Professional Documents

Culture Documents

Income Tax Chapter Review

Uploaded by

libraolrack0 ratings0% found this document useful (0 votes)

266 views12 pagesThis document contains sample problems and solutions from Chapter 11 of the textbook "Income Taxation 5th Edition" by Valencia & Roxas. It discusses taxation of individuals, including personal exemptions, deductions, tax rates, and sample computations. The chapter contains true/false questions, word problems, and multi-step tax calculations for individuals with various sources of income such as employment, business, interest, dividends, and capital gains.

Original Description:

INCOME TAX OF INDIVIDUALS

Original Title

Chapter 11 (Income Tax of Individuals)

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains sample problems and solutions from Chapter 11 of the textbook "Income Taxation 5th Edition" by Valencia & Roxas. It discusses taxation of individuals, including personal exemptions, deductions, tax rates, and sample computations. The chapter contains true/false questions, word problems, and multi-step tax calculations for individuals with various sources of income such as employment, business, interest, dividends, and capital gains.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

266 views12 pagesIncome Tax Chapter Review

Uploaded by

libraolrackThis document contains sample problems and solutions from Chapter 11 of the textbook "Income Taxation 5th Edition" by Valencia & Roxas. It discusses taxation of individuals, including personal exemptions, deductions, tax rates, and sample computations. The chapter contains true/false questions, word problems, and multi-step tax calculations for individuals with various sources of income such as employment, business, interest, dividends, and capital gains.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 12

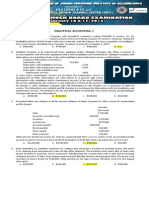

INCOME TAXATION 5TH Edition (BY: VALENCIA & ROXAS)

Chapte !!: In"o#e Ta$ o% Indi&id'a()

CHA*TER !!

INCOME TAX O+ IN,IVI,-ALS

Problem 11 1 TRUE OR FALSE

1. False Qualifed dependent parents and siblings are not entitled for additional

exemption.

2. False must be more than 180 days.

3. False NRA NBT are not allowed for personal exemptions.

4. True

5. True

6. True

7. True

8. True

9. True

10.True

11.False No personal exemption is allowed to NRANEBT.

12.True

Problem 11 2 TRUE OR FALSE

1. False additional exemptions are allowed only for qualifed dependent children.

2. False not payment for hospitalization but payment of premium for health and

hospitalization insurance provided that the family income does not exceed P250,000 per

year.

3. True

4. False 15% of gross income

5. False creditable withholding income tax.

6. False qualifed dependent parent and siblings are not entitled for additional exemption.

7. False Tax credit of income taxes paid outside the Philippines is allowed only for

resident Filipino citizen.

8. False The creditable withholding tax is 15%.

9. False Gross income includes other income but not compensation income.

10.False Tax-exempt

11.True

12.True

Problem 11 3 Problem 11 4 Problem 11 5

1. D 1. D 1. Not in the choices. P25,000 per child (R.A. 9504)

2. D 2. B 2. Not in the choices. P50,000 basic (R.A. 9504)

3. A 3. C 3. B

4. A 4. A 4. C

5. A 5. B 5. B

6. B 6. D 5. B

7. D 7. B 6. A, B & C

8. C 8. B 7. D

9. C 9. B 8. D

10. B 10. A 9. D

10. C

Problem 11 6 A

Income from the Philippines (P10,000 x 12) P120,000

Less: Personal exemption single 50,000

Income subject to tax in the Philippines P 70,000

Note: It is assumed that Juan works as OFW for more than 183 days. Income earned by OFW

outside the Philippines is not subject to tax in the Philippines. The income from the sari-sari

store in the Philippines is earned from January to December of the taxable year.

Problem 11 7 C

Gross compensation income Philippines (P250,000 x 12) P3,000,000

Multiplied by special income tax rate 15%

Income tax payable P 450,000

69

INCOME TAXATION 5TH Edition (BY: VALENCIA & ROXAS)

Chapte !!: In"o#e Ta$ o% Indi&id'a()

Problem 11 8 A

Basic personal exemption of couple:

Husband P50,000

Wife 50,000

Additional exemptions:

4 qualifed dependent children (P25,000 x 4) 100,000

Maximum amount of personal exemption P200,000

Problem 11 9 C

Only P50,000 basic personal exemption because the taxpayers category is single.

Problem 11 10 B

Basic personal exemption Married P50,000

Additional exemption 25,000

Total personal exemptions P75,000

Problem 11 11 C

Basic personal exemption P50,000

Additional exemption (a & b only) (P25,000 x 2) 50,000

Total personal and additional exemptions P100,000

Problem 11 12 A

Basic personal exemption married P 50,000

Nonresident alien engaged in business in the Philippines is allowed of basic personal exemption

subject to limit, but additional exemption is not allowed. Personal exemptions for foreigners are

subject to the rule of reciprocity with limit of whichever is lower.

Problem 11 13 A

P200 per month. For the month of December only.

Problem 11 14 D

No special deduction is allowed. The family income exceeding P250,000 is not allowed for a

special deduction for health insurance.

Problem 11 15 D

Zero. Maria has no income.

Problem 11 16 A

No net tax payable at the end of the taxable year because the senior citizens income does not

exceed P60,000 during the year. The tax withheld from interest income is fnal tax.

