Professional Documents

Culture Documents

B.COM Insurance Principles Study Guide

Uploaded by

Stanly Thomas70%(23)70% found this document useful (23 votes)

34K views16 pagesThis document provides a summary of key concepts in insurance principles:

1. Insurance is a social mechanism for reducing risks and losses in society by compensating against possible losses. It provides security against risks and losses.

2. The insurer agrees to compensate the insured in the event of losses in exchange for a premium. The policy is the document outlining the terms of the insurance contract.

3. Key concepts include the insured, insurer, subject matter, premium, policy, insurable interest, and contingency. Various types of insurance are discussed including life, fire, marine, motor, and health insurance. Important organizations in the Indian insurance industry are also mentioned such as LIC, GIC, and IRDA

Original Description:

mvocm

Original Title

Mcq Bcom II-Principles of Insurance(1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides a summary of key concepts in insurance principles:

1. Insurance is a social mechanism for reducing risks and losses in society by compensating against possible losses. It provides security against risks and losses.

2. The insurer agrees to compensate the insured in the event of losses in exchange for a premium. The policy is the document outlining the terms of the insurance contract.

3. Key concepts include the insured, insurer, subject matter, premium, policy, insurable interest, and contingency. Various types of insurance are discussed including life, fire, marine, motor, and health insurance. Important organizations in the Indian insurance industry are also mentioned such as LIC, GIC, and IRDA

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

70%(23)70% found this document useful (23 votes)

34K views16 pagesB.COM Insurance Principles Study Guide

Uploaded by

Stanly ThomasThis document provides a summary of key concepts in insurance principles:

1. Insurance is a social mechanism for reducing risks and losses in society by compensating against possible losses. It provides security against risks and losses.

2. The insurer agrees to compensate the insured in the event of losses in exchange for a premium. The policy is the document outlining the terms of the insurance contract.

3. Key concepts include the insured, insurer, subject matter, premium, policy, insurable interest, and contingency. Various types of insurance are discussed including life, fire, marine, motor, and health insurance. Important organizations in the Indian insurance industry are also mentioned such as LIC, GIC, and IRDA

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 16

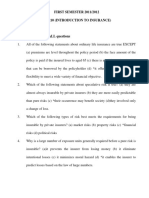

B.

COM SEMESTER II -CORE - PRINCIPLES OF INSURANCE

Common for Private Registration BCom(Co-oporation, Finance and Taxation & Travel

and Tourism Programme.and for BCom (CA), BCom (TT) under Off Campus Stream

1. ________ is a social device for eliminating or reducing the

loss of society from certain risk.

a) Premium b) Policy c) Insurance d) Contract Ans.(c)

2. Insurance provides security against ________

a) Risk b) Losses c) Both (a) & (b) d) None of them Ans.

(c)

3. The ________ is the party who agrees to compensate the other

person against possible losses.

a) Insured b) Insurer c) Assured d) None Ans.

(b)

4. The ________ is the party who gets his life or property

insured against risks.

a) Insured b) Insurer c) Assurer d) None Ans.

(a)

5. The insurer agrees to compensate the insured in consideration

of a sum of money is called

a) Premium b) Policy c) Subject matter d) None Ans.

(a)

6. The things or property insured is called ________ of the

insurance

a) Subject matter b) Insurable interest c) Policy d) None Ans.

(a)

7. The document which lays down the terms of the contract of

the insurance is called the ________

a) Policy b) Subject matter c0 Premium d) Insurable interest Ans.

(a)

8. The interest which the insured has in the subject matter of

insurance is called ________

a) Premium b) Insurance interest c) both (a) & (b) d) None Ans.

(b)

9. A contract of insurance is a ________ agreement.

a) Contingent b) Constant c) both d) None of these Ans.

(a)

10. The Life Insurance Corporation of India (LIC) was formed in

________

a) 1952 b) 1956 c) 1957 d) 1962 Ans.

(b)

11. The Bombay Mutual Assurance Society Ltd. formed in

________

a) 1870 b) 1970 c) 1960 d) 1865 Ans.

(a)

12. ________ was the first Indian Insurance Company

a) Bombay Mutual Assurance Society Ltd.

b) Bombay Insurance Society Ltd.

c) Insurance Regulatory Development Authority

d) General Insurance Corporation

Ans.

(a)

13. ________ is a valid contract between the insured on the one

side and the insurer on the other

a) Policy b) Insurance c) Warranties d) None Ans.

(b)

14. Risk is evaluated on the basis of ________ theory

a) Variability b) Contingency c) Probability d) All Ans.

(c)

15. From the following, which is not a type of risk?

a) Speculative risks b) Dynamic risks c) Fundamental d)

Quantitative

Ans.

(d)

16. Insurance is a written agreement between the insurer and the

________

a) People b) Individuals c) Institutions d) Insured Ans.

(d)

17. ________ means to make good the actual loss and nothing

more than the actual loss.

a) Indemnity b) Subrogation c) Contribution d) None Ans.

(a)

18. Insurable interest means ________ interest

a) Individual b) Social c) Monetary d) All of these Ans.

(c)

19. Which of the following insurance contract is not based on the

principle of indemnity.

a) Fire insurance b) Marine insurance c) Life insurance d)

None

Ans.

(c)

20. Human life is the subject matter of a contract of ________

a) Life assurance b) Fire insurance c) Marine insurance d)

None - Life insurance

Ans.

(a)

21. Motor insurance provides insurance cover to ________

a) Private vehicles b) Commercial vehicles c) Motorcycles d)

All of these

Ans.

(d)

22. The Malhotra Committee submitted its report in ________

a) 1993 b) 1994 c) 1995 d) 1996 Ans.

(b)

23. Expanded form of IRDA is ________

a) Insurance Regulatory Development Authority

b) Insurance Reforms Development Act

c) Insurance Restructure Development Act

d) Indian Re-insurance Development Authority

Ans.

(a)

24. Employee's State Insurance Corporation was established in

________

a) 1968 b) 1958 c) 1948 d) 1988 Ans.

