Professional Documents

Culture Documents

E Banking

Uploaded by

sureshsusi0 ratings0% found this document useful (0 votes)

394 views10 pagesA STUDY ON CUSTOMER SATISFACTION TOWARDS online Banking services RENDERED BY SELECTED PUBLIC SECTOR BANKSWITH SPECIAL REFERENCE to COIMBATORE CITY.

Original Description:

Original Title

eBanking

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA STUDY ON CUSTOMER SATISFACTION TOWARDS online Banking services RENDERED BY SELECTED PUBLIC SECTOR BANKSWITH SPECIAL REFERENCE to COIMBATORE CITY.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

394 views10 pagesE Banking

Uploaded by

sureshsusiA STUDY ON CUSTOMER SATISFACTION TOWARDS online Banking services RENDERED BY SELECTED PUBLIC SECTOR BANKSWITH SPECIAL REFERENCE to COIMBATORE CITY.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 10

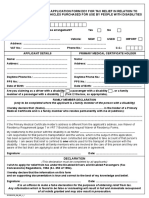

A STUDY ON CUSTOMER SATISFACTION TOWARDS ONLINE BANKING

SERVICES RENDERED BY SELECTED PUBLIC SECTOR BANKSWITH

SPECIAL REFERENCE TO COIMBATORE CITY.

I. PERSONAL DETAILS.

1.1 Name :

1.2 Gender :

a) Male b) Female

1.3 Age :

a) Below 20yrs b) 21- 30yrs c) 31- 40yrs d) Above 40yrs

1.4 Educational Qualification :

a) Illiterate b) School Level c) College Level d) Professional

e) Others

1.5 Marital Status :

a) Married b) Unmarried

1.6 Occupational Status :

a) Business b) Employed c) Professional d) Others

1.7 Average Monthly Income :

a) Up to 10,000 b) 10,001 to 15,000

c) 15,000 to 20,000 d) Above 20,000

II. CUSTOMER INFORMATION AND AWARNESS.

2.1 In which bank do you have an account?

a) Indian bank b) Indian overseas bank c) Bank of India d) Canara Bank.

2.2 Type of account you maintained in that bank?

a) Current a/c b) Savings a/c c) Demat a/c d) Current and savings a/c e) Both B and C

f) all the a, b, c

2.3 Mention your association period with your bank?

a) Less than 2 years b) 2 - 4 years c) 4 - 6 years d) above 6 years.

2.4 Purpose of opening bank a/c?

a) Personal b) Business c) Industrial d) Others

2.5 Sources of awareness of your bank?

a) Advertisement b) Friends/ Relatives c) Representatives d) Others

2.6 Rank (1, 2, 3) reasons for preferring your bank.

S.NO

REASONS

RANK

a Innovative Products

b Quality and Quick Services

c Reputed Bank

d Customer Care

e Easy Access

f Nominal Service

g Charges

h Necessity

i Technology

2.7 Frequency of transaction in your bank. Mark [Tick]

Type of a/c Daily Weekly Once Once in 15 days As and when

needed

Current a/c

Savings a/c

Demat a/c

2.8 Indicate the online services you are aware of? Mark [Tick]

S.NO SERVICE AWARE

a Bill Payment

b Fund Transfer / Card Card

Fund Transfer

c Share Trading/ Forex rate

enquiry

d Ticket Booking/ Online

Reservation

e Smart Money Orders

f Prepaid Mobile Recharge

g Change password/Pin no

h Cheque status enquiry/Order

cheque book and Request stop

payment of cheque

i View a/c balance statement and

details of loan a/c

jj Online Brokerage/ Online

Shopping

2.9 Do you aware of online investment in E-Banking?

S.No Investments Yes No

a Mutual Funds/

b Initial and Public offers

c Derivatives

d Insurance

e Post saving schemes

2.10 Rank services frequently used by you in online banking.

S.No SERVICE RANK

a Bill Payment

b Fund Transfer

c Share Trading / Forex rate

enquiry

d Ticket Booking/ Online

Reservation

e Smart Money Orders

f Prepaid Mobile Recharge

g Change password/Pin no

h Cheque status enquiry/Order

cheque book and Request stop

payment of cheque

i Card Card Fund Transfer

j View a/c balance statement and

details of loan a/c

k Online Brokerage/

l Online Shopping

III. UTILIZATION OF SERVICES.

3.1 Purpose of using online banking?

a) Online Verification b) Online Transaction service and request c) All the above.

