Professional Documents

Culture Documents

Becker CPA Review Summary of Changes Included in The V1.1 REG Textbook

Uploaded by

mohit2ucOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Becker CPA Review Summary of Changes Included in The V1.1 REG Textbook

Uploaded by

mohit2ucCopyright:

Available Formats

1

Becker CPA Review

Summary of Changes Included

in the V1.1 REG Textbook

The purpose of this document is to provide you with a list of the items that have been changed/updated in

the May 2014 version of the Regulation textbook (V1.1). If you have a V1.0 REG textbook purchased

between November 2013 and the end of April 2014, you can either purchase the new V1.1 textbook for

$15 or use this document to update your V1.0 textbook.

Please note that the tax portion of the Regulation exam focuses primarily on principles and concepts, and

not on year-specific amounts, thresholds and phase-outs. This document provides updates for year-

specific amounts that changed as of J anuary 1, 2014. New tax law is not testable until six months after

the date passed by Congress. Therefore, to the extent you would see these new amounts on the CPA

exam, they will be testable beginning J uly 1, 2014.

Also included in this update are

A link to an Appendix for REG 4 dealing with the "repairs regs" (Additional Expenditures on

Existing Assets) and

Additional information for REG 2 on the Affordable Care Act.

2

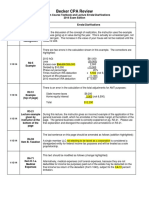

REGULATION 1

R1-4, Exemption amount at the

bottom of the page. R1-10,

Item I. R1-11, Item II. R1-13,

Item B.2. For 2014, the personal exemption amount is $3,950.

R1-7, Item I.A.2.b. For 2014, the gross income amount referenced here is $1,000.

R1-11, Item D. For 2014, the phaseout starts when AGI exceeds $305,050 for

married filing jointly and surviving spouses, $279,650 for heads

of households, $254,200 for single taxpayers, and $152,525 for

married filing separately.

R1-11 Example In the Example, the married couple has AGI of $317,050 in 2014.

$317,050 - $305,050 =$12,000. The other numbers remain the

same.

R1-11, Item II. Replace the first two sentences with the following:

Text above Pass Key. The amount of this exemption is $3,950 for 2014.

R1-13, Item 2. The exemption amount is $3,950 for 2014.

R1-14, Item C.2. Second line above Example box: change 2012 to 2013 and

change 2013 to 2014.

R1-20, Item g.(3) The value of employer provided parking is $250 per month for

2014.

R1-20, Item g.(4) The value of employer provided transit passes is $130 per month

for 2014.

R1-22, Item 2.b. Possessions of the United States include Guam and Puerto

Rico.

R1-22, Item 2.c.(2) For 2014, the phase out begins at $76,000 for single and head of

household and $113,950 for married filing jointly.

R1-22 and R1-23, Item 3 The basic standard deduction for a child is $1,000 in 2014.

R1-24 Item (c) Tax Rates These rates apply for 2014 (15%, 0% and 20%)

R1-28, Item 2. e For 2014, the standard mileage rate is 56 cents per mile.

R1-29, Item 4.a.(2)(a) & (c) The Social Security Wage Base increased to

$115,500 in 2014

R1-46, Item P.7. For 2014, the amount excludable from income goes to $99,200.

3

R1-46 The maximum exclusion for 2014 is $29,760, or 30%

Note box at bottom of page of the $99,200 maximum foreign income exclusion.

REGULATION 2

R2-3, Item II. A. The Educator Expenses and the Tuition and Fee

& R2-11, Item E. Deduction expired 12/31/13.

R2-4, Item B The Educator Expenses Deduction expired 12/31/13.

R2-5, Item c.(1) For 2014 the phase-out for Single/HH is $60,000-$70,000 and

J oint is $96,000-$116,000.

R2-5, Item c.(2)(b) For 2014, the phase-out for an individual who is not an active

participant in an employer sponsored retirement plan, but whose

spouse is, increases to $181 -$191,000.

R2-5, Example, bottom of page; Replace with the following Example

Kristi, a single taxpayer, is an active participant in her employer's pension plan. Kristi's

2014 AGI is $62,000. Kristi's maximum 2014 IRA deduction is $4,400, calculated as

follows:

2014 AGI $ 62,000

Less (60,000)

Excess over $60,000 2,000

Divided by $10,000 (phase-out range) 10,000

Phase out percentage 20%

Times maximum IRA deduction 5,500

Amount of IRA phased out (1,100)

2014 maximum IRA deduction $ 4,400

R2-6, Item d.(1) and (2) For 2014, the maximum IRA deduction remains at $5,500 for a

single taxpayer and $11,000 for married taxpayers.

4

R2-6, Notes on bottom of page For 2014 the phase-out for J oint is $96,000-$116,000.

For 2014, the phase-out for an individual who is not an active

participant in an employer sponsored retirement plan, but whose

spouse is increases to $181,000-$191,000.

