Professional Documents

Culture Documents

TCS Financial Results: Quarter I FY 2014 - 15

Uploaded by

Bethany Casey0 ratings0% found this document useful (0 votes)

75 views28 pagesTCS corporate financials

Original Title

TCS_Factsheet

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTCS corporate financials

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

75 views28 pagesTCS Financial Results: Quarter I FY 2014 - 15

Uploaded by

Bethany CaseyTCS corporate financials

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 28

1

Copyright 2014 Tata Consultancy Services Limited

TCS Financial Results

Quarter I FY 2014 - 15

17th July 2014

2

Disclaimer

Certain statements in this release concerning our future prospects are forward-looking

statements. Forward-looking statements by their nature involve a number of risks and

uncertainties that could cause actual results to differ materially from market expectations.

These risks and uncertainties include, but are not limited to our ability to manage growth,

intense competition among Indian and overseas IT services companies, various factors

which may affect our cost advantage, such as wage increases or an appreciating Rupee,

our ability to attract and retain highly skilled professionals, time and cost overruns on

fixed-price, fixed-time frame contracts, client concentration, restrictions on immigration,

our ability to manage our international operations, reduced demand for technology in our

key focus areas, disruptions in telecommunication networks, our ability to successfully

complete and integrate potential acquisitions, liability for damages on our service

contracts, the success of the companies in which TCS has made strategic investments,

withdrawal of governmental fiscal incentives, political instability, legal restrictions on

raising capital or acquiring companies outside India, unauthorized use of our intellectual

property and general economic conditions affecting our industry. TCS may, from time to

time, make additional written and oral forward-looking statements, including our reports

to shareholders. These forward-looking statements represent only the Companys current

intentions, beliefs or expectations, and any forward-looking statement speaks only as of

the date on which it was made. The Company assumes no obligation to revise or update

any forward-looking statements.

3

Click to edit Master title style Highlights

4

Q1 FY15 Performance Highlights

Revenue:

- INR Revenue of `221,110 Mn, growth of 2.6% QoQ and 22.9% YoY

- USD Revenue of $3,694 Mn, growth of 5.5% QoQ and 16.7% YoY

- Constant currency revenue growth of 4.8%, volume growth of 5.7% QoQ

Profit:

- Operating Income at ` 58,149 Mn, Operating Margin of 26.3%

- Net Income at ` 50,578 Mn, Net Margin of 22.9%

Demand:

- Clients in $50M+ revenue band increased by 5 and in $20M+ revenue band by 8

- Strong growth in Telecom, Retail and Life Science

People:

- Gross addition of 15,817 associates, closing headcount: 305,431

- Utilization at 85.3% (ex-trainees) and 79.8% (including trainees)

5

Click to edit Master title style

Financial Performance

6

Growth Summary (INR)

221,110

179,871

209,772

212,940 215,511

Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15

Revenue

`

M

i

l

l

i

o

n

48,627

63,295 63,347 62,810

58,149

Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15

Operating Income

`

M

i

l

l

i

o

n

51,532

66,390 66,865 66,534

63,670

Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15

EBITDA

`

M

i

l

l

i

o

n

39,866

46,539

51,797

52,967

50,578

Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15

Net Income

`

M

i

l

l

i

o

n

18.9%

51.5%

44.6%

44.1%

19.6%

11.6%

30.2%

0.1% -0.8%

-7.4%

Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15

Y-o-Y Growth Q-o-Q Growth

18.9%

49.5%

43.7% 42.8%

23.6%

10.6%

28.8%

0.7% -0.5%

-4.3%

Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15

Y-o-Y Growth Q-o-Q Growth

21.0%

34.3%

32.5%

31.2%

22.9%

9.5%

16.6%

1.5% 1.2% 2.6%

Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15

Y-0-Y Growth Q-0-Q Growth

16.7%

37.5%

43.6%

51.5%

26.9%

14.0%

16.7%

11.3%

2.3%

-4.5%

Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15

Y-o-Y Growth Q-o-Q Growth

7

Growth Summary (USD)

