Professional Documents

Culture Documents

White&Case Shipping Financing Nov2013

Uploaded by

Chris Ramesh0 ratings0% found this document useful (0 votes)

51 views6 pagesdry bulk shipping

Original Title

21. White&Case Shipping Financing Nov2013

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentdry bulk shipping

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

51 views6 pagesWhite&Case Shipping Financing Nov2013

Uploaded by

Chris Rameshdry bulk shipping

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

The absence of market equilibrium in the marine

sector poses a threat to all stakeholders. Owners

and operators have faced restructurings and some

have failed. Various banks have exited the sector or

reduced lending levels. How will the industry obtain

the capital it needs given the challenges it faces?

By Christopher Frampton and David Manson,

Partners, White & Case

Uncharted

waters

Industry analysis Shipping

T

he nancial crisis of 2008 set in motion a series of events that converged

to threaten all stakeholders in the marine sector. Global trade slowed as

economies contracted and crises in the nancial markets and banking

sector saw banks retreat from prior lending practices. And yet the order

books for eet expansion remained at signicant levels.

As new vessel deliveries continued, the supply-demand imbalance was exacerbated,

earning capacity for eets dwindled further, and it became increasingly dicult for

many shipping companies to service debt and pay other operating costs. Economic

growth failed to revive enough to restore nancial health to many parts of the sector and,

eventually, various operators were forced below the break-even point.

A wave of restructurings followed, some consensual and some resulting in formal

insolvency proceedings. It is unlikely that the industry has seen the end of this downturn

and its consequences.

Present challenges and outlook

The fundamental challenges facing the industry are relatively simple. There are still too

many vessels for too little trade. The banking sector the traditional source of nance

for the marine industry is not expected to be able to provide the full amount of capital

needed to address anticipated capital expenditure and renancing requirements in the

coming years. By some estimates, more than US$215bn of debt capital is required by the

maritime sector through the end of 2014.

On the revenue side, two industry benchmarks paint a sobering picture. The Baltic Dry

Index has fallen from a high of 11,783 points on 20 May 2008 to a range of 700-2,000 points

in 2013. Rates for capesizes large-sized bulk carriers and tankers typically above 150,000

deadweight tonnage are expected to average US$11,500 a day in 2013, according to the

median of nine analyst estimates compiled by Bloomberg. This might be 40 percent more

than 2012, but it is still well below the US$16,000 a day the largest ships need to turn a

prot, according to estimates by Oslo-based investment bank Pareto Securities.

The picture is not all gloomy, however. For 2013, although the IMF predicts subdued

growth of 3.1 percent in world trade, projections increase to 3.8 percent for 2014.

Technological advances in the maritime sector oer potentially substantial cost savings

as a result of fuel eciencies for those able to nance a large modern eet or the

necessary retrots to existing vessels. The opening of the Northern Sea Route similarly

oers cost savings on the Europe to Asia routes. Strategic partnerships, such as the one

between UASC and China Shipping Container Lines, as well as the alliance of Maersk,

MSC and CMA CGM, are expected to produce operational eciencies.

There are other bright spots. The transport of LPG (liqueed petroleum gas) and LNG

(liqueed natural gas) is expected to grow. The market for oshore rigs and related assets

remains strong. Product and crude tankers are seen as a relatively healthy part of the

industry, with rates expected to rise. In 2013 and for the coming years, new deliveries of

many vessel classes are expected to nally begin to slow down.

These developments are positive, but in the absence of a broad-based return to health

for the global economy and corresponding increases in world trade, more is required.

Financial discipline

Banks, particularly in Europe, have signicant exposures to the marine sector. Petron

Research believes that European banks hold approximately 75 percent of an estimated

US$450-500bn in global shipping loans. These banks have been hit particularly hard by

the downturn.

Many industry insiders lament the way in which the marine

sector has inicted harm on itself. To these people, credit was

extended too easily to nance new builds or roll over existing

debt during the boom years. Similarly, unjustied optimism

about the future health of the industry and/or an unwillingness

to face the bleak realities of the downturn delayed the type of

enforcement action on nonperforming loans or restructurings

involving a deleveraging of the balance sheet that might have

brought a much-needed sense of nancial discipline to the sector.

What developed has been referred to as an amend and extend

approach, one where creditors deferred repayments and

restructured terms to avoid foreclosures without a timely

write-o of a portion of the relevant loans or the taking of other

action in collaboration with the relevant shipping company to

address the underlying economic realities.