3.2 Which of the following cards do you use?

a) Credit Card b) ATM cum Debit Card c) International Card d) Both A and B e) All the

above

3.3 Do you avail online bill payment facility?

a) Yes b)No

3.4 If yes means online bill payment facility towards?

a) Telephone and EB bill b) Mobile phone post paid bill c) Insurance Premium

d) Credit card dues e) Others. f) All the above

3.5 Do you avail ticket booking facility.

a) Yes b) No

3.6 Yes means ticket booking facility towards?

a) Railways b) Airways c) Both

3.7 Have you activated auto debit systems in online banking?

a) Yes b) No

3.8 If yes means mention the circumstances.

a) Whenever purchase made by using debit card.

b) When the minimum balance of an a/c goes less.

c) Only when instructions given

d) All the above

3.9) Factors influence you to go for online banking.

a) Knowledge of E-Banking

b) Multiple services and offers

c) Business Requirements.

d) Regular share trading

e) Encouragement by others

3.10 Rank the benefits from online banking services.

S.no BENEFITS RANK

a 24*7/365 Service

b Fast Transaction

c Easy access

d Security

e Privacy

f No queuing

g No charges for multiple fund

transfer

h More useful to business

i Transparency in services offered

3.11 Rank the reasons for prefer online banking

S.No REASONS RANK

a 24*7/365 Availability

b Low or no transaction cost

c Self Operation

d Access from anywhere

e Easier way to solve banking

needs.

IV CUSTOMER SATISFACTION

4.1 Level of satisfaction on the following aspects related to online banking

S.No Aspects Highly

Satisfied

Satisfied Neutral Dissatisfied Highly

Dissatisfied

1. Cost of

operation

2. Customer care

3. Advertisement

4. SMS Alerts

5. Business

permited

through online

6. Access and

Tarrif

7. Time taken for

processing

8. Security

Measures

9. Privacy

4.2 State level of satisfaction with the following main and add on services availed through online

services.

S.No Aspects Highly

Satisfied

Satisfied Neutral Dissatisfied Highly Dissatisfied

1. Bill Payment

2. Fund Transfer

/

3. Share Trading/

4. Forex rate

enquiry

5. Ticket

Booking/

Online

Reservation

6. Smart Money

Orders

7. Prepaid

Mobile

Recharge

8. Change

password/Pin

no

9. Cheque status

enquiry/Order

cheque book

and Request

stop payment

of cheque

10. View a/c

balance

statement and

details of loan

a/c

11. Online

Brokerage/

Shopping

4.3 Problems facing in online banking .Mark [tickz]

S.No PROBLEMS TICK

a Network Systems

b Wrong Entries

c Mail Spoofing

d Web Spoofing

e Lack of confidence

f Fund transfer limit

g Bad customer service

hh Lack of advertising and

promotion activities about e-

banking.

4.4 Will you recommend online banking services of your bank to others?

a) Yes b) No

4.5 Suggestions for improving quality of service of online banking in your bank.

You might also like

- Audit Risks for ACCA F8 Scenario QuestionsDocument6 pagesAudit Risks for ACCA F8 Scenario Questionsramen pandeyNo ratings yet

- Customer Satisfaction On ATMDocument6 pagesCustomer Satisfaction On ATMShreekanth B0% (1)

- Chapter 5. Closing Entries and The Post-Closing Trial BalanceDocument26 pagesChapter 5. Closing Entries and The Post-Closing Trial BalanceNguyen Dac ThichNo ratings yet

- Questionnaire On Digital BankingDocument2 pagesQuestionnaire On Digital BankingRohit Shrigadi100% (2)

- Data Migration StrategyDocument16 pagesData Migration Strategyakhyar ahmadNo ratings yet

- A Brief History of Money PDFDocument52 pagesA Brief History of Money PDFCristian CambiazoNo ratings yet