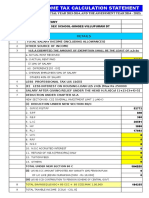

Here is the updated Summary Chart for the bottom of page R2-6.

R2-7, Item g. The additional catch-up contribution for age 50 or over remains

at $1,000 for 2014.

R2-7, Item 3.d. For 2014, the Roth IRA contribution limits remain at $5,500 for a

single taxpayer and $11,000 for married taxpayers.

R2-7, Item 3.e. The 2014 phase-out for Roth Contributions increases to

$114,000-$129,000 for Single and HH; and $181,000-

$191,000 for J oint filers.

R2-8, Item 4.a.(1) For 2014, the Non-Deductible IRA contribution limit

remains at $5,500.

R2-9, Item 5.d.(2) The contribution limit per beneficiary remains $2,000 for 2014.

5

R2-10, Item (4) Chart Use the following as a replacement chart.

R2-10, Item D.2. The 2014 phase-out for student loan interest for joint filers

changes to $130,000-$160,000. Single filers changes to

$65,000-$80,000.

R2-11, Item E. Tuition and Fees Deduction expired 12/31/13.

R2-11, Item F.1. For 2014, pre-tax contributions increase to $3,300 ($6,550

for families).

R2-11, Item F.3. For 2014, a high deductible plan must have at least a

$1,250 deductible ($2,500 for families).

R2-11, Item F.3.a. For 2014, the out of pocket limitation is $6,350 for

individuals and $12,700 for families.

R2-12, Item 4.c. For 2014 $3,200 goes to $3,250 and $6,450 goes to $6,550.

R2-12, Item 4.d. The first sentence is deleted. For 2014, $4,300 goes to $4,350,

and $7,850 goes to $8,000.

R2-12, Item 3.a.(1) For 2014, the standard moving mileage rate is 23.5 cents per

mile.

R2-13, Item J .1. For 2014, the $51,000 deductible amount increases to $52,000.

R2-13, Item J .2. For 2014, the $51,000 additional amount above the deductible

amount increases to $52,000.

R2-14, Item 3, Example The same amounts apply for 2014.

R2-15, Item III, A. For 2014, the standard deduction for single goes to $6,200,

head of household $9,100, married filing joint $12,400, and

married filing separately $6,200.

6

R2-16, Item A. 1. For 2014, the $1,500 number increases to $1,550, and the

$3,000 number increases to $3,100.

Replace the existing Example with the following one:

R2-16, Item A. 2. Standard Deductionthese amounts did not change for 2014.

R2-16, Item B. 1. For 2014, the phaseouts are as follows. The phaseout starts

when AGI exceeds $305,050 for married filing jointly and

surviving spouses, $279,650 for heads of households, $254,200

for single taxpayers, and $152,525 for married filing separately.

R2-19, Item d. (5)(b) For 2014, the standard medical mileage rate is 23.5 cents per

mile.

R2-21, Item (4) The sales tax deduction expired after 2013.

R2-22, Item (3) The mortgage insurance premium deduction expired after 2013.

R2-23 Items b. (3) & (4) Headings The correct term is "Investment Expense" (delete "Interest").

R2-28, Item (2) For 2014, the standard mileage rate is 56 cents per mile.

R2-31.I.A. Individual Rate Structure: rates remain the same for 2014.

R2-33 Item B. Child and Dependent Care Credit: numbers remain the same for

2014.

R2-34 Item 2 (top of page) and

Example (bottom of page) All numbers remain the same for 2014.

R2-36-37, Item D.1. a. g. All amounts indicated for 2013 remain unchanged for 2014.

R2-37, Item II.D.2.e. For 2014, the credit phase-out begins with MAGI exceeding

$54,000 ($108,000 on a joint return), with full phase-out at

$64,000 ($128,000 for joint returns).

7

R2-38 2014 Education Tax Incentives Summary Chart (revised chart below)

R2-39, Item F.1. The adoption credit goes to $13,190 for 2014 from $12,970.

R2-39, Item F.2. For 2014 the phase-out for the adoption credit goes to $197,880-

$237,880

R2-39, Item F. 3.d. For adoption assisted programs the 2014 amount goes from

$12,970 to $13,190 and the phase out goes to $197,880-

$237,880.

R2-39, Item G. The final sentence beginning with It is limited should be

deleted. The sentence beginning "For 2013, nonrefundable"

should say 2014.

8

R2-40 (top of page), Item G. 2. The credit ranges are as follows:

50% $0 - $36,000 MFJ and $0 - $18,000 Single/MFS

20% $36,001 - $39,000 MFJ and $18,001 - $19,500 Single/MFS

10% $39,001 - $60,000 MFJ and $19,501 - $30,000 Single/MFS

0% over $60,000 MFJ and over $30,000 Single /MFS

*Footnote to the table: For 2014, full phase-out applies to AGI

for MFJ over $60,000, to HH over $45,000, and to single and

MFS over $30,000.

