Professional Documents

Culture Documents

Chapter 8 - Investment Property, Non-current Assets & Held for Sale

Uploaded by

PrincessAngelaDeLeon100%(5)100% found this document useful (5 votes)

9K views6 pages1) The document discusses accounting for investment property, noncurrent financial assets, and noncurrent assets held for sale. It provides examples of how to classify different types of assets and record transactions related to these accounts.

2) It includes problems that address the classification and accounting for investment property, advances to officers, prepaid insurance, sinking funds, and assets held for sale. Sample journal entries are provided for transactions such as purchases, sales, and impairments.

3) Accounting topics covered include depreciation, fair value changes, prepaid expenses, and gains or losses on disposals. Guidance is given on presenting these accounts in financial statements.

Original Description:

Empleo Robles

Original Title

Intermediate Accounting Ch 8 Vol 1 2012 Answers

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The document discusses accounting for investment property, noncurrent financial assets, and noncurrent assets held for sale. It provides examples of how to classify different types of assets and record transactions related to these accounts.

2) It includes problems that address the classification and accounting for investment property, advances to officers, prepaid insurance, sinking funds, and assets held for sale. Sample journal entries are provided for transactions such as purchases, sales, and impairments.

3) Accounting topics covered include depreciation, fair value changes, prepaid expenses, and gains or losses on disposals. Guidance is given on presenting these accounts in financial statements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

100%(5)100% found this document useful (5 votes)

9K views6 pagesChapter 8 - Investment Property, Non-current Assets & Held for Sale

Uploaded by

PrincessAngelaDeLeon1) The document discusses accounting for investment property, noncurrent financial assets, and noncurrent assets held for sale. It provides examples of how to classify different types of assets and record transactions related to these accounts.

2) It includes problems that address the classification and accounting for investment property, advances to officers, prepaid insurance, sinking funds, and assets held for sale. Sample journal entries are provided for transactions such as purchases, sales, and impairments.

3) Accounting topics covered include depreciation, fair value changes, prepaid expenses, and gains or losses on disposals. Guidance is given on presenting these accounts in financial statements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

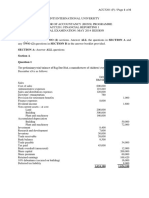

CHAPTER 8

INVESTMENT PROPERTY, OTHER NONCURRENT FINANCIAL ASSETS

AND NONCURRENT ASSETS HELD FOR SALE

PROBLEMS

8-1 Investment Property

(a), (b), (c), (e), (g), (o), (r) with option to or not to report as investment property

(d) not shown in the financial statements

(f) Property, Plant and Equipment

(h) Property, Plant and Equipment, until consummation of lease

(i) Inventories

(j) Inventories

(k) Construction in Progress (Inventories)

(l) Property, Plant and Equipment

(m) Property, Plant and Equipment

(n) Property, Plant and Equipment

(p) Property, Plant and Equipment

(q) not shown, unless leased under finance lease (PPE)

8-2 (Sebastian Corporation)

a. Purchase price P 8,600,000

Commission to real estate agent 430,000

Costs of clearing the land (net of timber and gravel recovered

amounting to P65,000) 70,000

Total cost . P 9,100,000

b. Down payment P 4,000,000

Market value of shares issued (20,000 x 240) 4,800,000

Present value of non-interest bearing note issued

(2,000,000 x 2.4869) 4,973,800

Total cost of land and building P13,773,800

Cost allocated to land (30% x 13,773,800) P 4,132,140

Cost allocated to building (70% x 13,773,800) P 9,641,660

8-3 (Precious Realty Corporation)

1/2/12 Buildings 8,200,000

Accumulated Depreciation Building Held as

Investment Property

4,200,000

Buildings Held as Investment Property 8,200,000

Accumulated Depreciation - Buildings 4,200,000

12/31/12 Depreciation Expense Buildings 200,000

Accumulated Depreciation - Buildings 200,000

Chapter 8 Investment Property, Other Non-current Financial Assets & Non-current Assets Held for Sale

