Professional Documents

Culture Documents

Investment Management: The Wisco Team

Uploaded by

Greg SchroederOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Management: The Wisco Team

Uploaded by

Greg SchroederCopyright:

Available Formats

Investment Management

Wisco

Second Quarter 2014

Dear Clients & Friends;

The fnancial markets experienced broad-based gains in the second quarter. The U.S. equity market extended its

upward climb, rising 5%, while International equity markets, in aggregate, rose 5% this period as well. Domestic Fixed

Income posted a 2% gain in the quarter as treasury yields continued their downward trend. Alternative Investments also

produced favorable results this quarter, driven primarily by high single-digit gains in Real Estate Investment Trusts and

Energy Master Limited Partnerships and mid-single digit returns in Metals. Overall, we continue to believe that well-

diversifed, low-cost investment strategies will continue to produce favorable results over time.

As a reminder, our policy is to rebalance client portfolios on a semi-annual basis. This allows us to realign your portfolio

with our current market expectations. To that end, we recently completed our mid-year portfolio adjustments and will

be rebalancing portfolios over the next few weeks. As always, feel free to contact us to discuss the rebalancing of your

portfolio, your targeted risk level, or any other life changes that may be relevant to how your portfolio is invested.

We will also be integrating the Morningstar Offce suite into our business this summer. This will enhance our ability to

provide you with portfolio performance reporting and analysis, as well as other features you may fnd helpful. We plan

to get in touch with you this summer to discuss your interest in receiving performance reports on a regular basis and to

introduce our new web portal capabilities that might help simplify communications and document delivery between us.

Looking ahead, we are planning to host our third quarter investment seminar on Wednesday, August 27th at 6:00 pm

at Blackhawk Country Club. Please let us know if you would like to attend or if you feel a friend or family member might

beneft from joining us. In addition, as we move into the warmer summer months, we are excited to be sponsors of

the Smart Growth Greater Madison and the Madison Parks

Foundation golf outings.

We would like to thank you for providing us with the

opportunity to work with you as your investment

adviser. We appreciate your business!

Sincerely,

The Wisco Team

402 Gammon Place, Suite 380

Madison, WI 53719

Offce: 608.442.5507

Fax: 608.237.2206

Stephen Share

sshare@wiscoinvest.com

Chas Janisch

cjanisch@wiscoinvest.com

Greg Schroeder

gschroeder@wiscoinvest.com

Second Quarter 2014 Market Review

Domestic Equity

The domestic equity market had a solid quarter

posting a 5% gain. The S&P 500, once again, reached

a new all-time high this quarter when it closed at

1962.87 on June 20th. S&P 500 1Q14 operating

earnings grew a respectable 7% y/y, however, GDP

was surprisingly weak in 1Q14 declining 2.9%. Most

economists attributed this weakness to a harsh winter

and inventory drawdowns both of which could be

temporary headwinds. We would expect to see higher

GDP growth in both 2Q and 3Q. Steady job gains in the

United States continues to strengthen the economy

and we feel this improvement more than offsets

the headwinds of The Federal Reserves continued

tapering of its bond purchases.

Year-to-date the domestic stock market is up 7%. On

a valuation basis, the S&P 500 is trading at a P/E of

16.7x 2014 consensus earnings which suggests to us

multiple expansion opportunities may be limited in the

second half of the year. Furthermore, we think it may

be hard for the market to perform as well in the 2nd

half of 2014 as it did in the frst half of the year.

Interestingly, small cap stocks have lagged both the

domestic and international stock market so far in

2014. Therefore, Wisco is reinitiating a small cap

position in our Balanced, Balanced Growth and

Growth models and increasing our small cap

exposure in the Aggressive model.

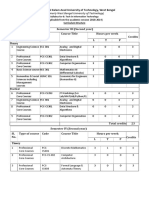

Wisco Investment Management

Wisco model portfolios are constructed using fve different asset classes; Domestic Equity, International Equity,

Domestic Fixed Income, Alternative Investments and Money Market. As of July 1st, our model portfolio asset class

allocations are as follows:

Wisco Model Portfolios

Conservative Balanced Balanced Growth Growth Aggressive

Domestic Equity 33% 41% 49% 57% 62%

International Equity 5% 11% 18% 23% 28%

Domestic Fixed Income 42% 31% 19% 6% 0%

Alternative Investments 10% 10% 10% 10% 8%

Money Market 10% 7% 5% 4% 2%

Total 100% 100% 100% 100% 100%

Target Volatility

*

6% 8% 10% 12% 14%

*Target Volatility is our estimate for the annual standard deviation of portfolio returns.

