Professional Documents

Culture Documents

Mergers and Acquisitions - A Beginner's Guide

Uploaded by

Fforward16050 ratings0% found this document useful (0 votes)

125 views8 pagesMergers and Acquisitions – A beginner’s guide

Original Title

Mergers and Acquisitions – A beginner’s guide

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMergers and Acquisitions – A beginner’s guide

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

125 views8 pagesMergers and Acquisitions - A Beginner's Guide

Uploaded by

Fforward1605Mergers and Acquisitions – A beginner’s guide

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

Cogent Analytics M&A Manual

Mergers and Acquisitions A

beginners guide

Cogent Analytics M&A Manual

2

Valuation

M&A involves using more than one valuation technique to

arrive at a valuation that we think is fair. The most common

techniques used are:

! Comparable Publicly traded companies (Public Comps) this analysis

indicates how the stock markets are valuing companies that are similar to

the target

! Precedent Comparable Transaction analysis (Transaction Comps) this

analysis indicates the valuations at which prior M&A transactions have

been done in the same industry as that of the target.

! DCF analysis is one of the most important valuation techniques

! Sum-of-the-parts analysis If a target has more than one lines of

business, the financial advisor will value each business separately.

Therefore, each part might have its own Public Comps, Transaction

comps and DCF (with different WACCs for each part). The total value is

the sum of the parts

! Other depending on the unique characteristics of the transaction,

financial advisors will perform a number of other analyses to arrive at fair

value like Leveraged Buyout (LBO) Analysis, Historical Exchange

Ration analyses etc.

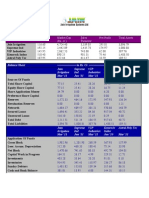

PUBLIC COMPS

Compare the current trading level of a Company to its peer group of

companies

The peer group is a set of 5 to 10 companies that are most similar to the

target in terms of business mix and strategy, geographic risks(same

country), margins and size. (i.e. processed meats and raw meats are

different).

To find a good peer group start broad (all companies in the SIC code) and

then narrow the list to the most comparable peers. Also refer to equity

Cogent Analytics M&A Manual

3

research reports, industry reports, the companys 10K where its discusses

competitors and Bloomberg (Quote 2) to identify the most comparable

peers. (look at filing 8K, prospectuses when they do a filing for new debt or

equity in freeedgar.)

The goal of the analysis is to understand how the markets is valuing the

peer group in terms of Price to Earnings, Price to Book value, Price to

Cashflow to Equity, What the PEG ratio is, Enterprise Value to Revenues,

EBITDA, Net Assets etc. Also understand if merger premium is already

built into price industry group should know this.

There are always some industry specific comps (Telecom Enterprise

Value to POPs and SUBs, Electric Utilities - $/Mw etc.). Make sure you

capture these in your analysis.

Using these, we will try to value the target bearing in mind that public

comps dont reflect the control premium that an acquirer will pay for

buying control of the target. The control premium is generally around 30%

for U.S. transactions. Also, some companies that are widely perceived to

be acquisition targets may have some premium built into their stock price.

Most common multiples are:

1. Equity Multiples: P/E (Price / LTM EPS, Price / 1-Year forward EPS, Note

that the Earnings need to be after Preferred Dividends so that they are

earnings that are available to Common shareholders), Price to Book

(Price / Book value of equity per share).

2. Enterprise Value Multiples: EV/Revenues, EV/ EBITDA, EV/EBIT (Note

that the Revenues, EBITDA and EBIT multiples could be computed for

LTM and 1-Year forward projected numbers)

TRANSACTION COMPS

The goal here is to understand the multiples at which transactions in the

targets industry sector have been announced or completed. The

importance difference with public comps is that in this case, a control

premium is built into the offer price and therefore the multiples.

Specifically, determine the pricing of past deals as compared to the

targets financial performance and unaffected (pre-announcement) market

value

Understand why Equity

valuation and Enterprise

valuation are different

Cogent Analytics M&A Manual

4

Transactions selected should be as comparable to our proposed

transaction as possible, so one should look for recent deals, where a

company with highly similar business was acquired, in the same country

as the target etc.