83

8-4 Absolute Corporation

Cost Model

(a) Investment Property at December 31, 2012

Land P 5,000,000

Building

Cost P20,000,000

Accumulated Depreciation

20,000,000/40 x 3 1,500,000 18,500,000

Total Investment Property P23,500,000

(b) Amounts and Accounts Taken to Profit or Loss

Rent Revenue P 3,000,000

Depreciation Expense (500,000)

Administrative and Security Salaries (200,000)

Property Taxes (120,000)

Maintenance (340,000)

Profit P1,960,000

Fair Value Model

(a) Investment Property at December 31, 2012

Land P6,800,000

Building 20,000,000

Total Investment Property P26,800,000

(b) Amounts and Accounts Taken to Profit or Loss

Rent Revenue P 3,000,000

Change in Fair Value of Investment Property

Land 800,000

Building 1,000,000

Depreciation Expense (500,000)

Administrative and Security Salaries (200,000)

Property Taxes (120,000)

Maintenance (340,000)

Profit P3,760,000

8-5 Raymond Company

1. Building Construction Fund Cash

Cash

2. Building Expansion Fund Securities

Building Expansion Fund Cash

3. Building Expansion Fund Securities

Interest Receivable Building Expansion Fund

Building Expansion Fund Cash

4. Building Expansion Fund Cash

Dividend Income

5. Building Expansion Fund Expenses

Building Expansion Fund Cash

Chapter 8 Investment Property, Other Non-current Financial Assets & Non-current Assets Held for Sale

84

6. Building Expansion Fund Cash

Interest Receivable Building Expansion Fund

Interest Income

7. Building Expansion Fund Securities

Building Expansion Fund Cash

8. Building Expansion Fund Cash

Building Expansion Fund Securities

Gain on Sale of Building Expansion Fund Securities

Interest Income

9. Building Expansion Fund Cash

Dividend Income

10. Building Expansion Fund Cash

Building Expansion Fund Securities

Gain on Sale of Building Expansion Fund Securities

11. Buildings

Building Expansion Fund Cash

12. Cash

Building Expansion Fund Cash

8-6 Cordero Corporation

a. Required Semiannual Deposit

= P15,000,000/ FV of annuity of 1 discounted at 4% for 20 periods

= P15,000,000 / 29.7781 = P503,726

b. 1/2/12

Bond Sinking Fund Cash 503,726

Cash 503,726

6/30/12

Bond Sinking Fund Cash 523,875

Cash 503,726

Interest Income (503,726 x 4%) 20,149

12/31/12

Bond Sinking Fund Cash 544,830

Cash 503,726

Interest Income 41,104

4% ( 503,726 + 523,875) = 41,104

8-7 Dorina Company

a. Entries for 2008 through 2013

7/01/08 Prepaid Life Insurance 120,000

Cash 120,000

12/31/08 Life Insurance Expense 60,000

Prepaid Life Insurance 60,000

Chapter 8 Investment Property, Other Non-current Financial Assets & Non-current Assets Held for Sale

85

06/30/09 Prepaid Life Insurance 120,000

Cash 120,000

12/31/09 Life Insurance Expense 120,000

Prepaid Life Insurance 120,000

06/30/10 Prepaid Life Insurance 120,000

Cash 120,000

12/31/10 Life Insurance Expense 120,000

Prepaid Life Insurance 120,000

06/30/11 Prepaid Life Insurance 120,000

Cash 120,000

12/31/11 Life Insurance Expense 120,000

Prepaid Life Insurance 120,000

12/31/11 Cash Surrender Value* 36,000

Life Insurance Expense 36,000

06/30/12 Prepaid Life Insurance 120,000

Cash 120,000

12/31/12 Life Insurance Expense 120,000

Prepaid Life Insurance 120,000

Cash Surrender Value 13,000

Life Insurance Expense 13,000

3/31/13 Life Insurance Expense 30,000

Prepaid Life Insurance 30,000

Receivable from Insurance Company 4,000,000

Prepaid Life Insurance 30,000

Cash Surrender Value 49,000

Gain on Insurance Settlement 3,921,000

*The cash surrender value of life insurance may be recognized on the anniversary date

(June 30, 2011 and every June 30 thereafter). No proportionate adjustment, however, is

necessary at year end because there is no actual increase in cash surrender between

anniversary dates.

b. If the president or his heirs were the beneficiaries of the policy, the premiums paid shall

be charged to employees benefit expense and no cash surrender value will be set up by

the company.

