

- Cebu City Ordinance For Hotel EstablishmentsDocument9 pagesCebu City Ordinance For Hotel EstablishmentsDebra RuthNo ratings yet

- Crimpro Cases-Rights of AccusedDocument14 pagesCrimpro Cases-Rights of AccusedDebra RuthNo ratings yet

- Course Outline 2015Document5 pagesCourse Outline 2015Debra RuthNo ratings yet

- Labor Assignment Case DigestDocument2 pagesLabor Assignment Case DigestDebra RuthNo ratings yet

- Skippers Vs Doza Case DigestDocument2 pagesSkippers Vs Doza Case DigestDebra RuthNo ratings yet

- Metromedia Times Corp., vs. PastorinDocument2 pagesMetromedia Times Corp., vs. PastorinDebra RuthNo ratings yet

- Neri vs. NLRC, G.R. Nos. 97008-09, July 23, 1993, 224 SCRA 717Document2 pagesNeri vs. NLRC, G.R. Nos. 97008-09, July 23, 1993, 224 SCRA 717Lizzy Liezel100% (1)

- Metromedia Times Corp., vs. PastorinDocument2 pagesMetromedia Times Corp., vs. PastorinDebra RuthNo ratings yet

- 9 - ABS-CBN Vs NazarenoDocument2 pages9 - ABS-CBN Vs NazarenoDebra RuthNo ratings yet

- REYES, R.T., J.:: Certiorari of The DecisionDocument19 pagesREYES, R.T., J.:: Certiorari of The DecisionDebra RuthNo ratings yet

- Anguita Geologiacal Guidebook To Dantes PeakDocument6 pagesAnguita Geologiacal Guidebook To Dantes PeakDebra RuthNo ratings yet

- KSS - RPMETT - Sept 29 2021Document37 pagesKSS - RPMETT - Sept 29 2021Geramer Vere DuratoNo ratings yet

- Form No GJS1Document6 pagesForm No GJS1NIKHIL SWAMY B C0% (1)

- Gerald Bowe Resuello JurisprudenceDocument9 pagesGerald Bowe Resuello JurisprudenceGerald Bowe ResuelloNo ratings yet

- KLD Registration FormDocument2 pagesKLD Registration FormUncle Bully100% (3)

- GST Certificate JaDocument3 pagesGST Certificate JaParesh BabariaNo ratings yet

- Deed of Undertaking (DOST)Document1 pageDeed of Undertaking (DOST)Princes Dinglasan BulaclacNo ratings yet

- Checklist For Tourist Visa PDFDocument3 pagesChecklist For Tourist Visa PDFTrial MichuNo ratings yet

- Islamic WillDocument44 pagesIslamic WilldilsheNo ratings yet

- Federal Marine Terminals v. Worcester Peat Co.: Charter PartiesDocument4 pagesFederal Marine Terminals v. Worcester Peat Co.: Charter PartiesLarz MozoNo ratings yet

- Dignos V CA GR No L-59266 Feb 29 198Document7 pagesDignos V CA GR No L-59266 Feb 29 198Bonito BulanNo ratings yet

- Bar Q & A On PropertyDocument8 pagesBar Q & A On PropertyFe Portabes100% (1)

- (!court: Laepublic of Tbe !lbilippines FflanilaDocument14 pages(!court: Laepublic of Tbe !lbilippines FflanilaGladys Bustria OrlinoNo ratings yet

- 2BBC One Lotto2Document4 pages2BBC One Lotto2Krishna PriyaNo ratings yet

- DISCLAIMER The Information Being Offered Here IsDocument42 pagesDISCLAIMER The Information Being Offered Here IsJulie Hatcher-Julie Munoz JacksonNo ratings yet

- VasuDocument4 pagesVasuapi-3802158No ratings yet

- Armstrong v. Manzo, 380 U.S. 545 (1965)Document6 pagesArmstrong v. Manzo, 380 U.S. 545 (1965)Scribd Government DocsNo ratings yet

- Dycoco V Orina (Belgira) PDFDocument2 pagesDycoco V Orina (Belgira) PDFCathy BelgiraNo ratings yet

- Dismisssal RequestDocument119 pagesDismisssal RequestRick Karlin100% (1)

- Official Opinions of The Compliance Board 1 (2010) : Joseph H. PotterDocument4 pagesOfficial Opinions of The Compliance Board 1 (2010) : Joseph H. PotterCraig O'DonnellNo ratings yet

- Tio V AbayataDocument3 pagesTio V AbayataNikablin BalderasNo ratings yet

- Boston Equity V Toledo FactsDocument8 pagesBoston Equity V Toledo FactsRein GallardoNo ratings yet

- Ana Pegler-Gordon - Chinese Exclusion, Photography, and The Development of U.S. Immigration PolicyDocument28 pagesAna Pegler-Gordon - Chinese Exclusion, Photography, and The Development of U.S. Immigration PolicyCarlos CarranzaNo ratings yet

- Astm.b557 TensileDocument20 pagesAstm.b557 TensileHeber Esparza CslashNo ratings yet

- DN Script ThumbelinaDocument9 pagesDN Script ThumbelinaMaria Andreina MontañezNo ratings yet

- Agency Midterm Reviewer (Tantoco - Galang)Document29 pagesAgency Midterm Reviewer (Tantoco - Galang)Aleezah Gertrude RaymundoNo ratings yet

- 2023.01.31 - Doc. 16 Motion To Dismiss For Lack of Subject Matter - Diversity JurisdictionDocument5 pages2023.01.31 - Doc. 16 Motion To Dismiss For Lack of Subject Matter - Diversity JurisdictionLuPardus vs HomesiteNo ratings yet

- Affirmative Defenses KanssogdefDocument4 pagesAffirmative Defenses KanssogdefRicharnellia-RichieRichBattiest-CollinsNo ratings yet

- KafalahDocument5 pagesKafalahNur IskandarNo ratings yet