Professional Documents

Culture Documents

Adjudication Order in Respect of Praveen Poddar in The Matter of M/s Gangotri Textiles Limited

Uploaded by

Shyam Sunder0 ratings0% found this document useful (0 votes)

24 views27 pagesThe shares of Gangotri are listed on the BSE Limited, National Stock Exchange, Calcutta Stock Exchange, Madras Stock Exchange and Coimbatore Stock Exchange. During the investigation period the scrip was traded only at NSE and BSE. The highest price during this period was 52. (intra day high on February 6, 2006) and lowest price during this time was 58. (intera day low on May 31, 2006).

Original Description:

Original Title

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe shares of Gangotri are listed on the BSE Limited, National Stock Exchange, Calcutta Stock Exchange, Madras Stock Exchange and Coimbatore Stock Exchange. During the investigation period the scrip was traded only at NSE and BSE. The highest price during this period was 52. (intra day high on February 6, 2006) and lowest price during this time was 58. (intera day low on May 31, 2006).

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views27 pagesAdjudication Order in Respect of Praveen Poddar in The Matter of M/s Gangotri Textiles Limited

Uploaded by

Shyam SunderThe shares of Gangotri are listed on the BSE Limited, National Stock Exchange, Calcutta Stock Exchange, Madras Stock Exchange and Coimbatore Stock Exchange. During the investigation period the scrip was traded only at NSE and BSE. The highest price during this period was 52. (intra day high on February 6, 2006) and lowest price during this time was 58. (intera day low on May 31, 2006).

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 27

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 1 of 27 August 27, 2014

BEFORE THE ADJUDICATING OFFICER

SECURITIES AND EXCHANGE BOARD OF INDIA

[ADJUDICATION ORDER NO. JJ/AK/AO-113/2014]

UNDER SECTION 15-I OF SECURITIES AND EXCHANGE BOARD OF INDIA

ACT, 1992 READ WITH RULE 5 OF SEBI (PROCEDURE FOR HOLDING

INQUIRY AND IMPOSING PENALTIES BY ADJUDICATING OFFICER) RULES,

1995

In respect of

Praveen Poddar

(PAN No. AAVPP5645D)

In the matter of Gangotri Textiles Limited

FACTS OF THE CASE IN BRIEF

1. Securities and Exchange Board of India (hereinafter referred to as SEBI)

conducted investigation in respect of buying, selling and dealing in the

shares of Gangotri Textiles Limited (hereafter referred to as

Gangotri/Company/scrip), during the period from April 07, 2006 to

May 31, 2006 (hereinafter referred to as Investigation Period). The

shares of Gangotri are listed on the BSE Limited (hereinafter referred to as

BSE), National Stock Exchange (hereinafter referred to as NSE),

Calcutta Stock Exchange, Madras Stock Exchange and Coimbatore Stock

Exchange, but during the investigation period the scrip was traded only at

NSE and BSE.

Price-Volume Analysis:

2. Before Investigation Period (January 2006 to April 6, 2006): It was observed

that the scrip of Gangotri was not listed in NSE during January 2006 to April

6, 2006 and it was only traded in BSE. The highest price during this period

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 2 of 27 August 27, 2014

was ` 52.25 (intra day high on February 6, 2006) and lowest price during

this period was ` 40.55 (intra day low on March 28, 2006). The average

daily traded quantity during this period was for 77,036 shares.

3. During Investigation Period (April 7, 2006 to May 31, 2006): The scrip of

Gangotri was traded in both NSE & BSE. Details of price volume data at

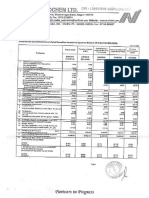

BSE & NSE for the period April 07, 2006 to May 31, 2006 are as follows:-

It was observed that during investigation period the price of the scrip

went up by 33.24% in BSE and 26.88% in NSE while the Sensex

recorded a decrease of 12.21% (from 11845.13 on April 07, 2006 to

10398.61 on May 31, 2006) and Nifty recorded a decrease of 12.89%

(from 3525.6 on April 07, 2006 to 3071.05 on May 31, 2006).

The price of the scrip mainly increased from April 20, 2006 to May 05,

2006, i.e. during these 12 trading days, the price of the scrip has

increased from ` 41.2 / 43 (NSE/BSE) on April 19, 2006 to

`71.05/70.95 (NSE/BSE) on May 05, 2006 a rise of 72.45%/65%

(NSE/BSE) along with volume spurt.

As on March 06, 2013 the price of the scrip at NSE and BSE was

`2.55 and `2.24 respectively.

4. After Investigation Period (June 2006 to December 2006): The scrip of

Gangotri was opened at `45.95 / 45.2 (NSE/BSE) on June 1, 2006 and

closed at `27.35 / 26.7 (NSE/BSE) on December 29, 2006. The highest

price during this period was `46.25 in (intra day high on June 2, 2006) in

NSE and `46.65 (intra day high on June 5, 2006) in BSE. The lowest price

Exchange Open High Low Close Volume Average

Daily

Volume

BSE 53.25

April 07, 2006

70.95

May 05, 2006

43.00

April 19, 2006

44.35

May 31, 2006

8941975 241675

NSE 56.00

April 07, 2006

71.05

May 05, 2006

41.25

April 19, 2006

45.40

May 31, 2006

6816750 184236

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 3 of 27 August 27, 2014

during this period was `24 (intra day low on December 13, 2006) in both

NSE and BSE. The average daily traded quantity during this period was for

34,080 / 43,717 (NSE/BSE) shares.

5. The role of the entities who had traded in the scrip of Gangotri was

scrutinized. It was observed during the investigation period that certain

entities collectively referred to as Vishvas Group namely, Sunita Gupta

(hereinafter referred to as "Sunita"), Purshottam Khandelwal (hereinafter

referred to as "Purshottam") Cosmo Corporate Services Limited

(hereinafter referred to as "Cosmo"), Ishita Finstock Limited (hereinafter

referred to as "Ishita"), Master Finlease Limited (hereinafter referred to as

"Master"), Avisha Credit capital Limited (hereinafter referred to as

"Avisha"), Vishvas Projects Limited (hereinafter referred to as "VPL"),

Praveen Poddar (hereinafter referred to as "Praveen"), Quantum Global

Securities and Leasing Company Limited (hereinafter referred to as

Quantum), Mefcom Securities Limited (hereinafter referred to as

Mefcom ), ISF Securities Ltd (hereinafter referred to as ISF), Vishvas

Securities Limited (hereinafter referred to as VSL), Anupama

Communications Private Limited (hereinafter referred to as Anupama)

and SIC Stock Brokers and Services Private Limited (hereinafter referred to

as SIC) had allegedly executed synchronized trades, circular trades and

reversal trades among themselves and traded in significant variation to the

Last Traded Price (LTP) in the shares of Gangotri.

