Professional Documents

Culture Documents

OLP

Uploaded by

2005.discoverCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OLP

Uploaded by

2005.discoverCopyright:

Available Formats

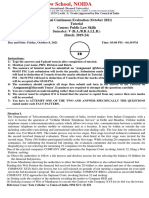

Creating Use Case for On-line Purchase System (OLP)

Order Items

Shipping

Process Order

Update Stock

(A2)

(A3)

<<include>>

Registration

Get Payment

By Road By Air

Create Order

Billing

<<include>>

<

<

in

c

lu

d

e

>

>

<<include>>

U1

U2

Manger

U3

U5

U6

U7

U9

U10

U

11 U

12

Inventory

System

Check In

<

<

e

x

te

n

d

>

>

[o

p

tio

n

=

n

e

w

]

U4

(A

12

) Staff

(A1)

(A

11

)

Customer

Other

Use case diagram for OLP

Order Items

Shipping

Process Order

Update Stock

(A2)

(A3)

<<include>>

Registration

Get Payment

By Road By Air

(A

12

)

Create Order

Billing

<<include>>

[delete]

<

<

in

c

lu

d

e

>

>

<<include>>

U1

U2

Manger

U3

U5

U6

U7

U9

U10

U

11 U

12

Inventory

System

Check In

<

<

e

x

te

n

d

>

>

[o

p

tio

n

=

n

e

w

]

U4

Staff

(A1)

(A

11

)

Customer

Other

Delete Order

<<extend>>

U8

Use case diagram of OLP with Delete Order

Use case: Order Items

Scenario 1: Option is new

Prompt for Registration

Call Registration // Extend Registration use case

Display registration status

Exit

Scenario 2:Option is login

Call Check In // Include Check In use case

Alternative 2.1: Login is valid

Prompt for Item Details

Call Create Order // Include Create Order use case

Display order status

Exit

Alternative 2.2: Login is invalid

Display login fail

Exit

Use case: Registration

Scenario 1: Customer is a staff member

Select customer type as staff.

Get data for a customer as staff.

Check the validity of the staff customer.

Alternative 1.1: Disqualify the validity of a staff

Message Registration fail.

Alternative 1.2: Qualify the validity of a staff

Check for already registered customer.

Alternative 1.2.1: Registration exist

Message Registration fail.

Alternative 1.2.1: Registration does not exist

Message Registration successful.

Create a new customer c.

Update record with c.

Scenario 2: Customer is other than staff

Select customer type as other.

Get data for a customer as other.

Check for already registered customer.

Alternative 2.1: Registration exist

Message Registration fail.

Alternative 2.2: Registration does not exist

Message Registration successful.

Create a new customer c.

Update record with c.

Use Case Template: Documenting Use Cases in the Use Case Model

Use cases are documented in the use case model following a use case template. The structure of

the use case template is shown below.

Use Case Template

Use Case Name Each use case is given a name.

Summary A brief description of the use case, typically one or two sentences.

Actors This section names the actors in the use case. There is always a primary

actor who initiates the use case. In addition, there may be secondary actors

who also participate in the use case.

Preconditions One or more conditions that must be true at the start of use case; for

example, the ATM machine is idle, displaying a welcome message.

Description The bulk of the use case is a narrative description of the main sequence of

the use case, which is the most usual sequence of interactions between the

actor and the system. The description is in the form of the input from the

actor, followed by the response of the system. The system is treated as a

black box, that is, dealing with what the system does in response to the

actors inputs, not the internals of how it does it.

Alternatives Narrative description of alternative branches off the main sequence. There

may be several alternative branches from the main sequence. For example,

if the customers account has insufficient funds, display apology and eject

card.

Postcondition Condition that is always true at the end of the use case if the main sequence

has been followed; for example, customers funds have been withdrawn.

Dependencies This optional section describes whether the use case depends on other use

cases, that is, whether it includes or extends another use case.

Example:

Use Case Name

Borrow Book

Summary

This use case describes how a library user selects and then borrows a book

from the library.

Actors

Borrower

Preconditions

None

Description

1. The user selects the search function from the main menu.

2. The system displays the search form.

3. The user enters the title of a book (possibly using wild-cards).

4. The library system presents a list of all matching books

5. The user selects a book.

6. The system displays the detail view for this book.

7. The user selects borrow from the menu for this book.

8. The user is already logged in. The system issues a message to the

archive that the book is reserved for the user.

Alternatives 1

3.1 The user enters the name of the author.

3.2 The user selects the author from an author list.

3.2.1 The user clicks on select author.

3.2.2 The system displays a selection list of all authors.

3.2.3 The user selects an author from the list.

Alternatives 2

4.1 There are no matches to the query.

4.2 The system returns to the main screen.

Alternatives 3

8.1 The user is not logged in.

8.2 The user logs in as described in Log in.

Postcondition

The user is registered as the borrower of the book in the library system.

