Professional Documents

Culture Documents

Financial Feasibility of Business Plan

Uploaded by

Rizaldi DjamilCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Feasibility of Business Plan

Uploaded by

Rizaldi DjamilCopyright:

Available Formats

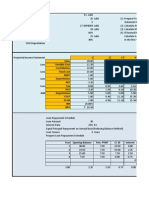

ABC Company

Assumptions

cash balanced

Spot Exchange Rate

Terranian Francs/ 1 36.85

Terranian Francs/ 1 23.32

Projected Inflation Rate Year 0 Year 1 Year 2 Year 3

UK & EU 2% 3% 3%

Terrania 20% 15% 10%

Exchange Rate

Terranian Francs/ 1 36.85 43.35 48.40 51.69

Terranian Francs/ 1 23.32 27.44 30.63 32.71

Year 0 Year 1 Year 2 Year 3

Capex 500.00 - - -

Debt financing % 25% 0% 50% 50%

Equity financing % 75% 100% 50% 50%

Trade days 90 90 90

Labor cost days 30 30 30

Sales and distribution days 60 60 60

Other payable days 90 90 90

Depreciation

Depreciation Method SL

Depreciation rate 20%

Unit Costs in year 1

Labour (based upon using 250 workers) T 3800

Local components T 1800

Component from Germany 30

Sales and distribution T 400

Production/ Sales 60000 per year

Selling price 400 Year 1

Local Workes 300

Labor capacity 250

Fixed Costs in Million T 50

Tax Rate 20%

CAPITAL STRUCTURE

Equity 75%

Total Debt

Long Term Debt 25%

Long Term Debt:

Life of loan 5 Years

Interest rate (% p.a.) 15%

Short Term Financing 5%

Click here for Cash Balancing

Valuation

Profit after Tax 27.77 45.29 53.92

Tax shield from Depraeciation - - -

Investment (500.00)

Working capital requirement #REF! #REF! #REF! #REF!

#REF! #REF! #REF! #REF!

#REF! #REF! #REF! #REF!

Year 4

3%

10%

55.21

34.94

Year 4

-

50%

50%

90

30

60

90

58.44

-

#REF!

#REF! #REF!

#REF!

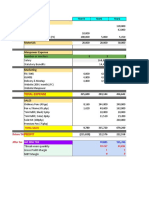

ABC Company

Valuation

WACC 16.50%

Cost of debt on longterm loan 12.00%

Cost of equity 18.00%

Debt % based on book value 25.00%

Equity % based on book value 75.00%

Terminal growth rate 8.00%

Marketing discount 0%

Outstanding shares 12,000

Tax rate 20%

Year 0 Year 1 Year 2 Year 3 Year 4

Cashflow from Operating Activities - 30.7 116.2 112.7 104.2

Cashflow from Investing Activities (500.0) - - - -

Adj. Treasury - 15.0 14.3 13.4 12.4

Debt free cash Flow (500.0) 45.7 130.4 126.0 116.6

Discount factor 1.00 0.86 0.74 0.63 0.54

PV of Debt free cash flows (222)

PV of Terminal Value 804

583

Less: Marketability Discount 0%

Value of the Company 583

Add: Cash 24

Business Enterprise Value 607

Less: Debt (119)

