Professional Documents

Culture Documents

Income Tax

Uploaded by

incrediblenikhil0 ratings0% found this document useful (0 votes)

18 views13 pagesMerger and Acquisitions

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMerger and Acquisitions

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views13 pagesIncome Tax

Uploaded by

incrediblenikhilMerger and Acquisitions

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 13

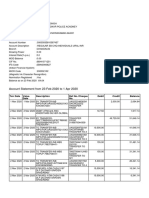

AMALGAMATION

Section No Section Heading

2 Definitions

10A Special provision in respect of newly established undertakings in free trade zone, etc

10AA Special provisions in respect of newly established Units in Special Economic Zones

10B

Special provisions in respect of newly established hundred per cent export-oriented

undertakings

32 Depreciation

32A Investment allowance

32AC Investment in new plant or machinery

33 Development rebate

33A Development allowance

34 Conditions for depreciation allowance and development rebate

35 Expenditure on scientific research

35A Expenditure on acquisition of patent rights or copyrights

35AB Expenditure on know-how

35ABB Expenditure for obtaining licence to operate telecommunication services

35D Amortisation of certain preliminary expenses

35DD Amortisation of expenditure in case of amalgamation or demerger

35DDA Amortisation of expenditure incurred under voluntary retirement scheme

35E Deduction for expenditure on prospecting, etc., for certain minerals

41 Profits chargeable to tax

42

Special provision for deductions in the case of business for prospecting, etc., for

mineral oil

43

Definitions of certain terms relevant to income from profits and gains of business or

profession

43C Special provision for computation of cost of acquisition of certain assets

44DB

Special provision for computing deductions in the case of business reorganization of co-

operative banks

47 Transactions not regarded as transfer

72A

Provisions relating to carry forward and set off of accumulated loss and unabsorbed

depreciation allowance in amalgamation or demerger, etc

72AA

Provisions relating to carry forward and set-off of accumulated loss and unabsorbed

depreciation allowance in scheme of amalgamation of banking company in certain

cases

72AB

Provisions relating to carry forward and set off of accumulated loss and unabsorbed

depreciation allowance in business reorganisation of co-operative banks

79 Carry forward and set off of losses in the case of certain companies

80-IA

Deductions in respect of profits and gains from industrial undertakings or enterprises

engaged in infrastructure development, etc.

80-IB

Deduction in respect of profits and gains from certain industrial undertakings other

than infrastructure development undertakings

80JJAA Deduction in respect of employment of new workmen.

115VY Amalgamation.

155 Other amendments.

Fourth Schedule

APPENDIX -

Section 2

[1B] Merger of one or more companies with another company or merger of two or more companies

to form one company such that all the assets and liabilities of the amalgamating company become

the assets and liabilities of the amalgamated company and shareholders holing not more than 3/4

th

in value of shares in the amalgamating company(s) become shareholder of the amalgamated

company.

Section 10A

Where any undertaking of an Indian company which is entitled to the deduction under this section

regarding deduction of profits of article or thing or computer software is transferred, before the

expiry of the period specified in this section, to another Indian company in a scheme of

amalgamation, the provisions of this section shall, as far as may be, apply to the amalgamated

company as they would have applied to the amalgamating company if the amalgamation had not

taken place.

Section 10AA

Where any undertaking of an Indian company which is entitled to the deduction under this section

regarding deduction of profits from manufacturing or producing articles or things or providing any

services during the previous year relevant to the assessment year is transferred, before the expiry of

the period specified in this section, to another Indian company in a scheme of amalgamation, the

provisions of this section shall, as far as may be, apply to the amalgamated company as they would

have applied to the amalgamating company if the amalgamation had not taken place.

Section 10B

Where any undertaking of an Indian company which is entitled to the deduction under this section

regarding deduction of profits derived by a hundred per cent export-oriented undertaking from the

export of articles or things or computer software during the previous year relevant to the

assessment year is transferred, before the expiry of the period specified in this section, to another

Indian company in a scheme of amalgamation, the provisions of this section shall, as far as may be,

apply to the amalgamated company as they would have applied to the amalgamating company if the

amalgamation had not taken place.