Source: Wisco Investment Management LLC

Source: Dow Jones U.S. Broad Stock Market Index and Wisco.

35%

30%

25%

20%

15%

10%

5%

0%

2

Q

1

4

1

Q

1

4

4

Q

1

3

3

Q

1

3

2

Q

1

3

2

0

1

3

2

0

1

2

2

0

1

1

2

0

1

0

2

0

0

9

6%

10%

3%

5%

33%

28%

17%

1%

16%

Quarterly Returns

2%

International Equity

The international equity markets posted a 5% return

in the quarter, with emerging markets recovering from

a 1Q14 decline to outperform developed markets.

In Europe, the STOXX 50 gained 2% this quarter as

Eurozone GDP showed modest 1Q14 growth of 0.7%.

Year-to-date, Denmarks Copenhagen Index (up 20%)

and Italys FTSE MIB Index (up 15%) are among the

top European markets, while Austrias ATX Index is

fat this year. Japans Nikkei 225 increased 2% in the

quarter as the countrys GDP increased 1.6%. The

FTSE Emerging Market Index returned 7% in 2Q14, as

Russias RTSI index recovered from a weak 1Q14 to

post an 11% return. Brazils IBOVESPA increased 5%

in the quarter, while the Shanghai composite was up

1% in 2Q14.

While Wisco continues to have a positive view on the

Developed International Markets, we are modestly re-

ducing our exposure to these markets in all our mod-

els except the Conservative model. We feel it makes

sense to reduce our holdings given the strength of the

market and redeploy these assets in areas that have

less risk or have lagged in performance. Furthermore,

we continue to be cautious on Emerging International

Markets and feel many of these markets could under-

perform should global interest rates go up.

Domestic Fixed Income

The Barclays Capital U.S. Aggregate Bond Index

increased 2% in the quarter, as interest rates

remained low. The Federal Reserve continues to

taper its bond buying program with a $10 billion

reduction in July to $45 billion a month and we think

the Fed would like to end this program by year end.

The 10-year treasury yield fell from 2.72% at the start

of the quarter to a low of 2.44% on May 28th before

moving back up to 2.52% at the end of the quarter.

Barclays U.S. Treasury Infation Protected Securities

Index (TIPS) increased 4% in the quarter, and is up 6%

year-to-date. Annual CPI reached 2.1% in May, its

highest percentage increase since October 2012.

Investment grade and high yield corporate bonds

increased 3% and 2%, respectively.

Wisco continues to expect low Fixed Income

returns for the foreseeable future. We feel a

potential improvement in economic growth along

with less monetary support of the Treasury market

could push yields gradually higher. That said, we

continue to have a Fixed Income position in our more

conservative models to take advantage of the asset

classes low volatility. We are supplementing our

aggregate bond ETF exposure with a TIPS ETF to

protect against infation.

Source: MSCI ACWI ex USA and Wisco

40%

30%

20%

10%

0%

-10%

-20% 2

Q

1

4

1

Q

1

4

4

Q

1

3

3

Q

1

3

2

Q

1

3

2

0

1

3

2

0

1

2

2

0

1

1

2

0

1

0

2

0

0

9

10%

5%

-3%

5%

14%

37%

11%

-14%

17%

Quarterly Returns

0%

Source: Barclays Capital U.S. Aggregate Bond Index and Wisco.

10%

8%

6%

4%

2%

0%

-2%

-4%

2

Q

1

4

1

Q

1

4

4

Q

1

3

3

Q

1

3

2

Q

1

3

2

0

1

3

2

0

1

2

2

0

1

1

2

0

1

0

2

0

0

9

1%

-1%

-3%

-2%

6%

7%

8%

3%

Quarterly Returns

2% 2%

Wisco Investment Management LLC is a registered investment adviser. Information presented is for educational purposes only

and does not intend to make an offer or solicitation for the sale or purchase of any specifc securities product, service, or invest-

ment strategy. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to frst consult with a qualifed

fnancial adviser, tax professional, or attorney before implementing any strategy or recommendation discussed herein.

