Professional Documents

Culture Documents

Final MOL - People For Green Space

Uploaded by

Brooklyn Heights Blog0 ratings0% found this document useful (0 votes)

4K views26 pagesSave Pier 6 literature.

Original Title

Final MOL_people for Green Space

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSave Pier 6 literature.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4K views26 pagesFinal MOL - People For Green Space

Uploaded by

Brooklyn Heights BlogSave Pier 6 literature.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 26

1

SUPREME COURT OF THE STATE OF NEW YORK

COUNTY OF KINGS

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - x

PEOPLE FOR GREEN SPACE FOUNDATION, INC., : Index No.:

LORI SCHOMP and J OSEPH MERZ ( )

:

Petitioners,

:

For a J udgment Pursuant to Article 78 of the Civil Practice

Law and Rules :

-against-

:

NEW YORK STATE URBAN DEVELOPMENT

CORPORATION, doing business as, EMPIRE STATE :

DEVELOPMENT COPORATION AND BROOKLYN

BRIDGE PARK DEVELOPMENT CORPORATION, :

Respondents. :

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - x

PETITIONERS MEMORANDUM IN SUPPORT OF PETITION

AND PRELIMINARY INJUNCTION

ABRAMS, FENSTERMAN, FENSTERMAN

EISMAN, FORMATO, FERRARA & WOLF, LLP

Frank V. Carone, Esq.

1 Metrotech Center, Suite 1704

Brooklyn, New York 11201

(718) 215-5300

Attorneys for Petitioners People For Green Space

Foundation, Inc., Lori Schomp and J oseph Merz

2

TABLE OF CONTENTS

PAGE

PRELIMINARY STATEMENT3

FACTS..4

ARGUMENT...7

I. PETITIONERS ARE ENTITLED TO A TEMPORARY RESTRAINING ORDER

AND PRELIMINARY INJ UNCTION...7

II. PETITIONERS ARE LIKELY TO PREVAIL ON THE MERITS OF THE

PETITION....8

A. ESDC Violated SEQRA by Failing to Prepare a Supplemental

EIS..8

1. A Supplemental Environmental Impact Statement is Required Due to

Change in Circumstances12

a. Superstorm Sandy...12

b. Increased Vehicular and Pedestrian Traffic....13

2. A Supplemental EIS Is Required Due to Newly Discovered

Information.15

a. Change in Park Finances.....15

b. School Overcrowding......19

B. ESDC Has Violated the UDCA Because the RFP Contains an Impermissible

Alteration to the Project Inconsistent with the GPP..21

III. PETITIONERS WILL SUFFER IRREPARABLE HARM ABSENT INJ UNCTIVE

RELIEF..24

IV. THE BALANCE OF EQUITIES TILTS IN PETITIONERS FAVOR...25

CONCLUSION..26

3

PRELIMINARY STATEMENT

Petitioners submit this Memorandum of Law in support of their Petition, an application

for a temporary restraining order and for a preliminary injunction seeking: (a) a declaration that

Respondents New York State Urban Development Corporation d/b/a the Empire State

Development Corporation (ESDC) and Brooklyn Bridge Park Development Corporation

(BBPDC) acted in a manner that is arbitrary, capricious, an abuse of discretion and in violation

of law; (b) enjoining Respondents from accepting or approving or taking any other actions

concerning proposals submitted in response to a Request for Proposal (RFP) dated May 13,

2014 concerning development of Pier 6 in Brooklyn Bridge Park; (c) annulling the RFP; (d)

directing Respondents to prepare or cause to be prepared a Supplemental Environmental Impact

Statement (Supplemental EIS); (e) awarding Petitioners costs and reasonable attorneys fees;

and (f) granting such other and further relief as the Court may deem just, proper and equitable.

Brooklyn Bridge Park was designed to be a financially self-sustaining entity with as

minimal development in the Park as necessary to support its budget for maintenance and

operations. However, the RFP requires developers to include affordable housing which

substantially alters the Project without performing a proper environmental review and without

abiding by the requisite administrative procedures.

First, ESDCs actions violate the State Environmental Quality Review Act (SEQRA),

N.Y. Environmental Conservation Law 8-0109, by failing to analyze the changes in

circumstances and newly discovered information concerning Brooklyn Bridge Park in a

Supplemental EIS before releasing its RFP. N.Y. Comp. Codes R. & Regs. tit. 6, 617.9.

(1996). Since the Final Environmental Impact Statement (FEIS) was issued in 2005, Brooklyn

Bridge Park has experienced significant changes in circumstances and new information

4

discovered, including the occurrence of Superstorm Sandy, significantly increased vehicular and

pedestrian traffic, a change in Park finances, and overcrowding in neighborhood schools.

According to SEQRA, the ESDC is required to review the significant adverse impacts of these

changes on the Project area in a Supplemental EIS before issuance of a RFP.

Second, ESDC, which is subject to the Urban Development Corporation Act (UDCA),

violated the UDCA by altering the Project by including affordable housing without modifying

the GPP. N.Y. Unconsol. Law 6266 (McKinney 1990). The Project contemplates as minimal

development in the Park as financially possible. ESDC was therefore required to follow the

required notice and comment procedure set out in the UDCA before altering the Project Plan.

FACTS

The original Brooklyn Bridge Park Development Corporation was established in 1998 by

Downtown Brooklyns elected officials and funded by the State of New York. (See Illustrative

Master Plan (IMP), Exhibit A, Page 2). The corporation developed an Illustrative Master

Plan (IMP) in 2000, which set forth a vision for a financially self-sustaining park along the

Brooklyn waterfront providing recreational and cultural opportunities, subject to any

refinements thereto arising from the completion of the planning and environmental review

processes for the Project. (See Memorandum of Understanding (MOU), Exhibit B, Page

3). The IMP was heavily influenced by the Thirteen Guiding Principles, which include the

Principle of Develop[ing] a Fiscally Prudent Plan. (See Thirteen Guiding Principles, Exhibit

C, Page 2). This Principle states that [t]he site shall have only so much commercial

development in a park-like setting as is necessary to enliven the area, to provide security and to

finance ongoing operations. (Exhibit C, Page 2).

5

On May 2, 2002, then Governor George Pataki and then Mayor Michael Bloomberg

signed a Memorandum of Understanding (MOU) providing for the creation of what is now

known as the Brooklyn Bridge Park Development Corporation (BBPDC) to plan, design, and

build Brooklyn Bridge Park. (Exhibit B, Page 3). BBPDC is a subsidiary of ESDC. (Exhibit

B, Page 3).

The two parties to the MOU agreed that the IMPs provisions would guide the Project.