Section 32

(1) Aggregate deduction in respect of depreciation of tangible and intangible assets allowed to

amalgamating company and the amalgamated company in case of amalgamation shall not exceed

the amount calculated as if the succession has not taken place.

In this section, "sold" includes a transfer by way of exchange or a compulsory acquisition but does

not include a transfer, in a scheme of amalgamation, of any asset by the amalgamating company to

the amalgamated company where the amalgamated company is an Indian company or in the

scheme of amalgamation of a banking company.

Section 32A

(5) Any allowance received under this section shall be deemed to be wrongly made for the purposes

of this Act if (a) the investment in the ship, aircraft, machinery or plant is sold or transferred by the

assessee to any person before the expiry of 8 years; (b) or utilise amount credited as Investment

Allowance Reserve Account for 10 years

Nothing in this clause (a) of this sub section shall apply where the sale or transfer of the ship,

aircraft, machinery or plant is made in connection with the amalgamation or succession.

Section 32AC

Any allowance received under this section regarding deduction of amount on capital asset for

production of article or thing will be reversed if the new asset acquired and installed by the assessee

is sold within a period of five years from the date of installation and is applicable in case of

amalgamation also.

Section 33

Any development rebate in respect of a new ship or new machinery or plant shall continue to the

amalgamated company in the scheme of amalgamation, provided the amalgamated company shall

continue to fulfil the conditions mentioned in section 34(3) in respect of the reserve created by the

amalgamating company and within which such new ship, new machinery or plant shall not be sold

and in case of any default, section 155(5) shall apply.

Section 33A

Any allowance under this section shall be deemed to have been wrongly made for the purposes of

this Act, if any such land is sold or otherwise transferred by the assessee to any person at any time

before the expiry of eight years from the end of the previous year in which the deduction was

allowed.

The above provisions shall not apply where the land is sold to the government or related authorities

or where transfer of land is made in connection with amalgamation or succession.

Any development allowance in respect of such land shall continue to the amalgamated company in

the scheme of amalgamation, provided the amalgamated company shall continue to fulfil the

conditions of sub section 3 in respect of the reserve created by the amalgamating company and

within which such new ship, new machinery or plant shall not be sold and in case of any default,

section 155(5) shall apply. The same goes in case of succession of the firm by a company.

Section 34

This section related to depreciation allowance and development rebate shall not apply where the

sale or transfer of the ship, machinery or plant is made in connection with the amalgamation or

succession, referred to in sub-section (3) or sub-section (4) of section 33.

Section 35

(5) Where, in a scheme of amalgamation, the amalgamating company sells or otherwise transfers to

the amalgamated company (being an Indian company) any asset representing expenditure of a

capital nature on scientific research, the provisions of this section shall, as far as may be, apply to

the amalgamated company as they would have applied to the amalgamating company if the latter

had not so sold or otherwise transferred the asset.

Provided the amalgamating company shall not be allowed the deduction under clause (ii) or clause

(iii) of sub-section (2)

Section 35A

(6) Where, in a scheme of amalgamation, the amalgamating company sells or otherwise transfers

the rights so acquired to the amalgamated company (being an Indian company), the provisions of

this section shall, as far as may be, apply to the amalgamated company as they would have applied

to the amalgamating company if the amalgamation had not taken place.

Section 35AB

(3) Where there is a transfer of an undertaking under a scheme of amalgamation and the

amalgamating company is entitled to a deduction under this section regarding expenditure on know-

how, then, the amalgamated company, as the case may be, shall be entitled to claim deduction

under this section in respect of such undertaking to the same extent and in respect of the residual

period as it would have been allowable to the amalgamating company, as the case may be, had such

amalgamation not taken place.

