Professional Documents

Culture Documents

Sebi

Uploaded by

abigail.godinho0 ratings0% found this document useful (0 votes)

102 views45 pagesabout sebi and governance

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentabout sebi and governance

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

102 views45 pagesSebi

Uploaded by

abigail.godinhoabout sebi and governance

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 45

E-mail: contactus@tari.co.

in; Phone: +91 11 41022447; +91 11 41022448;

Address: Thought Arbitrage Research Institute; C-25, Qutab Institutional Area, New Delhi 110016

Study on the State of

Corporate Governance

in India

Gatekeepers of Corporate Governance

Securities and Exchange Board of India (SEBI)

Authors: Kshama V Kaushik

Rewa P Kamboj

Indian Institute of Management Calcutta

Indian Institute of Corporate Affairs

Thought Arbitrage Research Institute

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

Table of Contents

Executive Summary .............................................................................................................................. 1

Literature Review .................................................................................................................................. 3

1. Introduction .............................................................................................................................. 6

2. Regulatory Framework of Securities and Exchange Board of India (SEBI)....................... 7

3. SEBI & Corporate Governance ............................................................................................. 11

4. Effectiveness of SEBI as a Gatekeeper of Corporate Governance in India ..................... 12

4.1 Study of extent of adoption of corporate governance norms by listed companies ...... 12

4.2 Study of Effect of Adoption of corporate governance norms on listed companies ...... 14

Movement of Companies toward Better Corporate Governance ................................................... 20

Data Skewness .................................................................................................................................... 21

4.3 Study of effectiveness of SEBIs overall regulatory mechanism by analysing the first

level of authority, that is, the Assessing Officer level as well as the appeals process,

that is, the Securities Appellate Tribunal (SAT) ............................................................. 24

4.4 Study the mechanism of Consent Orders and analyse its prevalence, effectiveness as a

deterrent and transparency of the system .................................................................... 31

Annexure I SEBI ............................................................................................................................... 41

Annexure II SEBI .............................................................................................................................. 42

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

1

Executive Summary

This section analyses the role of perhaps the most important regulator of the capital market

and the corporate world in India, the Securities Exchange Board of India (SEBI).

We begin with the evolution of SEBI as a regulator and trace its growth through various

phases. We briefly discuss the regulatory framework of SEBI and the broad contours of the

mechanism of corporate governance it has devised.

The methodology used is:

a. We have analysed data from National Stock Exchange of company-wise submissions

with respect to compliance with provisions of corporate governance code for the

quarter ended 30

th

June 2011 and found that over 70% of companies are adhering to

the corporate governance norms. However, this analysis is limited to only examine

whether companies had declared adherence to prescribed corporate governance

mechanisms and did not cover examining the quality of such mechanisms or the

benefit of such mechanisms for individual companies

b. We have analysed the effect of adoption of corporate governance norms mandated

by SEBI on 100 companies forming part of BSE 100 index over a period of seven (7)

years since they were introduced in 2005, that is, an analysis of around 800 financial

statements. We have used the established statistical tool of Tobins Quotient to

examine effectiveness of Clause 49. We have relied on financial evaluation tools

including important financial ratios to examine whether the barometer of financial

performance displays trends that indicate effectiveness of Clause 49. Finally, we co-

related these ratios to study their inter-relationships and co relationships. The

analysis indicates a causality between improvement ofcorporate governance

processes following the introduction oftt Clause 49 in India. However, we could not

create a co relation between improved corporate governance and sustained

corporate performance.

c. We have analysed SAT orders passed in case of 100 appeals and the corresponding

100 Adjudicating Officer (AO)/ SEBI orders passed to ascertain the effectiveness of

the adjudicating and appellate process. Our analysis shows that the investigation and

appeals process tends to be slow, often arbitrary, due to higher discretionary powers

and at times opaque. Often the fines are very small compared to the extent of

alleged offences and the rules of disgorgement of profits by the perpetrators rarely

followed, creating no punitive action or dis-incentivising inappropriate business

conduct. While the inherent spirit of framework is robust and in line with best

practices of bringing in timely justice and fair play, its implementation needs to be

more effective for capital markets to be buoyant and transparent.

d. We have analysed consent orders to determine the efficacy of the entire process and

found that while the system of consent orders may be effective for settling cases, it

lacks transparency and is marred with opacity in many areas. We also noticed that

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

2

the Adjudicating Officer is very powerful in the entire process by playing a significant

role in the issue of show cause notices, enquiry, forwarding the case for settlement

and approving authority in consent orders which calls for greater transparency and

clearer guidelines.

We conclude that SEBI has played a big role in instituting a basic standard of corporate

governance in the country, albeit only for listed companies. These measures have reduced

information asymmetry and improved market liquidity; however, how much these measures

have helped in improving corporate performancea real barometer of effectivenessis not

evident.

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

3

Literature Review

Gatekeepers are individuals, institutions or agencies that are interposed between investors

and managers/owners in order to play a watchdog role to reduce agency costs. If

gatekeepers are absent or do their job inefficiently then, it is reasonable to believe, there will

be fewer checks on managers/owners to behave in a manner consistent with placing

investors interests above self-interest. In other words, market efficiency will be lower which,

in turn, would raise the cost of capital.

Kraakman (1986) defines gatekeepers as parties who are in a position to prevent

misconduct by others by withholding their co-operation.

1

Scholars like Kraakman and Coffee further define gatekeepers as reputational intermediaries

who provide verification and certification services to investors. But they also acknowledge

that the role of gatekeepers as reputational intermediaries who can more easily be deterred

than the principals they serve has been developed in theory but less often examined in

practice

2

.

Gatekeepers essentially assess or vouch for corporate clients own statements or a specific

transactionif this sounds like duplication, it is; however, this duplication is necessary

because it is generally accepted that a gatekeeper has a lesser incentive to lie than the

client andregards the gatekeepers word as being more credible

3

.

Hamdani defines gatekeepers as parties who sell a product or provide a service that is

necessary for clients wishing to enter a particular market or engage in certain activities

4

.

Therefore, bankers, auditors and analysts are gatekeepers for clients wishing to enter the

capital market. Extending the argument, for clients who wish to raise money through shares,

the capital market regulator (Securities Exchange Board of India) is a major gatekeeper.

Lending to the corporate sector is one of the main planks of a commercial bank; therefore,

the banking sector regulator (Reserve Bank of India) is another gatekeeper to ensure

corporate governance through the regulatory mechanism of prudential lending norms and

monitoring use of money, among other things.

