Professional Documents

Culture Documents

Artemis Capital Q3 2011 - Fighting Greek Fire With Fire

Uploaded by

ThorHollisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Artemis Capital Q3 2011 - Fighting Greek Fire With Fire

Uploaded by

ThorHollisCopyright:

Available Formats

Fighting Greek Fire with Fire: Volatility, Correlation, and Truth

Note: The following article is an excerpt from the Third Quarter 2011 Letter to Investors from Artemis Capital

Management LLC published on September 30, 2011.

Artemis Capital Management, LLC | Letter to Investors Third Quarter 2011 Page 2

www.artemiscm.com (310) 496-4526

520 Broadway, Suite 350

Santa Monica, CA 90401

(310) 496-4526 phone

(310) 496-4527 fax

www.artemiscm.com

c.cole@artemiscm.com

Fighting Greek Fire with Fire: Volatility, Correlation, and Truth

The world economy is fighting a fearsome wildfire as the European sovereign debt crisis

burns its way closer toward the tinderbox of a second global recession. The insolvency

inferno has no prejudice and will fuse to the flesh of any asset class fueling a blistering

spiral of correlation and volatility. The third quarter of 2011 was characterized by explosive

movements in equity markets as the S&P 500 index declined -14% in the worst

performance since the crash of 2008. Global indices officially entered bear market territory

with the MSCI All-Country World Index down more than -20% since peaking in May. The

10-year US Treasury yield reached the lowest level on record in September as credit

markets braced for an economic slowdown. Over the quarter implied volatility increased

+96% as the VIX index climbed to 42.96. If you heeded the omens of variance markets

earlier this year you were richly rewarded by this increase in volatility.

A wildfire is blind and cruel in violently transforming the essence of any material to ash. In this sense the end-effect of fire is

always correlation and volatility. The common method to extinguish a wildfire is by dousing it with water but what if this is

not enough? Is it possible for fire to resist or spread through the addition of liquidity? Ironically in recorded history there is

one such type of flame... Greek Fire. Greek Fire was the most feared weapon of the Byzantine Empire because water alone

was powerless against its flames. The composition of the weapon is an ancient secret but modern scientists believe it was

made with calcium phosphide (heating lime, bones, charcoal) which, upon contact with water, ignites spontaneously. Greek

Fire was so difficult to extinguish that it was known to continue to burn even underneath bodies of water. The fire could fuse

to any surface, including the sea, explode and spread uncontrollably. For this reason the ancient napalm was very effective in

naval warfare and saved Constantinople from two Arab sieges. The guardians of the formula were so afraid it would fall into

enemy hands that its secrets were eventually lost to time

(1)

. For those who fought against Greek Fire a liquidity trap became a

liquidity grave.

In the new era of global interconnectedness liquidity alone is not enough to extinguish Europe's Greek Fire. The smoldering

flames of default are spreading impervious to fiat money creation. The unintended consequences of unprecedented

intervention in markets are culminating in higher cross-asset correlations and violent price gyrations. All we left have to show

for our three year liquidity orgy is the most correlated period in modern finance. The propensity for erratic movements in

DJ IA daily lagged returns is at the most extreme levels in over nine decades of recorded data. We are trapped in a binary

market governed by the flip of a macroeconomic coin with deflation on one side and government bail-outs on the other. In this

hyper-correlated market many alpha generating strategies resemble directional volatility trades.

The more global asset classes move in lockstep the more haphazardly the international response to the crisis has become. A

currency war is raging as central banks alternate dousing sovereign insolvency flames with uncoordinated currency

devaluation. Whether this is Brazil unexpectedly cutting rates by 50 basis points despite the highest inflation in six years or

Switzerland pegging the Franc to the Euro to protect exports it is every man, woman, and central bank for itself. Every day we

see new kinks in the armor of prior economic and political alliances that lay vulnerable to surrender in a vicious self-

reinforcing cycle of devaluation. While public opposition grows to bail-out economics the Federal Reserve has very few

credible stimulus options remaining to battle the inferno.

Greek Fire in Europe threatens to ignite a global recession and if you haven't already noticed, your alpha is burning. There are

no safe havens and to survive the flames of the next decade we must embrace and harness their nature.

Fight fire with fire ...volatility with volatility

In markets and in life, to find truth

Artemis Capital Management, LLC | Letter to Investors Third Quarter 2011 Page 3

www.artemiscm.com (310) 496-4526

Thoughts on Volatility - Omens and Intuition

In my last letter I spoke at length about the abnormally

steep volatility term-structure arguing it represented

structural imbalances in risk driven by the unintended

consequences of monetary policy ("Is Volatility Broken:

Normalcy Bias and Abnormal Variance" Q1 2011).

Earlier this year it was clear the volatility markets were

bracing for a correction following the end of QE2. With

this thesis in mind Artemis recommended shorting the

long-end of the VIX futures curve where volatility of

volatility ("VOV") was expensive and replacing that

exposure with more sensitive volatility positions on the

front of the curve where VOV was cheap. The strategy

was extremely effective when equity markets collapsed

and the VIX futures curve inverted while options skew

flattened.

What happens from here is much more difficult to

understand. The consensus view is that volatility is mean

reverting and when the VIX is above 40 and realized

volatility is only at 30 the implied volatility premium is

very expensive. Nonetheless my intuition tells me that

given the current Euro-crisis, hyper-correlations, lack of

remaining stimulus options, and structural fragility of

markets there are enough catalysts for the VIX to break

even higher in the next few months.

Investors have a limited imagination regarding the

potential for greater realized volatility. Historical realized

volatility data of the DJ IA going back to 1929 shows

volatility climbed to 2008 highs a total of six times in the

past eighty years. If options existed during the Great

Depression we would have seen multiple observations of

50+implied volatility levels from 1928 to 1933 (based on

realized volatility calculated from DJ IA returns). During

the Black Monday crash of 1987 the VIX index would

most likely have recorded levels above 100! That blows

away the intra-day high of 89.53 reached on October 24,

2008 at the height to the last crash. A retest of volatility

extremes last seen in 2008 and 1987 would require an

uncontrolled default on Greek debt (similar to Lehman

2008) in combination with some kind of structural shock

(similar to the flash crash in 2010). This is improbable

but within the realm of possibility so look for signs of

contagion that would spark realized and implied volatility

to break the rules of power laws all over again.

With this uncertainty in mind the best course of action is to play both tails of the probability distribution. Global markets

are now hyper-correlated and therefore asset selection is less important. Look for tail risk hedges in assets that exhibit low

implied volatility relative to realized and cheap skew to the upside and downside. You can use this market schizophrenia to

your advantage by entering long volatility tail positions on both sides of the return distribution during the peaks and the

valleys of the market rollercoaster.