Section 35ABB

(6) Where, in a scheme of amalgamation, the amalgamating company sells or otherwise transfers

the licence to the amalgamated company (being an Indian company), the provisions of this section

shall, as far as may be, apply to the amalgamated company as they would have applied to the

amalgamating company if the amalgamation had not taken place.

Section 35D

Where the undertaking of an Indian company which is entitled to the deduction under this section

for preliminary expenses is transferred to another Indian company in a scheme of amalgamation, the

provisions of this section shall, as far as may be, apply to the amalgamated company as they would

have applied to the amalgamating company if the amalgamation had not taken place.

Section 35DD

Where an assessee, being an Indian company, incurs any expenditure wholly and exclusively for the

purposes of amalgamation or demerger of an undertaking, the assessee shall be allowed a deduction

of an amount equal to one-fifth of such expenditure for each of the five successive previous years

beginning with the previous year in which the amalgamation or demerger takes place.

Section 35DDA

Where the assessee, being an Indian company, is entitled to the deduction under this section

regarding amortisation of expenditure incurred under VRS and the undertaking of such Indian

company entitled to the deduction under this section is transferred to another Indian company in a

scheme of amalgamation, the provisions of this section shall, as far as may be, apply to the

amalgamated company as they would have applied to the amalgamating company if the

amalgamation had not taken place.

However, no deduction shall be allowed to the amalgamated company for the previous year in

which amalgamation as the case may be, takes place.

Section 35E

Where the undertaking of an Indian company which is entitled to the deduction under this section

regarding deduction for expenditure on prospecting, etc., for certain minerals is transferred to

another Indian company in a scheme of amalgamation, the provisions of this section shall, as far as

may be, apply to the amalgamated company as they would have applied to the amalgamating

company if the amalgamation had not taken place.

Section 41

Succession in the said section includes amalgamation but sold does not include amalgamation.

Section 42

Where in a scheme of amalgamation, the amalgamating company sells or otherwise transfers the

business to the amalgamated company (being an Indian company), the provisions of this section

shall, as far as may be, apply to the amalgamated company as they would have applied to the

amalgamating company if the amalgamation had not taken place.

Section 43

Where, in a scheme of amalgamation, any capital asset is transferred by the amalgamating company

to the amalgamated company (being an Indian company), the actual cost of the transferred capital

asset to the amalgamated company shall be taken to be the same as it would have been if the

amalgamating company had continued to hold the capital asset for the purposes of its own business.

Section 43C

Where an asset [not being an asset referred to in sub-section (2) of section 45] which becomes the

property of an amalgamated company under a scheme of amalgamation, is sold by the amalgamated

company as stock-in-trade of the business carried on by it, the cost of acquisition of the said asset to

the amalgamated company in computing the profits and gains from the sale of such asset shall be

the cost of acquisition of the said asset to the amalgamating company, as increased by the cost, if

any, of any improvement made thereto, and the expenditure, if any, incurred, wholly and exclusively

in connection with such transfer by the amalgamating company.

Section 44DB

Provisions of the section regarding business reorganisation of co-operative banks include

amalgamation.

Section 47

Following transactions should be exempt from tax:-

(vi) any transfer, in a scheme of amalgamation, of a capital asset by the amalgamating company to

the amalgamated company if the amalgamated company is an Indian company;]

[(via) any transfer, in a scheme of amalgamation, of a capital asset being a share or shares held in an

Indian company, by the amalgamating foreign company to the amalgamated foreign company, if

(a) at least twenty-five per cent of the shareholders of the amalgamating foreign company

continue to remain shareholders of the amalgamated foreign company, and

(b) such transfer does not attract tax on capital gains in the country, in which the

amalgamating company is incorporated;]

(viaa) any transfer, in a scheme of amalgamation of a banking company with a banking institution of

a capital asset by the banking company to the banking institution.

