Professional Documents

Culture Documents

Eric Sprott: The Ongoing Rot in The Economy

Uploaded by

Investor Relations Vancouver0 ratings0% found this document useful (0 votes)

72 views5 pagesThe Ongoing Rot in the Economy

By: Eric Sprott

While most have been conveniently blaming the tepid first quarter -2.9% GDP growth figure on the weather, we believe that it is just another symptom of a much deeper malaise. As we have argued many times before (see, for example, the March 2014 Markets at a Glance), the U.S. economy has been on life support, graciously provided by Central Planners. However hard they try, they will soon realize that no amount of money printing can cleanse the rot of the U.S. economy.

Original Title

Eric Sprott: The Ongoing Rot in the Economy

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Ongoing Rot in the Economy

By: Eric Sprott

While most have been conveniently blaming the tepid first quarter -2.9% GDP growth figure on the weather, we believe that it is just another symptom of a much deeper malaise. As we have argued many times before (see, for example, the March 2014 Markets at a Glance), the U.S. economy has been on life support, graciously provided by Central Planners. However hard they try, they will soon realize that no amount of money printing can cleanse the rot of the U.S. economy.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

72 views5 pagesEric Sprott: The Ongoing Rot in The Economy

Uploaded by

Investor Relations VancouverThe Ongoing Rot in the Economy

By: Eric Sprott

While most have been conveniently blaming the tepid first quarter -2.9% GDP growth figure on the weather, we believe that it is just another symptom of a much deeper malaise. As we have argued many times before (see, for example, the March 2014 Markets at a Glance), the U.S. economy has been on life support, graciously provided by Central Planners. However hard they try, they will soon realize that no amount of money printing can cleanse the rot of the U.S. economy.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

1

The Ongoing Rot

in the Economy

By: Eric Sprott

Follow us on

While most have been conveniently blaming the tepid first quarter -2.9% GDP growth

figure on the weather, we believe that it is just another symptom of a much deeper

malaise. As we have argued many times before (see, for example, the March 2014

Markets at a Glance), the U.S. economy has been on life support, graciously provided by

Central Planners. However hard they try, they will soon realize that no amount of money

printing can cleanse the rot of the U.S. economy.

Most tellingly, in a recent interview with Reuters, Bill Simon, Wal-Marts Chief Executive

Officer for the U.S., said that Weve reached a point where its not getting any better

but its not getting any worse at least for the middle (class) and down.

1

Indeed, if one looks past headline figures, things are not really getting better. As shown

in Figure 1, real disposable income per capita in the U.S. has increased only modestly

since the Great Recession. However, all of this increase is due to Government Transfers,

not from an improvement in the real economy. If we exclude those transfers from the

numbers, disposable income per capita is actually lower than it was at the end of 2005

and has been painfully flat since 2011. Also, those numbers assume that the headline

Consumer Price Index (CPI) accurately represents peoples purchasing power.

In this Markets at a Glance, we investigate the U.S. consumer and show that for a large

portion of the population, things are not anywhere close to being better, in fact they are

worse than before the recession.

www.sprott.com | THE ONGOING ROT IN THE ECONOMY | JULY 2014

JULY 2014

2

A H I S T O R Y O F O U T P E R F O R MA N C E

Sprott Asset Management LP Markets at a Glance

www.sprott.com | THE ONGOING ROT IN THE ECONOMY | JULY 2014

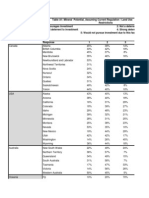

First of all, there is income inequality. Those in the top 20% have seen their incomes increase while those

in the bottom 40% have stagnated or even decreased. Figure 2 shows the average after-tax income of U.S.

households by quintiles, as measured by the Bureau of Labor Statistics Consumer Expenditure Survey,

since 2005. It is hard to see from the chart, but in 2012 for the lowest 20% (Quintile 1) of U.S. households,

the average annual after-tax income is $10,171 (up from $9,220 in 2005). Similarly, the next 20% is not

much better off, with incomes averaging $27,743 (up from $25,200 in 2005). By contrast, during the same

period, the average household income for the top earning quintile (Quintile 5) increased 14% to $158,024.

