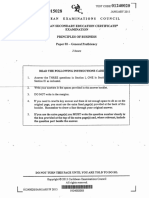

Professional Documents

Culture Documents

Unit 3 Revision Business Studies

Uploaded by

Saifulahmed490 ratings0% found this document useful (0 votes)

132 views19 pagesBusiness Studies

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBusiness Studies

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

132 views19 pagesUnit 3 Revision Business Studies

Uploaded by

Saifulahmed49Business Studies

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 19

by Sophia Abramchuk

Making Business Decisions

Unit 4a Business Studies

4.3.1 What is a Mission Statement

The mission statement of a business sets out what the main

purpose of a business is e.g. why it exists

The mission is likely to be determined by the values of

organisation (i.e. its culture)

The aims of the business expressed in qualitative terms

such as the desire to be the best in the industry

They highlight the culture, values and beliefs of the business

Should be short, specic and convey to everyone the value of

the brand and why it exists

It will include information for all stockholders

A more inspirational and motivating version of a corporate aim

Corporate aims are broad long term ideas on how the

business should develop. Can be very vague e.g. to be

protable/successful in the future

An effective Mission Statement

Identies the reason why the business exists

A good mission statement will help to develop SMART

corporate objectives, and be supported and adhered to in all

levels of the business

Ensures that everyone is focused and working towards

achieving goals

Many believe that a Mission Statement should have a grand

scale, be socially meaningful and be measurable

A pyramid of terms

Corporate objectives

Derived from mission statement/corporate aims

General objectives that refer to the business as a whole

Need to be practical and effective, e.g. relating to survival,

prot, market standing, social responsibility

They are specic, measurable,r elastic and measurable

(SMART) goals which an organisation plans to achieve within

a given time period. These goals will inuence its internal

decisions

Strategy

A plan of actions that has been designed to full an objectives.

A strategy cannot be formed until an objective has been

dened

Are Mission Statements useful

Stakeholders and objectives

YES NO

Can give stard a sense of

common purpose and

direction

Can just be a PR exercise,

design to create a good

public image

Can increase motivation Usually impossible to prove

Can help stakeholders

understand the main aim of

the business

May be rather vague

Can inform the consumer It is impossible to sum up

what a business is all about

in a few sentence

Stakeholder Objectives Conict

Consumers Good value vs. price products

Buying experience (service and

support)

Safe Product

Shareholders

Managers

Employees

Shareholders Maximisation of prots and return

on investment

Decreasing costs and improving

revenues

Consumers- product

qualities

Government- cutting taxes

reducing costs

Local Community- ethics

Employees-wages

Managers- salaries

Suppliers- costs reduction

Suppliers Paid in time for supplies

Best deals- prot maximisation

Consistency

More orders

Fair prices

Managers

Shareholders

Employees Good working conditions

Fair wages

Fair treatment, motivation and

rewards

Good public image

Job satisfaction

Promotion

Shareholders- reduced

costs

Managers- reduce costs

Managers Clear objectives and guidelines

from the directors and

shareholders

Prot maximisation for

shareholders

Training

Employees

Shareholders

Directors

Suppliers

Government

Regular tax payment

Creation of jobs

Follow the legislation

Pollution

FDI

Shareholders

Managers

Directors

The Local Community

The Local

Community

Employment

Pollution

Environment

Local conditions

No illegal practices

Shareholders

Government

Managers

Customers

1

Mission

statement

Corporate

aims

Corporate objectives

Corporate strategy

Functional objectives

Functional strategy

by Sophia Abramchuk

Supermarket wants to open a new superstore on a

greeneld site- Local community can have the conict with

shareholders of the business. This is due to the interest of

shareholders to maximise sales and do whatever they need to

attract as many customers, without ethical considerations.

The local community will be interested in preserving the

greenland and environment, because building of a

supermarket implies a lot of pollution, distraction of natural

habitat and the rural area around it. It might be possible that

local community will benet from cheap food supply from the

supermarket as well as this will create jobs and improve

employment in the area, but on the other hand it can be

argued that there is urban space in the city that can be used

and which will not have the same environmental impact with

the same benets. And shareholders will want to minimise the

costs of wages and production, so it is possible that the local

workers will be paid less as well as more pollution and waste

will be implemented.

A meat processing business wants to open a new abattoir

close to a residential area- restaurants and residents of the

area. For restaurants the suppliers will be closer, the transport

costs and fresh produce, but the local residents will feel

uncomfortable with the meat production.

Summary

Despite the apparent number of conicts most stakeholders

will have some common ground, e.g. long term protability

BUT

There are some irreconcilable differences e.g. local residents

will never be keen on a new runway/airport near their home.

Conicts between ethical objectives and prot-

based objectives

Argument- being ethical/socially responsible increases costs

BUT

Some ethical companies- highly protable

Can avoid need for outsider regulation (which can be costly)

Can improve motivation/leadership

Corporate Social Responsibility

Social Responsibility and business ethics are not

the same things

Social-responsibility- broad concept that concerns the

impact that the business has on society as a whole

Ethics relates to the way a individual or group behaves and

the way society judges this as right or wrong

Means taking decisions that take account of all

stakeholder interests.

Because#

Desire to behave responsibly

Positive public image#

Smokescreen to hind behind Spin-offs:

Good public relations exercise#

Can increase sales#

Reduces potential stakeholder conict

Ethical Decisions making conict

Following codes of practice that embody moral values:

What to manufacture eg arms & cigarettes make prot but

both are destructive#

Where to manufacture eg movement of production overseas

to reduce costs causing unemployment

Capital and labour ie machinery or more jobs

Pay & working conditions eg trade off between beVer

standards and lower costs#

The environment trade of between controlling pollution and

lower costs#

Ethical Behaviour and Protability#

Trade off between ethical behaviour and protability?#

However companies with ethical behaviour still make prot eg

Kraft foods, PepsiCo, Dell, IBM

Drawback to behaving ethically

Labour costs increase#

Supplies and materials higher costs#

Controlling environmental damage increase costs#

Change in organisation culture expensive#

If Competitors less ethical so lower costs/prices

#

Advantages to behaving ethically:

Favourable media attention#

Improved public image can lead to increased sales and brand

loyalty#

Ethically produced products can carry a premium price without

damaging sales#

More motivated workforce and possible increases in

productivity#

Improved relationships with suppliers leading to beVer quality

service#

Can actually be protable

2

by Sophia Abramchuk

Corporate culture

Organisational culture

The way we do things around here- a result of tradition,

history and structure

The values, attitudes and believes of the people working in an

organisation that control the way they interact with each other

and with external stakeholder groups

Google organisational culture

It comes from

People and talent and skills, collection of special people

Corporate aims

Atmosphere and environment

No bureaucracy

Freedom to work

Different background

Multicultural food, sports, care for workers

Working habits

No dress code, casual and open plan ofce

Multinational culture

Sources of organisational structure

Weak and Strong Culture

Weak

Employees dont support the corporate culture

Productivity and motivation likely to be low

Danger of us and them mentally

Capable staff may move on, leaving disaffected discontent

staff behind

Staff need to be forced to comply with company rules

End results to be poor performance

Strong

Employees believe the corporate culture and strongly support

it

Staff tend to be more loyal

Staff turnover is reduced

Mutual respect between management and employees grow

Motivation tends to be high

Productivity tends to be higher

Good communication exists

A strong culture may encourage superior performance

Success depends upon

People in the organisation; their skills and their ability to work

independently or as part of a team

Situation facing the business- do cultures need to change in

difcult times e.g. recession

Products/services being sold

Problems of changing organisational culture

Demotivation of employees that need to adopt to a new way

of doing things around here

Takes time and effort, reduces productivity and motivation if

new culture is more strict and allows less freedom

Need to invest in training

Cultural clashes between different groups inside the business

(Mergers and takeovers)

International businesses, diversity, scale, size, geographical

spread of the organisation

Current management/leadership styles

Current organisational structure

Lack of experience in managing cultural change

Negative outcomes of change

Types of Culture

Power

This type of culture has few rules- so decisions can be made

quickly

Centralised and concentrated between few people culture

control bus

Role

Traditional business structure- often reected in an

organisational chart

A hierarchy will exist with delegated authority- it comes from a

persons position in the structure

Task

Involves forming teams to address specic task- reected by a

Matrix organisational structure

Person

Where individual employees focus on themselves that the

business- which can create problems

This type of culture is more common where employees have

similar qualications- e.g. accountants

Sources of

organisational culture

Quote School Examples

Symbol In my job management

have their own parking

spaces and their own

ofces

Student artwork, Head

Boy/Girl board, sports

trophies, new 6th form

block

Stories In my workplace

Mr.Wenview is a legend

he sold his house to set

up the business. He

had so much faith it

would work!

Stories about teachers,

students and directors

Organisational

Structure

In my job decisions are

made centrally. We

dont get much say in

what goes on. Head

Ofce makes most of

the decisions

Hierarchy, bureaucracy,

a lot of layers in

organisation,

centralised decision

making by directors

Formal controls In my job my colleague

was given a formal

warning because he

was 5 minutes late

twice in 1 month

Lesson lates, high/low

levels, dress code,

code of conduct,

clocking in and out,

detentions, exclusion,

cameras

Power structures In my job we can

challenge management

views. In fact

challenging

management us

encouraged

Student council,

debates with teachers,

rep meetings

Rituals and myths In my job start every

day with a company

meeting where we sing

the company song

School hymn,

assemblies, Student

Council, year book,

prize giving evening,

graduation, Moves

show, musicals, cake

stalls, houses

3

by Sophia Abramchuk

Corporate Strategy

Once the corporate objectives have been decided, a busies

must begin to plan how they will be achieved

What is Corporate Strategy?

Long term plan to achieve corporate objectives

Can be implemented in a number of ways e.g.

Entering/leaving certain markets

Acquiring new companies

Introducing/phasing out products and services etc.

No one way to do this but different approaches which can be

used which are looked at in this presentation

Developing Corporate Strategy Portfolio Analysis

The Boston Matrix#

An attempt by the Boston Consulting Group to analyse the

product portfolio of a rm

Market share does the product being sold have a low or

high market share?

Market growth are the numbers of potential customers in the

market growing or not

The Boston Matrix Analysis

Stars are high growth products competing in markets where

they are strong compared with the competition.

Often Stars need heavy investment to sustain growth.

Eventually growth will slow and, assuming they keep their

market share, Stars will become Cash Cows

Question marks are products with low market share

operating in high growth markets.

This suggests that they have potential, but may need

substantial investment to grow market share at the expense of

larger competitors. Management have to think hard about

Question Marks - which ones should they invest in? Which

ones should they allow to fail or shrink?

Cash cows are low-growth products with a high market

share. These are mature, successful products with relatively

little need for investment.

They need to be managed for continued prot - so that they

continue to generate the strong cash ows that the company

needs for its Stars

Unsurprisingly, the term dogs refers to products that have

a low market share in unattractive, low-growth markets. Dogs

may generate enough cash to break-even, but they are rarely,

if ever, worth investing in.$ Dogs are usually sold or closed.

How Useful is the Boston Matrix?

Balanced portfolio needed

Stars and problem children potential

Cash cows will eventually fade away so stars/problem

children need nurturing.

Helps to think about balance in product range

BUT

Only a snapshot of current position

No real predictive value

High market growth doesnt mean the market is attractive

High market share does not mean the product is able to

generate cash

Focus on market share and market growth ignores other

issues such as developing a sustainable competitive

advantage

Useful when comparing with the product life cycle

Achieving Competitive Advantage through Distinctive

Capabilities

Competitive Advantage

Any feature of a business that enables it to complete

effectively. May be based on price, quality, service, reputation

or innovation.

Distinctive Capabilities

The ideas, resources and capabilities that a business

possesses that are better than those of its competitors.

Goal of business strategy is to achieve competitive advantage

that is sustainable for as long as possible. The more

distinctive capabilities a business has, the more likely it is to

create a competitive advantage and to make it last

Impact of Strategic and Tactical Decisions

Strategic Decisions

Made in order to meet the objectives of the business. They

are usually long term in nature. For example, should we enter

a new market?

Tactical Decisions

Shorter term steps taken to achieve the strategy. For

example, what price should we charge?

Both types of decisions will impact upon human resources,

physical resources and nancial resources.

4

by Sophia Abramchuk

Porters 5 Forces Analysis

(Michael Porter, a key business management author)

A way to look at the competitive environment

5 forces (factors) which determine the protability of an

industry

Ultimate aim of competitive strategy is to cope with and ideally

change those rules in favour of the business

When the collective strength of those 5 forces is favourable, a

business will be able to earn above average rates of return on

capital

When they are unfavourable, a business will be locked into

low returns or widely uctuating returns

The Bargaining Power of Suppliers

Suppliers want to maximise prot

The more power a supplier has over competitors the higher

the prices they can charge

Limiting the power of the supplier will improve the competitive

position of a business

To do this it can:

Grow vertically

Seek out new suppliers

Minimise the information provided to suppliers in order to

prevent the supplier realising its power over the consumer

The Bargaining Power of Consumers

The less customers there are, the more power they have

Buyers want to obtain supplies for the lowest price

If buyers or customers have enough market power they are

able to beat down prices offered by suppliers

One way a business can improve its competitive position

against buyers is to extend into the buyers market through

forward vertical integration

It could encourage other businesses to set up in its

customers market to reduce the power of existing customers

It could try to make it expensive for customers to switch to

another supplier e.g. games console manufacturers keep up

the price of computer games for their machines by making

them technically incompatible with other machines

Threat of New Entrants

If businesses can easily come into an industry and leave it

again if prots are low, it becomes difcult for existing

businesses in the industry to charge high prices and make

high prots

Existing businesses are constantly under threat that is their

prots rise too much, this will attract new suppliers into the

market who will undercut their prices.

