Professional Documents

Culture Documents

Razones Financieras Mexico

Uploaded by

Jenniffer Basulto EspadasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Razones Financieras Mexico

Uploaded by

Jenniffer Basulto EspadasCopyright:

Available Formats

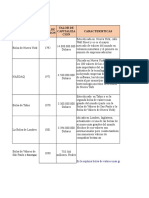

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Razn del cido = (activo circulante - inventario) / pasivo circulante

94 - 05

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

Total mercado

117

1.0

0.8

0.9

1.0

1.0

1.1

0.8

0.9

0.9

0.9

1.0

1.0

0.9

1.0

0.9

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

0.9

1.0

1.0

0.8

1.0

1.3

1.0

0.8

0.8

1.9

1.0

0.7

1.5

1.0

0.5

1.3

1.1

0.9

1.2

1.4

0.5

1.0

1.6

0.4

1.1

2.0

0.4

1.4

1.2

0.4

1.5

1.1

0.3

1.6

1.2

0.5

1.3

1.2

0.6

1.2

1.0

0.9

1.3

1.4

0.4

Bienes de consumo

Cemento

Constructoras

5

7

8

0.5

1.5

1.2

1.3

1.2

0.9

2.1

1.3

0.9

1.0

1.5

1.2

1.1

1.2

0.9

1.3

0.8

0.8

1.1

0.4

0.6

0.9

0.9

1.0

0.6

0.6

1.1

1.0

0.7

1.2

1.0

0.7

1.3

1.0

0.9

1.9

1.1

1.0

1.1

1.2

1.2

0.9

1.0

0.7

1.2

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4

4

13

0.4

1.4

0.7

0.5

0.9

0.7

0.7

0.9

1.0

0.7

1.0

0.8

0.6

1.1

0.7

0.6

1.4

0.8

0.6

1.4

0.6

0.6

1.5

0.8

0.5

1.8

0.7

0.6

2.2

0.8

0.6

1.8

0.9

0.6

2.0

1.0

0.6

1.5

0.8

0.6

1.1

0.8

0.6

1.8

0.8

Comunicacin y transportes

Grupos industriales

Hoteles y restaurantes

11

10

5

1.7

0.8

0.6

1.3

0.6

0.2

1.5

0.6

0.1

1.4

0.7

0.2

1.5

0.7

0.4

1.6

0.8

1.0

0.7

0.7

0.6

0.9

0.7

0.6

1.0

0.8

0.7

0.9

1.0

0.8

1.0

1.1

0.8

0.9

1.5

1.0

1.2

0.8

0.6

1.5

0.7

0.4

0.9

1.0

0.8

Mineras

Papel y celulosa

Qumicas

3

3

4

1.1

1.1

1.1

2.7

1.0

1.3

3.9

1.9

1.4

1.7

2.3

1.2

3.1

1.4

0.9

1.4

1.7

0.6

0.7

1.1

0.5

0.6

1.3

0.7

0.6

0.6

0.3

1.1

0.6

0.4

1.4

1.4

1.2

1.5

1.4

1.3

1.7

1.3

0.9

2.3

1.6

1.1

1.0

1.1

0.7

Siderrgicas

Textiles

4

4

0.6

0.4

0.4

0.6

0.5

0.5

0.9

0.6

0.7

0.8

1.0

0.6

1.0

0.8

0.7

0.4

1.0

1.1

1.4

1.3

1.5

1.1

1.6

0.7

0.9

0.7

0.7

0.6

1.2

0.9

Elaborado por Alberto Calva-Mercado y Acus Consultores, S.C. a partir de los estados financieros de empresas que cotizan en la

Bolsa Mexicana de Valores. Todas las razones financieras se obtuvieron tomando el saldo final a diciembre de cada ao en el balance

general y no el promedio.

El autor no se hacen responsable por las decisiones que se tomen con base en la informacin y comentarios aqu presentados, ni por la

exactitud de las cifras. The author is not responsible for any decisions made based on the information or comments here presented,

neither for the accuracy of the figures.

Acus Consultores, S.C.

www.acus.com.mx

acus@acus.com.mx

-1(55)5807-6891 y (55)5272-4032

Alberto Calva-Mercado

acalva@acus.com.mx

acalva@prodigy.net.mx

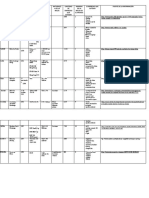

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Clientes / proveedores

94 - 05

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

Total mercado

117

1.7

1.5

1.5

1.4

1.3

1.4

1.3

1.4

1.4

1.5

1.6

1.7

1.5

1.5

1.5

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

1.9

1.2

1.3

2.1

1.1

1.6

2.1

1.0

1.2

2.0

1.0

1.2

1.8

0.9

1.4

1.8

0.9

1.4

1.7

0.8

1.4

1.9

0.7

1.2

1.7

0.6

1.0

1.5

0.6

0.9

1.3

0.6

0.7

1.4

0.6

0.9

1.8

0.8

1.2

2.0

1.0

1.4

1.6

0.7

1.0

Bienes de consumo

Cemento

Constructoras

5

7

8

2.6

2.8

5.3

2.1

2.3

3.5

2.6

1.8

3.1

2.4

1.7

3.5

1.4

1.9

1.9

3.0

1.5

2.9

2.1

1.3

2.9

1.8

1.8

2.6

2.1

1.3

2.8

2.1

1.2

2.3

2.2

1.0

2.2

2.3

1.2

2.2

2.2

1.6

2.9

2.3

2.0

3.4

2.1

1.3

2.5

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4

4

13

0.1

3.6

0.8

0.1

2.6

1.0

0.1

1.7

1.1

0.0

1.8

0.9

0.0

2.0

0.7

0.1

2.6

0.9

0.1

3.3

0.7

0.1

3.2

0.7

0.1

3.6

0.6

0.1

3.4

0.8

0.1

3.2

1.0

0.1

3.0

1.3

0.1

2.8

0.9

0.1

2.4

0.9

0.1

3.3

0.8

Comunicacin y transportes

Grupos industriales

Hoteles y restaurantes

11

10

5

2.2

1.8

5.0

1.7

1.8

5.6

4.0

1.5

0.7

4.2

1.4

0.5

4.0

1.5

1.0

5.5

1.6

1.0

5.6

1.2

1.2

6.5

1.3

1.1

6.8

1.4

1.0

6.6

1.5

1.1

10.6

1.4

1.3

12.3

1.5

1.5

5.8

1.5

1.8

3.6

1.6

2.3

8.1

1.4

1.2

Mineras

Papel y celulosa

Qumicas

3

3

4

2.1

1.6

2.8

2.2

2.3

2.4

1.3

2.3

2.7

1.6

2.2

2.1

1.0

2.5

1.9

0.8

2.0

1.2

0.8

2.5

1.2

0.7

2.2

1.5

0.7

2.2

1.1

1.3

2.2

1.0

1.7

2.2

1.1

2.1

1.8

1.6

1.4

2.2

1.7

1.5

2.2

2.2

1.2

2.2

1.3

Siderrgicas

Textiles

4

4

2.8

1.9

1.5

1.3

1.5

1.4

1.6

2.2

1.4

2.9

1.9

1.8

1.7

2.2

1.6

1.6

1.6

1.9

1.6

1.8

1.7

1.2

1.9

1.7

1.7

1.8

1.8

1.9

1.7

1.8

Elaborado por Alberto Calva-Mercado y Acus Consultores, S.C. a partir de los estados financieros de empresas que cotizan en la

Bolsa Mexicana de Valores. Todas las razones financieras se obtuvieron tomando el saldo final a diciembre de cada ao en el balance

general y no el promedio.

El autor no se hacen responsable por las decisiones que se tomen con base en la informacin y comentarios aqu presentados, ni por la

exactitud de las cifras. The author is not responsible for any decisions made based on the information or comments here presented,

neither for the accuracy of the figures.

