Professional Documents

Culture Documents

SSRN Id1342255

Uploaded by

Anoop PatsariyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SSRN Id1342255

Uploaded by

Anoop PatsariyaCopyright:

Available Formats

Electronic copy available at: http://ssrn.

com/abstract=1342255

Perspective on economic growth of BRIC countries: A case of Brazil and India

Naresh Kumar

National Institute of Science Technology & Development Studies,

K. S. Krishnan Marg, New Delhi 110 012, India

Tel: +91 11 2584 3102, Fax: +91 11 2584 6640

Email: nareshqumar@yahoo.com

Alina Fodea

State Agency on Intellectual Property of the Republic of Moldova

Chisinau, Republic of Moldova

Tel: +37322 400592; Fax: +37322 440119

Email: alina.fodea@agepi.md

Abstract

Global economy is under uncertainty due to recent meltdown of economic and

industrial growth. Though process of globalisation has boosted economic growth

resulting in the structural changes of the world economy. This has triggered rapid

changes in developing economies and may predominantly contribute to global

economic growth in the coming decade, though it has posed several challenges in

countries such as Brazil, Russia, India and China. In spite of studies show that there

may be a major shift in the global economic balance and it is argued that BRIC

countries may emerge as a global economy in future. As a result, the current

slowdown in the economy is a major concern of all countries. This phenomenon

necessitates a broad analysis. Therefore, the purpose of this paper is to analysis

various economic indicators such as GDP, GDP growth by sectors, import and export

and FDI inflows of Brazilian and Indian economy using forecasting techniques. Based

on analytical results future trends and potential of both the economies are discussed.

Results demonstrate that both countries have a budding economic growth.

Electronic copy available at: http://ssrn.com/abstract=1342255

2

Introduction

Over the last few decades the world economy has undergone a lot of changes

in geopolitical and economic terms, and in the location and distribution of production.

Therefore, many developing countries/emerging economies such as Brazil, Russian,

India, and China (BRICs) have attained an important role in the world economy as

producers of goods and services and receivers of capital. The four countries went

through major institutional transitions and changes in their economic structure in the

recent history. Though BRICs countries followed a sustainable growth path in their

integration into globalise learning economy. Despite, these newly emerging

economies having a big part of their large population are still not integrated in the

market economy. After several socio-economic transformations around the middle of

the twentieth century all these countries were inward orientated and followed more or

less centrally planned development strategies from the 1950s to the 1970s. Therefore,

they were replaced by gradual integration in the global economy in the 1980s and

1990s. In recent times, there is a surge in the global economy particularly in BRICs

countries due to economic liberalisation. The economic transformation blending with

diffusion of Information and Communication Technologies (ICTs) led to major shift

in the world economy.

The new economic order and good economic policies have accelerated

developing economy like China, India in Asia, Brazil, Russia, South Korea and South

Africa. In these countries a new economy is emerging and if the current growth

persists they may be the global economic player in near future. Studies show [1] that

in the next few decades, the growth generated by the large developing countries,

particularly the BRICs (Brazil, Russia, India and China) could become a much larger

force in the world economy than it is nowand much larger than many investors

3

currently anticipate. It is evident that from the onset of the 21

st

century more than a

third of the worlds growth has originated in these countries. So, the rise of new

powerhouse economies in the developing world can shift the equation of global

economic [2] order. It is also projected that the BRICs economies as a whole could be

larger than the G6 in future. Thus the BRIC thesis recognizes that Brazil, Russia,

India and China [3] have changed their political systems to embrace global capitalism.

Moreover, Brazil, Russia, India and China have long been a favourable destination of

emerging market investors. This is optimistic for economic growth and huge

investment may come to the BRICs in coming decades. The spur in economic growth

requires a broad analysis to have a right picture of the BRICs economic growth and

development. Therefore, in this paper certain economic indicators pertaining to Brazil

and India, a constituent of the BRICs countries, are analyzed by applying

mathematical models particularly growth models. Although, these models frequently

used to study innovation growth and forecasting but several studies have also been

conducted to analyze economic trajectories [4,5} by applying growth functions. The

analysis suggests that BRICs countries, particularly Brazil and India could become a

very important source of new global economy in the coming years.