Equity value of Company 488

Shares no. 12,000

Value per share 0.04

ABC Company

Longterm Financial Projection

INCOME STATEMENT

Year 0 Year 1 Year 2 Year 3 Year 4

Sales 658.4 735.2 785.1 838.5

Costs

Labor Cost 273.6 314.6 346.1 380.7

Local Component Cost 108.0 124.2 136.6 150.3

Component from Germany 49.4 56.8 60.7 64.8

Sales and distribution 24.0 27.6 30.4 33.4

Depreciation 100.0 80.0 64.0 51.2

Fixed Costs 50.0 57.5 63.3 69.6

Total Cost 605.0 660.7 701.0 749.9

Earning before interest and taxes 53.5 74.4 84.1 88.5

Interest 18.8 17.8 16.7 15.5

Earning before tax 34.7 56.6 67.4 73.0

Tax Amount 6.9 11.3 13.5 14.6

Profit afetr Tax 27.8 45.3 53.9 58.4

Accumulated Profit/ (loss) 27.8 73.1 127.0 185.4

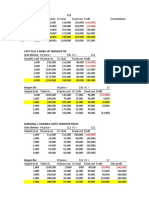

ABC Company

Longterm Financial Projection

BALANCE SHEET

Equity and Liabilities Year 0 Year 1 Year 2 Year 3 Year 4

Equity

Equity Investement 375.00 375.0 375.0 375.0 375.0

Accumulated profit/ (loss) 27.8 73.1 127.0 185.4

Total Equity 375.0 402.8 448.1 502.0 560.4

Liabilities

Longterm Loan 125.0 118.8 111.6 103.3 93.8

Short term financing - - - - -

Payable - 65.2 75.0 82.1 89.8

Total Liabilities 125.0 184.0 186.6 185.4 183.6

Total Equity and Liabilities 500.0 586.8 634.7 687.4 744.0

Assets

Fixed Assets

Tangible Assets 500.0 400.0 320.0 256.0 204.8

Total Fixed Assets 500.0 400.0 320.0 256.0 204.8

Current Assets

Account Receivable - 162.4 181.3 193.6 206.7

Cash and Bank - 24.4 133.4 237.8 332.5

Total Current Assets - 186.8 314.7 431.4 539.2

Total Assets 500.0 586.8 634.7 687.4 744.0

- - - - -

ABC Company

Longterm Financial Projection

CASH FLOW STATEMENT

Operating Activities

Cash Receipt - 496.1 716.2 772.8 825.3

Cash Payment

Labor Cost (251.1) (311.3) (343.5) (377.9)

Local Component Cost - (81.4) (120.2) (133.6) (146.9)

Component from Germany - (37.2) (55.0) (59.7) (63.8)

Sales and distribution - (20.1) (27.0) (29.9) (32.9)

Tax Payment (6.9) (11.3) (13.5) (14.6)

Interest Payment (18.8) (17.8) (16.7) (15.5)

Fixed Costs (50.0) (57.5) (63.3) (69.6)

Total Cash Payment - (465.4) (600.1) (660.1) (721.1)

Total Operating Activities - 30.7 116.2 112.7 104.2

Investment Activities

Fixed Capital Investment (500.0) - - - -

Total Investment Activities (500.0) - - - -

Financing Activities

Euity Investment 375.0 - - - -

Increase / (decrease) of short term loan - - - - -

Increase / (decrease) of longterm loan 125.0 (6.3) (7.2) (8.3) (9.5)

Total Financing Activities 500.0 (6.3) (7.2) (8.3) (9.5)

Net Cashinflows/ (outflows) - 24.4 109.0 104.4 94.7

Opening Cash Balance - 24.4 133.4 237.8

Ending Cash Balance - 24.4 133.4 237.8 332.5

ABC Company

Statement of Revenue Projection

Year 1 Year 2 Year 3 Year 4

Sales (units) 60,000 60,000 60,000 60,000

Sales price () 400 400 400 400

Revenue in 24,000,000 24,000,000 24,000,000 24,000,000

Exchange Rate ( Terranian Francs/ 1) 27.44 30.63 32.71 34.94

Revenue in Terranian Francs in Million 658.45 735.16 785.12 838.48

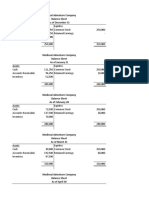

ABC Company

NOTES:

Equity Year 0 Year 1 Year 2 Year 3 Year 4

Opening - 375 375 375 375

Addition 375 - - - -

Withdraw

Ending 375 375 375 375 375

Trade Debts

Opening - 162 181 194

Addition 658 735 785 838

Collection 496 716 773 825

Ending - 162 181 194 207

Days 90 90 90 90

Payable

Labor Cost 22.49 25.86 28.45 31.29

Local Component Cost 26.63 30.62 33.69 37.06

Component from Germany 12.18 14.00 14.95 15.97

Sales and distribution 3.95 4.54 4.99 5.49

Ending Payable 65.24 75.03 82.08 89.81

Payment

Labor Cost 251.11 311.27 343.52 377.87

Local Component Cost 81.37 120.21 133.56 146.91

Component from Germany 37.21 54.96 59.70 63.76

Sales and distribution 20.05 27.01 29.91 32.90

Total Payment 389.74 513.45 566.68 621.44

Labor Cost

Opening - 22 26 28

Addition 274 315 346 381

Payment 251 311 344 378

Ending - 22 26 28 31

Days 30 30 30 30

Local Component Cost

Opening - 27 31 34

Addition 108 124 137 150

Collection 81 120 134 147

Ending - 27 31 34 37

Days 90 90 90 90

Component from Germany

Opening - 12 14 15

Addition 49 57 61 65

Collection 37 55 60 64

Ending 12 14 15 16

Days 90 90 90 90

Sales and distribution

Opening - 4 5 5

Addition 24 28 30 33

Payment 20 27 30 33

Ending 4 5 5 5

Days 60 60 60 60

Fixed Assets

Opening Value 500 400 320 256

Addition 500 - - - -

Depreciation 20% 100 80 64 51

Ending Value 500 400 320 256 205

Longterm Financing Financing

Year 0 Year 1 Year 2 Year 3 Year 4

Opening - 125.0 118.8 111.6 103.3

Addition #### - - - -

Principal payment - 6.3 7.2 8.3 9.5

Outstanding 125.0 118.8 111.6 103.3 93.8

Financial Charges

6 months Kibor - 18.8 17.8 16.7 15.5

Premium

Payment 25.0 25.0 25.0 25.0

Short term Financing

Year 0 Year 1 Year 2 Year 3 Year 4

Opening - - - - -

Addition - - - - -

Principal payment - - - - -

Outstanding - - - - -

Financial Charges

6 months Kibor - - - - -

Premium

Payment - - - -

- - - -

Operating cash + debt repayment (24.4) (109.0) (104.4) (94.7)

Closing Balance 475.6 366.6 262.2 167.5

Cash requirement 500 - - - -

- - - - -

You might also like

- Ipo ModelDocument5 pagesIpo ModelspuiszisNo ratings yet

- Financial Model - SolutionDocument6 pagesFinancial Model - SolutionOssama AliNo ratings yet

- IRR Financial ModelDocument110 pagesIRR Financial ModelericNo ratings yet

- Financial Projection Template: Strictly ConfidentialDocument62 pagesFinancial Projection Template: Strictly ConfidentialKnightspageNo ratings yet

- Business Model ManufacturerDocument84 pagesBusiness Model ManufacturerFarhan ShafiqueNo ratings yet

- Financial Feasibility of Product ADocument4 pagesFinancial Feasibility of Product AMuhammad AsadNo ratings yet

- Investment Feasibility AssessmentDocument27 pagesInvestment Feasibility Assessmentad001No ratings yet

- Financial ModellingDocument13 pagesFinancial ModellingPrashant Dhage100% (2)

- Operation Expenses and Sales Analysis for Stationery Business Over 5 YearsDocument31 pagesOperation Expenses and Sales Analysis for Stationery Business Over 5 YearsJanine PadillaNo ratings yet

- MGMT600 Final Business Plan Grading Rubric 4.2Document18 pagesMGMT600 Final Business Plan Grading Rubric 4.2Grad StudentNo ratings yet

- Spinning Project FeasibilityDocument19 pagesSpinning Project FeasibilityMaira ShahidNo ratings yet

- EFM Classic Business Free TrialDocument290 pagesEFM Classic Business Free TrialadildastiNo ratings yet