(c)

25. IRDA is a ________ member team

a) 10 b) 20 c) 15 d) 18 Ans.

(a)

26. The General Insurance business in India was nationalised in

________

a) 1962 b) 1972 c) 1982 d) 1992 Ans.

(b)

27. LIC means ________

a) Life India Corporation

b) Life Insurance Corporation of India

c) Life Insurance Contract

d) Non of these

Ans.

(b)

28. Export Risks Insurance Corporation was established to insure

________

a) Import Risks b) Exchange Risks c) Export Risks d) All of

these

Ans.

(c)

29. The Chairman of Malhotra Committee was ________

a) R.N. Malhotra b) R.K. Malhotra c) R.B. Malhotra d) R.S.

Malhotra

Ans.

(a)

30. The subject matter of insurance is ________

a) Risk b) Return c) Income d) Profit Ans.

(a)

31. In insurance the risk is ________

a) Certain b) Uncertain c) Both (a) & (b) d) None Ans.

(b)

32. Marine insurance may cover loss or damage to the ________

a) Ship b) Cargo c) Any other subject of Marine adventure d)

All of these

Ans.

(d)

33. From the following which is not a miscellaneous insurance?

a) Motor insurance b) Third party insurance c) Social

insurance d) Burglary insurance

Ans.

(c)

34. ________ insurance is not a contract of indemnity

a) Fire b) Marine c) Health d) Life Ans.

(d)

35. Marine insurance is for one year or for a specified ________

a) Voyage b) Year c) Loss d) None Ans.

(a)

36. Burglary insurance policy covers the risks from burglary

________

a) Theft b) Robbery c) Both (a) & (b) d) None Ans.

(c)

37. From the following which is the dilly or powers of IRDA.

a) To regulate, promote and ensure orderly growth of the

insurance business

b) To exercise all powers and functions of the Controller of

Insurance

c) To promote and regulate professional organizations

connected with insurance business

d) All of these

Ans.

(d)

38 __________ provides risks coverage to the life of person

(a) ( Life Insurance (b) Health Insurance (c) Death

Insurance

(d) All of these

Ans. A

39. From the following which is the importance of life Insurance?

(a) Encourage investments (b) Credit work ness

(c) Tax benefit (d) All of these

Ans. D

40. The Life Insurance contract is expressed in a document known

as _________

(a) Premium (b) Policy (c) Indemnity

(d) None of these

Ans. B

41. __________ refers to the right of an insurer to refuse

admittance of the claim by the insured.

(a) Replication (b) Repudiation (c) Dufalication

(d) None

Ans. B

42. FPR Means ________

(a) First Premium Receipt (b) Fourth Premium

Receipt

(c) First Policy Receipt (d) First Police Record

Ans. A

43. __________ is a voluntary termination of the contract by the

policy holders.

(a) Report (b) Surrender (c) Prospectus (d) Cover

note

Ans. B

44. ________ means closure or writing off the policy before its

actual maturity

(a) Fore closure (b) Surrender (c) Endorsement

(d_ Cover note

Ans. A

45. If the insured dies before the expiry of the term of the policy,

is known as ________

(a) Policy (b) Premium (c) Death claim

(d) Death Policy

Ans. C

46. If more than one person claim the policy money is called

_______

(a) Death claim (b) Rival claim

(c) Both (d) None

Ans. B

47. ________ is concerned with overseas trade

(a) Life Insurance (b) Non-life insurance

(c) Marine insurance (d) Fire insurance

Ans. C

48. A marine insurance is a contract of _________

(a) Increment (b) Indemnity

(c) Maturity (d) None

Ans. B

49. Which is not a subject matter of marine insurance

(a) Hull insurance (b) Cargo insurance

(c) Fright Insurance (d) Fire insurance

Ans. D

50. __________ means the body or frame of the ship or vessel and

its machinery.

(a) Cargo (b) Fright (c) Hull (d) Voyage Ans. C

51. ________ means goods or commodities carried in a ship

(a) Hull (b) Cargo (c) Fright (d) Wares Ans. B

52. ________ is the charge to be paid to the transportation of the

goods.

(a) Hull (b) Cargo (c) Fright (d) Premium Ans. C

53. The first requirement of the corporation in the cases of death

claim is __________

(a) Imitation of death (b) Intimation of death

(c) Certificate of death (d) None of these

Ans. B

54. From the following which is not a content of the letter of

intimation

(a) Name of the life assured (b) Date of Death

(c) Cause of death (d) Date of birth

Ans. D

55. Time policy is taken in the case of ________ insurance

(a) Hull (b) Cargo (c) Fright (d) All of these Ans. A

56. _______ policy covers both land and sea sides

(a) Blanket (b) Block (c) Currency (d) Cargo Ans. B

57. Expanded form of PPL policy is ___________

(a) Policy Procedure of Interest (b) Policy Port of Interest

(c) Policy proof of interest (d) Port proof of interest

Ans. C

58. ______ Policy is taken for the shipment of a particular cargo

only

(a) Blanket (b) Block (c) Cargo (d) Composite Ans. C

59. __________ means a complete loss or destruction of the

subject matter in the policy.

(a) Partial loss (b) Total loss (c) Actual loss (d)

None

Ans. B

60. ___________ Policy is issued to cover the risks involved

when the ship is anchored in the post.

(a) Cargo (b) Port risk (c) Currency (d) Fleet Ans. B

61. ________ policy is taken to cover different risks for a single

shipment.