Acus Consultores, S.C.

www.acus.com.mx

acus@acus.com.mx

-2(55)5807-6891 y (55)5272-4032

Alberto Calva-Mercado

acalva@acus.com.mx

acalva@prodigy.net.mx

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Apalancamiento = pasivo total / capital contable

94 - 05

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

Total mercado

117

0.8

0.9

0.8

0.9

0.8

0.8

1.3

1.2

1.3

1.3

1.3

1.2

1.0

0.8

1.2

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

0.8

0.4

1.5

0.9

0.5

1.8

0.7

0.5

2.8

0.4

0.5

3.4

0.6

0.5

5.2

1.0

0.4

1.4

1.1

0.6

2.0

0.6

0.5

1.9

0.8

0.5

1.9

0.6

0.8

1.9

0.7

0.8

1.9

0.6

0.6

1.9

0.7

0.5

2.3

0.7

0.5

2.7

0.7

0.6

1.9

Bienes de consumo

Cemento

Constructoras

5

7

8

1.8

0.8

1.4

0.5

0.9

1.3

0.3

0.9

1.2

0.5

0.8

1.8

0.4

0.7

1.9

0.4

0.7

1.4

0.6

1.0

1.7

0.9

0.9

1.7

1.5

1.1

1.5

0.6

1.2

1.3

0.7

1.0

1.2

0.7

1.4

1.3

0.8

0.9

1.5

0.7

0.8

1.5

0.8

1.1

1.5

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4

4

13

0.6

0.8

0.9

0.5

1.0

1.1

0.4

1.2

0.8

0.5

0.7

1.0

0.5

0.6

1.1

0.5

0.5

1.1

0.7

1.0

1.6

0.7

0.9

1.8

0.7

1.1

1.6

0.7

1.0

1.8

0.6

1.0

1.9

0.7

1.0

1.9

0.6

0.9

1.4

0.5

0.8

1.0

0.7

1.0

1.8

Comunicacin y transportes

Grupos industriales

Hoteles y restaurantes

11

10

5

0.7

1.0

1.5

0.6

1.3

4.8

0.5

1.4

55.7

0.7

1.5

24.7

0.7

1.3

1.1

0.7

1.1

0.5

1.6

1.6

0.7

1.7

1.7

0.8

1.7

1.5

0.9

1.5

1.5

0.9

1.8

1.3

0.9

1.7

0.9

0.9

1.2

1.3

7.8

0.7

1.3

14.7

1.7

1.4

0.9

Mineras

Papel y celulosa

Qumicas

3

3

4

0.5

0.7

0.9

0.5

0.8

0.7

0.4

0.7

0.6

0.5

0.6

0.7

0.6

0.7

1.3

1.0

0.8

1.3

1.3

1.2

1.8

1.4

1.2

1.5

1.7

1.4

1.8

1.5

1.8

2.3

1.2

1.9

1.1

0.8

1.4

0.9

1.0

1.1

1.2

0.6

0.7

0.9

1.3

1.5

1.6

Siderrgicas

Textiles

4

4

1.2

1.2

1.2

1.0

1.0

1.2

1.1

1.2

1.2

0.9

0.8

1.5

1.2

2.8

1.1

3.9

1.2

2.2

1.1

1.7

0.6

1.8

0.5

3.8

1.0

1.9

1.1

1.2

1.0

2.7

Elaborado por Alberto Calva-Mercado y Acus Consultores, S.C. a partir de los estados financieros de empresas que cotizan en la

Bolsa Mexicana de Valores. Todas las razones financieras se obtuvieron tomando el saldo final a diciembre de cada ao en el balance

general y no el promedio.

El autor no se hacen responsable por las decisiones que se tomen con base en la informacin y comentarios aqu presentados, ni por la

exactitud de las cifras. The author is not responsible for any decisions made based on the information or comments here presented,

neither for the accuracy of the figures.

Acus Consultores, S.C.

www.acus.com.mx

acus@acus.com.mx

-3(55)5807-6891 y (55)5272-4032

Alberto Calva-Mercado

acalva@acus.com.mx

acalva@prodigy.net.mx

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Deuda de corto plazo = pasivo de corto plazo / pasivo total

94 - 05

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

Total mercado

117

0.5

0.5

0.5

0.5

0.5

0.5

0.5

0.4

0.4

0.4

0.4

0.4

0.4

0.5

0.4

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

0.6

0.5

0.3

0.6

0.4

0.2

0.5

0.5

0.3

0.5

0.4

0.3

0.4

0.5

0.5

0.5

0.5

0.5

0.6

0.4

0.7

0.5

0.4

0.8

0.4

0.4

0.8

0.3

0.3

0.8

0.4

0.3

0.8

0.4

0.4

0.8

0.5

0.4

0.6

0.5

0.5

0.4

0.4

0.4

0.8

Bienes de consumo

Cemento

Constructoras

5

7

8

0.8

0.3

0.5

0.7

0.3

0.4

0.7

0.3

0.4

0.8

0.3

0.6

0.8

0.3

0.7

0.7

0.3

0.7

0.6

0.5

0.7

0.7

0.3

0.7

0.8

0.3

0.6

0.7

0.3

0.6

0.7

0.3

0.6

0.7

0.3

0.4

0.7

0.3

0.6

0.7

0.3

0.6

0.7

0.3

0.6

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4

4

13

0.8

0.6

0.7

0.8

0.7

0.9

0.9

0.6

0.7

0.9

0.7

0.7

0.9

0.6

0.7

0.9

0.7

0.8

0.7

0.5

0.6

0.7

0.5

0.6

0.7

0.4

0.6

0.7

0.4

0.7

0.7

0.5

0.7

0.7

0.4

0.7

0.8

0.5

0.7

0.9

0.6

0.8

0.7

0.4

0.7

Comunicacin y transportes

Grupos industriales

Hoteles y restaurantes

11

10

5

0.3

0.5

0.3

0.4

0.5

0.6

0.4

0.6

0.8

0.4

0.5

0.7

0.4

0.5

0.5

0.4

0.5

0.3

0.6

0.4

0.3

0.4

0.4

0.3

0.3

0.4

0.3

0.4

0.4

0.3

0.4

0.4

0.3

0.4

0.4

0.3

0.4

0.4

0.4

0.4

0.5

0.5

0.4

0.4

0.3

Mineras

Papel y celulosa

Qumicas

3

3

4

0.5

0.4

0.5

0.4

0.5

0.5

0.3

0.3

0.5

0.4

0.3

0.6

0.2

0.4

0.4

0.2

0.3

0.5

0.2

0.4

0.6

0.3

0.3

0.5

0.3

0.6

0.8

0.2

0.5

0.9

0.2

0.2

0.4

0.3

0.3

0.4

0.3

0.4

0.5

0.3

0.4

0.5

0.3

0.4

0.6

Siderrgicas

Textiles

4

4

0.5

0.8

0.4

0.8

0.4

0.8

0.3

0.6

0.3

0.6

0.3

0.6

0.3

0.4

0.3

0.6

0.3

0.3

0.2

0.3

0.3

0.3

0.4

0.3

0.3

0.5

0.4

0.7

0.3

0.3

Elaborado por Alberto Calva-Mercado y Acus Consultores, S.C. a partir de los estados financieros de empresas que cotizan en la

Bolsa Mexicana de Valores. Todas las razones financieras se obtuvieron tomando el saldo final a diciembre de cada ao en el balance

general y no el promedio.

El autor no se hacen responsable por las decisiones que se tomen con base en la informacin y comentarios aqu presentados, ni por la

exactitud de las cifras. The author is not responsible for any decisions made based on the information or comments here presented,

neither for the accuracy of the figures.

