Professional Documents

Culture Documents

Group Project

Uploaded by

Tran UyenOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Group Project

Uploaded by

Tran UyenCopyright:

Available Formats

VIETNAM NATIONAL UNIVERSITY HO CHI MINH CITY

INTERNATIONAL UNIVERSITY

MANAGERIAL ECONOMICS

PROJECT

RICE MARKET IN VIETNAM

Group Members

Vo Ngoc Duy Nghi

Tran Nguyen Hoang Uyen

Ho Chi Minh City, 2014

Managerial Economics Project

1

INTRODUCTION 2

I. OVERVIEW OF VIETNAM RICE MARKET 3

1. An overview of agriculture and the role of rice

in Vietnamsfood industry 3

2. Rice production and domestic rice market 4

2.1 Rice varieties and quality 4

2.2 Distribution 5

3. Rice for export market 9

3.1 Vietnams rice export before joining WTO 9

3.1.1 Overview 9

3.1.2 Export revenue 9

3.1.3 Major export markets 10

3.1.4 Barriers 11

3.2 Vietnams rice export after joining WTO 11

3.2.1 Overview 11

3.2.2 Export revenue 12

3.2.3 Improvements 13

3.2.4 Challenges 14

II. AN ANALYSIS OF VIETNAM RICE MARKET 15

1. Rice production and rice market 15

1.1 Resources for production 15

1.2 Rice production and crops situation 16

III. SOLUTION FOR VIETNAM RICE EXPORT 18

1. Lession from other rice exporting countries 18

1.1 Thailand 18

1.2 India 18

1.3 America 19

2. Solution 19

2.1 A clear export strategy in specific periods 19

2.2 The specification and proper policies 19

Managerial Economics Project

2

2.3 Maintain the stability of domestic and export demand 20

2.4 Develop the related processing industry 20

CONCLUSION

Managerial Economics Project

3

INTRODUCTION

Rice is the most important commodity in many countries. In some countries with

advantageous natural conditions, rice is not only for domestic demand but also become one of

the main exported products, even with worldwide reputation.

In agricultural products, absolutely; rice is indispensable to the daily life of the 90 million

Vietnamese. It plays the most important role in Vietnams food security and rural economy

which generates jobs for 60% of the countrys labor force and is a source of export revenue.

The two rich locations are Red River of the North & Mekong Deltas of the South,

respectively are responsible for most of the rice.

Vietnam is known as one of the most important rice producers and exporters in the world. We

couldnt imagine that before 1986, our country had to import rice, because at that time

Vietnam had not enough rice for domestic demand. These necessary rice imports were high -

exceeding 1 million tons during the late 1960s and in 1976.

Along with a series of profound macroeconomic and institutional policy reforms after 1986

and accessing to WTO, Vietnamese economy had run on the path to becoming a market

economy effectively. Vietnam had more chances to improve economy and agriculture as

well. From an agriculture industry with weak financial capacity, shortage of capital to

improve production technology and low labor productivity, becoming a member of WTO,

Vietnam reach the second largest exporter for rice in the world with many improvements and

supporting policies from government.

With the knowledge from studying Managerial Economics, and under Managerial

Economists point of view, we analyze the Vietnamese rice export market from 2003 to 2013,

and suggest some realistic and effective solutions to improve our export situation for rice by

quantity and quality as well. We divide this project into 3 main parts:

1. Overview of Vietnam rice market

2. Rice products in Vietnam market

3. Lessons for Vietnam

Managerial Economics Project

4

Since limited time and sources, mistakes cannot be avoided. The comments of readers will be

valuable for our project to be more completed.

I. OVERVIEW OF VIETNAM RICE MARKET

1. An overview of agriculture and the role of rice in Vietnams food industry

Agriculture is contributing more than 20% of Vietnams GDP, accounting for up to one

quarter of the national exports revenue, and creating jobs for half of the workforce with 65%

of them in rural areas, plays a mandatory role in the economic development of a developing

country. Over the years, agriculture has been a foundation of Vietnams economy.

In 2013, agriculture in Vietnam witnessed a spectacular overall growth of 2.67%. The

primary agricultural sectors are farming and export of rice, corn, vegetables; developing short

term and perennial industrial plants; planting fruit cops; and livestock. A number of policies

have been deployed focusing on hunger eradication, poverty reduction, and social security

maintenance in rural areas. The government raised over 41.3 thousand billion VND for New

Rural Area program in this year, making a firm background for agriculture development in

the future.

Rice is Vietnam's second most valuable export, after oil and Vietnam is the third largest

exporter of rice (after Thailand and the United States) in the world. Rice is very common in

daily meal of 90 million Vietnamese people and is identified as the most significant product

in food security of Vietnam. It also plays an important role in employment situation as the

number of rice farmer accounts for 60% of the agricultural labor force of the country. The

Mekong Delta and the Red River Delta regions are two main granaries, holding for over 5

million hectare of rice cultivation land in Vietnam. In 2013, the area of rice cultivation

reached 7.9 million hectare for the whole year, while rice productivity was 55.8 quintal per

hectare, yielding a total of 44.1 million ton of rice. During the 10 year period from 2003 to

2013, the annual rice export maintained 4 5 million tons with an export turnover of 2 2.7

billion USD. Rice yield has increased constantly during the recent years after high-yield

varieties have been put into cultivation and production. These not only guarantee the national

food security, satisfy the domestic demand, but solidify the position of Vietnam in worlds

rice export and contribute in the overall development of the national economy also.

Managerial Economics Project

5

2. Rice production and domestic rice market

2.1 Rice varieties (brand) and quality

Figure 1 describes in detail the process of paddy/rice processing in the Me-kong River Delta.

