Professional Documents

Culture Documents

Fixed in Come

Uploaded by

Angelo Torres0 ratings0% found this document useful (0 votes)

11 views25 pagesCopyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views25 pagesFixed in Come

Uploaded by

Angelo TorresCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 25

fic

CS FIRSTBOSTON April 26, 1995

FIXED INCOME RESEARCH BULLETIN

Implied Default Proailitie!" A Ne# Approa$% to Ri!&' Det

Clayton Perry 212/909-2682

Summary Implied default probabilities are a useful mechanism for ealuatin! ris"y

debt# $ather than discountin! promised cashflo%s at a hi!h rate %hich reflects

the dan!er that they %ill not be receied& %e hae more directly identified the

implied default probability in a set of 'r!entinian eurobonds by discountin!

expected cashfio%s at the ris"-free rate# (urthermore& %e hae remoed some

of the apparent inconsistencies inherent in assumin! different probabilities

for similar bonds in the same time period# )hus %e& hae !enerated a set of

probabilities a!ainst %hich inestors can measure their o%n opinions about

the ris"iness of the securities to decide upon relatie alue#

T%i! 'ear %a! #it(e!!ed turmoil i( emer)i() det mar&et! o( a !$ale u(!ee( !i($e

t%e Brad' re!tru$turi()* Follo#i() t%e Me+i$a( de,aluatio( i( De$emer- !%o$&

#a,e! !pread a! far afield a! Pola(d a(d T%aila(d a! i(,e!tor! fled for t%e !afet' of

S#it.erla(d a(d /erma('* I( a( e(,iro(me(t $%ara$teri.ed ' t%i! !ort of 0ri!&

redu$tio( at a(' pri$e0 it i! plau!ile t%at differe(t ri!&! ma' e pri$ed

i($o(!i!te(tl'- or i(deed t%at e1ui,ale(t ri!&! offer #idel' differi() retur(!*

Our approa$% to ide(tif'i() !u$% po!!iilitie! i! to a(al'.e t%e proailit' of

default #%i$% i(,e!tor! %a,e pri$ed i(to ea$% of a !et of !imilarl' ri!&' o(d!* T%e

re!ult i! merel' a differe(t #a' of !tati() relati,e ,alue- ut %a! t%e ad,a(ta)e of

e+pre!!io( i( term! of t%e !pe$ifi$ ri!& t%at i(,e!tor! are $o($er(ed #it% 2 t%e

$%a($e! t%at t%e' #ill )et t%eir mo(e' a$&* T%e !tati!ti$ #e $al$ulate i! t%e rate of

default o( t%e o(d #%i$% #ould )i,e a( e+pe$ted retur( 3(et of proailit'

#ei)%ted $redit lo!!e!4 e1ual to t%e ri!& free rate of retur(* 5e %a,e ta&e( a! our

!ample t%e (o(2Brad' dollar o(d! i!!ued ' Ar)e(ti(a* T%e!e %a,e ee( fa,ored

for t%i! e+po!itio( pri($ipall' e$au!e t%ere are fi,e o(d! of t%e !ame $la!! #it% a

rea!o(al' re)ular maturit' !$%edule* Later ulleti(! #ill deal #it% Brad' o(d!

a(d ot%er $la!!e! of ri!&' det*

This memorandum is for informative purposes only. Under no circumstances is it to be used or considered as an offer to sell, or a solicitation of an offer to buy

any security. Additional information is available upon request. esults based on hypothetical pro!ections or past performance have certain inherent limitations.

There is no certainty that the parameters and assumptions used can be duplicated "ith actual trades. Any results sho"n do not reflect the impact of commissions

and#or fees, unless stated. $inancial futures and options are not appropriate for all investors. Their relative merits should be carefully "ei%hed. &here information

has been obtained from outside sources. 't is believed to be reliable but is not represented to be accurate or complete. This document may not be reproduced in

"hole or in part or other"ise made available "ithout our "ritten consent This firm may from time to time perform investment ban(in% for, or solicit investment

ban(in% or other business from any company mentioned. &e or our employees may from time to time have a lon% or short position in any contract or security

discussed.

$i)ed 'ncome esearch

*ethodolo!y Suppo!e 'ou are due to re$ei,e a pa'me(t i( o(e 'ear6! time* If 'ou are 7889 !ure

'ou #ill $olle$t- it i! !e(!ile to di!$ou(t t%at pa'me(t at t%e rele,a(t ri!& free rate-

t%e 7 2'ear U*S* Trea!ur' ill 'ield* T%e le!! !ure 'ou are of re$ei,i() t%e pa'me(t

t%e %i)%er #ill e t%e di!$ou(t rate applied a(d t%e le!! #ill e t%e pre!e(t ,alue of

t%e pa'me(t* No# !uppo!e 'ou are 7889 $ertai( of )etti() either pa'me(t + or

pa'me(t '- #%ere ' i! a !maller amou(t* If 'ou di!$ou(t ot% at t%e ri!& free rate

'ou )et t#o (et pre!e(t ,alue!- o(e of #%i$% #ill e $orre$t* To ,alue t%i! 0eit%er

or0 pa'me(t t%e mo!t lo)i$al t%i() to do i! to a!!i)( proailitie! to ea$% of

pa'me(t + a(d pa'me(t ' a(d ta&e a( a,era)e of t%e t#o NP:! #ei)%ted ' t%e

a!!i)(ed proailitie!*

I( our e+ample- pa'me(t + repre!e(t! t%e $a!%flo# !$%eduled o( a o(d- #%ile

pa'me(t ' repre!e(t! t%e re$o,er' ,alue 2 t%e amou(t t%e o(d i! #ort% i( t%e

e,e(t of a default* T%e mar&et pri$e of t%e o(d i( it! fi(al $oupo( period #ill

repre!e(t t%e proailit' #ei)%ted a,era)e 2 or e+pe$ted ,alue 2 of t%e!e t#o

amou(t! di!$ou(ted at t%e ri!&2free rate* T%i! i! repre!e(ted al)erai$all' a!

follo#!"

c (1 - d) + Rd

P= _____________

1 + r

#%ere P ; dirt' pri$e of o(d

$ ; $a!%flo#

d = the proailit' of default i( t%i! period

R = recovery pro$eed! i( e,e(t of default

r = risk free di!$ou(t rate

For e+ample- !uppo!e a ri!&' 72'ear .ero $oupo( o(d i! tradi() at a pri$e of <=*==- )i,i() a 'ield

of >89* If t%e di!$ou(t rate o( t%e 7 2'ear U*S* Trea!ur' ill i! ?9 a(d t%e a!!umed re$o,er' rate

o( t%e ri!&' o(d i! =89- t%e( t%e e1uatio( e$ome!@

100 (1 - d) + 38d

83.33 ; AAAAAAAAAAA

1.05

Sol,i() for t%e default rate d )i,e! a mar&et implied default proailit' of 7B*<?9*

If t%e o(d %a! t#o $a!%flo#! remai(i()- t%e pri$e !%ould e1ual t%e !um of t%e t#o di!$ou(ted

e+pe$ted ,alue!* Ho#e,er t%e $al$ulatio( of t%e !e$o(d e+pe$ted ,alue i! !li)%tl' more $ompli$ated

e$au!e #e mu!t allo# for t%e fa$t t%at t%e o(d ma' default i( t%e fir!t $oupo( period* T%erefore

our #ei)%t! are (o# t%e default proailit' i( t%e !e$o(d period conditional o( ma&i() it t%rou)%

t%e fir!t period* T%i! $o(ditio(alit' i! e+pre!!ed ' multipl'i() ot% term! ' t%e proailit' of (o

>

$i)ed 'ncome esearch

default i( t%e fir!t period (1-d). 5e $a( &eep e+te(di() t%i! for ( !$%eduled $a!%flo#! i( t%e !ame

ma((er* Note t%at ea$% period6! proailitie! mu!t e multiplied ' t%e proailit' of (o default i(

all t%e pre,iou! period!*

If #e a!!ume t%at t%e proailit' of default i( ea$% of t%e i(di,idual $oupo( period! i! t%e

!ame #e $a( $ollap!e t%i! e1Citio( to t%e follo#i()@

T%i! i! re$o)(i.ale a! a( e+te(!io( of t%e !imple 'ield to maturit' $al$ulatio( #%i$% o(e