3,165

3,337

3,438

3,503

3,694

Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15

Revenue

$

M

i

l

l

i

o

n

856

1,007

1,023

1,021

972

Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15

Operating Income

$

M

i

l

l

i

o

n

701

740

836

861 845

Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15

Net Income

$

M

i

l

l

i

o

n

16.0%

17.0% 16.6%

15.2%

16.7%

4.1%

5.4%

3.0%

1.9%

5.5%

Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15

Y-o-Y Growth Q-o-Q Growth

11.6%

19.6%

26.4%

33.6%

20.5%

8.8%

5.6%

13.0%

2.9%

-1.9%

Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15

Y-o-Y Growth Q-o-Q Growth

14.0%

31.9%

27.3% 26.6%

13.5%

6.1%

17.7%

1.6%

-0.2%

-4.8%

Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15

Y-o-Y Growth Q-o-Q Growth

8

Click to edit Master title style Operational Performance

9

Growth by Market

52.2%

2.2%

17.7%

12.0%

6.3%

7.6%

2.0%

North America

Latin America

UK

Continental Europe

India

Asia Pacific

MEA

Geography (%) Q1 FY14 Q4 FY14 Q1 FY15

Q-o-Q

Growth

Y-o-Y

Growth

Americas

North America 54.1 52.2 52.2 2.6 18.5

Latin America 2.4 2.2 2.2 1.4 13.5

Europe

UK 17.0 17.8 17.7 2.3 28.1

Continental Europe 9.9 12.1 12.0 1.8 49.3

India 7.6 6.2 6.3 5.2 2.1

Asia Pacific 6.9 7.4 7.6 4.5 34.9

MEA 2.1 2.1 2.0 -2.0 20.1

Total 100.0 100.0 100.0 2.6 22.9

Note: The growth rates reported here are based on actual revenues in INR. Calculating growth using the % Rev figures might result in some variance due to rounding error.

Growth in INR terms

10

Growth by Domain

41.7%

9.4%

13.8%

8.6%

5.5%

6.3%

3.6%

3.9%

2.7%

4.5%

BFSI

Telecom

Retail & Distribution

Manufacturing

Hi-Tech

Life Sciences & Healthcare

Travel & Hospitality

Energy & Utilities

Media & Entertainment

Others

IP Revenue (%) Q1 FY14 Q4 FY14 Q1 FY15

Q-o-Q

Growth

Y-o-Y

Growth

BFSI 43.0 42.9 41.7 -0.3 19.3

Telecom 9.6 9.3 9.4 4.0 20.6

Retail & Distribution 14.0 13.5 13.8 4.3 20.1

Manufacturing 8.4 8.6 8.6 2.6 24.8

Hi-Tech 5.5 5.3 5.5 5.6 23.5

Life Sciences & Healthcare 5.5 6.1 6.3 6.4 41.2

Travel & Hospitality 3.4 3.5 3.6 5.6 30.5

Energy & Utilities 3.7 3.8 3.9 5.0 30.8

Media & Entertainment 2.1 2.6 2.7 9.8 61.1

Others 4.8 4.4 4.5 5.6 15.9

Total 100.0 100.0 100.0 2.6 22.9

Note: The growth rates reported here are based on actual revenues in INR. Calculating growth using the % Rev figures might result in some variance due to rounding error.

Growth in INR terms

11

Growth by Service Line

40.8%

15.9%

8.6%

4.5%

12.6%

3.2%

2.5%

11.9%

Application Development & Maint.

Enterprise Solutions

Assurance Services

Engineering & Industrial Services

Infrastructure Services

Global Consulting

Asset Leveraged Solutions

Business Process Services

SP Revenue (%) Q1 FY14 Q4 FY14 Q1 FY15

Q-o-Q

Growth

Y-o-Y

Growth

IT Solutions and Services

Application Development & Maint.

42.3 41.0 40.8 2.0 18.3

Enterprise Solutions

15.1 15.7 15.9 4.1 29.8

Assurance Services

8.1 8.4 8.6 5.9 31.8

Engineering & Industrial Services

4.7 4.8 4.5 -2.6 17.9

Infrastructure Services

11.9 12.0 12.6 7.2 30.0

Global Consulting

3.5 3.4 3.2 -2.1 13.7

Asset Leveraged Solutions

2.5 2.6 2.5 -3.5 20.8

Business Process Services

11.9 12.1 11.9 0.3 22.5

Total 100.0 100.0 100.0 2.6 22.9

Note: The growth rates reported here are based on actual revenues in INR. Calculating growth using the % Rev figures might result in some variance due to rounding error.

Growth in INR terms

12

Client Parameters

*Last Twelve Months' services revenues

US$ 1m+ Clients 657 714 724

US$ 5m+ Clients 309 354 359

US$ 10m+ Clients 216 231 244

US$ 20m+ Clients 124 136 144

US$ 50m+ Clients 53 53 58

US$ 100m+ Clients 19 24 24

Q4 FY14 Clients Contribution * Q1 FY15 Q1 FY14

13

Operational Parameters

Delivery Location

Local Delivery 46.3 47.0 47.1

Remote Delivery 53.7 53.0 52.9

Global DC 5.2 5.6 5.7

India DC 48.5 47.4 47.2

Contract Type

Time & Material 47.8 47.6 47.5

Fixed Price & Time 52.2 52.4 52.5

Revenue % Q1 FY15 Q1 FY14 Q4 FY14

14

Key Wins

A US based global pharmaceutical and medical device company has selected TCS for a multi-year multi-

million dollar end to end IT infrastructure outsourcing deal.

A leading Nordics based Operator selected TCS as its partner to modernize and simplify the fixed network

operations in a multi year contract.

A large Australian Bank selected TCS as the preferred partner for providing IT services for its private

banking, wealth management, insurance and superannuation lines of businesses.

Leading North American Specialty Retailer has selected TCS as a Strategic Preferred Partner for Global

Technology transformation.

TCS has won a multi-million euro, multi-year engagement to provide Infrastructure Services to a leading

fashion apparel retailer in Europe.

Selected by a North American insurance company for a multi-million dollar, multi-year engagement to

support and enhance their core IT Applications.