- NOTE 3: Operating Expenses: Quarter 4 2020 Advertising Tools PriceDocument9 pagesNOTE 3: Operating Expenses: Quarter 4 2020 Advertising Tools PriceERICKA GRACE DA SILVANo ratings yet

- Five-Year Financial Projection Pineapple Square House Projected Statement of Comprehensive Income For The Years Ended December 31, 2017-2021Document4 pagesFive-Year Financial Projection Pineapple Square House Projected Statement of Comprehensive Income For The Years Ended December 31, 2017-2021Rey PordalizaNo ratings yet

- Startup Ms - EXcelDocument9 pagesStartup Ms - EXcelSumit BindalNo ratings yet

- Sample Financial ModelDocument99 pagesSample Financial ModelNur Alahi100% (1)

- Cash Flow ProjectionDocument8 pagesCash Flow ProjectionSuhailNo ratings yet

- Business Unit Financial PlanDocument419 pagesBusiness Unit Financial PlanModelSheet0% (1)

- Restaurant Financial ProjectionsDocument37 pagesRestaurant Financial ProjectionsPaul NdegNo ratings yet

- HR Cost of Hiring CalculatorDocument2 pagesHR Cost of Hiring Calculatornandex777No ratings yet

- PRM Self Assessment ToolDocument26 pagesPRM Self Assessment ToolBinson VargheseNo ratings yet

- Financial Projection Model for Your Business Name HereDocument70 pagesFinancial Projection Model for Your Business Name HerenabayeelNo ratings yet

- Mapping New Expert-KEUDocument37 pagesMapping New Expert-KEUApdev OptionNo ratings yet

- Financial Model 1Document92 pagesFinancial Model 1bharat_22nandulaNo ratings yet

- Cma of HostelDocument128 pagesCma of HostelkolnureNo ratings yet

- Pestle Analysis - Alesh and GroupDocument18 pagesPestle Analysis - Alesh and GroupJay KapoorNo ratings yet

- Stakeholder Analysis ToolDocument8 pagesStakeholder Analysis ToolRichard Thodé JrNo ratings yet

- Payback Period TemplateDocument3 pagesPayback Period TemplateSobanah ChandranNo ratings yet

- Module 3 Small & Medium EnterprisesDocument18 pagesModule 3 Small & Medium EnterprisesJanardhan ShettyNo ratings yet

- Meezan BankDocument39 pagesMeezan BankAsif Ali0% (2)

- Balance Sheet 2014 (In Millions) Mcdonalds: Current Assets Sub-Total $ 4,185.50Document10 pagesBalance Sheet 2014 (In Millions) Mcdonalds: Current Assets Sub-Total $ 4,185.50jackNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisGaurav PoddarNo ratings yet

- How To PITCH and Register Your StartupDocument13 pagesHow To PITCH and Register Your StartupDivyanshuNo ratings yet

- Course Project ADocument9 pagesCourse Project AJay PatelNo ratings yet

- 5-Year Financial Projection of Operational Expenses: Marian School of San JacintoDocument4 pages5-Year Financial Projection of Operational Expenses: Marian School of San Jacintonorvel19No ratings yet

- Performance Toolkit V2Document16 pagesPerformance Toolkit V2BobbyNicholsNo ratings yet

- Financial Report 2017Document106 pagesFinancial Report 2017Le Phong100% (1)

- Different Types of Financial Models For Financial ModellingDocument4 pagesDifferent Types of Financial Models For Financial Modellingshivansh nangiaNo ratings yet

- Test 3 Project Finance Case Question Yogesh GandhiDocument14 pagesTest 3 Project Finance Case Question Yogesh GandhiYogi GandhiNo ratings yet

- Valuation Cash Flow A Teaching NoteDocument5 pagesValuation Cash Flow A Teaching NotesarahmohanNo ratings yet

- Brand Valuation - Marginal Cash Flow and Excess Cash FlowDocument12 pagesBrand Valuation - Marginal Cash Flow and Excess Cash Flowbipaf44641izzumcomNo ratings yet