8-8 Solidbank

a. P10,000,000 x 0.3220 = P3,220,000

b. Interest Income in 2011 = 12% x P3,220,000 = P386,400

c. 1/1/11 Advances to Officers 3,220,000

Prepaid Compensation Expense 6,780,000

Cash 10,000,000

Chapter 8 Investment Property, Other Non-current Financial Assets & Non-current Assets Held for Sale

86

12/31/11 Advances to Officers 386,400

Interest Revenue 386,400

Compensation Expense 678,000

Prepaid Compensation Expense 678,000

6,780,000/10 = 678,000

12/31/ Advances to Officers 432,768

Interest Revenue 432,768

(3,220,000 + 386,400) x 12% = 432,768

Compensation Expense 678,000

Prepaid Compensation Expense 678,000

d. Amortized Cost at December 31, 2012 = 3220,000 + 386,400 + 432,768 =

4,039,168

8-9 Patriarch, Inc.

a 12/31/11 Machinery Group Held For Sale 1,400,000

Accumulated Depreciation Machinery 1,200,000

Impairment Loss Machinery 200,000

Machinery 2,200,000

Machinery Tools 380,000

Machinery Parts 220,000

b. 07/17/12 Cash (1,520,000 60,000) 1,460,000

Machinery Group Held For Sale 1,400,000

Gain on Sale of Machinery 60,000

8-10 (Invecargill Ltd.)

a. 08/01/12 Impairment Loss Equipment 15,000

Loss from Decline in NRV of Inventory 5,000

Accumulated Depr- Equipment 15,000

Inventory 5,000

b. Assets Held for Sale 350,000

Accumulated Depreciation 95,000

Impairment Loss 30,000

Plant 220,000

Equipment 160,000

Inventory 75,000

Goodwill 20,000

c. 02/01/13 Cash (380,000 30,000) 350,000

Assets Held For Sale 350,000

Chapter 8 Investment Property, Other Non-current Financial Assets & Non-current Assets Held for Sale

87

8-11

Correction: Change March 1 to March 31

Cost = 42,000 3/5) = 70,000 Accumulated Depreciation = 70,000 42,000 = 28,000

(a) Mar. 31 Depreciation Expense (14,000 x 3/12) 3,500

Accumulated Depreciation 3,500

Asset Held for Sale 36,000

Impairment Loss 2,500

Accumulated Depreciation 31,500

Equipment 70,000

Dec. 31 Asset Held for Sale 2,500

Recovery of Previous Impairment 2,500

(b) Dec. 31 Impairment Loss 1,000

Asset Held for Sale 1,000

MULTIPLE CHOICE

MC1 C

MC2 C

MC3 B

MC4 A

MC5 B

MC6 C

MC7 C

MC8 D

MC9 B

MC10 A

MC11 B

MC12 A

MC13 D

MC14 B

MC15 C

MC16 A

MC17 B 10M + 20M = 30M

MC18 A Revaluation surplus is credited; transfer is from owner-occupied property.

MC19 D 20,000,000 15,000,000

MC20 D 18,000,000 x 39/40 = 17,550,000; depreciation = 18,000,000/40 = 450,000

MC21 C FV = 20,000,000; gain = 20,000,000 18,000,000 = 2,000,000

MC22 A 110,000 (115,000 80,000) = 75,000

MC23 D 9,000,000 1,500,000 = 7,500,000 which is lower than carrying amount of

P8,000,000.

MC24 D (9,200,000 1,300,000) 7,500,000 = 400,000

MC25 C 2,000,000 x 0.7972 = 1,594,400

1,594,400 x 12% x 6/12 = 95,664; 1,594,400 + 95,664 = 1,690,064

MC26 B 100,000 + (200,000 160,000) = 140,000

MC27 D 40,000 (108,000 87,000) 6,000 = 13,000

MC28 B 2,250,000 + 450,000 + 75,000 + 150,000 25,000 = 2,900,000

MC29 C 5,000,000/ 5.11 = 978,500

You might also like

- 2014 Vol 1 CH 7 AnswersDocument18 pages2014 Vol 1 CH 7 AnswersSimoun Torres83% (6)