The most common ones are same as in the case of public comps but,

additionally, transaction comps also cover Premium paid (Offer price

premium as % of 1-day, 1-week and 4-week trading prices).

DCF (Merger model has this already built into it)

Discount unleveraged projected free cash flows (or in some cases

dividendable income) at Companys cost of capital to obtain an economic

present value of assets. Subtract market value of outstanding net debt

and preferred capital from the present value of assets to get present value

of equity. Free cash flow is after-tax operating earnings plus non-cash

charges less increases in working capital less capital expenditures. (On

leveraged DCF analysis, free cash flow is reduced by after-tax interest

expense)

Sensitivities on discount rates, terminal value assumptions and operating

scenarios are frequently used to estimate the uncertainty in the values

obtained

LBO

Goal is to understand how much value a financial buyer (with no operating

synergies) could buy the target for

To understand the economics of an LBO lets do an example: Company

As equity market capitalization is $100MM and it has Debt of $75MM.

This year it reported EBITDA of $50MM. A financial sponsor realizes that

the even if it bought the stock at a 30% premium to market for $130MM, it

could generate attractive returns. So, the sponsor approaches

management and structure a deal where the firm borrows an additional

$100MM to buy back stock. The sponsor supplies the remaining $30MM

required to buy the public float and ends up owning a 100% of the equity

of the firm. The new firm has $75MM of old and $100MM of new debt

outstanding which is sustained by the $50MM of annual EBITDA and an

equity cushion of $30MM.

To finance a LBO, the restructured company has to have a Debt to Total

Capitalization (Debt+Equity) not exceeding 80% and a Debt to EBITDA

Cogent Analytics M&A Manual

5

ratio that does not exceed 5.0x. Note that these could vary based on the

nature of the industry.

Assume current market scenarios for pricing the new debt

The exit mechanism is an important element since it defines what the

sponsor will do in, say, 5 years to exit the investment. In other words, is

the sponsor planning an IPO or sale to strategic players? The sponsors

returns will be driven by EBITDA growth rate, margins improvements,

Capex, and exit multiples

In a LBO, the entire equity is privately held, while in a Leveraged

Recapitalization, there is usually a small percentage owned by publicly.

Cogent Analytics M&A Manual

6

Selected Public Comps statistics explained

(1) Closing price: most recent closing stock price (from Bloomberg, ILX

or Populator). Prices for all companies should be as of the same

date.

(2) Equity value: last closing stock price multiplied by number of shares

outstanding. Shares outstanding from front page of latest 10K, 10Q,

or other public document adjusted for options or other instruments in

existence (if applicable). Note date of shares outstanding on the

exhibit. The following is a list of definitions of shares outstanding:

Basic: The actual outstanding shares which can be found on the cover of

the latest 10Q or 10K.

Diluted: This is the Basic shares plus the dilutive impact of any in-the-

money options or warrants that are outstanding as calculated by the

Treasury stock adjustment method. Look for average strike price and if

lower than closing price then assume would convert. Look at public

comps template. Option info is in 10K.

Fully diluted: Basic + All options and warrants (as if all converted into

equity)

Average: This calculates the average shares that were outstanding during

the year or quarter

(3) Firm value (or Enterprise Value): Equity market value + LT debt +

ST debt + preferred stock + Minority Interest (-) cash. (Enterprise

value may value from firm to firm or industry to industry sum of total

value of firm. Comes from cash flows of business.)

Use net income to common for common share price

Up to EBIT still enterprise #s. As soon as you pay interest the

net income belongs to equity holders.

LT debt: from latest 10K/Q under N/C liabilities LT debt plus

redeemable pfd. (Other types of pfd. stock are not considered LT

debt.)

Cogent Analytics M&A Manual

7

ST debt: from latest 10K/Q under current liabilities ST borrowings,

bank notes, loans, plus accrued interest and current maturities

of LT debt (if any)

Preferred stock: from latest 10K/Q under stockholders equity. Use

market values, if possible, otherwise book values. (Market value can

frequently be obtained from Bloomberg.)