R2-41, Item 1. K. Delete this entire line and move line l to line k.

R2-41, Item J . The Work Opportunity Credit expired after 2013.

R2-42, Item K.4.b. The $3,000 remains in effect in 2014.

R2-43, Item 4.a. For 2014, the maximum credit is $496.

R2-43, Item 4.b. For 2014, the maximum credit is $3,305.

R2-43, Item 4.c. For 2014, the maximum credit is $5,460.

R2-43, Item 4.d. For 2014, the maximum credit is $6,143.

R2-43, Item 5. For 2014, the disqualified income amount is $3,350.

R2-44, Item R. The residential energy credits expired after 2013.

R2-45, Item I. A. For 2014, the $179,500 should be $182,500 in both places.

R2-48, Item B. For 2014, the exemption amounts are $82,100 for married filing

jointly, $52,800 for single, and $41,050 for married filing

separately. For 2014, the phaseout thresholds start at $156,500

for married filing jointly, $117,300 for single, and $78,250 for

married filing separately.

R2.49 Item C 8 Medical deduction For taxpayers age 65 and over, the rate is 10%, not 7.5%.

R2-50, Item F.2.f.(3) Add "adjustment for taxpayers age 65 and older" to the end of

the line.

9

R2-52, add to end of page:

A. Additional Medicare Tax

The Affordable Care Act imposes an additional Medicare tax of .9% on wages in excess of

$250,000 for married filing jointly, $125,000 for married filing separately, and $200,000 for all

other taxpayers.

1. Employers are responsible for withholding this additional tax on all wages paid to an

employee that exceed $200,000 in a calendar year.

2. Any amounts withheld in excess, can be claimed as a credit on the taxpayers individual

income tax return.

III. TAX PENALTY IMPOSED BY INDIVIDUAL MANDATE SECTION OF AFFORDABLE CARE ACT

The Affordable Care Act further imposes a tax penalty on certain individuals that are not covered

by health insurance.

A. Tax Amount

In 2014, the amount of the tax is the greater of a flat rate of $95 per person (up to a

maximum of $285), or 1% of household income that exceeds filing requirements.

1. Children are assessed at 50% of the minimum penalty.

2. Certain low income taxpayers are exempt from the tax.

3. The penalty is pro-rated by month.

4. No penalty applies to a gap in coverage of 3 months or less.

5. The IRS is prohibited from using liens or levies to collect the tax.

REGULATION 3

R3-22 In the 11th line under Ordinary Expenses, this item should

show Section 179 depreciation (in the IRC column) as

2014 =$25,000 (not 2013 =$500,000)

R3-28 Item C These rates remain the same for 2014.

R3-33, Item c (3), Example In the 4

th

line, change 2013 to 2014:

Interest earned in 2014 on the bond was $800.

10

REGULATION 4

R4-3, bottom of page Add the following text:

E. Additional Expenditures on Existing Assets

1. Improvements to a single unit of property (UOP) must be capitalized if they result in a

betterment to the property, adapt the property to a new or different use, or result in a restoration

of the property.

2. A single unit of property is defined as all components that are functionally interdependent. A

component is functionally interdependent if the placing in service of one component is dependent

on the placing in service of other components.

3. When additional expenditures are not required to be capitalized, then they are deemed to be

"repairs" and are expensed.

Note: New rules related to repairs and capital improvements were recently enacted by the IRS.

Please see the appendix at the end of this lecture for a discussion of these new rules.

A copy of the Appendix has been included with this document.

R4-31, Item C For tax year 2014 the taxpayer can expense up to $25,000 of the

cost of qualifying property. This maximum expensing amount is

reduced dollar-for-dollar if the taxpayer purchases and places in

service during the year more than $200,000 of qualifying

property. For tax year 2014, there is no election to deduct

qualified real property.

Bonus depreciation expired at the end of 2013.

R4-59, Item I. A. The phrase "articles of incorporation" should be replaced with

"articles of organization".

R4-59, Item I. B. The final sentence begins "A single member LLC".

Add following LLC: not electing to be taxed as a corporation

R4-61, Items

D.1.c and

D.2.b

R4-69, Item III.

A.

R4-70, Bottom

of chart

R4-71, Item

E.1

R4-72, Items E.2.

and E.3 For 2014, the "applicable exclusion amount" increases from

R4-77, Item V $5,250,000 to $5,340,000. This amount provides for a unified

estate and gift tax credit of $2,081,800 for 2014.

11

R4-64 and R4-66 Replace the 2013 chart with the following 2014 chart.

(same chart on both pages).