In general, there are seven different steps in the process from paddy to rice. The first step is

checking the standard requirement on moisture and the grain length of paddy. Secondly, the

paddy is then sorted ac- cording to C1 and C2 standard quality. After sorting, some paddy

that contains a high moisture degree will be dried by the dryer or sun-dry. The well-dried

paddy then will be stored in the warehouse. The next step is rice processing. The paddy will

be put into the processing chains for milling into brown or white rice. In the case of

producing rice for export, the brown rice will be polished into polished rice before weighing

and packaging. Finally, the finished products will be stored in the warehouse till it will be

sold on the market.

Figure 1. Steps in the paddy to rice process

Vietnamese farmers have cultivated local varieties through years. It is estimated that there are

over 200 rice varieties planted in Vietnam. Some of these varieties are Du Huong Rice, Nang

P

A

D

D

Y

Checking Sorting Drying

Storing

Milling Export

Polishing Packaging Storing Selling

Domestic

Market

(Brown Rice)

(White Rice)

(Polished Rice) (Polished Rice)

(White Rice)

Managerial Economics Project

6

Thom Cho Dao Rice (Long An), Nep Cai Hoa Vang glutinous rice (Nam Dinh), Tai Nguyen

Rice (Long An), Tam Xoan Rice (Nam Dinh), etc. Besides, some foreign rice varieties that

give better quality are gradually popularized for farming, such as Thai Jasmine, Japanese

Akita, Kown Dak Mali, etc. Hybrid rice, which gives double yield compared to other rice

varieties and provides farming advantages like better insect resistance, shorter life time,

higher quality and higher selling price, is now planted on a wide scale and becomes one of

the most important products in food security in Vietnam

A research conducted by Can Tho University revealed the supply chain of rice product in

Vietnam. Main components of rice supply chain are inputs, production, collection,

manufacture, trade, and consumption. Almost all rice is sold to collectors, or merchants.

Intermediary parties may get intervene in this process. Collectors sell rice directly to

marketplaces, wholesalers, or retailers; or to food processing companies that include

polishing and husking mills. In the Mekong Delta region, one third rice is consumed

domestically, and the other is for export purpose. Domestic market is considered secondary

export market where consumes rice product not qualified for export.

2.2 Distribution

There are three groups of participants in rice marketing in the Mekong River Delta, namely:

1) Merchants; 2) Commission agents/brokers; and 3) Facilitators

Merchants, such as rice assemblers, wholesalers, millers/polisher, retailers, and

middleman/brokers are the main actors in the market. In general, more than 7 million tons of

paddy from the Mekong River Delta were marketed every year, passing through the hands of

assemblers, millers, wholesalers, transporters, and retailers. At least 2 million tons were

transferred to deficit regions within Vietnam, and more than 3.5 million tons were

exported. A study has been made of these actors in five major market places in the Mekong

River Delta (Tiengiang, Angiang, Vinhlong, Cantho, and Soctrang). In fact 53 rice

millers/polishers, 18 assemblers, 49 wholesalers, and 30 retailers were interviewed in this

area.

The merchants

Assembler: Sometimes also known as the trader/transporter, he is the first link between the

farmer and other middlemen. He takes title and collects several smaller lots of scattered rural

Managerial Economics Project

7

production by his own capital and combines them into a single load at one location. In so

doing, he typically classifies these di- verse lots into fewer types. To the extent he arranges

for or provides shipping, the key function the assembler provides in addition to assembly is

transport.

Wholesaler: He concentrates the various loads and puts the product into large, uniform units.

These activities all contribute to price formation. In so doing, the wholesaler provides

information to suppliers (e.g., farmers, rural assemblers) and assumes to a varying degree the

risks associated with the transfer of prop- erty rights attached to the goods and services being

bought and sold. He also fa- cilitates mass and specialized storage operations, transportation

and, in general, the subsequent distribution operations involving retailers.

The distinction between wholesaler and retailer is well known: wholesal- ing is concerned

with the activities of those persons which sell to retailers and other merchants and

commercial users, but do not sell in significant amounts to final consumers. In some of the

studies on food marketing in developing countries, wholesale traders are subdivided into rural

assembling traders, collecting wholesalers and distributing wholesalers. Rural assembling

traders accumulate products in the production areas to sell to collecting wholesalers, who

carry the commodities to large towns. On arrival, they sell to distributing wholesalers, who in

turn sell to retail- ers.

Retailers: The main function of the retailer is to buy wholesale agricultural pro- duce and sell

to consumers at convenient locations and times in various forms and quantities. In general,

retailers can be found on the markets of agricultural products: retailer-assemblers involved in

buying to complement their stock and retailer-distributors involved in selling from their

stock. In town, retailers often buy from wholesaler-distributors or their brokers and resell to

the consumers. They may also travel to assemble in agricultural production areas. At harvest

time in particular, when the villages in the vicinity of the market hold surpluses, retailers may

prefer to purchase directly from the millers. In addition, the retail- ers may have a fixed base:

a stall, a shop or a place on the ground, or they may be hawkers, who carry their products

around.

Millers/Food processing companies: Enterprises that use agricultural commodi- ties as raw

material. In the case of rice business, processors or rice mill- ers/polishers have a very

important role in the marketing channel. They change the form of the product (from paddy

Managerial Economics Project

8

rice to milled rice). The quality of rice in the market mostly depends on the quality of rice

processing. Depending on the availability of rice polishing machines, rice millers are usually

classified into three groups: pure millers, polishers, and miller-polishers. Pure millers are

mill- ers without any polishing machines. Polishers are rice processors engaged only in

polishing activities and do not mill paddy into raw rice. They buy raw rice from other mills

and process it further. The third group of miller-polishers con- sists of those millers who have

also polishing machines. These are the most technologically complete mills, able to process

paddy into a polished rice of high quality suitable for export. Moreover, processors or rice

millers not only provide the milling services but sometimes they also are rice trad-

ers/wholesalers. They can buy paddy directly from the farmers or rural assem- blers, after

milling they sell the milled rice to SOEs, wholesalers, and retailers.

