Professional Documents

Culture Documents

Bosch 1qcy2014ru 290414

Uploaded by

Tirthajit SinhaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bosch 1qcy2014ru 290414

Uploaded by

Tirthajit SinhaCopyright:

Available Formats

Please refer to important disclosures at the end of this report

1

Y/E Dec (` cr) 1QCY14 1QCY13 % chg (yoy) 4QCY13 % chg (qoq)

Net Sales 2,450 2,209 10.9 2,162 13.3

EBITDA 399 382 4.4 213 86.8

EBITDA Margin (%) 16.3 17.3 (102)bp 9.9 640bp

Adj. PAT 326 260 25.6 139 134.8

Source: Company, Angel Research

Bosch (BOS) recorded strong results for 1QCY2014 driven by

better-than-expected operating performance, and a significant increase in other

income led by treasury gains. We broadly maintain our revenue and earnings

estimates for CY2014/15 as we expect the demand environment in the

automotive sector to remain sluggish in 2QCY2014 as well. Nonetheless,

expected easing of interest rates in 2HCY2014 following expected tapering of

inflation is likely to revive demand and drive growth going ahead. We believe that

the company will continue to enjoy premium valuations and therefore maintain our

Accumulate rating on the stock.

Strong 1QFCY2014 results: BOS posted a strong top-line growth of 10.9% yoy

(13.3% qoq) to `2,450cr, sharply ahead of our estimates of `2,230cr, led by

12% yoy growth in the automotive segment. The non-automotive segment though

posted a modest growth of 4.9% yoy. The overall growth was driven by continued

momentum in exports, which witnessed a robust growth of ~35% yoy (~13% of

sales); whereas, domestic sales too posted a healthy growth of ~9% yoy driven by

strong off-take in domestic tractor sales. EBITDA margins stood at 16.3% (up

640bp qoq) as against our expectation of 15.8%. The performance improvement

was mainly on account of substantial decline in other expenditure (down

21.7% qoq) and aided by cost reduction initiatives. On a yoy basis though EBITDA

margins contracted 102bp due to the negative impact of the INR depreciation on

the raw-material cost front. Net profit grew strongly by 25.6% yoy to `326cr,

outperforming our expectations of `240cr. The bottom-line benefitted from higher

other income (up 59.3% yoy and 52.9% qoq) on account of treasury gains related

to sale of certain investments.

Outlook and valuation: We remain positive on the long term prospects of BOS due

to its technological leadership and strong and diversified product portfolio. We expect

the companys earnings growth to revive going ahead led by revival in the domestic

automotive industry coupled with localization initiatives and expected emission norm

change due to roll out in 2015. We maintain our Accumulate rating on the stock with

a target price of `11,424.

Key financials (Standalone)

Y/E Dec (` cr) CY2012 CY2013E CY2014E CY2015E

Net Sales 8,659 8,820 10,021 11,715

% chg 6.0 1.9 13.6 16.9

Net Profit 874 885 1,146 1,435

% chg (18.1) 1.2 29.5 25.3

EBITDA (%) 15.6 14.6 16.8 17.9

EPS (`) 278.3 281.7 364.8 456.9

P/E (x) 38.0 37.5 29.0 23.1

P/BV (x) 6.0 5.3 4.6 4.0

RoE (%) 15.7 14.1 15.9 17.1

RoCE (%) 18.3 14.9 18.3 20.5

EV/Sales (x) 3.3 3.2 2.7 2.3

EV/EBITDA (x) 22.5 23.0 17.3 13.5

Source: Company, Angel Research; Note: CMP as of April 28, 2014

ACCUMULATE

CMP `10,576

Target Price `11,424

Investment Period 12 Months

Stock Info

Sector

Bloomberg Code

BOS@IN

Shareholding Pattern (%)

Promoters 71.2

MF / Banks / Indian Fls 14.3

FII / NRIs / OCBs 7.5

Indian Public / Others 7.0

Abs. (%) 3m 1yr 3yr

Sensex 7.1 8.6 17.3

Bosch 16.0 17.2 56.0

10

22,632

6,761

BOSH.BO

Auto Ancillary

Avg. Daily Volume

Market Cap (` cr)

Beta

52 Week High / Low

33,209

0.2

11,500/8,000

1,606

Net Debt (` cr) (3,495)

Face Value (`)

BSE Sensex

Nifty

Reuters Code

Yaresh Kothari

022-3935 7800 Ext: 6844

yareshb.kothari@angelbroking.com

Bosch

Performance Highlights

1QCY2014 Result Update | Auto Ancillary

April 29, 2014

Bosch | 1QCY2014 Result Update

April 29, 2014

2

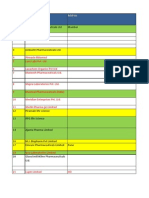

Exhibit 1: Quarterly financial performance (Standalone)

Y/E Dec (` cr) 1QCY14 1QCY13 % chg (yoy) 4QCY13 % chg (qoq) CY2013 CY2012 % chg (yoy)

Net Sales 2,450 2,209 10.9 2,162 13.3 8,820 8,659 1.9

Consumption of RM 840 726 15.7 705 19.2 2,860 2,851 0.3

(% of sales) 34.3 32.9

32.6

32.4 32.9

Staff costs 328 286 14.5 313 4.6 1,191 1,037 14.9

(% of sales) 13.4 13.0

14.5

13.5 12.0

Purchases of TG 506 464 9.2 448 12.9 1,922 1,908 0.8

(% of sales) 20.7 21.0

20.7

21.8 22.0

Other Expenses 378 351 7.7 482 (21.7) 1,555 1,514 2.7

(% of sales) 15.4 15.9

22.3

17.6 17.5

Total Expenditure 2,052 1,827 12.3 1,949 5.3 7,529 7,310 3.0

Operating Profit 399 382 4.4 213 86.8 1,291 1,349 (4.3)

