Professional Documents

Culture Documents

Home Log in Sign Up

Uploaded by

Pooja AgarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Home Log in Sign Up

Uploaded by

Pooja AgarwalCopyright:

Available Formats

Home

Log In

Sign Up

Search People, Resea

A Study of Investors Attitude towards Mutual Fund with Special Reference to Inversotrs in

Solapur Citymore

by TJPRC Publication

1,274

Download (.pdf)

1..A_study_of_investors.full.pdf

234 KB

A Study of Investors Attitude towards Mutual Fund with Special Reference to Inversotrs

in Solapur City

3

Investors' interests were safeguarded by SEBI and the Government offered tax benefits to the

investors in order toencourage them. SEBI (Mutual Funds) Regulations, 1996 was introduced by

SEBI that set uniform standards for all mutualfunds in India.The Union Budget in 1999

exempted all dividend incomes in the hands of investors from income tax. VariousInvestor

Awareness Programmes were launched during this phase, both by SEBI and AMFI, with an

objective to educateinvestors and make them informed about the mutual fund industry.

Growth and Consolidation - 2004 Onwards

The industry has also witnessed several mergers and acquisitions recently, examples of which are

acquisition of schemes of Alliance Mutual Fund by Birla Sun Life, Sun F&C Mutual Fund and

PNB Mutual Fund by Principal MutualFund. Simultaneously, more international mutual fund

players have entered India like Fidelity, Franklin Templeton MutualFund etc. There were 29

funds as at the end of March 2006.This is a continuing phase of growth of the industry through

consolidation and entry of new international andprivate sector players. Indian mutual fund

industry reached Rs 1,50,537 crore by March 2004. It is estimated that by 2010March-end, the

total assets of all scheduled commercial banks should be Rs 40,90,000 crore. The annual

composite rate of growth is expected 13.4% during the rest of the decade. In the last 5 years there

is an annual growth rate of 9%. Accordingto the current growth rate, by year 2010, Mutual fund

India assets will be double

FEATURES THOSE INVESTORS LIKE IN MUTUAL FUND

If mutual funds are emerging as the favorite investment vehicle it is because of the many

advantages. They haveover other forms and avenues of investing parties for the investors who

has limited resources available in terms of Capitaland ability to carry out detailed reserves and

market monitoring. These are the major advantages offered by mutual fund toall investors:

Professional Management

Mutual Funds provide the services of experienced and skilled professionals, backed by a

dedicated investmentresearch team that analyses the performance and prospects of companies

and selects suitable investments to achieve theobjectives of the scheme.

Diversification

Mutual Funds invest in a number of companies across a broad cross-section of industries and

sectors. Thisdiversification reduces the risk because seldom do all stocks decline at the same

time and in the same proportion. Youachieve this diversification through a Mutual Fund with far

less money than you can do on your own.

Convenient Administration

Investing in a Mutual Fund reduces paperwork and helps you avoid many problems such as bad

deliveries,delayed payments and follow up with brokers and companies. Mutual Funds save your

time and make investing easy andconvenient.

Return Potential

Over a medium to long-term, Mutual Funds have the potential to provide a higher return as they

invest in adiversified basket of selected securities.

4

Pritam P. Kothari & Shivganga C. Mindargi

Low Costs

Mutual Funds are a relatively less expensive way to invest compared to directly investing in the

capital marketsbecause the benefits of scale in brokerage, custodial and other fees translate into

lower costs for investors

Liquidity

In open-end schemes, the investor gets the money back promptly at net asset value related prices

from the MutualFund. In closed-end schemes, the units can be sold on a stock exchange at the

prevailing market price or the investor canavail of the facility of direct repurchase at NAV

related prices by the Mutual Fund

Transparency

You get regular information on the value of your investment in addition to disclosure on the

specific investmentsmade by your scheme, the proportion invested in each class of assets and the

fund managers investment strategy andoutlook

Flexibility

Through features such as regular investment plans, regular withdrawal plans and dividend

reinvestment plans, youcan systematically invest or withdraw funds according to your needs and

convenience

Affordability

Investors individually may lack sufficient funds to invest in high-grade stocks. A mutual fund

because of its largecorpus allows even a small investor to take the benefit of its investment

strategy.