- Financial Model Template Financial Model Template Financial Model TemplateDocument29 pagesFinancial Model Template Financial Model Template Financial Model TemplatetfnkNo ratings yet

- Financial Model - Revised (05!11!2020)Document39 pagesFinancial Model - Revised (05!11!2020)Fazal ImranNo ratings yet

- CSR Strategy FormulationDocument20 pagesCSR Strategy FormulationEr Vipul VermaNo ratings yet

- Sensitivity AnalysisDocument13 pagesSensitivity Analysisrastogi paragNo ratings yet

- Bank Ratio Analysis Sample RatiosDocument4 pagesBank Ratio Analysis Sample Ratiosmicrolab777No ratings yet

- Financial Strategic MeasuresDocument17 pagesFinancial Strategic MeasuresVIVEK KUMARNo ratings yet

- Financial AnalisysDocument12 pagesFinancial AnalisysMuhamad FajriNo ratings yet

- Cash Budget Model Cash Budget Model - Case Study: InflowsDocument1 pageCash Budget Model Cash Budget Model - Case Study: Inflowsayu nailil kiromahNo ratings yet

- Square Pharma Investment AnalysisDocument62 pagesSquare Pharma Investment AnalysisFaraz SjNo ratings yet

- Assumption Sheet Financial ModelDocument5 pagesAssumption Sheet Financial ModelVishal SachdevNo ratings yet

- Investment Analysis - Project ReportDocument15 pagesInvestment Analysis - Project ReportChirag PatelNo ratings yet

- Investment Banking, 3E: Valuation, Lbos, M&A, and IposDocument11 pagesInvestment Banking, 3E: Valuation, Lbos, M&A, and IposBook Sittiwat100% (1)

- Financial Forecast Template ExcelDocument43 pagesFinancial Forecast Template ExcelPro Resources100% (1)

- Financial ModelDocument42 pagesFinancial Modelarhawnn33% (3)

- 5 Year Financial Plan Manufacturing 1Document30 pages5 Year Financial Plan Manufacturing 1SuhailNo ratings yet

- Energy Efficiency Modelling - PT Empat SekawanDocument24 pagesEnergy Efficiency Modelling - PT Empat SekawanRetno PamungkasNo ratings yet

- Kellogg: Balance SheetDocument14 pagesKellogg: Balance SheetSubhajit KarmakarNo ratings yet

- Projection and Valuation Example - SolutionDocument13 pagesProjection and Valuation Example - SolutionPrince Akonor AsareNo ratings yet

- BASIC MODEL - Construction.Document10 pagesBASIC MODEL - Construction.KAVYA GUPTANo ratings yet

- The Reason For Decertification ISO 9001Document12 pagesThe Reason For Decertification ISO 9001Rizaldi DjamilNo ratings yet

- Manage Blood Banks & Donations with a Centralized SystemDocument4 pagesManage Blood Banks & Donations with a Centralized SystemRizaldi Djamil100% (1)

- Surveyor Comment - 2 Pages - Health Information Management SystemDocument2 pagesSurveyor Comment - 2 Pages - Health Information Management SystemRizaldi DjamilNo ratings yet

- 11 Pages Assessment Material For Procurement and Operations ManagementDocument12 pages11 Pages Assessment Material For Procurement and Operations ManagementRizaldi DjamilNo ratings yet

- Simple Guidelines For Project Operation Management - A Sample From UNDocument2 pagesSimple Guidelines For Project Operation Management - A Sample From UNRizaldi DjamilNo ratings yet

- 3 Pages Description of Mstering Management SystemDocument3 pages3 Pages Description of Mstering Management SystemRizaldi DjamilNo ratings yet

- 3 Pages - MIS IntroductionDocument5 pages3 Pages - MIS IntroductionRizaldi DjamilNo ratings yet

- 3 Simple Pages of Content Management SystemDocument3 pages3 Simple Pages of Content Management SystemRizaldi DjamilNo ratings yet