Economic status of the BRICs-India and Brazil

Due to the process of economic liberalisation the GDP of emerging economies

rose significantly from 1990 onward. Among emerging economies the BRICs

countries have been doing considerably well. The average economic growth rate of

BRICs in 2006 was about 8.3 percent far above that of the world. A brief status of

Brazilian and Indian economy is given below:

India

4

After independence India grew at an average rate of growth relative to other

developing countries for a number of decades. In the beginning India managed to hold

a relatively high savings rate, which allowed the government to gather some resources

and capital. During the 1960s and 1970s India had an inward-looking trade and

investment policy, which included import substitution. This import substitution

strategy allowed the country to be self-sufficient but the costs of many goods for

consumers were high because the industries did not face competition from abroad and

multinational companies (MNCs). But in 1980, India began to follow economic

liberalization approach wherein tariffs and import and export controls were relaxed.

This reduced the costs to import inputs and further reduced the costs of some

consumer goods. Thus the economic reforms resulted into real GDP growth, export

growth, productivity increases, along with increased government borrowing and

spending and an ever-expanding fiscal deficit. Foreign direct investment (FDI) was

also encouraged and moved into the country with the hopes for increases in consumer

demand. Economic growth picked up once again but the budget deficit was found to

be quite challenging to reduce. In addition, focus was placed on education specifically

for the high technology sector in order to encourage productivity and foreign direct

investment. As a result Indias GDP growth increased constantly and productivity was

also quite strong. Learning from the experience India further liberalised its economy

in the early 1990s, which resulted momentous growth in Indian economy.

Brazil

Brazil possesses large and well-developed agricultural, mining, manufacturing

and service sectors. As a result, Brazil's economy outweighs that of all other South

American countries and is expanding its presence in world markets too. However,

Brazilian economy grew, on average, only 1.1% per year as the country absorbed a

5

series of domestic and international economic shocks by imposing proper economic

policies. The three pillars of the Brazilian economic program were (i) a floating

exchange rate (ii) an inflation-targeting regime and (iii) tight fiscal policy, which have

been reinforced by a series of economic reforms programs. Further for increasing

international trade the currency depreciated sharply after 2000, which contributed to a

dramatic current account adjustment. In 2003, Brazil ran a record trade surplus and

recorded the first current account surplus since 1992. Though economic management

has been good there remain important economic vulnerabilities. The bigger challenge

was maintaining economic growth over a period of time to generate employment and

make the government debt burden more manageable. Thus, whereas Indian economy

was performing well, on the other hand the Brazilian economy was facing several

economic shocks. However, during the 1960s and 1970s, Brazil successfully

implemented import substitution models, which increased economic growth and

allowed its industrial sector to develop and diversify, since it did not have to deal with

foreign competition with greater market power. This strategy also helped the country

to reduce its reliance on coffee as its main export. Consequently, it succeeded on

moving from an agricultural economy to a manufacturing one. However, inward-

looking strategies, such as import substitution, are difficult to continue as a long-term

strategy because they are costly to protect the domestic industries. Even after these

reforms were in place, foreign direct investment has been slow to enter the country,

and export growth has not been nearly as high as in the other BRICs countries. One

reason is that corporate taxes are quite high and there is limited financing for small

businesses, which constrains Brazilian exporters. The reforms reduced tariffs and

other trade barriers. Further, to overcome economic slowdown Brazil entered the

Mercosur trading bloc [6] in 1994 with Argentina, Paraguay and Uruguay, which

6

moved the country further toward the global economy. A comparative picture of both

the countries are given in Table 1-2.

