Professional Documents

Culture Documents

University of Pittsburgh: Financial Aid Application Supplement (FAAS) For The 2014-15 School Year

Uploaded by

Aisha KannehOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

University of Pittsburgh: Financial Aid Application Supplement (FAAS) For The 2014-15 School Year

Uploaded by

Aisha KannehCopyright:

Available Formats

INSTRUCTIONS FOR COMPLETING THE FAAS:

Te Financial Aid Application Supplement (FAAS) is a required document used by the Ofce of Admissions and Financial Aid to process

fnancial aid applications for students who are selected for verifcation.

Ofce of Admissions and Financial Aid

4227 Fifth Avenue, Alumni Hall

Pittsburgh, PA 15260-6601

Financial Aid Application Supplement (FAAS)

for the 2014-15 School Year

University of Pittsburgh

412-624-7488

oafa@pitt.edu

www.oafa.pitt.edu/learn-about-aid

UNDERGRADUATE STUDENTS ONLY

Please answer every question. If your answer to any question is zero, indicate 0. If a particular question does not apply to you, answer N/A.

If questions are unanswered, the FAAS will be returned to you. Tis will delay the processing of your fnancial aid application and will afect

the date that your application is considered complete.

If any of the information you submit on the FAAS changes after you have returned it to the Ofce of Admissions and Financial Aid, it is

your responsibility to update the FAAS to ensure accurate processing of your fnancial aid application. Corrected information should be

provided to the Ofce in writing.

Questions 1, 2, and 3 Print your full frst and last names and your Pitt Student ID Number, if known, and the last four digits of

your Social Security Number. Note: Name and Student Identifcation Number are required at the top of each of the FAAS Pages.

Question 4 Provide information about each member of your household who will be supported by your parents (or you, if you are

an independent student) during the 2014-15 school year. For most students, this means yourself, parents and any siblings living at

home. Please indicate the number of persons attending a post-secondary school on at least a half-time basis in 2014-15, excluding

your parents, in Part C. Please provide the last four digits of the Social Security Number for each family member listed.

Question 5 Indicate your 2013 Federal income tax fling status. If your 2014-15 FAFSA is selected for verifcation, please note:

In keeping with the US Department of Education regulations, Federal Income Tax returns are not acceptable for student fnancial

aid verifcation purposes. If received by this ofce, these documents will be shredded. A copy of your IRS Tax Return Transcript

is the required document. You can obtain a copy of a Tax Return Transcript by visiting www.irs.gov, Order a Transcript, Get

Transcript ONLINE, select Return Transcript. Te Tax Return Transcript will be availalbe for print or download. You can also

request a transcript be mailed to you by calling 1-800-908-9946.

Questions 6 and 7 Complete all items in these sections for each item named. If the amount received by your family in any cat-

egory is zero, indicate 0 in the blank space provided.

Question 8 Please indicate whether you or a member of your family received food stamps at any time during 2012 or 2013. Please

attach agency documentation to confrm.

Question 9 Please indicate whether any portion of an IRA distribution or untaxed pension was a rollover. Please attach a copy

of the 1099 R with the appropriate distribution code indicating such.

Question 10 If you have been awarded fnancial aid from a source outside the Ofce of Admissions and Financial Aid, it must

be reported. Indicate both the name of the scholarship or grant and the dollar amount of the award for the 2014-15 school year.

Outside sources might include, but are not limited to, ROTC scholarships, Ofce of Vocational Rehabilitation grants, resident

assistantships, tuition remission, private or corporate scholarships or grants.

Question 11 Please indicate the number of credits for which you intend to enroll for both the fall and spring terms of the 2014-

15 academic year.

Question 12 Requested signatures must be provided. An unsigned FAAS is considered incomplete and will be returned to you

for signatures.

PLEASE DO NOT STAPLE THESE PAGES TOGETHER WHEN YOU SUBMIT THEM

2014-15 FINANCIAL AID APPLICATION SUPPLEMENT

Tis form covers the Fall 2014 and Spring 2015 Semesters (Terms 2151 and 2154)

1. Student

Name

Last First M.I.

2. Pitt Student ID Number

3. Student Social Security Number

(last four digits)

4. Give information for each person who will be provided at least half of their support by your parents/step-parents

(or you, if you/spouse are an independent student) during the 2014-15 school year.

