Professional Documents

Culture Documents

What's Behind That Credit Score

Uploaded by

DanRanckOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What's Behind That Credit Score

Uploaded by

DanRanckCopyright:

Available Formats

YOU & YOUR

B U S I N E S S

Whats Behind that Credit Score?

by Dan Ranck

HomeBridge Financial

Services, Inc.

hen considering qualification for a mortgage to purchase a home, there are three main characteristics that

are considered. Sometimes referred to as the Three Cs, they

are Cash, Collateral and Credit.

Cash is fairly simplehow much money does the borrower

earn, and how much do they have for their down payment,

closing costs and reserves if needed? Are the income and

assets verifiable, and is the income stable and able to support

the monthly mortgage payment as well as other monthly liabilities?

Collateralthe home. What is it worth? Is it an acceptable

property? How much are you looking to borrow against the

home? Once again, a fairly simple piece of the equation.

And third, the credit score. That mystical number that

generates multiple questions from consumers. What does it

mean? How is it determined? What score is needed to qualify

for a mortgage? How does it increase? What makes it

decrease? The questions surrounding credit scores can be infinite.

Ultimately, the credit score represents a borrowers

creditworthiness with a history of how they have managed

certain liabilities with timely payments, balanced usage and

ability to repay incurred debts. Depending on the reporting

source, credit scores can range anywhere from 300-850.

Mortgage lenders use a borrowers credit score as part of

the evaluation process to determine eligibility. In most cases,

the minimum credit score required for a mortgage qualification

is 600; however, that number will vary from one lender to

another. Ideally, the higher the score, the more qualified a

borrower may be and is considered less likely to default based

on past credit history. However, this is not always the case.

The credit score may appear strong on the surface, but there

may be more to the story.

Its the information that can lurk behind a credit score that

can impact a borrowers ability to qualify for a mortgage.

Many other financial obligations that may not be part of a

credit report or could be aged may not have a direct impact on

ones current credit score. Financial obligations such as tax

liens, judicial liens, delinquent child support or alimony obligations and even other outstanding mortgage debt may not be

exposed on a current credit report. These issues can be

detrimental in hindering ones ability to qualify for a mortgage,

4

even though their score could be at an acceptable level.

Any mortgage lender is going to do an in-depth review of a

borrowers credit report, even if their score is at an acceptable

level. It is quite possible to have large collection accounts,

charge-offs and even judgments from several years ago linger

on a credit report but not impact the current reported score. In

most cases, the score impact occurs at the time the derogatory

account reports; and if the account remains dormant and the

borrower has favorable credit accounts otherwise, the score

may continue to increase over the years. It is very possible for

a borrower to have a score in the low 700 range but have

derogatory accounts from the past as part of the overall credit

history. In most cases, these accounts may need to be resolved

in order to qualify for a mortgage.

Borrowers often ask why a derogatory account from

several years ago can impact their current qualification. Ideally,

a lender is only evaluating history for a fraction of the time

compared to 30-year repayment period that is part of the

mortgage. Without having a crystal ball to look 30 years into

the future, the period of time that is being evaluated and taken

into consideration is going to be considerably less than the

period of time until the mortgage debt is paid in full . . . in most

cases, 30 years. Past occurrences and payment patterns are all a

lender has to make a credit determination for a mortgage approval.

It is extremely important that a borrower fully discloses any

past or current issues that may not appear on a credit report

but could impact the transaction and purchase of a home. On a

mortgage application, a borrower is asked about outstanding

judgments, bankruptcy, foreclosure, pending lawsuits, delinquency or default on federal debt and if they are obligated to

pay alimony or child support.

Since a borrower is signing an application, it would be

assumed that these questions are answered truthfully and to

the best of their knowledge. If the borrower has a belief that

not disclosing the information may allow it to go unnoticed,

they are essentially committing loan fraud, which can impact

all parties involved in the mortgage and purchase transaction.

Mortgage lenders and loan originators should always take

these questions seriously and inform a borrower that all credit

(continues on page 5)

Closing Comments

YOU & YOUR

B U S I N E S S

Whats Behind that Credit Score? (continued from page 4)

issues, both past and present, need to be disclosed.

All consumers have rights under the Fair Credit Reporting

Act and should obtain a copy of their credit report at a minimum of an annual basis. For more information, consumers

may contact the Federal Trade Commission at www.FTC.gov

or (202) 326-2222.

