Professional Documents

Culture Documents

2013-01-15 P8A SG (DBS Vickers) (REG) Post Conference Notes - A Friendlier 2013

Uploaded by

Kelvin Fu0 ratings0% found this document useful (0 votes)

37 views49 pagesCordlife Group

Original Title

2013-01-15 P8A=SG (DBS Vickers) (REG) Post Conference Notes_ A friendlier 2013

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCordlife Group

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

37 views49 pages2013-01-15 P8A SG (DBS Vickers) (REG) Post Conference Notes - A Friendlier 2013

Uploaded by

Kelvin FuCordlife Group

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 49

In Singapore, this research report or research analyses may only be distributed Recipients of this report, received from DBS

BS Vickers Research (Singapore) Pte Ltd

to Institutional Investors, Expert Investors or Accredited Investors as defined in the (DBSVR), are to contact DBSVR at +65 6398 7954 in respect of any matters arising

Securities and Futures Act, Chapter 289 of Singapore. from or in connection with this report.

www.dbsvickers.com

Refer to important disclosures at the end of this report

ed: SGC/OY / sa: TW

Regional Equity Strategist

Joanne Goh (65) 6878 5233

joannegohsc@dbs.com

DBSVickers regional research team

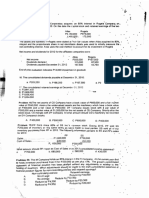

Fig. 1: Top 10 companies with strong interest

EPS

CAGR

Price Mkt Cap Target FY13 FY12-14

10-Jan-13 US$m Price PE (x) (%) Rating

1

Wing Tai Holdings Ltd S$ 2.08 1,332 . 3.2y

2

Central Pattana Bt 82.25 5,813 90.00 33.6 19 Buy

3

Charoen Pokphand Foods Bt 33.25 8,540 42.00 13.6 66 Buy

4

Quality Houses Bt 2.48 642 3.00 11.5 24 Buy

5

UEM Land RM 2.10 3,004 2.10 23.5 12 Hold

6

Evergrande Real Estate HK$

4.52 8,741 4.70 5.7 22 Buy

7

Religare Health Trust S$ 0.90 580 0.97 4.4* na Buy

8

Far East Hospitality Trust S$ 0.985 1,292 1.09 6.0* 5* Buy

9

Thai Union Frozen Products Bt 71.25 2,700 91.00 12.6 28 Buy

10

Ascendas Hospitality Trust S$ 0.97 638 0.98 4.3* na Buy

Source: DBSVickers

* FY13 Dividend Yield and DPU CAGR 12-14

Fig. 2: MSCI FEXJ net % of companies with upward

revisions upgrades can be expected

-80

-60

-40

-20

0

20

40

00 01 02 03 04 05 06 07 08 09 10 11 12

(%)

Source: IBES, Datastream

Fig. 3: Wide Asia earnings yield gap over US bond yield

provides room for PE expansion rally is sustainable

0

1

2

3

4

5

6

7

8

9

10

02 03 04 05 06 07 08 09 10 11 12 13

(%)

Equity is

cheap

Equity is

expensive

Source: IBES, Datastream. Dotted proforma yield gap when US 10 year

DBS Group Research . Equity 14 Jan 2013

Regional Market Focus

Post Conference Notes

A friendlier 2013

3,000 meeting requests from 400 clients for 84

companies concluded the successful 3-day Pulse of

Asia conference held in Singapore

Property companies made up close to 40% of

companies which were showcased; investor

interest remain strong in Asia property companies

Guidance from companies were generally upbeat,

seeing 2013 as a friendlier environment; concerns

over tighter labor and rising labor costs were

frequently raised

Industrials and consumer companies likely to see

earnings upgrades

Property companies continued to be driven by positive

domestic economy and low interest rates. There was

enthusiastic attendance at meetings with property

companies. We believe the positive domestic sentiment

and low interest rate environment will continue to

support sector interest with an asset reflation theme.

Guidance from industrials and consumer companies

were generally upbeat. Most companies have capex

plans but are prudent in assessing business

opportunities. Costing pressure will come mainly from

rising labor costs; raw material costs are generally not an

issue.

Exceptionally strong Interest in Thai companies. Thai

companies accounted for three out of five companies

that attracted the strongest interest at the conference.

Thailands transport minister gave a detailed

presentation on Thai infrastructure projects. These

projects are likely to drive growth in Thailand over the

next few years. We have an Overweight weighting for

Thailand.

Earnings and forecasts may be raised following positive

guidance. We had upgraded Tat Hong following the

conference.

Key themes for 1H13: 1) Buy Thailand; 2) TIP property

sector will outperform in 1H; 3) current rally is

sustainable premised on potential for earnings upgrades,

especially industrial and consumer stocks.

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 2

Key interests in Property and Thailand

We featured a record number of 84 companies from

Singapore, Malaysia, Hong Kong, China, Korea, Indonesia,

Thailand and Philippines in the DBSV Pulse of Asia Conference

last week. There were 3,000 meeting requests from 400

clients. The attendance is one of the highest in recent years

with a median average of 32 meetings for each company.

Interest is strong across the board particularly in the property

sector and Thai market. Interest in ASEAN remains strong

despite investment focus having turned toward the North Asia

markets.

Property companies made up close to 40% of companies

which were showcased. Interest in the sector continued to be

driven by strong domestic economies and low domestic as well

as global interest rates, which are driving asset reflation.

Singapore kicks off the reporting season this week starting

with the REITs, resulting in fewer REITS attending our

conference. Clients were mostly interested in residential

developer Wing Tai, wanting to know the impact of the

governments repeated attempts to cool down the red hot

property sector. Indeed, over the weekend, the government

had introduced more property control measures. However, we

see this as a pre-emptive move to avoid further price

speculation and advice prudence before the white paper on

population is released. Concerns over a slower Singapore

economy potentially affecting the Services sector, especially

Hotels, also saw strong interest towards hospitality REITs.

Investors should look for stocks that could deliver earnings-

accretive acquisitions now that dividend yield gaps have

compressed.

There was also strong interest in Thai, Indonesia, the

Philippines, Malaysia and China property firms.

Wage costs rising but raw material costs were generally stable.

There were concerns over rising wage pressure in most Asian

markets amid regulations to raise minimum wage (Thailand,

Indonesia, Malaysia) and tightening labor markets (Singapore,

China). Labor-intensive sectors like plantations, ports, and

shipbuilding in China, are likely to see higher wage pressure.

However, companies are benefiting from stable or falling raw

material costs, although some may not feel the benefit until

2H. CP Foods may be one of the cheapest consumer stocks in

the region after the sharp price correction last year, but

earnings is expected to turnaround only in 2H.

Highlights in Oil & Gas sector

Among the eclectic list of industrials, most gave positive

guidance with many in expansion mode, adding capacity in

anticipation of stronger volumes as the global environment

improves. Companies with scalable businesses, such as those

in the oil & gas sector, are likely to benefit the most from this

modest recovery. We also raised earnings for Tat Hong after

the conference as its crane rental business is reaping higher

margins in the oil & gas segment.

Asia regional markets: Negative real rates boosting Asset

inflation

Source: Datastream, DBS. real rate: Saving rate minus Inflation

We also hosted more than 100 participants in our

presentations on the Philippines, China and Thailand markets.

Philippines. The market had risen in a straight line over the

past four years, but the speaker highlighted some risks during

the lunch presentation titled What can turn sour?. In our

view, the top down picture still looks strong for the Philippines

as its external balance is one of the strongest among ASEAN

countries due to BPOs, which are less volatile than exports, and

OFW remittances. Consumption had been the main growth

driver and will continue to be so, but upside growth surprise

will have to come from successful PPP in infrastructure projects

to justify the lofty valuations.