Businesses can counteract this by creating barriers to entry

e.g. patents/copyright or creating strong brands which will

attract customer loyalty and make customers less price

sensitive

Large amounts of advertising can be a deterrent because it

represents a large cost to a new entrant which might have to

match the spending to grow some market share.

Large sunk costs (costs which have to be paid at the start but

are difcult to recoup if the business leaves the industry, can

deter new entrants

Substitutes

The more substitutes there are for a particular product the

ercer the competitive pressure on a business making the

product

A business making a product with few or no substitutes is

likely to be able to charge high prices and make high prots

A business can reduce the number of potential substitutes

through research and development and then patenting the

substitutes itself

Sometimes a business will buy the patent for a new invention

from a third party and do nothing with it simply to prevent the

product coming to market

Businesses can also use marketing tactics to stop the spread

of substitute products e.g. a local newspaper might use

predatory pricing if a new competitor come into its market to

drive it out again

Rivalry Amongst Existing Firms

The degree of rivalry among existing rms in an industry will

also determine prices and prots for any single rm

If rivalry is erce, businesses can reduce the rivalry by forming

cartels or engaging in anti-competitive practices (in UK/EU

law this is illegal but not uncommon)

Businesses can reduce competition by buying up their rivals

(horizontal integration)

In industries where there are relatively few businesses, often

businesses dont compete on price

This allows them to maintain high protability

Instead they tend to compete by bringing out new products

and through advertising, thus creating strong brands

As a result their costs are higher than they might otherwise

be, but they can also charge higher prices than in a more

competitive market creating high prots

5

by Sophia Abramchuk

Porters Generic Strategies

3 generic strategies that businesses could follow in order to

gain a competitive advantage.

Cost Leadership Tesco, Ryanair

Competitive Advantage comes from:

Providing a Basic Good at Minimum Cost (i.e. to become the

lowest cost producer)

Must have the lowest costs in the industry to succeed at this

strategy.

Can be achieved by a range of methods e.g. economies of

scale, best technology, increased productivity, more skilled

workers etc.

This gives pricing exibility: Could have very low prices and

increase market share OR could keep prices at industry

average and have large prots.

Must keep their source of low cost savings secret from rivals

to maintain an edge!

Differentiation - apple

Competitive Advantage comes from:

Creating products which are unique

Could be in terms of functions, design, features, after-sales

support or durability.

Requires an effective R&D dept. and a highly skilled

workforce to make top quality products

Enables the business to charge higher prices and achieve

higher prot margins

Focus

Competitive Advantage comes from:

Offering a specialised product in a niche market

Business targets a particular segment or segments within the

market and focuses on satisfying their needs. Cost focus

focus on cost and price. Differentiation focus - concentrate on

distinctive nature of the product.

Businesses using focus strategies aim their products at niche

markets, e.g./ SAGA = over 50s. They can tailor their

products to meet their customers exact needs.

The Key to Success with Porter

Firms must choose one of these 4 strategies, they will not

succeed if they try to follow some middle course.

Competition vs co-operation

Competition

Traditional way compete and maintain a competitive

advantage

Globalisation/trade liberalisation more competition

Internet increases competitive pressure

Corporate strategy more difcult as level of competition and

speed of change increase

Strategic decisions need to be exible in order to cope with

competitive threats

Co-operation

Factors which may persuade a business to co-operate:

Avoid the pressures of competition (e.g. Ba and Iberia run

some routes jointly)

Resources can be shared for mutual benet

Managerial time and effort can be put towards pushing the co-

operative venture rather than ghting off the opposition

Co-operation may be a legal requirement (e.g. in India and

China a joint venture might be required by law before MNCs

can enter a domestic marketplace)

Political, Legal and Other Inuences on Strategy

Political

E.g. economic policy

MNCs operating under different Governments may face

different regulations

Legal

Changes in law may mean businesses have to change the

way they operate e.g. working time directive/minimum wage

Other

E.g. social/technological can alter strategy as some objective

become easier or obsolete

Economic policy to achieve economic growth

Fiscal policy taxes + expenditure of the government

Monetary policy control of money supply and interest rates

Supply side policy managing supply through education/

training

Ination costs rise or demand increase

6

by Sophia Abramchuk

4.3.2 Making strategic decisions

Ansoffs Matrix

Ansoffs Matrix is a ways of classifying marketing strategies in

terms of existing and new products in existing and new

markets

The degree of risk involved in each strategy is an important

element of the analysis

Strategies

Market penetration

This is about increasing market share by concentrating on

existing products in existing markets. This strategy arises by:

Finding new customers

Taking customers from competitors

Persuading existing customers to increase usage e.g. cereals

to be eaten as a snack during the day and just for breakfast

New product development

This is about launching new products into your editing market.

Strategies may include:

Changing an existing product

Developing new products

Market development

This is about nding new markets for existing products. This

can be carried out in the following ways:

Repositioning the product to target a different market segment

e.g. Land Rovers traditional market was farming and military

use; it has now repositioned the product to appeal to town

dwellers

Moving into new markets e.g. opening branches abroad

Diversication

Developing a new product in a new market. This is the most

risky strategy but can also lead to the most extraordinary

success.

7

by Sophia Abramchuk

Investment Appraisal

The importance of investment

Investment in capital (e.g. medium to long term assets)

features;

Substantial nancial resources required

Opportunity and nancial costs: therefore risk

Should aim to achieve nancial as well as corporate

objectives

Investment appraisal

The process of analysing the nancial merits of a possible

future investment

Investment appraisal is a decision making tool which

examines whether capital investment is worthwhile, or which

from a range of options is the best to undertake

Payback period

This method calculates how long it takes a project to pay back

the initial investment involved

It concentrates on cash-ow, highlighting projects that quickly

recover their initial investment

Regard payback as one of the rst methods you use to

assess competing projects- an initial screening tool, but

inappropriate as a basis for sophisticated investment

decisions

This formula is used to nd the month when payback occurs:

Remaining cash needed to payback/net inow expected in

that year x 12 months

Advantages

Helps to see how long the capital will take to payback

Very simplistic and easy to use

Quick

Disadvantages

Doesn't look at protability of the capital in long term

Only a forecast, other tools should be used to complement to

make the decision

Steps to calculate Payback

Create a table of cash inows and outows over the life of the

investment

Identify in which year investment cost is recouped

Narrow down the month using the formula:

Remaining cash needed to payback x 1 2

months

Net inow expected in that year

Express result as Payback of x achieved in x years and x

months

88,000/125,000 x 12= 8.448, 2 years and 9 months

Average Rate of Return

This method calculates the expected annual return from the

investment, expressed as a percentage of the capital invested

in the project.

Quantitatively the higher the rate of return, the better the

investment is!