Alternative Investments

The United States Commodity Index (USCI) returned

3% in the quarter. In agriculture, corn prices fell 14%

1

and Soybean prices declined 2%

1

, as early indications

point to strong yields from North America pushing

agricultural prices lower. Precious metals saw prices

drift higher in the second quarter with gold up 4%

2

and silver up 6%

3

. Higher infation and political

uncertainty in the Middle East and Ukraine may have

caused investors to rotate into safe-haven metals.

Real Estate Investment Trusts (REIT) had a nice quarter

returning 7%

4

and are now up 18% year-to-date. In the

Energy market, crude oil returned 5%

5

while Energy

Master Limited Partnerships returned 9%

6

.

In Wiscos Aggressive model we are replacing the REIT

ETF with an Energy Master Limited Partnership ETF.

This change better aligns our Aggressive model with

our more conservative models which now all hold an

energy infrastructure master limited partnership. We

expect the MLP ETF to offer consistent returns at a

better yield than most fxed income investments. We

also hold a broad-based commodity ETF in all our

model portfolios except the Conservative model. We

like this investment both for its return potential as

well as its low correlation to other investments

we hold. Finally, our Conservative model portfolio

continues to hold a gold ETF, to protect against

infation eroding the value of this models

substantial Fixed Income exposure.

Money Market

Wisco keeps a modest money market allocation in

all of our model portfolios. The current yield of the

Schwab Money Market is 0.01%. Low Federal Funds

rates have held down short-term yields. We think

short-term interest rates will remain low for an

extended period of time.

1

Return calculation based on the near future contract as quoted in the Wall Street Journal.

2

Return calculation uses ETFS Physical Swiss Gold Shares (SGOL) as a proxy for gold.

3

Return calculation uses iShares Silver Trust ETF (SLV) as a proxy for silver.

4

Return calculation uses Schwab U.S. REIT ETF (SCHH) as a proxy for Real Estate Investment Trusts.

5

Return calculation uses Cushing, OK WTI spot price FOB as a proxy for oil.

6

Return calculation uses Alerian MLP (AMLP) as a proxy for Energy Master Limited Partnerships.

You might also like

- Investment Management: The Wisco TeamDocument4 pagesInvestment Management: The Wisco TeamGreg SchroederNo ratings yet

- Investment Management: The Wisco TeamDocument4 pagesInvestment Management: The Wisco TeamGreg SchroederNo ratings yet

- 2Q12 Wisco Client LetterDocument4 pages2Q12 Wisco Client LetterGreg SchroederNo ratings yet

- Wisco Newsletter Q315Document4 pagesWisco Newsletter Q315Greg SchroederNo ratings yet

- 3Q12 Wisco Client LetterDocument4 pages3Q12 Wisco Client LetterGreg SchroederNo ratings yet

- Investment Management: The Wisco TeamDocument4 pagesInvestment Management: The Wisco TeamGreg SchroederNo ratings yet

- Wisco Team: Fourth QuarterDocument4 pagesWisco Team: Fourth QuarterGreg Schroeder100% (1)

- Wisco Team: Third QuarterDocument4 pagesWisco Team: Third QuarterGreg SchroederNo ratings yet

- Wisco Newsletter Q215Document4 pagesWisco Newsletter Q215Greg SchroederNo ratings yet

- Wisco Team: First QuarterDocument4 pagesWisco Team: First QuarterGreg SchroederNo ratings yet

- Wisco Team: First QuarterDocument4 pagesWisco Team: First QuarterGreg SchroederNo ratings yet

- Wisco Newsletter Q415Document4 pagesWisco Newsletter Q415Greg SchroederNo ratings yet

- Spring 2014 HCA Letter FinalDocument4 pagesSpring 2014 HCA Letter FinalDivGrowthNo ratings yet

- BDC II Newsletter July 2014: Month BDC Fund II Hfri Ehi S&P 500 TR Dow JonesDocument5 pagesBDC II Newsletter July 2014: Month BDC Fund II Hfri Ehi S&P 500 TR Dow JonesBhansen24No ratings yet

- Stock Market Commentary June 2016Document10 pagesStock Market Commentary June 2016Edward C LaneNo ratings yet