Table 1: Economic Indicators of India (in US $ million)

Year

Annual sectoral growth (%)

Export

Import

FDI

Trade

Balance

GDP Agriculture Industry Service

2000 6.1 -0.10 6.5 5.5 36822 49671 2439 -9613.47

2001 4.4 6.20 2.7 7.1 44560 50536 2908 -5976.17

2002 5.8 -6.90 7.0 7.3 43827 51413 4222 -7586.86

2003 3.8 10.00 7.6 8.2 52719 61412 3134 13402.31

2004 8.5 0.70 8.6 9.9 63843 78150 2634 -14306.65

2005 7.5 2.30 9.0 9.8 83536 111518 3755 -27819.06

Source: http:// dipp.nic.in

Table 2: Economic Indicators of Brazil (in US $ million)

Year

Annual sectoral growth (%)

Export

Import

FDI

Trade

Balance

GDP Agriculture Industry Service

2000 4.5 2.1 4.8 3.8 55100 55800 32779 700

2001 1.3 5.6 -0.5 1.7 58200 55600 22457 2600

2002 1.9 5.5 2.6 1.6 60400 47200 16590 13000

2003 0.5 4.4 0.1 0.6 73100 48300 10144 24900

2004 4.9 4.5 5.8 2.9 96500 62800 18146 33700

2005 2.2 4.3 3.7 2.4 117500 73000 15067 44500

Source: www.brazilchamber.org/resources/econ_br.htm

Methodology and Analysis

The objective of the paper is to analyse the emerging pattern of economic

growth in Brazil and India, which are a part of BRICs countries. For this purpose

certain economic indicators pertaining to these countries namely Gross Domestic

Product (GDP), Foreign Direct Investment (FDI), Import and Export are analysed

using mathematical models. In addition, sectoral growth namely agriculture, industry

7

and service sectors are also analysed for the period 2000-2005. For analysis of data

and investigation of growth pattern innovation growth models are used. The growth

models are generally applied to study natural growth phenomenon [7], commonly

called the natural growth model. In these models it is assumed that the population

grows at a rate that is proportional to itself. For example, if P represents such

population then the assumption of natural growth can be written symbolically as:

P k

dt

dP

where k is a positive constant. However, growth models have many applications

besides natural growth. Therefore, to study different trends of the economic indicators

linear, logistic, Gompertz [8], exponential and power models are used for comparative

analysis. The mathematical equations of these functions/models are given below:

(i) Linear model:

bx a y

(ii) Logistic model

bx

a

k

y

1

(iii) Gompertz model

bx

ae

ke y

(iv) Exponential model

bx

ae y

(v) Power model

b

ax y

where x, y are independent and dependent variables, k is upper limit, a, and b,

are constants. These mathematical models have been found very versatile tools in

8

socio-economic modelling in general and diffusion models in particular. In this paper

these models are used to investigate the pattern of economic indicators of Brazil and

India. The choice of these growth models is based on the fact that it provides a

convenient medium to describe growth phenomenon over time of any variable [9,10].

Consequently, for analysing empirical trends of economic growth, different forms of

growth models namely (i) logistic and Gompertz models for GDP growth (ii) logistic

and power models for FDI (iii) exponential and power models for import and export

(iv) logistic and linear for trade balance and (v) power and linear models for sectoral

growth (agriculture, industry and service sector) are applied. For parameter

estimations Quasi-Newtonian iteration method is used with the help of SYSTAT [11].

On the basis of the parameters obtained projections are made upto the year 2012 AD,

which are listed in Tables 3-6.