A Global Semiconductor company awarded multi-year, multi-million dollar end to end managed

infrastructure services deal.

Won an engagement with an American healthcare and insurance company to build big data platform for

enabling 360 degree customer view

Selected by a large North American food retail chain to develop digital application to provide on the go

analytics and enable quicker decision making for store managers

Chosen by a leading global insurance major to develop customer centric sales applications using digital

technologies.

Won an engagement to define strategic roadmap and provide consulting services on operating model for

campaign management for a major Australian superannuation service provider.

Selected by an Asian telecom company to define its big data strategy and roadmap.

15

Click to edit Master title style Human Resources

16

Total Employee Base

Q1-14 Q2-14 Q3-14 Q4-14 Q1-15

277,586

285,250

290,713

300,464

305,431

Total Employees : 305,431

17

Q1 Consolidated - Gross Additions 15,817 & Net Additions 4,967

Gross Additions:

3,452 Trainees & 8,488 Laterals in India

3,877 employees overseas

FY14 - Q1 FY14 - Q2 FY14 - Q3 FY14 - Q4 FY15 - Q1

10,611

17,362

14,663

18,564

15,817

1,390

7,664

5,463

9,751

4,967

Gross Additions Net Additions

Attrition

*

:

12.0% (LTM), including

BPS

Utilization Rate

*

:

85.3% (excluding Trainees)

79.8% (including Trainees)

Diversity:

Women employees: 32.7%

Nationalities: 119

*

Excluding CMC & Diligenta

18

Click to edit Master title style Annexure

19

IFRS Income Statement

Q1 FY14 Q4 FY14 Q1 FY15 Q1 FY14 Q4 FY14 Q1 FY15

Revenue 179,871 215,511 221,110 100.00 100.00 100.00

Cost of revenue 96,700 114,640 122,432 53.76 53.19 55.37

Gross margin 83,171 100,871 98,678 46.24 46.81 44.63

SG & A expenses 34,544 38,061 40,529 19.21 17.66 18.33

Operating income 48,627 62,810 58,149 27.03 29.15 26.30

Other income (expense), net 4,422 6,990 8,151 2.46 3.24 3.69

Income before income taxes 53,049 69,800 66,300 29.49 32.39 29.99

Income taxes 12,312 16,313 15,312 6.84 7.57 6.93

Income after income taxes 40,737 53,487 50,988 22.65 24.82 23.06

Minority interest 871 520 410 0.49 0.24 0.19

Net income 39,866 52,967 50,578 22.16 24.58 22.87

Earnings per share in ` 20.37 27.04 25.82

Consolidated IFRS

` Million %of Revenue

Expenses include an additional one time charge of ` 1,746 million in depreciation on account of change in useful life of assets as at April 1, 2014