R4-70, Chart, Estate Transfer Tax Change "<Gift Taxes Paid>" (first column, near bottom) to "<Gift

Taxes Payable>"

R4-72, Item 2. 2. Applicable Exclusion Amount: The last sentence in this

item should read: The net result is generally an estate tax due

equal to: 40% X [tentative tax base at death minus $5,340,000.]

R4-72 Below is the Example for this page, updated to 2014.

R4-74, Item IV For 2014, the per-year-per-donee exclusion remains at

R4-76, Item G $14,000 per donee and $28,000 for married couples who

elect gift splitting.

R4-76, Item G, Example Sentences at the bottom of the example should read:

J ack would owe gift tax only if the amount of J ack's cumulative

(all years) taxable gifts exceed $5,250,000 $5,340,000.

However, J ack must file a gift tax return because the value of at

least one of his gifts exceeds the $14,000 per donee exclusion

amount.

12

R4-77, Item V. With respect to the generation-skipping transfer tax, the

maximum total exemption for married couples is $10,680,000

(increased from $10,500,000) for 2014. The exemption amount

has increased for 2014 from $5,250,000 to $5,340,000.

Becker Professional Education | CPA Exam Review Regulation 4

DeVry/Becker Educational Development Corp. All rights reserved. R4- 83

A P P E N D I X

De d u c t i o n a n d C a p i t a l i z a t i o n o f E x p e n d i t u r e s Re l a t e d t o Ta n g i b l e P r o p e r t y

( Re p a i r Re g u l a t i o n s )

I. DEDUCTION AND CAPITALIZATION OF EXPENDITURES RELATED TO TANGIBLE PROPERTY

(REPAIR REGULATIONS)

The IRS has issued regulations specifying whether and when a taxpayer must capitalize costs

incurred in acquiring, maintaining, or improving tangible property. If the regulations do not require

capitalization, then the costs are considered to be repairs and are expensed.

A. Tangible Property Must Be Capitalized

The general rule is that all tangible property that is not inventory must be capitalized unless

there is an exception.

1. Materials and Supplies

a. Generally, an item that costs $200 or less or has an economic life of 12 months or

less qualifies as materials and supplies.

b. If the tangible property qualifies as materials and supplies, it can be deducted in the

year of consumption if non-incidental, or in the year paid if incidental.

(1) Incidental materials and supplies are those for which no inventories or records

of consumption are kept.

2. Amounts Paid to Acquire or Produce Property

Amounts paid or incurred to produce or acquire tangible and intangible property must

be capitalized.

3. Improvements

a. Improvements to a single unit of property must be capitalized if they result in a

betterment to the property, adapt the property to a new or different use, or result in

a restoration of the property.

(1) An improvement is a betterment if the expenditure corrects a defect or betters

a condition, is for a material addition, or increases productivity or efficiency.

(2) An improvement is an adaptation if the expenditure adapts the property to a

new or different use than was originally intended by the taxpayer.

(3) An improvement is a restoration if the expenditure restores basis taken into

account, returns the property to a working order, results in a like-new condition

at the end of the depreciation class life, or replaces a structural part or major

component of the property.

b. Indirect costs, such as otherwise deductible repair or removal costs, that directly

benefit or are incurred by reason of an improvement, must be capitalized.

c. Indirect costs that do not directly benefit and are not incurred by reason of an

improvement are not capitalized, even if paid or incurred at the same time as

an improvement.

R4- 84 DeVry/Becker Educational Development Corp. All rights reserved.

Regulation 4 Becker Professional Education | CPA Exam Review

4. Single Unit of Property

a. A single unit of property (UOP) is defined as all components that are functionally

interdependent. A component is functionally interdependent if the placing in service

of one component is dependent on the placing in service of other components.

b. A building structure is a single unit of property to the extent of the building and its

structural components other than those designated as building systems.

c. Designated building systems considered separate from the building

structure include:

(1) Heating, ventilation, and air conditioning systems

(2) Plumbing systems

(3) Electrical systems

(4) Escalators

(5) Elevators

(6) Alarm and fire protection systems

(7) Security systems

(8) Gas distribution systems

d. Any amounts paid or incurred to improve designated building systems

are considered separate from the building structure and subject to the

improvement rules.

5. Intangible Property

Amounts paid or incurred for acquiring, creating, or enhancing intangible property must

be capitalized.

B. De Minimis Rule

Companies can make a de minimis annual expense election regarding expenditures to acquire

or produce property if they have a capitalization policy in effect as of the beginning of the year.

This election can also be applied to materials and supplies.

1. The capitalization policy must be a written accounting policy for nontax purposes that

treats as an expense in the financial statements:

a. property purchases under a certain dollar amount; and/or

b. property with an economic useful life of 12 months or less.

2. If a company has an applicable financial statement, the maximum amount is $5,000.

3. If a company does not have an applicable financial statement, the maximum amount

is $500.

4. An applicable financial statement is:

a. a financial statement required to be filed with the SEC; or

b. an audited financial statement; or

c. a financial statement, other than a tax return, required to be provided to a federal or

state government or agency (other than the IRS or SEC).

