Professional Documents

Culture Documents

Case Study On Securities Scam

Uploaded by

Sharanya Sv0 ratings0% found this document useful (0 votes)

618 views11 pagesits a detailed study on the securities scam that shattered thousands of investors as well as shocked the regulators of the financial markets.

Original Title

Case Study on securities scam

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentits a detailed study on the securities scam that shattered thousands of investors as well as shocked the regulators of the financial markets.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

618 views11 pagesCase Study On Securities Scam

Uploaded by

Sharanya Svits a detailed study on the securities scam that shattered thousands of investors as well as shocked the regulators of the financial markets.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 11

CASE STUDY 1

HARSHAD MEHTHA SCAM

Harshad Mehta: the high-profile stockbroker

Harshad Shantilal Mehta (1954-2002) was an Indian stockbroker who grabbed headlines for

the notorious BSE security scam of 1992. Born in a lower middle-class Gujarati Jain family,

Mehta spent his early childhood in Mumbai where his father was a small-time businessman.

The family relocated to Raipur in Chhattisgarh after doctors advised Mehtas father to shift to

a drier place on account of his health.

Transition from an ordinary broker to big bull

Mehta started his career at The New India Assurance Company. He quit his job in 1980 and

sought a new one with BSE-affiliated stockbroker P. Ambalal before going on to become a

jobber on the BSE for stockbroker P.D. Shukla. In 1981, Mehta became a sub-broker for

stockbrokers J.L. Shah and Nandalal Sheth. Having gained considerable experience as a sub-

broker, he teamed up with his brother Sudhir to float a new venture called Grow More

Research and Asset Management Company Limited. When the BSE auctioned a brokers

card, the Mehta duos company bid for it with the financial support of J.L. Shah and Nandalal

Sheth. Another name that is rumoured to have a crucial hand in the scam was Nimesh Shah.

However, Shah could keep a safe distance from the accusations and is currently known to be

a heavy player in the Indian stock market.

By year 1990, Mehta became a prominent name in the Indian stock market. He started buying

shares heavily. The shares of India's foremost cement manufacturer Associated Cement

Company (ACC) attracted him the most and the scamster is known to have taken the price of

the cement company from 200 to 9000 (approx.) in the stock market implying a 4400% rise

in its price. It is believed that it was later revealed that Mehta used the replacement cost

theory to explain the reason for the high-level bidding. The replacement cost theory basically

states that older companies should be valued on the basis of the amount of money that would

be needed to create another similar company. By the latter half of 1991, Mehta had come to

be called the Big Bull as people credited him with having initiated the Bull Run.

The 1992 security scam and its exposure

Mehta's illicit methods of manipulating the stock market were exposed on April 23, 1992,

when veteran columnist Sucheta Dalal wrote an article in India's national daily The Times of

India. Dalals column read: The crucial mechanism through which the scam was affected

was the ready forward (RF) deal. The RF is in essence a secured short-term (typically 15-day)

loan from one bank to another. Crudely put, the bank lends against government securities just

as a pawnbroker lends against jewellers. The borrowing bank actually sells the securities to

the lending bank and buys them back at the end of the period of the loan, typically at a

slightly higher price. In a ready-forward deal, a broker usually brings together two banks for

which he is paid a commission. Although the broker does not handle the cash or the

securities, this was not the case in the prelude to the Mehta scam. Mehta and his associates

used this RF deal with great success to channel money through banks.

The securities and payments were delivered through the broker in the settlement process. The

broker functioned as an intermediary who received the securities from the seller and handed

them over to the buyer; and he received the check from the buyer and subsequently made the

payment to the seller. Such a settlement process meant that both the buyer and the seller may

not even know the identity of the other as only the broker knew both of them. The brokers

could manage this method expertly as they had already become market makers by then and

had started trading on their account. They pretended to be undertaking the transactions on

behalf of a bank to maintain a faade of legality.