Having a network or series of gatekeepers is, however, no guarantee that corporate

wrongdoing will be detected or avoided. In a wave of corporate scandals starting from Enron,

we have seen instances of multiple gatekeeping failure in which wrongdoing went

undetected through several layers. The failure of this network of gatekeepers was a

recurring theme in business scandals. In too many instances, the gatekeepers in pursuit of

1

Gatekeepers: Anatomy of a Third-party Enforcement Strategy, Kraakman, R.H., Journal of Law,

Economics and Organisation 2, 53-104

2

The Acquiescent Gatekeeper: Reputational Intermediaries, Auditor Independence and the

Governance of Accounting, John C.Coffee, Jr., May 2001, Columbia Law and Economics Working

Paper No.191. available at SSRN:http://ssrn.com/abstract=270944

3

Understanding Enron: Its About the Gatekeepers, Stupid, John C.Coffee, Jr., Columbia Law

School, page 5

4

Gatekeeper Liability, Hamdani, Assaf, Southern California Law Review, volume 77, page 7,

available at SSRN:http://ssrn.com/abstract=466040

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

4

their own financial self-interest compromised the values and standards of their profession in

the recent round of corporate scandals, the first tierthe managersfailed and then the

gatekeepers failed as well.

5

In fact, some scholars believe that, theoretically at least, the services of gatekeepers can be

performed either from within or outside the corporation

6

. Of course the law mandates that

certain gatekeepers must be external to the organization such as auditors but there are other

gatekeepers like lawyers or internal auditors who may serve their function just as effectively

if they worked from within the corporation.

Accountability of a gatekeeper requires a certain quantum of liability s/he must bear. As far

as individual gatekeepers are concerned (such as auditors, lawyers, etc.), every country has

some rules to punish errant behaviour. However, there are few (if any) instances of

accountability of gatekeepers who are institutions; for instances, if SEBI or RBI fails to detect

or deter abuse of governance norms by companies or banks, the investor has little recourse

to hold them accountable. Gatekeepers liability may not always be created for the

gatekeepers own waysalthough this is also a possibilitybut for the wrongs attributed to

the corporation that could have been deterred or at least minimised by precautions taken by

gatekeepers.

Andrew Tuchs study shows that incentive problems will arise if gatekeepers are not capable

of bearing the full liability imposed on them. In other words, gatekeepers incentives to take

precautions are diluted where they are protected from full liability arising from their activities

7

A similar assertion is made by Steven Shavell in an optimal deterrence theory which

prescribes the legal rules that optimally deter socially harmful conduct and discusses the

dilution of incentives arising from a wrongdoers inability to pay for the losses it causes

8

.

A gatekeeper may even be shielded from the full effects of a liability regime by insolvency,

although it rarely occurs in practice (Arthur Anderson being a notable example). Some

categories of gatekeepers may collaborate with each other to adopt risk-shifting

arrangements; for example, comfort letters exchanged among bankers, analysts, auditors,

etc. Likewise, communications among regulators (such as between SEBI and RBI) may also

be termed as risk-shifting or risk-sharing arrangements. The objective of such an exercise

may be variedallocating liability or getting additional knowledge of the clients affairs or

information exchange.

Corporate conduct is overseen by multiple gatekeepers who act on different aspects of

business transactions. This ought to lead to an interlocking web of protection against

5

AAA&S, Report of the American Academy of Corporate Responsibility Steering Committee

6

The Devolution of the Legal Profession: A Demand Side Perspective, Ronald J.Gilson, 49 Md

L.Rev., 869, 905 (1990).

7

Multiple Gatekeepers, Andrew F.Tuch,Virginia Law Review, Vol.96, Issue 7, pp 1583-1672.

Available at SSRN:http://ssrn.com/abstract=1577405

8

Economic Analysis of Accident Law, Steven Shavell, 1

st

Harvard University Press paperback

edition 2007, 1987, page 167-68.

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

5

wrongdoing by all gatekeepers, calling into question the conception of the gatekeeper as a

unitary actor

9

Gatekeepers operate in an interdependent rather than independent manner and it is

important to have a certain degree of collective responsibility among all gatekeepers to

harness the total capacity to deter wrongdoing. A regime of fault-based liability coupled with

joint and several liability would be optimal for advancing the cause of optimal deterrence

10

.

9

Multiple Gatekeepers, Andrew F.Tuch, Discussion paper no.33, 3/2010, Harvard Law School,

Cambridge, MA

10

Andrew Tuch, page 86

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

6

Securities and Exchange Board of India

1. Introduction

At independence, India had a functioning stock market (Bombay Stock Exchange is Asias

oldest stock exchange), a flourishing trading sector, a fledgling industrial sector and a well-

developed banking sector. The concept of joint stock companies was immensely popular

since it was first introduced by the British rulers and Indian businessmen took to the

concept very well as it helped disperse risk more widely and provided better access to

funding resources.

However, the method of running these companies or corporate governance took an entirely

indigenous flavourbusinessmen hardly altered their style of working under sole-

proprietorship or partnership mode and often treated the company as their personal

property. Promoters were unwilling to give up unbridled control over the business that is

inevitable in a joint-stock company. The concept of a managing agency house (often a

partnership firm that provided specific services) where promoters would pass a resolution

appointing their family firm as the managing agent almost in perpetuity and with unfettered

powers was a neat solution.

Corporate governance, as is understood in the modern context, was an alien concept to

indigenous Indian business houses for a long time. The socialist policies followed by the

government after independence also contributed to weak governance norms that was more

evident in Indias huge public sector and nationalised banks where the governing ethos took

on a form of its own.

Faced with a fiscal crisis in 1991, the Indian Government responded by enacting a series of

reforms aimed at general economic liberalization. This opened up the Indian economy not

only in terms of business opportunities and newer funding avenues but also to fresher ideas

of governance models. To develop Indias capital markets further, the central government

established regulatory control over stock markets through the formation of the Securities

and Exchange Board of India. SEBI, which was originally established in 1988 as an

advisory body, was granted authority to regulate the securities market under the Securities

and Exchange Board of India Act of 1992 (SEBI Act). Through the passage of this Act,

Parliament established SEBI as an independent statutory authority, but required it to submit

annual reports to the legislature.

SEBI was designed to serve as a market oriented independent entity to regulate the

securities market akin to the role of the Securities and Exchange Commission (SEC) in

the United States The stated purpose of the agency is to protect the interests of investors

in securities and to promote the development of, and to regulate, the securities

market.

The first initiative at introducing corporate governance in a structured manner in India was by

the industry through its association, CII in 1998. It was a purely voluntary set of

recommended governance norms that companies could adopt and be seen as being well-

run companies. But to ensure more wide-spread adoption of corporate governance norms it

is necessary to have a certain statutory compliance value and therefore, SEBI undertook the

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

7

second initiative in corporate governance by introducing a code formed by a committee

under the chairmanship of a leading industrialist, Kumarmangalam Birla in 1999. The

recommendations of this committee contained new provisions in line with global

developments such as putting out a Management Discussion & Analysis report as part of the

annual report, emphasising on Board committees and advocating the role of independent

directors. These proposals were introduced by SEBI in 2000 for companies within its

jurisdictionlisted companiesby amending the Listing Agreement that companies enter

into with stock exchanges.

But SEBIs mandate extends only to companies listed on stock exchanges and a

comprehensive adoption of corporate governance norms for all companies can be brought

about in India only through the legislative route. Therefore, the third set of corporate

governance proposals was carried out by the Department of Company Affairs (now Ministry of

Corporate Affairs) based on the recommendations of the Naresh Chandra committee in

December 2002. It made recommendations in two key aspects of corporate governance:

financial and non-financial disclosures and independent auditing and board oversight of

management and also a series of recommendations regarding statutory auditors.