Acus Consultores, S.C.

www.acus.com.mx

acus@acus.com.mx

-4(55)5807-6891 y (55)5272-4032

Alberto Calva-Mercado

acalva@acus.com.mx

acalva@prodigy.net.mx

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Das cartera das clientes = (clientes * 360 / ventas netas)

94 - 05

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

Total mercado

117

59

49

46

49

46

45

41

43

40

41

44

43

46

49

42

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

40

25

61

36

21

55

28

20

47

30

21

57

34

20

51

31

20

41

28

18

73

32

17

54

34

15

61

28

16

53

28

15

44

28

16

43

31

19

53

33

21

52

29

16

55

Bienes de consumo

Cemento

Constructoras

5

7

8

99

58

111

142

50

158

127

42

121

80

41

183

128

42

113

127

40

105

83

42

118

84

35

114

103

28

111

99

29

113

102

24

130

105

39

128

106

39

125

117

46

132

96

33

119

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4

4

13

4

153

34

4

151

48

5

110

51

3

110

43

3

108

37

4

104

48

5

116

32

5

119

42

4

133

31

4

137

40

3

149

50

3

151

60

4

128

43

4

123

44

4

134

43

Comunicacin y transportes

Grupos industriales

Hoteles y restaurantes

11

10

5

65

55

83

56

51

106

67

46

73

64

50

46

66

53

49

57

56

28

58

42

29

60

49

28

54

49

31

52

53

39

55

55

41

46

53

40

58

51

49

62

52

64

54

50

35

Mineras

Papel y celulosa

Qumicas

3

3

4

80

75

104

43

65

70

35

68

72

37

68

71

34

71

68

65

74

71

37

71

64

34

77

74

33

79

76

42

83

73

46

74

74

34

72

74

43

73

74

49

70

76

38

76

72

Siderrgicas

Textiles

4

4

124

125

54

88

52

83

58

83

54

90

63

119

62

120

61

109

65

93

57

91

56

67

72

68

65

95

68

98

62

91

Elaborado por Alberto Calva-Mercado y Acus Consultores, S.C. a partir de los estados financieros de empresas que cotizan en la

Bolsa Mexicana de Valores. Todas las razones financieras se obtuvieron tomando el saldo final a diciembre de cada ao en el balance

general y no el promedio.

El autor no se hacen responsable por las decisiones que se tomen con base en la informacin y comentarios aqu presentados, ni por la

exactitud de las cifras. The author is not responsible for any decisions made based on the information or comments here presented,

neither for the accuracy of the figures.

Acus Consultores, S.C.

www.acus.com.mx

acus@acus.com.mx

-5(55)5807-6891 y (55)5272-4032

Alberto Calva-Mercado

acalva@acus.com.mx

acalva@prodigy.net.mx

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Das inventario = (inventario * 360 / costo de ventas)

94 - 05

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

Total mercado

117

93

83

74

78

76

71

67

66

63

59

63

56

71

79

62

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

104

102

184

88

77

182

74

79

150

76

78

154

86

74

119

67

74

61

59

73

114

86

73

95

85

74

102

72

66

101

57

61

129

55

53

93

76

74

124

82

81

142

69

66

106

Bienes de consumo

Cemento

Constructoras

5

7

8

150

73

52

227

74

79

193

69

88

96

63

89

214

60

68

198

78

87

124

78

111

99

64

144

125

69

162

169

56

173

156

56

228

172

46

196

160

65

123

180

69

77

141

61

169

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4

4

13

53

110

80

47

101

90

51

109

79

61

123

85

53

106

84

57

84

79

52

92

75

52

75

83

55

84

78

49

83

81

50

86

83

47

85

78

52

95

81

54

105

83

51

84

80

Comunicacin y transportes

Grupos industriales

Hoteles y restaurantes

11

10

5

155

97

451

145

82

386

55

74

130

65

77

103

68

79

85

36

84

70

33

79

58

36

76

72

27

78

72

26

73

65

33

82

60

28

71

53

59

79

134

87

82

204

31

76

63

Mineras

Papel y celulosa

Qumicas

3

3

4

164

68

45

116

55

42

115

60

40

111

59

41

108

52

44

155

65

47

88

59

42

79

55

46

86

53

41

92

57

39

88

50

34

77

51

46

107

57

42

128

60

43

85

54

41

Siderrgicas

Textiles

4

4

117

121

110

83

109

94

112

125

122

133

115

118

112

101

102

86

101

64

79

71

115

73

135

82

111

96

114

112

107

80

Elaborado por Alberto Calva-Mercado y Acus Consultores, S.C. a partir de los estados financieros de empresas que cotizan en la

Bolsa Mexicana de Valores. Todas las razones financieras se obtuvieron tomando el saldo final a diciembre de cada ao en el balance

general y no el promedio.

El autor no se hacen responsable por las decisiones que se tomen con base en la informacin y comentarios aqu presentados, ni por la

exactitud de las cifras. The author is not responsible for any decisions made based on the information or comments here presented,

neither for the accuracy of the figures.

Acus Consultores, S.C.

www.acus.com.mx

acus@acus.com.mx

-6(55)5807-6891 y (55)5272-4032

Alberto Calva-Mercado

acalva@acus.com.mx

acalva@prodigy.net.mx

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Rotacin del activo fijo = (ventas netas / activo fijo neto)

94 - 05

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

Total mercado

117

0.93

0.97

1.06

1.13

1.17

1.21

1.33

1.28

1.28

1.37

1.55

1.69

1.25

1.08

1.42

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

1.50

1.06

1.74

1.65

1.15

2.02

2.08

1.18

2.70

1.70

1.26

2.84

1.64

1.30

3.56

1.82

1.41

3.58

2.05

1.52

1.39

1.86

1.53

1.67

1.96

1.57

1.78

2.11

1.63

1.99

2.29

1.79

2.46

2.30

1.92

3.07

1.91

1.44

2.40

1.73

1.23

2.74

2.09

1.66

2.06

Bienes de consumo

Cemento

Constructoras

5

7

8

1.58

0.55

2.71

1.21

0.48

1.56

1.28

0.55

2.08

2.05

0.60

2.29

1.30

0.71

2.53

1.23

0.73

2.75

1.15

0.68

2.50

1.51

0.80

4.97

1.25

0.76

6.07

1.33

0.79

5.69

1.42

0.86

8.72

1.53

0.99

7.86

1.40

0.71

4.14

1.44

0.60

2.32

1.37

0.82

5.97

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4

4

13

2.13

1.54

3.27

2.15

1.05

3.84

2.17

1.07

4.48

2.01

1.21

4.75

2.28

1.33

5.29

2.29

1.52

3.93

2.38

1.67

5.51

2.45

1.72

4.34

2.47

1.77

5.79

2.49

1.87

5.79

2.53

2.05

5.56

2.51

2.07

5.59

2.32

1.57

4.85

2.17

1.29

4.26

2.47

1.86

5.43

Comunicacin y transportes

Grupos industriales

Hoteles y restaurantes

11

10

5

0.67

0.96

0.48

0.67

1.06

0.33

0.70

1.16

0.30

0.90

1.21

0.38

0.95

1.14

0.42

0.99

1.20

0.44

0.98

1.52

0.50

1.03

1.31

0.61

0.98

1.31

0.65

1.07

1.51

0.70

1.22

1.79

0.78

1.37

2.16

0.89

0.96

1.36

0.54

0.81

1.12

0.39

1.11

1.60

0.69

Mineras

Papel y celulosa

Qumicas

3

3

4

0.40

0.73

0.90

0.87

0.84

1.40

0.76

0.75

1.39

0.57

0.81

1.38

0.59

0.81

1.17

0.42

0.88

0.92

0.66

0.94

1.02

0.56

0.84

1.02

0.50

0.82

0.92

0.55

0.83

1.07

0.84

0.97

1.36

1.12

1.09

1.51

0.65

0.86

1.17

0.60

0.80

1.19

0.70

0.92

1.15

Siderrgicas

Textiles

4

4

0.43

0.55

0.54

0.94

0.69

1.12

0.72

1.06

0.66

1.21

0.68

0.84

0.74

0.90

0.67

0.86

0.64

0.87

0.75

0.81

1.19

0.91

1.84

0.90

0.80

0.91

0.62

0.95

0.97

0.87

Elaborado por Alberto Calva-Mercado y Acus Consultores, S.C. a partir de los estados financieros de empresas que cotizan en la

Bolsa Mexicana de Valores. Todas las razones financieras se obtuvieron tomando el saldo final a diciembre de cada ao en el balance

general y no el promedio.