ARR Pros and Cons

Simply and relatively easy to understand

Expressed in percentage terms which may make it easier for

managers to use

Focus on prot / return

ARR doesn't take account of the project duration or the timing

of cash ows over the course of the project

A subjective tool there is no denitive signal given by the

ARR to help managers decide whether or not to invest

Steps to calculate ARR

Create a table of cash inows and outows over the life of the

investment

Calculate the total prot from the investment

Divide the prot over the life of the investment to give an

annual prot rate

Calculate the average rate of return using the following

formula:

Average annual prot x100%

Initial investment

Express result as % return

Net Present Value (NPV)

This method calculates the present value of all future cash

ows from each investment project.

To do this, rstly the future cash ows are set down in a table,

year by year

Future cash ows are discounted to arrive at a present

value, using a discount factor (given in the exam) that relates

to the cost of capital or borrowing for the company

NPV Pros and Cons

Makes an allowance for the opportunity cost of investing

Takes into account cash inows and outows for the duration

of the investment

Choosing the discount rate is difcult especially for long-

term projects

A complex method to calculate and easily misunderstood

Choosing the discount rate is difcult especially for

long-term projects

Cash outow

Cash inow Net cash

ow

Balance

Year 0 310,000 0 (310,000) (310,000)

Year 1 15,000 125,000 110,000 (200,000)

Year 2 15,000 127,000 112,000 (88000)

Year 3 15,000 140,000 125,000 37,000

Year 4 15,000 140,000 125,000 162,000

Year 5 15,000 130,000 115,000 277,000

8

by Sophia Abramchuk

Steps to calculate NPV

Create a table of cash inows and outows over the life of the

investment

Multiply the inows by the given discount factor (e.g. 5%,

10%)

Calculate the total value of the investment (discounted

inows discounted outows)

Express the result as a monetary value in today's terms

Investment Appraisal The Reality

The main idea with investment appraisal is to evaluate the

likely success and value of capital investments to help the

company succeed in the long term.

In reality, nancial considerations are only part of the story

when it comes to making investment decisions.

Bear in mind these facts when answering questions

Politics Permeate Decisions are ultimately made and

inuenced by humans, who think well beyond the gures

(unless they are boring accountants). They will consider their

own objectives (especially if there is a divorce between

ownership and control) and will favour projects giving them,

for example, more power and reward.

Corporate Objectives: Compani es may undertake

investments for reasons other than prot maximisation. For

example, they may be trying to protect their long term security,

or deny competitors an opportunity

Mistakes and Errors: Its actually really difcult to accurately

estimate future cash-ows for most projects, and indeed the

actual cost / time required to complete an investment. This

undermines the accuracy of all quantitative methods.

Decision Tree

The tree is a diagram that compares all possible outcomes of

multi-stage decisions

In order to make a decision it is necessary to calculate

the expected value (EV) of every decision- this considers

the estimated value and probability of each event

To calculate the expected value using a diagram- work

backwards from right to left; subtract the original cost of each

option

The option with the highest expected value would normally be

chosen

Advantages

The diagram may highlight possibilities that had not previously

been considered

It requires numerical values to be placed upon decisions- this

tends to require research, and thus improves results

It takes into account the risks involved in decisions, and

makes the decision-maker aware of them

Disadvantages

Time-lags may mean data used is out of data as process is

time-consuming

It does not consider non-numerical factors, e.g. laws

The probabilities used are often estimated

The diagram can quickly become complex and unmanageable

9

by Sophia Abramchuk

Critical Path Analysis

CPA is a planning tool- not a decision making tool

A method of organising the activities in a project to nd the

most efcient method of completing the project without

wasting resources (time, money, materials.)

Aims of CPA

To plan complex operations

To identify when a project must commence

To illustrate the order of activities

To identify critical activities which are those activities which

must be completed rst

To identify the times when resources can be reallocated

The oat

With the network complete you can now identify any idle time.

This spare time is known as the oat.

Resources can be allocated to other duties during the oat

time.

To make an Analysis

A list of activities assign each a letter and length

Information on the order of tasks to be completed

The time it takes to complete each task

Any constraints on completing

Assessing the value of CPA

Efciency: shows those tasks, which can be carried out at the

same time. Shows critical tasks and ones that can be delayed.

Decision making: estimating the length a project will take-

analysis of the tasks involved should lead to deadlines being

met more effectively as the implications of delays can be

assessed, identied and prevented.

Time based management: ensure project is done as quick as

possible

Working capital control: identifying when resources will be

required can help a business to manage its working capital

cycle. Especially important if a business operated in a just in

time system of stock control.

Advantages:

Maximises efciency in the use of time

Improve efciency and generate costs saving in the use of

recourse

Benecial to monitoring cash ow

Identify potential problems in implementing operation

Identies where and when recourses (including human ones)

are needed

Disadvantages:

Usefulness may be limited in complex and large scale

operation

Necessity of having clear and reliable information

Skilled management and team philosophy is essential

Although critical path analysis is clearly of value a business

must not assume that simply because it produces a network

its project will be completed without delay

Information used to estimate times in networks may be

incorrect

Changes sometimes take place when new projects are carried

out; unforeseen events such as weather

10

by Sophia Abramchuk

Special order/ unexpected

contribution

Total contribution- the difference between a products sales

revenue and its variable costs

Non-nancial factors to consider before accepting the

order

Capacity- a business must ensure that it has enough

recourses to complete the order e.g. are workers prepared to

work extra hours? Is there enough space in the factory, etc.

Customer response- if existing customers nd out that

products have been sold to other at a lower price this may

cause resentment

Future orders- sometimes up-protable orders are accepted

in anticipation of future, more protable orders from the new

customers

Current utilisation- an unprotable order might be accepted

to keep employees occupied

Retaining customer loyalty- A business might accept an

unprotable order from a regular customer as a favour in

order to retain them loyal.

Question :

Single product manufacturer has this cost structure:

Materials 25 per unit

Direct labour 28 per unit

Variable overheads 12 per unit

Fixed overheads total 420 000

Product price 120

Annual output 80% of the total capacity is 20 000

DIY store wants to buy extra 4000 units per annum, to sell

as own label

Price 85

10 000 of set up costs

For the business:

Prot- Rev - TC

Rev= 120 x 20 000= 2 400 000

TC= FC + VC

= 420,000 + (65 x 20 000)

=1 300 000

BE= 420 000/ 55 (present contribution= 120- (25+28+12)) =

7,636

Margin of safety is 20 000-7 636= 12 364

Forecast prot is 680 000 (12 364x 55) and revenue 916

000 (120 x 7 636)

For DIY store order:

Contribution= 340 000 (sales revenue)- 22x4000

= 80 000 -10 000 (set up production costs)

= 70 000

BE= 420 000/ 20= 21,000 units of the DIY order will have to

be sold without other orders to break even

Capacity of 80% out of 20 000= spare

Contingency planning

Contingency planning- preparing for unwanted and non-

routine possibilities such as:

A severe recession

Bankruptcy of a major customer

A sudden change in demand

A contingency plan ensures that a business is proactive

rather than active

Managers are forced to look for potential; changes in the

environment rather than merely dealing with changes

when they occur

Contingency plans could include:

Ensuring that new products are in development if there is a

sudden fall in demand for existing products

Training employees to be multi-skilled so that they can

perform many jobs to cover absence or meet changes in

demand

Using more than one supplier to ensure that a problem with

one supplier will not jeopardise production

Contingency planning uses variable resources such as

time and money, presenting an opportunity cost

To decide on which events to plan for a rm may

consider:

Likelihood- how likely is a particular event is to happen?

