Professional Documents

Culture Documents

Anti Dumping Duty Notifications (Customs) No.39/2014 Dated 14th August, 2014

Uploaded by

stephin k jCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Anti Dumping Duty Notifications (Customs) No.39/2014 Dated 14th August, 2014

Uploaded by

stephin k jCopyright:

Available Formats

TO BE PUBLISHED IN PART II, SECTION 3, SUB-SECTION (i) OF THE GAZETTE OF

INDIA, EXTRAORDINARY]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

Notification

No. 39/2014-Customs (ADD)

New Delhi, the 14th August, 2014

G.S.R. (E). Whereas, the designated authority, vide notification No. 15/12/2012-

DGAD dated 22nd November, 2012, published in the Gazette of India, Extraordinary, Part I,

Section 1, had initiated a review in the matter of continuation of anti-dumping duty on imports of

Ceftriaxone Sodium Sterile, also known as Ceftriaxone Disodium Hemiheptahydrate-Sterile

(hereinafter referred to as subject goods) falling under heading 2941 or 2942 of the First Schedule

to the Customs Tariff Act, 1975 (51 of 1975) (hereinafter referred to as the Customs Tariff Act),

originating in or exported from the Peoples Republic of China (hereinafter referred to as the

subject country), imposed vide notification of the Government of India, in the Ministry of Finance

(Department of Revenue), No. 98/2008-Customs dated 27th August, 2008, published in the

Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 614(E),

dated the 27th August, 2008;

And whereas, the Central Government had extended the anti-dumping duty on the subject

goods, originating in or exported from the subject country upto and inclusive of the 28th

November, 2013 vide notification of the Government of India, in the Ministry of Finance

(Department of Revenue), No. 50/2012-Customs dated (ADD) dated 29th November, 2012,

published in Part II, Section 3, Sub-section (i) of the Gazette of India, Extraordinary vide number

G.S.R 855(E), dated the 29th November, 2012;

And whereas, in the matter of review of anti-dumping duty on import of the subject goods,

originating in or exported from the subject country, the designated authority in its final findings,

published vide notification No. 15/12/2012-DGAD dated 20th May, 2014, in Part I, Section 1 of

the Gazette of India, Extraordinary, has come to the conclusion that-

(i) there is continued dumping of the product concerned from the subject country,

causing injury to the domestic industry;

(ii) dumping of the product under consideration is likely to intensify from the subject

country should the current anti-dumping duty be withdrawn,

and has recommended imposition of the anti-dumping duty on the subject goods, originating in or

exported from subject country.

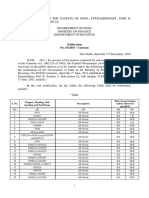

Now, therefore, in exercise of the powers conferred by sub-sections (1) and (5) of section 9A

of the Customs Tariff Act, read with rules 18 and 23 of the Customs Tariff (Identification,

Assessment and Collection of Anti-dumping Duty on Dumped Articles and for Determination of

Injury) Rules, 1995, the Central Government, after considering the aforesaid final findings of the

designated authority, hereby imposes on the subject goods, the description of which is specified in

column (3) of the Table below, specification of which is specified in column (4), falling under tariff

item of the First Schedule to the Customs Tariff Act as specified in the corresponding entry in

column (2), originating in the countries as specified in the corresponding entry in column (5), and

exported from the countries as specified in the corresponding entry in column (6), and produced by

the producers as specified in the corresponding entry in column (7), and exported by the exporters as

specified in the corresponding entry in column (8), and imported into India, an anti-dumping duty at

the rate equal to the amount as specified in the corresponding entry in column (9) in the

currency as specified in the corresponding entry in column (11) and as per unit of measurement as

specified in the corresponding entry in column (10) of the said Table, namely:-

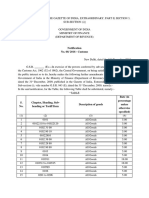

Table

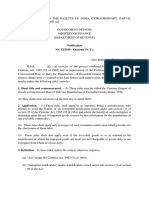

2. The anti-dumping duty imposed under this notification shall be effective for a period of

five years (unless revoked, superseded or amended earlier) from the date of publication of this

notification in the Official Gazette and shall be paid in Indian currency.

Sl.

No.