Dan Ranck Mortgage Loan Originator NMLS #140989

HomeBridge Financial Services, Inc. NMLS #6521

2148 Embassy Drive, Suite 120 Lancaster, PA 17603

Direct: 717.271.2400 efax: 866.849.4320

dranck@homebridge.com www.danranck.com

Pennsylvania Mortgage Lender License #20394

Green Renovations

by Matt & Mike Blank

MBC Building &

Remodeling, LLC

ccording to a recent Green Building Council study, 70

percent of homebuyers are more inclined to purchase a

green home than a conventional home during a down housing

market. Green renovations can include new windows, insulation or roofing, as well as smaller and less expensive options

discussed below. All of these environmentally-friendly upgrades

can greatly reduce a homes energy bills, as well as help sell a

house that has been sitting on the market for some time.

1. Consider appliances that use less water and electricity.

Many companies sell appliances like washing machines and

dishwashers that use 10-15 percent less energy and water

than standard models. Check with the utility company to

see if they offer any incentives.

2. Change heavily used lights with energy-efficient models.

According to the U.S. Department of Energy EnergyStar

program, if every American home replaced its five most

frequently-used light fixtures, such as the kitchen ceiling

lamps, outdoor lamps or the living room lamps, with fixtures

that have earned the EnergyStar, almost $8 billion would be

saved each year in energy costs and greenhouse gasses

reduced at the rate of almost 10 million cars. A 60 watt bulb

only uses about 13 watts of energy, and they last longer

than regular bulbs.

3. Keep inside air from escaping. Seals around windows and

doors can break or be damaged over time and need to be

replaced. Depending on the severity of the damage,

resealing your doors and windows can be a simple project

for any homeowner to do themselves.

August 2014

New Members

Designated Affiliate

Kyle King ....................................... John Kline Septic Services, LLC

Timothy Miller ...................... Homes and Land of Lancaster County

Designated Realtor

Scott Lederer ...................................................... Berkshire Hathaway

Realtors*

Shannon Bauer .......................... Selections Real Estate Services, LLC

Ashley Corbett ........................ Coldwell Banker Select Professionals

Nicole Dommel .................................................. Berkshire Hathaway

Leah Egolf ................................................................ Hostetter Realty

Donald Faraci .......................................................... Kingsway Realty

Dawn Fox .......................................................... Berkshire Hathaway

Shaffer Johnson ........................ Selections Real Estate Services, LLC

Melanie Miller .......................... Selections Real Estate Services, LLC

Marisela Ortiz .......................................... Charles & Associates, Inc.

Peter Panzini ...................................................... Berkshire Hathaway

Nicholas Polito .................................................. Berkshire Hathaway

Matthew Stoltzfus ............................................ Berkshire Hathaway

Sonia Stuckman ......................... William Penn Real Estate Associates

Michele Velez .................................................... Berkshire Hathaway

* Approved, pending completion of New Member Orientation

Members on the Move

Russ Akinin ................................. Keller Williams of Central PA East

Robert Dalton ................................... ReMax Associates of Lancaster

Candice Hozza ..................................... Highland Realty Group, LLC

Kathy Koser ..................................... ReMax Associates of Lancaster

Charles Mayo .................................. A La Carte Real Estate Services

Randy Myers .................................................... Berkshire Hathaway

Daniel Stoltzfus ................................................. Berkshire Hathaway

Membership Statistics

(as of 7/31/2014)

Real Estate Firms ............................................ 146

Real Estate Branches ........................................ 15

Affiliate Firms .................................................. 87

Realtors ......................................................... 986

Designated Realtors ...................................... 143

Pending/Tentative ............................................. 92

Salespeople ....................................................... 27

Affiliates ......................................................... 127

Thought of the Day

You only have to do a very few things

right in your life so long as you

dont do too many things wrong.

