Professional Documents

Culture Documents

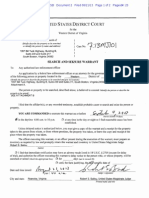

Search Warrant - August 2013

Uploaded by

SouthsideCentral0 ratings0% found this document useful (0 votes)

3K views24 pagesSearch Warrant - August 2013

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSearch Warrant - August 2013

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3K views24 pagesSearch Warrant - August 2013

Uploaded by

SouthsideCentralSearch Warrant - August 2013

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 24

CLERK'S OFFICE U

.s. Djsx cour AO 106 (Rev

.04/10) Application for a Search Warrant

FILED

U NITED STATES D ISTRICT COURT Akg 2 ! 20

for the x u ou uux cuu

W estena District of Virginia BY;

tl-rY CLERK

ln the Matter of the Search of

(Briefly describe the property to be searched

or ident# the person by name and address)

1057 Bill Tuck Highway, Building B,

Suite 239 and Suite 217

South Boston, Virginia 24592

.

134 T z/ C

ase No. .

APPLICATION FOR A SEARCH W ARM NT

1, a federal law enforcement oftice!- or an attorney for the government, request a search warrant and state under

penalty of perjury that l have reason to belleve that on the following person or property (identh the person or describe the

property to be searched and give its locationl:

See Attachment A

located in the Western District of Virginia , there is now concealed (identh the

person or describe the property to be seizedll

See Attachment B

The basis for the search under Fed. R. Crim. P. 41(c) is (checkone or morel'.

V evidence of a crime',

Vcontraband, fruits of crime, or other items illegally possessed;

Yproperty designed for use, intended for use, or used in committing a crime;

O a person to be arrested or a person who is unlawfully restrained.

The search is related to a violation of:

Code Section

18 U.S.C. j 2342 (b)

18 U.S.C. j 1957

26 U.S.C. j 5762(a)(3)

The application is based on these facts:

see attached affidavit, Attachment A

# Continued on the attached sheet.

Offense Description

Contraband Cigarette Trafficking Act

Money Laundering

Tax Evasion

O Delayed notice of days (give exact ending date if more than 30 days: ) is requested

under l 8 U.S.C. j 3 l 03a, the basis of which is set forth on the attached sheet.

/

Applicant 's signature

' eq G IGTGAJS spigctwt- h%c+ar

Printed name and title

Sworn to before me and signed in my presence.

Date: 7 /

v I-'Q /2

F

City and state: Roanoke, Virginia

Judge 's nknature

Robert S. Ballou, United States Magistrate Judge

Printed name and title

Case 7:13-mj-00101-RSB Document 1 Filed 08/21/13 Page 1 of 15 Pageid#: 1

CLERKS OFFICE U,S. DISX COUG

AT ROANOKE, VA

FILED

ALC 2 1 2913

JUL DU LEY CLERK

BY;

PUTY CLERK

IN THE UNITED STATES DISTRICT COURT

FOR THE W ESTERN DISTRICT OF VIRGINIA

IN TllE M ATTER OF THE SEARCH OF;

The Premises at

1057 Bill Tuck Highway, Building B, Suites 239 and 217

South Boston, Virginia 24592

) V:13$ Tll

AFFIDAVIT IN SUPPORT OF SEARCH W ARRANT

1, Special Agent Robert E. M artens, being duly sworn herby depose and say:

INTRODUCTION

I have been employed as a Special Agent (SA) with the lnternal Revtnue Service (IRS),

Crim inal lnvestigation Division for 9 years. For the last approximately 2.5 years, l have

been detailed to the Alcohol Tobacco Tax and Trade Bureau (TTB). As a Special Agent

with lRS my duties include, but are not lim ited to, conducting criminal investigations

concerning violations of the Internal Revenue Code, money laundering, the bank secrecy

act, and m ore recently violations regarding tobacco diversion including the Contraband

Cigarette TrafGcking Act.

2. As a result of m y personal participation in the investigation of matters referred to in this

affidavit, l am fam iliar with the facts and circumstances of this investigation. On the

basis of personal observation, as well as familiarity, I have determined the following:

For the past 12 months your affiant has been involved in an investigation of Kathryn C.

Farley, CB Holdings LLC, Firebird M anufacturing LLC, a cigarette m anufacturing in the

W estern District of Virginia, and Cherokee Tobacco Company LLC, for a conspiracy to

fail to pay the Federal excise tax on cigarettes that Firebird M anufacturing LLC

manufactures. Based on my investigation, there is probable cause to believe that Kathryn

C. Farley, President of both Firebird M anufacturing LLC and Cherokee Tobacco

Company LLC, owned by CB Holdings LLC is involved in a conspiracy to commit wire

fraud, conspiracy to com mit money laundering, and conspiracy to violate the Contraband

tl d

.

/ > .J'

Case 7:13-mj-00101-RSB Document 1 Filed 08/21/13 Page 2 of 15 Pageid#: 2

Cigarette Trafficking Act. Your affiant bases this affidavit upon personal knowledge,

information obtained from the review of official records, public records, and information

filed with TTB.

4. This affidavit is submitted in support of an application for a search warrant for Firebird

M anufacturing LLC and Cherokee Tobacco Company LLC, 1057 Bill Tuck Highway,

Building B, South Boston, Virginia 24592; and 1057 Bill Tuck Highway Suite 239,

South Boston, Virginia 24592, which is further described in Attachment A.

BACK GROUND

The Alcohol Tobacco Tax and Trade Bureau (TTB) administers and enforces laws and

TTB regulations pertaining to producing tobacco products and for collecting excise taxes

on tobacco.

6. The Contraband Cigarette Trafticking Act (CCTA) requires that any person who sells,

ships, transfers or otherwise disposes of more than 10,000 cigarettes in a single

transaction maintain records of the transaction that state the full name of the purchaser,

the street address (including city and sute) to which the cigarettes were destined, and the

quantity of the cigarettes in question. The CCTA makes it illegal for any person

knowingly to make any false statement or representation with respect to the information

required to be kept in the records of any person who ships, sells, or distributes any

quantity of cigarettes in excess of l 0,000 in a single transaction.

7. Proper and truthful record keeping and documentation as mandated by federal law and

regulations are essential to enable TTB to perform its function with regard to record

keeping of operations and transactions by cigarette manufacturers. False record keeping

impedes perform ance of TTB'S function and unduly hinders the effective administration

ofjustice.

8. It is unlawful under Federal law to conspire to impede a federal agency's perform ance of

its function or unduly hinder the administration of justice, falsify records or make false

statements concerning a matter under thejurisdiction of a federal agency, including IRS

and TTB, evade Federal Cigarette Excise Taxes or to use the mails or wires in

furtherance of a scheme to defraud.

9. Firebird M anufacturing, LLC, is a corporation organized and existing under the laws of

Virginia, and has manufactured Cherokee brand cigarettes since purchasing the

manufacturing facility from Virginia Brands, LLC, in early 2010. Firebird

M anufacturing, LLC, has also manufactured Sem inole and Palmetto brand cigarettes

2 /

yu /

(

/ $J?

Case 7:13-mj-00101-RSB Document 1 Filed 08/21/13 Page 3 of 15 Pageid#: 3

during that time frame. Firebird is located at 1057 Bill Tuck Highway, Building B, South

Boston, Virginia 24592, within the W estern District of Virginia. Cherokee Tobacco LLC

is a wholesaler of tobacco products and is located at 1057 Bill Tuck Highway, Suite 239,

South Boston, Virginia 24592, within the W estern District of Virginia.

