Professional Documents

Culture Documents

Analyzing Bank Results

Uploaded by

cabhargavCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analyzing Bank Results

Uploaded by

cabhargavCopyright:

Available Formats

How to analyse bank performance without the clutter

Higher net profit or net interest margin does matter, while analysing

thefinancial performance of a bank. RBI may also consider mandating banks

reporting total assets/ balance sheet size rather than the so-called 'total

bsiness' adding deposits, liabilities and loan assets to ha!e a tre and fair

sense of banks' bsiness growth

Come quarterl y and annual bank financial results and investors and readers

of business and financial newspapers are all agog over some anal yst gushing

' Bank As net profit rises 3!" and some other anal yst emoting #Bank Bs $%&

is highest at or ' !' ( And all these are taken by readers and investors as hol y

grail suggesting that banks concerned have been e)ceptionall y efficient and

profitable( *his need" and may" not at all be so+ But before seeing why" it would

onl y be instructive and value,adding to consider the business modelof a t ypical

competi tive" efficient" safe" and sound bank+

A bank is t ypical l y characterised by relativel y high financial leverage" which" in

turn" is measured by what is known as -quit y &ultiplier .-&/" which" in turn" is

nothing but total assets of a bank divided by its common equit y0 shareholder

funds+ &ultipl yi ng this leverage .-&/ by what is called 1eturn on Assets .12A/

gives 1eturn on -quit y .12-/ for a bank+ *ypicall y" compet itive" efficient" safe

and sound banks have had historicall y an average 12A of about 3! and a

reasonabl y safe -& of about 3" impl yi ng an average market,compet itive

equilibrium 12- of about 3!+

%n the recent period" the %ndian Banking 4ystem has had leverage of about 33 to

35 ti mes+ 4ignificant l y" and hearteningl y" to the credit of 1eserve Bank of %ndia

.1B%/ and the %ndian banking sector" this corresponds to an average leverage

ratio . inverse of -&/ of 6!7" which" at about 8+ times" is way higher than 3!

mandated by new Basel %%% capital rules to be compli ed with only in 893: ( %n

other words" the %ndian banking sector is already more than 8+ times compli ant

on this critical Basel %%% parameter ((

%n this conte)t" another key financial parameter is what is known as $et %nterest

&argin .$%&/" which is the difference between interest earned and interest

e)pended as apercentage of a banks assets+ Collectivel y for %ndian Banks in the

recent period" $%& has varied between 8+ ! to 3!+ %f we deduct 12A from

$%&" we get what can be called $on %nterest cost of %ntermedi ation+ %n fact" it is

this critical parameter0 ob; ective function vi< .$%&,12A/ which" for a given

12A derived" in turn" from a given 12- and -&" it must be the dharma/

mantra of a role model bank management to mini mi <e for ma)i mi <ing returns to

depositors and0 or minimi<ing costs to borrowers + *hus" either way" constrained

minimi<at ion of the ob; ective function .$%&,12A/ delivers value to all

stakeholders vi<" shareholders" insured and uninsured depositors" borrowers"

ta)payers" in particul ar" and the real economy" in general+

*o recapitulat e" =the business model of a compet itive" efficient" safe and

sound bank is one which" while by minimi<ing the ob; ective function .$%&,

12A/ sub; ect to the constraint of a given 12A" derived" in turn" from a given

market,competi tive equilibrium 12-" ma)i mi <es value for all stakeholders vi<"

depositors" borrowers" shareholders and public policy institutions" and allows it

to grow sustainabl y by helping the real sector grow consistent with

' financial sector,real sector balance ' where the financial sector is ever a means

to the real sector end (( =

"ignificance of #I$-R%&

>e are now ready to unclutter the clutter in bank financial performance analysi s

and evaluation+ As regards the myt h of $%& being a key measure of

profitabil it y" let it be said that $%& by" and in" itself conveys nothing more than