Impact- what is potential damage if it does occur?

The greater the likelihood and potential damage of an event

the more likely a rm is to prepare a contingency plan for it

When good times go bad, the impacts of a crisis:

When an unexpected event does happen a contingency plan

should allow effective crisis management. Decisions will not

have need rushed, and there is a clear process to deal with

the crisis.

When managing a crisis it is important to:

Identify the key factors as quickly as possible- what is the

scale of the crisis, people involved etc

Have a suitable and effective communication system in place

(the schools emergency closure line for example)

Ensure all communication with third parties outside of the

organisation is clearly co-ordinated to ensure the business

creates an impression that they are in control of situation

Have authority and recourses available to make decisions

quickly

11

by Sophia Abramchuk

Liquidity, protability ratios,

balance sheets

Concept/Stages of Ratio Analysis

Ratio Analysis: a method of assessing a rm's nancial

situation by comparing two sets of linked data.

Stages in using ratio Analysis

Identifying the reason for the investigation, is the info needed

to decide wether to become an investor,customer or supplier

or is it being used by the organisation to improve efciency.

Decide on relevant ratio to achieve purpose of the user.

Gather info required and then calculate the ratio.

Interpret the ratio. what is the meaning of the results?

Make appropriate comparisons in order to understand

signicance of ratio.

Take appropriate actions then reevaluate with same process

after implementation.

Ratio Comparisons

Ratios alone are meaningless therefore we compare them

with other results.

Inter-rm Comparisons - Between 2 companies, a company

should compare to rival competitors, in order to assess its

relative performance. these should be selected as the ones

with the most in common in order to take into external factors

which should effect the both.

Intra-rm Comparisons - Within a company. the efciency of

different divisions or areas of a company can be compared.

Should also be between similar areas.

Comparisons to a Standard - Certain levels are seen as

efcient, a company can compare to these standards to

assess objectively

Comparisons Over Time - Whatever basis is used, a

company ratio should be compared over time to see trends in

efciency and to allow for exceptional events.

Users of ratios

Managers - Identify efciency of the rm and its different

areas, to plan ahead and see effectiveness of policies

Employees - Whether the rm can afford wage rise and to

see if prots are being fairly distributed

Government - To review success of its economic policies and

nd ways to improve efciency overall.

Competitors - To compare their performance against rival

rms and discover their relative strengths and weaknesses.

Suppliers - To know the sort of payment terms that are being

offered to other suppliers, and can they afford to pay.

Customers - Know the future and make sure guaranties and

after sale services are secure

Shareholders - Compare nancial benets with other

investments.

Types of Ratio

Protability Ratio - These compare prots with the size of

the rm, as prot is often primary aim of a company (ROCE)

Liquidity Ratios - These show whether a rm is likely to be

able to meet its short-term liabilities. although prot shows

long-term success its vital to hold sufcient liquidity to avoid

difculties in paying debts. (Current Ratio & Acid Test Ratio)

Gearing - Focuses on long-term liquidity and shows whether

a rm's capital structure is likely to be able to continue to meet

interest payments on, to repay long term debts. (Gearing

Ratio)

Financial Efciency Ratio - Focuses on management of

working capital, used to asses the efciency of rm in

managing assets and short- term liabilities. (Asset turnover,

Inventory turnover, Payables days & Receivables days)

Shareholders Ratios - Focus on drawing conclusions about

nancial shareholder benets from their company shares.

(Divided per Share & Divided Yield)

Measuring protability

Gross Prot Margin

The amount of prot a business makes on its cost of sales.

The mark up prot on each item sold.

The higher the margin the better

A high gross prot may suggest a USP adding value to the

items sold, low material costs or a high selling price.

This can be improved by reducing raw material costs or

increasing the selling price.

Net Prot Margin

The amount of prot a business/product generates after

paying expenses, as a percentage of turnover

The higher the prot margin the better

A failing net prot margin may suggest that the business is

wasting money through unnecessary expenditure

Protability Ratio Return On Capital Employed

The capital employed is a measure of the value of the

resources used by a business and is an excellent guide to its

size. Prot targets are often expressed as a ROCE which

uses the formula below:

ROCE = Operating Prot /Capital Employed x 100

Measures the efciency with which the rm generates prot

from the funds invested in the business.

Compares net prot to the amount of money in the business

A higher percentage gure is better

Can be compared with: previous gures; alternative

investments, e.g. bank rates.

Liquidity Ratios

Liquidity: the ability a business has to repay its debts

Current assets: what you own - stock cash debtors

Current liabilities: what you owe short term loans

Two liquidity ratios - Current ratio & Acid test ratio used in

order to assess the ability of an organisation to meet its short-

term Liabilities.

Current Ratio: In order to meet liabilities a rm can draw on

its current assets,bank balance,debtors and stock that is sold.

Generally, higher numbers are better, implying that the rm

has a higher amount of current assets when compared to

current liabilities and should easily be able to pay off its short-

term debt.

Current ratio = Current assets/current liabilities

Company should aim to be between 1.5:1 and 2:1 as an ideal

ratio

Acid Test Ratio: Firms cannot be sure that their inventories

will sell quickly so acid test is used as an alternative. Acid test

ignores inventories in its calculation considering only cash,

bank balances and receivables.

12

by Sophia Abramchuk

ATR= Current assets - Inventories/current liabilities

The ideal Acid Test Ratio is between 0.75:1 and 1:1

Gearing

Gearing examines the capital structure of a rm and its likely

impact on the rm's ability to stay solvent.

Gearing (%) = Non-current Liabilities/ (Total equity + Non-

current liabilities) X 100

Non-current liabilities normally take the form of loans, such as

debentures or long-term loans from the bank

High Gearing is greater than 50%. High gearing ratio shows

that a business has borrowed a lot of money in relation to its

total capital.

Low Gearing is below 25%. Low gearing ratio indicates that a

rm has raised most of its capital from shareholder, in the

form of share capital and retained prot.

Gearing Benets

Benets of High Gearing

There are relatively few shareholders, so it is easier for

existing shareholders to keep control of the company.

The company can benet from a very cheap source of nance

when interested.

In times of high prot, interest payments are lower than

shareholders' dividend requirements, allowing greater retained

prot.

Benets of Low Gearing

Is permanent share capital avoids creditors pushing them into

liquidation.

A low gearing company avoids the problem of having to pay

high levels of interest on borrowed capital when interest rates

are high.