Exporters/State Owned Enterprises (SOEs): In general, these are companies that mostly buy

and sell agricultural products in foreign markets. These products vary from those freshly

harvested to those that have gone through various stages of processing. Considering rice

trading, rice exporters mainly are the SOEs or government companies.

Commission agent Broker

These agents work for a commission on behalf of other participants. They oper- ate at all

levels of the marketing channel. Typically, they work for either a flat rate or percentage (of

the selling price) commission. Brokers bring buyers and sellers together and assist in

negotiations on a more ad hoc basis. Some brokers may operate as auctioneers, auctioning

products on behalf of collecting whole- salers.

Purchasing agents are most common. They generally have a long-standing relationship with

buyers and make purchases for them. In addition to purchasing agents, also selling agents are

found. Brokers do not invest in trade, nor do they take any price- risks. They provide an

insight into the functioning of the market as they are relatively better informed than

wholesalers. Moreover the existence of commission agents or brokers permits wholesalers to

devote their energy to the commercial functions for which they have a comparative

advantage.

Facilitators

Traders not only use brokers but also facilitating intermediaries. With regard to the rice

Managerial Economics Project

9

market in Vietnam, warehousing firms and trans- portation firms are considered as important

facilitators in the market. Other gov- ernment institutions or private agencies, also involved in

the marketing chain are: porters, bag-sewers, banks, money-changers, agents for market

regulation like quality control, tax agent, market authority, etc. In sum, the above classifi-

cation of marketing agents is useful for our study. They will be applied for analyzing in more

detail all types of actors/agents that perform different marketing functions in the rice

marketing channels in Vietnam

Brokers

Facilitators

s

Buying Agent

Selling Agent

Transporter

Porter

Bag-sewer

Banks

Store Manager

Agent for market regulation (quality control, tax

agent, market authority, etc.)

Actor

Merchant

Assembler

Wholesaler

Retailer

Miller

Exporter/SOEs

Managerial Economics Project

10

3. Rice for export market

3.1 Vietnams rice export before joining WTO

3.1.1 Overview

Vietnam is known as one of the most important rice producers and exporters in the world.

Surprisingly, before 1986, the country had to import rice, because rice production could not

meet domestic demand. Starting in 1987, the country began exporting rice, and transformed

itself from a rice importer to a rice exporter in 1989. From having to import rice to meet

domestic demand, Vietnam became the second largest rice exporter after Thailand in 1997

and rice has always been one of main export products of Vietnam.

Differ from other regional countries, Vietnamese agricultural production in general and rice

production in particular developed stably and quickly. The important point that marked the

development and growth of Vietnamese rice export in 2003-2006 was its high stability in the

fiercely competitive world market. Export value of the latter year was higher than the

previous one.

3.1.2 Export revenue

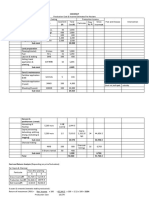

Table 1 : Vietnamese rice export quantity and value in 2009 2013 (Source: Vietnam

General Administration of Customs)

Year 2009 2010 2011 2012 2013

Quantity

(1000 tons)

4,191 4,466 5,775 5,107 5,012

Value (USD

1000)

791,907 1,045,426 1,547,951 1,403,485 1,638,965

Managerial Economics Project

11

The rice export quantity was 4.19 million tons in 2009 and 4.46 million tons in 2010. In

2011, it was the first time rice export quantity reached 5.77 million tons which brought about

1.4 billion USD for the country. This is Vietnamese highest result in all 3 criteria: quantity,

export value and price since Vietnam officially joined in the world rice market. In

comparison with 2009, the export rice quantity in 2011 increased by 1.58 million tons (38%),

export value increased nearly double (95%). 2011 was the 23th time Vietnam continuously

exported rice, and the 10th year Vietnamese rice export quantity was over 5 million tons, the

8th year Vietnamese rice export value was over 1 billion USD; and maintained the 2nd

position in the world on exporting rice that overcame India. Reasons for this success was that

Vietnamese rice met 579 strict standards instead of 250 ones in previous time.

The result was highly appreciated by international organizations and buyers. Differ from

other regional countries, Vietnamese agricultural production in general and rice production in

particular developed stably and quickly. Rice production and export helped to increase

income of farmers who planted rice thanks to the highly increase of domestic rice price.

3.1.3 Major export markets

Vietnamese rice does not only exist in traditional markets such as Philippines, Cuba,

Indonesia, it is also expanded to prissy markets such as Japan, EU, South Africa, and Middle

East.

Table 2: 10 leading export markets of Vietnamese rice in 2007 (Source: FAO)

No Export market Export volume

(ton)

Export value

(USD)

Percentage out

of total export

value (USD)

1 Philippines 1,464,136 468,044,523 44.24%

2 Indonesia 1,169,429 378,979,955 35.82%

3 Malaysia 379,513 116,683,893 11.03%

Managerial Economics Project

12

4 Singapore 82,389 25,911,742 2.45%

5 Japan 64,640 18,728,676 1.77%

6 China 42,720 15,936,649 1.51%

7 Russia 38,594 13,406,442 1.27%

8 South Africa 36,980 10,908,910 1.03%

9 Taiwan 19,521 7,855,138 0.74%

10 UAE 4,561 1,525,849 0.14%

Total 3,302,483 1,057,971.777 100%

3.1.4 Barriers

Vietnamese rice producers are often of small size and disperse. They have no shared strategy

on production procedure, and this leads to difficulty in agreeing for trade mark, quality,

appearance and prices. In addition, producers small size always accompanied with weak

financial capacity, shortage of capital to improve production technology and low labor

productivity. Meantime, in countries with developed agriculture, agricultural production are

conducted on large farms, application advanced production and harvest technology with cut

cost for production. In addition, tremendous difficulty of peasants is their restriction in access

to information on modern science and technology and poor awareness about Vietnam

participation in international economical organizations that is the setback for proper

improvement.