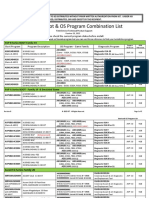

Table 3: Estimates for GDP growth and FDI in Brazil and India

Year

GDP growth (%)

Brazil

GDP growth (%)

India

FDI inflow Brazil FDI inflow India

Logistic Gompertz Logistic Gompertz Logistic Power Logistic Power

2008 2.16 2.16 7.23 6.67 14986.75 10273.70 3182.00 3958.19

2009 2.16 2.16 7.40 6.76 14986.75 9728.23 3182.00 4120.12

2010 2.16 2.16 7.59 6.86 14986.75 9259.79 3182.00 4288.66

2011 2.16 2.16 7.85 7.10 14986.75 8851.86 3182.00 4464.10

2012 2.16 2.16 8.10 7.55 14986.75 8492.49 3182.00 4646.72

Parameters estimates

k

a

b

MSE

2.16

-0.52

21.045

14.526

2.16

0.734

35.476

14.526

0.802

-0.795

-0.003

377.00

318787.98

11.583

0.001

377.68

14986.7

-630936.6

16.758

46787.00

32049.00

-0.0518

12283.00

3182.00

-209.029

70.721

3068.00

2759.218

0.040

3052.00

9

Table 4: Estimates for import and export in Brazil and India

Year

Brazil (Import) India (Import) Brazil (Export) India (Export)

Expo. Power Expo. Power Expo. Power Expo. Power

2008 65145 79034 184409.102 118271.585 130831 193579 132038.831 90359.745

2009 65989 83929 224032.693 125624.580 138384 231000 156472.871 95324.829

2010 66762 89127 272170.122 132669.216 145592 275654 185428.477 100050.915

2011 67475 94647 330650.737 139444.856 152500 328939 219742.374 104569.801

2012 68138 100510 401696.958 145983.010 159143 392526 260406.123 108906.794

Parameters estimates

a

b

MSE

49.809

0.112

983.00

46.017

0.060

988.00

31990.492

0.195

1481.00

33621.525

0.572

1453.00

39.454

0.177

1917.00

40.584

0.533

1840.00

28646.08

0.170

9506.00

29614.672

0.508

9407.00

Table 5: Estimates for growth of agriculture and industry in Brazil and India

Year Brazil (Agriculture) India (Agriculture) Brazil (Industry) India (Industry)

Logistic Linear Logistic Linear Logistic Linear Logistic Linear

2008 4.860 5.437 4.265 3.982 2.340 4.463 14.522 11.740

2009 4.860 5.626 4.956 4.336 2.340 4.774 16.959 12.620

2010 4.860 5.814 5.793 4.690 2.340 5.086 19.898 13.500

2011 4.860 6.003 6.817 5.045 2.340 5.397 23.462 14.380

2012 4.860 6.191 8.094 5.399 2.340 5.709 27.803 15.260

Parameters estimates

k

a

b

MSE

4.860

0.839

22.402

40.836

3.740

0.189

58.391

15.214

-12.888

0.115

8.871

0.793

0.354

13.50

2.340

-0.126

16.685

16.506

1.660

0.311

23.536

29.10

-0.994

-0.001

149.606

04.881

0.880

99.919

10

Table 6: Estimates for growth of service sector and trade balance in Brazil and

India

Year Brazil (Service) India (Service) Brazil (Trade

balance)

India (Trade balance)

Logistic Linear Logistic Linear Power Linear Power Linear

2008 1.84 1.47 14.01 12.80 95330 70840 -40904.59 -32262.89

2009 1.84 1.35 17.09 13.68 115320 80100 -47020.38 -35743.89

2010 1.84 1.22 21.92 14.56 136980 89370 -53336.90 -39224.88

2011 1.84 1.09 30.56 15.44 160300 98630 -59841.58 -42705.88

2012 1.84 1.01 50.44 16.32 185240 107890 -66523.60 -46186.87

Parameters estimates

k

a

b

MSE

1.840

1.960

35.434

10.456

2.607

-0.126

14.222

27.01

-0.995

-0.0001

198.013

4.887

0.880

197.179

1.800

1.807

1943.38

-12.520

9.263

1938.78

-2237.642

1.322

6980.00

-933.936

-3480.995

6222.00

For comparative assessment projections are considered where Mean square Error

(MSE) is lesser.