Mehta and his associates used another instrument called the bank receipt (BR). Securities

were not traded in reality in a ready forward deal but the seller gave the buyer a BR which is

a confirmation of the sale of securities. A BR is a receipt for the money received by the

selling bank and pledges to deliver the securities to the buyer. In the meantime, the securities

are held in the sellers trust by the buyer.

Complicit lenders

Armed with these schemes, all Mehta needed now were banks which would readily issue fake

BRs, or ones without the guarantee of any government securities. His search ended when he

found that the Bank of Karad (BOK), Mumbai and the Metropolitan Co-operative Bank

(MCB) two small and little known lenders, were willing to comply. The two banks agreed to

issue BRs as and when required. Once they issued the fake BRs, Mehta passed them on to

other banks who in turn lent him money, under the false assumption that they were lending

against government securities. Mehta used the money thus secured to enhance share prices in

the stock market. The shares were then sold for significant profits and the BR retired when it

was time to return the money to the bank.

Outcome

Mehta continued with his manipulative tactics, triggering a massive rise in the prices of stock

and thereby creating a feel-good market trajectory. However, upon the exposure of the scam,

several banks found they were holding BRs of no value at all. Mehta had by then swindled

the banks of a staggering Rs 4,000 crore. The scam came under scathing criticism in the

Indian Parliament, leading to Mehta's eventual imprisonment. The scams exposure led to the

death of the Chairman of the Vijaya Bank who reportedly committed suicide over the

exposure. He was guilty of having issued checks to Mehta and knew the backlash of

accusations he would have to face from the public.

A few years later, Mehta made a brief comeback as a stock market expert and started

providing investment tips on his website and in a weekly newspaper column. He worked with

the owners of a few companies and recommended the shares of those companies only. When

he died in 2002, Mehta had been convicted in only one of the 27 cases filed against him.

What attracted the taxmans attention was Mehta's advance tax payment of Rs 28-crore for

the financial year 1991-92. Another eye-catcher was his extravagant lifestyle.

I-T, PSBs recover dues nine years after Mehta's death

Nine years after Harsad Mehta died the I-T department and public sector banks (PSBs) have

successfully recovered a significant portion of their claims emerging out of the securities

scam from his liquidated assets. The Supreme Court directed the Custodian of the attached

properties and assets of the Harshad Mehta Group (HMG) in March 2011 to make payments

of Rs1,995.66-crore to the I-T department and Rs 199.25-crore to the State Bank of India

(SBI), making the two institutions two of the earliest claimants to recover their dues.

While the SBIs total principal amount claim of Rs 1,000-crore have been largely settled,

financial institutions have also received some money. However, Standard Chartered Bank,

which had claimed Rs 500-crore, has yet to recover its dues it was one of the late claimants.

Although the total claim over the HMG is of more than Rs 20,000-crore, the apex court has

said that for the present, it would only consider claims towards the principal amount.

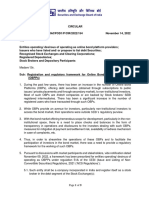

SEBIs Role after the scam

HM scam and the formation of the regulator, the scam became a catalyst for policy-makers to

think hard. It set in motion a chain reaction which lead to developments like the listing

agreement. The first boost to SEBI's arsenal was the Securities Laws (Amendments) Act

1995. This widened SEBI's jurisdiction and allowed it to regulate depositories, FIIs, venture

capital funds and credit-rating agencies. To secure investor interest, SEBI could also make it

mandatory for disclosures by companies issuing securities. SEBI was also empowered to

penalise capital-market violations with a fine of Rs 10 lakhs. And allowed its investigative

arm could summon persons, enforce production of books of accounts, and conduct enquiries,

audits and inspections of MFs, stock exchanges and other intermediaries. Greater autonomy

ensued when SEBI was given immunity from civil action. The Securities Appellate Tribunal

was established to give SEBI greater credibility.