Becker Professional Education | CPA Exam Review Regulation 4

DeVry/Becker Educational Development Corp. All rights reserved. R4- 85

E X A MP L E

Center Corporation has an applicable financial statement and at the beginning of Year 1 has a written

accounting policy to expense amounts paid for tangible property costing up to $5,000. During Year 1,

Center pays $32,000 for 8 desks.

Center may deduct the entire $32,000 in Year 1 under the de minimis rule. The cost of $4,000 per desk

($32,000 / 8) is below the $5,000 per item threshold.

E X A MP L E

Center Corporation has an applicable financial statement and at the beginning of Year 1 has a written

accounting policy to expense amounts paid for tangible property costing up to $10,000. During Year 1,

Center pays $50,000 for 8 desks.

For financial reporting purposes, Center can expense the entire $50,000 paid for the 8 desks because

each desk costs less than the $10,000 limit ($50,000 / 8 = $6,250 per desk). However, for tax purposes,

Center must capitalize all of the purchases unless their economic life is less than 12 months because the

de minimis rule is not met. The de minimis rule is not met because the purchases exceed $5,000 each.

C. Safe Harbors

1. Routine Maintenance

There is an elective safe harbor that allows taxpayers to expense routine maintenance

that the taxpayer reasonably expects to occur more than once during the class life of the

asset and does not result in a betterment.

a. Routine maintenance does not include amounts paid or incurred for the:

(1) replacement of a component of a unit of property that has been deducted as a

loss other than a casualty loss.

(2) replacement of a component of a unit of property that has been accounted for

in realizing gain or loss from the sale or exchange of the component.

(3) repair of damage to the unit of property that has been taken as a basis

adjustment as a result of a casualty loss.

(4) return of a unit of property to its ordinary operating condition if it has

deteriorated and is no longer functional for its intended use.

2. Qualifying Small Taxpayers

Qualifying small taxpayers can expense costs related to an eligible building if they do not

exceed the lesser of 2 percent of unadjusted basis of the building or $10,000.

a. Amounts deducted under the de minimis or routine maintenance rules will count

toward the $10,000 limit.

b. A qualifying small taxpayer is a taxpayer with average annual gross receipts of $10

million or less during the three preceding tax years.

c. An eligible building is any building with an unadjusted basis that does not exceed

$1 million.

E X A MP L E

Data, Inc. is a qualifying small taxpayer and owns an office building. The building has an unadjusted basis

of $850,000, and in Year 3, Data pays $8,750 for repairs and improvements.

Under the qualifying small taxpayer safe harbor rule, the building is an eligible building because the

unadjusted basis of $850,000 is under $1 million. The safe harbor rule will apply because the total

amount paid of $8,750 is below the lesser of $17,000 (2% of $850,000) or $10,000. Data Inc. would

expense the repairs and maintenance of $8,750.

R4- 86 DeVry/Becker Educational Development Corp. All rights reserved.

Regulation 4 Becker Professional Education | CPA Exam Review

E X A MP L E

Data, Inc. is a qualifying small taxpayer and owns an office building. The building has an unadjusted basis

of $850,000, and in Year 3, Data pays $12,000 for repairs and improvements.

Under the qualifying small taxpayer safe harbor rule, the building is an eligible building because the

unadjusted basis of $850,000 is under $1 million. However, the qualifying small taxpayer safe harbor rule

will not apply because the total amount paid of $12,000 exceeds the lesser of $17,000 (2% of $850,000)

or $10,000.

Therefore, Data Inc. will:

expense the repairs and improvements of $12,000 if the repairs and improvements are considered to

be routine maintenance and Data elects to apply the routine maintenance safe harbor rule; or

capitalize the repairs and improvements if they result in the betterment, adaptation, or restoration of

the office building.

You might also like

- Becker CPA Review: Regulation Course Textbook and Lecture Errata/Clarifications 2012 Exam EditionDocument7 pagesBecker CPA Review: Regulation Course Textbook and Lecture Errata/Clarifications 2012 Exam Editionfadihasan2No ratings yet

- Regulation Ch1 3Document10 pagesRegulation Ch1 3cpatutuNo ratings yet

- 2006 R2 ErrataDocument5 pages2006 R2 Erratamail1anand100% (2)

- 2006 R1 ErrataDocument3 pages2006 R1 Erratamail1anandNo ratings yet

- Budget Responses 04-03-2023Document6 pagesBudget Responses 04-03-2023Caitlyn FroloNo ratings yet

- Crosswalk CPA Review: Tax Inflation Adjustments 2021Document15 pagesCrosswalk CPA Review: Tax Inflation Adjustments 2021Adhira VenkatNo ratings yet

- Ithaca Budget NarrativeDocument42 pagesIthaca Budget NarrativeTime Warner Cable NewsNo ratings yet