- GI Report January 2012Document3 pagesGI Report January 2012Bill HallmanNo ratings yet

- Weekly Market Commentary 03302015Document5 pagesWeekly Market Commentary 03302015dpbasicNo ratings yet

- JPM Weekly MKT Recap 5-21-12Document2 pagesJPM Weekly MKT Recap 5-21-12Flat Fee PortfoliosNo ratings yet

- JPM Weekly MKT Recap 10-1-12Document2 pagesJPM Weekly MKT Recap 10-1-12Flat Fee PortfoliosNo ratings yet

- q2 2014 Client Newsletter FinalDocument4 pagesq2 2014 Client Newsletter Finalapi-265511218No ratings yet

- IVA Worldwide QR 2Q13Document2 pagesIVA Worldwide QR 2Q13BaikaniNo ratings yet

- C O M P A N Y P R O F I L E: Achal Gupta Managing Director & Chief Executive OfficerDocument61 pagesC O M P A N Y P R O F I L E: Achal Gupta Managing Director & Chief Executive OfficervipinkathpalNo ratings yet

- BlackRock Midyear Investment Outlook 2014Document8 pagesBlackRock Midyear Investment Outlook 2014w24nyNo ratings yet

- PIMCO TRF PropsectusDocument23 pagesPIMCO TRF PropsectusZerohedgeNo ratings yet

- LPL 2014 Mid-Year OutlookDocument15 pagesLPL 2014 Mid-Year Outlookkbusch32No ratings yet

- Market Outlook 2024 - Kotak SecuritiesDocument36 pagesMarket Outlook 2024 - Kotak Securitiesgg1512100% (1)

- Bumps On The SlopeDocument2 pagesBumps On The SlopeJanet BarrNo ratings yet

- Clarion Global Real Estate Market Commentary Q3 2016Document9 pagesClarion Global Real Estate Market Commentary Q3 2016cutmytaxesNo ratings yet

- Q3 - 2015 Commentary: 5.1% and 10.3%, RespectivelyDocument5 pagesQ3 - 2015 Commentary: 5.1% and 10.3%, RespectivelyJohn MathiasNo ratings yet

- Weekly Market Commentary 3-19-2012Document4 pagesWeekly Market Commentary 3-19-2012monarchadvisorygroupNo ratings yet

- Weekly Market Commentary 7/1/2013Document4 pagesWeekly Market Commentary 7/1/2013monarchadvisorygroupNo ratings yet

- LinkDocument24 pagesLinkDhileepan KumarasamyNo ratings yet

- Lane Asset Management Stock Market Commentary May 2014Document7 pagesLane Asset Management Stock Market Commentary May 2014Edward C LaneNo ratings yet

- Monthly equity strategy outlookDocument6 pagesMonthly equity strategy outlookGaurav PatelNo ratings yet

- 4Q 2015 Market CommentaryDocument3 pages4Q 2015 Market CommentaryAnonymous Ht0MIJNo ratings yet

- Market Commentary 2/25/13Document3 pagesMarket Commentary 2/25/13CLORIS4No ratings yet

- Q1 2015 Market Review & Outlook: in BriefDocument3 pagesQ1 2015 Market Review & Outlook: in Briefapi-284581037No ratings yet

- Weekly Market Commentary 7-2-13Document3 pagesWeekly Market Commentary 7-2-13Stephen GierlNo ratings yet

- Stock Market Commentary February 2015Document9 pagesStock Market Commentary February 2015Edward C LaneNo ratings yet

- The Monarch Report 2/25/2013Document3 pagesThe Monarch Report 2/25/2013monarchadvisorygroupNo ratings yet

- Weekly Market Commentary 1/28/2013Document3 pagesWeekly Market Commentary 1/28/2013monarchadvisorygroupNo ratings yet

- Piper Serica Monthly Portfolio NoteDocument2 pagesPiper Serica Monthly Portfolio NoteShankey VarmaNo ratings yet

- Third Q Uarter R Eport 2010Document16 pagesThird Q Uarter R Eport 2010richardck50No ratings yet

- Monthly Strategy Report Q3 2013Document7 pagesMonthly Strategy Report Q3 2013dpbasicNo ratings yet

- Q1 15 UpdateDocument6 pagesQ1 15 UpdatedpbasicNo ratings yet

- The Globe Assets or Cash Bonds or StocksDocument7 pagesThe Globe Assets or Cash Bonds or Stocksmi.ahmadi1996No ratings yet