3.2 Vietnams rice export after joining WTO

3.2.1 Overview

Vietnam exports rice to 120 countries. Asia and Africa are the two main importers of

Vietnams rice, responsible for 71% and 21% of Vietnams rice exports, respectively.

Traditional importers of Vietnamese rice include the Philippines, Indonesia, Singapore,

Malaysia, Taiwan, Cuba, the Ivory Coast, Angola and Ghana. Asia was the largest market for

Managerial Economics Project

13

Vietnamese rice, demand from the Asian countries, Vietnams traditional rice export markets

- especially the Philippines, Indonesia, and Malaysia - still has potential.

China has emerged as the largest buyer of Vietnams rice, importing about 2.1 million tons a

year, accounting for more than one-fourth of Vietnams rice shipments.

3.2.2 Export revenue

Vietnam primarily has a rice-based agricultural economy. Rice is cultivated on 82% of the

arable land and provinces 80% carbohydrate, and 40% of the protein intake of the average

Vietnamese. The two rich details of the north and south Red River and Mekong,

respectively are responsible for most of the rice. The Mekong River delta accounts for 52%

and Red River delta another 18% of Vietnams rice.

Firgue 2: Vietnams export of rice, 2009-2013 (billion USD) (Source: General

Department of Vietnam Customs)

Vietnams rice export revenue enjoyed a steady growth rate of around 13% - 17% during the

4 year-period and the average revenue doubles that of the period before Vietnams joining

WTO. This shows that the achievement stems not only from the Governments policies

(intensive Investment, R&D, credit support, in rice production sector) but also from the

positive impact of joining WTO as follows:

Managerial Economics Project

14

- First, many policies have been changed to follow the requirements of the WTO.

These changes have enabled many rice enterprises to improve and develop their

capacities, ranging from production to processing and export.

- Second, there have been changes in the business practices and organizational

structures of many firms and enterprises, especially exporting ones. To be able to

survive in the highly competitive world market, rice exporting enterprises have tried

hard to improve the quality of their products. High quality rice has successfully

entered difficult markets such as Japan.

- Third, gaining the entry to the WTO has created an excellent opportunity for many

Vietnamese enterprises to export to and integrate into the world market. Agricultural

exporting products in general and rice in particular are on the lowest tariff and many

non-tariff barriers have been removed.

- Fourth, becoming a member of the WTO helps to open the Vietnamese economy. The

economic structure will be forced to change focusing on industries which have high

competitive advantages, especially those in rice sector. Agricultural resources will be

used to produce high productive products which can be exported to the world market

with less trade barriers.

3.2.3 Improvements

- Vietnams farmers are rice-growing experts, experienced and industrious.

- Many major rice-growing areas, with highly-evolved, heavily-invested irrigation

systems, have abundant water for irrigation. Further, these areas have convenient

roads and waterways for transporting the rice.

- Rice quality for export is improving thanks to a high rate of mechanization in

agriculture.

- The quantity of rice available for export is often sufficient; hence, rice is regularly

mass grown in a range of quality-classifications throughout the year.

- Vietnams joining the World Trade Organization (WTO) helps rice export. Vietnam

will expand its market and trademarked products that will be protected and at global-

scale. Investors and companies have peace of mind in their own trademark building.

- International business respects Vietnams rice and Vietnamese rice exporters.

Managerial Economics Project

15

- Vietnam businessmen are dynamic, fair, and have flair in approaching and developing

export markets.

- Vietnamese government also conducted many positive policies to achieve efficiency

and productivity in growing rice, for example, implementing policy on Management

of agriculture land (protect land for rice cultivation), increasing investment for

infrastructure development in the main rice production areas and strengthen

investment for development of infrastructure serving for socio-economics in

specialized rice producing localities.

- Open trade policy for rice export.

3.2.4 Challenges

- Export price of Vietnamese rice is quite low in comparison with others.

- The use of many high-yield rice varieties which are usually of low quality and

production dominated by small-scale farmers lead to the inconsistency in rice quality

and make it difficult to create brand name for Vietnamese rice.

- Rice production in Vietnam still has many limitations, such as high production cost,

less sustainable agricultural practices, frequently damaged by natural disaster, poor

infrastructure, especially irrigation and transport in mountainous area and storage

facility for rice in the Mekong delta.

Managerial Economics Project

16

II. AN ANALYSIS OF VIETNAM RICE MARKET

1. Rice production and rice market

1.1 Resources for production

While rice farm size in the Mekong Delta region is generally large, the Red River Delta

region consists of most small size of rice farm. Besides these two important granaries, rice is

also sown in many other regions in Vietnam.

Figure 3: The rice farm size segmentation in Vietnam (Source: The Asian Development Bank

Institute, ADBA)

Total rice farm land area tends to decrease during the recent time due to urbanization;

however, productivity has constantly increased thanks to new varieties and improvements of

According to General Statistics Office of Vietnam report, the proposition of agricultural

households in Vietnam has declined significantly, from 55.7% in 2002 to 51.7% and then

49.2% percentage of households in 2004 and 2016 respectively (GSO, General Statistics

Office of Vietnam 2010). In the Mekong delta in 2011, the number of agricultural households

Managerial Economics Project

17

was about 1.83 million, and these covered more than four million hectares of rice land (GSO,

General Statistics Office of Vietnam 2012). The number of agricultural households declined

consistently, and the amount of agricultural land available remained quite limited.

