Professional Documents

Culture Documents

Corporate Law

Uploaded by

Kim HuatCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Law

Uploaded by

Kim HuatCopyright:

Available Formats

VEIL OF INCORPORATION

Used to protect shareholders from personal liabiltiy to creditors (i.e.: protecting members personal

assets from lawsuits)

1. Salomon v Salomon & Co Ltd

Fact: Company was controlled by Salomon, who was the controlling director and

majority shareholder. He contracted debts from creditors under the name of the

company.

Held: Company was separate legal entity and solely responsible for its own debts.

See also: Fairview Schools Bhd v Indrani Rajaratnam & Ors

2. Effects of incorporation S16(5)

On and from the date of incorporation (after receiving certificate of incorporation), the

company shall be a

i. Body corporate

ii. Capable of suing and being sued in its own name (Foss v Harbottle)

iii. Having perpetual succession (In Re Noel Tedman)

iv. Common seal with power to hold properties (Macaura v Northern Assurance Co

Ltd)

PIERCING THE VI

The court will exercise caution and there must be a reason when called upon to lift VI Yap Sing Hock

& Anor v Public Prosecutor

1. Judicial Exception

Instrument of fraud: Gilford Motor Co Ltd v Horne

Fact: Mr EB Horne was formerly a managing director of the Gilford Motor Co

Ltd. His employment contract stipulated not to solicit customers of the company

if he were to leave employment of Gilford Motor Co. Mr. Horne was fired,

thereafter he set up his own business and undercut Gilford Motor Co's prices.

The company had no such agreement with Gilford Motor about not competing,

however Gilford Motor brought an action alleging that the company was used

as an instrument of fraud to conceal Mr Horne's illegitimate actions.

Held: VI is pierced as the company was set up for main purpose of

dishonestly/perpetuate fraud (in this case, the breach of contract).

Avoid contractual duty: Jones v Lipman

Fact: Mr Lipman contracted to sell a house to Mr Jones. He changed his mind

and refused to complete. To try and avoid a specific performance order, he

conveyed it to a company formed for that purpose alone, which he alone owned

and controlled.

Held: VI is pierced where the corporate form was set up to avoid a contractual

duty (to avoid performance of the contract).

Company employed as agent of its controller: Smith, Stone & Knight Ltd v Birmingham

Corp

Fact: SSK owned some land, and a subsidiary company operated on this land. BC

issued a compulsory purchase order on this land. Any company which owned

the land would be paid for it, and would reasonably compensate any owner for

the business they ran on the land. Since the subsidiary company did not own the

land, BC claimed they were entitled to no compensation.

Held: The subsidiary company was an agent and BC must pay compensation.

Groups of companies: DHN Food Distributors Ltd v Tower Hamlet

Fact: A subsidiary company of DHN owned land which LBTB issued a compulsory

purchase order on.

Held: DHN was able to claim compensation because it and its subsidiary were a

single economic unit.

Company as faade: In Re FG (Films) Ltd

Fact: An American company registered their movie under the British Film

Association to take advantage of monetary incentives the right to screren their

movies in Europe, and to participate in British Film Fair Award.

Held: Although owned by a UK company, was considered "made" by the

Americans who financed and worked on it. The company was registered as a

mask to fraud the system.

2. Statutory Exception

Only one director: S36

If a company carries on business without at least two members for more than

six months, he will be personally liable for the debts of the company.

The law under S122(1) requires at least two directors in a company.

Untrue statements: S46(1)

An officer shall be personally liable to pay compensation for any untrue

statements made in companys prospectus to persons who relied on it.

Certificate of Commencement: S52(4)

Any contract made by a company before the date at which it is entitled to

commence business shall be provisional only, where the officers can be

personally liable.

Share buyback: S67(3)

Where the company contravenes the prohibition against providing financial

assistance for share buyback, its officers shall be guilty of an offense against this

Act.

Loan repayment: S303(3), 304(2)

If the officer contracting a debt had no reasonable or probable ground of

expectation to repay the debt, the officer shall be guilty.

Where a person has been convicted of an offence under subsection 303(3) the

Court, may declare that the person shall be personally responsible without any

limitation of liability for the payment of the whole or any part of that debt.