Dependencies

Log in

Use Case Name Log in

Summary

This use case describes how a library user logs into the system to prove his

identity.

Actors Borrower

Preconditions None

Description

1. The user selects log in from the main menu.

2. The system asks the user for his login name.

3. The user enters his login name.

4. The system asks the user for his password.

5. The user enters his password.

6. The system verifies login and password. They are ok.

7. The system logs the user on.

Alternatives 1

6.1 The combination of login and password is not valid.

6.1.1 If the number of retries is not exceeded, repeat the use case from

step 2.

Postcondition

The user is logged in.

Dependencies None

Practice: ATM System

1. PIN Validation

2. Query Account

3. Withdraw Money

4. Transfer fund

Use Case: Withdraw Funds

Use Case Name: Withdraw Funds

Summary: Customer Withdraws a specific amount of funds from a valid bank account.

Actor: ATM Customer

Precondition: ATM is idle, displaying a Welcome message.

Description:

1. Customer inserts the ATM card into the Card Reader.

2. If the system recognizes the card, it reads the card number.

3. System prompts customer for PIN number.

4. Customer enters PIN.

5. System checks the expiration date and whether the card is lost or stolen.

6. If card is valid, the system then checks whether the user-entered PIN matches the card

PIN maintained by the system.

7. If PIN numbers match, the system checks what accounts are accessible with the ATM

card.

8. System displays customer accounts and prompts customer for transaction type:

Withdrawal, Query, or Transfer.

9. Customer selects Withdrawal, enters the amount, and selects the account number.

10. System checks whether customer has enough funds in the account and whether daily

limit has been exceeded.

11. If all checks are successful, system authorizes dispensing of cash.

12. System dispenses the cash amount.

13. System prints a receipt showing transaction number, transaction type, amount

withdrawn, and account balance.

14. System ejects card.

15. System displays Welcome message.

Alternatives:

If the system does not recognize the card, the card is ejected.

If the system determines that the card date has expired, the card is confiscated.

If the system determines that the card has been reported lost or stolen, the card is

confiscated.

If the customer entered PIN does not match the PIN number for this card, the system re-

prompts for the PIN.

If the customer enters the incorrect PIN three times, the system confiscates the card.

If the system determines there are insufficient funds in the customers account, then it

displays an apology and ejects the card.

If the system determines the account number is invalid, then it displays an error message

and ejects the card.

If the system determines the maximum allowable daily withdrawal amount has been

exceeded, it displays an apology and ejects the card.

If the ATM is out of funds, the system displays an apology, ejects the card, and shuts

down the ATM.

If the customer enters cancel, the system cancels the transaction and ejects the card.

Postcondition: Customer funds have been withdrawn.

Use Case: Query Account

Use Case Name: Query Account.

Summary: Customer receives the balance of a valid bank account.

Actor: ATM Customer

Precondition: ATM is idle, displaying a Welcome message.

Description:

1. Customer inserts the ATM card into the card reader.

2. If the system recognizes the card, it reads the card number.

3. System prompts customer for PIN number.

4. Customer enters PIN.

5. System checks the expiration date and whether the card is lost or stolen.

6. If card is valid, the system then checks whether the user-entered PIN matches the card

PIN maintained by the system.

7. If PIN numbers match, the system checks what accounts are accessible with the ATM

card.

8. System displays customers accounts and prompts customer for transaction type:

Withdrawal, Query, or Transfer.

9. Customer selects Query, enters account number.

10. System reads account balance.

11. System prints a receipt showing transaction number, transaction type and account

balance.

12. System ejects card.

13. System displays Welcome message.

Alternatives:

If the does not recognize the card, the card is ejected.

If the system determines that the card date has expired, the card is confiscated.

If the system determines that the card has been reported lost or stolen, the card is

confiscated.

If the customer-entered PIN does not match the PIN number for this card, the

system re-prompts for the PIN.

If the customer enters the incorrect PIN three times, the system confiscates the

card.

If the system determines the account number is invalid, it displays an error

message and ejects the card.

If the customer enters Cancel, the system cancels the transaction and ejects the

card.

Postcondition: Customer account has been queried.

Use Case: Transfer Funds

Use Case Name: Transfer Funds

Summary: Customer transfers funds from one valid bank account to another.

Actor: ATM customer

Precondition: ATM is idle, displaying a Welcome message.

Description:

1. Customer inserts the ATM card into the Card Reader.

2. If the system recognizes the card, it reads the card number.

3. System prompts customer for PIN number.

4. Customer enters PIN.

5. System checks the expiration date and whether the card is lost or stolen.

6. If card is valid, the system then whether the user-entered PIN matches the card PIN

maintained by the system.

7. If the numbers match, the system checks what accounts are accessible with the ATM

card.