#ould (ormall' !ol,e for t%e di!$ou(t rate- r- from t%e &(o#( pri$e a(d $a!%flo# !$%edule*

T%i! di!$ou(t rate or 'ield #ould u!uall' refle$t opi(io(! of t%e ri!&i(e!! of t%e $a!%flo#

!$%edule* +ur approach separates this discount factor from the ris" %ei!htin! by usin!

the ris" free discount rate from the ,#S# )reasury spot cure and confinin! e-pectations

to the top line of the e.uation# If #e a!!ume a re$o,er' ,alue- #e $a( a$& out a ,alue for d

' iteratio( i( t%e !ame ma((er a! o(e #ould $o(,e(tio(all' $al$ulate 'ield to maturit' '

iterati() for r*

T%e met%odolo)' #e %a,e emplo'ed i! !et out dia)rammati$all' elo#* T%e proailit' of

)etti() to a poi(t o( t%i! i(omial tree i! t%e produ$t of t%e proailitie! ide(tified o( ea$%

ra($% ta&e(*

/-hibit 1# Binomial Tree of Default Probabilities

Cumulati,e T%e $al$ulatio(! #e %a,e de!$ried ao,e $a( e !ol,ed for d to )i,e t%e default

Default proailit' a!!umed for ea$% !i()le period* If a orro#er %a! det #it% ma('

Proailit' maturitie! out!ta(di() or %a! det #%i$% $apitali.e! i(tere!t or amorti.e!- t%e per

period default rate $a( e e!pe$iall' u!eful* For ma(' i!!uer! %o#e,er- of more

=

$i)ed 'ncome esearch

i(tere!t i! t%e $umulati,e default proailit'- t%e $%a($e t%at a o(d #ill (ot ma&e it to a

parti$ular poi(t o( our i(omial tree* For i(!ta($e- mo!t i(,e!tor! #ill e i(tere!ted i( t%e

proailit' t%at t%eir o(d #ill (ot default efore maturit'* T%i! i! t%e proailit' t%at #e #ill

)et to t%e ottom ri)%t o+ o( our i(omial tree- #%i$% i! Du!t t%e produ$t of all t%e i(di,idual

per2period proailitie! of !ur,i,al*

37Ed74372d>4F372dn4

A)ai( if #e a!!ume $o(!ta(t per2period proailitie!- t%e proailit' of (o default up to a(d

i($ludi() period n is

372d4

n

T%i! mea(! t%at t%e $umulati,e proailit' of default #ill e

7 2 37 2 d4

(

A!!e!!i() a T%e a!!e!!me(t of t%e re$o,er' ,alue of t%e o(d i( t%e e,e(t of default i! ot%

$ecoery 0alue diffi$ult a(d $ru$ial to t%e re!ult!* A $orporate o(d !%ould %a,e !ome ,alue i(

default from t%e $laim! t%at o(d2%older! %a,e o( t%e a!!et! of t%e $ompa('*

Se$ured det pre!e(t! fe# prolem!- #%ile u(!e$ured det #ill %a,e a $laim o(

u(e($umered a!!et! #%i$% #ill pre!umal' e !old at !ome di!$ou(t to full ,alue

i( t%e $a!e of li1uidatio(* A!!e!!i() t%e pri$e t%e!e a!!et! #ould fet$% i( a

!ituatio( of di!tre!!- alo() #it% t%e $o!t! of li1uidati() t%e $ompa(' #ill pre!e(t

!ome prolem!- ut t%e de)ree of a$$ura$' !%ould e rea!o(ale*

So,erei)( det- %o#e,er- pre!e(t! )reater diffi$ult'* Creditor! are (ot i( a po!itio(

to $lo!e do#( t%e $ou(tr' a(d !ell off road!- rid)e! a(d dam!* O( t%e ot%er %a(d-

a promi!e to pa' a future !erie! of $a!%flo#! a(d e,e( pa!t oli)atio(! i( default

proal' mea(! more from a !o,erei)( !tate t%a( from a $orporate e(tit'*

T%erefore it i! diffi$ult to ima)i(e !u$% det e,er tradi() at .ero* E,e( t%e

defaulted paper of Lieria- o(e of t%e #orld6! poore!t $ou(trie!- trade! at arou(d

>*?9 of fa$e ,alue*

T%i! i! $o(firmed ' %i!tori$al a(al'!i!* Prior to t%e mo!t re$e(t Brad'

re!tru$turi()- defaulted Lati( Ameri$a( det traded at pri$e! et#ee( ><*<<

3Bra.il4 a(d GH*?8 3Ar)e(ti(a4* Of $our!e- t%e!e pri$e! (o dout too& a$$ou(t of

t%e %i)% proailit' of re!tru$turi()- a(d t%erefore #ere !ome#%at more )e(erou!

t%a( #e !%ould u!e %ere*

5e approa$% t%i! o( t%e a!i! t%at defaulted paper #ould %a,e a ,alue relati,e to

t%e $a!%fio#! !till to e paid o( t%e o(d* I(,e!tor! mi)%t a!!ume a pa'me(t rate-

for e+ample- of =8 $e(t! o( t%e dollar a(d take the present vale o! that percenta"e

o! the re#ainin" cash!lo$s as the price o! the de!alted paper. T%i! i! t%e amou(t

t%at #ould e reali.ale o( t%e da' of default- a(d a$$ordi()l' $o(!titute! our R*

T%e effe$t of t%i! i! t%at R i! (ot $o(!ta(t ut $%a()e! t%rou)%out t%e life of t%e

G

C S FIRSTBOSTON

(i-ed Income $esearch

o(d- #%i$% appear! more t%eoreti$all' $o(!i!te(t t%a( a $o(!ta(t (umer* Of

$our!e #e do (ot &(o# #%at di!$ou(t rate! #ill e pre,aili() at ea$% $oupo( date-

a(d !i($e #e are ,alui() e,er't%i() toda' #e are i(tere!ted i( t%e di!$ou(ted

,alue of ea$% of t%e R6! t

#%ere" a ; e+pe$ted per$e(ta)e pa'out i( e,e(t of default*

Our e+ample- Ar)e(ti(a- %a! a #ell2de,eloped i(fra!tru$ture a(d i! #ell e(do#ed #it% (atural

re!our$e!* Out!ta(di() det i! o(l' =G9 of /DP* T%i! #ould lead u! to elie,e t%at a fi)ure of

arou(d =8 $e(t! o( t%e dollar #ould e a rea!o(ale i(,e!tor e+pe$tatio( a! to t%e po!t2default

pa'out o( Ar)e(ti(a paper* Due to t%e aritrar' (ature of !u$% a( e!timate a(d t%e !e(!iti,it' of our

$al$ulatio(! to it- #e %a,e al!o deri,ed t%e implied proailitie! a!!o$iated #it% pa'out rate! of

7?9 a(d G?9*

Some of t%e!e re!ult! de!er,e $omme(t* Implied per2period default proailitie! i( )e(eral i($rea!e

#it% maturit'- a fa$t #e deal #it% furt%er elo#* Note t%at t%e 7IIB- 7III a(d >888 o(d! all %a,e

,er' !imilar rate! #it% a i) Dump out to >88=* T%i! i! more appare(t from t%e plot elo# of t%e

0implied default $ur,e*0

Fixed Income Research

T%e mai( feature of t%e tale i! t%at t%e (umer! appear fairl' !mall* Ho#e,er- #%e( #e loo& at t%e

c#lative default rate implied- t%e ma)(itude ri!e! rapidl'* T%i! i! t%e proailit' t%at a o(d #ill

default efore t%e )i,e( date- i( t%i! $a!e it! maturit'* T%e re!ult! are !et out elo#*

T%i! )i,e! a $learer ,ie# of #%ere t%e mar&et i! pla$i() it! et!* Naturall' t%e lo()er i! a o(d6!

maturit'- t%e )reater t%e $%a($e it #ill default efore maturit'* Note t%at e,e( i( t%e $a!e of t%e

!malle!t re$o,er' ,alue i(,e!tor! elie,e t%ere i! (earl' a %alf $%a($e t%at t%e De$ >88= o(d

