Professional Documents

Culture Documents

viewPDFdynamically JSP

Uploaded by

Mayank GautamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

viewPDFdynamically JSP

Uploaded by

Mayank GautamCopyright:

Available Formats

TCS Confidential

Ref: TCS/2013-14/CC-C2/376258

April 17, 2013

Ms. Manisha Gautam

TCS - Mumbai

Dear Manisha Gautam,

I would like to appreciate your contribution and effort during the year that helped team TCS deliver credible results

despite a challenging business environment. Going forward we should focus on developing our competencies to

stay relevant to our customers.

I am pleased to share with you your Annual Compensation of Rs. 8,94,164/-for the year 2013-14.This includes a

potential performance pay ofRs. 2,88,000/- annually. A part of this performance pay will be paid to you on a

monthly basis and the remainder on closure of each quarter, subject to company, unit and individuals achieving

their targets.

The details of your compensation and related benefits are enclosed in the Annexure to this letter. Kindly note that

the above details are specific to India and may be subject to change in case of long term deputation on international

assignments, if any.

I look forward to your continued commitment and a fulfilling career with TCS in the years to come.

Warm regards and best wishes,

Ajoyendra Mukherjee

Executive Vice President & Head Global Human Resources

: 1 :

TCS Confidential

Ref: TCS/2013-14/CC-C2/376258

ANNEXURE I

The details of your compensation and benefits are given below.

FIXED COMPENSATION

Basic Salary

Your Basic Salary will be Rs. 15,800/- per month.

BOUQUET OF BENEFITS (BoB)

Bouquet of Benefits offers you the flexibility to design this part of your compensation within the defined framework,

twice in a financial year. All the components will be disbursed on a monthly basis. Bouquet of Benefits comprises the

following salary components.

House Rent Allowance

To avail tax benefit on this amount, you have to access the TRLP link in Ultimatix and submit rent receipts at least

once a quarter to the Finance department of your base branch.

Conveyance Allowance

Conveyance Allowance up to a certain limit is exempt from tax.

Sundry Medical Reimbursement

To avail tax benefit on this amount, you have to access the sundry medical expenses form in Ultimatix and

submit medical bills for the medical expenses incurred for your family and yourself.

Leave Travel Allowance

If you wish to avail tax benefits, you need to apply for a minimum of three days of earned leave in Ultimatix and

submit supporting travel documents.

Food Coupons

Food coupons up to a certain limit are exempt from tax. These can be used in the company cafeteria, restaurants

and for buying groceries. The coupons will be made available to you at your depute location.

Personal Allowance

This component is fully taxable. This is not a grade-linked benefit and does not accrue automatically. This

allowance is subject to review and may change or be adjusted against other emoluments at a later date.

: 2 :

TCS Confidential

Ref: TCS/2013-14/CC-C2/376258

PERFORMANCE PAY

Your performance pay will comprise of 2 parts as indicated below.

Monthly Performance Pay

You will receive a monthly performance pay of Rs. 19,400/-.

Quarterly Variable Allowance

Your variable allowance will be Rs. 4,600/- per month, and will be paid at the closure of each quarter based on the

performance of the company and your unit. Additionally, the extent of your allocation to the business unit would

also be a measure of your variable allowance. The payment is subject to your being active on the company rolls on

the date of announcement of Quarterly Variable Allowance.

These amounts shall be treated as productivity bonus in lieu of statutory profit bonus.

OTHER BENEFITS

Health Insurance Scheme

You are covered by the Group Health Insurance Scheme. The insurance cover entitles your family and you towards

reimbursement of medical expenses up to Rs. 1,00,000/- per annum per insured. This scheme also provides

enhanced hospitalisation cover up to Rs. 7,00,000/- per annum per family, on payment of premium, as applicable.

For details, please refer to the policy on HIS.

RETIRALS

Provident Fund

TCS will contribute 12% of your basic salary every month as contribution to the Provident Fund.

Gratuity

You will be eligible for gratuity in accordance with the rules applicable.

: 3 :

TCS Confidential

Ref: TCS/2013-14/CC-C2/376258

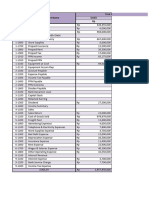

ANNEXURE II

Table 1: Compensation Details

COMPONENT CATEGORY MONTHLY ANNUAL

FIXED COMPENSATION

Basic Salary 15,800 1,89,600

Bouquet Of Benefits # 31,682 3,80,192

Provident Fund 1,896 22,752

Gratuity 760 9,120

Health Insurance* NA 4,500

PERFORMANCE PAY

Monthly Performance Pay 19,400 2,32,800

Quarterly Variable Allowance 4,600 55,200

TOTAL SALARY 74,138 8,94,164

# Refer to Table 2 for TCS defined structure.

* Premium for Health Insurance Scheme for self and dependants borne by TCS.