6. It was alleged that one of the entity, Mr. Praveen Poddar (hereinafter

referred to as "Praveen"/"Noticee") had violated the provisions of section

12A(a), 12A(b), 12A(c) of Securities and Exchange Board of India Act, 1992

(hereinafter referred to as "SEBI Act") and Regulations 3(a), 3(b), 3(c),

3(d), 4(1), 4(2)(a) and 4(2)(e) of SEBI (Prohibition of Fraudulent and Unfair

Trade Practices relating to Securities Markets) Regulations, 2003

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 4 of 27 August 27, 2014

(hereinafter referred to as PFUTP Regulations) and therefore, liable for

monetary penalty under section 15HA of SEBI Act.

APPOINTMENT OF ADJUDICATING OFFICER

7. Shri Piyoosh Gupta was appointed as Adjudicating Officer, vide order dated

August 08, 2013 under section 15-I of Securities and Exchange Board of

India Act, 1992 (hereinafter referred to as SEBI Act) and rule 3 of SEBI

(Procedure for Holding Inquiry and Imposing Penalties by Adjudicating

Officer) Rules, 1995 (hereinafter referred to as Rules) to enquire into and

adjudge under section 15HA of the SEBI Act for the alleged violations of

provisions of section 12A(a), 12A(b), 12A(c) of SEBI Act and Regulations

3(a), 3(b), 3(c), 3(d), 4(1), 4(2)(a) and 4(2)(e) of PFUTP Regulations by

Praveen. Consequent, to the transfer of Shri Piyoosh Gupta, the

undersigned was appointed as Adjudicating Officer vide order dated

November 08, 2013 to enquire and adjudge the matter

SHOW CAUSE NOTICE, HEARING AND REPLY

8. Show Cause Notice reference no. EAD/JJ/AK/32192/2013 dated

December 12, 2013 (hereinafter referred to as SCN) was issued to the

Noticee under rule 4(1) of the Rules to show cause as to why an inquiry

should not be held against the Noticee and penalty be not imposed under

section 15HA of SEBI Act for the alleged violations specified in the said

SCN. The said SCN was sent at the last known address of the Noticee i.e.

at "308 Skipper Corner, 88 Nehru Place, New Delhi - 110019" which was

returned undelivered. Thereafter, as per rule 7(c) of the Rules the said SCN

dated December 12, 2013 was affixed at the last known address of the

Noticee on March 07, 2014 (affixture report is present on record). Form the

documents available on record, it is observed that the Noticee had not

submitted any reply to the SCN.

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 5 of 27 August 27, 2014

9. In the interest of natural justice and in order to conduct an inquiry as per

rule 4(3) of the Rules, the Noticee was granted an opportunity of personal

hearing on August 26, 2014 at SEBI, Head Office, Mumbai, vide notice

dated August 07, 2014. The said Notice of hearing dated August 07, 2014

was affixed at the last known address of the Noticee on August 13, 2014

(affixture report is present on record). However, it is observed that the

Noticee have neither submitted any reply nor did it avail the opportunity of

personal hearing.

10. In view of the aforesaid steps taken, I am convinced that opportunities have

been given to the Noticee to explain its case. As per rule 4(7) of the Rules,

if any person fails, neglects or refuses to appear as required by sub-rule (3)

before the Adjudicating Officer, he may proceed with the inquiry in the

absence of such person after recording the reasons therefor. Despite

having been given the opportunity of being heard, the Noticee had failed to

avail of the same. I am, therefore, compelled to proceed with the matter ex-

parte based on the material available on record.

CONSIDERATION OF ISSUES AND FINDINGS

11. After perusal of the material available on record, the issues that arise for

consideration in the present case are as under:

A. Whether the Noticee have violated the provisions of section 12A(a),

12A(b), 12A(c) of SEBI Act and Regulations 3(a), 3(b), 3(c), 3(d), 4(1),

4(2)(a) and 4(2)(e) of PFUTP Regulations?

B. Whether the Noticee is liable for monetary penalty under section 15HA

of the SEBI Act ?

C. What quantum of monetary penalty should be imposed on the Noticee

taking into consideration the factors mentioned in Section 15J of SEBI

Act ?

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 6 of 27 August 27, 2014

FINDINGS

12. On perusal of the material available on record and giving regard to the facts

and circumstances of the case, I record my findings hereunder:

ISSUE 1: Whether the Noticee have violated the provisions of section

12A(a), 12A(b), 12A(c) of SEBI Act and Regulations 3(a), 3(b),

3(c), 3(d), 4(1), 4(2)(a) and 4(2)(e) of PFUTP Regulations?

13. Before moving forward, it will be appropriate to refer to the relevant

provisions of SEBI Act and PFUTP Regulations, which read as under:

SEBI Act

Prohibition of manipulative and deceptive devices, insider trading and

substantial acquisition of securities or control.

Section 12A. No person shall directly or indirectly

(a) use or employ, in connection with the issue, purchase or sale of any

securities listed or proposed to be listed on a recognized stock

exchange, any manipulative or deceptive device or contrivance in

contravention of the provisions of this Act or the rules or the

regulations made thereunder;

(b) employ any device, scheme or artifice to defraud in connection with

issue or dealing in securities which are listed or proposed to be listed

on a recognised stock exchange;

(c) engage in any act, practice, course of business which operates or

would operate as fraud or deceit upon any person, in connection with

the issue, dealing in securities which are listed or proposed to be listed

on a recognised stock exchange, in contravention of the provisions of

this Act or the rules or the regulations made thereunder;

PFUTP Regulations

Regulation 3: - Prohibition of certain dealings in securities

3. No person shall directly or indirectly

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 7 of 27 August 27, 2014

(a) buy, sell or otherwise deal in securities in a fraudulent manner;

(b) use or employ, in connection with issue, purchase or sale of any

security listed or proposed to be listed in a recognized stock exchange,

any manipulative or deceptive device or contrivance in contravention of

the provisions of the Act or the rules or the regulations made

thereunder;

(c) employ any device, scheme or artifice to defraud in connection with

dealing in or issue of securities which are listed or proposed to be listed

on a recognized stock exchange;

(d) engage in any act, practice, course of business which operates or would

operate as fraud or deceit upon any person in connection with any

dealing in or issue of securities which are listed or proposed to be listed

on a recognized stock exchange in contravention of the provisions of the

Act or the rules and the regulations made thereunder.

Regulation 4:-Prohibition of manipulative, fraudulent and unfair trade practices

(1) Without prejudice to the provisions of regulation 3, no person shall indulge in

a fraudulent or an unfair trade practice in securities.