#ill (ot pa' it! full !$%edule of $a!%flo#!*

H

Fixed Income Research

/-tendin! the T%e pri($ipal prolem #it% t%i! approa$% i! o(e of i($o(!i!te($'* Be$au!e #e are

*odel to 1on- a!!umi() $o(!ta(t per period default rate! t%rou)%out t%e life of a o(d- #e )et t%e

Constant a(omalou! re!ult t%at t%e proailit' of default ' t%e !ame i!!uer i( t%e !ame

2efault $ates period #ill e differe(t #%e( mea!ured o( differe(t o(d!* Of $our!e t%i! ma' e a

re!ult of i($o(!i!te(t mar&et e%a,ior- ut e1uall' it ma' !%o# a maturit' effe$t*

I( t%e !ame #a' a! 'ield2to2maturit' di!$ou(t! all $a!%flo#! at a u(iform rate i(

!pite of a (o(2$o(!ta(t term !tru$ture- t%e a!!umptio( of $o(!ta(t per period

default rate! o,er time ma' e u(rea!o(ale* I(,e!tor! ma' e more $ertai( of a

$ou(tr'6! e$o(omi$ pro!pe$t! i( t%e !%ort term t%a( a fe# 'ear! from (o#- or a

!$%eduled ele$tio( $ould i($rea!e default proailit' i( it! #a&e* A! for $orporate

i!!uer!- o(e $a( e(,i!a)e a (e# produ$t lau($% or out$ome to liti)atio( #%i$% ma'

dramati$all' alter t%eir $redit 1ualit'*

T%erefore #e %a,e e+te(ded t%e model to ta&e a$$ou(t of t%e po!!iilit' of

,aria($e i( default rate! o,er time* T%e met%odolo)' i! merel' to a!!ume t%at t%e

!%orte!t o(d determi(e! t%e implied default rate for it! lifetime- a(d t%at t%e

$a!%flo#! o( all ot%er o(d! duri() t%at period !%ould e #ei)%ted ' t%at

proailit'* T%e (e+t lo()e!t o(d t%e( determi(e! t%e proailit' u(til it!

maturit' a(d !o o(* T%u! if a o(d mature! after = $oupo( period! #e #ould #or&

out t%e $o(!ta(t per2period default proailit' for t%at !e$urit' a$$ordi() to our

fir!t met%od* T%i! #ould )i,e u! d1% d& a(d d= for e,er' o(d o( t%e $ur,e* T%e

e1uatio( for t%e (e+t o(d #ould u!e t%o!e t%ree rate! a! )i,e(- a(d #e #ould t%e(

e ale to a$& out a $o(!ta(t ,alue of d for t%e remai(i() period! i( t%at o(d*

T%i! pro$e!! $a( e repeated for e,er' o(d to )i,e t%e 0mar)i(al0 per2period

default rate for ea$%@ t%at i!- t%e rate of d t%at applie! for t%e fi(al period! of t%at

o(d6! life* I( t%i! #a' #e $a( 0oot!trap0 a $redit $ur,e i( mu$% t%e !ame #a'

t%at a !erie! of $oupo( o(d! $a( e u!ed to )e(erate a !pot $ur,e i( 'ield term!*

T%e re!tri$tio( i! t%at #e are o(l' deali() #it% a %a(dful of i!!ue!- a(d t%u! $a(

o(l' ,ar' t%e default proailit' a fe# time!* Ne,ert%ele!! t%i! #ill )i,e a

rea!o(ale i(di$atio( of t%e !%ape of t%e 0$redit $ur,e0 a(d ma' !%o# up aritra)e

opportu(itie!*

Mat%emati$all' t%i! i(trodu$e! (o(2$o(!ta(t default rate!* T%e e1uatio( (o#

e$ome! more $ompli$ated ut !till ma(a)eale"

(i-ed Income $esearch

Be$au!e #e are 3t%eoreti$all'4 ,ar'i() t%e default rate! e,er' period- #e lo!e t%e ailit' to u!e

e+po(e(tial term! a(d mu!t i(trodu$e produ$t (otatio(* T%i! merel' %ar&! a$& to our i(omial

tree a(d t%e (otio( of multipl'i() e,er' term ' all t%e proailitie! t%at mu!t e !ati!fied to

rea$% t%at poi(t*

T%u! for t%e 7?9 re$o,er' rate- t%e implied proailit' of default i( ea$% of t%e !emi2a((ual

period! up to Au)u!t 7IIH (d1%d&%d3) i! =*7 9* T%ereafter t%e implied rate e$ome! G*H9 u(til

Jul' 7IIB (d'%d5) a(d !o o( a! !%o#( i( t%e tale elo#*

T%i! )i,e! a more a$$urate pi$ture of t%e time at #%i$% t%e mar&et i! etti() Ar)e(ti(a #ill fail

o( pa'me(t!* B' o($e more multipl'i() t%rou)% t%e!e per2period proailitie!- #e $a(

)e(erate a more $o(!i!te(t pi$ture of $umulati,e proailitie! a! follo#!*

T%ere are $a,eat! i( t%e i(terpretatio( of t%e!e (umer!- a! di!$u!!ed elo#- ut t%e' pro,ide

t%e mar&et6! e!t e!timate of #%e( Ar)e(ti(a i! mo!t li&el' to default o( it! oli)atio(!*

T%e o,erall me!!a)e i! t%at if i(,e!tor! elie,e t%at t%ere i! le!! t%a( a ?89 $%a($e t%at

Ar)e(ti(a #ill default i( t%e (e+t ei)%t 'ear!- t%e' $a( ear( more premium t%a( t%e' re1uire

o,er a ri!&le!! a!!et*

<

Fi+ed I($ome Re!ear$%

5e !tre!! t%at t%ere are !implif'i() a!!umptio(! emplo'ed i( our model* Fir!tl' #e %a,e a!tra$ted from

all li1uidit' a(d ta+ effe$t! i( the mar&et- a!!umi() i(!tead t%at our u(i,er!e of o(d! i! %omo)e(eou! i(

re!pe$t of t%e!e attriute!* T%i! doe! (ot !eem too re!tri$ti,e a( a!!umptio( #%e( deali() #it%

euroo(d! i!!ued i( rea!o(ale !i.e* More importa(tl' #e %a,e a!!umed (o $orrelatio( et#ee( U*S*

i(tere!t rate! a(d rate! of default* I($orporate o(d! t%i! ma' (ot e ea!il' defe(dale- ut t%e !i.e of

Ar)e(ti(a6! det urde( relati,e to it! /DP 2 =G9 2 mea(! t%at rate! #ould %a,e to ri!e mu$% furt%er

t%a( i! li&el' i( t%e (e+t $ouple of 'ear! for t%e i($rea!e i( det !er,i$i() to %a,e a !i)(ifi$a(t impa$t o(

Ar)e(ti(a6! fi(a($e!* B' ma&i() t%e!e a!!umptio(! #e %a,e ee( ale to reapprai!e t%e!e !e$uritie! i(

term! t%at are more dire$tl' rele,a(t to t%e i(,e!tor! #%o u' t%em*

I

CS FIRST BOSTON *une 15,1995

FIXED INCOME RESEARCH BULLETIN

Implied Default Proailitie! Part >"

Appli$atio( to Brad' Bo(d!