(a) Blanket (b) Named (c) Specific cover (d) Block Ans. C

62. The receipt and rate of premium is mentioned in _____ clause.

(a) Waiver (b) Premium (c) Barratry (d) Jettison Ans. B

63. Salvage charges means the charges increased by a _______

(a) Salver (b) Salvages (c) Insurer (d) Insured Ans. A

64. G.A., P.A. etc. are used in the freight causes are known as

(a) Insurance Freight clauses (b) Institute Freight clauses

(c) Interest on Freight clauses (d) None of these

Ans. B

65. General Insurance policies are issued for a period of

(a) 1 year (b) 2 year (c) 10 year (d) 4 year Ans. A

66. _______ means the act of throwing a part of the cargo over

board lighten the ship in emergencies

(a) Barratry (b) Jettison (c) Waiver (d) Premium Ans. B

67. Fire insurance came into existence after the Great Fire of the

London in ___________

(a) 1666 (b) 1866 (c) 1686 (d) 1687 Ans. A

68. Fire insurance is a device to compensate the insured for the

loss caused by _______

(a) Fire (b) Water (c) Flood (d) None Ans. A

69. Fire insurance is a contract of ____________

(a) Uberrimae Fidei (b) Uberrima Fide (c) Uberrim

fidi

(d) Uperrima fibi

Ans. A

70. Uberrimae Fidei means _________

(a) Absolute good faith (b) Absolute faith

(c) Relative faith (d) these

Ans. A

71. A valuable policy is just opposite to the ________

(a) Value policy (b) Valued policy (c) Both (d) None Ans. B

72. ________ Policy covers both fixed and current assets of

insured manufactures.

(a) Block (b) Blanket (c) Transit (d) Excess Ans. B

73. _________ is a contract between two insures i.e. original

insurer and another insurer.

(a) Insurance (b) Reinsurance (c) Policy (d) Premium Ans. B

74. Reinsurance can be called as ________

(a) Insurance of Insurance (b) Insurance of insures

(c) Insurance of insurance policy (d) None

Ans. A

75. Under _________ no insurer will transit the business

individually

(a) Reinsurance (b) Treaty reinsurance

(c) Pool insurance (d) Facultative insurance

Ans. C

76. EEI means

(a) Electrical Equipment Insurance

(b) Electronic Equipment Insurance

(c) Elective Insurance

(d) Electronic Erection Insurance

Ans. D

77. ____________ Policy is a combination of floating and average

policies

(a) Excess (b) Floating (c) Specific (d) Valued Ans. A

78. __________ means insuring a risk with two or more insurers

and the total sum insured also exceeds the actual value of the

subject matter.

(a) Reinsurance (b) General Insurance

(c) Single insurance (d) Double insurance

Ans. D

79. _______ involves proportionate sharing of the insurance

among more than one insurer.

(a) Reinsurance (b) Double Insurance

(c) Co-insurance (d) None

Ans. C

80. ________ means insuring again.

(a) General insurance (b) Reinsurance (c) Co-

insurance

(d) Double insurance

Ans. B

81. From the following which is function of insurance

(a) Risk bearing (b) Provide savings (c) Provides savings

(d) All of these

Ans. D

82. The amount given by way of insurance and therefore the

amount accepted by the reinsurance is known as __________

(a) Cession (b) Retrocession (c) Retention (d) Ceding Ans. A

83. The insurer who obtains a guarantee is _________

(a) Ceding insurer (b) Re-insurer (c) Direct insurer

(d) Under write

Ans. A

84. The proportion of the risk which the direct insurer holds on his

own account is called _________

(a) Cession (b) Retention (c) Retrocession (d)

Line

Ans. B

85. Re-insurer is the insurer who grants a guarantee from the

_______

(a) Ceding insurer (b) Direct insurer (c) Underwriter

(d) Line

Ans. B

86. From the following which is not a non-proportional form of

reinsurance?

(a) Excess of loss method (b) Pools method of re insurance

( c) Treaty method of reinsurance

(d) Quata Method of reinsurance

Ans. D

87. When the amount for which a subject matter is insured is more

than its actual value, it is called _________

(a) Reinsurance (b) Double insurance (c) Over insurance

(d) None

Ans. C

88. ________ insurance means an alternative to purchasing

insurance in a commercial market.

(a) External (b) Internal (c) Double (d) Re insurance Ans. B

89. __________ Insurance is a contract to provide a measure of

financial support to farmers in the event of a crop failure due

to drought or flood.

(a) Cattle (b) Crop (c) Burglary (d) Fire Ans. B

90. ________ means the transfer of all the rights and remedies

available to the insured in respect of the subject matter to the

insurer after indemnity has been effected.

(a) Subrogation (b) Indemnity (c) Contribution

(d) None

Ans. A

91. ____________ is a policy in which the limits of the risks are

determined by place of particular voyage.

(a) Time policy (b) Valued policy (c) Voyage Policy

(d) Floating policy

Ans. C

92. Life insurance policies are issued for ________ years

duration.

(a) 15-20 (b) 5-10 (c) 10-15 (d) 10-20 And. B

93. A fire policy containing an average clause is _________

(a) Valued policy (b) Average policy (c) Specific policy

(c) Floating policy

Ans. B

94. A ___________ policy covers loss on goods which are laying

in different places.

(a) Specific (b) Declaration (c) Replacement

(d) Floating

Ans. D

95. An unlooked mishap or an untoward event which is not

expected or designed

(a) Risk (b) Accident (c) Loss (d) None Ans. B

96. Property Insurance may not include ___________

(a) Burglary (b) Fidelity (c) Insolvency (d) Sickness Ans. D

97. ___________ is a contract against injury or death resulting

from accident.

(a) Property insurance (b) Liability Insurance

(c) Personal accident insurance (c) None of these

Ans. C

98. _________ is known as Rashtriya Krishi Bima Yojana

(a) Crop insurance (b) Hut Insurance (c) Property

Insurance

(c) None

Ans. A

99. Crop insurance scheme came into existence in India in

________

(a) 1998 (b) 1999 (c) 1997 (d) 2000 Ans. B

100. Crop insurance covers the risks of __________

(a) Natural fire (b) Storm (c) Drought (d) All

of these

Ans. D

101. From the following which is not a horticulture crop?

(a) Grape (b) Litrus (c) Banana (d) Coffee Ans. D

102. Crop insurance scheme is also known as __________

(a) Multi purpose policy (b) Wagering policy

(c) Rashtriya Krishi Bima Yougan (d) Jan Arogya

Bima policy

Ans. C

103. Motor vehicle insurance begin in ___________

(a) U.K. 9b) USA (c) India (d) Japan Ans. A

104. Public liability Insurance act established in _______

(a) 1990 (b) 1991 (c) 1992 (d) 1993 Ans. B

105. From the following which is not a type of Public Liability

Risk Insurance

(a) Industrial Risk Insurance (b) Industrial All Risk

Insurance

(c) Non - Industrial Risk Insurance (d) Business

premises Insurance

Ans. D

106. The person whose risk is insured is called ________

(a) Assured (b) Insured (c) Underwriter (d) Both Ans. D

107. In Marine Insurance, insurable interest is enough at the time of

_______

(a) Maturity (b) Insurance (c) Loss (d) Claim Ans. C

108. Risk insured against death is a contract of _______-

(a) Agreement (b) Indemnity (c) Assurance (d)

None

Ans. C

109. _____________ Policy issued on the basis of the number of

persons assured.