(vii) any transfer by a shareholder, in a scheme of amalgamation, of a capital asset being a share or

shares held by him in the amalgamating company, if

(a) the transfer is made in consideration of the allotment to him of any share or shares in the

amalgamated company except where the shareholder itself is the amalgamated company,

and

(b) the amalgamated company is an Indian company;

Section 72A

Amalgamation should be of

A company owning an industrial undertaking or a ship or a hotel with another company.

Banking Company with Specified Bank.

PSUs engaged in business of operation of aircrafts.

Conditions to be satisfied by Amalgamating Company

The unabsorbed business loss are from the main activity of said company it is in business for

preceding 3 or more years.

As on date of amalgamation, amalgamating company has held continuously 75% of the book

value of fixed assets held by it two years prior to the date of amalgamation.

Conditions to be satisfied by Amalgamating Company

The company should hold continuously for a minimum period of 5 years, atleast 75% of book

value of fixed assets.

The company should continue the business of amalgamating company for at least 5 years.

Any other conditions to be satisfied if required to ensure that amalgamation is for genuine

business purpose.

In case of non-compliance later, amount set off to be considered as income of that year.

Section 72AA

Where there has been an amalgamation of a banking company with any other banking institution,

the accumulated loss and the unabsorbed depreciation of such banking company shall be deemed to

be the loss or, as the case may be, allowance for depreciation of such banking institution for the

previous year in which the scheme of amalgamation was brought into force and other provisions of

this Act relating to set-off and carry forward of loss and allowance for depreciation shall apply

accordingly.

Section 72AB

Conditions to be satisfied by predecessor co-operative bank

Has been engaged in the business of banking for three or more years.

As on date of amalgamation, predecessor bank has held continuously 75% of the book value

of fixed assets held by it two years prior to the date of amalgamation.

Conditions to be satisfied by successor co-operative bank

The bank should hold continuously for a minimum period of 5 years, atleast 75% of book

value of fixed assets.

The bank should continue the business of predecessor bank for at least 5 years.

Any other conditions to be satisfied if required to ensure that amalgamation is for genuine

business purpose.

In case of non-compliance later, amount set off to be considered as income of that year.

Section 79

There shall be no carry forward and set off of losses allowed to the company unless on the last day

of the previous year, beneficial shareholders holding shares not less than 51% of the voting power in

the closely held company in which such loss occur becomes the beneficial shareholders holding

shares of 51% of the voting power of other company.

If there is any change in the shareholding of an Indian company which is a subsidiary of a foreign

company as a result of amalgamation of a foreign company subject to the condition that fifty-one

per cent shareholders of the amalgamating or demerged foreign company continue to be the

shareholders of the amalgamated foreign company, then the provisions of this section shall not

apply.

Section 80IA

Where any undertaking of an Indian company which is entitled to the deduction under this section

regarding tax benefits on the profits or gain derived from the business of the undertaking of eligible

business is transferred before the expiry of the period specified in this section and before 1

st

April,

2007, shall, as far as may be, apply to the amalgamated company as they would have applied to the

amalgamating company if the amalgamation had not taken place.

Section 80IB

Where any undertaking of an Indian company which is entitled to the deduction under this section

regarding tax benefits on the profits or gain derived from the business of the undertaking of eligible

business is transferred before the expiry of the period specified in this section, shall, as far as may

be, apply to the amalgamated company as they would have applied to the amalgamating company if

the amalgamation had not taken place.