- Questionnaire On E-BankingDocument3 pagesQuestionnaire On E-Bankingdevngri75% (24)

- YONO SBI - Final QuestionnaireDocument3 pagesYONO SBI - Final QuestionnaireMusic & Art0% (2)

- QuestionaireDocument4 pagesQuestionaireBhargavChaudhariNo ratings yet

- Consumer Satisfaction Union BankDocument23 pagesConsumer Satisfaction Union BankShyam Rout100% (2)

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- HDFC Questionnaire - Digital ServicesDocument3 pagesHDFC Questionnaire - Digital ServicesRamneet Parmar80% (20)

- Online BankingDocument31 pagesOnline BankingRavi Kashyap506No ratings yet

- Questionnaire Comparative Study On Public Bank and Private Bank.Document4 pagesQuestionnaire Comparative Study On Public Bank and Private Bank.Lavkush Tiwari100% (1)

- Literature ReviewDocument4 pagesLiterature Reviewdivya100% (1)

- QUESTIONAIREDocument3 pagesQUESTIONAIREsunny12101986No ratings yet

- AppendixDocument47 pagesAppendixsowmiNo ratings yet

- Customer Perception E-Banking SurveyDocument2 pagesCustomer Perception E-Banking SurveyTakibbNo ratings yet

- Questionnaire Survey For Digital Banking: Name: Bank A/c: A/c Type: A) Current A/c B) Savings A/c C) Salary A/cDocument4 pagesQuestionnaire Survey For Digital Banking: Name: Bank A/c: A/c Type: A) Current A/c B) Savings A/c C) Salary A/cDigwendra kumarNo ratings yet

- Questionnaire On Consumer Awareness and Perception About Credit Cards in IndiaDocument6 pagesQuestionnaire On Consumer Awareness and Perception About Credit Cards in IndiaSARATH KUMAR D100% (1)

- Questionnaire of SBIDocument5 pagesQuestionnaire of SBIthegame110163% (16)

- Financial Services Industry FutureDocument3 pagesFinancial Services Industry FutureVickySalve0% (1)

- Final Questionnaire 2Document1 pageFinal Questionnaire 2Debasis Adhikary100% (1)

- QuestionnaireDocument4 pagesQuestionnaireChandu ShindeNo ratings yet

- Customer Opinion E-Banking SurveyDocument3 pagesCustomer Opinion E-Banking SurveybkaaljdaelvNo ratings yet

- QuestionnaireDocument4 pagesQuestionnaireBishu BiswasNo ratings yet

- Questionnaire Final PDFDocument4 pagesQuestionnaire Final PDFnidin johny100% (1)

- Customer Satisfaction in Public and Private Sector BanksDocument43 pagesCustomer Satisfaction in Public and Private Sector BanksAnkit Tiwari50% (2)

- QUESTIONNAIREDocument3 pagesQUESTIONNAIRESelsiya AmulrajNo ratings yet

- Techonology in Banking QuestionnaireDocument3 pagesTechonology in Banking Questionnairekushal karthikNo ratings yet

- Questionnaire On Internet BankingDocument4 pagesQuestionnaire On Internet Bankingcena2115No ratings yet

- A Study On Consumer Perception Towards Mobile Banking Services of State Bank of IndiaDocument45 pagesA Study On Consumer Perception Towards Mobile Banking Services of State Bank of IndiaVijaya Anandhan100% (1)

- Questionnaire On Credit CardDocument2 pagesQuestionnaire On Credit CardVaibhav Goyal100% (6)

- User Perception of Et Banking QuestionnaireDocument4 pagesUser Perception of Et Banking QuestionnairePoojan JoshiNo ratings yet

- Customer Satisfaction QuestionnaireDocument6 pagesCustomer Satisfaction Questionnairesid1982No ratings yet

- Online Banking QuestionnaireDocument4 pagesOnline Banking QuestionnaireMukesh Arya100% (3)

- Study On Customer SatisfactionDocument8 pagesStudy On Customer SatisfactionRavinder AhujaNo ratings yet