CASE STUDY 2

KETAN PAREKH SCAM

Who is Ketan Parekh

Ketan Parekh is a former stockbroker based in Mumbai who was convicted in 2008 for being

involved in engineering the technology stocks scam in Indias stock market in 1999-2001. A

chartered accountant by training, Parekh comes from a family of brokers and is currently

serving a period of disqualification from trading in the Indian bourses till 2017.

Ketan Parekh has been accorded with sobriquets such as the Pentafour Bull and the One Man

Army by the countrys national business newspapers, while the market simply refers to him

as KP or associates him with his firm NH Securities. Parekh is known to have no reluctance

in meeting the press. He is also known to have razor-sharp forecasts on market developments.

What distinguishes Ketan Parekh from the 'Big Bull' late Harshad Mehta

The two have been compared by people to have operated their scams using similar means and

that their backgrounds were similar as well. But the differences are very conspicuous.

At the outset, Mehta came from a lower middle-class and modest background, while KPs

family has been engaged as stockbrokers for a significant time. He is also related to many

prominent brokers. Secondly, when Mehta was operating, the market was still a closed one

and was just beginning to liberalize. It was revealed later that Mehta operated using the

money of other people as his last recourse. Further, Mehta is known to have resorted to

aggressive publicity campaigns whereas KP operates almost clandestinely. The latter has also

been successful at creating stories and selling them aggressively to institutional investors.

The Midas touch

Parekh attracted the attention of market players and they kept track of every move of Parekh

as everything he was laying his hands on was virtually turning into gold. But the Pentafour

Bull still kept a low profile, except when he hosted a millennium party that was attended by

politicians, business magnates and film stars. And by 1999-2000, as the technology industry

began embracing the entire world, Indias stock markets started showing signs of hyper-

activity as well and this was when KP struck.

Almost everyone, from investment firms which were mostly controlled by promoters of listed

companies to foreign corporate bodies and cooperative banks were eager to entrust their

money with Parekh, which, he in turn used to inflate stock prices by making his interest

obvious. Almost immediately, stocks of firms such as Visual soft witnessed meteoric rises,

from Rs 625 to Rs 8,448 per unit, while those of Sonata Software were up from Rs 90 to Rs

2,150. However, this fraudulent scheme did not end with price rigging. The rigged-up stocks

needed dumping onto someone in the end and KP used financial institutions such as the UTI

for this.

When companies seek to raise money from the stock market, they take the help of brokers to

back them in raising share prices. KP formed a network of brokers from smaller bourses such

as the Allahabad Stock Exchange and the Calcutta Stock Exchange. He also used BENAMI

or share purchase in the names of poor people living in Mumbais shanties. KP also had large

borrowings from Global Trust Bank and he rigged up its shares in order to profit significantly

at the time of its merger with UTI Bank. While the actual amount that came into Parekh's

kitty as loan from Global Trust Bank was reportedly Rs 250 crore, its chairman Ramesh Gelli

is known to have repeatedly asserted that Parekh had received less than Rs 100 crore in

keeping with RBI norms.

Parekh and his associates also secured Rs 1,000-crore as loan from the Madhavpura

Mercantile Co-operative Bank despite RBI regulations that the maximum amount a broker

could get as a loan was Rs15-crore. Hence, it was clear that KPs mode of operation was to

inflate shares of select companies in collusion with their promoters.

Lady luck disfavours Parekh!

Notably, a day after the presentation of the Union Budget in February 2001, Parekh appeared

to have run out of luck. A team of traders, Shankar Sharma, Anand Rathi and Nirmal Bang,

known as the bear cartel, placed sell orders on KPs favorite stocks, the so called K-10

stocks, and crushed their inflated prices. Even the borrowings of KP put together could not

rescue his scrips. The Global Trust Bank and the Madhavpura Cooperative were driven to

bankruptcy as the money they had lent Parekh went into an abyss with his reportedly

favourite K-10 stocks.