10. Firebird Manufacturing is a TTB permitted Manufacturer of Tobacco Products (MTP),

permit number TP-VA-15004.

l 1. Title 26, United States Code, j 5701(b) imposes a tax on tobacco products manufactured

in the United States. On cigarettes weighing not more than 3 pounds per thousand, the

tax is $50.33 per thousand, or $10.066 per carton.

12. In 1998, forty-six states and six territories entered into a M aster Settlement Agreement

(MSA) with several major cigarette manufacturers. The parties intended the settlement to

end further litigation between state governm ents and cigarette manufacturers. As part of

the settlement, the states released the manufacturers from past and future liability in

exchange for the m anufacturers' agreement to abide by advertising and promotional

restrictions and to m ake annual moneury payments to the states based on annual cigarette

sales. Under the settlement, the manufacturers' payments to the States were subject to

reduction based on lost market share, but the paym ent was not reduced if the State

enacted and enforced a Iaw that required cigarette manufacturers that were not parties to

the Master Settlement Agreement (Non-participating Manufacturers) to make specifed

annual deposits into an escrow fund based on the number of the m anufacturer's cigarettes

sold in the state, as measured by state excise taxes applied to such cigarette sales. The

states' Iaws also required that such manufacturers file annual certifications truthfully

stating that the required escrow deposits were made.

l3. Firebird Manufacturing LLC, is a Non-participating Manufacturer (NPM) of the

Cherokee cigarette brand for a related company, Cherokee Tobacco Company, and

several private label brands of cigarettes, cigars and pipe tobacco. In order to be

profitable, Cherokee cigarettes sold to wholesalers in M SA states must include escrow

payments in the sale price to wholesalers who will stamp and sell Cherokee cigarettes.

14. Title 26, United States Code, j 5703(a)(1) provides that the manufacturer or importer of

tobacco products and cigarette papers and tubes shall be liable for the taxes imposed

thereon by Section 5701 .

15. Title 26, United States Code, j 5703(b)(1) provides that the taxes imposed by Section

5701 shall be determ ined at the tim e of removal of the tobacco products and cigarette

papers and tubes, that such taxes shall be paid on the basis of a return, that the Secretary

3

o/

?

('% ylM

Case 7:13-mj-00101-RSB Document 1 Filed 08/21/13 Page 4 of 15 Pageid#: 4

shall, by regulations prescribe the period or the event for which such return shall be made

and the information to be furnished on such return.

16. Title 26, United States Code, j 57624a) states that whoever, with the intent to defraud the

United States:

(2)...Fai1s to keep or make any record, return, reporq or inventory, or keeps or makes

any false or fraudulent record, return, report, or inventory required by this chapter or

regulations thereunder; or

(3)...Refuses to pay any tax imposed by this chapter, or attempts in any manner to

evade or defeat the tax or the paym ent thereof; or

(4)...Removes, contrary to this chapter or regulations thereunder, any tobacco

products or cigarette papers or tubes subject to tax under this chapter:

Shall, for each such offense, be fined not more than $10,000, or imprisoned not more

than 5 years or both.

17. Title 26, United States Code, j 5741 , provides that every manufacturer of tobacco

products or cigarette papers and tubes, every importer, and every export warehouse

proprietor shall keep such records in such a manner as the Secretary shall by regulation

prescribe. The records required under this section shall be available for inspection by any

internal revenue officer during business hours.

18. Title 26, United States Code, j 5705, provides that Credit or refund of any tax imposed

by this chapter or section 7652 shall be allowed or made (without interest) to the

manufacturer, importer, or export warehouse proprietor, on proof satisfactory to the

Secretary that the claimant manufacturer, importer, or export warehouse proprietor has

paid the tax on tobacco products and cigarette papers and tubes withdrawn by him from

the market; or on such articles lost (otherwise than by theft) or destroyed, by fire,

casualty, or act of God, while in the possession of ownership of the claimant.

19. Title 18, United States Code, j 1957 states: Whoever... knowingly engages or attempts

to engage in a monetary transaction in criminally derived property of a value greater than

$10,000 and is derived from specified unlawful activity.

20. 27 CFR 40.181, provides that every manufacturer of tobacco products m ust keep records

of his operations and transactions which shall reflect, for each day, the information

specified in 40.182 and 40.183. For this purpose day shall m ean calendar day. ..

27 CFR 40.185, Retention of records, provides that al1 records required to be kept under

this part, including copies of authorizations, claims, inventories, notices, reports, returns

4

f-/

$

) P sj t

Case 7:13-mj-00101-RSB Document 1 Filed 08/21/13 Page 5 of 15 Pageid#: 5

and schedules, shall be retained by the manufacturer for three years following the close

of the calendar year in which filed or made, or in the case of an authorization, for three

years following the close of the calendar year in which the operation under such

authorization is concluded. Such records shall be kept in the factory or a place

convenient thereto, and shall be made available for inspection by any TTB offker upon

his request.

STATEM ENT OF FACTS

22. Firebird Manufacturing LLC, (Firebird) is a manufacturer of tobacco products located in

South Boston, Virginia that at least from M arch 2010 to July 2013, manufacmred

Cherokee brand cigarettes as well as other cigarettes and filtered cigars. Cherokee

Tobacco Company LLC, is a wholesaler of tobacco products that primarily sells the

cigarettes manufactured by Firebird. During this tim e, Kathryn Farley started as Vice

President and in June 2012 was promoted to President of both Firebird and Cherokee

Tobacco Company LLC. Firebird's manufacturing plant is located at 1057 Bill Tuck

Highway, Building B and Suite 239, South Boston, Virginia, located in the W estern

District of Virginia.

23. Cooperating Witness //1 (CW#1) contacted TTB in June of 2012 and has been and

continues to be a highly reliable source of information. Information provided by CW #1

has been corroborated by records filed with TTB and other cooperating witnesses.

24. On September 14, 201 1 TTB authorized Firebird to destroy 3,792,800 sticks of cigarettes.

After the product was destroyed, Firebird filed a claim of $190,891.62 for the Federal

Excise Tax (FET) on these products.

25. Firebird claimed the cigarettes were returned for a variety of reasons m ostly due to

quality issues on cigarettes m anufactured since Firebird started business in M arch 2010.

26. A TTB Auditor witnessed the destruction on October 7, 201 l . The number of sticks was

reduced to 3,750,760 and the tax amount adjusted to $188,775.75. The claim for a

Federal Excise Tax refund was denied as an audit team did not feel the documentation

supplied was sufficient.

27. After the destruction CW #1 contacted TTB. CW #1 claimed Firebird had planned to

destroy oId product they had not manufactured or paid taxes on, but when TTB wanted to

witness the destruction they changed the product and altered records given to TTB.

28. CW #1 stated that Firebird planned to destroy imported product and old product from the

manufacturer they had purchased. CW #1 stated that once notified TTB would observe

5

43 J' *1

s

/

Case 7:13-mj-00101-RSB Document 1 Filed 08/21/13 Page 6 of 15 Pageid#: 6

the destruction the product was switched out for new product and the destruction team

ordered to go slow. Firebird would not have been eligible for a tax refund associated

with the destruction of product manufactured or imported by the previous manufacturer,

to be eligible for a tax refund, Firebird would need to destroy product that they had

manufactured since the purchase of the manufacturing facility in M arch 2010.

29. CW #1 stated that Firebird pulled new product to destroy in order to conceal the old

product they planned to destroy, but the new product they destroyed did not match

invoices from M arch 2010 when they began manufacturing. Firebird destroyed Cherokee

M enthol Gold Kings but the invoices they were planning on using for support had

M enthol Green and M enthol Gold 100s and M enthol Green Kings. CW #l produced

original invoices and altered invoices to show changes that had been made.