- Bank Customer QuestionnaireDocument4 pagesBank Customer QuestionnaireVishal VishNo ratings yet

- Sample QuestionnaireDocument4 pagesSample QuestionnaireAnonymous F17qIBHxNo ratings yet

- Customer Awareness and Preference Towards E-Banking Services of Banks (A Study of SBI)Document10 pagesCustomer Awareness and Preference Towards E-Banking Services of Banks (A Study of SBI)aurorashiva1No ratings yet

- Banking 3Document2 pagesBanking 3Manju MessiNo ratings yet

- QestionnaireDocument4 pagesQestionnairePreet AmanNo ratings yet

- PrefaceDocument6 pagesPrefaceArpit GuptaNo ratings yet

- Online Banking Services Icici BankDocument10 pagesOnline Banking Services Icici BankMohmmedKhayyumNo ratings yet

- Banking QuestionnaireDocument4 pagesBanking QuestionnaireMayank KhareNo ratings yet

- UBI QuestionnaireDocument2 pagesUBI QuestionnaireAbhi SinhaNo ratings yet

- Introduction of E CommerceDocument2 pagesIntroduction of E CommerceAkanksha KadamNo ratings yet

- Project Report On Online BankingDocument24 pagesProject Report On Online BankingDrSanjeev K Chaudhary100% (3)

- Electronic Banking QuestionnaireDocument5 pagesElectronic Banking QuestionnaireSenche100% (1)

- Questionnaire On Credit CardsDocument2 pagesQuestionnaire On Credit Cardssanjuyadav100% (1)

- QuestionnaireDocument3 pagesQuestionnaireSimran Jit Singh80% (20)

- Customer Satisfaction Towards ATM UsersDocument25 pagesCustomer Satisfaction Towards ATM UsersPurnima kumariNo ratings yet

- Questionnaire For Customer SurveyDocument4 pagesQuestionnaire For Customer SurveyKushboo JainNo ratings yet

- Retail Loans ProjectDocument43 pagesRetail Loans ProjectLeo SamNo ratings yet

- SBI Internet BankingDocument21 pagesSBI Internet BankingHiteshwar Singh Andotra60% (5)

- QuestionnaireDocument2 pagesQuestionnairevarun100% (2)

- Sample Questionnaire On Customer Satisfaction in BanksDocument6 pagesSample Questionnaire On Customer Satisfaction in BanksFerdous AminNo ratings yet

- Limitations of E-Banking: Security, Cost, AwarenessDocument1 pageLimitations of E-Banking: Security, Cost, AwarenessanithapblNo ratings yet

- Research Methodology Title of Project "A Comparative Study On Retail Banking With Special Reference To AXIS Bank"Document6 pagesResearch Methodology Title of Project "A Comparative Study On Retail Banking With Special Reference To AXIS Bank"Rajpal SheoranNo ratings yet

- A Study On Customer AwarenessDocument4 pagesA Study On Customer Awarenessnivantheking123No ratings yet

- 05 Hints MCQs Payment System and Fee Based ServicesDocument2 pages05 Hints MCQs Payment System and Fee Based ServicesVikashKumarNo ratings yet

- TBU QUIZ: Top 40 Questions on SBI Products, Services and PlatformsDocument26 pagesTBU QUIZ: Top 40 Questions on SBI Products, Services and PlatformsER SAABNo ratings yet

- 05 MCQs Payment System and Fee Based ServicesDocument2 pages05 MCQs Payment System and Fee Based ServicesVikashKumarNo ratings yet

- Questionnaire For CustomersDocument5 pagesQuestionnaire For CustomersAkhilNo ratings yet

- Business QuizDocument73 pagesBusiness QuizsureshsusiNo ratings yet

- Garatte Ranking TableDocument1 pageGaratte Ranking TablesureshsusiNo ratings yet

- Definition ofDocument4 pagesDefinition ofsureshsusiNo ratings yet

- Nature of Economic AnalysisDocument4 pagesNature of Economic AnalysissureshsusiNo ratings yet

- Nature of Economic AnalysisDocument4 pagesNature of Economic AnalysissureshsusiNo ratings yet

- World Steel ProducitonDocument3 pagesWorld Steel ProducitonsureshsusiNo ratings yet