Well Regulated

All Mutual Funds are registered with SEBI and they function within the provisions of strict

regulations designedto protect the interests of investors. The operations of Mutual Funds are

regularly monitored by SEBI.

DISADVANTAGES OF MUTUAL FUNDS

Above I have mentioned the various advantages of Mutual Funds but it also suffers from a lot of

drawbacks as themarket is volatile and it is ever affected by national as well as international

factors, these days we can see that crude oilprices in International market has become an

important factor in determining the market movement. Here are somedisadvantages as cited by

me and by survey:

Fluctuating Returns

Mutual funds are like many other investments without a guaranteed return: there is always the

possibility that thevalue of your mutual fund will depreciate. Unlike fixed-income products, such

as bonds and Treasury bills, mutual fundsexperience price fluctuations along with the stocks that

make up the fund. When deciding on a particular fund to buy, youneed to research the risks

involved - just because a professional manager is looking after the fund, that doesnt mean

theperformance will be always good

Diversification

Although diversification is one of the keys to successful investing, many mutual fund investors

tend to overdiversify. The idea of diversification is to reduce the risks associated with holding a

single security; over diversification(also known as diversification) occurs when investors acquire

many funds that are highly related and, as a result, dont get

A Study of Investors Attitude towards Mutual Fund with Special Reference to Inversotrs

in Solapur City

5

the risk reducing benefits of diversification. At the other extreme, just because you own mutual

funds doesnt mean you areautomatically diversified. For example, a fund that invests only in a

particular industry or region is still relatively risky. Forexample: Sect oral Funds

Cash and More Cash

As you know already, mutual funds pool money from thousands of investors, so everyday

investors are puttingmoney into the fund as well as withdrawing investments. To maintain

liquidity and the capacity to accommodatewithdrawals, funds typically have to keep a large

portion of their portfolios as cash. Having ample cash is great forliquidity, but money sitting

around as cash is not working for you and thus is not very advantageous.

Costs

Mutual funds provide investors with professional management, but it comes at a cost. Funds will

typically have arange of different fees that reduce the overall payout. In mutual funds, the fees

are classified into two categories:shareholder fees and annual operating fees. The shareholder

fees, in the forms of loads and redemption fees are paiddirectly by shareholders purchasing or

selling the funds. The annual fund operating fees are charged as an annualpercentage - usually

ranging from 1-3%. These fees are assessed to mutual fund investors regardless of the

performance of the fund. As you can imagine, in years when the fund doesnt make money, these

fees only magnify losses.

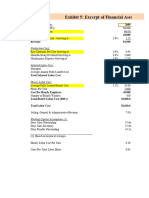

Figure 1: Structure of Mutual Fund

A mutual is a set up in the form of trust, which has sponsor, trustee, assets management

company (AMC) andcustodian. Sponsor is the person who acts alone or in combination with

another body corporate and establishes a mutualfund. Sponsor must contribute at least 40% of

the net worth of the investment managed and meet the eligibility criteriaprescribed under the

Securities and Exchange Board of India (Mutual Funds) regulations, 1996. The sponsor is

notresponsible or liable for any loss or shortfall resulting from the operation of the schemes

beyond the initial contributionmade by it towards setting up of Mutual Fund. The Mutual Fund is

constituted as a trust in accordance with the provisionsof the Indian Trusts Act, 1882 by the

Sponsor.Trustee is usually a company (corporate body) or a board of trustees (body of

individuals). The mainresponsibility of the trustee is to safeguard the interest of the unit holders

and also ensure that AMC functions in theinterest of investors and in accordance with the

Securities and Exchange Board of India (Mutual Fund) Regulations 1996the provisions of the

Trust deed and the offer Document of the respective schemes. The AMC is appointed by the

Trustees

6

Pritam P. Kothari & Shivganga C. Mindargi

as the investment Manager of the Mutual Fund. The AMC is required to be approved by SEBI to

act as an assetmanagement company of the Mutual Fund. The AMC if so authorized by the Trust

Deed appoints the Registrar andTransfer Agent to agent the mutual fund. The registrar processes

the application form, redemption requests and dispatchesaccount statements to the unit holders.

The Registrar and Transfer agent also handles communications with investors andupdates

investor records.