Undue criticism of these actions, many of which were taken

in the chaotic aftermath of 2008 or at a time when a return to

prosperity was the expectation of many analysts, seems harsh

and unnecessary. More importantly, there are some clear lessons

to be learned. On the creditor side, those lessons have begun

to be heeded, encouraged by a variety of legal and regulatory

developments, governmental pressure and investor demands

to improve returns. Among other things:

new bank credit lines appear to be based on healthier loan-to-

value ratios, with some falling to the 60-70 percent range;

a number of banks have made clear their intent to reduce new

lending and/or to shrink, sell or wind down existing loan portfolios;

faced with the challenges of a complex and wide-ranging

restructuring of particular debtors, some banks have been

prepared to accept equity positions in consideration of further

credit extensions and/or modications of existing payment terms

and covenants; and

a number of banks have begun using warehousing and other

similar structures, thereby segregating nonperforming assets

with a view to ultimately addressing their exposures, whether

through portfolio dispositions, joint venture or other structured

arrangements with alternate operators or otherwise.

The transaction concluded in April 2013 between

HSH Nordbank and the Navios Group is illustrative of the actions

that may need to be taken. By restructuring its existing exposure

of approximately US$300m into senior and nonrecourse

subordinated loans and partnering with an experienced operator,

HSH was able to reduce its risk exposure and put in place an

arrangement that will allow it to mitigate potential losses if the

underlying assets ultimately begin to perform protably again.

European banks have not signaled an en masse retreat from

the marine industry. Some have openly committed to the sector

for the long term, despite substantial exposures. Many of those

are, however, focusing on a ight to quality, whether in respect

of underlying credits and/or those sectors deemed to be in

relatively better health (such as oshore rigs and related assets

or LPG and LNG carriers). Others are adjusting their strategy and

adopting a broader-based focus on transportation assets in general.

The cleanup has begun in the banking sector. While the

necessary corrective actions are far from over and there are likely to

be further challenges arising from additional restructurings and/or

failures of particular operators, this is an important step. That said,

a funding gap has nonetheless opened up given the extent to which

the banks have reduced their overall lending to the sector.

Funding the future

Where will the money come from if not from the banks? This is a

question that applies to all nancing challenges the industry faces

and the answer is not going to be the same in all cases. Signicant

variations are expected depending on the credit quality of the

underlying obligor, the relevant class of vessel or other marine

asset, the particular nancing need or opportunity being addressed

and a variety of other factors.

European bond market: Some relief on the debt side has been

found through the issuances of corporate bonds by European

shipping companies. In June 2013, Hamburg-based Rickmers

Holding raised 175m through an issue on the Frankfurt Stock

Exchanges specialist SME board. In August 2013, Teekay LNG

Partners sold NOK 900m of ve-year senior secured bonds in the

Norwegian market.

Some are skeptical about the signicance of these transactions

for the broader marine sector, citing among other factors limited

availability to a relatively select group of high-quality issuers and

the discrete size of the Frankfurt and Norwegian exchanges. For

the companies involved, however, a vital new source of capital has

been accessed.

Latitudes

There are fundamental issues to

be addressed regarding the way

the marine sector nances itself.

The banks are going to have to

address underperforming loans,

and owner/operators are going

to have to implement nancial

models that allow for long-

term protability

Randee Day, President & CEO, Day & Partners

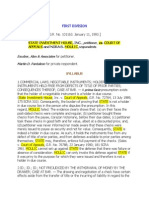

Benchmarks and funding sources

A declining revenue base

A growing eet

Deliveries nally

slowing

Funding the future

2008:

773.77 million

Gross Tonnage (Start Year)

2013:

1092.91 million

Gross Tonnage (Start Year)

2005:

632.92 million

Gross Tonnage (Start Year)

4

,

1

0

6

3

,

9

4

3

1

,

2

5

4

1

,

1

3

0

8

5

0

$

4

8

,

4

8

3

$

1

4

,

4

6

6

$

1

5

,

4

2

6

$

1

4

,

3

7

7

$

1

2

,

5

4

9

$

9

,

6

5

1

$

9

,

5

6

6

1

1

,

7

8

3

2,435

2,124

910

1,977

US capital markets: These oer an intriguing and potentially

signicant source of nance for the marine sector. Institutional

investors in the United States, many of which have provided

lending for other transportation sectors, have demonstrated a

willingness to consider alternate asset classes as a way of

addressing their own portfolio objectives.