(2) Dealing in securities shall be deemed to be a fraudulent or an unfair trade

practice if it involves fraud and may include all or any of the following,

namely:-

(a) indulging in an act which creates false or misleading appearance of

trading in the securities market;

(b) ..

(c) ..

(d) ..;

(e) any act or omission amounting to manipulation of the price of a

security;

Connections between Vishvas Group entities:

14. From the documents available on records, following details were observed

with respect to the connection between Vishvas Group entities:

Sr.

No

Entity Name

(Brokers Name)

Connection with other entities of

Group

Traded Qty. (During

Investigation Period)

1 Master Finlease Ltd.

(Integrated Master

securities Pvt. Ltd.)

Same address as Avisha Credit

Capital & Vishvas Projects Ltd.

(Mefcom Agro. Industries Ltd.)

Share holder in Vishvas

securities Ltd. (Unlisted

Company - 19.24%

shareholding as on 30.09.2006)

BSE: Buy-38000

Sell-18386

NSE: Buy-20500

Sell-111400

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 8 of 27 August 27, 2014

Off market transfers with

Vishvas Securities limited.

2 Purshottam Khandelwal

(SIC Stock and Services

Pvt. Ltd.)

Off Market Transfers from

Anupama Communications Pvt.

Ltd.

Entered into Synchronized

trades with entities at sr. no. 8,

9.

BSE: Buy 2927835

Sell 2882486

NSE:-Buy-NIL

Sell-NIL

3 Anupama Communications

Pvt. Ltd.

Transferred shares off market

to Purshottam Khandewal.

Directors of Anupama

Communications Pvt. Ltd. (

Rakesh Mishra, Ram dutt joshi)

are also directors in Cosmo

corporate services Ltd.

Nil Trading at BSE &

NSE

4 Cosmo Corporate services

limited.

(Integrated Master

securities Ltd.)

Entered into Off Market

Transfers with Master Finlease

Ltd.

Entered into Synchronized

trades with entities at sr. no.

6,7,8,9.

BSE:Buy-445643

Sell-320630

NSE:Buy-401520

Sell-471184

5 ISF Securities limited

(BSE:-Sam Global

Securities Ltd.

NSE:-ISF Securities Ltd.)

Off Market Transfers from

Master Finlease Ltd.

Entered into Synchronized

trades with entities at sr. no.

6,7,8,9.

BSE:Buy-389748

Sell-338795

NSE:Buy-453396

Sell-368574

6 Quantum Global Securities

and leasing company Ltd.

Entered into Synchronized

trades with entities at sr. no. 4,

5, 7, 10, and 12.

BSE: Buy-NIL

Sell-NIL

NSE:Buy-302095

Sell-286835

7 Ishita Finstock Ltd.

(Vishvas securities Ltd.)

Entered into large no. of

Synchronized trades with

entities at sr. no. 1, 4, 5, 6, and

10.

BSE: Buy-NIL

Sell-NIL

NSE:Buy1953803

Sell-1569204

8 Praveen Poddar

(TCP Stock Brokers Ltd)

Entered into large no. of

Synchronized trades with

entities at sr. no. 2, 4, 5, 9 and

10.

BSE:Buy-460990

Sell-460990

NSE:-Buy-NIL

Sell-NIL

9 Sunita Gupta

(Parasram Holdings)

Entered into large no. of

Synchronized trades with

entities at sr. no. 2, 4, 5, 8 and

10.

BSE:Buy-342246

Sell-342246

NSE:-Buy-NIL

Sell-NIL

10 Mefcom Securities limited

(Mefcom Securities limited)

Same address, same e-mail Id,

same director (Vijay Mehta) as

of Mefcom infrastructure project

Limited. And director (vijay

mehta) belongs to promoter

group of Vishvas Projects Ltd.

(Formerly Known as Mefcom

agro Industries Ltd.)

BSE:Buy-443942

Sell-348370

NSE:Buy-610646

Sell-667122

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 9 of 27 August 27, 2014

11 Avisha Credit capital Ltd.

(Shriram Insight Share

Brokers Ltd.)

Holder of 25% stake in Vishvas

Sec Ltd. (Unlisted Co.) 337380

Shares as on 30.09.2006.

Same address as Vishvas

projects Ltd. (mefcom Agro

Industries Ltd.) & Master

Finlease Ltd.

Directors of Avisha Credit

Capital Ltd.( Shubha Jhindal,

Vijay Jhindal, & Rakesh

Agarwal) are also directors in

Master Finlease Ltd.

BSE: Buy-50000

Sell-NIL

NSE:-Buy-NIL

Sell-NIL

12 Vishvas Securities Ltd.

(Vishvas Securities Ltd.)

Old Address of Mefcom Agro

Industries Limited same as

address of Vishvas Securities

Ltd. i.e. 912, Kailash Building,

Kasturba Gandhi Marg, New

Delhi".

Off market transfer to Master

Finlease Ltd., SIC Stock and

Services Pvt. Ltd. (8/7/2006,

50000 shares) and Avisha

Credit Capital Ltd.

Avisha Credit capital Ltd. and

Master Finlease Ltd. were the

shareholders of Vishvas

Securities Ltd. as on

30.9.2006.(Unlisted Co.)

Atul Joshi one of the director of

Vishvas Securities Ltd. is also

director in Mefcom Agro

Industries Ltd.

BSE: Buy-NIL

Sell-NIL

NSE:Buy-134460

Sell-118661

13 Vishvas Projects limited

(Formerly Known as

Mefcom Agro Industries

Ltd.

(Mefcom Securities Ltd)

Same address as Avisha Credit

Capital & Master Finlease.

BSE:Buy-100000

Sell-NIL

NSE:-Buy-NIL

Sell-NIL

14 SIC Stocks and Services

Pvt. Ltd.

Received 50,000 shares from

Vishvas Securities Ltd. through

off market.

Holding 10.7% shares in

Mefcom Agro Industries Ltd.

(listed company) as on

20/9/2006.

Transfer of substantial amount

to avisha credit capital Limited

as per bank statements.

NIL Trading at BSE &

NSE

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 10 of 27 August 27, 2014

From the above table I find the following:

The members of Vishvas Group namely, Purshottam, Ishita, Cosmo,

Praveen, Sunita, Master, Quantum, VPL, Avisha, Mefcom, ISF, VSL,

Anupama and SIC are connected to each other.

Noticee had traded through broker TCP Stock Brokers Limited

(hereinafter referred to as "TCP") in the scrip of Gangotri at BSE.