A. Number of family members in 2014-15 in your household.

B. Number of college students in 2014-15 enrolled at least

half-time in a post-secondary school (excluding parents).

C.

Check box if attending college

Full name of ALL family members

included in 4A above

Age

Relationship to

student

Last four digits

of Social Security

Number

Name of school or college

2014-15 school year

Full Time

Half

Time

Less Tan

Half Time

1. You - Student Applicant University of Pittsburgh

2.

3.

4.

5.

6.

7.

X X X X X

5. Income Information. Please check all that apply below for Student/(Spouse) and Parents/Step-Parents, if you are a

dependent student. Since you have been selected for verifcation, you must provide copies of your 2013 Federal Income

Tax Transcript (unless you successfully utilized the IRS Data Retrieval Tool), copies of your W-2s and other earnings state-

ments.

A. Student/Spouse Income & Tax Filing Information

___ Never married ___ Married/Remarried ___ Divorced/Separated ___ Widowed

Date of Marital Status: ___ / ___

Check all that apply for student/spouse:

__ Filed or will fle a 2013 Federal Income Tax Return.

__ Worked and received a W-2, but is not required to fle a 2013 Federal Income Tax Return.

__ Is self employed.

__ Did not work in 2013 and is not required fle a 2013 Federal Income Tax Return.

B. Parents(s) Income and Tax Filing Information

Who is considered a parent? Parent refers to a biological or adoptive parent.

-Grandparents, foster parents, legal guardians, older siblings, and uncles or aunts are not considered parents on

this form unless they have legally adopted you. If your legal parents are living and married to each other, answer

the questions about both of them.

- If your legal parents are not married and live together, answer the questions about both of them.

-In case of divorce or separation, give information about the parent you lived with most in the last 12 months. If

you did not live with one parent more than the other, give information about the parent who provided you the

most fnancial support during the last 12 months or during the most recent year you received support.

-If your divorced or widowed parent has remarried, provide information about your parent and stepparent.

Indicate the current marital status for the parent(s) listed above in 4 C.

___ Never married ___ Married/Remarried ___ Divorced/Separated ___ Widowed

___ Unmarried, and both parents living together Date of Marital Status: ___ / ___

Indicate the Tax Filing Status for parent(s) listed above in 4 C.

___ Single ___ Married fling jointly ___ Married fling separately

___ Head of household ___ Qualifying widow(er) with dependent child

a. First Parent- Mother/Father/Step-Parent listed above in 4C. Check all that apply to the frst parent above:

___Filed or will fle a 2013 Federal Income Tax Return.

___Worked and received a W-2, but is not required to fle a 2013 Federal Income Tax Return.

___Is self employed.

___Did not work in 2013 and is not required fle a 2013 Federal Income Tax Return.

b. Second Parent- Mother/Father/Step-Parent listed above in 4C. Check all that apply to the second parent

above.

___Filed or will fle a 2013 Federal Income Tax Return.

___Worked and received a W-2, but is not required to fle a 2013 Federal Income Tax Return.

___Is self employed.

___Did not work in 2013 and is not required fle a 2013 Federal Income Tax Return.

Last First M.I. Pitt Student ID Number

6. Additional Financial Information

2013 Tax YearJanuary 1, 2013 to December 31, 2013

a. Child support paid because of divorce or separation or as a result of a legal require-

ment. Dont include support for children in your household.

a1. Name of person to whom child support was paid:_______________________

a2. Name and ages of children for whom support was paid:___________________

_____________________________________________________________

b. Taxable earnings from need-based employment programs, such as Federal Work-

Study and need-based employment portions of fellowships and assistantships.

c. Taxable student grant/scholarship aid reported to the IRS in your adjusted gross in-

come. Includes AmeriCorps benefts (awards, living allowances, and interest accrual

payments), as well as grant or scholarship portions of fellowships and assistantships.

d. Combat pay or special combat pay. Only enter the amount that was taxable and

included in your adjusted gross income. Do not enter non-taxed combat pay.

e. Earnings from work under a cooperative education program ofered by the college.