The fourth initiative on corporate governance in India was again carried out by SEBI based on

the recommendations of the Narayana Murthy committee which was set up to review Clause

49and suggest measures to improve corporate governance standards.

This was done in the wake of the Enron scandal in the United States in order to evaluate the

adequacy of the existing Clause 49 and to further improve existing practices in order to

enhance the transparency and integrity of Indias stock markets and ensure compliance

with corporate governance codes, in substance and not merely in form. The changes

suggested reflect global norms of corporate governance developed in Anglo Saxon countries

that have a different business environment than India.

2. Regulatory Framework of Securities and Exchange Board of India

(SEBI)

SEBI acts as a developer and regulator of the capital market in India. SEBI has delegated

powers to two exchanges (Bombay Stock Exchange, National Stock Exchange) to ensure

that their members adhere to the SEBI regulations and instructions.

The total market capitalization as on March 31, 2011 of listed companies in India at Bombay

Stock Exchange is Rs 68,39,084 crores as per SEBIs Annual Report for the year ending

March 31,2011.

Some of the roles that SEBI performs as a market regulator are:

1. To regulate the market by creating rules for functioning of various products.

2. To approve/ amend the laws of stock exchanges.

3. To inspect the books of accounts and call for periodical returns from recognized stock

exchanges.

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

8

4. To inspect the books of accounts of financial intermediaries and levy fees/ charges on

them.

5. To compel certain companies to list their shares in one or more stock exchanges.

6. To educate investors.

7. To prosecute and judge directly the violation of certain provisions of the companies

Act.

8. To prohibit and prevent insider trading

9. To frame rules for merger and takeover of companies.

10. To regulate issue of capital and debt in primary and secondary market.

11. To prevent unfair trade practice and market manipulation.

Thus, SEBI drafts regulations in its legislative capacity, conducts investigations and

authorizes enforcement action in its executive function, passes rulings and orders in its

judicial capacity. Though this makes it very powerful, there is an appeals process to ensure

fairness and accountability through a Securities Appellate Tribunal (SAT). SAT was formed

in 1995 to act as a forum of justice to appeal against the orders passed by SEBI Board or

the adjudicating officer (AO) appointed under SEBI Act.

The general process flow of adjudicating and appeals process is usually as below but may

vary a little in some cases:

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

9

Flowchart for Adjudication Proceedings

Commitment of Offence

SEBI obtaining information on the basis

of reports from stock exchanges or

otherwise

SEBI Ordering and enquiry, Enquiry

Proceedings completed, summons

may be issued for collection of

evidence, Enquiry Report submitted

to SEBI and Show Cause Notice may

be sent to the defaulter.

Appointment of Adjudicating Officer

Issue of Show Cause Notice

Submission of reply and evidence/

records/. Opportunity given for

personal hearing through legal

representation

Submission of reply and evidence/

records. In case of non-receipt of reply,

an ex-parte order may be issued

Detailed investigation and order passed

by SEBI Board/ Adjudicating Officer

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

10

Flowchart for Appeal Process

(At any stage an appeal can be filled with the Central Government of India)

Order Passed by SEBI Board/ AO

Appeal filed with SAT

SAT may send the case back to SEBI

for fresh order/ speedy investigation

Appeal decided in favour of

SEBI/ Appellant

Aggrieved party may approach

High Court

High Court passes an interim/

final order

Appeal can be filled in Supreme

Court

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

11

3. SEBI & Corporate Governance

SEBI has set out corporate governance provisions that are intended to drive in a minimum

standard of corporate governance among listed companies in India. This is issued as a part

of the Listing Agreement that each listed company signs with the stock exchange under the

title Clause 49. Clause 49 remains the most significant corporate governance reform and

established a new corporate governance regime.

Like corporate governance standards in the United States and the United Kingdom, Indias

corporate governance reforms followed a fiduciary and agency cost model. With a focus on

the agency model of corporate governance, the Clause 49 reforms included detailed rules

regarding the role and structure of the corporate board and internal controls. These

norms lay criterions for:

1. Appointment of independent directors in board.

2. Appointment, composition and Powers of Audit Committee

3. Functioning of Remuneration Committee, Investors Grievances Redressal

Committee

4. Compensation that can be paid to non-executive directors.

5. Adherence to internal control of conduct by Board of Directors and other top

executives.

6. Disclosure of Accounting Policies, Contingent Liabilities, Related Party

Transactions, IPO Proceed utilisation.

7. Certification by CEO/ CFO on adequacy of internal control system,

correctness of the reported financials.

8. Whistle Blower Policy.

A certificate of compliance on terms contained in Clause 49 is required to be signed by the

director and auditors/ company secretary of the company is to be annexed to the annual

report.

The stock exchanges are mandated to ensure compliance with the above provisions at the

time of listing of shares and through quarterly compliance reports received from listed

companies. Listed companies are also required to submit a consolidated compliance report

to SEBI within 30 days of the end of each quarter.

The Clause 49 reforms were phased in over several years, applying at first to larger

entities and eventually to smaller listed companies.

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

12

Eventually, compliance of corporate governance must be carried out by:

Issuer Companies

Stock Exchanges

Central Securities Depositories

Stock Brokers

Mutual Funds

Foreign Institutional Funds

Investment Banks

Depository Participants

Credit Rating Agencies

Venture Funds

Registrars and Underwriters

4. Effectiveness of SEBI as a Gatekeeper of Corporate Governance in

India

SEBI is the capital market regulator in India and has been active in recent years in its efforts

to usher in a standard form of corporate governance. This part of the study analyses

effectiveness of SEBIs role in implementing corporate governance mechanisms. This is

done in four parts:

a. Study of the extent of adoption by listed companies of SEBI corporate

governance norms.

b. Study of the effect of such adoption on the performance of companies

c. Study of effectiveness of SEBIs overall regulatory mechanism by analysing

the first level of mechanism, that is, the Assessing Officer level as well as the

appeals process, that is, the Securities Appellate Tribunal (SAT)

d. Study of the mechanism of Consent Orders and analyse its prevalence,

effectiveness as a deterrent and assess transparency of the system

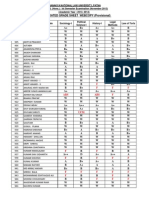

4.1 Study of extent of adoption of corporate governance norms by listed companies

We have analysed data from National Stock Exchange of company-wise submissions with

respect to compliance with provisions of corporate governance code for the quarter ended

30

th

June 2011.

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

13

Our analysis showed that almost all companies were following corporate governance

measures:

*Cannot Comment: Data includes fields which did not have any input,

hence cannot determine if compliance is done or not.

This analysis is limited to only examine whether companies had declared adherence to

prescribed corporate governance mechanisms and did not cover examining the quality of

such mechanisms or the benefit of such mechanisms for individual companies.