- Performance Management System Training ScheduleDocument1 pagePerformance Management System Training ScheduleRizaldi DjamilNo ratings yet

- Payroll Management System SynopsisDocument4 pagesPayroll Management System SynopsisShashi Shekar KnNo ratings yet

- Library Management System SynopsisDocument3 pagesLibrary Management System SynopsisieeexploreprojectsNo ratings yet

- Moss Management Agreement NewDocument2 pagesMoss Management Agreement NewRizaldi DjamilNo ratings yet

- 1 Page - Guideline of Marketing ManagementDocument1 page1 Page - Guideline of Marketing ManagementRizaldi DjamilNo ratings yet

- Marketing Plan GuidelinesDocument5 pagesMarketing Plan Guidelinesv04hannaNo ratings yet

- New Ground - Non-Traditional Sectors Benefitting From Project ManagementDocument3 pagesNew Ground - Non-Traditional Sectors Benefitting From Project ManagementRizaldi DjamilNo ratings yet

- 3 Pages Sample of HR Management OutlineDocument3 pages3 Pages Sample of HR Management OutlineRizaldi DjamilNo ratings yet

- Simple Approach of Production and Operation Management - Less PagesDocument2 pagesSimple Approach of Production and Operation Management - Less PagesRizaldi DjamilNo ratings yet

- Stratagic Marketing Plan - A Sample IntroductionDocument4 pagesStratagic Marketing Plan - A Sample IntroductionRizaldi DjamilNo ratings yet

- 1 Page of Statement Audit - Simple ExampleDocument1 page1 Page of Statement Audit - Simple ExampleRizaldi DjamilNo ratings yet

- 7 Pages - Basic Lecture On HR MANAGEMENTDocument8 pages7 Pages - Basic Lecture On HR MANAGEMENTRizaldi DjamilNo ratings yet

- 2 Simple Pages - Introduction To CommunicationDocument2 pages2 Simple Pages - Introduction To CommunicationRizaldi DjamilNo ratings yet

- 3 Simple Pages - Sample For JOB DESCRIPTION of HR CoordinatorDocument3 pages3 Simple Pages - Sample For JOB DESCRIPTION of HR CoordinatorRizaldi DjamilNo ratings yet

- 2 Pages - Simple Introduction To Performance ManagementDocument2 pages2 Pages - Simple Introduction To Performance ManagementRizaldi DjamilNo ratings yet

- Sample of Audit Plan - Short and Simple ApproachDocument2 pagesSample of Audit Plan - Short and Simple ApproachRizaldi DjamilNo ratings yet

- 4 Pages - Introduction To Performance ManagementDocument4 pages4 Pages - Introduction To Performance ManagementRizaldi DjamilNo ratings yet

- Sample of Internal Audit Program Fo Is Admin & AccessSecurityDocument10 pagesSample of Internal Audit Program Fo Is Admin & AccessSecurityRizaldi DjamilNo ratings yet

- Single Page Audit Observation - A Sample ReportDocument1 pageSingle Page Audit Observation - A Sample ReportRizaldi DjamilNo ratings yet

- 7 Pages of Basic Information Security ConceptsDocument8 pages7 Pages of Basic Information Security ConceptsRizaldi DjamilNo ratings yet

- Information Security and IT GovernanceDocument6 pagesInformation Security and IT GovernanceSreekarNo ratings yet

- 4 Page Sample of Sylabus of Information SecurityDocument4 pages4 Page Sample of Sylabus of Information SecurityRizaldi DjamilNo ratings yet

- Stracoma FinalssDocument53 pagesStracoma FinalssAeron Arroyo IINo ratings yet

- Module 1 Current LiabilitiesDocument13 pagesModule 1 Current LiabilitiesLea Yvette SaladinoNo ratings yet