From our calculations, the bottom 40% of the U.S. population receives approximately 12% of the nations

after-tax income, while the highest 20% receives more than 50%. So, because of the wide disparity

between U.S. households, it is grossly misleading to consider aggregate measures to assess the

health of the U.S. consumer. (Note: For the rest of this analysis we combine the bottom two quintiles

(bottom 40%) as they share common characteristics and it facilitates the discussion.)

FIGURE 1: REAL DISPOSABLE INCOME PER CAPITA (INDEX 2005 Q4 = 100)

90

100

110

120

May-14 Jan-12 Jan-10 Jan-08 Dec-05

Excluding Government Transfers Including Government Transfers

Source: Bureau of Economic Analysis, U.S. Census Bureau, Sprott Calculations

FIGURE 2: INCOME INEQUALITY CONTINUES TO WIDEN AFTER-TAX ANNUAL INCOME BY QUINTILE

2005 2006 2007 2008 2009 2010 2011 2012

Quintile 1 Quintile 2 Quintile 3 Quintile 4 Quintile 5

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

Source: Bureau of Labor Statistics - Consumer Expenditure Survey

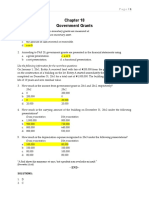

In light of these disparities and to facilitate the analysis, we have combined the two bottom quintiles

(bottom 40% of households) incomes and expenditures for 2005 (pre-crisis) and 2012 (most recent data

from the Bureau of Labour Statistics). Data is presented in Figure 3.

3

A H I S T O R Y O F O U T P E R F O R MA N C E

Sprott Asset Management LP Markets at a Glance

www.sprott.com | THE ONGOING ROT IN THE ECONOMY | JULY 2014

FIGURE 3: AVERAGE ANNUAL INCOME AND EXPENDITURES

BOTTOM 40% OF U.S. HOUSEHOLDS (QUINTILES 1 AND 2)

Year 2005 2012 % Change

Income

After tax income of which: $17,463 $18,844 8%

Wages and Salaries $9,610 $9,953 4%

Social Security, private and government retirement $6,135 $6,995 14%

Unemployment and workers compensation, veterans benefits $159 $321 102%

Public assistance, supplemental security income, food stamps $669 $936 40%

Note: Government transfers as % of after tax income 40% 44%

Expenses

Food $3,557 $4,000 12%

Shelter $5,131 $6,253 22%

Utilities, fuels, and public services $2,285 $2,580 13%

Transportation $4,049 $4,451 10%

Health Care $1,893 $2,230 18%

Other $7,109 $7,854 10%

Total $24,024 $27,368 14%

Expenses as a % of after tax income

Total of which: 138% 145%

Food 20% 21%

Shelter 29% 33%

Utilities, fuels, and public services 13% 14%

Transportation 23% 24%

Health Care 11% 12%

Total non-discretionary spending 97% 104%

Source: Consumer Expenditure Survey, 2012, 2005 & Sprott Calculations

The first panel of Figure 3 shows after tax income for the bottom 40% of households in 2005 and 2012,

along with a breakdown of some of its components. All figures are in current dollars (i.e. not adjusted for

inflation). Not too surprisingly, average after-tax annual household income increased by a meagre 8%, from

$17,463 to $18,844. Wages and salaries, which represent about half of income, increased only 4%. Most of

the increase has been in the form of government transfers; social security increased 14%, unemployment

and veteran benefits 102% and other forms of public assistance 40%. In fact, of the $1,380 increase in

average after-tax income, 93% comes from increases in government transfers.

The second and third panels of Figure 3 show average annual expenses in dollars as well as in percent of after

tax income. We also show a breakdown of spending for categories that we consider non-discretionary, in

the sense that they are unavoidable expenses such as food, shelter, utilities, health care and transportation.

Perhaps the most striking (but not that surprising) finding from that table is the fact that 40% of U.S.

households spend about 40% more than they make (138% and 145% in 2005 and 2012, respectively)! In

case you wonder how a household can spend more than it earns, there are many ways such as: borrowing,

4

A H I S T O R Y O F O U T P E R F O R MA N C E

Sprott Asset Management LP Markets at a Glance

www.sprott.com | THE ONGOING ROT IN THE ECONOMY | JULY 2014

selling assets, assistance from family, etc. While incomes increased only 8%, total expenses increased

14%, driven by very large increases in shelter (22%) and health care (18%) spending.