The exposure of the dupe

Ketan Parekh's fraudulent practices were first exposed by veteran columnist Sucheta Dalal.

Sucheta's column read, It was yet another black Friday for the capital market. The BSE

sensitive index crashed another 147 points and the Central Bureau of Investigation (CBI)

finally ended Ketan Parekhs two-year dominance of the market by arresting him in

connection with the Bank of India (BoI) complaint. Many people in the market are not

surprised with Parekhs downfall because his speculative operations were too large, he was

keeping dubious company, and he was dealing in too many shady scrips.

When the prices of select shares started constantly rising, innocent investors who had bought

such shares believing that the market was genuine were about to stare at huge losses. Soon

after the scam was exposed, the prices of these stocks came down to the fraction of the values

at which they had been bought. When the scam did actually burst, the rigged shares lost their

values so heavily that quite a few people lost their savings. Some banks including Bank of

India also lost significant amounts of money.

Dalal goes on to state that Parekh's scheme was not visible to a layman given the positive

deflection that media had made him a hero while some of the biggest national dailies had

even quoted him profusely on that years Union Budget. Dalal added that KPs arrest and the

uncanny similarity of his operations to the Harshad Mehta securities scam of 1992 vindicated

the miserable inadequacy of the countrys regulatory system. The Securities Exchange Board

of India (SEBI) and the Reserve Bank of India (RBI) had remained complacent when the

stock bubble was created during the latter half of 1999 and through 2000 while it had not

bothered to take any action through 2001 when it was ready to burst.

SEBIs damage control measures

SEBI investigations into Parekh's money laundering affairs revealed that KP had used bank

and promoter funds to manipulate the markets. It then proceeded with plugging the many

loopholes in the market. The trading cycle was cut short from a week to a day. The carry-

forward system in stock trading called BADLA was banned and operators could trade using

this method. SEBI formally introduced forward trading in the form of exchange-traded

derivatives to ensure a well-regulated futures market. It also did away with broker control

over stock exchanges. In KPs case, the SEBI found prima facie evidence that he had rigged

prices in the scrips of Global Trust Bank, Zee Telefilms, HFCL, Lupin Laboratories, Aftek

Infosys and Padmini Polymer.

Furthermore, the information provided by the RBI to the Joint Parliamentary Committee

(JPC) during the investigation revealed that financial institutions such as Industrial

Development Bank of India (IDBI Bank) and Industrial Finance Corporation of India (IFCI)

had given loans of Rs 1,400 crore to companies known to be close to Parekh.

Criticism of SEBI

Some of the regulatory actions SEBI undertook came under scathing criticism from some

quarters who accused it of still being clueless about its supervisory duties. Observers said the

regulator still continued believing that its only priority was to prevent a fall in stock prices.

It was rumoured that SEBI banned short sales and increased margins creating a virtual cash

market in the process and squeezed turnover to a sixth of the normal level. It also fired all

broker directors from the Bombay Stock Exchange and Calcutta Stock Exchange and

declared the completion of three controversial settlements of the Kolkata bourse by retaining

a sizeable proportion of the payout of operators who had allegedly tied-up for collusive deals.

Furthermore, SEBI rounded up the bear operators and launched an inquiry into their alleged

short sales.

Stringent regulatory measures follow Parekh episode

Parekh's fraudulent operations motivated the authorities to take necessary steps that have

made made India's stock markets relatively safer in present times. He can also be credited for

having forced indolent policy-makers to bring about reforms in the financial system.