The company avoids the pressure facing highly geared

companies that must repay their borrowing at some stage.

Financial Efciency Ratios

Asset Turnover: This ratio measures how well a company

uses its assets in order to achieve sales revenue.

Asset Turnover = Revenue / Net Assets

High AT shows the business is using assets efciently to

achieve sales.

Low AT shows the business is not using assets efciently to

achieve sales.

Capital intensive rms will have lower asset turnover than

labour intensive rms, because capital owned is included in

net assets where labour is not.

Stock Turnover

This ratio measures the number of times a year a business

sells and replaces stock.

Stock turnover= Cost of Goods Sold/Avg Stock Held

the stock turnover gure represents the number of times in a

year that a rm sells the value of its stock. 3 time a year =

once every 4 months

The stock turnover can be improved by:

Reducing the average level of stocks held, without losing

sales

Increasing the rate of sales without raising the level of stocks

In different industries the rate of stock turnover will be

different, e.g. greengrocer would have a ration of 250 to 300

days of turnover due to the need of his stock to be fresh,

whereas a business operating in service would have a zero

turnover as no stock is held.

Factors inuencing the rate of Stock Turnover

The Nature of the Product - Perishable products or products

that become dated, e.g. (newspapers) have high stock

turnover.

The Importance of Holding Stock - Clothes retailers need to

hold high levels of stock to encourage shoppers

The Length of the Product Life Cycle - Fashionable

products are expected to sell quickly and products with short

life cycles must also have a rapid turnover.

Stock Management System - Just-In-Time stock control =

low levels of stock so stock turnover is faster.

Quality of Management - Poor market research may lead to

inappropriate stock levels = low stock turnover.

The Variety of Products - Company with 20 products will

hold greater levels of stock than a company with 1.

Limitations of Ratio Analysis

Accounting information is historic in nature

Not easy to make accurate projections of future performance

from the data

Only focused on monetary items- what about changes in staff/

strength of product portfolio/future new product pipeline/age of

key assets etc.

Does not take into account the nature of the business: the

qualitative factors: size; market penetration/business activity/

objectives

Take a look too at the chairmans directors for further

guidance

13

by Sophia Abramchuk

Human Recourses

Competitiveness

Efciency can be measured by calculating the productivity of a

rm

Productivity- the amount that can be produced with the

resources that are available

Factors that affect efciency

Labour intensive- relatively few machines are needed-

common where specialist skills are required; in the service

sector

Capital intensive- relies more upon machinery- e.g. where

identical products are produced

Capital or labour intensive

The size of the business

Capital equipment can be expensive

Small rms may be unable to afford to buy machinery

Even if they can afford it, they will have to calculate whether

the cost can be justied

The relative costs of inputs

New technology is expensive

It may be cheaper not to automate

Even if a job can be automated it may not be cost-effective

This depends on the wage demands of staff

The product of service

Products which can be mass produced will be capital

intensive- e.g. cars

Whilst custom-made product, and many services will be

labour intensive- e.g. hairdressing

Labour Turnover

This is the measure of how quickly the staff in the workplace

change

Ideal rate

It depends upon

The level of unemployment in the region

Whether staff are full or part-time

The level of skills required by staff

E.g. Private sector- 16.8%

Public sector- 12.6%

Voluntary sector- 16.4%

Why is Labour turnover important

Positive

New workers may be more enthusiastic

A rm can employ staff who have the specic skills required

for different jobs

New staff may bring new ideas and new ways of working

Negative

Recruiting new workers is expensive

New staff will need training and induction, which is costly and

time consuming

It can have a negative impact on staff morale, if lots of staff

are leaving

Voluntary Labour Turnover- sometimes workers will leave a

job voluntarily, due to retirement; nding another job and

volunteering for redundancy

This can be helpful to a business that is looking to decrease

their labour costs- since they may not have to replay the staff

that leave

Internal and external inuences on workforce

planning

The process of anticipating in advance the human resource

requirements of the organisation, both in terms of the number

of individuals required and the appropriate skill mix.

Recruitment and training policies are devices with a long-term

focus, in order to ensure the business is able to operate

without being limited by a shortage of appropriate labour

Internal inuences

The are of rise in workforce productivity- automation can

improve productivity, as well as motivating employees through

job enrichment, agreeing nancial objectives and other

appraisal systems; there is a lot evidence that this is

expensive, but little that it is effective

The business strategy itself-expansion strategies- if

proven to be success, a business can double pressure to

employ and train new stuff

The attitude of the leadership towards the structure of

hierarchy- if a new leader decides to delayer the

organisation, the job losses and the retaining needs will cause

work (and stress) for the HR department; this will need to be

built into the workforce plan

The attitude of the leadership towards a diverse

workforce- there is a tendency to hiring white males,

educated in the private sector; diversity strategy is the

preferable, as this practice could benet from greater

understanding among the staff of the lives of people from

other cultures.

External inuences

External opportunities-such as the period when a

developing country moves from commodity based purchasing

(rice, chicken, oranges) towards modern products, services

and brands

Legislation- now the legistalition towards the requirements to

get hired and discrimination became more laissez-fair; now

businesses can decide on what sex, different race or age of

workers to hire; this is reversed by more restrictions on

migration policies, some rms making use of the inow of

skilled workers and some putting extra training and time into

British workers to get the required skills that can be in short

supply

14

by Sophia Abramchuk

4.3.4. Company growth

Business size can be measured in many ways- e.g.

assets, sales revenue, operating prot, market share,

value added, number of employees

Growth implies increase in one or more of the above metrics

Large companies enjoy

Great volume of sales

Higher sales revenue

Larger prots

Higher market share

Greater inuence over market prices

Economies of scale

Greater stability- they are more robust and better able to cope

with economic problems

Aims of business growth

To increase prot

To achieve market leadership/dominance

To enjoy economies of scale and therefore lower unit costs

To control outlets and/or suppliers

To spread risks by diversifying

To reduce the range of takeover

To increase security

To remain competitive

To ride uctuations in the economy

For survival

As a defensive strategy

To increase status

To obtain the benets of synergy

Reasons of personal ambition

Economies of scale- an advantage of producing on a large

scale; unit costs fall as the scale of production rises

Financing growth by borrowing (this has consequences for

gearing and interest cover); share issue (consequences for

control); and internal nance (reinvestment of past prots but

at the expense of dividends)