Problem 11 17

Subject to

1. Not in the choices = P790,000 & P160,000 Tabular tax Final tax

Compensation income P240,000

Business and other income:

Professional income (P300,000 + P200,000) 500,000

Interest income without 60,000

Dividend income without 40,000

Total net income before personal exemption P840,000

Less: Basic personal exemption single ( 50,000)

Net income to ITR tabular tax P790,000

Interest income within P100,000

Dividend income within 60,000

Income subject to fnal tax P160,000

70

INCOME TAXATION 5TH Edition (BY: VALENCIA & ROXAS)

Chapte !!: In"o#e Ta$ o% Indi&id'a()

2. A

Compensation income P240,000

Business income:

Professional income 300,000

Total net income before personal exemption P540,000

Less: Basic personal exemption single 50,000

Net income to ITR tabular tax P490,000

Interest income within P100,000

Dividend income within 60,000

Income subject to fnal tax P160,000

Note: The problem is silent as to whether the taxpayer opted for OSD, hence, OSD should not be

deducted from the business gross income. In order to qualify for OSD, the taxpayer should

indicate in his return that he is opting OSD instead of itemized deductions. (Sec. 34 (L), NIRC)

Alternative Solution of Prob. 11-17:If X opted to use OSD

Subject to

1. A Tabular tax Final tax

Compensation income P240,000

Business and other income:

Professional income (P300,000 + P200,000) 500,000

Interest income without 60,000

Dividend income without 40,000

Total business and other income P600,000

Less: OSD (P600,000 x 40%) ( 240,000)

Net business income P360,000

Total net income before personal exemption P600,000

Less: Basic personal exemption single ( 50,000)

Net income to ITR tabular tax P550,000

Interest income within P100,000

Dividend income within 60,000

Income subject to fnal tax P160,000

2. Not in the choices = P370,000 & P160,000

Compensation income P240,000

Business income:

Professional income, net of OSD (P300,000 x 60%) 180,000

Total net income before personal exemption P420,000

Less: Basic personal exemption 50,000

Net income to ITR tabular tax P370,000

Interest income within P100,000

Dividend income within 60,000

Income subject to fnal tax P160,000

Problem 11 18 D

Husband Wife

Net taxable income P140,000 P250,000

Income tax P 22,500 P 50,000

Less: Withholding tax 20,000 45,000

Net tax payable P 2,500 P 5,000

Problem 11 19 D

Compensation as researcher P 600,000

Less: Personal exemption married 50,000

Net taxable compensation income P 550,000

Tax on P500,000 P125,000

Tax on excess (P50,000 x 32%) 16,000

Total income tax from compensation P141,000

Dividend income tax (P120,000 x 10%) 12,000

71

INCOME TAXATION 5TH Edition (BY: VALENCIA & ROXAS)

Chapte !!: In"o#e Ta$ o% Indi&id'a()

Interest income tax (P500,000 x 7.5%) 37,500

Total income tax due P190,500

Problem 11 20 D

Capital gains tax on shares of stock (P80,000 x 5%) P 4,000

Capital gains tax on sale of land (P2,000,000 x 6%) 120,000

Total capital gains tax paid P124,000

Problem 11 21 B

1. B

Final tax on copyright royalty (P11,250/90%) x 10% P 1,250

Final tax on mineral claim royalty (P12,000/80%) x 20% 3,000

Final tax on share from trading partnership as dividend (P270,000/90%) x

10%

30,000

Total fnal tax P34,250

2. Not in the choices

None. All reported earnings are subject to fnal tax.

Problem 11 22 B

Percent of service 100%

Add: Output VAT 12%

Total 112%

Less: Withholding tax 20%

Percent of net proceeds 92%

Net proceeds P 92,000

Divided by percent of net proceeds 92%

Service fee P100,000

Withholding tax (P100,000 x 20%) P 20,000

VAT (P100,000 x 12%) P 12,000

Problem 11 23

1. A

Salaries of assistants

Traveling expenses

Light and water, Ofce

Stationeries and supplies

Ofce rent

Total expenses before contribution

Add: Contribution subject to limit (P500,000 P176,850) x 10%

Total allowable deductions

P 96,000

11,000

7,890

1,960

60,000

P176,850

32,315

P209,165

2. C

Professional fees

Less: Allowable deductions

Net income from business

Add: Income from compensation:

Allowance as director of Corporation A

Commissions

Net income before personal and additional exemptions

P25,000

5,000

P500,000

209,165

P290,835

30,000

P320,835

3. D

Net income before personal and additional exemptions

Less: Personal and additional exemptions:

Basic widower

Additional exemptions (P25,000 x 3 qualifed children)

Net taxable income

P 50,000

75,000

P320,835

125,000

P195,835

Tax on P140,000

Tax on excess (P55,835) x 30%

P 22,500

13,959

72

INCOME TAXATION 5TH Edition (BY: VALENCIA & ROXAS)

Chapte !!: In"o#e Ta$ o% Indi&id'a()

Income tax due P 36,459

Problem 11 24

1. P164,200

Net worth, December 31, 2009

Less: Net worth, December 31, 2008

Unadjusted Net income for year 2009

Add back: Non-deductible expenses

Contributions (P20,000 + P50,000)

Total

Less: Non-taxable income

Income before contribution

Less: Contributions:

Deductible in full

With limit

Actual, P50,000

Limit, P268,000 x 10% = P26,800

Allowed

Net income before personal exemptions

Less: Personal exemptions (P50,000 +p100,000)