V

I

X

V

X

F

1

V

X

F

2

V

X

F

3

V

X

F

4

V

X

F

5

V

X

F

6

V

X

F

7

1

51

101

151

201

251

1

6

-

J

u

l

-

0

8

1

6

-

S

e

p

-

0

8

1

4

-

N

o

v

-

0

8

2

0

-

J

a

n

-

0

9

2

3

-

M

a

r

-

0

9

2

2

-

M

a

y

-

2

4

-

J

u

l

-

0

9

2

4

-

S

e

p

-

0

9

2

4

-

N

o

v

-

0

9

2

8

-

J

a

n

-

1

0

3

1

-

M

a

r

-

1

0

0

2

-

J

u

n

-

1

0

0

3

-

A

u

g

-

1

0

0

4

-

O

c

t

-

1

0

0

3

-

D

e

c

-

1

0

0

4

-

F

e

b

-

1

1

0

7

-

A

p

r

-

1

1

0

9

-

J

u

n

-

1

1

1

0

-

A

u

g

-

1

1

VIX Futures

Volatility of VIX Futures Curve (Vol of Vol)

(2008 to Present)

V

I

X

V

X

F

1

V

X

F

2

V

X

F

3

V

X

F

4

V

X

F

5

V

X

F

6

V

X

F

7

0.50x

0.70x

0.90x

1.10x

1.30x

1.50x

1.70x

J

a

n

-

1

1

F

e

b

-

1

1

M

a

r

-

1

1

A

p

r

-

1

1

M

a

y

-

1

1

J

u

l

-

1

1

A

u

g

-

1

1

S

e

p

-

1

1

VIX Futures

V

i

x

F

u

t

u

r

e

/

V

I

X

s

p

o

t

VIX Futures Curve

(normalized by spot VIX / Jan 2011 to Sept 2011

Artemis Capital Management, LLC | Letter to Investors Third Quarter 2011 Page 4

www.artemiscm.com (310) 496-4526

Fire & Water / Volatility and Money

From water comes life and from cash liquidity

comes asset prices. Money itself is not immune to

the laws of supply and demand and we can

measure its volatility. Extremes in the volatility

of the money supply, defined here as annualized

monthly changes in M1 through M3, reflect

important turning points in the US economy. To

this effect we have never

When the money supply is volatile the risk of a

recession grows incrementally higher. The

volatility of M1, defined as physical currency in

circulation and checking deposits, typically

spikes before the onset of a recession because

market participants transfer risk assets back into

physical cash (see graphic). In this sense, money

is one of the only assets whereby volatility spikes

occur in conjunction with high demand (US

Treasury securities also come to mind).

experienced a spike in

M1 volatility as large as what was recorded in

August 2011 without an ensuing recession.

The evolution of cash volatility provides clues to

the mystery of elevated global correlations. The

volatility of the money supply has been climbing

higher since the 1970s and the relationship

between the volatility of M3 and M1 resembles

an expanding sine wave or feedback loop (see

chart). This is indicative of the fact increasingly

violent shifts in the M1 physical cash supply are

not matched by higher volatility in the broader

M3 measurement that estimates credit creation

and animal spirits

(2)

. Therefore it takes vastly

more liquidity today to rouse the shadow banking

system but at the cost of higher potential for

market dislocation.

The ancient weapon of Greek Fire was deadly

because its flames fused to the very liquidity used

to fight it resulting in a larger blaze. Europe is a

perfect example of this paradox. How can the EU

provide unlimited liquidity to a stability fund

backstopping most of southern Europe without

threatening the sovereign credit of stronger

member nations like France or Germany in the

process? What happens if a member nation that

serves as a pillar of that facility in calm markets

is then forced to use it in times of market stress?

In this self-feeding predicament excess liquidity

during a contagion fuels further insolvency and is

arguably the cause of, not the solution to, market

disequilibrium.

0

5

10

15

20

25

30

35

1

9

7

1

1

9

7

2

1

9

7

4

1

9

7

6

1

9

7

8

1

9

8

0

1

9

8

2

1

9

8

4

1

9

8

6

1

9

8

8

1

9

9

0

1

9

9

2

1

9

9

4

1

9

9

5

1

9

9

7

1

9

9

9

2

0

0

1

2

0

0

3

2

0

0

5

2

0

0

7

2

0

0

9

2

0

1

1

V

o

l

a

t

i

l

i

t

y

o

f

M

o

n

e

y

S

u

p

p

l

y

Volatility of Money Supply

(annualized / 1971 to 2011)

Recession (Peak to Trough)

Volatility of M1

Volatility of M2

Volatility of M3 Source: M1,M2 & M3 values from Shadow Government Statistics

-25

-20

-15

-10

-5

0

5

10

15

1

9

7

2

1

9

7

4

1

9

7

6

1

9

7

8

1

9

7

9

1

9

8

1

1

9

8

3

1

9

8

5

1

9

8

6

1

9

8

8

1

9

9

0

1

9

9

2

1

9

9

3

1

9

9

5

1

9

9

7

1

9

9

9

2

0

0

0

2

0

0

2

2

0

0

4

2

0

0

6

2

0

0

7

2

0

0

9

2

0

1

1

D

i

f

f

e

r

e

n

c

e

M

o

n

e

y

S

u

p

p

l

y

V

o

l

a

t

i

l

i

t

y

Difference Annual M3 Volatility- M1 Volatility

(annualized / 1971 to 2011)

Recession (Peak to Trough)

Volatility of M3 - Volatility of M1

Source: M1,M2 & M3 values from Shadow Government Statistics

Artemis Capital Management, LLC | Letter to Investors Third Quarter 2011 Page 5

www.artemiscm.com (310) 496-4526

Assets to Ash - Correlation in the Greek Fire

It is not a secret that we are experiencing some of the highest cross-asset correlations in market history rending traditional

portfolio diversification futile. For example in this quarter we recorded the highest realized correlation readings ever for the

50 largest S&P 500 index stocks, S&P 500 sectors, Country ETFs, and in the CBOE S&P 500 Implied Correlation Index. We

have yet to fully comprehend the extent to which bail-out economics, competitive currency devaluation, and unprecedented

global monetary stimulus are contributing to what is now a decade long trend of higher correlation drift.