DEMERGER

Section No Section Heading

2 Definitions

10A Special provision in respect of newly established undertakings in free trade zone, etc

10AA Special provisions in respect of newly established Units in Special Economic Zones

10B

Special provisions in respect of newly established hundred per cent export-oriented

undertakings

32 Depreciation

32AC Investment in new plant or machinery

35A Expenditure on acquisition of patent rights or copyrights

35AB Expenditure on know-how

35ABB Expenditure for obtaining licence to operate telecommunication services

35D Amortisation of certain preliminary expenses

35DDA Amortisation of expenditure incurred under voluntary retirement scheme

35E Deduction for expenditure on prospecting, etc., for certain minerals

42

Special provision for deductions in the case of business for prospecting, etc., for mineral

oil

43

Definitions of certain terms relevant to income from profits and gains of business or

profession

44DB

Special provision for computing deductions in the case of business reorganization of co-

operative banks

47 Transactions not regarded as transfer

49 Cost with reference to certain modes of acquisition

72A

Provisions relating to carry forward and set off of accumulated loss and unabsorbed

depreciation allowance in amalgamation or demerger, etc

72AB

Provisions relating to carry forward and set off of accumulated loss and unabsorbed

depreciation allowance in business reorganisation of co-operative banks

79 Carry forward and set off of losses in the case of certain companies

80-IA

Deductions in respect of profits and gains from industrial undertakings or enterprises

engaged in infrastructure development, etc.

80-IB

Deduction in respect of profits and gains from certain industrial undertakings other

than infrastructure development undertakings

115AC

Tax on income from bonds or Global Depository Receipts purchased in foreign

currency or capital gains arising from their transfer.

115VZ Demerger.

Section 2

[2] An arrangement is said to be a demerger when:

All the properties and liabilities of the undertaking are transferred.

The properties and liabilities are transferred at book value.

Shareholders holing not more than 3/4th in value of shares in the amalgamating company(s)

become shareholder of the amalgamated company.

Consideration is discharged by issue of shares.

The transfer of the undertaking in on the going concern basis.

[22] Dividend does not include any distribution of shares pursuant to a demerger by the resulting

company to the shareholders of the demerged company (whether or not there is a reduction of

capital in the demerged company).

[42A] In the case of a capital asset, being a share or shares in an Indian company, which becomes the

property of the assessee in consideration of a demerger, there shall be included the period for which

the share or shares held in the demerged company were held by the assessee.

Section 10A

Where any undertaking of an Indian company which is entitled to the deduction under this section

regarding deduction of profits of article or thing or computer software is transferred, before the

expiry of the period specified in this section, to another Indian company in a scheme of demerger,

the provisions of this section shall, as far as may be, apply to the resulting company as they would

have applied to the demerged company if the demerger had not taken place.

Section 10AA

Where any undertaking of an Indian company which is entitled to the deduction under this section

regarding deduction of profits from manufacturing or producing articles or things or providing any

services during the previous year relevant to the assessment year is transferred, before the expiry of

the period specified in this section, to another Indian company in a scheme of demerger, the

provisions of this section shall, as far as may be, apply to the resulting company as they would have

applied to the demerged company if the demerger had not taken place.

Section 10B

Where any undertaking of an Indian company which is entitled to the deduction under this section

regarding deduction of profits derived by a hundred per cent export-oriented undertaking from the

export of articles or things or computer software during the previous year relevant to the

assessment year is transferred, before the expiry of the period specified in this section, to another

Indian company in a scheme of demerger, the provisions of this section shall, as far as may be, apply

to the resulting company as they would have applied to the demerged company if the demerger had

not taken place.

Section 32

(1) Aggregate deduction in respect of depreciation of tangible and intangible assets allowed to the

demerged company or the resulting company in the case of demerger shall not exceed the amount

calculated as if the succession or demerger has not taken place.

In this section, "sold" includes a transfer by way of exchange or a compulsory acquisition but does

not include a transfer, in a scheme of amalgamation, of any asset by the amalgamating company to

the amalgamated company where the amalgamated company is an Indian company or in the

scheme of amalgamation of a banking company.

Section 32AC

Any allowance received under this section regarding deduction of amount on capital asset for

production of article or thing will be reversed if the new asset acquired and installed by the assessee

is sold within a period of five years from the date of installation and is applicable in case of demerger

also.