30. Firebird's QuickBooks files were obtained during a civil audit conducted by TTB in

November 201 1. The records were kept at the place to be searched. A review of the

QuickBooks's Audit Trail file showed that the invoices provided by CW#1 showed that

the invoices provided by CW #l had been altered on October l2, 20l l , after the TTB

auditor asked for supporting documents.

31 . Starting in November 201 1, the amount of tax reported on and paid per Firebird's tax

returns was less than the amount of tax due based on a calculation of the removals on the

monthly reports.

32. The TTB Monthly Reports, Form 5210.5, are filed and signed, under penalty of perjul.y

by Kathy Farley, and report manufacture and removal information for the manufacturer.

33. CW #1 stated that office personnel prepare the TTB M onthly Reports, Form 5210.5,

based upon the manufacture and removal information provided to CW #1, and provides

the report for filing to Farley.

34. The federal excise tax returns, filed twice a month, and three times in September, are

filed electronically through a user account established by Farley.

35. Using the monthly report of removals filed with TTB the tax due for the month was

recalculated using the Removed Subject to Tax line of the monthly report. This figure

was then reconciled to the tax returns filed by Firebird for the corresponding period. The

figure should match, however since November 201 1 the tax payment has been far less

than the tax Iiability calculated from the m onthly reports.

6

6 #/

i

/ t!#

Case 7:13-mj-00101-RSB Document 1 Filed 08/21/13 Page 7 of 15 Pageid#: 7

36. The tax liability associated with the underpaym ent from November 201 1 through July

2013 is approximately 10.8 million dollars.

37. CW #1 also stated that office personnel complete a tax calculation and prepare draft TTB

Excise Tax Returns, which are provided to Farley. CW #1 was able to provide the draft

returns provided to Farley by office personnel for January 2013. The tax liability on the

draft tax returns reconciles with the tax liability of the TTB M onthly report for the period.

CW #1 stated that oftke personnel provide Farley with the draft tax returns based upon

the monthly report.

38. 1 approached CW #2 in approximately October 2012.

information in the past to multiple federal agencies.

business.

CW #2 has provided reliable

CW #2 operates a tobacco wholesale

39. CW #2 has been providing documentary evidence as well as conducting consensually

monitored phone calls on our behalf. Additionally CW #2 has met face to face with

Farley in a monitored situation.

40. CW #2 operates in states that participate in the M SA. The M SA fee is approximately

$5.80 a carton. The Federal Excise Tax is approximately $10.06 per carton. Thus if

Federal Taxes and the M SA are paid, the regulatory costs and taxes on a carton of

cigarettes is at least $15.86 a carton.

41. ln August of 2012 Kathy Farley offered to sell cartons of Cherokee cigarettes to CW #2

for $16 a carton. After three sales totaling 8,220 cartons, the price was reduced to $15 a

carton.

42. For a1I the sales to CW#2 at $15 and $16 a carton, Farley created false documents to hide

the true price. Farley invoiced CW#2 at a higher price, for example $19.95 a carton, then

issued a credit memo to the company to reduce the price to approximately $1 8.25. Farley

then drafts CW#2's account for a cost of approximately $1 8.25 a carton. Farley later

wires funds back to CW #2 to reduce the effective price to $15 a carton.

43. Between August 1, 2012 and June 6, 2013 Farley sold cigarettes to CW #2 using the false

invoicing schem e to sell cigarettes below the regulatory cost creating at least 32 false

invoices, for a total of 2 10,600 cartons of cigarettes and drafted CW #2's account for a

total of $4,201,470 and wired CW #2 return wires totaling $1,033,842.

44. Farley wired CW #2 funds to reduce and conceal his actual price on at least 15 occasions,

where all but one occasion exceeded $10,000.

13

,

( 2 #l.

4/

Case 7:13-mj-00101-RSB Document 1 Filed 08/21/13 Page 8 of 15 Pageid#: 8

45. As part of an undercover operation on M ay 22, 2013 and M ay 23 2013, CW #2 toured the

manufacturing facility, the Firebird and Cherokee Tobacco offices, and met directly with

Farley. W hile at the manufacturing facility, CW #2 noticed that Firebird appeared to have

a large volume of raw materials. The evening of M ay 22, 2013, while at a party hosted by

Cherokee Tobacco, Farley confirmed that CW#2 would continue to receive the $l5 a

carton pricing.

46. Your affiant is also aware that in addition to documentary evidence records and other

evidence of crimes are kept in digital format on computers and other electronic media. lt

is the affiant's further experience that both physical and electronic evidence relating to

transactions for tobacco manufacturing and wholesaling businesses are kept for lengthy

periods of time, in order to respond to audits and for other business reasons. By law,

tobacco manufacturers and wholesalers are required to maintain records for a period of

three years.

47. Your affiant has examined land records, utility records, and business records for the

locations to be searched, and has conducted surveillance of the locations to be searched.

M y exam ination has determined that, as to each of the locations to be searched, it is a

business location for the individuals described in paragraph three of this afGdavit.

48. The offenses described in this afsdavit are associated with persons and businesses that

routinely keep records in paper, digital, and electronic forms. Individuals involved in

fraud schemes, money laundering and CCTA violations maintain documents, letters and

records relating to their illegal activities for long periods of time. This documentary

evidence is usually secreted within their residences and the surrounding outbuildings;

their vehicles; the residences of fam ily members, friends and associates; the places in

which they conduct their business; or in storage areas. Regulations require that

manufacturers of cigarettes maintain the required records for a term of three years.

According to TTB and persons/entities in the industry the normal business practice for

retention of records in the industry is even longer - a period of seven years. Based on the

facts set forth in this affidavit it is believed that probable cause exist that records, fruits,

instrumentalities, and evidence of a crime pertaining to the alleged offenses are

maintained at the locations owned or occupied by the conspirators detailed in attachment

A, which is incorporated and made a part of this Affdavit.

DIGITAL EVIDENCE

49. As described above and in Attachment B, this application seeks permission to search for

records that might be found on the PREM ISES, in whatever form they are found. One

form in which the records m ight be found is data stored on a computer's hard drive or

other storage m edia. Thus, the warrant applied for would authorize the seizure of

electronic storage media or, potentially, the copying of electronically stored information,

all under Rule 41(e)(2)(B).

8

l bl

y l ) #

Case 7:13-mj-00101-RSB Document 1 Filed 08/21/13 Page 9 of 15 Pageid#: 9

50. Your affiant knows that Firebird and Cherokee Tobacco LLC are required by Federal law

to keep records that relate to the business of cigarette manufacturing and that Firebird and

Cherokee Tobacco keep records in both written and computer maintained dal. Your

affant knows that Firebird m aintains its financial records in a computerized format since

TTB was provided with computerized format during an audit in 20l 1 .

51 . lRS Special Agent-cls Robbie O'Brien is a Computer lnvestigative Specialist with the

IRS and has specialized training and experience in investigations involving computer and

other digital evidence. ClS O'Brien informed me that computer hardware, sohware,

documentation, passwords, and data security devices may be important to a criminal

investigation in 4 respects, they may: (l) contain contraband, (2) be an instrumentality of

an offense, (3) be fruits of a crime, or (4) contain evidence of crime (items that are

evidence or may have been used to collect and-store information about crimes) created,

stored or maintained as electronic or digital data/information. Rule 41 of the Federal

Rules of Criminal Procedure permits the government to search for and seize computer

hardware, software, documentation, passwords, and data security devices which are (1)

contraband, (2) instrumentality's, (3) fruits, or (4) evidence of crime. The computer and

related media can be one or more of the aforementioned classifk ations.

52. Probable cause. l subm it that if a computer or storage medium is found on the

PREM ISES, there is probable cause to believe those records will be stored on that

computer or storage medium, for at least the following reasons:

Based on m y knowledge, training, and experience, l know that computer files or

remnants of such files can be recovered months or even years after they have been

downloaded onto a storage medium, deleted, or viewed via the Internet. Electronic

files downloaded to a storage medium can be stored for years at little or no cost.