Results and discussions

Analysis indicates that both Brazilian and Indian economy is growing. In the

case of Brazil GDP growth rate may be constant in futuer however, both the models

logistic and Gompertz could not converge the empirical data. Conversely, Indian GDP

is growing significantly. It is estimated that by the 11

th

fiver year plan the GDP

growth of India may be more than 8%. It is fascinating that FDI in India will be

increasing whereas it is expected that FDI in Brazil may decline in future. Moreover,

import and export are showing growing pattern in both the countries. Though, trade

balance in Indian case is negatively increasing while in the case of Brazil it is showing

positive increasing which is a good signal for Brazilian economy. Among the sectors

namely agriculture, industry and service in Brazil the agriculture sector seems to be

promising whereas service sector is growing marginally. In India service sector has

11

enormous potential followed by agriculture and industry. Estimates show that industry

and service sectors in India may grow considerable which account nearly for 26% and

48% of GDP, respectively, while agriculture contribute about 25% of GDP. Thus,

India may dominate world markets in services and manufacturing. On the other hand,

in Brazil tertiary, secondary and primary sectors contribute about 57%, 36% and 8%

respectively. Hence, Brazil may too dominate in the tertiary and secondary sectors.

Further, fast growth of Indian economy may lead as an attractive investment

destination.

The process of economic liberalisation has led to various developments in

economic and political spheres by increasing interdependence among developing

countries more than ever before. Economic forecasts of various studies [OECD, 1998,

& IEA 2004] predict that emerging countries, especially those of BRICs countries,

will continue to higher growth rates compared to developing countries. Consequently,

Asian, African and Latin American countries, particularly the BRICs (Brazil,

Russia, India, China) are undergoing economic transformation. Therefore, to cope

with they have already elaborated national strategies in order to support economic

growth on a long-term perspective, balancing the interests of economy, society and

environment for sustainable development. It is also predicted [12] that the GDP of the

BRICs countries (China, Russia, India, and Brazil) would be half of the combined

GDP of the US, J apan, Germany, France, Italy and Britain in the future. Accordingly,

if the growth in these countries continues they may emerge as dominant economies in

the world. Although each of these countries is large, their economic growth would

bring them into competition with larger and wealthier economic blocs like the EU.

To keep pace of growth there is a need of harmonious and balanced approach

of economic development to benefit each other. Therefore, BRICs would be a

12

partnership of equals who would bring complementary competencies on a common

platform for mutual interest. For example, while India dominates services, most of the

world manufacturing may be shifting to China. This needs further agenda for

cooperation among BRICs. In recent years, the Brazilian government has been putting

efforts into such areas as the agribusiness and eco-business sectors. Economic growth

in India, meanwhile, is led primarily by the service sector. There are expectations that

India will develop into a labor market that stably supplies outstanding human

resources and into a promising consumption market in the future due to Indias

expanding middle-class stratum, which has real purchasing power. For the future, to

cope with the population growth, the development of the manufacturing sector is

essential in order to effectively generate jobs. The government is committed to

fostering pharmaceutical, and biotech industries, etc.

References

1. Wilson, D. and Purushothaman, R., Dreaming with BRICs: The Path to 2050,

October 2003, Global Economics Paper No.: 99, Goldman Sachs Global

Economics (http://www.gs.com/insight/research/reports/99.pdf).

2. Bloomberg, W. P., BRICs Deserve Bigger in Global Economy, The China

Post, J anuary 27, 2007.

3. Farah, Paolo. D., Five Years of Chinas WTO Membership: EU and US

Perspectives on Chinas Compliance with Transparency Commitments and the

Transitional Review Mechanism, Legal Issues of Economic Integration Vol.

33 (3), pp. 263304, 2006.