OPM (%) 16.3 17.3

9.9 64.8 14.6 15.6

Interest 1 0 162.1 2 (69.4) 3 6 (47.6)

Depreciation 88 84 4.6 124 (29.0) 384 367 4.7

Other Income 142 89 59.3 93 52.9 353 369 (4.5)

PBT (excl. Extr. Items) 452 387 16.9 180 151.3 1,257 1,346 (6.7)

Extr. Income/(Expense) - - - - -

PBT (incl. Extr. Items) 452 387 16.9 180 151.3 1,257 1,346 (6.7)

(% of Sales) 18.5 17.5

8.3

14.2 15.5

Provision for Taxation 126 127 (0.8) 41 207.6 372 388 (4.1)

(% of PBT) 27.8 32.8

22.8

29.6 28.8

Reported PAT 326 260 25.6 139 134.8 885 958 (7.7)

Adj PAT 326 260 25.6 139 134.8 885 958 (7.7)

Adj. PATM 13.3 11.8

6.4

10.0 11.1

Equity shares (cr) 31.4 31.4

31.4

31.4 31.4

Reported EPS (`) 103.9 82.7 25.6 44.3 134.8 281.7 305.2 (7.7)

Adjusted EPS (`) 103.9 82.7 25.6 44.3 134.8 281.7 305.2 (7.7)

Source: Company, Angel Research

Exhibit 2: 1QCY2014 Actual vs Angel estimates

Y/E Dec (` cr) Actual Estimates Variation (%)

Net sales 2,450 2,230 9.9

EBITDA 399 353 12.9

EBITDA margin (%) 16.3 15.8 44bp

Adj. PAT 326 240 35.9

Source: Company, Angel Research

Top-line registers strong growth: For 1QCY2014, BOS posted a strong top-line

growth of 10.9% yoy (13.3% qoq) to `2,450cr, sharply ahead of our estimate of

`2,230cr, led by a 12% yoy growth in the automotive segment. The

non-automotive segment though posted a modest growth of 4.9% yoy during the

quarter. The overall growth was driven by continued momentum in exports, which

witnessed a robust growth of ~35% yoy (~13% of sales); whereas, domestic sales

too posted a healthy growth of ~9% yoy driven by strong off-take in domestic

tractor sales.

Bosch | 1QCY2014 Result Update

April 29, 2014

3

According to the Management, strong growth in tractor sales, market share gains

in the fuel injection systems and strong exports growth, primarily in the automotive

segment, aided the overall performance. The exports performance was aided by a

strong performance in the European region (especially in Germany) and healthy

growth in Russia and China. The localization level for the company currently stands

at ~60% (imports stand at ~40%). An improvement towards localization is

expected going ahead led by commencement of new facilities.

Exhibit 3: Segmental performance

Y/E Dec (` cr) 1QCY14 1QCY13 % chg (yoy) 4QCY13 % chg (qoq) CY2013 CY2012 % chg (yoy)

Revenue

Automotive 2,133 1,904 12.0 1,878 13.6 7,697 7,726 (0.4)

Others 321 306 4.9 294 9.4 1,136 980 16.0

Total 2,454 2,210 11.0 2,172 13.0 8,833 8,706 1.5

Less: Inter-segment revenue 4 2

10 (60.7) 13 47

Net sales 2,450 2,209 10.9 2,162 13.3 8,820 8,659 1.9

EBIT

Automotive 341 296 15.2 133 157.2 993 1,028 (3.3)

Others 35 40 (14.1) 11 229.6 55 89 (37.8)

Total EBIT 376 337 11.7 143 162.5 1,049 1,117 (6.1)

Add: Net interest income 1 0 162.1 (2) (130.6) (3) (6) (47.6)

Less: unallocable exp. (77) (50) 52.9 (39) 96.6 (211) (235) (10.4)

Total PBT 454 387 17.1 180 152.2 1,257 1,346 (6.7)

EBIT Margin (%)

Automotive 16.0 15.6 44bp 7.1 893bp 12.9 13.3 (39)bp

Others 10.8 13.2 (238)bp 3.6 722bp 4.9 9.1 (421.6)

Total 15.3 15.2

6.6

11.9 12.8

Source: Company, Angel Research

Exhibit 4: Strong growth in top-line

Source: Company, Angel Research

Exhibit 5: Segment-wise revenue trend

Source: Company, Angel Research

EBITDA margin witnesses steep recovery; beats estimates: On the operating front,

EBITDA margins improved better than our expectations and stood at 16.3% (up

640bp qoq) as against our expectations of 15.8%. The performance improvement

was mainly on account of substantial decline in other expenditure (down 21.7%

qoq) and aided by cost reduction initiatives. On a yoy basis though, EBITDA

margins contracted 102bp due to the negative impact of the INR depreciation on

2

,

2

9

5

2

,

1

7

8

2

,

0

5

4

2

,

1

3

2

2

,

2

0

9

2

,

3

0

7

2

,

1

4

7

2

,

1

6

2

2

,

4

5

0

10.0

5.8

3.1

5.1

(3.8)

5.9

4.5

1.4

10.9

(6.0)

(4.0)

(2.0)

0.0

2.0

4.0

6.0

8.0

10.0

12.0

1,800

1,900

2,000

2,100

2,200

2,300

2,400

2,500

1

Q

C

Y

1

2

2

Q

C

Y

1

2

3

Q

C

Y

1

2

4

Q

C

Y

1

2

1

Q

C

Y

1

3

2

Q

C

Y

1

3

3

Q

C

Y

1

3

4

Q

C

Y

1

3

1

Q

C

Y

1

4

(%) (` cr) Net sales Net sales growth (RHS)