Figure 4: The proposition of agriculture households in Vietnam (Source: GSO, General

Statistics Office of Vietnam, 2010)

The upcoming issue is that the governments policies are limiting production scales in terms

of both the area of land being used and its duration of use, and this may consequently affect

the technical efficiency of rice production in the area.

1.2 Rice production and crops situation

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

2002 2004 2006 2008 2010

Agriculture household segmentation

Whole Country

Managerial Economics Project

18

Figure 5: Vietnams rice production and land cultivation area (Source: GSO,

General Statistics Office of Vietnam 2012)

After joining WTO since November 2007, the rice production in Vietnam tends to generally

increase but not remarkably. In the reality towards farmers, the agriculture lands are not only

being dried out, but the saltwater, rain flood submerging ... also cause tens of thousands of

poor farmers in the Mekong Delta still in poor cycle life. At the harvest upcoming, the price

is appeared to be dropped dramatically. Over the years, farmers must suffer the loss to sell

rice with below the production cost; they almost cannot decide the selling price but have to

follow the requested price from the traders. Nevertheless, even though Vietnams rice land

has gradually declined 11% - from 4.5 million hectares in 1999 to the present 4.0 million

hectares - because of industrialization and urbanization, the equivalent area in rice reached

7.75 million hectares in 2012 due to the technological application of the growing of three

crops of rice a year.

On the other side, in 2007 2008, the World witnessed a record of price rising which pushed

around 1 billion population falling into poverty. The triple times increase in rice price during

the period of food crisis in 2008 impacted substantially to the falling of domestic

consumption (from 350$/ton in 11/2007 rose up to 1100$/ton in 5/2008). However, under the

Government subsidize, Vietnam came over the crisis successfully and sustain the gradually

rising from 2009 2013. Besides the population growth annually, the application of new

Managerial Economics Project

19

technique in rice production (Global GAP standards, for example) brought about high quality

rice seed with lower cost which promoted strongly the domestic consumption.

Figure 6: Vietnams domestic consumption from 2003 2013 (Source: Indexmundi, 2014)

III. SOLUTION FOR VIETNAM RICE EXPORT

1. Lessons from other rice exporting countries

1.1 Thailand

Thailand is the world leading rice exporter in terms of quantities and turnovers. The decisive

factor in its price in the international market is its quality. Thailand rice is tasty, aromatic,

soft and agreed by all. Its high quality is based on the good nature of the rice itself as well as

the mindset of its scientists - farmers exporting companies customers.

1.2 India

India is one of the leading rice exporters in the world market. Its quantities incessantly

increase during the past decades. The reason is because it has applied various solutions in the

Green Evolution.

Indian government encourages the land and paddy rice cultivation, Baxmati, to serve both

domestic and export demand. India undertakings includes providing machinery and

Managerial Economics Project

20

agricultural equipment to farmers through subsidies, credits, supplying them with knowledge

and modern agricultural techniques through courses organized in the form of level consistent

with the farmers. The export procedures are simplified to the greatest extent, reducing the

administrative procedures to encourage maximum traders involved in exporting rice.

1.3 America

To have a high reputation in international market, the United States has many policies of

providing capitals for the production and processing of rice for export. It invests heavily in

technology and engineering, resulting in high quality rice.

With lessons from other countries together with challenges and opportunities Vietnam rice

products meet during the last decade, below are the suggestions for Vietnamese government

to enhance the rice image and its value in the world market.

2. Solution

2.1 A clear rice export strategy in specific periods

What is the target, core value of exporting rice in medium and long-terms? What are the main

missions in certain stages of development considering the position of Vietnam in current and

future world rice market? The government should clarify its role, enterprises and farmers so

that each will make the best performance out of their resources. Vietnamese government

should make suitable adjustments in investment policies, especially policy on management of

agriculture land (land for rice cultivation) to increase investment for infrastructure

development in the main rice production areas, development of infrastructure serving for

socio-economics; investment to develop new rice varieties with high yield and are able to

adapt to climate change (especially hybrid rice); investments for technology in harvesting and

post-harvesting, etc. so that rice products will not only increase in quantity but also in quality,

scales and scopes, ensuring a stable and promising outlook for export activities even during

crisis economic time.

2.2 The specification and proper policies

The government needs to have specified policies to support rice farmers in disadvantaged

regions or areas that are lacking in food, also support the provinces that are located in the

projected area specializing in rice, and helps them to produce efficiently. The government

Managerial Economics Project

21

should also have insurance policy for food producing farmer against force majeure. For

example, if the quantities for export cannot be exported because of unexpected economic

events, government should have proper policy to solve those remaining quantities such as

buying all of them from the farmers and store in the national reserves. Government must also

have suitable budget in terms of time and other economic conditions for the farmers and have

to take into account the regulations of relevant organizations that Viet Nam participates in,

especially WTO, so that the export activity can amend itself to comply with all the related

regulations and take full advantage of the market situations to have a proper and excellent

development.

In certain examples we analyzed, the value chain in rice export consists of 5 factors: farmers,

merchant, mill plant, polishing plant and export companies. If the total increasing value of 1

kg rice export is 100%, the farmers get 36.5%, merchant get 18.9%, mill plant gets 18.9%,

polishing plant gets 12.3% and export companies get 28.9%. Thus, the farmers who directly

produce rice export only get less than 2/5 the total benefit of the export activities.

Government should intervene with policies to boost the value for farmers; for example, by

subsidizing, the government will encourage the farmers to produce more, ensuring their

incomes, making full use of the labor and other resources.

2.3 Maintain the stability of domestic and export demand

As we all know, rice is the main and most important produce for most of the countries in the

world including Vietnam. Therefore, when exporting price, on one hand the government has

policies to boost up the production and export activities; on the other hand, however, it must

guarantee the balance between domestic supply and demand, and the rest will be for export.

