Professional Documents

Culture Documents

AFM Assignment

Uploaded by

Mudit Bhargava0 ratings0% found this document useful (0 votes)

163 views7 pages- The document contains two balance sheets from Maynard Company for June 1 and June 30 showing changes in assets, liabilities, and equity over that period. There was an increase in cash and current liabilities from June 1 to June 30.

- It also contains information about the Dispensers of California case study including transactions that occurred throughout the year that affected the income statement and balance sheet. An income statement and ending balance sheet are provided. The company had net income of $52,500 for the year.

Original Description:

Accounting For managers question and answers

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document- The document contains two balance sheets from Maynard Company for June 1 and June 30 showing changes in assets, liabilities, and equity over that period. There was an increase in cash and current liabilities from June 1 to June 30.

- It also contains information about the Dispensers of California case study including transactions that occurred throughout the year that affected the income statement and balance sheet. An income statement and ending balance sheet are provided. The company had net income of $52,500 for the year.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

163 views7 pagesAFM Assignment

Uploaded by

Mudit Bhargava- The document contains two balance sheets from Maynard Company for June 1 and June 30 showing changes in assets, liabilities, and equity over that period. There was an increase in cash and current liabilities from June 1 to June 30.

- It also contains information about the Dispensers of California case study including transactions that occurred throughout the year that affected the income statement and balance sheet. An income statement and ending balance sheet are provided. The company had net income of $52,500 for the year.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 7

AFM ASSIGNMENT

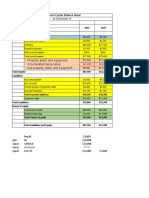

MAYNARD COMPANY CASE STUDY (A)

ANSWER. 1

BALANCE SHEET AS OF JUNE 1

LIABILITES AMOUNT ASSESTS AMOUNT

Accounts payable $ 8517

Accounts receivable $ 21798

Bank notes payable $ 8385 Cash $ 34983

Accrued wages

payable

$ 1974 Note receivable $ 11700

Taxes payable $ 5700 Merchandise

Inventory

$ 29835

Capital stock $ 390000 Supplies on hand $ 5559

Retained earnings $ 221511 Land $ 89700

Other non-current

liabilities

$ 2451 Building $ 429000

Equipment $ 7956

Prepaid Insurance $ 3150

Other Noncurrent

assets

$ 4857

$ 638538 $ 638538

BALANCE SHEET AS OF JUNE 30

LIABILITES AMOUNT ASSETS AMOUNT

Accrued Wages $ 2202

Accounts receivable $ 26505

Bank Note Payable $ 29250 Building $ 427050

Other non Current

Liabilities

$ 2451 Equipment $ 30732

Retained Earnings $ 229446 Cash $ 66660

Taxes Payable $ 7224 Land $ 89700

Capital Stock $ 390000 Merchandise

inventory

$ 26520

Account Payable $ 21315 Other Non Current

Assets

$ 5265

Prepaid Insurance $ 2826

Supplies on Hand $ 6630

$ 681888 $681888

ANSWER. 2

There was an increase in cash balance and the current liabilities also

increased so its not good for the company as it will reduce the profits

of the company

ANSWER. 3

The retained earnings increased by $229,446 - $221,511 = $7,935.

Diane Maynard got a dividend of $11700 which she then used to

repay her loan

ANSWER. 4

Yes. Shareholder equity is capital in business

So Capital stock + Retained Earnings

390000+229446 = 619446

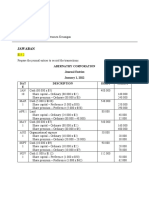

Dispensers of California Inc Case Study

Answer 1.

