Professional Documents

Culture Documents

ICRA Report 2 Wheelers

Uploaded by

Mayank JainCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICRA Report 2 Wheelers

Uploaded by

Mayank JainCopyright:

Available Formats

ICRA LIMITED P a g e | 1

si

Corporate Ratings

Anjan Deb Ghosh

+91 22 3047 0006

aghosh@icraindia.com

Contacts:

Subrata Ray

+91 22 3047 0027

subrata@icraindia.com

Jitin Makkar

+91 124 4545 368

jitinm@icraindia.com

ICRA RESEARCH SERVICES

ICRA RATING FEATURE

Indian Two-Wheeler Industry

Near term growth pressures on both domestic and exports front

March 2013

ICRA LIMITED P a g e | 2

1. Overview

2. Is the Indian two-wheeler industry staring at the possibility of sluggish volume growth over the next few years?

Past Revisited: What had caused the sharp slump in two-wheeler sales in 2007-08?

What has changed in the last five years that poses risk to two-wheeler industry growth?

Medium term demand drivers

3. The promise of exports

How did the three key two-wheeler markets of the world perform in CY2012?

Trend in two-wheeler sales volumes in key markets

Geographical mix of global two-wheeler volumes

Bajaj Auto: Bearing the mantle of two-wheeler exports from India

Hero MotoCorp wants to make it big too, but challenges galore

4. Segmental Analysis of the Two-Wheeler Industry

Trend in two-wheeler segment volume mix

Trend in segment-wise sales volume growth of two-wheelers

5. Motorcycles Segment

Trend in Sales Volumes

Trend in Market Share Movement

Medium Term Outlook

6. Scooters Segment

Trend in Sales Volumes

Trend in Market Share Movement

Medium Term Outlook

7. Reality Check: Buying decision from the standpoint of total cost of ownership

Product Price Comparison

Annual Running Cost Comparison (Fuel Economy, Servicing Costs, Spare Parts Costs, Resale Value)

8. Each OEM navigating a specific set of challenges! What are they?

9. Quarterly Performance trend of listed two-wheeler OEMs

Hero MotoCorp Limited

Bajaj Auto Limited

TVS Motor Company Limited

10. Annexure Monthly sales Volume Trends.31

WHATS INSIDE?

ICRA LIMITED P a g e | 3

OVERVIEW

INDIAN TWO-WHEELER INDUSTRY

Near term growth pressures on both domestic and exports front

March 2013

Volume Trajectory

With domestic volume growth of 3.9% YoY and exports volume growth of minus (-) 1.1% YoY in 11m 2012-13, the Indian two-wheeler (2W) is currently amidst a

slowdown phase last experienced in 2007-08/ 2008-09. Several factors including high inflation, firm interest rates, rising petrol prices, besides weak monsoons have

been dampening demand in the domestic market over last several quarters. At the same time, overseas sales have been adversely impacted by increase in interest

rates in several target countries, increase in import duty in Sri Lanka, trade restrictions imposed by Argentina and dollar sales embargo with Iran. This apart, the

reduction in incentives available to 2W exporters, twice over the last 18 months, has persuaded Indian 2W OEMs to partially hike product prices in overseas markets,

adding to the pressure on export volumes. One noteworthy statistic, however, is that based on CY2012 volumes, India is now the largest 2W market in the world with

sales volumes of 13.8 million units (domestic), having overtaken China at 12.6 million units. In fact, while 2W sales volumes in India grew by 5.8% in CY2012 over the

previous year, the domestic demand in both China and Indonesia (the second and third largest 2W markets, respectively) shrunk by 10.0% and 9.2%, respectively.