what it apparentl y does vi<" as we have seen before" it is ;ust the difference

between interest earned" and interest e)pended" as a percentage of a banks

assets+ %t is ; ust a means to an end and not an end in itself ( ?or it" therefore" to

make any sense" it needs to be analysed further beyond what it is by considering

.$%&,12A/+ ?or if $%& be '!" and 12A be <ero" then automaticall y 12- will

also be <ero and it is no brainer to see that this nominall y very high $%& onl y

establishes that the bank is neither competit ive" efficient" safe nor sound ( -ven

if 12A be" say 8!" then . $%&,12A/ will be .'!,8!/ i+ e+ 5!+ And this bank

will be far less efficient and competi tive than a bank whose $%& is" say 3!" and

12A " say 3! " and" therefore" .$%&,12A/ 8! ( *his is because non,interest

cost of intermediat ion of the higher, $%& bank is twice that of the lower, $%&

bank and it is precisel y this twice as large .$%&,12A/ and its reasons through

its granular anal ysis and dissection that should engage the attent ion of bank

anal ysts and investors(

?or it is this .$%&,12A/ that subsumes all non, interest e)penses such as

ta)es" salaries0wages 0compensation" operational e)penses" loan loss provisions"

marked,to,market provisions" write,offs etc+ And this .$%&,12A/ becomes even

more significant" if the reported gross $@As .non performing assets/ are

unusuall y low( *herefore" in the above e)ample" the bank with lower .$%&,

12A/ will be twice as efficient and competi tive as the one with higher .$%&,

12A/ because the former ma)imi<es value for all stakeholders vi<" depositors

by way of higher deposit interest rates" borrowers by way of lower borrowing

costs" shareholders by way of given 12A and market , competit ive equilibrium

12- (

Higher net profit may not show real growth

?inall y" coming to too much being made of" say 8! to 3! growth in net

profits" this too needs to be regarded with circumspect ion for these numbers

need to be ad; usted for the growth in balance sheet 0 assets and not ; ust

considered in isolation and on a stand, alone basis+ ?or if net profit grows at

3!" on a year,on,year " or a CAA1" basis and assets0balance sheet also grow

by" say 3!" then there is reall y nothing to write home " or to feel gung,ho"

about for the bank in question has been no more" and no less" efficient and

profitable than before ( Another equall y insightful way to see this is in terms of

change in 12A+ ?or e)ample" if previous 12A be" say 3!" then there is no

change in 12A as the 12A also remains unchanged at 3! for 3! growth both

in net profits and assets0balance sheet( 2n the other hand" if for a 3! growth in

net profit" assets0 balance sheet grow by" say 8!" then the bank has been more

efficient and profitable only to the e)tent of .3+ 303+ 8,3/B399 i+ e+ 7 :!" and not

3!" as bank anal ysts would unwittingl y have readers and investors believe ( %n

this case" 12A increases fom 3! to 3B3+ 9: i+ e 3+ 9:! onl y( Also" significant l y"

and equall y" if assets0 balance sheet grow by 59!" then the so,called nominal

profit growth of 3! will translate into a less efficient and less profitable

performance of .3+ 303+ 59,3/B399 i+ e , 3+ ! and not 3! as 12A will decline to

9+ C'! from 3! previously although absolute net profit increased by 3! ( *his

then is the conceptuall y robust and technical l y rigorous nuts,and,bolts way of

how bank anal ysts and investors must dissect bank financial performance and

; udge true and fair value of banking stocks for value investing0 buying(

'laws in sing deposits and loans as total bsiness

>hile on the how,and,how,not of bank financial performance anal ysis and

evaluat ion" a tail piece on banks' reporting of ' total business' will not be out of

place and conte)t+ *ypi call y" in %ndia" it is routine for banks to report total

business as the sum of deposits and loans to give anal ysts and investors a sense

of growth in banks' business+ But this is not only at variance with the

internat ional practice but also intellectual l y and conceptuall y flawed and

vitiat ed for all ' business' is about generating revenues and returns for

shareholders and it is ' total assets' that precisel y do that and it is tautological

