Professional Documents

Culture Documents

FuelPrices SouthAfrica Calculated

Uploaded by

trnemoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FuelPrices SouthAfrica Calculated

Uploaded by

trnemoCopyright:

Available Formats

Fuel Prices in South Africa How is it calculated?

The petrol pump price is composed of a number of price elements and these can be divided into

international elements and domestic elements. The international element, or Basic Fuel price

(BFP), is based on an import parity principal. In other words, it is what it would cost a South

African importer of petrol to buy the petrol from an international refinery, transport the product

from that refinery, insure the product against losses at sea and land the product on South African

shores.

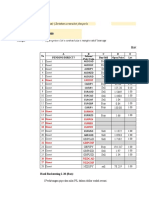

Composition of the Petrol Pump Price 93 Octane

(Gauteng) in SA cent per litre 502 c/l - 06 April 2005

Basi c fuel pri ce

& Sl ate Levy

250.232 c/l

49.8%

Del i very cost

7 c/l

1.4%

Transport cost

13.4 c/l

2.7%

Fuel tax

116 c/l

23.1%

RAF

31.5 c/l

6.3%

Customs & Exci se

4 c/l

0.8%

Tax

151.5 c/l

30.2%

Retai l margi n

40.6 c/l

8.1%

Whol esal e margi n

39.268 c/l

7.8%

Composition fo the Diesel 0.3%S Estimated Pump Price

(Gauteng) in SA cent per litre 514 c/l - 06 April 2005

" Deemed"

Retai l Margi n

40.1 c/l

7.8%

Whol esal e margi n

39.26 c/l

7.6%

Basi c fuel pri ce

& Sl ate Levy

278.73 c/l

54.2%

Transport cost

13.4 c/l

2.6%

Del i very cost

7 c/l

1.4%

Tracer dye l evy

0.01 c/l

0.002%

Customs & Exci se

4 c/l

0.8%

RAF

31.5 c/l

6.1%

Fuel tax

100 c/l

19.5%

Tax

135.51 c/l

26.4%

Note Diesel Retail price not regulated, retail margin estimated to be similar to regulated retail margin

on petrol

Now for some more detailed explanation of the terminology used above in the graph.

1. Basic Fuel Price (BFP)

The In Bond Landed Cost (IBLC) was first introduced in the 1950s with the establishment of the

first refinery in South Africa, and was previously revised in 1995, when a market spot price

component was introduced. In a world constantly changing, the use of refinery gate prices

posted by international refiners known as postings, has become somewhat anachronistic in world

trade and no longer track international market prices consistently. This has resulted in the IBLC

losing credibility as a reasonable proxy for international fuel prices.

The Basic Fuel Price (BFP) formula has replaced the IBLC formula, with effect from 2 April 2003.

This formula was negotiated in a positive spirit, with government and industry (AMEF & SAPIA)

agreeing on the new pricing formula, maintaining an import parity price structure.

The BFP formula reflects the realistic cost of importing a litre of product from international

refineries with products of a similar quality compared to local South African specifications on a

sustainable basis.

This element changes on the first Wednesday of every month based on the average daily

international price movements and exchange rate fluctuations from the 26

th

of the previous month

the 25

th

of the month preceding the price change.

BFP consists of a number of elements as it is based on import parity, reflecting the cost of what

an actual import of product would cost.

Components include:

Petrol =50% of

Singapore Prices

Diesel &

Kero: 50%

of Arab Gulf

Prices

Petrol, Diesel

& Kero: 50%

of Med Prices

Freight,

Demurrage,

Insurance,

Losses

Landing & wharfage,

Storage & Finance cost

International market spot prices

The largest component of the basic fuels price is the price that one would be paying on

international markets when physically importing product to South Africa. The FOB (Free on ships

board) product prices from different locations in the world, based on international product

availability and product quality, are used. The petrol FOB price is calculated as 50% of the

Mediterranean spot price for Premium unleaded petrol and 50% of the Singapore spot price for

95 Octane unleaded petrol. For the FOB price of Diesel, the new BFP formula use spot prices

calculated as 50% of the Mediterranean price for Gas oil and 50% of the Arab Gulf price for Gas

oil, plus the quoted spot price market premiums applicable.