El autor no se hacen responsable por las decisiones que se tomen con base en la informacin y comentarios aqu presentados, ni por la

exactitud de las cifras. The author is not responsible for any decisions made based on the information or comments here presented,

neither for the accuracy of the figures.

Acus Consultores, S.C.

www.acus.com.mx

acus@acus.com.mx

-7(55)5807-6891 y (55)5272-4032

Alberto Calva-Mercado

acalva@acus.com.mx

acalva@prodigy.net.mx

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Rotacin activo total = (ventas netas / activo total)

94 - 05

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

Total mercado

117

0.53

0.56

0.61

0.63

0.65

0.66

0.71

0.74

0.73

0.72

0.75

0.81

0.68

0.61

0.74

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

0.81

0.70

0.60

0.90

0.78

0.60

1.11

0.77

0.77

0.84

0.79

0.78

0.82

0.84

0.97

0.72

0.88

1.24

0.76

0.92

0.75

0.97

0.89

0.87

0.95

0.85

0.90

1.11

0.71

1.01

1.19

0.75

1.09

1.18

0.79

1.19

0.95

0.81

0.90

0.87

0.80

0.82

1.03

0.82

0.97

Bienes de consumo

Cemento

Constructoras

5

7

8

0.67

0.32

0.45

0.53

0.30

0.27

0.57

0.34

0.31

0.89

0.37

0.37

0.59

0.42

0.48

0.60

0.44

0.52

0.57

0.40

0.46

0.75

0.45

0.58

0.63

0.44

0.63

0.65

0.46

0.65

0.66

0.48

0.67

0.69

0.57

0.59

0.65

0.42

0.50

0.64

0.36

0.40

0.66

0.47

0.60

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4

4

13

1.39

0.67

1.46

1.40

0.52

1.43

1.33

0.57

1.48

1.26

0.66

1.51

1.46

0.73

1.59

1.44

0.84

1.35

1.51

0.87

1.65

1.59

0.89

1.50

1.58

0.85

1.73

1.59

0.86

1.60

1.63

0.89

1.41

1.65

0.87

1.31

1.49

0.77

1.50

1.38

0.67

1.47

1.59

0.87

1.53

Comunicacin y transportes

Grupos industriales

Hoteles y restaurantes

11

10

5

0.44

0.53

0.20

0.46

0.57

0.15

0.44

0.68

0.15

0.47

0.71

0.24

0.48

0.67

0.27

0.53

0.69

0.35

0.53

0.83

0.41

0.59

0.76

0.47

0.57

0.76

0.48

0.57

0.75

0.50

0.59

0.81

0.57

0.69

0.94

0.60

0.53

0.73

0.37

0.47

0.64

0.23

0.59

0.81

0.51

Mineras

Papel y celulosa

Qumicas

3

3

4

0.27

0.51

0.58

0.49

0.58

0.82

0.46

0.53

0.85

0.37

0.56

0.84

0.38

0.58

0.73

0.27

0.57

0.61

0.44

0.62

0.67

0.39

0.58

0.65

0.34

0.58

0.63

0.36

0.58

0.65

0.51

0.67

0.78

0.64

0.76

0.69

0.41

0.59

0.71

0.37

0.55

0.74

0.45

0.63

0.68

Siderrgicas

Textiles

4

4

0.31

0.39

0.41

0.56

0.51

0.64

0.50

0.62

0.44

0.64

0.45

0.50

0.47

0.55

0.45

0.54

0.44

0.59

0.51

0.55

0.72

0.63

0.86

0.62

0.51

0.57

0.44

0.56

0.57

0.58

Elaborado por Alberto Calva-Mercado y Acus Consultores, S.C. a partir de los estados financieros de empresas que cotizan en la

Bolsa Mexicana de Valores. Todas las razones financieras se obtuvieron tomando el saldo final a diciembre de cada ao en el balance

general y no el promedio.

El autor no se hacen responsable por las decisiones que se tomen con base en la informacin y comentarios aqu presentados, ni por la

exactitud de las cifras. The author is not responsible for any decisions made based on the information or comments here presented,

neither for the accuracy of the figures.

Acus Consultores, S.C.

www.acus.com.mx

acus@acus.com.mx

-8(55)5807-6891 y (55)5272-4032

Alberto Calva-Mercado

acalva@acus.com.mx

acalva@prodigy.net.mx

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Rotacin capital empleado = (ventas netas / capital empleado)

94 - 05

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

Total mercado

117

0.65

0.68

0.74

0.78

0.80

0.85

0.93

0.94

0.94

0.91

0.99

1.10

0.86

0.75

0.97

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

0.97

0.84

0.75

1.08

0.91

0.73

1.37

0.92

0.97

1.12

0.95

0.98

1.00

0.99

1.30

1.07

1.08

1.60

1.18

1.18

1.03

1.13

1.20

1.25

1.13

1.24

1.33

1.32

0.89

1.48

1.51

0.94

1.75

1.49

1.00

2.19

1.20

1.01

1.28

1.10

0.95

1.05

1.30

1.07

1.51

Bienes de consumo

Cemento

Constructoras

5

7

8

0.87

0.35

0.60

0.69

0.33

0.33

0.67

0.38

0.38

1.12

0.40

0.50

0.75

0.47

0.75

0.73

0.50

0.73

0.74

0.44

0.70

1.03

0.52

1.03

1.22

0.51

1.06

0.80

0.54

1.05

0.80

0.54

1.03

0.86

0.66

0.91

0.86

0.47

0.76

0.80

0.40

0.55

0.91

0.54

0.96

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4

4

13

2.15

0.80

2.07

2.15

0.66

2.02

2.15

0.74

2.05

2.14

0.85

2.11

2.48

0.93

2.46

2.50

1.04

2.02

2.68

1.04

2.47

2.65

1.09

2.35

2.54

1.02

2.96

2.63

1.08

2.73

2.65

1.11

2.45

2.76

1.12

2.41

2.46

0.95

2.34

2.26

0.84

2.12

2.65

1.07

2.56

Comunicacin y transportes

Grupos industriales

Hoteles y restaurantes

11

10

5

0.54

0.63

0.22

0.57

0.68

0.16

0.53

0.82

0.18

0.57

0.86

0.33

0.59

0.81

0.31

0.70

0.84

0.39

0.71

1.03

0.44

0.76

0.93

0.52

0.72

0.95

0.54

0.72

0.92

0.57

0.81

1.04

0.65

0.94

1.34

0.68

0.68

0.91

0.41

0.58

0.78

0.26

0.78

1.04

0.57

Mineras

Papel y celulosa

Qumicas

3

3

4

0.32

0.65

0.68

0.71

0.69

1.05

0.61

0.65

1.02

0.45

0.69

1.02

0.48

0.70

0.88

0.30

0.70

0.74

0.50

0.76

0.83

0.44

0.70

0.80

0.41

0.70

0.78

0.42

0.73

0.89

0.63

0.85

1.00

0.84

0.97

0.85

0.51

0.73

0.88

0.48

0.68

0.90

0.54

0.78

0.86

Siderrgicas

Textiles

4

4

0.34

0.49

0.46

0.64

0.56

0.83

0.57

0.76

0.49

0.73

0.50

0.58

0.53

0.64

0.51

0.66

0.51

0.69

0.60

0.63

0.85

0.75

1.03

0.74

0.58

0.68

0.49

0.67

0.67

0.69

Elaborado por Alberto Calva-Mercado y Acus Consultores, S.C. a partir de los estados financieros de empresas que cotizan en la

Bolsa Mexicana de Valores. Todas las razones financieras se obtuvieron tomando el saldo final a diciembre de cada ao en el balance

general y no el promedio.