- Market Analysis Aug 2023Document17 pagesMarket Analysis Aug 2023nktradzNo ratings yet

- Blog - Looking Back at Equity Factors in Q1 With WisdomTree-2Document7 pagesBlog - Looking Back at Equity Factors in Q1 With WisdomTree-2Owm Close CorporationNo ratings yet

- Weekly Commentary 2-25-13Document3 pagesWeekly Commentary 2-25-13Stephen GierlNo ratings yet

- Spring NewsletterDocument8 pagesSpring NewsletterWealthcare Financial SolutionsNo ratings yet

- ZacksInvestmentResearchInc ZacksMarketStrategy Mar 05 2021Document85 pagesZacksInvestmentResearchInc ZacksMarketStrategy Mar 05 2021Dylan AdrianNo ratings yet

- Mid-Year Outlook 2014 Abridged: Investor's Almanac Field NotesDocument4 pagesMid-Year Outlook 2014 Abridged: Investor's Almanac Field NotesJanet BarrNo ratings yet

- Bond Market Perspectives 06092015Document4 pagesBond Market Perspectives 06092015dpbasicNo ratings yet

- Weekly Market Commentary: Two and ADocument2 pagesWeekly Market Commentary: Two and Aapi-234126528No ratings yet

- Philam Dollar Bond Fund Performance and HoldingsDocument1 pagePhilam Dollar Bond Fund Performance and HoldingsDiata IanNo ratings yet

- Weekly Trends Jan 23-1Document4 pagesWeekly Trends Jan 23-1dpbasicNo ratings yet

- BondMarketPerspectives 060215Document4 pagesBondMarketPerspectives 060215dpbasicNo ratings yet

- The Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataFrom EverandThe Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataRating: 2 out of 5 stars2/5 (1)

- The Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsFrom EverandThe Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsRating: 4 out of 5 stars4/5 (1)

- Wisco Team: Third QuarterDocument4 pagesWisco Team: Third QuarterGreg SchroederNo ratings yet

- Wisco Newsletter Q216Document4 pagesWisco Newsletter Q216Greg SchroederNo ratings yet

- Wisco Team: First QuarterDocument4 pagesWisco Team: First QuarterGreg SchroederNo ratings yet

- Wisco Team: First QuarterDocument4 pagesWisco Team: First QuarterGreg SchroederNo ratings yet

- Wisco 3Q 2014 NewsletterDocument4 pagesWisco 3Q 2014 NewsletterGreg SchroederNo ratings yet

- Wisco Newsletter Q415Document4 pagesWisco Newsletter Q415Greg SchroederNo ratings yet

- Wisco Team: Fourth QuarterDocument4 pagesWisco Team: Fourth QuarterGreg Schroeder100% (1)

- Wisco Newsletter Q215Document4 pagesWisco Newsletter Q215Greg SchroederNo ratings yet

- Wisco Newsletter Q4 2013Document4 pagesWisco Newsletter Q4 2013Greg SchroederNo ratings yet

- Wisco 1Q2013 NewsletterDocument4 pagesWisco 1Q2013 NewsletterGreg SchroederNo ratings yet

- Wisco 2Q2013 NewsletterDocument4 pagesWisco 2Q2013 NewsletterGreg SchroederNo ratings yet

- Investment Management: The Wisco TeamDocument4 pagesInvestment Management: The Wisco TeamGreg SchroederNo ratings yet

- Briefing Book TemplateDocument16 pagesBriefing Book TemplateBronwen Elizabeth MaddenNo ratings yet

- Monetary and Fiscal Policies Coordination: Pakistan's ExperienceDocument11 pagesMonetary and Fiscal Policies Coordination: Pakistan's ExperienceUmer RajaNo ratings yet

- Financial Times Europe 30 11 2021Document18 pagesFinancial Times Europe 30 11 2021Luis Adrian GarciaNo ratings yet

- Insurance Industry Analysis March 2013Document34 pagesInsurance Industry Analysis March 2013Pieter NoppeNo ratings yet

- Business Environment and Policy: Dr. V L Rao Professor Dr. Radha Raghuramapatruni Assistant ProfessorDocument41 pagesBusiness Environment and Policy: Dr. V L Rao Professor Dr. Radha Raghuramapatruni Assistant ProfessorRajeshwari RosyNo ratings yet