2,010

1,943

1,832

1,917 1,904

2,034

1,885 1,878

2,133

275

245 231 225

306

274 264

294 321

0

500

1,000

1,500

2,000

2,500

1

Q

C

Y

1

2

2

Q

C

Y

1

2

3

Q

C

Y

1

2

4

Q

C

Y

1

2

1

Q

C

Y

1

3

2

Q

C

Y

1

3

3

Q

C

Y

1

3

4

Q

C

Y

1

3

1

Q

C

Y

1

4

(` cr) Automotive revenue Other revenue

Bosch | 1QCY2014 Result Update

April 29, 2014

4

raw-material expenses. Operating profit at `399cr, up 4.4%, is ahead of our

expectation of `353cr. EBIT margins in the automotive segment expanded by 44bp

yoy (steep 893bp qoq) to 16%; while the non-auto segment reported a 238bp yoy

decline in EBIT margins to 10.8%.

Net profit grew strongly by 25.6% yoy to `326cr, significantly beating our

expectation of `240cr. The bottom-line benefitted from higher other income (up

59.3% yoy and 52.9% qoq) on account of treasury gains related to sale of certain

investments.

The company intends to incur capital expenditure of `600cr, a majority of which

would be towards the new plant in Bidadi and the rest towards construction of two

new buildings at the existing facility in Bangalore. According to the Management,

negotiations with workers at the Nashik plant are at an advanced stage and an

agreement is expected to be finalized in the coming weeks.

Exhibit 6: EBITDA margin beats estimates...

Source: Company, Angel Research

Exhibit 7: ... leading to a beat on the bottom-line

Source: Company, Angel Research

20.8

15.1

13.3

12.5

17.3

15.7 15.2

9.9

16.3

54.7

57.3 57.7

53.8 54.2

56.4

54.7

55.9 55.4

0.0

10.0

20.0

30.0

40.0

50.0

60.0

70.0

1

Q

C

Y

1

2

2

Q

C

Y

1

2

3

Q

C

Y

1

2

4

Q

C

Y

1

2

1

Q

C

Y

1

3

2

Q

C

Y

1

3

3

Q

C

Y

1

3

4

Q

C

Y

1

3

1

Q

C

Y

1

4

(%) EBITDA margins Raw material cost/sales

3

3

6

2

4

7

2

0

3

1

7

2

2

6

0

2

5

2

2

3

4

1

3

9

3

2

6

14.6

11.4

9.9

8.1

11.8

10.9 10.9

6.4

13.3

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

16.0

0

50

100

150

200

250

300

350

400

1

Q

C

Y

1

2

2

Q

C

Y

1

2

3

Q

C

Y

1

2

4

Q

C

Y

1

2

1

Q

C

Y

1

3

2

Q

C

Y

1

3

3

Q

C

Y

1

3

4

Q

C

Y

1

3

1

Q

C

Y

1

4

(%) (` cr) Net profit Net profit margin (RHS)

Bosch | 1QCY2014 Result Update

April 29, 2014

5

Investment arguments

Technology intensive industry supplemented by high bargaining power: The

company enjoys high margins in the auto component segment due to strong

entry barriers and its dominant position in the market. Nonetheless, due to

decline in utilization levels (~70-75% across plants) and sharp INR

depreciation, the company has witnessed a steep 390bp contraction in

operating margins over the last two years. While the demand in the

automotive space is expected to remain muted in the near term, we expect the

demand environment to improve in 2HCY2014, which will improve utilization

levels and thus the margins. As a result, we estimate BOS to post a ~15%

CAGR in its top-line over CY2013-15E. Additionally, the benefits of ongoing

cost reduction initiatives coupled with expected improvement in utilization

levels are likely to lead to recovery in margins over the next two years. We

therefore expect the bottom-line to grow at a robust CAGR of ~27% over

CY2013-15E.

Dependent on favorable CV cycle for growth: BOS's prospects are largely

derived from demand arising in the commercial vehicle (CV) and tractor

segments. While the slowdown in the CV segment is expected to continue in

the near term, the tractor segment has witnessed a strong revival following

better monsoon and expectations of better kharif crop. We expect the CV cycle

to reverse in 2HFY2015 which is expected to revive companys revenue and

earnings growth. Further, greater visibility on newer growth opportunities is

emerging for the company, following its investments in new and innovative

technologies such as CRS and gasoline systems.

Outlook and valuation

We broadly maintain our revenue and earnings estimates for CY2014/15 as we

expect the demand environment in the automotive sector to remain sluggish in the

near term. Nonetheless, expected easing of interest rates in 2HCY2014 following

expected tapering of inflation is likely to revive demand and drive growth going

ahead.

Exhibit 8: Change in estimates

Y/E December Earlier Estimates Revised Estimates % chg

CY2014E CY2015E CY2014E CY2015E CY2014E CY2015E

Total income (` cr) 10,074 11,708 10,021 11,715 (0.5) 0.1

OPM (%) 17.0 18.0 16.8 17.9 (24)bp (13)bp

EPS (`) 369.0 448.6 364.8 456.9 (1.1) 1.9

Source: Company, Angel Research

We remain positive on the long term prospects of BOS due to its technological

leadership and strong and diversified product portfolio. We expect the companys

earnings growth to revive going ahead led by revival in the domestic automotive

industry coupled with localization initiatives and expected emission norm changes

due to roll out in 2015. At, `10,576 the stock is trading at 23.1x CY2015E

earnings. We believe that BOS will continue to enjoy premium valuations and

maintain our Accumulate rating on the stock with a target price of `11,424.