In case, you wish not to opt for the BoB, Defined Structure as given in Table 2 will be applicable.

Table 2: TCS Defined Structure for Bouquet of Benefits

COMPONENT CATEGORY MONTHLY ANNUAL

House Rent Allowance 7,900 94,800

Conveyance Allowance 800 9,600

Sundry Medical Reimbursement 1,250 15,000

Leave Travel Allowance 1,316 15,800

Food Coupons 2,000 24,000

Personal Allowance 18,416 2,20,992

BOUQUET OF BENEFITS 31,682 3,80,192

Taxation: Taxation will be governed by the Income Tax rules. The Company will be deducting tax at source as per

income tax guidelines.

To design your Bouquet of Benefits access the Link to BoB in the Global Employee Self Service Link on Ultimatix.

You might also like

- Compensation LetterDocument5 pagesCompensation LetterJonathan Adams100% (1)

- Mr. Aditya Vardhan PatniDocument9 pagesMr. Aditya Vardhan PatniAdityaPatniNo ratings yet

- KaranDocument19 pagesKarankaranbankar54No ratings yet

- YogeshDocument19 pagesYogeshkaranbankar54No ratings yet

- Private and Confidential TCSL/1809553 1Document19 pagesPrivate and Confidential TCSL/1809553 1Aditya NarayanNo ratings yet

- Offer: Computer Consultancy Ref: TCSL/DT20222184615/Lucknow Date: 26/04/2022Document18 pagesOffer: Computer Consultancy Ref: TCSL/DT20222184615/Lucknow Date: 26/04/2022Saikiran GrandhiNo ratings yet

- Mrinal OfferDocument22 pagesMrinal Offerjawedaman123No ratings yet

- Mrinal LOIDocument22 pagesMrinal LOIjawedaman123No ratings yet

- Tcs 22Document17 pagesTcs 22Praveen NegiNo ratings yet

- Offer LetterDocument19 pagesOffer LetterMukesh YadavNo ratings yet

- Offer LetterDocument20 pagesOffer LetterJerome FrancisNo ratings yet

- 265-285 Anupriya K - EceDocument21 pages265-285 Anupriya K - Ece6055 - Ragul TNo ratings yet

- Offer: Computer Consultancy Ref: TCSL/DT20184248190/Ahmedabad Date: 11/01/2019Document17 pagesOffer: Computer Consultancy Ref: TCSL/DT20184248190/Ahmedabad Date: 11/01/2019Sandipan DasNo ratings yet

- Mr. Jagannath Panda Tcs OfferletterDocument17 pagesMr. Jagannath Panda Tcs OfferletterJagan PandaNo ratings yet

- ChamanDocument19 pagesChamankaranbankar54No ratings yet

- 286-306 Guna V - EceDocument21 pages286-306 Guna V - Ece6055 - Ragul TNo ratings yet

- Offer Letter 70Document19 pagesOffer Letter 70Aashish PMNo ratings yet

- Offer LetterDocument20 pagesOffer LetterstepouthouseNo ratings yet

- Offer: Computer Consultancy Ref: TCSL/DT20222317867/Hyderabad Date: 30/07/2022Document21 pagesOffer: Computer Consultancy Ref: TCSL/DT20222317867/Hyderabad Date: 30/07/2022jd2saiNo ratings yet

- Tcs Offer LetterDocument21 pagesTcs Offer Letter4subs170No ratings yet

- DT20195775183 PDFDocument18 pagesDT20195775183 PDFAbs SriNo ratings yet

- Offer: Computer Consultancy Ref: TCSL/DT20222769689/Hyderabad Date: 30/07/2022Document21 pagesOffer: Computer Consultancy Ref: TCSL/DT20222769689/Hyderabad Date: 30/07/2022jd2saiNo ratings yet

- 223-243 Pramoth K - CseDocument21 pages223-243 Pramoth K - Cse6055 - Ragul TNo ratings yet

- 307-325 Janani PDocument19 pages307-325 Janani P6055 - Ragul TNo ratings yet

- 27 16x31a04c2 Shriya Reddy PonnalaDocument19 pages27 16x31a04c2 Shriya Reddy Ponnalaranjit sivakumarNo ratings yet