Net taxable income

P 20,000

26,800

P375,000

325,000

P 50,000

150,000

70,000

P270,000

2,000

P268,000

46,800

P221,200

150,000

P 71,200

2. P140,000

Corrected net taxable income

Less: Reported net income subject to tax

Unreported taxable income

P 71,200

24,200

P 47,000

Problem 11 25

1. Itemized deduction

Compensation income

Gross income from business

Less: Itemized deduction

Total income before personal exemptions

Less: Personal exemptions

Basic personal exemptions

Additional exemptions (P25,000 x 4)

Taxable income

P 400,000

150,000

P 50,000

100,000

P 20,000

250,000

P270,000

150,000

P120,000

Computation of income tax:

Tax on P70,000

Tax on excess (P50,000) x 20%

Income tax before withholding tax

Less: Withholding tax

Income tax due and payable

P 8,500

10,000

P 18,500

1,000

P 17,500

2. Optional standard deduction

Compensation income

Gross income from business

Less: Optional standard deduction (40%)

Total income before personal exemptions

Less: Personal exemptions

Basic personal exemptions

Additional exemptions (P8,000 x 4)

Taxable income

P 400,000

160,000

P 50,000

100,000

P 20,000

240,000

P260,000

150,000

P110,000

Computation of income tax:

Tax on P70,000

Tax on excess (P40,000 x 20%)

Income tax before withholding tax

Less: Withholding Tax

P 8,500

8,000

P 16,500

1,000

73

INCOME TAXATION 5TH Edition (BY: VALENCIA & ROXAS)

Chapte !!: In"o#e Ta$ o% Indi&id'a()

Income tax due and payable P 15,500

Problem 11 26

2010 net income from business

Capital gains transactions

Short term capital gains (P40,000 x 100%)

Long term capital gains (P30,000 x 50%)

Short term capital loss (P10,000 x 100%)

Capital gains

Less: 2009 Capital loss carry over limit

Income before personal exemptions

Basic personal exemption- married

Additional exemption (P25,000 x 3)

Taxable income, 2010

P 40,000

15,000

(10,000)

P45,000

35,000

P 50,000

75,000

P 600,000

10,000

P 610,000

125,000

P 485,000

Note: The applicable capital loss carry-over should only be limited to P35,000, because it should

not exceed the net income from operation of such year (Sec. 39D, NIRC).

Problem 11 27

1. Compensation income (P240,000 + P30,000) P270,000

Less: Personal exemption (P50,000 + P25,000) 75,000

Net taxable compensation P195,000

Business income P100,000

Less: Business expenses 120,000

Net loss from business (P20,000) 0 -

Net taxable income P195,000

2. Tax on P140,000 P22,500

Tax on excess (P55,000 x 25%) 13,750

Income tax due P36,250

Less: Tax credit 30,000

Income tax still due and payable P 6,250

Problem 11 28

1. Salary (P30,000 x 12) P360,000

Add: Taxable 13

th

month pay (P35,000 P30,000) 5,000

Total P365,000

Less: SSS contribution P3,000

Medicare/Philhealth contribution 2,000 5,000

Taxable compensation income before personal exemption P360,000

Less: Personal exemption 50,000

Net taxable compensation income P310,000

Estimated income tax due:

Tax on P250,000 P50,000

Tax on excess (P60,000 x 30%) 18,000

Total income tax due per year P68,000

Divided by number of months in a year 12

Monthly withholding tax P 5,667

2. Quarterly business income tax

Business income per quarter

Less: Business expense per quarter

Net income per quarter

Tax on P70,000

Tax on excess (P10,000 x 20%)

Quarterly business income tax frst quarter to third quarter

P200,000

120,000

P 80,000

P 8,500

2,000

P 10,500

74

INCOME TAXATION 5TH Edition (BY: VALENCIA & ROXAS)

Chapte !!: In"o#e Ta$ o% Indi&id'a()

Problem 11 29

1. Entertainment fee (P1,700,000/85%) P2,000,000

Business income

Philippines 500,000

Japan 1,000,000

Net income before personal exemption P3,500,000

Less: Personal exemption - basic P50,000

Additional (P25,000 x 4) 100,000 150,000

Net taxable income P3,350,000

Note: The OSD is not used because the problem is silent that the taxpayer opted to utilize it.

OSD is allowed only if the taxpayer indicated in his return that he is using it otherwise he is

using itemized deduction. If the taxpayer did not indicate that he is using OSD and at the same

time he has no itemized deduction, he cannot deduct expenses from his gross business income.

(Sec. 34 (L), NIRC)

2. Tax on P500,000 P 125,000

Tax on excess (P2,850,000 x 32%) 912,000

Income tax due P1,037,000

3. Tax credit

Creditable withholding tax on fees

(P2,000,000 x 15%) P300,000

Business income tax paid - Philippines 40,000

Japan (P1,037,000 x 1,000,000/3,500,000))

P296,286 vs. actual P300,000, lower 296,286 P 636,286

4. Income tax still due (P1,037,000 P636,286)) P 400,714

Alternative Solution of Problem 11-29: If Rosanna Roces opted to use OSD

1. Entertainment fee (P1,700,000/85%) P2,000,000

Business income

Philippines 500,000

Japan 1,000,000

Total gross income P3,500,000

Less: OSD (P3,500,000 x 40%) 1,400,000

Net income before personal exemption P2,100,000

Less: Personal exemption - basic P50,000

Additional (P25,000 x 4) 100,000 150,000

Net taxable income P1,950,000

2. Tax on P500,000 P 125,000

Tax on excess (P1,450,000 x 32%) 464,000

Income tax due P 589,000

3. Tax credit

Creditable withholding tax on fees

(P2,000,000 x 15%) P300,000

Business income tax paid - Philippines 40,000

Japan (P589,000 x 594,000*/2,100,000))