Nevertheless, export activities must be stable because exporting rice is one of the most

important activities that accounts for the positive balance of trade and payment in the national

income. One sudden change or unexpected fluctuation in rice revenue will lead to serious

economic, and even social, problems. Thus, rice production must first serve satisfactorily the

domestic and second will be for export. The government will have suitable approaches for its

stability when taking into consideration all of the economic and social effects.

2.4 Develop the related processing industry

The government should develop the other industries that directly support the production and

transporting rice such as fertilizer production, agricultural mechanization tools and storage,

Managerial Economics Project

22

especially the processing and preservation stages. As we all know, developing processing

industry not only creates the value added for products but it is also an important criteria to

help Vietnam overcome all the technical barriers from other countries, especially when

Vietnam is a member of WTO. Processing industry can be improved by re-equipping with

modern production line to produce varieties of outputs, labels, sizes with competitive prices

in many stages such as drying, sorting, preserving, pre-processing, processing and packaging.

This will result in a considerable improvement in the quality of rice, and in turn, an

increasing flow of net income for the country.

In conclusion, all of the suggestions above will help the government to enhance the

Vietnamese rice brand in the world market. From applying technology into producing and

processing as well as establishing strong relationships between farmers, enterprises and

scientists to harmonize the benefits of all, the government will gradually consolidating the

main factors in rice production and export and will improve the total performance of them all,

leading to an effective and expected gradual increase in annual national income. With such

improvement and if the trade promotion is properly facilitated, the market for Vietnamese

rice will certainly expand in both width and depth: successfully retaining and boosting

transactions with old customers along with finding new ones. At that time, not only rice

products but also the country will gain considerable reputation and prestige in the world

dynamic market.

Managerial Economics Project

23

CONCLUSION

Building up from an agriculture country with favorable natural conditions, having been

through a long period preparing to become a member of WTO, rice market in Vietnam has

had many advantages, opportunities, but barriers and challenges as well.

Vietnamese agricultural production in general and rice production in particular developed

stably and quickly. Thanks to some governments policies in favor of rice production

development, rice production in Vietnam is improving quantity and quality as well. And after

joining WTO, Vietnam has many significant improvements for rice production and export.

Nowadays, Vietnam exports rice to 120 countries, and become the second largest rice

exporter in the world, competing with many other strong competitors such as India, Thailand,

Australia, Cambodia, China (Mainland), Egypt, Paraguay, Pakistan, and the United States.

However, the government does not pay enough attention to the standard life of rice farmers,

and poor management in rice land planning holds back the development of rice production,

makes production cost increase and wastes labor force. In addition, export price of

Vietnamese rice is quite low in comparison with others; exported rice is still low quality; rice

production in Vietnam still has high production cost, less sustainable agricultural practices,

frequently damaged by natural disaster, poor infrastructure, especially irrigation and transport

in mountainous area and storage facility for rice in the Mekong delta.

Vietnam has had a turning point since it joined WTO with many opportunities and challenges

waiting ahead. As the economy is integrating into the international market,

Vietnamese government now has greater responsibility to control and maintain its stability,

ensuring the mutual benefits of all participants in the national economy. Basing on this

condition, all of the solutions we have made will, to a certain extent, encourage the rice

domestic and export activities in a way that stable development is maintained. Only with such

development can Vietnam really compete healthy and strongly prosper in the contemporary

world market in the foreseeable future.

Managerial Economics Project

24

REFERENCE

Asian Development Bank Institute (ADBI) , The Second Training on Agriculture

Productivity and Natural Resources Management, Rice Value Chain in Vietnam

Do Tuyet Khanh, 2009, "Food crisis in the world and Vietnam's agriculture", Thoi Dai Moi,

2009: 17

Food and Agriculture Organization of the United Nations (FAO). Available at:

http://faostat.fao.org/

General Statistics Office of Vietnam (GSO). Statistical Yearbook of Vietnam, various years.

Available at: http://www.gso.gov.vn/

Indexmundi, 2014, Viet Nam Milled Rice Domestic Consumption by Year, Retrieved 13

Jan, 2014 from http://www.indexmundi.com/agriculture/?country=vn&commodity=milled-

rice&graph=domestic-consumption

Mekong Oryza. Available at: http://mekongoryza.com/

Tran Duc Vien, Nguyen Thi Duong Nga, 2009, Economic Impact of Hybrid Rice in Vietnam:

An Initial Assessment

Vietnam Customs. Available at: http://www.customs.gov.vn/English/Default.aspx

Vietnam Food Association (VFA). Available at: http://www.vietfood.org.vn/en/

Vo Thi Thanh Loc & Nguyen Phu Son, 2010, Value Chain Analysis of Rice Product in the

Mekong Delta

You might also like

- Vietnamese Rice Sector 2008Document46 pagesVietnamese Rice Sector 2008Thuan DuongNo ratings yet

- PT Loi The Canh Tranh Cua GaoDocument17 pagesPT Loi The Canh Tranh Cua Gaot2nNo ratings yet

- I. Limitations and Threats Existed in The Trading Between Vietnam and PhilippineDocument5 pagesI. Limitations and Threats Existed in The Trading Between Vietnam and PhilippineNhư TâmNo ratings yet

- Strategy of Vietnam Rice Export To 2030Document4 pagesStrategy of Vietnam Rice Export To 2030Kiều LoanNo ratings yet

- ContentsDocument27 pagesContentsShilpi RaniNo ratings yet

- SIAYAN WHITE CORN VALUE CHAIN ANALYSIS - Jan23Document32 pagesSIAYAN WHITE CORN VALUE CHAIN ANALYSIS - Jan23ma. chona mapanoNo ratings yet