- TCS - 1Document19 pagesTCS - 1viruridsNo ratings yet

- Offer: Computer Consultancy Ref: TCSL/DT20218163154/Delhi Date: 09/12/2021Document20 pagesOffer: Computer Consultancy Ref: TCSL/DT20218163154/Delhi Date: 09/12/2021Dr. Bhasker Pratap ChoudharyNo ratings yet

- Offer: Computer Consultancy Ref: TCSL/DT20173834070/Mumbai Date: 25/03/2021Document19 pagesOffer: Computer Consultancy Ref: TCSL/DT20173834070/Mumbai Date: 25/03/2021dasdNo ratings yet

- Surajrhishi TCSDocument18 pagesSurajrhishi TCSSuraj Rhishi100% (1)

- Compensation 1682945 2020-2021Document9 pagesCompensation 1682945 2020-2021Alisha riya FrancisNo ratings yet

- OfferLetter PDFDocument11 pagesOfferLetter PDFNaveen GaneshNo ratings yet

- 244-264 Vijay S - CseDocument21 pages244-264 Vijay S - Cse6055 - Ragul TNo ratings yet

- May5 OfferLetter DT20229728024 SaiKiranGrandiDocument20 pagesMay5 OfferLetter DT20229728024 SaiKiranGrandiSaikiran GrandhiNo ratings yet

- CT20213696016 OlDocument20 pagesCT20213696016 OlChintala Srujan Reddy ChintalaNo ratings yet

- 81-101 Jaya Lakshmi M - CseDocument21 pages81-101 Jaya Lakshmi M - Cse6055 - Ragul TNo ratings yet

- DT20229919409 OlDocument20 pagesDT20229919409 OlDattatray PokleNo ratings yet

- TCS - OfferLetterDocument11 pagesTCS - OfferLetterSai KrishnaNo ratings yet

- Tata Consultancy Layer FormatDocument21 pagesTata Consultancy Layer FormatChinnu SalimathNo ratings yet

- TCS Offer LetterDocument20 pagesTCS Offer LetterSurya rohitNo ratings yet

- Offer: Computer Consultancy Ref: TCSL/DT20206377163/Kolkata Date: 12/10/2021Document20 pagesOffer: Computer Consultancy Ref: TCSL/DT20206377163/Kolkata Date: 12/10/2021Ahana BhattacharjeeNo ratings yet

- DT20218354147 OlDocument20 pagesDT20218354147 OlAyush srivastavaNo ratings yet

- Offer: Computer Consultancy Ref: TCSL/DT20229947609/Hyderabad Date: 29/07/2022Document21 pagesOffer: Computer Consultancy Ref: TCSL/DT20229947609/Hyderabad Date: 29/07/2022jd2sai100% (1)

- Tcs Offer Letter - MergedDocument39 pagesTcs Offer Letter - Mergednishanegi9375No ratings yet

- DT20218544042 OlDocument20 pagesDT20218544042 OlReejas dmotilalNo ratings yet

- Offer: Computer Consultancy Ref: TCSL/DT20195226094/Hyderabad Date: 23/09/2019Document18 pagesOffer: Computer Consultancy Ref: TCSL/DT20195226094/Hyderabad Date: 23/09/2019vineeth sagarNo ratings yet

- To The Concerned Authority Date: 23.05.2021Document20 pagesTo The Concerned Authority Date: 23.05.2021Vikas MahorNo ratings yet

- Mr. Vitlesh PanditaDocument5 pagesMr. Vitlesh PanditaVitlesh PanditaNo ratings yet

- Offer: Computer Consultancy Ref: TCSL/DT20195413544/Lucknow Date: 14/01/2022Document20 pagesOffer: Computer Consultancy Ref: TCSL/DT20195413544/Lucknow Date: 14/01/2022venkateshNo ratings yet

- Satish Jadav 101777 26504-1Document20 pagesSatish Jadav 101777 26504-1Rakhi JadavNo ratings yet

- TCS Offer Letter Salary ITADocument18 pagesTCS Offer Letter Salary ITAChandra Sekhar60% (5)

- User FileDocument9 pagesUser FileBaljinder SinghNo ratings yet

- User FileDocument9 pagesUser Filesaireddy4b1No ratings yet

- Take It AgainDocument16 pagesTake It AgainTestNo ratings yet

- Offer Letter - 24-Mar-2022 - 02 - 35 - 52Document15 pagesOffer Letter - 24-Mar-2022 - 02 - 35 - 52TestNo ratings yet

- C3892637 - RAKSHITHK S - OfferLetter-1 PDFDocument6 pagesC3892637 - RAKSHITHK S - OfferLetter-1 PDFmithuncyNo ratings yet