P166,603 vs. actual P300,000, lower 166,603 P 506,603

4. Income tax still due (P589,000 P506,603) P 82,397

Supporting computation of net taxable income before personal exemptions:

Within Outside Total

Gross receipts 2,500,000 1,000,000 3,500,000

Percent 71% 29% 100%

75

INCOME TAXATION 5TH Edition (BY: VALENCIA & ROXAS)

Chapte !!: In"o#e Ta$ o% Indi&id'a()

Allocated OSD x percent 994,000 406,000 1,400,000

Net income before personal exemption 1,506,000 594,000 2,100,000

Problem 11 30

Mr. Bravo Mrs. Bravo

Gross professional income (P100,000/90%) P111,111

Rent income (P300,000/2) 150,000 P150,000

Gross compensation income 225,000 300,000

Total P486,111 P450,000

Less: Personal exemptions 150,000 50,000

Net taxable income P336,111 P400,000

Tax on P250,000 P 50,000 P 50,000

Tax on excess:

Mr. Bravo (P86,111 x 30%) 25,833

Mrs. Bravo (P150,000 x 30%) . 45,000

Income tax due P 75,833 P 95,000

Withholding tax on compensation ( 25,000) ( 50,000)

Withholding tax on professional income (P111,111 P100,000) ( 11,111) .

Income tax still due and payable P 39,722 P 45,000

Note: No OSD is allowed because the taxpayer did not opt to use it in lieu of itemized deduction.

(Sec. 34 (L), NIRC)

Alternative Solution of Prob. 11-30: If taxpayers opted to use OSD

Mr. Bravo Mrs. Bravo

Gross professional income (P100,000/90%) P111,111

Rent income (P300,000/2) 150,000 P150,000

Total gross income P261,111 P150,000

Less: OSD (40%) 104,444 60,000

Net income from business P156,667 P 90,000

Add: Gross compensation income 225,000 300,000

Total P381,667 P390,000

Less: Personal exemptions 150,000 50,000

Net taxable income P231,667 P340,000

Tax on P140,000/ P250,000 P 22,500 P 50,000

Tax on excess:

Mr. Bravo (P91,667 x 25%) 22,917

Mrs. Bravo (P90,000 x 30%) . 27,000

Income tax due P 45,417 P 77,000

Withholding tax on compensation ( 25,000) ( 50,000)

Withholding tax on professional income (P111,111 P100,000) ( 11,111) .

Income tax still due and payable P 9,306 P 27,000

Problem 11 31

1. P290,000

Compensation income P300,000

Taxable 13

th

month pay and bonuses (P40,000 P30,000) 10,000

Net business income (P400,000 P300,000) 100,000

Capital gains long-term (P60,000 x 50%) 30,000

Total P440,000

Less: Personal exemptions (P50,000 + P100,000) 150,000

Net taxable income P290,000

76

INCOME TAXATION 5TH Edition (BY: VALENCIA & ROXAS)

Chapte !!: In"o#e Ta$ o% Indi&id'a()

2. (P8,000)

Tax on P250,000 P 50,000

Tax on excess (P40,000 x 30%) 12,000

Total income tax due P 62,000

Less: Income tax paid on:

Compensation P 50,000

Quarterly business income 20,000 70,000

Income tax refund (P 8,000)

Problem 11 32

Gross income from business (P1,000,000 P700,000) P 300,000

Operating expenses (P250,000 P60,000 P30,000) ( 160,000)

Deductible interest expense (P30,000) (P20,000 x 12/32) ( 22,500)

Deductible contribution (P300,000 P160,000 P22,500) x 10% ( 11,750)

Net business income P 105,750

Capital asset transactions:

Capital gains short-term (P300,000 x 100%) P 300,000

Capital losses long-term (P400,000 x 50%) 200,000 100,000

Lotto winning, USA 300,000

Gambling winnings P 200,000

Gambling losses (excess cannot be deducted from other income) 250,000

Gross compensation income (P180,000 + P20,000) 200,000

Taxable 13

th

month pay (P35,000 P30,000) 5,000

Net taxable income before exemption P 710,750

Less: Personal exemptions (P50,000 + P100,000) 150,000

Net taxable income P 560,750

Tax on P500,000 P 125,000

Tax on excess (P60,750 x 32%) 19,440

Total income tax due P 144,440

Less: Withholding tax on compensation 20,000

Income tax still due and payable P 124,440

Problem 11 33

1. 13

th

month pay P25,000

Other benefts:

Excess of clothing allowance (P4,500 P4,000) P 500

Excess of rice subsidy (P1,600 P1,500) x 12 1,200 1,700

Total (not exceeding P30,000) nontaxable P26,700

Allowable de minimis:

Clothing allowance P4,000

Rice subsidy (P1,500 x 12) 18,000 22,000

Total 13

th

month pay and other benefts P48,700

2. Basic salary (P25,000 x 12) P300,000

Less: Personal exemptions 150,000

Net taxable compensation income P150,000

Tax on P140,000 P22,500

Tax on excess (P10,000 x 25%) 2,500

Total income tax due P25,000

Withholding tax from January to November 2009

(P25,000/12) x 11 P22,917

3. Net taxable compensation income P150,000

Add: Net business income:

Professional fees (P224,000/1.12) P 200,000

Gross income from sales (P5,000,000 P3,200,000) 1,800,000

77

INCOME TAXATION 5TH Edition (BY: VALENCIA & ROXAS)

Chapte !!: In"o#e Ta$ o% Indi&id'a()

Less: Itemized deductions: P2,000,000

Operating expenses, net of interest expense

(P900,000 P50,000) P850,000

Interest expense (P50,000 (P75,000 x 38%) 21,500 871,500

Net income before contribution P1,128,500

Less: Contribution, actual = P100,000, lower

Contribution, limit (P1,128,500 x 10%)= P112,850 100,000 1,028,500

Net taxable income P1,178,500

Tax on P500,000 P125,000

Tax on excess (P678,500 x 32%) 217,120

Total income tax due P342,120

Less: Tax credits:

WTW from Jan to Nov., 2009 P22,917

WT on Professional income (P224,000 P200,000) 24,000 46,917

Income tax still due and payable on December 31, 2009 P295,203

Problem 11 34

Note: OSD is not applicable unless the taxpayer signifed in his ITR that he opted to use OSD in

lieu of itemized deductions. (Sec. 34 (L), NIRC)

Ta$pa.e i) a e)ident "iti/en

a.Normal (tabular) tax:

Salaries: Philippines U. S. A. Total

Within (P180,000/90%) P200,000

Without ($2,250/90%) x P50 P125,000 P325,000

Commissions:

Within (P57,000/ 95%) 60,000

Without ($950/ 95%) x P50 50,000 110,000

Interest income-without 75,000 75,000

($1,200/80%) x P50

Dividend-without ($1,800/90%) x P50 . 100,000 100,000

Totals P260,000 P350,000 P610,000

Less: Personal exemption basic 50,000

Taxable income P560,000

Tax on P500,000

Tax on excess (P60,000) x 32%

Total

Less: Tax credits:

Compensation (P200,000 x 10%)

Commission (P60,000 x 5%)

Allowable tax credit - foreign*

Income tax due and payable, after tax credits

P20,000

3,000

40,000

P125,000

19,200

P144,200

63,000

P 81,200

*Allowable tax credit paid outside the Philippines is lower than tax limit or actual tax

paid. The tax credit is computed as follows:

Limit (P350,000/P610,000) x P144,200

Actual foreign taxes paid:

Interest (P75,000 x 20%)

Compensation (P125,000 x 10%)

Dividend (P100,000 x 10%)

Commissions (P50,000 x 5%)

Total

Allowable foreign tax credit - lower

P82,738

P15,000

12,500

10,000

2,500

P40,000

P40,000

78

INCOME TAXATION 5TH Edition (BY: VALENCIA & ROXAS)

Chapte !!: In"o#e Ta$ o% Indi&id'a()

Note: The actual tax paid outside the Philippines is lower than the computed tax limit;

hence, the actual tax paid without is the allowable tax credit.

b.Passive income tax:

Interest income within (P50,000/ 80%) x 20%

Dividend income within (P9,000/ 90%) x 10%

Total passive income tax for the year

P12,500

1,000

P13,500

Note: Philippine Lotto winnings are tax-exempt.

Ta$pa.e i) a none)ident "iti/en

a.Normal (tabular) tax:

Salaries - within (P180,000/90%)

Commissions- within (P57,000/ 95%)

Net income

Less: Personal exemption - basic

Taxable income

P200,000

60,000

P260,000

50,000

P210,000

Tax on P140,000

Tax on excess (P70,000) x 25%

Total tax due

Less: Withholding taxes within (P20,000 + P3,000)

Income tax due and payable

P22,500

17,500

P40,000

23,000

P17,000

b.Passive income tax:

Interest income within (P50,000/80%) x 20%

Dividend income within (P9,000/90%) x 10%

Total passive income tax for the year

P12,500

1,000

P13,500

Note: Nonresident citizens are taxable only on income derived within the Philippines.

Ta$pa.e i) a e)ident a(ien0 Solution is the same as nonresident citizen.

Ta$pa.e i) a none)ident a(ien en1a1ed in tade o 2')ine)) in the *hi(ippine)0

The taxpayer cannot be regarded as doing business in the Philippines because he has

no business income in the Philippines.

If the taxpayer has stayed more than 180 days in the Philippines, he is regarded as

doing business. The computation of his net income tax payable in the Philippines will

be the same as in number 2 under the assumption that his country is granting the

same privilege of reciprocity to nonresident Filipino doing business in that foreign

country.

Ta$pa.e i) a none)ident a(ien not en1a1ed in tade o 2')ine)) in the *hi(ippine)0

Nonresident aliens are subject to tax of 25% based on their gross income derived within

the Philippines. In our illustration, let us assume that the source of income has been

deducted with 25% tax on the income given to the taxpayer - that is, the amount shown

in the problem is net of 25% fnal tax.

The income tax of Mr. Ramsay Colorado would be:

Salaries- within (P180,000/75%) P240,000

Commissions- within (P57,000/ 75%) 76,000

Interest income within (P50,000/ 75%) 66,667

Dividend income within (P9,000/ 75%) 12,000

Gross income within P394,667

Multiplied by tax rate 25%

Income tax for the taxable year within P 98,667

Note: In computing the income tax, a fractional part of a peso less than P0.50 shall be

disregarded. If the fractional part is P0.50 or more, its shall be rounded up to P1.00 (R.A. 590).