An active trader

According to an Intelligence Bureau report, though disbarred from trading in the countrys

bourses until 2017, is still operating in the markets through conduits, vindicating Dalal

Streets belief that he has never left the market. The report says that as recently as December

2010, KP has been rallying behind different stocks and placing some of them at rigged up

prices to large institutions such as the LIC. He is operating through little-known investment

firms, market operators and a following of loyal brokers. KP, who was at the forefront during

the technology shares-led bull run in 1999-2000, is apparently using front entities such as

Orchid Chemicals , GMR Infrastructure, Cairn India, Deccan Chronicles Holdings, Reliance

Industries, Punj Lloyd, Indiabulls Real Estate, Pipavav Shipyard, Amtek Auto, Hindustan Oil

Exploration, UCO Bank, State Bank of India, EIH and JSW Steel, among others, to trade in

shares.

The report further states that KP has been instrumental in inflating the share price of SKS

Microfinance from Rs850 to Rs1,100 following its listing in August 2010. He has also rigged

IPOs of little known companies by buying out 50% of the issue in collusion with his Kolkata-

based associates. KP and his associates have also acquired very large positions in petroleum

companies such as ONGC and HPCL, according to the report. An IB official has further said

that KP and his team have revealed to their close associates that they have insider information

on the government's proposal to decontrol the sale of gas which is expected to raise profit

margins of these companies by about 20%.

With Ketan Parekh's famous K-10 stocks being hammered down and coating many investors

their lives savings, came the SEBI (Amendment) Act of 2002. This gave SEBI the power to

call for records from any bank, authority or board. It also empowered the regulator to inspect

books of any listed public company. SEBI could now, suspend trading of a security, bar

persons and companies from accessing markets and suspend any office bearer in a stock

exchange. It was also granted powers to attach, impound, and retain the proceeds of any

transaction that was not by the book. SEBI could also specify requirements for listing and

transfer of securities. Also, offences like insider trading and unfair trade practices were spelt

out better, and expressly forbidden. More power also came in the own of higher punitive

powers. So fines of upto Rs 25 cr or three times the unlawful gains, whichever is higher, were

allowed and were jail terms from 1 to 10 years were introduced. The Securities Laws

(Amendment) Act of 2004 followed. As per the recommendations of the Joint Parliamentary

Committee on the stock market scam, a law was enacted for the de-mutualisation of

exchanges. This put an end to exchanges being incorporated as mutual organisations where

the traders and brokers owned, controlled an managed the exchange. So exchanges were

corporatized, putting public interest first. These wholesale changes contributed towards

arming the regulator better.

You might also like

- Harshad Mehta ScamDocument4 pagesHarshad Mehta Scamvanitathakur91No ratings yet

- ScamDocument23 pagesScameunice19970315No ratings yet

- Harshad Mehta CaseDocument16 pagesHarshad Mehta Casegunjan67% (3)

- Nitin - Harshad Mehta Scam PDFDocument12 pagesNitin - Harshad Mehta Scam PDFAnkit SangwanNo ratings yet

- Scams That Rattled Indian Stock MarketDocument22 pagesScams That Rattled Indian Stock MarketvinithaNo ratings yet

- Chander MohanDocument8 pagesChander Mohanron thakurNo ratings yet

- Harshad Mehta & Ketan Parekh Stock ScamsDocument10 pagesHarshad Mehta & Ketan Parekh Stock Scamssidrock_sharma11No ratings yet

- Frauds in BankingDocument12 pagesFrauds in BankingPankaj Salunke100% (1)

- PNB Fraud Story - Who is Nirav ModiDocument6 pagesPNB Fraud Story - Who is Nirav Modiparesh shiralNo ratings yet

- Survey reveals majority aware of stock market scams in India and their impactDocument8 pagesSurvey reveals majority aware of stock market scams in India and their impactRohit Jain100% (2)

- Vicky Black Book Stock Market ScamDocument69 pagesVicky Black Book Stock Market ScamVicky VishwakarmaNo ratings yet

- Scams & Scrutiny in The Indian Securities Market: Posted OnDocument18 pagesScams & Scrutiny in The Indian Securities Market: Posted OnSharvil GupteNo ratings yet