As it is, we do not see potential for upside surprises in the PPP.

We have initiated Philippine as Neutral and recommend

consumer stocks as main beneficiaries of the strong domestic

economy. Government spending is expected to be strong prior

to the regional elections in the middle of the year.

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 3

Philippines: Electricity sales growth - economic growth

proxy

China. DBSV is upbeat on China with a forecast Philippines to

cont The challenge imarkets to Among these 2 of our main

concerns are infrastructure and Indeed

some risks of t While the guidance for second half / 2013 is

nothing to write home about companies in general do not

expect second half to be worse than first half. The

environment will be conducive for clearing inventory and filling

up order books as scheduled, with less stress as expected on

Source: Meralco, First metro secs

China. DBS is upbeat on China and has one of the highest

2013 GDP growth forecast on the street at 9%. DBS China

economist, Chris Leung, spoke on the new government

promoting urbanisation in China, which should support the

need for FAI spending to boost headline growth. Urban FAI in

central China has gained prominence.

China: Urbanisation in smaller cities with younger

populations (% of FAI breakdown by region)

Source: CEIC

Thailand. This year, Thailands Minister of Transport presented

on Thailands infrastructure plans for the next 10 years. The

focus is on Dawei deep seaport and industrial estate

development project that is projected to cost US$10.7 bn.

Dawei is at the south-western Thai / Myanmar border. The

industrial estate will include heavy industries such as: steel

mills, oil refineries, petrochemical complex, fertilizer plants,

power plant, and other utility services including cross border

road and rail links with connecting transmission lines, as well

as residential and commercial developments.

Thailand: Potential for fiscal boost in infrastructure

spending with low budget deficit

Source: Datastream, DBS

Key themes for 1H13. In conclusion, our major takeaways from

the conference are the following key themes:-

1) Thai/ Indonesia/ Philippines property should continue to

outperform the region in 1H13

2) Interest in Chinese stocks is still limited to big caps and

property stocks. Conviction in mid caps is still low. We

believe as headline disappointment in China eased,

sentiments are likely to improve. Rally which is supported

by improving confidence is likely to be sustainable and

interest could spread to the mid caps and small caps

names.

3) We are more convicted in our Thai overweight as investor

interests are stronger than expected. The infrastructure

plans are clear and if executed should bring bountiful

benefits to Thailand and the region. Parts of the

infrastructure works have already commenced.

4) Mid caps oil and gas are still expected to outperform.

5) Yield gaps in Singapore REITS are still seen as a relatively

attractive investments

6) Current rally is sustainable given potential for earnings

upgrades, especially with industrial and consumer

stocks

-5

-4

-3

-2

-1

0

1

2

2005 2006 2007 2008 2009 2010 2011 2012

0

1

2

3

4

5

6

Policy rate (R)

Budget deficit (L)

(%) (%)

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 4

SINGAPORE CORPORATES

CORDLIFE GROUP

(NOT RATED S$0.58; TP: S$0.65; CLGL SP)

Number of clients met >40

Salient points in management presentation

1) Possible acquisition of assets from Australian entity - in

particular assets in India, the Philippines and Indonesia that

could boost revenue by about 35%. Has enough money from

IPO to fund acquisitions. Company operating cashflow is

earmarked for dividend payments.

2) More room to improve penetration rate via education.

Stable growth in Singapore and HK, driven by increasing

penetration. Long term contract with customers for 21 years in

Singapore, and 18 years in HK.

3) Adequately insured - maximum payout S$4m per case; total

insurance premium paid last year about S$50,000 (vs revenue

of S$29m)

Data points and other guidance made:

1) Market share in Singapore currently stands at 70% of

private cord blood bank. Penetration in Singapore of about

28%. Estimated implied growth of about 10-15%.

2) 48% of customers opting to pay 21 yrs; 40% opting for

annual plan; the rest are on 10 year plan. Upfront payment has

been reduced to S$1600 from about S$2000 previously due to

economies of scale. Currently still about S$200 more than

competitors.

3) Cordlife has done eight successful transplants so far, vs

about 120 transplants for Singapore Cord Blood Bank (public

bank).

Three frequently asked questions (and response by

management)

1) What were the reasons for higher market share? Company

believes in accreditation and has done eight transplant vs none

by its competitors. Triple blood system, has six markers in

BIOSAFE bag. It is able to get 97% recovery of stem cells from

cord blood drawn, compared to 87% from normal blood

recovery system. It has also has put more effort into marketing.

2) Public vs private. Why do for public if private is free?

Singapore Cord Blood Bank has a target inventory of 10k cord

blood units, so it will discard some if the ethnic match is

common. Cord blood may not be available to donors when it is

needed years down the road. The company is educating clients

on this point.

3) Risks on contracts? The company is not liable for force

majeure events, such as natural disasters. It is also not liable for

cord blood that has been contaminated during collection and

not suitable for storage. It will only provide refunds. It is liable

for the matching of cord blood, or payment of up to

US$25,000. Professional indemnity of up to S$4m payout, as

per other healthcare players, such as Parkway, Raffles Medical.

4) What is the lifespan of the stem cells collected?

There are different studies done and results vary as the oldest

cord blood bank is probably <50 yrs. So far studies have shown

that the cells stored are still viable and some studies even

predict a lifespan of 1000 yrs!

5) How are revenues recognised?

Those clients who paid up front are recognised on a deferred

basis while those on an annual payment scheme are

recognised based on a discounted cashflow basis (discount rate

10%)

We do not cover this counter. Non-rated.

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 5

COSCO CORPORATION

(FULLY VALUED; S$0.985; TP: S$0.80;

COS SP)

Number of clients met: 17

Salient Points in Management Presentation:

1. Offshore enquiries remain healthy

2. Cosco has scaled up and has improved on project execution.

3. Offshore remains the bright spot while the shipbuilding

outlook is still challenging

Data-points and other guidance made:

1. New order wins target will be announced in Feb. Probably

will be similar to US$2bn achieved last year.

2. Gross margins for offshore is expected to hover around 10%

on average.

Three frequently asked questions (and response by

management)

1. Outlook for new orders

- Cosco will focus on offshore orders in the coming two years

and expect stable demand from this segment. Shipbuilding

orders may improve slightly from 2012 but remain sluggish as

supply is abundant in spite of declining bulk carrier deliveries in

2013.

2. Cancellation or rescheduling risk

- most of the shipowners are looking to take deliveries on

schedule except a couple of units that have been postponed

from Dec to Jan, which is the industry norm.

3. Inflationary cost pressure

- Steel cost will likely be rather stable and labour cost may

increase in single digits only

CWT (NOT RATED; S$1.26; CWT SP)

Number of clients met: 53

Salient Points in Management Presentation:

1. The majority of CWTs commodity supply chain

management business (80% of 9M12 revenue) is related to

copper, lead and zinc concentrates. The group is also looking

to expand into refined metals, diesel, gasoline, naphtha, coal

and iron ore.

2. The profits from commodity trading come from (a) sourcing

(e.g. buying copper from the mines) (b) logistics/freight (i.e.

finding the cheapest way to transport the commodity from the

mine to a port) (3) onshore logistics (e.g. finding the lowest tax

bracket on which to import the commodity, finding the best

location in which it can deliver the goods to its customers).

CWTs historical strength has been onshore as it has secured

exclusive access to critical ports or delivery points.

3.CWTs freight logistics arm (7% of 9M12 revenues) is the

third largest LCL (less than container load) consolidator for sea

freight. This business is involved in the collection of smaller

parcels from various freight forwarders and consolidating the

volumes for the larger logistics players such as DHL and DB

Schenker.

Data-points and other guidance made:

1. CWT will have over 11.1m square feet of warehouse space

under management by 2014.

2. The group trades about 1.4m MT of base metals with 2m

MT target near term.