- Installment Sales OldDocument3 pagesInstallment Sales OldThea Grace Bianan0% (1)

- 2014 Vol 1 CH 6 AnswersDocument6 pages2014 Vol 1 CH 6 AnswersSimoun Torres100% (2)

- 2019 Vol 1 CH 5 AnswersDocument21 pages2019 Vol 1 CH 5 AnswersArkhie Davocol80% (5)

- Chapter 8-The Master Budget: True/FalseDocument46 pagesChapter 8-The Master Budget: True/FalseAngela Viernes100% (2)

- Investments in Debt SecuritiesDocument13 pagesInvestments in Debt SecuritiesArkhie DavocolNo ratings yet

- Answer Key For EmpleoDocument17 pagesAnswer Key For EmpleoAdrian Montemayor100% (2)

- Fin Ac Robles Empleo CH 5 Vol 1 Answers2012Document18 pagesFin Ac Robles Empleo CH 5 Vol 1 Answers2012Engel Ken Castro71% (7)

- Lease calculation problemDocument7 pagesLease calculation problemGelo Owss33% (9)

- Chapter 1 - Guide to Current Liabilities, Provisions and ContingenciesDocument86 pagesChapter 1 - Guide to Current Liabilities, Provisions and ContingenciesSutnek Isly94% (17)

- 06 Standard Costing KEYDocument13 pages06 Standard Costing KEYKlasz Klasz100% (1)

- Advanced Accounting Vol 2 2014 Edition Baysa-LupisanDocument110 pagesAdvanced Accounting Vol 2 2014 Edition Baysa-LupisanIzzy B100% (4)

- 2016 Vol 1 CH 4 AnswersDocument15 pages2016 Vol 1 CH 4 AnswersIsabella Sandigan Marilag100% (2)

- Chapter 7 - Calculating Earnings Per Share and Diluted EPSDocument5 pagesChapter 7 - Calculating Earnings Per Share and Diluted EPSthenikkitr0% (1)

- CHAPTER 1 Managerial Accounting: True or FalseDocument4 pagesCHAPTER 1 Managerial Accounting: True or FalseJinky P. RefurzadoNo ratings yet

- Intermediate Accounting Volume 2 Robles Solution Manual: Click Here Read/DownloadDocument2 pagesIntermediate Accounting Volume 2 Robles Solution Manual: Click Here Read/DownloadmaxsNo ratings yet

- Answers - Chapter 4 Vol 2 RvsedDocument15 pagesAnswers - Chapter 4 Vol 2 Rvsedjamflox50% (2)

- PPE NotesDocument4 pagesPPE Notesaldric taclanNo ratings yet

- Financial Accounting 2 ExamDocument9 pagesFinancial Accounting 2 ExamEzekiel MalazzabNo ratings yet

- Reviewees IntaccDocument6 pagesReviewees IntaccMarvic Cabangunay0% (2)

- Audit of Shareholders' Equity Practice Problems IDocument5 pagesAudit of Shareholders' Equity Practice Problems IAngel VenableNo ratings yet

- LPU-CBA Departmental Quiz 4 Highlights Key Accounting ConceptsDocument3 pagesLPU-CBA Departmental Quiz 4 Highlights Key Accounting ConceptsJazzen MartinezNo ratings yet

- FAR 3 Quiz 2Document13 pagesFAR 3 Quiz 2Kathlyn PostreNo ratings yet

- Cost Accounting 2014Document94 pagesCost Accounting 2014Juliet Leron MediloNo ratings yet

- Formation of Partnership 1. 1-JanDocument23 pagesFormation of Partnership 1. 1-Janhae1234100% (1)

- Reviewer 5Document8 pagesReviewer 5Kindred Wolfe100% (1)

- Profit Planning and BudgetingDocument3 pagesProfit Planning and BudgetingRoyce Maenard EstanislaoNo ratings yet

- Carlyn Cpa EncodeDocument221 pagesCarlyn Cpa EncodePaul Espinosa100% (6)

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)Janine LerumNo ratings yet

- Accounting for Equity InvestmentsDocument11 pagesAccounting for Equity InvestmentsdfsdfdsfNo ratings yet