20

COR SG&A Details

Q1 FY14 Q4 FY14 Q1 FY15 Q1 FY14 Q4 FY14 Q1 FY15

Employee cost 68,221 79,555 86,468 37.93 36.91 39.11

Fees to external consultants 11,025 12,377 13,244 6.13 5.74 5.99

Equipment & software 4,027 3,559 3,264 2.24 1.65 1.48

Depreciation 1,809 2,469 3,608 1.01 1.15 1.63

Travel 2,447 2,885 3,788 1.36 1.34 1.71

Communication 1,511 1,570 1,594 0.84 0.73 0.72

Facility expenses 3,731 4,534 4,580 2.07 2.10 2.07

Other expenses 3,929 7,691 5,886 2.18 3.57 2.66

Cost of Revenue 96,700 114,640 122,432 53.76 53.19 55.37

Q1 FY14 Q4 FY14 Q1 FY15 Q1 FY14 Q4 FY14 Q1 FY15

Employee cost 24,006 25,794 28,341 13.35 11.97 12.82

Fees to external consultants 766 1,718 1,242 0.43 0.80 0.56

Provision for Doubtful Debts 206 190 374 0.11 0.09 0.17

Depreciation 1,096 1,255 1,913 0.61 0.58 0.87

Facility expenses 2,737 2,818 2,453 1.52 1.31 1.11

Travel 2,117 2,569 2,335 1.18 1.19 1.06

Communication 637 720 779 0.35 0.33 0.35

Education, Recruitment and training 582 756 468 0.32 0.35 0.21

Marketing and Sales promotion 661 914 1,048 0.37 0.42 0.47

Other expenses 1,736 1,327 1,576 0.97 0.62 0.71

S G & A expenses 34,544 38,061 40,529 19.21 17.66 18.33

COR

SGA

` Million

` Million

% of Revenue

% of Revenue

21

IFRS Balance Sheet

` Million % ` Million %

Assets

Property and equipment 103,644 15.04 105,370 14.11

Intangible assets and Goodwill 41,568 6.03 41,539 5.56

Accounts Receivable 182,304 26.45 191,373 25.63

Unbilled Revenues 40,056 5.81 42,961 5.75

Investments 34,617 5.03 86,726 11.62

Cash and Cash equivalents 14,688 2.13 20,730 2.78

Other current assets 180,934 26.26 185,319 24.82

Other non current assets 91,314 13.25 72,685 9.73

Total assets 689,125 100.00 746,703 100.00

Liabilities and Shareholders' Equity

Shareholders' Funds 553,355 80.30 557,555 74.67

Long term borrowings 1,273 0.18 1,209 0.16

Short term borrowings 1,696 0.25 814 0.11

Other current liabilities 109,055 15.83 163,677 21.92

Other non-current liabilities 16,844 2.44 16,526 2.21

Minority Interest 6,902 1.00 6,922 0.93

Total Liabilities 689,125 100.00 746,703 100.00

Consolidated IFRS

31-Mar-14 30-Jun-14

22

IFRS Income Statement In USD

Q1 FY14 Q4 FY14 Q1 FY15 Q1 FY14 Q4 FY14 Q1 FY15

Revenue 3,165 3,503 3,694 100.00 100.00 100.00

Cost of revenue 1,701 1,863 2,045 53.76 53.19 55.37

Gross margin 1,464 1,640 1,649 46.24 46.81 44.63

SG & A expenses 608 619 677 19.21 17.66 18.33

Operating income 856 1,021 972 27.03 29.15 26.30

Other income (expense), net 78 114 136 2.46 3.24 3.69

Income before income taxes 934 1,135 1,108 29.49 32.39 29.99

Income taxes 217 265 256 6.84 7.57 6.93

Income after income taxes 717 870 852 22.65 24.82 23.06

Minority interest 16 9 7 0.49 0.24 0.19

Net income 701 861 845 22.16 24.58 22.87

Earnings per share in $ 0.36 0.44 0.43

Consolidated IFRS

$ Million %of Revenue

Expenses include an additional one time charge of $ 29 million in depreciation on account of change in useful life of assets as at April 1, 2014