3. The group has about US$1.2bn of uncommitted lines, 50-

60% of which has been utilised.

Three frequently asked questions (and response by

management)

1. Does CWT intend to sell more of its warehouses? The group

will only sell when it requires cash to construct a new

warehouse. For example Pandan Logistics Hub was sold in

2012 to fund the construction of CWT Cold Hub 2 and the

expansion of Toh Guan Road East.

2. How does CWT manage the commodity price risk in its

supply chain manager business? CWT notes that it does not

take on price risks. This is achieved by entering into a futures

contract when it sources the supply of copper concentrate.

When it finds a customer for the concentrate, it then enters

into another futures contract to hedge against any price risks.

This is required by the banks that provide financing to CWT.

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 6

60% of the hedging is conducted by the banks themselves,

with the remaining 40% down by CWT with documented

proof to the banks.

3. Would CWT be interested in expanding to Johor, Malaysia?

CWT is not interested as there is only a 10% cost (consisting of

warehousing, labour and freight) differential to Singapore. In

addition the group is also concerned about the freight volumes

available there.

DEL MONTE PACIFIC LIMITED

(NOT RATED ; S$0.685; DELM SP)

Number of clients met: c. 30

Salient points in management presentation

1) Its focus is on packaged beverages vs concentrates, and

fresh fruits vs contract pack for fruits.

2) 75% dividend payout maintained.

3) It shared its long-term optimism. Five main points by 2015,

including termination of supply contract in Nov 2014, change

in pricing model for fresh pineapple contract, and expiration of

toll contract with San Miguel that has lower margins.

Data points and other guidance made:

1) Branded accounts for 70% of business vs 30% of OEM.

2) General trade of 70%. Penetrate over 90k stores out of

500k. Relevant stores would be about 150k sari sari stores.

Three frequently asked questions (and response by

management)

1) The reason for sales decline in 2009? It had problems with

pineapples. I tried using outgrowers programme but the

tonnage declined. 95% of pineapples are produced internally.

2) Capex? c.25m per year.

3) Biggest competitor? Dole is the largest competitor overall,

and Del Monte in Asia. Heinz in the Philippines for the culinary

segment.

Recommendation: we do not cover the stock currently.

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 7

EZION HOLDINGS

(BUY S$1.88; TP: S$2.12; EZION SP)

Number of clients met: 27 (half day of meetings)

Salient Points in Management Presentation:

1. Expect robust demand for their liftboats/service rigs to

persist over the next five years at least, driven by the need for

platform maintenance.

2. Focus on maintenance phase of oil field lifecycle, less

volatility in oil companies budget in this segment.

3. Strategy going forward need to balance project portfolio

of liftboats (higher margins, ROE, but longer gestation period)

vs refurbished service rig projects (lower margins, ROE, but

quicker time-to-market); also depends on what customers

require at the end of the day.

Data-points and other guidance made:

1. Ratio of offshore platforms to liftboats in Asia Pacific.

2. Age profile of offshore platforms.

Three frequently asked questions (and response by

management)

1. What do the new strategic shareholders bring to the table?

Tan Boy Tee brings years of experience and his industry

network as founder/CEO of Labroy, as well as his ability to co-

fund the equity portion of future potential projects. EDBI is

more of an endorsement of Ezions niche and first-mover

advantage in the liftboat space in Asia Pacific, which has the

potential to set a new industry standard for platform

maintenance in the sector. Ezion hopes EDBI's presence will

help open doors to two Asian-based national oil companies for

which EDBI has existing traction with.

2. Is Ezion likely to raise equity capital in the foreseeable

future?

Will not do so for general fund raising purposes management

is very adverse to dilution of existing common shareholders,

unless it spots compelling acquisition/projects (e.g. earnings

accretive or good business at bombed out valuations) that

require funding.

EZRA HOLDINGS

(BUY (UR) S$1.325; TP: S$1.30 (UR); EZRA SP)

Number of clients met: 40

Salient Points in Management Presentation:

1. Sees no slowdown in subsea market; strong offshore activity

levels as clients continue to push out new projects

2. Full subsea fleet will be able to address the entire spectrum

of deepwater subsea construction projects

3. Day rates for large AHTS have been inching up; expect them

to strengthen significantly in 2H 2013

Data-points and other guidance made:

1. Tender book for subsea projects currently stands at

~US$4bn; 30% historical hit rate

2. Subsea fleet utilisation rate to be much improved y-o-y;

towards high 70s/low 80s

Three frequently asked questions (and response by

management)

1. Administration cost trend: Management guides that most

of the hiring required for the combined Ezra-AMC group

hasbeen done, just another team of 100 people are needed to

support the operations of Lewek Constellation subsea vessel

when it is delivered in 2014

2. What is the current subsea orderbook, and how much is to

be recognized over FY13/14?

Currently at ~US$900m, most (60-70%) to be booked in FY13;

remainder in FY14-16

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 8

FAR EAST HOSPITALITY TRUST

(BUY S$0.985; TP: S$1.09; FEHT SP)

Number of clients met: >30

Salient Points in Management Presentation:

1. Management advocates their medium term positive view on

the sector given the opening of various attractions (West Zone)

and River Safari underpinning growth in the sector for 2013. It

believes that demand will continue to outstrip supply and

occupancy will remain high at 85pct.

2. Asset refurbishment plans on track. Post refurbishment rates

are in excess of 5-10pct portfolio wide. Refurbishments will

complete by end of 1Q13.

3. Its acquisition pipeline is one of the strongest amongst peers

which is likely to be ready to make acquisitions within the next

18 months. Prior to that, in the immediate term the group has

signed a non-binding MOU with Straits Trading to acquire

Grand Rendezvous Singapore

Data-points and other guidance made in response to

questions:

1. Demand for rooms have remained fairly weak in Jan13 given

that the corporate market has yet to start fixing meetings and

start traveling before the Chinese New Year but Feb is likely to

be a good month. Corporates rates are signed in excess of 5pct

growth y-o-y. It has receive positive feedback from refurbished

rooms in Orchard Parade Hotel and the Landmark Hotel and it

has been able to sign an increased number of large corporate

deals for it.

2. Funding of Grand Rendezvous Hotel not decided yet but

could need new equity given its size. However, management

remains confident that it will be an accretive deal. Gearing

target of between 30-35pct.

3. Its serviced residence portfolio is seeing some weakness, due

to weaker demand from the financial sector but it is not

significant. Occupancy is expected to remain above 80pct.

However, booking visibility is getting shorter (lesser than one

year leases), more of three to six months rolling, thus its ability

to raise rates is limited but still positive

We have a buy call with TP 1.09. Potential upside coming from

acquisitions not factored in at this moment

GOLDEN AGRI RESOURCES

(NOT RATED S$0.66; TP: S$0.71; GGR SP)

Number of clients met: c.40

Salient Points in Management Presentation:

1. The group revealed that the 16k ha planted oil palm estates

it had acquired (announced 21 Dec12) has an average age of

13 years. The group purchased this asset from a large group

that they had declined to disclose. The acquisition price was

US$11,100/ha. GGR also revealed that US$220m of further

investment in Verdant Fund LP was for an acquisition of c.17k

ha of planted land, which was part of the land acquired in

point 1. The rationale: The fund was initially formed to

develop a c.200k ha concession in Liberia for which GGR had

invested US$50m. The total investment cost needed for this is

US$1.5bn; but so far there are no other investors in the fund.

Hence, to help attract other investors for Verdant Fund LP, it

was injected with this asset. At this point GGR has yet to

provide further information regarding the terms and conditions

of its investment in Verdant Fund LP. According to GGR,

Verdant Fund is run by an ex-McKinsey professional manager.

2. The fund raising exercise through CB was primarily on the

cost consideration (i.e. 2.5% vs. 7-8% through straight bonds).