Growth Constituents

The deceleration in volume growth of the domestic 2W industry, 3.9% YoY in 11m 2012-13, is largely attributable to the motorcycles segment which grew by 0.9%YoY;

even as the scooters segment posted 16.2% YoY expansion during this period, albeit at a smaller base. With this, the share of the scooters segment in the domestic

2W industry volumes increased to 21.1% in 11m 2012-13 from 17.5% in 2010-11. Within the motorcycles segment, while the entry and executive segments comprising

of 100cc bikes and the premium segment comprising of 150cc bikes have been experiencing anaemic demand, the 125cc segment (contribution of 20% to domestic

motorcycle sales in 11m 2012-13) has been a positive outlier recording a volume growth of 29.7% YoY in 11m 2012-13, benefitting both from new model launches as

also the trend in up-trading and down-trading from the respective lower and upper price/ performance segments.

Market Share Movement

The last year and a half has been marked by greater traction in new product launches and focus on expansion of customer touch points by most 2W OEMs. However,

a dull demand environment restricted the ability of most OEMs to leverage the supply-side efforts adequately. As demand levels failed to impress, the 2W OEMs

resorted to even more supply-side doses viz., attractive financing schemes, discounts on insurance for limited period etc. The OEMs had generally not resorted to

these latter set of tools in 2009-10, 2010-11 and 2011-12 and their return to use as a promotional lever is indicative of the weak demand conditions. In terms of

market share, while Hero MotoCorp continues to remain the distant leader with a share of 43.0% in 11m 2012-13, it saw its share erode by 220 basis points (bps)

during this period compared to the corresponding previous. A large part of this market share set-back was caused by weakness in Hero MotoCorps sales volumes in

the 100cc segment, even as the OEM expanded its market share in some of the other segments like the relatively faster growing scooters segment and the 125cc

segment of bikes, by virtue of new product launches. The other two leading Indian OEMs too, namely, Bajaj Auto and TVS Motor experienced decline in their

respective share in the domestic 2W market in 11m 2012-13. Honda, however, continued to demonstrate steady gains in market share across the board and

strengthened its market share from 14.9% in 2011-12 to 18.6% in 11m 2012-13. Having overtaken TVS volumes in October 2011 and having achieved parity with Bajaj

Autos volumes in recent months, Honda is now the second largest 2W OEM in India. In ICRAs view, the ongoing environment of weak demand is likely to have a

dissimilar impact on each player depending on the respective OEMs product portfolio mix and marketing strategy. Hero MotoCorps adeptness at protecting its 100cc

segment moat, Bajaj Autos ability to maintain a consistent brand strategy, TVS ability to plug its product portfolio gaps and Hondas success in scaling up its

distribution and service network will govern the overall domestic 2W market share distribution in the times to come.

ICRA LIMITED P a g e | 4

Capacity Expansions and Investments

Several industry participants have announced greenfield capacity expansion plans in recent periods: Hero MotoCorp plans to invest Rs. 15 billion over the next two

years towards establishing facilities in Rajasthan and Gujarat; Honda is in the process of setting-up its third manufacturing facility in Karnataka; Yamaha too is setting-

up a new plant in Tamil Nadu at an investment of Rs. 15 billion. Together, these three OEMs will add 4 million units of additional 2W capacity over the next two years,

representing 22% addition on existing industry capacity. This apart, the new product development/ refurbishment expenses are also expected to increase as OEMs

scramble to launch new products in a bid to generate consumer interest and sustain market share. ICRA expects these large investments to exert pressure on the

industrys profitability metrics over the near term as volume growth moderation further takes root in the absence of immediate demand triggers.

Outlook

Overall, ICRA expects the domestic 2W industry to report a moderate volume growth of 4-5% in 2012-13 as demand slowdown as well as base effect catches up with

the industry that has demonstrated a strong volume expansion over the last three years at cumulative annual growth rate (CAGR) of 21.8%. Over the medium term,

the 2W industry is expected to report a volume CAGR of 8-9% to reach a size of 22-23 million units (domestic + exports) by 2016-17 (our longer-term growth forecast

remains at 9-11%), as we believe the various structural positives associated with the domestic 2W industry including favourable demographic profile, moderate 2W

penetration levels (in relation to several other emerging markets), under developed public transport system, growing urbanization, strong replacement demand and

moderate share of financed purchases remain intact; as also the large opportunity available to grow presence in overseas markets, mainly Africa and Latin America.