The US private placement transaction closed this summer by

Meridian Spirit ApS (Meridian) is illustrative. Meridian renanced

the debt associated with an LNG tanker by issuing US$195m of

debt in a transaction rated Baa1 by Moodys. The security package

included a traditional ship mortgage (and related assignments and

pledges) as well as an assignment of a long-term charter to Total

E&P Norge AS (TN). Particularly noteworthy is that the notes had

a 17-year tenor, with a nal maturity in August 2030, a few months

before the scheduled expiration of the underlying charter with TN.

In its analysis of the transaction, Moodys noted among

other things the importance of the credit quality of both TN

and its parent, Total S.A. (rated Aa1 negative), and the

importance of the LNG market to Total. Also relevant were what

Moodys considered to be the favorable terms of the underlying

charter and the particularities of the LNG market and LNG

transport sector, which were noted as being less risky than

other oil and gas nancings.

Whether the success of the Meridian transaction will be able

to be replicated for other participants in the marine sector remains

to be determined. That transaction had the benet of one of the

sectors bright spots from an asset class perspective (LNG

tankers), combined with the likelihood of relatively stable

long-term cash ows as a result of the charter arrangements.

Dierent and likely harder challenges will exist for the

nancing of other classes of marine assets in the US market,

but those may be able to be addressed if, for example, investors

are presented with nancing structures used in other

transport sectors.

Industry analysis Shipping

&

Latitudes

Sources: Bloomberg; Clarksons Research Services Limited; BRL Maritime Data Services

Baltic Dry Index: An assessment of the price

of moving a range of commodities by dry bulk

carriers (based on 23 shipping routes and

measured on a timecharter basis). Snapshot

fgures from the month of May in each year.

ClarkSea Index (US$/Day): A weighted average index

of earnings for the main vessel types where the weighting

is based on the number of vessels in each feet sector.

Snapshot fgures from the month of December in each year,

apart from 2013 (latest available fgure derives from October).

The number of new vessel deliveries

(all classes) from 2010-2013.

HISTORIC HIGH POINT

2008 2009 2010 2011 2012 2013

HISTORIC HIGH POINT

2008 2007 2009 2010 2011 2012 2013 2010 2011 2012 2013

US Capital

Markets

Export Credit

Agencies

Banks

Private Equity

& Funds

European Bonds

The disclosure requirements that need to be addressed in

this market may limit the universe of issuers prepared to consider

this alternative. That notwithstanding, the fundamental forces

aecting the industry make it likely that there will be increased

activity for US investors and shipping companies alike, at least for

so long as the US market oers issuers the potential for pricing

advantages with tenors no longer (or rarely) available in the bank

market (or elsewhere) and/or until investors have better or

preferred means of satisfying portfolio diversication strategies.

Export credit agencies (ECAs) and other state support:

ECAs and other instrumentalities of state-supported nance

have a clear rationale to support the maritime sector where jobs

and the national interest are in play. In Asia, this is particularly

acute given the rivalries between the shipyards of Korea, Japan

and China. An added element is also in play in the region in the

case of LNG vessels and technology. The shift in Asian energy

policy towards LNG eectively creates a double strategic benet

supporting the economic health of the shipyards and securing

transportation for the resource required to meet domestic

energy demand.

The type of support provided by the Asian ECAs is evolving.

The Korea Trade Insurance Corporation (K-Sure) and The

Export-Import Bank of Korea (KEXIM) are reported to be planning

additional products, including insurance and/or guarantees of

bonds to be issued by purchasers of marine assets built in Korean

shipyards. While other ECAs, notably in the United States and

Europe, have issued similar products in support of aviation

manufacturers, this will represent an innovative development for

the marine industry. This will particularly be the case if such

arrangements are provided in conjunction with direct loans by the

ECAs, eectively enhancing the leverage provided by state support

and bringing new investors into the marine space.

While oshore rigs and LNG vessels are likely to be the

primary targets for these products, broader usage should not

be ruled out, especially where the asset purchasers are deemed

suciently strong from a credit perspective and/or the assets

are scheduled for usage under favorable charter arrangements.

The announcement by Scorpio Tankers Inc. on 28 August 2013

of a letter of intent from KEXIM for a loan facility of up to

US$300m to nance various new builds upon delivery, subject

to various conditions, indicates the importance of the role to be

played by the ECAs.