- PNB Scam: " Shining Diamond Trader Took Away PNB's Shine "Document13 pagesPNB Scam: " Shining Diamond Trader Took Away PNB's Shine "Tadashi HamadaNo ratings yet

- Jinal Black BookDocument7 pagesJinal Black Bookhardik patel0% (1)

- Banking Scams in IndiaDocument3 pagesBanking Scams in IndiaMohit ChoudharyNo ratings yet

- Scams in IndiaDocument90 pagesScams in IndiaVaibhav shigvanNo ratings yet

- Ms. Manisha Chaudhary: AdvocateDocument29 pagesMs. Manisha Chaudhary: AdvocateanonymousNo ratings yet

- Harshad Mehta PDFDocument17 pagesHarshad Mehta PDFaniket deshpandeNo ratings yet

- MAIN 2G SPECTRUM SCAM - PPT MAINDocument24 pagesMAIN 2G SPECTRUM SCAM - PPT MAINRahulNo ratings yet

- Punjab National Bank Scam: Feny Mirium Jacob Kavya Elizebeth Johny Arjun JorgeDocument6 pagesPunjab National Bank Scam: Feny Mirium Jacob Kavya Elizebeth Johny Arjun JorgeFeny Mirium50% (2)

- Satyam ScamDocument3 pagesSatyam Scammynareshk100% (8)

- Sebi detects IPO scam involving manipulation of primary marketDocument4 pagesSebi detects IPO scam involving manipulation of primary marketMonika SharmaNo ratings yet

- Financial Scams in IndiaDocument64 pagesFinancial Scams in India123rajnikantNo ratings yet

- Harshad Mehta.Document14 pagesHarshad Mehta.Priya SethiNo ratings yet

- Lic Housing ScamDocument10 pagesLic Housing ScamAnkesh ShrivastavaNo ratings yet

- Saytam ScamDocument24 pagesSaytam Scamvishal narvekarNo ratings yet

- Financial Scams and ScandalsDocument29 pagesFinancial Scams and ScandalsGungun KumariNo ratings yet

- Scams in India OriginalDocument62 pagesScams in India OriginalKumar Raghav Maurya100% (1)

- Team-Iibm Indians: Mushkurul Kishor Rohit Praful Sachin Pratik Sandip Deepak Yashwant AkshayDocument15 pagesTeam-Iibm Indians: Mushkurul Kishor Rohit Praful Sachin Pratik Sandip Deepak Yashwant AkshayMushkurul Haque SiddiqueNo ratings yet

- Notes On The DHFL SCAM AT A GLANCE: FROM THE PERSPECTIVES OF AILING FD HOLDERSDocument16 pagesNotes On The DHFL SCAM AT A GLANCE: FROM THE PERSPECTIVES OF AILING FD HOLDERSDebaprasad BandyopadhyayNo ratings yet

- Harshad Mehta ScamDocument16 pagesHarshad Mehta ScamAshu JainNo ratings yet

- Stock Market ScamDocument23 pagesStock Market Scamroney_2n4uNo ratings yet

- Scam PPT'Document7 pagesScam PPT'cherryNo ratings yet

- Harshad Mehta ScamDocument28 pagesHarshad Mehta Scamjoseph_kachappilly0% (1)

- The BIG Bull SCAM: The Harshad Mehta Securities ScamDocument16 pagesThe BIG Bull SCAM: The Harshad Mehta Securities ScamZeeshan Ahmad100% (1)

- Punjab National Bank ScamDocument17 pagesPunjab National Bank ScamAnuj SinghNo ratings yet

- Stock Market ScamsDocument15 pagesStock Market Scamssabyasachitarai100% (2)

- PNB ScamDocument13 pagesPNB ScamPrachi ChhedaNo ratings yet

- Chapter 3 PDFDocument174 pagesChapter 3 PDFniku007No ratings yet

- Case Study: BioconDocument8 pagesCase Study: BioconNishant SatamkarNo ratings yet