8. System displays customer accounts and prompts customers for transaction type:

Withdrawal, Query, or Transfer.

9. Customer selects Transfer, enters amount, from account and to account.

10. If the system determines that the customer has enough funds in the from account, it

performs the transfer.

11. System prints a receipt showing transaction number, transaction type, amount transferred,

and account balance.

12. System ejects card.

13. System displays Welcome message.

Alternatives:

If the system does not recognize the card, the card is ejected.

If the system determines the card date has been expired, the card is confiscated.

If the system determines the card has been reported lost or stolen, the card is

confiscated.

If the customer-entered PIN does not match the PIN number for this card, the

system re-prompts for the PIN.

If the customer enters the incorrect PIN three times, the system confiscates the

card.

If the system determines that the from account number is invalid, it displays an

error message and ejects the card.

If the system determines that the to account number is invalid, it displays an error

message and ejects the card.

If the system determines there are insufficient funds in the customers from

account, it displays an apology and ejects the card.

If the customer enters cancel, the system cancels the transaction and ejects the

card.

Postcondition: Customer funds have been transferred.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Reading Comprehension Animals Copyright English Created Resources PDFDocument10 pagesReading Comprehension Animals Copyright English Created Resources PDFCasillas ElNo ratings yet

- Understanding PersonalityDocument318 pagesUnderstanding PersonalityRoxanna12100% (1)

- Arup Blockchain Technology ReportDocument74 pagesArup Blockchain Technology ReportHarin VesuwalaNo ratings yet

- Mil PRF 46010FDocument20 pagesMil PRF 46010FSantaj Technologies100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Art of Communication PDFDocument3 pagesThe Art of Communication PDFHung Tran JamesNo ratings yet

- Groundwater Control For Cross PassagesDocument6 pagesGroundwater Control For Cross PassageskrainajackaNo ratings yet

- User Manual FotonaDocument103 pagesUser Manual Fotonarasheeque100% (3)

- Test Initial Engleza A 8a Cu Matrice Si BaremDocument4 pagesTest Initial Engleza A 8a Cu Matrice Si BaremTatiana BeileșenNo ratings yet

- International History 1900-99Document5 pagesInternational History 1900-99rizalmusthofa100% (1)

- (AC-S08) Week 08 - Pre-Task - Quiz - Weekly Quiz - INGLES III (14653)Document3 pages(AC-S08) Week 08 - Pre-Task - Quiz - Weekly Quiz - INGLES III (14653)Eduardo Arucutipa60% (5)

- 1 Research Methodology The Study of Conducting Research Is Research MethodologyDocument6 pages1 Research Methodology The Study of Conducting Research Is Research MethodologyGanesan MurthyNo ratings yet

- StdoutDocument1 pageStdout2005.discoverNo ratings yet

- InstallDocument2 pagesInstalldurgaprasadkankanalaNo ratings yet

- CDocument1 pageC2005.discoverNo ratings yet

- ItnewDocument1 pageItnew2005.discoverNo ratings yet

- DOSBox 0.74 ManualDocument25 pagesDOSBox 0.74 ManualBistock NababanNo ratings yet

- HTML TutorialDocument134 pagesHTML Tutorial2005.discoverNo ratings yet

- Project TopicsDocument2 pagesProject Topics2005.discoverNo ratings yet

- 02 HTMLDocument27 pages02 HTML2005.discoverNo ratings yet

- AEIE Final Upto 4thyear Syllabus 23.07.13Document57 pagesAEIE Final Upto 4thyear Syllabus 23.07.132005.discoverNo ratings yet

- Visual ProgrammingDocument2 pagesVisual Programming2005.discoverNo ratings yet

- ACOxxxxx7E G4Document2 pagesACOxxxxx7E G42005.discoverNo ratings yet

- Sample Project SynopsisDocument5 pagesSample Project Synopsisaftab_ansariNo ratings yet

- Ecommerce LabDocument6 pagesEcommerce Lab2005.discoverNo ratings yet

- IT Short TermDocument5 pagesIT Short Term2005.discoverNo ratings yet

- Assignment 1Document1 pageAssignment 12005.discoverNo ratings yet

- Saroj Mohan Institute of Technology Internal Assessment Visual Programming & Web Technology Dept: CSE Sem: 7 Year: 4th CODE:CS-703 Time: 45 MinDocument1 pageSaroj Mohan Institute of Technology Internal Assessment Visual Programming & Web Technology Dept: CSE Sem: 7 Year: 4th CODE:CS-703 Time: 45 Min2005.discoverNo ratings yet

- CH 01Document11 pagesCH 01sunil-dhyani-8489No ratings yet

- Data CommunicationDocument2 pagesData Communication2005.discoverNo ratings yet

- Problem Statement:: Lab AssignmentDocument1 pageProblem Statement:: Lab Assignment2005.discoverNo ratings yet