Even when files have been deleted, they can be recovered months or years later using

forensic tools. This is so because when a person ''deletes'' a file on a computer, the

data contained in the file does not actually disappear; rather, that data remains on the

storage medium until it is overwritten by new data.

Therefore, deleted files, or remnants of deleted files, may reside in free space or slack

space-that is, in space on the storage medium that is not currently being used by an

active file-for Iong periods of time before they are overwritten. ln addition, a

computer's operating system may also keep a record of deleted data in a ''swap'' or

''recovery'' file.

W holly apart from user-generated files, computer storage media-in particular,

computers' internal hard drives-contain electronic evidence of how a computer has

9

,'

)

t Iz

Case 7:13-mj-00101-RSB Document 1 Filed 08/21/13 Page 10 of 15 Pageid#: 10

been used, what it has been used for, and who has used it. To give a few examples,

this forensic evidence can take the form of operating system configurations, artifacts

from operating system or application operation, file system data structures, and

virtual memory ''swap'' or paging files. Computer users typically do not erase or

delete this evidence, because special software is typically required for that task.

However, it is technically possible to delete this information.

Similarly, fles that have been viewed via the lnternet are sometim es autom atically

downloaded into a temporary Internet directory or ''cache.''

53. Forensic evidence. As further described in Attachment B, this application seeks

permission to locate not only computer Gles that might serve as direct evidence of the

crimes described on the warrant, but also for forensic electronic evidence that establishes

how computers were used, the purpose of their use, who used them, and when. There is

probable cause to believe that this forensic electronic evidence will be on any computer

in the PREM ISES because:

Data on the storage medium can provide evidence of a file that was once on the

storage medium but has since been deleted or edited, or of a deleted portion of a file

(such as a paragraph that has been deleted from a word processing filel. Virtual

memory paging systems can leave traces of information on the storage medium that

show what tasks and processes were recently active. W eb browsers, e-mail programs,

and chat programs store configuration information on the storage medium that can

reveal information such as online nicknames and passwords. Operating systems can

record additional information, such as the attachment of peripherals, the attachment

of USB tlash storage devices or other external storage media, and the times the

computer was in use. Computer file systems can record information about the dates

files were created and the sequence in which they were created.

Forensic evidence on a computer or storage medium can also indicate who has used

or controlled the computer or storage medium . This ''user attribution'' evidence is

analogous to the search for ''indicia of occupancy'' while executing a search warrant

at a residence. For example, registry information, configuration files, user profiles, e-

mail, e-mail address books, ''chat,'' instant messaging logs, photographs, the presence

or absence of malware, and correspondence (and the data associated with the

foregoing, such as file creation and last-accessed dates) may be evidence of who used

or controlled the computer or storage medium at a relevant tim e.

A person with appropriate familiarity with how a computer works can, after

examining this forensic evidence in its proper context, draw conclusions about how

computers were used, the purpose of their use, who used them, and when.

10

) W

'

) (l

Case 7:13-mj-00101-RSB Document 1 Filed 08/21/13 Page 11 of 15 Pageid#: 11

The process of identifying the exact files, blocks, registry entries, logs, or other forms

of forensic evidence on a storage medium that are necessary to draw an accurate

conclusion is a dynamic process. W hile it is possible to specify in advance the

records to be sought, computer evidence is not always data that can be merely

reviewed by a review team and passed along to investigators. W hether data stored on

a computer is evidence may depend on other inform ation stored on the computer and

the application of knowledge about how a computer behaves. Therefore, contextual

information necessary to understand other evidence also falls within the scope of the

warrant.

Further, in finding evidence of how a computer was used, the purpose of its use, who

used it, and when, sometimes it is necessary to establish that a particular thing is not

present on a storage medium . For example, the presence or absence of counter-

forensic programs or anti-virus programs (and associated data) may be relevant to

establishing the user's intent.

54. Necessity ofseizing or copying entire computers or storage media. In most cases, a

thorough search of a premises for information that might be stored on storage media often

requires the seizure of the physical storage m edia and later off-site review consistent with

the warrant. In lieu of removing storage media from the premises, it is sometimes

possible to make an image copy of storage media. Generally speaking, imaging is the

taking of a complete electronic picture of the computer's data, including al1 hidden

sectors and deleted files. Either seizure or imaging is often necessary to ensure the

accuracy and completeness of data recorded on the storage m edia, and to prevent the loss

of the data either from accidental or intentional destruction. This is true because of the

following:

a. The tim e required for an examination. As noted above, not all evidence takes the

form of documents and files that can be easily viewed on site. Analyzing

evidence of how a computer has been used, what it has been used for, and who

has used it requires considerable time, and taking that much time on premises

11

l

f 4) '

Case 7:13-mj-00101-RSB Document 1 Filed 08/21/13 Page 12 of 15 Pageid#: 12

could be unreasonable. As explained above, because the warrant calls for forensic

electronic evidence, it is exceedingly likely that it will be necessary to thoroughly

exam ine storage media to obtain evidence. Storage media can store a large

volume of information. Reviewing that information for things described in the

warrant can take weeks or months, depending on the volume of data stored, and

would be impractical and invasive to attempt on-site.

b. Technical reguirements. Computers can be configured in several different ways,

featuring a variety of different operating systems, application sohware, and

contigurations. Therefore, searching them sometimes requires tools or knowledge

that might not be present on the search site. The vast array of computer hardware

and software available makes it difficult to know before a search what tools or

knowledge will be required to analyze the system and its data on the Premises.

However, taking the storage media off-site and reviewing it in a controlled

environment will allow its exam ination with the proper tools and knowledge.

Varietv of form s of electronic media. Records sought under this warrant could be

stored in a variety of storage media formats that may require off-site reviewing

with specialized forensic tools.

55. Nature ofexamination. Based on the foregoing, and consistent with Rule 41(e)(2)(B),

when persons executing the warrant conclude that it would be impractical to review the

media on-site, the warrant l am applying for would permit seizing or imaging storage

media that reasonably appear to contain some or al1 of the evidence described in the

warrant, thus permitting its later examination consistent with the warrant. The

examination may require techniques, including but not lim ited to computer-assisted scans

of the entire m edium , that m ight expose many parts of a hard drive to human inspection

in order to detennine whether it is evidence described by the warrant.

12

/ ,?'% t

p,I 4

Case 7:13-mj-00101-RSB Document 1 Filed 08/21/13 Page 13 of 15 Pageid#: 13

REQUEST FOR SEALING

Because this is a continuing investigation, your Affant requests that the search warrant, search

warrant application, sealing application and order, and this affidavit be sealed until such time as

the Court directs otherwise. Public disclosure of these documents at this time would seriously

jeopardize the ongoing investigation, provide an opportunity to destroy evidence, change

patterns of behavior, notify confederates, or allow confederates to flee or continue tlight from

prosecution. Furthermore, this investigation may result in applications for additional search

warrants to be executed at other locations in the near future.

CONCLUSION

Based on the information outlined above, your affiant believes that Firebird, Cherokee Tobacco

LLC, and President Kathryn Farley have violated Title l 8 U.S.C. j 2342 (b), by knowingly

making a false statement with respect to the information required by a licensee; Title 18 U.S.C. j

1957 for knowingly engaging in a m onetary transaction in criminally derived property of a value

greater than $ 10,000 and is derived from a specified unlawful activity; Title 26 U.S.C. j

5762($43) by refusing or failing to pay taxes imposed by Title 26 U.S.C. j 5703 and 5701.

