Professional Documents

Culture Documents

Psychology of M&a Deals

Uploaded by

Samir GhoshOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Psychology of M&a Deals

Uploaded by

Samir GhoshCopyright:

Available Formats

Psychology of M&A Deals

1

Sanjay Bakshi

28 September 2013

Warren Buffett on General Acquisition Behaviour

As our history indicates, we are comfortable both with total ownership of businesses and

with marketable securities representing small portions of businesses. We continually look

for ways to em- ploy large sums in each area. (But we try to avoid small commitments -

"If something's not worth doing at all, it's not worth doing well".) Indeed, the liquidity

requirements of our insurance and trading stamp businesses mandate major investments

in marketable securities.

Our acquisition decisions will be aimed at maximising real economic benets, not at

maximising either managerial domain or reported numbers for accounting purposes. (In

the long run, managements stressing accounting appearance over economic substance

usually achieve little of either.)

Regardless of the impact upon immediately reportable earnings, we would rather buy

10% of Wonderful Business T at X per share than 100% of T at 2X per share. Most

corporate managers prefer just the reverse, and have no shortage of stated rationales for

their behaviour.

However, we suspect three motivations - usually unspoken - to be, singly or in

combination, the important ones in most high-premium takeovers:

Leaders, business or otherwise, seldom are decient in animal spirits and often relish

increased activity and challenge. At Berkshire, the corporate pulse never beats faster than

when an acquisition is in prospect.

Most organisations, business or otherwise, measure themselves, are measured by others,

and compensate their managers far more by the yardstick of size than by any other

yardstick. (Ask a Fortune 500 manager where his corporation stands on that famous list

and, invariably, the number responded will be from the list ranked by size of sales; he

may well not even know where his corporation places on the list Fortune just as faithfully

compiles ranking the same 500 corporations by protability.)

Many managements apparently were overexposed in impressionable childhood years to

the story in which the imprisoned handsome prince is released from a toad's body by a

kiss from a beautiful princess. Consequently, they are certain their managerial kiss will

do wonders for the protability of Company T(arget). Such optimism is essential.

Absent that rosy view, why else should the shareholders of Company A(cquisitor) want to

own an interest in T at the 2X takeover cost rather than at the X market price they would

pay if they made direct purchases on their own? In other words, investors can always buy

toads at the going price for toads. If investors instead bankroll princesses who wish to pay

Psychology of M&A Deals

2

double for the right to kiss the toad, those kisses had better pack some real dynamite.

We've observed many kisses but very few miracles. Nevertheless, many manage- rial

princesses remain serenely condent about the future potency of their kisses - even after

their corporate backyards are knee-deep in unresponsive toads.

Psychology of M&A Deals

3

All the Other Kids Have One!

Story Told By Warren Buffett

Over time, the skill with which a company's managers allocate capital has an enormous

impact on the enterprise's value. Almost by denition, a really good business generates

far more money (at least after its early years) than it can use internally. The company

could, of course, distribute the money to shareholders by way of dividends or share

repurchases. But often the CEO asks a strategic planning staff, consultants or

investment bankers whether an acquisition or two might make sense. That's like asking

your interior decorator whether you need a $50,000 rug.

The acquisition problem is often compounded by a biological bias: Many CEO's attain

their positions in part because they possess an abundance of animal spirits and ego. If

an executive is heavily endowed with these qualities - which, it should be acknowledged,

sometimes have their advantages - they won't disappear when he reaches the top. When

such a CEO is encouraged by his advisors to make deals, he responds much as would a

teenage boy who is encouraged by his father to have a normal sex life. It's not a push he

needs.

Some years back, a CEO friend of mine - in jest, it must be said - unintentionally

described the pathology of many big deals. This friend, who ran a property-casualty

insurer, was explaining to his directors why he wanted to acquire a certain life insurance

company. After droning rather unpersuasively through the economics and strategic

rationale for the acquisition, he abruptly abandoned the script. With an impish look, he

simply said: "Aw, fellas, all the other kids have one."

Psychology of M&A Deals

4

Tata Corus Acquisition - The Thrill of the Chase. . .

In many of these acquisitions, managerial intellect wilted in competition with

managerial adrenaline The thrill of the chase blinded the pursuers to the consequences of

the catch.- Warren Buffett

Tata Corus acquisition - Wikipedia, the free encyclopedia

Timelines

On October 20, 2006, Tata Steel announced that it had agreed to pick

up a 100% stake in the Anglo-Dutch steel maker Corus at 455 pence

per share in an all cash deal, cumulatively valued at GBP 4.3 billion

(USD 8.04 billion).

On November 19, 2006, the Brazilian steel company CSN launched a

counter offer for Corus at 475 pence per share, valuing it at $8.4

billion.

On December 11, 2006, Tata preemptively upped the offer to 500

pence, which was within hours trumped by CSN's offer of 515 pence

per share, valuing the deal at $ 9.6 Billion. The Corus board promptly

recommended both the revised offers to its shareholders.

Psychology of M&A Deals

5

On December 11, 2006, CSN announced a formal offer for the

Company at an offer price of 515 pence per Corus Share, valuing the

deal at $ 9.6 Billion.. The CSN Acquisition would also be implemented

by way of a scheme of arrangement and is subject to a pre-condition

that either Corus Shareholders reject the Tata Scheme or the Tata

Scheme is otherwise withdrawn by Corus or lapses. The Corus board

promptly recommended both the revised offers to its shareholders.

Also on December 19, 2006, UK Watchdog the Panel on Takeovers

and Mergers announced that the last date for each of Tata and CSN to

announce revised offers for the Company, should they wish to do so, is

30 January 2007. They also warned that it would begin an auction

procedure if the two remained in competition.