Volatility of the Fire

If volatility is the heat of the fire correlations are the winds

stirring the flames. The implied volatility of an index, such as

the S&P 500, is more sensitive

5

15

25

35

45

55

65

75

85

F

e

b

-

0

5

J

u

n

-

0

5

O

c

t

-

0

5

F

e

b

-

0

6

J

u

n

-

0

6

O

c

t

-

0

6

F

e

b

-

0

7

J

u

n

-

0

7

O

c

t

-

0

7

F

e

b

-

0

8

J

u

n

-

0

8

O

c

t

-

0

8

F

e

b

-

0

9

J

u

n

-

0

9

O

c

t

-

0

9

F

e

b

-

1

0

J

u

n

-

1

0

O

c

t

-

1

0

F

e

b

-

1

1

J

u

n

-

1

1

S

&

P

5

0

0

-

2

1

d

a

y

R

o

l

l

i

n

g

C

o

r

r

e

l

a

t

i

o

n

I

n

d

e

x

Realized Correlation of 50 Largest Cap S&P 500 stocks

(1 month rolling- 2005 to Present)

33

38

43

48

53

58

63

68

73

78

F

e

b

-

0

7

M

a

y

-

0

7

A

u

g

-

0

7

N

o

v

-

0

7

F

e

b

-

0

8

M

a

y

-

0

8

A

u

g

-

0

8

N

o

v

-

0

8

F

e

b

-

0

9

M

a

y

-

0

9

A

u

g

-

0

9

N

o

v

-

0

9

F

e

b

-

1

0

M

a

y

-

1

0

A

u

g

-

1

0

N

o

v

-

1

0

F

e

b

-

1

1

M

a

y

-

1

1

A

u

g

-

1

1

S

&

P

5

0

0

I

n

d

e

x

I

m

p

l

i

e

d

C

o

r

r

e

l

a

t

i

o

n

Implied Correlation of S&P 500 Index

(12 month constant adjustement)

-80

-60

-40

-20

0

20

40

60

80

100

120

1 101 201 301 401 501 601 701 801 901 1001 1101 1201

2

1

d

a

y

R

e

a

l

i

z

e

d

C

o

r

r

e

l

a

t

i

o

n

Ranking (Lowest to Highest)

Ranked 21 day Realized Correlations of 50 LargeCap Stocks in SPX

(2005 to Present)

9/7/2011 (Highest Correlation at 0.82)

2008 Crash High (11/13/2008 - Correlation at 0.76)

Bull Market Low (11/3/2006 - Correlation at 0.10)

0.05

0.15

0.25

0.35

0.45

0.55

0.65

0.75

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

S&P 500 Sector Correlation

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

Country ETF Correlation

when the average correlations

between the components of the index are greater. For

example, if average correlation of index components rises

from 0.35 to 0.70 the volatility of that index should be 45%

more sensitive. Therefore as correlations have drifted higher

over the past decade so has the volatility of volatility. Today

correlation is at all-time highs so it is natural to expect

similar extremes for changes in volatility. This partly

explains why the volatility of the VIX index reached the

highest level in its history at the end of August (see graph)

surpassing readings achieved during the 2008 financial crash

and 2010 flash crash. The trend is troublesome for traditional

portfolio management but presents opportunities for

volatility as an asset class. Look to capitalize on higher

volatility of volatility potential through timely execution of

long vega/convexity positions in the tails of the return

distribution.

20

70

120

170

220

270

J

a

n

-

0

0

J

u

n

-

0

0

N

o

v

-

0

0

A

p

r

-

0

1

S

e

p

-

0

1

F

e

b

-

0

2

J

u

l

-

0

2

D

e

c

-

0

2

M

a

y

-

0

3

O

c

t

-

0

3

M

a

r

-

0

4

A

u

g

-

0

4

J

a

n

-

0

5

J

u

n

-

0

5

N

o

v

-

0

5

A

p

r

-

0

6

S

e

p

-

0

6

F

e

b

-

0

7

J

u

l

-

0

7

D

e

c

-

0

7

M

a

y

-

0

8

O

c

t

-

0

8

M

a

r

-

0

9

A

u

g

-

0

9

J

a

n

-

1

0

J

u

n

-

1

0

N

o

v

-

1

0

A

p

r

-

1

1

S

e

p

-

1

1

V

o

l

a

t

i

l

i

t

y

o

f

t

h

e

V

I

X

i

n

d

e

x

(

%

a

n

n

u

a

l

i

z

e

d

)

21d Volatility of the VIX Index

(2000 to Present)

Artemis Capital Management, LLC | Letter to Investors Third Quarter 2011 Page 6

www.artemiscm.com (310) 496-4526

Everyone is a Volatility Trader

It is becoming harder and harder to make money

from money. The alpha derived from active

management can be decomposed into two

components 1) asset selection and; 2) volatility bias.

In highly correlated markets the asset selection

component is negated and alpha becomes

increasingly driven by rising and falling vol. When

this happens many classic hedge fund strategies

converge to simple synthetic volatility trades. This

could be one reason why many high profile

managers including Druckenmiller and Soros are

quitting the business while they are still ahead of the

curve. For example strategies that rely upon mean

reversion such as traditional value investing, pairs

trading, and statistical arbitrage become akin to

shorting volatility. The common retail strategy of

buying a stock on dips and selling on strength is

literally part of the process for synthetic replication

of a variance swap (rebalanced to one share every day). Remove the asset selection component entirely and you are

effectively shorting volatility. Likewise investment strategies that rely on trend following such as managed futures and

global-macro are akin to going long volatility. This is one reason why, like everything else, hedge fund returns are becoming

more correlated with one another (see graphic / HFRX indices).

Volatility and the Carry Trade

When Greek Fire fuses to the sea the water itself becomes an extension of the flames. To this effect the daily performance of

equity volatility and currencies is increasingly indistinguishable. I understand that some volatility traders hate currencies on

the basis that you never know when central banks will change the rules of the game. In today's markets currency trading and

volatility trading are being played on the same court with the same unpredictable referees. We can best understand excessive

correlation drift between equity vol and risk currencies as being driven by lower interest rates in developed economies that

provide fuel to the carry trade fire. Since 2008 the VIX index and the J PY/AUD cross has moved in near perfect lockstep

(see below) recording a 0.85 correlation. The trend is also noticeable in the correlation drift between the VIX index and a

cross-section of "risk" currencies. Furthermore the correlation drift between the VSTOXX (European equity volatility) and

the Euro/USD is also at historical extremes. The marriage of volatility and currency is a worrisome devlopment because it

implies the equity risk premium is not about economic fundamentals but instead is a function of global central banks fueling

leveraged carry trades.