15. Traded quantity of Vishvas Group at BSE and NSE (During Investigation

Period)

From the above table I find the following:

Nine members of Vishvas Group namely, Master, Purshottam,

Cosmo, ISF, Praveen, Sunita, Mefcom, Avisha and VPL had traded

in the scrip of Gangotri at BSE.

Sr.

No.

Members of

Vishvas Group

Traded quantity (During Investigation Period)

BSE NSE

Buy Sell Buy Sell

1 Master

38000 18386 20500 111400

2 Purshottam

2927835 2882486 0 0

3 Anupama

0 0 0 0

4 Cosmo

445643 320630 401520 471184

5 ISF

389748 338795 453396 368574

6 Quantum

0 0 302095 286835

7 Ishita

0 0 1953803 1569204

8 Praveen

460990 460990 0 0

9 Sunita

342246 342246 0 0

10 Mefcom

443942 348370 610646 667122

11 Avisha

50000 0 0 0

12 VSL

0 0 134460 118661

13 VPL

100000 0 0 0

14 SIC

0 0 0 0

Total

5198404 4711903 3876420 3592980

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 11 of 27 August 27, 2014

Seven members of Vishvas Group namely, Master, Cosmo, ISF,

Quantum, Ishita, Mefcom and VSL had traded in the scrip of

Gangotri at NSE.

Total buy and sell quantity of the members of Vishvas Group at BSE

is 51,98,404 shares and 47,11,903 shares respectively.

Total buy and sell quantity of the members of Vishvas Group at NSE

is 38,76,420 shares and 35,92,980 shares respectively.

Noticee had bought 4,60,990 shares of Gangotri and sold 4,60,990

shares of Gangotri i.e. net position of the Noticee after investigation

period was zero.

TRADE CONCENTRATION

AT BSE:

16. From the trade & order log and documents available on record, I find that

total traded volume of the scrip of Gangotri during investigation period was

89,41,975 shares in BSE. During the investigation period, the trading details

of top 10 trading brokers were analyzed and found that they had contributed

68.5% (61,29,624 shares) and 61.8% (55,24,429 shares) of the gross buy

and gross sell respectively. Further, it is observed that Noticee's broker

TCP appeared in top 10 trading brokers by gross buy and gross sell.

Noticee's broker TCP had contributed 4,82,190 shares to gross buy and

4,81,890 shares to gross sell of total market quantity.

17. During investigation period, the trading details of top 10 trading clients were

analyzed and found that they had contributed 62.47% (55,86,236 shares)

and 57.82% (51,69,927 shares) of the gross buy and gross sell

respectively. Further, it is observed out of top 10 trading clients, seven

members of Vishvas Group namely, Purshottam, Praveen, Cosmo,

Mefcom, ISF, Sunita and VPL were appeared in gross buy with total

contribution of 57.1% (51,10,404 shares) of total traded quantity and six

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 12 of 27 August 27, 2014

members of Vishvas Group namely, Purshottam, Praveen, Mefcom, Sunita,

ISF and Cosmo were appeared at gross sell with a total contribution of

52.5% (46,93,517 shares) of total traded quantity. Noticee had contributed

4,60,990 shares to gross buy and 4,60,990 shares to gross sell of total

market quantity.

18. During investigation period, the trading details of top 10 clients with net buy

and net sell position were also analyzed and found that 6 members of

Vishvas Group namely, Cosmo, VPL, Mefcom, ISF, Avisha and Purshottam

are appearing at net buy position. The net buy position of the Noticee was

zero.

SYNCHRONIZED TRADES

AT BSE

19. Upon perusal of data, trade & order log and documents available on record,

I find that during investigation period, 24,154 trades were executed for a

total traded quantity of 89,41,975 shares at BSE. Out of these, 430 trades

for 15,60,914 shares (17.45% of the total traded quantity) were

synchronized trades i.e. the difference between buy order time and sell

order time was less than 60 seconds and there was no difference between

buy order rate and sell order rate as well as there was no difference

between buy order quantity and sell order quantity.

20. It is observed that there were 34 trading days (out of total 37 trading days

during the investigation period) when synchronized trading was being done

at BSE, out of which members of Vishvas Group appeared in 26 trading

days. Out of these 26 days, on 25 days, the matching of synchronized

trades of members of Vishvas Group with total market synchronized trades

was more than 50% and on 12 days, the contribution of volumes through

synchronized trades by the members of Vishvas Group was more than 15%

to the total market volume. For e.g. on May 30, 2006 the total day traded

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 13 of 27 August 27, 2014

volume was 31,756 shares out of which 19,416 shares (61.14% shares)

were synchronized by the members Vishvas Group.

21. It is observed that the eight members of Vishvas Group namely,

Purshottam, Cosmo, Sunita, Praveen, Mefcom, ISF, Avisha and VPL,

indulged in 210 synchronized trades for 12,26,309 shares (78.56% of total

synchronized quantity). The details of synchronized trade amongst the

member of Vishvas Group are as under:

Particulars Seller Name

Buyer Name Purshottam Praveen Sunita Mefcom Cosmo Avisha VPL ISF Total

Praveen 189069 00 14774 29621 36377 00 00 00 269841

Mefcom 123830 16999 15455 00 6500 00 00 32500 195284

ISF 99968 19990 5500 17146 29019 00 00 00 171623

Sunita 47858 14240 00 38951 24367 00 00 51397 176813

Cosmo 101825 15900 23811 21700 00 00 00 7000 170236

Purshottam 1 46841 14665 37040 14188 00 00 39820 152555

Avisha 49999 00 00 00 00 00 00 00 49999

VPL 23958 00 00 00 10000 00 00 6000 39958

Total 636508 113970 74205 144458 120451 00 00 136717 1226309

From the above table, it is observed that:

Out of total shares bought (4,60,990 shares) by the Noticee during

investigation period, 2,69,841 shares were synchronized with the

other members of the Vishvas Group i.e. Purshottam, Sunita,

Mefcom and Cosmo.

Out of total shares sold (4,60,990 shares) by the Noticee during

investigation period, 1,13,970 shares were synchronized with the

other members of the Vishvas Group i.e. Mefcom, ISF, Sunita,

Cosmo and Purshottam.

One of the instances of the synchronized trade and reversal trade by

the Noticee with other members of Vishvas Group is that on May 23,

2006, Noticee bought 5,000 shares of Gangotri @ ` 49.9 from

Purshottam at 10:33:32. The buy order was placed by Noticee at

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 14 of 27 August 27, 2014

10:33:31 @ `49.9 for 5,000 shares and the sell order was placed by

Purshottam at 10:33:26 @ ` 49.9 for 5,000 shares. The order time

difference was 5 seconds. Noticee again sold 5,000 Gangotri shares

back to Purshottam @ ` 50.65 at 10:51:40 i.e. the trade was

reversed within 20 minutes. In the reverse trade the buy order was

placed by Purshottam at 10:51:39 @ ` 50.65 for 5,000 shares and

the sell order was placed by Noticee at 10:51:34 @ ` 50.65 for 5,000

shares. The order time difference was 5 seconds. During

investigation period, similar trading patterns of synchronized trading

were also observed between Noticee and other members of Vishvas

Group.