Fraud: S304(1)

If it appears that any business of the company has been carried on for any

fraudulent purpose, the Court may do declare that any person who is carrying

on of the business shall be personally responsible.

Dividends: S365

(1) No dividend shall be payable to the shareholders of any company except out

of profits.

(2)(b) Every director or manager of a company who wilfully pays or permits to

be paid any dividend out of what he knows is not profits shall be liable to the

creditors.

PROMOTERS

1. Pre-Incorporation Contracts & Provisional Contracts

A: Common Law View

The promoter cannot legally enforce payment from the company for services

rendered or expenses incurred because the company was incapable of incurring

any contractual liability. The contracts are null and void, cannot be ratified

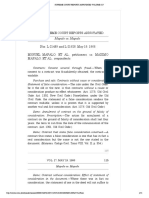

Newborne v Sensolid

Company promoters will not be liable unless they were acting as principals. The

mere fact that a person signs a contract for a non-existent company does not

mean the person intends to be personally liable Baxter v Kelner, Black v Small

Wood.

B: Statutory View

S52(1) Contracts entered into by a public limited company after obtaining its

Certificate of Incorporation but before it has obtained its Certificate of

Commencement This does not apply to private limited companies.

S52(4) Contracts are valid but unenforceable until it obtains Certificate of

Commencement.

S35(1) Any PIC formed may be ratified by the company after its incorporation,

which then binds to the company.

S35(2) If the company does not ratify the contract, the promoter shall be

personally bound by the contract.

Phonogram Ltd v Lane Promoters could avoid liability if there is an

express exclusion or disclaimer in the PIC.

2. Promoters Definition

Promoter is a person who registers the company and makes necessary business

preparations for the pre-incorporated companies.

Such a person is known as active partner Twycross v Grant

He may be interested in the company or professionals who incorporate a company

as a part of their business.

S4 excludes any person by reason only of his acting in a professional capacity

Passive promoter is a person who contributes to the initial working capital and will

benefit from the incorporation Tracy v Mandalay Ptd Ltd

3. Significance

Disclosure of any benefits given to promoters for public company when issuing

shares Schedule 5, Prospectus, Para 14.

Promoters owe fiduciary duties. It is useful to ascertain whether he has breached his

duty.

S35(2) Promoter may be personally liable in pre-incorporation contracts.

4. Duties

Bona fide in the best interest of the company

No conflict of interest avoid taking up a contract which belongs to the company

Must not make secret profit - Fairview Schools Bhd v Indrani Rajarathnam

Must make full and frank disclosure of any personal advantage he obtains as a

promoter EITHER to

Independent Board of Directors Erlanger v New Sombrero Phosphate Co

Fact: Erlanger bought the lease of an island to set up New Sombrero for

phosphate mining for GBP55, 000. Later, he sold the island at GBP110,

000 to the company through a nominee. One of the directors is an

independent of the syndicate that formed the company. Erlanger

ratified the contract with no disclosure of such profits to the

independent director.

Held: A promoter must make disclosures of any secret profits earned as

a promoter of a company

OR to potential shareholders to the company Gluckstein v Barnes

Fact: The promoters disclose the profits made on the sale of premises to

the company but not the profits made on the repayment of the

debentures bought at discount.

Held: Court allowed the liquidator to recover the undisclosed profits

from promoters. Further held that partial disclosure is insufficient.

Duty not to disclose confidential information even after leaving the company

5. Remedies

Rescission of contract (equitable remedy)

Company has not ratified the contract after discovering the breach of duty

Company does not delay in bringing an action in court for the breach

Third parties have not acquired any rights under the contract

Recovery of secret profit

If rescission is not possible, the company may still recover the secret profit

made by the promoters Gluckstein v Barnes

Damages

Company may sue for damages if it suffers loss as a result of the promoters

breach of duties

COMPANY FORMATION

Procedure

1. Decide what type of company

a. Limited/Unlimited

b. Public/Private

2. Choose a suitable name under S22-24

3. Submit Form 13A to CCM to check the availability of the name

4. Prepare documents

a. Memorandum of Association S18-21

b. Articles of Association S30&31

c. Form 6 Statutory Declaration by Company Secretary

d. Form 48A Statutory Declaration of compliance by promoter

e. Form 48A SD of compliance by directors S125 & S130

f. Other documents

Eg: Form 46 for public company with share capital and share qualifications

S123 & 124

g. Registered office and address S19

5. Name of first two directors and secretary be named in MAA

6. Registration fee according to the authorized capital and fee schedule in the CA65

7. Stamp duty of RM100

Certificate of Incorporation

If CCM is satisfied with the incorporation documents lodged, CI will be issued by the registrar:

Form 8 Public Company

Form 9 Private Company

S361 CI is the conclusive evidence that all requirements of the Act in respect of registration have been

complied with.

You might also like

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Tutorial 3 Company LawDocument6 pagesTutorial 3 Company LawWei Weng ChanNo ratings yet

- Important Caselaws On Company LawDocument15 pagesImportant Caselaws On Company LawMohit Prasad100% (2)

- Topic 4 - Concept of Corporate Entity (1) - 1Document30 pagesTopic 4 - Concept of Corporate Entity (1) - 1Bernard ChrillynNo ratings yet

- Promoters & Pre Incorporation ContractsDocument4 pagesPromoters & Pre Incorporation ContractsKimberly TanNo ratings yet

- Doctrine of Lifting of or Piercing The Corporate VeilDocument5 pagesDoctrine of Lifting of or Piercing The Corporate VeilNiraj Dhar DubeyNo ratings yet

- Corporatelaw CaselawsDocument8 pagesCorporatelaw Caselawslekha1997No ratings yet

- Effects of Company Incorporation and Separate Legal Entity StatusDocument4 pagesEffects of Company Incorporation and Separate Legal Entity StatusKhoo Chin KangNo ratings yet

- Important Caselaws On Company LawDocument15 pagesImportant Caselaws On Company Lawshaurya JainNo ratings yet

- Company Law Case LawsDocument12 pagesCompany Law Case LawsAayushNo ratings yet

- Law 346Document16 pagesLaw 346Hasrul DaudNo ratings yet

- Formation of a CompanyDocument14 pagesFormation of a CompanyYwani Ayowe KasilaNo ratings yet

- Company Law 1Document5 pagesCompany Law 1Mutale Kambatizee MbebetaNo ratings yet

- Lifting The Corporate VeilDocument4 pagesLifting The Corporate VeilSenelwa AnayaNo ratings yet

- No 2 - PromoterDocument6 pagesNo 2 - Promoterroukaiya_peerkhan100% (1)

- Unit 5Document12 pagesUnit 5جاين شاكوNo ratings yet

- Module 2 - Company FormationDocument76 pagesModule 2 - Company FormationAryaman BhauwalaNo ratings yet

- Company Law Fast TrackDocument157 pagesCompany Law Fast TrackjesurajajosephNo ratings yet

- Tutorial 3Document8 pagesTutorial 3Pooja NairNo ratings yet

- MAS 354 UNIT 4Document25 pagesMAS 354 UNIT 4nartmishNo ratings yet

- Claw Ch3 Formation of A CompanyDocument20 pagesClaw Ch3 Formation of A CompanyNeha RohillaNo ratings yet

- Unit 2-PromotersDocument8 pagesUnit 2-PromotersRenNo ratings yet

- Promoters and Pre-Incoporation NotesDocument11 pagesPromoters and Pre-Incoporation NotesAgitha GunasagranNo ratings yet

- Company Law NotesDocument178 pagesCompany Law Notessiewhong93100% (6)

- Lifting of Corporate VeilDocument6 pagesLifting of Corporate VeilSamiksha Pawar100% (1)

- Summary Notes, Entire Course Summary Notes, Entire CourseDocument17 pagesSummary Notes, Entire Course Summary Notes, Entire CourseRjRajora100% (1)

- Tri 1910 - UCL3612 - Topic 2 (STD V)Document37 pagesTri 1910 - UCL3612 - Topic 2 (STD V)Ammar MustaqimNo ratings yet

- Company PromotionDocument20 pagesCompany PromotionLevin makokha100% (1)

- Lifting of Corporate VeilDocument4 pagesLifting of Corporate VeilPadmasree HarishNo ratings yet