Tariff Item Description of

goods

Specifications Country of

origin

Country of

export

Producer Exporter Amount Unit Curre

ncy

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

1 2941 90 90 or

2942 00 90

Ceftriaoxane

Sodium Sterile

or,

Ceftriaxone

Disodium

Hemiheptahyd

rate-Sterile

Any

Peoples

Republic of

China

Peoples

Republic of

China

Any Any 21.85 Kg US

Dollar

2 2941 90 90 or

2942 00 90

Ceftriaoxane

Sodium Sterile

or,

Ceftriaxone

Disodium

Hemiheptahyd

rate-Sterile

Any Peoples

Republic of

China

Any country

other than

Peoples

Republic of

China

Any Any 21.85 Kg US

Dollar

3 2941 90 90 or

2942 00 90

Ceftriaoxane

Sodium Sterile

or,

Ceftriaxone

Disodium

Hemiheptahyd

rate-Sterile

Any Any country

other than

Peoples

Republic of

China

Peoples

Republic of

China

Any Any 21.85 Kg US

Dollar

Explanation.- For the purposes of this notification, rate of exchange applicable for the purposes

of calculation of such anti-dumping duty shall be the rate which is specified in the notification of

the Government of India, in the Ministry of Finance (Department of Revenue), issued from time to

time, in exercise of the powers conferred by section 14 of the Customs Act, 1962 (52 of 1962), and

the relevant date for the determination of the rate of exchange shall be the date of presentation of

the bill of entry under section 46 of the said Customs Act.

[F.No. 354/166/2007-TRU (Pt.-I)]

(Pramod Kumar)

Under Secretary to the Government of India

You might also like

- Customs Circular No.04/2015 Dated 9th February, 2016Document5 pagesCustoms Circular No.04/2015 Dated 9th February, 2016stephin k jNo ratings yet

- Customs Circular No.05/2015 Dated 9th February, 2016Document21 pagesCustoms Circular No.05/2015 Dated 9th February, 2016stephin k jNo ratings yet

- Customs Circular No.10/2016 Dated 15th March, 2016Document4 pagesCustoms Circular No.10/2016 Dated 15th March, 2016stephin k jNo ratings yet

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Document2 pagesCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jNo ratings yet

- Customs Circular No. 27/2015 Dated 23rd October, 2015Document13 pagesCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- Customs Circular No. 28/2015 Dated 23rd October, 2015Document3 pagesCustoms Circular No. 28/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- Customs Circular No.03/2015 Dated 3rd February, 2016Document4 pagesCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jNo ratings yet

- Customs Circular No. 25/2015 Dated 15th October, 2015Document10 pagesCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jNo ratings yet

- Customs Circular No. 10/2014 Dated 17th October, 2014Document3 pagesCustoms Circular No. 10/2014 Dated 17th October, 2014stephin k jNo ratings yet

- Customs Circular No. 03/2015 Dated 16th January, 2015Document2 pagesCustoms Circular No. 03/2015 Dated 16th January, 2015stephin k jNo ratings yet

- Customs Circular No. 16/2015 Dated 19th May, 2015Document6 pagesCustoms Circular No. 16/2015 Dated 19th May, 2015stephin k jNo ratings yet

- Customs Circular No. 13/2014 Dated 18th November, 2014Document3 pagesCustoms Circular No. 13/2014 Dated 18th November, 2014stephin k jNo ratings yet

- Customs Circular No. 06/2015 Dated 11th February, 2015Document1 pageCustoms Circular No. 06/2015 Dated 11th February, 2015stephin k jNo ratings yet

- Customs Circular No. 20/2015 Dated 31st July 2015Document15 pagesCustoms Circular No. 20/2015 Dated 31st July 2015stephin k jNo ratings yet

- Customs Tariff Notifications No.67/2016 Dated 31st December, 2016Document34 pagesCustoms Tariff Notifications No.67/2016 Dated 31st December, 2016stephin k j100% (2)

- Customs Tariff Notifications No.66/2016 Dated 31st December, 2016Document26 pagesCustoms Tariff Notifications No.66/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.26/2016 Dated 16th February, 2016Document11 pagesCustoms Non Tariff Notifications No.26/2016 Dated 16th February, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.20/2016 Dated 8th February, 2016Document4 pagesCustoms Non Tariff Notifications No.20/2016 Dated 8th February, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.64/2016 Dated 31st December, 2016Document22 pagesCustoms Tariff Notifications No.64/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.63/2016 Dated 31st December, 2016Document38 pagesCustoms Tariff Notifications No.63/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.34/2016 Dated 29th February, 2016Document2 pagesCustoms Non Tariff Notifications No.34/2016 Dated 29th February, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Document5 pagesCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jNo ratings yet

- Customs Tariff Notifications No.54/2016 Dated 3rd October, 2016Document6 pagesCustoms Tariff Notifications No.54/2016 Dated 3rd October, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.30/2016 Dated 1st March, 2016Document6 pagesCustoms Non Tariff Notifications No.30/2016 Dated 1st March, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.11/2016 Dated 12th January, 2016Document3 pagesCustoms Non Tariff Notifications No.11/2016 Dated 12th January, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jNo ratings yet

