Professional Documents

Culture Documents

Top of Mind Article - RMC 4-2013

Uploaded by

mborja15Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Top of Mind Article - RMC 4-2013

Uploaded by

mborja15Copyright:

Available Formats

TOP OF MIND: YOU GET WHAT YOU GIVE

Several researches have shown that being charitable benefits not only the receiver but also the giver.

Aside from the proven emotional and health benefits, charity has a tangible tax benefit. In fact, no less

than the Philippine Constitution rewards charity by giving tax exemption to real properties of charitable

institutions which are actually, directly, and exclusively used for such purpose. In addition, Section 34 of

the NIRC allows contributions to charitable institutions as a deduction from gross income. Probably the

most rewarding provision of all is that provided in Section 30 of the NIRC exempting charitable

institutions from income tax.

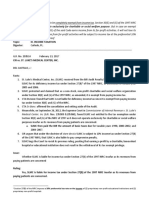

Thus, Revenue Memorandum Circular (RMC) No. 4-2013 received a vehement opposition from the

covered institutions saying that the BIR has gone too far. The said Circular not only requires proprietary

non-profit hospitals to submit a request for revalidation of their tax-exempt status but also invalidates

all rulings issued prior to November 1, 2012 granting them tax exemption. The Bureau of Internal

Revenue (BIR), however, justifies the circular invoking the ruling by the Supreme Court in the case of

Commissioner of Internal Revenue v. St. Lukes Medical Center.

In the said case, St. Lukes Medical Center which enjoyed tax exemption under Section 30(E) of the NIRC

was required to pay income taxes on services rendered to paying patients as these were considered as

activities conducted for profit.

The Supreme Court said that with the introduction of Section 27(B) in the 1997 National Internal

Revenue Code (NIRC) proprietary non-profit educational institutions and proprietary non-profit hospitals

will be subject to the 10% preferential rate instead of the ordinary 30% corporate rate under the last

paragraph of Section 30.

The Court explained that proprietary means private and non-profit means no net income or asset

accrues to or benefits any member or specific person, with all the net income or asset devoted to the

institutions purposes and all its activities conducted not for profit. However, the Court clarified that

non-profit does not necessarily mean charitable. It adopted the definition of charity in the Lung

Center of the Philippines v. Quezon City case as a gift, to be applied consistently with existing laws, for

the benefit of an indefinite number of persons, either by bringing their minds and hearts under the

influence of education or religion by assisting them to establish themselves in life of otherwise lessening

the burden of government.

A charitable institution is not automatically entitled to a tax exemption. The Court declared that under

Section 30(e) of the NIRC a charitable institution must be: (1) a non-stock corporation or association; (2)

organized exclusively for charitable purposes; (3) operated exclusively for charitable purposes; and (4)

no part of its net income or asset shall belong to or inure to the benefit of any member, organizer,

officer of any specific person. The organization of the institution refers to its corporate form while

operation refers to its regular activities. To be exempt from income taxes, both the organization and

the operation of the institution must be exclusively for charitable purposes. Therefore, the Court

concluded that if a tax exempt charitable institution conducts any activity for profit, such activity is not

tax exempt even as its not-for-profit activities remain tax exempt.

In light of this ruling, the BIR, through RMC No. 4-2013 now requires all hospitals and non-stock, non-

profit organizations operating hospitals to submit a request for revalidation accompanied by (a)a letter

application seeking tax exemption under a specific paragraph of Section 30 of the NIRC; (b) copies of the

latest Articles of Incorporation and By-laws duly certified by the SEC; (c) Certificate of Registration with

the BIR; (d) Tax Clearance issued by the Revenue District Office where the corporation is registered; (e)

Copies of Income Tax Returns or Annual Information Returns and Financial Statements for the last three

years; and (f) a statement of its modus operandi stating therein its sources of revenues.

The request shall be submitted to the Revenue District Office where the organization is registered which

shall determine whether the organization qualifies as an exempt corporation under Section 30 of the

NIRC. If the RDO finds that the organization is qualified to be tax-exempt, it shall forward its

recommendation to the Office of the Regional Director for review. If The Regional Director agrees with

the recommendation, the same shall be forwarded to the Office of the Assistant Commissioner, Legal

Division, which will conduct further review and if in order, shall prepare the appropriate Certificate of

Tax Exemption for signature of the Commissioner or her duly authorized representative.