Your affiant believes that there is probable cause to believe that there is evidence of these

violations of Federal law, specifkally identified in Attachment A, present at the business

location of Firebird M anufacturing LLC, and Cherokee Tobacco LLC, 1057 Bill Tuck Highway,

Suites 239 and 217, South Boston, VA 24592, and 1057 Bill Tuck Highway, Building B, South

Boston, VA 24592. Your affiant believes that this evidence is stored in handwritten, typewritten

and electronic format. Your affiant respectfully requests that a warrant be issued to authorize the

search of the premises described in Attachment A, at 1057 Bill Tuck Highway, Building B, Suite

239 and Suite 217, South Boston, Virginia 24592, and to seize the items described in Attachment

B.

OBER . M ARTENS, SPECIAL AGENT

1RS CRIM INAL INVESTIGATION

13

l.b

yl

1

1 Jt

4

Case 7:13-mj-00101-RSB Document 1 Filed 08/21/13 Page 14 of 15 Pageid#: 14

z/-

swon AND suBscmBEo BEFORE ME ox THIs IL DAY OF AUGUST, 2013.

ROBERT S. BALLOU

UNITED STATES M AGISTRATE JUDGE

W ESTERN DISTRICT OF VIRGINIA

ATTACHM ENTS

ATTACHM ENT A - DESCY PTION OF LOCATION S TO BE SEARCHED

ATTACHM ENT B - ITEM S TO BE SEIZED

Case 7:13-mj-00101-RSB Document 1 Filed 08/21/13 Page 15 of 15 Pageid#: 15

IN THEUNITEDSTATESDISTRICT COURT

FORTHEWESTERNDISTRICTOFVIRGINIA

INTHEMATTEROFTHESEARCHOF:

)

)

ThePremisesat )

1057BillTuckHighway,BuildingB, Suites239and217 )

SouthBoston, Virginia24592 )

ATTACHMENTA

DESCRIPTIONOFLOCATIONSTOBE SEARCHED- WDVA

Youraffiantsubmitsthatthere is probablecauseto believethatarticlesconstitutingcontraband,

evidence,fruits, and instrumentalitiesoftheaforementionedcriminalviolationswill befound on

thepersonsoforat thetarget locationslisted below:

1. 1057BillTuckHwy, BuildingB, South Boston, Virginia24592. Thepremises, is

identifiedasthe currentwarehouseand manufacturingfacility forFirebird

ManufacturingLLC,and CherokeeTobaccoCompanyLLCand is describedasan

industrial warehouseand manufacturingfacility. Thebuildingis located behind

1057,BuildingA, which is an unrelated business. CherokeeTobaccoand Firebird

Manufacturingsignsarevisibleonthefrontofthe building.Thebuilding is tan and

metal. Thefrontand sideofthe buildingappearto havewarehousedoors.

Case 7:13-mj-00101-RSB Document 1-1 Filed 08/21/13 Page 1 of 5 Pageid#: 16

---

2. 1057Bill TuckHwy, Suite239,South Boston,VA24592, is located in a multi-office

officebuildingthathouses theofficesfor Firebird ManufacturingLLC and Cherokee

Tobacco LLC. Sourceshaveprovided thatthe mainCherokeeTobaccoLLCand

Firebird ManufacturingLLCofficesarehoused insuite239. Thebuildingis tan

concrete buildingwithfrontand rearentrances. Thefrontentrancehasexterior

concretestairsand largetwo level glasswindowssurroundingtheglassentrydoors.

Thereare no similarbuildings in thearea.

Case 7:13-mj-00101-RSB Document 1-1 Filed 08/21/13 Page 2 of 5 Pageid#: 17

3. 1057 Bill TuckHwy,Suite217,South Boston,VA 24592, is located in a multi-office

officebuildingthat housestheofficesfor FirebirdManufacturingLLC and Cherokee

TobaccoLLC. Sourceshaveindicatedthatat leastone FirebirdManufacturingLLC

employeeworksatthis location. Thebuildingis tanconcretebuildingwithfrontand

rearentrances. Thefrontentrance hasexteriorconcretestairsand largetwo level

glasswindowssurroundingtheglassentrydoors. Thereare no similarbuildingsin

thearea.

Case 7:13-mj-00101-RSB Document 1-1 Filed 08/21/13 Page 3 of 5 Pageid#: 18

2. 1057Bill TuckHwy, Suite239, South Boston,VA24592, is located in a multi-office

officebuildingthathousestheofficesfor FirebirdManufacturingLLCand Cherokee

TobaccoLLC. SourceshaveprovidedthatthemainCherokeeTobaccoLLCand

Firebird ManufacturingLLCofficesare housed in suite239. Thebuilding is tan

concretebuildingwith frontand rearentrances. Thefrontentrancehas exterior

concretestairsand largetwo level glass windowssurroundingtheglassentrydoors.

Therearenosimilarbuildings in thearea.

Case 7:13-mj-00101-RSB Document 1-1 Filed 08/21/13 Page 4 of 5 Pageid#: 19

3. 1057Bill TuckHwy, Suite217,SouthBoston, VA24592, is locatedin a multi-office

officebuildingthathousestheofficesfor Firebird ManufacturingLLCandCherokee

TobaccoLLC. SourceshaveindicatedthatatleastoneFirebirdManufacturingLLC

employeeworksatthis location. The buildingis tanconcretebuildingwithfrontand

rearentrances. Thefrontentrancehasexteriorconcretestairsand largetwo level

glasswindowssurroundingtheglassentrydoors. Thereareno similarbuildingsin

thearea.

Case 7:13-mj-00101-RSB Document 1-1 Filed 08/21/13 Page 5 of 5 Pageid#: 20

INTHEUNITEDSTATESDISTRICTCOURT

FORTHEWESTERNDISTRICTOFVIRGINIA

INTHEMATTEROF THESEARCHOF: )

)

ThePremisesat )

1057BillTuckHighway, BuildingB, Suites239and217 )

SouthBoston, Virginia24592 )

ATTACHMENT B

DESCRIPTIONOFITEMSTOBESEIZED- WESTERN DISTRICTOFVIRGINIA

I) Blackberry, J-Phone, Droid orsimilarstyled device/cellulartelephone,PDA,I-Pad or

similardevicecapableofperformingsimilarfunctions regardlessofthemakeor

brand nameofthedevice, belongingtoorunderthedominionorcontrol of Kathryn

Farley,Firebird ManufacturingLLC,orCherokeeTobaccoLLC,oranyperson

involved in thesaleofdistributionofproductfrom Firebird ManufacturingLLCor

CherokeeTobaccoLLC.

2) Businessand/orpersonal recordsofcigaretteortobacco producttransactionsand

financial recordsandotherrecordsordocumentsreflectingdiversionactivityorthe

disposition ofproceedsofanyspecified unlawful activity including, but not limited

to, thefollowing:

a) retained copiesoffederal, state,and local excise,corporate,partnership,

business,and personal incometax returns; FormsW-2; Forms 1099; tax

records; anysupportingdocumentationand attachments; and any

correspondenceto/from taxingagencies;

b) notesoffinancial transactionsand/or cigaretteortobaccoproducts

transactions;

c) correspondence, including electronic mail transmissions. letters. {axes. and

notes. relatingto financial transactionsand/or cigaretteoftobaccoproducts

transactions, includingthe identificationofcustomers,suppliers, associates,

partnersandco-conspirators;

Case 7:13-mj-00101-RSB Document 1-2 Filed 08/21/13 Page 1 of 4 Pageid#: 21

d) bank records, includingdepositslips,cancelledchecks,withdrawal slips,and

accountstatements, investmentrecords, including brokeragestatements,and

creditand debitcard records;

e) currency, bankchecks,cashier'schecks, negotiablefinancial instruments,

wiretransferdocumentation, moneyorders, stocks, bonds, preciousmetals,

and real estate records; and/orwork sheets, tallysheetsorledgersheets

reflectingoraccountingfor money received, disbursed orexchanged.