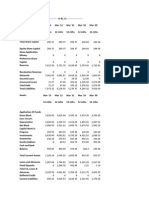

Table 1: Trend in Sales Volumes of Indian 2W Industry

Volumes (Units, Nos.) YoY Growth (%)

Domestic 2009-10 2010-11 2011-12 11m, 2012-13 2009-10 2010-11 2011-12 11m, 2012-13

Motorcycles 7,341,122 9,013,888 10,096,062 9,305,708 25.9% 22.8% 12.0% 0.9%

Scooters 1,462,534 2,057,604 2,562,841 2,673,649 27.4% 40.7% 24.6% 16.2%

Mopeds 564,584 697,418 776,866 717,333 30.9% 23.5% 11.4% 2.2%

Total Domestic 9,370,951 11,768,910 13,435,769 12,696,690 26.0% 25.6% 14.2% 3.9%

Exports 2009-10 2010-11 2011-12 11m, 2012-13 2009-10 2010-11 2011-12 11m, 2012-13

Motorcycles 1,102,978 1,474,678 1,847,517 1,723,961 13.6% 33.7% 25.3% -0.6%

Scooters 30,125 50,646 90,605 83,401 16.7% 68.1% 78.9% -4.1%

Mopeds 6,905 6,295 9,076 3,298 -5.4% -8.8% 44.2% -63.4%

Total Exports 1,140,058 1,531,619 1,947,198 1,810,660 13.5% 34.3% 27.1% -1.0%

Source: SIAM

ICRA LIMITED P a g e | 5

Please contact ICRA to get a copy of the full report

CORPORATE OFFICE

Building No. 8, 2nd Floor,

Tower A, DLF Cyber City, Phase II,

Gurgaon 122002

Ph: +91-124-4545300, 4545800

Fax; +91-124-4545350

REGISTERED OFFICE

1105, Kailash Building, 11

th

Floor,

26, Kasturba Gandhi Marg,

New Delhi 110 001

Tel: +91-11-23357940-50

Fax: +91-11-23357014

CHENNAI

Mr. Jayanta Chatterjee

Mobile: 9845022459

Mr. D. Vinod

Mobile: 9940648006

5th Floor, Karumuttu Centre,

498 Anna Salai, Nandanam,

Chennai-600035.

Tel: +91-44-45964300,

24340043/9659/8080

Fax:91-44-24343663

E-mail: jayantac@icraindia.com

d.vinod@icraindia.com

HYDERABAD

Mr. M.S.K. Aditya

Mobile: 9963253777

301, CONCOURSE, 3rd Floor,

No. 7-1-58, Ameerpet,

Hyderabad 500 016.