This Circular is intended to address the substantial loss of income and value-added taxes from these

sources and to avoid the abuse of the tax exemption privileges by these hospitals.

You might also like

- The Law of Tax-Exempt Healthcare Organizations 2016 SupplementFrom EverandThe Law of Tax-Exempt Healthcare Organizations 2016 SupplementNo ratings yet

- G.R. No. 195909, September 26, 2012: Commissioner of Internal Revenue vs. St. Luke'S Medical Center, IncDocument5 pagesG.R. No. 195909, September 26, 2012: Commissioner of Internal Revenue vs. St. Luke'S Medical Center, IncDarren RuelanNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- CIR vs. St. Luke's Medical Center GR No. 203514, Feb. 13, 2017Document11 pagesCIR vs. St. Luke's Medical Center GR No. 203514, Feb. 13, 2017Anonymous sgEtt4No ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- St. Luke's liable for 10% tax on income under Section 27(B) NIRCDocument4 pagesSt. Luke's liable for 10% tax on income under Section 27(B) NIRCCharmaine Ganancial SorianoNo ratings yet

- Cir vs. ST Luke's 2012 CaseDocument5 pagesCir vs. ST Luke's 2012 Casewinter_equinox4No ratings yet

- CIR Vs ST LukeDocument7 pagesCIR Vs ST LukeMark Lester Lee Aure100% (2)

- RMC No 67-2012Document5 pagesRMC No 67-2012evilminionsattackNo ratings yet

- Commissioner of Internal Revenue vs. ST Luke's Medical CenterDocument14 pagesCommissioner of Internal Revenue vs. ST Luke's Medical CenterRaquel DoqueniaNo ratings yet

- Cir V SLMC DigestDocument3 pagesCir V SLMC DigestYour Public ProfileNo ratings yet

- Cir Vs St. Luke - S Medical CenterDocument13 pagesCir Vs St. Luke - S Medical CenterJon Gilbert MagnoNo ratings yet

- Tax 6-14Document36 pagesTax 6-14mjpjoreNo ratings yet

- Commissioner of Internal Revenue vs. St. Luke'S Medical Center, IncDocument1 pageCommissioner of Internal Revenue vs. St. Luke'S Medical Center, IncEman EsmerNo ratings yet

- Commissioner of Internal Revenue vs. ST Luke's Medical CenterDocument5 pagesCommissioner of Internal Revenue vs. ST Luke's Medical CenterMarie CecileNo ratings yet

- Commissioner of Internal Revenue Vs ST Lukes Medical Center IncSt Lukes Medical Center Inc Vs Commissioner of Internal RevenueDocument5 pagesCommissioner of Internal Revenue Vs ST Lukes Medical Center IncSt Lukes Medical Center Inc Vs Commissioner of Internal RevenueKhian JamerNo ratings yet

- CIR V St Luke's Tax Exemption RulingDocument22 pagesCIR V St Luke's Tax Exemption Rulingada mae santoniaNo ratings yet

- Cir v. St. Luke's - BassigDocument2 pagesCir v. St. Luke's - Bassigynahbassig100% (1)

- CIR v. St. Luke's Medical CenterDocument3 pagesCIR v. St. Luke's Medical CenterZandra LeighNo ratings yet

- Comm. of Internal Revenue vs. St. Luke's Medical Center, IncDocument2 pagesComm. of Internal Revenue vs. St. Luke's Medical Center, Incmaginoo69No ratings yet

- Supreme Court Rules on Sin Tax LawDocument6 pagesSupreme Court Rules on Sin Tax LawNoel IV T. Borromeo0% (1)

- Title: Commissioner of Internal Revenue vs. St. Luke's Medical Center, IncDocument3 pagesTitle: Commissioner of Internal Revenue vs. St. Luke's Medical Center, IncKim GuevarraNo ratings yet

- 17 - CIR Vs ST Luke - SDocument20 pages17 - CIR Vs ST Luke - SsophiaNo ratings yet