(a) Single life (b) Level Premium (c) Annuity (d)

Multiple life

Ans. D

110. _________ is an agreement where by the insurer agrees to

indemnity the insured against marine losses.

(a) Fire Insurance (b) Marine Insurance (c) Life

Insurance

(d) Property insurance.

Ans. C

111. The danger of loss from the unforeseen circumstances in

future refers to _________

(a) Perils (b) Hazards (c) Damage (d) Risk Ans. D

112. _____________ Policy is granted only in respect of stocks of

inventories of the insured under fire insurance business.

(a) Declaration (b) Floating (c) Replacement (d)

Valued

Ans. A

113. The term 'Assurance' refers to ___________

(a) Life Insurance business (b) Fire insurance business

(c) Motor Vehicle insurance (d) Marine insurance

Ans. A

114. __________ provides evidence of insurance to the police and

Registration Authorities under Motor Vehicle Act.

(a) Endorsement (b) Policy Form (c) Certificate of

insurance

(d) Cover note

Ans. C

115. __________ is an age which a person or insured has attained

in relation to a given date.

(a) Attained age (b) Attainable age (c) Maturity age

(d) None

Ans. A

116. Policy holders are expected to pay premium on due dates, a

period of 15-30 days is allowed as grace to make payment of

premium from the due date is _________

(a) Days of grace (b) Days of indemnity (c) both (d)

None

Ans. A

117. A schedule of prices, fees and fares is known as _________

(a) Mortgage (b) Underwriting (c) Tariff (d) None Ans. C

118. The main cause of loss or damage is _____________

(a) Proximate cause (b) Indirect Loss

(c) Consequential loss (d) All of these

Ans. A

119. _________ is a theft committed by breaking or out of the

premises.

(a) Burglary (b) Blanket (c) Fire (d) None Ans. A

120. The cause of a possible loss, such as fire windstorm theft etc.

is known as ___________

(a) Peril (b) Barratry (c) both (d) None Ans. A

121. Martine Peril is also called as _________

(a) Moral hazards (b) Morale hazards (c) Peril of the sea

(d) None

Ans. C

122. ________ is a package policy which provides protection

against a number of separate points.

a) Single peril policy b) Group peril policy

c) Multiperil policy d) None

Ans. C

123. ________ is the property saved from loss

a) Profit b) Salvage c) Stand d) Jettison Ans. B

124. ________ are the rules formed to help in solving the cases of

General Average Losses in foreign courts.

a) York - Antwerp rules b) General Average rules

c) Both (a) and (b) d) None

Ans. A

125. When a company reinsures its liability with another, then it

________ business

a) Cession b) Cedes c) Ceding d) None Ans. B

126. The percentage of losses incurred to premiums earned

________ ratio

a) Incurred Loss b) Expense

c) Loss event d) None

Ans. A

127. The scope of protection provided under the contract of

insurance is ________

a) Condition b) Coverage c) Contribution d) None Ans. B

128. Medical expense insurance is also known as ________

a) Personal insurance b) Liability insurance

c) Medi claim d) Fidelity

Ans. C

129. The risk of individuals and families are cored under ________

a) Personal insurance b) Property insurance

c) Liability insurance d) All

Ans. A

130. The organization structure of ________ is four tier structures.

a) IRDA b) LIC c) GIC d) All Ans. B

131. The central office of LIC of India is located at ________

a) Mumbai b) New Delhi c) Bangalore d) Chennai Ans. A

132. The constitution of the IRDA consists of not more than

________ members.

a) 8 members b) 9 members c) 10 members d) 11

members

Ans. B

133. Under ________ insurance, loss of profit policy is called as

consequential loss policy

a) Marine b) Property c) Fire d) Life Ans. C

134. From the following which is not an example of fundamental

risk?

a) War b) Unemployment c) Inflation d) Burning of a

house

Ans. D

135. ________ is also termed as group risk

a) Fundamental risk b) Static risk

c) Property risk d) Liability risk

Ans. A

136. ________ is based on the principle of co-operation

a) Indemnity b) Insurance c) Claim d) None Ans. B

137. ________ means a willful and intentional act on part of the

self destroyer

a) Murder b) Death c) Accident d) Suicide Ans. B

138. Life Insurance Company was set up in ________

a) 1823 b) 1832 c) 1822 d) 1821 Ans. A

139. Risks are not suited to treatment by insurance are ________

a) Static risk b) Particular risk

c) Dynamic risk d) Property risk

Ans. C

140. IRDA refers to ________

a) Indian Regulatory Development Authority

b) Insurance Regulatory Development Association

c) Institute of Regulation Development Association

d) Insurance Regulatory Development Authority

Ans. D

141. The principle of indemnity does not apply to

a) Life Insurance b) Personal accident insurance

c) Both (a) and (b) d) None

Ans. C

142. From the following which is not a life insurance

a) Fire insurance b) Marine insurance

c) Vehicle insurance d) Cattle insurance

Ans. D

143. Final accounts of Life Insurance Companies include

a) Revenue account b) Profit and loss account

c) Receipt and payment account d) All of these

Ans. D

144. The concept of ________ is very important for an insurance

company in deciding the methods financing.

a) Capital b) Cost of capital c) Capital structure d)

None

Ans. B

145. Single revenue account is prepared in ________ insurance

a) Life b) Accident c) Property d) Marine Ans. A

146. In ________ separate revenue accounts are prepared for each

type of business.