4. Kumar, Naresh and Rai, L. P., Prospects of Industrial Growth in South Asian

Region, Pranjana, Vol. 8, No. 1, pp. 43-48, 2005.

13

5. Kumar, Naresh, Assessment of Sectoral Growth of Indian Economy Using

Growth Models, Paradigm, Forth coming Issue.

6. www.cerc.com/pdfs/emergingbrics.pdf

7. Malthus, T. R., An Essay on the Principles of Populations, St. Paulss,

London, 1978.

8. Gompertz, B., On the Nature of the Function Expressive of the Law of Human

Mortality, Philosophical Transactions of the Royal Society of London, Series

A, Vol. 115, pp. 513-580, 1825.

9. Mansfield, E. and Hensley, C, The Logistic Process - Tables of the Stochastic

Epidemic Curve and Applications, J ournal of the Royal Statistical Society

Series B-Statistical Methodology 22(2), pp. 332-337, 1960.

10. Lekvall, P., and Wahlbin, C., A Study of Some of Assumptions Underlying

Innovation Diffusions, Swedish journal of Economics, Vol. 75(4), pp. 362-

377, 1973.

11. SYSTAT, SYSTAT Inc., 1800 Sherman Avenue, Evanston, IL60201, 312,

864-5670, 1988.

12. www2.goldmansachs.com/hkchina/insight/research/pdf/BRICs_3_12-1-05.pdf

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- TM 9-1751 Cylinder, Radial, Gasoline Engine (Continental Model R975-C1) 1944Document237 pagesTM 9-1751 Cylinder, Radial, Gasoline Engine (Continental Model R975-C1) 1944Kelsey Yuen50% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Igt - Boot Os List Rev B 10-28-2015Document5 pagesIgt - Boot Os List Rev B 10-28-2015Hector VillarrealNo ratings yet

- Unit 3: The Catering Service Industry Topic: Catering Service Concept Digest (Discussion)Document5 pagesUnit 3: The Catering Service Industry Topic: Catering Service Concept Digest (Discussion)Justin MagnanaoNo ratings yet

- A320 21 Air Conditioning SystemDocument41 pagesA320 21 Air Conditioning SystemBernard Xavier95% (22)

- (Case Study) IkeaDocument4 pages(Case Study) IkeaSachin Parmar100% (1)

- Chapter 1Document3 pagesChapter 1Anoop PatsariyaNo ratings yet

- Chapter 2Document5 pagesChapter 2Anoop PatsariyaNo ratings yet

- Mutual FundDocument59 pagesMutual FundAnoop PatsariyaNo ratings yet

- Mutual FundDocument248 pagesMutual FundManish BhagatNo ratings yet

- CAT 2013 Schedule: S No. Activity Date(s) 1 2 3 4 5Document1 pageCAT 2013 Schedule: S No. Activity Date(s) 1 2 3 4 5Siddharth SidNo ratings yet

- RatiotablesDocument6 pagesRatiotablesAnoop PatsariyaNo ratings yet

- 074988600Document15 pages074988600Anoop PatsariyaNo ratings yet

- Topic: The Employee Participation at Bank of BarodaDocument12 pagesTopic: The Employee Participation at Bank of BarodaritikapbhNo ratings yet

- APA Format GuideDocument11 pagesAPA Format GuidelostfornowNo ratings yet

- Fiscal Policy Objectives and InstrumentsDocument25 pagesFiscal Policy Objectives and InstrumentsAnoop PatsariyaNo ratings yet

- Why India's Current Account Deficit Will Improve Over TimeDocument2 pagesWhy India's Current Account Deficit Will Improve Over TimeAnoop PatsariyaNo ratings yet

- Portfolio SelectionDocument3 pagesPortfolio SelectionAnoop PatsariyaNo ratings yet