- Offer LetterDocument14 pagesOffer LetterPramod KumarNo ratings yet

- TCS Anniversary2Document4 pagesTCS Anniversary2Vitlesh PanditaNo ratings yet

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- Health Care Reform Act: Critical Tax and Insurance RamificationsFrom EverandHealth Care Reform Act: Critical Tax and Insurance RamificationsNo ratings yet

- Amit Desi - MPhil ThesisDocument41 pagesAmit Desi - MPhil ThesisMayank GautamNo ratings yet

- A Computational Model of A Phase Change Material Heat Exchanger in A Vapor Compression System With A Large Pulsed Heat Load - ACT - Advanced Cooling TechnologiesDocument9 pagesA Computational Model of A Phase Change Material Heat Exchanger in A Vapor Compression System With A Large Pulsed Heat Load - ACT - Advanced Cooling TechnologiesMayank GautamNo ratings yet

- Material Sciences Chap13 PolymersDocument15 pagesMaterial Sciences Chap13 PolymersNadziim FitriNo ratings yet

- Department of Atomic Energy Department of Atomic Energy (DAE)Document3 pagesDepartment of Atomic Energy Department of Atomic Energy (DAE)Mayank GautamNo ratings yet

- Japan 201415Document8 pagesJapan 201415Mayank GautamNo ratings yet

- 14 DesignDocument10 pages14 DesignMayank GautamNo ratings yet

- .:: Astrill Error ::. &NBSP Socket Error # 10053 Software Caused Connection Abort. What Can You Do To Solve The Error: Try To Switch To Another Server If The Error Persists.Document36 pages.:: Astrill Error ::. &NBSP Socket Error # 10053 Software Caused Connection Abort. What Can You Do To Solve The Error: Try To Switch To Another Server If The Error Persists.franz_passariniNo ratings yet

- GA6 Iron Ore Titr Rev4 94Document3 pagesGA6 Iron Ore Titr Rev4 94pathisharmaNo ratings yet

- OnGc 278481Document1 pageOnGc 278481Mayank GautamNo ratings yet

- 12-Modelling For Capture of Carbon Dioxide Using Aqueous Ammonia From Flue Gases of A Brick KilnDocument8 pages12-Modelling For Capture of Carbon Dioxide Using Aqueous Ammonia From Flue Gases of A Brick KilnWARP-World Academy of Research and PublicationNo ratings yet

- DC User GuidelinesDocument1 pageDC User GuidelinesMayank GautamNo ratings yet

- Lect09 10 InterruptsDocument30 pagesLect09 10 InterruptsMayank GautamNo ratings yet

- Paper HKNaik FinalDocument17 pagesPaper HKNaik FinalMayank GautamNo ratings yet

- Summer in A Startup BrouchureDocument20 pagesSummer in A Startup BrouchureMayank GautamNo ratings yet

- Turbulence - Volume II PDFDocument11 pagesTurbulence - Volume II PDFMayank GautamNo ratings yet

- 040Document12 pages040Mayank GautamNo ratings yet

- Final List of US UniversitiesDocument1 pageFinal List of US UniversitiesMayank GautamNo ratings yet

- 6603 PDFDocument3 pages6603 PDFMayank GautamNo ratings yet

- BITS F437 TC Aug 2011 HandoutDocument3 pagesBITS F437 TC Aug 2011 HandoutMayank GautamNo ratings yet

- Department FlyerDocument2 pagesDepartment FlyerMayank GautamNo ratings yet

- Steam Jet Ejectors: Index DescriptionDocument18 pagesSteam Jet Ejectors: Index DescriptionMuhammad NaveedNo ratings yet

- Future Vision and Thermodynamics of Refinery ProcessesDocument52 pagesFuture Vision and Thermodynamics of Refinery ProcessesMayank GautamNo ratings yet

- Lab 3 - PotentiometryDocument5 pagesLab 3 - PotentiometryMayank GautamNo ratings yet

- 12-Modelling For Capture of Carbon Dioxide Using Aqueous Ammonia From Flue Gases of A Brick KilnDocument8 pages12-Modelling For Capture of Carbon Dioxide Using Aqueous Ammonia From Flue Gases of A Brick KilnWARP-World Academy of Research and PublicationNo ratings yet

- PPT-5 Carbon NanostructuresDocument34 pagesPPT-5 Carbon NanostructuresMayank GautamNo ratings yet

- Development of An Analytical MethodDocument111 pagesDevelopment of An Analytical MethodMayank GautamNo ratings yet