Cash: from latest 10K/Q cash and cash equivalents plus

marketable securities (if any)

Common Firm Value multiples are: FV/Revenues, FV/EBITDA,

FV/EBIT, FV/Cashflow, FV/Customers etc. We do NOT calculate

FV/Net Income or FV/Book Value since the denominators in these

belong to equity holders and so they are Equity multiples not Firm

value multiples.

(4) Equity value multiples: While the Firm value multiples reflect how

the business is valued, equity multiples reflect how equities are valued

relative to the net income or EPS (LTM and projected) and Book value

(latest available).

Divide the LTM NI by the weighted average number of shares

outstanding from the most recent 10Q to calculate LTM EPS.

(Do not use LTM average shares!)

Divide stock price by LTM EPS

Projected P/E: Get median I/B/E/S estimates for the next two years.

(Available on Bloomberg, Infocenter, Insight, or Populator by inputting = IDD

(ticker, FY1MEDIA or FY2MEDIA, 0). These estimates are reported on

fully diluted basis and updated every Thursday. Always use median I/B/E/S

(not mean) to avoid skewed data values. Calendarize earnings estimates as

needed

Projected net income multiple: Multiply forward I/B/E/S by I/B/E/S projected

weighted average shares outstanding (=IDD (ticker, ibesshrs, 0) to obtain

projected net income. (Note that I/B/E/S shares are not fully diluted and

are source from Exlel not street analysts. It is thus important to

check to see that I/B/E/S projected shares outstanding are consistent

with credible brokerage reports; if not, use most recent 10-Q shares

outstanding to derive fully diluted shares.) Divide projected net income

into current equity value.

(5) Long-term EPS growth rate: Get median I/B/E/S estimate from

Infocenter, Insight, or Populator by typing = IDD (ticker, MEDLTG,

Cogent Analytics M&A Manual

8

0). These estimates are updated every Thursday. It is advisable to

crosscheck this with analyst reports. (Bloomberg)

(6) Other equity multiples:( look at PEG ratios)

Price/book value per share: Book value equal to sum of common

equity accounts on most recent financial stated divided by most recent

number of shares outstanding; this result then divided into most

recent stock price.

Price/cash flow per share: Cash flow refers to operating cash flow,

or NI plus D&A plus deferred taxes plus other non-cash charges,

divided by average number of shares outstanding; this result is then

divided into most recent stock price.

(7) Last 12-Month (LTM) statistics: In order to see how a firm trades

it is customary to calculate LTM Revenues, EBITDA, EBIT, Cashflow

and Net Income or EPS (before any extraordinary items). Say, you

are spreading comps in September 2001 for a company that has a

Jan-Dec financial year. You would calculate the LTM EBITDA as

follows: FYE 12/31/00 EBITDA (from 10K) + 6-Month EBITDA for

2001 (from the 10Q dated 6/30/01) (-) 6-Month EBITDA for 2000 (from

the 10Q dated 6/30/01).

(8) Projected firm value statistics: In addition to LTM multiples, its

customary to look at the multiples of 1 and 2 year forward Revenues,

EBITDA, EBIT etc. We usually cite recent equity analyst reports as

sources for publicly available projections. However, we could also

make our own (private) projections and use them for calculation

multiples. To adjust projected net income:

EBT = (NI + (Pref. Dividends + Minority Interest)) (1 - marginal tax

rate)

EBIT = EBT + net interest expense

EBITDA = EBIT + Depreciation + Amortization

You might also like

- LBO Case: Did Carlyle Make the Right Call Buying Seven DaysDocument6 pagesLBO Case: Did Carlyle Make the Right Call Buying Seven DaysDNo ratings yet

- LBO Case StudyDocument3 pagesLBO Case Studywilliamnyx100% (1)

- Carlyle Model Interview Test - InstructionsDocument2 pagesCarlyle Model Interview Test - Instructionsjorgeetcheverria100% (1)

- Avention Strategic Account Plan TemplateDocument19 pagesAvention Strategic Account Plan TemplateSan Lizas AirenNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Paper LBODocument2 pagesPaper LBOAljon Del Rosario0% (1)

- M&I Valuation-GuideDocument58 pagesM&I Valuation-GuideSai AlluNo ratings yet

- Lbo Model Long FormDocument5 pagesLbo Model Long FormGabriella RicardoNo ratings yet