- Tax Digest 11-19Document23 pagesTax Digest 11-19Marc ChicanoNo ratings yet

- CIR Vs ST LukesDocument4 pagesCIR Vs ST LukesJohn Dexter FuentesNo ratings yet

- Perpetual Succour Hospital Inc vs. CIRDocument2 pagesPerpetual Succour Hospital Inc vs. CIRLisa BautistaNo ratings yet

- Cir vs. St. Luke'S Medical Center, IncDocument4 pagesCir vs. St. Luke'S Medical Center, IncKevin AmanteNo ratings yet

- TAX II Case 21 30Document27 pagesTAX II Case 21 30Raymarc Elizer AsuncionNo ratings yet

- St. Lukes Case DIgest TAxDocument3 pagesSt. Lukes Case DIgest TAxKayee KatNo ratings yet

- Types of Organizations Revised Corporation CodeDocument11 pagesTypes of Organizations Revised Corporation CodeNadie LrdNo ratings yet

- 2013 Tax-Exemption Guidelines For Non-Stock, Nonprofit Corporations FDM 8.1.13Document2 pages2013 Tax-Exemption Guidelines For Non-Stock, Nonprofit Corporations FDM 8.1.13cyrilNo ratings yet

- 000 Final Bir-TaxDocument6 pages000 Final Bir-TaxChristian AribasNo ratings yet

- 8.cir vs. ST - LukesDocument2 pages8.cir vs. ST - LukesAnonymous FvcKWLNo ratings yet

- CIR Vs St. Luke's Medical Center, Inc.Document3 pagesCIR Vs St. Luke's Medical Center, Inc.Nathalie YapNo ratings yet

- Tax Case 114Document1 pageTax Case 114ChugsNo ratings yet

- 2 CIR v. St. Luke'sDocument28 pages2 CIR v. St. Luke'sKristine COrpuzNo ratings yet

- BIR Revokes Tax Exemption for Philippine Canine ClubDocument0 pagesBIR Revokes Tax Exemption for Philippine Canine ClubRheneir MoraNo ratings yet

- 14 Commissioner of Internal Revenue vs. St. Lukes Medical Center Inc. 682 SCRA 66 September 26 2012Document28 pages14 Commissioner of Internal Revenue vs. St. Lukes Medical Center Inc. 682 SCRA 66 September 26 2012DannethGianLatNo ratings yet

- CIR vs. ST Lukes DigestDocument2 pagesCIR vs. ST Lukes DigestKath Leen100% (4)

- Republic of the Philippines Supreme Court Rules on Tax Exemption for Non-Profit HospitalsDocument17 pagesRepublic of the Philippines Supreme Court Rules on Tax Exemption for Non-Profit HospitalsDianne YcoNo ratings yet

- Lung Center of The Philippines Vs Quezon CityDocument19 pagesLung Center of The Philippines Vs Quezon CityJohnRouenTorresMarzoNo ratings yet

- BIR RULING NO. 485-14.39461-2014-BIR - Ruling - No. - 485-1420210505-11-twf9g6Document8 pagesBIR RULING NO. 485-14.39461-2014-BIR - Ruling - No. - 485-1420210505-11-twf9g6KC AtinonNo ratings yet

- CIR vs. St. Luke's Medical CenterDocument2 pagesCIR vs. St. Luke's Medical CenterTogz Mape100% (1)

- CIR v. St. LukesDocument8 pagesCIR v. St. LukesEarlcen MinorcaNo ratings yet

- VII. CIR vs. St. Luke's Medical Center, Inc. G.R. No. 195909Document10 pagesVII. CIR vs. St. Luke's Medical Center, Inc. G.R. No. 195909stefocsalev17No ratings yet

- VII. CIR vs. St. Luke's Medical Center, Inc. G.R. No. 195909Document11 pagesVII. CIR vs. St. Luke's Medical Center, Inc. G.R. No. 195909Stef OcsalevNo ratings yet

- Tax Review Cases 2 - Page 1 of 24Document24 pagesTax Review Cases 2 - Page 1 of 24el jeoNo ratings yet