Section 35A

(6) Where, in a scheme of demerger, the demerged company sells or otherwise transfers the rights

so acquired to the resulting company (being an Indian company), the provisions of this section shall,

as far as may be, apply to the resulting company as they would have applied to the demerged

company if the demerger had not taken place.

Section 35AB

(3) Where there is a transfer of an undertaking under a scheme of demerger and the demerged

company is entitled to a deduction under this section regarding expenditure on know-how, then, the

resulting company, as the case may be, shall be entitled to claim deduction under this section in

respect of such undertaking to the same extent and in respect of the residual period as it would have

been allowable to the demerged company, as the case may be, had such demerger not taken place.

Section 35ABB

(6) Where, in a scheme of demerger, the demerged company sells or otherwise transfers the licence

to the resulting company (being an Indian company), the provisions of this section shall, as far as

may be, apply to the resulting company as they would have applied to the demerged company if the

amalgamation had not taken place.

Section 35D

Where the undertaking of an Indian company which is entitled to the deduction under this section

for preliminary expenses is transferred to another Indian company in a scheme of demerger, the

provisions of this section shall, as far as may be, apply to the resulting company as they would have

applied to the demerged company if the demerger had not taken place.

Section 35DDA

Where the assessee, being an Indian company, is entitled to the deduction under this section

regarding amortisation of expenditure incurred under VRS and the undertaking of such Indian

company entitled to the deduction under this section is transferred to another Indian company in a

scheme of demerger, the provisions of this section shall, as far as may be, apply to the resulting

company as they would have applied to the demerged company if the demerger had not taken

place.

However, no deduction shall be allowed to the resulting company for the previous year in which

demerger as the case may be, takes place.

Section 35E

Where the undertaking of an Indian company which is entitled to the deduction under this section

regarding deduction for expenditure on prospecting, etc., for certain minerals is transferred to

another Indian company in a scheme of demerger, the provisions of this section shall, as far as may

be, apply to the resulting company as they would have applied to the demerged company if the

demerger had not taken place.

Section 42

Where in a scheme of demerger, the demerged company sells or otherwise transfers the business to

the resulting company (being an Indian company), the provisions of this section shall, as far as may

be, apply to the resulting company as they would have applied to the demerged company if the

demerger had not taken place.

Section 43

Where, in a scheme of demerger, any capital asset is transferred by the demerged company to the

resulting company (being an Indian company), the actual cost of the transferred capital asset to the

resulting company shall be taken to be the same as it would have been if the demerged company

had continued to hold the capital asset for the purposes of its own business.

Section 44DB

Provisions of the section regarding business reorganisation of co-operative banks include demerger.

Section 47

Following transactions should be exempt from tax:-

(vib) any transfer, in a demerger, of a capital asset by the demerged company to the resulting

company, if the resulting company is an Indian company;

(vic) any transfer in a demerger, of a capital asset, being a share or shares held in an Indian

company, by the demerged foreign company to the resulting foreign company, if

(a) the shareholders holding not less than three-fourths in value of the shares of the

demerged foreign company continue to remain shareholders of the resulting foreign

company; and

(b) such transfer does not attract tax on capital gains in the country, in which the demerged

foreign company is incorporated

(vid) Any transfer or issue of shares by the resulting company, in a scheme of demerger to the

shareholders of the demerged company if the transfer or issue is made in consideration of demerger

of the undertaking

Section 72A

[4] In the case of a demerger, the accumulated loss and the allowance for unabsorbed depreciation

of the demerged company shall

(a) where such loss or unabsorbed depreciation is directly relatable to the undertakings

transferred to the resulting company, be allowed to be carried forward and set off in the

hands of the resulting company;

(b) where such loss or unabsorbed depreciation is not directly relatable to the undertakings

transferred to the resulting company, be apportioned between the demerged company and

the resulting company in the same proportion in which the assets of the undertakings have

been retained by the demerged company and transferred to the resulting company, and be

allowed to be carried forward and set off in the hands of the demerged company or the

resulting company, as the case may be.