Freight cost to bring product to South African ports

The freight component of the BFP reflects the cost of voyages from Augusta (in the

Mediterranean), Singapore and Mina-al-Ahmadi (in the Arab Gulf), in 50:50 combinations as

appropriate to the international markets used in the FOB calculations of the products concerned.

Tariffs as published by the World Scale Association for transporting refined products via medium-

range vessels to a weighted average for South African coastal ports, plus demurrage for an

average 35 000 ton vessel for 3 days, adjusted with the Average Freight Rate Assessment

(AFRA) of the London Tanker Brokers Panel, plus a 15% premium for transporting fuels to South

Africa.

Insurance costs

Calculated as 0.15% of the product FOB and freight costs, to cover insurance cost, as well as

other costs such as letters of credit, surveyors and agents fees, and laboratory costs.

Ocean loss allowance

In international petroleum products trading, shipping and insurance, a loss of 0.3% for products

has been accepted as a normal leakage/clingage and evaporation loss. Simply put, this means

that the normal loss is not insurable and has to be accepted by the buyer. The buyer therefore

has a financial loss of 0.3% of FOB, Insurance and Freight costs.

Wharfage

The BFP calculates Wharfage charges in terms of the ruling National Ports Authority of South

Africa contract tariffs for petroleum products, currently being R18,72 per kilo-litre.

Coastal Storage

This element is to cover the cost of providing storage and handling facilities at coastal terminals.

Storage is calculated based on the typical cost of international product storage of $3 per ton per

month for 25 days worth of stock, currently 2.132 SA c/l per month. This cost factor is escalated

annually in accordance with movements in the Producer Price Index as at J une of each year.

Stock Financing Cost

The BFP includes a charge for the financing of 25 days stock at an interest rate of 2 percentage

points below the ruling prime rate of the Standard Bank of South Africa.

The BFP as determined above is converted to SA cents per litre by applying the applicable SA

Rand/US Dollar exchange rate (four banks selling rates at eleven o clock averaged over the

period 26

th

of the previous month to 25

th

of the month before the price change), and a constant

litre per gallon factor of 3.8038 for petrol.

2. Domestic Elements

To arrive at the final pump price in the different pricing zones (magisterial district zones) certain

domestic transport costs, government imposts, or taxes and levies and retail and wholesale

margins needs to be added to the international price.

a. Transport costs (Zone differential)

Keeping in mind the import principle used, this element recovers the cost of transporting

petroleum products from the nearest coastal harbour (Durban, Port Elizabeth, East

London, Mossel Bay or Cape Town) to the inland depot serving the area or zone.

Transport to the different pricing zones are determined by using the most economical

mode of transport i.e. pipelines (C zones), road (B zones) or rail (A zones). This is the

only element which values differ per pricing zone, and is the reason why the petrol price

is not the same for the whole country.

b. Delivery costs (Service differential)

This element compensates marketers for actual depot related costs (storage and

handling) and distribution costs from the depot to the end user at service stations. The

value is calculated on actual historical costs of the previous year, averaged over the

country and industry.

c. Wholesale (Marketing) margin

Money paid to the oil company through whose branded pump the product is sold, to

compensate for marketing activities. This margin is controlled by the government,

allowing for changes based on the oil companies return on their marketing assets.

The formula used to determine the wholesale margin is based on the results of a

cost/financial investigation by a chartered accountant firm into the profitability of the

wholesale marketers. The level of the margin is calculated on an industry basis and is

aimed at granting marketers a return of 15% on depreciated book values of assets, with

allowance for additional depreciation, but before tax and payment of interest.

d. Retail margin

The retail margin is fixed by DME and is determined on the basis of actual costs incurred

by the service station operator in distributing petrol. Account is taken of all proportionate

driveway related costs such as rental, interest, labour, overheads and profit. The way in

which the margin is determined creates an incentive to dealers to strive towards greater

efficiency, to beat the average and to realise a net profit proportionate to their efficiency.