TOTAL

7. Untaxed Income

2013 Tax YearJanuary 1, 2013 to December 31, 2013

a. Child support received for all children. Dont include foster or adoption payments.

b. Housing, food and other living allowances paid to members of the military, clergy, and

others (including cash payments and cash value of benefts). Do not include the value

of on base military housing or the value of a basic military allowance for housing.

c. Veterans noneducation benefts such as Disability, Death Pension, or Dependency &

Indemnity Compensation (DIC), and/or VA Educational Work-Study Allowances.

d. Other untaxed income not reported in items 45a through 45h (student) and 94a through

94h (parent), of the FAFSA, such as workers compensation, disability, etc. Also include

the untaxed portions of health savings accounts from IRS Form 1040-line 25. Dont in-

clude extended foster care benefts, student aid, earned income credit, additional child tax

credit, welfare payments, untaxed Social Security benefts, Supplemental Security Income,

Workforce Investment Act educational benefts, on-base military housing or a military

housing allowance, combat pay, benefts from fexible spending arrangements (e.g., cafete-

ria plans), foreign income exlcusion or credit for federal tax on special fuels.

e. Money received, or paid on your behalf (e.g., bills), not reported elsewhere on this

form. Tis includes money that you received from a non-custodial parent that is not

part of a legal child support agreement.

TOTAL

ALL students and their families must complete these sections.

DEPENDENT STUDENTS should complete both parents and students columns.

INDEPENDENT STUDENTS should complete only student/spouse column.

Parents

$

$

$

$

$

$

Parents

$

$

$

$

$

Student/Spouse

$

$

$

$

$

$

Student/Spouse

$

$

$

$

$

IF ANSWER IS $0, YOU MUST ENTER 0.

IF LEFT BLANK, FORM WILL BE

RETURNED TO YOU, AND YOU MAY MISS

IMPORTANT DEADLINES.

Last First M.I. Pitt Student ID Number

8. Did you (student) or a family member listed in Question 4 receive food stamps at any time during 2012 or 2013?

No Yes

If you answered Yes concerning food stamps, you must attach documentation from the agency issuing the food stamps to confrm.

Please print student name and Pitt ID number on the documentation before submitting.

9. Was any portion of an IRA Distribution or untaxed pension a rollover?

No Yes

If you answered Yes concerning a rollover, you must submit a copy of the 1099 R with the appropriate distribution code indicating

such. Please print student name and Pitt ID number on the documentation before submitting.

11. Anticipated Enrollment

Please indicate the number of credits you plan to enroll for during each term of the 2014-15 academic year. Assume three credits per

class if you do not know the exact number of credits for which you will enroll.

FALL SPRING

12 or more credits (Full time enrollment) 12 or more credits (Full time enrollment)

6-11 credits (Half time) 6-11 credits (Half time)

5 or fewer credits (Less than half time) 5 or fewer credits (Less than half time)

Will not enroll Will not enroll

12. Student, Parent and/or Spouse Certifcation

I certify that all of the information on this form is true and complete to the best of my knowledge. If asked by an authorized ofcial,

I agree to give proof of the information that I have given on this form. I realize that this proof may include a copy of my 2013 U.S.

income tax transcript and all W-2s. I realize that if I do not give proof when asked, I may not get aid and that incorrect information

can result in aid being reduced or cancelled with repayment due from my family.

10. If you are the recipient of a scholarship or grant from a source outside the Ofce of Admissions and Financial Aid for the 2014-15

school year, report the department, organization, or agency and the annual dollar amount below:

Name of Scholarship/Grant Annual Dollar Value

$

$

$

$

$

0213

Students Signature __________________________________________________________ Date ___________________________

Month Day Year

Spouses Signature __________________________________________________________ Date ___________________________

Month Day Year

Fathers Signature ___________________________________________________________ Date ___________________________

Month Day Year

Mothers Signature __________________________________________________________ Date ___________________________

Month Day Year

Last First M.I. Pitt Student ID Number

You might also like

- PHD Ordinance Msubaroda IndiaDocument15 pagesPHD Ordinance Msubaroda IndiaBhagirath Baria100% (1)

- Documentation in Psychiatric NursingDocument15 pagesDocumentation in Psychiatric NursingShiiza Dusong Tombucon-Asis86% (7)