79

INCOME TAXATION 5TH Edition (BY: VALENCIA & ROXAS)

Chapte !!: In"o#e Ta$ o% Indi&id'a()

80

You might also like

- Taxation for Australian Businesses: Understanding Australian Business Taxation ConcessionsFrom EverandTaxation for Australian Businesses: Understanding Australian Business Taxation ConcessionsNo ratings yet

- Federal Register PostDocument4 pagesFederal Register PostThe Western JournalNo ratings yet

- Understanding Business Accounting For DummiesFrom EverandUnderstanding Business Accounting For DummiesRating: 3.5 out of 5 stars3.5/5 (8)

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- The Comprehensive Guide on How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandThe Comprehensive Guide on How to Read a Financial Report: Wringing Vital Signs Out of the NumbersRating: 2 out of 5 stars2/5 (1)

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Chapter 3 Cost Accounting ProblemsDocument8 pagesChapter 3 Cost Accounting Problemsxxxxxxxxx100% (1)

- Practical Accounting 1 With AnswersDocument10 pagesPractical Accounting 1 With Answerslibraolrack50% (8)

- Architectural Consultancy AgreementDocument6 pagesArchitectural Consultancy AgreementprashinNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Amended Articles of IncorporationDocument5 pagesAmended Articles of IncorporationAileen Castro RigorNo ratings yet

- Chapt 11+Income+Tax+ +individuals2013fDocument13 pagesChapt 11+Income+Tax+ +individuals2013fiamjan_10180% (15)

- Chapter 10Document4 pagesChapter 10Judith Salome Basquinas0% (1)

- The ProprietorDocument3 pagesThe ProprietorBernard Nii Amaa100% (1)

- People Vs de Los SantosDocument8 pagesPeople Vs de Los Santostaktak69No ratings yet

- Chap 5 Exclude From Gross Income2013Document10 pagesChap 5 Exclude From Gross Income2013Quennie Jane Siblos100% (2)

- Business and Transfer Taxation by Valencia and Roxas-Solution ManualDocument4 pagesBusiness and Transfer Taxation by Valencia and Roxas-Solution ManualFiona Manguerra81% (32)

- M7 - P1 Individual Income Taxation - Students'Document66 pagesM7 - P1 Individual Income Taxation - Students'micaella pasionNo ratings yet

- Income Taxation Valencia Roxas Tax Chapter 14: Income Taxes of Estates &trustsDocument11 pagesIncome Taxation Valencia Roxas Tax Chapter 14: Income Taxes of Estates &trustsSharn Linzi Buan Montaño83% (6)

- Chapt-6 FB TaxDocument8 pagesChapt-6 FB Taxhumnarvios50% (4)

- Chapt 12+Income+Tax+ +corporations2013fDocument15 pagesChapt 12+Income+Tax+ +corporations2013fLouie De La Torre100% (4)

- Chapter04 (1) Advanced Accounting Larson Reference AnswersDocument31 pagesChapter04 (1) Advanced Accounting Larson Reference AnswersRamez AhmedNo ratings yet

- Chapter 8 Stat Con DigestsDocument6 pagesChapter 8 Stat Con DigestsClarisse Anne Florentino AlvaroNo ratings yet

- Relevant Costing CPARDocument13 pagesRelevant Costing CPARxxxxxxxxx100% (2)

- The Real NotesDocument33 pagesThe Real NotesKarlo KapunanNo ratings yet

- The ICC and Confronting Myths in AfricaDocument24 pagesThe ICC and Confronting Myths in AfricaWendel DamascenoNo ratings yet

- Bill of Rights Sec 1Document295 pagesBill of Rights Sec 1Anabelle Talao-UrbanoNo ratings yet

- Barredo vs. Hon. Vinarao, Director, Bureau of Corrections (Spec Pro)Document1 pageBarredo vs. Hon. Vinarao, Director, Bureau of Corrections (Spec Pro)Judy Miraflores DumdumaNo ratings yet

- Chapter 11-Income Taxation by E. ValenciaDocument10 pagesChapter 11-Income Taxation by E. ValenciaLeonard Cabuyao100% (1)

- Income Tax Chapter 11 GuideDocument10 pagesIncome Tax Chapter 11 GuideAiden PatsNo ratings yet

- Chapt-11 Income Tax - IndividualsDocument10 pagesChapt-11 Income Tax - Individualshumnarvios100% (4)

- Chapt-10 Basic Tax PatternsDocument4 pagesChapt-10 Basic Tax Patternshumnarvios100% (3)

- Chapt 14+Income+Taxes+ +estates+ 26+trusts2013fDocument11 pagesChapt 14+Income+Taxes+ +estates+ 26+trusts2013fLouie De La Torre100% (1)

- VAT and Taxation Rules for ServicesDocument10 pagesVAT and Taxation Rules for ServicesJean Chel Perez Javier100% (3)

- Chapter 12 (Income Tax On Corporations)Document10 pagesChapter 12 (Income Tax On Corporations)libraolrackNo ratings yet

- Income Tax of Individuals: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument28 pagesIncome Tax of Individuals: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersKen ZafraNo ratings yet

- Chapt-13 Income Taxes - Partnerships, Estates & TrustsDocument11 pagesChapt-13 Income Taxes - Partnerships, Estates & Trustshumnarvios100% (6)