a) Life insurance b) General insurance

c) Crop insurance d) All of these

Ans. B

147. From the following, which is a type of reserve in insurance

business

a) Unearned Premium Reserve b) Un-expired Risk

Reserve

c) Outstanding Claims Reserve d) All of these

Ans. D

148. Equity capital refers

a) Borrowed capital b) Cost of capital

c) Debenture capital d) Own capital

Ans. D

149. The current ratio measures the ________ position of an

insurance policy

a) Solvency b) Liquidity c) Profitability d)

Activity

Ans. B

150. The books maintained on the basis of magnitude of the

business are

a) Subsidiary books b) Register of claims

c) Register of policies d) Statutory books

Ans. A

151. Fire insurance contract is a contract of

a) Guarantee b) Validity c) Contribution d) Indemnity Ans. D

152. The normal period of a ________ insurance contract is one

year

a) Life b) Marine c) Fire d) Property Ans. C

153. ________ is also known as all risk policy

a) Comprehensive policy b) Excess policy

c) Floating policy d) Adjustable policy

Ans. A

154. Re-instatement policy is also known as

a) Replacement policy b) Replacement policy

c) Both (a) and (b) d) None

Ans. C

155. In Life Insurance, risk may be in the form of

a) Standard b) Sub standard c) Delivered d) All of these Ans. D

156. Marine insurance protects against

a) Fire perils b) Marine perils c) both (a) & (b) d)

None

Ans. B

157. In ________ the individual risk is offered by an insurer for

acceptance or rejection by re-insurer

a) Treaty reinsurance b) Facultative reinsurance

c) Pool reinsurance d) None

Ans. B

158. Health insurance can be availed by people aged between

________ and ________

a) 10 and 100 b) 7 and 75 c) 5 and 75 d) 10 and 70 Ans. C

159. A health insurance should be

a) Affordable b) Continuous c) Universal d) All

of those

Ans. D

160. Motor Vehicle Act was established in ________

a) 1888 b) 1988 c) 1998 d) 1978 Ans. B

161. ________ enables to recoup the losses suffered by people

consequent on burglary or hour breaking

a) Burglary insurance b) Fire insurance

c) both (a) and (b) d) None

Ans. A

162. ________ is a document issued in advance of the policy

a) Endorsements b) Cover note

c) Certificate of deposit d) None

Ans. B

163. Bombay Mutual Life Assurance Society came into existence

in ________

a) 1987 b) 1971 c) 1871 d) 1878 Ans. C

164. The Life Insurance Corporation was formed with a capital

contribution of ________

a) 10 Crores b) 6 Crores c) 5 Crores d) 7 Crores Ans. C

165. The term ________ is referred only Life Insurance business

a) Warranties b) Utmost good faith c) Assurance d)

None

Ans. C

166. ________ are the basis of the contract between the proposer

and insurer.

a) Assurance b) Warranties c) Insurance d) None Ans. B

167. ________ plan also refers to an exclusive policy for exclusive

people.

a) Jeevan Aadhar b) Jeevan Shree

c) Money Back Policy d) Jeevan Vishwas

Ans. B

168. ________ is a plan designed for businessmen and

professionals as money is available periodically.

a) Jeevan Surabhi b) Jeevan Saathi

c) Jeevan Kishore d) Jeevan Sukanya

Ans. A

169. From the following which is a character of Life Insurance

Services

a) Intangibility b) Heterogeneity

c) Inseparability d) All of these

Ans. D

170. LIC Housing Finance Ltd. was incorporated on ________

a) 1984 b) 1989 c) 1969 d) 1993 Ans. B

171. From the following which is not an individual loan scheme of

LIC Housing Finance

a) Griha Prakash b) Griha Tara

c) Griha Jyothi d) Griha Suraksha

Ans. D

172. The Head Office of National Insurance Co. Ltd. is at

________

a) Mumbai b) Chennai c) New Delhi d) Kolkatta Ans. D

173. The Head Office of Oriental Insurance Co. Ltd. is at ________

a) Chennai b) Mumbai c) New Delhi d) Kolkatta Ans. C

174. Marine policy is also known as ________

a) Voyage policy b) Time policy

c) Valued policy d) Sex policy

Ans. D

175. Re-insurance Treaties can be used for ________ re-insurance

a) Hull b) Cargo c) Both (a) and (b) d)

None

Ans. C

176. From the following which is a usual clause incorporated with

Marine Policy?

a) Assignment clause b) Touch and stay clause Ans. D

c) All risks clause d) All of these

177. From the following which is a loss due to fire?

a) Loss of Assets b) Loss of profit

c) Both (a) and (b) d) None

Ans. C

178. The corpus fund is created with contributions from the Central

Government and State Government on ________ basis

a) 60:40 b) 55:45 c) 50:50 d) 25:75 Ans. C

179. An international code of ________ rules applied to Marine

losses

a) York Antwerp rule b) York Antiperil rule

c) Both (a) and (b) d) None

Ans. A

180. ________ is sort of contract which is approved by Indian

Contracts Act

a) Insurance contract b) Indian Companies Act

c) Reinsurance d) None

Ans. A

181. New Delhi is the head office of

a) United India Insurance Co. Ltd.

b) Oriental Insurance Co. Ltd.

c) National Insurance Co. Ltd.

d) New India Assurance Co. Ltd.