- Assignment: Advertising in The Website With CMS Problem StatementDocument1 pageAssignment: Advertising in The Website With CMS Problem Statement2005.discoverNo ratings yet

- Verilog TutorialDocument37 pagesVerilog TutorialSameer NandanNo ratings yet

- Self Test QuizDocument27 pagesSelf Test QuizSandeep KumarNo ratings yet

- Assignment: Advertising in The Website With CMS Problem StatementDocument1 pageAssignment: Advertising in The Website With CMS Problem Statement2005.discoverNo ratings yet

- COMP3210 CourseSummary 2007-2008Document3 pagesCOMP3210 CourseSummary 2007-20082005.discoverNo ratings yet

- Unix System ProgDocument71 pagesUnix System Prog2005.discoverNo ratings yet

- Prolog Lab FileDocument20 pagesProlog Lab FileKaushal Shakya0% (2)

- Teaching Functional Verification: Design Automation Conference Sunday, June 9, 2002Document12 pagesTeaching Functional Verification: Design Automation Conference Sunday, June 9, 20022005.discoverNo ratings yet

- Financial ManagementDocument2 pagesFinancial Management2005.discoverNo ratings yet

- Colorectal Disease - 2023 - Freund - Can Preoperative CT MR Enterography Preclude The Development of Crohn S Disease LikeDocument10 pagesColorectal Disease - 2023 - Freund - Can Preoperative CT MR Enterography Preclude The Development of Crohn S Disease Likedavidmarkovic032No ratings yet

- VB6 ControlDocument4 pagesVB6 Controlahouba100% (1)

- 1603 Physics Paper With Ans Sol EveningDocument8 pages1603 Physics Paper With Ans Sol EveningRahul RaiNo ratings yet

- 2017 Climate Survey ReportDocument11 pages2017 Climate Survey ReportRob PortNo ratings yet

- Unit 3 Administrative AdjudicationDocument18 pagesUnit 3 Administrative AdjudicationkipkarNo ratings yet

- Capetown Halal RestaurantsDocument1 pageCapetown Halal RestaurantsKhawaja UsmanNo ratings yet

- Methods of GeographyDocument3 pagesMethods of Geographyramyatan SinghNo ratings yet

- Sach Bai Tap Tieng Anh8 - Mai Lan HuongDocument157 pagesSach Bai Tap Tieng Anh8 - Mai Lan Huongvothithao19750% (1)

- 100 Commonly Asked Interview QuestionsDocument6 pages100 Commonly Asked Interview QuestionsRaluca SanduNo ratings yet

- AMSY-6 OpManDocument149 pagesAMSY-6 OpManFernando Piñal MoctezumaNo ratings yet

- Marketing Case Study - MM1 (EPGPX02, GROUP-06)Document5 pagesMarketing Case Study - MM1 (EPGPX02, GROUP-06)kaushal dhapareNo ratings yet

- Integrating Force - Com With MicrosoftDocument11 pagesIntegrating Force - Com With MicrosoftSurajAluruNo ratings yet

- Solar PV Power Plants Harmonics Impacts: Abstract - The Power Quality (PQ) Effects of AggregatedDocument5 pagesSolar PV Power Plants Harmonics Impacts: Abstract - The Power Quality (PQ) Effects of Aggregatederic saputraNo ratings yet

- Lincoln's Last Trial by Dan AbramsDocument6 pagesLincoln's Last Trial by Dan AbramsdosatoliNo ratings yet

- Khilafat Movement Pakistan Studies (2059)Document5 pagesKhilafat Movement Pakistan Studies (2059)emaz kareem Student0% (1)

- Advproxy - Advanced Web Proxy For SmoothWall Express 2.0 (Marco Sondermann, p76) PDFDocument76 pagesAdvproxy - Advanced Web Proxy For SmoothWall Express 2.0 (Marco Sondermann, p76) PDFjayan_Sikarwar100% (1)

- Shah Wali Ullah Syed Haji Shariat Ullah Ahmad Barelvi (Notes)Document2 pagesShah Wali Ullah Syed Haji Shariat Ullah Ahmad Barelvi (Notes)Samreen KapasiNo ratings yet

- Symbiosis Law School ICE QuestionsDocument2 pagesSymbiosis Law School ICE QuestionsRidhima PurwarNo ratings yet

- Effect of Disinfectants On Highly Pathogenic Avian in Uenza Virus (H5N1) in Lab and Poultry FarmsDocument7 pagesEffect of Disinfectants On Highly Pathogenic Avian in Uenza Virus (H5N1) in Lab and Poultry FarmsBalvant SinghNo ratings yet

- 6 Economics of International TradeDocument29 pages6 Economics of International TradeSenthil Kumar KNo ratings yet