Section 72AB

(3) The amount of set-off of the accumulated loss and unabsorbed depreciation, if any, allowable to

the assessee being a resulting co-operative bank shall be,

(i) the accumulated loss or unabsorbed depreciation of the demerged co-operative bank if

the whole of the amount of such loss or unabsorbed depreciation is directly relatable to the

undertakings transferred to the resulting co-operative bank; or

(ii) the amount which bears the same proportion to the accumulated loss or unabsorbed

depreciation of the demerged co-operative bank as the assets of the undertaking

transferred to the resulting co-operative bank bears to the assets of the demerged co-

operative bank if such accumulated loss or unabsorbed depreciation is not directly relatable

to the undertakings transferred to the resulting co-operative bank.

Section 79

There shall be no carry forward and set off of losses allowed to the company unless on the last day

of the previous year, beneficial shareholders holding shares not less than 51% of the voting power in

the closely held company in which such loss occur becomes the beneficial shareholders holding

shares of 51% of the voting power of other company.

If there is a change in the shareholding of an Indian company which is a subsidiary of a foreign

company as a result of demerger of a foreign company subject to the condition that fifty-one per

cent shareholders of the demerged foreign company continue to be the shareholders of the

resulting foreign company, then the provisions of this section shall not apply.

Section 80IA

Where any undertaking of an Indian company which is entitled to the deduction under this section

regarding tax benefits on the profits or gain derived from the business of the undertaking of eligible

business is transferred before the expiry of the period specified in this section and before 1

st

April,

2007, shall, as far as may be, apply to the resulting company as they would have applied to the

demerged company if the demerger had not taken place.

Section 80IB

Where any undertaking of an Indian company which is entitled to the deduction under this section

regarding tax benefits on the profits or gain derived from the business of the undertaking of eligible

business is transferred before the expiry of the period specified in this section, shall, as far as may

be, apply to the resulting company as they would have applied to the demerged company if the

demerger had not taken place.

SLUMP SALE

Section 2(42C)

"slump sale" means the transfer of one or more undertakings as a result of the sale for a lump sum

consideration without values being assigned to the individual assets and liabilities in such sales.

Section 50B

Any profits or gains arising from the slump sale affected in the previous year shall be chargeable to

income-tax as capital gains arising from the transfer of long-term capital assets and shall be deemed

to be the income of the previous year in which the transfer took place

Capital gain from undertaking held for not more than thirty-six months immediately preceding the

date of its transfer shall be deemed to be the capital gains arising from the transfer of short-term

capital assets.

Every assessee, in the case of slump sale, shall furnish a report indicating the computation of the net

worth of the undertaking or division

"net worth" shall be the aggregate value of total assets of the undertaking or division as

reduced by the value of liabilities of such undertaking or division as appearing in its books of

account :

revaluation of assets shall be ignored

the aggregate value of total assets shall be,

(a) in the case of depreciable assets, the written down value of the block of assets

(b) in the case of capital assets in respect of which the whole of the expenditure has been

allowed or is allowable as a deduction under section 35AD, nil; and

(c) in the case of other assets, the book value of such assets

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Greendot 4 Account-Statement (Recovered)Document5 pagesGreendot 4 Account-Statement (Recovered)Karis LeeNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CashDocument7 pagesCashhellohello100% (1)

- Haryana CST Return Format Form - 1Document2 pagesHaryana CST Return Format Form - 1Virender SainiNo ratings yet

- Solution of Governmentl CH 5Document18 pagesSolution of Governmentl CH 5Ahmad KamalNo ratings yet

- Confirmation For Booking ID # 849524949Document1 pageConfirmation For Booking ID # 849524949Saibal SenNo ratings yet

- Mund Manufacturing Inc Started Operations at The Beginning of TheDocument1 pageMund Manufacturing Inc Started Operations at The Beginning of TheLet's Talk With HassanNo ratings yet