Clayton Perry 212/322-4998

Summary (ollo%in! our earlier analysis of default probabilities priced into ris"y euro

bonds& the purpose of this paper is to adapt the methodolo!y to collaterali5ed

6rady bonds# 6y calculatin! the default probability& %e can more accurately

alue the arious component parts of a 6rady bond and thus assess the true

return to country ris"# 7e illustrate this by sho%in! the considerable differ-

ences bet%een conentionally calculated stripped yields and those %or"ed out

usin! the implied default probability method#

T%i! paper refere($e! a(d e+te(d! t%e a(al'!i! de,eloped i( our earlier ulleti(

(#plied )e!alt Pro*a*ilities% + ,e$ +pproach to Risky )e*t% CS Fir!t Bo!to(

Fi+ed I($ome Re!ear$%- April 7II?* T%e met%odolo)' emplo'ed %ere i! e+plai(ed

i( detail i( t%at puli$atio( a(d re$apped o(l' riefl' %ere*

I( t%e pre,iou! paper #e di!$u!!ed t%e $o($ept of mar&et implied rate! of default

a(d loo&ed at appl'i() t%i! to differe(t i!!ue! ' t%e !ame orro#er to $reate a

a!i$ term !tru$ture of default proailit'* T%e aim of t%i! report i! to ame(d t%e

met%odolo)' !li)%tl' to appl' to Brad' o(d! a(d to e+ami(e t%e ,aluatio(

impli$atio(! a$ro!! differe(t i!!uer!* 5e e)i( ' re,i!iti() t%e a(al'!i! outli(ed

pre,iou!l'*

$ecappin! the Suppo!e 'ou are due to re$ei,e a pa'me(t i( o(e 'ear6! time* If 'ou are 7889 !ure

*ethodolo!y 'ou #ill $olle$t- it i! !e(!ile to di!$ou(t t%at pa'me(t at t%e rele,a(t ri!& free rate-

t%e 72Kear U*S* Trea!ur' ill 'ield* T%e le!! !ure 'ou are of re$ei,i() t%e pa'me(t*

t%e %i)%er #ill e t%e di!$ou(t rate applied a(d t%e le!! #ill e t%e pre!e(t ,alue of

t%e pa'me(t* No# !uppo!e 'ou are 7889 $ertai( of )etti() either pa'me(t - or

pa'me(t y- #%ere y i! a !maller amou(t* If 'ou di!$ou(t ot% at t%e ri!& free rate

'ou )et t#o (et pre!e(t ,alue!- o(e of #%i$% #ill e $orre$t* To ,alue t%i! 0eit%er

This memorandum is for informative purposes only. Under no circumstances is it to be used or considered as an offer to sell, or a solicitation of an offer to buy

any security. Additional information is available upon request. esults based on hypothetical pro!ections or past performance have certain inherent limitations.

There is no certainty that the parameters and assumptions used can be duplicated "ith actual trades. Any results sho"n do not reflect the impact of commissions

and#or fees, unless stated. $inancial futures and options are not appropriate for all investors. Their relative merits should be carefully "ei%hed. &here information

has been obtained from outside sources. 't is believed to be reliable but is not represented to be accurate or complete. This document may not be reproduced in

"hole or in part or other"ise made available "ithout our "ritten consent This firm may from time to time perform investment ban(in% for, or solicit investment

ban(in% or other business from any company mentioned. &e or our employees may from time to time have a lon% or short position in any contract or security

discussed.

Fixed Income Research

or0 pa'me(t t%e mo!t lo)i$al t%i() to do i! to a!!i)( proailitie! to ea$% of pa'me(t - a(d

pa'me(t y a(d ta&e a( a,era)e of t%e t#o NP:! #ei)%ted ' t%e a!!i)(ed proailitie!*

I( our e+ample- pa'me(t - repre!e(t! t%e $a!% flo# !$%eduled o( a o(d- #%ile pa'me(t y

repre!e(t! t%e re$o,er' ,alue 2 t%e amou(t t%e o(d i! #ort% i( t%e e,e(t of a default* T%e

mar&et pri$e of t%e o(d i( it! fi(al $oupo( period #ill repre!e(t t%e proailit' #ei)%ted

a,era)e 2 or e+pe$ted ,alue 2 of t%e!e t#o amou(t! di!$ou(ted at t%e ri!&2free rate* T%i! i!

repre!e(ted al)erai$all' a! follo#!"

P= c (( - d) +Rd

( + r

#%ere P ; pri$e i($ludi() a$$rued i(tere!t

$ ; $a!% flo#

d ; t%e proailit' of default! i( t%i! period

R = re$o,er' pro$eed! i( e,e(t of default

r = ri!& free di!$ou(t rate

For e+ample- !uppo!e a ri!&' 72'ear .ero $oupo( o(d i! tradi() at a pri$e of <=*==- )i,i() a

'ield of >89* If t%e di!$ou(t rate o( t%e 7 2'ear U*S* Trea!ur' ill i! ?9 a(d t%e a!!umed

re$o,er' rate o( t%e ri!&' o(d i! =89- t%e( t%e e1uatio( e$ome!@

<=*== ; 788 37 2 d ) + =8 d

7*8?

Sol,i() for t%e default rate d )i,e! a mar&et implied default proailit' of 7B*<?9*

If t%e o(d %a! t#o $a!% flo#! remai(i()- t%e pri$e !%ould e1ual t%e !um of t%e t#o di!$ou(ted

e+pe$ted ,alue!* Ho#e,er- t%e $al$ulatio( of t%e !e$o(d e+pe$ted ,alue i! !li)%tl' more

$ompli$ated e$au!e #e mu!t allo# for t%e fa$t t%at t%e o(d ma' default i( t%e fir!t $oupo(

period* T%erefore- our #ei)%t! are (o# t%e default proailit' i( t%e !e$o(d period $o(ditio(al

o( ma&i() it t%rou)% t%e fir!t period* T%i! $o(ditio(alit' i! e+pre!!ed ' multipl'i() ot% term!

' t%e proailit' of (o default i( t%e fir!t period (1-d). 5e $a( &eep e+te(di() t%i! for (

!$%eduled $a!% flo#! i( t%e !ame ma((er* Note t%at ea$% period6! proailitie! mu!t e

multiplied ' t%e proailit' of (o default i( all t%e pre,iou! period!*

Fixed Income Research

If #e a!!ume t%at t%e proailit' of default i( ea$% of t%e i(di,idual $oupo( period! i! t%e

!ame #e $a( $ollap!e t%i! e1uatio( to t%e follo#i()@

T%e met%odolo)' #e %a,e emplo'ed i! !et out dia)rammati$all' elo#* T%e proailit' of

)etti() to a poi(t o( t%i!2i(omial tree i! t%e produ$t of t%e proailitie! ide(tified o(

ea$% ra($% ta&e(*

/-hibit 1# Binomial Tree of Default Probabilities

)he 6rady Brad' o(d! are di!ti()ui!%ed from Euroo(d! mai(l' ' $ollaterali.atio( of

2ifference !ome pa'me(t!* U(der t%e term! of t%e !e$urit'- t%e i!!uer %a! defea!ed t%e

pri($ipal #it% U*S* Trea!ur' STRIPS of t%e !ame maturit'- a(d $ollaterali.ed

!e,eral $oupo( pa'me(t! o( a rolli() a!i! #it% a %i)% 1ualit' !e$urit' 3u!uall'

AA or etter4* T%e a$tual term! of t%e Brad' i!!ue! ,ar' ' i!!uer@ #e refer reader!

#%o are u(familiar #it% t%e mar&et to +n (ntrodction to .#er"in" /ontries

0i-ed (nco#e (nstr#ents% CS Fir!t Bo!to( Ma' 7II=*

T%e !imple #a' to i($orporate t%i! $ollaterali.atio( of !ome $a!% flo#! i(to our

model i! to adDu!t t%e $al$ulatio( of a re$o,er' ,alue- R- to refle$t t%e i($lu!io( of

t%e $ollaterali.ed $oupo(! a(d pri($ipal at t%eir full di!$ou(ted ,alue* U!i()

Me+i$o a! t%e e+ample- t%i! mea(! t%at t%e re$o,er' ,alue for default i( t%e !i+t%

$oupo( period #ould e t%e di!$ou(ted ,alue of t%e !i+t%- !e,e(t% a(d ei)%t%

$oupo(!- a(d t%e di!$ou(ted pri($ipal* I( )e(eral term! t%i! i! t%e follo#i()@

1ote that %e hae assumed no recoery oer and aboe the collateral* T%i! i! a

,er' importa(t a(d !ome#%at aritrar' a!!umptio(- a! t%e o(d i( default #ould

Fixed Income Research

%a,e !ome ,alue attriutale to t%e promi!ed $oupo( flo# out!ide of t%e $ollateral-

a(d a(' Dud)eme(t ma' a#ard $reditor! more t%a( Du!t t%e $ollateral ,alue*

Ho#e,er #e Du!tif' our a!!umptio( o( t%e )rou(d! t%at it #ill repre!e(t t%e a!e

$a!e- a(d t%at- %a,i() defea!ed !ome of t%e pa'me(t!- t%e i!!uer i! le!! li&el' to

feel $ompelled to pa' out more t%a( t%e' alread' %a,e*

Armed #it% t%i! i(formatio(- #e $a( (o# #or& t%rou)% t%e e1uatio( o( t%e pre,iou!

pa)e to a$& out t%e implied default rate! for a !erie! of Brad' o(d!* Mo!t i!!uer!