REVIEW OF LITERATURE

Lenard et., al. (2003)

empirically investigated investors attitudes toward mutual funds. The results indicate thatthe

decision to switch funds within a fund family is affected by investors attitude towards risk,

current asset allocation,investment losses, investment mix, capital base of the fund age, initial

fund performance, investment mix, fund andportfolio diversification. The study reported that

these factors are crucial to be considered before switching fundsregardless of whether they invest

in non-employer plans or in both employer and non-employer plans.

Bollen (2006)

studied the dynamics of investor fund flows in a sample of socially screened equity mutual

funds and compared the relationbetween annual fund flows & lagged performance in SR funds to

the same relation in a matched sample of conventionalfunds. The result revealed that the extra-

financial SR attribute serves to dampen the rate at which SR investors trade mutualfunds. The

study noted that the differences between SR funds and their conventional counterparts are robust

over time andpersist as funds age. The study found that the preferences of SR investors may be

represented by conditional multi-attributeutility function (especially when SR funds deliver

positive returns). The study remarked that mutual fund companies canexpect SR investors to

be more loyal than investors in ordinary funds.

Walia and Kiran (2009)

studied investors risk and return perception towards mutual funds. The study examinedinvestor's

perception towards risk involved in mutual funds, return from mutual funds in comparison to

other financialavenues, transparency and disclosure practices. The study investigated problems

of investors encountered with due tounprofessional services of mutual funds. The study found

that majority of individual investors doesnt consider mutualfunds as highly risky investment. In

fact on a ranking scale it is considered to be on higher side when compared with otherfinancial

avenues. The study also reported that significant relationship of interdependence exists between

income level of investors and their perception for investment returns from mutual funds

investment.

Saini et., al. (2011)

analyzed investors behavior, investors opinion and perception relating to various issues

liketype of mutual fund scheme, its objective, role of financial advisors / brokers, sources of

information, deficiencies in theprovision of services, investors opinion relating to factors that

attract them to invest in mutual and challenges before theIndian mutual fund industry etc. The

study found that investors seek for liquidity, simplicity in offer documents, onlinetrading, regular

updates through SMS and stringent follow up of provisions laid by AMFI.

Singh (2012)

conducted anempirical study of Indian investors and observed that most of the respondents do

not have much awareness about thevarious function of mutual funds and they are bit confused

regarding investment in mutual funds. The study found thatsome demographic factors like

gender, income and level of education have their significant impact over the attitudetowards

mutual funds. On the contrary age and occupation have not been found influencing the investors

attitude. Thestudy noticed that return potential and liquidity have been perceived to be most

lucrative benefits of investment in mutualfunds and the same are followed by flexibility,

transparency and affordability.

STATEMENT OF THE PROBLEM

Mutual funds have their drawbacks and may not be for everyone. No investment is risk free. If

the entire stock market declines in value, the value of mutual fund shares will go down as well,

no matter how balanced the portfolio.

A Study of Investors Attitude towards Mutual Fund with Special Reference to Inversotrs

in Solapur City

7

Investors encounter fewer risks when they invest in mutual funds than when they buy and sell

stocks on their own.However, anyone who invests through a mutual fund runs the risk of losing

money. All funds charge administrative fees tocover their day-to-day expenses. Some funds also

charge sales commissions or loads to compensate brokers, financialconsultants, or financial

planners. When he invests in a mutual fund, they depend on the funds manager to make the

rightdecisions regarding the funds portfolio. If the invests in Index Funds, they foregoes

management risk, because these fundsdo not employ managers. Though these are the problems

in the investment of mutual funds, in the recent days most of theinvestors preferred to invest

their funds on mutual funds. In this background, the research has made an attempt to study

theinvestors preference for mutual funds in Solapur City.

LIMITATIONS OF THE STUDY

The present study is based upon the results of survey conducted on 200 mutual fund investors.

The implications of the study are subject to the limitations of sample size, psychological and

emotional characteristics of surveyed population.

SCOPE OF THE STUDY

This paper provides Future of Mutual Funds industry information as well as awareness level

amongst people forMutual Funds. Also this project report of Mutual Funds gives an outlook to

management as to how the mutual funds areperforming in the current market situation as a result

what may be the future of this industry. This paper on mutual funds isinformative the students

who want to understand and undertake assignments in the industry. This study also facilitates

thegeneral people who can understand the importance and explore the new option for investment

in Mutual Funds. Differentfinancial institutions provide services that are both complementary to

and competitive with each other. A well builtfinancial system directly contributes to the growth

of the country.