The profit plan can be used to analyze the assets and liabilities of the

business and forecast the future financial position. The profit plan

contain sales, cost which will serve as guide in managing all the expense

and objectives

Answer 2

ASSETS = LIABILITES + CAPITAL

1.a Patent $120,000 Common stock $120,000

1.b Cash $80,000 Common stock $80,000

2. Incorporation costs ($2500) Retained earnings ($2500)

3. Equipment purchase

Cash ($85,000)

Equipment $85,000

4. Redesign cost ($25,000) Retained earnings ($25,000)

5. Parts purchase

Inventory $212,100

Cash ($212,100)

6 Cash $30,000

Cash repaid ($30,000)

Loan interest ($500)

Bank loan

$30,000

Bank loan

($30,000)

Retained earnings ($500)

7. Cash ($145,000) Retained earnings ($145,000)

8. Cash ($62,000) Retained earnings ($62,000)

9. Cash ($63,000) Retained earnings ($63,000)

10. Inventory ($197,000) Retained earnings ($197,000)

11. Cash $598,500

Retained earnings $598,500

12. Equipment ($8,500) Retained earnings ($8,500)

13. Patent amortization ($20,000) Retained earnings ($20,000)

14. Cash ($5,000) Retained earnings ($5,000)

15. Taxes payable

$22,500

Retained earnings ($22,500)

Total Assets Total Liabilities + Capital

$270,000 $ 270,000

Answer 3.

INCOME SHEET

Sales $598,500

Components $197,000

Manufacturing payroll $145,000

Other Mfg. $62,000

Depreciation $8,500 = $412,500

Gross margin $186,500

Selling, general and administration $$63,000

Patent $20,000

Redesign costs $25,000

Incorporation costs $2,500

Operating profits $75,500

Interest $500

Profit after taxes $75,000

Tax expenses $22,500

Net income $52,500

ANSWER 4.

BALANCE SHEET

ASSETS LIABILITES

Cash $78,400

Taxes payable $22,500

Inventory $15,100

Capital stock $200,000

Current assets $93,500

Retained earnings $47,500

Equipment $76,500

Patent $100,000

Total $270,000

Total $270,000

You might also like

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Sample Financial Management ProblemsDocument8 pagesSample Financial Management ProblemsJasper Andrew AdjaraniNo ratings yet

- Bloomberg ReferenceDocument112 pagesBloomberg Referencephitoeng100% (1)

- Deep Value Investing - C. Mayer - July 2018Document72 pagesDeep Value Investing - C. Mayer - July 2018Chris Mayer100% (3)

- Alfred Cesar QuinsayDocument3 pagesAlfred Cesar QuinsayIrah Louise67% (3)

- Rights of Shareholders, Strategic Alliance vs. Radstock Securities, RonaldDocument2 pagesRights of Shareholders, Strategic Alliance vs. Radstock Securities, RonaldJoshua PielagoNo ratings yet

- HW 4Document4 pagesHW 4Mishalm96No ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Dispensers of CaliforniaDocument4 pagesDispensers of CaliforniaShweta GautamNo ratings yet

- AHM13e - Chapter 01 - Key To EOC Problems and CasesDocument14 pagesAHM13e - Chapter 01 - Key To EOC Problems and CasesArunesh SN100% (1)

- Panlilio Vs Citi BankDocument2 pagesPanlilio Vs Citi BankRed HoodNo ratings yet

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- Jawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditDocument6 pagesJawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditChupa HesNo ratings yet

- Bitfinex Preview BFX Conversion PitchDocument25 pagesBitfinex Preview BFX Conversion PitchAnonymous wRn8eDNo ratings yet

- 704Document5 pages704Bhoomi GhariwalaNo ratings yet

- Exhibit 17. Goodwill Calculation and The Consolidated Balance SheetDocument4 pagesExhibit 17. Goodwill Calculation and The Consolidated Balance SheetЭниЭ.No ratings yet

- HARD ROCK COMPANY Statement of Financial PositionDocument3 pagesHARD ROCK COMPANY Statement of Financial PositionJade Lykarose Ochavillo GalendoNo ratings yet

- Dr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Document3 pagesDr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Ishrat Jahan PapiyaNo ratings yet

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- 4355913Document2 pages4355913mohitgaba19No ratings yet

- Statement of Cash Flows: Balances Accounts Jan 1, 2015 Dec 31, 2015Document2 pagesStatement of Cash Flows: Balances Accounts Jan 1, 2015 Dec 31, 2015Alyssa AlejandroNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- Working CapitalDocument6 pagesWorking CapitalElizabeth Sanabria AriasNo ratings yet