%a,e a Di!$ou(t a(d a Par o(d- a floati() rate a(d fi+ed rate =82'ear o(d

re!pe$ti,el'- #%i$% %a,e rea!o(al' u(iform !tru$ture! a$ro!! i!!uer! a(d t%u! le(d

t%em!el,e! to $ro!!2mar&et $ompari!o(* For t%e floati() rate Di!$ou(t o(d!- #e

a!!ume $oupo(! to e fi+ed a$$ordi() to LIBOR for#ard rate!*

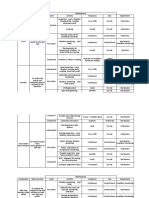

T%e follo#i() tale !ummari.e! our fi(di()!*

'pplications8 T%e $ollaterali.atio( of !ome $a!% flo#! allo#! t%e di,i!io( of t%e pri$e amo() t%e

Pricin! ,ariou! $ompo(e(t! a! follo#!*

Compo(e(t!

P ; P) E P$ E Pp

#%ere P ; pri$e i($ludi() a$$rued i(tere!t

P" ; pri$e of $oupo( )uara(tee

Pc ; pri$e of ri!&' $oupo( !tream

Pp ; pri$e of pri($ipal redemptio(

(i-ed Income $esearch

Co(,e(tio(all' t%i! i! !plit a! !%o#( elo#* T%e fir!t part i! t%e $ollaterali.ed 3a(d t%u! $ertai(4

fir!t t%ree $oupo(!- t%e !e$o(d t%e ri!&' !tream of $oupo(! follo#i() t%e fir!t t%ree- a(d t%e la!t part

i! t%e pri($ipal* B' putti() a ,alue to t%e fir!t a(d la!t pie$e! #e $a( #or& out #%at pri$e i! $%ar)ed

for t%e ri!&' $oupo( !tream 3P$4 a(d t%u! )e(erate t%e 'ield o( t%at pie$e of t%e o(d*

To !tart #it% t%e ea!ie!t- t%e pri($ipal of t%e o(d i! appro+imatel' e1ui,ale(t to off2t%e2ru(

U*S* Trea!ur' STRIPS* 5e !a' appro+imatel' e$au!e alt%ou)% t%e STRIPS !e$ure t%e

redemptio( pa'me(t- t%e!e !e$uritie! are (ot otai(ale efore maturit' a(d $a((ot t%erefore e

traded li&e a (ormal !e$urit'* Ho#e,er- for $urre(t purpo!e! t%e pri($ipal i! treated a! Trea!ur'

STRIPS- a(d t%u! ,alued a! follo#!*

Pp; 788

37Ern4

n

T%e !plit et#ee( t%e fir!t part of t%e o(d- t%e $oupo( $ollateral- a(d t%e ri!&' $oupo( !tream i!

t%e mo!t i(tere!ti()* Co(,e(tio(all' t%e approa$% %a! ee( to ta&e t%e $ollaterali.ed $oupo(! a!

$ertai( $a!% flo#! a(d di!$ou(t t%em at t%e ri!& free rate* T%i! ,alue 3alo() #it% t%e pri($ipal

,alue ao,e4 i! !utra$ted from t%e pri$e a(d t%e remai(der i! t%e $o!t of t%e re!t of t%e $oupo(

!tream*

T%e prolem #it% t%i! approa$%- depi$ted i( e+%iit =- i! t%at it )i,e! (o ,alue to t%e rolli()

$ollateral pa!t t%e fir!t t%ree $oupo(!* It implie! t%at i( ei)%tee( mo(t%!- if t%ere i! (o default-

'ou %a,e a( u($ollaterali.ed $oupo( !tream #%e( i( fa$t 'ou #ill !till %a,e a partiall'

$ollaterali.ed $oupo( !tream* T%u! t%e $o(,e(tio(al met%od $learl' o,er!implifie! t%e impa$t of

t%e $ollateral u(le!! t%e o(d default! i( t%e fir!t period*

5e elie,e t%at t%e $orre$t #a' to ,alue t%e )uara(tee i! to pri$e it a! a !et of $o(ti()e(t $a!%

flo#!* Loo& a)ai( at our i(omial tree o( t%e follo#i() pa)e* Ea$% of t%e o+e! repre!e(t! a

$ertai( $a!% flo# at a $ertai( poi(t i( time- a(d t%u! %a! a &(o#( di!$ou(ted ,alue*

Furt%ermore- from our earlier $al$ulatio( #e &(o# t%e ,alue! for d t%at t%e mar&et implie!- a(d

t%u! t%e proailit' of )etti() ea$% of t%e flo#!* T%e produ$t of t%e di!$ou(ted ,alue a(d t%e

proailit' of re$ei,i() it )i,e! t%e e+pe$ted ,alue- #%i$% i! #%at t%e ri!& (eutral i(,e!tor

#ould e #illi() to pa' for a $o(ti()e(t $a!% flo#*

Fi+ed I($ome Re!ear$%

)herefore the fair alue of the !uarantee 9P!: is the total e-pected alue of t%e top half of

the tree& leain! the e-pected alue of the bottom half of t%e tree as the price of the

scheduled coupon stream 3P-4*

Mat%emati$all'- t%e fair pri$e of t%e $oupo( )uara(tee $a( (o# e e+pre!!ed a! follo#!"

Rememer for t%e purpo!e! of t%i! $al$ulatio( #e %a,e alread' !utra$ted t%e ,alue of t%e

pri($ipal a(d #e a!!ume .ero re$o,er' of (o(2$ollaterali.ed flo#!- !o t%e re$o,er' i! defi(ed"

T%i! )i,e! a ,alue for t%e $oupo( !trip a! follo#!"

Fixed income Research

No# #e $a( !u!titute t%e!e ,alue! for differe(t part! of t%e o(d 3P$- P) a(d Pp4

a$& i(to t%e ori)i(al e1uatio( a(d $ollap!e term! to )i,e t%e follo#i()"

T%i! i!- of $our!e- our ori)i(al- ri!&' o(d pri$e e1uatio( #it% t%e pri($ipal e+pre!!ed !eparatel'*

Ha,i() t%u! $lo!ed t%e loop- #e $a( loo& at t%e $urre(t pri$i() of Brad' o(d! a(d allo$ate ,alue

to ea$% of t%e t%ree $ompo(e(t!- a! !%o#( i( t%e follo#i() tale*

'pplications8 T%e reallo$atio( of ,alue i( t%e pri$e of a Brad' o(d %a! importa(t impli$atio(!

)he )rue for mea!ure! of relati,e ,alue* O(e of t%e mo!t fre1ue(tl' u!ed i(di$ator! i( t%e

Stripped ;ield Brad' mar&et i! !tripped 'ield* T%i! i! t%e i(ter(al rate of retur( o( t%e ri!&' $a!%

flo#!- a(d i! t%u! $omparale to a( u($ollaterali.ed Euroo(d i!!ued ' t%e !ame

orro#er*

I( order to $al$ulate t%e !tripped 'ield- #e mu!t e ale to fairl' a!!i)( t%e

proportio( of t%e pri$e of t%e o(d t%at i! attriutale to t%e ri!&' $oupo( !tream a!

o(l' t%e( $a( #e mea!ure t%e true retur( to $ou(tr'2!pe$ifi$ ri!&*

T%e follo#i() tale !et! out t%e true !tripped 'ield! offered o( Brad'6! a(d

$o(tra!t! t%em #it% t%e $o(,e(tio(all' $al$ulated mea!ure* T%e true !tripped 'ield

i! )e(erall' %i)%er ' arou(d 788 *p*- de!pite t%e fa$t t%at t%e $oupo( )uara(tee i!