El autor no se hacen responsable por las decisiones que se tomen con base en la informacin y comentarios aqu presentados, ni por la

exactitud de las cifras. The author is not responsible for any decisions made based on the information or comments here presented,

neither for the accuracy of the figures.

Acus Consultores, S.C.

www.acus.com.mx

acus@acus.com.mx

-9(55)5807-6891 y (55)5272-4032

Alberto Calva-Mercado

acalva@acus.com.mx

acalva@prodigy.net.mx

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Margen operativo de ventas = utilidad de operacin / ventas

94 - 05

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

Total mercado

117

14.2%

14.6%

14.7%

14.7%

15.1%

16.8%

15.4%

15.9%

15.5%

15.1%

16.0%

16.1%

15.3%

15.0%

15.7%

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

11.1%

13.5%

-0.9%

9.8%

10.2%

1.1%

9.8%

12.1%

5.2%

9.5%

15.7%

5.6%

9.4%

15.6%

6.6%

6.7%

16.5%

3.0%

4.4%

17.9%

4.4%

7.2%

18.7%

3.1%

8.2%

20.4%

2.6%

6.6%

18.6%

4.0%

7.5%

17.9%

7.1%

9.5%

17.9%

8.5%

8.3%

16.2%

4.2%

9.4%

13.9%

3.4%

7.2%

18.6%

4.9%

Bienes de consumo

Cemento

Constructoras

5

7

8

8.1%

25.2%

16.5%

20.9%

22.6%

7.8%

16.9%

24.1%

6.3%

7.5%

22.6%

6.8%

5.9%

26.9%

7.2%

10.9%

29.4%

1.3%

-4.2%

29.4%

2.7%

-0.1%

24.2%

1.7%

6.1%

21.8%

10.6%

7.7%

22.2%

10.8%

6.9%

22.7%

15.1%

8.5%

17.0%

16.5%

7.9%

24.0%

8.6%

11.7%

25.1%

7.6%

4.2%

22.9%

9.6%

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4

4

13

4.3%

1.9%

6.3%

3.2%

-10.9%

9.0%

4.1%

-5.4%

6.8%

4.4%

5.7%

6.1%

4.2%

10.4%

5.9%

5.0%

11.8%

7.4%

5.0%

12.1%

5.3%

5.1%

12.9%

7.0%

4.9%

12.8%

5.0%

5.3%

12.5%

4.8%

6.0%

12.5%

5.4%

6.4%

11.4%

6.3%

4.8%

7.3%

6.3%

4.2%

2.2%

6.9%

5.4%

12.4%

5.6%

Comunicacin y transportes

Grupos industriales

Hoteles y restaurantes

11

10

5

28.4%

12.1%

19.4%

23.6%

14.2%

0.5%

28.0%

14.4%

-42.2%

25.2%

14.9%

0.2%

26.1%

15.8%

11.0%

32.0%

15.0%

15.7%

30.7%

10.4%

12.9%

30.3%

10.6%

13.4%

26.9%

10.2%

10.6%

25.2%

9.3%

10.6%

22.8%

9.4%

12.2%

22.7%

9.3%

14.6%

26.8%

12.1%

6.6%

27.2%

14.4%

0.8%

26.4%

9.9%

12.4%

Mineras

Papel y celulosa

Qumicas

3

3

4

17.7%

20.4%

8.9%

38.2%

25.4%

17.9%

28.1%

27.4%

17.1%

21.4%

25.9%

15.1%

16.4%

26.5%

12.8%

7.3%

28.7%

4.6%

12.7%

27.5%

2.6%

0.4%

23.1%

1.0%

5.2%

22.3%

-3.6%

10.9%

20.0%

-0.8%

31.7%

18.8%

2.1%

36.6%

19.0%

7.9%

18.9%

23.8%

7.1%

21.5%

25.7%

12.7%

16.2%

21.8%

1.5%

Siderrgicas

Textiles

4

4

5.3%

0.4%

19.3%

8.9%

19.3%

12.0%

18.3%

11.5%

17.7%

14.8%

14.7%

4.4%

12.4%

5.9%

10.0%

-1.6%

7.5%

9.7%

7.8%

5.2%

28.4%

0.8%

12.1%

-6.9%

14.4%

5.4%

15.8%

8.7%

13.0%

2.2%

Elaborado por Alberto Calva-Mercado y Acus Consultores, S.C. a partir de los estados financieros de empresas que cotizan en la

Bolsa Mexicana de Valores. Todas las razones financieras se obtuvieron tomando el saldo final a diciembre de cada ao en el balance

general y no el promedio.

El autor no se hacen responsable por las decisiones que se tomen con base en la informacin y comentarios aqu presentados, ni por la

exactitud de las cifras. The author is not responsible for any decisions made based on the information or comments here presented,

neither for the accuracy of the figures.

Acus Consultores, S.C.

www.acus.com.mx

acus@acus.com.mx

- 10 (55)5807-6891 y (55)5272-4032

Alberto Calva-Mercado

acalva@acus.com.mx

acalva@prodigy.net.mx

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Ebitda / ventas

94 - 05

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

Total mercado

117

19.8%

21.2%

21.3%

21.3%

21.8%

24.7%

22.3%

23.9%

23.4%

23.2%

23.5%

23.0%

22.5%

21.7%

23.2%

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

14.0%

17.4%

1.7%

13.5%

14.6%

5.8%

13.6%

17.4%

8.7%

14.0%

21.2%

10.2%

14.0%

20.8%

10.8%

11.4%

22.1%

20.1%

10.8%

23.5%

8.2%

18.5%

24.0%

5.4%

12.9%

26.3%

4.4%

12.8%

23.8%

6.6%

11.2%

23.0%

9.0%

12.9%

22.7%

9.8%

13.3%

21.4%

8.4%

13.4%

18.9%

9.5%

13.2%

23.9%

7.2%

Bienes de consumo

Cemento

Constructoras

5

7

8

11.8%

33.8%

21.6%

25.2%

34.3%

15.6%

21.3%

31.2%

13.3%

12.8%

32.9%

12.9%

10.1%

35.3%

11.9%

15.3%

38.1%

7.1%

1.7%

37.6%

9.3%

5.4%

34.7%

8.9%

10.8%

30.5%

14.1%

11.4%

30.9%

14.4%

10.4%

30.9%

18.3%

12.0%

23.9%

19.5%

12.4%

32.8%

13.9%

16.1%

34.2%

13.8%

8.6%

31.4%

14.1%

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4

4

13

6.0%

4.4%

9.2%

5.4%

-7.1%

11.0%

6.3%

-2.2%

8.6%

6.5%

9.3%

7.8%

6.1%

12.6%

7.6%

7.0%

13.9%

9.3%

7.0%

14.3%

6.9%

7.0%

15.2%

8.9%

6.8%

15.0%

6.8%

7.2%

14.8%

6.5%

7.9%

14.6%

7.3%

8.3%

13.4%

8.2%

6.8%

9.9%

8.2%

6.2%

5.2%

8.9%

7.4%

14.5%

7.4%

Comunicacin y transportes

Grupos industriales

Hoteles y restaurantes

11

10

5

39.2%

17.3%

25.0%

38.1%

19.7%

8.8%

45.1%

19.6%

-33.8%

40.4%

20.0%

7.7%

42.2%

21.1%

18.2%

48.7%

20.4%

23.1%

45.6%

14.9%

20.4%

44.9%

16.0%

20.6%

42.4%

15.7%

18.4%

41.2%

14.4%

17.8%

37.3%

14.1%

19.4%

35.3%

13.1%

21.0%

41.7%

17.2%

13.9%

42.3%

19.7%

8.2%

41.1%

14.7%

19.6%

Mineras

Papel y celulosa

Qumicas

3

3

4

26.9%

25.8%

15.5%

44.8%

29.9%

22.7%

36.1%

32.6%

22.0%

30.7%

32.0%

20.4%

27.3%

32.3%

18.5%

19.3%

34.7%

12.1%

16.2%

32.8%

10.8%

13.2%

28.8%

9.1%

19.1%

28.9%

12.8%

23.9%

26.5%

5.7%

41.0%

24.8%

8.6%

45.3%

24.7%

11.7%

28.6%

29.5%

14.2%

30.9%

31.2%

18.5%

26.4%

27.7%

9.8%

Siderrgicas

Textiles

4

4

13.0%

8.4%

27.4%

14.9%

26.9%

18.5%

24.6%

18.5%

24.6%

21.8%

22.3%

13.9%

19.8%

15.1%

17.9%

8.7%

16.0%

19.5%

15.4%

16.7%

33.2%

10.9%

14.7%

4.6%

21.3%

14.3%

23.1%

16.0%

19.5%

12.6%

Elaborado por Alberto Calva-Mercado y Acus Consultores, S.C. a partir de los estados financieros de empresas que cotizan en la

Bolsa Mexicana de Valores. Todas las razones financieras se obtuvieron tomando el saldo final a diciembre de cada ao en el balance

general y no el promedio.