- Nature of Economic AnalysisDocument4 pagesNature of Economic AnalysissureshsusiNo ratings yet

- Global RecessionDocument15 pagesGlobal RecessionsureshsusiNo ratings yet

- GrapeDocument67 pagesGrapeDhiva ManoNo ratings yet

- What Is International MarketingDocument51 pagesWhat Is International MarketingsureshsusiNo ratings yet

- Ben DoverDocument2 pagesBen DoverZerohedge0% (1)

- Part I: Concept of Credit TransactionsDocument31 pagesPart I: Concept of Credit TransactionsLee SomarNo ratings yet

- Rekap Data Permohonan Buka Rekening Bni PuskesmasDocument8 pagesRekap Data Permohonan Buka Rekening Bni PuskesmasmsrepetNo ratings yet

- Road Transport Act SummaryDocument9 pagesRoad Transport Act SummaryFarah Najeehah ZolkalpliNo ratings yet

- Operational Risk: An Overview: Dr. Richa Verma BajajDocument37 pagesOperational Risk: An Overview: Dr. Richa Verma BajajJoydeep DuttaNo ratings yet

- HLCM Top 100 and Beneficial Owner Report As of Dec. 31, 2018Document8 pagesHLCM Top 100 and Beneficial Owner Report As of Dec. 31, 2018Brian SeeNo ratings yet

- 2 PDFDocument110 pages2 PDFAndrew FinchNo ratings yet

- Reinsurance Industry in IndiaDocument18 pagesReinsurance Industry in Indiapriyank2380804621100% (12)

- Amanah BankDocument3 pagesAmanah BankMaannavie MarcosNo ratings yet

- My Value Trade Equity DP NSDL FormDocument56 pagesMy Value Trade Equity DP NSDL FormchetanjecNo ratings yet

- Unexpired ReserveDocument16 pagesUnexpired ReservePreethaNo ratings yet

- Marketing Plan Report ItradeDocument8 pagesMarketing Plan Report ItradeVkNo ratings yet

- Chevron HeadquartersDocument2 pagesChevron HeadquartersGunjan DoshiNo ratings yet

- Account Details and Transaction History: eCA-I OnlineDocument2 pagesAccount Details and Transaction History: eCA-I OnlineTaufiq KurniawanNo ratings yet

- Financial Leasing in Tanzania: BriefingDocument3 pagesFinancial Leasing in Tanzania: BriefingArden Muhumuza KitomariNo ratings yet

- FinCEN Ripple Labs Facts and ViolationsDocument6 pagesFinCEN Ripple Labs Facts and ViolationscryptosweepNo ratings yet

- Account StatementDocument12 pagesAccount StatementDavidRiyazMithraNo ratings yet

- Department of Justice V ITS Financial RulingDocument233 pagesDepartment of Justice V ITS Financial RulingKelly Phillips ErbNo ratings yet

- Adrian Douglas: Gold Market Isn't 'Fixed' It's RiggedDocument12 pagesAdrian Douglas: Gold Market Isn't 'Fixed' It's RiggedChrys AureusNo ratings yet

- dd1 PDFDocument3 pagesdd1 PDFChazMichaelmichaelsNo ratings yet

- Correction of Accounting Errors GuideDocument2 pagesCorrection of Accounting Errors GuideJean Emanuel100% (1)

- The United Republic of Tanzania: Annual Report For The Year Ended 30 JUNE 2018Document130 pagesThe United Republic of Tanzania: Annual Report For The Year Ended 30 JUNE 2018Hussein BoffuNo ratings yet

- Prudential Financial Inc BondDocument2 pagesPrudential Financial Inc BonddroidNo ratings yet

- State Wise Banker DetailsDocument6,584 pagesState Wise Banker DetailsAshwani KumarNo ratings yet

- Ravi Kant.Document2 pagesRavi Kant.kksingh007indiaNo ratings yet

- IAIS Issues Paper on Solvency Assessments and Actuarial IssuesDocument50 pagesIAIS Issues Paper on Solvency Assessments and Actuarial Issuesthanhtam3819No ratings yet