and a)iomatic that there is no way revenue generating assets can e)ist and grow

without corresponding e)pense contributing liabi lit ies( *hat is also precisel y

why" as sources and uses of funds" liabil iti es and assets appear opposite each

other on a balance sheet+ 4ignificantl y" the so called total business of banks has

t ypical l y e)ceeded total assets0 balance sheet si<e by about 9!(

*herefore" while bank anal ysts and investors will do well to go that e)tra mile to

have a true and fair sense of banks' business growth" with a view to aligning

with the internat ional practice" 1B% may also consider mandat ing banks

reporting total assets0 balance sheet si<e rather than the so called ' total business'

adding deposit liabi lit ies and loan assets+

You might also like

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Ratio Analysis: OV ER VIE WDocument40 pagesRatio Analysis: OV ER VIE WSohel BangiNo ratings yet

- Chapter 08Document18 pagesChapter 08Tam NguyenNo ratings yet

- Capital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview QuestionsDocument12 pagesCapital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview Questionsdhsagar_381400085No ratings yet

- Reading Between the Lines of Corporate Financial Reports: In Search of Financial MisstatementsFrom EverandReading Between the Lines of Corporate Financial Reports: In Search of Financial MisstatementsNo ratings yet

- C 3 A F S: Hapter Nalysis of Inancial TatementsDocument27 pagesC 3 A F S: Hapter Nalysis of Inancial TatementskheymiNo ratings yet

- Cash Flow EstimationDocument38 pagesCash Flow EstimationMuhammad Mohsin Shahzad KahloonNo ratings yet

- LenovoDocument5 pagesLenovoamin233No ratings yet

- Chapter12 Managing and Pricing Deposit ServicesDocument12 pagesChapter12 Managing and Pricing Deposit ServicesVisal Chin0% (1)

- Ratio Analysis GuideDocument9 pagesRatio Analysis GuiderakeshkchouhanNo ratings yet

- Ross 9e FCF SMLDocument425 pagesRoss 9e FCF SMLAlmayayaNo ratings yet

- SCDL PGDBA Finance Sem 1 Management AccountingDocument19 pagesSCDL PGDBA Finance Sem 1 Management Accountingamitm17No ratings yet

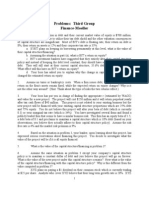

- Problems: Third Group Finance-MoellerDocument4 pagesProblems: Third Group Finance-MoellerEvan BenedictNo ratings yet

- 5th Part of PBLDocument9 pages5th Part of PBLanwerhossanNo ratings yet

- Credit Appraisal Techniques ExplainedDocument35 pagesCredit Appraisal Techniques ExplainedDilip RkNo ratings yet

- Comparative Financial Analysis of Prism Cement and Ambuja CementDocument55 pagesComparative Financial Analysis of Prism Cement and Ambuja Cementsauravv7No ratings yet

- ACC-OBJDocument6 pagesACC-OBJSha SharonNo ratings yet

- KOTAK MahindraDocument121 pagesKOTAK MahindraRahul SoganiNo ratings yet

- Chapter 10-Statement of Cash Flows: Multiple ChoiceDocument26 pagesChapter 10-Statement of Cash Flows: Multiple ChoiceAsma JamshaidNo ratings yet

- Data analysis and company ratiosDocument31 pagesData analysis and company ratiosAnonymous nTxB1EPvNo ratings yet

- 38 Ratio AnalysisDocument11 pages38 Ratio AnalysisBrian JonesNo ratings yet

- Ratio Analysis Of Beximco Pharmaceuticals LTDDocument5 pagesRatio Analysis Of Beximco Pharmaceuticals LTDimzeeroNo ratings yet

- Chapter 14 Capital Structure and Financial RatiosDocument12 pagesChapter 14 Capital Structure and Financial Ratiossamuel_dwumfourNo ratings yet