22. Details of total number of synchronized buy and sell orders, trades and

trade quantity by the members of Vishvas Group during investigation period

are as under:

Client Name Buy Sell Total

Count

of Buy

Orders

Count

of Buy

Trades

Total

Buy Qty

Count of

Sell

Orders

Count

of Sell

Trades

Total

Sell Qty

Total

Order

Total

Trades

Total

Qty

Praveen

39 39 269841 21 21 113970 60 60 383811

Mefcom 49 49 195284 27 27 144458 76 76 339742

ISF 28 28 171623 28 28 136717 56 56 308340

Sunita

30 30 176813 17 17 74205 47 47 251018

Cosmo.

22 22 170236 20 20 120451 42 42 290687

Purshottam 36 36 152555 97 97 636508 133 133 789063

Avisha 1 1 49999 0 0 0 1 1 49999

VPL 5 5 39958 0 0 0 5 5 39958

Total

210 210 1226309 210 210 1226309 420 420 2452618

From the above table, it is observed that out of total 420

synchronized trades (buy & sell) by Vishvas Group for 24,52,618

shares, Noticee was indulged in 60 synchronized trades for 3,83,811

shares.

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 15 of 27 August 27, 2014

CIRCULAR TRADES and REVERSAL TRADES

23. Upon analysis of trade log in BSE, it is observed that there were

substantial number of trades in which parties and counterparties to the

trade were same entities which belong to Vishvas Group. They were

creating an artificial volume in the market by trading among themselves i.e.

by circular trading and reversal trading. Nine members of Vishvas Group

were doing circular trading and reversal trading in BSE.

AT BSE

24. It is observed that that nine members of Vishvas Group viz. Purshottam,

Cosmo, Sunita, Praveen, Mefcom, ISF, Avisha, VPL and Master were

involved in circular trading in 29 trading days out of 37 trading days during

investigation period and created artificial volume of 26,90,184 shares

(30.08% of total traded quantity) by buying and selling among themselves.

These transactions took place in 2138 trades. Out of the same, circular

trades aggregating to 12,26,309 shares from 210 trades were

synchronized.

25. It is also observed that the members of Vishvas Group made large

contribution in circular/reversal trades as compared to the total market

volume in the scrip. The circular trades and reversal trades by the members

of Vishvas Group resulted in significant proportion of volume to the total

market volume in the scrip. Out of 29 trading days, on 10 days, the

percentage of circular trade volume of Vishvas Group to the total market

volume was more than 40% and on 3 days it was more than 60%.

26. The details of circular trades among the nine members of Vishvas Group

are as under:-

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 16 of 27 August 27, 2014

Circular

Trade Sellers

Buyers Cosmo Sunita Master Mefcom Purshottam ISF Praveen

Grand

Total

VPL 10000 8000 00 00 54509 6000 19597 98106

Avisha 00 00 00 00 50000 00 00 50000

Cosmo 5672 43875 00 59535 259186 7000 49152 424420

Sunita 38031 00 00 43901 82808 94132 29928 288800

Master 00 00 00 10000 13399 00 4000 27399

Mefcom 9500 36059 00 00 180381 45579 52274 323793

Purshottam 72446 150814 8386 108126 65025 124694 187160 716651

ISF 35602 19965 10000 21041 215666 00 38990 341264

Praveen 61559 29674 00 32044 279473 17001 00 419751

Grand Total 232810 288387 18386 274647 1200447 294406 381101 2690184

From the above table, it is observed that:

Out of total shares bought (4,60,990 shares) by the Noticee during

investigation period, 4,19,751 shares were involved in circular

trading with the other members of the Vishvas Group i.e. Cosmo,

Sunita, Mefcom, Purshottam and ISF.

Out of total shares sold (4,60,990 shares) by the Noticee during

investigation period, 3,81,101 shares were involved in circular

trading with the other members of the Vishvas Group i.e. VPL,

Cosmo, Sunita, Master, Mefcom, Purshottam and ISF.

27. During investigation period, circular trading among Vishvas Group were

observed from April 21, 2006 till May 31, 2006. Some of the instances of

circular trading are as follows:

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 17 of 27 August 27, 2014

Trade Quantity = 7,475

Trade Quantity = 7,500 Trade Quantity = 7,500

Trade Quantity = 8,000 Trade Quantity = 10,000

Circular pattern observed on April 24, 2006 among the group is as

under:

PRICE MANIPULATION:

28. Last Traded Price (LTP) analysis:- It is observed that during investigation

period, the price of the scrip has decreased in patch I & III and increased in

patch II as discussed below:

Patch I (April 7, 2006 to April 20, 2006):

Exchange Opening price

(April 07, 2006)

Closing price

(April 20, 2006)

Trading

days

% Change in

price of the

scrip

Average

Daily Traded

Volume

BSE 53.25 44.75 8 Days 15.96%

(Decrease)

70713

NSE 56.00 44.40 8 Days 20.70%

(Decrease)

68005

Patch II (April 21, 2006 to May 5, 2006):

Exchange Opening price

(April 21, 2006)

Closing price

(May 05, 2006)

Trading

days

% Change in

price of the

scrip

Average

Daily

Traded

Volume

BSE 46.00 66.55 11 Days 44.70%

(Increase)

338391

NSE 46.00 66.90 11 Days 45.40%

(Increase)

213738

Cosmo

Sunita

Mefcom

Praveen

ISF

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 18 of 27 August 27, 2014

Patch III (May 8, 2006 to May 31, 2006):

Exchange Opening price

(May 08, 2006)

Closing price

(May 31,

2006)

Trading

days

% Change in

price of the

scrip

Average

Daily

Traded

Volume

BSE 64.50 44.35 18 Days 31.20%

(Decrease)

258554

NSE 63.55 45.40 18 Days 28.60%

(Decrease)

217866

It is observed that, all the members of Vishvas Group started trading

on or after April 21, 2006 i.e. they had traded only during patch II

(Period of price rise) and patch III (Period of price fall).

It is also observed that the day from when the members of Vishvas

Group start trading, the average trading volume of the scrip at BSE

had gone up significantly from 70,713 shares (during April 07, 2006

to April 20, 2006) to 3,38,391 shares (during April 21, 2006 to May

05, 2006) and 2,58,554 shares (during May 08, 2006 to May 31,

2006).