Tel: +91-40-23735061, 23737251

Fax: +91-40- 2373 5152

E-mail: adityamsk@icraindia.com

MUMBAI

Mr. L. Shivakumar

Mobile: 9821086490

3rd Floor, Electric Mansion,

Appasaheb Marathe Marg, Prabhadevi,

Mumbai - 400 025

Ph : +91-22-30470000,

24331046/53/62/74/86/87

Fax : +91-22-2433 1390

E-mail: shivakumar@icraindia.com

KOLKATA

Ms. Vinita Baid

Mobile: 9007884229

A-10 & 11, 3rd Floor, FMC Fortuna,

234/ 3A, A.J.C. Bose Road,

Kolkata - 700020

Tel: +91-33-22876617/ 8839,

22800008, 22831411

Fax: +91-33-2287 0728

E-mail: vinita.baid@icraindia.com

PUNE

Mr. L. Shivakumar

Mobile: 9821086490

5A, 5th Floor, Symphony,

S. No. 210, CTS 3202,

Range Hills Road, Shivajinagar,

Pune-411 020

Tel : +91- 20- 25561194,

25560195/196,

Fax : +91- 20- 2553 9231

E-mail: shivakumar@icraindia.com

GURGAON

Mr. Vivek Mathur

Mobile: 9871221122

Building No. 8, 2nd Floor,

Tower A, DLF Cyber City, Phase II,

Gurgaon 122002

Ph: +91-124-4545300, 4545800

Fax; +91-124-4545350

E-mail: vivek@icraindia.com

AHMEDABAD

Mr. Animesh Bhabhalia

Mobile: 9824029432

907 & 908 Sakar -II, Ellisbridge,

Ahmedabad- 380006

Tel: +91-79-26585049/2008/5494,

Fax:+91-79- 2648 4924

E-mail: animesh@icraindia.com

BANGALORE

Mr. Jayanta Chatterjee

Mobile: 9845022459

'The Millenia', Tower B,

Unit No. 1004, 10th Floor,

Level 2, 12-14, 1 & 2, Murphy Road,

Bangalore - 560 008

Tel: +91-80-43326400,

Fax: +91-80-43326409

E-mail: jayantac@icraindia.com

ICRA LIMITED P a g e | 6

ICRA Limited

An Associate of Moody's Investors Service

CORPORATE OFFICE

Building No. 8, 2

nd

Floor, Tower A; DLF Cyber City, Phase II; Gurgaon 122 002

Tel: +91 124 4545300; Fax: +91 124 4545350

Email: info@icraindia.com, Website: www.icra.in

REGISTERED OFFICE

1105, Kailash Building, 11

th

Floor; 26 Kasturba Gandhi Marg; New Delhi 110001

Tel: +91 11 23357940-50; Fax: +91 11 23357014

Branches: Mumbai: Tel.: + (91 22) 24331046/53/62/74/86/87, Fax: + (91 22) 2433 1390 Chennai: Tel + (91 44) 2434 0043/9659/8080, 2433 0724/ 3293/3294, Fax

+ (91 44) 2434 3663 Kolkata: Tel + (91 33) 2287 8839 /2287 6617/ 2283 1411/ 2280 0008, Fax + (91 33) 2287 0728 Bangalore: Tel + (91 80) 2559 7401/4049 Fax

+ (91 80) 559 4065 Ahmedabad: Tel + (91 79) 2658 4924/5049/2008, Fax + (91 79) 2658 4924 Hyderabad: Tel +(91 40) 2373 5061/7251, Fax + (91 40) 2373

5152 Pune: Tel + (91 20) 2552 0194/95/96, Fax + (91 20) 553 9231

Copyright, 2013 ICRA Limited. All Rights Reserved.

All information contained herein has been obtained by ICRA from sources believed by it to be accurate and reliable. Although reasonable care has been taken to ensure that the

information herein is true, such information is provided 'as is' without any warranty of any kind, and ICRA in particular, makes no representation or warranty, express or

implied, as to the accuracy, timeliness or completeness of any such information. All information contained herein must be construed solely as statements of opinion, and ICRA

shall not be liable for any losses incurred by users from any use of this publication or its contents.

You might also like

- E.R. Hooton, Tom Cooper - Desert Storm - Volume 2 - Operation Desert Storm and The Coalition Liberation of Kuwait 1991 (Middle East@War) (2021, Helion and CompanyDocument82 pagesE.R. Hooton, Tom Cooper - Desert Storm - Volume 2 - Operation Desert Storm and The Coalition Liberation of Kuwait 1991 (Middle East@War) (2021, Helion and Companydubie dubs100% (5)

- A DETAILED LESSON PLAN IN TLE DraftingDocument16 pagesA DETAILED LESSON PLAN IN TLE DraftingJude PellerinNo ratings yet

- E - Bike Market.Document86 pagesE - Bike Market.masterineducation100% (1)

- Permit Part-2 Process-Oriented Permit in SAPDocument13 pagesPermit Part-2 Process-Oriented Permit in SAPsachinWebDNo ratings yet

- EXIDEIND Stock AnalysisDocument9 pagesEXIDEIND Stock AnalysisAadith RamanNo ratings yet

- Media's Role in Indian Democracy and Fulfilling Social ResponsibilitiesDocument8 pagesMedia's Role in Indian Democracy and Fulfilling Social ResponsibilitiesMayank JainNo ratings yet

- Lecture Notes in Airport Engineering PDFDocument91 pagesLecture Notes in Airport Engineering PDFMaya RajNo ratings yet