- GMR Finance ReportDocument14 pagesGMR Finance ReportsaranshjainNo ratings yet

- Soal LatihanDocument1 pageSoal Latihanflypop13No ratings yet

- Mphasis HSBCDocument9 pagesMphasis HSBCmittleNo ratings yet

- Partnership Dissolution: Prepared By: Cristopherson A. Perez, CPADocument59 pagesPartnership Dissolution: Prepared By: Cristopherson A. Perez, CPAKyla de SilvaNo ratings yet

- Chapter 9 InvestmentsDocument19 pagesChapter 9 Investmentsjuennagueco100% (2)

- 2 Marginal CostingDocument75 pages2 Marginal CostingAritra DeyNo ratings yet

- 2022 Full Year Results presentationCCHBC-FY-2022-presentation-20230214Document27 pages2022 Full Year Results presentationCCHBC-FY-2022-presentation-20230214FelipeWeissNo ratings yet

- Financial Statement - With Adjustments - DPP 13Document4 pagesFinancial Statement - With Adjustments - DPP 13dhruvNo ratings yet

- REED FileDocument4 pagesREED FileJake VargasNo ratings yet

- 5.9.2.6 Allocating Goodwill To Cash-Generating Units: Indian Accounting Standard 36Document16 pages5.9.2.6 Allocating Goodwill To Cash-Generating Units: Indian Accounting Standard 36RITZ BROWNNo ratings yet

- Format of Financial StatementsDocument11 pagesFormat of Financial StatementssarlagroverNo ratings yet

- Clothing Retailers Financial Statements AnalysisDocument15 pagesClothing Retailers Financial Statements Analysisapi-277769092No ratings yet

- X201 Midterm Exam Worksheet 2021Document1 pageX201 Midterm Exam Worksheet 2021Kharen PadlanNo ratings yet

- Davey Brothers in Class WorkingDocument13 pagesDavey Brothers in Class WorkingPiyush KumarNo ratings yet

- December 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesDecember 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- Case Analysis - Cost of CapitalDocument5 pagesCase Analysis - Cost of CapitalHazraphine Linso100% (1)

- Asset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDocument3 pagesAsset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDidhane MartinezNo ratings yet

- Fin661 - Lesson Plan - March2021Document2 pagesFin661 - Lesson Plan - March2021MOHAMAD ZAIM BIN IBRAHIM MoeNo ratings yet

- Solutions To Capital Budgeting Problems Capital Budgeting Handout 3 Expansion Problems Ellis Construction Company T 0 Initial InvestmentDocument9 pagesSolutions To Capital Budgeting Problems Capital Budgeting Handout 3 Expansion Problems Ellis Construction Company T 0 Initial InvestmentAnand SridharanNo ratings yet

- Baltic Group Cost Analysis and Transfer Pricing StrategiesDocument4 pagesBaltic Group Cost Analysis and Transfer Pricing StrategiesSangtani PareshNo ratings yet

- SAR-MAR-210422-1227PM - RR - 034-COPY 1.editedDocument12 pagesSAR-MAR-210422-1227PM - RR - 034-COPY 1.editedJishnu ChaudhuriNo ratings yet

- ACC501 Solved MCQsDocument6 pagesACC501 Solved MCQsMuhammad aqeeb qureshiNo ratings yet

- Indian Gaap V/s Us GaapDocument32 pagesIndian Gaap V/s Us GaapArun PandeyNo ratings yet

- Installment SalesDocument3 pagesInstallment SalesIryne Kim PalatanNo ratings yet

- TCS-Registration Process - User Flow DocumentDocument8 pagesTCS-Registration Process - User Flow DocumentMadhan kumarNo ratings yet

- 01 Investment in Equity Securities - V2 With AnswersDocument17 pages01 Investment in Equity Securities - V2 With AnswersJEFFERSON CUTE71% (7)

- 11-1 Medieval Adventures CompanyDocument8 pages11-1 Medieval Adventures CompanyWei DaiNo ratings yet

- Accounting Ratios - Class NotesDocument8 pagesAccounting Ratios - Class NotesAbdullahSaqibNo ratings yet