29. LTP contribution of Visvas Group entities at BSE: Total cumulative

positive and negative LTP contribution was `1130.40 and `1139.25

respectively during investigation period in BSE whereas, it is observed that

the nine members of Vishvas Group namely, Purshottam, Mefcom,

Praveen, Sunita, ISF, Cosmo, Avisha, VPL and Master had contributed

`718.05 to positive LTP and `468.65 to Negative LTP. The details of LTP

contribution of nine members Vishvas Group to cumulative Positive and

Negative LTP variation are as under:

Sr.

No.

Client Name Sum of Positive

LTP `

Sum of Negative

LTP `

Total positive

Cumulative LTP

1 Purshottam 673.5 -431.7 241.8

2 Mefcom 18.30 -24.25 -5.95

3 Praveen 10.20 -3.20 7

4 Sunita 5.70 -4.35 1.35

5 ISF 5.10 -3.05 2.05

6 Cosmo 4.75 -1.70 3.05

7 Avisha 0.15 0 0.15

8 VPL 0.35 -0.20 0.15

9 Master 0 -0.20 -0.2

Total 718.05 -468.65 249.4

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 19 of 27 August 27, 2014

Noticee had contributed ` 10.20 to total cumulative positive LTP and

` 3.20 to total cumulative negative LTP.

30. It is observed that the Noticee's contribution towards LTP was not much.

However, the role of the Noticee in executing the larger game plan of

creating manipulation in the scrip of Gangotri in concert with the other

entities of the Vishvas Group cannot be overlooked i.e. the Noticee had

mostly traded with Purshottam, Mefcom, VPL, Cosmo, ISF, and Sunita, who

are the contributors towards LTP variation. Further, most of the

synchronized trades and circular trades of the Noticee's were with

Purshottam, Mefcom, Master, VPL, Cosmo, ISF, and Sunita. It is not

possible for a single entity to manipulate the market and the role of the

entire Vishvas group has to be considered in a holistic manner to arrive at

any conclusion. Thus, Noticee have also aided and abetted the other

members of Vishvas Group in manipulating the price of the scrip of

Gangotri.

31. I find that during the investigation period, the Noticee had bought 4,60,990

shares and sold 4,60,990 shares (total traded volume of the Noticee was

9,21,980 shares). Out of total trading volume of the Noticee, 3,83,811

shares of the Noticee were synchronized and 8,00,852 shares were circular

with other members of Vishvas Group. I also find that at the end of the

investigation period the net position of the Noticee was zero.

32. I find that the patterns of circular trading among the Vishvas Group are in

the manner [ABCDA]. Almost same numbers of shares were

rotated in a circular manner among the Vishvas Group on daily basis and

the pattern depicts that the trades were planned with a manipulative intent.

Thus, the said circular trading was not just a co-incidence and the same

indicates their concerted effort and manipulative intent to increase the price

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 20 of 27 August 27, 2014

of the scrip by creating false and artificial volume in the scrip. Due to the

concerted effort of Vishvas Group the price of the scrip in BSE had

increased from `43 on April 19, 2006, touched the high to `70.95 on May

05, 2006 and then decreased to `44.35 on May 31, 2006 within a period of

one and half month. This gave an impression to other investors in the

market that the scrip of Gangotri was being actively traded at the prevailing

price but actually this was not the case.

33. The pattern of synchronized order placement, reversal trading and circular

trading clearly points out that the transactions were carried out with the

intention that the orders of particular entities should match and there was a

prior arrangement with respect to these transactions. These transactions

resulted in creation of artificial volume. The pattern of trading indicates

several instances where the time difference between buy and sell orders

was less than 20 seconds. No unknown person can trade continuously with

same set of persons by putting orders in such pattern contributing

significantly to total volume in the market. The Noticee along with the other

members of Vishvas Group have transacted amongst themselves in the

shares of Gangotri through circular, reversal and synchronized order

placement in a contrived pricing pattern and it led to creation of artificial

volumes in the scrip as the trades were reversed in a short time. The

increase in the trading volume of Gangotri shares can be attributed to the

trades done by the Noticee in collusion with the other members of Vishvas

Group. Thus, these trades were fraudulent and manipulative in nature as

Noticee have misused the trading mechanism and also created artificial

trading volume.

34. The fact is that had the trades of the members of Vishvas Group been

executed in the normal course of business, the possibility of such perfect

matching would not have been possible. The buy and sell prices of one

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 21 of 27 August 27, 2014

entity were close to the buy/sell rates of the other entity in all the

settlements, such that the trades of these entities were always matched.

Greater the number of synchronized trades, the larger is the chance of

trades not being genuine in nature, which is bound to affect the market

equilibrium. A trade can be executed on the screen and still be manipulative

in nature. Considering the number of such trades, it is clear that there has

been a gross mis-use of the screen based trading system. It is also to be

stated that intention is inherent in all cases of synchronized trading

involving large scale price manipulation and the same was also brought out

in the case of Nirmal Bang Securities (P) Ltd. vs SEBI by the Honble SAT

whereby it was observed that Intention is reflected from the action of the

Appellant. Choosing selective time slots does not appear to be an involuntary

action.

35. The trading pattern of the Noticee creates doubts about the genuineness of

his trades. I am of the view that the trades carried out were fraudulent and

manipulative in nature. However, in the present case, the records show that

most of the trading carried out by the Noticee was with a fixed set of entities

i.e. members of Vishvas Group namely, Purshottam, Mefcom, VPL, Cosmo,

ISF, and Sunita.

36. Therefore, I am of the view that the trades of the members of Vishvas

Group were with the intention not to transfer the beneficial ownerships of

the shares of Gangotri but with an intention to operate only as a device to

inflate, depress or cause fluctuations in the price of shares of Gangotri for

wrongful gains. Thus the Noticee through collusion with the other members

of the Vishvas Group has transacted in the shares of Gangotri in such a

manner that it led to creation of artificial volumes in the scrip and a false

market leading to price movement in the scrip which lacked presence of any

sort of fundamentals.

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 22 of 27 August 27, 2014

37. It is evident from the trading pattern of the Noticee and other members of

Vishvas Group that through circular, reversal and synchronized trades, they

have manipulated the price of the scrip during the period under scrutiny. It

is also observed that there was no transfer of ownership of shares.