- St. Luke's Medical Center Tax Exemption CaseDocument2 pagesSt. Luke's Medical Center Tax Exemption CaseOlan Dave LachicaNo ratings yet

- Tax 2 - Compilation - Case Digest - Part 2Document12 pagesTax 2 - Compilation - Case Digest - Part 2Andrea Patricia DaquialNo ratings yet

- Circular On Taxation of NGOsDocument7 pagesCircular On Taxation of NGOsAdina MarcuNo ratings yet

- 63.-St. Luke's Medical Center, Inc. v. CIR, G.R No. 195909Document15 pages63.-St. Luke's Medical Center, Inc. v. CIR, G.R No. 195909Christine Rose Bonilla LikiganNo ratings yet

- Aiiim Tax 1 DigestsDocument8 pagesAiiim Tax 1 DigestsJohn Matthew CruelNo ratings yet

- Lung Center of The Philippines DigestDocument3 pagesLung Center of The Philippines DigestJeremy FountNo ratings yet

- Assessment of Charitable Trust and InstitutionDocument52 pagesAssessment of Charitable Trust and InstitutionAnonymous JJhHAdY5HzNo ratings yet

- 85-CIR v. St. Luke's Medical Center, Inc. G.R. No. 195909 September 26, 2012Document11 pages85-CIR v. St. Luke's Medical Center, Inc. G.R. No. 195909 September 26, 2012Jopan SJNo ratings yet

- CIR vs. St. Luke's Medical Center (2017)Document17 pagesCIR vs. St. Luke's Medical Center (2017)Phulagyn CañedoNo ratings yet

- Supreme Court Rules Proprietary Non-Profit Hospitals Exempt from Income TaxDocument17 pagesSupreme Court Rules Proprietary Non-Profit Hospitals Exempt from Income TaxOlivia JaneNo ratings yet

- CIR Vs ST Lukes G.R. 195909Document23 pagesCIR Vs ST Lukes G.R. 195909John BernalNo ratings yet

- RDO No. 25A - Plaridel BulacanDocument2,132 pagesRDO No. 25A - Plaridel Bulacanatty_denise_uy80% (10)

- Code of Ethics For Teachers PDFDocument10 pagesCode of Ethics For Teachers PDFMevelle Laranjo AsuncionNo ratings yet

- RR No. 6-2019 - IRR Estate Tax AmnestyDocument5 pagesRR No. 6-2019 - IRR Estate Tax AmnestyAlexander Julio ValeraNo ratings yet

- Annex A - Allowable Deductions From The Gross EstateDocument4 pagesAnnex A - Allowable Deductions From The Gross EstateダニエルNo ratings yet

- CGT ReturnDocument2 pagesCGT Returnmborja15No ratings yet

- RA 10870 - Philippine Credit Card Industry Regulation Law PDFDocument11 pagesRA 10870 - Philippine Credit Card Industry Regulation Law PDFmborja15No ratings yet

- DO No. 49, S. 2006Document29 pagesDO No. 49, S. 2006Mhelygene Tesoro100% (2)

- RR 2-98Document85 pagesRR 2-98mborja15No ratings yet

- Revised Rules On Administrative Cases in The Civil ServiceDocument30 pagesRevised Rules On Administrative Cases in The Civil Servicemborja15No ratings yet

- L Oppenheim, International Law A Treatise Vol IDocument634 pagesL Oppenheim, International Law A Treatise Vol IFrancisco EstradaNo ratings yet

- My Tax Espresso Jan 2023Document20 pagesMy Tax Espresso Jan 2023Claudine TanNo ratings yet

- CIR Vs de La Salle UniversityDocument20 pagesCIR Vs de La Salle UniversityMoon BeamsNo ratings yet

- REPUBLIC v. CITY OF PARAÑAQUEDocument17 pagesREPUBLIC v. CITY OF PARAÑAQUEKhate AlonzoNo ratings yet

- SC Rules in Favor of La Salle Foundation's Tax Exemption StatusDocument2 pagesSC Rules in Favor of La Salle Foundation's Tax Exemption StatusCherrie May OrenseNo ratings yet