e. Equalisation Fund levy

The statutory fund levy is a fixed monetary levy, and the fund is regulated by ministerial

directives issued by the Minister of Mineral and Energy Affairs in concurrence with the

Minister of Finance, as laid down by the Central Energy Fund Act, No 38 of 1977 as

amended In terms of Ministerial Directives the Fund is principally utilised to smooth out

fluctuations in the price of liquid fuels through slate payments; to afford synfuel producers

tariff protection and to finance the crude oil premium (price differential applicable to SA

oil purchases during the late 1970s).

f. Fuel tax

Tax levied by Government annually adjusted by the Minister of Finance effective from the

price change in April of each year, announced in the Minister of Finance in his annual

budget speech.

g. Customs & Excise levy

A duty collected in terms of the Customs Union agreement.

h. Road Accident Fund (RAF)

The Road Accident Fund receives a fixed value which is used to compensate third party

victims in motor accidents.

i. Slate levy

A levy paid by the motorists recovering money owed to the oil companies, due to the

time delay in the adjustment of the petrol pump price.

You may now have a number of questions including:

Who set the price and control it?

The petrol retail price is regulated by government, and changed every month on the first

Wednesday of the month. The calculation of the new price is done by Central Energy Fund

(CEF) on behalf of the Department of Minerals and Energy (DME).

As the BFP is used by the government as the transfer price between refining and marketing in the

price build-up for petrol retail price control, South African refineries are price-takers. Neither the

local refineries nor the government has any control over changes in this element, as it is based

on international petrol prices. It also means that South African refineries have to compete with

very large and efficient international refineries, based in Singapore, the Mediterranean and the

Arabian Gulf.

Margin and transport element changes are based on actual cost incurred by the South African

industry and are calculated according to specific formula ensuring efficiency in operations. These

changes have to be approved by the Minister of Minerals and Energy before it is allowed into the

price.

What drives international petrol prices?

Essentially, prices are driven by supply and demand for petrol in a particular market. Additionally

crude oil prices have a major effect on the petrol prices. A crude oil refinerys biggest input cost

is crude oil. In order for a refinery to make a profit, the price for the product manufactured from

crude oil has to be higher than that of the crude oil price. When crude oil prices increase as

they have over the past number of months the petrol price must increase so that crude oil

refineries are able to cover their own costs.

While the above scenario is relevant to Natref, crude oil prices do not influence Sasol Synfuels

because their input cost is that of coal. The capital cost of Sasol Synfuels is however, much

higher than that of a conventional crude oil refinery.

Because both crude oil and international petrol prices are dollar-based, any weakening of the SA

rand / US dollar exchange rate will also increase the domestic petrol price.

Why did crude oil prices begin to increase again?

Oil prices started to increase because of low levels of availability. This decrease in oil supply

resulted from a number of OPEC (Organisation of Petroleum Export Countries) agreements to

limit oil production. The situation has been exacerbated by a strong demand for petrol in the

United States driven by people preferring to drive instead of flying, after the September tragedy

of 2001 and extremely low stock inventories of crude oil and petroleum products worldwide.

There after the war between the US and Iraq has led to a war premium been added to the price

of crude oil by oil traders on the international markets. More recently low inventories couple

together with the MTBE ban in the US is pushing up prices in anticipation of possible product

shortages.

What effect does the petrol price have on Sasols business?

Depending on the increase in the petrol price relative to crude oil, the impact of the higher petrol

price on Natref could be negative, neutral or positive. For SSF a rise will always be positive and

a decline negative.

Why are the Sasol branded fuel not cheaper, being a local company producing fuel from

coal?

Sasol Synfuels produce about 30% of the countrys fuel from coal, the rest on the petrol are

produced in conventional crude refineries having to import crude oil and refine it into petrol.

SSF produced petrol, are also subjected to petrol retail price control as stipulated in the

Petroleum Products Act, and we therefore cannot sell it at a price different to the regulated retail

price. This petrol price regulation means that the petrol pump price at all service stations in a

pricing area must be the same, and no discounting is allowed.

Why dont Sasol employees get fuel cheaper?

The Petroleum Products Act, Number 120 of 1977, forms the basis for retail petrol price control.