El autor no se hacen responsable por las decisiones que se tomen con base en la informacin y comentarios aqu presentados, ni por la

exactitud de las cifras. The author is not responsible for any decisions made based on the information or comments here presented,

neither for the accuracy of the figures.

Acus Consultores, S.C.

www.acus.com.mx

acus@acus.com.mx

- 11 (55)5807-6891 y (55)5272-4032

Alberto Calva-Mercado

acalva@acus.com.mx

acalva@prodigy.net.mx

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Retorno sobre la inversin = utilidad de operacin / activo total

94 - 05

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

Total mercado

117

7.6%

8.2%

9.0%

9.3%

9.8%

11.1%

11.0%

11.7%

11.3%

10.8%

12.0%

13.1%

10.4%

9.2%

11.7%

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

9.0%

9.5%

-0.5%

8.8%

7.9%

0.7%

10.8%

9.3%

4.0%

8.0%

12.5%

4.3%

7.7%

13.0%

6.4%

4.8%

14.6%

3.8%

3.4%

16.4%

3.3%

6.9%

16.7%

2.7%

7.8%

17.3%

2.3%

7.3%

13.2%

4.0%

8.9%

13.4%

7.8%

11.2%

14.2%

10.1%

7.9%

13.2%

4.1%

8.2%

11.1%

3.1%

7.6%

15.2%

5.0%

Bienes de consumo

Cemento

Constructoras

5

7

8

5.4%

7.9%

7.5%

11.2%

6.8%

2.1%

9.6%

8.1%

2.0%

6.6%

8.3%

2.6%

3.5%

11.3%

3.5%

6.5%

12.9%

0.7%

-2.4%

11.8%

1.3%

0.0%

11.0%

1.0%

3.8%

9.6%

6.6%

5.0%

10.3%

7.0%

4.5%

10.9%

10.1%

5.9%

9.7%

9.8%

5.0%

9.9%

4.5%

7.1%

9.2%

3.0%

2.8%

10.6%

6.0%

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4

4

13

5.9%

1.2%

9.2%

4.5%

-5.7%

12.9%

5.4%

-3.0%

10.0%

5.6%

3.8%

9.3%

6.2%

7.6%

9.3%

7.3%

10.0%

10.0%

7.6%

10.5%

8.7%

8.1%

11.5%

10.5%

7.7%

10.9%

8.7%

8.4%

10.8%

7.6%

9.8%

11.2%

7.5%

10.5%

9.9%

8.2%

7.2%

6.5%

9.3%

5.8%

2.3%

10.1%

8.7%

10.8%

8.5%

Comunicacin y transportes

Grupos industriales

Hoteles y restaurantes

11

10

5

12.4%

6.4%

3.9%

10.8%

8.1%

0.1%

12.2%

9.8%

-6.5%

11.9%

10.7%

0.0%

12.5%

10.6%

2.9%

16.9%

10.4%

5.5%

16.1%

8.7%

5.2%

18.0%

8.0%

6.3%

15.4%

7.8%

5.1%

14.4%

7.0%

5.3%

13.5%

7.6%

6.9%

15.7%

8.7%

8.7%

14.2%

8.6%

3.6%

12.8%

9.3%

1.0%

15.5%

8.0%

6.3%

Mineras

Papel y celulosa

Qumicas

3

3

4

4.8%

10.5%

5.1%

18.9%

14.6%

14.7%

12.8%

14.5%

14.5%

7.9%

14.6%

12.7%

6.2%

15.3%

9.4%

1.9%

16.3%

2.8%

5.5%

17.2%

1.8%

0.2%

13.4%

0.7%

1.8%

13.0%

-2.3%

3.9%

11.6%

-0.5%

16.1%

12.7%

1.6%

23.4%

14.4%

5.5%

8.6%

14.0%

5.5%

8.8%

14.3%

9.9%

8.5%

13.7%

1.1%

Siderrgicas

Textiles

4

4

1.7%

0.1%

8.0%

5.0%

9.8%

7.7%

9.3%

7.2%

7.8%

9.4%

6.6%

2.2%

5.8%

3.3%

4.5%

-0.8%

3.3%

5.7%

4.0%

2.8%

20.4%

0.5%

10.4%

-4.3%

7.6%

3.2%

7.2%

5.3%

8.1%

1.2%

Elaborado por Alberto Calva-Mercado y Acus Consultores, S.C. a partir de los estados financieros de empresas que cotizan en la

Bolsa Mexicana de Valores. Todas las razones financieras se obtuvieron tomando el saldo final a diciembre de cada ao en el balance

general y no el promedio.

El autor no se hacen responsable por las decisiones que se tomen con base en la informacin y comentarios aqu presentados, ni por la

exactitud de las cifras. The author is not responsible for any decisions made based on the information or comments here presented,

neither for the accuracy of the figures.

Acus Consultores, S.C.

www.acus.com.mx

acus@acus.com.mx

- 12 (55)5807-6891 y (55)5272-4032

Alberto Calva-Mercado

acalva@acus.com.mx

acalva@prodigy.net.mx

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Retorno sobre capital empleado = Nopat / capital empleado