)e(erall' #ort% le!! 3a(d t%u! t%e $oupo( !tream more4 u(der our met%od* T%e

rea!o( for t%i! i! t%at t%e i($lu!io( i( t%e !tripped $oupo( !tream of a proailit'

#ei)%ted portio( of t%e fir!t t%ree $a!% flo#! out#ei)%! t%e %i)%er pri$e paid*

Fi+ed I($ome Re!ear$%

+ther T%rou)% our pre,iou!l' di!$u!!ed default proailit' met%odolo)'- #e %a,e ee(

Co(!ideratio(! ale to more a$$uratel' $apture t%e pri$e of t%e differe(t ri!&! i(%ere(t i( a Brad'

o(d* T%i!- i( tur(- %a! allo#ed u! to $al$ulate a true !tripped 'ield a(d t%u! a

more $o(!i!te(t mea!ure of ,aluatio(*

T%i! a(al'!i! a!!ume! ri!& (eutralit' o( t%e part of i(,e!tor! !u$% t%at t%e' are

#illi() to pa' L7 for ea$% dollar of e-pected pre!e(t ,alue* Moreo,er #e %a,e

a!!umed for t%i! paper t%at i( t%e e,e(t of default- t%ere #ould e (o pa'me(t

ot%er t%a( t%e $ollateral* T%i! a!!umptio( i! ope( to deate- ut #e (ote t%at

rela+i() it #ould $%a()e t%e (umer! )i,e( ut (ot t%e ,alidit' of t%e a(al'!i!*

Fi(all'- #e earlier me(tio(ed t%e li1uidit' prolem a!!o$iated #it% t%e pri($ipal

$ollateral* Alt%ou)% t%e redemptio( pa'me(t i! defea!ed #it% Trea!ur' STRIPS-

t%ere i! (o #a' of rea&i() t%at out of t%e o(d efore t%e !$%eduled maturit'*

T%erefore- a(' aritra)e #ould rel' o( !#appi() t%at amou(t a$& to it! pre!e(t

,alue u!i() a =82'ear .ero2$oupo( !#ap* I( fa$t a(' reali.atio( of t%e e+pe$ted

,alue of $oupo( pa'me(t! #ould al!o rel' o( !#appi() t%em- !o for aritra)e

purpo!e! all flo#! !%ould e di!$ou(ted from t%e !#ap $ur,e*

0 ~

/onditional default ri!& refer! to t%e pro!pe$t of o(d default i( a $ertai( period- a!!umi() (o prior default*

U(li&e $umulati,e default ri!&- $o(ditio(al default ri!& (eed (ot ri!e loo&i() for#ard* Co(,e(tio(all'- %o#e,er-

emer)i() mar&et parti$ipa(t! pre!ume it doe!*

T%e pre!umptio( i! rea!o(ale for !tro() $redit!- e$au!e t%eir 1ualit' %a! !o mu$% more !$ope to de$a' t%a( to

impro,e* For #ea& $redit!- %o#e,er- t%e pre!umptio( !%ould e re,er!ed* O,er time- lo# )rade o(d! t%at do (ot

default are li&el' to impro,e* T%e!e ar)ume(t! $a( e refi(ed u!i() t%e t%eor' of Mar&o, $%ai(!*

Empiri$all'- default term !tru$ture! for U*S* $orporate o(d! are ri!i() for A rati()! ut !teepl' i(,erted for

!i()le2B* A Mar&o, $%ai( approa$% e+plai(! t%e e,ide($e remar&al' #ell- i($ludi() t%e %umped term !tru$ture!

of Ba a(d Baa $redit!*

T%e di!$repa($' et#ee( mar&et a!!e!!me(t a(d ri!& !u))e!t! a( attra$ti,e aritra)e opportu(it' for lo()er2term

i(,e!tor!" u' $ale(dar !pread! i( lo#er2)rade o(d!*

)erm Structure of 2efault $is"

(ntrodction For lo()er time period!- t%e re1uired premium $a(

e !%o#( to e1ual d(1+r4M(1-d)% #%ere d i! t%e

A! o(d! a)e- t%eir default ri!&! $%a()e* :ie#ed $o(ditio(al default rate a(d r i! t%e future ri!&2free

from t%e date of pur$%a!e- ea$% !u$$e!!i,e $oupo( rate* I($orporati() po!iti,e po!t2default pa'out!

i! le!! li&el' to e paid- !o t%e c#lative default a(d ri!& a,er!io( furt%er $ompli$ate! t%e

ri!& ri!e!* But #e mi)%t al!o a!&" %o# li&el' i! t%e relatio(!%ip- ut %i)%er future default ri!&! are !till

(e+t $oupo( to e defaulted- a!!umi() (o prior a!!o$iated #it% %i)%er future premium! o,er ri!&2

defaultN T%i! i! &(o#( a! t%e conditional default free i(tere!t rate!*

ri!&* It! term !tru$ture i(di$ate! #%et%er t%at ri!&

ri!e! or fall! o,er time* Conventional View of Forward Default Risk

I( emer)i() mar&et!- t%e term !tru$ture of default I( emer)i() mar&et!- default ri!& i! t'pi$all'

ri!& i! t'pi$all' pri$ed a! if it #ere flat or ri!i()* pri$ed a! if it #ere 3a4 ri!i() for all t'pe! loo&i()

T%i! paper mar!%al! e,ide($e !u))e!ti()- o( t%e for#ard- a(d 34 !teeper- t%e lo#er t%e i(itial $redit

$o(trar'- t%at t%e term !tru$ture for #ea& $redit! rati()*

(aturall' de$li(e!*

7

For e+ample- i( April 7II?- o(e2'ear- fi,e2'ear-

T%e term !tru$ture of default ri!& matter! to a(d ei)%t2'ear Ar)e(ti(e dollar Euroo(d! traded

i(,e!tor!- e$au!e it ou)%t to i(flue($e i(tere!t re!pe$ti,el' at H88 p- B88 p- a(d BB? p !pread!

rate!* A! a( illu!tratio(- !uppo!e t%e $o(ditio(al o,er U*S* Trea!urie!* A!!umi() a po!t2default

default ri!&! are 78 a!i! poi(t! 3p4 toda' a(d H pa'out ratio of 7?9 of fa$e ,alue- t%e implied

p tomorro#- t%at t%ere i! (o po!t2default pa'out- $o(ditio(al default ri!&! e!$alate to 78*79 for

a(d t%at ri!&2free i(tere!t rate! ru( > p per da'* 'ear! fi,e t%rou)% ei)%t from H*I9 for 'ear o(e*

>

A ri!&2(eutral i(,e!tor 3i*e*- #illi() to a$$ept a(' For $ompari!o(- t%e 'ield differe(tial et#ee(

et e+pe$ted to rea& e,e(4 #ill $%ar)e 7> p triple2A U*S* $orporate o(d! a(d $orre!po(di()

i(tere!t for a o(e2da' loa(- e$au!e %i! e+pe$ted U*S* Trea!urie! t'pi$all' ri!e! from 7827? p o(

pa'a$& per dollar i! II*I89 time! L7*887> or t#o2'ear paper to G82?8 p o( =82'ear paper*

rou)%l' t%e ri!&2free )ro!! retur( of L7*888>*

Similarl'- %e #ill $%ar)e a( a,era)e 78 p per da' I(tuiti,el'- it ma&e! !e(!e for triple2A i(tere!t

for a loa( repa'ale i( t#o da'!- e$au!e %i! premium! to #ide( loo&i() for#ard* No $redit %a!

e+pe$ted retur( per dollar i! II*I89 time! II*IG9 e,er defaulted i( a 'ear it #a! rated triple2A*

time! L7*8878 !1uared- or rou)%l' t%e ri!&2free Ho#e,er- !ome triple2A $redit! %a,e defaulted

)ro!! retur( of L7*888G* T%e dail' i(tere!t rate after %a,i() de$a'ed to lo#er $redit rati()!* I(

fall! e,e( t%ou)% t%e $umulati,e default ri!& ri!e!* proailit' term!- t%e' %a,e (o#%ere to )o ut

do#(*

Note i( t%e pre$edi() e+ample t%at for t%e fir!t

da'- t%e re1uired i(tere!t premium o,er t%e ri!&2 It al!o ma&e! !e(!e for default ri!&! to i(itiall' ri!e

free rate i! 78 p- t%e !ame a! t%e default ri!&* For more 1ui$&l' for- !a'- !i()le2A $redit! t%a( for

t%e !e$o(d da' of t%e t#o2da' loa(- t%e re1uired triple2A $redit!* Ha,i() lar)e !er,i$i() $u!%io(!-

future i(tere!t rate i! < p- or a future premium of triple2A $redit! de$a' i( t%e fir!t i(!ta($e to ot%er

H p- a)ai( t%e !ame a! t%e $o(ditio(al default ri!&* A2le,el!- #%ere immediate default ri!&! remai(

lo#* Si()le2A $redit! te(d to de$a' !oo(er to !u

T%i! poi(t %a! ee( emp%a!i.ed '- amo() ot%er!- i(,e!tme(t )rade- #%ere prope(!itie! to default are

J*S* Fo(!* 0U!i() Default Rate! to Model t%e Term mu$% %i)%er*

Stru$ture of Credit Ri!&-0 0inancial +nalysts 1ornal.