It was revealed that it did not employ bank loans because it

had hit the banks' legal lending limit. The group will utilise

proceeds from warrants exercise this year (c.US$300m) as well

as through various fund raising efforts (including US$400m CB

and RM1.5bn Sukuk) for refinancing and M&A opportunities.

3. The group is looking into further investments for the

upstream (c.15% IRR) and downstream (c.20% IRR). It is

considering further acquisitions in Indonesia as well as refining

capacity in India. In India, it will form a partnership with a local

entity; and is looking at opportunities in Southern India. The

investment amount and capacity will still depend on whom it

chooses to partner with; and currently it is in talks with various

parties.

Data-points and other guidance made:

1. Capex will remain at between US$400m and US$500m;

dividend payout will go back to 20-30%

2. Expansion target remains 20-30k ha (c.20k ha of which is

organic). The group will continue to pursue acquisitions of 10-

15k ha this year. There is a higher likelihood that own planting

will reach 20k ha this year (realised expansion over the past

two years is 10-15k ha); as the group had made adjustments to

the changing regulatory environment and higher compensation

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 9

demands over the past two years; such as allocating more

resources to areas of expansions and better socialisation.

3. Cost to maturity is US$7k/ha over three years (inclusive of

the mill, which is approximately US$1,500/ha).

Three frequently asked questions (and response by

management)

1. Are there cost pressures going forward?

The group expects its cash cost of production/MT to increase

by c.5% y-o-y this year (from around US$300/MT last year),

taking into account the various increases in minimum wages

throughout Indonesia. It had undertaken a cost analysis impact

and found that the hectarage-weighted labour cost increase

would be 15% this year, or approximately 5% higher than

normal. Labour cost accounts for approximately 45% of the

group's overall cost; while fertiliser cost accounts for 30%. It

expects fertiliser cost to increase by less than 5% this year

(after imputing that CPO output will grow at the lower end of

5-10% range this year).

2. What is the group's outlook on CPO price (inventory

situation)?

The current weakness is mostly coming from China, as the

substitution from soybean oil is not happening. This was

because China had a significant soybean meal requirement and

was therefore heavily importing soybeans - thus creating ample

supplies of soybean oil. However, GGR believes this is

temporary and expects the CPO price to rebound to a more

sustainable level of c.US$1,000/MT (perhaps as soon as 1Q13),

as inventory levels normalise (i.e. to below 2m MT in Malaysia,

quoting Oil World). This is based on expectations that 1Q13

production will seasonally drop and exports to continue to

remain strong. According to the company, CPO prices have

hovered around US$1,000/MT over the past two years and

fundamentals have not changed much. Unless the CPO prices

drop to US$500/MT, the group will continue to focus on

improving its output and expand organically as well as

inorganically. GGR expects to sell more inventory in 1Q13 (as

its strategy to hold stock in 3Q12 backfired).

3. Why has operations in China incurred losses and what is the

4Q12 outlook?

High input cost, combined with restrictions on domestic

cooking oil prices made worse by shadow financing. 4Q12

situation should improve because soybean prices have

declined; and as inflation has eased, there should be less

tightening (therefore less shadow financing). They expect no

operational differences with Wilmar.

This counter is not covered; but we have a fair value estimate

of S$0.71 (excluding new 16k ha of planted land acquisition).

Will share amended fair once data is imputed.

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 10

GOODPACK

(HOLD; S$1.89; TP: S$1.95; GPACK SP)

Number of clients met: 35

Salient Points in Management Presentation:

1.Goodpack intends to grow its revenue in excess of US$300m

(FY12 US$177m). This will come from increased penetration

of existing customers, growth in existing markets and

expansion into the automotive sector.

2. Given its strong balance sheet, for new IBCs (intermediate

bulk containers), 50% will be leased with the remainder being

owned. Goodpack may also look to buy the IBC's that it is

currently leasing from the banks.

3. Goodpack is targeting a 10-15% marketshare in automotive

parts over the next five years. This will drive Goodpack's

medium-term growth outlook.

Data-points and other guidance made:

1. Current utilisation stands at 58% up from 56% last year.

The target is to reach 60% with a potential maximum

utilisation rate of between 65-70%

2. Automotive parts are only expected to contribute 2% of

FY13 profits.

3. Each IBC currently costs US$250

Three frequently asked questions (and response by

management)

1. What are the competing transport solutions? The main

competition are wooden boxes/pallets and corrugated boxes.

There are also some providers of steel and plastic boxes.

Goodpack's steel IBC's have an advantage compared to

wooden boxes as there is no risk of wooden contaminants. For

corrugated boxes and plastic boxes, steel IBC's have a higher

carrying capacity. Goodpack also has the advantage of a global

network that other steel box companies do not have.

2. What is the current margin outlook? Goodpack expects

variable costs as a percentage of revenue to remain stable.

3. What is the difference between Goodpacks and Brambles

business models?

Management explained that Brambles primary business is the

leasing of pallets for FMCG (fast moving consumer goods) with

a domestic focus. Goodpack in contrast is mainly involved in

the international movement of rubber and automotive parts.

HUTCHISON PORT HOLDINGS TRUST

(BUY; US$0.82; TP US$0.88; HPHT SP)

Number of clients met: >30

Salient Points in Management Presentation:

1. Expect c. 5% throughput volume growth in 2013, driven

mainly by higher transshipment and intra-Asia volumes. Europe

remains worrying whilst some signs of a mild US recovery

2. Cost pressures will mainly come from higher labour costs

(+10% y-o-y in PRC and +5% y-o-y in HK), as well as a slightly

higher tax rate (effective 16% in 2013) and higher interest

costs (on refinancing of existing loans and more debt to fund

capex).

3. ASPs to move 2%-3% higher, more or less in line with

inflation.

Data-points and other guidance made:

1. HK$3.5bn more in capex to be spent (HK$1bn spent so far)

on Westport Phase 2 over 2013 to 2015, which will be roughly

evenly distributed. Total capex for 2013 estimated at HK$1.5bn

(including recurring/maintenance capex), funded by debt

2. Can make DPU guidance as per prospectus (US 6.6cts) due

to capex deferral but as 2013 will see significant capex, DPU is

likely to be lower (already previously guided to the market).

Three frequently asked questions (and response by

management)

Frequently asked questions mainly revolve around the above

key points.

Our take

Nothing too surprising said by HPHT. The trust's prospects are

largely determined by the macro-economic environment, and

should see some core earnings improvement on a slightly

improved world outlook in 2013 and stronger China growth.

Although we expect DPU to decline in FY13 as its capex plans

resumes, the dividend yield of over 7.5% is attractive in our

view

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 11

JARDINE CYCLE & CARRIAGE

(NOT RATED; S$48.68; JCNC SP)

Number of clients met: 42

Salient Points in Management Presentation:

1.JCC believes low cost green (LCG) cars in Indonesia will be

more headline grabbing than actually resulting in a substantial

boost to profits. This is because of the low price point and low

profitability of these cars. LCG may also boost headline Astras

marketshare data. In addition there is a risk of the LCG cars

cannabilising sales of cars at the higher price points. While

Astra will have the first mover advantage, other Japanese car

makers also have models at the lower price point.

2. Vietnamese business has suffered from high inflation and

political instability over last few years. Sales were down 30% y-

o-y. JCC does not expect the situation to improve anytime

soon.

3. The heavy equipment business (United Tractors) has not

been good as low coal prices triggered coal miners to curtail

investment in new equipment. The business was also impacted

by price discounting. This resulted from an oversupply of

equipment (mainly Hitachi) in China being sent to Indonesia. In

addition the coal miners have reduced strip ratios which

impacted the contract mining business. Currently operating

conditions are ok but there has not been any improvement.