State support can no doubt be helpful in isolation, but

widespread intervention is suggestive of systemic ill health.

The overall environment for commercial debt has cooled

considerably. But the shortfall is partly being lled by enhanced

capital allowances and export-import nance orders, and by

government support for the shipbuilding industry, says Erik

Nikolai Stavseth, an analyst at Arctic Securities.

This represents a risk to recovery, as most segments need

to have their access to additional capacity constrained.

Private equity and other funds : There has been much talk in

shipping circles of an inux of private equity and hedge fund or

similar capital, and a number of high-prole transactions have

been completed.

Costamare formed a joint venture with York Capital

Management for investing in box-ships. Delos Shipping and

Tennenbaum Capital picked up majority control of German KG

Knig & Cie. Other private equity sources have been active in a

number of dierent segments of the maritime industry, including

through investments in General Maritime and that companys

successful prepackaged Chapter 11 plan of reorganization. In

addition, private equity has recently been active in the secondhand

market and has provided funds to acquire a eet of MR tankers

from TORM A/S, as well as pursuing strategic joint venture

partnerships with both Ocean Bulk Maritime and Rickmers.

There is skepticism in various quarters about the role that

this capital source will play in the marine sector, with previously

anticipated investment levels having failed to materialize.

Latitudes

Caption to come

here: caption to

come here

Restoring fnancial health to the marine industry

will require cooperation and a fresh approach from

all stakeholders, old and new alike.

Some believe that the industry does not t the classic model

for the relevant investors.

Traditional private equity looks for an exit before it invests,

says Paul Slater, chairman of First International. Where is the

return from shipping in three years, or ve years?

Such skepticism notwithstanding, the speculation

surrounding this capital source has intensied in recent

months, with some projections anticipating, nally, signicant

increases in investment. In August 2013, Kohlberg Kravis Roberts

announced its entry into the marine space through a new nance

company capitalized with US$580m of equity. Its focus will

include the structuring, underwriting and distribution of

secured debt nancings in the marine sector.

Given the cyclical nature of the industry and the

opportunities that exist in a down cycle, there are investors

seeking discounted investments in the secondary debt market

and/or in respect of low vessel valuations. This may increase

if further restructurings are faced by the industry.

Others in this area are exploring the possibility of an

operating lessor model not dissimilar to that used in the

aviation sector.

The deployment of this new capital source will not be without

signicant challenges. New investors will have to conduct careful

diligence and select partners with the necessary industry expertise

to ensure an understanding of, among other things, regulatory

compliance with sanctions-based regimes, potential trading and

environmental risks and liabilities, contingent maritime liabilities,

the interaction between trading routes, risks for maritime arrests

from unsecured creditors and potential board and shareholder

liabilities. The length of time for which capital is intended to be

deployed will also be signicant, and whether that is tied to

potential exit opportunities through IPOs, secondary listings or

otherwise will also have to be considered.

Uncharted waters

The world of maritime nancing will likely look very dierent in

the coming years when compared with the bank-driven nance

market of 2008.

It remains to be seen whether ECA intervention will

ultimately be viewed as having provided a necessary bridge

between the old and new regimes or as having contributed to

an extension of the sectors supply-demand imbalances. What

seems evident, however, is that the sectors nancing needs

will not be able to be met solely by the ECAs.

Additional capital sources will be required, and whether

these ultimately come from the issuance of bonds, capital markets

oerings and/or private equity and hedge or other funds, or

otherwise, it seems likely that these new sources of capital will

bring changes with them. New capital providers can be expected to

approach the industry with a dierent type of investing discipline,

as well as using techniques and structures deployed with success in

other industries. It is to be hoped that the combined eect of these

changes will help the industry return to nancial health.

Future growth in global trade will of course also be a signicant

determining factor in how and when the industry returns to health.

And then there are the imponderables, such as the impact of recent

discoveries of a variety of energy sources in the United States. As

noted by Poten & Partners: With crude oil production in the US

rising to levels unseen in 22 years, the self-imposed restrictions on

the export of crude oil is resulting in the rening of this product and

an increase in product tanker movement from the Gulf Coast to the

South American, Central American and West African zones.

Although the US oil surge is having a positive eect on US product

tanker movement, it is hurting the already weak European rening

and product tanker markets, and could prove to have longer-term

negative eects on European reners if current conditions persist.

This development highlights both the uncertainties and

the opportunities faced by the maritime sector and all of its

stakeholders, including those considering entry for the rst time.