Additionally, an ever increasing proportion of peoples after tax income goes towards what we call

non-discretionary spending. As shown at the bottom of Figure 3, in 2005 those households used

to spend 97% of their income for basic necessities, while in 2012 this has increased to 104%.

Five years into this so-called economic recovery, on average 40% of the poorest U.S. households

still spend more than they earn (including government transfers) for basic necessities!

We believe that there are two main reasons for this. The first one has to do with income inequality;

as we have shown, incomes have been almost constant since 2005, with most of the increase driven

by unsustainable governmental assistance. Furthermore, prices for basic necessities, which constitute

the entirety of these households budgets, have been increasing at a steady pace. Figure 4 shows the

reported price over the past 7 years for energy, food commodities and rents against the Official Headline

Consumer Price Index (CPI).

Over that period, overall price levels, as measured by the CPI, went up 22% (versus 8% for after tax

incomes). However, for the same period, rent, energy and food prices increased 26%, 54% and 115%,

respectively. No wonder those same households spend 33% of their income on shelter, 21% on food

and 14% on utilities and fuels!

ENDNOTES

1

http://www.reuters.com/article/2014/07/08/us-walmart-simon-idUSKBN0FC2GW20140708

How can we have an economic recovery when there is barely any discretionary disposable income for

40% of the population? As we have shown above, those that have seen their incomes grow and not the

ones most likely to spend, while the bottom 40% of households still rely heavily on government assistance,

have had stagnant incomes and have been faced with increasing inflation for non-discretionary goods that

constitute a very large share of their incomes.

There is clearly no recovery

FIGURE 4: THE PRICE OF BASIC NECESSITIES IS WELL AHEAD OF OFFICIAL INFLATION

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Average Gasoline and Electricity Prices

Commodity Research Bureau BLS/US Sprott Foodstuff

U.S. Census Bureau Rents Index

Headline CPI

80

100

120

140

160

180

200

220

240

260

Source: Bloomberg, Sprott Calculations

0

7

1

4

3

7

3

0

7

/

1

4

_

S

A

M

_

M

A

A

G

_

E

Sprott at a Glance

With a history going back to 1981, Sprott Inc. offers a collection of investment managers, united by one common goal: delivering outstanding

long-term returns to our investors. Our team-based approach allows us to uncover the most attractive investment opportunities for our investors.

When an emerging investment opportunity is identifed, we invest decisively and with conviction. We also co-invest our own capital to align our

interests with our investors.

Our Businesses

Sprott Asset Management LP is one of Canadas leading

independent asset management companies headquartered in

Toronto. The company manages the Sprott family of mutual funds,

hedge funds, physical bullion funds and specialty products and is

dedicated to achieving superior returns for its investors over the

long term.

For more information, please visit www.sprott.com

Sprott Private Wealth LP provides customized wealth

management to Canadian high-net-worth investors, including

entrepreneurs, professionals, family trusts, foundations

and estates. We are dedicated to serving our clients through

relationships based on integrity and mutual trust.

For more information, please visit www.sprottwealth.com

Sprott Private Equity and Debt strategies were developed

to capitalize on our expertise in natural resources and provide

investors with counter-cyclical investments in the resource sector.

For more information, please visit www.sprottinc.com/pe

Sprott Global Resource Investments Ltd., our full-service

US brokerage frm, specializes in natural resource investments

worldwide. Founded in 1993, the frm is led by Rick Rule and

dedicated to investing in global natural resource companies.

The team is comprised of geologists, mining engineers and

investment professionals.

For more information, please visit www.sprottglobal.com

Sprott Asset Management USA Inc., offers Managed

Accounts that invest in precious metals and natural resources.

Led by renowned resource investors Eric Sprott and Rick Rule,

we offer the collective expertise of Sprotts investment team.