- Florida Agricultural and Mechanical University: 2013-2014 Verification Worksheet Dependent StudentDocument4 pagesFlorida Agricultural and Mechanical University: 2013-2014 Verification Worksheet Dependent StudentdraykidNo ratings yet

- 2014-2015 Verification Worksheet-Dependent Student IDOCDocument4 pages2014-2015 Verification Worksheet-Dependent Student IDOCJoshChukwubudikeBarnesNo ratings yet

- Faculty of Law Admission Bursary Application 2017 - 2018: Early Deadline: Final DeadlineDocument5 pagesFaculty of Law Admission Bursary Application 2017 - 2018: Early Deadline: Final DeadlinekarenNo ratings yet

- 2012-13 Transfer Aid ApplicationDocument4 pages2012-13 Transfer Aid ApplicationLufinancial AidNo ratings yet

- Financial Aid Appeal 1516Document7 pagesFinancial Aid Appeal 1516Dylan AshburnNo ratings yet

- CUNY Standard Verification WorksheetDocument3 pagesCUNY Standard Verification Worksheethicu0No ratings yet

- 2014-15 Verification Worksheet - Dependent Student Institutional Documentation Service (IDOC)Document4 pages2014-15 Verification Worksheet - Dependent Student Institutional Documentation Service (IDOC)Brenn WhitingNo ratings yet

- English 13-14 App and LTRDocument5 pagesEnglish 13-14 App and LTRapi-259143520No ratings yet

- 1314 Verification Independent WorksheetDocument2 pages1314 Verification Independent WorksheetAngela JenkinsNo ratings yet

- Customized PROFILE Application InstructionsDocument11 pagesCustomized PROFILE Application InstructionsArunaNo ratings yet

- 2012-2013 Texas Application For State Financial Aid (TASFA) : (For House Bill 1403/senate Bill 1528 Students Only)Document4 pages2012-2013 Texas Application For State Financial Aid (TASFA) : (For House Bill 1403/senate Bill 1528 Students Only)jposada09No ratings yet

- WWW Financialaid Ou EduDocument3 pagesWWW Financialaid Ou EduJoel VandiverNo ratings yet

- 2012-13 Upperclass Financial Aid ApplicationDocument4 pages2012-13 Upperclass Financial Aid ApplicationLufinancial AidNo ratings yet

- 2012-2013 Verification Worksheet Independent StudentDocument3 pages2012-2013 Verification Worksheet Independent StudentJennifer ChinellNo ratings yet

- 2015-2016 Dependent Verification FormDocument2 pages2015-2016 Dependent Verification FormxxxtoyaxxxNo ratings yet

- CSS Profile InstructionsDocument10 pagesCSS Profile InstructionsVickyNo ratings yet

- 2011-12 Fafsa Tap Quick GuideDocument2 pages2011-12 Fafsa Tap Quick GuideModou LoNo ratings yet

- International Student Financial Aid ApplicationDocument5 pagesInternational Student Financial Aid ApplicationRahul VermaNo ratings yet

- Spring Scholarship Aid Application Form 16 17Document4 pagesSpring Scholarship Aid Application Form 16 17CHIBUIKE DANIELNo ratings yet

- NABA Financial Aid FormDocument6 pagesNABA Financial Aid FormHien Giang Vu NgocNo ratings yet

- 2020-2021 Verification Worksheet: A. Student InformationDocument2 pages2020-2021 Verification Worksheet: A. Student InformationHaider AliNo ratings yet

- 2012-13 Graduate Financial Aid ApplicationDocument2 pages2012-13 Graduate Financial Aid ApplicationLufinancial AidNo ratings yet

- FafsaDocument5 pagesFafsaapi-244239127No ratings yet

- 18-19 FINAL GA Dependent VerificationDocument2 pages18-19 FINAL GA Dependent VerificationJared MccafreyNo ratings yet

- 1516 International Student FinAid AppDocument5 pages1516 International Student FinAid AppSteve MacarioNo ratings yet

- 2014 Undergraduate Application FormDocument4 pages2014 Undergraduate Application Formleomille2No ratings yet

- 04 DeterminingFamilySize enDocument47 pages04 DeterminingFamilySize enAshar AwanNo ratings yet

- WWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enDocument17 pagesWWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enLeslie BrownNo ratings yet