- Wall Street Prep Premium Exam Flashcards QuizletDocument1 pageWall Street Prep Premium Exam Flashcards QuizletRaghadNo ratings yet

- 109 04 Simple LBO ModelDocument7 pages109 04 Simple LBO Modelheedi0No ratings yet

- Elevator Pitch DraftDocument2 pagesElevator Pitch DraftJack JacintoNo ratings yet

- LBO Structuring and Modeling in Practice - CaseDocument11 pagesLBO Structuring and Modeling in Practice - CaseZexi WUNo ratings yet

- LBO Model - ValuationDocument6 pagesLBO Model - ValuationsashaathrgNo ratings yet

- PIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsFrom EverandPIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsNo ratings yet

- Lebanon Economic VisionDocument1,274 pagesLebanon Economic VisionFforward1605100% (1)

- Chapter 9 - Prospective AnalysisDocument4 pagesChapter 9 - Prospective AnalysisjonaxxNo ratings yet

- OTBI User Guide BookDocument1,420 pagesOTBI User Guide Bookmuraligm2003100% (1)

- KuisDocument38 pagesKuismc2hin90% (1)

- Adv Business Calculations L3 Model Answers Series 4 2013 PDFDocument10 pagesAdv Business Calculations L3 Model Answers Series 4 2013 PDFKhin Zaw HtweNo ratings yet

- ch07 - Incremental AnalysisDocument49 pagesch07 - Incremental AnalysisPadlah Riyadi. SE., Ak., CA., MM.No ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Measuring Value for M&ADocument18 pagesMeasuring Value for M&Arishit_93No ratings yet

- Relative Valuation Primer for M&A AnalysisDocument16 pagesRelative Valuation Primer for M&A AnalysisPankaj AgrawalNo ratings yet

- 2011 Houlihan Lokey PPA Study PDFDocument49 pages2011 Houlihan Lokey PPA Study PDFSoloUnico100% (1)

- Company Analysis and ValuationDocument13 pagesCompany Analysis and ValuationAsif Abdullah KhanNo ratings yet

- Valuation Methods OverviewDocument44 pagesValuation Methods OverviewAleem AbdulNo ratings yet

- Chapter 11 Leveraged Buyout Structures and ValuationDocument27 pagesChapter 11 Leveraged Buyout Structures and ValuationanubhavhinduNo ratings yet

- Piper Jaffray - US LBO MarketDocument40 pagesPiper Jaffray - US LBO MarketYoon kookNo ratings yet

- Corp - Restructuring, Lbo, MboDocument54 pagesCorp - Restructuring, Lbo, MboRaveendra RaoNo ratings yet

- LBO TutorialDocument8 pagesLBO Tutorialissam chleuhNo ratings yet

- Discussion of Valuation MethodsDocument21 pagesDiscussion of Valuation MethodsCommodityNo ratings yet

- Wso CoverletterDocument1 pageWso CoverletterJack JacintoNo ratings yet

- LBO Structuring and Modeling in Practice - Readings Volume 2Document245 pagesLBO Structuring and Modeling in Practice - Readings Volume 2Zexi WUNo ratings yet

- Ibig 04 08Document45 pagesIbig 04 08Russell KimNo ratings yet

- Financial Modeling Fundamentals QuizDocument10 pagesFinancial Modeling Fundamentals QuizdafxNo ratings yet

- Solution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267Document74 pagesSolution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267sarojNo ratings yet

- Cash Flow Estimation: Understanding FCFF and FCFEDocument56 pagesCash Flow Estimation: Understanding FCFF and FCFEYagyaaGoyalNo ratings yet

- Private Companies (Very Small Businesses) Key Financial DifferencesDocument50 pagesPrivate Companies (Very Small Businesses) Key Financial DifferencesFarhan ShafiqueNo ratings yet

- Valuation of Distressed CompaniesDocument18 pagesValuation of Distressed CompaniesfreahoooNo ratings yet

- IPO Valuation ModelDocument10 pagesIPO Valuation ModelJason McCoyNo ratings yet