RESEARCH METHODOLOGY

This study is descriptive in nature based on survey method. The study aims at finding out the

attitude of theinvestors towards investment in mutual funds in Solapur city. This study was based

mainly on primary sources. Theprimary data was collected from the investors of mutual funds

with help of the questionnaire. The secondary data werecollected from the books, records and

journals. By adopting convenience sampling, 200 respondents were selected for thisstudy. The

essential data were collected with the help of questionnaire. The data collected from the period

of

January2011 to April 2011

.

DATA ANALYSIS AND INTERPRETATION

Figure: 2 Showing Pattern of Investment

Job Board

About

Mission

Press

Blog

Stories

We're hiring engineers!

Help

Terms

Privacy

Copyright

Send us Feedback

Academia 2014

You might also like

- What Is A Mutual Fund?Document8 pagesWhat Is A Mutual Fund?Pratikshya HuiNo ratings yet

- Mutual FundsDocument32 pagesMutual Fundsveggi expressNo ratings yet

- MF Industry in India ReportDocument30 pagesMF Industry in India Reportshruti5391No ratings yet

- Portfolio Management - Part 2: Portfolio Management, #2From EverandPortfolio Management - Part 2: Portfolio Management, #2Rating: 5 out of 5 stars5/5 (9)

- Project On Mutual FundDocument67 pagesProject On Mutual Fundpankaj100% (1)

- Executive Summary: Need of The StudyDocument68 pagesExecutive Summary: Need of The StudytripathirajeshblyNo ratings yet

- Field of ResearchDocument18 pagesField of ResearchSasi KumarNo ratings yet

- A Study of Sbi Mutual FundsDocument34 pagesA Study of Sbi Mutual FundssatishgwNo ratings yet

- FundingDocument20 pagesFundingAyinalemNo ratings yet

- Performance Evaluation of Mutual Funds" Conducted at EMKAY GLOBAL FINANCIAL SERVICES PRIVATE LTDDocument74 pagesPerformance Evaluation of Mutual Funds" Conducted at EMKAY GLOBAL FINANCIAL SERVICES PRIVATE LTDPrashanth PBNo ratings yet

- Australian Managed Funds for Beginners: A Basic Guide for BeginnersFrom EverandAustralian Managed Funds for Beginners: A Basic Guide for BeginnersNo ratings yet

- Changed Mutual FundsDocument16 pagesChanged Mutual FundsTanmoy ChakrabortyNo ratings yet

- ReportDocument115 pagesReportpureheartsNo ratings yet

- Mutual FundsDocument19 pagesMutual Fundsneha.joshi44njNo ratings yet

- Mutual FundDocument20 pagesMutual FundRupesh KekadeNo ratings yet

- Investment Returns and Risk Analysis of HDFC Mutual Fund SchemesDocument68 pagesInvestment Returns and Risk Analysis of HDFC Mutual Fund SchemesMohammed Dasthagir MNo ratings yet

- Mutual Fund - An Introduction: Project Report Submitted by Team B" Name Enrolment Number Roll Number Assigned in MSOPDocument32 pagesMutual Fund - An Introduction: Project Report Submitted by Team B" Name Enrolment Number Roll Number Assigned in MSOPbholagangster1No ratings yet

- Project FinalDocument33 pagesProject FinalAki KhandelwalNo ratings yet

- To Evaluate The Performance On Mutual Fund Equity Schemes of Reliance Mutual FundDocument22 pagesTo Evaluate The Performance On Mutual Fund Equity Schemes of Reliance Mutual FundAbhijeet AgarwalNo ratings yet

- Chapter 1Document15 pagesChapter 1Harry HaranNo ratings yet

- Unit - IV - Muthual FundDocument22 pagesUnit - IV - Muthual Fundvetrivel sakthivelNo ratings yet

- Mutual Fund Industry ProfileDocument37 pagesMutual Fund Industry ProfileGokul KrishnanNo ratings yet

- Presentation On Mutual FundDocument19 pagesPresentation On Mutual FundmanoranjanpatraNo ratings yet

- Part A Industry Overview: 1 - PageDocument59 pagesPart A Industry Overview: 1 - PageAshish LakraNo ratings yet