Prots are essential for growth

The ploughing back of past prots is a major source of funds

for growth

Only protable rms generate the funds for reinvestment

Debt nance for expansion is usually dependent upon a track

record of successful and protable operations

The success of a share issue is also dependent on past and

current performance

Obstacles to growth

Financial constraints- lack of vince for investment

Market size limitations- the market is too small for the rm to

grow

Lack of personal ambition in the owner

Internal resistance to change- e.g. from middle

management and workforce

Organisational inexibility- inability to cope with a new,

larger organisation

Competitor activity- aggressive competition prevents

acquisition of a large market share

Resource constraints- capacity constraints or lack os

physical assets

Problems of growth

Cash ow problems

Danger of overtrading- expanding with insufcient working

capital

Diseconomies of scale- paper work and problems

associated with large scale

Personnel problems- employee motivation and employee

problems

Risk of loss of direction and control

Organic growth

This is expansion from within

Organic/internal growth arises from within the business either

by selling more of existing products or by launching new ones

Growth by- reinvesting prots back into the business to

increase capacity; using the existing, internal resources of the

business

The mechanism for organic growth

Prots are re-invested

This increases capacity

As a result output and sales rise

Increased product leads to a rise in the capital (balance sheet)

value of the business

Favourable conditions for organic growth

When the market is growing fast

When one rms performing better than others and therefore

gains market share

When new rms enter the market

Reasons for pursuing organic growth

Absence of suitable acquisition targets might make this the

only route for expansion

Involves less risk and disruption that external growth

Can be planned more carefully than external growth

Can b nanced from own resources without need to raise

external nance

Same style of management and organisational culture can be

maintained

Economies of scale available from more efcient use of

central head ofce functions

Advantages

Makes best use of existing resources

Consistent with existing culture

Leads to economies of scale

Easier to control

Can be planned carefully

Can be nanced from retained prots

Involves less risk

Long term, working relationships maintained

Capitalises on existing expertise

Disadvantages

Takes place slowly as the rm builds capacity and grows

markets

Firms have to acquire resources

Organic growth is limited by growth in the market

It can result in an over-cautious approach

Handicapped by limitations of existing skills and expertise

May be too slow for the dynamics of the market

15

by Sophia Abramchuk

External growth

Growth by acquisition/take-over or merger

Instead of build up resources internally the rm seeks to

acquire additional resources from other businesses

Resources acquired include capacity, a workforce, tangible

assets, technology, and a consumer base

It is a much used strategic option

A voluntary joining together of companies is known as a

merger, a forced acquisition of one company by another

known as a take over (or acquisition)

When is external growth is a preferred strategy

Existing products are in the later stages of its life cycle

Business lacks knowledge or resources to develop internally

Speed of growth is a high priority

Costs are more favourable than those of organic growth

Advantages

Quick access to resources the business needs

Overcome barriers to entry

Helps spread risks

Wider range of products and greater geographical spread

Provides cost saving opportunities

Reduces competition

Economies of scale

Provides benets of synergy (the interaction of elements that

when combined produce a total effect that is greater than the

sum of the individual elements, contributions)

Disadvantages

High cost involved

Problems of valuation

Clash of cultures

Upset customers; customers might not remain loyal

Involves high risk

Problems of integration

Problems of implementing the changes

Resistance from employees

Problems in achieving the benets

Incompatibility of management styles, structure and cultures

Negative synergy (2+2=3!)

Often driven more by personal ambition

Forms rarely take non-nancial factors in to account

High failure rate

Diseconomies of scale

Mergers

Dened as a voluntary and permanent combination of

businesses whereby one go more rms integrate their

operations and identities with those of another

Or a combining and pooling of business organisations to form

a new business

Shareholders come together to share the resources of the

enlarged or merged organisation

It usually involves the two existing businesses surrendering

independence, shareholders exchanging their existing shares

for shares in the merged company and the new business

taking on a new identity

Acquisition

One rm (the acquirer) purchasing and absorbing the

operations of another (the acquired)

The purchase of a controlling interest in another rm

The acquired business becomes either a subsidiary of or fully

absorbed by the other

The word takeover means the same as acquisition although

the rem is often used in the case of a hostile takeover

A hostile takeover is made agains the advice and

recommendations of the directors of the company being taken

over

Reasons for making an acquisition

To gain economies of larger scale

To acquire intangible assets (patents, trade marks, brands)

To acquire assets that can be protably sold off (a practice

known as asset stripping)

To secure access to suppliers of distribution channels

To spread risks by diversifying

To increase market share

To reduce competition in the market

To overcome barriers to entry to new markets

To defend itself agains a takeover threat

To buy-in a new product range

To eliminate competition

To acquire skills, knowledge, competency

Synergy

Synergy occurs when the combined results produce a better

rate of return than would be achieved by using the same

resources independently

The benets of combining exceed the aggregate i.e. 2+2=5

Synergy is an example of the whole is greater than the sum of

its parts

Synergy is any unrealised potential open to a group from

mixing and matching resources better

The resulting rm is more efcient and effective than the

aggregate of the previous rms

Acquisitions usually fall

The results of external growth are often disappointing- in fact

external growth is notoriously difcult to achieve successfully

At least 50% of all mergers and acquisitions fail to add value

to the existing rms

The benets of synergy are often elusive. Rather than

performing better than the previously independent enterprises

it is quite common for the enlarged company to perform less

well than prior to acquisition or merger

Porter found that in a study he undertook 53% of related

acquisitions were soon followed by divestment (selling off).

The gure rose to 74% in the case of unrelated acquisitions

Reasons for failure of acquisitions

Cultural incompatibility

Lack of communication

Loss of key personnel

Price paid for acquisition was too high

Lack of research prior to acquisition

Personnel ambition over-ruled business

Increased bureaucracy

The creation of a lumbering giant that is soon outpaced by

smaller rivals

Many mergers fail because the new companys management

underestimated, ignoring or mishandled the integration tasks

16

by Sophia Abramchuk

Impact of competition legislation in the UK

Monopolies are considered to be against the interests of

consumers

Competition legislation seeks to ensure that rms with a large

markets share do not abuse their position

A dominant rm is one with a 25% (or greater) market share

The commission can rule agains a merger or, alternatively,

impose conditions

Ansoffs Growth Matrix

Ansoff identied four growth strategies which are in order of

increasing risk:

Market penetration- selling more of the same product to the

same type of customer

Market development- selling the existing product to a new

type of customer

Product development- selling new products to existing

customers

Diversication- selling new products to new customers

Directions of growth

Related growth

The joining of rms in the same industry

Vertical integration: different stage in production chain

Horizontal integration: same stage in the production chain

Diversication

Joining together of two forms in different industries

Centric diversication- linked by some feature in common

such as transferable skills

Conglomerate diversication: where there is no obvious risk

Alternatives to organic and external growth

Consortia- formal agreement between companies to

collaborate

Joint venture with another rm

Licensing- allowing other rms to produce goods

Franchising- allows the franchisee to undertake part of the

business

Sub-contracting/outsourcing non-core activities

17

by Sophia Abramchuk

Greggs and Growth

Suitability of the growth options

The options can be assessed against three key criteria:

Suitability: - does the chosen strategy:

Build on strengths and/or solve weaknesses?#

Exploit opportunities and/or respond to potential threats?

Satisfy the goals and objectives of the business?#

Fit the culture of the business?

Acceptability:

Depends on the views of the key stakeholders#

What level of risk does the business want to take?