On January 31, 2007 Tata Steel won their bid for Corus after offering

608 pence per share, valuing Corus at $11.3bn

Psychology of M&A Deals

6

Before and After

Psychology of M&A Deals

7

Spot the Models

1. Envy

2. Deprival Super Reaction Syndrome

3. Low Contrast Effect

4. Overcondence

5. Bias from Commitment and Consistency

6. Authority Bias (auctioneer as expert)

7. Social Proof

You might also like

- Section 1: 10-K (10-K) : United States Securities and Exchange CommissionDocument129 pagesSection 1: 10-K (10-K) : United States Securities and Exchange CommissionSamir GhoshNo ratings yet

- 2015 Annual Report Complete enDocument236 pages2015 Annual Report Complete enSamir GhoshNo ratings yet

- 2015 Annual Report Compensation Report enDocument10 pages2015 Annual Report Compensation Report enSamir GhoshNo ratings yet

- Johnson & Johnson JNJ Stock-Sample Analysis Report Intrinsic ValueDocument12 pagesJohnson & Johnson JNJ Stock-Sample Analysis Report Intrinsic ValueOld School Value100% (2)

- Avanti Field Insights PDFDocument15 pagesAvanti Field Insights PDFSamir GhoshNo ratings yet

- Soa10134 DR 129329 - Good PDFDocument38 pagesSoa10134 DR 129329 - Good PDFSamir GhoshNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

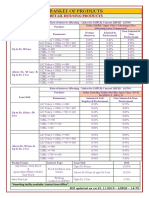

- BASKET OF RETAIL PRODUCTS RATESDocument3 pagesBASKET OF RETAIL PRODUCTS RATESVirendra K VermaNo ratings yet

- Vendor Supplier Registration Information SheetDocument3 pagesVendor Supplier Registration Information SheetEnzo MarquezNo ratings yet

- MPBFDocument6 pagesMPBFhiteshgauranaNo ratings yet

- Reverse Charge Mechanism in GST Regime With ChartDocument6 pagesReverse Charge Mechanism in GST Regime With ChartSwathi VikashiniNo ratings yet

- The Founding Fathers, 30 Years OnDocument8 pagesThe Founding Fathers, 30 Years OnJames WarrenNo ratings yet

- Financial Accounting and Accounting StandardDocument18 pagesFinancial Accounting and Accounting StandardZahidnsuNo ratings yet

- Week 10 Compiled PDFDocument12 pagesWeek 10 Compiled PDFChaNo ratings yet

- Presentation KenwoodDocument18 pagesPresentation KenwoodAsfand KhanNo ratings yet

- ISO 37001: Anti-Bribery Management System StandardDocument10 pagesISO 37001: Anti-Bribery Management System StandardNada ChraibiNo ratings yet

- Af ManifestDocument23 pagesAf ManifestCwasi Musicman100% (1)

- PMEGP Scheme प्रधानमंत्री रोजगार सृजन कार्यक्रमDocument31 pagesPMEGP Scheme प्रधानमंत्री रोजगार सृजन कार्यक्रमAbinash MandilwarNo ratings yet

- Table B5: Bank-Wise Non-Performing Assets (Npas) of Scheduled Commercial Banks - 2006Document2 pagesTable B5: Bank-Wise Non-Performing Assets (Npas) of Scheduled Commercial Banks - 2006Rekha BaiNo ratings yet

- Corporate Strategies: 10 Case StudiesDocument7 pagesCorporate Strategies: 10 Case StudiesBskTeja0% (2)

- DETAILS OF G.OsDocument16 pagesDETAILS OF G.OsRaghu Ram50% (2)

- Fiat Case StudyDocument10 pagesFiat Case StudyVipra PandeyNo ratings yet

- Principles of Taxation I SyllabusDocument7 pagesPrinciples of Taxation I SyllabusShreyaNo ratings yet

- NLRC Lacks Jurisdiction in Labor Case Involving Foreign EmployerDocument2 pagesNLRC Lacks Jurisdiction in Labor Case Involving Foreign EmployerAnsis Villalon PornillosNo ratings yet

- Internship Report NiB BankDocument10 pagesInternship Report NiB BankAbdul WaheedNo ratings yet

- Nestle USA Grainger purchases and paymentsDocument81 pagesNestle USA Grainger purchases and paymentsnelsonNo ratings yet

- Bella v1Document4 pagesBella v1ug8No ratings yet

- ElectroluxDocument3 pagesElectroluxRupeet Singh100% (1)

- Jack Trout - Trout On StrategyDocument5 pagesJack Trout - Trout On StrategyCosmin StefanNo ratings yet

- Office Order Unit HeadDocument31 pagesOffice Order Unit HeadRajkumar PrasadNo ratings yet

- Megaworld 1st Quarter 2019 Financial ReportDocument29 pagesMegaworld 1st Quarter 2019 Financial ReportRyan CervasNo ratings yet

- Global Strategy Mike PengDocument28 pagesGlobal Strategy Mike PengRui Fernando Correia FerreiraNo ratings yet

- Law DigestDocument4 pagesLaw DigestPatricia Adora AlcalaNo ratings yet

- Lista de Empresas Bolivianas Vinculadas en El Caso Panamá PapersDocument6 pagesLista de Empresas Bolivianas Vinculadas en El Caso Panamá PapersLos Tiempos DigitalNo ratings yet

- CEO Road Rules1Document233 pagesCEO Road Rules1sammyyankee100% (1)

- Novartis AcquistionDocument17 pagesNovartis AcquistionashkuchiyaNo ratings yet

- GE Commercial Distribution Finance Corporation v. Frost Hardware Company Et Al - Document No. 3Document3 pagesGE Commercial Distribution Finance Corporation v. Frost Hardware Company Et Al - Document No. 3Justia.comNo ratings yet