In terms of regulations issued under this act, it is not allowed to give discounts in any form what

so ever on petrol volumes sold to end-consumers.

Why dont Government deregulate the oil industry, surely this will result in lower prices if

local market forces are allowed to determine the price?

In the White Paper on the Energy Policy of South Africa, Government has indicated that it

believes it to best for the liquid fuels industry to operate in an environment of minimum

governmental intervention and regulation. We agree with Government and acknowledge that

they first need to achieve the socio-economic milestones as described in the white paper, before

the oil industry can be deregulated.

The import pricing principle is an arms-length market related approach used by most countries

worldwide and is a system that benefits the consumer. It ensure that local refineries compete

with international state of the art refineries, ensuring cost efficiency and astute crude acquisition

strategies to ensure survival in a volatile and competitive environment eliminating domestic

inflationary pressures.

The graph below illustrates the rising trend in the petrol pump price over the last number of years.

As from 1999 it is clear that the petrol price has not increased with the same magnitude than the

crude oil price. This is clearly an indication of the current import pricing mechanisms benefits. It

forces the South African refiners to operate at the same efficiency as international refineries.

Crude (SA c/l ) vs. Pump Pri ce 93 Octane Leaded (Coast)

0.0

50.0

100.0

150.0

200.0

250.0

300.0

350.0

400.0

450.0

500.0

M

a

r

-

9

0

M

a

r

-

9

1

M

a

r

-

9

2

M

a

r

-

9

3

M

a

r

-

9

4

M

a

r

-

9

5

M

a

r

-

9

6

M

a

r

-

9

7

M

a

r

-

9

8

M

a

r

-

9

9

M

a

r

-

0

0

M

a

r

-

0

1

M

a

r

-

0

2

M

a

r

-

0

3

M

a

r

-

0

4

M

a

r

-

0

5

S

a

c

/

l

Crude Price

Pump Price

What will happen next month or year to the prices?

It is difficult to predict as one will have to make assumptions regarding the US dollar SA rand

exchange rate, world crude oil demand and what OPEC is willing to supply, world consumer

demand for petrol and the ability of international refiners to supply petrol to the market.

Comparing the South African petrol pump prices with prices in various other countries during

2003, has revealed that South African prices compares favourable with the rest of the world.

Internati onal Petrol Pri ces - March 2005

0.0

20.0

40.0

60.0

80.0

100.0

120.0

140.0

160.0

USA Canada South

Africa

J apan Spain France Germany Italy UK

U

S

c

/

l

Tax

Excl Tax

We understand the impact of the high petrol prices on consumers as it impacts on the whole

South African economy and we sympathise with consumers. However, we must congratulate the

South African Government, working towards the achievement of socio-economic objectives,

whilst also managing to achieve an international competitive price.

You might also like

- Pricing Strategy RefineryDocument13 pagesPricing Strategy RefineryAnuj GuptaNo ratings yet

- Pricebuildup DieselDocument2 pagesPricebuildup Dieselgundogan21No ratings yet

- JET FUEL PRICING IMPACT ON INDIA'S CIVIL AVIATION INDUSTRYDocument26 pagesJET FUEL PRICING IMPACT ON INDIA'S CIVIL AVIATION INDUSTRYIndradeep DasNo ratings yet

- Petroleum Product Pricing MechanismDocument20 pagesPetroleum Product Pricing MechanismSonu PatelNo ratings yet

- Nigerian Oil SectorDocument52 pagesNigerian Oil SectorYusuf AdamuNo ratings yet

- Republic Act 8479 and 6361Document16 pagesRepublic Act 8479 and 6361MayAnn SisonNo ratings yet

- Pricebuildup Dom LPGDocument2 pagesPricebuildup Dom LPGgracious007No ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument10 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledErica EncaboNo ratings yet

- Kerosene LPG Pricing IndiaDocument4 pagesKerosene LPG Pricing IndiaAshish MahapatraNo ratings yet

- Global oil and gas tax guide overviewDocument14 pagesGlobal oil and gas tax guide overviewmuki10No ratings yet