(Exhibit B, Page 3). The MOU states that not less than 80% of the Project would be reserved

as open space and would be dedicated as parkland, and the MOU requires that all revenue

derived from appropriate commercial activities in the Project area be used exclusively for the

maintenance and operation of the Project. (Exhibit B, Page 3).

The GPP, adopted J uly 26, 2005, notes that the MOU requires that the park be

financially self-sustaining. (See General Project Plan (GPP), Exhibit D, Page 5). To

accomplish this mandate, the GPP included a plan for revenue-generating developments in the

Park to provide funding. (Exhibit D, Page 5). This funding analysis was included in the FEIS,

dated December 2005, prepared before the GPP was formally adopted in its modified form on

December 18, 2006. (See FEIS, Exhibit E, Page F-1). The FEIS states that the proposed

project would introduce . . . market rate housing units to accommodate the financially self-

sustaining mandate. (Exhibit Z, Page 4-7)

Although ESDC was committed to having a financially self-sustaining park, the ESDC

was also committed to minimal Park development. In 2007, the ESDC submitted a Brief to the

Appellate Division in Brooklyn Bridge Park Legal Def. Fund v. New York State Urban Dev.

Corp., 856 N.Y.S.2d 235 (2d Dept 2008), and announced its commitment to building the

minimum development necessary to cover the Parks maintenance and operation needs. (See

6

Brief for Respondents-Respondent, dated May 30, 2007 (ESDC Brief), Exhibit F, Page 15).

ESDC also promised that if market conditions allowed for less development to support the Parks

needs, the development program would be reduced accordingly. (Exhibit F, Page 16).

On May 13, 2014, BBPDC released an RFP for development at Pier 6, requiring

proposals to be submitted by J uly 21, 2014. (See RFP, Exhibit G, Page 1). According to the

RFP, each of the two development parcels on Pier 6 consists of approximately 9,880 square feet

of vacant land. (Exhibit G, Page 5). Parcel A has a maximum build height of 315 feet and

Parcel B has a maximum build height of 155 feet. (Exhibit G, Page 9). In total, the Pier 6

parcels consist of approximately 4,643,600 square feet. Although the RFP requires developers to

submit proposals that abide by the GPP requirements, the RFP also requires that approximately

130,000 gross square feet of the Pier 6 parcels (approximately 30% of the apartments) be

allocated for affordable housing. (Exhibit G, Page 9).

The RFP was the first time in the history of the Project that inclusion of affordable

housing was required. Yet, BBPDC provided no rationale whatsoever in the RFP or subsequent

documents for the new affordable housing mandate.

Affordable housing would provide little to no revenue to the Park, such that its inclusion

in the Pier 6 development directly conflicts with the Projects objective of having as minimal

development as necessary to fund the Park. The allocation of 30% of Pier 6s development to

uses generating little or no revenue indicates that the Park can afford to have less development to

support its financial needs.

Even if the affordable housing units actually generate revenue, these units would still

provide much less revenue than the market rate apartment units the FEIS contemplated. Since

the affordable housing units would be sold or rented at a much lower rate than the market rate

7

apartment units, Brooklyn Bridge Park would be losing the maximum revenue potential from

these apartments. Moreover, more units of affordable housing would be necessary to generate

the same amount of revenue that market rate units would generate. The construction of more

apartments than financially necessary in Pier 6 violates the Projects objective of minimal

development and is inconsistent with the GPP.

ARGUMENT

I. PETITIONERS ARE ENTITLED TO A TEMPORARY RESTRAINING

ORDER AND PRELIMINARY INJUNCTION

CPLR 6301 provides in relevant part: A temporary restraining order may be granted

pending a hearing for a preliminary injunction where it appears that immediate and irreparable

injury, loss or damage will result unless the defendant is restrained before the hearing can be

had. CPLR 6313 also provides that [i]f, on a motion, for a preliminary injunction, the

plaintiff shall show that immediate and irreparable injury, loss or damage will result unless the

defendant is restrained before a hearing can be had, a temporary restraining order may be granted

without notice. Yonkers Racing Corp. v. Catskill Regional Off-Track Betting Corp., 143

A.D.2d 345, 346, 532 N.Y.S.2d 407, 408 (2d Dept 1988) recognized that a temporary

restraining order is premised on a demonstration that immediate and irreparably injury, loss or

damage will result unless the [other party] is restrained before the hearing can be held.

It is well settled that in order to be entitled to a preliminary injunction, a movant must

clearly demonstrate (1) the likelihood of ultimate success on the merits, (2) irreparable injury

absent a granting of the preliminary injunction, and (3) a balancing of the equities in the

movants favor. E.g., Doe v. Axelrod, 73 N.Y.2d 748, 750, 532 N.E.2d 1272, 1273 (N.Y. 1988);

McVay v. Wing, 303 A.D.2d 727, 758 N.Y.S.2d 88 (2d Dept 2003); MacIntyre v. Metropolitan

Life Ins. Co., 221 A.D.2d 602, 634 N.Y.S.2d 180, 180-81 (2d Dept 1995).

8

A preliminary injunction is a provisional remedy; its function is not to determine the

ultimate rights of the parties, but to maintain the status quo until there can be a full hearing on

the merits. Destiny USA Holdings, LLC v. Citigroup Global Markets Realty Corp., 69 A.D.3d

212, 889 N.Y.S.2d 793 (4

th

Dept 2009). In ruling on a motion for a preliminary injunction, the

courts must weigh the interests of the general public as well as the interests of the parties to the

litigation. Id. at 223. Once the RFP is completed and proposals are in, the community will be

hard pressed to stop the momentum and will be forced to litigate with the developer and their

press teams, et al. Essentially, the RFP completion will render the developer of Site A and B for

Pier 6 a fait accompli before the requisite Supplemental EIS is prepared and GPP is modified.

Additionally, contractors, developers, and all parties involved would be irreparably

harmed based on their reliance on the illegitimate parameters set forth in the RFP. Specifically,

the RFP improperly includes the mandate of affordable housing. The Respondents further failed

to adequately address various adverse environmental impacts in a Supplemental EIS before

issuing the RFP. The RFP is therefore misleading and would result in irreparable harm to

anyone submitting a response thereto since the affordable housing component is contrary to the

GPP and in violation of the UDCA.

Indeed, bidders are relying, to their detriment, on this inappropriate scheme when

composing proposals for submission. The proposals will be for a building that is drastically and

materially different than what the GPP requires. As such, the contractors and developers would

be irreparably harmed unless the RFP is stayed.