Ans. B

182. A Re-insurance of Re-insurance refers to

a) Retention b) Retrocession c) Ceding insurer d)

Line

Ans. B

183. In which year insurance began in India

a) 1870 b) 1818 c) 1897 d) 1896 Ans. B

184. ________ is a document in which contains the terms and

conditions of the insurance contract is known as ________

a) Insurance premium b) Insurance policy

c) Contribution d) None

Ans. B

185. ________ are extra benefits under the policy

a) Riders b) Loans c) both (a) and (b) d) None Ans. A

186. Submitting a policy back to the insurer before maturity is

________

a) Surrender b) Nomination c) Assignment d)

Revival

Ans. A

187. An insurance policy will be only if ________ is paid

a) Policy b) Premium c) Document d) None Ans. B

188. Insurable interest must be present in an ________ insurance

contract at the time of contract and at the time of loss.

a) Fire b) Marine c) Property d) Life Ans. A

189. Which is the year of 'Great Fire of London'?

a) 1969 b) 1666 c) 1967 d) 1566 Ans. B

190. The transit risk caused by fire is covered under ________

policy

a) Excess policy b) Floating policy

c) All risk policy d) transit policy

Ans. D

191. ________ is the total premium that a policy holder pays

a) Gross premium b) Avg. premium

c) Partial premium d) All of these

Ans. A

192. ________ means a premium which remains unchanged

through out the life of a policy.

a) Avg. premium b) Gross premium

c) Total premium d) Level premium

Ans. D

193. ________ is a formal statement or announcement

a) Declaration b) Premium

c) Cover note c) Certificate of insurance

Ans. A

194. The time frame for which an insurance policy provides

coverage is known as ________

a) Policy term b) Policy loan

c) Policy mode d) None

Ans. A

195. An exceptionally large risk is known as ________

a) Great risk b) Jumbo risk c) Giant risk d) None Ans. B

196. A person who gains or benefits as per a contract is known as

______

a) Beneficiary b) Annuitant c) Assurer d) None Ans. A

197. Intimation of Death is the information of death to the

________

a) Beneficiary b) Insurer c) Both (a) and (b) d)

None

Ans. B

198. Gross premium means Net premium plus ________

a) Profit b) Loss c) Expense d) Expense

loading

Ans. D

199. ________ is a form of health insurance against loss by

accidental bodily injury

a) Property insurance b) Marine insurance

c) Personal insurance d) Accident insurance

Ans. D

200. ________ Means restoring the victim of a loss by payment,

repair or replacement.

a) Premium b) Declaration c) Indemnity d)

Assurance

Ans. C

You might also like

- Risk MGMT - MCQ'sDocument56 pagesRisk MGMT - MCQ'skeshav Rana92% (13)

- MCQ On Holding CompanyDocument4 pagesMCQ On Holding Companytushar100% (3)

- Corporate Account MCQDocument25 pagesCorporate Account MCQArul Dass67% (12)

- 6C HSE Capability Assessment QuestionnaireDocument70 pages6C HSE Capability Assessment Questionnairem.kartikaNo ratings yet

- Florida Real Estate Exam Prep: Everything You Need to Know to PassFrom EverandFlorida Real Estate Exam Prep: Everything You Need to Know to PassNo ratings yet

- Banking Law MCQDocument33 pagesBanking Law MCQShivansh Bansal100% (7)

- Multiple Choice Questions (MCQ) : Indian Financial SystemDocument4 pagesMultiple Choice Questions (MCQ) : Indian Financial SystemPriyadarshini Mahakud100% (2)

- Important MCQs of Financial DerivativesDocument22 pagesImportant MCQs of Financial Derivativespk100% (4)

- Financial Accounting MCQs on Amalgamation, Absorption and External Reconstruction (B.ComDocument12 pagesFinancial Accounting MCQs on Amalgamation, Absorption and External Reconstruction (B.ComsameerNo ratings yet

- Term - I MCQ Base QuestionDocument41 pagesTerm - I MCQ Base QuestionKadam Kartikesh100% (3)

- 33 - Inspection & AuditsDocument27 pages33 - Inspection & AuditsP Eng Suraj Singh100% (1)

- NISM DP 1300 MCQS - by Vinay Kumar Gandi PDFDocument175 pagesNISM DP 1300 MCQS - by Vinay Kumar Gandi PDFaditi100% (9)

- Everything You Need to Know About Bonus PaymentsDocument4 pagesEverything You Need to Know About Bonus PaymentsPratik67% (3)

- Assessment Summary / Cover Sheet: Student Assessment CHCCCS015 Provide Individualised SupportDocument16 pagesAssessment Summary / Cover Sheet: Student Assessment CHCCCS015 Provide Individualised SupportGurpreet Singh Wirring67% (3)

- 21.0 - Permit To Work Systems v3.0 English (Full Permission)Document18 pages21.0 - Permit To Work Systems v3.0 English (Full Permission)Amal JagadiNo ratings yet

- Unit III Risk and Return MCQDocument4 pagesUnit III Risk and Return MCQsvpranav8018100% (8)

- Venture Capital Firms, Finance Companies, and Financial Conglomerates ExplainedDocument8 pagesVenture Capital Firms, Finance Companies, and Financial Conglomerates ExplainedShuvro Rahman75% (12)

- Risk Assessment For Repair of ManholeDocument5 pagesRisk Assessment For Repair of Manholeflmm09No ratings yet

- BCOM Insurance Question BankDocument27 pagesBCOM Insurance Question BankDrJay Trivedi71% (17)

- MCQ Bcom II Principles of Insurance 1 PDFDocument16 pagesMCQ Bcom II Principles of Insurance 1 PDFNaïlêñ Trïpūrå Jr.100% (1)

- MCQ Questions For Entrepreneurship DevelopmentDocument13 pagesMCQ Questions For Entrepreneurship DevelopmentShradha Bhandari100% (3)

- Risk Assessment For Installation of Cable Tray and TruckingDocument1 pageRisk Assessment For Installation of Cable Tray and Truckingazer33% (3)

- Mil STD 3006cDocument113 pagesMil STD 3006ccher28No ratings yet

- Chapter 3 ChooseDocument15 pagesChapter 3 ChooseHamadaAttiaNo ratings yet

- CourseDocument2 pagesCourseNitu TibrewalaNo ratings yet

- MCQ Compensation Mgt. Sem IiiDocument7 pagesMCQ Compensation Mgt. Sem IiiCharu Lata100% (1)

- Writing An Effective Pentest Report v1.0 Rev 10022016 by Semi YuliantoDocument88 pagesWriting An Effective Pentest Report v1.0 Rev 10022016 by Semi YuliantoIlham AlifNo ratings yet