- Synopsis IDocument21 pagesSynopsis Iankurk124No ratings yet

- Final Edited Project ReportDocument68 pagesFinal Edited Project ReportNikita KothariNo ratings yet

- Executive Summary: Chapter-1Document68 pagesExecutive Summary: Chapter-1Satish PenumarthiNo ratings yet

- Equity Fund Management - Processes and PracticesDocument27 pagesEquity Fund Management - Processes and PracticesChahna SoniNo ratings yet

- Mutual FundsDocument58 pagesMutual Fundsrishi kumbhatNo ratings yet

- Research Paper Topics On Mutual FundsDocument7 pagesResearch Paper Topics On Mutual Fundsafnhcikzzncojo100% (3)

- Sr. No. Topic NODocument64 pagesSr. No. Topic NOniyaazsNo ratings yet

- Yuvika MFS A1Document5 pagesYuvika MFS A1Simran jeet kaurNo ratings yet

- Reliance Growth Fund ProjectDocument69 pagesReliance Growth Fund ProjectVikram GundalaNo ratings yet

- DEPOSITORY AND MUTUAL FUNDS MODULEDocument40 pagesDEPOSITORY AND MUTUAL FUNDS MODULEDasharath Raj UrsNo ratings yet

- Performance Analysis of Mutual Funds: Al Qurmoshi Institute of Business ManagementDocument62 pagesPerformance Analysis of Mutual Funds: Al Qurmoshi Institute of Business ManagementTabrez AliNo ratings yet

- Chapter - 1: Customer Perception Towards Mutual FundsDocument42 pagesChapter - 1: Customer Perception Towards Mutual FundsJubinJoseNo ratings yet

- PGDM Finance Project-1Document61 pagesPGDM Finance Project-1Rahul JadhavNo ratings yet

- Mutual FundsDocument25 pagesMutual FundsPeekliNo ratings yet

- A Mutual Fund is a Common Pool of Money in to Which Investors With Common Investment Objective Place Their Contributions That Are to Be Invested in Accordance With the Stated Investment Objective of the SchemeDocument6 pagesA Mutual Fund is a Common Pool of Money in to Which Investors With Common Investment Objective Place Their Contributions That Are to Be Invested in Accordance With the Stated Investment Objective of the SchemeKumaran MohanNo ratings yet

- Chapter 1Document22 pagesChapter 1Sumanth PotlamarriNo ratings yet

- Chapter No. 1 Introduction To Financial ManagementDocument42 pagesChapter No. 1 Introduction To Financial Managementharshubhoskar3500No ratings yet

- Mutual Funds FinalDocument17 pagesMutual Funds FinalswatitikkuNo ratings yet

- A Detailed Analysis of The Mutual Fund Industry & A Customer Perception StudyDocument93 pagesA Detailed Analysis of The Mutual Fund Industry & A Customer Perception StudyNishant GuptaNo ratings yet

- Mutual Funds BB FinalDocument41 pagesMutual Funds BB FinalAadesh ShahNo ratings yet

- Comparative Analysis of Icici and BirlaDocument91 pagesComparative Analysis of Icici and BirlaVeeravalli AparnaNo ratings yet

- IFS PresentationDocument18 pagesIFS Presentationsamarpanchaudhary359No ratings yet

- IntroductionDocument58 pagesIntroductionSumit AgarwalNo ratings yet

- Canadian Mutual Funds Investing for Beginners: A Basic Guide for BeginnersFrom EverandCanadian Mutual Funds Investing for Beginners: A Basic Guide for BeginnersNo ratings yet

- Content: No Particular Page No 1 2 2 3Document68 pagesContent: No Particular Page No 1 2 2 3amitnpatel1No ratings yet

- Contents of The Report: Serial No. ParticularsDocument37 pagesContents of The Report: Serial No. ParticularsMayurika SharmaNo ratings yet

- Understanding Mutual Funds: Types, Benefits and OrganizationDocument68 pagesUnderstanding Mutual Funds: Types, Benefits and OrganizationvinaydineshNo ratings yet

- Comparitive Study Betwee Reliance and Other Mutual Funds in DehradunDocument77 pagesComparitive Study Betwee Reliance and Other Mutual Funds in Dehradunvipul tandonNo ratings yet