- Academic Year 2019-2020: St. John College of Humanities & SciencesDocument78 pagesAcademic Year 2019-2020: St. John College of Humanities & SciencesRinkesh SoniNo ratings yet

- Credit Card Project-2Document17 pagesCredit Card Project-2Jeevan JNo ratings yet

- Cobblers ScamDocument5 pagesCobblers ScamPankajNo ratings yet

- RBI Credit History - Final - Revised RBI - AckDocument20 pagesRBI Credit History - Final - Revised RBI - AckMoneylife Foundation100% (1)

- Harshad Mehta ScamDocument20 pagesHarshad Mehta ScamVinay Singh0% (1)

- SEBI issues regulatory framework for Online Bond Platform ProvidersDocument9 pagesSEBI issues regulatory framework for Online Bond Platform ProvidersJom JeanNo ratings yet

- What Is The DHFL ScamDocument4 pagesWhat Is The DHFL ScamSarah MajumderNo ratings yet

- E-Commerce Systems ExplainedDocument112 pagesE-Commerce Systems ExplainedAbhimanyu VermaNo ratings yet

- Ketan Parekh Scam Impact on Financial SectorDocument5 pagesKetan Parekh Scam Impact on Financial SectorJinal Shah100% (1)

- Story of Demat ScamDocument66 pagesStory of Demat Scamapi-3701467No ratings yet

- Financial Scams in India's MarketsDocument78 pagesFinancial Scams in India's MarketsPratik Rambhia100% (2)

- Harshad Mehta & Ketan Parekh ScamDocument6 pagesHarshad Mehta & Ketan Parekh Scammeet22591No ratings yet

- Ketan Parekh ScamDocument6 pagesKetan Parekh ScamRaunaq BagadeNo ratings yet

- SummaryDocument4 pagesSummaryAparna JindalNo ratings yet

- Harshad Mehta Scam: Subject: FMPIDocument12 pagesHarshad Mehta Scam: Subject: FMPIHarsh DesaiNo ratings yet

- Harshad MehtaDocument6 pagesHarshad MehtaBenika RajputNo ratings yet

- Business Eathics (Case Study On Harshad Mehta)Document8 pagesBusiness Eathics (Case Study On Harshad Mehta)Anonymous f8tAzEb3o0% (1)

- Keynes TheoryDocument3 pagesKeynes TheorySharanya SvNo ratings yet

- Objectives of The StudyDocument2 pagesObjectives of The StudySharanya SvNo ratings yet

- Concepts of National IncomeDocument4 pagesConcepts of National IncomeLini IckappanNo ratings yet

- Raw Banana ParantheDocument1 pageRaw Banana ParantheSharanya SvNo ratings yet

- Project Dated 4-A STUDY OF RETAIL INVESTOR BEHAVIOR ON INVESTMENT DECISIONDocument124 pagesProject Dated 4-A STUDY OF RETAIL INVESTOR BEHAVIOR ON INVESTMENT DECISIONSharanya SvNo ratings yet

- Notes On KB and MouseDocument17 pagesNotes On KB and Mousebans78No ratings yet

- Kachche Kele Ke ParantheDocument1 pageKachche Kele Ke ParantheSharanya SvNo ratings yet

- Investor Preference To Derivative MarketsDocument11 pagesInvestor Preference To Derivative MarketsSharanya SvNo ratings yet

- Chicken BiriyaniDocument1 pageChicken BiriyaniSharanya SvNo ratings yet

- Investor Risk PreferenceDocument11 pagesInvestor Risk PreferenceSharanya SvNo ratings yet

- Internship Report BMTCDocument65 pagesInternship Report BMTCSharanya Sv67% (6)

- Project AppraisalDocument62 pagesProject Appraisalsagarlakra100% (1)

- Rate of Return 14.33%Document3 pagesRate of Return 14.33%Smriti MehtaNo ratings yet