- Introduction To: Capital MarketsDocument57 pagesIntroduction To: Capital MarketsTharun SriramNo ratings yet

- Mergers Acquisitions Valuation With ExcelDocument4 pagesMergers Acquisitions Valuation With ExcelTazeen Islam0% (1)

- Why Private Equity: Deeper Analysis and Value CreationDocument8 pagesWhy Private Equity: Deeper Analysis and Value CreationhelloNo ratings yet

- Advanced 04 Advanced LBO Model Quiz PDFDocument24 pagesAdvanced 04 Advanced LBO Model Quiz PDFVineetNo ratings yet

- Defining Free Cash Flow Top-Down ApproachDocument2 pagesDefining Free Cash Flow Top-Down Approachchuff6675100% (1)

- LBO ModelingDocument66 pagesLBO Modelingalexander ThielNo ratings yet

- LBO in PracticeDocument12 pagesLBO in PracticeZexi WUNo ratings yet

- Disstressed AnalysisDocument5 pagesDisstressed Analysisrafael castro ruiz100% (1)

- LBO Fundamentals: Structure, Performance & Exit StrategiesDocument40 pagesLBO Fundamentals: Structure, Performance & Exit StrategiesSouhail TihaniNo ratings yet

- 6 Finance Interview Qs Test Market KnowledgeDocument2 pages6 Finance Interview Qs Test Market KnowledgeJack JacintoNo ratings yet

- Paper LBO Model Solutions BIWSDocument10 pagesPaper LBO Model Solutions BIWSDorian de GrubenNo ratings yet

- Contact details for 3 professionalsDocument14 pagesContact details for 3 professionalsladyjacket420% (1)

- LBO analysis IRR target 25Document7 pagesLBO analysis IRR target 25c17r15100% (2)

- Ib Club Careers - Interview Tips PDFDocument9 pagesIb Club Careers - Interview Tips PDFqcrvtbNo ratings yet

- Weeks 1 To 4 Fundamental AnalysisDocument166 pagesWeeks 1 To 4 Fundamental Analysismuller1234No ratings yet

- Article - Mercer Capital Guide Option Pricing ModelDocument18 pagesArticle - Mercer Capital Guide Option Pricing ModelKshitij SharmaNo ratings yet

- Quick LBO ModelDocument10 pagesQuick LBO Modelraphael varaneNo ratings yet

- LBO OverviewDocument21 pagesLBO Overviewjason0No ratings yet

- LBO Analysis CompletedDocument9 pagesLBO Analysis CompletedVenkatesh NatarajanNo ratings yet

- Analyst/Associate Investment Banking Interview Questions: Checklist For InterviewerDocument6 pagesAnalyst/Associate Investment Banking Interview Questions: Checklist For Interviewermanish mishraNo ratings yet

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- Behind the Curve: An Analysis of the Investment Behavior of Private Equity FundsFrom EverandBehind the Curve: An Analysis of the Investment Behavior of Private Equity FundsNo ratings yet

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondFrom EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondNo ratings yet

- Solar Energy PrimerDocument8 pagesSolar Energy PrimerFforward1605No ratings yet

- Anatomy of A SlideDocument1 pageAnatomy of A SlideFforward1605No ratings yet

- Insight 144 Sepahvand and TombaDocument6 pagesInsight 144 Sepahvand and TombaFforward1605No ratings yet

- Ipad GUI Design TemplateDocument1 pageIpad GUI Design TemplateFforward1605No ratings yet

- Doing Business in ZugDocument32 pagesDoing Business in ZugFforward1605No ratings yet

- Barclays Iran Primer The Long Road AheadDocument59 pagesBarclays Iran Primer The Long Road AheadZerohedgeNo ratings yet

- Solar Energy PrimerDocument16 pagesSolar Energy PrimerFforward1605No ratings yet

- Juice Analytics: Guide To Dashboard DesignDocument49 pagesJuice Analytics: Guide To Dashboard DesignchuksezNo ratings yet

- Ipad GUI Design TemplateDocument1 pageIpad GUI Design TemplateFforward1605No ratings yet

- Market Entry StrategyDocument9 pagesMarket Entry StrategygamascribdNo ratings yet