Bosch | 1QCY2014 Result Update

April 29, 2014

6

Exhibit 9: Key assumptions

Volumes (mn units) CY10 CY11 CY12E CY13E CY14E CY15E

Fuel injection pumps 3.7 4.4 4.0 4.0 4.4 4.9

Nozzles 21.5 23.0 22.2 23.3 24.4 29.4

Auto electrical 1.5 2.0 2.4 2.4 2.5 2.7

Source: Company, Angel Research

Exhibit 10: Angel vs consensus forecast

Y/E Dec. (` cr) Angel estimates Consensus Variation (%)

CY14E CY15E CY14E CY15E CY14E CY15E

Total op. income 10,021 11,715 9,874 11,796 1.5 (0.7)

Net profit 1,146 1,435 1,093 1,382 4.8 3.8

Source: Company, Angel Research

Exhibit 11: One-year forward P/E band

Source: Company, Angel Research

Exhibit 12: Premium/ Discount to Sensex

Source: Company, Angel Research

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

J

a

n

-

0

3

F

e

b

-

0

4

A

p

r

-

0

5

M

a

y

-

0

6

J

u

l

-

0

7

A

u

g

-

0

8

O

c

t

-

0

9

N

o

v

-

1

0

J

a

n

-

1

2

F

e

b

-

1

3

A

p

r

-

1

4

(`) Share price (`) 15x 20x 25x 30x

(100)

(50)

0

50

100

150

200

A

p

r

-

0

2

M

a

y

-

0

3

J

u

n

-

0

4

J

u

l

-

0

5

A

u

g

-

0

6

S

e

p

-

0

7

O

c

t

-

0

8

N

o

v

-

0

9

J

a

n

-

1

1

F

e

b

-

1

2

M

a

r

-

1

3

A

p

r

-

1

4

(%) Absolute premium Five-yr average premium

Bosch | 1QCY2014 Result Update

April 29, 2014

7

Exhibit 13: Auto Ancillary Recommendation summary

Company Reco.

CMP

(`)

Tgt. price

(`)

Upside

(%)

P/E (x) EV/EBITDA (x) RoE (%) FY13-16E EPS

FY15E FY16E FY15E FY16E FY15E FY16E CAGR (%)

Amara Raja Batteries Accumulate 403 440 9.3 16.4 14.8 10.0 8.5 26.8 23.8 16.3

Automotive Axle

^

Neutral 361 - - 24.4 13.6 8.3 5.8 7.7 12.9 (3.6)

Bharat Forge* Buy 413 485 17.6 19.2 15.4 8.5 7.1 18.5 20.0 51.0

Bosch India

#

Accumulate 10,576 11,424 8.0 29.0 23.1 17.3 13.5 15.9 17.1 18.0

Exide Industries Accumulate 125 134 6.5 19.2 16.6 9.2 7.8 14.0 14.5 7.0

FAG Bearings

#

Neutral 2,110 - - 21.8 16.1 13.0 9.3 15.1 17.6 11.0

Motherson Sumi* Accumulate 266 299 12.4 19.8 15.1 7.4 5.9 32.1 32.0 36.7

Subros Accumulate 28 32 12.4 8.5 5.3 3.5 3.0 6.7 10.0 15.8

Source: Company, Angel Research; Note: * Consolidated results;

#

December year end;

^

September year end

Company background

Bosch, promoted by Robert Bosch GmbH, is the largest auto ancillary company in

India and a dominant player in the fuel injection segment with ~75% market

share. The company has a diverse product portfolio of diesel and gasoline fuel

injection systems, automotive aftermarket products, auto electricals, special

purpose machines, packaging machines, electric power tools and security systems.

The automotive segment contributes 90% to BOS' total revenue. The company also

has one of the largest distribution networks of spare parts in the country, with

after-market component sales accounting for ~20% of revenue. BOS has

five manufacturing facilities located at Bangalore, Nasik, Naganathpura,

Jaipur and Goa.

Bosch | 1QCY2014 Result Update

April 29, 2014

8

Profit and loss statement (Standalone)

Y/E Dec. (` cr) CY10 CY11 CY12 CY13E CY14E CY15E

Total operating income 6,882 8,166 8,659 8,820 10,021 11,715

% chg 37.8 18.7 6.0 1.9 13.6 16.9

Total expenditure 5,629 6,654 7,310 7,529 8,338 9,618

Net raw material costs 3,598 4,444 4,783 4,782 5,402 6,263

Other mfg costs 432 445 460 495 540 632

Employee expenses 796 896 1,037 1,191 1,277 1,436

Other 803 870 1,030 1,061 1,120 1,287

EBITDA 1,253 1,512 1,350 1,291 1,683 2,098

% chg 54.1 20.6 (10.7) (4.3) 30.4 24.6

(% of total op. income) 18.2 18.5 15.6 14.6 16.8 17.9

Depreciation & amortization 254 258 367 384 432 478

EBIT 999 1,254 983 907 1,252 1,619

% chg 96.0 25.5 (21.7) (7.7) 38.0 29.3

(% of total op. income) 15.0 15.7 11.5 10.5 12.7 14.1

Interest and other charges 4 0 6 3 3 4

Other income 7 320 369 353 388 434

PBT (recurring) 1,002 1,574 1,346 1,257 1,636 2,050

% chg 26.3 57.0 (14.5) (6.7) 30.2 25.3

Extraordinary exp./ (income) - 56 84 - - -

PBT (reported) 1,002 1,518 1,262 1,257 1,636 2,050

Tax 344 451 388 372 491 615

(% of PBT) 34.3 29.7 30.7 29.6 30.0 30.0

PAT (reported) 659 1,123 958 885 1,146 1,435

ADJ. PAT 658 1,067 874 885 1,146 1,435

% chg 25.0 62.1 (18.1) 1.2 29.5 25.3

(% of total op. income) 9.8 13.3 10.3 10.2 11.7 12.5

Basic EPS (`) 209.7 357.5 305.2 281.7 364.8 456.9

Adj. EPS (`) 209.6 339.7 278.3 281.7 364.8 456.9

% chg 25.0 62.1 (18.1) 1.2 29.5 25.3

Bosch | 1QCY2014 Result Update

April 29, 2014

9

Balance sheet statement (Standalone)