- Customs Non Tariff Notifications No.31/2016 Dated 1st March, 2016Document2 pagesCustoms Non Tariff Notifications No.31/2016 Dated 1st March, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.22/2016 Dated 8th February, 2016Document9 pagesCustoms Non Tariff Notifications No.22/2016 Dated 8th February, 2016stephin k jNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Course: Citizenship Education and Community Engagement: (8604) Assignment # 1Document16 pagesCourse: Citizenship Education and Community Engagement: (8604) Assignment # 1Amyna Rafy AwanNo ratings yet

- Module 2Document42 pagesModule 2DhananjayaNo ratings yet

- CGSC Sales Method - Official Sales ScriptDocument12 pagesCGSC Sales Method - Official Sales ScriptAlan FerreiraNo ratings yet

- Recycle Used Motor Oil With Tongrui PurifiersDocument12 pagesRecycle Used Motor Oil With Tongrui PurifiersRégis Ongollo100% (1)

- Factsheet B2B PunchOut en 140623Document2 pagesFactsheet B2B PunchOut en 140623Curtis GibsonNo ratings yet

- SD-SCD-QF75 - Factory Audit Checklist - Rev.1 - 16 Sept.2019Document6 pagesSD-SCD-QF75 - Factory Audit Checklist - Rev.1 - 16 Sept.2019Lawrence PeNo ratings yet

- Practical Research 2: Self-Learning PackageDocument3 pagesPractical Research 2: Self-Learning PackagePrinces BaccayNo ratings yet

- AE-Electrical LMRC PDFDocument26 pagesAE-Electrical LMRC PDFDeepak GautamNo ratings yet

- (Bio) Chemistry of Bacterial Leaching-Direct vs. Indirect BioleachingDocument17 pages(Bio) Chemistry of Bacterial Leaching-Direct vs. Indirect BioleachingKatherine Natalia Pino Arredondo100% (1)

- Ground Water Resources of Chennai DistrictDocument29 pagesGround Water Resources of Chennai Districtgireesh NivethanNo ratings yet

- Rheology of Polymer BlendsDocument10 pagesRheology of Polymer Blendsalireza198No ratings yet

- Design and Analysis of Crankshaft ComponentsDocument21 pagesDesign and Analysis of Crankshaft Componentssushant470% (1)

- Newcomers Guide To The Canadian Job MarketDocument47 pagesNewcomers Guide To The Canadian Job MarketSS NairNo ratings yet

- Application D2 WS2023Document11 pagesApplication D2 WS2023María Camila AlvaradoNo ratings yet

- WhatsoldDocument141 pagesWhatsoldLuciana KarajalloNo ratings yet

- 'K Is Mentally Ill' The Anatomy of A Factual AccountDocument32 pages'K Is Mentally Ill' The Anatomy of A Factual AccountDiego TorresNo ratings yet

- Robocon 2010 ReportDocument46 pagesRobocon 2010 ReportDebal Saha100% (1)

- Clean Agent ComparisonDocument9 pagesClean Agent ComparisonJohn ANo ratings yet

- Supplier GPO Q TM 0001 02 SPDCR TemplateDocument6 pagesSupplier GPO Q TM 0001 02 SPDCR TemplateMahe RonaldoNo ratings yet

- Deluxe Force Gauge: Instruction ManualDocument12 pagesDeluxe Force Gauge: Instruction ManualThomas Ramirez CastilloNo ratings yet

- Waves and Thermodynamics, PDFDocument464 pagesWaves and Thermodynamics, PDFamitNo ratings yet

- (Variable Length Subnet MasksDocument49 pages(Variable Length Subnet MasksAnonymous GvIT4n41GNo ratings yet

- Sieve Shaker: Instruction ManualDocument4 pagesSieve Shaker: Instruction ManualinstrutechNo ratings yet

- Finance at Iim Kashipur: Group 9Document8 pagesFinance at Iim Kashipur: Group 9Rajat SinghNo ratings yet

- 10 Slides For A Perfect Startup Pitch DeckDocument6 pages10 Slides For A Perfect Startup Pitch DeckZakky AzhariNo ratings yet

- Measuring Renilla Luciferase Luminescence in Living CellsDocument5 pagesMeasuring Renilla Luciferase Luminescence in Living CellsMoritz ListNo ratings yet

- Land Measurement in PunjabDocument3 pagesLand Measurement in PunjabJunaid Iqbal33% (3)

- Environmental Technology Syllabus-2019Document2 pagesEnvironmental Technology Syllabus-2019Kxsns sjidNo ratings yet

- Guide to Fair Value Measurement under IFRS 13Document3 pagesGuide to Fair Value Measurement under IFRS 13Annie JuliaNo ratings yet

- Symmetry (Planes Of)Document37 pagesSymmetry (Planes Of)carolinethami13No ratings yet