- The Next Five Years: Mena PeDocument62 pagesThe Next Five Years: Mena PeMena CammettNo ratings yet

- Industrial ElectronicsDocument2 pagesIndustrial ElectronicsMartinFS110380% (5)

- ECON F315 - FIN F315 - Compre QP PDFDocument3 pagesECON F315 - FIN F315 - Compre QP PDFPrabhjeet Kalsi100% (1)

- Updates On Delisting Offer (Company Update)Document28 pagesUpdates On Delisting Offer (Company Update)Shyam SunderNo ratings yet

- Effect of Assignment On Consolidated Balance Sheet at Acquisition FileDocument13 pagesEffect of Assignment On Consolidated Balance Sheet at Acquisition FileAbel ReginaldoNo ratings yet

- Use The Following Information For The Next Three Questions:: Book Value Per ShareDocument6 pagesUse The Following Information For The Next Three Questions:: Book Value Per ShareYazNo ratings yet

- With Activities Bapf-106 Ba - Module-3Document20 pagesWith Activities Bapf-106 Ba - Module-3Armalyn Cangque100% (1)

- Notes On Foreign TranslationDocument3 pagesNotes On Foreign TranslationcpacpacpaNo ratings yet

- 2007 ACE Limited Annual ReportDocument221 pages2007 ACE Limited Annual ReportACELitigationWatchNo ratings yet

- Valuation of SharesDocument10 pagesValuation of SharesMeraj HassanNo ratings yet

- Metro Pacific NLEXDocument273 pagesMetro Pacific NLEXKing RonquilloNo ratings yet

- Valuing Equity with Residual Operating IncomeDocument49 pagesValuing Equity with Residual Operating IncomeAudriel VanessaNo ratings yet

- Answers To Problem Sets: Financial AnalysisDocument11 pagesAnswers To Problem Sets: Financial AnalysisSnehanshu SumanNo ratings yet

- Company - Jain Irrigation System LTDDocument31 pagesCompany - Jain Irrigation System LTDNoor_DawoodaniNo ratings yet

- ACCOUNTANCY AND BUSINESS STATISTICS First Paper: Corporate AccountingDocument12 pagesACCOUNTANCY AND BUSINESS STATISTICS First Paper: Corporate AccountingGuruKPONo ratings yet

- Partnership Dissolution MethodsDocument6 pagesPartnership Dissolution MethodsAisea Juliana VillanuevaNo ratings yet

- Subject Areas For Transactional Business Intelligence in FinancialsDocument338 pagesSubject Areas For Transactional Business Intelligence in FinancialsrameshNo ratings yet

- National Municipal Asset Valuation ManualDocument86 pagesNational Municipal Asset Valuation Manualkhan_sadi0% (1)

- Handout 3 - Plant Assets, Natural Resources, and Intangible AssetsDocument81 pagesHandout 3 - Plant Assets, Natural Resources, and Intangible Assetsyoussef abdellatifNo ratings yet

- The Accounting Process: Adjusting The Accounts Cash Versus Accrual Basis of AccountingDocument12 pagesThe Accounting Process: Adjusting The Accounts Cash Versus Accrual Basis of AccountingKim Patrick Victoria100% (1)

- Super Project FinalDocument29 pagesSuper Project FinalSamuel ChuquistaNo ratings yet

- Math-Based Quiz Questions Worked OutDocument130 pagesMath-Based Quiz Questions Worked OutJ MNo ratings yet

- PRELIM-EXAMS 2223 with-ANSWERDocument5 pagesPRELIM-EXAMS 2223 with-ANSWERbrmo.amatorio.uiNo ratings yet

- Chapter 9 Plant Assets, Natural Resources and Intangible Assets PDFDocument67 pagesChapter 9 Plant Assets, Natural Resources and Intangible Assets PDFJed Riel BalatanNo ratings yet

- AFAR 2 NotesDocument157 pagesAFAR 2 NotesAlexandria EvangelistaNo ratings yet

- 12 07 2021 Session 5 Reformuation BASICSDocument72 pages12 07 2021 Session 5 Reformuation BASICSAkshayNo ratings yet