II. PETITIONERS ARE LIKELY TO PREVAIL ON THE MERITS OF THE

PETITION

A. ESDC Violated SEQRA by Failing to Prepare a Supplemental EIS

9

According to the GPP, ESDC is the lead agency of the Project and is subject to SEQRA

for environmental review of the Projects impacts. (Exhibit D, Page 16). The standard of duty

for a lead agency under SEQRA, and the standard of review for the Courts, is well established:

courts may, first, review the agency procedures to determine

whether they were lawful. Second, we may review the record to

determine whether the agency identified the relevant areas of

environmental concern, took a hard look at them, and made a

reasoned elaboration of the basis for its determination. Court

review, while supervisory only, insures that the agencies will

honor their mandate regarding environmental protection by

complying strictly with prescribed procedures and giving reasoned

consideration to all pertinent issues revealed in the process.

Jackson v. New York State Urban Dev. Corp., 503 N.Y.S.2d 298 (N.Y. 1986).

Once a project has obtained its necessary approvals and the lead agency has issued its

statement of findings, the SEQRA process is completed. Id. However, when there are changes

proposed to the project and new or amended approvals are necessary, the obligations of the lead

agency under SEQRA are revived and the agency may not approve the project again without

fulfilling its SEQRA obligations, as the amended approval is an action under SEQRA. 6

N.Y.C.C.R.R. 617.2.

The SEQRA regulations recognize that in certain circumstances changes to the project,

changes in circumstances or material new information may require the preparation of a

Supplemental Environmental Impact Statement (Supplemental EIS). The regulations state:

Supplemental EISs.

(i) The lead agency may require a supplemental EIS, limited to the

specific significant adverse environmental impacts not addressed

or inadequately addressed in the EIS that arise from:

[a] changes proposed for the project; or

[b] newly discovered information; or

[c] a change in circumstances related to the project.

[ii] The decision to require preparation of a supplemental EIS, in

the case of newly discovered information, must be based upon the

following criteria:

10

[a] the importance and relevance of the information; and

[b] the present state of the information in the EIS.

[iii] If a supplement is required, it will be subject to the full

procedures of this Part.

6 N.Y.C.C.R.R. 617.9.

Although SEQRA does not define changes in circumstances, the purpose of a

[Supplemental EIS] is to account for new information bearing on matters of environmental

concern not available at the time of the original environmental review. Coalition Against

Lincoln West, Inc. v. Weinshall, 21 A.D.3d 215, 799 N.Y.S.2d 205 (1

st

Dept 2005); Municipal

Art Soc. of New York, Inc. v. New York State Convention Center Development Corp., 15 Misc.3d

1138(A) (N.Y. Sup. Ct. 2007). In lieu of a Supplemental EIS, agencies often prepare a

Technical Memorandum to examine and address potential environmental effects associated

with proposed modifications . . . and changes in background conditions. Jackson, 67 N.Y.2d

400, 423; Coalition Against Lincoln West, Inc., 21 A.D. 3d 215, 219; Municipal Art Soc. of New

York Inc., 841 N.Y.S.2d 821, 827.

In Develop Dont Destroy (Brooklyn), Inc. v. Empire State Development Corp., 914

N.Y.S.2d 572 (N.Y. Sup. Ct. 2010) the court held that the UDC erred in not taking a hard look

at impacts of delays in project construction and not providing a reasoned elaboration for its

determination. The shift from a 10-year construction period to a 25-year construction period was

a changed circumstance in the Project that the UDC should have evaluated. Id. at 628.

The Brooklyn Bridge Park Projects FEIS was prepared in 2005. (Exhibit E, Page 1).

Edward Applebome, one of the project directors for the FEIS, followed the guidelines of the

2001 City Environmental Quality Review (CEQR) Technical Manual to conduct the

environmental review of the Project. (See Affidavit of Edward Applebome in Support of Cross-

Motion to Dismiss Petition, dated J une 28, 2006 (Applebome Aff.), Exhibit H, Page 3).

11

(Applebome prepared the FEIS in accordance with the CEQR Manual because it is standard

practice for projects located in New York City to conduct such review. (Exhibit H, Page 3).

According to the 2001 and 2014 CEQR Technical Manuals, Build Year is defined as

the year when the action would be substantially operational, since this is when the actions

effects would be felt, and when mitigation of project impacts would have to be in place. (See

City Environmental Quality Review Manual, dated 2001 (2001 CEQR Manual), Exhibit I,

Page 2-4); City Environmental Quality Review Manual, dated 2014 (2014 CEQR Manual),

Exhibit J , Page 2-4). (Applebome estimated the Projects Build Year to be 2012 and

conducted his analyses accordingly. (Exhibit H, Page 4). However, it is clear that the analyses

based off the 2012 estimated year of completion are outdated and have been rendered obsolete.

As of 2014, two years after the estimated year of completion, the Project is not even

remotely close to being considered substantially operational. In fact, only one of the five

proposed developments in Brooklyn Bridge Park is completed and three other developments are

still undergoing construction. (Exhibit G, Pages 10-11). Meanwhile, the RFP for development

on Pier 6 was only released in May 2014 and there has yet to be any construction on Pier 6.

(Exhibit G, Page 1).

Moreover, since 2005, Brooklyn Bridge Park has experienced significant changes in

circumstances and new information discovered which change the entire complexion of the

Project. These changes and newly discovered information include, but are not limited to, the

effect of Superstorm Sandy, substantially increased vehicular and pedestrian traffic, a change in

Park finances, and the overcrowding of schools. Each of these issues has resulted in significant

environmental impacts in and around Brooklyn Bridge Park. Yet, ESDC has failed to prepare a

Supplemental EIS or a Technical Memorandum to address these significant adverse

12

environmental impacts. Therefore, the RFP process must be stayed until these impacts are

properly evaluated in a Supplemental EIS.

1. A Supplemental EIS is Required Due to Changes in Circumstances

a. Superstorm Sandy

Since the FEIS was published in 2005, Pier 6 has experienced a dramatic increase in

flood risk. According to FEMAs revised New York City flood map, Pier 6 development sites

went from having a 0.2% risk of catastrophic flood activity to a 1% annual risk. (See FEMA

Flood Map, Exhibit K). An area with a 1% Annual Chance of Flood (ACF) is considered by

FEMA to be a High Risk Area. (Exhibit K).

This five-fold increase demonstrates the transition of Pier 6 from a Low Risk Area to a

High Risk flood area. The Pier 6 area is also categorized by FEMA as an AE Zone which is

considered a high-risk flood area with a capacity for damage and destruction to buildings.