~ Warren Buffett

5

You might also like

- Mortgage Financing ThesisDocument6 pagesMortgage Financing Thesisbethhalloverlandpark100% (2)

- The Foreclosure ReportDocument19 pagesThe Foreclosure ReportAndyJackson100% (3)

- Protect Your Home From Predatory LendersDocument2 pagesProtect Your Home From Predatory LendersSC AppleseedNo ratings yet

- Planning For Homeownership GuideDocument20 pagesPlanning For Homeownership Guideapi-295818061No ratings yet

- Ebook 1st Home BuyerDocument4 pagesEbook 1st Home BuyerKenny JonesNo ratings yet

- The True Impact of TRIDDocument2 pagesThe True Impact of TRIDDanRanckNo ratings yet

- GW First Time Homebuyer Book 20Document15 pagesGW First Time Homebuyer Book 20Adil HussainNo ratings yet

- Foreclosure BrochureDocument6 pagesForeclosure BrochureAnnMarie BelairNo ratings yet

- SC Predatory Lending BrochureDocument2 pagesSC Predatory Lending BrochureSC AppleseedNo ratings yet

- Winter 2015 ColorDocument8 pagesWinter 2015 Colorapi-309082881No ratings yet

- Print - AamirDocument19 pagesPrint - AamirAamir BasraiNo ratings yet

- Good Mortgage Advice: The Home Buyer's Guide to Financing a Home - A Crash Course for ConfidenceFrom EverandGood Mortgage Advice: The Home Buyer's Guide to Financing a Home - A Crash Course for ConfidenceRating: 5 out of 5 stars5/5 (1)

- An Instructional Guide Short Sales And Foreclosed Properties For The Experienced The Novice And The Merely LazyFrom EverandAn Instructional Guide Short Sales And Foreclosed Properties For The Experienced The Novice And The Merely LazyNo ratings yet

- How to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 2From EverandHow to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 2No ratings yet

- 100% Financing For Your New Home Guaranteed. No FICO Score Requirement!From Everand100% Financing For Your New Home Guaranteed. No FICO Score Requirement!No ratings yet

- Home Buying 101: A Handbook and Guide While Buying Your Dream Home!From EverandHome Buying 101: A Handbook and Guide While Buying Your Dream Home!No ratings yet

- Just The Faqs:: Answers Common Questions About Reverse MortgagesDocument16 pagesJust The Faqs:: Answers Common Questions About Reverse MortgagesValerie VanBooven RN BSNNo ratings yet

- Assignment of Personal FinancingDocument11 pagesAssignment of Personal FinancingRimpy GeraNo ratings yet

- Getting to Closing!: Insider Information to Help You Get a Good Deal on Your MortgageFrom EverandGetting to Closing!: Insider Information to Help You Get a Good Deal on Your MortgageNo ratings yet

- Research Papers On Reverse Mortgage LoanDocument5 pagesResearch Papers On Reverse Mortgage Loanafmcuafnh100% (1)

- From Bad to Good Credit: A Practical Guide for Individuals with Charge-Offs and CollectionsFrom EverandFrom Bad to Good Credit: A Practical Guide for Individuals with Charge-Offs and CollectionsNo ratings yet

- Creating Residential Income: How to Get Your Money to Work For YouFrom EverandCreating Residential Income: How to Get Your Money to Work For YouNo ratings yet

- Budget Basics For Modular Home Buyers - How Much Home Can I Afford?Document3 pagesBudget Basics For Modular Home Buyers - How Much Home Can I Afford?SEAN NNo ratings yet

- Loans and MortgagesDocument26 pagesLoans and Mortgagesparkerroach21No ratings yet

- 2017 Understanding Credit BookDocument28 pages2017 Understanding Credit BookDinu MariusNo ratings yet

- Mortgage IntroductionDocument11 pagesMortgage IntroductionVenu GopalNo ratings yet

- Remier Ealth Trategies: The Do It Yourself Credit Repair ManualDocument69 pagesRemier Ealth Trategies: The Do It Yourself Credit Repair ManualFreedomofMindNo ratings yet

- SPR 11 ColorDocument8 pagesSPR 11 Colorapi-309082881No ratings yet

- PDF 6161Document18 pagesPDF 6161api-309082881100% (1)

- Divorce & CreditDocument15 pagesDivorce & CreditFredPahssenNo ratings yet

- Aussie First Home Buyers GuideDocument36 pagesAussie First Home Buyers Guidegear123nNo ratings yet

- UntitledDocument24 pagesUntitledEric JohnsonNo ratings yet

- First Time Home Buyer GuideDocument19 pagesFirst Time Home Buyer GuideGerald Bouthner100% (1)