- Ass&Sa Claro Bac07-18Document28 pagesAss&Sa Claro Bac07-18Steffi Anne D. ClaroNo ratings yet

- Chapter 11 TaxDocument11 pagesChapter 11 Taxkp_popinjNo ratings yet

- Chapt-12 Income Tax - CorporationsDocument8 pagesChapt-12 Income Tax - Corporationshumnarvios86% (7)

- Income Taxes of Estates & Trusts: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument13 pagesIncome Taxes of Estates & Trusts: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersJane Mae CruzNo ratings yet

- Chapter 14 - Percentage Taxes2013Document11 pagesChapter 14 - Percentage Taxes2013JB RealizaNo ratings yet

- Chapter 6 - Donor S Tax2013Document12 pagesChapter 6 - Donor S Tax2013incubus_yeah100% (8)

- Chapt 10 - Mixed Business TransactionsDocument6 pagesChapt 10 - Mixed Business TransactionsGemine Ailna Panganiban NuevoNo ratings yet

- Front - Maintain Training FacilitiesDocument5 pagesFront - Maintain Training FacilitiesRechie Gimang AlferezNo ratings yet

- Chapter 7 - Business Taxes2013Document8 pagesChapter 7 - Business Taxes2013PrincessAngelaDeLeon100% (1)

- Fabm Week 1 Asnd 2Document5 pagesFabm Week 1 Asnd 2John Calvin GerolaoNo ratings yet

- Income Taxes of Estates & Trusts: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument11 pagesIncome Taxes of Estates & Trusts: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersAudette AquinoNo ratings yet

- What Is The Income Tax Rate in The Philippines?Document4 pagesWhat Is The Income Tax Rate in The Philippines?Anonymous zQNRQq2YNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- The Fast Plan for Tax Reform: A Fair, Accountable, and Simple Tax Plan to Chop Away the Federal Tax ThicketFrom EverandThe Fast Plan for Tax Reform: A Fair, Accountable, and Simple Tax Plan to Chop Away the Federal Tax ThicketNo ratings yet

- Wiley Registered Tax Return Preparer Exam Review 2012From EverandWiley Registered Tax Return Preparer Exam Review 2012No ratings yet

- R2Total Quality ManagementDocument4 pagesR2Total Quality ManagementlibraolrackNo ratings yet

- Manage farm business info with MISDocument17 pagesManage farm business info with MISKisilu MbathaNo ratings yet

- Chapter 1: Introduction To Management Information SystemsDocument14 pagesChapter 1: Introduction To Management Information SystemsvinuoviyanNo ratings yet

- Lecture 1-Intro To MGT ActngDocument7 pagesLecture 1-Intro To MGT ActnglibraolrackNo ratings yet

- Market Participation by Rural Households in A Low-Income CountryDocument55 pagesMarket Participation by Rural Households in A Low-Income CountrylibraolrackNo ratings yet

- Hoyle 11e Chapter 10Document57 pagesHoyle 11e Chapter 10bliska100% (2)

- Lecture 1-Intro To MGT ActngDocument7 pagesLecture 1-Intro To MGT ActnglibraolrackNo ratings yet

- Lecture 1-Intro To MGT ActngDocument7 pagesLecture 1-Intro To MGT ActnglibraolrackNo ratings yet

- Cash equivalents and bad debt expenseDocument29 pagesCash equivalents and bad debt expenselibraolrackNo ratings yet

- Calculating unrealized intercompany inventory profit adjustmentDocument22 pagesCalculating unrealized intercompany inventory profit adjustmentxxxxxxxxx100% (3)

- Written Report On GG and CSRDocument6 pagesWritten Report On GG and CSRlibraolrackNo ratings yet

- Chapter 15: Short-Term Liabilities QuestionsDocument191 pagesChapter 15: Short-Term Liabilities QuestionslibraolrackNo ratings yet

- What Is Accounting?Document1 pageWhat Is Accounting?Ali Bukhari ShahNo ratings yet

- Joint VentureDocument28 pagesJoint VentureJovani TomaleNo ratings yet

- Balance Sheet and Cash Flow Statement GuideDocument45 pagesBalance Sheet and Cash Flow Statement Guidelibraolrack100% (1)

- Fundamentals of Advanced Accounting: (Check Figures For Multiple Choice Questions Not Provided.)Document1 pageFundamentals of Advanced Accounting: (Check Figures For Multiple Choice Questions Not Provided.)libraolrackNo ratings yet

- Chapter 15: Short-Term Liabilities QuestionsDocument191 pagesChapter 15: Short-Term Liabilities QuestionslibraolrackNo ratings yet

- International Financial Accounting and ReportingDocument2 pagesInternational Financial Accounting and ReportinglibraolrackNo ratings yet

- Chapter 4: General Principles of AccountingDocument4 pagesChapter 4: General Principles of AccountinglibraolrackNo ratings yet

- 02 Advanced AccountingDocument9 pages02 Advanced AccountinglibraolrackNo ratings yet

- Corporate Governance GuidelinesDocument7 pagesCorporate Governance GuidelineslibraolrackNo ratings yet

- Philippine Tax FactsDocument9 pagesPhilippine Tax FactsAizel MaronillaNo ratings yet

- Chapter 9Document6 pagesChapter 9libraolrackNo ratings yet

- Chapter 5Document5 pagesChapter 5chocolatebears67% (3)

- OECD Principles of Corporate GovernanceDocument9 pagesOECD Principles of Corporate GovernancelibraolrackNo ratings yet