23

COR SG&A Details In USD

Q1 FY14 Q4 FY14 Q1 FY15 Q1 FY14 Q4 FY14 Q1 FY15

Employee cost 1,200 1,293 1,445 37.93 36.91 39.11

Fees to external consultants 194 201 221 6.13 5.73 5.99

Equipment & software 71 58 55 2.24 1.65 1.48

Depreciation 32 40 60 1.01 1.15 1.63

Travel 43 47 63 1.36 1.34 1.71

Communication 26 25 27 0.84 0.73 0.72

Facility expenses 66 74 76 2.07 2.10 2.07

Other expenses 69 125 98 2.18 3.58 2.66

Cost of Revenue 1,701 1,863 2,045 53.76 53.19 55.37

Q1 FY14 Q4 FY14 Q1 FY15 Q1 FY14 Q4 FY14 Q1 FY15

Employee cost 422 419 474 13.35 11.97 12.82

Fees to external consultants 13 28 21 0.43 0.80 0.56

Provision for Doubtful Debts 4 3 6 0.11 0.09 0.17

Depreciation 19 20 32 0.61 0.58 0.87

Facility expenses 48 46 41 1.52 1.31 1.11

Travel 37 42 39 1.18 1.19 1.06

Communication 11 12 13 0.35 0.33 0.35

Education, Recruitment and training 11 12 8 0.33 0.35 0.21

Marketing and Sales promotion 12 15 17 0.37 0.42 0.47

Other expenses 31 22 26 0.96 0.62 0.71

S G & A expenses 608 619 677 19.21 17.66 18.33

COR

SGA

$ Million % of Revenue

$ Million % of Revenue

24

IFRS Balance Sheet in USD

$ Million % $ Million %

Assets

Property and equipment 1,726 15.04 1,754 14.11

Intangible assets and Goodwill 692 6.03 692 5.56

Accounts Receivable 3,035 26.46 3,186 25.63

Unbilled Revenues 667 5.81 715 5.75

Investments 576 5.02 1,444 11.61

Cash and Cash equivalents 245 2.13 345 2.78

Other current assets 3,012 26.26 3,085 24.82

Other non current assets 1,520 13.25 1,210 9.74

Total assets 11,473 100.00 12,431 100.00

Liabilities and Shareholders' Equity

Shareholders' Funds 9,213 80.30 9,282 74.67

Long term borrowings 21 0.18 20 0.16

Short term borrowings 28 0.25 14 0.11

Other current liabilities 1,816 15.83 2,725 21.92

Other non-current liabilities 280 2.44 275 2.21

Minority Interest 115 1.00 115 0.93

Total Liabilities 11,473 100.00 12,431 100.00

30-Jun-14 31-Mar-14

Consolidated IFRS

25

Indian GAAP Income Statement - Consolidated

Q1 FY14 Q4 FY14 Q1 FY15 Q1 FY14 Q4 FY14 Q1 FY15

INCOME

a) IT & Consultancy Services 17,552 21,142 21,793 97.58 98.10 98.56

b) Manufacturing, Sale of equipment and Licences 435 409 318 2.42 1.90 1.44

Total Income 17,987 21,551 22,111 100.00 100.00 100.00

EXPENDITURE

a) Salaries & Wages 6,965 7,581 8,532 38.72 35.18 38.59

b) Overseas business expenditure 2,498 3,186 3,283 13.89 14.78 14.85

c) Other operating expenses 3,380 4,095 3,943 18.79 19.00 17.83

Total Expenditure 12,843 14,862 15,758 71.40 68.96 71.27

Profit Before Interest, Depreciation, Taxes

& Other Income

5,144 6,689 6,353 28.60 31.04 28.73

Interest 7 12 9 0.04 0.06 0.04

Depreciation 297 375 417 1.65 1.74 1.89

Profit Before Taxes & Other Income 4,840 6,302 5,927 26.91 29.24 26.80

Other income (expense), net 259 721 787 1.44 3.35 3.56

Profit Before Taxes & Exceptional Items 5,099 7,023 6,714 28.35 32.59 30.36

Exceptional items - - 490 - - 2.22

Profit Before Taxes 5,099 7,023 7,204 28.35 32.59 32.58

Provision For Taxes 1,226 1,613 1,599 6.82 7.49 7.23

Profit After Taxes & Before Minority Interest 3,873 5,410 5,605 21.53 25.10 25.35

Minority Interest 33 52 37 0.18 0.24 0.17

Net Profit 3,840 5,358 5,568 21.35 24.86 25.18

Consolidated Indian GAAP

` Crore %of Revenue

Exceptional items consist of a write back of ` 665 crore due to change in method of charging depreciation on assets as at April 1, 2014 and a

charge of ` 175 crore in depreciation due to change in useful life of assets as at April 1, 2014

26

Indian GAAP Balance Sheet - Consolidated

31-Mar-14 30-Jun-14 31-Mar-14 30-Jun-14

EQUITY AND LIABILITIES

Shareholders' Funds 49,195 44,373 73.27 60.40

Minority Interest 708 712 1.06 0.97

Short term and long term borrowings 254 158 0.38 0.22

Deferred tax liabilities (net) 309 327 0.46 0.44

Current liabilities and provisions 15,543 26,725 23.15 36.38

Non-current liabilities and provisions 1,129 1,171 1.68 1.59

Total Liabilities 67,138 73,466 100.00 100.00

ASSETS

Fixed Assets (net) 10,444 11,265 15.56 15.34

Investments 3,434 8,598 5.11 11.70

Deferred tax assets (net) 420 444 0.63 0.60

Goodwill (on consolidation) 2,269 2,272 3.38 3.09

Cash and Bank Balance 14,442 14,304 21.51 19.47

Current Assets, Loans and Advances 27,297 29,684 40.66 40.41

Non-current assets, Loans and advances 8,832 6,899 13.15 9.39

Total Assets 67,138 73,466 100.00 100.00

Consolidated Indian GAAP

% ` Crore

27

Currency mix and average realized rates in INR

Q4 FY14 Q1 FY15 Q4 FY14 Q1 FY15

USD 61.53 59.85 56.03% 55.83%

GBP 101.84 100.80 15.82% 15.85%

EUR 84.32 81.92 9.34% 9.14%

Others 18.81% 19.18%

Total 100.00% 100.00%

Currency

Average rates % of Revenue

Thank You

IT Services

Business Solutions

Consulting

You might also like

- Goldman Sachs Presentation To Credit Suisse Financial Services ConferenceDocument10 pagesGoldman Sachs Presentation To Credit Suisse Financial Services ConferenceGravity The NewtonsNo ratings yet

- Current liability problems and solutionsDocument5 pagesCurrent liability problems and solutionsNoSepasi FebriyaniNo ratings yet

- Message From The CEO and COODocument4 pagesMessage From The CEO and COOravihctmNo ratings yet

- Terminix Execs Discuss Termite Damage Claim ProblemsDocument50 pagesTerminix Execs Discuss Termite Damage Claim ProblemsThomas F CampbellNo ratings yet

- CMA Part 1 Virtual Classroom No. 1Document28 pagesCMA Part 1 Virtual Classroom No. 1Amr TarekNo ratings yet

- IAS 38 Intangible For PresentDocument20 pagesIAS 38 Intangible For Presentnati100% (2)

- ShilpaMedicare BUY BPWealth 18.05.18Document22 pagesShilpaMedicare BUY BPWealth 18.05.18Bethany CaseyNo ratings yet

- Genpact's BFSI operations and impact of inflationDocument57 pagesGenpact's BFSI operations and impact of inflationAlan JacobNo ratings yet

- 1 Conceptual Framework - Lecture Notes PDFDocument10 pages1 Conceptual Framework - Lecture Notes PDFCatherine RiveraNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNo ratings yet

- Redington IndiaDocument73 pagesRedington Indialokesh38No ratings yet

- Revenue Assurance in TelecomsDocument50 pagesRevenue Assurance in TelecomsaimoneyNo ratings yet

- Barclays-Infosys Ltd. - The Next Three Years PDFDocument17 pagesBarclays-Infosys Ltd. - The Next Three Years PDFProfitbytesNo ratings yet

- Singer Bangladesh - Financial AnalysisDocument24 pagesSinger Bangladesh - Financial AnalysisMd Nurul Hoque FirozNo ratings yet