A study on corporate governance in India

11

states that India has one of the best corporate

governance laws but poor implementation together which, together with socialistic policies of

the pre reform era has affected corporate governance. The legal environment plays a crucial

role in determining the nature of corporate governance in any country and encompasses two

important aspects the protection offered in the laws (de jure protection) and to what extent

the laws are enforced in real life (de facto protection).

Two indices have been used for this purpose a shareholder rights index ranging from 0

(lowest) to 6 (highest) and a rule of law index ranging 0 (lowest) to 10 (highest) to measure

the effective protection of shareholder rights. The first index captures the extent to which the

written law protected shareholders while the latter reflects to what extent the law is enforced

in reality. India has a shareholder rights index of 5, being one highest in the sample

examined of 49 countries but the rule of law index a score of 4.17 on this index ranking

41st out of 49 countries studied.

Thus it appears that Indian laws provide great protection of shareholders rights on paper

while the application and enforcement of those laws are lamentable. This difference in

protection of shareholders rights has led to completely different trajectories of financial and

economic developments in the different countries.

The study concludes that the bigger challenge in India lies in the proper implementation of

corporate governance rules at the ground level.

11

Corporate Governance in IndiaEvolution and Challenges by Rajesh Chakrabarti, College of

Management, Georgia Tech, USA

Particulars Number of companies Percentage

Complied 1044 71

Non Complied 106 7

Cannot comment* 312 21

Total 1462 100

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

14

4.2 Study of Effect of Adoption of corporate governance norms on listed companies

OECD Principles of Corporate Governance (2004) and various corporate governance

indexes (such as Standard & Poors Corporate Governance Index) focus on the

characteristics of corporate governance mechanisms rather than outcomes based on the

principle that effective and robust processes result in appropriate results. However, authors

like Pitabas Mohanty argue that if a company has got a governance system then it must get

reflected in certain outcome(s). (The argument is that) if the processes are in order, we must

observe certain desirable outcomes. If the outcomes are not present, then the mere

existence of a process does not amount to anything

12

.

Significant research on this area conducted by Gompers et al. (2003), Bebchuk and Cohen

(2004) and Bebchuk, Cohen and Ferrell (2009) show that firms with stronger stockholder

rights have higher Tobin Qs, their proxy for measurement of corporate value, indicating that

better-governed firms are more valuable.

Brown and Caylor in Corporate Governance and Firms performance ( 2004) create a

summary index of firm-specific governance, Gov-Score, and relate it to operating

performance, valuation, and cash payouts for 2,327 firms in USA. They show that poorly-

governed firms (i.e., those with low Gov-Scores) have lower operating performance, lower

valuations, and pay out less cash to their shareholders, while better-governed firms have

higher operating performance, higher valuations, and pay out more cash to their

shareholders.Scholars also agree that there are no formalized & generally accepted criteria

for determining if a particular system of corporate governance system works

13

.

Bain and Band (1996)

14

and Bhagat and Jefferies

15

believe that the following form the pillars

of corporate governance and have a positive relationship with the value of a firm.

Independent board of directors

Equal rights of minority shareholders

Dispersed ownership

Timely & transparent information system

Independent auditor

There are also other factors that affect the relationship between the value of a firm and

corporate governance which include a) role of judiciary, banks, government and politicians,

b) macro-economic factors such as economic growth rate, inflation, interest rates c)

intangibles such as goodwill, customer relations, supply chain and growth potential, etc.

12

Mohanty, Pitabas, Institutional Investors and Corporate Governance in India,

www.nseindia.com/content/research/Paper42.pdf, accessed on 20/1/12

13

Macy, J., Measuring the Effectiveness of Different Corporate Governance Systems: Towards a

More Scientific Approach, Journal of Applied Corporate Finance, Vol 63, No. 2, 1998

14

Bain, Neville and David Band, Winning Ways Through Corporate Governance, Macmillan

Business 1996

15

Bhagat, Sanjai and Richard H Jefferies, 2002, The Economics of Corporate Governance

Studies, MIT Press

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

15

In other words, the value of a firm is a combination of of the monetary value plus the social

value of the firm.

Indian corporate governance systems are drawn from the Anglo Saxon model of corporate

governance where the focus is on shareholder value maximisationshareholder value being

derived in terms of market valuation of a firm

16

.

Several studies have linked different parameters of performance to corporate governance to

assess its effectiveness. Some of these parameters include share price movements,

volatility of share prices, earnings per share, etc. Kaplan

17

and Gibson

18

suggest that

performance of a corporate governance system can be evaluated by investigating the link

between corporate performance and CEO turnover. The reasoning is that an effective

governance system requires poor performing managers to be penalised by removal.

However, Gibson also provides evidence that when the firm has a domestic private large

shareholder, the relationship between CEO turnover and corporate performance weakens in

emerging markets. This is also indicated in India, where the agency gap between owners

and managers is low , which is compounded by the fact that owners of the top 500

companies in BSE as on 30 September 2011 hold 60 % of the listed companies, creating a

strong entrenchment of management and therefore CEO turnover may not provide accurate

indications of good or bad corporate governance.

Chhaochharia and Laeven (2007)

19

have evaluated the impact of firm-level corporate

governance provisions on the valuation of firms in a large cross-section of countries. They

have distinguished between governance provisions that are set at the country-level and

those that are adopted at the firm-level and conclude that governance provisions adopted by

firms beyond those imposed by regulations and common practices among firms in the

country have a strong, positive effect on firm valuation.

Despite the costs associated with improving corporate governance at the firm level, many

firms choose to adopt governance provisions beyond what can be considered the norm in

the country, and these improvements in corporate governance have a positive effect on firm

valuation. Indian software and other companies listed overseas, especially in the USA ,

followed these principles of voluntarily imbibing greater measures of corporate governance

for the perceived value it created for their businesses.

The challenge is to find a broad yet accurate measurement indicator that factor in the effect

of corporate governance by linking two or more appropriate parameters which reflect the

performance of a company within a certain environment. Tobins Quotient is widely used by

16

Kakani, Ram Kumar, Biswatosh Saha, V.N.Reddy, Determinants of Financial Performance of

Indian Corporate Sector in the Post Liberalisation Era: An Exploratory Study, May 2006

17

Kaplan, S.N., Top Executive Rewards and Firm Performance: A Comparison of Japan and the

United States, Journal of Political Economy, Vol 102, No.3, 1994, pp 510-546), Abe (Abe, Y, Chief

Executive Turnover and Firm Performance in Japan, Journal of the Japanese and International

Economies, Vol 11, 1997, pp 2-26

18

Gibson, M.S., Is Corporate Governance Ineffective in Emerging Markets, Journal of Financial and

Quantitative Analysis, Vol 38, No.1, March 2003, pp 231-250

19

Chhaochharia, Vidhi and Luc Laeven, The Invisible Hand in Corporate Governance

http://www.luclaeven.com/papers_files/CG_Provisions.pdf, 2007

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

16

academicians as a proxy for firm performance when studying the relationship between firm

performance and corporate governance. Tobins Quotient or Tobins Q is a ratio devised by

Nobel Laureate James Tobin of Yale University in 1969 who hypothesised that the combined

market value of all companies on the stock market should be equal to their replacement

costs. The ratio is calculated as:

Tobins Q= Total Market Value of a Firm

Total Asset Value

(Where Total Asset Value refers to the replacement value of assets.)