- Calculating retirement benefit costs and defined benefit liabilityDocument33 pagesCalculating retirement benefit costs and defined benefit liabilityJoeneil DamalerioNo ratings yet

- Employee Benefits Part 2 pROBLEM 3-8Document2 pagesEmployee Benefits Part 2 pROBLEM 3-8Christian QuidipNo ratings yet

- p2 With TheoryDocument40 pagesp2 With TheoryGrace Corpo0% (1)

- Module 2A - CVP AnalysisDocument5 pagesModule 2A - CVP AnalysisBhosx KimNo ratings yet

- Problems 3 PRELIM TASK FINALDocument4 pagesProblems 3 PRELIM TASK FINALJohn Francis RosasNo ratings yet

- AP Equity 1Document3 pagesAP Equity 1Mark Michael Legaspi100% (1)

- Ch18 Raiborn SMDocument23 pagesCh18 Raiborn SMMendelle Murry100% (1)

- Semis Examination BDocument12 pagesSemis Examination BCHENG50% (2)

- Retirement Seatwork New Answer Key - With Asset CeilingDocument25 pagesRetirement Seatwork New Answer Key - With Asset CeilingsweetEmie031No ratings yet

- Week 6 Basic Earnings Per ShareDocument4 pagesWeek 6 Basic Earnings Per SharePearlle Ivana TavarroNo ratings yet

- Financial Accounting Part 3 Quiz 1Document1 pageFinancial Accounting Part 3 Quiz 1Jenica Joyce Bautista100% (1)

- P1 Day1 RMDocument4 pagesP1 Day1 RMabcdefg100% (2)

- Chapter 8 - Investment Property, Other Non-current AssetsDocument7 pagesChapter 8 - Investment Property, Other Non-current AssetsPamela Cruz100% (1)

- CH 8 AnswersDocument5 pagesCH 8 Answersmharieee13No ratings yet

- Cpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)Document10 pagesCpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)RIZA LUMAADNo ratings yet

- Investment Property, Other Noncurrent Financial Assets and Noncurrent Assets Held For Sale Problems 8-1 (Sebastian Corporation)Document5 pagesInvestment Property, Other Noncurrent Financial Assets and Noncurrent Assets Held For Sale Problems 8-1 (Sebastian Corporation)ExequielCamisaCrusperoNo ratings yet

- 2021 - A2S2 Solution-OplossingDocument19 pages2021 - A2S2 Solution-OplossingmeghdyckNo ratings yet

- ACC01B1 REK1B01 MAIN.pdfDocument10 pagesACC01B1 REK1B01 MAIN.pdfLebohang NgubaneNo ratings yet

- BSA 314 Module 4 Output, Atillo Lyle CDocument10 pagesBSA 314 Module 4 Output, Atillo Lyle CJeth MahusayNo ratings yet

- ReviewerDocument4 pagesReviewerDrie LimNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Audit of Liabilities SolManDocument3 pagesAudit of Liabilities SolManReyn Saplad PeralesNo ratings yet

- ACC3201Document6 pagesACC3201natlyhNo ratings yet

- Workshop Solutions T1 2014Document78 pagesWorkshop Solutions T1 2014sarah1379No ratings yet

- Chapter 4 Governmental AccountingDocument8 pagesChapter 4 Governmental Accountingmohamad ali osmanNo ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- CPA Review Center Final Exam SolutionsDocument16 pagesCPA Review Center Final Exam SolutionsMike Oliver NualNo ratings yet

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- Investment in Associate ExercisesDocument7 pagesInvestment in Associate ExercisesJo KeNo ratings yet

- P vs. BonoanDocument2 pagesP vs. BonoanPrincessAngelaDeLeonNo ratings yet

- People v. LamahangDocument2 pagesPeople v. LamahangPrincessAngelaDeLeonNo ratings yet

- MacDocument40 pagesMacPrincessAngelaDeLeonNo ratings yet

- MPH V Gsis NotesDocument3 pagesMPH V Gsis NotesPrincessAngelaDeLeonNo ratings yet

- Case Digest For GR No. 209287 - Araullo vs. Aquino DigestDocument20 pagesCase Digest For GR No. 209287 - Araullo vs. Aquino Digestkim_santos_2084% (19)