Data-points and other guidance made:

1. The group spends about US$0.5bn on replacement/new

equipment for its contract mining business and own mines.

2. NPLs in the vehicle finance business should improve given

the imposition of 20% down payment for new car purchases

last year.

Three frequently asked questions (and response by

management)

1.Do you see any new competitive threats in the Indonesian

automotive space? The group does not see any significant

threats near term given the groups advantage from having a

large distribution network and local assembly/manufacturing.

The South Korean manufacturers such as Hyundai and Kia are

trying to enter the market but as they dont have local

production it is hard for the company to gain scale to compete

effectively against Astra. In addition the strong growth by

Honda last year should not be a concern as Honda was severely

impacted by the Thai floods the previous year.

2.Is there any risk of oversupply given increases in 4W

production capacity in Indonesia? JCC notes that some of its

competitors are increasing production by 10-20% but believes

there should be sufficient demand to absorb the increase. Mr

Chiew (the CFO) however would be nervous if everyone

expanded aggressively.

3.What are JCCs growth plans? The group will continue to

invest mainly in its Indonesian automotive business. They are

also looking at automotive opportunities in the Philippines.

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 12

RAFFLES MEDICAL

(HOLD S$2.89; TP: S$2.59; RFMD SP)

Number of clients met > 32

Salient points in management presentation

1) Revenue CAGR of 16% since 1994, showing strong

performance and relative resilience of the healthcare sector,

even in 1998, 2001, 2003 and 2009.

2) Growth through primary care services, expansion of hospital

in Singapore. Submitted tender for greenfield hospital in HK.

3) Hospital expansion expected to start in 2013, subject to

finalisation of plans, with a 24-month timeframe.

Data points and other guidance made:

1) Still in discussion with authorities on a provisional plan

approval for its proposed specialist medical centre at Thong Sia

building at Orchard. Unsure how long this would take.

2) Bed occupancy still stays at c.50-60%. No guidance on the

outlook. Our sense is it is stable, and we should see a low

teens growth in financial numbers.

3) Corporates account for about 50-60% of Healthcare

services, and one-third of hospitals.

Three frequently asked questions (and response by

management)

1) How are the doctors compensated and what are their

contract terms? Doctors are on contracts, for about two to

three years. Compensation via salary, profit share and share

options. Profit share based on business division and matrix.

Structured to benefit the group.

2) What percentage of patients are foreign? About one-third

of patients are international patients as Singapore develops its

medical tourism.

3) Funding of expansion. Estimated cost is $80-100m, and met

by internal cash at c.$60m and internal cash flow of c.$40-

50m/ yr.

RELIGARE HEALTH TRUST

(BUY S$0.90; TP: S$0.97; RHT SP)

Number of clients met: 50

Salient points in management presentation

1) Fortis has been growing 6% q-o-q. During crisis, healthcare

is relatively resilient. Outlook has not changed since the listing.

2) 96% are operational assets and low risks of development

risks. Focused on secondary and tertiary care. Acquired all

assets of fortis in India, except one which is pending litigation.

Acquisitions going forward are likely to be in India.

3) Gurgaon clinical establishment has agreed upon fees. Expect

a ramp up to make up for the expiry of distribution waiver by

FY15. In a worst case scenario, distribution could stay the

same. Expect DPS to have an upside.

Data points and other guidance made:

1) Hedged at 47.28 for FY14, no significant changes since IPO.

2) Average revenue per bed growth of 7-8% per day guided in

prospectus. Assumed 17-18% revenue growth from Fortis in

model in prospectus.

3) 75% hospital revenue is cash basis, 25% mixture of

insurance, pension funds.

Three frequently asked questions (and response by

management)

1) What will be the driver to increase bed capacity? Depends

on the occupancy. First 48 hours account for about 80% of

revenue. Depending on needs, it may make increases. Optimal

occupancy is about <80%. Occupancy not based on

seasonality, except for summer months due to as malaria.

2) How much does bed prices increase by? Tends to track

inflation.

3) Rental coverage is 2.6x. Rental on EBITDA cover. Rent as a

percentage of reveneue is about 15%. Fortis matured has

about 27-28% margins. Stabilisation period is about three to

four yrs on average. Shalimar Bagh is about 14 months.

4) Target gearing? Does not envisage going beyond 30-35% in

the long term. Currently the gearing is at 6%.

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 13

TAT HONG

(BUY S$1.455; TP S$1.80; TAT SP)

Number of clients met: >30

Salient Points in Management Presentation:

1. Growth momentum will continue - management sees

improving demand driven by 1) infrastructure spending in

Singapore, Malaysia, Thailand, and Hong Kong 2) Australia's

O&G projects. Capex plans demonstrates management's

confidence.

2. Crane rental rates and utilisation will be on the uptrend

fuelled by bouyant crane demand. Current rates are still 15%

off its 2008 peak, currently over S$500/month/ton.

3. Competitive advantage will strengthen with the expansion

of bigger tonnage crane units in its coming fleet expansion

plans.

Data-points and other guidance made:

1. Guided sustainable utilisation to be 80%. Targets

FY13F/FY14F utilisation to be 75%/80%. Highest ever recorded

in a single month was 88%. 2Q13 utilisation was 73%.

2. Rental rates have increased 15% for the past 15 months up

till Sept 2012, currently at over S$500/month/ton.

3. Capex is budgeted at S$50-70m for c.40 mobile/crawler

cranes. Tonnage to increase by 10,000 tons.

4. Payback period for an average crane is approximately three

to four years.

Three frequently asked questions (and response by

management)

1. Competition - Competitors will take longer time to reach

TAT's scale since they have smaller fleet sizes, lower and

limited tonnage range. TAT has higher capacity cranes and a

fleet size that cannot be replicated overnight. TAT's more

robust fleet management ensures it delivers most large

contractors' requirements on a regional basis. Also there are

not many players in the market. TAT is the region's no.1.

Closest competitors are Tiong Woon (fleet size 200), JP Nelson,

Hwa Tiong.

2. Utilisation rates - See data points and guidance

3. Visibility of contracts and contract lengths - Real time

visibility is six months. Rental demand is typically pre-booked

up to six months ahead for an average rental period of three to

six months. Australia's O&G market averages one to one-and-

a-half years in rental period.

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 14

HK/CHINA CORPORATES

CC LAND

(HOLD HK$3.00; TP: HK$2.00; 1224 HK)

Number of clients signed up: c. 30

Salient Points in Management Presentation:

1. FY13 is a turnaround year for CC Land from loss making to

profit making. 2. CC Land expects to enter into a stable

growth stage of 20% to 30% per annual growth in both

presales and completion. 3. CC Land took opportunities to buy

land in year-end 2012. The company is looking for

opportunities to enter Xi'an and Kunming in 2013. It had a

project in Kunming, but it has been completed. Therefore, CC

Land is looking for a new project there.

Data-points and other guidance made:

1. FY13 contracted sales target has not been set but should be

at least Rmb8.5bn compared with FY12's over Rmb7bn. 2.

1.5m sm saleable resources in FY13. CC Land's ASP of

residential units may go down slightly to c. Rmb7k/sm from

FY12's c. Rmb8k/sm due to more mass market products, while

commercial portion with a higher ASP may compose a higher

percentage than in FY12. 3. Net debt ratio by end-FY12 is

expected to maintain low at c. 20%.

Three frequently asked questions (and response by

management)

1. Please give market updates in China especially in Chongqing.

Chengdu market was picking up in 2H12 in general. CC Land

did well in Chengdu due to the rolling over of more mid-end

smaller sized units to meet the end-user demand. Chongqing

has no HPR policy but the market was very weak during Sep

2011-Feb 2012 as buyers were waiting for more policies. After

that, end-user demand started to enter the market when

policies looked stable.