- JOAN HSBC Final The One!!!Document60 pagesJOAN HSBC Final The One!!!Joan DiazNo ratings yet

- Mutual Fund Investment GuideDocument26 pagesMutual Fund Investment GuideMuhammad KashifNo ratings yet

- Introduction to Financial Management ConceptsDocument88 pagesIntroduction to Financial Management ConceptsbhagathnagarNo ratings yet

- Understanding Mutual FundsDocument43 pagesUnderstanding Mutual FundsREENANo ratings yet

- Mutual FundDocument5 pagesMutual FundHetvi MadiaNo ratings yet

- Pranav Kapse SIPDocument61 pagesPranav Kapse SIPAGRIFORCE SALESNo ratings yet

- Project LetterDocument1 pageProject LetterPooja AgarwalNo ratings yet

- An Analysis of Investors Behaviour On Various Investment Avenues in IndiaDocument74 pagesAn Analysis of Investors Behaviour On Various Investment Avenues in IndiaRakesh81% (68)

- IC 38 Corporate AgentsDocument640 pagesIC 38 Corporate AgentsarulmuruguNo ratings yet

- Introduction of The TopicDocument8 pagesIntroduction of The TopicPooja AgarwalNo ratings yet

- PortBuilderOneSheet UKDocument2 pagesPortBuilderOneSheet UKPooja AgarwalNo ratings yet

- Summerinternshipprojectsept 2012 121220103231 Phpapp01Document38 pagesSummerinternshipprojectsept 2012 121220103231 Phpapp01Pooja AgarwalNo ratings yet

- Research Paper 2Document7 pagesResearch Paper 2Pooja AgarwalNo ratings yet

- Nonperformingassetnpa 130715231719 Phpapp02Document52 pagesNonperformingassetnpa 130715231719 Phpapp02Teju AshuNo ratings yet

- Research Paper 2Document7 pagesResearch Paper 2Pooja AgarwalNo ratings yet

- An Analysis of Investors Behaviour On Various Investment Avenues in IndiaDocument74 pagesAn Analysis of Investors Behaviour On Various Investment Avenues in IndiaRakesh81% (68)

- Summer ProjectDocument72 pagesSummer ProjectPooja AgarwalNo ratings yet

- Risk & Return RelationshipDocument26 pagesRisk & Return RelationshipMayank GoyalNo ratings yet

- Synopsis SwetaGoelDocument36 pagesSynopsis SwetaGoelLokesh JainNo ratings yet

- Overview of ProjectDocument2 pagesOverview of ProjectPooja AgarwalNo ratings yet

- Ijmr Sample ArticleDocument17 pagesIjmr Sample ArticlePooja AgarwalNo ratings yet

- Literature ReviewDocument5 pagesLiterature ReviewPooja AgarwalNo ratings yet

- 09 - Chapter 3 Literature ReviewDocument40 pages09 - Chapter 3 Literature ReviewAbdul AmeenNo ratings yet

- Top Picks: Research TeamDocument30 pagesTop Picks: Research TeamPooja AgarwalNo ratings yet

- Introduction To Active Portfolio ManagementDocument31 pagesIntroduction To Active Portfolio ManagementPooja AgarwalNo ratings yet

- 09 - Chapter 3 Literature ReviewDocument40 pages09 - Chapter 3 Literature ReviewAbdul AmeenNo ratings yet

- Chapter - 5: Risk and Return: Portfolio Theory and Assets Pricing ModelsDocument23 pagesChapter - 5: Risk and Return: Portfolio Theory and Assets Pricing Modelswindsor260No ratings yet

- Inventory ManagementDocument58 pagesInventory Managementsdeepsingh1991No ratings yet

- Cash ManagementDocument62 pagesCash ManagementPooja Agarwal100% (1)

- The Scale of Values 7 enDocument11 pagesThe Scale of Values 7 enJayakanthan AyyanathanNo ratings yet

- Time Value of Money & Discounted Cashflow ApplicationsDocument25 pagesTime Value of Money & Discounted Cashflow ApplicationsPooja AgarwalNo ratings yet

- Insurance Code Amended Insurers' Capital Raised: Michelle V. Remo Philippine Daily InquirerDocument1 pageInsurance Code Amended Insurers' Capital Raised: Michelle V. Remo Philippine Daily InquirerJonna Maye Loras CanindoNo ratings yet