If Tobins Q is equal to 1.0, the market value will be perfectly reflected by the recorded

assets of the company. If Tobins Q is greater than 1.0 then the value is greater than the

value of the companys recorded assets. The accepted view is that in such cases the market

value reflects some unmeasured or unrecorded asset of the company. This extra value is

often used as a proxy for corporate governance.

Cheung and Pruitt

20

developed and empirically tested the robustness and usefulness of the

simple formulation of Tobins q. They concluded that the co-relation of the values obtained

through q values is theoretically correct and can be safely applied. This conclusion in many

ways supports the main assertions of another prior study on Tobins q by Perfect and Wiles.It

is now widely accepted that Tobins q is an appropriate proxy for the underlying, true q,

which is an indicative measure to invest.

Clause 49 of the Listing Agreement of Indian Companies

The corporate governance mandate is contained in the revised Clause 49 issued by

Securities and Exchange Board of India effective from April 1, 2004 for listed companies.

These provisions have been in effect for a period of seven years and can reasonably be

expected to be entrenched long enough for its effect to be reflected in certain parameters.

These provisions are designed to improve the way in which companies are managed. The

main provisions of Clause 49 are:

Guidelines Impact Objective

Board of

Directors

Professionalization of directorial oversight,

transparency of board remuneration & processes

Independence of

Oversight

Audit

Committees

Improvement in quality of financial oversight and

therefore in firm performance

Risk Assurance

Subsidiary

Companies

Greater oversight of unlisted companies by

shareholders of holding company

Capital Protection

Disclosures Better control mechanisms being implemented,

better risk management processes

Financial

Transparency

CEO/CFO

certification

Greater ownership of financial affairs of the

company leading to better oversight mechanism

Accountability

20

Chung, Kee H. and Pruitt, Stephen W. , A Simple Approximation of Tobin's Q. Financial

Management, Vol. 23, No. 3, 1994. Available at SSRN: http://ssrn.com/abstract=957032

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

17

Methodology and Analysis

We have used Tobins Q as a proxy to analyse the effectiveness of corporate governance

practices that listed companies in India are mandated to implement.

We have analysed the movement of Tobins Q over 100 companies comprising BSE 100

index over a period of seven years from the financial year 2004-5 to 2010-11. This involved

analysis of 800 financial statements to collect financial data to examine whether introduction

of SEBIs corporate governance mechanisms has had an impact on corporate performance.

This ratio was originally intended to be calculated on the replacement value of assets.

However, it is difficult to obtain an estimate of the replacement cost of assets unless there is

a defined market for used equipment. Indian laws require assets to be recorded at historical

cost adjusted for depreciation; in certain cases mark-to-market is used but this is not the

usual case. Therefore, we have used total assets as they appear in the financial statements

of companies.

We have also analysed certain financial performance indicators of the 100 companies

comprising BSE 100 index over this period of seven years to study the link, if any, between

corporate governance mechanisms. For instance, Return on Assets (ROA) is an indicator

of how profitable a company is relative to its total assets and may be considered as a proxy

for efficiency of management in using its assets to generate earnings; in other words, ROA

may be considered as a proxy for operating performance.

Return on Equity (ROE) is an indicator of maximisation of shareholder wealth which, in

terms of the Anglo Saxon model, is the basic purpose of corporate governance. ROE is the

amount of income returned on the equity invested in the company and may be considered a

proxy for the ability of the company to maximise shareholders wealth.

Net Profit to sales is an indicator of how efficiently a company is being operated. It may be

considered as a proxy for effectiveness of certain corporate governance mechanisms that

seek to improve operational performance.

Employee Cost as a percentage of sales indicates whether certain HR processes included

in corporate governance mechanisms are effective in improving employee efficiency.

Cost of Debt indicates whether the company is being run effectively enough to bring down

the debt component and improve cost efficiencies and may be considered as a proxy for

financial efficiency.

Terms Explained:

1. Tobins Q is the ratio of market capitalisation over the total assets of the company.

Market Capitalisation has been calculated by multiplying the number of shares with the

issued capital. Total Assets are taken as per Annual Financials reduced for deferred

revenue expenditure to the extent not written off.

2. Return is Net Profit after Tax

Net Profit (after tax) = Earnings Before Interest & Taxes minus Interest minus Taxes

Earnings Before Interest & Taxes = Operating Revenue- Operating Expenses+ Non-

Operating Income.

Operating Revenue= Sales Revenue

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

18

Operating Expenses= Cost of Goods Sold+ Selling, General and Administrative

Expenses+ Depreciation & Amortisation+ Other Expenses

Non-Operating Income= Dividend Income+ Profits from Investments+ Gains on

account of foreign Exchange.

3. Return on Assets is the ratio of returns for a year over the average of total assets

during the years. Average Assets is the summation of opening and closing assets

divided by two.

4. Equity means Shareholders Funds ie Share Capital + Reserves and Surplus. Return

on Equity is the ratio of returns for a year over the reported equity.

5. Sales are before excise duty adjustments and in case of banks it refers to the interest

earned.

6. Total Debt includes both secured and unsecured long term debt. Cost of Debt is ratio

of interest cost over average debt. Average Debt is the summation of opening and

closing debt divided by two.

7. Price/ Earnings Ratio is the ratio of Closing market price of the shares at BSE divided

by reported Earnings per Share.

8. Mean is simple average of the data variables over sample size and period.

9. Median is the middle most value of the data variables over sample size and period.

10. Skewness is a measure of the asymmetry of the data around the average mean. If

skewness is negative, the data are spread out more to the left of the mean than to the

right. If skewness is positive, the data are spread out more to the right. The skewness

of the normal distribution (or any perfectly symmetric distribution) is zero. In case data

skewness is more than +/- 5, the mean has been substituted by the median for

analysis.

Our discussion and analysis:

The table below depicts the average Tobins Q of BSE 100 companies annually since the

introduction of SEBIs Clause 49 in April 2005.

Tobins Q

(mean)

2011 2010 2009 2008 2007 2006 2005 Trend

Market

Cap/Total

Assets

3.47 3.5 2.2 4.04 3.85 4.24 3.27 Oscillating

We observe that there was a marked increase in Tobins Q one year after corporate

governance regulations were introduced in 2005 and there has been a marked improvement

in the measure over the next 3 years, suggesting that the capital market reacted favourably

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

19

and rewarded companies for implementing corporate governance mechanisms. This

observation is in line with prior empirical studies done by Jain, Kim and Rezaee in 2006 ,

suggesting that SOX regulations in the USA created a buoyancy in the markets by reducing

information asymmetry due to higher levels of disclosures, which increased the market

liquidity and size.

At an average Tobins Q of over 3 for all years (except one), it indicates that markets value

companies far more than what they are worth as compared to the amount of investment

made by them.