- LPG/Propane Price Review ProcessDocument7 pagesLPG/Propane Price Review ProcessBudiarso BudiarsoNo ratings yet

- Investment and Decision Analysis For Petroleum ExplorationDocument24 pagesInvestment and Decision Analysis For Petroleum Explorationsandro0112No ratings yet

- Terms of ReferenceDocument5 pagesTerms of Referencekateerine08No ratings yet

- CHAPTER NINETEEN - Refinery Operating Cost - 2003 - Refining Processes HandbookDocument10 pagesCHAPTER NINETEEN - Refinery Operating Cost - 2003 - Refining Processes HandbookSơn PhanThanhNo ratings yet

- Spring 2022 - MGT605 - 2Document2 pagesSpring 2022 - MGT605 - 2Usman GhaniNo ratings yet

- SA retail fuel industry structureDocument9 pagesSA retail fuel industry structureRorisang365No ratings yet

- Nigeria's Government Considers Petroleum Industry Bill 2020, A New Framework For The Oil and Gas SectorDocument6 pagesNigeria's Government Considers Petroleum Industry Bill 2020, A New Framework For The Oil and Gas Sectorpradeep s gillNo ratings yet

- ANNEXURE A BFP Version2017Document12 pagesANNEXURE A BFP Version2017Breitz GroupNo ratings yet

- 2009 October Rating Methodology Oil CoDocument8 pages2009 October Rating Methodology Oil Cohitesh185No ratings yet

- New Bunker Adjustment Factor (BAF) : Customer AdvisoryDocument4 pagesNew Bunker Adjustment Factor (BAF) : Customer AdvisoryJulius Eric PajarilloNo ratings yet

- IOC Risk Management Policy for Hedging Oil InventoriesDocument10 pagesIOC Risk Management Policy for Hedging Oil InventoriesAditya VermaNo ratings yet

- VCS-Publish-PRN 002Document40 pagesVCS-Publish-PRN 002Ndee PitsiNo ratings yet

- Refinery Operating Cost: Chapter NineteenDocument10 pagesRefinery Operating Cost: Chapter NineteenJuan Manuel FigueroaNo ratings yet

- Administrative Pricing Mechanism (APM)Document14 pagesAdministrative Pricing Mechanism (APM)Amber Chourasia50% (2)

- Refining GRMDocument12 pagesRefining GRMVivek GoyalNo ratings yet

- Africa Oil and Gas GuideDocument205 pagesAfrica Oil and Gas Guidekalite123No ratings yet

- Oil and GasDocument14 pagesOil and GasTarun N. O'Brain GahlotNo ratings yet

- Day1 - 06 - Ramona Volciuc-Ionescu - Volvic-Ionescu SCADocument21 pagesDay1 - 06 - Ramona Volciuc-Ionescu - Volvic-Ionescu SCAaegean227No ratings yet

- Parliamentary Report On Oil Supply in ZambiaDocument38 pagesParliamentary Report On Oil Supply in ZambiaChola MukangaNo ratings yet

- Indian Automobile SWOT Analysis Strengths WeaknessesDocument40 pagesIndian Automobile SWOT Analysis Strengths WeaknessesAtul BansalNo ratings yet

- Republic Act No. 8479Document13 pagesRepublic Act No. 8479Charmaine Teodoro ParejaNo ratings yet

- Petroleum Subsidies: A Case Against SubsidiesDocument25 pagesPetroleum Subsidies: A Case Against Subsidiesanmol_bajajNo ratings yet

- DEPB SchemeDocument4 pagesDEPB SchemeHarshada PawarNo ratings yet

- Export Promotion SchemesDocument45 pagesExport Promotion Schemesasifanis100% (1)

- Oil & Gas PSC Cost RecoveryDocument1 pageOil & Gas PSC Cost RecoveryrinaghaniNo ratings yet

- Importance of Quality Control and Market AcceptanceDocument19 pagesImportance of Quality Control and Market AcceptanceM Sanjid AnwarNo ratings yet

- To Remove Anormalies PDFDocument3 pagesTo Remove Anormalies PDFAnzaarNo ratings yet