For more information on our brokerage services, please visit

www.sprottusa.com

Royal Bank Plaza, South Tower

200 Bay Street, Suite 2700, P.O. Box 27

Toronto, ON M5J 2J1

Business: 416.943.6707

Facsimile: 416.943.6497

Toll Free: 1.866.299.9906

www.sprott.com

For further information, please contact invest@sprott.com

This article may not be reproduced in any form, or referred to in any other publication, without acknowledgement that it was produced

by Sprott Asset Management LP and a reference to www.sprott.com. The opinions, estimates and projections (information) contained within

this report are solely those of Sprott Asset Management LP (SAM LP) and are subject to change without notice. SAM LP makes every effort to ensure

that the information has been derived from sources believed to be reliable and accurate. However, SAM LP assumes no responsibility for any losses

or damages, whether direct or indirect, which arise out of the use of this information. SAM LP is not under any obligation to update or keep current

the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please

contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market

sector should not be considered an indication of trading intent of any investment funds managed by Sprott Asset Management LP. These views are

not to be considered as investment advice nor should they be considered a recommendation to buy or sell. The information contained herein does not

constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or

to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their

fnancial advisor to determine whether securities of the Funds may be lawfully sold in their jurisdiction. SAM LP and/or its affliates may collectively

benefcially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. SAM LP and/or its affliates may hold

short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, SAM LP and/or its affliates

may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

You might also like

- Juggernaut (TSX-V: JUGR) Commences Inaugural Drill Campaign On Midas PropertyDocument3 pagesJuggernaut (TSX-V: JUGR) Commences Inaugural Drill Campaign On Midas PropertyInvestor Relations VancouverNo ratings yet

- NEWS Feb 12 2018 Juggernaut Exploration (JUGR) Discovers Eskay-Style Body, Drill ReadyDocument3 pagesNEWS Feb 12 2018 Juggernaut Exploration (JUGR) Discovers Eskay-Style Body, Drill ReadyInvestor Relations VancouverNo ratings yet

- Survey of Mining Companies 2014Document97 pagesSurvey of Mining Companies 2014Investor Relations Vancouver100% (1)

- Full Report RBC Canadian Provincial Economic Outlook March 2014Document16 pagesFull Report RBC Canadian Provincial Economic Outlook March 2014Investor Relations VancouverNo ratings yet

- Fraser Institute: Mining Survey 2013 Data XLS DatasetDocument368 pagesFraser Institute: Mining Survey 2013 Data XLS DatasetInvestor Relations VancouverNo ratings yet

- Fraser Institute: Real Game Changer Supreme Court of Canada Tsilhqotin DecisionDocument6 pagesFraser Institute: Real Game Changer Supreme Court of Canada Tsilhqotin DecisionInvestor Relations VancouverNo ratings yet

- SNL Metals & Mining - State of The Market Mining and Finance ReportDocument46 pagesSNL Metals & Mining - State of The Market Mining and Finance ReportInvestor Relations Vancouver100% (1)

- Canadian Government Debt 2014Document61 pagesCanadian Government Debt 2014Investor Relations VancouverNo ratings yet

- Fraser Institute: The Cost To Canadians of Complying With Personal Income TaxesDocument53 pagesFraser Institute: The Cost To Canadians of Complying With Personal Income TaxesInvestor Relations VancouverNo ratings yet

- Fraser Institute: Divergent Mineral Rights Regimes A Natural Experiment in Canada and The United States Yields LessonsDocument42 pagesFraser Institute: Divergent Mineral Rights Regimes A Natural Experiment in Canada and The United States Yields LessonsInvestor Relations VancouverNo ratings yet

- Fraser Institute - Mining Survey 2013 PDF Report: Alberta Top Canadian Jurisdiction in Annual Global Mining Survey, Quebec Sinking Fast.Document134 pagesFraser Institute - Mining Survey 2013 PDF Report: Alberta Top Canadian Jurisdiction in Annual Global Mining Survey, Quebec Sinking Fast.Investor Relations VancouverNo ratings yet

- RBC BC Provincial Economic Outlook March 2014 Overview (2 Pages)Document1 pageRBC BC Provincial Economic Outlook March 2014 Overview (2 Pages)Investor Relations VancouverNo ratings yet