- CustomAccountStatement07 02 2024Document3 pagesCustomAccountStatement07 02 2024bsen51642No ratings yet

- Mr. Shyam Singh's bank account statement and detailsDocument3 pagesMr. Shyam Singh's bank account statement and detailsShyamNo ratings yet

- Guide to the Negotiable Instruments LawDocument13 pagesGuide to the Negotiable Instruments LawPaul Christopher PinedaNo ratings yet

- SETUPS FOR ALLDocument22 pagesSETUPS FOR ALLpadmanabha14No ratings yet

- Lic Ecs Mandate Form EnglishDocument3 pagesLic Ecs Mandate Form EnglishpajipitarNo ratings yet

- Revenue Circular Amends Real Property Transfer RequirementsDocument1 pageRevenue Circular Amends Real Property Transfer RequirementsReymund BumanglagNo ratings yet

- Tax RemediesDocument22 pagesTax RemediesJezreel CastañagaNo ratings yet

- Intacc Chap 16 ReviewerDocument8 pagesIntacc Chap 16 ReviewerJea XeleneNo ratings yet

- Assesment Procedure: By: Smriti KhannaDocument25 pagesAssesment Procedure: By: Smriti KhannaSmriti KhannaNo ratings yet

- Mireillenkuansambumiss DiavuaDocument3 pagesMireillenkuansambumiss DiavuaMayamona Nkuansambu LikeNo ratings yet

- BQs Tax 2011 2012Document44 pagesBQs Tax 2011 2012Dem SalazarNo ratings yet

- Proposed Adjusting Journal EntriesDocument8 pagesProposed Adjusting Journal EntriesEli Mae Rose Densing100% (1)

- NIL (Negado Notes Midterms Reviewer)Document40 pagesNIL (Negado Notes Midterms Reviewer)Lynielle Zairah CrisologoNo ratings yet

- SOP For Clients - 07022022 Final v1.9 - ADP TeamDocument17 pagesSOP For Clients - 07022022 Final v1.9 - ADP TeamPuvaneswary BalachandrenNo ratings yet

- PDFDocument4 pagesPDFAmit vohraNo ratings yet

- Supply Order For Proj Stores (Aqumat Admixutre) - 135-Capital Sealers PDFDocument1 pageSupply Order For Proj Stores (Aqumat Admixutre) - 135-Capital Sealers PDFTariq MahmoodNo ratings yet

- Part II. Chapter 5 Collection of Real Property TaxDocument39 pagesPart II. Chapter 5 Collection of Real Property TaxRuiz, CherryjaneNo ratings yet

- Loss by Roberry 3 Months After Death Unpaid Income Tax For 2014 Legacy in Favor of Philippines National Red Cross Legacy To City of MakatiDocument7 pagesLoss by Roberry 3 Months After Death Unpaid Income Tax For 2014 Legacy in Favor of Philippines National Red Cross Legacy To City of MakatiClaire BarbaNo ratings yet

- Meralco v. CBAADocument1 pageMeralco v. CBAAkdescallarNo ratings yet

- Income Tax Deductions GuideDocument12 pagesIncome Tax Deductions GuideolafedNo ratings yet

- Important Information About Form 1099-G: D D Flaumenbaum 2481 Haff Ave North Bellmore Ny 11710-2735Document1 pageImportant Information About Form 1099-G: D D Flaumenbaum 2481 Haff Ave North Bellmore Ny 11710-2735ddouglasf2357No ratings yet

- PrmPayRcpt 64850330justinDocument1 pagePrmPayRcpt 64850330justinNarendar KumarNo ratings yet

- How To Setup EBTax So Tax Is Calculated On Payables InvoiceDocument21 pagesHow To Setup EBTax So Tax Is Calculated On Payables InvoiceFajar S YogiswaraNo ratings yet

- Tax AuditDocument9 pagesTax AuditUmar Sajjad AwanNo ratings yet