- Lesson 3-Tariff 4Document30 pagesLesson 3-Tariff 4pm6ph862gmNo ratings yet

- 1996.3.27 RA 8180 Oil Industry Deregulation Act of 1996Document5 pages1996.3.27 RA 8180 Oil Industry Deregulation Act of 1996Jasmine NatividadNo ratings yet

- Central Excise & Customs: Salient Features of Budgetary ChangesDocument5 pagesCentral Excise & Customs: Salient Features of Budgetary ChangesYunus ShaikhNo ratings yet

- Arl Internship ReportDocument19 pagesArl Internship ReportChaudhry RashidNo ratings yet

- Oil Deregulation LawDocument13 pagesOil Deregulation LawChristine ErnoNo ratings yet

- Guidelines on Philippine Downstream Oil Industry ReportsDocument65 pagesGuidelines on Philippine Downstream Oil Industry ReportsLoren SanapoNo ratings yet

- 113 2011 ND-CP 134727Document4 pages113 2011 ND-CP 134727Lê Bảo NgọcNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument11 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledSwitle Mae TamangNo ratings yet

- Pricing of Products in GAILDocument32 pagesPricing of Products in GAILSimmi SharmaNo ratings yet

- Train Law QuestionsDocument14 pagesTrain Law QuestionsGilleane100% (2)

- Foreign Trade Policy ObligationsDocument8 pagesForeign Trade Policy ObligationsAmol UjawaneNo ratings yet

- Covid 19Document11 pagesCovid 19namratagadkari03No ratings yet

- 1336507-15-15 - Petroleum Market UpdateDocument3 pages1336507-15-15 - Petroleum Market UpdaterichardkwofieNo ratings yet

- C CC CCCCC CCCC C CCC C CCCCCCCC C!CCDocument10 pagesC CC CCCCC CCCC C CCC C CCCCCCCC C!CCravi_umang2001No ratings yet

- Modvat and CenvatDocument3 pagesModvat and CenvatpravinsankalpNo ratings yet

- Cost Analysis of Oil Industry in IndiaDocument12 pagesCost Analysis of Oil Industry in IndiaAashir AgrawalNo ratings yet

- EpcgDocument9 pagesEpcgAshfaque KhanNo ratings yet

- Crude PricingDocument17 pagesCrude PricingAkshay MathurNo ratings yet

- Oil Industry Glossary OpisDocument40 pagesOil Industry Glossary OpisGadhoumiWalidNo ratings yet

- Reaching Zero with Renewables: Biojet FuelsFrom EverandReaching Zero with Renewables: Biojet FuelsNo ratings yet

- Fuel Pumps & Fuel Tanks (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandFuel Pumps & Fuel Tanks (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesFrom EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesNo ratings yet

- How To Apply For A VisaDocument4 pagesHow To Apply For A VisatrnemoNo ratings yet

- Hub Map 0914Document1 pageHub Map 0914trnemoNo ratings yet

- StickmanDocument1 pageStickmantrnemoNo ratings yet

- High Alt CookDocument3 pagesHigh Alt CooktrnemoNo ratings yet

- Railsback UnConventionalReservoirs&HCs01Document1 pageRailsback UnConventionalReservoirs&HCs01trnemoNo ratings yet

- Well Testing SpeDocument5 pagesWell Testing Speiqbalpec12345No ratings yet

- Well Testing SpeDocument5 pagesWell Testing Speiqbalpec12345No ratings yet

- Petr 2013Document2 pagesPetr 2013trnemoNo ratings yet

- Railsback UnConventionalReservoirs&HCs01Document1 pageRailsback UnConventionalReservoirs&HCs01trnemoNo ratings yet

- Unit Systems 2002Document33 pagesUnit Systems 2002Mohamed AlaaNo ratings yet

- WTA Notes SummaryDocument1 pageWTA Notes SummarytrnemoNo ratings yet

- 9DAYDETOXDocument5 pages9DAYDETOXtrnemoNo ratings yet

- Grainless BreadDocument2 pagesGrainless BreadtrnemoNo ratings yet

- Almond Meal PancakesDocument1 pageAlmond Meal PancakestrnemoNo ratings yet

- Nexa BrochureDocument12 pagesNexa BrochureSuDoku100% (1)