38. Honble Securities Appellate Tribunal (hereinafter referred as SAT), in

Ketan Parekh Vs. Securities & Exchange Board of India (Appeal No. 2 of

2004), observed that, A synchronized transaction even on the trading screen

between genuine parties who intend to transfer beneficial interest in the trading

stock and who undertake the transaction only for that purpose and not for rigging

the market is not illegal and cannot violate the regulations. As already observed

synchronisation or a negotiated deal ipso facto is not illegal. A synchronised

transaction will, however, be illegal or violative of the Regulations if it is executed

with a view to manipulate the market or if it results in circular trading or is

dubious in nature and is executed with a view to avoid regulatory detection or does

not involve change of beneficial ownership or is executed to create false volumes

resulting in upsetting the market equilibrium. Any transaction executed with the

intention to defeat the market mechanism whether negotiated or not would be

illegal. Whether a transaction has been executed with the intention to manipulate

the market or defeat its mechanism will depend upon the intention of the parties

which could be inferred from the attending circumstances because direct evidence

in such cases may not be available. The nature of the transaction executed, the

frequency with which such transactions are undertaken, the value of the

transactions, whether they involve circular trading and whether there is real

change of beneficial ownership, the conditions then prevailing in the market are

some of the factors which go to show the intention of the parties. This list of

factors, in the very nature of things, cannot be exhaustive. Any one factor may or

may not be decisive and it is from the cumulative effect of these that an inference

will have to be drawn.

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 23 of 27 August 27, 2014

39. In my view, the Noticee through the said artificial trades interfered with the

market mechanism by manipulating the price and volume of the said scrip.

When the trades were inherently non genuine, I do not feel that it is

necessary to prove that investors had, in fact got induced and bought and/

or sold on the basis of these trades. Similar views were expressed by

Honble SAT in its order dated 14.7.2006 in Ketan Parekh Vs. SEBI wherein

it had observed that When a person takes part in or enters into transactions in

securities with the intention to artificially raise or depress the price he thereby

automatically induces the innocent investors in the market to buy /sell their stocks.

The buyer or the seller is invariably influenced by the price of the stocks and if that

is being manipulated the person doing so is necessarily influencing the decision of

the buyer / seller thereby inducing him to buy or sell depending upon how the

market has been manipulated. We are therefore of the view that inducement to any

person to buy or sell securities is the necessary consequence of manipulation and

flows therefrom. In other words, if the factum of manipulation is established it will

necessarily follow that the investors in the market had been induced to buy or sell

and that no further proof in this regard is required. The market, as already

observed, is so wide spread that it may not be humanly possible for the Board to

track the persons who were actually induced to buy or sell securities as a result of

manipulation and law can never impose on the Board a burden which is impossible

to be discharged. This, in our view, clearly flows from the plain language of

Regulation 4(a) of the Regulations.

40. Keeping in mind the dicta of the SAT as reproduced above, I see no reason

to take a different view in the present case.

41. As per regulation 2 (1) (c) of PFUTP Regulations, "fraud" includes any act,

expression, omission or concealment committed whether in a deceitful manner or

not by a person or by any other person with his connivance or by his agent while

dealing in securities in order to induce another person or his agent to deal in

securities, whether or not there is any wrongful gain or avoidance of any loss.

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 24 of 27 August 27, 2014

42. I find that the Noticee has failed to file any reply to the said SCN and has

not refuted the charges. The Honble Securities Appellate Tribunal (SAT) in

the matter of Classic Credit Ltd. v/s SEBI [2007] 76 SCL 51 (SAT -

MUM.) inter-alia held the appellants did not file any reply to the second show-

cause notice. This being so, it has to be presumed that the charges alleged against

them in the show-cause notice were admitted by them. The order passed by

Honble SAT is relied upon in this case for guidance. Therefore, I presumed

that the Noticee has admitted the charges alleged in the said SCN.

43. Therefore, I hold that the charges leveled against the Noticee are proved

and that the allegation of violation of provisions of section 12A(a), 12A(b),

12A(c) of SEBI Act and regulations 3(a), 3(b), 3(c), 3(d), 4(1), 4(2)(a), &

4(2)(e) of PFUTP Regulations by the Noticee stand established.

ISSUE 2: Whether the Noticee is liable for monetary penalty under

section 15HA of the SEBI Act ?

44. The aforesaid violations of SEBI Act and PFUTP Regulations by the

Noticee make him liable for penalty under Section 15HA of SEBI Act which

reads as follows:

Section 15HA. Penalty for fraudulent and unfair trade practices.

If any person indulges in fraudulent and unfair trade practices relating to

securities, he shall be liable to a penalty of twenty-five crore rupees or three times

the amount of profits made out of such practices, whichever is higher.

45. In the matter of SEBI Vs. Shri Ram Mutual Fund [2006] 68 SCL 216 (SC),

the Honble Supreme Court of India has held that In our considered opinion,

penalty is attracted as soon as the contravention of the statutory obligation as

contemplated by the Act and the regulation is established and hence the intention of

the parties committing such violation becomes wholly irrelevant.

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 25 of 27 August 27, 2014

46. As already observed that, Noticee have violated the provisions of sections

12A(a), 12A(b), 12A(c) of SEBI Act and regulations 3(a), 3(b), 3(c), 3(d),

4(1), 4(2)(a) & 4(2)(e) of PFUTP Regulations. Therefore, I find that the

Noticee is liable for monetary penalty under Section 15HA of the SEBI Act.

ISSUE 3: What quantum of monetary penalty should be imposed on

the Noticee taking into consideration the factors mentioned

in Section 15J of SEBI Act ?

47. While determining the quantum of penalty under Section 15HA of SEBI Act,

it is important to consider the factors stipulated in section 15J of SEBI Act,

which reads as under:-

15J - Factors to be taken into account by the adjudicating officer

While adjudging quantum of penalty under section 15-I, the adjudicating officer

shall have due regard to the following factors, namely:-

(a) the amount of disproportionate gain or unfair advantage, wherever

quantifiable, made as a result of the default;

(b) the amount of loss caused to an investor or group of investors as a result of the

default;

(c) the repetitive nature of the default.

48. I note that on the basis of data available on record, it is difficult, in cases of

such nature, to quantify exactly the disproportionate gain or unfair

advantage enjoyed by the Noticee and the consequent losses suffered by

the investors. Further the amount of loss to an investor or group of investors

also cannot be quantified on the basis of available facts and data. Even

though the monetary loss to the investors cannot be computed, any

manipulation in the volume or price of the stocks caused by vested interest

always erodes investor confidence in the market so that investors find

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 26 of 27 August 27, 2014

themselves at the receiving end of market manipulators. Hence, anyone

could have been carried away by the unusual fluctuations in the

volume/price and been induced into investing in the said scrip. Besides, this

kind of activity seriously affects the normal price discovery mechanism of

the securities market. People who indulge in manipulative, fraudulent and

deceptive transactions, or abet the carrying out of such transactions which

are fraudulent and deceptive, should be suitably penalized for the said acts

of omissions and commissions. Considering the continuous effort of the

Noticee in this aspect where the trading was carried out over a period of

time, it can safely be surmised that the nature of default was also repetitive.