(Exhibit K). Accordingly, there is a Federal flood insurance mandate for that area. (Exhibit

K). FEMA has also provided construction guidelines for such flood zones, and the RFP only

recommends, but surprisingly does not require, proposals to consider flood resiliency measures.

(Exhibit G, Page 5).

Moreover, according to New York Citys Climate Resilience Deliverables Report, sea

levels are likely to rise 1-2 feet and could rise by more than 2.5 feet, in addition to the 1 foot rise

that has already occurred since 1900. (See New York Citys Climate Resilience Deliverables

Report (CRD Report), Exhibit L, Page 6). As sea levels rise, they increase the chances of

extreme floods by todays standards. (See Climate Centrals New York and the Surging Sea

Report (CC Report), Exhibit M, Page 17).

13

Sandy produced a storm surge of 9 feet. (Exhibit M, Page 17). Assuming a 2 foot sea

level rise, the annual chance of extreme flooding would increase from 1% to 10%, over ten times

todays estimate. (Exhibit M, Page 17). Sandy, which flooded Pier 6 and is now designated

as a 100 year flood, would become a 10 year flood. (Exhibit M, Page 17). With a 2 foot level

sea rise and a storm comparable to Superstorm Sandy, Pier 6 would experience significant

flooding. (See Sea Surge Map 8 feet (SS 8), Exhibit N; Sea Surge Map 10 feet (SS

10), Exhibit O). Obviously, if flooding comparable to Sandy could recur every 10 years, it

would be folly not to evaluate the potential impact in a Supplemental EIS prior to receiving RFP

responses from developers.

Unlike Hurricane Floyd in Riverkeeper, Inc. v. Planning Bd. Of Town of Southeast, 9

N.Y.3d 219, 233, 851 N.Y.S.2d 76, 82, 881 N.E.2d 172, 178 (N.Y. 2007), Superstorm Sandy is a

change of circumstances that has caused significant adverse impacts as demonstrated by the five-

fold increase of flood risk to the Pier 6 area and the designation of Pier 1 as an evacuation flood

zone by FEMA. Therefore, the effects of Superstorm Sandy on Brooklyn Bridge Park require

preparation of a Supplemental EIS.

b. Increased Vehicular and Pedestrian Traffic

The FEIS analyzed the proposed traffic impacts associated with the proposed Park and on

site commercial and residential uses on the downtown Brooklyn waterfront. (See FEIS, Chapter

14: Traffic and Parking (FEIS, Ch. 14), Exhibit P; FEIS, Chapter 15: Transit and Pedestrians

(FEIS, Ch. 15), Exhibit Q). According to the FEIS, the Project would generate a net total of

3,132 person trips in the weekday AM peak hour, compared to 8,040, 7,175 and 9,189 new trips

during the weekday midday, PM and Sunday midday peak hours, respectively. (Exhibit P,

Page 14-1).

14

The FEIS also stated that there would likely be no new significant traffic or parking

impacts in the AM peak hour not already disclosed for the other peak hours when project-

generated demand would be substantially greater. (Exhibit P, Page 14-1). The Project would

generate demand for an estimated 1,282 parking spaces in the weekday midday and 1,497 spaces

in the Sunday midday. (Exhibit P, Page 14-45).

As for the subway and pedestrian impact, the FEIS stated that the Project would generate

an estimated 989 subway trips during the weekday midday peak hour, 1,558 trips during the

5:00-6:00PM peak hour and 1,375 trips during the Sunday 2:00-3:00PM peak hour. (Exhibit

Q, Page 15-2). The FEIS also estimated that four of the areas subway stations or station

complexes (York Street, High Street, Clark Street, Borough Hall/Court Street) would only

experience a peak hour demand in excess of 200 persons per hour in either the PM or Sunday

peak hours, or both. (Exhibit Q, Page 15-2). Additionally, the FEIS stated that significant

adverse pedestrian impacts were not expected to occur at sidewalks along the principal

pedestrian access corridors serving the proposed project area. (Exhibit Q, Page 15-35).

However, these estimates conducted in the 2005 FEIS are completely outdated and are no

longer reliable. For instance, the estimates severely underestimated the traffic impact on the

surrounding neighborhood even without the proposed Project. Traffic in the surrounding

neighborhood has also drastically increased as a result of the Atlantic Yards Project.

Moreover, pedestrian traffic has also drastically increased beyond what the FEIS

anticipated. The FEIS expected the Park to generate approximately 27,000 trips during a

typical summer Sunday and 15,000 trips during a typical summer weekday. (See FEIS,

Appendix B, Exhibit R, Page 1).

15

However, the actual numbers have turned out to be much higher. Nancy Webster,

Executive Director of the Brooklyn Bridge Park Conservancy, stated that while Brooklyn Bridge

Park has yet to carry out a visitor count in 2014, roughly 100,000 people visited [the Park] each

Saturday and Sunday [in 2013]. (See Mary Frost, Mayor de Blasio re-nominates Regina Myer

president Brooklyn Bridge Park Corp, Exhibit S).

On the topic of the 2014 visitor count, Webster stated that while [Brooklyn Bridge Park]

[hasnt] counted, the numbers feel higher. (Exhibit S). These numbers demonstrate that the

FEIS drastically understated the number of visitors and pedestrians of Brooklyn Bridge Park,

even without the Pier 6 development.

In view of the aforementioned, ESDC should be required to prepare a Supplemental EIS

to include evaluations on vehicular and pedestrian traffic as well as a recalculation of the

Projects Build Year.

2. A Supplemental EIS is Required Due to Newly Discovered

Information

a. Change in Park Finances

The Parks maintenance and operations budget proposal is $15.2 million, as calculated by

Singe Nielsen, an agent of the Respondents, in 2004. (See Affidavit of Signe Nielsen, for

Respondents, In Support of Cross-Motion to Dismiss Petition and in Opposition to Petition,

dated J uly 30, 2006 (Nielsen Aff.), Exhibit T, Page 3). Since its inception, Brooklyn Bridge

Park was meant to be financially self-sustaining and developments were to be constructed

according to the Parks need for revenue. (Exhibit C; Exhibit A; Exhibit B). Respondents

previously conceded in Brooklyn Bridge Park Legal Def. Fund v. New York State Urban Dev.

Corp., that the development program would be reduced depending on market conditions:

16

BBPDC has committed to building the minimum development

necessary to cover the park's maintenance and operations needs.

Accordingly, the plan analyzed in the FEIS and described in the

GPP represents the maximum build-out that would occur as part of

the Project. If, once requests for proposals are issued for the

development components, it becomes clear that market conditions

will allow for less development to support the park's needs, the

development program will be reduced accordingly.