f) financial statements, incomestatements, balancesheets,cashreceipts,cash

disbursements, payroll, inventory, manufacturingrecords andjournalsand

records; and any supportingwork papers, schedules, attachmentsor

documents;

g) bills and invoices, including sales. purchases and expenses;

h) recordsoffinancial paymentspaid and received;

i) mortgageor loan recordspayableorreceivableand insurance records;

j) Deeds, titlesorotherproofofownershipofproperty;

k) recordsand keys ofstoragefacilitiesowned or rented;

I) recordsofbusinessfilings or licensesand minutesofmeetings;

m) recordsofpersonal and businessexpenses;

n) safe depositrecords and keys;

0) postoffice box and private mail box records;

p) equipmentrental records and otherleaseand rental agreements;

q) transportation records, including butnot limited to, accounts, bills, receipts

and invoices, billsoflading, airway bills, freight bills, aircargo bills, dispatch

records, logs, manifests,shippingdocuments, and invoices;

r) creditapplications,creditcard statementsand receipts;

s) papertickets, notes, schedules, receipts, and otheritems relatingto travel;

t) cellularphones belongingto orunderthedominionorcontrol ofKathryn

Farley, Firebird ManufacturingLLC,orCherokeeTobaccoLLC, orany

person involved in the saleofdistribution ofproductfrom Firebird

Case 7:13-mj-00101-RSB Document 1-2 Filed 08/21/13 Page 2 of 4 Pageid#: 22

Manufacturing LLC or Cherokee Tobacco LLC, and cellular and landline

telephone statements and records relating thereto;

u) any packages and related shipping materials related to importations or

interstate shipments of cigarettes, including, but not limited to Federal Express

Mail receipts along with all Western Union receipts for sending or receiving

money.

3) Safes and their contents, iffound, or indications that a safe was previously installed or

located in the business

4) Records that identify customers, suppliers, associates partners, and/or co-conspirators,

including, but not limited to: contracts, address books, telephone books, rolodexes,

telephones, pagers, or personal digital assistants with stored telephone information,

notes reflecting telephone and pager numbers, photographs (to include still photos,

negatives, movies, slides, video tapes), and recordings of conversations, including

those made over telephone answering machines.

5) Identification documents, to include driver's license, passports, visas or similar

documents and representative exemplars or original handwriting samples.

6) Papers, tickets, notes, receipts, and other documents or items relating to domestic and

international travel.

7) Indicia of occupancy, residency, and/or ownership of the premises, property and/or

vehicles, including keys, photographs, or documents.

8) Documents showing custody and control of the residence or room where evidence is

seized, including, but not limited to, utility and other bills, driver's licenses,

passports, visas and other handwritten notes or other correspondence addressed to or

from the occupants of the residence or room.

9) For purposes of this attachment, the following definitions and inclusions apply:

a) Records and Information

The terms "records" and "information" include all of the foregoing items of

evidence in whatever form and by whatever means they may have been created or

stored, including any electrical, electronic, or magnetic form (such as any

information on an electronic or magnetic storage device, including floppy

diskettes, hard disks, ZIP disks, CD-ROMs, optical discs, backup tapes, printer

buffers, smart cards, memory calculators, pagers, personal digital assistants such

as Palm Pilot computers, as well as printouts or readouts from any magnetic

storage device); any handmade form (such as writing, drawing, painting); any

mechanical form (such as printing or typing); and any photographic form (such as

Case 7:13-mj-00101-RSB Document 1-2 Filed 08/21/13 Page 3 of 4 Pageid#: 23

microfilm, microfiche, prints, slides, negatives, videotapes, motion pictures,

photocopies).

b) Computer Hardware

Computer hardware consists of all equipment which can collect, analyze, create,

display, convert, store, conceal, or transmit electronic, magnetic, optical, or

similar computer impulses or data. This includes any data-processing devices

(such as central processing units, memory typewriters, and self-contained

"laptop" or "notebook" computers); internal and peripheral storage devices (such

as fixed disks, external hard disks, floppy disk drives and diskettes, tape drives

and tapes, optical storage devices, transistor-like binary devices, and other

memory storage devices); peripheral input/output devices (such as keyboards,

printers, scanners, plotters, video display monitors, and optical readers); related

communications devices (such as modems, cables and connections, recording

equipment, RAM or ROM units, acoustic couplers, automatic dialers, speed

dialers, programmable telephone dialing or signaling devices, and electronic tone-

generating devices); as well as any devices, mechanisms, or parts that can be used

to restrict access to computer hardware (such as physical keys and locks).

c) Computer Software

Computer software is digital information which can be interpreted by a computer

and any of its related components to direct the way it works. Software is stored in

electronic, magnetic, optical, or other digital form. It commonly includes

programs to run operating systems, applications (like word-processing, graphics,

or spreadsheet programs, utilities, compilers, interpreters, and communications

programs).

d) Computer-related Documentation

Any documentation, operating logs and reference manuals regarding the operation

of the computer equipment, storage devices or software.

Any passwords, password files, test keys, encryption codes or other information

necessary to access the computer equipment, storage devices or data.

Case 7:13-mj-00101-RSB Document 1-2 Filed 08/21/13 Page 4 of 4 Pageid#: 24

You might also like

- Pincourt v. Palmer, District Supervisor, 190 F.2d 390, 3rd Cir. (1951)Document4 pagesPincourt v. Palmer, District Supervisor, 190 F.2d 390, 3rd Cir. (1951)Scribd Government DocsNo ratings yet

- North Dakota Ex Rel. Flaherty v. Hanson, 215 U.S. 515 (1910)Document9 pagesNorth Dakota Ex Rel. Flaherty v. Hanson, 215 U.S. 515 (1910)Scribd Government DocsNo ratings yet

- Mcgoldrick, City Comptroller, V. Berwind-White Coal Mining CoDocument23 pagesMcgoldrick, City Comptroller, V. Berwind-White Coal Mining CoScribd Government DocsNo ratings yet

- United States v. Richard A. Boggs, 775 F.2d 582, 4th Cir. (1985)Document9 pagesUnited States v. Richard A. Boggs, 775 F.2d 582, 4th Cir. (1985)Scribd Government DocsNo ratings yet

- S211990 Motion For Judicial Notice ISO Oppn To Writ - Part 1Document106 pagesS211990 Motion For Judicial Notice ISO Oppn To Writ - Part 1Equality Case FilesNo ratings yet

- Rod Filing Traffic CaseDocument11 pagesRod Filing Traffic Caserodclassteam100% (2)

- Kheper Games v. Packed Party - ComplaintDocument12 pagesKheper Games v. Packed Party - ComplaintSarah BursteinNo ratings yet

- Redacted Kahmiri IndictmentDocument76 pagesRedacted Kahmiri IndictmentDan McDermottNo ratings yet

- Redacted Patel IndictmentDocument96 pagesRedacted Patel IndictmentDan McDermottNo ratings yet

- Linda Wall Wins Over IRSDocument12 pagesLinda Wall Wins Over IRSJeff Anderson89% (9)

- Thompson v. Kentucky, 209 U.S. 340 (1908)Document7 pagesThompson v. Kentucky, 209 U.S. 340 (1908)Scribd Government DocsNo ratings yet

- Foreclosure DeedDocument5 pagesForeclosure DeedLisa Stinocher OHanlonNo ratings yet

- Neal, Complaint For Quiet TitleDocument36 pagesNeal, Complaint For Quiet Titleronaldhouchins100% (1)