- Ebook PDF Byrd Chens Canadian Tax Principles 2019 2020 Edition PDFDocument42 pagesEbook PDF Byrd Chens Canadian Tax Principles 2019 2020 Edition PDFtony.rodriguez470100% (30)

- 2019 TSP/IRA Contribution LimitsDocument4 pages2019 TSP/IRA Contribution LimitsFedSmith Inc.No ratings yet

- Interim Mayor Todd Gloria: News From City of San DiegoDocument1 pageInterim Mayor Todd Gloria: News From City of San Diegoapi-63385278No ratings yet

- IRS Retirement Plan Adjustments For 2014Document3 pagesIRS Retirement Plan Adjustments For 2014Doug PotashNo ratings yet

- Collier 1ce Solutions Ch04Document10 pagesCollier 1ce Solutions Ch04Oluwasola OluwafemiNo ratings yet

- 2014 Reg TextDocument2 pages2014 Reg Textxhitechx1No ratings yet

- Q3 2023 Updates FinalDocument10 pagesQ3 2023 Updates FinalReshma MarathiNo ratings yet

- Special City Council Meeting Agenda Packet 03-19-13Document115 pagesSpecial City Council Meeting Agenda Packet 03-19-13L. A. PatersonNo ratings yet

- Running Head: Career and Budget Report 1Document6 pagesRunning Head: Career and Budget Report 1Stephen MunozNo ratings yet

- Your 2013 Income Taxes Have Gone UP Folks!Document2 pagesYour 2013 Income Taxes Have Gone UP Folks!mikerogeroNo ratings yet

- CM Fimbres Fiscal Year 2013 Recommended BudgetDocument2 pagesCM Fimbres Fiscal Year 2013 Recommended BudgetRichard G. FimbresNo ratings yet

- FY 2011-2012 ADOPTED Budget 20110614Document829 pagesFY 2011-2012 ADOPTED Budget 20110614City of GriffinNo ratings yet

- Tax-Sheltered Annuity Plans (403 (B) Plans) : For Employees of Public Schools and Certain Tax-Exempt OrganizationsDocument22 pagesTax-Sheltered Annuity Plans (403 (B) Plans) : For Employees of Public Schools and Certain Tax-Exempt OrganizationsBogdan PraščevićNo ratings yet

- 17 Altprob 7eDocument6 pages17 Altprob 7eAshish BhallaNo ratings yet

- A Guide To 2013 Tax Changes (And More)Document15 pagesA Guide To 2013 Tax Changes (And More)Doug PotashNo ratings yet

- F3.ffa Examreport d14Document4 pagesF3.ffa Examreport d14Kian TuckNo ratings yet

- 2014-2015 City of Sacramento Budget OverviewDocument34 pages2014-2015 City of Sacramento Budget OverviewCapital Public RadioNo ratings yet

- West Hartford Proposed Budget 2024-2025Document472 pagesWest Hartford Proposed Budget 2024-2025Helen BennettNo ratings yet

- Gross Income Exclusions and Deductions For AGI: ©2010 CCH. All Rights ReservedDocument10 pagesGross Income Exclusions and Deductions For AGI: ©2010 CCH. All Rights ReservedPorky ChutNo ratings yet

- Fiscal Year 2012-13 Adopted Budget: 260 North San Antonio Road, Suite A Santa Barbara, CA 93110 805-961-8800Document31 pagesFiscal Year 2012-13 Adopted Budget: 260 North San Antonio Road, Suite A Santa Barbara, CA 93110 805-961-8800Besir AsaniNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Sa5 Pu 14 PDFDocument102 pagesSa5 Pu 14 PDFPolelarNo ratings yet

- Management Accounting Canadian 6th Edition Horngren Solutions ManualDocument17 pagesManagement Accounting Canadian 6th Edition Horngren Solutions ManualCharlesSmithfdbgx100% (13)

- PPTXDocument16 pagesPPTXJenifer KlintonNo ratings yet

- Full Download Income Tax Fundamentals 2018 36th Edition Whittenburg Solutions ManualDocument35 pagesFull Download Income Tax Fundamentals 2018 36th Edition Whittenburg Solutions Manualbej7wharperNo ratings yet

- Dwnload Full Income Tax Fundamentals 2018 36th Edition Whittenburg Solutions Manual PDFDocument35 pagesDwnload Full Income Tax Fundamentals 2018 36th Edition Whittenburg Solutions Manual PDFseritahanger121us100% (7)

- Pdfs AFTR2016 PDFDocument111 pagesPdfs AFTR2016 PDFpaulgiron275No ratings yet

- Fem Preliminary 1112 RevisedDocument92 pagesFem Preliminary 1112 RevisedaldenweerNo ratings yet

- Sa4 Pu 15 PDFDocument9 pagesSa4 Pu 15 PDFPolelarNo ratings yet

- 2013 Manitoba Budget SummaryDocument44 pages2013 Manitoba Budget SummarytessavanderhartNo ratings yet