(Exhibit F, Pages 15-16)(Emphasis added).

BBPDCs statements supporting minimal development in Brooklyn Bridge Park are also

included in the FEIS. The FEIS analyzed the necessary development of the Park and

acknowledged that market conditions may impact the size of development:

The final step in the [development] analysis was to create the

smallest program that could prudently support the annual

maintenance and operations of the park . . . it should be noted that

the revenue analysis was completed in late 2004 and all

assumptions, including land values, construction costs, and

financial assumptions, are based on data available at that time.

(See FEIS, Chapter 1, Exhibit U, Page 1-15).

The development program contained in the proposed plan

represents the minimal level of development that is required to

prudently support the annual maintenance and operations of the

park based on the analysis undertaken in 2004 . . . development

may be smaller, if market conditions permit it, because the value of

land and other factors may well be different from those assumed in

this analysis.

(Exhibit U, Page 1-18)(Emphasis added).

Since Brooklyn Bridge Park is financially self-sustaining, revenues from its development

sites as well as other Park revenues provide the Park with funding to cover its expenses. To date,

the Park has four active real estate development projects: 1 Brooklyn Bridge Park, Pier 1

Development (Pierhouse), J ohn Street development, and Empire Stores. (Exhibit G, Pages

10-11).

17

Once these four projects and the Pier 6 project are completed, Brooklyn Bridge Park is

estimated to cost $12 million per year to operate and maintain, with an approximate $210 million

in total to cover one-time maritime infrastructure repair expenses related to the Parks waterfront

piers. (See Pier 6 Development Sites RFP Update, dated April 10, 2014 (RFP Update),

Exhibit V, Page 4). The Park projects that revenue from the four development sites awarded to

date will cover 92% of annual operating expenses (approximately $11 million of the $12 million

project annual budget upon completion) and 38% of maritime expenses (approximately $80

million of $210 million in projected expense over the next 50 years). (Exhibit V, Page 5).

Revenue from the Pier 6 development sites is expected to cover the remainder of the operating

and maritime expenses. (Exhibit V, Page 5).

Pier 6 is one of the most valuable development sites in Brooklyn and the condominium

prices in Brooklyn Bridge Park are rapidly increasing. Since the 2005 FEIS, there have been

dramatic increases in real estate prices and land value in Brooklyn Bridge Park. The Pier 1 and

Pier 6 development sites were projected to sell for $750 and $725 per square foot in the FEIS in

2005. (See FEIS, App. C., Exhibit W, Page 3). However, according to the Wall Street

J ournal, prices for the Pierhouse development site of Pier 1 have been raised six times since

launch and are 25% higher than the developer projected last fall. (See J osh Barbanel,

Brooklyn Park Condos Sizzle, Exhibit X, Page 1). The condominium units have sold at an

unusually fast pace at an average price of $1,800 per square foot, a record for Brooklyn.

(Exhibit X, Page 1).

Obviously, the projected estimates of $750 or $725 per square foot are far below the

current $1,800 per square foot sale price in Brooklyn Bridge Park. This difference in sales price

implies that the potential revenue from these two developments sites is much more than what

18

was projected in the 2005 FEIS. Meanwhile, the annual maintenance and operations budget has

only modestly increased since 2005. According to Appendix C of the 2005 FEIS, the annual

budget was $15.2 million, while the BBP Financial Model Update in October 2013 stated that

the projected expenses would be $16 million. (Exhibit W, Page 56); (See BBP Financial

Model Update, dated October 21, 2013 (BBP FMP), Exhibit Y, Page 4).

If the Park meets its funding threshold through property taxes of the existing four

development projects and market conditions thereby allow for less development to support the

Parks needs, the Pier 6 housing development must be reduced or may even be unnecessary.

Furthermore, BBPDCs inclusion of affordable housing in the Pier 6 development

scheme contributes to the idea that the Parks budget for maintenance and operations can be met

without total completion of the proposed Pier 6 development plan. BBPDC mandated that

130,000 gross square feet (approximately 30% of the apartments) be allocated to affordable

housing. (Exhibit G, Page 9). Assuming a sale price of $1,800 (the market value of square

footage in Brooklyn Bridge Park) and a 15% loss factor to calculate net saleable square feet, the

Park could be foregoing almost $200 million in revenue in order to accommodate affordable

housing. This is clearly illogical and BBPDC has failed to provide any rationale for the

inclusion of this less than profitable housing scheme in the RFP.

If Brooklyn Bridge Park can afford to forego millions of dollars by including affordable

housing in the Pier 6 development, then Brooklyn Bridge Park has enough funding to reduce

development on Pier 6 instead of injecting affordable housing into a scheme that only

contemplates a self-sustaining Park of minimal development. See ESDC Brief, at 16.

Because these finances are a change in circumstance and an example of newly discovered

19

information since the FEIS in 2005, the Parks finances should be evaluated in a Supplemental

EIS to determine the necessity of Pier 6s development.

b. School Overcrowding

Chapter 4 of the FEIS evaluated the effects the Project would have on community

facilities, such as schools. (See FEIS, Chapter 4, Exhibit Z). The FEIS concluded that the

proposed project would not have significant adverse impacts on community facilities. (Exhibit

Z, Page 4-1). The FEIS stated even with the student-age population generated by the proposed

project, there would be sufficient capacity in the public school system to accommodate this

added demand. (Exhibit Z, Page 4-1).

The Brooklyn Bridge Park project site lies within the boundaries of Region 2 of

Community School District 13 (CSD 13). (Exhibit Z, Page 4-2). According to the

Department of Educations (DOE) enrollment and capacity figures from the 2003-2004 school

year, the elementary schools in this Region were operating at approximately 65% capacity.

(Exhibit Z, Page 4-2).

According to the FEIS, all of the children living in the proposed residential buildings on

the project site would be zoned to attend public schools in CSD 13. (Exhibit Z, Page 4-7).

Even with the estimated additional 327 elementary school students from the Project, the FEIS

calculated that elementary schools in Region 2 of CSD 13 would only operate at 75% capacity in

2012. (Exhibit Z, Page 4-7).

However, according to the New York State School Construction Authority, the

elementary schools listed in the FEIS are, in fact, operating over capacity and overcrowded. (See

New York State School Construction Authority, 2012-2013 Enrollment, Capacity and Utilization

Report (NYSSCA Report 2012), Exhibit 1, Pages 60-61); New York State School

20

Construction Authority, 2013-2014 Enrollment, Capacity and Utilization Report, Book One

(NYSSCA Report 2013), Exhibit 2, Pages 94-95).