- MTN Annual Financial Results Booklet 2014Document40 pagesMTN Annual Financial Results Booklet 2014The New VisionNo ratings yet

- KPIT 2QFY16 Outlook ReviewDocument5 pagesKPIT 2QFY16 Outlook ReviewgirishrajsNo ratings yet

- Press Release: Hinduja Global Solutions LimitedDocument24 pagesPress Release: Hinduja Global Solutions LimitedShyam SunderNo ratings yet

- Q1 Revenues Grew by 13.3% Year On Year Sequentially Grew by 4.3%Document7 pagesQ1 Revenues Grew by 13.3% Year On Year Sequentially Grew by 4.3%Aradhya SrivastavaNo ratings yet

- Press Release INR PDFDocument13 pagesPress Release INR PDFVenkatesh HaNo ratings yet

- Presentation To Investor / Analyst (Company Update)Document51 pagesPresentation To Investor / Analyst (Company Update)Shyam SunderNo ratings yet

- Infy Earnings Call Q2-2013-14Document15 pagesInfy Earnings Call Q2-2013-14Niranjan PrasadNo ratings yet

- Bluedart Express (Bludar) : Holding Its Operational Levers Justifies ValuationDocument11 pagesBluedart Express (Bludar) : Holding Its Operational Levers Justifies ValuationDinesh ChoudharyNo ratings yet

- Mindtree Model ReferenceDocument66 pagesMindtree Model Referencesaidutt sharma100% (1)

- Larsen and Toubro Infotech LimitedDocument55 pagesLarsen and Toubro Infotech Limitedlopcd8881No ratings yet

- Assignment On Annual ReportsDocument4 pagesAssignment On Annual ReportsPranay JainNo ratings yet

- Investors' Presentation (Company Update)Document28 pagesInvestors' Presentation (Company Update)Shyam SunderNo ratings yet

- Tata Motors Profitability AnalysisDocument72 pagesTata Motors Profitability AnalysisBhanu PrakashNo ratings yet

- TCS PressRelease IFRS INR Q4 14Document7 pagesTCS PressRelease IFRS INR Q4 14vineetvj7No ratings yet

- IT BPO Industry Insights Sep 2012 FinalDocument17 pagesIT BPO Industry Insights Sep 2012 FinalRemiNo ratings yet

- Eclerx - JainMatrix Investments - Nov2011Document6 pagesEclerx - JainMatrix Investments - Nov2011Punit JainNo ratings yet

- Grant Thornton Dealtracker April 2015 - IbefDocument11 pagesGrant Thornton Dealtracker April 2015 - Ibefరమణి శ్రీ అడుసుమల్లిNo ratings yet

- Polar Is 12Document28 pagesPolar Is 12Yashi BiyaniNo ratings yet

- Q2 Revenues Grew by 16.7% Year On Year Sequentially Grew by 4.5%Document6 pagesQ2 Revenues Grew by 16.7% Year On Year Sequentially Grew by 4.5%FirstpostNo ratings yet

- Bharti Airtel Annual Report 2012 PDFDocument240 pagesBharti Airtel Annual Report 2012 PDFnikhilcsitmNo ratings yet

- Declaration: "Ebit & Eps of Wipro Limited" Project ReportDocument24 pagesDeclaration: "Ebit & Eps of Wipro Limited" Project ReportRohit ChoudharyNo ratings yet

- InternDocument9 pagesInternPalak HemnaniNo ratings yet

- Aurionpro AR 2013Document104 pagesAurionpro AR 2013susegaadNo ratings yet

- Press Release q3 Fy22Document9 pagesPress Release q3 Fy22ashokdb2kNo ratings yet

- Valuetronics 2014 ANNUAL REPORTDocument84 pagesValuetronics 2014 ANNUAL REPORTKenneth W K KohNo ratings yet

- Artivision Technologies LTD Annual Report 2015Document134 pagesArtivision Technologies LTD Annual Report 2015WeR1 Consultants Pte LtdNo ratings yet

- EY Revenue Assurance Report 2008Document20 pagesEY Revenue Assurance Report 2008jadeleongNo ratings yet

- Medtronic Commentary-FY23Q3-FINALDocument12 pagesMedtronic Commentary-FY23Q3-FINALcena1987No ratings yet

- Bharti Airtel Annual Report 2012Document240 pagesBharti Airtel Annual Report 2012Saurav PatroNo ratings yet

- Investor Presentation May 2016 (Company Update)Document29 pagesInvestor Presentation May 2016 (Company Update)Shyam SunderNo ratings yet

- 17 - 1 - 2013 - 13 - 10 - 12 - FileName - HCLT-Q2-2013-OND'12-IR ReleaseDocument26 pages17 - 1 - 2013 - 13 - 10 - 12 - FileName - HCLT-Q2-2013-OND'12-IR ReleasepajijayNo ratings yet

- Atento Investor Presentation Highlights GrowthDocument35 pagesAtento Investor Presentation Highlights Growthgns1234567890No ratings yet