- Financial Accounting HomeworkDocument9 pagesFinancial Accounting HomeworkDương Nguyễn BìnhNo ratings yet

- 704Document3 pages704Bhoomi GhariwalaNo ratings yet

- CHEMALITEDocument1 pageCHEMALITEPurva TamhankarNo ratings yet

- FDNACCT - Quiz #1 - Solutions To PS - Set CDocument2 pagesFDNACCT - Quiz #1 - Solutions To PS - Set CleshamunsayNo ratings yet

- Chintia Novrianti 3c Lat 12 RevDocument6 pagesChintia Novrianti 3c Lat 12 RevShintia NovriantiNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- 6 DesemberDocument8 pages6 DesemberKezia N. ApriliaNo ratings yet

- Acctg 115 - CH 2 SolutionsDocument9 pagesAcctg 115 - CH 2 SolutionsRand_A100% (1)

- Cash Flow - Additional Exercises - SOLDocument5 pagesCash Flow - Additional Exercises - SOLMathieu HindyNo ratings yet

- Confra Financial StatementsDocument3 pagesConfra Financial StatementsPia ChanNo ratings yet

- Chapter 5 Class ExercisesDocument13 pagesChapter 5 Class ExercisesSky GatdulaNo ratings yet

- Practice 3 Balance SheetDocument4 pagesPractice 3 Balance SheetsherinaNo ratings yet

- FDNACCT - Quiz #1 - Solutions To PS - Set ADocument2 pagesFDNACCT - Quiz #1 - Solutions To PS - Set AleshamunsayNo ratings yet

- Chapter 15 Part 2Document8 pagesChapter 15 Part 2Mauren putri SalendaNo ratings yet

- CH23 - Transactional Approach and CFExercises and SolutionsDocument6 pagesCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNo ratings yet

- FDNACCT - Quiz #1 - Solutions To PS - Set BDocument2 pagesFDNACCT - Quiz #1 - Solutions To PS - Set BleshamunsayNo ratings yet

- Tugas MK11Document2 pagesTugas MK11Nan BaeeeNo ratings yet

- Protecto Company Purchaesed 75 Percent of StrandDocument4 pagesProtecto Company Purchaesed 75 Percent of Strandlaale dijaanNo ratings yet

- Pacilio Securtiy Service Accounting EquationDocument11 pagesPacilio Securtiy Service Accounting EquationKailash KumarNo ratings yet

- Question 75: Basic Consolidation: Profit For The Year 9,000 3,000Document5 pagesQuestion 75: Basic Consolidation: Profit For The Year 9,000 3,000Lidya Abera100% (1)

- Fath Abdul Azis - A031211044Document6 pagesFath Abdul Azis - A031211044Fath Abdul AzisNo ratings yet

- Chapter 12 ExercisesDocument2 pagesChapter 12 ExercisesAreeba QureshiNo ratings yet

- Examination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Financial Management (Problems)Document12 pagesFinancial Management (Problems)Prasad GowdNo ratings yet

- Financial Statement Analysis QuestionsDocument4 pagesFinancial Statement Analysis QuestionsRisha OsfordNo ratings yet

- M - 30 S 2020 o ($'000) ($'000) ADocument10 pagesM - 30 S 2020 o ($'000) ($'000) AAmmar TahirNo ratings yet

- Statement of Change in Working Capital & Inflows/Outflows of Working CapitalDocument5 pagesStatement of Change in Working Capital & Inflows/Outflows of Working CapitalChandani DesaiNo ratings yet

- 9381 - Soal Uas Akl 2Document14 pages9381 - Soal Uas Akl 2Kurnia Purnama Ayu0% (3)

- Sherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingDocument7 pagesSherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingSTEFANI NUGRAHANo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- Professor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Document3 pagesProfessor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Precious Uminga100% (1)

- RIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningDocument4 pagesRIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningRizka OktavianiNo ratings yet

- ABM 14 - Casañas - BALANCE SHEETDocument1 pageABM 14 - Casañas - BALANCE SHEETCasañas, Gillian DrakeNo ratings yet

- Fundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualDocument16 pagesFundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions Manualeffigiesbuffoonmwve9100% (20)