P.S. 8 and P.S. 46 are two elementary schools listed in the FEIS that are operating over

capacity. For example, in the 2012-2013 school year, P.S. 8 operated at 119% capacity while

P.S. 46 operated at 103% capacity. (Exhibit 1, Pages 60-61). Overall, the schools listed in the

FEIS for CSD 13 operated at 90% capacity in the 2012-2013 school year. (Exhibit 1, Pages

60-61). This 15% difference in operational capacity demonstrates that the FEIS drastically

underestimated the significant adverse impact the Project has on schools.

Furthermore, the Project continues to have an increasingly significant adverse impact on

surrounding schools. For example, in the 2013-2014 school year, P.S. 8 operated at 142%

capacity while P.S. 46 operated at 103% capacity. (Exhibit 2, Pages 94-95). Overall, the

schools listed in the FEIS for CSD 13 operated at 95% capacity in the 2013-2014 school year

and were significantly overcrowded. (Exhibit 2, Pages 94-95).

Even though the Project currently has only one completed development, the significant

overcrowding of schools demonstrates that the Project already has a significant adverse impact

on surrounding schools in addition to the significant adverse impact from population increases in

the surrounding neighborhood. Moreover, the three developments currently undergoing

construction have yet to contribute more elementary school students into this already

overcrowded school system. (Exhibit G, Pages 10-11). It follows that the Project would

continue to have a significant adverse impact on school capacity, even without the inclusion of

the Pier 6 development.

21

The overcrowding of schools is newly discovered information that has arisen since the

FEIS was executed in 2005 and therefore the Projects significant adverse impact on community

facilities should be reevaluated in a Supplemental EIS.

In sum, given the effect of Superstorm Sandy, the substantial increase in vehicular and

pedestrian traffic, the change in Park finances, and the increase in school overcrowding,

Petitioners have demonstrated that ESDC failed to identify the areas of environmental concern

and did not take a hard look at them. 825 N.Y.S.2d at 356. Therefore, ESDC must prepare or

cause a Supplemental EIS to be prepared to analyze these changed circumstances and this newly

acquired information before proceeding with the Pier 6 development.

B. ESDC Has Violated The UDCA Because the RFP Contains an Impermissible

Alteration to the Project Inconsistent with the GPP

The determination to release the RFP was arbitrary and capricious, affected by an error in

law and an abuse of discretion because the inclusion of affordable housing is an impermissible

alteration to the Project and a violation of the UDCA.

The UDCA of 1968 created the UDC for the purpose of improving New York States

economy through various development projects. N.Y. Unconsol. Law 6252. UDC, doing

business now as ESDC, is subject to the provisions of the UDCA. Id. at 6262. BBPDC, as a

subsidiary of ESDC, is also subject to the provisions of the UDCA. (Exhibit D, Page 2).

According to the UDCA, ESDC must provide notice and opportunity for comment on

proposed changes to the Project Plan before commencing the . . . alteration or improvement of

any project. N.Y. Unconsol. Law 6266(2). After providing notice to the community of these

proposed changes, the corporation must conduct a public hearing pursuant to such notice and if

any substantive negative testimony or comment is received at such public hearing, the

22

corporation may, after due consideration of such testimony and comment, affirm, modify, or

withdraw the plan. Id.

As conceded by ESDC in Develop Dont Destroy Brooklyn v. Empire State Dev. Corp.,

914 N.Y.S.2d 572, In practice . . . when the need for modification arises, ESDC adopts

amendments to the GPP to incorporate the relevant modifications; and thereafter affirms a

modified GPP, following the statutory public hearing process for the initial adoption of such a

plan. (See Respondents Memorandum of Law, dated November 12, 2009 (ESDC MOL),

Exhibit 3, Page 7).

The GPP never contemplated affordable housing. The GPP has only previously

contemplated revenue-generating commercial or residential developments in the Park.

As noted by the 2006 GPP:

[A] need of the Project is to include program components that are

appropriate commercial uses that can generate sufficient funds to

support the annual maintenance and operations of the Project.

(Exhibit D, Page 2).

The cost of operations, maintenance and upkeep would be paid out

of the revenues received from appropriate commercial activities

and residential projects located within the Project.

(Exhibit D, Page 3).

[T]he MOU requires the Project to be self-sufficient by providing

for its own ongoing maintenance and operations. Therefore,

appropriate commercial revenue producing activities would be

located within the Project to support its annual maintenance and

operations.

(Exhibit D, Page 5).

The 2002 MOU . . . outlining conditions for the creation and

operation of the Project, requires that the park be financially self-

sustaining, that is, that the parks annual operation and

maintenance budget be provided by revenue generated from within

the Project.

23

(Exhibit D, Page 12).

This revenue-generating commercial and residential mandate must be considered in light

of the BBPDCs promises to have as minimal development as necessary to fund the Park.

(Exhibit F, Page 16; Exhibit U, Page 1-18).

The GPP lacks any mention whatsoever of affordable housing units. In fact, the only

kind of housing units the FEIS analyzed is market rate housing units. (Exhibit Z, Pages 4-1

and 4-7). Since affordable housing units would, at best, be below market rate, this inclusion of

affordable housing in the development of Pier 6 would be an alteration to the Project that is

subject to the notice and comment procedure outlined in the UDCA. Enjoining the BBPDC from

accepting or approving Pier 6 proposals until formally modifying the GPP is the appropriate

remedy under the UDCA.

The UDCA implicitly grants municipalities the power to require a development

corporation to perform Project work according to the Project Plan provisions and the power to

subject said corporation to penalties when the corporation does not act in accordance with the

terms of the Project Plan. N.Y. Unconsol. Law 6266(3). Enjoining the BBPDC from

accepting or approving Pier 6 proposals that include affordable housing would also be an

appropriate penalty incidental to the proper enforcement of the project plan, since the plan

makes no mention of including affordable housing in Brooklyn Bridge Park. Id.

Moreover, ESDC provided no rationale whatsoever for the inclusion of affordable

housing in the Pier 6 development. Petitioners strongly object to BBPDCs attempts to bypass

the administrative review process by sneaking in this significant alteration in the later stages of

the Project and not providing a basis, let alone a justifiable basis, for its inclusion. Accordingly,

Petitioners respectfully request that BBPDC be directed to act in conformance with the

requirements of the UDCA and hold a duly noticed public hearing on such proposed

24

modifications and to provide an opportunity for the general public to submit oral and written

comments on the inclusion of affordable housing in Brooklyn Bridge Park.