- Session 2 Additional NotesDocument9 pagesSession 2 Additional NotesDang Minh HaNo ratings yet

- Solution For The Analysis and Use of Financial Statements (White.G) ch03Document50 pagesSolution For The Analysis and Use of Financial Statements (White.G) ch03Hoàng Thảo Lê69% (13)

- Analyzing Financial Performance of Bata BangladeshDocument54 pagesAnalyzing Financial Performance of Bata BangladeshCarbon_AdilNo ratings yet

- IXI Services Case Study For BanksDocument6 pagesIXI Services Case Study For Bankshab_dsNo ratings yet

- Financial Statements, Cash Flows, and Taxes: Homework ForDocument9 pagesFinancial Statements, Cash Flows, and Taxes: Homework Foradarshdk1No ratings yet

- Types and Costs of Financial Capital: True-False QuestionsDocument8 pagesTypes and Costs of Financial Capital: True-False Questionsbia070386No ratings yet

- Analysis of Determinants Affecting Cash Dividends Policy of Listed Producing Companies in ChinaDocument3 pagesAnalysis of Determinants Affecting Cash Dividends Policy of Listed Producing Companies in ChinaAysha ShahidNo ratings yet

- Solutions Manual The Investment SettingDocument7 pagesSolutions Manual The Investment SettingQasim AliNo ratings yet

- Financial Services: Optimizing Retail Banking Revenues Through Increased Customer Touchpoint ProductivityDocument19 pagesFinancial Services: Optimizing Retail Banking Revenues Through Increased Customer Touchpoint Productivityshail92No ratings yet

- Cooperative Banking Operations – Credit Management - Ratio Analysis & Break Even AnalysisDocument6 pagesCooperative Banking Operations – Credit Management - Ratio Analysis & Break Even AnalysisNitin SharmaNo ratings yet

- How Does ??? Impact The Three Financial Statements?: What Is APV?? Adjusted Present ValueDocument3 pagesHow Does ??? Impact The Three Financial Statements?: What Is APV?? Adjusted Present ValueSaakshi AroraNo ratings yet

- Ratio AnalysisDocument28 pagesRatio Analysisdivyesh_variaNo ratings yet

- Commonly Used Ratios I. LiquidityDocument7 pagesCommonly Used Ratios I. LiquidityJohn Lexter GravinesNo ratings yet

- Chapter 04 - AnswerDocument9 pagesChapter 04 - AnswerCrisalie Bocobo0% (1)

- CH 10 IMDocument46 pagesCH 10 IMAditya Achmad Narendra WhindracayaNo ratings yet

- Aaaaaaaaaaaa: Income StatementsDocument11 pagesAaaaaaaaaaaa: Income StatementszainalijanjuyaNo ratings yet

- Case #84 Risk and Rates of Return - Filmore EnterprisesDocument9 pagesCase #84 Risk and Rates of Return - Filmore Enterprises3happy3100% (5)

- AIOU Report FormatDocument6 pagesAIOU Report FormatZain NabiNo ratings yet

- Civil & Water Eng. Business NotesDocument15 pagesCivil & Water Eng. Business NotesBright MuzaNo ratings yet

- RatiosDocument6 pagesRatiosFaisal AwanNo ratings yet

- Compliance of IAS-7 Cash Flow StatementsDocument11 pagesCompliance of IAS-7 Cash Flow StatementsShamsuddin AhmedNo ratings yet

- FINANCIAL PERFORMANCEDocument23 pagesFINANCIAL PERFORMANCESajib DevNo ratings yet

- Npa 2Document106 pagesNpa 2Jaspreet SinghNo ratings yet

- Accounting GlossaryDocument242 pagesAccounting GlossaryNelson FernandezNo ratings yet

- 11 LasherIM Ch11Document26 pages11 LasherIM Ch11jimmy_chou1314100% (1)

- Final Report Mutual Fund Valuation and Accounting 1Document69 pagesFinal Report Mutual Fund Valuation and Accounting 1Neha Aggarwal AhujaNo ratings yet