- Business Article - The Business Value of Good Corporate GovernanceDocument8 pagesBusiness Article - The Business Value of Good Corporate Governancemanpreetkr26No ratings yet

- Camarines Sur election results by cityDocument2 pagesCamarines Sur election results by cityRey PerezNo ratings yet

- Olaf Peter Juda v. Dennis Michael Nerney, Assistant U.S. Attorney, Northern District of California Stephen R. Kotz, Assistant U.S. Attorney, Albuquerque, New Mexico John J. Kelly, U.S. Attorney, Albuquerque, New Mexico Michael Yamaguchi, U.S. Attorney, San Francisco, California Robert L. Holler, District Director, U.S. Customs Service, El Paso, Texas Leonard S. Walton, Acting Assistant Commissioner, U.S. Customs Service, Washington, D.C. Bonnie L. Gay, Foia Unit, Attorney-In-Charge, Washington, D.C. John and Jane Does 1-25 United States of America, Olaf Peter Juda v. United States Customs Service, Robert L. Holler, Joy M. Hughan, Daniel Luar, Rita Alfaro, Dolores Payan, Gina E. Fuentes, Internal Revenue Service, George Terpack, Carolyn Leonard, Timothy A. Towns, John Does, Jane Does, 149 F.3d 1190, 10th Cir. (1998)Document13 pagesOlaf Peter Juda v. Dennis Michael Nerney, Assistant U.S. Attorney, Northern District of California Stephen R. Kotz, Assistant U.S. Attorney, Albuquerque, New Mexico John J. Kelly, U.S. Attorney, Albuquerque, New Mexico Michael Yamaguchi, U.S. Attorney, San Francisco, California Robert L. Holler, District Director, U.S. Customs Service, El Paso, Texas Leonard S. Walton, Acting Assistant Commissioner, U.S. Customs Service, Washington, D.C. Bonnie L. Gay, Foia Unit, Attorney-In-Charge, Washington, D.C. John and Jane Does 1-25 United States of America, Olaf Peter Juda v. United States Customs Service, Robert L. Holler, Joy M. Hughan, Daniel Luar, Rita Alfaro, Dolores Payan, Gina E. Fuentes, Internal Revenue Service, George Terpack, Carolyn Leonard, Timothy A. Towns, John Does, Jane Does, 149 F.3d 1190, 10th Cir. (1998)Scribd Government DocsNo ratings yet

- Innovation and Excellence Reviwer Edjpm Lesson 5 and 6Document11 pagesInnovation and Excellence Reviwer Edjpm Lesson 5 and 6Edjon PayongayongNo ratings yet

- 19 People V Madrigal-GonzalesDocument14 pages19 People V Madrigal-GonzalesFrench TemplonuevoNo ratings yet

- RELIGION - (ICCPR) A.18 - Freedom of Thought, Conscience, Religion-Subject To Public Safety, OrderDocument6 pagesRELIGION - (ICCPR) A.18 - Freedom of Thought, Conscience, Religion-Subject To Public Safety, OrdermanikaNo ratings yet

- PwC Webinar on the Extractive Sector Transparency Measures Act (ESTMADocument40 pagesPwC Webinar on the Extractive Sector Transparency Measures Act (ESTMAShravan EtikalaNo ratings yet

- Imran Husain Sentencing Memo Oct 2019Document15 pagesImran Husain Sentencing Memo Oct 2019Teri BuhlNo ratings yet

- Contractualization 4Document4 pagesContractualization 4grace hutallaNo ratings yet

- Consitutional and Statutory Basis of TaxationDocument50 pagesConsitutional and Statutory Basis of TaxationSakshi AnandNo ratings yet

- CPCS 2021-013 Grant of Extraordinary and Miscellaneous ExpensesDocument3 pagesCPCS 2021-013 Grant of Extraordinary and Miscellaneous ExpensesEdson Jude DonosoNo ratings yet

- MENA Blasphemy Laws & ExtremismDocument3 pagesMENA Blasphemy Laws & ExtremismRose SabadoNo ratings yet

- Treason Laurel Vs Misa Facts: Laurel Filed A Petition For Habeas Corpus. HeDocument29 pagesTreason Laurel Vs Misa Facts: Laurel Filed A Petition For Habeas Corpus. HeBiyaah DyNo ratings yet

- China Banking Corp V Co GR No. 174569Document16 pagesChina Banking Corp V Co GR No. 174569Kaye Miranda LaurenteNo ratings yet

- Mercado V AMA - April 13, 2010 - LaborDocument18 pagesMercado V AMA - April 13, 2010 - LaborStGabrielleNo ratings yet

- Lahore High Court, Lahore: Judgment SheetDocument12 pagesLahore High Court, Lahore: Judgment SheetM Xubair Yousaf XaiNo ratings yet

- 07 GR 211721Document11 pages07 GR 211721Ronnie Garcia Del RosarioNo ratings yet

- Statement of AccountDocument1 pageStatement of AccountMary MacLellanNo ratings yet

- Case Briefing Assingment#1Document2 pagesCase Briefing Assingment#1Puruda AmitNo ratings yet

- Nab McqsDocument23 pagesNab McqsIzzat FatimaNo ratings yet

- DM No. 2021-0245 Creation of PCWHS Health Promotion CommitteeDocument4 pagesDM No. 2021-0245 Creation of PCWHS Health Promotion CommitteegeraldanderzoneNo ratings yet