- First Time Home BuyerguideDocument24 pagesFirst Time Home BuyerguidevinujiNo ratings yet

- 2019 Real Estate Directory: Us Directory of Real Estate Agents, Brokers, And RealtorsFrom Everand2019 Real Estate Directory: Us Directory of Real Estate Agents, Brokers, And RealtorsNo ratings yet

- Credit ScoresDocument2 pagesCredit ScoresAditya SinghalNo ratings yet

- Real Estate Principles A Value Approach 5Th Edition Ling Solutions Manual Full Chapter PDFDocument19 pagesReal Estate Principles A Value Approach 5Th Edition Ling Solutions Manual Full Chapter PDFoctogamyveerbxtl100% (7)

- Understand Your Credit Report and ScoreDocument34 pagesUnderstand Your Credit Report and ScoreshalzadhawanNo ratings yet

- Automated Injustice: How A Mechanized Dispute System Frustrates Consumers Seeking To Fix Errors in Their Credit Reports, NCLC (2009)Document48 pagesAutomated Injustice: How A Mechanized Dispute System Frustrates Consumers Seeking To Fix Errors in Their Credit Reports, NCLC (2009)Jillian SheridanNo ratings yet

- How to Get Started Improving Your Credit: The Inside Information You Need to Avoid Costly Mistakes and Do Things Right the First TimeFrom EverandHow to Get Started Improving Your Credit: The Inside Information You Need to Avoid Costly Mistakes and Do Things Right the First TimeRating: 4 out of 5 stars4/5 (3)

- Ben Carter - Foreclosure Continuing Legal EducationDocument48 pagesBen Carter - Foreclosure Continuing Legal EducationGlenn AugensteinNo ratings yet

- Short Sale Hardship Letter Guidelines & SamplesDocument8 pagesShort Sale Hardship Letter Guidelines & SamplesDawn CatechisNo ratings yet

- Real EstateDocument16 pagesReal EstateCadillac NewsNo ratings yet

- Refinancing GuideDocument4 pagesRefinancing GuideSteven Mah Chun HoNo ratings yet

- Guide To Understanding Credit GuideDocument11 pagesGuide To Understanding Credit GuideRobert Glen Murrell JrNo ratings yet

- Underwriting GuidelinesDocument6 pagesUnderwriting GuidelinesHitkaran Singh RanawatNo ratings yet

- Your Credit Score: What It Means To You As A Prospective Home BuyerDocument5 pagesYour Credit Score: What It Means To You As A Prospective Home BuyerRyan5Cents100% (2)

- Ultimate First Time Home Buyer Guide: Step-By-Step Instructions On How to Buy Your First HomeFrom EverandUltimate First Time Home Buyer Guide: Step-By-Step Instructions On How to Buy Your First HomeNo ratings yet

- Reverse Mortgage DissertationDocument7 pagesReverse Mortgage DissertationCustomPapersOnlineCanada100% (1)

- Dec NewsletterDocument4 pagesDec NewsletterOz NedNo ratings yet

- Wakefield Reutlinger Realtors Newsletter 3rd Quarter 2013Document4 pagesWakefield Reutlinger Realtors Newsletter 3rd Quarter 2013Wakefield Reutlinger RealtorsNo ratings yet

- Front-End Ratio:: Debt-To-Income RatiosDocument3 pagesFront-End Ratio:: Debt-To-Income RatiosAbhishek GavandeNo ratings yet

- Interesting Facts to Know in Your Home Loan AgreementDocument3 pagesInteresting Facts to Know in Your Home Loan AgreementJnanamNo ratings yet

- TRID-Where Are We Now?Document2 pagesTRID-Where Are We Now?DanRanckNo ratings yet

- The True Impact of TRIDDocument2 pagesThe True Impact of TRIDDanRanckNo ratings yet

- Integrated Disclosures... What You Need To KnowDocument2 pagesIntegrated Disclosures... What You Need To KnowDanRanckNo ratings yet

- The Year of ChangeDocument2 pagesThe Year of ChangeDanRanckNo ratings yet

- How Qualified Are Your Buyers?Document2 pagesHow Qualified Are Your Buyers?DanRanckNo ratings yet

- Module 2B. Debt RestructuringDocument17 pagesModule 2B. Debt RestructuringAaron MañacapNo ratings yet