- Thesis LaraDocument6 pagesThesis LaraLara LaranceNo ratings yet

- Project Report in JSWDocument44 pagesProject Report in JSWmohd arif khan71% (14)

- Utility Daniel WodajoDocument91 pagesUtility Daniel WodajogezahegnNo ratings yet

- Global Project ManagementDocument56 pagesGlobal Project ManagementNabila KhanNo ratings yet

- Single Stage Configuration: Water Evaporation CapacityDocument4 pagesSingle Stage Configuration: Water Evaporation CapacityugandaNo ratings yet

- Reliance IndustriesDocument9 pagesReliance IndustriesNaveenkumar YerawarNo ratings yet

- Himsen Cat h2533Document12 pagesHimsen Cat h2533Mohsen50% (2)

- Ideals Vs PsalmDocument2 pagesIdeals Vs PsalmJesse Nicole Santos100% (1)

- 302 E. Carson Marketing FlyerDocument2 pages302 E. Carson Marketing Flyercassie_cataniaNo ratings yet

- All BDocument146 pagesAll BChristian Joshua TalaveraNo ratings yet

- Oil DA - MichiganClassic 2013Document254 pagesOil DA - MichiganClassic 2013deabtegoddNo ratings yet

- Gas Flow Meter Calibrator - 1500 Liter Per MinDocument1 pageGas Flow Meter Calibrator - 1500 Liter Per Minajimon 00971No ratings yet

- Chapter 2Document16 pagesChapter 2Aly AshrafNo ratings yet

- 2-A-GNLW363CD Standard Decanter CentrifugeDocument6 pages2-A-GNLW363CD Standard Decanter CentrifugeGeorgeNo ratings yet

- Design and Fabrication of Safety Stand For Two WheelersDocument4 pagesDesign and Fabrication of Safety Stand For Two WheelersVishwas ShettyNo ratings yet

- Đánh Giá Phần Mềm Quản Lý Bất Động SảnDocument67 pagesĐánh Giá Phần Mềm Quản Lý Bất Động SảnNguyễn Thế PhongNo ratings yet

- XE70 Fan-Coil Thermostats Control SpecsDocument4 pagesXE70 Fan-Coil Thermostats Control Specsoutlander2008No ratings yet

- Flyback SMPS Design GuideDocument16 pagesFlyback SMPS Design GuideRevathy100% (1)

- TD Esc 03 de en 15 048 Rev001 Electrical SiteworksDocument19 pagesTD Esc 03 de en 15 048 Rev001 Electrical SiteworksarhipadrianNo ratings yet

- TCB Role Measurement CalibarationDocument68 pagesTCB Role Measurement CalibarationRidhWanNo ratings yet

- Energy Auditing: Tool To Increase Energy EfficiencyDocument52 pagesEnergy Auditing: Tool To Increase Energy EfficiencywahyuNo ratings yet

- Mehods To Initiate VenturesDocument29 pagesMehods To Initiate VenturesAngelie AnilloNo ratings yet

- Parking Recap Form October 2018Document39 pagesParking Recap Form October 2018OffNo ratings yet

- BrahmaDocument4 pagesBrahmamegaciclonNo ratings yet

- (Silakan Diubah Jika Tidak Sesuai) - Sertakan Screenshot Jika PerluDocument56 pages(Silakan Diubah Jika Tidak Sesuai) - Sertakan Screenshot Jika Perlufaishal idrisNo ratings yet

- Proceedings of National Seminar On Etdg-12Document189 pagesProceedings of National Seminar On Etdg-12Ayush SagarNo ratings yet

- GSPLDocument22 pagesGSPLdurgeshrpNo ratings yet

- Industrial Training ReportDocument47 pagesIndustrial Training ReportMohd Izdiharudin Ibrahim50% (4)

- Heavy Trucks Buses Catalogue Eng Tcm795-1611335Document72 pagesHeavy Trucks Buses Catalogue Eng Tcm795-1611335chuydb0% (1)