- TG Comply With WP Hygiene Proc 270812 PDFDocument224 pagesTG Comply With WP Hygiene Proc 270812 PDFEmelita MendezNo ratings yet

- Changes in The Marketing Strategies of Automobile Sector Due To RecessionDocument102 pagesChanges in The Marketing Strategies of Automobile Sector Due To RecessionVivek SinghNo ratings yet

- RA 8042 and RA 10022 ComparedDocument37 pagesRA 8042 and RA 10022 ComparedCj GarciaNo ratings yet

- 244256-Exabeam Security Content in The Legacy Structure-Pdf-EnDocument142 pages244256-Exabeam Security Content in The Legacy Structure-Pdf-EnYoussef MohamedNo ratings yet

- PfizerWorks structure improves efficiencyDocument2 pagesPfizerWorks structure improves efficiencyDigitizedReaper73% (11)

- BAJAJ Vs HERO HONDA Comparative Analysis in Automobile Industry Thesis 86p.Document88 pagesBAJAJ Vs HERO HONDA Comparative Analysis in Automobile Industry Thesis 86p.Chandani Thakur100% (1)

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Q.850 ISDN Cause CodesDocument12 pagesQ.850 ISDN Cause CodesJack CastineNo ratings yet

- Ranjana Project Report On Inventory ManagementDocument93 pagesRanjana Project Report On Inventory Managementranjanachoubey90% (10)

- Industry: Key Points Supply DemandDocument4 pagesIndustry: Key Points Supply DemandHarsh AgarwalNo ratings yet

- Automobile Sector-Two Wheeler SegmentDocument41 pagesAutomobile Sector-Two Wheeler SegmentSandhya UpadhyayNo ratings yet

- Automobiles Industry ReportDocument5 pagesAutomobiles Industry ReportvaasurastogiNo ratings yet

- MotoGaze - ICICI February 2013Document18 pagesMotoGaze - ICICI February 2013Vivek MehtaNo ratings yet

- Introduction To The Study On Brand ImageDocument79 pagesIntroduction To The Study On Brand ImageArun Mannur0% (1)

- Tvs ReportDocument62 pagesTvs ReportvipinkathpalNo ratings yet

- CARE Industry Risk Evaluation - Two WheelersDocument11 pagesCARE Industry Risk Evaluation - Two WheelersSrinivas RaoNo ratings yet

- SH 2015 Q3 1 ICRA AutocomponentsDocument7 pagesSH 2015 Q3 1 ICRA AutocomponentsjhampiaNo ratings yet

- Bajaj Auto - Case AnalysisDocument7 pagesBajaj Auto - Case Analysisadnan0% (1)

- Project On Tvs Vs BajajDocument63 pagesProject On Tvs Vs BajajSk Rabiul Islam100% (1)

- Case Study Report - 22MBAB35Document50 pagesCase Study Report - 22MBAB35varshini vishakanNo ratings yet

- TiniDocument3 pagesTiniBrijesh M JaradiNo ratings yet

- Comparative Study OF V/S: Project Report of Research Methodology OnDocument52 pagesComparative Study OF V/S: Project Report of Research Methodology OnMayank Jain NeerNo ratings yet

- Industry Overview - Automobile Sector in India 2012-13Document18 pagesIndustry Overview - Automobile Sector in India 2012-13Kinshuk AcharyaNo ratings yet

- Indian Two Wheeler Industry OutlookDocument18 pagesIndian Two Wheeler Industry OutlookPankaj Goenka100% (1)

- Auto Industy Demand AnalysisDocument8 pagesAuto Industy Demand Analysisppc1110No ratings yet

- AutomobileDocument2 pagesAutomobilekishorepatil8887No ratings yet

- Credit Rating of Tata MotorsDocument11 pagesCredit Rating of Tata MotorsSharonNo ratings yet

- Shutiya BnoingDocument4 pagesShutiya BnoingVM MonuNo ratings yet

- Customer Satisfaction Study of Bajaj Pulsar in NashikDocument46 pagesCustomer Satisfaction Study of Bajaj Pulsar in NashikMayurNo ratings yet