- Service Manual: DCR-DVD150E/DVD450E/DVD650/ DVD650E/DVD850/DVD850EDocument71 pagesService Manual: DCR-DVD150E/DVD450E/DVD650/ DVD650E/DVD850/DVD850EJonathan Da SilvaNo ratings yet

- Depreciation Methods ExplainedDocument2 pagesDepreciation Methods ExplainedAnsha Twilight14No ratings yet

- FM Butterfly ValvesDocument3 pagesFM Butterfly ValvesahsanNo ratings yet

- NYU Stern Evaluation NewsletterDocument25 pagesNYU Stern Evaluation NewsletterCanadianValueNo ratings yet

- 47-Article Text-201-1-10-20180825Document12 pages47-Article Text-201-1-10-20180825kevin21790No ratings yet

- Office of The Protected Area Superintendent: Mt. Matutum Protected LandscapeDocument3 pagesOffice of The Protected Area Superintendent: Mt. Matutum Protected LandscapeNurah LaNo ratings yet

- Philips Lighting Annual ReportDocument158 pagesPhilips Lighting Annual ReportOctavian Andrei NanciuNo ratings yet

- SUTI Report - Metro ManilaDocument87 pagesSUTI Report - Metro ManilaIvan Harris TanyagNo ratings yet

- What Is Propaganda DeviceDocument3 pagesWhat Is Propaganda DeviceGino R. Monteloyola100% (1)

- TMS Software ProductsDocument214 pagesTMS Software ProductsRomica SauleaNo ratings yet

- TurboVap LV Users ManualDocument48 pagesTurboVap LV Users ManualAhmad HamdounNo ratings yet

- Project IGI 2 Cheat Codes, Hints, and HelpDocument4 pagesProject IGI 2 Cheat Codes, Hints, and Helppadalakirankumar60% (5)

- B JA RON GAWATDocument17 pagesB JA RON GAWATRon GawatNo ratings yet

- Duratone eDocument1 pageDuratone eandreinalicNo ratings yet

- IPR GUIDE COVERS PATENTS, TRADEMARKS AND MOREDocument22 pagesIPR GUIDE COVERS PATENTS, TRADEMARKS AND MOREShaheen TajNo ratings yet

- Folic AcidDocument5 pagesFolic Acidjyoti singhNo ratings yet

- Seaflo Outdoor - New Pedal Kayak Recommendation July 2022Document8 pagesSeaflo Outdoor - New Pedal Kayak Recommendation July 2022wgcvNo ratings yet

- Dhabli - 1axis Tracker PVSYSTDocument5 pagesDhabli - 1axis Tracker PVSYSTLakshmi NarayananNo ratings yet

- Business Study Quarterly Paper by Vijay SirDocument3 pagesBusiness Study Quarterly Paper by Vijay Sirmonish vikramNo ratings yet

- 2018 Price List: Account NumberDocument98 pages2018 Price List: Account NumberPedroNo ratings yet

- Online Job Interviews For International Careers: Business MeetingDocument8 pagesOnline Job Interviews For International Careers: Business Meetingintercultural_c2593No ratings yet

- Open Recruitment Member Kejar Mimpi Periode 2023 (Responses)Document22 pagesOpen Recruitment Member Kejar Mimpi Periode 2023 (Responses)Sophia Dewi AzzahraNo ratings yet

- Sys Admin Guide Xerox WorkCentre 7775Document185 pagesSys Admin Guide Xerox WorkCentre 7775dankorzon1No ratings yet

- 136 ADMU V Capulong (Roxas)Document2 pages136 ADMU V Capulong (Roxas)Trisha Dela RosaNo ratings yet

- Đề Số 1 - Đề Phát Triển Đề Minh Họa 2023Document20 pagesĐề Số 1 - Đề Phát Triển Đề Minh Họa 2023Maru KoNo ratings yet

- 3.1.2 Cable FPLR 2X18 AwgDocument3 pages3.1.2 Cable FPLR 2X18 Awgluis rios granadosNo ratings yet