2. Any worries about policy coming back? As affordability in

Chongqing and Chengdu is at a fair level at 6-7x of people's

annual income. There is not much need for further tightening.

We only expect to see 5% to 10% growth in price in 2013

which is acceptable in the government's view.

3. What's the expected margin of the new land acquired in

Nov/Dec 2012? c. 20% based on the current selling price. It

can be higher in later phases when prices go up.

CENTRAL CHINA

(BUY (UR) HK$2.85; TP: HK$2.39 (UR);

832 HK)

Number of clients signed up: c. 30.

Salient Points in Management Presentation:

1. Central China will continue to focus on county level cities in

FY13. As Henan has been designated as the core of China's

Central Economic Development Zone. Urbanisation progress

will speed up and more investments from the central

government is expected to be in place. Central China's strategy

is consistent with this macro trend.

2. Construction pace may further speed up in FY13. High asset

turn is what the company will continue to focus on. The

projects acquired in FY12 may potentially enter into the pre-

sales pipeline.

3. Cautious positive view on the Henan market driven by

volume growth. ASP could be higher but not

necessarily. Central China will continue to gain market share.

Data-points and other guidance made:

1. Although the company has not set the FY13 sales target yet,

Rmb12bn is a rough estimate which represents around 20% y-

o-y growth based on a Rmb20bn saleable resources and 60%

sales-through rate. Among the saleable resources, around

Rmb13-14bn are new launches.

2. Net debt ratio by end-year 2012 could maintain at a level of

50% to 60%. The company will try to remain the net debt

ratio stable.

Three frequently asked questions (and response by

management)

1. Any plan to do equity fund raising or debt? It is an option,

but the company needs approval from its major shareholder

(Capitaland) to do any share placement. As Capitaland will be

diluted, it is hard for them to approve the deal. Debt issuance

could be a way to lower its lending cost now. But the company

does not seem to be going down that route.

2. Any potential impact from CB? As CB conversion price is

HK$2.98/share, the current share price has been close to that.

Management plans to wait for a higher price to convert. If it

converts the CB to shares, it could hold over 8% of the

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 15

company's share. This could be an overhang to the share price

as the CB holder is a PE firm.

3. How to face the competition from newcomers? The stronger

developers will remain strong. Central China is the first

developer in Henan to achieve Rmb10bn contracted sales.

Central China is better positioned to compete in the province

with a larger land bank and ready local teams.

CHINASOFT

(NOT RATED HK$1.81; 354 HK)

Number of clients met: c.15

Salient Points in Management Presentation:

1. Urbanisation is +ve to Chinasoft. In the past, it may be

difficult for entrants to enter into certain industries.

Urbanisation creates IT service demand in second and third tier

cities, which is easier for entrants (such as Chinasoft) to tap

into.

2. Government is encouraging industry consolidation (i.e.

reducing # of vendors)

3. Labour cost remains under pressure. Chinasoft will relocate

some staff to the inner part of China.

Data-points and other guidance made:

1. Maintain c.25% revenue growth in the next few years.

2. Current utilisation is 85%.

3. Staff turnover rate in FY12 is similar to that in FY13.

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 16

EVERGRANDE

(BUY HK$4.52; TP: HK$4.70; 3333 HK)

Number of clients met: 58

Salient Points in Management Presentation:

1. 2013 saleable resources will be c: 26m sm. This may

translate into 161bn, assuming ASP of 6K. DBSV estimate: c.

100bn pre-sales to be achieved, assuming 62% sales rate,

similar to last year.

2. Lowering gearing is still its top priority. Target to lower the

gearing to below 80% by end-13.

3. 2nd Tier city contribution to 2013 pre-sales may increase

from 44% to above 50% as a result of more acquisitions in

Tier 2 cities in 2012. This should help support ASP.

Data-points and other guidance made:

1.It launched 58 new projects in 2012; 2013 new launches

may be >50 2.Mgmt is exploring different funding channel,

such as doing more JV to minimise risk and lower capital

involvement

Three frequently asked questions (and response by

management)

1. What is the likely pre-sales target for 2013?

2. Has mgmt undertaken any actions to improve market

perception about its corporate governance?

3. What's the plan to lower the gearing other than selling

more?

FORTUNE REIT

(BUY HK$6.40; TP: HK$6.97; 778 HK)

Salient point in mgmt presentation

1) AEI remains one of the growth drivers. AEI at Jubilee Square

is underway. Fortune REIT plans to do another AEI at Ma On

Shan Plaza in 2013 and study the feasibility of AEI for

Belvedere Square.

2) Fortune REIT continues to explore acquisition opportunities.

3) Lease expiry in 2013 will concentrate on Metro Town and

Fortune City One

Data point and other guidance

1) In 9M12, rental reversion was 20.1pc

2) Less than 5 pc of revenue from turnover rent

3) Cost to income ratio should be maintained at 28pc or below

Three FAQs

1) Does Fortune REIT intend to expand outside HK or buy

industrial properties and convert into retail use? No

2) Does Fortune REIT plan to dispose of any asset? No

3) Outlook of retail market? Remain positive

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 17

FRANSHION

(BUY HK$2.93; TP: HK$3.37; 817 HK)

Number of clients met: 49

Salient Points in Management Presentation:

1.Presales may see 20% growth from 10.4bn achieved in 2012,

but this may include Rmb1.8bn sales carried forward from

Shanghai Shipping Center

2.Changsha sales may further go up to 900mu with higher AV

3.Commercial prop sales contribution to 2013 will drop

substantially to be c. 30% to 35%

Data-points and other guidance made:

1.May still have Rmb 5bn for new land acquisitions in 2013 if

gearing is to stay at below 60%

2.Next acquisition targets are Nanjing, Changsha and

Chongqing

3 Hotel spin-off may not come through until post 2015 as

management plans to grow hotel portfolio further before spin-

off

Three frequently asked questions (and response by

management)

1. What is the pre-sales target for 2013?

2. Planning for the new Shanghai land acquired in Dec2012?

3. Performance of its office and hotel portfolio?

NETDRAGON WEBSOFT

(BUY (UR) HK$11.52; TP: HK$11.46 (UR);

777 HK)

Number of clients met: >30

Salient Points in Management Presentation:

1. The Online Games segment is fairly mature but growing

steadily and is a good cash cow for the company with c. 42%

operating margin. The company is also taking less risk in this

business - cancelling six of 12 projects, as online gaming

becomes more of a miss than hit business.

2. The company's next focus of growth is on its Mobile Internet,

which has seen its revenue grow at an exponential rate from

less than Rmb1m in 3Q10 to over Rmb86m in 3Q12, and the

growth momentum is expected to continue.

This comes on the back of the total installation base rising from

less than 5m in 3Q10 to nearly 180m in 3Q12.

3. The company has recently announced plans to spin-off its

mobile internet business on HK GEM, which awaits shareholder

approval

Data-points and other guidance made:

1. The Mobile Internet business is expected to continue

growing strongly, and could double or even triple its revenue in

2013 2. The company is the market leader in both the iOS and

Android segments.

Three frequently asked questions (and response by

management)

1. What is the competitive landscape for Mobile Internet?

NetDragon has a huge lead as China's preferred app

distribution platform and as an experienced player, will be

looking to hold on to this lead. Attempts by hardware players

to lock-in users to their eco-system have generally not worked

out well (especially in China).

2. Dividend policy? The company is in a strong cash position

and is highly cash generative, it has been paying out at least

50% earnings and should continue.

3. Can smartphone penetration rates in China improve further?

There is definitely room for further growth as China's

smartphone penetration rate is only 60% of South Korea

(28% vs 52%) and with lower end smartphones becoming

more readily available (even Apple is rumoured to be

introducing lower end models), smartphone penetration rate

should continue to improve strongly in China, to help underpin

the company's mobile internet business' growth.