- Lean Fundly - Pitch Deck 02-11-13 V 0.3Document18 pagesLean Fundly - Pitch Deck 02-11-13 V 0.3analyticsvr100% (1)

- 1213 PDFDocument23 pages1213 PDFnamasralNo ratings yet

- Discounting and Cash Flow Considerations For P&C Insurers: Revised Educational NoteDocument18 pagesDiscounting and Cash Flow Considerations For P&C Insurers: Revised Educational NotemarhadiNo ratings yet

- Primer On Investment BankingDocument2 pagesPrimer On Investment BankingRaul KoolNo ratings yet

- Good Afternoon: Tupperwar E in IndiaDocument24 pagesGood Afternoon: Tupperwar E in Indiasroy86No ratings yet

- (Star B.) The MACD Profit AlertDocument6 pages(Star B.) The MACD Profit AlertHaoNo ratings yet

- Courier ServicesDocument5 pagesCourier ServicesAyman KhalidNo ratings yet

- Research Paper SpuDocument21 pagesResearch Paper SpuMithil JoshiNo ratings yet

- Baf Blackbook Gold Part 2Document6 pagesBaf Blackbook Gold Part 2suparnakonarNo ratings yet

- CFL 2010 Retaining Wall Inventory Condition PDFDocument188 pagesCFL 2010 Retaining Wall Inventory Condition PDFHarvin Julius LasqueroNo ratings yet

- NFT Marketplace Potential and Its Expected GrowthDocument5 pagesNFT Marketplace Potential and Its Expected GrowthXANALIA100% (1)

- OtDocument9 pagesOtOTU LIMITEDNo ratings yet

- (SpringerBriefs in Economics) Ashima Goyal (Auth.) - History of Monetary Policy in India Since Independence-Springer India (2014)Document89 pages(SpringerBriefs in Economics) Ashima Goyal (Auth.) - History of Monetary Policy in India Since Independence-Springer India (2014)Dinesh MahapatraNo ratings yet

- Diane chptr1 DoneDocument13 pagesDiane chptr1 DoneRosemenjelNo ratings yet

- A Brief History of Copper Mining in LepantoDocument3 pagesA Brief History of Copper Mining in LepantoGuinevere Raymundo100% (1)

- Deposit Collection at BOKDocument34 pagesDeposit Collection at BOKKrishna Bahadur ThapaNo ratings yet

- Manual Ceteris ParibusDocument14 pagesManual Ceteris ParibusSiddhant ChhabraNo ratings yet

- LendIt PDFDocument4 pagesLendIt PDFLuis GNo ratings yet

- Corporate Fraud AnalysisDocument39 pagesCorporate Fraud AnalysisAnonymous u6yR25kiobNo ratings yet

- Chapter 1Document5 pagesChapter 1Aron Matthew Dela Cruz MolinaNo ratings yet

- Impermanent Loss Hedge Total Return Swap WhitepaperDocument7 pagesImpermanent Loss Hedge Total Return Swap WhitepaperxanderNo ratings yet

- Analyzing Financial Performance of ABAY Banks in Ethiopia: CAMEL ApproachDocument6 pagesAnalyzing Financial Performance of ABAY Banks in Ethiopia: CAMEL ApproachAshebirNo ratings yet

- Best Examples of Chart Patterns For 2012Document12 pagesBest Examples of Chart Patterns For 2012Peter L. Brandt100% (1)

- Basics of International BusinessDocument496 pagesBasics of International Businessadelineo vlog O100% (5)

- MNC Nep PresentationDocument53 pagesMNC Nep PresentationSaajan RathodNo ratings yet

- Ass 2Document4 pagesAss 2Asim HussainNo ratings yet

- Quant Congress - BarCapDocument40 pagesQuant Congress - BarCapperry__mason100% (1)

- Reasons Why Companies Go Public & Zomato's Successful IPODocument10 pagesReasons Why Companies Go Public & Zomato's Successful IPOrohan guptaNo ratings yet