49. In the forgoing paragraphs, it is now established that the Noticee have

violated the provisions of sections 12A(a), 12A(b), 12A(c) of SEBI Act and

regulations 3(a), 3(b), 3(c), 3(d), 4(1), 4(2)(a) & 4(2)(e) of PFUTP

Regulations. In view of the above and considering the facts and

circumstances of the case and factors under Section 15J of the SEBI Act

and the violation committed by the Noticee, I find that imposing a penalty of

` 70,00,000/- (Rupees Seventy Lakhs only) on the Noticee would be

commensurate with the violations committed by him.

ORDER

50. In exercise of the powers conferred under Section 15-I of the SEBI Act and

in terms of the provisions of Section 15HA of the SEBI Act & Rule 5(1) of

the Rules, I hereby impose a penalty of ` 70,00,000/- (Rupees Seventy

Lakhs only) on Praveen Poddar for violation of provisions of sections

12A(a), 12A(b), 12A(c) of SEBI Act and regulations 3(a), 3(b), 3(c), 3(d),

4(1), 4(2)(a) & 4(2)(e) of PFUTP Regulations.

51. The Noticee shall pay the said amount of penalty by way of demand draft

drawn in favour of SEBI Penalties Remittable to Government of India

Brought to you by http://StockViz.biz

Adjudication Order in respect of Praveen Poddar in the matter of M/s Gangotri Textiles Limited

Page 27 of 27 August 27, 2014

payable at Mumbai within 45 days of receipt of this Order. The said demand

draft shall be forwarded to the Division Chief, Investigation Department (IVD

ID6), Securities and Exchange Board of India, Plot No. C4-A, G Block,

Bandra Kurla Complex, Bandra (E), Mumbai 400051.

52. In terms of rule 6 of the Rules, copies of this order are sent to the Noticee

and also to SEBI.

Date: August 27, 2014 Jayanta Jash

Place: Mumbai Adjudicating Officer

Brought to you by http://StockViz.biz

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Administrative Law Exam FrameworkDocument20 pagesAdministrative Law Exam FrameworkH100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Administrative Law Lecture Notes 1 PDFDocument49 pagesAdministrative Law Lecture Notes 1 PDFkowc kousalyaNo ratings yet

- The Art & Science:Handling Domestic InquiryDocument18 pagesThe Art & Science:Handling Domestic InquirysabkhanNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Main ProjectDocument86 pagesMain ProjectsoniyabellaniNo ratings yet

- Law309 Tutorial Week 6Document2 pagesLaw309 Tutorial Week 6NURSYAFIKA MASROMNo ratings yet

- UntitledDocument28 pagesUntitledKasu Venkata Rami ReddyNo ratings yet

- List of DatesDocument15 pagesList of DatesPramodKumarNo ratings yet

- An Overview of Natural Justice in India: Concept, Priciples and ExceptionsDocument8 pagesAn Overview of Natural Justice in India: Concept, Priciples and ExceptionsYASHI JAINNo ratings yet

- Nestle India Limited V The Food Safety and Standards Authority of India - 2015Document71 pagesNestle India Limited V The Food Safety and Standards Authority of India - 2015Mojo JojoNo ratings yet

- Admin AssignmentDocument14 pagesAdmin AssignmentMadhav SinghNo ratings yet

- Reasoned DecisionDocument20 pagesReasoned DecisionRuchi Rampuria100% (4)

- Constitutional Safeguards for Civil Servants under the Indian ConstitutionDocument27 pagesConstitutional Safeguards for Civil Servants under the Indian ConstitutionMayuri Yadav100% (1)

- CCMA guidelines misconduct arbitrationsDocument48 pagesCCMA guidelines misconduct arbitrationsJoseph MtoloNo ratings yet

- Adjudication Order Against M Apte Kantilal Pvt. Ltd. in The Matter of Apte Amalgamations LTDDocument13 pagesAdjudication Order Against M Apte Kantilal Pvt. Ltd. in The Matter of Apte Amalgamations LTDShyam SunderNo ratings yet

- Moot Court Petitioner FINAL MAINDocument27 pagesMoot Court Petitioner FINAL MAINR.selva muthanNo ratings yet

- Solution For Over Delayed CIC File (Writ of Mandamus) PDFDocument3 pagesSolution For Over Delayed CIC File (Writ of Mandamus) PDFKuldeep BansalNo ratings yet

- WRITSDocument15 pagesWRITSRavneet KaurNo ratings yet

- LAW 309-Chapter 2 PDFDocument11 pagesLAW 309-Chapter 2 PDFhafriNo ratings yet

- Judicial Review & Control of Administrative ActionDocument10 pagesJudicial Review & Control of Administrative ActionTanya AhujaNo ratings yet

- Administrative Law Notes & SyllabusDocument93 pagesAdministrative Law Notes & Syllabusjennifer royNo ratings yet

- Kumaon Mandal Vikas Nigam LTD Vs Girja Shankar Pant - BIASDocument13 pagesKumaon Mandal Vikas Nigam LTD Vs Girja Shankar Pant - BIASRoop KumarNo ratings yet

- Ang Game HongDocument21 pagesAng Game HongattyczarNo ratings yet

- Jindal Moot RespondentDocument45 pagesJindal Moot Respondentanon_896508536No ratings yet

- Administrative Law Assignment TopicsDocument6 pagesAdministrative Law Assignment TopicsSherminasNo ratings yet

- Civil Appeal 91 of 2018Document9 pagesCivil Appeal 91 of 2018Moses AdamsNo ratings yet

- Fundamental Rights and Parliamentary Power to Punish for ContemptDocument34 pagesFundamental Rights and Parliamentary Power to Punish for ContemptAkashNo ratings yet

- (1976) 102 Itr 281 (SCDocument4 pages(1976) 102 Itr 281 (SCJaimin DaveNo ratings yet

- Principles of Natural Justice and Article 14Document14 pagesPrinciples of Natural Justice and Article 14dsingh1092No ratings yet

- A. K. Kraipak & Ors. Etc Vs Union of India & Ors On 29 April, 1969Document12 pagesA. K. Kraipak & Ors. Etc Vs Union of India & Ors On 29 April, 1969mohit kumarNo ratings yet

- Corder and Mavedzenge - Pursuing Good Goveernance PDFDocument169 pagesCorder and Mavedzenge - Pursuing Good Goveernance PDFGerald MakokolaNo ratings yet