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 18

Our take

Although NDs share price has almost doubled since our

initiation, we still see attractive upside at current valuations

(only 0.23x PEG against 38% 3-year CAGR) and view it as the

best SMC proxy to gain exposure to the mobile internet market.

We lift our SOTP TP by 34% to HK$11.46 on greater mobile

internet earnings contribution, BUY.

SHUI ON LAND

(HOLD HK$3.86; TP: HK$3.56; 272 HK)

Number of clients signed up: c. 40

Salient Points in Management Presentation:

1.Residential subscribed sales in FY12 was c. Rmb8.4bn after

including Rmb2.7bn Shanghai RHXC subscribed in Dec. Shui

On Land missed its residential sales target of Rmb10bn mainly

due to slow sales in Chongqing and Dalian.

2. The company has started to put more of its resources into

Shanghai for relocation and construction as the market is

relatively strong. Further launches of Shanghai RHXC will be in

2Q and the following months.

3. Shui On Land earning visibility in 2013 is not low. It has

Rmb6.4bn unbooked sales and Rmb2.7bn subscribed sales by

end-FY12. This means total unbooked sales have been up to

Rmb9bn.

Data-points and other guidance made:

1. Rmb12 to Rmb13bn residential saleable resources with

Rmb5.5bn in Shanghai. This includes Rmb2.7bn have been

subscribed but not contracted in Dec 2012. Enbloc sale of

Rmb6bn to 8bn is under negotiation.

2. Net debt ratio has been lowered after issuing the perpetual

notes. We estimate it may be below 80%.

Three frequently asked questions (and response by

management)

1. Why was Chongqing sales slow? Shui On Land didn't cut

prices for the Chongqing project. It tried to cut prices in 2008

when the market was difficult, but didn't boost sales

significantly. And it made customers have less confident about

the project. The company decided not to cut price in this round

of market downturn, given the project's luxury nature.

2. Financing plan in 2013? Shui On Land will have two major

debt due in 2013. One is Rmb2.7bn CB puttable in FY13 with

a conversion price of HK$4.5/share. Another one is Rmb3bn

senior notes. Shui On Land may issue new debt to refinance

them.

3. Why did the company choose to issue the perpetual bond?

The action is mainly to manage the company's gearing ratio.

As the perpetual bond will be treated as equity, net debt ratio

can be lowered effectively. In the meanwhile, it is callable in

five years. It gives Shui On Land an option to reduce the debt

in the future.

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 19

SITC INTERNATIONAL HOLDINGS

(BUY HK$2.68; TP: HK$2.90; 1308 HK)

Number of clients met: >30

Salient Points in Management Presentation:

1. SITC is not just a container liner, but an integrated logistics

player with 60% of earnings coming from land logistics, with a

unique focus on solely Intra-Asia trade. Land logistics include

freight forwarding, ship agency, customs clearance,

warehousing etc. 90% of its land logistics business is related to

its container business.

2. The company's high frequency (>300 weekly services) and

high density model (over 50 routes and 48 ports in Asia),

enables them to offer a product and service that is superior to

most, allowing them to charge higher prices (by a few percent)

whilst customers remain sticky

3. In the longer term, SITC is targeting the third party logistics

(3PL) market in China as another further engine of growth for

the company.

Data-points and other guidance made:

1. The company expects to order another 15 vessels in 1H13,

together with the one confirmed, would receive these in 2014

and 2015. Expected CAPEX in 2013 is US$100m to US$200m,

most of which would be going to deposits for these vessels.

2. Company is targeting 10% volume growth in 2013 with

stable ASPs. Overall margins should hold steady as lower vessel

costs from the 13 owned vessels delivered in 2012 should help

protect margins.

Three frequently asked questions (and response by

management)

1. Who are SITC's largest clients? SITC has over 10,000 clients

with none exceeding 1% of revenue. Most of SITC's clients are

involved in high value products such as FMCG, chemicals,

apparel and textiles and consumer electronics. Some of their

biggest customers include Toyota and Canon.

2. Does SITC have a dividend policy? SITC does not have an

official dividend policy, but has been steadily paying dividends

in the last 10 years (36% payout in 2010, and 42% payout in

2011, and the eight years before IPO in 2010). Management is

also incentivised to pay dividends as key management and

employees own 75% of the company.

3. Is the company worried about competition, especially amidst

over-supply generally? Competition has always been firm in

this sector but SITC has been growing at a CAGR of 10% since

its founding 20 years ago, using its unique business model (see

points 1 and 2). Whilst ASPs have been affected as seen in

2010 and 2011 results due to over-supply generally, it would

be difficult for competitors to replicate its model and services

completely (SITC's fleet averages 1,000 TEUs per vessel which

fits a high frequency, high density model whereas attempts to

employ larger vessels on such a model may not be profitable),

and SITC has remained fairly profitable whilst other major liners

have been loss-making.

Our take

We believe SITC will continue to benefit from robust intra-Asia

trade demand and that it has great potential from its land

logistics business.

SITC offers 16% ROE and a decent ~5% dividend yield, but is

still trading far below its historical average valuation. We have

a BUY call with HK$2.90 TP (1.2x FY13 P/b)

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 20

SUNAC

(NOT RATED HK$6.73; 1918 HK)

Number of clients signed up: c. 20

Salient Points in Management Presentation:

1. Sunac's landbank is valuable, although the size looks not

large. As of now, Sunac has 14m sm landbank only, but it can

turn into over Rmb200bn saleable resources. If factoring

growth, the landbank is sufficient for three to four year's

development.

2. The management emphases risk control by (1) focusing on a

limited number of key cities with high market depth and

growing population (2) controlling sales proceeds collection (3)

avoiding mistakes in land purchases which can cost the

company more than it appears to be, if taking the opportunity

cost into consideration.

3. Sunac will be less aggressive in using leveraging to buy land

in FY13, but may enter one more new cities within existing

regions.

Data-points and other guidance made:

1. FY12 sales-through rate based on launched saleable

resources was over 75%, compared with c. 50% based on that

with sales permit.

2. Pre-sales target in FY13 is Rmb45bn (Rmb30bn on an

attributable bases) based on RMB80bn to Rmb90bn saleable

resources.

3. Management expect net debt ratio by end-FY12 to be less

than 100% and is comfortable with a100% net debt ratio

level.

Three frequently asked questions (and response by

management)

1. Whether to raise fund from equity? Company still has over

Rmb10bn cash on its balance sheet. Management views the

share price still has upwards potential and may wait for a

better price to do a placement. As Sunac will be less

aggressive in purchasing land, there is no need to place shares

at present. 2. Will CDH and Bain further sell down their

holdings? CDH and Bain still hold c. 10% of the company's

shares. They indicated they won't further sell when Sunac

communicated with them recently. However, Sunac

management believes its reduction of the holdings will improve

stock liquidity and welcome the sale to remove the overhang.

In addition, private equity's tenure is usually five to seven years.

CDH and Bain may need to get out before 2015 if we assume

it will pull out upon the fund's maturity. 3. How is the

cooperation with various partners doing? Sunac leverages on

partners' financial resources and various expertise, while

Sunac's strength is on the market knowledge side and property

pricing side. In several cases of the JV projects, Sunac priced

the projects better than their partners' expectations without

lowering the sales-through rates.

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 21

TCL COMM

(FULLY VALUED HK$2.53; TP:1.40; 2618 HK)

Number of clients met: c.15

Salient Points in Management Presentation:

1. TCLC is planning to leverage the strong TCL TV brand and

distribution network in China to sell its smartphones.

2. The demand for mid-end smartphone (ASP at c.US$200) is

building up (from replacement), compared with mostly entry

level smartphones for first time smartphone users one to two

years ago.