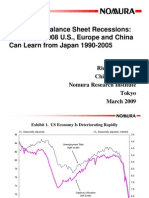

- Richard Koo PresentationDocument34 pagesRichard Koo Presentationpkedrosky100% (14)

- Libby Financial Accounting Chapter9Document11 pagesLibby Financial Accounting Chapter9Jie Bo TiNo ratings yet

- Simple Interest and Discount Notes ExplainedDocument25 pagesSimple Interest and Discount Notes ExplainedWee Yong KeeNo ratings yet

- Working Capital Management - Amit MishraDocument28 pagesWorking Capital Management - Amit MishraPradeep NambiarNo ratings yet

- Importance of the Five Cs of Finance for CreditworthinessDocument3 pagesImportance of the Five Cs of Finance for Creditworthinessccm internNo ratings yet

- Khulna Power Company Limited: Balnace Sheet StatementDocument9 pagesKhulna Power Company Limited: Balnace Sheet StatementTahmid ShovonNo ratings yet

- Computation of Idc PDFDocument1 pageComputation of Idc PDFdsanandaNo ratings yet

- Upload Sheet 15072013Document17 pagesUpload Sheet 15072013Sonakshi TayalNo ratings yet

- Advance Financial Management AssignmentDocument4 pagesAdvance Financial Management AssignmentRishabh JainNo ratings yet

- Corporate Liability in Bankruptcy and the Principle of ProportionalityDocument7 pagesCorporate Liability in Bankruptcy and the Principle of ProportionalityZikri MohamadNo ratings yet

- Accounting NoteDocument132 pagesAccounting NoteRobsan AfdalNo ratings yet

- MODULE 5 SVV Interest Rate StudentDocument6 pagesMODULE 5 SVV Interest Rate StudentJessica RosalesNo ratings yet

- OMB Approval No. 2502-0265 Good Faith Estimate (GFE) BreakdownDocument3 pagesOMB Approval No. 2502-0265 Good Faith Estimate (GFE) BreakdownEdwin RajNo ratings yet

- Business and Consumer LoansDocument10 pagesBusiness and Consumer LoansAngelica ZipaganNo ratings yet

- ReceivablesDocument36 pagesReceivablesElla MalitNo ratings yet

- FM Case - First National BankDocument32 pagesFM Case - First National BankBilal Shakil Qureshi100% (3)

- Performance Task 2 - Mini Case AnalysisDocument3 pagesPerformance Task 2 - Mini Case AnalysisPSHNo ratings yet

- Accounting for Current Liabilities, Provisions and ContingenciesDocument15 pagesAccounting for Current Liabilities, Provisions and ContingenciesPillos Jr., ElimarNo ratings yet

- Foundations of Finance 9th Edition Keown Solutions Manual 1Document32 pagesFoundations of Finance 9th Edition Keown Solutions Manual 1carita100% (38)

- Principles of lending and priority sector lendingDocument29 pagesPrinciples of lending and priority sector lendingAsadul HoqueNo ratings yet

- Desiree Mendoza - Personal BankruptcyDocument2 pagesDesiree Mendoza - Personal Bankruptcyapi-522804698No ratings yet

- How To Outright Cancel 100 of Your Unsecured Debt Rev 2018 05 21 PDFDocument50 pagesHow To Outright Cancel 100 of Your Unsecured Debt Rev 2018 05 21 PDFJoshua of courseNo ratings yet

- Compound Interest QuizDocument16 pagesCompound Interest Quizvijeta diwanNo ratings yet

- Edu 2009 Fall Exam FM QuesDocument34 pagesEdu 2009 Fall Exam FM Quescl85ScribNo ratings yet

- Dizon vs Gaborro land disputeDocument1 pageDizon vs Gaborro land disputeJude ChicanoNo ratings yet

- AICC Practical Examination July 2020 FinalDocument1 pageAICC Practical Examination July 2020 FinalNiloy BiswasNo ratings yet

- SP CMBS Legal and Structured Finance CriteriaDocument248 pagesSP CMBS Legal and Structured Finance CriteriaVijay GogiaNo ratings yet

- Time Value of MoneyDocument76 pagesTime Value of Moneyrhea agnesNo ratings yet

- Law and Practice of International FinanceDocument9 pagesLaw and Practice of International FinanceCarlos Belando PastorNo ratings yet