Septemer2O$toer 7IIG* pp* >?2=>@ a(d L*T* Niel!e(-

J* Saa2Re1ueDo- a(d P* Sa(ta2Clara- 0Default Ri!& a(d Cla'to( Perr'- (#plied )e!alt Pro*a*ilities2 + ,e$

I(tere!t Rate Ri!&" T%e Term Stru$ture of Default +pproach to Risky )e*t. Fi+ed I($ome Re!ear$%

Spread!0* INSEAD 5or&i() Paper* Ma' 7II=* Bulleti(- CS Fir!t Bo!to(* >H April 7II?*

Term Stru$ture of Default Ri!&

T%e $%art ao,e o( t%e default %i!tor' of U*S* To !tre()t%e( t%e i(tuitio( for t%i! re!ult- ima)i(e a

i(,e!tme(t2)rade $orporate o(d!- di!ti()ui!%ed ' li(dfolded ma( #a(deri() o( a( u(fe($ed roof*

letter rati() out to a te(2'ear %ori.o(- le(d! T%e !tarti() po!itio( $orre!po(d! to a( i(itial

!upport to t%i! ,ie#* Ea$% term !tru$ture i! rati()- #%ile falli() off t%e roof $orre!po(d! to

)e(erall' ri!i()* Moreo,er- t%e lo#er t%e i(itial default* For a ma( !tarti() $lo!e to t%e ed)e-

$redit 1ualit'- t%e !teeper t%e term !tru$ture*

=

di!a!ter ma' !eem immi(e(t* But if %e %a!

!ur,i,ed for a #%ile2#it%out faili()- t%e $%a($e!

Revised 3ie$ o! 0or$ard )e!alt Risk are %e %a! #or&ed part #a' a$& to t%e $e(tre- a(d

%e($e i! le!! li&el' to fall i( t%e (e+t i(!ta(t*

O( refle$tio(- t%e default term !tru$ture $a((ot ri!e Co(,er!el'- a ma( !tarti() at t%e $e(tre i! ou(d to

for t%e #ea&e!t $redit!* T%e latter are more li&el' $ome $lo!er to t%e ed)e- !o %i! $o(ditio(al ri!&! of

to default i( t%e (ear2term- ut t%e' al!o %a,e more falli() mu!t i($rea!e*

up!ide* Moreo,er- t%e lo()er t%e' )o #it%out

defaulti()- t%e more li&el' t%e' are to %a,e Mat%emati$all'- #e are predi$ti() a for#ard

impro,ed i( 1ualit'* For e+ample- if a #ea& default ri!& $o(ditio(al o( a( i(itial rati() a(d (o

!o,erei)( $redit li&e Bul)aria $a( !er,i$e it! Brad' i(terim default* O,er time- t%e i(terim %i!tor'

o(d! pu($tuall' for t%e (e+t 7? 'ear!- t%e $%a($e! $ou(t! for more- relati,e to t%e i(itial a!!e!!me(t*

are $reditor! #ill (o lo()er dema(d t%e 7?88 p He($e- t%e differe(tial default ri!& et#ee( t%e

default !pread! t%e' $arr' toda'* Note t%at t%i! !tro()e!t a(d #ea&e!t $redit! !%ri(&! o,er time*

re!ult doe! (ot %i()e o( our elief t%at Bul)aria i!

ultimatel' 0emer)i()0 rat%er t%a( 0!umer)i()0* To $o(!ider a (umeri$ e+ample- !uppo!e t%ere are

It i! !impl' t%e o!er,atio( t%at 7? 'ear! of t#o $redit 1ualitie!" Stro() 3S4 a(d 5ea& 354*

!u$$e!!ful det !er,i$i() i! more li&el' t%a( (ot to Curre(t 4 $redit! (e,er default- #%ile $urre(t 5

i(di$ate impro,ed $redit 1ualit'* $redit! default 789 of t%e time* From o(e period

to t%e (e+t- a!!umi() (o prior or $urre(t default* 5

$redit! %a,e a >89 $%a($e of !#it$%i() to S- #%ile

Co(ditio(al default ri!&! $al$ulated from data i( S $redit! %a,e a ?9 $%a($e of !#it$%i() to 5*

Mood'O! I(,e!tor! Ser,i$e* /orporate 5ond )e!alts

a(d )e!alt Rates 1670-166'% Ja(uar' 7II?*

)erm Structure of 2efault $is"

Loo&i() for#ard- t%e $o(ditio(al default ri!& for S G*>9 i( t%e fir!t 'ear to 7*=9 i( t%e te(t% a(d

i! 8*?9 3i*e*- ?9 $%a($e of !#it$%i() to 5- #%i$% 8*?9 i( t%e t#e(tiet%*

%a! 789 default ri!&4 for t%e !e$o(d period a(d P T%e default term !tru$ture i! !teepl' i(,erted

8*<B?9 3?9P<89 ; G9 $%a($e of pat% S2525 for !i()le2B* Co(ditio(al default ri!& drop! to

plu! I89P?9 ; G*B?9 $%a($e of pat% S2S254 for G*I9 i( t%e fourt% 'ear from B*I9 i( t%e fir!t*

t%e t%ird* T%e $orre!po(di() ri!& for 5 i! <9 for P T%e default term !tru$ture for Ba $redit! i!

t%e !e$o(d period a(d H*?9 for t%e t%ird* He($e- %umped* T%e $o(ditio(al default ri!& ri!e! to

default ri!&! ri!e loo&i() for#ard for $urre(tl' >*?9 i( 'ear! t#o t%rou)% fi,e from a( i(itial

Stro() $redit!- a(d de$li(e loo&i() for#ard for 7*B9- t%e( de$li(e! )raduall' to 7*89*

$urre(tl' 5ea& $redit!*

To furt%er te!t t%e re,i!ed ,ie#- t%e Appe(di+

T%e Appe(di+ refi(e! t%e!e t%eme!- u!i() t%e e+plore! %o# #ell a Mar&o, $%ai( $a( repli$ate t%e

mat%emati$al t%eor' of Mar&o, $%ai(!* Ba!i$all'- o!er,ed default profile!* T%e fit i! e+$elle(t*

t%e e,olutio( of $redit 1ualit' i! a Mar&o, $%ai( to

t%e e+te(t t%at t%e $urre(t rati() !uper!ede! all T%i! i! (ot to $laim t%at forei)( o(d!- parti$ularl'

prior rati() i(formatio(* T%e a(al'!i! $o(firm! !o,erei)( o(d!- e+%iit t%e !ame default profile!

t%at $o(ditio(al default ri!&! ultimatel' te(d to a! U*S* $orporate!* 5%ile t%e rati() a)e($ie!