III. PETITIONERS WILL SUFFER IRREPARABLE HARM ABSENT

INJUNCTIVE RELIEF

Irreparable injury, for purposes of equity, has been held to mean any injury for which

money damages are insufficient. E.g., Walsh v. Design Concepts, Ltd., 221 A.D.2d 454, 455, 633

N.Y.S.2d 579, 580 (2d Dept 1995); Klein, Wagner & Morris v. Lawrence A. Klein, P.C., 186

A.D.2d 631, 633, 588 N.Y.S.2d 424, 426 (2d Dept 1992).

Petitioners would be irreparably harmed by construction of a development based on the

illegitimate parameters set forth in the RFP. Specifically, the RFP improperly includes the

mandate of affordable housing, and the Respondents failed to adequately address adverse

environmental impacts in a Supplemental EIS before releasing the RFP.

Absent injunctive relief, the planning and construction of Pier 6 would commence

according to the illegitimate parameters of the RFP. Petitioners would be subjected to an

unnecessarily oversized development on Pier 6. Respondents made promises that only as much

development as financially necessary would be constructed. (Exhibit F, Pages 15-16). As

frequent users of the Park and advocates for green space, Petitioners would be harmed by the

unnecessary overdevelopment of the Park and the unnecessary reduction of the Parks natural

resources.

Moreover, Petitioners would be harmed by the Pier 6 developments adverse

environmental impacts on the surrounding neighborhood that were not adequately addressed in a

Supplemental EIS. Respondents have not analyzed the changed circumstances and newly

discovered information relating to the Project since the 2005 FEIS and have not even attempted

to mitigate these significant adverse environmental impacts accordingly. Petitioners will be

25

irreparably harmed by the unnecessary increase in vehicular and pedestrian traffic and the

unnecessary increase of students into a school region that is already experiencing significant

school overcrowding.

As such, Petitioners would be irreparably harmed absent injunctive relief.

IV. THE BALANCE OF EQUITIES TILTS IN PETITIONERS FAVOR

A balancing of the equities requires that the motion be granted if the irreparable injury to

be sustained by plaintiff is more burdensome than the harm caused to defendants through

imposition of the injunction. E.g., Fischer v. Deitsch, 168 A.D.2d 599, 563 N.Y.S.2d 836 (2d

Dept 1990); Nassau Roofing & Sheet Metal Co. v. Facilities Development Corp., 70 A.D.2d

1021, 418 N.Y.S.2d 216 (3d Dept 1979).

A preliminary injunction has been held to be warranted in a case in which irreparable

harm to the plaintiff was debatable, but the balance of equities was in plaintiffs favor; plaintiff

made a strong showing on the merits that the injunction would merely maintain the status quo.

See Danae Art International Inc. v. Stallone, 163 A.D.2d 81 (1

st

Dept 1990).

Essentially, the purpose of a preliminary injunction is to maintain the status quo pending

ultimate determination. See Walker Memorial Baptist Church v. Saunders, 285 N.Y 462, 474;

Bachman v. Harrington, 184 N.Y. 458, 464. That is the basis of the instant proceeding.

If the injunction were granted, Respondents would merely be required to abide by the

governing law (SEQRA and UDCA), and be delayed in the construction of the Pier 6

development.

Respondents inconvenience is far outweighed by the irreparable harm Petitioners will

suffer if an injunction is not granted. If the injunction were not granted, the planning and

26

construction of Pier 6 according to the illegitimate parameters of the RFP would proceed and it

will become increasingly more difficult to undo once the process moves forward.

Since the Pier 6 development is still only in the RFP phase and construction has yet to

begin, the preliminary injunction would maintain the status quo until Petitioners claims can

ultimately be decided. See, Fischer, 168 A.D.2d 599; Nassau Roofing & Sheet Metal Co., 70

A.D.2d 1021; Walker Memorial Baptist Church, 285 N.Y 462; Bachman, 184 N.Y. 458.

CONCLUSION

For all of the foregoing reasons, Petitioners application and petition should be granted in

its entirety.

ABRAMS, FENSTERMAN, FENSTERMAN, EISMAN,

FORMATO, FERRARA & WOLF, LLP

By: ______________________

Frank V. Carone

Attorneys for Petitioners

1 MetroTech Center, Suite 1704

Brooklyn, New York 11201

(718) 215-5300

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Save The View Now Presentation at BBP CACDocument14 pagesSave The View Now Presentation at BBP CACBrooklyn Heights BlogNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- 2015 K Admissions Info SessionsDocument15 pages2015 K Admissions Info SessionsBrooklyn Heights BlogNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Bugle Bugle Newspaper Special Edition #1Document4 pagesBugle Bugle Newspaper Special Edition #1Brooklyn Heights BlogNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- People For Green Space Foundation, Inc.: 1 Metrotech, Suite 1704, Brooklyn, NY 11201Document3 pagesPeople For Green Space Foundation, Inc.: 1 Metrotech, Suite 1704, Brooklyn, NY 11201Brooklyn Heights BlogNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Ps8overcrowdingletterpetition DoeDocument1 pagePs8overcrowdingletterpetition DoeBrooklyn Heights BlogNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- OSC - People For Green SpaceDocument2 pagesOSC - People For Green SpaceBrooklyn Heights BlogNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Ps8overcrowdingletterpetition Newconstruction PDFDocument1 pagePs8overcrowdingletterpetition Newconstruction PDFBrooklyn Heights BlogNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- People For Greenspace Presentation On BBP FinancingDocument30 pagesPeople For Greenspace Presentation On BBP FinancingBrooklyn Heights BlogNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Cranberry Fair Flyer FinalDocument1 pageCranberry Fair Flyer FinalBrooklyn Heights BlogNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Pier 6 RFP Responses (2014-08-06)Document114 pagesPier 6 RFP Responses (2014-08-06)brooklynpaperNo ratings yet

- Origins Brooklyn Bridge ParkDocument91 pagesOrigins Brooklyn Bridge ParkBrooklyn Heights BlogNo ratings yet

- Final Petition - People For Green SpaceDocument21 pagesFinal Petition - People For Green SpaceBrooklyn Heights BlogNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Brooklyn Ten Year Sales StudyDocument8 pagesBrooklyn Ten Year Sales StudyBrooklyn Heights BlogNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Pier 6 RFP Release 5.13.14Document3 pagesPier 6 RFP Release 5.13.14Brooklyn Heights BlogNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Doh Letter Closing LichDocument1 pageDoh Letter Closing LichBrooklyn Heights BlogNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Strabone SUNY Testimony 20131115Document2 pagesStrabone SUNY Testimony 20131115Brooklyn Heights BlogNo ratings yet

- BPL Brooklyn Heights RFPDocument71 pagesBPL Brooklyn Heights RFPBrooklyn Heights BlogNo ratings yet