Y/E Dec. (` cr) CY10 CY11 CY12 CY13E CY14E CY15E

SOURCES OF FUNDS

Equity share capital 31 31 31 31 31 31

Reserves & surplus 4,067 4,697 5,542 6,226 7,152 8,368

Shareholders Funds 4,098 4,728 5,573 6,257 7,184 8,399

Total loans 276 245 185 132 132 132

Deferred tax liability (218) (228) (255) (299) (299) (299)

Other long term liabilities - 37 33 39 39 39

Long term provisions - 172 218 252 252 252

Total Liabilities 4,156 4,955 5,755 6,381 7,307 8,523

APPLICATION OF FUNDS

Gross block 3,017 3,352 3,935 4,409 4,954 5,492

Less: Acc. depreciation 2,588 2,767 3,078 3,462 3,894 4,372

Net Block 430 585 857 947 1,060 1,120

Capital work-in-progress 224 321 417 442 496 550

Goodwill 6 6 6 6 6 6

Investments 1,607 1,635 1,520 2,185 2,502 2,919

Long term loans & advances - 333 226 226 226 226

Current assets 3,752 4,024 4,623 4,780 5,423 6,301

Cash 1,326 952 1,487 1,441 1,749 2,006

Loans & advances 896 993 1,019 1,057 1,179 1,379

Other 1,530 2,079 2,117 2,281 2,496 2,916

Current liabilities 1,863 1,948 1,894 2,204 2,406 2,598

Net current assets 1,889 2,075 2,729 2,575 3,017 3,703

Total Assets 4,156 4,955 5,755 6,381 7,307 8,523

Note: Cash includes term deposits with banks with maturity of more than 3 months but less than 12

months

Bosch | 1QCY2014 Result Update

April 29, 2014

10

Cash flow statement (Standalone)

Y/E Dec. (` cr) CY10 CY11 CY12 CY13E CY14E CY15E

Profit before tax 1,002 1,518 1,262 1,257 1,636 2,050

Depreciation 254 258 367 384 432 478

Change in working capital (14) (561) (41) 103 (134) (429)

Others (5) 1 149 - - -

Other income (7) (320) (369) (353) (388) (434)

Direct taxes paid (344) (451) (388) (372) (491) (615)

Cash Flow from Operations 886 445 981 1,019 1,055 1,050

(Inc.)/Dec. in fixed assets (277) (431) (679) (499) (599) (592)

(Inc.)/Dec. in investments (190) (27) 115 (665) (317) (416)

Other income 7 320 369 353 388 434

Cash Flow from Investing (460) (138) (195) (811) (528) (574)

Issue of equity - - - - - -

Inc./(Dec.) in loans (8) (31) (60) (53) - -

Dividend paid (Incl. Tax) 110 493 157 201 219 219

Others (270) (552) (314) - - -

Cash Flow from Financing (168) (91) (217) (254) (219) (219)

Inc./(Dec.) in cash 258 216 (109) (46) 307 257

Opening Cash balances 1,068 74 290 1,487 1,441 1,749

Closing Cash balances 1,326 290 181 1,441 1,749 2,006

Note: Closing cash balance excludes term deposits with banks with maturity of more than 3 months

but less than 12 months

Bosch | 1QCY2014 Result Update

April 29, 2014

11

Key ratios

Y/E Dec. CY10 CY11 CY12 CY13E CY14E CY15E

Valuation Ratio (x)

P/E (on FDEPS) 38.7 31.1 38.0 37.5 29.0 23.1

P/CEPS 29.9 25.1 26.8 26.2 21.1 17.4

P/BV 8.1 7.0 6.0 5.3 4.6 4.0

Dividend yield (%) 0.4 1.3 0.6 0.5 0.6 0.6

EV/Sales 4.3 3.6 3.3 3.2 2.7 2.3

EV/EBITDA 24.4 20.4 22.5 23.0 17.3 13.5

EV / Total Assets 7.4 6.2 5.3 4.7 4.0 3.3

Per Share Data (`)

EPS (Basic) 273.4 339.7 278.3 281.7 364.8 456.9

EPS (fully diluted) 209.6 339.7 278.3 281.7 364.8 456.9

Cash EPS 354.3 421.8 395.2 404.1 502.3 609.3

DPS 40.0 135.0 60.0 55.0 60.0 60.0

Book Value 1,305 1,506 1,775 1,993 2,288 2,675

Dupont Analysis

EBIT margin 15.0 15.7 11.5 10.5 12.7 14.1

Tax retention ratio 0.7 0.7 0.7 0.7 0.7 0.7

Asset turnover (x) 2.6 2.4 2.1 1.9 1.9 1.9

ROIC (Post-tax) 25.9 26.3 16.7 14.2 17.0 19.1

Cost of Debt (Post Tax) 0.9 0.1 1.8 1.3 1.7 2.0

Leverage (x) (0.6) (0.6) (0.5) (0.5) (0.6) (0.6)

Operating ROE 9.7 11.5 9.2 7.3 8.4 9.4

Returns (%)

ROCE (Pre-tax) 26.2 27.5 18.3 14.9 18.3 20.5

Angel ROIC (Pre-tax) 35.3 31.3 23.0 18.4 22.5 24.8

ROE 16.1 22.6 15.7 14.1 15.9 17.1

Turnover ratios (x)