- Friends of 440 Scholarship Application 2012Document16 pagesFriends of 440 Scholarship Application 2012Mrs. LibbyNo ratings yet

- 2011-2012 Dependent Verification Worksheet: About The Verification ProcessDocument2 pages2011-2012 Dependent Verification Worksheet: About The Verification ProcessJerry WilkNo ratings yet

- Frequently Asked Tax Questions 2015sdaDocument8 pagesFrequently Asked Tax Questions 2015sdaVikram VickyNo ratings yet

- 2014 Income Tax Extension Filer's Form: Attach A Copy of Your 2014 W-2 Form(s)Document1 page2014 Income Tax Extension Filer's Form: Attach A Copy of Your 2014 W-2 Form(s)daaneelNo ratings yet

- International Student Fa App 1617Document4 pagesInternational Student Fa App 1617JeesonAntonyNo ratings yet

- LHS ExemptionForm Final-1Document6 pagesLHS ExemptionForm Final-1rayghanaachmatNo ratings yet

- 11-12 CCA Family Income FormDocument1 page11-12 CCA Family Income FormWilliena OwesNo ratings yet

- Income Expense WorksheetDocument2 pagesIncome Expense WorksheetNithya ShivakumarNo ratings yet

- Income-Driven Repayment Plan Request How To Complete YourDocument13 pagesIncome-Driven Repayment Plan Request How To Complete YourAnonymous 6jR6DuNo ratings yet

- Free Tuition Fee Application Form: University of Rizal SystemDocument2 pagesFree Tuition Fee Application Form: University of Rizal SystemCes ReyesNo ratings yet

- Tuition StatementDocument7 pagesTuition StatementAnonymous 9FlDK6YrJNo ratings yet

- 2015-2016 Verification of Other Untaxed Income For 2014Document3 pages2015-2016 Verification of Other Untaxed Income For 2014Chris HuntNo ratings yet

- 2022-2023 Income and Expenses WorksheetDocument2 pages2022-2023 Income and Expenses WorksheetDesy SelawatiNo ratings yet

- 101652-Appendix B - Parents, Guardians or Sponsors 2017-18 2Document4 pages101652-Appendix B - Parents, Guardians or Sponsors 2017-18 2allen.solorzano57No ratings yet

- 2011-2012 Dependent Verification FormDocument4 pages2011-2012 Dependent Verification FormCoachRich3No ratings yet

- Additional Financial Information: Funds Were ReceivedDocument1 pageAdditional Financial Information: Funds Were ReceivedaushishinhamoriNo ratings yet

- Fee Waiver Parent LetterDocument8 pagesFee Waiver Parent LetterCristina CotraNo ratings yet

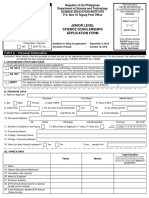

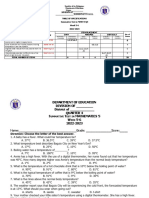

- Junior Level Science Scholarships Application Form: FORM A - Personal InformationDocument4 pagesJunior Level Science Scholarships Application Form: FORM A - Personal InformationAbigail SaballeNo ratings yet

- Osu AffidavitDocument2 pagesOsu AffidavitFahad AhmedNo ratings yet

- Plication For Tuition AssistanceDocument4 pagesPlication For Tuition Assistanceturdly2009100% (2)

- Federal Tax Benefits For EducationDocument5 pagesFederal Tax Benefits For EducationMichael NolanNo ratings yet

- DSFADocument2 pagesDSFAGraham Mc NamaraNo ratings yet

- 2012 13 Do You Need MoneyDocument2 pages2012 13 Do You Need MoneytcrphsNo ratings yet

- Income Driven Repayment FormDocument13 pagesIncome Driven Repayment Formtumi50No ratings yet

- Non-Filer Statement Independent Student 2015-2016Document1 pageNon-Filer Statement Independent Student 2015-2016ddyjrxNo ratings yet

- Attention:: Order Information Returns and Employer Returns OnlineDocument6 pagesAttention:: Order Information Returns and Employer Returns OnlinepdizypdizyNo ratings yet

- International Student Fa App 2011-12Document3 pagesInternational Student Fa App 2011-12daudinhanNo ratings yet