- Canadas Catch 22 State of Canada Us Relations in 2014Document62 pagesCanadas Catch 22 State of Canada Us Relations in 2014Investor Relations VancouverNo ratings yet

- Fraser Institute: Post Stimulus Spending Trends in CanadaDocument13 pagesFraser Institute: Post Stimulus Spending Trends in CanadaInvestor Relations VancouverNo ratings yet

- Federal Budget 2014-15 The Road To Balance: Creating Jobs and OpportunitiesDocument18 pagesFederal Budget 2014-15 The Road To Balance: Creating Jobs and OpportunitiesInvestor Relations VancouverNo ratings yet

- U.S. Energy Information Administration Drilling Productivity Report. For Key Tight Oil and Shale Gas RegionsDocument10 pagesU.S. Energy Information Administration Drilling Productivity Report. For Key Tight Oil and Shale Gas RegionsInvestor Relations VancouverNo ratings yet

- Ernst & Young: Canadian Mining Eye Q4 2013Document12 pagesErnst & Young: Canadian Mining Eye Q4 2013Investor Relations VancouverNo ratings yet

- PIMCO's Bill Gross February 2014 Investment Outook: Most "Medieval"Document5 pagesPIMCO's Bill Gross February 2014 Investment Outook: Most "Medieval"Investor Relations VancouverNo ratings yet

- Fraser Institute: Quebec's Mining Policy Performance: Greater Uncertainty and Lost Advantage Mining Policy Studies in by Alana Wilson Project Director: Kenneth P. GreenDocument68 pagesFraser Institute: Quebec's Mining Policy Performance: Greater Uncertainty and Lost Advantage Mining Policy Studies in by Alana Wilson Project Director: Kenneth P. GreenInvestor Relations VancouverNo ratings yet

- Fraser Alert: Corporate Income Taxes Who Pays? by Philip CrossDocument5 pagesFraser Alert: Corporate Income Taxes Who Pays? by Philip CrossInvestor Relations VancouverNo ratings yet

- Fraser Institute: Measuring Government in The 21st CenturyDocument130 pagesFraser Institute: Measuring Government in The 21st CenturyInvestor Relations VancouverNo ratings yet

- 2014 Periodic Table of Commodity ReturnsDocument1 page2014 Periodic Table of Commodity ReturnsInvestor Relations VancouverNo ratings yet

- Responsible Energy Resource Development in Canada - Summary of The Dialogue of The Charrette On Energy, Environment and Aboriginal IssuesDocument22 pagesResponsible Energy Resource Development in Canada - Summary of The Dialogue of The Charrette On Energy, Environment and Aboriginal IssuesInvestor Relations VancouverNo ratings yet

- Deloitte - Tracking The Trends 2014 - The Top 10 Issues Mining Companies Will Face in The Coming YearDocument44 pagesDeloitte - Tracking The Trends 2014 - The Top 10 Issues Mining Companies Will Face in The Coming YearInvestor Relations VancouverNo ratings yet

- World Economic Forum: The Global Energy Architecture Performance Index Report 2014Document104 pagesWorld Economic Forum: The Global Energy Architecture Performance Index Report 2014Investor Relations VancouverNo ratings yet

- Fraser Institute Global Petroleum Survey 2013Document122 pagesFraser Institute Global Petroleum Survey 2013Investor Relations VancouverNo ratings yet

- Fraser Institute: Economic Freedom of North America 2013Document92 pagesFraser Institute: Economic Freedom of North America 2013Investor Relations VancouverNo ratings yet

- ECB Working Paper Nov 2013 - High Frequency Trading PDFDocument57 pagesECB Working Paper Nov 2013 - High Frequency Trading PDFInvestor Relations VancouverNo ratings yet

- 2013 Rideau Club Ottawa PDFDocument39 pages2013 Rideau Club Ottawa PDFInvestor Relations VancouverNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Mba 3 Sem Tax Planning and Management Kmbfm02 2020Document2 pagesMba 3 Sem Tax Planning and Management Kmbfm02 2020Vinod GuptaNo ratings yet