-0.9

-0.7

-0.5

-0.3

-0.1

0.1

0.3

0.5

A

u

g

-

0

3

F

e

b

-

0

4

A

u

g

-

0

4

F

e

b

-

0

5

A

u

g

-

0

5

F

e

b

-

0

6

A

u

g

-

0

6

F

e

b

-

0

7

A

u

g

-

0

7

F

e

b

-

0

8

A

u

g

-

0

8

F

e

b

-

0

9

A

u

g

-

0

9

F

e

b

-

1

0

A

u

g

-

1

0

F

e

b

-

1

1

A

u

g

-

1

1

3-month Correlation VIX to

Risk Currencies

(AUD.USD; CAD.USD ; NZD.USD; AUD.JPY; EUR.CHF)

-0.6

-0.4

-0.2

0

0.2

0.4

0.6

M

a

r

-

0

0

S

e

p

-

0

0

M

a

r

-

0

1

S

e

p

-

0

1

M

a

r

-

0

2

S

e

p

-

0

2

M

a

r

-

0

3

S

e

p

-

0

3

M

a

r

-

0

4

S

e

p

-

0

4

M

a

r

-

0

5

S

e

p

-

0

5

M

a

r

-

0

6

S

e

p

-

0

6

M

a

r

-

0

7

S

e

p

-

0

7

M

a

r

-

0

8

S

e

p

-

0

8

M

a

r

-

0

9

S

e

p

-

0

9

M

a

r

-

1

0

S

e

p

-

1

0

M

a

r

-

1

1

S

e

p

-

1

1

3-month Correlation VSTOXX to

Euro/USD 0

20

40

60

80

100

120 0

10

20

30

40

50

60

70

80

90

A

p

r

-

0

7

J

u

l

-

0

7

O

c

t

-

0

7

J

a

n

-

0

8

A

p

r

-

0

8

J

u

l

-

0

8

O

c

t

-

0

8

J

a

n

-

0

9

A

p

r

-

0

9

J

u

l

-

0

9

O

c

t

-

0

9

J

a

n

-

1

0

A

p

r

-

1

0

J

u

l

-

1

0

O

c

t

-

1

0

J

a

n

-

1

1

A

p

r

-

1

1

J

u

l

-

1

1

J

P

Y

/

A

U

D

V

I

X

i

n

d

e

x

%

VIX (lhs) vs. Japanese Yen/Aussie Dollar(rhs)

Correlation = 0.85 since September 2008

-0.3

-0.1

0.1

0.3

0.5

0.7

0.9

J

a

n

-

0

8

A

p

r

-

0

8

J

u

l

-

0

8

O

c

t

-

0

8

J

a

n

-

0

9

A

p

r

-

0

9

J

u

l

-

0

9

O

c

t

-

0

9

J

a

n

-

1

0

A

p

r

-

1

0

J

u

l

-

1

0

O

c

t

-

1

0

J

a

n

-

1

1

A

p

r

-

1

1

J

u

l

-

1

1

Hedge Fund Strategies 1-month Correlations

(HFRX Equity Hedge, Relative Value, Event Driven / 2-day lag)

Artemis Capital Management, LLC | Letter to Investors Third Quarter 2011 Page 7

www.artemiscm.com (310) 496-4526

40 years of Mean Reversion

The degree of up and down days in the DJIA is at the most extreme level in recorded history representing a pinnacle in an

era of daily mean reversion. It only takes a casual observer of markets to see that the propensity for large-up days followed

by large-down days seems particularly vicious in today's cycle. The excessive intra-day and day-to-day volatility is

nauseating to professional and retail investors alike and multi-100 point swings in the DJ IA are all too common.

On a macro-level changes in the size and volatility of the money supply may be connected to a phenomenon called serial

correlation drift. Modern derivative pricing theory is based on a conceptual idea that knowledge of past prices has no

bearing on future returns (martingales). Despite this fact there is evidence that asset returns show signs of "serial correlation"

whereby past returns are correlated (to some level) with future results. There are two forms of serial correlation 1) Negative

serial correlation measures the propensity for today's return to be the opposite of yesterday's and rewards reversion to the

mean strategies. For example an asset that alternates between being +1% and -1% every day demonstrates perfect negative

serial correlation. 2) Positive serial correlation is associated with consecutive days of asset price movement in the same

direction and rewards trend following models. Both forms of serial correlation can occur in up or down trending markets.

We are going nowhere at the fastest pace in market history. The rolling one year serial correlation of daily lagged

logarithmic returns in the DJ IA reached a generational peak on May 25th, 1971. Less than three months later on August 15th,

1971 President Nixon surprised the international monetary system by cancelling the direct convertibility of the United States

dollar to gold. After the "Nixon Shock" positive serial correlation in DJ IA daily returns began a four decade decline. On

August 11th, 2011 we reached the lowest levels of serial correlation in the 82 year history of the DJ IA almost exactly 40

years to the day that Nixon abandoned the gold standard.

Is this a statistical coincidence? A random coin flip, whereby heads represent a +1%

day on the market and tails a -1%, will also occasionally exhibit serial correlation

extremes on a rolling one year basis. Despite this fact, this coin flip test, run over

100 years through 10,000 simulations shows nowhere near the serial correlation

drift seen in the DJ IA results and has much lower positive and negative extremes

(see one sample simulation to the right).

If DJ IA serial correlation drift is real is it possible that monetary expansion has

artificially rewarded stock market mean reversion strategies (such as value investing

and buying on dips) for the past 40 years? If this is true does today represent the

beginning of the new era of trend following and volatility?

-0.4

-0.3

-0.2

-0.1

0

0.1

0.2

0.3

0.4

0.5

1

9

2

9

1

9

3

2

1

9

3

5

1

9

3

8

1

9

4

1

1

9

4

4

1

9

4

7

1

9

5

0

1

9

5

3

1

9

5

6

1

9

5

9

1

9

6

2

1

9

6

5

1

9

6

8

1

9

7

1

1

9

7

4

1

9

7

7

1

9

8

0

1

9

8

3

1

9

8

6

1

9

8

9

1

9

9

2

1

9

9

5

1

9

9

8

2

0

0

1

2

0

0

4

2

0

0

7

2

0

1

0

Rolling 1yr Serial Correlation of daily lagged returns

Dow Jones Industrial Average (1928 to 2011)

<0 Negative Daily Correlation >0 Positive Daily Correlation

P

o

s

i

t

i

v

e

S

e

r

i

a

l

C

o

r

r

e

l

a

t

i

o

n

N

e

g

a

t

i

v

e

S

e

r

i

a

l

C

o

r

r

e

l

a

t

i

o

n

10/9/1931

6mo Return = -51%

11/24/1964

6mo Return = +3%

Lowest Negative Serial Correlation

8/11/2011 6mo Return = ??

9/30/2008 6mo Return = -37%

3/18/2004 6mo Return = -0.1%

8/15/1971

US leaves gold standard

-0.2

-0.15

-0.1

-0.05

0

0.05

0.1

0.15

0.2

0.25

Y

e

a

r

1

Y

e

a

r

9

Y

e

a

r

1

7

Y

e

a

r

2

5

Y

e

a

r

3

3

Y

e

a

r

4

1

Y

e

a

r

4

9

Y

e

a

r

5

7

Y

e

a

r

6

5

Y

e

a

r

7

3

Y

e

a

r

8

1

Rolling Correlation Random Coin Flips

(Heads = +1% , Tails = -1%)

<0 Negative Daily Correlation >0 Positive Daily Correlation

P

o

s

i

t

i

v

e

S

e

r

i

a

l

N

e

g

a

t

i

v

e

S

e

r

i

a

l

Artemis Capital Management, LLC | Letter to Investors Third Quarter 2011 Page 8

www.artemiscm.com (310) 496-4526

Smoke in the Panic Room

As investors sought refuge from crashing markets many "safe haven" assets actually began to appear risky. At alternating

times during the quarter confidence was shaken in established havens including the US dollar, US Treasury securities, Swiss

Franc, and Gold. This was a stark reminder that "risk-free" is a myth.