- People V. Narvaez GR. Nos. L-33466-67 Makasiar, J.: FactsDocument3 pagesPeople V. Narvaez GR. Nos. L-33466-67 Makasiar, J.: FactsPrincessAngelaDeLeonNo ratings yet

- Case Digest Summary Part 2 MidtermsDocument8 pagesCase Digest Summary Part 2 MidtermsPrincessAngelaDeLeonNo ratings yet

- Mac Recipe 1Document17 pagesMac Recipe 1PrincessAngelaDeLeonNo ratings yet

- Mendoza - ConcurringDocument18 pagesMendoza - ConcurringJoyceNo ratings yet

- Part 1 CasesDocument6 pagesPart 1 CasesPrincessAngelaDeLeonNo ratings yet

- MPH V Gsis NotesDocument3 pagesMPH V Gsis NotesPrincessAngelaDeLeonNo ratings yet

- People V AguilosDocument2 pagesPeople V AguilosPrincessAngelaDeLeon100% (5)

- Legres HWDocument2 pagesLegres HWPrincessAngelaDeLeonNo ratings yet

- Baleros Vs PeopleDocument4 pagesBaleros Vs PeoplePrincessAngelaDeLeonNo ratings yet

- People V AguilosDocument2 pagesPeople V AguilosPrincessAngelaDeLeon100% (5)

- Mamangun V People - GR NO 149152Document2 pagesMamangun V People - GR NO 149152PrincessAngelaDeLeon100% (2)

- Valenzuela Vs PeopleDocument2 pagesValenzuela Vs PeoplePrincessAngelaDeLeon100% (5)

- Mamangun V People - GR NO 149152Document2 pagesMamangun V People - GR NO 149152PrincessAngelaDeLeon100% (2)

- People Vs DecenaDocument1 pagePeople Vs DecenaPrincessAngelaDeLeonNo ratings yet

- People vs. Sy PioDocument3 pagesPeople vs. Sy PioPrincessAngelaDeLeon100% (2)

- The People of The Philippine Islands VsDocument2 pagesThe People of The Philippine Islands VsPrincessAngelaDeLeonNo ratings yet

- People V KalaloDocument2 pagesPeople V KalaloPrincessAngelaDeLeon100% (1)

- Sulpico Intod Vs CADocument1 pageSulpico Intod Vs CAPrincessAngelaDeLeonNo ratings yet

- PP Vs DioDocument2 pagesPP Vs DioPrincessAngelaDeLeon100% (2)

- PEOPLE v. ILIGAN: Proximate Cause in Homicide CaseDocument2 pagesPEOPLE v. ILIGAN: Proximate Cause in Homicide CasePrincessAngelaDeLeonNo ratings yet

- Alejandro Estrada Vs Soledad EscritorDocument2 pagesAlejandro Estrada Vs Soledad EscritorPrincessAngelaDeLeonNo ratings yet

- Double Jeopardy Bars Second Prosecution for Same Offense of Reckless ImprudenceDocument3 pagesDouble Jeopardy Bars Second Prosecution for Same Offense of Reckless ImprudencePrincessAngelaDeLeonNo ratings yet

- Urbano v. Intermediate AppelatteDocument2 pagesUrbano v. Intermediate AppelattePrincessAngelaDeLeonNo ratings yet

- People V SaladinoDocument1 pagePeople V SaladinoPrincessAngelaDeLeon100% (1)

- Jacinto Vs PeopleDocument1 pageJacinto Vs PeoplePrincessAngelaDeLeonNo ratings yet

- AFAR04. Long Term Construction ContractsDocument4 pagesAFAR04. Long Term Construction ContractsJohn Kenneth BacanNo ratings yet

- Management of Financial Services (MB 924)Document14 pagesManagement of Financial Services (MB 924)anilkanwar111No ratings yet

- ITD GYE21 GTS 2051 2021 0026 SignedDocument6 pagesITD GYE21 GTS 2051 2021 0026 SignedY'aa M'ichaelNo ratings yet

- Credit Bureau Development in The PhilippinesDocument18 pagesCredit Bureau Development in The PhilippinesRuben Carlo Asuncion100% (4)