94 - 05

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

Total mercado

117

5.1%

5.5%

6.0%

6.3%

6.7%

7.9%

7.9%

8.2%

8.0%

7.6%

8.7%

9.8%

7.3%

6.2%

8.4%

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

5.9%

6.2%

-0.4%

5.9%

5.1%

0.5%

7.4%

6.1%

2.8%

5.9%

8.2%

3.0%

5.2%

8.5%

4.7%

3.9%

9.8%

2.7%

2.9%

11.6%

2.5%

4.5%

12.4%

2.1%

5.1%

14.0%

1.9%

4.8%

9.1%

3.3%

6.2%

9.3%

6.8%

7.8%

9.8%

10.3%

5.5%

9.2%

3.3%

5.7%

7.3%

2.2%

5.2%

11.0%

4.5%

Bienes de consumo

Cemento

Constructoras

5

7

8

3.8%

4.9%

5.5%

8.0%

4.1%

1.4%

6.3%

5.0%

1.3%

4.6%

5.0%

1.9%

2.4%

6.9%

3.0%

4.3%

8.0%

0.5%

-1.7%

7.2%

1.1%

0.0%

6.9%

1.0%

4.1%

6.1%

6.2%

3.4%

6.6%

6.2%

3.0%

6.8%

8.5%

4.0%

6.2%

8.2%

3.5%

6.1%

3.7%

4.9%

5.7%

2.3%

2.1%

6.6%

5.2%

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4

4

13

5.0%

0.8%

7.2%

3.8%

-3.9%

10.0%

4.8%

-2.2%

7.6%

5.2%

2.7%

7.1%

5.8%

5.3%

7.9%

6.9%

6.7%

8.2%

7.4%

6.9%

7.1%

7.4%

7.7%

9.0%

6.8%

7.2%

8.2%

7.6%

7.4%

7.2%

8.7%

7.6%

7.2%

9.6%

7.0%

8.3%

6.6%

4.4%

7.9%

5.3%

1.6%

8.0%

7.9%

7.3%

7.9%

Comunicacin y transportes

Grupos industriales

Hoteles y restaurantes

11

10

5

8.4%

4.2%

2.3%

7.3%

5.3%

0.0%

8.2%

6.5%

-4.1%

7.9%

7.1%

0.0%

8.5%

7.1%

1.9%

12.4%

7.0%

3.4%

12.1%

5.9%

3.1%

12.7%

5.4%

3.8%

10.7%

5.3%

3.1%

10.0%

4.7%

3.3%

10.2%

5.4%

4.3%

11.8%

6.8%

5.5%

10.0%

5.9%

2.2%

8.8%

6.2%

0.6%

11.2%

5.6%

3.9%

Mineras

Papel y celulosa

Qumicas

3

3

4

3.2%

7.2%

3.3%

14.8%

9.7%

10.3%

9.4%

9.8%

9.6%

5.3%

9.9%

8.4%

4.3%

10.2%

6.2%

1.2%

11.0%

1.9%

3.4%

11.4%

1.2%

0.1%

8.9%

0.4%

1.2%

8.6%

-1.6%

2.5%

8.0%

-0.4%

11.0%

8.8%

1.1%

16.8%

10.1%

3.7%

6.1%

9.5%

3.7%

6.4%

9.6%

6.6%

5.8%

9.3%

0.8%

Siderrgicas

Textiles

4

4

1.0%

0.1%

4.9%

3.1%

6.0%

5.5%

5.7%

4.8%

4.7%

5.9%

4.0%

1.4%

3.6%

2.1%

2.8%

-0.6%

2.1%

3.7%

2.6%

1.8%

13.3%

0.3%

6.9%

-2.8%

4.8%

2.1%

4.4%

3.5%

5.2%

0.8%

Elaborado por Alberto Calva-Mercado y Acus Consultores, S.C. a partir de los estados financieros de empresas que cotizan en la

Bolsa Mexicana de Valores. Todas las razones financieras se obtuvieron tomando el saldo final a diciembre de cada ao en el balance

general y no el promedio.

El autor no se hacen responsable por las decisiones que se tomen con base en la informacin y comentarios aqu presentados, ni por la

exactitud de las cifras. The author is not responsible for any decisions made based on the information or comments here presented,

neither for the accuracy of the figures.

Acus Consultores, S.C.

www.acus.com.mx

acus@acus.com.mx

- 13 (55)5807-6891 y (55)5272-4032

Alberto Calva-Mercado

acalva@acus.com.mx

acalva@prodigy.net.mx

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Retorno sobre capital = utilidad neta / capital contable

94 - 05

1994

1995

1996

1997

1998

1999

2000

Total mercado

117

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

Bienes de consumo

Cemento

Constructoras

0.3%

7.8%

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

11.9%

12.6%

7.3%

10.1%

10.0%

9.1%

6.7%

8.0%

14.0%

16.0%

9.5%

8.3%

10.6%

5.1%

13.8%

0.9%

4.5%

-22.9% -15.3%

13.6%

10.0%

1.9%

27.1%

10.5%

3.9%

4.7%

8.5%

-27.7%

4.5%

10.4%

20.9%

1.7%

10.7%

3.1%

1.0%

12.0%

0.6%

4.4%

11.3%

-9.8%

0.9%

8.8%

-1.8%

6.1%

12.4%

9.3%

12.2%

10.9%

20.7%

7.9%

9.2%

-1.4%

11.5%

7.4%

-6.5%

4.4%

11.0%

3.7%

5

7

8

-27.2%

12.1%

2.5%

-2.4%

11.8%

-2.3%

0.7%

19.2%

5.4%

5.5% -12.7%

12.2% 12.8%

-43.8% -7.4%

-2.5%

15.1%

-8.1%

-17.3% -38.9% -35.8%

14.6% 15.0%

9.6%

-11.4% -32.6% -2.6%

2.6%

11.0%

3.1%

3.4%

15.8%

13.7%

1.6%

19.6%

12.6%

-10.3%

14.1%

-5.9%

-6.4%

13.9%

-8.9%

-14.1%

14.2%

-2.9%

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4

4

13

6.1%

1.6%

3.4%

13.7%

-13.1%

14.4%

13.3%

-5.6%

16.7%

13.4%

9.0%

10.4%

11.6%

9.4%

10.7%

11.9%

11.9%

12.2%

11.7%

11.9%

11.7%

10.6%

13.8%

14.9%

10.2%

12.3%

1.8%

10.2%

12.6%

13.2%

13.5%

15.9%

15.1%

12.9%

13.0%

11.9%

11.6%

7.7%

11.4%

11.7%

2.2%

11.3%

11.5%

13.3%

11.4%

Comunicacin y transportes

Grupos industriales

Hoteles y restaurantes

11

10

5

5.7%

8.8%

8.5%

16.5% 10.3%

-4.5%

6.8%

9.0%

15.6%

5.2%

-14.4% -57.7% -621.9% -201.8% -6.0%

11.0%

13.0%

3.6%

15.0%

7.4%

3.4%

13.9%

5.7%

3.5%

9.4%

3.8%

1.0%

13.0%

0.7%

1.5%

16.0%

10.8%

6.0%

22.3%

13.7%

7.6%

12.5% 10.1% 14.9%

7.3%

7.5%

7.0%

-72.9% -149.7% 3.8%

Mineras

Papel y celulosa

Qumicas

3

3

4

-4.7%

-5.7%

-9.3%

20.9%

14.0%

15.9%

13.7%

23.1%

15.7%

10.0%

19.6%

11.3%

4.2%

11.9%

2.7%

5.1%

20.9%

-1.2%

5.4%

20.0%

-14.3%

-4.3%

21.7%

-2.3%

Siderrgicas

Textiles

4

4

-22.0%

-29.8%

3.5%

-9.9%

28.4%

15.3%

15.2%

9.3%

0.4%

7.5%

5.5%

-0.8%

3.7%

-5.0% -0.7%

-14.2% -27.9% -13.1%

-5.2% -4.8% 15.0% 12.7%

-7.7% -9.5% 15.9% 17.7%

-30.7% -32.9% -23.6% -10.1%

1.7%

1.4%

5.7%

11.8%

-6.6%

8.2%

14.0%

5.9%

3.1%

9.7%

-19.0%

27.3% 11.3%

5.8%

0.3% -101.1% -13.6%

5.2%

-1.4%

6.4%

-25.8%

Elaborado por Alberto Calva-Mercado y Acus Consultores, S.C. a partir de los estados financieros de empresas que cotizan en la

Bolsa Mexicana de Valores. Todas las razones financieras se obtuvieron tomando el saldo final a diciembre de cada ao en el balance

general y no el promedio.

El autor no se hacen responsable por las decisiones que se tomen con base en la informacin y comentarios aqu presentados, ni por la

exactitud de las cifras. The author is not responsible for any decisions made based on the information or comments here presented,

neither for the accuracy of the figures.