- Lifting of Corporate VeilDocument22 pagesLifting of Corporate VeilManpreet KaurNo ratings yet

- Pooja Patra Corporate Governance AssignmentDocument5 pagesPooja Patra Corporate Governance Assignmentraj vardhan agarwalNo ratings yet

- LECTURE 1 (Company & Its Characteristics) : Salomon V Salomon & Co (Page 27)Document18 pagesLECTURE 1 (Company & Its Characteristics) : Salomon V Salomon & Co (Page 27)Ahmad Syafiq Mohd Amin100% (3)

- Directors Duties Cases UkDocument13 pagesDirectors Duties Cases UkRodney Gabriel Vaz67% (3)

- CompanypdfDocument174 pagesCompanypdfPranshu YadavNo ratings yet

- Chapter 2: Company Formation: Commission of Malaysia (Companies Division) - Under The Regulations of The CompaniesDocument8 pagesChapter 2: Company Formation: Commission of Malaysia (Companies Division) - Under The Regulations of The Companiesng shiminNo ratings yet

- Lecture 12 Company Law.Document28 pagesLecture 12 Company Law.tensasd8No ratings yet

- Sangita Asiignment of Company LawDocument21 pagesSangita Asiignment of Company LawHasanul ShawonNo ratings yet

- Company Formation, Regulation and Key ConceptsDocument7 pagesCompany Formation, Regulation and Key ConceptsKate WellingNo ratings yet

- PromotorDocument6 pagesPromotor26amitNo ratings yet

- Module II (Autosaved)Document10 pagesModule II (Autosaved)SatyamNo ratings yet

- Unit-2 Company LawDocument15 pagesUnit-2 Company LawVishi AwasthiNo ratings yet

- Acca D Formation of A CompanyDocument12 pagesAcca D Formation of A CompanyNana AmalinaNo ratings yet

- PromotersDocument3 pagesPromotersKhoo Chin KangNo ratings yet

- W4 PromotersDocument14 pagesW4 PromotersAlastair MartinNo ratings yet

- Consequences of Incorporation NotesDocument28 pagesConsequences of Incorporation NotesPhoebe Sim100% (8)

- DocumentDocument12 pagesDocumentMutale Kambatizee MbebetaNo ratings yet

- Company Law FoundationDocument17 pagesCompany Law FoundationVanshika chalwaNo ratings yet

- Indian Partnership ActDocument7 pagesIndian Partnership ActRonit RampuriyaNo ratings yet

- Q1. (Tute 3) Who Is Promoter?: Types of PromotersDocument6 pagesQ1. (Tute 3) Who Is Promoter?: Types of PromotersWinging FlyNo ratings yet

- The Companies Act, 2013: Session 2,3Document21 pagesThe Companies Act, 2013: Session 2,3Shravani SinghNo ratings yet

- Corporate VeilDocument4 pagesCorporate Veilronakronakkumar3857No ratings yet

- CL, 2013Document13 pagesCL, 2013Aryan GuptaNo ratings yet

- Company Law Revision Full NoteDocument130 pagesCompany Law Revision Full NoteChip choiNo ratings yet

- Company Law Notes - Anirudh BelleDocument61 pagesCompany Law Notes - Anirudh BelleSamkiti JainNo ratings yet

- October 2008 Part B q2Document11 pagesOctober 2008 Part B q2Azarith SofiaNo ratings yet

- PROMOTER DUTIESDocument25 pagesPROMOTER DUTIESLim Yew TongNo ratings yet

- 1.1. The Principle of Separate Legal EntityDocument9 pages1.1. The Principle of Separate Legal Entityreine_jongNo ratings yet

- Law485 c3 Company As A CorporationDocument29 pagesLaw485 c3 Company As A CorporationndhtzxNo ratings yet

- Company Law BasicsDocument21 pagesCompany Law Basicsrong004100% (1)

- The Week USA - October 10 2020Document42 pagesThe Week USA - October 10 2020Евгений СоболевNo ratings yet

- Cazo Juan ValdezDocument26 pagesCazo Juan Valdezux20nr091No ratings yet

- PENGEMBANGAN PASCA AMANDEME KONTITUSI Hisbun NashorDocument11 pagesPENGEMBANGAN PASCA AMANDEME KONTITUSI Hisbun Nashorإلهام البدوNo ratings yet