- Robert Clark and Billie Clark v. State Farm Fire & Casualty Insurance Company, Regional Credit Association, and Paul Watts, 54 F.3d 669, 10th Cir. (1995)Document6 pagesRobert Clark and Billie Clark v. State Farm Fire & Casualty Insurance Company, Regional Credit Association, and Paul Watts, 54 F.3d 669, 10th Cir. (1995)Scribd Government DocsNo ratings yet

- FTC v. National Casualty Co., 357 U.S. 560 (1958)Document4 pagesFTC v. National Casualty Co., 357 U.S. 560 (1958)Scribd Government DocsNo ratings yet

- Criminal AllegationsDocument9 pagesCriminal AllegationsCalebNo ratings yet

- Challenge of Juristiction at 06cvh044589Document35 pagesChallenge of Juristiction at 06cvh044589joe100% (1)

- Lawsuit Challenging Virginia's New Expanded Background ChecksDocument44 pagesLawsuit Challenging Virginia's New Expanded Background ChecksWSETNo ratings yet

- Official NotificationDocument41 pagesOfficial Notificationعلي الاسديNo ratings yet

- Isaac Camacho v. Autoridad de Telefonos de Puerto Rico, 868 F.2d 482, 1st Cir. (1989)Document14 pagesIsaac Camacho v. Autoridad de Telefonos de Puerto Rico, 868 F.2d 482, 1st Cir. (1989)Scribd Government DocsNo ratings yet

- YamanohaDocument18 pagesYamanohaNicoleNo ratings yet

- Morehouse II Enterprises, LLC v. Atf, Doj & Steven M. Dettelbach Complaint FinalDocument66 pagesMorehouse II Enterprises, LLC v. Atf, Doj & Steven M. Dettelbach Complaint FinalAmmoLand Shooting Sports News100% (1)

- Worthington v. Office of National Drug Control Policy Et AlDocument63 pagesWorthington v. Office of National Drug Control Policy Et AlMuhammad Yar LakNo ratings yet

- Colorado Marijuana Legalization Lawsuit: Civil Action No. 15-349 Safe Streets Alliance Lawsuit 1Document43 pagesColorado Marijuana Legalization Lawsuit: Civil Action No. 15-349 Safe Streets Alliance Lawsuit 1The Denver postNo ratings yet

- Ucc Demand Summons CourtDocument13 pagesUcc Demand Summons CourtApril ClayNo ratings yet

- United States v. James J. Belcher, 927 F.2d 1182, 11th Cir. (1991)Document10 pagesUnited States v. James J. Belcher, 927 F.2d 1182, 11th Cir. (1991)Scribd Government DocsNo ratings yet

- California Patriot Coalition v. Alex PadillaDocument9 pagesCalifornia Patriot Coalition v. Alex PadillaDaily Caller News FoundationNo ratings yet

- 9 - Shrout Appoint Judge Notice of Appointment A4v and LienDocument7 pages9 - Shrout Appoint Judge Notice of Appointment A4v and LienFreeman Lawyer100% (4)

- 02-06-09 Lynn Federal Court OrderDocument6 pages02-06-09 Lynn Federal Court OrdermderigoNo ratings yet

- Plead Paper Flow BK Pleading Paper 42 USC 1983 CRAMINDocument22 pagesPlead Paper Flow BK Pleading Paper 42 USC 1983 CRAMINantoinebachaNo ratings yet

- United States Court of Appeals, Third CircuitDocument23 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Reilly ComplaintDocument54 pagesReilly ComplaintErin FuchsNo ratings yet

- Miske DocumentsDocument14 pagesMiske DocumentsHNN100% (1)

- 6 Eastern Telecom vs. ICC Case DigestDocument3 pages6 Eastern Telecom vs. ICC Case DigestJaja GkNo ratings yet

- United States v. Katz, 271 U.S. 354 (1926)Document9 pagesUnited States v. Katz, 271 U.S. 354 (1926)Scribd Government DocsNo ratings yet

- GC Defendant Sentencing MemoDocument35 pagesGC Defendant Sentencing MemoJ RohrlichNo ratings yet

- Comp Quiet TitleDocument8 pagesComp Quiet TitleNoble Sulaiman Bey100% (2)

- Affidavit and Official Cancellation Discharge Note-DraftDocument3 pagesAffidavit and Official Cancellation Discharge Note-DraftYarod EL100% (18)

- 001 Debt Collection Agency NoticeDocument3 pages001 Debt Collection Agency NoticeSUCCESSIN100% (2)

- CFPB Transunion Rental Screening Solutions Inc Trans Union LLC Complaint 2023 10Document16 pagesCFPB Transunion Rental Screening Solutions Inc Trans Union LLC Complaint 2023 10dkanellisNo ratings yet

- Notice of Contract Cancellation - Actual and Constructive Notice - Cook County Sherrif - 7420 S Bennett AVeDocument3 pagesNotice of Contract Cancellation - Actual and Constructive Notice - Cook County Sherrif - 7420 S Bennett AVebindi boya bey100% (1)

- Lawsuit Filed by Tom Keefer Against Jonathan Garlow, David Laforce, and Two Row TimesDocument11 pagesLawsuit Filed by Tom Keefer Against Jonathan Garlow, David Laforce, and Two Row TimesReal Peoples Media100% (1)

- Online DecisionDocument15 pagesOnline DecisionCircuit MediaNo ratings yet

- Plead Paper Flow BK Pleading Paper Statement Disqualification Cramin 1-19-2012Document29 pagesPlead Paper Flow BK Pleading Paper Statement Disqualification Cramin 1-19-2012antoinebachaNo ratings yet

- 8 1 17 Cohen Search WarrantDocument42 pages8 1 17 Cohen Search WarrantLaw&CrimeNo ratings yet

- Solicitud Fianza Angel Perez OteroDocument6 pagesSolicitud Fianza Angel Perez OteroVictor Torres MontalvoNo ratings yet

- Steele v. Bulova Watch Co., 344 U.S. 280 (1952)Document10 pagesSteele v. Bulova Watch Co., 344 U.S. 280 (1952)Scribd Government DocsNo ratings yet

- Jeremiah J. Kelley v. United States, 393 U.S. 963 (1968)Document4 pagesJeremiah J. Kelley v. United States, 393 U.S. 963 (1968)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Eighth CircuitDocument23 pagesUnited States Court of Appeals, Eighth CircuitScribd Government DocsNo ratings yet

- United States Court of Appeals, Seventh CircuitDocument3 pagesUnited States Court of Appeals, Seventh CircuitScribd Government DocsNo ratings yet

- FOIA TemplateDocument22 pagesFOIA Templaterodclassteam100% (13)

- Fontana Resort and Country Club, Inc. vs. TanDocument20 pagesFontana Resort and Country Club, Inc. vs. TanXtine CampuPotNo ratings yet

- CMS PDFDocument6 pagesCMS PDFRecordTrac - City of OaklandNo ratings yet

- Case Digest 6Document7 pagesCase Digest 6Emmanuel Enrico de VeraNo ratings yet

- Sample Motion to Vacate, Motion to Dismiss, Affidavits, Notice of Objection, and Notice of Intent to File ClaimFrom EverandSample Motion to Vacate, Motion to Dismiss, Affidavits, Notice of Objection, and Notice of Intent to File ClaimRating: 5 out of 5 stars5/5 (21)

- Sutherlin Mansion Expenses-February 2016Document1 pageSutherlin Mansion Expenses-February 2016SouthsideCentralNo ratings yet

- GW Police ReportDocument3 pagesGW Police ReportSouthsideCentralNo ratings yet

- EcomNets Indictment Filed and DocketedDocument27 pagesEcomNets Indictment Filed and DocketedSouthsideCentral100% (1)