- Auto Component Sector Report: Driving Out of Uncertain TimesDocument24 pagesAuto Component Sector Report: Driving Out of Uncertain TimesAshwani PasrichaNo ratings yet

- Indian Auto IndustryDocument55 pagesIndian Auto IndustrySk Rabiul IslamNo ratings yet

- "Marketing Strategies of Two Wheeler Dealers" Automobile SectorDocument65 pages"Marketing Strategies of Two Wheeler Dealers" Automobile Sectorpawan dhingraNo ratings yet

- Vegi Sree Vijetha (1226113156)Document6 pagesVegi Sree Vijetha (1226113156)Pradeep ChintadaNo ratings yet

- Hero Motor and TVS StrategyDocument34 pagesHero Motor and TVS StrategyVarshaa Dhuwalia67% (3)

- Bajaj Auto LTDDocument17 pagesBajaj Auto LTDAvinav ThapaNo ratings yet

- Analysis of Automobile IndustryDocument9 pagesAnalysis of Automobile IndustryNikhil Kakkar100% (1)

- Marketing Strategy of Bajaj AutomobilesDocument57 pagesMarketing Strategy of Bajaj AutomobilesShruti Das57% (7)

- Study On Two Wheeler Market Segmentation and Its Strategy in IndiaDocument3 pagesStudy On Two Wheeler Market Segmentation and Its Strategy in IndiaAnonymous J7Ra0dNo ratings yet

- Bajaj Auto Ltd. (BAL) Is One of The Oldest and The Largest Manufacturer ofDocument19 pagesBajaj Auto Ltd. (BAL) Is One of The Oldest and The Largest Manufacturer ofSadaf RazzaqueNo ratings yet

- Hero Moto CorpDocument4 pagesHero Moto Corpsouravag4uNo ratings yet

- 1.0 Executive Summary: Automotive Sector (Contributes 95% To Total Revenue)Document15 pages1.0 Executive Summary: Automotive Sector (Contributes 95% To Total Revenue)Koustav S MandalNo ratings yet

- A Project Report On Measuring Customer Satisfaction Level and Sales Promotion in YamahaDocument TranscriptDocument39 pagesA Project Report On Measuring Customer Satisfaction Level and Sales Promotion in YamahaDocument TranscriptShaju PerryNo ratings yet

- Research Report On Indian Two Wheeler IndustryDocument7 pagesResearch Report On Indian Two Wheeler IndustryTapas DashNo ratings yet

- India's Growing Automobile IndustryDocument79 pagesIndia's Growing Automobile Industry2014rajpoint0% (1)

- Auto Component: Industry StructureDocument5 pagesAuto Component: Industry StructurechompoonootNo ratings yet

- Automobiles Sector ReportDocument9 pagesAutomobiles Sector ReportNihar AkunuriNo ratings yet

- Macro EnvironmentDocument13 pagesMacro EnvironmentTanvi Gupta100% (2)

- Indian Two-Wheeler Industry: A PerspectiveDocument9 pagesIndian Two-Wheeler Industry: A Perspectiverohityadav2510No ratings yet

- Marketing Strategies of Hero MotoCorpDocument68 pagesMarketing Strategies of Hero MotoCorpVishnuNadarNo ratings yet

- Comparative Study of Hero and Bajaj Two Wheeler CompaniesDocument76 pagesComparative Study of Hero and Bajaj Two Wheeler CompaniesSubramanya DgNo ratings yet

- 4 Key Points Financial Year '10 Prospects Sector Do's and Dont'sDocument3 pages4 Key Points Financial Year '10 Prospects Sector Do's and Dont'sBhushan KasarNo ratings yet

- Management Discussion and AnalysisDocument30 pagesManagement Discussion and Analysispanditak521No ratings yet

- Initiating Coverage Hero MotoCorpDocument10 pagesInitiating Coverage Hero MotoCorpAditya Vikram JhaNo ratings yet