- CIR v. Mirant PagbilaoDocument4 pagesCIR v. Mirant Pagbilaoamareia yap100% (1)

- In The Matter Of: Re U (Child) (1999)Document7 pagesIn The Matter Of: Re U (Child) (1999)Fuzzy_Wood_PersonNo ratings yet

- Innovative Financing of Metro Rail ProjectsDocument8 pagesInnovative Financing of Metro Rail ProjectsNivesh ChaudharyNo ratings yet

- 7.MSBTE Examination Procedures of Examination Cell and COEDocument5 pages7.MSBTE Examination Procedures of Examination Cell and COEpatil_raaj7234100% (1)

- Salvacion vs. Central BankDocument19 pagesSalvacion vs. Central BankEvan NervezaNo ratings yet

- Mha Advisory 396650Document1 pageMha Advisory 396650Qwerty541No ratings yet

- Final ObliconDocument4 pagesFinal ObliconPortgas D. AceNo ratings yet

- CRM2020-346 Decision and DocumentsDocument71 pagesCRM2020-346 Decision and DocumentspaulfarrellNo ratings yet

- Wills and Succession ReviewerDocument85 pagesWills and Succession ReviewerYoshimata Maki100% (1)

- Application For Subsequent Release of Educational Assistance LoanDocument2 pagesApplication For Subsequent Release of Educational Assistance LoanNikkiQuiranteNo ratings yet

- ERA1209-003 Clarification About Responsibilities For Populating ERADISDocument7 pagesERA1209-003 Clarification About Responsibilities For Populating ERADISStan ValiNo ratings yet

- Filinvest Land v. NgilaDocument6 pagesFilinvest Land v. NgilashallyNo ratings yet

- 2022 San Beda Red Book Labor Law and Social LegislationDocument196 pages2022 San Beda Red Book Labor Law and Social LegislationJohn Carlo Barangas100% (2)

- Letter From ElectedsDocument2 pagesLetter From ElectedsJon RalstonNo ratings yet

- Finland's rich history and culture revealedDocument76 pagesFinland's rich history and culture revealedMarius AlexandruNo ratings yet

- Sandoval V HretDocument5 pagesSandoval V HretSarah Jane UsopNo ratings yet

- Euromaidan, Revolution of Dignity, and The War in DonbasDocument4 pagesEuromaidan, Revolution of Dignity, and The War in DonbaskesavanNo ratings yet

- QatarDocument5 pagesQatarRuth BehailuNo ratings yet

- Mapalo vs. MapaloDocument12 pagesMapalo vs. MapaloRoizki Edward MarquezNo ratings yet

- Gachon v. Devera, Jr.Document14 pagesGachon v. Devera, Jr.Vanessa Kate Del PradoNo ratings yet

- Bache & Co Phil Inc v. RuizDocument3 pagesBache & Co Phil Inc v. RuizRobby DelgadoNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument4 pagesSworn Statement of Assets, Liabilities and Net WorthJeffrey MacalinoNo ratings yet

- Barredo vs. Hon. Vinarao, Director, Bureau of Corrections (Spec Pro)Document1 pageBarredo vs. Hon. Vinarao, Director, Bureau of Corrections (Spec Pro)Judy Miraflores DumdumaNo ratings yet

- Contract of SalesDocument3 pagesContract of SalesJoyce TenorioNo ratings yet

- Transparency and Accountability in Pakistan's State-Owned EnterprisesDocument18 pagesTransparency and Accountability in Pakistan's State-Owned EnterprisesMuzamil Hussain SoomroNo ratings yet

- 1 Introduction To Law and Society and Reasons For LawsDocument19 pages1 Introduction To Law and Society and Reasons For Lawsapi-88846630100% (2)

- CRIMINAL LAW 1: RULE OF LENITY APPLIED IN INTERPRETING CORPORATION CODE PROVISIONSDocument24 pagesCRIMINAL LAW 1: RULE OF LENITY APPLIED IN INTERPRETING CORPORATION CODE PROVISIONSJoyleen HebronNo ratings yet