- CASH FLOW ExampleDocument4 pagesCASH FLOW ExampleBiancaNo ratings yet

- Feed Back Kuis Akl Praktikum (Uts)Document5 pagesFeed Back Kuis Akl Praktikum (Uts)KiwidNo ratings yet

- Clairemont Co Ejercio de Practica MartesDocument2 pagesClairemont Co Ejercio de Practica Martescarlos huertasNo ratings yet

- ExerciseDocument12 pagesExercisesde.ofcl20No ratings yet

- QUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDocument4 pagesQUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDaffa Ramadhan ArcheryNo ratings yet

- BUS FPX4060 - Assessment2 1Document14 pagesBUS FPX4060 - Assessment2 1AA TsolScholarNo ratings yet

- Answer 4 - Excel For Diff. Acctg.Document42 pagesAnswer 4 - Excel For Diff. Acctg.Rheu ReyesNo ratings yet

- Problem 1-3 Module 1Document7 pagesProblem 1-3 Module 1Tiffany GunawanNo ratings yet

- Electrona Financial StatementsDocument18 pagesElectrona Financial StatementsAnonymous HVLVK4No ratings yet

- AmalgamationDocument41 pagesAmalgamationZooNo ratings yet

- 7 Cost of Capital CTDI October 2013Document85 pages7 Cost of Capital CTDI October 2013Diane SerranoNo ratings yet

- Mergers and AcquisitionsDocument4 pagesMergers and AcquisitionsAmbrish (gYpr.in)No ratings yet

- Investment in Equity Securities - Problem 16-5 and 16-7Document4 pagesInvestment in Equity Securities - Problem 16-5 and 16-7Jessie Dela CruzNo ratings yet

- Radio AnalysisDocument100 pagesRadio Analysisabhayjain686No ratings yet

- Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst CaseDocument9 pagesMar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst CaseYASH KOTHARINo ratings yet

- HM-Sampoerna AR 2015 PDFDocument164 pagesHM-Sampoerna AR 2015 PDFgisela 322016015No ratings yet

- FinshikshaDocument5 pagesFinshikshaAnirban MitraNo ratings yet

- Bir Ruling 197-93 (May 7, 1993)Document5 pagesBir Ruling 197-93 (May 7, 1993)matinikkiNo ratings yet

- Topic 6 Supplement (Cost of Capital, Capital Structure and Risk)Document36 pagesTopic 6 Supplement (Cost of Capital, Capital Structure and Risk)Jessica Adharana KurniaNo ratings yet

- Impact of M&A Announcement On Acquiring and Target Firm's Stock Price: An Event Analysis ApproachDocument5 pagesImpact of M&A Announcement On Acquiring and Target Firm's Stock Price: An Event Analysis ApproachAbhishek PandaNo ratings yet

- Financial&managerialaccounting - 15e Williams Haka Bettner Chap2Document14 pagesFinancial&managerialaccounting - 15e Williams Haka Bettner Chap2mzqace100% (1)

- Acctstmt DDocument3 pagesAcctstmt Dmaakabhawan26No ratings yet

- Afar - Tutorial - QuestionsDocument5 pagesAfar - Tutorial - QuestionsRalph Anthony MakinanoNo ratings yet

- 3.2 Equity Securities Hand OutDocument8 pages3.2 Equity Securities Hand OutAdyangNo ratings yet

- Financial RatiosDocument30 pagesFinancial RatiosVenz LacreNo ratings yet

- Pharma Case Excel File For StudentsDocument53 pagesPharma Case Excel File For StudentsJerodNo ratings yet

- Chapter 10 HWDocument6 pagesChapter 10 HWAlysha Harvey EANo ratings yet

- PTC ProjectDocument31 pagesPTC ProjectShahid MehmoodNo ratings yet

- Hoyle Ch3 SolutionsDocument32 pagesHoyle Ch3 SolutionskhawlaNo ratings yet

- Facts:: Corporation Law Case Brief Set 6Document3 pagesFacts:: Corporation Law Case Brief Set 6Vincent Quiña PigaNo ratings yet

- Annex 19Document2 pagesAnnex 19hetalsangoiNo ratings yet