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

20

Movement of Companies toward Better Corporate Governance

We analysed the movement of these 100 companies over a period of seven years to see if

assimilation of corporate governance mechanisms recommended by Clause 49 has helped

companies to move up on the index of Tobins Q. This was analysed with reference to the

mean Tobins Q ratio for each of the years to observe the migration of companies past the

mean towards a higher benchmark.

The results, as depicted in the table below, indicate that the number of companies that are

below the mean Tobins Q ratio for BSE 100 has only increased over this period. If corporate

governance mechanisms were effective, it is expected that companies would have moved

closer to the higher Tobins Q benchmark. This could also mean that the market accepts a

certain corporate governance standard as the basic after a period of time and does not

continue to reward companies beyond a certain point.

Therefore, while the number of companies below mean Tobins Q has increased over time, it

is not clear whether this is because of ineffectiveness of corporate governance mechanisms

or because the market expects such standard behaviour from everyone and does not

recognize these basic efforts.

Distribution of Companies around Mean Tobins Q

Distribution of

Companies Above &

Below Mean Tobins

Q

2011 2010 2009 2008 2007 2006 2005

Number of

Companies More

than mean

30 30 26 33 31 28 23

Number of

Companies less than

mean

70 69 71 63 59 58 59

NA

-

1

3

4

10

14

18

Total 100 100 100 100 100 100 100

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

21

Data Skewness

We also observed that there is great data skewness in the sample of BSE 100 with Tobins

Q ranging from less than 1 up to 25 as shown in the table below. Such a high Tobins Q

suggests that assets of those companies may be over utilised as compared to the amount of

capital invested in them. Theoretically, a high Tobins Q should encourage those companies

to invest more in capital to balance market valuations.

Tobins Q Spread Year-Wise

Tobins Q Ratio 2011 2010 2009 2008 2007 2006 2005

Not Available

-

1

3

4

10

14

18

Upto 1

39

31

41

25

27

23

27

1 to 2

13

19

27

16

12

9

18

2 to 3

16

16

9

15

14

13

13

3 to 5

13

14

10

16

10

18

9

5 to 10

11

12

8

18

20

15

10

More than 10

8

7

2

6

7

8

5

Total

100

100

100

100

100

100

100

Alternatively, this high Tobins Q indicates that there is unexplained exuberance in capital

markets regarding certain companies which puts their market capitalisation far above what

the companies are actually worth. Sectors like Capital Goods, FMCG and Transport

Equipment show a high Tobins Q above 5 up to 25 which is inexplicable. Information

Technology shows Tobins Q on an average between 2 to 5, indicating that the capital

market factors in intangibles in the IT sector that is not reflected in total assets appearing in

financial statements. Only the Finance sector shows a consistent Tobins Q between 0 and

1.

Therefore, average Tobins Q depicted in the first table needs to be read in the context of

this skewness.

Other Financial Ratios:

We have analysed data of 100 companies

21

over a period of seven years. This translates

into 800 financial statements from which we have extracted financial ratios that could

indicate effectiveness of corporate governance mechanisms. These ratios have then been

aggregated into annual figures to show the trend across BSE 100 companies and the results

are depicted in the table below:

21

Forming part of BSE 100

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

22

Financial Ratios Over 7 Years

Analysis: Return on Assets: The data shows an oscillating trend and appears to reflect

general macroeconomic factors as well. The effect of corporate governance mechanisms is

not very apparent.

Return on Equity: The data showed an increasing trend initially and then has declined

steadily, mirroring the recessionary trend in those years. This suggests impact of

macroeconomic factors rather than improvement in corporate governance mechanisms.

Net Profit/Sales: Although the data shows an oscillating trend, after factoring in recession,

profitability shows an improvement over the years. However, it may be premature to

conclude that this is as a result of corporate governance mechanisms.

Employee Cost/Sales: Employee costs over sales shows a rising trend over the years of

the sample period. Improving corporate governance should contribute to more efficient HR

systems which should help to bring down employee costs as a percentage of sales, which,

however, is not supported by data. Rising employee cost can also be explained by rising

inflation (which would also have an adverse effect on sales) and therefore the effect of

corporate governance on employee costs is not clear.

Cost of Debt: Other than the exceptional year of 2009, the cost of debt shows a declining

trend. This could indicate that more value is created for shareholders as cost of financing

goes down.

Corporate governance is expected to bring in efficiencies in the way a business is run

and must, in the final analysis, be reflected in the outcomes as represented by

financial numbers. Some of these efficiencies would be reflected in a lower cost of

debt, more efficient employee costs per unit of sales, besides providing better returns

on assets and to shareholders.

Ratios 2011 2010 2009 2008 2007 2006 2005 Trend

Return on

assets

12.98

13.67

13.16

15.94

15.98

14.29

13.41

Oscillating

Return on

Equity

18.59

19.28

19.17

23.08

24.77

21.53

20.75

Oscillating

Net Profit/

Sales

14.78

15.17

13.75

15.07

14.07

13.31

13.75

Oscillating

Employee cost

as %age of sales

6.10

5.88

5.52

5.78

5.19

5.52

5.61

Oscillating

Cost of Debt

6.34

6.50

8.39

6.98

6.63

5.97

7.07

Oscillating

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

23

Our analysis of data reveals that at an aggregate level, these financial ratios do not

provide any trend that conclusively points to the effect of better governance by itself

and may depict the influence of other macro-economic factors as well.

Correlation Coefficient

We find that these financial ratios do not independently provide conclusive proof of the effect

of corporate governance on financial performance. Therefore we examine if there is any

correlation between Tobins Q ratio (the proxy for corporate governance) and the main

profitability ratios of Return on Assets (ROA) and Return on Equity (ROE) as well as the

share prices (of corporate performance). Correlation coefficient is a measure of the strength

of linear association between two variables and will be between -1.0 and +1.0; that is, if the

co-relation is positive, there is a positive relationship between the two variables and vice

versa. The strength of the relationship is determined by the fraction beyond zero.

We have conducted a series analysis between Tobins Q and each of ROA, ROE and Share

Prices for each company in BSE 100 over seven years. We then found the correlation

coefficient for each of these companies and the result for the entire sample is:

Co-relation Co-effcient of Tob Q with ROA, ROE & Share Prices

Correlation

coefficient

Return on

Assets

(ROA)

Return on

Equity

(ROE)

Share Prices

NA

3

3

3

0 to -1

18

28

7

0 to 0.5

30

30

24

0.5 to 1

49

39

66

Total

100

100

100

We observe from this data that:

ROA: As many as seventy nine per cent (79%) of companies in our sample showed a

positive correlation between corporate governance and profitability as measured by return

on assets.

ROE: Up to sixty nine (69%) of companies in our sample showed a positive correlation

between corporate governance and increased shareholder wealth (ROE)

Share Prices: As many as ninety per cent (90%) of companies in our sample showed a

positive correlation between corporate governance and higher share prices. That is, markets

recognized improvements in corporate governance by rewarding these companies at the

stock exchange.

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

24

We observe that at a broad level, there appears to be a positive correlation between Tobins

Q ratio and certain profitability indicators as well as share prices. This suggests that

companies that are perceived by stakeholders to be better governed also, in fact, deliver

better returns. That is, not only do companies that rank higher on the corporate governance

actually display higher profitability but also their shares are valued higher.