- Dripto Mukhopadhyay, Associate Fellow, NCAER1: Indian Two-Wheeler Industry: A PerspectiveDocument7 pagesDripto Mukhopadhyay, Associate Fellow, NCAER1: Indian Two-Wheeler Industry: A Perspectivesmba25No ratings yet

- Automobile: Industry AnalysisDocument21 pagesAutomobile: Industry AnalysisSwapn DeepNo ratings yet

- Fundamental and Technical Analysis of Automobile SectorDocument82 pagesFundamental and Technical Analysis of Automobile Sectormba_financearticles88% (8)

- FRSA Group Assignment-2Document23 pagesFRSA Group Assignment-2sanjay gujjetiNo ratings yet

- Initiating Coverage Maruti SuzukiDocument13 pagesInitiating Coverage Maruti SuzukiAditya Vikram JhaNo ratings yet

- Marketing by BajajDocument102 pagesMarketing by BajajDhruv ShahNo ratings yet

- Research Papers On Two Wheeler Industry in IndiaDocument5 pagesResearch Papers On Two Wheeler Industry in IndiaafnjobmwsvoamuNo ratings yet

- Chapter 1Document45 pagesChapter 1Prasanna BNo ratings yet

- Project Report on Metro Tyres LimitedDocument37 pagesProject Report on Metro Tyres LimitedAnmolDhillonNo ratings yet

- Automotive Glass Replacement Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandAutomotive Glass Replacement Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- General Automotive Repair Revenues World Summary: Market Values & Financials by CountryFrom EverandGeneral Automotive Repair Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sector 10 - Noida Ext - Financial SnapshotDocument2 pagesSector 10 - Noida Ext - Financial SnapshotMayank JainNo ratings yet

- Saket Bahuguna - Chief Legal Officer - IndiabullsDocument1 pageSaket Bahuguna - Chief Legal Officer - IndiabullsMayank JainNo ratings yet

- Nobal Reschedulement in PSPDocument1 pageNobal Reschedulement in PSPMayank JainNo ratings yet

- Plotted Commercial - Excluding GMUCDocument1 pagePlotted Commercial - Excluding GMUCMayank JainNo ratings yet

- Plotted Commercial - Inclduing GMUCDocument1 pagePlotted Commercial - Inclduing GMUCMayank JainNo ratings yet

- Silicon City LayoutDocument1 pageSilicon City LayoutMayank JainNo ratings yet

- 67 A Affordable-ModelDocument1 page67 A Affordable-ModelMayank JainNo ratings yet

- Affordable Housing India-1Document20 pagesAffordable Housing India-1Venkat RamanNo ratings yet

- Presentations PapersDocument20 pagesPresentations PapersMayank JainNo ratings yet

- Deen Dayal Jan Awas YojanaDocument4 pagesDeen Dayal Jan Awas YojanaMayank JainNo ratings yet

- Affordable HousingDocument11 pagesAffordable HousingMayank JainNo ratings yet

- Architecture Technical Module Web Booklet Chapter6Document17 pagesArchitecture Technical Module Web Booklet Chapter6Bhanu Shankar SinghNo ratings yet

- Area Norms For Licence in Low and Medium-9.2.2016Document2 pagesArea Norms For Licence in Low and Medium-9.2.2016Mayank JainNo ratings yet

- Affordable Housing Project Wise DetailsDocument8 pagesAffordable Housing Project Wise DetailsMayank JainNo ratings yet

- EDC Relief PolicyDocument2 pagesEDC Relief PolicyMayank JainNo ratings yet

- Architecture Technical Module Web Booklet Chapter6Document17 pagesArchitecture Technical Module Web Booklet Chapter6Bhanu Shankar SinghNo ratings yet

- TVS 2013Document101 pagesTVS 2013Mayank Jain100% (1)

- Content For MeDocument1 pageContent For MeMayank JainNo ratings yet

- Ezycolour Beautiful Homes GuideDocument40 pagesEzycolour Beautiful Homes GuideMayank JainNo ratings yet