3. Management believes that overseas market is where it can

make profit. China market is simply too competitive.

Data-points and other guidance made:

1. Expect turnaround in 2Q13 or 3Q13

2.4G phones will be available this year

3. Currently entry level smartphone margin was as low as 13-

15%, but the target is 20% for mid-end smartphones.

Three frequently asked questions (and response by

management):

1. How does TCLCs smartphone differentiate from others'?

TCLC is not competing with Apple or Samsung. Cost is lower

than for foreign brands. As compared with ZTE and Huawei, a

strong overseas distribution network (and Alcatel branding) is

the advantage.

2.What is the business strategy for FY13 to turn around the

business? Improving smartphones time-to-market to secure

ASP and margins.

3. When should we expect to see the business turn around?

2Q13 or 3Q13.

Recommendation: FULLY VALUED; TP: HK$1.40

YANLORD

(HOLD S$1.605; TP: S$1.24; YLLG SP)

Number of clients signed up: c. 40

Salient Points in Management Presentation:

1. Management agrees with the market view that the company

needs to improve its asset turn. It will try to speed up

construction gradually in FY13 to improve its asset turn.

2. Investment property (IP) income may see high growth in

2013 given improvement in occupancy rates as three

investment properties are maturing.

3. May restart landbanking in FY13. Yanlord didn't buy any

land in FY12. In FY13, Yanlord may considering buy some land,

especially in Nanjing. The Nanjing market performed the best

among the cities Yanlord has a presence in, and Yanlord's land

bank in Nanjing has dropped in the city. Yanlord may try to

replenish it.

Data-points and other guidance made:

1. Yanlord maintains its FY13 sales target of Rmb13bn which it

set in Nov 2012 and expect a balanced contracted sales

split between1H 13 and 2H13.

2. Four new projects will be launched for sale in FY13,

namely: Shenzhen Longguang project, Chengdu Riverbay,

Tangshan Nanhu Eco city, and Zhuhai Marina Center. If the

construction pace allows, three more new projects in Shanghai

( Qingpu Xujiang Town, Yanlord Eastern Garden, and Tang

Dong Nan) may be added into the pre-sales pipeline towards

year end in 2013.

Three frequently asked questions (and response by

management)

1. Should we expect further tightening as ASP may be back to

an upward trend? Management believes local government's

financial needs to invest in public projects create resistance to

further tightening. Management expects only a gradual

increase in ASP and believes this will not trigger further

tightening.

2. Any financing plan? No urgent need to raise funding at this

stage despite of the wide-opened debt market and good share

price performance. Unlike 2012, Yanlord has no major debt to

refinance in 2013. Onshore bank borrowing is not hard to get

either. Unless there is good land to buy, Yanlord will not raise

money through either equity or debt.

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 22

3. Margin expectations. Management expects a stable recovery

in margin. In 2012, most of the GFA delivered was the first

phases of the projects which enjoys lower margin. In 2013, the

impact will be still there but less, while in 2014, the

management expects a recovery in margins.

YUEXIU

(NOT RATED HK$2.69; 123HK)

Number of clients met: 35

Salient Points in Management Presentation:

1.2013 salable resources may grow by >20%. This may imply

20% pre-sales growth, assuming similar sales rate of 2012, in

our view.

2.Saleable resources outside of Guangdong may go beyond

20% in 2013 3.More JV has been done in 2H for new land

acquisitions to minimise execution risk in new cities

Data-points and other guidance made:

1.Average funding cost in 2013 will further go down from

7.5% in 1H12 due to the disposal of IFC, more offshore term

loans being done, and pay-down of trust loans in China.

2. By 2015 pre-sales contribution from outside of Guandong

my go beyond 30 to 40% from current 12%.

Three frequently asked questions (and response by

management)

1. Pre-sales target in 2013?

2. Gross margin in cities outside of Guangdong?

3.Assets to be injected to Yeuxiu REITs over the next few years?

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 23

YUEXIU REIT

(NOT RATED HK$3.86; 405 HK)

Number of clients met: c. 20

Salient Points in Management Presentation:

1. Guangzhou IFC is expected to see improvement in

occupancy rate and rental income in all the four components

(office, retail, hotel, service apartment) in 2013 2. Yuexiu REIT

will focus on the operation of Guangzhou IFC and

consolidation of the management team in 2013 rather

acquisitions.

Data-points and other guidance made:

1. DPU 2012 is expected to be close to the Rmb2.063 as what

the company illustrated in the circulation of the GZ IFC

acquisition deal.

2. Maintenance CAPEX in 2013 may be higher than previous

years due to renovation of 2F of GZ White Horse.

3. Potential interest cost saving of Rmb45mn if it can replace

the loan brought forward from GZ IFC deal with lower cost

financing.

Three frequently asked questions (and response by

management)

1. How is the Guangzhou office market doing? New supply of

office in Guangzhou has peaked in FY12. It put some pressure

on rents in the market. But going forward, occupancy rates

may start to decrease as new supply drops. Rent is expected to

start to grow.

2. What is the acquisition plan? In FY13, Yuexiu REIT will only

focus on the performance of GZ IFC. However, going forward,

Yuexiu REIT will try to acquire one new asset every two to

three years from either the Yuexiu Property or 2nd parties. As

the market cap and financial capability of Yuexiu REIT have

been improved after the GZ IFC deal, Yuexiu REIT is better

positioned to acquire assets from external sources. It also

considers acquiring asset outside Guangzhou, including Beijing,

Shanghai, Hong Kong, and Macao.

3. Any updates on rental and occupancy status of GZ IFC? At

present, the office portion sees c. 70% occupancy rate and

average rent of c. Rmb250/sm/month. The retail part sees an

occupancy rate of c. 96%. Four Seasons and Service

Apartment portions see occupancy rates of c. 38% and 10%.

All improved from the level when Yuexiu REIT acquired it.

Office portion is expected to see further pickup in occupancy

rate to 80% to 85%, which is the major rental growth driver

for FY13.

foosuanyee@imci.sg FooSuan Yee 05/23/14 06:06:11 AM IMC INVESTMENTS PTE. LTD.

Regional Market Focus

Post Conference Notes

Page 24

KOREA CORPORATES

COM2US

(BUY KRW46,900; TP: KRW70,000;

078340 KQ)

Number of clients met: >25

Salient Points in Management Presentation:

1. The companys strong growth in 2012 is bolstered by higher

smart phone penetration globally including in South Korea

(58%, US 48%, Japan 31%, China 24%)

2. It has focused on Smartphone games and Freemium (free to

play) and social games which offers broader audience/mass

market and longer life cycle.

3. Domestic and overseas revenue contributes 65%, 35% in

3Q12, respectively and overseas revenue is strengthening its

growth. US accounts for 50%, Japan accounts for 15% and

Taiwan contributes 10% to the total overseas revenue.

Data-points and other guidance made:

1. The company had launched 24 games in 2012 and will

launch 50 games (33 in-house games, 17 publishing games in

2013. Especially 11 games will be introduced to the market in

1Q13.

2. The company will increase new game launch in the

messenger platform (KAKAO talk in Korea and Line in Japan)

to 16 games in 2013 from four games in 2012.

3. To increase margins, it will enhance use of the companys

platform Com2us HuB, which is able to save the commission

payment to the platform such as Apple Store, Google Play and

Messengers.

Three frequently asked questions (and response by

management)

Investors asked about the companys guidance for 2012s and

2013s results, but the company hasnt suggested any

guidance.

However, according to its IR team, our analyst estimate would

be acceptable. Our analyst estimates on 2012 are KRW 78bn

revenue and KRW 17bn operating profit. For 2013, revenue,

OP and NP are KRW110bn, KRW28bn, respectively.

Our take

We maintain our BUY call with KRW70,000 TP since the