- Assigment 3Document20 pagesAssigment 3swati raghuvansiNo ratings yet

- Module 2Document54 pagesModule 2Aryaman BhauwalaNo ratings yet

- Cag QuestionsDocument24 pagesCag QuestionsJason Dave VidadNo ratings yet

- Pableo Final DefenseDocument97 pagesPableo Final DefenseDinalyn OfqueriaNo ratings yet

- Introduction to Business & EconomicsDocument128 pagesIntroduction to Business & EconomicsVamsi KrishnaNo ratings yet

- Department of Education: Second Quarter Examination Business MathematicsDocument3 pagesDepartment of Education: Second Quarter Examination Business MathematicsGlaiza FloresNo ratings yet

- How many hours will a person allocate to leisure activities given concave indifference curvesDocument11 pagesHow many hours will a person allocate to leisure activities given concave indifference curveshyld3n100% (1)

- Absorption and Variable Costing MethodsDocument7 pagesAbsorption and Variable Costing MethodsJoneric RamosNo ratings yet

- Adam Smith Theory of Development in EconomicsDocument8 pagesAdam Smith Theory of Development in EconomicsElungatNo ratings yet

- Taxguru - In-All About Annual Information Statement AISDocument102 pagesTaxguru - In-All About Annual Information Statement AISChaithanya RajuNo ratings yet

- Salary slip templateDocument1 pageSalary slip templatePtesgNo ratings yet

- Government Grants: Use The Following Information For The Next Three QuestionsDocument2 pagesGovernment Grants: Use The Following Information For The Next Three QuestionsJEFFERSON CUTENo ratings yet

- Session 23-25 Permissible Deduction From Gross Total IncomeDocument14 pagesSession 23-25 Permissible Deduction From Gross Total Incomeomar zohorianNo ratings yet

- MCQ Conceptual Frame Work - 1Document16 pagesMCQ Conceptual Frame Work - 1Koko LaineNo ratings yet

- Baja PDFDocument3 pagesBaja PDFdindakharismaNo ratings yet

- Ch03 SM 9eDocument156 pagesCh03 SM 9ekmmkmNo ratings yet

- ArthaYantra Buy vs. Rent Score (ABRS) - ChennaiDocument24 pagesArthaYantra Buy vs. Rent Score (ABRS) - ChennaiArthaYantraNo ratings yet

- Islamic Strategy for Just DevelopmentDocument368 pagesIslamic Strategy for Just Developmentjmohideenkadhar100% (1)

- Dirty Surplus Accounting TitleDocument20 pagesDirty Surplus Accounting TitleXyzNo ratings yet

- 1 - Error Correction - Final PDFDocument5 pages1 - Error Correction - Final PDFJohn Paul EslerNo ratings yet

- (Midterm-Second Week) Maam CJ Chris Ramtom: Technical English 1 (Investigative Report Writing and Presentation) Cdi 5Document7 pages(Midterm-Second Week) Maam CJ Chris Ramtom: Technical English 1 (Investigative Report Writing and Presentation) Cdi 5Givehart Mira BanlasanNo ratings yet

- 'Polarization, Horizontal Inequalities and Violent Civil ConflictDocument21 pages'Polarization, Horizontal Inequalities and Violent Civil ConflictAdrian MacoveiNo ratings yet

- Cpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsDocument12 pagesCpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsSophia PerezNo ratings yet

- AHM Chapter 3 Exercises CKvxWXG1tmDocument2 pagesAHM Chapter 3 Exercises CKvxWXG1tmASHUTOSH BISWALNo ratings yet

- Merchandising Periodic SampleDocument14 pagesMerchandising Periodic SampleYam Pinoy100% (2)

- Dpum Ar2020Document272 pagesDpum Ar2020Dina Puspa AmandaNo ratings yet

- Mawjihan Tsakilla 023001701045 710:13.15 Selpita&LisnaDocument8 pagesMawjihan Tsakilla 023001701045 710:13.15 Selpita&Lisnaadis salsabilaNo ratings yet

- Cost Accounting and Control System-1Document33 pagesCost Accounting and Control System-1Regine VegaNo ratings yet

- LGDocument48 pagesLGSifiso MayisaNo ratings yet