However, while there may be some individual trends noticed in different years for certain

companies, these appear to be more because of sectoral and macroeconomic factors

cannot clearly be said to be because of introduction of corporate governance mechanisms

contained in Clause 49.

Perhaps the most significant result is the shifting of the mean Tobins Q over a period of

seven years which would indicate whether Clause 49 has helped companies achieve better

corporate governance. As indicated in table above this improvement of Tobins Q ratio has

not occurred, which, we believe, indicates that there are only a few companies which excel

on corporate governance parameters while the vast majority of companies (60 to 70 per

cent) have made no movement towards better corporate governance over the years, as

perceived by the capital market.

Thus, we conclude that there is no clear evidence of effectiveness of Clause 49 on

performance of companies.

4.3 Study of effectiveness of SEBIs overall regulatory mechanism by analysing the

first level of authority, that is, the Assessing Officer level as well as the appeals

process, that is, the Securities Appellate Tribunal (SAT)

We have analysed SAT orders passed in case of 100 appeals and the corresponding 100

Adjudicating Officer (AO)/ SEBI orders passed to ascertain the effectiveness of the

adjudicating and appellate process. The period of study for SAT orders is from March 1,

2010 to September 30, 2011 and the sample has been selected on a random basis within

the constraints of data availability

22

.

The objective of the analysis is to study the nature of offences, time taken by SEBI in

completion of adjudicating proceedings, nature of penalties levied, analysis of SAT orders

whether it has taken independent decisions in favour or against SEBI and reduced the

penalties for appellant ensuring law of justice, time taken to complete appeal proceedings at

SAT and finally the time taken at SEBIs end for disposal of cases.

Methodology Followed

1. SAT orders were examined on following parameters:

Date of SAT order

Name of the Appellant

Nature of Offence

Appeal decided in favour of

22

Source: (www.watchoutinvestors.com) & (www.sebi.gov.in)

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

25

Revised Penalty

2. The respective AO/ SEBI order were analyzed to study the entire judiciary process on

following factors:

Date of order

Date of Appointment of Adjudicating Officer

Date of Show cause Notice

Time of Offence

Original Penalty

3. A detailed analysis was carried out to ascertain:

Types of Violation covered under these orders

Type of Penalties Charged by AO/ SEBI order

Appeals decided in favour of SEBI/ Appellant

Amount/ Quantum of Penalties waived

Time lag between the date of offence and date of appointment of AO

Time lag between the date of appointment of AO and date of show cause notice

Time lag between the date of show cause notice and the date of order passed by

AO/ SEBI

Time lag between the date of order passed by AO/ SEBI and the date of SAT order

Time lag between the date of SAT order and date of offence

Time lag between the date of AO/ SEBI order and date of offence

Assumptions of the study / Limitations of the Data

1. Samples of 100 appellants with maximum of 2 appellants in one SAT order have been

considered.

2. Date of offence is the first date of violation. In cases of offence relating to

noncompliance with summons issued by SEBI, date of offence has been taken as the

date of 1st summons issued.

3. Date of appointment of adjudicating officer could not be found in case of ex-parte

orders/ investigations ordered by SEBI/ otherwise (32 such cases). We could not

ascertain the reasons why this date was not written in the orders. In 5 cases, date of

appointment of adjudicating officer is after the date of show cause notice which are

essentially show causes issued by enquiry officer, these have been taken as enquiry

cases.

4. In one case, no show cause notice has been issued, hence the date of show cause

cannot be analysed.

5. To ascertain whether the outcome of SAT order was in favour of SEBI/ Appellant,

following assumptions have been made:

Appeals decided in favour of Appellant comprise of cases where the order has

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

26

been completely set aside or the monetary penalty has been reduced to zero.

Appeals decided in favour of SEBI consist of cases where there is no reduction

in the penalty or the order has been withheld by Appellant. Cases withdrawn

unconditionally or cases settled thru consent order have been also clubbed

under the category of favourable to SEBI.

Appeals where the order has been withheld but the quantum or conditions or

amount of penalty has been reduced by Appellate have been taken as Relief to

Appellant. In case the order has been sent back to SEBI for further

investigation or a fresh order have been also considered as relief to Appellant.

6. In order to determine the nature of violations, data has been clubbed in the following

manner:

a) Price Manipulation comprises of the cases where promoters or directors or broker or

company has involved itself in synchronised/ circular/ cross deals to create artificial

volume and rig securities prices. It also consists of cases whereby false or misleading

corporate public announcements have been made or insider trading has been done.

b) Takeover violation comprises of the cases where the regulations relating to takeover

code i.e. Disclosures of more than 2%/5% voting rights, shareholding pattern by the

company have not been followed.

c) Investors grievances relate to the companies delays in dematerialisation of shares,

non-redress of investors grievances, huge selling in the shares with an objective to

defraud investors, delay in refund of investors funds, non-implementation of moral

code of conduct to protect investors interest.

d) Violation of code of conduct of brokers encompass the cases where the brokers

have not maintained proper books of accounts, segregation of client moneys and own

funds, fund based activities, unauthorised terminals, KYC norms non-compliance etc.

e) Non responsiveness of summons issued by SEBI includes the cases of zero

response or non-cooperation as to the quantum & timeliness of information submitted.

f) Failure to pay stock broker registration charges on a timely basis.

g) IPO manipulation includes the cases where fraudulent financing of IPOs have been

done to oversubscribe the shares and make disproportionate profits on the date of

listing or create benami shareholding. It also includes subscription to avoid under

subscription of shares.

7. This study cannot comment on final collection of the penalty amount by SEBI.

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

27

Observations

1. Nature of Offence

We have identified the nature of violations by categorising them as under:

In our study, most of the cases pertain to share price manipulation or IPO manipulation

(56%), Stock Broker code of conduct violations (15%), Takeover Code Violation (12%).

This reflects the state of securities market where securities price manoeuvring is rampant

either at the time of issue of shares or later through means of circular trades, synchronised

deals and cross deals.

In such fictitious transactions the beneficial ownership in the scrip does not change but

artificial volumes are created, perhaps to lure common investors. In such cases the price is

not derived by fair market mechanism but by creating an artificial buying pressure.

However more research is required to comment upon SEBIs detection and disciplinarian

role in such cases.

49

15

12

8

7

6

2

1

Nature of Offence

Share Price Manipulation Stock Broker Code of Conduct Violation

Takeover Code Violation Investors Grievances

IPO Manipulation Non Responsiveness to summons issued

Non Payment of Broker Registration Fees Listing Agreement Violation

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

28

2) Nature of Penalty

The amount and nature of penalties are laid down in Section 15 of SEBI Act. The penalties

in our sample are:

In 73% of the cases monetary penalty has been charged. A further analysis of the penalties

has been done in the following section on disposal of cases.

3) Disposal of Appeals

In 49% of the cases the appeal has been decided in favour of SEBI and remaining 51%

cases the appellant has given full or partial relief to appellant.