- V1 DepDocument5 pagesV1 DepMardochee DadeNo ratings yet

- TAG Additional Data Collection - External - DependentDocument1 pageTAG Additional Data Collection - External - Dependentmonicabennett3419No ratings yet

- Irvs GovnDocument4 pagesIrvs Govnanaga1982No ratings yet

- EstimatorDocument3 pagesEstimatorapi-320221579No ratings yet

- BBDM1023 BOM Coursework - Specs 202301Document7 pagesBBDM1023 BOM Coursework - Specs 202301SHEVENA A/P VIJIANNo ratings yet

- Agoraphobia 1Document47 pagesAgoraphobia 1We Are HanakoNo ratings yet

- Onapp Platform Brochure PDFDocument8 pagesOnapp Platform Brochure PDFJohn C. YoungNo ratings yet

- Responsibilities of Incident ManagerDocument3 pagesResponsibilities of Incident ManagerMelissa MillerNo ratings yet

- Nutech University Admission SlipDocument3 pagesNutech University Admission SlipaliiiiNo ratings yet

- Communication Technology Definition PDFDocument2 pagesCommunication Technology Definition PDFVictoriaNo ratings yet

- UG Unconditional Offer LetterDocument2 pagesUG Unconditional Offer Letterzwt208961360No ratings yet

- English Test Unit 1 3rd GradeDocument3 pagesEnglish Test Unit 1 3rd GradeJasmín GálvezNo ratings yet

- What Is Pair ProgrammingDocument4 pagesWhat Is Pair ProgrammingMalik AmmarNo ratings yet

- 9th BASIC ENGLISH TEST - 10-08-19 PDFDocument3 pages9th BASIC ENGLISH TEST - 10-08-19 PDFJIM GUIMACNo ratings yet

- Eyes Open 1.2 A Unit 7 TestDocument4 pagesEyes Open 1.2 A Unit 7 TestDorota SmolinskaNo ratings yet

- College Wise Pass PercentageDocument6 pagesCollege Wise Pass PercentageShanawar BasraNo ratings yet

- MBA in Healthcare Management - Masters in Hospital AdministrationDocument2 pagesMBA in Healthcare Management - Masters in Hospital AdministrationSandeep SonawneNo ratings yet

- Lesson Plan in Physical Education Final DemoDocument7 pagesLesson Plan in Physical Education Final DemoJunel SildoNo ratings yet

- Obtain Nursing PermitDocument10 pagesObtain Nursing PermitKewkew AzilearNo ratings yet

- TOEFL Writing PDF PDFDocument40 pagesTOEFL Writing PDF PDFFaz100% (1)

- 2004 - THOMPSON - The (Mis) Measurement of Body Image Ten Strategies To ImproveDocument8 pages2004 - THOMPSON - The (Mis) Measurement of Body Image Ten Strategies To ImproveCarolina RuasNo ratings yet

- Cognitive Errors: Mahwish NazDocument15 pagesCognitive Errors: Mahwish NazIxhaq motiwalaNo ratings yet

- PROFESSIONDocument19 pagesPROFESSIONdonnaNo ratings yet

- Professionals Play MinimaxDocument22 pagesProfessionals Play MinimaxManish GoyalNo ratings yet

- EBI R310 1 CompatibilityDocument8 pagesEBI R310 1 CompatibilityRødrigø PøpNo ratings yet

- HSSC Registration PDFDocument1,791 pagesHSSC Registration PDFMyra Samir SilasNo ratings yet

- Advisory Assignment Order Junior High SchoolDocument1 pageAdvisory Assignment Order Junior High SchoolJaz and Ysha's ChannelNo ratings yet

- Application Questions To PonderDocument5 pagesApplication Questions To PonderJasmin KumarNo ratings yet

- Chương Trình Tiếng Anh Tăng Cường Khối 3Document12 pagesChương Trình Tiếng Anh Tăng Cường Khối 3nguyenNo ratings yet

- ST3 - Math 5 - Q4Document3 pagesST3 - Math 5 - Q4Maria Angeline Delos SantosNo ratings yet

- Lab 1 - Intro To Comp ProgramsDocument11 pagesLab 1 - Intro To Comp Programssyahira NurwanNo ratings yet

- PepsicoDocument17 pagesPepsicoUsman GhaniNo ratings yet