MBA programs teach their students to use the yield on US government debt as the "risk-free rate" of return in the capital

asset pricing model. The only problem is now "risk-free" is rated AA+. In a bold decision on August 5th, Standard & Poor's

announced that it lowered the United States' credit rating citing political risks and a rising debt burden. Prior to the

downgrade US Treasury Bonds and the dollar were already losing value as partisan bickering over the debt ceiling raised the

specter of an unthinkable US default. Counter intuitively this represented a buying opportunity. In August and September

US Treasury securities rallied on recession fears and the yield on the 10 year fell 84 basis points to an all time low of 1.72%

by September 22nd. Nonetheless our political risk is rapidly becoming credit risk.

Over the past few years the Swiss Franc was a popular safe haven appreciating +28% against the Euro and +50% against the

dollar since 2003 much to a chagrin of the people who export quality watches and chocolate. On September 6th in a surprise

decision the Swiss National Bank devalued the Franc pegging it at 1.20x to the Euro resulting in an immediate +8.9% gain

against the dollar.

The new risks in supposedly "safe

haven" currencies may encourage us

all to become gold bugs, but before

you buy a shotgun and a strongbox

keep in mind that gold also took a

beating this quarter. In September the

GLD ETF was down -11.06%

compared to -7.18% decline in the

S&P 500 index. The thesis for gold

ownership is logical considering

global competitive currency

devaluation but it is always dangerous

to be in the most crowded trade when

the margin comes due. In these

markets gold has behaved like a safe

haven in the good times, and a

commodity during the bad. This is

disappointing if the objective is true

safe haven status.

If recent history is any guide investors

seeking shelter from crisis are finding

smoke in every panic room. The

global financial system seems poised

for monumental changes over the next

decade and there is no telling if today's

safe haven may be tomorrow's risk

asset.

To this effect the importance of

volatility and convexity in a portfolio

shouldn't be underestimated because

they offer protection against risks we

don't yet know or fully understand.

-

5

0

%

-

4

0

.

0

%

-

3

0

.

0

%

-

2

0

.

0

%

-

1

0

.

0

%

A

T

M

1

0

.

0

%

2

0

.

0

%

3

0

.

0

%

4

0

.

0

%

0.95x

1.15x

1.35x

1.55x

1.75x

1.95x

2

4

-

J

u

n

-

1

1

0

8

-

J

u

l

-

1

1

2

2

-

J

u

l

-

1

1

0

5

-

A

u

g

-

1

1

1

9

-

A

u

g

-

1

1

0

2

-

S

e

p

-

1

1

1

6

-

S

e

p

-

1

1

3

0

-

S

e

p

-

1

1

% OTM

I

m

p

l

i

e

d

V

o

l

a

t

i

l

i

t

y

/

A

T

M

V

o

l

R

a

t

i

o

GLD ETF - 120 Day Volatility Skew

June 24 to September 30, 2011

-0.20x

-0.15x

-0.10x

-0.05x

0.00x

0.05x

0.10x

0.15x

0.20x

Jun-11 Jul-11 Aug-11 Sep-11

GLD 20% OTM Vol Skew

-

5

0

%

-

4

0

.

0

%

-

3

0

.

0

%

-

2

0

.

0

%

-

1

0

.

0

%

A

T

M

1

0

.

0

%

2

0

.

0

%

3

0

.

0

%

4

0

.

0

%

0.75x

0.95x

1.15x

1.35x

1.55x

1.75x

1.95x

2.15x

2.35x

2

4

-

J

u

n

-

1

1

0

8

-

J

u

l

-

1

1

2

2

-

J

u

l

-

1

1

0

5

-

A

u

g

-

1

1

1

9

-

A

u

g

-

1

1

0

2

-

S

e

p

-

1

1

1

6

-

S

e

p

-

1

1

3

0

-

S

e

p

-

1

1

% OTM

I

m

p

l

i

e

d

V

o

l

a

t

i

l

i

t

y

/

A

T

M

V

o

l

R

a

t

i

o

UUP ETF ($USD Index Bullish) - 120 Day Volatility Skew

June 24 to September 30, 2011

-0.60x

-0.50x

-0.40x

-0.30x

-0.20x

-0.10x

0.00x

Jun-11 Jul-11 Aug-11 Sep-11

UUP 10% OTM Vol Skew

-

5

0

%

-

4

0

.

0

%

-

3

0

.

0

%

-

2

0

.

0

%

-

1

5

.

0

%

-

1

0

.

0

%

-

5

.

0

%

A

T

M

5

.

0

%

1

0

.

0

%

1

5

.

0

%

2

0

.

0

%

3

0

.

0

%

4

0

.

0

%

5

0

.

0

%

0.80x

0.90x

1.00x

1.10x

1.20x

1.30x

1.40x

1.50x

1.60x

1.70x

2

4

-

J

u

n

-

1

1

1

5

-

J

u

l

-

1

1

5

-

A

u

g

-

1

1

2

6

-

A

u

g

-

1

1

1

6

-

S

e

p

-

1

1

% OTM

I

m

p

l

i

e

d

V

o

l

/

A

T

M

V

o

l

R

a

t

i

o

TLT 20+ US Treasury ETF- 120 Day Volatility Skew

June 24 to Sept 30 2011

0.17x

0.19x

0.21x

0.23x

0.25x

0.27x

Jun-11 Jul-11 Aug-11 Sep-11

TLT 20+ US Treasury ETF - 5% OTM Vol Skew

-

5

0

%

-

4

0

.

0

%

-

3

0

.

0

%

-

2

0

.

0

%

-

1

0

.

0

%

A

T

M

1

0

.

0

%

2

0

.

0

%

3

0

.

0

%

4

0

.

0

%

5

0

.