- Auto CompaniesDocument6 pagesAuto CompaniesMayank JainNo ratings yet

- The St. Olaf College Fieldhouse Project - PaperDocument16 pagesThe St. Olaf College Fieldhouse Project - PaperMayank JainNo ratings yet

- 06 MPBF PDFDocument3 pages06 MPBF PDFMayank JainNo ratings yet

- Credit Information Bureaue (India) LTDDocument14 pagesCredit Information Bureaue (India) LTDMayank JainNo ratings yet

- CDRDocument17 pagesCDRMayank JainNo ratings yet

- 8 - Modes of LendingDocument21 pages8 - Modes of LendingMayank JainNo ratings yet

- Rbi Monetary PolicyDocument2 pagesRbi Monetary PolicyMayank JainNo ratings yet

- Cold CallingDocument1 pageCold CallingMayank JainNo ratings yet

- Service Manual: DCR-DVD150E/DVD450E/DVD650/ DVD650E/DVD850/DVD850EDocument71 pagesService Manual: DCR-DVD150E/DVD450E/DVD650/ DVD650E/DVD850/DVD850EJonathan Da SilvaNo ratings yet

- COA Full Syllabus-CSEDocument3 pagesCOA Full Syllabus-CSEAMARTYA KUMARNo ratings yet

- Company BackgroundDocument17 pagesCompany Backgroundzayna faizaNo ratings yet

- ION8650 DatasheetDocument11 pagesION8650 DatasheetAlthaf Axel HiroshiNo ratings yet

- Edgevpldt Legazpi - Ee As-Built 121922Document10 pagesEdgevpldt Legazpi - Ee As-Built 121922Debussy PanganibanNo ratings yet

- JDC Merchanndising ActivityDocument6 pagesJDC Merchanndising ActivityShaira Sahibad100% (1)

- Pabahay Bonanza: Philippine National Bank As of September 30, 2009Document80 pagesPabahay Bonanza: Philippine National Bank As of September 30, 2009ramonlucas700No ratings yet

- Basic Accounting Principles and Budgeting FundamentalsDocument24 pagesBasic Accounting Principles and Budgeting Fundamentalskebaman1986No ratings yet

- Open Recruitment Member Kejar Mimpi Periode 2023 (Responses)Document22 pagesOpen Recruitment Member Kejar Mimpi Periode 2023 (Responses)Sophia Dewi AzzahraNo ratings yet

- Training and Development Project Report - MessDocument37 pagesTraining and Development Project Report - MessIqra Bismi100% (1)

- Project IGI 2 Cheat Codes, Hints, and HelpDocument4 pagesProject IGI 2 Cheat Codes, Hints, and Helppadalakirankumar60% (5)

- Instructions Manual Skatey 150/250/400/600Document19 pagesInstructions Manual Skatey 150/250/400/600Denys GavrylovNo ratings yet

- Refractomax 521 Refractive Index Detector: FeaturesDocument2 pagesRefractomax 521 Refractive Index Detector: FeaturestamiaNo ratings yet

- Web Based Tour Management for Bamboo ParadiseDocument11 pagesWeb Based Tour Management for Bamboo Paradisemohammed BiratuNo ratings yet

- Graphics Coursework GcseDocument7 pagesGraphics Coursework Gcseafiwhlkrm100% (2)

- Money and Financial InstitutionsDocument26 pagesMoney and Financial InstitutionsSorgot Ilie-Liviu100% (1)

- Mr. Arshad Nazer: Bawshar, Sultanate of OmanDocument2 pagesMr. Arshad Nazer: Bawshar, Sultanate of OmanTop GNo ratings yet

- Quiz UtpDocument7 pagesQuiz UtplesterNo ratings yet

- Nippon Metal Primer Red Oxide TDSDocument2 pagesNippon Metal Primer Red Oxide TDSPraveen KumarNo ratings yet

- Circuit Project Electronic: Simple Pulse Generator by IC 555 TimerDocument1 pageCircuit Project Electronic: Simple Pulse Generator by IC 555 TimerM Usman RiazNo ratings yet

- The Mpeg Dash StandardDocument6 pagesThe Mpeg Dash Standard9716755397No ratings yet