Five years on from the crisis of 2008, the industry remains in

uncharted waters.

Latitudes Industry analysis Shipping

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- NCERT Solutions For Class 11th: CH 1 Introduction To Accounting AccountancyDocument36 pagesNCERT Solutions For Class 11th: CH 1 Introduction To Accounting Accountancydinesh100% (1)

- Very Good Project Acct Doc - IntegrationsDocument15 pagesVery Good Project Acct Doc - IntegrationsConrad Rodricks100% (1)

- Red BullDocument23 pagesRed BullMohona Abedeen0% (1)

- Lorenzo V Posadas (Digest)Document2 pagesLorenzo V Posadas (Digest)StBernard15No ratings yet

- ATP Case Digest 2Document7 pagesATP Case Digest 2Tay Wasnot TusNo ratings yet

- Svci Fieldtrip FormDocument1 pageSvci Fieldtrip FormSheNo ratings yet

- Policy Implementation: Dr. Upul Abeyrathne, Dept. of Economics, University of Ruhuna, MataraDocument14 pagesPolicy Implementation: Dr. Upul Abeyrathne, Dept. of Economics, University of Ruhuna, MatarawikibhattyNo ratings yet

- Halina Mountain Resort (B)Document5 pagesHalina Mountain Resort (B)SuzetTe OlmedoNo ratings yet

- Culinary Union Letter To Gaming Control Board Re: Alex MerueloDocument5 pagesCulinary Union Letter To Gaming Control Board Re: Alex MerueloMegan MesserlyNo ratings yet

- BUSANA1 Chapter2 - Compound InterestDocument101 pagesBUSANA1 Chapter2 - Compound InterestIzzeah RamosNo ratings yet

- Mathematics & Decision MakingDocument9 pagesMathematics & Decision MakingXahed AbdullahNo ratings yet

- LawDocument10 pagesLawTannaoNo ratings yet

- Banking Theory and Practice Chapter ThreeDocument36 pagesBanking Theory and Practice Chapter Threemubarek oumerNo ratings yet

- A Kerl of ShillerDocument11 pagesA Kerl of Shillerramy6233No ratings yet

- Basic Accounting SystemDocument37 pagesBasic Accounting SystemGetie TigetNo ratings yet

- Fringe Benefit FSLGDocument92 pagesFringe Benefit FSLGkashfrNo ratings yet

- SCreportDocument10 pagesSCreportAmir Azfar Ainul AsyiqinNo ratings yet

- Unit 2 Tutorial Worksheet AnswersDocument15 pagesUnit 2 Tutorial Worksheet AnswersHhvvgg BbbbNo ratings yet

- Birch Paper CompanyDocument1 pageBirch Paper CompanySwami R RNo ratings yet

- Microoven InvoiceDocument1 pageMicrooven InvoiceNiharikaNo ratings yet

- NPV and IRRDocument2 pagesNPV and IRRsaadhashmi97No ratings yet

- University of Nairobi Faculty of Business and Management Science Microfinance Assignment Submitted To: Prof Josiah AdudaDocument25 pagesUniversity of Nairobi Faculty of Business and Management Science Microfinance Assignment Submitted To: Prof Josiah AdudaMohamed LibanNo ratings yet

- ABC Corporation Annual ReportDocument9 pagesABC Corporation Annual ReportCuong LyNo ratings yet

- Article - Discount For Lack of Marketability (6649)Document7 pagesArticle - Discount For Lack of Marketability (6649)Saurabh KhubchandaniNo ratings yet

- 2.0 Product Details: 2.1 Scenario of Customer Using ProductDocument6 pages2.0 Product Details: 2.1 Scenario of Customer Using ProductElsa Tan XQNo ratings yet

- SBLC Purchase 38+2 R1 SKVDocument23 pagesSBLC Purchase 38+2 R1 SKVKRIYERNo ratings yet

- Managerial and Legal Economics: Debarchana ShandilyaDocument28 pagesManagerial and Legal Economics: Debarchana ShandilyaPritam RoyNo ratings yet

- State Investment Vs CA and MoulicDocument10 pagesState Investment Vs CA and MoulicArlyn R. RetardoNo ratings yet

- State of Microfinance in BhutanDocument45 pagesState of Microfinance in BhutanasianingenevaNo ratings yet

- IIBF Annual Report 2018-19 PDFDocument111 pagesIIBF Annual Report 2018-19 PDFanantNo ratings yet