- Infotech Enterprises Result UpdatedDocument11 pagesInfotech Enterprises Result UpdatedAngel BrokingNo ratings yet

- CRISIL Research Ier Report Sterlite Technologies 2012Document28 pagesCRISIL Research Ier Report Sterlite Technologies 2012J Shyam SwaroopNo ratings yet

- Analyst Presentation - Aptech LTD Q3FY13Document31 pagesAnalyst Presentation - Aptech LTD Q3FY13ashishkrishNo ratings yet

- Pernod Ricard (India) : Premiumization MantraDocument6 pagesPernod Ricard (India) : Premiumization MantraMayank DixitNo ratings yet

- Smart Gains 42 PDFDocument4 pagesSmart Gains 42 PDF476No ratings yet

- Corporate Finance Term Paper on Bangas LimitedDocument14 pagesCorporate Finance Term Paper on Bangas LimitedAshikur Rahman ShikuNo ratings yet

- Infosys Technologies: Cautious in The Realm of Rising UncertaintyDocument7 pagesInfosys Technologies: Cautious in The Realm of Rising UncertaintyAngel BrokingNo ratings yet

- EarningscallDocument25 pagesEarningscallAK GNo ratings yet

- Relazione Bloomberg Infoys TechnologiesDocument4 pagesRelazione Bloomberg Infoys TechnologiesMattia CostantiniNo ratings yet

- Annual Analyst & Investor Meet FY11Document44 pagesAnnual Analyst & Investor Meet FY11sujith1202No ratings yet

- Executive Summary: 1 Team-Vladmir BraveheartDocument17 pagesExecutive Summary: 1 Team-Vladmir BraveheartratttzzzNo ratings yet

- PLDT 2012 Annual ReportDocument54 pagesPLDT 2012 Annual ReportAlen MirandaNo ratings yet

- Airtel Jio StrategyDocument15 pagesAirtel Jio Strategyshuvam banerjee100% (1)

- q2 Earnings Press ReleaseDocument2 pagesq2 Earnings Press ReleaseAbhayNo ratings yet

- 1Document8 pages1getaneh yanteamlakNo ratings yet

- Project Report on International Business Strategies of WiproDocument17 pagesProject Report on International Business Strategies of WiproathiraNo ratings yet

- Professional & Management Development Training Revenues World Summary: Market Values & Financials by CountryFrom EverandProfessional & Management Development Training Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- HAL Annual Report 2022Document390 pagesHAL Annual Report 2022Bethany CaseyNo ratings yet

- Nirlon Limited Updates Investor Presentation for Nine Months Ended December 2021Document28 pagesNirlon Limited Updates Investor Presentation for Nine Months Ended December 2021Bethany CaseyNo ratings yet

- Inclusive GrowthDocument7 pagesInclusive GrowthnehaNo ratings yet

- Indian Monetary Policy - RBIDocument15 pagesIndian Monetary Policy - RBIBethany CaseyNo ratings yet

- Metro Brand Ltd. Initiating Coverage Note - 03.04.2022Document25 pagesMetro Brand Ltd. Initiating Coverage Note - 03.04.2022Bethany CaseyNo ratings yet

- Challenges in Msme Finance Rbi GovernorDocument11 pagesChallenges in Msme Finance Rbi GovernorAJAY KUMAR GUPTANo ratings yet

- Sinclairs Hotels Limited investor presentation highlights expansion plansDocument66 pagesSinclairs Hotels Limited investor presentation highlights expansion plansBethany CaseyNo ratings yet

- Shilpa MedicareDocument27 pagesShilpa MedicareBethany CaseyNo ratings yet

- Gabriel India Ltd. Q3 FY22 Results and Business UpdateDocument44 pagesGabriel India Ltd. Q3 FY22 Results and Business UpdateBethany CaseyNo ratings yet

- NSE Annual REportDocument310 pagesNSE Annual REportBethany CaseyNo ratings yet

- Challenges in Msme Finance Rbi GovernorDocument11 pagesChallenges in Msme Finance Rbi GovernorAJAY KUMAR GUPTANo ratings yet

- Indian Monetary Policy - RBIDocument15 pagesIndian Monetary Policy - RBIBethany CaseyNo ratings yet

- Yes Bank Ltd. Scheme of ReconstructionDocument7 pagesYes Bank Ltd. Scheme of ReconstructionBethany CaseyNo ratings yet

- Indian Economy at A Crossroad - A View From Financial Stability AngleDocument12 pagesIndian Economy at A Crossroad - A View From Financial Stability AnglesuranaNo ratings yet

- Concor - Q1FY20 - Result Update PDFDocument6 pagesConcor - Q1FY20 - Result Update PDFBethany CaseyNo ratings yet

- BHEL - CrisilDocument3 pagesBHEL - CrisilBethany CaseyNo ratings yet

- Concor - Q1FY20 - Result Update PDFDocument6 pagesConcor - Q1FY20 - Result Update PDFBethany CaseyNo ratings yet

- Building The Critical Path For Covid-19 TherapeuticsDocument36 pagesBuilding The Critical Path For Covid-19 TherapeuticsBethany CaseyNo ratings yet