- Brasstrax White PaperDocument24 pagesBrasstrax White PaperaramisNo ratings yet

- CAF608833F3F75B7Document47 pagesCAF608833F3F75B7BrahimNo ratings yet

- Joanne Mae VDocument5 pagesJoanne Mae VAndrea Denise VillafuerteNo ratings yet

- Transportation: Edit EditDocument3 pagesTransportation: Edit EditRebecca JordanNo ratings yet

- B.E., B.S., B.Ed. (H), DPT, BA/LL.B (Test Based) B.E., B.S., B.Ed. (H), DPT, BA/LL.B (Test Based) B.E., B.S., B.Ed. (H), DPT, BA/LL.B (Test Based)Document1 pageB.E., B.S., B.Ed. (H), DPT, BA/LL.B (Test Based) B.E., B.S., B.Ed. (H), DPT, BA/LL.B (Test Based) B.E., B.S., B.Ed. (H), DPT, BA/LL.B (Test Based)Anas ArifNo ratings yet

- Far Eastern Bank (A Rural Bank) Inc. Annex A PDFDocument2 pagesFar Eastern Bank (A Rural Bank) Inc. Annex A PDFIris OmerNo ratings yet

- DPC Cookie GuidanceDocument17 pagesDPC Cookie GuidanceshabiumerNo ratings yet

- 1.statement of Financial Position (SFP)Document29 pages1.statement of Financial Position (SFP)Efrelyn Grethel Baraya Alejandro100% (4)

- Choa Tiek Seng Vs CADocument2 pagesChoa Tiek Seng Vs CAReg Yu0% (1)

- Jurnal Deddy RandaDocument11 pagesJurnal Deddy RandaMuh Aji Kurniawan RNo ratings yet

- Bacolod, Lanao Del NorteDocument2 pagesBacolod, Lanao Del NorteSunStar Philippine NewsNo ratings yet

- Bangladesh Merchant Shipping Act 2020Document249 pagesBangladesh Merchant Shipping Act 2020Sundar SundaramNo ratings yet

- TIP Report 2015Document17 pagesTIP Report 2015SamNo ratings yet

- Characteristics of SovereigntyDocument9 pagesCharacteristics of SovereigntyVera Mae RigorNo ratings yet

- B.Tech in Civil Engineering FIRST YEAR 2014-2015: I Semester Ii SemesterDocument1 pageB.Tech in Civil Engineering FIRST YEAR 2014-2015: I Semester Ii Semesterabhi bhelNo ratings yet

- Pi SC4000 17-06 enDocument1 pagePi SC4000 17-06 enAlexandre RogerNo ratings yet

- Takeovers: Reading: Takeovers, Mergers and BuyoutsDocument4 pagesTakeovers: Reading: Takeovers, Mergers and BuyoutsFreakin 23No ratings yet

- Feleccia vs. Lackawanna College PresentationDocument8 pagesFeleccia vs. Lackawanna College PresentationMadelon AllenNo ratings yet

- High Commission of India: Visa Application FormDocument2 pagesHigh Commission of India: Visa Application FormShuhan Mohammad Ariful HoqueNo ratings yet

- Organized Group Baggage HandlingDocument2 pagesOrganized Group Baggage HandlingFOM Sala Grand TuyHoaNo ratings yet

- Bagatsing V RamirezDocument3 pagesBagatsing V RamirezAnonymous iOYkz0wNo ratings yet

- Trusted Platform ModuleDocument14 pagesTrusted Platform Moduleramu278No ratings yet

- Al Nokhitha Fund Prospectus Sep2010 Tcm9-8959Document27 pagesAl Nokhitha Fund Prospectus Sep2010 Tcm9-8959wesamNo ratings yet

- Auguste Comte LectureDocument9 pagesAuguste Comte LectureAyinde SmithNo ratings yet

- Aster Pharmacy: Earnings DeductionsDocument1 pageAster Pharmacy: Earnings DeductionsRyalapeta Venu YadavNo ratings yet

- Biraogo vs. Philippine Truth CommissionDocument3 pagesBiraogo vs. Philippine Truth CommissionJulesMillanarNo ratings yet