- Micro EconomyDocument17 pagesMicro EconomyPhạm Thế Trung K60CA-FNo ratings yet

- How To Grow RiceDocument7 pagesHow To Grow RiceSunshineNo ratings yet

- Rice Exports From IndiaDocument36 pagesRice Exports From Indiaamol100% (1)

- Industry Profile of Srini Food ParkDocument12 pagesIndustry Profile of Srini Food ParkJ.M Sai TejaNo ratings yet

- 3rd Theory 3Document4 pages3rd Theory 3Taushif AhammedNo ratings yet

- Cereal ImportationDocument26 pagesCereal ImportationQP0072 Nguyen Van BaNo ratings yet

- Current Situation of VietnamDocument6 pagesCurrent Situation of VietnamNhat Minh NguyenNo ratings yet

- Share Developments in Rice and Allied Sectors, Promote The Concept of Knowledge EconomyDocument14 pagesShare Developments in Rice and Allied Sectors, Promote The Concept of Knowledge EconomyMujahid AliNo ratings yet

- Vietrade - : Vietnam's Rice Export For The First 6 Months of 2013Document4 pagesVietrade - : Vietnam's Rice Export For The First 6 Months of 2013VikanhnguyenNo ratings yet

- Post Harvest Compendium - RICE PDFDocument63 pagesPost Harvest Compendium - RICE PDFJane AlfaroNo ratings yet

- Institute of Business Management and ResearchDocument11 pagesInstitute of Business Management and ResearchMukti GuptaNo ratings yet

- Agriculture and Forestry Notes by Ayesha YounasDocument65 pagesAgriculture and Forestry Notes by Ayesha YounasAadil Jutt88% (17)

- 1 Biscuit PlaDocument3 pages1 Biscuit PlaSampath KumarNo ratings yet

- Pakistan's Agriculture SecterDocument28 pagesPakistan's Agriculture SecterAbdul wahabNo ratings yet

- Bread Industry in IndiaDocument22 pagesBread Industry in IndiaFarazShaikhNo ratings yet

- Natural Resources of BangladeshDocument9 pagesNatural Resources of BangladeshMa BasharNo ratings yet

- Rice Value Chain Report 1.1 Value Chain DefinitionDocument24 pagesRice Value Chain Report 1.1 Value Chain DefinitionStoryteller VZNo ratings yet

- Cashew Kernel ReportDocument8 pagesCashew Kernel ReportRohit Sachdeva100% (2)

- Trade Performance of CottonDocument35 pagesTrade Performance of CottonNitin PandyaNo ratings yet

- Promotion of Paddy Production and Rice Export of CambodiaDocument45 pagesPromotion of Paddy Production and Rice Export of CambodiaThach BunroeunNo ratings yet

- 10 11648 J Jher 20200601 12 PDFDocument17 pages10 11648 J Jher 20200601 12 PDFSajitsew WadimNo ratings yet

- Cung Cầu Thị Trường Lúa Gạo Việt NamDocument9 pagesCung Cầu Thị Trường Lúa Gạo Việt Namngothithuytrang1802No ratings yet

- Determination of Operational Mechanisms For Increased Productivity and Income Among Corn Farmers in Abra de Ilog, Occidental MindoroDocument9 pagesDetermination of Operational Mechanisms For Increased Productivity and Income Among Corn Farmers in Abra de Ilog, Occidental MindoroLeonardo TizaNo ratings yet

- 1.1 Industry Profile: 1.1.1 The Food Industry IncludesDocument71 pages1.1 Industry Profile: 1.1.1 The Food Industry IncludesBhavaniNo ratings yet

- Rice Export ProjectDocument23 pagesRice Export Projectdan_cool78691% (11)

- Rice MillDocument42 pagesRice MillHoward UntalanNo ratings yet

- TAP Rice & Maize Synopsis Nov 2010Document20 pagesTAP Rice & Maize Synopsis Nov 2010frederickilcherNo ratings yet

- IOP - Proc - Food Processing Tech - Rice Bioindustry - S WidowatiDocument7 pagesIOP - Proc - Food Processing Tech - Rice Bioindustry - S WidowatiSwido WatiNo ratings yet

- Industry-Agriculture: Issue: Wastage in Post Harvest Management in Potato IndustryDocument15 pagesIndustry-Agriculture: Issue: Wastage in Post Harvest Management in Potato Industryminnimadaan26No ratings yet

- Table ofDocument17 pagesTable ofSwethaNo ratings yet

- Rice Supply Chain Paper - Revised1Document11 pagesRice Supply Chain Paper - Revised1Siddharth RaiNo ratings yet

- Importance of Agriculture MarketingDocument3 pagesImportance of Agriculture MarketingShuvojeet MandalNo ratings yet

- Vinamilk's Supply Chain and The Small Farmers' Involvement: Luc Thi Thu HuongDocument9 pagesVinamilk's Supply Chain and The Small Farmers' Involvement: Luc Thi Thu HuongĐức MinhNo ratings yet

- Group 7 Report 1Document23 pagesGroup 7 Report 1Đức Bảo PhùngNo ratings yet

- Agriculture Sector of PakistanDocument14 pagesAgriculture Sector of Pakistannayab rafiqNo ratings yet

- Dairy Farming : Modern Approaches to Milk Production and ProcessingFrom EverandDairy Farming : Modern Approaches to Milk Production and ProcessingNo ratings yet

- IB ProjectDocument4 pagesIB Projectyatin rajputNo ratings yet

- Rice IndustryDocument89 pagesRice Industryraghu007nairNo ratings yet

- CHAPTER - 01 Agri. Business ManagementDocument187 pagesCHAPTER - 01 Agri. Business Management10rohi10No ratings yet

- 25th November, 2014 Daily Global Rice E-Newsletter by Riceplus MagazineDocument17 pages25th November, 2014 Daily Global Rice E-Newsletter by Riceplus MagazineMujahid AliNo ratings yet