0

%

0.95x

1.00x

1.05x

1.10x

1.15x

1.20x

1.25x

2

4

-

J

u

n

-

1

1

0

8

-

J

u

l

-

1

1

2

2

-

J

u

l

-

1

1

0

5

-

A

u

g

-

1

1

1

9

-

A

u

g

-

1

1

0

2

-

S

e

p

-

1

1

1

6

-

S

e

p

-

1

1

3

0

-

S

e

p

-

1

1

% OTM

I

m

p

l

i

e

d

V

o

l

a

t

i

l

i

t

y

/

A

T

M

V

o

l

R

a

t

i

o

FXF ETF (Swiss Franc Bullish) - 120 Day Volatility Skew

June 24 to September 30, 2011

-0.15x

-0.10x

-0.05x

0.00x

0.05x

0.10x

0.15x

0.20x

Jun-11 Jul-11 Aug-11 Sep-11

FXF Swiss Franc 10% OTM Vol Skew

Evolution of Implied Volatility Surface for Investor Safe Havens

Third Quarter 2011

Artemis Capital Management, LLC | Letter to Investors Third Quarter 2011 Page 9

www.artemiscm.com (310) 496-4526

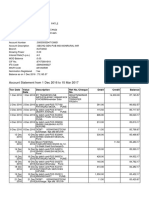

Fighting Greek Fire with Fire

Fight volatility with volatility and take advantage of

the erratic movements in markets to strategically

establish long tail risk positions on both sides of the

return distribution in asset classes with competitively

priced skew and vol. The strategy is effectively a

global macro-straddle that is long volatility and

convexity. As world draws closer to a second

recession the unpredictable rising and falling tides of

liquidity will either lift or sink all ships. Owning a

small amount of volatility in both tails of the

distribution gives the potential for exponential profits

during the next deflationary crisis or shock-and-awe

government intervention. The table to right presents a

multi-asset comparison of volatility risk premiums

that will serve as a starting point. For example during

the next vicious short covering rally you may consider

buying competitively priced far-OTM put options in

emerging economies or Asian equities. In the event

developed economies like the US and Europe fall back

into recession there is little reason to believe equity

volatility in China, J apan, South Africa, or Chile will

be immune given trends in correlation. When equity

markets are oversold protect against surprise monetary

intervention using unloved far-OTM call options on

financials, high yield debt, and OTM puts on the Yen

and US dollar index. With a small amount of risk

capital you can win on both sides of the

macroeconomic coin toss.

Monetize Volatility of Volatility

VIX options provide attractive opportunities for

sophisticated investors to hedge against global

contagion risk. Although the VIX index is currently

elevated the skew, or spread between the local

volatilities for VIX options (adjusted by historical

standard deviation moves) is extremely flat. When the

VIX index increases the option skew typically

pancakes as volatility of volatility shifts from OTM

calls to OTM puts reflecting higher probability of

mean reversion (see chart). Hedgers can monetize this

flat skew by executing a reverse ratio spread that will

protect a portfolio in the event of cataclysmic decline

in markets. To execute this trade sell OTM VIX calls

at +1 or +2 standard deviations above the respective

November or December VIX futures price and

purchase 2x the number of further OTM calls. This

"Euro-apocalypse" hedge will provide an exponential

payoff in the event the VIX increases above 50+but

will otherwise result in a small loss of capital.

0.60x

0.70x

0.80x

0.90x

1.00x

1.10x

1.20x

1.30x

1.40x

V

o

l

a

t

i

l

i

t

y

o

f

V

I

X

F

u

t

u

r

e

s

a

s

a

r

a

t

i

o

t

o

A

T

M

V

o

l

VIX Strike Price Expressed as Standard Deviation of VIX future

Volatility Skew of the VIX Index

(VIX options at 30 days to expiry)

Current Skew VIX@ 42

Average Skew Since 2004

Average Skew for 1yr

Average Skew for 6mos

Post-Lehman Sept16 2008

OTM VIX Puts OTM VIX Calls

0.00x 0.20x 0.40x 0.60x 0.80x 1.00x 1.20x 1.40x 1.60x

SPY

QQQ

IWM

^VIX

XLY

XLP

XLE

XLF

XLI

XLK

XLB

XLU

EFA

EEM

FXI

EWH

EWY

EWA

EWJ

EWZ

ECH

EWW

EZA

EWG

EWI

EWP

EWU

TLT

IEI

IEF

LQD

HYG

JNK

PFF

TIP

BND

AGG

UUP

FXC

FXA

FXF

FXE

FXS

FXY

GLD

SLV

USO

GDX

UNG

DBA

MOO

DBB

JJC

Volatility Insurance Ratio

E

x

c

h

a

n

g

e

T

r

a

d

e

d

P

r

o

d

u

c

t

Cross-Asset ETF Volatility Insurance Ratio

Ratio = Avg. 12 Month Volatility Skew & Implied Vol / Historic Vol

Higher Ratio = Higher Cost for Protection against Loss

Domestic Equity

Volatility

Domestic Equity - Sectors

Intl. Equity - Index

Intl. Equity - Asia

Intl. Equity - Americas & S. Africa

Intl. Equity - Europe

Domestic Fixed Income

Currency

Commodities

Source: Ivolatility.com Ratio= Average of [(10% OTM Put Vol - 10% OTM Call Vol) / ATM Vol] and [1m Implied Vol/1m Historic Realized Vol]

Artemis Capital Management, LLC | Letter to Investors Third Quarter 2011 Page 10

www.artemiscm.com (310) 496-4526

Volatility and Truth

It is becoming harder for markets to deny the existential state of the global economy. The large banks that were too-big-to-

fail are now even bigger than before the crisis. Unemployment is an epidemic and will result in a lost generation for millions

of Americans and Europeans. The middle class is under significant pressure with 14 million Americans officially out of work

and another 16 million underemployed which in combination would form a state with the population of Texas. In Spain

nearly half of the people under the age of 25 are unemployed and in Greece, Italy, and Ireland nearly a third. The number of

unemployed youth in OECD countries is higher than at any time since the organization started collecting data in 1976

(3)

.

These are the lost children of the global economy.

Things are likely to get worse before they get better. As we move closer to a second global recession it is highly questionable

whether or not the European and domestic banking systems can withstand another systemic shock. The difference this time is

that Main Street is ready to revolt against any new round of bail-out economics. A movement called Occupy Wall-Street that

opposes corporate greed, financial bail-outs, and the political influence of banks is attracting hundreds of grass-roots

followers and conducting protests in lower Manhattan and across the country. As I write this letter 700 people were just

arrested for blocking traffic on the Brooklyn Bridge. This movement is spreading and has held demonstrations in Boston, St.

Louis, Chicago, Philadelphia, and Los Angeles. The group is similar to protests across Europe including the indignados ("the

outraged") movement in Spain and escalating strikes and sit-ins in Greece. A recent poll shows that two thirds of German's

believe their parliament should block any more demands for euro bail-outs

(4)

. The question we should ask ourselves is not

whether policy makers can or cannot orchestrate another massive bail-out of the global banking system, but whether or not

the citizens of developed countries are going to allow it. How this will end is impossible to predict, but in the next decade

we are about to learn a lot more about volatility.