- Shashank Ion of Cumene ProductionDocument22 pagesShashank Ion of Cumene ProductionMayank GautamNo ratings yet

- Aspen Manual v11.1Document112 pagesAspen Manual v11.1api-3750488100% (6)

- Aspen Manual v11.1Document112 pagesAspen Manual v11.1api-3750488100% (6)

- Adjustments Quiz 1Document6 pagesAdjustments Quiz 1Christine Mae BurgosNo ratings yet

- Preference Share Capital Does Not Decrease Outstanding Shares Does Not Decrease Declaration Outstanding Shares Treasury Shares, RFHBDocument2 pagesPreference Share Capital Does Not Decrease Outstanding Shares Does Not Decrease Declaration Outstanding Shares Treasury Shares, RFHBMaryrose SumulongNo ratings yet

- NBM Iron and Steel Trading 11dec2019Document5 pagesNBM Iron and Steel Trading 11dec2019Yasien ZaveriNo ratings yet

- 2013 Pan European Private Equity Performance Benchmarks Study Evca Thomson Reuters Final VersionDocument28 pages2013 Pan European Private Equity Performance Benchmarks Study Evca Thomson Reuters Final VersionAbdullah HassanNo ratings yet

- 14 - Audit Other Related ServicesDocument38 pages14 - Audit Other Related ServicesSyafiq AhmadNo ratings yet

- Tally Notes PDFDocument115 pagesTally Notes PDFLokesh Yadav100% (6)

- Income Tax AustraliaDocument23 pagesIncome Tax AustraliaDarshit PrajapatiNo ratings yet

- 7333-1998-Bir Ruling No. 029-98 PDFDocument3 pages7333-1998-Bir Ruling No. 029-98 PDFjeffreyNo ratings yet

- Valuation of EquityDocument40 pagesValuation of EquityPRIYA KUMARINo ratings yet

- CIR vs. ALGUE INC. G.R. No. L 28896. February 17 1988 PDFDocument10 pagesCIR vs. ALGUE INC. G.R. No. L 28896. February 17 1988 PDFZenith EuropaNo ratings yet

- New Business Plan ProjectDocument7 pagesNew Business Plan ProjectPrakash KumawatNo ratings yet

- Capital Structure: Particulars Company X Company YDocument7 pagesCapital Structure: Particulars Company X Company YAbhishek GavandeNo ratings yet

- Shareholders' EquityDocument9 pagesShareholders' EquityLeah Hope CedroNo ratings yet

- Brown-Forman Initiating CoverageDocument96 pagesBrown-Forman Initiating CoverageRestructuring100% (1)

- Jawaban E 5-7 E5-8 Advanced AccountingDocument3 pagesJawaban E 5-7 E5-8 Advanced AccountingMutia Wardani100% (2)

- AxasxDocument26 pagesAxasxГал БадрахNo ratings yet

- Unit I - Working Capital PolicyDocument16 pagesUnit I - Working Capital Policyjaskahlon92No ratings yet

- Customer Satisfaction in LICDocument69 pagesCustomer Satisfaction in LICGauri Soni100% (2)

- Tutorial 2 Financial Statements & FSADocument10 pagesTutorial 2 Financial Statements & FSAHằngg ĐỗNo ratings yet

- Treasury Stock ENtriesDocument3 pagesTreasury Stock ENtrieseuphoria2No ratings yet

- Siklus Akuntansi Pada PT Adi JayaDocument11 pagesSiklus Akuntansi Pada PT Adi Jayafitrianura04No ratings yet

- Intraday Equity Logbook For ZERODHADocument4 pagesIntraday Equity Logbook For ZERODHAfelixrichNo ratings yet

- Nextcare Medical Reimbursement FormDocument1 pageNextcare Medical Reimbursement FormKunal NandyNo ratings yet

- Tax RemediesDocument15 pagesTax RemediesJonard GodoyNo ratings yet

- Family Law Divorce Without ChildDocument33 pagesFamily Law Divorce Without ChildDr LipseyNo ratings yet

- Managerial Accounting AssignmentDocument7 pagesManagerial Accounting AssignmentBedri M Ahmedu100% (1)

- Hershey CaseDocument9 pagesHershey Casesb73_617No ratings yet

- St. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingDocument3 pagesSt. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingGennelyn Grace Peñaredondo100% (1)

- Business RiskDocument4 pagesBusiness Riskrotsacreijav66666No ratings yet

- Subject Code Subject Description Module Description Objective OF ThisDocument12 pagesSubject Code Subject Description Module Description Objective OF ThisRuby Amor DoligosaNo ratings yet