Acus Consultores, S.C.

www.acus.com.mx

acus@acus.com.mx

- 14 (55)5807-6891 y (55)5272-4032

Alberto Calva-Mercado

acalva@acus.com.mx

acalva@prodigy.net.mx

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Inversin / depreciacin del ejercicio

94 - 05

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

Total mercado

117

3.3

2.0

2.1

1.5

2.0

1.7

2.5

1.6

1.5

1.5

1.5

1.6

1.9

2.1

1.7

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

6.1

4.0

17.6

2.7

3.9

2.6

1.9

2.6

-0.4

0.9

2.5

1.1

3.5

1.9

0.9

2.2

1.6

-1.4

0.3

1.6

4.6

0.3

2.3

-1.2

1.9

1.4

0.4

-0.5

4.5

0.5

0.6

2.7

-0.6

1.9

1.3

4.3

1.8

2.5

2.4

2.9

2.8

3.4

0.7

2.3

1.3

Bienes de consumo

Cemento

Constructoras

5

7

8

14.1

3.1

8.7

1.5

3.0

2.9

0.9

4.8

2.4

0.5

1.5

-8.3

2.1

2.0

8.0

1.0

2.1

0.9

1.9

6.6

0.7

0.1

1.4

-2.4

0.2

2.6

-1.4

-0.9

1.7

0.4

0.7

2.2

1.0

0.2

3.6

1.9

1.9

2.9

1.2

3.4

2.8

2.4

0.4

3.0

0.0

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4

4

13

4.1

3.0

0.5

2.3

3.1

2.8

1.6

1.3

4.6

0.9

-4.0

3.3

2.0

3.4

2.4

2.4

2.5

3.0

2.3

2.4

2.9

2.3

3.1

2.2

2.1

3.2

1.0

2.1

2.7

2.2

2.3

2.9

1.6

3.2

3.6

0.4

2.3

2.2

2.2

2.2

1.5

2.8

2.4

3.0

1.7

Comunicacin y transportes

Grupos industriales

Hoteles y restaurantes

11

10

5

2.3

3.0

14.3

1.0

2.5

1.2

1.3

2.3

2.4

1.2

2.2

2.5

0.8

2.7

4.3

1.5

1.4

0.5

3.0

1.8

4.7

2.0

1.0

1.1

1.7

0.7

0.9

1.3

1.1

-0.1

1.6

0.2

1.4

1.6

-0.8

2.5

1.6

1.5

3.0

1.3

2.4

4.2

1.9

0.7

1.7

Mineras

Papel y celulosa

Qumicas

3

3

4

0.4

1.9

0.6

1.3

3.2

0.2

3.0

5.7

1.2

5.8

1.2

1.4

1.3

1.6

1.7

5.4

1.3

0.6

-2.0

0.6

0.5

0.7

1.0

-2.2

0.8

0.9

0.1

0.6

0.0

0.0

1.3

0.4

0.0

1.8

0.6

-0.8

1.7

1.5

0.3

2.9

2.5

1.0

0.5

0.6

-0.4

Siderrgicas

Textiles

4

4

5.6

5.8

2.9

1.5

1.8

0.6

2.7

3.5

2.7

2.3

1.1

4.1

0.9

0.2

1.0

0.5

0.1

0.3

0.4

0.1

1.5

0.2

4.1

0.4

2.1

1.6

2.8

3.0

1.3

0.3

Elaborado por Alberto Calva-Mercado y Acus Consultores, S.C. a partir de los estados financieros de empresas que cotizan en la

Bolsa Mexicana de Valores. Todas las razones financieras se obtuvieron tomando el saldo final a diciembre de cada ao en el balance

general y no el promedio.

El autor no se hacen responsable por las decisiones que se tomen con base en la informacin y comentarios aqu presentados, ni por la

exactitud de las cifras. The author is not responsible for any decisions made based on the information or comments here presented,

neither for the accuracy of the figures.

Acus Consultores, S.C.

www.acus.com.mx

acus@acus.com.mx

- 15 (55)5807-6891 y (55)5272-4032

Alberto Calva-Mercado

acalva@acus.com.mx

acalva@prodigy.net.mx

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Gastos de operacin / (costo de ventas + gastos de operacin)

94 - 05

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

Total mercado

117

31%

31%

24%

25%

25%

26%

26%

27%

26%

25%

25%

26%

26%

27%

26%

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

32%

43%

15%

32%

39%

17%

30%

37%

15%

31%

37%

15%

34%

38%

15%

31%

39%

17%

32%

42%

19%

39%

42%

20%

39%

41%

22%

37%

40%

21%

36%

39%

18%

37%

38%

15%

34%

40%

17%

32%

39%

16%

37%

40%

19%

Bienes de consumo

Cemento

Constructoras

5

7

8

38%

20%

11%

35%

19%

14%

34%

19%

11%

29%

18%

12%

36%

19%

10%

33%

20%

10%

30%

20%

11%

30%

24%

15%

33%

27%

13%

32%

26%

12%

30%

26%

12%

28%

27%

11%

32%

22%

12%

34%

19%

11%

30%

25%

12%

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4

4

13

18%

32%

22%

18%

35%

21%

17%

33%

19%

17%

31%

17%

17%

31%

18%

16%

33%

18%

16%

34%

19%

16%

33%

19%

16%

34%

19%

17%

34%

20%

16%

33%

22%

16%

33%

23%

17%

33%

20%

17%

33%

19%

16%

33%

20%

Comunicacin y transportes

Grupos industriales

Hoteles y restaurantes

11

10

5

80%

22%

34%

79%

20%

51%

38%

22%

63%

47%

21%

51%

46%

18%

38%

41%

17%

41%

41%

17%

40%

40%

17%

35%

32%

17%

35%

30%

16%

36%

30%

15%

36%

31%

14%

37%

45%

18%

41%

55%

20%

46%

34%

16%

37%

Mineras

Papel y celulosa

Qumicas

3

3

4

20%

19%

15%

20%

16%

14%

21%

16%

13%

21%

14%

13%

22%

14%

20%

22%

13%

21%

11%

14%

20%

20%

13%

22%

22%

14%

21%

22%

15%

20%

19%

15%

17%

19%

15%

20%

20%

15%

18%

21%

15%

16%

19%

14%

20%

Siderrgicas

Textiles

4

4

12%

19%

12%

15%

11%

14%

10%

18%

11%

21%

13%

19%

13%

20%

17%

19%

13%

15%

11%

15%

10%

13%

9%

14%

12%

17%

12%

18%

12%

16%

Elaborado por Alberto Calva-Mercado y Acus Consultores, S.C. a partir de los estados financieros de empresas que cotizan en la

Bolsa Mexicana de Valores. Todas las razones financieras se obtuvieron tomando el saldo final a diciembre de cada ao en el balance

general y no el promedio.

El autor no se hacen responsable por las decisiones que se tomen con base en la informacin y comentarios aqu presentados, ni por la

exactitud de las cifras. The author is not responsible for any decisions made based on the information or comments here presented,

neither for the accuracy of the figures.

Acus Consultores, S.C.

www.acus.com.mx

acus@acus.com.mx

- 16 (55)5807-6891 y (55)5272-4032

Alberto Calva-Mercado

acalva@acus.com.mx

acalva@prodigy.net.mx

RAZONES FINANCIERAS SECTORIALES EN MEXICO

Num. de

empresas

promedio Depreciacin del ejercicio / ventas

94 - 05

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Prom

94 - 05

Prom

94-99

Prom

00-05

Total mercado

117

5.6%

6.6%

6.6%

6.6%

6.6%

7.9%

6.9%

8.0%

7.9%

8.1%

7.6%

6.9%

7.1%

6.7%

7.6%

Alimentos y cigarros

Bebidas

Autopartes

13

9

3

2.9%

3.9%

2.6%

3.7%

4.4%

4.7%

3.9%

5.4%

3.5%

4.5%

5.5%

4.6%

4.6%

5.2%

4.2%

4.7%

5.6%

17.1%

6.4%

5.6%

3.7%

11.3%

5.4%

2.3%

4.7%

5.8%

1.9%

6.2%

5.2%

2.6%

3.7%

5.1%

1.9%

3.4%

4.8%

1.3%

5.0%

5.2%

4.2%

4.0%

5.0%

6.1%

6.0%

5.3%

2.3%

Bienes de consumo

Cemento

Constructoras

5

7

8

3.7%

8.6%

5.0%

4.3%

11.7%

7.9%

4.4%

7.1%

7.0%

5.3%

10.3%

6.1%

4.2%

8.4%

4.8%

4.5%

8.7%

5.9%

5.9%

8.2%

6.6%

5.4%

10.4%

7.2%

4.7%

8.7%

3.5%

3.7%

8.7%

3.6%

3.5%

8.2%

3.2%

3.5%

7.0%

3.0%

4.4%

8.8%

5.3%

4.4%

9.1%

6.1%

4.5%

8.5%

4.5%

Comerciales autoservicio

Comerciales departamentales

Comerciales especializadas

4