Volatility as a concept is widely misunderstood. Volatility is not fear. Volatility is not the

VIX index. Volatility is not a statistic or a standard deviation, Black-Scholes input,

GARCH model, or any other number derived by abstract formula. Volatility is no

different in markets than it is to life.

Volatility is an instrument of truth. Regardless of how it is measured it reflects the

difference between the world as we imagine it to be and the world that actually exists. It

is the fire in Plato's cave that illuminates the shadows of reality for those chained to the

darkness. It is as global as a violent revolution resulting in social change; or as personal as

an exhilarating relationship with a complex woman who is very there and then

inexplicably gone. Volatility hurts but is necessary for growth. In nature volatility is so

fundamental that the trees of the great sequoia forest will not release their seeds without

first sensing heat from wildfires. It is from the flames of change that we derive the

potential for healthy resurrection and birth. In markets and in life if we don't recognize the

truth in each moment, deny revolution, suppress volatility no matter how painful, we will

not allow ourselves to prosper.

Volatility is change and the world is changing. The truth is that Greece will default. The truth is that if our leaders continue to

deny our problems history tells us the US will eventually default. These shocking events will hurt many people, markets will

collapse, life savings will be lost, there will be violence, upheaval, and massive political change but you know what? The

world will not end. When it is all said and done people will work, they will spend time with their children, they will cry,

laugh, and love... life will go on. We will find a way to prosper if we relentlessly search for nothing but the truth, otherwise

the truth will find us through volatility.

Vive la vrit Vive le volatilit

Artemis Capital Investors, L.P.

Christopher R. Cole, CFA

Managing Partner and Portfolio Manager

Artemis Capital Management, L.L.C.

Artemis Capital Management, LLC | Letter to Investors Third Quarter 2011 Page 11

www.artemiscm.com (310) 496-4526

THIS IS NOT AN OFFERING OR THE SOLICITATION OF AN OFFER TO PURCHASE AN INTEREST IN ARTEMIS CAPITAL

INVESTORS, L.P. (THE FUND). ANY SUCH OFFER OR SOLICITATION WILL ONLY BE MADE TO QUALIFIED

INVESTORS BY MEANS OF A CONFIDENTIAL PRIVATE PLACEMENT MEMORANDUM (THE MEMORANDUM) AND

ONLY IN THOSE JURISDICTIONS WHERE PERMITTED BY LAW. AN INVESTMENT SHOULD ONLY BE MADE AFTER

CAREFUL REVIEW OF THE FUNDS MEMORANDUM. THE INFORMATION HEREIN IS QUALIFIED IN ITS ENTIRETY BY

THE INFORMATION IN THE MEMORANDUM.

AN INVESTMENT IN THE FUND IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. OPPORTUNITIES FOR

WITHDRAWAL, REDEMPTION AND TRANSFERABILITY OF INTERESTS ARE RESTRICTED, SO INVESTORS MAY NOT

HAVE ACCESS TO CAPITAL WHEN IT IS NEEDED. THERE IS NO SECONDARY MARKET FOR THE INTERESTS AND

NONE IS EXPECTED TO DEVELOP. NO ASSURANCE CAN BE GIVEN THAT THE INVESTMENT OBJECTIVE WILL BE

ACHIEVED OR THAT AN INVESTOR WILL RECEIVE A RETURN OF ALL OR ANY PORTION OF HIS OR HER INVESTMENT

IN THE FUND. INVESTMENT RESULTS MAY VARY SUBSTANTIALLY OVER ANY GIVEN TIME PERIOD.

CERTAIN DATA CONTAINED HEREIN IS BASED ON INFORMATION OBTAINED FROM SOURCES BELIEVED TO BE

ACCURATE, BUT WE CANNOT GUARANTEE THE ACCURACY OF SUCH INFORMATION.

The General Partner has hired Unkar Systems, Inc. as NAV Calculation Agent and the reported rates of return are produced by

Unkar for Artemis Capital Fund. Actual investor performance may differ depending on the timing of cash flows and fee structure.

Past performance not indicative of future returns.

Footnotes and Citations:

Notes:

Unless otherwise noted all % differences are taken on a logarithmic basis. Price changes an volatility measurements are

calculated according to the following formula % Change = LN (Current Price / Previous Price)

Greek Fire / from Madrid Skylitzes / public domain

Flaming globe & Sequoia Tree photographs reproduced with rights from Istockphoto.com

Liberty Leading the People by Eugne Delacroix / public domain.

Security price data from Bloomberg and Yahoo Finance

Implied volatility data from IVolatility.com

Footnotes:

(1) "Greek Fire" from Toxepedia.com http://toxipedia.org/display/toxipedia/Greek+Fire

(2) The Federal Reserve ceased reporting M3 in March 2006. This report uses estimates of M3 provided by Shadow Government

Statistics which uses Fed reporting of major M3 components and SGS modeling of missing components. See

www.shadowstatistics.com for more information.

(3) "It's grim down south" & "the jobless young Left Behind", The Economist September 10th, 2011

(4) "Angela Merkel denies euro bailout backlash was cause of election defeat" The Telegraph September 5th, 2011

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Bichar BigyanDocument25 pagesBichar Bigyanrajendra434383% (12)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Account statement showing transactions from Dec 2016 to Feb 2017Document4 pagesAccount statement showing transactions from Dec 2016 to Feb 2017AnuAnuNo ratings yet

- 9 27 2016 ShillerEnhancedCAPEDocument5 pages9 27 2016 ShillerEnhancedCAPEThorHollisNo ratings yet

- Salient Epsilon Theory Ben Hunt Waiting For Humpty Dumpty June 24 2016Document3 pagesSalient Epsilon Theory Ben Hunt Waiting For Humpty Dumpty June 24 2016ThorHollisNo ratings yet

- JP ReflationDocument18 pagesJP ReflationThorHollisNo ratings yet

- Russell Clark On Are Lower Oil Prices Still Dollar BullishDocument4 pagesRussell Clark On Are Lower Oil Prices Still Dollar BullishThorHollisNo ratings yet

- Volatility VolatilityDocument12 pagesVolatility Volatilitywegerg123343No ratings yet

- ACM - Vol, Correlation, Unified Risk Theory - 092010Document8 pagesACM - Vol, Correlation, Unified Risk Theory - 092010ThorHollisNo ratings yet

- 1 10 17 Justmkt - DLDocument6 pages1 10 17 Justmkt - DLThorHollisNo ratings yet

- PR Mgr-WillowbridgwDocument4 pagesPR Mgr-WillowbridgwThorHollisNo ratings yet

- 10 25 16 Rising RatesDocument3 pages10 25 16 Rising RatesThorHollisNo ratings yet