Feasibility:

What resources are available to support the strategy? (e.g.

nance, experience; management resources)

Strategic Option: Organic Growth

Suitability

Fits well with existing strategy and objective of store roll outs "

Greggs has considerable experience of this approach#

Good t with the corporate growth objectives

Acceptability

Enables Greggs to protect and develop its USP#

Low risk because this is core business more of the same "

Could be considered as an essential strategy

Feasibility

A favourable option, but the market remains competitive

Probably possible to nance this option using internal nance

(as they have done up to now)

Strategic Option: Growth by Acquisition

Suitability

Limited previous experience of growth by acquisition but

Logical to expand through horizontal integration in this market

Acceptability

Shareholders might be supportive if the right opportunity

arises#

Medium to high risk because acquisitions and the anticipated

synergies are

hard to deliver in practice

Feasibility

Would require an integration strategy

Would require signicant capital to purchase the competitor,

but Greggs does

have a strong balance sheet and low gearing

Could work if they bought a regional bakery to plug some of

the current gaps in UK coverage

Strategic Option: Product development of a Coffee Chain

Suitability

Supports the corporate growth objective#

Builds upon Greggs current strengths at extending their

product lines with

low prices

Would need to be certain that competitors did not have

something better, but it may well become essential in this

market in the future to adopt this strategy in order to ourish

Acceptability

Low/Medium risk this is new ground for Greggs, but many

competitors already have coffee shop formats

Feasibility

Greggs can move into this product space quite quickly

Internal Growth External

Growth

Improving supply chains by consolidating already existing 79

in-store bakeries into regional retail network

Efciency in logistic solutions

Organic: In 2013 (close 68 shops), relocate 17 and open 51

in a new catchment area.

In 2012 Greggs opened 48% of its net new shops in locations

away from high streets, to make Greggs even more

accessible to people at work, travelling and at leisure

On the Go and Local bakery format shops

Planning additional 600 retail bakeries

Refurbishment of existing stores

Greggs the Bakery

Greggs newest local bakery concept shops give customers a

more traditional bakers shop experience, offering new lines

including artisan breads, new and traditional cake ranges and

exciting shop window displays, all alongside their best-loved

products

Greggs moment

This is a new coffee shop format where customers can relax

in a modern, contemporary environment and enjoy a menu of

outstanding bakery food with a wide selection of freshly

ground coffees and teas

Wholesale

Greggs supply a range of 21 savoury and sweet lines (the

bake at home range) in dedicated Greggs cabinets sold in

over 750 Iceland frozen food stores around the UK and

abroad

New 10 Moto

shops with

franchise

license. (This is

a partnership

with Moto which

brings together

Britains biggest

operator of

motorway

service areas

and Britains

biggest bakery

retailer. There

are plans for 30

Greggs at Moto

service areas

across the UK

in the future)

Bakers Oven

take over by

Greggs in 1994

Existing product New product

Existi

ng

mark

et

A Market Penetration Strategy: Organic

Growth

This option is about increasing market share in its

core bakery markets

Greggs would focus on:

Opening up the potential for an additional 600

retail bakeries in high quality locations in the UK

Further development of the segmented targeting

strategy including on the go and local bakery

formats

Keeping prices very competitive (as they are now)

Continuing to improve the range and quality of

bakery products

A Market Penetration Strategy: Growth by

Acquisition

This option is about generating immediate and

signicant growth in market share by acquiring a

competitor bakery retailer by way of horizontal

integration

Greggs would need to

Conduct appropriate market research to identify a

suitable target company

Ensure that the Competition Commission had

approved the acquisition (if it was a large chain

with signicant market share, such as Costa)

Ensure that the necessary funding was in place in

conjunction with shareholders and/or the banks

Prepare a plan for corporate integration and the

generation of synergies

Product Development

Strategy: Coffee at

Greggs...

This option is about

developing upon the current

retail capability and

developing a coffee

business in response to

customer needs

Greggs would need to

Develop a wider sourcing

strategy (for coffee) and

develop its supply chain

network

Undertake market research

to nd ways to beat the

large number of existing

competitors in the coffee

market

Design shop formats which

are bigger and different

from the current bakeries

(with eat in and seating)

Train the staff in providing

customer service in the new

shop format

Construct a strong

marketing campaign for the

new product line

New

mark

et

A Market Development Strategy: Targeting new

customers in airports, train stations, motorway

service areas and business parks...

This option involves replicating and extending the

successful Greggs business model and using the

on the go branding to tap into customers who are

hungry, busy and on the move

Greggs would need to:

Conduct market research to understand the

specic requirements of these new markets

Build new stores in target areas

Develop relationships, joint ventures and franchise

agreements with local partners such as Moto in

selected territories

Build upon the on the go marketing strategy

A Diversication Strategy:

A wholesale business?

This option involves

diversifying its sales

strategy via wholesale

arrangements with existing

multiple retail chains (such

as Iceland) to target

customers who know

Greggs as a High Street

retailer and who trust the

brand sufciently to want to

buy frozen products in a

supermarket retail

environment

Greggs would need to

Do its nancial calculations

carefully because wholesale

margins selling through

supermarkets are likely to

be quite tight

Put together deals with

leading supermarkets

Develop its supply chain

and delivery operations

18

by Sophia Abramchuk

Some more work may be required to set up the distribution

and delivery networks and to integrate it within their core

business

Strategic Option: Market Development at Transport Hubs

Suitability

There probably are gaps in the market in new territories,

especially for food on the go

The strategy is a good t with their growth objective and it has

synergies with the local bakery proposition

Acceptability

Greggs is very experienced at developing new markets#

Low/Medium risk with the prospect of good returns for early

success

Feasibility

Financial investment is probably available for a phased

expansion into new territories from internal nance because

the Balance Sheet is strong

Requires signicant up front work building joint ventures and

local partnerships /franchises with companies such as Moto

Strategic Option: Diversication into Wholesale Frozen

Food at home and abroad

Suitability

Greggs has some experience of the frozen food sector

through its arrangements with Iceland

Plays to Greggs strengths as a food manufacturer

Greggs does not have an international business model at the

moment

Acceptability

Acceptable in the medium term, so long as it does not mean

taking their eye off the ball in the core retail bakery market

Medium risk, returns may be tight in a wholesale environment

" International option is high risk and may be a 10-20 year

play

Feasibility

Sensible level of nancial investment required

-Organic growth, continue with their expansion plan on

reaching new places in the UK as its a more secure as they

already know the UK market due to their experience and their

brand is already known, therefore no massive advertisement .

-Also another option thats appropriate for Greggs is the

movement into transport hubs and business parks because its

still UK and they would need to operate in the same way,

more applicable to their food on the go business model

-Continue with their diversication plans in Iceland and

franchise with Motto

19

Rivalry of Industry Competitors (High)

Fragmented market with many large

and small players

Intense competition between brands

Short product life cycles

Reasonably easy to launch new

product lines

Threats of Substitution (Low/Medium)

Bread is the UK staple diet, but

Potatoes, rice and cereals could become more

popular if wheat prices keep rising