- Crosswalk CPA Review: Tax UpdateDocument4 pagesCrosswalk CPA Review: Tax UpdateAdhira VenkatNo ratings yet

- Assabet Budgets-How Much Does It Cost To Run? Marlborough Council, 1-23-12 AgendaDocument67 pagesAssabet Budgets-How Much Does It Cost To Run? Marlborough Council, 1-23-12 AgendaourmarlboroughNo ratings yet

- Management Accounting Canadian 6th Edition Horngren Solutions ManualDocument35 pagesManagement Accounting Canadian 6th Edition Horngren Solutions Manualchristopheratkinsxjnqirygse100% (23)

- Saver'S Tax Credit For Contributions by Individuals To Employer Retirement Plans and IrasDocument5 pagesSaver'S Tax Credit For Contributions by Individuals To Employer Retirement Plans and IrasIRSNo ratings yet

- Income Tax Calculation Statement: (Financial Year 2013-2014, and The Assessment Year 2014 - 2015)Document17 pagesIncome Tax Calculation Statement: (Financial Year 2013-2014, and The Assessment Year 2014 - 2015)saravanand1983No ratings yet

- Solution 1: Calculation of Total Assessable Income, Taxable Income, Tax LiabilityDocument14 pagesSolution 1: Calculation of Total Assessable Income, Taxable Income, Tax LiabilityDevender SharmaNo ratings yet

- Elina Shinkar w2 2014Document2 pagesElina Shinkar w2 2014api-318948819No ratings yet

- Livingston County Adopted Budget (2023)Document401 pagesLivingston County Adopted Budget (2023)Watertown Daily TimesNo ratings yet

- Solution Manual For South Western Federal Taxation 2020 Comprehensive 43rd Edition David M MaloneyDocument29 pagesSolution Manual For South Western Federal Taxation 2020 Comprehensive 43rd Edition David M MaloneyCourtneyCollinsntwex100% (38)

- Payroll Accounting 2017 3rd Edition Landin Solutions Manual 1Document48 pagesPayroll Accounting 2017 3rd Edition Landin Solutions Manual 1allen100% (41)

- Curve CCC!C CC"#$%C& CCC C''C (CC) CCC:) c11111111111111111cc2 cc11111111111111111111111c "$$3c4cc56"7cccccc CCCCCCCCCCDocument7 pagesCurve CCC!C CC"#$%C& CCC C''C (CC) CCC:) c11111111111111111cc2 cc11111111111111111111111c "$$3c4cc56"7cccccc CCCCCCCCCC037boyNo ratings yet

- 2022 Tax UpdatesDocument12 pages2022 Tax UpdatesJagmohan TeamentigrityNo ratings yet

- Man Acc 1Document4 pagesMan Acc 1KathleneGabrielAzasHaoNo ratings yet

- General Manager Pay: Report To Priorities and Finance Committee, Dec. 18, 2012Document3 pagesGeneral Manager Pay: Report To Priorities and Finance Committee, Dec. 18, 2012jmarkusoffNo ratings yet

- Syracuse Financial OverviewDocument24 pagesSyracuse Financial OverviewJimmy VielkindNo ratings yet

- Coronado Unified Bond Measure PublicDocument13 pagesCoronado Unified Bond Measure Publicapi-214709308No ratings yet

- Payroll Accounting 2015 1st Edition Landin Solutions ManualDocument34 pagesPayroll Accounting 2015 1st Edition Landin Solutions Manualhofulchondrin6migjb100% (22)

- Salary Deductions Pag Ibig and PhilhealthDocument3 pagesSalary Deductions Pag Ibig and PhilhealthBjorn Pete SarmientoNo ratings yet

- Affordable Power ProposalDocument6 pagesAffordable Power ProposalJames MallovNo ratings yet

- Comprehensive Exam EDocument10 pagesComprehensive Exam Ejdiaz_646247100% (1)

- IND 14 CHP 13 2 Homework Sol RETIREMENT Combined 2014Document8 pagesIND 14 CHP 13 2 Homework Sol RETIREMENT Combined 2014Nada Mucho100% (1)

- IG CH 03Document20 pagesIG CH 03Basa TanyNo ratings yet

- Bec Flash CardsDocument4,310 pagesBec Flash Cardsmohit2uc100% (1)

- Aud Flash CardsDocument3,014 pagesAud Flash Cardsmohit2uc100% (1)

- 2014 Final Review Homework FARDocument231 pages2014 Final Review Homework FARmohit2ucNo ratings yet

- 2013.AICPA - Newly.released - Questions REGDocument41 pages2013.AICPA - Newly.released - Questions REGgoldenpeanutNo ratings yet

- 2014 Final Review Homework REGDocument241 pages2014 Final Review Homework REGmohit2ucNo ratings yet