- Restructuring The World 07-28-2011Document8 pagesRestructuring The World 07-28-2011ThorHollisNo ratings yet

- Bridgewater Greater Risks in China PDFDocument10 pagesBridgewater Greater Risks in China PDFThorHollisNo ratings yet

- Bridgewater Greater Risks in China PDFDocument10 pagesBridgewater Greater Risks in China PDFThorHollisNo ratings yet

- Japanese Currency Selection Funds and The Case For Long Japanese Yen ShortDocument3 pagesJapanese Currency Selection Funds and The Case For Long Japanese Yen ShortThorHollisNo ratings yet

- Ubs Interest RatesDocument115 pagesUbs Interest RatesThorHollisNo ratings yet

- The Great Vega Short - Volatility, Tail Risk and StimulusDocument10 pagesThe Great Vega Short - Volatility, Tail Risk and StimulusThorHollisNo ratings yet

- ChrisCole - ArtemisVega - Grants Interest Rate Observer - Oct232012Document34 pagesChrisCole - ArtemisVega - Grants Interest Rate Observer - Oct232012ThorHollisNo ratings yet

- Proposed Glencore Acquisition of ViterraDocument134 pagesProposed Glencore Acquisition of ViterraThorHollisNo ratings yet

- 50 Largest Hedge Fund Managers in EuropeDocument12 pages50 Largest Hedge Fund Managers in Europehttp://besthedgefund.blogspot.comNo ratings yet

- April08 SimonHuntDocument34 pagesApril08 SimonHuntThorHollisNo ratings yet

- G V Snov 2012 Newsletter ArtemisDocument16 pagesG V Snov 2012 Newsletter ArtemisThorHollisNo ratings yet

- New Residential Spin-OffDocument24 pagesNew Residential Spin-OffValueInvestingGuyNo ratings yet

- Korean Spin Offs - 105-12Document6 pagesKorean Spin Offs - 105-12ThorHollisNo ratings yet

- 50 Largest Hedge Fund Managers in EuropeDocument12 pages50 Largest Hedge Fund Managers in Europehttp://besthedgefund.blogspot.comNo ratings yet

- Reserve Management Parts I and II WBP Public 71907Document86 pagesReserve Management Parts I and II WBP Public 71907Primo KUSHFUTURES™ M©QUEENNo ratings yet

- Couche Tard - Annual - 2011Document64 pagesCouche Tard - Annual - 2011ThorHollisNo ratings yet

- Part I II Worldbank Presentation 5607 - Frank VenerosoDocument52 pagesPart I II Worldbank Presentation 5607 - Frank VenerosoThorHollis100% (1)

- VLO - BofA Conf - 3-7-13Document9 pagesVLO - BofA Conf - 3-7-13ThorHollisNo ratings yet

- MDR - Presentation - 2013 AprDocument24 pagesMDR - Presentation - 2013 AprThorHollisNo ratings yet

- MDR - Presentation - 2013 AprDocument24 pagesMDR - Presentation - 2013 AprThorHollisNo ratings yet

- NBCC Heights - Brochure PDFDocument12 pagesNBCC Heights - Brochure PDFAr. Yudhveer SinghNo ratings yet

- 5d7344794eaa11567835257 1037739Document464 pages5d7344794eaa11567835257 1037739prabhakaran arumugamNo ratings yet

- Ralph & Eileen Swett Foundation - Grant ApplicationDocument8 pagesRalph & Eileen Swett Foundation - Grant ApplicationRafael Kieran MondayNo ratings yet

- Top 10 Mistakes (FOREX TRADING)Document12 pagesTop 10 Mistakes (FOREX TRADING)Marie Chris Abragan YañezNo ratings yet

- Questionnaires On Entrepreneurship DevelopmentDocument24 pagesQuestionnaires On Entrepreneurship DevelopmentKawalpreet Singh Makkar100% (1)

- Silver Producers A Call To ActionDocument5 pagesSilver Producers A Call To Actionrichardck61No ratings yet

- High Potential Near MissDocument12 pagesHigh Potential Near Missja23gonzNo ratings yet

- Annual Report 2019 Final TCM 83-498650 PDFDocument153 pagesAnnual Report 2019 Final TCM 83-498650 PDFzain ansariNo ratings yet

- PresentationDocument21 pagesPresentationFaisal MahamudNo ratings yet

- Liberal View of State: TH THDocument3 pagesLiberal View of State: TH THAchanger AcherNo ratings yet

- Far QuizDocument7 pagesFar QuizMeldred EcatNo ratings yet

- The Communistic Societies of The United StatesFrom Personal Visit and Observation by Nordhoff, Charles, 1830-1901Document263 pagesThe Communistic Societies of The United StatesFrom Personal Visit and Observation by Nordhoff, Charles, 1830-1901Gutenberg.org100% (2)

- University Grants Commission Bahadurshah Zafar Marg NEW DELHI-110 002Document10 pagesUniversity Grants Commission Bahadurshah Zafar Marg NEW DELHI-110 002Arun PrakashNo ratings yet

- Balance StatementDocument5 pagesBalance Statementmichael anthonyNo ratings yet

- Global Market Segmentation TechniquesDocument84 pagesGlobal Market Segmentation TechniquesRica de los SantosNo ratings yet

- Money Market and Its InstrumentsDocument8 pagesMoney Market and Its InstrumentsKIRANMAI CHENNURUNo ratings yet

- Exchange RatesDocument11 pagesExchange RatesElizavetaNo ratings yet

- Presented By:-: Sutripti DattaDocument44 pagesPresented By:-: Sutripti DattaSutripti BardhanNo ratings yet

- Chapter 1Document16 pagesChapter 1abhishek9763No ratings yet

- Seminar Assignments Multiple Choice Questions City Size Growth PDFDocument4 pagesSeminar Assignments Multiple Choice Questions City Size Growth PDFminlwintheinNo ratings yet

- StopfordDocument41 pagesStopfordFarid OmariNo ratings yet

- IAS 2 InventoriesDocument13 pagesIAS 2 InventoriesFritz MainarNo ratings yet

- Commercial BanksDocument9 pagesCommercial BanksPrathyusha ReddyNo ratings yet

- World Bank Review Global AsiaDocument5 pagesWorld Bank Review Global AsiaRadhakrishnanNo ratings yet

- Russia and Lithuania Economic RelationsDocument40 pagesRussia and Lithuania Economic RelationsYi Zhu-tangNo ratings yet

- Lead Dev Talk (Fork) PDFDocument45 pagesLead Dev Talk (Fork) PDFyosiamanurunNo ratings yet

- Individual Characteristics of The Successful AsnafDocument10 pagesIndividual Characteristics of The Successful AsnafAna FienaNo ratings yet

- Chapter 21 AppDocument2 pagesChapter 21 AppMaria TeresaNo ratings yet