Asset Turnover (Gross Block) 2.3 2.6 2.4 2.1 2.1 2.2

Inventory / Sales (days) 37 45 49 49 50 50

Receivables (days) 36 37 41 44 43 43

Payables (days) 60 66 59 73 71 67

WC cycle (ex-cash) (days) 25 38 50 49 44 46

Solvency ratios (x)

Net debt to equity (0.6) (0.5) (0.5) (0.6) (0.6) (0.6)

Net debt to EBITDA (2.1) (1.5) (2.1) (2.7) (2.4) (2.3)

Interest Coverage (EBIT / Int.) 254.3 3,135.3 178.6 313.8 381.1 421.3

Bosch | 1QCY2014 Result Update

April 29, 2014

12

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement Bosch

1. Analyst ownership of the stock No

2. Angel and its Group companies ownership of the stock No

3. Angel and its Group companies' Directors ownership of the stock No

4. Broking relationship with company covered No

Ratings (Returns): Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

Reduce (-5% to -15%) Sell (< -15%)

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

You might also like

- Bajaj Electricals: Pinch From E&P To End SoonDocument14 pagesBajaj Electricals: Pinch From E&P To End SoonYash BhayaniNo ratings yet

- TVS Motor Company: Performance HighlightsDocument12 pagesTVS Motor Company: Performance HighlightsAngel BrokingNo ratings yet

- Mahindra N Mahindra, 1Q FY 2014Document14 pagesMahindra N Mahindra, 1Q FY 2014Angel BrokingNo ratings yet

- Bajaj Auto: Performance HighlightsDocument12 pagesBajaj Auto: Performance HighlightsAngel BrokingNo ratings yet

- Bosch: Performance HighlightsDocument11 pagesBosch: Performance HighlightsAngel BrokingNo ratings yet

- Bosch: Performance HighlightsDocument10 pagesBosch: Performance HighlightsAngel BrokingNo ratings yet

- Motherson Sumi Systems Result UpdatedDocument14 pagesMotherson Sumi Systems Result UpdatedAngel BrokingNo ratings yet

- FAG Bearings Result UpdatedDocument10 pagesFAG Bearings Result UpdatedAngel BrokingNo ratings yet

- Bos 2qcy2012ruDocument12 pagesBos 2qcy2012ruAngel BrokingNo ratings yet

- Bosch 3qcy2012ruDocument12 pagesBosch 3qcy2012ruAngel BrokingNo ratings yet

- Allcargo Global Logistics LTD.: CompanyDocument5 pagesAllcargo Global Logistics LTD.: CompanyjoycoolNo ratings yet

- L&T 4Q Fy 2013Document15 pagesL&T 4Q Fy 2013Angel BrokingNo ratings yet

- Container Corp of India: Valuations Appear To Have Bottomed Out Upgrade To BuyDocument4 pagesContainer Corp of India: Valuations Appear To Have Bottomed Out Upgrade To BuyDoshi VaibhavNo ratings yet

- ITC Result UpdatedDocument15 pagesITC Result UpdatedAngel BrokingNo ratings yet

- Infosys 4Q FY 2013, 12.04.13Document15 pagesInfosys 4Q FY 2013, 12.04.13Angel BrokingNo ratings yet

- Bajaj Auto: Performance HighlightsDocument13 pagesBajaj Auto: Performance HighlightsAngel BrokingNo ratings yet

- Bajaj Auto Result UpdatedDocument11 pagesBajaj Auto Result UpdatedAngel BrokingNo ratings yet

- Maruti Suzuki, 1Q FY 2014Document16 pagesMaruti Suzuki, 1Q FY 2014Angel BrokingNo ratings yet

- Dabur India: Performance HighlightsDocument10 pagesDabur India: Performance HighlightsAngel BrokingNo ratings yet

- FAG Bearings: Performance HighlightsDocument10 pagesFAG Bearings: Performance HighlightsAngel BrokingNo ratings yet

- Itnl 4Q Fy 2013Document13 pagesItnl 4Q Fy 2013Angel BrokingNo ratings yet

- ACC Q4CY11 Result Update Fortune 09022012Document5 pagesACC Q4CY11 Result Update Fortune 09022012anknkulsNo ratings yet

- Infosys: Performance HighlightsDocument15 pagesInfosys: Performance HighlightsAtul ShahiNo ratings yet

- TVS Motor: Performance HighlightsDocument11 pagesTVS Motor: Performance HighlightsAngel BrokingNo ratings yet

- Supreme Infrastructure: Poised For Growth BuyDocument7 pagesSupreme Infrastructure: Poised For Growth BuySUKHSAGAR1969No ratings yet

- MM 1qfy2013 RuDocument13 pagesMM 1qfy2013 RuAngel BrokingNo ratings yet

- Hexaware Result UpdatedDocument13 pagesHexaware Result UpdatedAngel BrokingNo ratings yet

- Crompton Greaves Result UpdatedDocument14 pagesCrompton Greaves Result UpdatedAngel BrokingNo ratings yet

- Ashok Leyland Result UpdatedDocument13 pagesAshok Leyland Result UpdatedAngel BrokingNo ratings yet

- Indraprasth Gas Result UpdatedDocument10 pagesIndraprasth Gas Result UpdatedAngel BrokingNo ratings yet

- Spice JetDocument9 pagesSpice JetAngel BrokingNo ratings yet

- HMCL 4Q Fy 2013Document13 pagesHMCL 4Q Fy 2013Angel BrokingNo ratings yet

- Bajaj Auto 4Q FY 2013Document14 pagesBajaj Auto 4Q FY 2013Angel BrokingNo ratings yet

- Hindalco: Performance HighlightsDocument15 pagesHindalco: Performance HighlightsAngel BrokingNo ratings yet