- CAC RFP Briefing - Brooklyn Heights LibraryDocument49 pagesCAC RFP Briefing - Brooklyn Heights LibraryBrooklyn Heights BlogNo ratings yet

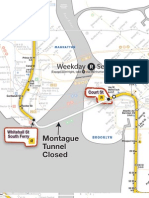

- R MontagueUnderRiverTubeDocument2 pagesR MontagueUnderRiverTubeBrooklyn Heights BlogNo ratings yet

- Breakdown of The Sustainability PlanDocument6 pagesBreakdown of The Sustainability PlanBrooklyn Heights BlogNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Montague Street 1976 PlanDocument71 pagesMontague Street 1976 PlanBrooklyn Heights Blog100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Empire Stores Cac PresentationDocument78 pagesEmpire Stores Cac PresentationBrooklyn Heights BlogNo ratings yet

- NYC Hurricane MapDocument1 pageNYC Hurricane MapJen ChungNo ratings yet

- Brooklyn Heights DistrictDocument5 pagesBrooklyn Heights DistrictBrooklyn Heights BlogNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- I 130 Cover Letter SampleDocument7 pagesI 130 Cover Letter Samplekylopuluwob2100% (3)

- Criminal Procedure Law II (Sentencing I)Document28 pagesCriminal Procedure Law II (Sentencing I)Hairi ZairiNo ratings yet

- Florida General Lines Agent Exam Questions and Answers 2023Document44 pagesFlorida General Lines Agent Exam Questions and Answers 2023Debs MaxNo ratings yet

- DownloadedDocument6 pagesDownloadedHaaj J MohammedNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- TN Apartment Ownership Rules 1997Document13 pagesTN Apartment Ownership Rules 1997Sreenadha Bezawada100% (1)

- Cyber Law of IndiaDocument14 pagesCyber Law of IndiaSatya KumarNo ratings yet

- FALSE: Accusations On Atty. Chel Diokno of Disbarment Cases ClaimDocument4 pagesFALSE: Accusations On Atty. Chel Diokno of Disbarment Cases ClaimPrincess Faye De La VegaNo ratings yet

- The Role of Institutional Quality in The InternatiDocument22 pagesThe Role of Institutional Quality in The InternatiAinotna odnilagNo ratings yet

- Dharangadhara Chemical Works LTD Vs State of Saurashtra 23111956 SCDocument8 pagesDharangadhara Chemical Works LTD Vs State of Saurashtra 23111956 SCIshitaNo ratings yet

- ERC Procedure COC ApplyDocument2 pagesERC Procedure COC Applygilgrg526No ratings yet

- Note On DPC. 2-1-23Document10 pagesNote On DPC. 2-1-23Molika AgrawalNo ratings yet

- Resuena, Et Al. vs. Court of Appeals and Juanito Boromeo, SR., G.R. No. 128338, March 28, 2005Document2 pagesResuena, Et Al. vs. Court of Appeals and Juanito Boromeo, SR., G.R. No. 128338, March 28, 2005Edeniel Cambarihan100% (1)

- Final Report: House of Assembly Select Committee On The House of Assembly Restoration BillDocument137 pagesFinal Report: House of Assembly Select Committee On The House of Assembly Restoration BillkaiNo ratings yet

- CustodyDocument9 pagesCustodyNawalRamayNo ratings yet

- Philippine Indigenous People and Their Customary LawsDocument66 pagesPhilippine Indigenous People and Their Customary LawsJohana Miraflor100% (1)

- Decree 10/04 Angolan Petroleum Activities LawDocument38 pagesDecree 10/04 Angolan Petroleum Activities LawDebbie CollettNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- DD Form 93 Spouse BriefDocument3 pagesDD Form 93 Spouse Briefeaglefrg100% (1)

- Aliling V Wide Wide WorldDocument5 pagesAliling V Wide Wide WorldAngela Marie AlmalbisNo ratings yet

- Contract Import ShablonDocument4 pagesContract Import ShablonAljona GeraščenkoNo ratings yet

- Plea Bargaining Motion To Set FOR EARLY Hearing ALAN DAVIDSON ALMENDRASDocument3 pagesPlea Bargaining Motion To Set FOR EARLY Hearing ALAN DAVIDSON ALMENDRASRoberto Iñigo SanchezNo ratings yet

- CIR vs. Metro StarDocument1 pageCIR vs. Metro StarRodney SantiagoNo ratings yet

- Eight Mile Style, LLC Et Al v. Apple Computer, Incorporated - Document No. 35Document8 pagesEight Mile Style, LLC Et Al v. Apple Computer, Incorporated - Document No. 35Justia.comNo ratings yet

- Master Circular On AIFsDocument113 pagesMaster Circular On AIFsIshani MukherjeeNo ratings yet

- Murillo vs. Bautista - No Digest YetDocument3 pagesMurillo vs. Bautista - No Digest YetBea Cape100% (1)

- Ghana Treaty Manual 2009Document41 pagesGhana Treaty Manual 2009Osagyefo Oliver Barker-VormaworNo ratings yet

- (G.R. NO. 151900: August 30, 2005) CHRISTINE CHUA, Petitioners, v. JORGE TORRES and ANTONIO BELTRAN, RespondentsDocument2 pages(G.R. NO. 151900: August 30, 2005) CHRISTINE CHUA, Petitioners, v. JORGE TORRES and ANTONIO BELTRAN, RespondentsJamiah Obillo HulipasNo ratings yet

- CA Erred in Ruling Dispute Intra-CorporateDocument1 pageCA Erred in Ruling Dispute Intra-CorporatePan Correo100% (3)

- 1 PointDocument37 pages1 PointFritzy Gwen BabaNo ratings yet

- Pad369 Slide PresentationDocument19 pagesPad369 Slide Presentationizatul294No ratings yet

- Questions AZB & PartnersDocument1 pageQuestions AZB & PartnersKunwarbir Singh lohatNo ratings yet

- The Rights of Nature: A Legal Revolution That Could Save the WorldFrom EverandThe Rights of Nature: A Legal Revolution That Could Save the WorldRating: 5 out of 5 stars5/5 (1)

- Art of Commenting: How to Influence Environmental Decisionmaking With Effective Comments, The, 2d EditionFrom EverandArt of Commenting: How to Influence Environmental Decisionmaking With Effective Comments, The, 2d EditionRating: 3 out of 5 stars3/5 (1)

- Principles of direct and superior responsibility in international humanitarian lawFrom EverandPrinciples of direct and superior responsibility in international humanitarian lawNo ratings yet