- Taxation, Imposition of Compulsory Levies On Individuals or Entities by Governments. Taxes AreDocument5 pagesTaxation, Imposition of Compulsory Levies On Individuals or Entities by Governments. Taxes AreIlly Zue Zaine GangosoNo ratings yet

- Setting Up Oracle Fusion Tax and ExpensesDocument5 pagesSetting Up Oracle Fusion Tax and ExpensesMahamood078615490% (1)

- Capital Commitment - Subscription FinanceDocument16 pagesCapital Commitment - Subscription FinanceTelly V. Onu100% (1)

- Limitations I Nthe Power To TaxDocument3 pagesLimitations I Nthe Power To TaxJoshua AmahitNo ratings yet

- Case DigestDocument7 pagesCase DigestKidMonkey2299No ratings yet

- PAGCOR VAT EXEMPTIONDocument20 pagesPAGCOR VAT EXEMPTIONDarrel John SombilonNo ratings yet

- 2023-Aug IKN Booklet Eng v2Document28 pages2023-Aug IKN Booklet Eng v2NugraNo ratings yet

- Part 4 PDFDocument39 pagesPart 4 PDFVolt LozadaNo ratings yet

- Mun CorpDocument522 pagesMun CorpIvy BoseNo ratings yet

- CIR Vs V. G. SincoDocument9 pagesCIR Vs V. G. SincoRhinnell RiveraNo ratings yet

- Greenfield Vs MeerDocument8 pagesGreenfield Vs MeerRyan Jhay YangNo ratings yet

- Partnership Taxation Outline GuideDocument36 pagesPartnership Taxation Outline GuideYojanny Reyes De la RosaNo ratings yet

- Texas Property Tax Law Changes: As of December 2021Document44 pagesTexas Property Tax Law Changes: As of December 2021jbc77No ratings yet

- H01 - Principles of TaxationDocument9 pagesH01 - Principles of Taxationnona galidoNo ratings yet

- Georgia 2019 List of Sales and Use Tax ExemptionsDocument17 pagesGeorgia 2019 List of Sales and Use Tax ExemptionsJonathan RaymondNo ratings yet

- TRAIN Law 2018Document27 pagesTRAIN Law 2018Solar PowerNo ratings yet

- Investment GuideDocument72 pagesInvestment Guideaqibaziz76No ratings yet

- Course Outline - Tax 1Document4 pagesCourse Outline - Tax 1Bplo CaloocanNo ratings yet

- PST ExemptionDocument1 pagePST ExemptioncubbywestNo ratings yet

- Taxation Law Reviewer FeuDocument108 pagesTaxation Law Reviewer FeuNeil RiveraNo ratings yet

- LUNG CENTER OF THE PHILIPPINES, Petitioner, vs. QUEZON CITY and CONSTANTINO P. ROSASDocument3 pagesLUNG CENTER OF THE PHILIPPINES, Petitioner, vs. QUEZON CITY and CONSTANTINO P. ROSASPrieti HoomanNo ratings yet

- Juned ProjectDocument76 pagesJuned ProjectSANKET WANJARENo ratings yet

- Chevron Philippines entitled to tax refund for petroleum products sold to Clark Development CorporationDocument39 pagesChevron Philippines entitled to tax refund for petroleum products sold to Clark Development CorporationEva TrinidadNo ratings yet

- LGU Taxation Case Analyzes Franchise Tax Exemption of Electric CompanyDocument6 pagesLGU Taxation Case Analyzes Franchise Tax Exemption of Electric CompanyAnonymous CWcXthhZgxNo ratings yet

- FABM2 Q2 MOD3 Income and Business Taxation PDFDocument29 pagesFABM2 Q2 MOD3 Income and Business Taxation PDFJoyce Anne ManzanilloNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesFrom EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesRating: 4 out of 5 stars4/5 (1)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsRating: 5 out of 5 stars5/5 (24)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- Owner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistFrom EverandOwner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistRating: 5 out of 5 stars5/5 (6)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- The Payroll Book: A Guide for Small Businesses and StartupsFrom EverandThe Payroll Book: A Guide for Small Businesses and StartupsRating: 5 out of 5 stars5/5 (1)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.From EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.No ratings yet

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)