- HACCP Plan Fruit SaladDocument22 pagesHACCP Plan Fruit SaladHACCPEuropa83% (6)

- Company Law-MCQDocument40 pagesCompany Law-MCQAkshit Singh100% (1)

- Introduction To Risk Management and MCQ L 1Document21 pagesIntroduction To Risk Management and MCQ L 1FarooqChaudhary92% (13)

- MCQ Finance Exam Advanced Financial ManagementDocument3 pagesMCQ Finance Exam Advanced Financial ManagementBasappaSarkar78% (36)

- Question Paper - Fundamentals of Insurance 2021 - Question & AnswersDocument14 pagesQuestion Paper - Fundamentals of Insurance 2021 - Question & Answersjeganrajraj100% (4)

- INTERNAL ANALYSIS MULTIPLE CHOICE QUESTIONS ON ORGANIZATIONAL CAPABILITIES AND VALUE CHAINSDocument8 pagesINTERNAL ANALYSIS MULTIPLE CHOICE QUESTIONS ON ORGANIZATIONAL CAPABILITIES AND VALUE CHAINSzaid67% (3)

- Specific Contract II Question BankDocument8 pagesSpecific Contract II Question BankSumit Bhardwaj60% (5)

- Internet Is Changing The Way Consumers Shop and Buys Goods and ServicesDocument7 pagesInternet Is Changing The Way Consumers Shop and Buys Goods and ServiceseshuNo ratings yet

- Corporate Governance MCQs on Risk Management, CSR and DirectorsDocument8 pagesCorporate Governance MCQs on Risk Management, CSR and DirectorsMusharafmushammad67% (6)

- Companies Act 1956 Multiple Choice QuestionsDocument5 pagesCompanies Act 1956 Multiple Choice QuestionsKaran Veer Singh100% (5)

- CHC24015 Certficate II in Active Volunteering Log Book - 201910 V2.7Document28 pagesCHC24015 Certficate II in Active Volunteering Log Book - 201910 V2.7Jayde Archer100% (1)

- 50 MCQs On Security Analysis and Portfolio ManagementDocument8 pages50 MCQs On Security Analysis and Portfolio ManagementDivyesh90% (10)

- Edsb Chapter 3 MCQDocument13 pagesEdsb Chapter 3 MCQdvpatel6680% (5)

- Bba B Law MCQ SampleDocument15 pagesBba B Law MCQ SampleSunita Singhal100% (1)

- Working Capital Management Objectives Set 1 McqsDocument13 pagesWorking Capital Management Objectives Set 1 McqsAmit Kumar75% (4)

- Health Insurance - MCQ'sDocument14 pagesHealth Insurance - MCQ'ssureshbeliver005No ratings yet

- Multiple Choice Questions-BRFDocument10 pagesMultiple Choice Questions-BRFAtreyi Ghosh76% (21)

- MCQ On Negotiable Instrument ActDocument2 pagesMCQ On Negotiable Instrument ActPraveen Makula80% (5)

- Test Bank For Introduction To Risk Management and Insurance 10th Edition by Dorfman Download 190327020242Document24 pagesTest Bank For Introduction To Risk Management and Insurance 10th Edition by Dorfman Download 190327020242Hasan Bin HusainNo ratings yet

- BSBINN601Document42 pagesBSBINN601Joanne Navarro Almeria78% (23)

- Project 1 HPCLDocument98 pagesProject 1 HPCLStanly Thomas100% (1)

- Banking and Finance Module 4 - Insurance QuestionsDocument5 pagesBanking and Finance Module 4 - Insurance Questionsdivya100% (1)

- 250 Question Insurance LawDocument43 pages250 Question Insurance LawShivansh MishraNo ratings yet

- MCQ Re-InsuranceDocument1 pageMCQ Re-InsuranceAMIT BHATIA100% (2)

- Fire Chapter 1 MCQ PDFDocument7 pagesFire Chapter 1 MCQ PDFjds0% (1)

- Insurance Claim AccountDocument12 pagesInsurance Claim AccountKadam Kartikesh50% (2)

- Fundamental Legal Principles of Insurance Contract: QUESTION One (Multiple Choice)Document13 pagesFundamental Legal Principles of Insurance Contract: QUESTION One (Multiple Choice)Ameer Elatma100% (1)

- Avinash Degree College Insurance Course OverviewDocument63 pagesAvinash Degree College Insurance Course Overviewkrishna chaitanyaNo ratings yet

- LEASE ACC - MCQ - FY B Com-converted-F10022vo3rON9mO0DtNs-COU20200917082041uFV-1810Document8 pagesLEASE ACC - MCQ - FY B Com-converted-F10022vo3rON9mO0DtNs-COU20200917082041uFV-1810Vineet KrNo ratings yet

- MCQ For MBFS PDFDocument19 pagesMCQ For MBFS PDFNaziya TamboliNo ratings yet

- Risk Final Exam QuestionsDocument6 pagesRisk Final Exam Questionsnathnael75% (4)

- MCQ Comp LawDocument39 pagesMCQ Comp LawplannernarNo ratings yet

- Class XII Sample Questions for Accountancy, Aptitude, Business Studies, EconomicsDocument6 pagesClass XII Sample Questions for Accountancy, Aptitude, Business Studies, EconomicsTanishkaNo ratings yet

- Isssue of Shares and Debentures MCQDocument42 pagesIsssue of Shares and Debentures MCQlolNo ratings yet

- Financial Management Wealth Maximisation MCQDocument3 pagesFinancial Management Wealth Maximisation MCQLakshmi NarasaiahNo ratings yet

- Sample MCQ 3Document8 pagesSample MCQ 3varunendra pandeyNo ratings yet

- SapmDocument35 pagesSapmShweta Shrivastava50% (4)

- Sale of Goods Act MCQ 20 MarksDocument22 pagesSale of Goods Act MCQ 20 MarksKapil DalviNo ratings yet

- Objective Type Questions SAPMDocument15 pagesObjective Type Questions SAPMSaravananSrvn77% (31)

- Tax-planning-And-management Solved MCQs (Set-3)Document8 pagesTax-planning-And-management Solved MCQs (Set-3)Umair VirkNo ratings yet