- Whitepaper - T&T - New Age Asset - Airline Passenger Revenue AccountingDocument9 pagesWhitepaper - T&T - New Age Asset - Airline Passenger Revenue AccountingBethany CaseyNo ratings yet

- La Opala's capacity expansion to drive earnings growthDocument12 pagesLa Opala's capacity expansion to drive earnings growthBethany CaseyNo ratings yet

- Bees PresentationDocument100 pagesBees PresentationBethany CaseyNo ratings yet

- KVB PresentationDocument44 pagesKVB PresentationBethany CaseyNo ratings yet

- Business of RetailingDocument28 pagesBusiness of RetailingBethany CaseyNo ratings yet

- Bees PresentationDocument100 pagesBees PresentationBethany CaseyNo ratings yet

- REpco Home Finance - ExceptsDocument7 pagesREpco Home Finance - ExceptsBethany CaseyNo ratings yet

- ABB LimitedDocument89 pagesABB LimitedBethany CaseyNo ratings yet

- Financial Stability Report 2014 - Reserve BankDocument82 pagesFinancial Stability Report 2014 - Reserve BankBethany CaseyNo ratings yet

- Recent Trends in Rural WagesDocument24 pagesRecent Trends in Rural WagesBethany CaseyNo ratings yet

- Week 1 - IBO 01 02 Financial System Explanation URP 2023-l and 1st AssigmentDocument16 pagesWeek 1 - IBO 01 02 Financial System Explanation URP 2023-l and 1st AssigmentJuliana Chancafe IncioNo ratings yet

- F 13 Financial Accounting CpaDocument9 pagesF 13 Financial Accounting CpaMarcellin MarcaNo ratings yet

- Xii Mcqs CH - 10 Issue of DebenturesDocument4 pagesXii Mcqs CH - 10 Issue of DebenturesJoanna GarciaNo ratings yet

- LK PT Ifishdeco Konsolidasian 2021Document74 pagesLK PT Ifishdeco Konsolidasian 2021Pramayurgy WilyakaNo ratings yet

- Income Tax 2Document27 pagesIncome Tax 2Mohammad AnikNo ratings yet

- Balaji Balakrishnan - FCR220906CR906137696 - UnlockedDocument4 pagesBalaji Balakrishnan - FCR220906CR906137696 - UnlockedclmnNo ratings yet

- AFA1-3C - Assignment 2Document10 pagesAFA1-3C - Assignment 2Segarambal MasilamoneyNo ratings yet

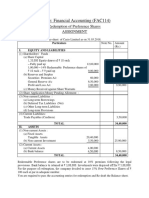

- Redemption of Preference SharesDocument9 pagesRedemption of Preference SharesRahul VermaNo ratings yet

- Abbott FINAL REPORTDocument42 pagesAbbott FINAL REPORTTaha NoorullahNo ratings yet

- LTIMindtreeDocument13 pagesLTIMindtreeShiv LalwaniNo ratings yet

- Learn Key Concepts of Business FinanceDocument23 pagesLearn Key Concepts of Business FinanceChu ChuNo ratings yet

- FAC114 Financial Accounting Redemption of Preference SharesDocument4 pagesFAC114 Financial Accounting Redemption of Preference SharesDhairya ShahNo ratings yet

- Cash Forecasting: Tony de Caux, Chief ExecutiveDocument6 pagesCash Forecasting: Tony de Caux, Chief ExecutiveAshutosh PandeyNo ratings yet

- Mid Term Review OnlineDocument16 pagesMid Term Review Onlinegeclear323No ratings yet

- FABM2 - Q1 - Module 5 Analysis and Interpretation of Financial StatementsDocument30 pagesFABM2 - Q1 - Module 5 Analysis and Interpretation of Financial StatementsEly BNo ratings yet

- Sadbhav Infrastructure ProjectDocument16 pagesSadbhav Infrastructure ProjectbardhanNo ratings yet

- IFRS Financial Statement Effects in IndiaDocument20 pagesIFRS Financial Statement Effects in IndiaKanav GuptaNo ratings yet

- Chapter 5Document56 pagesChapter 5mohamed faisalNo ratings yet

- 20004ipcc Paper5 Cp6.CrackedDocument122 pages20004ipcc Paper5 Cp6.CrackedNitteshdas ChatergiNo ratings yet

- Part A & BDocument6 pagesPart A & BRiya PrajapatiNo ratings yet

- Illustrative Examples - Financial StatementsDocument6 pagesIllustrative Examples - Financial StatementsChuchi SubardiagaNo ratings yet

- Accounting BasicsDocument42 pagesAccounting Basicssowmithra4uNo ratings yet

- What is imputed interestDocument9 pagesWhat is imputed interestmarites yuNo ratings yet

- 2014 AFR NatlGovt Volume IDocument244 pages2014 AFR NatlGovt Volume IErron ParazoNo ratings yet

- Assertions in Financial StatementsDocument3 pagesAssertions in Financial StatementsAprile AnonuevoNo ratings yet