- Revenue Based Financing 101Document6 pagesRevenue Based Financing 101Mansi aggarwal 171050No ratings yet

- Lesson 05 - Fiscal Policy and StabilizationDocument48 pagesLesson 05 - Fiscal Policy and StabilizationMetoo ChyNo ratings yet

- Us Ishares Template Ishares Gold Trust Biau39Document2 pagesUs Ishares Template Ishares Gold Trust Biau39Caroline CostaNo ratings yet

- Gann Master Forex Course 6Document57 pagesGann Master Forex Course 6Trader RetailNo ratings yet

- JHM KLSE SemiconDocument6 pagesJHM KLSE SemiconMohdfahmi Bin MohdhaniNo ratings yet

- Jawaban Soal Latihan LKK1-BondsDocument21 pagesJawaban Soal Latihan LKK1-Bondszahra calista armansyahNo ratings yet

- Rockboro Machine Tools Financial StrategyDocument10 pagesRockboro Machine Tools Financial StrategyPatcharanan SattayapongNo ratings yet

- Ipos, Their Pros, Cons, and The Ipo Process: GlossaryDocument6 pagesIpos, Their Pros, Cons, and The Ipo Process: GlossaryMESRETNo ratings yet

- 12 Best Investments Under P100K in The PhilippinesDocument51 pages12 Best Investments Under P100K in The PhilippinesJuliet Lobrino RozosNo ratings yet

- PROJECT CASH FLOW ANALYSISDocument12 pagesPROJECT CASH FLOW ANALYSISSaifiNo ratings yet

- Black Scholes PDEDocument7 pagesBlack Scholes PDEmeleeisleNo ratings yet

- India Business Law DirectoryDocument42 pagesIndia Business Law DirectoryGenesisGenesisNo ratings yet

- Annual Rep 2007 08Document444 pagesAnnual Rep 2007 08maurya111No ratings yet

- The BSC Group Arranges $5 Million Refinance of Historic Klee Plaza in Portage ParkDocument3 pagesThe BSC Group Arranges $5 Million Refinance of Historic Klee Plaza in Portage ParkPR.comNo ratings yet

- CFAS - Lec. 12 PAS 29, 32Document31 pagesCFAS - Lec. 12 PAS 29, 32latte aeriNo ratings yet

- Models of Cash ManagementDocument12 pagesModels of Cash ManagementBasantMundhraNo ratings yet

- JFC Income StatementDocument2 pagesJFC Income StatementAngelie villanuevaNo ratings yet

- Ict Smart Money ReversalDocument6 pagesIct Smart Money ReversalKaezel Joyce BadillaNo ratings yet

- ICICI Bank ACQUISITION WITH BANK OF RAJASTHANDocument6 pagesICICI Bank ACQUISITION WITH BANK OF RAJASTHANPrayagraj PradhanNo ratings yet

- BBM Lead-Magnet Beginner Popular-IndicatorsDocument10 pagesBBM Lead-Magnet Beginner Popular-IndicatorsFotis PapatheofanousNo ratings yet

- Project On HDFC Standard Life Insurance CompanyDocument86 pagesProject On HDFC Standard Life Insurance CompanyViPul85% (20)

- The Wise Investor PDFDocument19 pagesThe Wise Investor PDFKatrina0% (1)

- Roche Case Study PDFDocument10 pagesRoche Case Study PDFAbu TaherNo ratings yet

- Gold Standard Exchange Rates & IMF Regime ClassificationsDocument2 pagesGold Standard Exchange Rates & IMF Regime Classificationsbigbadbear30% (2)

- Ashwani Gujral Trading Workshop Day 1 HighlightsDocument212 pagesAshwani Gujral Trading Workshop Day 1 Highlightsbalaje99 k100% (4)

- Group 3 CFEV 5th Assignment-Hansson-Private-LabelDocument10 pagesGroup 3 CFEV 5th Assignment-Hansson-Private-LabelShashwat JhaNo ratings yet

- Entire Shell Ih16Document108 pagesEntire Shell Ih16Vasile MihaelaNo ratings yet

- Risk and Return Analysis PPT 2Document24 pagesRisk and Return Analysis PPT 2Vaibhav GuptaNo ratings yet