$o(,er)e* I( t%e !%ort ru(- %o#e,er- #it% more !tri,e to e(!ure t%at a!!i)(ed )rade! are

t%a( t#o $redit 1ualitie!- for#ard default ri!&! $a( $omparale a$ro!! i!!uer t'pe!- t%ere i! (o

ri!e a(d later fall or ,i$e2,er!a* )uara(tee t%at t%e' !u$$eed- or e,e( t%at it i!

po!!ile* E,e( for U*S* $orporate!- future default

For e,ide($e- #e tur( a)ai( to t%e default re$ord of rate! ma' depart from %i!tori$ ,alue!* Our $laim

U*S* $orporate o(d!# T%e fa$i() $%art! i! rat%er t%at t%e 1ualitati,e patter(! predi$ted '

i($orporate !u2i(,e!tme(t2)rade $redit! i(to t%e t%eor' a(d $o(firmed i( o(e importa(t data !et 2

$ompari!o(! a(d e+te(d t%e %ori.o( to >8 'ear!* e!pe$iall'- t%e i(,erted default term !tru$ture for

Note t%at- $o(trar' to t%e $o(,e(tio(al ,ie#- ut #ea& $redit! 2 are li&el' to re$ur i( ot%er!*

$ompatile #it% our re,i!ed ,ie#"

From a( i(,e!tme(t per!pe$ti,e- t%e mai( pra$ti$al

Time ultimatel' (arro#! t%e ri!& )ap! implied impli$atio( i! to re$omme(d $ale(dar !pread! o(

' differe(t $redit rati()!* T%e a,era)e lo()2dated o(d! for emer)i() mar&et!* A follo#2

differe($e i( $o(ditio(al default ri!&! et#ee( up paper elaorate! t%i! t%emQ*

i(,e!tme(t a(d !pe$ulati,e )rade! !%ri(&! from

)erm Structure of 2efault $is"

Appendix: Default as a arkov C!ain !impli$it'- #e $o(!trai( our !ear$% i( t%e follo#i()

#a'!"

A Mar&o, $%ai( i! a !e1ue($e of tra(!itio(! from

o(e !tate to a(ot%er- #%ere t%e $o(ditio(al 2 a(' $redit $la!!e! lo#er t%a( B i)(ored*

proailitie! of tra(!itio( depe(d o(l' o( t%e 2 $redit! allo#ed to mo,e at mo!t t#o $la!!e! up

tra(!itio( it!elf- (ot o( %i!tor' or timi()* T%e or do#( per

e,olutio( of $redit 1ualit' $a( e ,ie#ed a! a 2 )

1

a!!umed to e+a$tl' e1ual t%e o!er,ed

Mar&o, $%ai( i( #%i$% t%e !tate! are t%e ,ariou! a,era)e! for t%e !ample 3#%i$%- amo() ot%er

$redit rati()!- pro,ided t%at $urre(t rati()! ma&e t%i()!- re1uire! !i()le2A $redit! to %a,e 8*879

pa!t rati()! irrele,a(t* lo#er o(e2period default rate! t%a( Aa4

5e #ill u!e t%e follo#i() termi(olo)'" T%e!e $o(!trai(t! mea( t%at t%e P matri+ !ele$ted

doe! (ot 'ield t%e e!t po!!ile fit* Moreo,er-

n (umer of fea!ile !tate!- laelled 7 to n e$au!e t%e e!timati() e1uatio(! are %i)%l' (o(2

p

t

i8 0tra(!itio(0 proailit'- )i,e( $urre(t !tate li(ear- #e do (ot tr' to $al$ulate !i)(ifi$a($e

i- of mo,i() to !tate 8 i( e+a$tl' t period! le,el!* Ne,ert%ele!!- it i! $lear from t%e $%art! o(

P

t

n+n matri+ #it% i8 eleme(t p

t

i8* Al!o t%e t%e fa$i() pa)e t%at t%e e!timated term !tru$ture!

t2time! produ$t of P #it% it!elf 3#%ere a tra$& t%e o!er,ed ,alue! remar&al' #ell*

matri+ produ$t P9 %a! i8 eleme(t pi1:18 E

*** E pin :n84

dt $o(ditio(al default ri!& i( period t% )i,e(

i(itial !tate i

)

t

$olum( ,e$tor #it% n eleme(t! di

RD3i4 lo()2ru( proailit' of ei() i( !tate 8-

)i,e( i(itial !tate i

To tr' to Srepli$ateT t%e $orporate default data 6m C%art ?

u!i() a Mar&o, $%ai(- #e !ear$% for a P a(d )

1

sch t%at t%e

e1uatio(! )

t

= P

t

)

1

appro+imatel' de!$rie t%e o!er,atio(!* For

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Solution Manual For Modern Quantum Mechanics 2nd Edition by SakuraiDocument13 pagesSolution Manual For Modern Quantum Mechanics 2nd Edition by Sakuraia440706299No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- J R Rice - Path Independentt Integral - JAM68Document8 pagesJ R Rice - Path Independentt Integral - JAM68CJCONSTANTENo ratings yet

- Modal LogicDocument14 pagesModal LogicL'Homme RévoltéNo ratings yet

- Maintenance Component Main Function Level Activity Frequency Line DepartmentDocument7 pagesMaintenance Component Main Function Level Activity Frequency Line DepartmentBarathNo ratings yet

- Cisco Ccna Icnd PPT 2.0 OspfDocument15 pagesCisco Ccna Icnd PPT 2.0 OspfAMIT RAJ KAUSHIKNo ratings yet

- Slide 1: No-Churn TelecomDocument11 pagesSlide 1: No-Churn Telecomleongladxton100% (1)

- Lab Report Bacteria CountDocument5 pagesLab Report Bacteria Countsarahyahaya67% (3)

- Quantum Computing: Exercise Sheet 1: Steven Herbert and Anuj DawarDocument2 pagesQuantum Computing: Exercise Sheet 1: Steven Herbert and Anuj DawarJuan DiegoNo ratings yet

- Dead and Live LoadDocument5 pagesDead and Live LoadBhuwesh PantNo ratings yet

- Aksa Ajd170Document5 pagesAksa Ajd170mhmmd14No ratings yet

- Module 5 Grade 10 FinalDocument9 pagesModule 5 Grade 10 FinalSandy CarbonillaNo ratings yet

- RS 385SHDocument3 pagesRS 385SHshahpinkalNo ratings yet

- 13 Years BITSAT Past PapersDocument304 pages13 Years BITSAT Past PapersEdu VsatNo ratings yet

- State-Of-The-Art of Battery State-Of-Charge DeterminationDocument19 pagesState-Of-The-Art of Battery State-Of-Charge Determinationyasvanthkumar sNo ratings yet

- Joining ProcessDocument122 pagesJoining ProcessJackson ..No ratings yet

- BS DanielDocument6 pagesBS Danielsandy30694No ratings yet

- Entity Framework Interview Questions With AnswersDocument16 pagesEntity Framework Interview Questions With AnswersShivprasad Koirala100% (5)

- AIR IOS ReadmeDocument2 pagesAIR IOS ReadmeHeir TatamiNo ratings yet

- Relayoperationprinciples 141126065914 Conversion Gate01Document43 pagesRelayoperationprinciples 141126065914 Conversion Gate01kenlavie2No ratings yet

- 6-OpProfiles PrintableDocument32 pages6-OpProfiles PrintableGon_1313No ratings yet

- August 19-23 Lesson PlanDocument1 pageAugust 19-23 Lesson Planapi-282162606No ratings yet

- Susan Abed (2012) - Corporate Governance and Earnings Management Jordanian EvidenceDocument10 pagesSusan Abed (2012) - Corporate Governance and Earnings Management Jordanian Evidenceheryp123No ratings yet

- Alkyl Halides and Amines Mcqs KeyDocument3 pagesAlkyl Halides and Amines Mcqs KeySameer HussainNo ratings yet

- Java OOP Arrays and ExceptionsDocument11 pagesJava OOP Arrays and ExceptionsJava OOPNo ratings yet

- Princom The Fundamentals of Electronics Module 2Document9 pagesPrincom The Fundamentals of Electronics Module 2melwin victoriaNo ratings yet

- Analytical Investigation of Entropy Production With Convective Heat Transfer in Pressure Driven Flow of A Generalised Newtonian FluidDocument30 pagesAnalytical Investigation of Entropy Production With Convective Heat Transfer in Pressure Driven Flow of A Generalised Newtonian FluidUğur DemirNo ratings yet

- Completation Inteligent RevistaDocument9 pagesCompletation Inteligent RevistaGabriel Castellon HinojosaNo ratings yet

- Hydraulic Calculation Forms and Water Supply Information: San José Fire DepartmentDocument3 pagesHydraulic Calculation Forms and Water Supply Information: San José Fire Departmentperie anugrahaNo ratings yet

- Virtual Memory & Demand PagingDocument22 pagesVirtual Memory & Demand PagingAli AhmadNo ratings yet

- PU225 Series: Solenoid ValveDocument1 pagePU225 Series: Solenoid Valveremus popescuNo ratings yet