- Financial Management & Control FinalDocument25 pagesFinancial Management & Control FinalAnees Ur RehmanNo ratings yet

- Cogent Analytics M&A ManualDocument19 pagesCogent Analytics M&A Manualvan070100% (1)

- How Cooking the Books WorksDocument16 pagesHow Cooking the Books Worksrahul_k811No ratings yet

- Interneship ReportDocument49 pagesInterneship ReportPushpa BaruaNo ratings yet

- Orca Share Media1678615963308 7040625649368839273Document41 pagesOrca Share Media1678615963308 7040625649368839273Angeli Shane SisonNo ratings yet

- D & G Case StudyDocument10 pagesD & G Case StudyVrusti RaoNo ratings yet

- Solution Financial Management Strategy May 2009Document7 pagesSolution Financial Management Strategy May 2009samuel_dwumfourNo ratings yet

- My Movies ListDocument80 pagesMy Movies ListcabhargavNo ratings yet

- The Management MythDocument13 pagesThe Management Mythcabhargav100% (1)

- Echap 02Document25 pagesEchap 02Manish JaiswalNo ratings yet

- JPM Guide To The Markets 3Q 2014Document71 pagesJPM Guide To The Markets 3Q 2014DavidRHansonNo ratings yet

- Echap 02Document25 pagesEchap 02Manish JaiswalNo ratings yet

- Bitcoin: Market, Economics and RegulationDocument9 pagesBitcoin: Market, Economics and RegulationcabhargavNo ratings yet

- JPM Guide To The Markets 3Q 2014Document71 pagesJPM Guide To The Markets 3Q 2014DavidRHansonNo ratings yet

- Contact ConsultantsDocument1 pageContact ConsultantscabhargavNo ratings yet

- Cognitive ScienceDocument5 pagesCognitive SciencecabhargavNo ratings yet

- EBA Warning On Virtual CurrenciesDocument3 pagesEBA Warning On Virtual CurrencieszdfgbsfdzcgbvdfcNo ratings yet

- LessonsDocument40 pagesLessonscabhargavNo ratings yet

- Bitcoin: Market, Economics and RegulationDocument9 pagesBitcoin: Market, Economics and RegulationcabhargavNo ratings yet

- Shah Commission of Inquiry - Interim Report IDocument105 pagesShah Commission of Inquiry - Interim Report ISuresh Nakhua100% (1)

- Annual Report 2012-13 - Suzlon's Impact and ProgressDocument154 pagesAnnual Report 2012-13 - Suzlon's Impact and ProgresscabhargavNo ratings yet

- 123Document1 page123cabhargavNo ratings yet

- My Movies ListDocument80 pagesMy Movies ListcabhargavNo ratings yet

- 123Document1 page123cabhargavNo ratings yet

- 123Document1 page123cabhargavNo ratings yet

- How To Guide On NothingDocument1 pageHow To Guide On NothingcabhargavNo ratings yet

- 2011CI Rajan Financial DevelopmentDocument43 pages2011CI Rajan Financial DevelopmentAshima MishraNo ratings yet

- Corporate Performance AnalysisDocument24 pagesCorporate Performance AnalysiscabhargavNo ratings yet

- Philosophical Perspectives Through the AgesDocument13 pagesPhilosophical Perspectives Through the Agesshashankmay18No ratings yet

- Di OutlineDocument81 pagesDi OutlineRobert E. BrannNo ratings yet

- The Perfect Prayer by by Jon Courson - Matthew 6 9-13 The Lords PrayerDocument6 pagesThe Perfect Prayer by by Jon Courson - Matthew 6 9-13 The Lords PrayerRobert Beaupre100% (1)

- Unpacking of StandardsDocument41 pagesUnpacking of StandardsJealf Zenia Laborada CastroNo ratings yet

- EY The Cfo Perspective at A Glance Profit or LoseDocument2 pagesEY The Cfo Perspective at A Glance Profit or LoseAayushi AroraNo ratings yet