- Reg Flash CardsDocument3,562 pagesReg Flash Cardsmohit2ucNo ratings yet

- Notes Chapter 6 REGDocument8 pagesNotes Chapter 6 REGcpacfa90% (10)

- REG NotesDocument41 pagesREG NotesNick Huynh75% (4)

- Agency: REG - Notes Chapter 7Document9 pagesAgency: REG - Notes Chapter 7mohit2ucNo ratings yet

- 2015.74013.essentials of Spanish With Readings Volume I TextDocument459 pages2015.74013.essentials of Spanish With Readings Volume I TextmuytradingsNo ratings yet

- HRM NoteDocument60 pagesHRM Noteraazoo19No ratings yet

- SOP Customer ComplaintDocument2 pagesSOP Customer ComplaintMohd Kamil77% (52)

- Company Profile PDFDocument3 pagesCompany Profile PDFAbhay HarkanchiNo ratings yet

- Pengantar Ilmu PolitikDocument12 pagesPengantar Ilmu PolitikAmandaTabraniNo ratings yet

- Verbal Reasoning 8Document64 pagesVerbal Reasoning 8cyoung360% (1)

- Mollymawk - English (Çalışma)Document8 pagesMollymawk - English (Çalışma)Fatih OguzNo ratings yet

- Skill Developmet For Indian Textile Industry: S.K.SoniDocument66 pagesSkill Developmet For Indian Textile Industry: S.K.Sonisandipsoni221811No ratings yet

- Braintrain: Summer Camp WorksheetDocument9 pagesBraintrain: Summer Camp WorksheetPadhmennNo ratings yet

- Lesson 2 - BasicDocument7 pagesLesson 2 - BasicMichael MccormickNo ratings yet

- Michael Ortiz - Loss of Control and Technology Acceptance in (Digital) TransformationDocument100 pagesMichael Ortiz - Loss of Control and Technology Acceptance in (Digital) TransformationMaria Eugenia PuppoNo ratings yet

- ColaDocument4 pagesColaAkhil ChauhanNo ratings yet

- FINAL Haiti Electricity Report March 2018Document44 pagesFINAL Haiti Electricity Report March 2018Djorkaeff FrancoisNo ratings yet

- Physics Project Work Part 2Document9 pagesPhysics Project Work Part 2Find LetNo ratings yet

- Puyat vs. Arco Amusement Co (Gaspar)Document2 pagesPuyat vs. Arco Amusement Co (Gaspar)Maria Angela GasparNo ratings yet

- Nittscher vs. NittscherDocument4 pagesNittscher vs. NittscherKeej DalonosNo ratings yet

- 1 - JM Influencer MarketingDocument19 pages1 - JM Influencer MarketingMochamad RochmanNo ratings yet

- India's Cultural Diplomacy: Present Dynamics, Challenges and Future ProspectsDocument11 pagesIndia's Cultural Diplomacy: Present Dynamics, Challenges and Future ProspectsMAHANTESH GNo ratings yet

- Jose Ferreira Criminal ComplaintDocument4 pagesJose Ferreira Criminal ComplaintDavid Lohr100% (1)

- HANA Presented SlidesDocument102 pagesHANA Presented SlidesRao VedulaNo ratings yet

- CRM AssignmentDocument43 pagesCRM Assignmentharshdeep mehta100% (2)

- TS06C Jibril, Garba 5915Document13 pagesTS06C Jibril, Garba 5915Umar SunusiNo ratings yet

- Veronica Guerin Interview With Anne FelloniDocument2 pagesVeronica Guerin Interview With Anne FelloniDeclan Max BrohanNo ratings yet

- IBM Report Dah SiapDocument31 pagesIBM Report Dah Siapvivek1119No ratings yet

- 2020 2021 Important JudgementsDocument6 pages2020 2021 Important JudgementsRidam Saini100% (1)

- LAZ PAPER Ethics Ethical Conduct Challenges and Opportunities in Modern PracticeDocument15 pagesLAZ PAPER Ethics Ethical Conduct Challenges and Opportunities in Modern PracticenkwetoNo ratings yet

- Introducing HR Measurement and Reporting: Ensuring Executive Alignment and UnderstandingDocument35 pagesIntroducing HR Measurement and Reporting: Ensuring Executive Alignment and UnderstandingkoralbiruNo ratings yet

- CentipedeDocument2 pagesCentipedeMaeNo ratings yet

- MA-2012-Nico Vriend Het Informatiesysteem en Netwerk Van de VOCDocument105 pagesMA-2012-Nico Vriend Het Informatiesysteem en Netwerk Van de VOCPrisca RaniNo ratings yet

- Manual On Cargo Clearance Process (E2m Customs Import Assessment System)Document43 pagesManual On Cargo Clearance Process (E2m Customs Import Assessment System)Musa Batugan Jr.100% (1)