- HT Media: Performance HighlightsDocument11 pagesHT Media: Performance HighlightsTirthajit SinhaNo ratings yet

- Hero Motocorp: Performance HighlightsDocument14 pagesHero Motocorp: Performance HighlightsAngel BrokingNo ratings yet

- BUY Bank of India: Performance HighlightsDocument12 pagesBUY Bank of India: Performance Highlightsashish10mca9394No ratings yet

- AngelBrokingResearch SetcoAutomotive 4QFY2015RUDocument10 pagesAngelBrokingResearch SetcoAutomotive 4QFY2015RUvijay4victorNo ratings yet

- Maruti Suzuki: Performance HighlightsDocument12 pagesMaruti Suzuki: Performance HighlightsAngel BrokingNo ratings yet

- Apollo Tyre 4Q FY 2013Document14 pagesApollo Tyre 4Q FY 2013Angel BrokingNo ratings yet

- HCLTech 3Q FY13Document16 pagesHCLTech 3Q FY13Angel BrokingNo ratings yet

- Performance Highlights: CMP '203 Target Price '248Document10 pagesPerformance Highlights: CMP '203 Target Price '248Angel BrokingNo ratings yet

- GSK Consumer, 21st February, 2013Document10 pagesGSK Consumer, 21st February, 2013Angel BrokingNo ratings yet

- IRB Infrastructure: Performance HighlightsDocument14 pagesIRB Infrastructure: Performance HighlightsAngel BrokingNo ratings yet

- Persistent, 1Q FY 2014Document12 pagesPersistent, 1Q FY 2014Angel BrokingNo ratings yet

- Performance Highlights: NeutralDocument10 pagesPerformance Highlights: NeutralAngel BrokingNo ratings yet

- TVS Motor Result UpdatedDocument12 pagesTVS Motor Result UpdatedAngel BrokingNo ratings yet

- Earnings Update Q1 FY11Document6 pagesEarnings Update Q1 FY11ddhilipkumarNo ratings yet

- Bajaj Electricals: Performance HighlightsDocument10 pagesBajaj Electricals: Performance HighlightsAngel BrokingNo ratings yet

- Ashok Leyland: Performance HighlightsDocument13 pagesAshok Leyland: Performance HighlightsAngel BrokingNo ratings yet

- Wipro 4Q FY 2013Document15 pagesWipro 4Q FY 2013Angel BrokingNo ratings yet

- Aventis Pharma Result UpdatedDocument10 pagesAventis Pharma Result UpdatedAngel BrokingNo ratings yet

- Crompton Greaves: Performance HighlightsDocument12 pagesCrompton Greaves: Performance HighlightsAngel BrokingNo ratings yet

- Infosys Result UpdatedDocument14 pagesInfosys Result UpdatedAngel BrokingNo ratings yet

- TCS, 1Q Fy 2014Document14 pagesTCS, 1Q Fy 2014Angel BrokingNo ratings yet

- Mphasis Result UpdatedDocument13 pagesMphasis Result UpdatedAngel BrokingNo ratings yet

- Aventis Pharma: Performance HighlightsDocument10 pagesAventis Pharma: Performance HighlightsAngel BrokingNo ratings yet

- Finolex Cables: Performance HighlightsDocument10 pagesFinolex Cables: Performance HighlightsAngel BrokingNo ratings yet

- HCL Technologies: Performance HighlightsDocument15 pagesHCL Technologies: Performance HighlightsAngel BrokingNo ratings yet

- Collection Agency Revenues World Summary: Market Values & Financials by CountryFrom EverandCollection Agency Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Natural Disaster Vs Man Made DisasterDocument6 pagesNatural Disaster Vs Man Made DisasterTirthajit SinhaNo ratings yet

- Indian Oil (IOC) Advanced Chart - InvestingDocument1 pageIndian Oil (IOC) Advanced Chart - InvestingTirthajit SinhaNo ratings yet

- Gender Health: Keerti Bhushan PradhanDocument15 pagesGender Health: Keerti Bhushan PradhanTirthajit SinhaNo ratings yet

- Natural Disaster Vs Man Made DisasterDocument6 pagesNatural Disaster Vs Man Made DisasterTirthajit Sinha100% (1)

- Brief Summary of The Original COCOMO ModelDocument5 pagesBrief Summary of The Original COCOMO ModelTirthajit SinhaNo ratings yet

- q2 VTHDocument1 pageq2 VTHTirthajit SinhaNo ratings yet

- Psychodrama, Psychoanalytic, Socio DramaDocument8 pagesPsychodrama, Psychoanalytic, Socio DramaTirthajit SinhaNo ratings yet

- Introduction MACDDocument15 pagesIntroduction MACDTirthajit SinhaNo ratings yet

- A Quick Introduction To Unix - Components - Wikibooks, Open Books For An Open WorldDocument2 pagesA Quick Introduction To Unix - Components - Wikibooks, Open Books For An Open WorldTirthajit SinhaNo ratings yet

- Though Nothing Can Bring Back The HourDocument1 pageThough Nothing Can Bring Back The HourTirthajit SinhaNo ratings yet

- Dbs ChemaDocument3 pagesDbs ChemaTirthajit SinhaNo ratings yet

- Arc FunctionDocument7 pagesArc FunctionTirthajit SinhaNo ratings yet

- Cadbury Chocolate & Beverage BrandsDocument11 pagesCadbury Chocolate & Beverage BrandsTirthajit SinhaNo ratings yet

- Amul ProductsDocument39 pagesAmul ProductsTirthajit SinhaNo ratings yet

- Assembly System CallsDocument104 pagesAssembly System CallsTirthajit SinhaNo ratings yet

- Operations ResearchDocument1 pageOperations ResearchTirthajit SinhaNo ratings yet