In 49 cases which have been determined in favour of SEBI, a monetary penalty of Rs 296.50

lacs have been levied.

In 51 cases where the appellant has received full or partial relief, calculation has been done

to establish the amount of penalties waived by SAT. To facilitate the waiver calculation 11

cases have been excluded for the following reasons:

73

15

3 8

1

Nature of Penalty

Monetary

Debarred from dealings in

securities market

Debarred from dealings in

securities market & Monetary

49

34

17

Disposal of Appeals in Favour of

SEBI Relief to Appellant Appellant

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

29

a) Impounding of money by SEBI and then ordered to refund the amount so impounded to the

appellant.

b) Cases with monetary penalty sent back to SEBI for fresh order forming part of relief to

appellant have not been considered.

c) Debarment from dealing in securities or cancellation of share broker certificate.

In remaining 40 cases the penalty has been waived by 90% bringing from Rs.997.05 lacs in

the original order to Rs 101 lacs in SAT orders.

This shows a degree of ambiguity in the basis of penalties levied by SEBI and also in

the policy of reversal later on.

4) Ageing Analysis of Cases

-

10

20

30

40

50

60

Date of offence vs Date of appointment of AO

Date of appointment of AO vs show cause notice Date

Date of AO order vs show cause notice Date

Date of AO order vs offence Date

Date of SAT order vs AO order Date

Date of SAT order vs offence Date

N

o

.

o

f

O

r

d

e

r

s

Ageing Analysis of SAT Orders and AO Orders

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

30

Interpretations:

i. A comparison of date of offence with date of appointment of adjudicating officer to

examine the time taken by SEBI to start punitive action in case of default: In the 68

cases where date of appointment of AO is available, in 25% cases the AO has been

appointed within a year. However in 35% of the cases it took more than 4 years for

SEBI to appoint an AO. That is, there is a delay of as long as 4 years to appoint an

AO from the time of violation. This may result in loss of evidence and increase the

investors losses.

ii. A comparison of date of appointment of AO with date of issue of Show Cause Notice

to determine the time taken by AO to initiate adjudicating proceedings against the

violator: Out of 62 cases on which data was available, in 65% cases AO has issued

show cause notice within 6 months, whereas in 32% cases it took more than 6

months to issue the same. In 4% cases the show cause notice was issued after 36

months. In certain AO/ SEBI orders we have found instances of transfer of the

adjudicating officer resulting in unwarranted delays. There is no prescribed standard

time within which the AO is required to issue a show cause notice, which leaves room

for discretion.

iii. A comparison of the date of order by AO/ SEBI with the date of Show Cause Notice

to determine the amount taken to complete the process of enquiry after the notice

has been sent to the violator: In 37% of the cases the proceedings have been

completed in one year. However in 40% cases it took more than 2 years to complete

proceedings. Such long periods carry the risk of the defaulter becoming untraceable,

destruction of circumstantial evidence and increasing investor losses.

iv. A comparison of date of order by AO/SEBI with time when the offence was

committed to determine the time taken to actually punish the violation: In 25% cases

the order is passed within 3 years whereas in 56% cases it takes more than 5 years

to pass an order.

v. A comparison of date of SAT order with the date of passing an order by AO/ SEBI to

find the time taken by SAT to complete the appellate proceedings: In 59% of the

cases SAT proceedings have been completed within 6 months. This shows efficiency

in disposal of cases by SAT.

vi. A comparison of the date of SAT order with date of offence to ascertain the time lag

between the time of non-compliance and the final indictment after first leg of appeal

process is complete: It takes more than 5 years in 64% of the cases from the time of

offence to the time of disposal of appeal at SAT with 16% in more than 9 years

bracket.

The above analysis shows that the investigation and appeals process is slow, often

arbitrary and opaque. While the process framework is good and in line with best

practices of justice and fair play, the problem lies in the implementation in routine

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

31

everyday cases. The entire process of enquiry, adjudication, trial, decision and appeal

must be streamlined and the reasonable time frame strictly enforced to help SEBI

perform its role as a good gatekeeper of corporate governance.

4.4 Study the mechanism of Consent Orders and analyse its prevalence,

effectiveness as a deterrent and transparency of the system

According to the SEBI guidelines of April 2007, a consent order means "an order settling

administrative or civil proceedings between the regulator and a person (Party) who may

prima facie be found to have violated securities laws. It may settle all issues or reserve an

issue or claim, but it must precisely state what issues or claims are being reserved. A

consent order may or may not include a determination that a violation has occurred."

Consent order allows compounding of offence whereby an accused pays compounding

charges in lieu of undergoing consequences of prosecution. Consent orders were introduced

with an objective of appropriate action, remedy and deterrence without resorting to litigation,

lengthy proceedings and consequent delays. Consent Orders can be passed in respect of all

types of enforcement or remedial actions including administrative proceedings and civil

actions. Any person who is notified that a proceeding may or will be initiated/instituted

against him/her, or any party to a proceeding already initiated/instituted, may, at any time,

propose in writing for settlement.

Consent orders are aimed to reduce the regulatory cost, time and effort spent on pursuing

enforcement actions. We have analyzed a few consent orders to determine the efficacy of

the entire process. This has been done in the following parts:

Analysis of consent orders over a period of two years from September 1, 2009 to

September 30, 2011.

ii) Sample Study of 100 consent orders from May 1, 2009 to September 30, 2011

covering takeover regulations.

i. Analysis of consent orders over a period of two years from September 1, 2009 to

September 30, 2011

During the period of two years beginning September 2009 a total of 379 consent

orders have been passed. (Source: www/sebi.gov.in)

ii. The consent orders have been plotted quarterly and monthly in the under mentioned

tables and graphs.

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

32

The data portrays a declining trend in the number of consent orders issued from as

high as 37 cases in month of September 2009 to 10 cases in September 2009. The

reason can be on account of negative media opinion on the procedures followed in

passing consent orders.

The data pertaining to two years showed multiple consent orders passed for the

same applicant. In the cases of 12 applicants, repetition ranging from 2 to 4 consent

orders has been observed. However the study cannot comment on group entities or

persons acting in concert with different names of the applicants.

SEBI consent order scheme aims to achieve litigation free alternative of achieving

justice and discipline but over enthusiasm towards this process may dissuade the

honest law abiders. This may also help the offenders to relieve themselves of severe

regulatory action by paying a paltry sum of penalty. One of the considerations for

passing consent order and compounding charges is applicants past record that is it

has not been found guilty of similar or serious violations in the past. However by

allowing multiple consent orders from the same violator may encourage tendency of

violations without any fear of law and its consequences.

0

10

20

30

40

50

60

70

80

Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11

Number of orders Quarterly

Number of orders Quarterly

Study on the State of Corporate Governance in India

Gatekeepers of Corporate Governance Securities Exchange Board of India

33

ii) Sample Study of 100 consent orders from May 1, 2009 to September 30, 2011

covering takeover regulations.

A sample of 100 consent orders was studied for the following points:

Name of Applicant

Date of consent order

Year/ Date of offence

Amount of Penalty Imposed