- CHAPTER 01 Agri Business ManagementDocument187 pagesCHAPTER 01 Agri Business ManagementEufemia GumbanNo ratings yet

- Mini ProjectDocument9 pagesMini ProjectlakunarasimharaoNo ratings yet

- Basmati ReportDocument18 pagesBasmati ReportJai SoniNo ratings yet

- Assignment On WheatDocument10 pagesAssignment On WheatRiaz Khan50% (2)

- Agriculture of PakistanDocument5 pagesAgriculture of PakistanButt Butt100% (1)

- Food Processing Industry in IndiaDocument28 pagesFood Processing Industry in IndiaFarhan Khan50% (2)

- Value Chain Analysis For Rice inDocument65 pagesValue Chain Analysis For Rice indanishalammohdNo ratings yet

- Myanmar: Rice ExportDocument88 pagesMyanmar: Rice Exportericaalini100% (1)

- Rural Development: Important of AgricultureDocument5 pagesRural Development: Important of AgricultureHamad RazaNo ratings yet

- Class 7 AgricultureDocument10 pagesClass 7 AgricultureZeeshan ShaniNo ratings yet

- Rice Supply Chain in IndiaDocument12 pagesRice Supply Chain in IndiaSiddharth RaiNo ratings yet

- Proposed Lake Kachira Lowland Rice Plantation Project - Main DocumentDocument23 pagesProposed Lake Kachira Lowland Rice Plantation Project - Main DocumentHerbert BusharaNo ratings yet

- Pakistan's Agro IndustriesDocument15 pagesPakistan's Agro Industrieshbadar76No ratings yet

- AGGRAND® Natural Lawn CareDocument4 pagesAGGRAND® Natural Lawn CarePandMHillNo ratings yet

- IAS4Sure Government Schemes For Prelims 2021Document166 pagesIAS4Sure Government Schemes For Prelims 2021NandNo ratings yet

- Adelaide Visitor Guide 08Document81 pagesAdelaide Visitor Guide 08Carlos YanezNo ratings yet

- Desert Plants, Volume 3, Number 2 (Summer 1981)Document65 pagesDesert Plants, Volume 3, Number 2 (Summer 1981)Angel Eduardo Moreno AlboresNo ratings yet

- Blueberry Supply Chain in Peru: Planning, Integration and ExecutionDocument13 pagesBlueberry Supply Chain in Peru: Planning, Integration and ExecutionSandra QCNo ratings yet

- Dehydration FinalDocument14 pagesDehydration FinalStephen Moore100% (1)

- Causes of Biodiversity Loss A Human Ecological Analysis by Emmanuel Boon and HensDocument16 pagesCauses of Biodiversity Loss A Human Ecological Analysis by Emmanuel Boon and HensAshishKajlaNo ratings yet

- Bio FertilizersforOrganicAgricultureDocument7 pagesBio FertilizersforOrganicAgriculturenimra imtiazNo ratings yet

- Tropical Forest Conservation PDFDocument190 pagesTropical Forest Conservation PDFEmilio Patané Spataro100% (1)

- 2nd Sem Research Group 1ADocument53 pages2nd Sem Research Group 1ALovely LaplanaNo ratings yet

- Botany - Flower Structure PDFDocument5 pagesBotany - Flower Structure PDFMia Justine Soriano100% (1)

- David Conway A Nation of ImmigrantsDocument112 pagesDavid Conway A Nation of Immigrantsnerac34No ratings yet

- Effects of Stocking Density On The Growth and Flesh Quality of Rainbow Trout (Oncorhynchus Mykiss) Reared in A Low-Tech Aquaponic SystemDocument40 pagesEffects of Stocking Density On The Growth and Flesh Quality of Rainbow Trout (Oncorhynchus Mykiss) Reared in A Low-Tech Aquaponic Systemjeisson osorioNo ratings yet

- The California Wine ClusterDocument5 pagesThe California Wine ClusterTarek AssafNo ratings yet

- Study of PomeloDocument30 pagesStudy of PomeloKyle Cabusbusan75% (4)

- Sorghum Root and Stalk RotsDocument288 pagesSorghum Root and Stalk RotsFindi DiansariNo ratings yet

- Coco Cost of Production1Document3 pagesCoco Cost of Production1Cristobal Macapala Jr.No ratings yet

- Maize Project SlidesDocument35 pagesMaize Project SlidesnahunabilaNo ratings yet

- Supply Chain Management of OnionDocument44 pagesSupply Chain Management of Onionhina0863100% (3)

- 1432199420cedar Grove - May 2015 PDFDocument20 pages1432199420cedar Grove - May 2015 PDFCoolerAdsNo ratings yet

- (En) Download The Peru Country Profile PDFDocument8 pages(En) Download The Peru Country Profile PDFVictor CaceresNo ratings yet

- 011B - Feed Efficiency in Swine PDFDocument281 pages011B - Feed Efficiency in Swine PDFionut2007No ratings yet

- Gressingham Dine in With Duck BookletDocument16 pagesGressingham Dine in With Duck BookletAndrew Richard ThompsonNo ratings yet

- Smart Agriculture Using AutomationDocument5 pagesSmart Agriculture Using AutomationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Wheateldoret Publication PDFDocument14 pagesWheateldoret Publication PDFWilliam ChemosiNo ratings yet

- Design Considerations For The Construction and OpeDocument26 pagesDesign Considerations For The Construction and OpemurniNo ratings yet

- Annual Report RGITBTDocument19 pagesAnnual Report RGITBTStephen MooreNo ratings yet

- Myanmar INGO Directory 2012Document96 pagesMyanmar INGO Directory 2012Ko Gree KyawNo ratings yet

- As The Environment ChangesDocument1 pageAs The Environment ChangesJeramel Teofilo ManaloNo ratings yet