- What Is A ComputerDocument8 pagesWhat Is A ComputerTirthajit SinhaNo ratings yet

- Session On Industrial Skills For A Software Developer byDocument1 pageSession On Industrial Skills For A Software Developer byTirthajit SinhaNo ratings yet

- We Have Already Discussed The Three Sections of An Assembly ProgramDocument6 pagesWe Have Already Discussed The Three Sections of An Assembly ProgramTirthajit SinhaNo ratings yet

- Model SmallDocument1 pageModel SmallTirthajit SinhaNo ratings yet

- Assembly Language Is A LowDocument5 pagesAssembly Language Is A LowTirthajit SinhaNo ratings yet

- Distance Education Council ApprovalDocument1 pageDistance Education Council ApprovalTirthajit SinhaNo ratings yet

- Install EA SPORTS Cricket 2007Document1 pageInstall EA SPORTS Cricket 2007Tirthajit SinhaNo ratings yet

- An Assembly Program Can Be Divided Into Three SectionsDocument3 pagesAn Assembly Program Can Be Divided Into Three SectionsTirthajit Sinha0% (1)

- Graph TheoryDocument6 pagesGraph TheoryTirthajit SinhaNo ratings yet

- Sinha TutorialsDocument1 pageSinha TutorialsTirthajit SinhaNo ratings yet

- Distance Education Council ApprovalDocument1 pageDistance Education Council ApprovalTirthajit SinhaNo ratings yet

- Tap Your Superconscious Mind PowerDocument6 pagesTap Your Superconscious Mind PowerTirthajit SinhaNo ratings yet

- There Is A Slight Difference Between The Words Mantra and MantramDocument4 pagesThere Is A Slight Difference Between The Words Mantra and MantramTirthajit SinhaNo ratings yet

- Uiig Purchase DoaDocument24 pagesUiig Purchase DoaMANOJ VIJAYANNo ratings yet

- Young Entrepreneurs of IndiaDocument13 pagesYoung Entrepreneurs of Indiamohit_jain_90No ratings yet

- Business ModelDocument1 pageBusiness ModelMaddy AkuNo ratings yet

- Post Project Review TemplateDocument10 pagesPost Project Review TemplatehymerchmidtNo ratings yet

- Worksheets From The Silicon Valley Way 2Document31 pagesWorksheets From The Silicon Valley Way 2testi2015No ratings yet

- Internal Analysis of Google IncDocument10 pagesInternal Analysis of Google IncAbhishek Puri100% (1)

- FAQs On Entity Master 1Document13 pagesFAQs On Entity Master 1Shinil NambrathNo ratings yet

- 1st Public Auction Acquired AssetsDocument31 pages1st Public Auction Acquired AssetsPatrick LorenzoNo ratings yet

- Mumbai Pharma CompanyDocument8 pagesMumbai Pharma CompanyPankaj BaghNo ratings yet

- Harvard MentorManage 10 Resources and Tools by ModuleDocument24 pagesHarvard MentorManage 10 Resources and Tools by ModulendxtradersNo ratings yet

- Feast On ThisDocument13 pagesFeast On Thiscamelia_zagrean_1No ratings yet

- Supply Chain at Indian Chemical CompanyDocument4 pagesSupply Chain at Indian Chemical CompanySagar RelanNo ratings yet

- LeadingDocument3 pagesLeadingB-SIB1732- NADYATUL ALANI MOHD NAZRINo ratings yet

- 400 Bad Request 400 Bad Request Nginx/1.2.9Document13 pages400 Bad Request 400 Bad Request Nginx/1.2.9USAFVOSBNo ratings yet

- Chapter 1 Partnership Formation Test BanksDocument46 pagesChapter 1 Partnership Formation Test BanksRaisa Gelera91% (23)

- Principles of Book KeepingDocument78 pagesPrinciples of Book KeepingKaneNo ratings yet

- P - S4FIN - 1709.pdf-10 Question PDFDocument5 pagesP - S4FIN - 1709.pdf-10 Question PDFanon_286810595No ratings yet

- The importance of ethics in businessDocument6 pagesThe importance of ethics in businessAyisOgaNo ratings yet

- FAQ Teleworking Scheme Oct 2021Document17 pagesFAQ Teleworking Scheme Oct 2021Leonidas GalanisNo ratings yet

- VDA Standards - Why They Are Important & Overview of New Standards in 2020Document47 pagesVDA Standards - Why They Are Important & Overview of New Standards in 2020Daffa HanifNo ratings yet

- Reserach DraftDocument2 pagesReserach DraftMEGHA PALANDENo ratings yet

- 10 1108 - MF 06 2020 0300Document20 pages10 1108 - MF 06 2020 0300fenny maryandiNo ratings yet

- Significance of Consumer Behavior in BusinessDocument13 pagesSignificance of Consumer Behavior in BusinessMarlon DespoyNo ratings yet

- MG2351 Principles of Management Question Bank Anna UniversityDocument4 pagesMG2351 Principles of Management Question Bank Anna UniversityjeebalaNo ratings yet

- Oka Unit 2 MIS 2022Document20 pagesOka Unit 2 MIS 2022shivam gargNo ratings yet

- Chapter-10 C-Quality of Work LifeDocument17 pagesChapter-10 C-Quality of Work LifeJoginder GrewalNo ratings yet

- Chapter 6 Audit Planning Understanding The Client and AsseDocument44 pagesChapter 6 Audit Planning Understanding The Client and Asseindra83100% (1)

- Customer Satisfaction ProjectDocument52 pagesCustomer Satisfaction Projectdeep1arora0% (1)

- Group 4Document9 pagesGroup 4Nurul AinNo ratings yet

- Rapport Textile Ethiopië PDFDocument38 pagesRapport Textile Ethiopië PDFgarmentdirectorate100% (1)