- Security Analysis & Portfolio Management (MCQ, S & Short Answers)Document54 pagesSecurity Analysis & Portfolio Management (MCQ, S & Short Answers)Hamid Ilyas80% (10)

- Ic 88 MCQDocument78 pagesIc 88 MCQSamba SivaNo ratings yet

- IMS Engineering College Entrepreneurship MCQDocument10 pagesIMS Engineering College Entrepreneurship MCQAman yadav100% (1)

- Advance Account II MCQ FinalbsisjshDocument33 pagesAdvance Account II MCQ FinalbsisjshPranit Pandit100% (1)

- Core - Principles of InsuranceDocument32 pagesCore - Principles of InsuranceavinashkakarlaNo ratings yet

- Amalgamation, Absorption, Reconstruction, and General Insurance Company MCQDocument17 pagesAmalgamation, Absorption, Reconstruction, and General Insurance Company MCQbharat wankhedeNo ratings yet

- Ins 210-1-1Document40 pagesIns 210-1-1Daniel AdegboyeNo ratings yet

- Bcom Business Communicartion & MISDocument21 pagesBcom Business Communicartion & MISStanly ThomasNo ratings yet

- Business Regulatory FrameworkDocument30 pagesBusiness Regulatory FrameworkStanly ThomasNo ratings yet

- Chapter 1Document1 pageChapter 1Stanly ThomasNo ratings yet

- OEN India Organisational Study ReportDocument68 pagesOEN India Organisational Study ReportBASIL GEORGE100% (4)

- Apollo Tyres Ltd Organizational StudyDocument104 pagesApollo Tyres Ltd Organizational Studypurple0123No ratings yet

- NEWSDocument12 pagesNEWSgaithiacNo ratings yet

- ThanksDocument1 pageThanksrafaelasevedosNo ratings yet

- Os Report Fair For SubmissionDocument61 pagesOs Report Fair For SubmissionRakhi KarthaNo ratings yet

- DOSBox 0.74 ManualDocument25 pagesDOSBox 0.74 ManualBistock NababanNo ratings yet

- LicenseDocument6 pagesLicensemerrysun22No ratings yet

- InstallDocument2 pagesInstalldurgaprasadkankanalaNo ratings yet

- Osreportjobthomas 121103130341 Phpapp01Document115 pagesOsreportjobthomas 121103130341 Phpapp01Stanly ThomasNo ratings yet

- Group DiscussionDocument20 pagesGroup DiscussionUdhayasankar HariharanNo ratings yet

- NYJ Career Productivity Skills SW V1Document130 pagesNYJ Career Productivity Skills SW V1Ravi KrishnanNo ratings yet

- HMT OsDocument113 pagesHMT OsStanly ThomasNo ratings yet

- VectorDocument5 pagesVectorskv_net6336No ratings yet

- Sanctum of PadmanabDocument1 pageSanctum of PadmanabStanly ThomasNo ratings yet

- Unit 2 Classification of Parallel Computers: Structure NosDocument19 pagesUnit 2 Classification of Parallel Computers: Structure Nosjind_never_thinkNo ratings yet

- Product Life Cycle: Ken HomaDocument45 pagesProduct Life Cycle: Ken HomaDaedalus MoonNo ratings yet

- Classical Musicclassical MusicDocument1 pageClassical Musicclassical MusicStanly ThomasNo ratings yet

- MODULE 1 - Risk ManagementDocument15 pagesMODULE 1 - Risk ManagementJohn Luis MolanoNo ratings yet

- 5 AfDB PublicDocument13 pages5 AfDB PublicSeble GetachewNo ratings yet

- Glenn Greenberg at Columbia: How A Great Investor Thinks (Part 2) - Greg SpeicherDocument5 pagesGlenn Greenberg at Columbia: How A Great Investor Thinks (Part 2) - Greg SpeicherYen GNo ratings yet

- Thesis Topics Corporate FinanceDocument8 pagesThesis Topics Corporate FinanceGina Rizzo100% (2)

- AIT Participant Manual Complete Sept 1 2012 PDFDocument303 pagesAIT Participant Manual Complete Sept 1 2012 PDFadrianald7No ratings yet

- Analyzing Life Insurance ProductsDocument53 pagesAnalyzing Life Insurance ProductsNoura ShamseddineNo ratings yet

- Artificial Intelligence, Fintech, and Financial Inclusion 2023Document179 pagesArtificial Intelligence, Fintech, and Financial Inclusion 2023cerohad333No ratings yet

- National Coal Ash Report Embargoed For 3.4.19Document79 pagesNational Coal Ash Report Embargoed For 3.4.19petersoe0No ratings yet

- Innovation Loves CompanyDocument33 pagesInnovation Loves CompanycantuscantusNo ratings yet

- Papadakis (2005) - The Role of Broader Context and The Communication Program in Merger and Acquisition Implementation SuccessDocument20 pagesPapadakis (2005) - The Role of Broader Context and The Communication Program in Merger and Acquisition Implementation SuccessTeimur MunisNo ratings yet

- Insurance TermsDocument11 pagesInsurance TermsRenu SyamNo ratings yet

- Introduction For EHS Resume Sample Introduction For EHS Resume SampleDocument2 pagesIntroduction For EHS Resume Sample Introduction For EHS Resume SampleabzNo ratings yet

- Management 12th Edition Kreitner Test BankDocument30 pagesManagement 12th Edition Kreitner Test Bankmarmot.evocatei9z3k100% (22)

- BSBOPS403 Assessment 2Document21 pagesBSBOPS403 Assessment 2Naysha Blas Trujillo0% (1)

- Reserving Seminar 2018 IFRS 17 Overview: A Work in ProgressDocument7 pagesReserving Seminar 2018 IFRS 17 Overview: A Work in ProgressdouglasNo ratings yet

- p385 90Document35 pagesp385 90Edward MacDermidNo ratings yet

- Risk Management For Airline, 15.7.2019Document18 pagesRisk Management For Airline, 15.7.2019Tin Kyi Min100% (1)