- SDLC - Agile ModelDocument3 pagesSDLC - Agile ModelMuhammad AkramNo ratings yet

- Ororbia Maze LearningDocument10 pagesOrorbia Maze LearningTom WestNo ratings yet

- TOS and CID FORM-TLE 8 ANIMATIONDocument80 pagesTOS and CID FORM-TLE 8 ANIMATIONAriel AntaboNo ratings yet

- Atmospheres of Space The Development of Alvar Aalto S Free Flow Section As A Climate DeviceDocument18 pagesAtmospheres of Space The Development of Alvar Aalto S Free Flow Section As A Climate DeviceSebastian BaumannNo ratings yet

- United States Court of Appeals, Sixth CircuitDocument5 pagesUnited States Court of Appeals, Sixth CircuitScribd Government DocsNo ratings yet

- Thin Layer Chromatograph1Document25 pagesThin Layer Chromatograph12581974No ratings yet

- Report-Picic & NibDocument18 pagesReport-Picic & NibPrincely TravelNo ratings yet

- Semi-Detailed Lesson Plan Template: Pagsanjan Intergrated National High School 8Document3 pagesSemi-Detailed Lesson Plan Template: Pagsanjan Intergrated National High School 8Mae Ganate RoblesNo ratings yet

- Functional Appliances 2018Document45 pagesFunctional Appliances 2018tonhanrhmNo ratings yet

- APCHG 2019 ProceedingsDocument69 pagesAPCHG 2019 ProceedingsEnrico SocoNo ratings yet

- My Perspective On Ayurveda-ArticleDocument2 pagesMy Perspective On Ayurveda-ArticleAaryan ParashuramiNo ratings yet

- Reconsidering Puerto Rico's Status After 116 Years of Colonial RuleDocument3 pagesReconsidering Puerto Rico's Status After 116 Years of Colonial RuleHéctor Iván Arroyo-SierraNo ratings yet

- Software Security Engineering: A Guide for Project ManagersDocument6 pagesSoftware Security Engineering: A Guide for Project ManagersVikram AwotarNo ratings yet

- Dwi Athaya Salsabila - Task 4&5Document4 pagesDwi Athaya Salsabila - Task 4&521Dwi Athaya SalsabilaNo ratings yet

- Prophetic Prayer Declarations - September, 2021Document5 pagesProphetic Prayer Declarations - September, 2021Jelo RichNo ratings yet

- Sri Dakshinamurthy Stotram - Hindupedia, The Hindu EncyclopediaDocument7 pagesSri Dakshinamurthy Stotram - Hindupedia, The Hindu Encyclopediamachnik1486624No ratings yet

- Animal Quiz: SuperlativesDocument2 pagesAnimal Quiz: SuperlativesLuis LemusNo ratings yet

- P7 Summary of ISADocument76 pagesP7 Summary of ISAAlina Tariq100% (1)

- Why Narcissists Need You To Feel Bad About Yourself - Psychology TodayDocument51 pagesWhy Narcissists Need You To Feel Bad About Yourself - Psychology Todaytigerlo75No ratings yet

- 7 Years - Lukas Graham SBJDocument2 pages7 Years - Lukas Graham SBJScowshNo ratings yet

- ISE I Conversation Task - Rules and RegulationsDocument3 pagesISE I Conversation Task - Rules and RegulationsElena B. HerreroNo ratings yet

- 2 NDDocument52 pages2 NDgal02lautNo ratings yet

- DRR Module 4 Detailed Lesson PlanDocument8 pagesDRR Module 4 Detailed Lesson PlanFe Annalie Sacal100% (2)

- Chapter 1. Introduction To TCPIP NetworkingDocument15 pagesChapter 1. Introduction To TCPIP NetworkingPoojitha NagarajaNo ratings yet

- Umair Mazher ThesisDocument44 pagesUmair Mazher Thesisumair_mazherNo ratings yet