- Norhurst RepaymentDocument6 pagesNorhurst RepaymentSouthsideCentralNo ratings yet

- RDF2015 General PosterDocument1 pageRDF2015 General PosterSouthsideCentralNo ratings yet

- 2014-2015 RetireesDocument1 page2014-2015 RetireesSouthsideCentralNo ratings yet

- Dps 2015 StatsDocument1 pageDps 2015 StatsSouthsideCentralNo ratings yet

- RDF2015 Entertainment PosterDocument1 pageRDF2015 Entertainment PosterSouthsideCentralNo ratings yet

- Final School Board BudgetDocument1 pageFinal School Board BudgetSouthsideCentralNo ratings yet

- DRF 2014 GrantsDocument1 pageDRF 2014 GrantsSouthsideCentralNo ratings yet

- Superintendent Employment Agreement (Signed)Document15 pagesSuperintendent Employment Agreement (Signed)SouthsideCentralNo ratings yet

- DPSMeningitis LetterDocument1 pageDPSMeningitis LetterSouthsideCentralNo ratings yet

- Superintendent Employment Agreement (Signed)Document15 pagesSuperintendent Employment Agreement (Signed)SouthsideCentralNo ratings yet

- June RIFA Agenda - Page 11-13Document3 pagesJune RIFA Agenda - Page 11-13SouthsideCentralNo ratings yet

- Public Safety LetterDocument3 pagesPublic Safety LetterSouthsideCentralNo ratings yet

- Nascar TripDocument1 pageNascar TripSouthsideCentralNo ratings yet

- Discipline Data Comparison ReportDocument1 pageDiscipline Data Comparison ReportSouthsideCentralNo ratings yet

- Danville-Pittsylvania Regional Industrial Facility AuthorityDocument26 pagesDanville-Pittsylvania Regional Industrial Facility AuthoritySouthsideCentralNo ratings yet

- RIFA FinancialsDocument9 pagesRIFA FinancialsSouthsideCentralNo ratings yet

- Search Warrant - GrantedDocument2 pagesSearch Warrant - GrantedSouthsideCentralNo ratings yet

- School Discipline Report - August 11-29, 2014Document1 pageSchool Discipline Report - August 11-29, 2014SouthsideCentralNo ratings yet

- Discipline Data Comparison ReportDocument1 pageDiscipline Data Comparison ReportSouthsideCentralNo ratings yet

- SSED GrantsDocument1 pageSSED GrantsSouthsideCentralNo ratings yet

- Danville - General FundDocument3 pagesDanville - General FundSouthsideCentralNo ratings yet

- Ed Newsome's DPS ContractDocument6 pagesEd Newsome's DPS ContractSouthsideCentralNo ratings yet

- Merle Rutledge Gets Enjoined.Document18 pagesMerle Rutledge Gets Enjoined.SouthsideCentralNo ratings yet

- HCPS Pay ScalesDocument1 pageHCPS Pay ScalesSouthsideCentralNo ratings yet

- Seizure WarrantDocument2 pagesSeizure WarrantSouthsideCentralNo ratings yet

- Brosur Systec - V - D - Series - EN PDFDocument17 pagesBrosur Systec - V - D - Series - EN PDFSarana Prasarana BBLK SURABAYANo ratings yet

- Pages from Washer Dryer MeralcoDocument1 pagePages from Washer Dryer MeralcoLEON SOTNASNo ratings yet

- Adfd1820 3333B XDMDocument3 pagesAdfd1820 3333B XDMDavid Angulo EsguerraNo ratings yet

- Huawei Mini-Shelter FCC EMC Test Report of ITS1000M-FMS12-G1013Document16 pagesHuawei Mini-Shelter FCC EMC Test Report of ITS1000M-FMS12-G1013Cesar Antonio Bravo SerranoNo ratings yet

- Triangular Patch Antenna 1Document3 pagesTriangular Patch Antenna 1Isha JainNo ratings yet

- Vertica Column-vs-RowDocument64 pagesVertica Column-vs-RowsurreddNo ratings yet

- Lc40sh340e K PDFDocument106 pagesLc40sh340e K PDFlachiondoNo ratings yet

- fr150 Series User Manual en v1.2Document131 pagesfr150 Series User Manual en v1.2Hendrewel Ferreira NunesNo ratings yet

- Agrokid 210 220 230 240 WSM PDFDocument488 pagesAgrokid 210 220 230 240 WSM PDFjwd80% (5)

- ASK Multisim SimulationDocument2 pagesASK Multisim SimulationDhea Ayu AnggrainiNo ratings yet

- Kelman Transfix GEA-17280D-E 160128 R001 HRDocument2 pagesKelman Transfix GEA-17280D-E 160128 R001 HRTemitope OmoniyiNo ratings yet

- ElectrochemistryDocument7 pagesElectrochemistrythinkiitNo ratings yet

- Manual Ventiladores KVBFDocument23 pagesManual Ventiladores KVBFAndrés CrisostoNo ratings yet

- STEPPING SYSTEMS SAFETYDocument128 pagesSTEPPING SYSTEMS SAFETYMarcelo HANo ratings yet

- Nepal Telecom 2 PaperDocument3 pagesNepal Telecom 2 PaperJanup PokharelNo ratings yet

- NUS EE4218 Exam Prep: Embedded Hardware DesignDocument7 pagesNUS EE4218 Exam Prep: Embedded Hardware DesignAtlee YoungNo ratings yet

- Insulating Coatings For Electrical Steels by Composition, Relative Insulating Ability and ApplicationDocument4 pagesInsulating Coatings For Electrical Steels by Composition, Relative Insulating Ability and ApplicationjalilemadiNo ratings yet

- Adverbial ClausesDocument16 pagesAdverbial ClausesSisma Pratama Arum PutriNo ratings yet

- SAVING FAILED STATES - Foreign Policy 89 (Winter), Pp. 3-20Document10 pagesSAVING FAILED STATES - Foreign Policy 89 (Winter), Pp. 3-20ContreconduiteNo ratings yet

- HB1805A1 Subwoofer SpecsDocument5 pagesHB1805A1 Subwoofer SpecsAlberto DidoneNo ratings yet

- DWDM TrainingDocument47 pagesDWDM TrainingUsman TariqNo ratings yet

- SERVICE REF. NO. LCD-42XF8T-00Document48 pagesSERVICE REF. NO. LCD-42XF8T-00Cristian HerreraNo ratings yet

- JournalDocument5 pagesJournalRisa HapsariNo ratings yet

- Xpol 1710 2170Mhz 65° 17.5dbi Adjustable Electrical Downtilt Antenna, Manual or by Optional Rcu (Remote Control Unit)Document1 pageXpol 1710 2170Mhz 65° 17.5dbi Adjustable Electrical Downtilt Antenna, Manual or by Optional Rcu (Remote Control Unit)Rodrigo Arze ZabalagaNo ratings yet

- Product SpecificationDocument58 pagesProduct Specification123No ratings yet

- Sprs717f - TI AM335x DatasheetDocument236 pagesSprs717f - TI AM335x DatasheetjuampicNo ratings yet

- Practical Contact Ultrasonics - Angle Beam Inspection SetupDocument47 pagesPractical Contact Ultrasonics - Angle Beam Inspection Setuptony blas cristobalNo ratings yet

- Leaflet Delem DA-51 enDocument2 pagesLeaflet Delem DA-51 enharwindr67% (3)

- Meitrack t1 User Guide v1.8Document22 pagesMeitrack t1 User Guide v1.8Khor Su HakNo ratings yet

- Ge Oil and Gas Al: Process Control and System ProtectionDocument9 pagesGe Oil and Gas Al: Process Control and System Protectionkevinzzzxd1No ratings yet