- IAPM - I - Introduction of SubjectDocument8 pagesIAPM - I - Introduction of SubjectAnkit Goel100% (1)

- SYBCom-Business EconomicsDocument3 pagesSYBCom-Business EconomicsSwapnil Singh100% (1)

- HDFC MF - Yearbook 2024 - 1Document77 pagesHDFC MF - Yearbook 2024 - 1Nagesh ShettyNo ratings yet

- Aicpa: Public Accountants (AAPA) Was Formed. in 1916, The American Association of PublicDocument5 pagesAicpa: Public Accountants (AAPA) Was Formed. in 1916, The American Association of PublicYeng BonzaNo ratings yet

- SBV cuts USD deposit rate to record low of 0Document12 pagesSBV cuts USD deposit rate to record low of 0Trang Anh Thi TrầnNo ratings yet

- CW2 Gbe GiulyDocument10 pagesCW2 Gbe GiulyAlexandru NicolaeNo ratings yet

- VN Cuts From DollarDocument4 pagesVN Cuts From DollarThanh NguyenNo ratings yet

- Multinational Business Finance Eiteman 12th Edition Solutions ManualDocument5 pagesMultinational Business Finance Eiteman 12th Edition Solutions ManualGeorgePalmerkqgd100% (29)

- Domestic and International Monetary Stabilization of The BSP - GRP1Document12 pagesDomestic and International Monetary Stabilization of The BSP - GRP1Maura Athena Beatrixe LaurenteNo ratings yet

- A Funny Thing Happened on the Way to the Data Bank: Understanding Asset Values and the "Peso ProblemDocument11 pagesA Funny Thing Happened on the Way to the Data Bank: Understanding Asset Values and the "Peso ProblemVinit DhullaNo ratings yet

- Turbulence After Lift-Off: Global Economic and Insurance Market Outlook 2022/23Document42 pagesTurbulence After Lift-Off: Global Economic and Insurance Market Outlook 2022/23trietpmNo ratings yet

- Econ 2200 Exam 3Document42 pagesEcon 2200 Exam 3jeffbezosssNo ratings yet

- Repo RateDocument5 pagesRepo RateSweta SinghNo ratings yet

- March 2022 (v2) MS - Paper 2 CAIE Economics IGCSEDocument30 pagesMarch 2022 (v2) MS - Paper 2 CAIE Economics IGCSEjune.afrayma2No ratings yet

- Capitalistic MusingsDocument443 pagesCapitalistic MusingsSam Vaknin100% (1)

- PSSC Economics QPDocument43 pagesPSSC Economics QPAndrew ArahaNo ratings yet

- Minimum Wage Hurts Low Income WorkersDocument34 pagesMinimum Wage Hurts Low Income WorkersChristie ZamoraNo ratings yet

- Principles of Economics 1St Edition Asarta Test Bank Full Chapter PDFDocument68 pagesPrinciples of Economics 1St Edition Asarta Test Bank Full Chapter PDFmohurrum.ginkgo.iabwuz100% (6)

- Chapter 17Document34 pagesChapter 17Ji Seong BaeNo ratings yet

- Causes of Pakistan's Industrial BackwardnessDocument5 pagesCauses of Pakistan's Industrial BackwardnessEbad Khan100% (1)

- ECN 202 Final AssignmentDocument10 pagesECN 202 Final AssignmentFarhan Eshraq JeshanNo ratings yet

- Information Technology Syllabus-11.06.19 WBUTDocument29 pagesInformation Technology Syllabus-11.06.19 WBUTAyan ChandraNo ratings yet

- CFA Investment Foundations - Module 1 (CFA Institute) (Z-Library)Document39 pagesCFA Investment Foundations - Module 1 (CFA Institute) (Z-Library)gmofneweraNo ratings yet

- Week 4 Case Digest - MANLUCOB, Lyra Kaye B.Document6 pagesWeek 4 Case Digest - MANLUCOB, Lyra Kaye B.LYRA KAYE MANLUCOBNo ratings yet

- Engineering Economic Analysis 11th Edition EbookDocument61 pagesEngineering Economic Analysis 11th Edition Ebookdebra.glisson665100% (46)